|

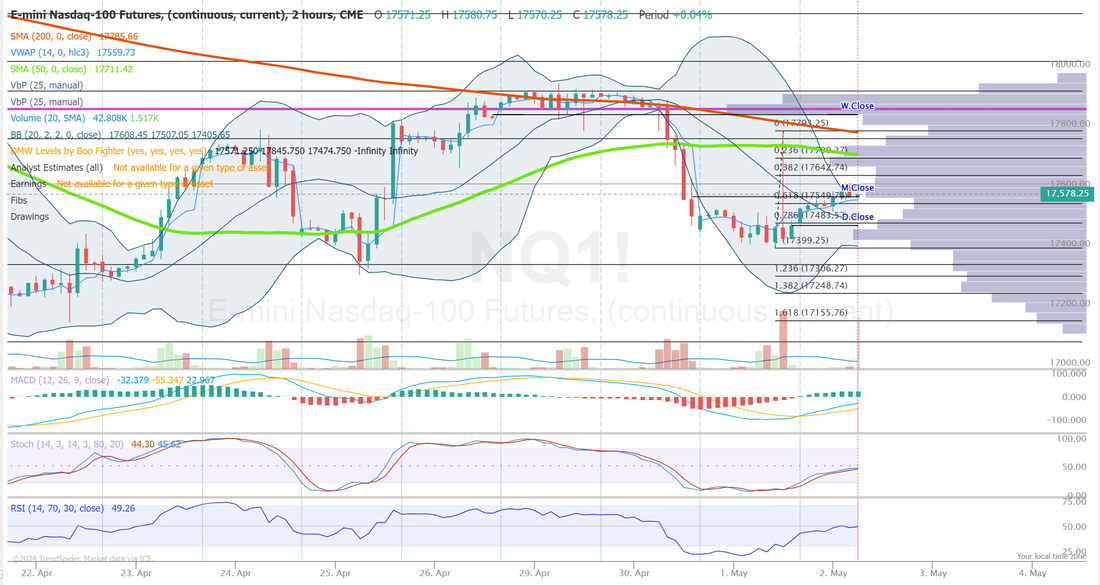

What a day yesterday! FOMC rarely disappoints when it comes to movement. One of the most difficult traits for a trader to develop is patience, discipline and the skill set of "sitting on your hands". We try to exercise all of those every day but especially on FOMC type days. Our day was made slightly more challenging in that we were starting the day with two rolled 0DTE positions. One in NDX and one in SPX. With some nice overlays we were able to bring both into a nice profit on the day. Our DASH and CVNA earnings trades also look set for some nice take profits at the open this morning. We'll have two more earnings setups today with AAPL and COIN. The biggest pain in my side right now is my SBUX position. It's really gotten beat up after earnings. I may be delusional but if you take a bigger view of 10 yr. earnings it still seems like its headed in the right direction but regardless, I'll need to pick up the cash flow component if this trade is going to make it into the green. ~33% of all S&P 500 stock trades are now executed in the last 10 minutes of the trading session. This is up from ~27% in 2021 and has been steadily increasing over the last few months. The entire trading session lasts for 390 minutes, but ONE THIRD of all trades are done in the last 10. Interestingly, assets of passive equity funds such as ETFs have risen to nearly $12 trillion in the US, according to Bloomberg. These funds usually execute their trades near the end of a trading session. This explains the significant spike in volatility at the end of the day. Futures look to rebound this morning, post FOMC but the technicals are still bearish Indices are at key levels today. This can either be a launching pad for higher movement or the cliff that we fall off of. Our trade docket for today: SMCI, /MCL, /ZN, BA, CVNA, CVS, DASH, DIA, GLD, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, ORCL?, XBI, AAPL and COIN. My lean today is neutral, even with futures up as I type. Intra-day levels for me: /ES; 5092/5105*(PoC. Could be an interesting butterfly level)/5115/5127 to the upside. 5071/5056/5046/5037 to the downside. /NQ: 17640/17701/17713/17793 to the upside. 17552/17483/17402/17345 to the downside. Bitcoin; 66134 is the first major resistance and 52116 is the next major support. Good luck and good trading folks!

0 Comments

Welcome to May! Welcome to FOMC day. Yesterday was a bust for me. Only one of the four 0DTE's worked and that was our Bitcoin setup which simply didn't have enough capital in it to move the needle. Fortunately scalping yielded some great results but still, not enough to get my account into the green. We'll try again today. Our full focus today is news driven. Stocks slumped on mixed earnings and rekindled concerns about US interest rate hikes for the foreseeable future, with all eyes on the Federal Reserve’s policy announcement later Wednesday. Brent crude fell for a third day. The risk-off sentiment remained, with S&P 500 futures pointing to more losses on Wall Street after US data on Tuesday reinforced betting that policymakers will hold interest rates at a two-decade high. Europe’s Stoxx 600 index moved down in holiday-shortened trade. The dollar index was barely altered, while the policy-sensitive two-year Treasury yield remained at a six-month high. The last time Fed Chair Jerome Powell spoke, he noted the lack of progress in lowering inflation. The most recent indications on prices and the economy, together with expectations for a strong jobs data on Friday, indicate that the prospects of a change in tune are minimal. We have PMI, JOLTS jobs openings, Crude oil inventory and FOMC release with Powells testimony to follow. These are what will drive the price action today. I generally don't look at levels on days like this because it will, ultimately be an Algo driven day. We generally sit on our hands for most of the day, waiting to pounce after Powell finishes speaking. Tenative trade docket for today: SMCI, AMD, AMZN, CVS, FSLR, IWM, MSTR, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, ORCL, PFE, PLTR, RIOT, SBUX, SOFI, WYNN. Overhang for the markets right now looks to be the 50DMA. (Yellow line) Here's the complete schedule for the day: Docket 08:15 ET US ADP Employment Change for April Median Forecast: 180k | Prior: 184k | Range: 220k / 120k 08:30 ET US Treasury Quarterly Refunding Announcement 09:45 ET US S&P Manufacturing PMI Final for April Median Forecast: 49.9 | Prior: 49.9 | Range: 50.3 / 48.9 10:00 ET US ISM Manufacturing PMI for April Median Forecast: 50 | Prior: 50.3 | Range: 51.5 / 48.5 US JOLTS Job Openings for March Median Forecast: 8.69M | Prior: 8.756M | Range: 8.836M / 8.474M 10:30 ET Weekly EIA Crude Oil Inventories for the week of April 26th Median Forecast: -2.5M | Prior: -6.368M | Range: 1.5M / -4.572M 14:00 ET US Interest Rate Decision Median Forecast is for no change at 5.5%. FOMC Rate Statement Speakers 13:30 ET ECB’s de Cos gives speech on monetary policy and inflation in London. 14:30 ET FOMC Post Meeting Press Conference with Chair Powell Video will be available here 16:10 ET RBNZ News Conference following the Financial Stability report released last night. 16:15 ET BoC’s Gov. Macklem & Senior Dep. Gov. Rogers speak to the Senate Banking Committee on banking, commerce and the economy. If you would like to follow Powell's speech you can do so here: See you all in the trading room shortly!

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |