|

Welcome back traders! Yesterday was a mixed bag for me. At the end of the day, my net liq finished down 7k. We had a mixed but good overall result with our four 0DTE's. The E.C. NDX lost -$943 dollars the Bitcoin made $81. The SPX made $150 and the NDX poured in $6,600 so $5,888 total net profits from the 0DTEs. That puts us at $12,356 profit, week to date on our 0DTE effort. Our goal was 10k for the week so I'd say we are doing well there, however, there were just too many fires that needed putting out yesterday. Even with NVDA adding $2,300 to our net liq, we had DIA, MSTR, SMCI an Copper all working against us. We'll work on all of those today. Let's take a look at the market: Markets had a solid day yesterday and most of the major indices hit new ATH's. The Labor Department’s report on Wednesday showed consumer prices rose +0.3% m/m in April, lower than the predicted figure of +0.4% m/m. On an annual basis, headline inflation eased to +3.4% in April from +3.5% in March, in line with expectations. Also, the core CPI, which excludes volatile food and fuel prices, eased to +3.6% y/y in April, in line with expectations and the smallest increase in 3 years. In addition, U.S. April retail sales were unchanged m/m, weaker than expectations of +0.4% m/m, while U.S. core retail sales rose +0.2% m/m in April, right on expectations. Finally, the U.S. NY Empire State manufacturing index arrived at -15.60 in May, weaker than expectations of -9.90. Minneapolis Fed President Neel Kashkari reiterated on Wednesday that the U.S. central bank probably needs to maintain interest rates at their current level for “a while longer” and raised doubts about how much they’re restraining the U.S. economy. “The biggest uncertainty in my mind is how much downward pressure is monetary policy putting on the economy. That’s an unknown - we don’t know for sure,” Kashkari said. “And that tells me we probably need to sit here for a while longer until we figure out where underlying inflation is headed before we jump to any conclusions.” Meanwhile, U.S. rate futures have priced in a 2.9% probability of a 25 basis point rate cut at the June FOMC meeting and a 30.2% chance of a 25 basis point rate cut at the July FOMC meeting. On the earnings front, notable companies like Walmart (WMT), Applied Materials (AMAT), Deere (DE), Take-Two Interactive (TTWO), and Under Armour (UAA) are slated to release their quarterly results today. On the economic data front, all eyes are focused on the U.S. Philadelphia Fed manufacturing index in a couple of hours. Economists, on average, forecast that the May Philadelphia Fed manufacturing index will stand at 7.7, compared to the previous value of 15.5. Also, investors are likely to focus on U.S. Industrial Production data, which came in at +0.4% m/m in March. Economists foresee the April figure to be +0.1% m/m. Our trade docket for today: /HE, /HG, /MCL, /ZN, BA, BIDU, CVNA, DE, DELL, DIA, GME?, GOOG, JD, META?, MSTR, SPX/NDX/E.C. NDX/Bitcoin 0DTE's, NVDA?, PFE, SMCI, XBI, AMAT, TTWO, DOCS. My lean today is silighty bullish to neutral. After hitting ATH's it wouldn't surprise me if we took a pause today. Intra-day levels for me: /ES; 5373/5415/5488/5500 to the upside. 5302/5254/5213*(PoC on 2 hr. chart)/5188 to the downside. /NQ; 18796/18870/18960/19000 to the upside. 18604/18497/18446/18327 to the downside. Bitcoin; Yesterdays explosive move to the upside opened up the range. 74179 is resistance. 60739 support. We've got some work cut out for us today. Have a good, safe day folks!

0 Comments

Welcome back to CPI Wednesday! Todays blog will be short and sweet (I hope). Yesterday was another banner day for us. Scalping was well above expectations. We ended up bringing in $3,280 gross profit on the day. We'll also be expanding to five days a week starting today. It's been a cash machine for us this last year. Our 0DTE's performed flawlessly. Bitcoin = 9%. E.C. NDX = 12% NDX= 28% SPX= 17% ROI. All told I put approx. 17K of capital in and generated almost $3,400 of profit. This puts our week to date 0DTE profit at $6,469 dollars. Our goal this week is $10,000 of profit. Where we end up is any bodies guess but I think we are on a good path here. We also had a very nice, quick profit turn on another Theta fairy. We put this on right before PPI and were able to hit our take profit in less than an hour. We'll try the same setup today with CPI. Todays focus is the CPI report. That will drive the market today so no levels for me. Our trade docket today: CSCO, /NG, BA, CVS, DELL, GME, GRPN, MSTR, SPX/NDX/E.C. NDX/Bitcoin 0DTE, ORCL, XBI, WMT, DE, BIDU, JD. We'll be running our scalping feed with google meets today so check the scalping server for log in info.

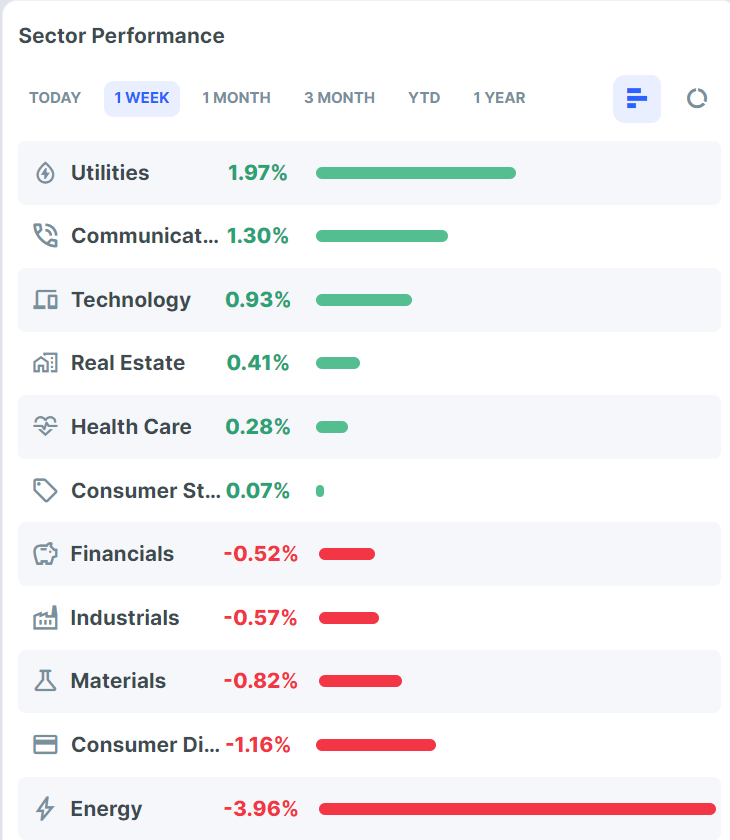

See you in the live trading room soon! Welcome back to "Trading Tuesday!" Yesterday was a nice start to the week for us. We had all four of our 0DTE setups hit for profit. Our $SPX trade was especially nice with a broken wing butterfly added in later in the day. That yielded a whopping 25% return. Our Bitcoin 0DTE was on point as well. All told, we brought in a profit of over $2,900 dollars on approx. 12k of capital outlay. We continue our consistent, plodding results and are honing in on our goal of over $200,000 profit before the end of June with all four 0DTE's combined. It would be an amazing accomplishment if we could finish the year with over $400,000 profit utilizing 15K-20K in capital. If you are interested in starting 0DTE trading or already trading but the setups you are using aren't yielding at least $1,000 a day of potential profit, I recommend you see how we approach things. Our record this year speaks for itself. You can jump in our live trading room for a full week for free. If you continue for the month,go through all the training and zoom sessions and don'f find this to be the highest value trading room you've seen, I'll give you double your first months subscription back! I said Monday morning we are setting a goal for $10,000 dollars of profit this week from our four 0DTE's. I also said to check back on Friday and see how we did. Who knows where we end up but we are off to a good start, up almost 3k on Monday. Today we'll be in our live scalping room. We use a unique set of indicators as well as a live order flow audible stream to trade price action. This program has been far and away, much more successful than we hoped or anticipated, so much so that we are working this week to expand it to five days a week. Our goal at the end of last year seemed a stretch. We wanted to generate $50,000+ of profit over 12 months, scalping twice a week with less than 5k of capital. Not only are we on track to beat that goal but we've only be using approx. $3,800 of capital to do it. Well..This Weds. we will attempt (I say attempt. There may be some hickups at first) to roll the program out to five days a week! Does this mean we are changing our goal to $100,000+ of profits on a rolling 12 month basis? Yes...yes it does! If you are either serious about your trading or, you're interested in becoming a full time trades but don't know how to make the leap to a potential six figure income, you owe it to yourself to see how we are accomplishing this. One day in the scalping room should be enough to get you hooked on scalping. One of the benefits of scalping is that it doesn't take a ton of capital to be able to generate six figure results. Capital is a challenge for all of us, myself included. None of us have enough of it. Prop trading is a great way to go. The prop firm gives you a series of tests to pass to verify that you won't blow yourself up. Once you pass you get access to up to $250,000 dollars of the firms capital to trade. You keep 90% of the profits and they take all the risk. This is something I recommend every trader do. It's a tremendous training. While I'm on the topic of tools to help you trade well, I keep getting inquires as to how we are trading Bitcoin 0DTE's. It is a separate trading platform but its absolutely free to sign up and you can get started trading with as little at $20 dollars so again, if you are serious about trading and want to see how average 9% returns daily on Bitcoin go here and sign up for free: Let's get into the markets for this Tuesday: Coming up from the Federal Reserve on Tuesday, 14 May 2024. Powell will be the focus: 1310 GMT / 0910 Federal Reserve Governor Lisa Cook speaks on growth and change at community development financial institutions at "Expanding Access to Capital for CDFIs," hosted by Federal Reserve Bank of New York 1400 GMT / 1000 US Eastern time Powell participates in a moderated discussion with De Nederlandsche Bank (DNB) President Klaas Knot (Knot is an ECB rate setter) at annual general meeting of the Foreign Bankers’ Association In addition to Powell speaking, we have PPI numbers out before the cash open. If you want to follow the PPI numbers release live, you can do so here: Markets put in another day where they looked tired. The squeeze is definitely on! On the support side we have the 50DMA. On the resistance side we have some hangover from the previous highs of the year. The markets getting pinched and that only lasts for so long. At some point, we'll break out. Trending markets tend to be easier to trade from a risk perspective vs. a consolidating one. Be on your toes for that break in price action. In terms of market breadth, the number of new highs vs. new lows is still impressive but, more and more individual stocks are slipping back below their 50DMA. As I mentioned, yesterday was a whole lot of nothing. Meme stocks are back! Look at the names of the two most searched tickers from yesterday. You should recognize them. We put a GME trade on yesterday and will see what we can do with AMC today. One ticker I'd keep an eye on is utilites. This is a "safe haven" sector that money flees to when risk-off is the move. It's been pumping lately. Our Trade docket for today: CVNA, /HE, BA, BABA, GRPN, HD, MSTR, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, SMCI, AMC, GME, BB and a new Theta Fairy prior to PPI release. No bias lean for me today with PPI and Powell being the main drivers. My intra-day levels will be from the daily charts today with only resistance/support. PPI will likely be the driver today. /ES; 5326 is resistance. 5115 is support and the PoC. /NQ; 18572 to the upside and 18102 to the downside. (this is 50DMA) Bitcoin; 66000 to the upside. 60656 to the downside. Let's hope we get some movement today we can capitalize on. Have a great day folks.

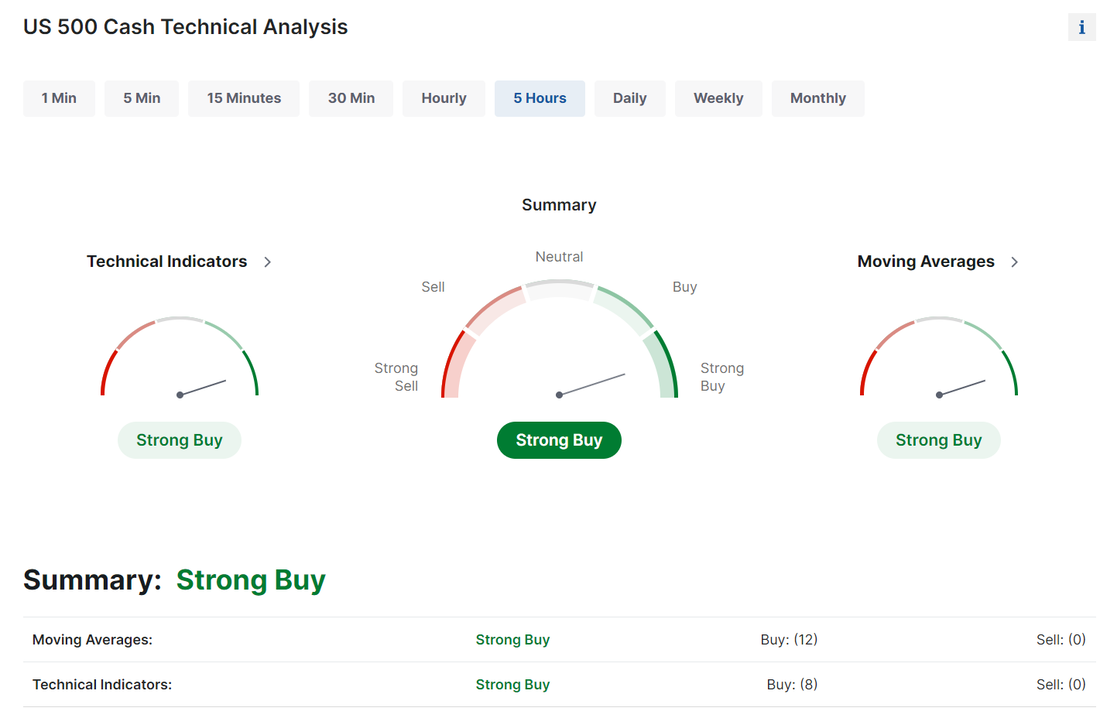

Welcome back traders. I hope everyone had a great weekend. Summer may have finally arrived here in Utah. Friday was a nice end to the week for us. We didn't have too many fires to put out and were able to get quite a few of our trades for the week to the finish line. My net liq ended up approx. $3,000 dollars. All four of our 0DTE's made money. Let's take a look at the markets. Technicals continue to show buying strength. The major indices took a pause on Friday. They are all holding their respective 50DMA and this is a key support area that needs to hold for bullish action to continue. At the same time, we are back to a pretty substantive resistance/consolidation zone. On the economic data front, the U.S. consumer inflation report for April will be the main highlight in the coming week. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. Core CPI, PPI, Core PPI, Retail Sales, NY Empire State Manufacturing Index, Business Inventories, Crude Oil Inventories, Building Permits (preliminary), Housing Starts, Export Price Index, Import Price Index, Initial Jobless Claims, Philadelphia Fed Manufacturing Index, Industrial Production, Manufacturing Production, and Leading Index. Meanwhile, Federal Reserve Chairman Jerome Powell is scheduled to participate in a moderated discussion with De Nederlandsche Bank President Klaas Knot at the Annual General Meeting of the Foreign Bankers’ Association on Tuesday. A host of other Fed officials will be making appearances throughout the week, including Mester, Jefferson, Cook, Kashkari, Bowman, Barr, Harker, Bostic, and Waller. The U.S. economic data slate is largely empty on Monday. Expected moves for this week are not too different from last week. Clocking the best performance of the major indexes, the SPY closed less than 1% from its all-time high and ended the week at $520.84 (+1.94%). The price found near-perfect support mid-week at the year-to-date Point of Control and even managed to flip back into ‘Strong Uptrend’ territory per the CHATS indicator. After finding support at the 50-SMA and the year-to-date Point of Control on the lowest volume day in more than a year, the QQQ closed the week strong at $442.06 (+1.57%). Notably, the CHATS indicator has yet to yield a ‘strong uptrend’ reading. The rotation out of small caps was clear this week, as the IWM lost its ‘outperformer’ status to close only slightly higher, at $204.31 (+1.21%). While the contrast in relative volume was not as apparent in this index as its counterparts, it did manage to find support at the 50-SMA. To give you some insight into one of our favorite setups, We love our "insider trade" setups. Here's one of our today. DIS. Dip buyer spotted buying right at support. Walt Disney Director & Former Morgan Stanley CEO James Gorman bought $2.1M in shares following a lackluster earnings report that sent the stock price down over -10%. Our trade docket for today: /MCL, /ZN, BA, CCL, DELL, DIA, SPX/NDX/Event contract NDX/Bitcoin 0DTE's SPY/QQQ 4DTE, NVDA, PFE, FSLR, WYNN, ORCL, IWM, CRM, PLTR, PYPL, SHOP, META, MSTR, SMCI, HD, BABA, DIS. My bias today is bullish, simply from the fact that "the trend is your friend...until it's not". Until we get to CPI and PPI data later this week I don't see any big catalysts to change our directional bias. Stay tuned for this Weds. I'm going to try to run a google meets scalping session in conjunction with our normal zoom. We've had a lot of desire to expand our scalping and this will be our first test to see how practical it is to go five days a week. Let's have a great week folks. My goal for our cummulative four 0DTE's this week is a cool $10,000 profit. We'll see on Friday how close we get. One quick side note. I've had a lot of inquires lately from individuals who want to trade but lack the funds to do so. Prop trading is the answer. Go through a training, pass an evaluation and get up to $250,000 of funds to trade futures with. You keep 90% of the profit and the prop fund takes all the risk. Even if you don't need funds, this is an amazing teaching lesson. I highly recommend it to all traders who want to seriously improve their trading skills. If you jump in, let me know and I can help you to maximize the opportunity. Intra-day levels: /ES; 5302/5375/5417/5489 to the upside. 5209/5189/5117/5077 to the downside. /NQ: 18,333/18,443/18,607/18704 to the upside. 18202/18113/18031/17932 to the downside. Bitcoin; 67585 is resistance. 58196 is support.  Welcome to the weekend and the supercross finale! Sorry. Yes, this is a trading blog! Yesterday was not an explosive day for us but everything just clicked again and we ended up solid at the close. Once again, scalping came in clutch. I was not excited at all about what we were going to get out of our 0DTE's. Volume is dead! Markets are stagnant. Earnings season is coming to a close. Everyones just waiting for next weeks economic reports when things should start picking up, volume wise. We did one scalp yesterday and in lasted 17 minutes. It yielded us $1,853 dollars of gross profit on $3,570 of buying power. We will be looking to expand our scalping program to five days a week (if I can figure out how to manage it and keep all the balls that I'm juggling in the air). If you are interested in becoming a full-time trader, scalping is an essential skill to master. Adding an extra $50,000 to $100,000 a year to your bottom line is not too bad either. After the dust settled my net liq was up $3,700 on the day. Scalping and our 0DTE's were the main contributors. We put on an inovative bullish zebra 0DTE with the SPX which ended up getting us $500 total profit on $2,000 of capital. All three of our other 0DTE's including bitcoin yielded profits as well. We don't have much on the economic news front today and its Friday. This is our designated day to: #1. Book any available profits. #2. De-risk the account. #3. Get as much buying power back as we can to be ready for next Monday when we start the process all over again. So, that being said, I'll make todays blog post short and cut right to the key points. Trade docket for today is pretty full but most of these should expire fully profitable on their own. We just need to monitor them: /ZN, AFRM, AKAM, CCL, CRM, DBX, DELL, FSLR, GLD, GRPN, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, NVDA, ORCL, PLTR, PYPL, SHOP, U, YELP. My lean today is neutral to slightly bullish. Not much to move the market one way or the other today. Intra-day levels for our 0DTE setups: /ES; 5299/5375/5417/5490 to the upside. 5235/5225/5188/5183 to the downside. /NQ; 18323/18439/18609/18704 to the upside. 18184/18126/18076/18024 to the downside. Bitcoin; 60645 support/66000 resistance. Have a great trading day folks. Let's finish strong today and cap off another solid week of profits.

Welcome back! We had a solid day yesterday. My net liq ended up $6,100 on the day. Most of our trades worked with very few of our open positions hurting us too much. An interesting development with our 0DTE's has started to take shape. Since the inception of the event contracts with NDX and Bitcoin we have found them to have better edge than the standard 0DTE setups. That's changed this week. I'm not sure why. I believe it's due to the consolidating markets in both the NDX and Bitcoin however, that last two days we have not been able to find great risk/reward setups using them. Our SPX 0DTE yesterday was a big hit with a 20% return and our NDX continues to carry most of the weight with a return over $3,400 on the day. We also had a nice start to the day with another unique setup on the Theta Fairy. It's all about the setups! We have EIGHT earnings trades that we put on yesterday that should all be in the profit zone this morning. We'll look to add six new ones today. We are back in the scalping room today. We've had a lot of success with scalping and are looking at ways we can expand it to five days a week. Lets take a look at the markets: Markets are largely continuing to consolidate back around the previous consolidation areas. They are all still holding above their respective 50DMA but its looking more and more tenuous. Take a look at the VTI. We are starting to get a divergence in the RSI. The Stoch is in overbought territory. MACD is flattening out and volume in dropping. PoC (Point of control) is quite a bit lower than our current level (purple line). It could act as a magnet to draw us down. Our trade docket for today looks busy but its largely a lot of profit taking from yesterdays earnings setups and adding the new ones in for today. /MCL, /ZN, ABNB, AFRM, AMC, ARM, BYND, CRM, DIA, GLD, HOOD, SPX/NDX/Event contract/Bitcoin 0DTE's, NVDA, RUN, XBI, GRPN, AKAM, BLNK, DBX, U, YELP. My bias for today is largely unchanged from yesterday. I'm mostly neutral to start the day. Unitl this consolidation zone clears. Be prepared for a potential big move as the market continues to coil. Looking at the heat map from yesterday you can see it was a largely mixed bag with not much directional bias. Intra-day levels for me: /ES; Tight ranges for today. 5209/5213/5223/5232 to the upside. 5200/5194/5182/5172 to the downside. /NQ; 18189/18211/18242/18208 to the upside. 18132/18104/18025/18000 to the downside. Bitcoin; Weakness continues with 65931 as substantive resistance. 60677 support with 59321 as secondary support. Good luck today folks. We have had so much success with our earnings trades and I don't see why today would be any different. As far as 0DTE's go? We'll have to see. I'm not sure how great the setups will be today. We'll do our best with scalping to try to take up any slack.

On a side note. I'm super grateful for those of you "good humans" who have expressed appreciation for my efforts and the content I put out. Let's all work together to be better traders and better humans. I appreciate you. Welcome back! Yesterday was one of those picture perfect days for us. I redeemed myself from the previous day of letting the NDX profit slip away. Everything clicked for us. Scalping was another blockbuster day. $1,190 gross profit. For most of the day it looked like it was going to be a big "nothing burger" for us. That happens with scalping. I use the analogy of fishing. Sometimes you catch a fish and sometimes you dont but, you NEVER catch anything if you don't put your line in. Since we switched to scalping the QQQ's vs. futures last year scalping has become much more consistent and you simply can't argue with the results. Scalping only twice a week with less than $5,000 of capital has us on pace for almost $55,000 of profits on a rolling 12 month basis. Lately we've talked about expanding the scalping program. It's obvioulsy working extremely well. A simple key to success in life is, "do more of what IS working and less of what is NOT". There are two ways we can expand. We could simply double the capital we are using...go from 5k to 10K. That would put us on pace for over $100,000 a year of potential cash flow. This is an option and, of course, you as an individual would still have the option of scaling to a lower amount if that capital commitment is too large. The other option is to expand scalping to five days a week vs. just two. There are some technical challenges with this as well as the simple time contraints put on me as I'm just one individual. We'll keep working on this but expect some big things with scalping soon! If you'd like to join us and are interseted in one of the most consistent ways to potentially make $500-$1,000 a day in profits come check it out. As far as the rest of our trades, my net liq was up $8,452 dollars yesterday. To say our 0DTE trades are working is an understatement. We traded all four of our standard setups yesterday with the NDX, once again, pouring on the profits. We are slowly, consistently, methodically marching our way to $200,000 dollars of profit YTD on our cumulative efforts with 0DTE trading. The event contracts and the edition of Bitcoin have helped but it's the NDX that's doing most of the work. This is all being done with approx. $15,000 to $20,000 of capital deployed daily. I'm sure if you searched, there is someone, somewhere doing better than us but I have to say, I'm incredibly satisfied with our results. If you'd like to see us generate these results for free you can jump in for a week and watch. Lets take a quick look at the markets: The good news, if you're a bull is that all our major indices have successfully cleared their respective 50DMA resistance levels. The bad news is that puts us right back into a big consolidation zone. We are still clinging to a buy rating but it wouldn't take much of a drawdown to give that right back. Trade docket for today is all about more earnings plays. We have five earnings plays from yesterday that all look like profits for us today. New trades for today: ARM, ABNB, HOOD, AFRM, RUN, BYND, WISH, AMC are all new earnings plays. IWM, LYFT, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, PLTR, RIVN, SHOP, TOST, TWLO, XBI. My lean today is slightly bearish. I think this consolidation zone holds the bulls at bay for a bit. Intra-day levels for me: /ES; 5208/5219/5226/5232 to the upside. 5195/5189/5176/5163 to the downside. /NQ; 18150/18174/18199/18248 to the upside. 18070/18047/18024/17982 to the downside. Bitcoin: We've got about a 5,000 point range. 66,008 resistence. 60673 support. Lets make it a great day! I think we've got a nice setup for 0DTE's today. Now its on us to make it happen!

Good morning traders! As I mentioned yesterday, our finish to last weeks trading was fantastic. That's great but it also returns a bunch of our capital to us. We re-deployed a lot of it yesterday. 28 total trades! Things should calm down for us today. Trade docket for today: /NG, CVS,DIA, DIS, DJT, IWM, LITE, META/TSLA pairs trade, SPX/NDX/Event contract NDX/Bitcoin 0DTE's., NVDA, PFE, SPY/QQQ 4DTE, WOOF and four potential earnings plays on RIVN, LYFT, TWLO, TOST. Let's take a look at the markets: All the major indices we trade reclaimed their respective 50DMA. This was a big step for the bulls however, its now placed all the markets right back into a major consolidation zone. I don't expect much out of the market today and am starting the day with a neutral stance. Optimism that the Federal Reserve will begin cutting interest rates this year, combined with a string of positive results, drove stocks and bonds higher this morning. Oil erased gains from yesterday following reports yesterday that indicated the potential for progress on ceasefire talks between Israel and Hamas. The Australian dollar underperformed following the RBA rate decision last night, where rates were left unchanged, as expected, repeating that nothing is ruled in or out in terms of future moves. Docket 12:00 ET (Tentative) The EIA releases the latest Short-Term Energy Outlook report. 13:00 ET US sells $58 bln 3-Year Notes 15:00 ET US Consumer Credit for March Median Forecast: 15B | Prior: 14.12B | Range: 20B / 5B Speakers 09:00 ET ECB’s de Cos speaks at the BIS Summit Watch Here 10:00 ET ECB’s Nagel speaks at a panel discussion titled “Empowering the Single Market – Opportunities and challenges” Event Details Here 11:30 ET Fed’s Kashkari participates in a fireside chat at the Milken Institute Global Conference. No indication of whether a text will be released, but a Q&A is expected. Watch Here ECB’s Nagel gives speach in Oestrich-Winkel at the Joint Spring Conference 2024 – Structural Changes and the Implications for Inflation Register Here Intra-day levels for me: /ES; 5213/5242/5252/5283 to the upside. 5171/5155/5146/5103 to the downside. /NQ; 18209/18327/18443/18608 to the upside. 18145/18108/18057/18025 to the downside. Bitcoin; No levels or planned Bitcoin trade today unless we get movement. Yesterday we had a successful Etherium 0DTE to replace the BTC trade. Neither one of them look to have very good risk/reward ratios for today.

Welcome back to a new trading week! I hope you all had a great weekend. Our last Friday was a wonderful finish to our week. My net liq was up over $9,000 on the day and topped an up and down week that saw a nice final result. All four of our 0DTE's contributed. BTC was 3% ROI. NDX Event contract was 9% ROI. NDX was 50% and SPX was 25% ROI. All told we had 18k of capital generating $8,300 of profit. Just as important, we had a good percentage of our weekly trades expire fully profitable so today will be a busy one, putting our capital back to work. Our trade docket for today: /HE, /HG, /MCL, /ZN, BA, CCL, DIA, GLD, IWM, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, NVDA, WYNN, XBI, ORCL, FSLR, CRM, PYPL, SHOP, PLTR, SPY/QQQ 4DTE, DIS, VRTX, LITE Let's take a look at the markets going into the new week. The technicals are working on firming up the bullish bias. All the major indices we track and trade are trying to break above their respective 50DMA with the exception of the IWM which was able to breach it on Friday. Today will be a critical day. Futures are up as I type. If the indices can pierce that 50DMA and finish above it, that would really pour some fuel on the bullish bandwagon. Lets look at the expected moves this week: Expected moves and respective I.V. is not great...it's not horrible. We may not be getting the premiums this week like last but it's still enough to find some good risk/reward setups. Looking at the heat map from last week, it's the energy sector and financials that are lagging. Most of the market internals look strong. Again, the 50DMA is key. If that can get shored up the bulls will have complete control. My intra-day levels for our 0DTE setups: /ES; 5175/5183/5187*(200 period moving avg. on 4 hr. chart)/5208 to the upside. 5161/5148/5126/5108 to the downside. /NQ; 18068/18272*(PoC on 4 hr. chart)/18345/18457 to the upside. 17984/17903/17807/17649 to the downside. Bitcoin; 65,800 is nearest resistance. 60538 nearest support. Next level of resistance is 67952. Next level of suppor is 57429. My lean today is bullish: With a light US economic calendar this week, the market’s direction might come from central bank officials, as well as policy summits in the United Kingdom, Australia, and Sweden.

Docket 11:30 ET US sells $70 bln 6-Month Bills US sells $70 bln 3-Month Bills Speakers 08:25 ET SNBs Chairman Jordan speaks at BIS Innovation Summit 2024 12:50 ET Fed’s Barkin delivers a speech on the economic outlook in Columbia, SC followed by audience questions. A separate media Q&A will follow. Text and Q&A are expected. No live stream is available 13:00 ET Fed’s Williams participates in fireside chat conversation at the Milken Institute Global Conference. No text expected, but there will be a Q&A Have a great week folks! Welcome to Friday! Yesterday was a really solid day for us. My net liq was up $7,000. We only got three 0DTE's on, skipping the event contract NDX as the risk/reward wasn't great. Our Bitcoin 0DTE was perfect with 8% ROI. SPX was o.k. with 2.5% and NDX was about 12% ROI. All told we deployed $15,700 of capital for a $1,330 of profit. Our efforts in the scalping room were successful, once again. $1,346 of profit keeps us right on track for a $50,000+ year with that one strategy. Our NVDA position has been sneaky good too. It's helped our net liq by approx. 3k a week for the last three weeks. Combine all that with our earnings trades and weekly setups and its been another good week. Lets take a look at the markets: We are building a tightly wound consolidation zone here. The indices look poised for a big "uncoiling". Whether that's up or down remains to be seen. We are back to a buy signal with the futures pushing up overnight. We've got NFP out this morning. It's usually a big mover. 08:30 ET US Nonfarm Payrolls for April Median Forecast: 240k | Prior: 303k | Range: 280k / 150k US Unemployment Rate for April Median Forecast: 3.8% | Prior: 3.8% | Range: 3.9% / 3.7% US Average Earnings YoY for April Median Forecast: 4% | Prior: 4.1% | Range: 4.2% / 4% 09:45 ET US S&P Services PMI Final for April Median Forecast: 51 | Prior: 50.9 | Range: 51.1 / 50.9 10:00 ET US ISM Services PMI for April Median Forecast: 52 | Prior: 51.4 | Range: 53.5 / 50.5 My lean today is bullish. Our trade docket for today: /HG, AAPL, BA, COIN, CRM, DELL, DIA, GOOG, MSTR, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, ORCL, PFE, SMCI, XBI. Our focus on Fridays is three fold. #1. De-risk the portfolio. #2. Book available profits. #3. Build buying power back for next weeks deployment. I will skip levels for today as NFP can be as big a mover as Powell speaking and the Algo's will dictate movement. We will stay flexible and focus on our three fold purpose for Fridays. Assuming we get some good results with our 0DTE's today it will conclude another good week. Congrats on your results. Have a great weekend all!

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |