|

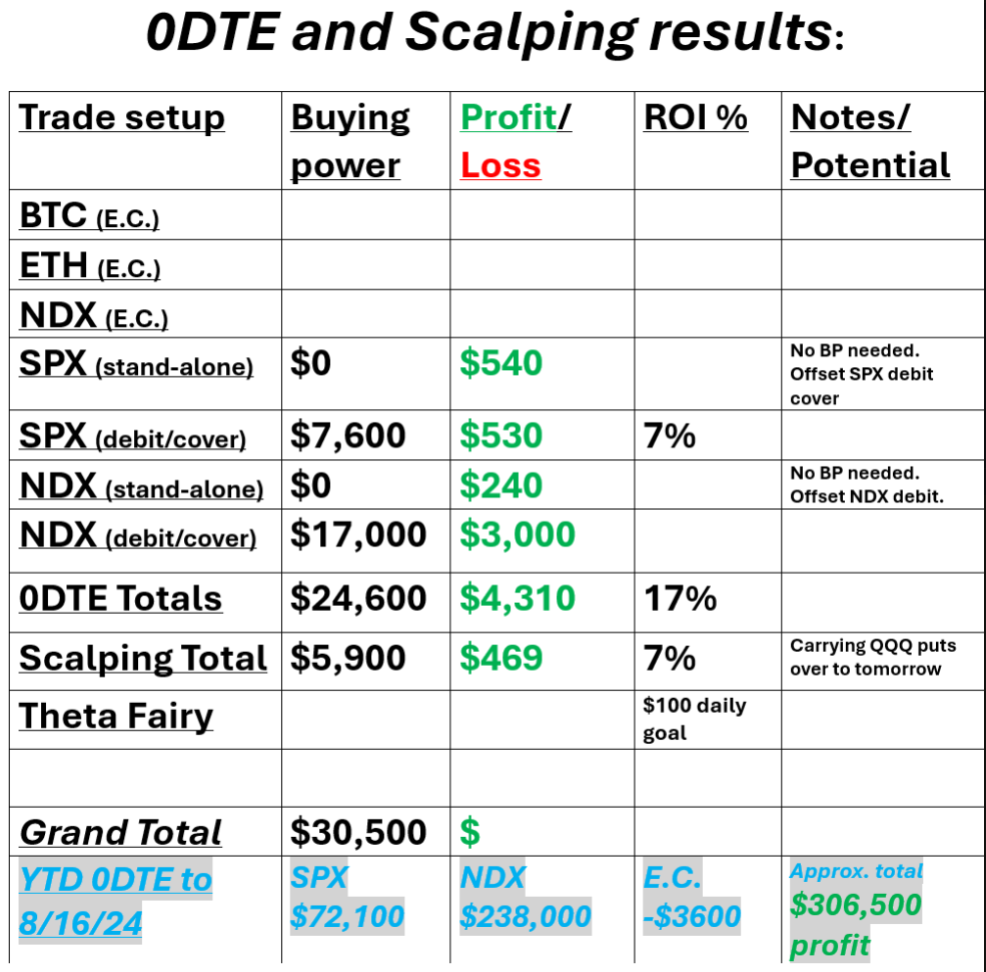

Welcome back traders! We had a pretty picture perfect day yesterday. Everything landed for a full profit. Check out our results below: We've got our NDX debit position expiring this Friday. It's been good to us but time to say goodbye. It will be interesting to see if the next one is a bullish or bearish setup. Let's take a look at the markets. Bullish indicators are holding strong. The major indices continue to break up through resistance after resistance zones. The SP and DIA in particular are trying to get back to those ATH's. September S&P 500 E-Mini futures (ESU24) are up +0.16%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.25% this morning as investors looked ahead to U.S. business activity data and the start of the Jackson Hole Symposium. The minutes of the Federal Open Market Committee’s July 30-31 meeting, released Wednesday, revealed that several Federal Reserve officials acknowledged there was a “plausible case” for reducing the central bank’s policy rate. “All participants supported maintaining the target range for the federal funds rate at 5.25 to 5.50 percent, although several observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision,” according to the FOMC minutes. Policymakers noted at the July meeting that inflation had moderated and that there had been “some further progress” toward the 2% goal in recent months. “The vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting,” the minutes said. “The Fed minutes removed all doubt about a September rate cut,” said Jamie Cox at Harris Financial Group. “The Fed’s communication strategy is to make its meetings less of a market-moving event, and they are following the script to the letter.” In yesterday’s trading session, Wall Street’s major indices closed higher. Keysight Technologies (KEYS) surged over +13% and was the top percentage gainer on the S&P 500 after the company reported upbeat Q3 results and issued solid Q4 guidance. Also, Target (TGT) climbed more than +11% after the retailer reported stronger-than-expected Q2 results and raised its full-year adjusted EPS forecast. In addition, Take-Two Interactive Software (TTWO) gained over +3% after revealing that its Borderlands 4 video game will be released next year. On the bearish side, American Express (AXP) fell more than -2% and was the top percentage loser on the Dow after BofA downgraded the stock to Neutral from Buy. Also, Macy’s (M) tumbled nearly -13% after reporting weaker-than-expected Q2 revenue and lowering its FY24 net sales outlook. The Bureau of Labor Statistics said Wednesday that the U.S. payrolls benchmark was revised down by -818,000 for the year through March, a steeper decline than the anticipated -600,000, marking the largest downward revision since 2009. This was a preliminary estimate. The final revision is set to be released in February 2025. “The main message from the revisions in my mind is to reinforce just how silly it is to let the next jobs number be the determinant in whether to go 25 or 50 in September. What this revision data implies is that whatever the next jobs number is going to be, it’s probably lower in reality,” said Neil Dutta at Renaissance Macro Research. U.S. rate futures have priced in a 69.5% probability of a 25 basis point rate cut and a 30.5% chance of a 50 basis point rate cut at the next central bank meeting in September. Meanwhile, the Jackson Hole Economic Symposium kicks off later today, with investors looking forward to a speech by Fed Chair Jerome Powell on Friday. Market participants will be keenly focused on what he indicates about the pace and timing of rate cuts in the coming months. On the earnings front, notable companies like Intuit (INTU), Workday (WDAY), Ross Stores (ROST), BJ’s Wholesale Club (BJ), and Peloton Interactive (PTON) are set to report their quarterly figures today. On the economic data front, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, set to be released in a couple of hours. Economists, on average, forecast that the August Manufacturing PMI will come in at 49.5, compared to last month’s value of 49.6. Also, investors will focus on the U.S. S&P Global Services PMI, which arrived at 55.0 in July. Economists foresee the preliminary August figure to be 54.0. U.S. Existing Home Sales data will come in today. Economists foresee this figure to stand at 3.94M in July, compared to 3.89M in June. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 232K, compared to last week’s value of 227K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.826%, up +1.27%. Our Trade docket for today: /MCL, ?MNQ, CRM?, DIA, DJT?, IWM, SNOW, WOLF, ZM, INTU, 0DTE's. My bias today is bullish. It's hard not to be with resistance zones being broken through and holding. Let's take a look at my key intra-day 0DTE levels: /ES; 5665/5671/5681 are new resistance levels. 5645/5639/5630 are support. /NQ; 20032/20061/20111 are the new resistance zones. 19938/19900/19863 are support. Let's go have another great day out there folks. Remember...everyday doesn't need to be a home run! We've had some tremendous days recently. $1,000 a day is pretty impressive for most traders. We don't need to swing for the fences!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |