|

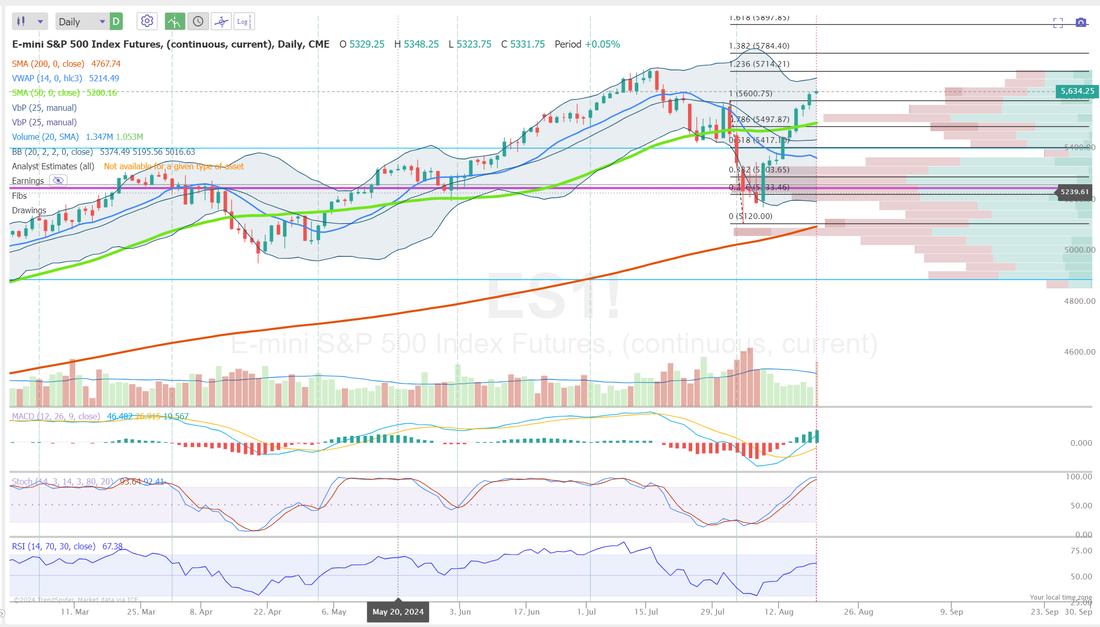

Good Tues. to you all! The bullish sentiment continued yesterday. It's been quite a run. 8 straight days of green and almost a 10% move on the SPX! The main question now is, can it continue? Eight days is a long run and a 10% move is pretty big inside that timeframe. Technicals still look strong and none of our indicators are particularly overstretched to the upside. Futures are green, as I type so I guess we'll see. Yesterday was a decent day for us. We needed to roll two call sides to today so those will form our starting point this morning. Here's a look at our results. Bullish mode technically is still in place, as I mentioned. Taking a look at the major indices we trade, you can see that the SPY and DIA are pushing back to their ATH's. QQQ and IWM still have a bit more work to do. Technically yesterday, we broke through the key levels of resistance I laid out and once that happened the buying accelerated. September S&P 500 E-Mini futures (ESU24) are up +0.01%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.09% this morning as market participants geared up for the release of the minutes of the Federal Reserve’s latest meeting and comments from Fed Chair Jerome Powell later in the week. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the benchmark S&P 500 posting a 1-month high, the tech-heavy Nasdaq 100 notching a 3-1/2 week high, and the blue-chip Dow posting a 2-week high. ZIM Integrated Shipping Services (ZIM) surged over +16% after the shipping giant reported better-than-expected Q2 results and raised its FY24 adjusted EBITDA guidance. Also, Advanced Micro Devices (AMD) climbed more than +4% and was the top percentage gainer on the Nasdaq 100 after announcing the acquisition of AI infrastructure provider ZT Systems in a deal valued at about $4.9 billion. In addition, McDonald’s (MCD) advanced over +3% and was the top percentage gainer on the Dow after Evercore ISI raised its price target on the stock to $320 from $300. On the bearish side, HP Inc. (HPQ) fell more than -3% and was the top percentage loser on the S&P 500 after Morgan Stanley downgraded the stock to Equal Weight from Overweight. Economic data on Monday showed that the Conference Board’s leading economic index for the U.S. dropped -0.6% m/m in July, weaker than expectations of -0.4% m/m. Minneapolis Fed President Neel Kashkari told the Wall Street Journal in an interview released on Monday that it was appropriate to discuss potentially lowering U.S. interest rates in September due to the increasing likelihood of a weakening labor market. “The balance of risks has shifted, so the debate about potentially cutting rates in September is an appropriate one to have,” he said. Kashkari stated inflation was making progress, but the labor market was exhibiting “concerning signs,” according to the Journal. Also, San Francisco Fed President Mary Daly told the Financial Times in an interview published on Sunday that recent U.S. economic data have provided her “more confidence” that inflation is under control and it is time to consider adjusting benchmark borrowing costs. Daly advocated for a “prudent” approach to policy, dismissing concerns about the risk of a sharp slowdown in the U.S. economy. Meanwhile, investors are awaiting the Federal Reserve’s minutes from the July meeting on Wednesday and Fed Chair Jerome Powell’s speech at Jackson Hole, Wyoming, on Friday to gain further clarity on the outlook for rate cuts. U.S. rate futures have priced in a 75.5% probability of a 25 basis point rate cut and a 24.5% chance of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. On the earnings front, notable companies like Lowe’s Companies (LOW), Medtronic (MDT), Keysight Technologies (KEYS), Toll Brothers (TOL), and Amer Sports (AS) are set to report their quarterly figures today. The U.S. economic data slate is empty on Tuesday. However, investors will likely focus on speeches from Fed Vice Chair for Supervision Michael Barr and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.870%, down -0.03%. My bias for today: I continue to be neutral to slightly bullish here. All our technicals and the price action itself are bullish but the eight days of green in a row is starting to get a little long in the tooth (IMHO). Trade docket for today: I'm traveling home today from my in-laws. They live in Port Ludlow which is an island just outside of Seattle. It's beautiful but also quite a treck. Taking ferries etc. to get to the airport so today will be broken up into two segments. Early morning right out of the gate well get as much done as we can and then later today, once I get to the airport, which should be one hour before the close. TJX, TJT, M, /MNQ scalp, BABA?, CCL, CRM, FSLR, IWM, LOW, MDT, PANW, 0DTE's. Let's look at the key intra-day levels for me today: /ES; We are at another critical level as we start today. Technicals are still bullish, as I mentioned but they are starting to wane. 5679 is the key level bulls need to break through to contiue the bullish sentiment. 5587 is the support the bears need to break. /NQ; The Nasdaq is a bit more overbought on the Stoch and you can see that buying vol on both the SPX and NDX is starting to trail off. The key levels for /NQ are 20063 first then if it can break that, 20279 to the upside. 19705 is first support level and then comes 19685 (50DMA). Let's see if we can have another good day at "the office" folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |