|

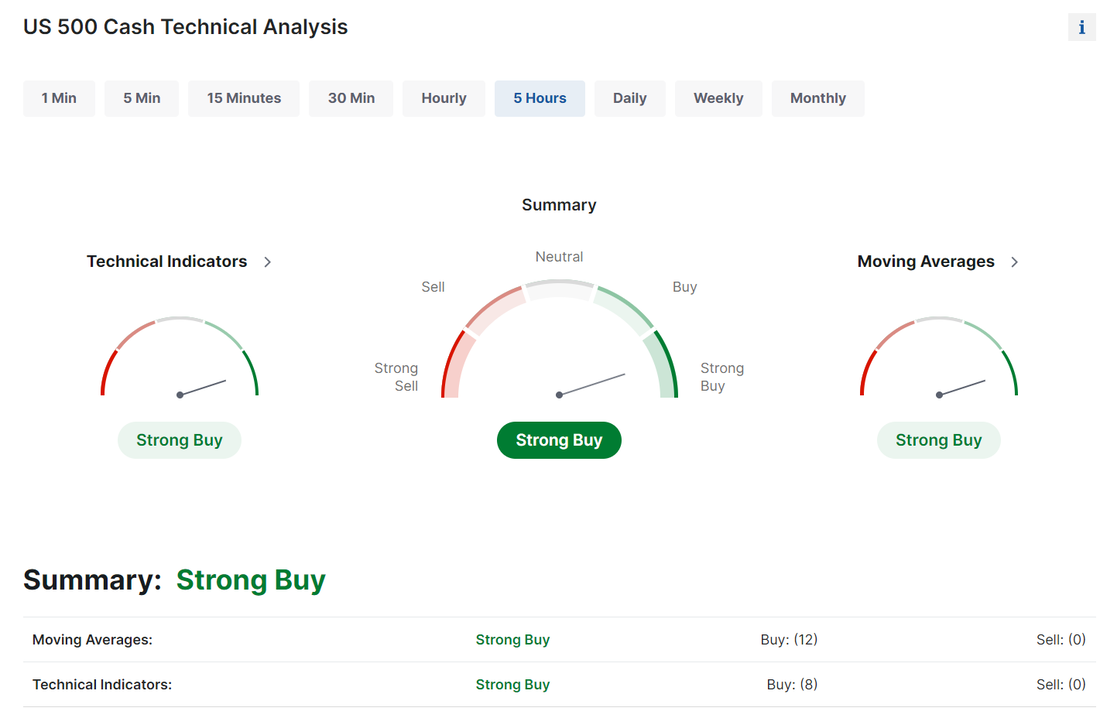

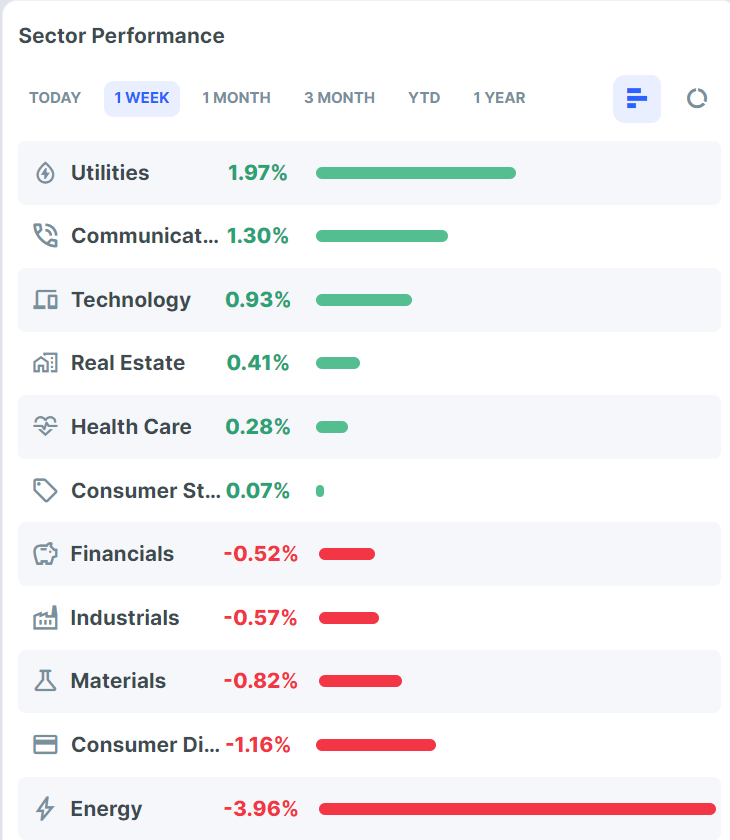

Welcome back to a new trading week! I hope you all had a great weekend. Our last Friday was a wonderful finish to our week. My net liq was up over $9,000 on the day and topped an up and down week that saw a nice final result. All four of our 0DTE's contributed. BTC was 3% ROI. NDX Event contract was 9% ROI. NDX was 50% and SPX was 25% ROI. All told we had 18k of capital generating $8,300 of profit. Just as important, we had a good percentage of our weekly trades expire fully profitable so today will be a busy one, putting our capital back to work. Our trade docket for today: /HE, /HG, /MCL, /ZN, BA, CCL, DIA, GLD, IWM, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, NVDA, WYNN, XBI, ORCL, FSLR, CRM, PYPL, SHOP, PLTR, SPY/QQQ 4DTE, DIS, VRTX, LITE Let's take a look at the markets going into the new week. The technicals are working on firming up the bullish bias. All the major indices we track and trade are trying to break above their respective 50DMA with the exception of the IWM which was able to breach it on Friday. Today will be a critical day. Futures are up as I type. If the indices can pierce that 50DMA and finish above it, that would really pour some fuel on the bullish bandwagon. Lets look at the expected moves this week: Expected moves and respective I.V. is not great...it's not horrible. We may not be getting the premiums this week like last but it's still enough to find some good risk/reward setups. Looking at the heat map from last week, it's the energy sector and financials that are lagging. Most of the market internals look strong. Again, the 50DMA is key. If that can get shored up the bulls will have complete control. My intra-day levels for our 0DTE setups: /ES; 5175/5183/5187*(200 period moving avg. on 4 hr. chart)/5208 to the upside. 5161/5148/5126/5108 to the downside. /NQ; 18068/18272*(PoC on 4 hr. chart)/18345/18457 to the upside. 17984/17903/17807/17649 to the downside. Bitcoin; 65,800 is nearest resistance. 60538 nearest support. Next level of resistance is 67952. Next level of suppor is 57429. My lean today is bullish: With a light US economic calendar this week, the market’s direction might come from central bank officials, as well as policy summits in the United Kingdom, Australia, and Sweden.

Docket 11:30 ET US sells $70 bln 6-Month Bills US sells $70 bln 3-Month Bills Speakers 08:25 ET SNBs Chairman Jordan speaks at BIS Innovation Summit 2024 12:50 ET Fed’s Barkin delivers a speech on the economic outlook in Columbia, SC followed by audience questions. A separate media Q&A will follow. Text and Q&A are expected. No live stream is available 13:00 ET Fed’s Williams participates in fireside chat conversation at the Milken Institute Global Conference. No text expected, but there will be a Q&A Have a great week folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |