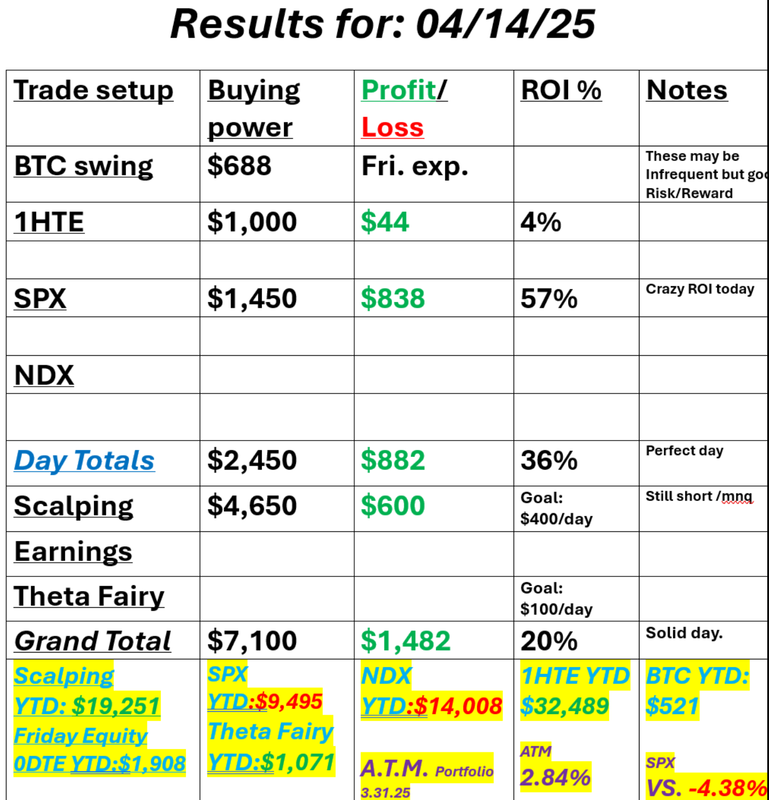

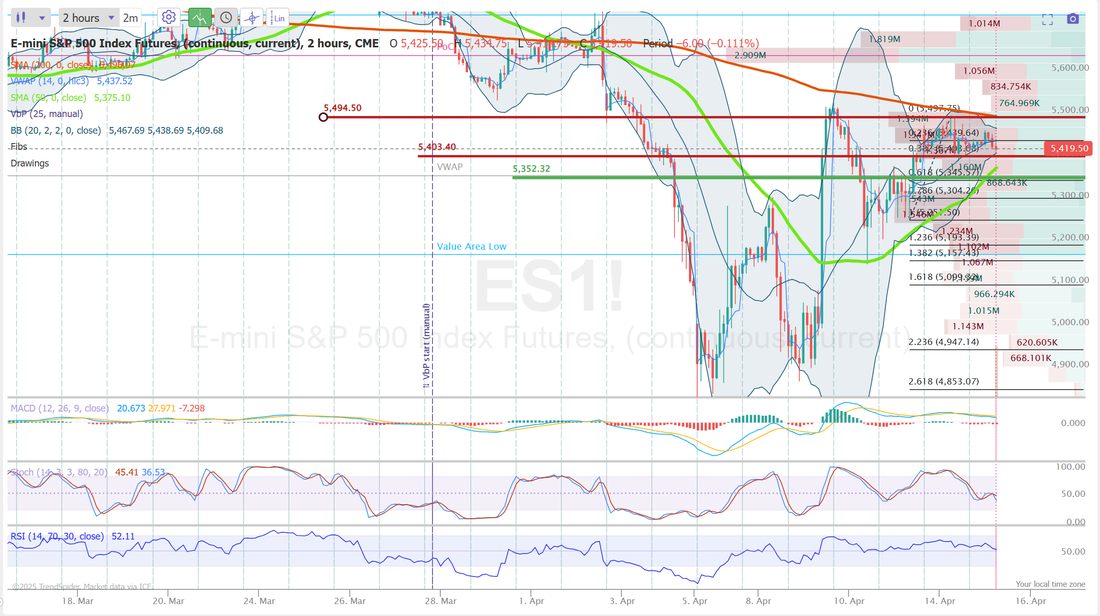

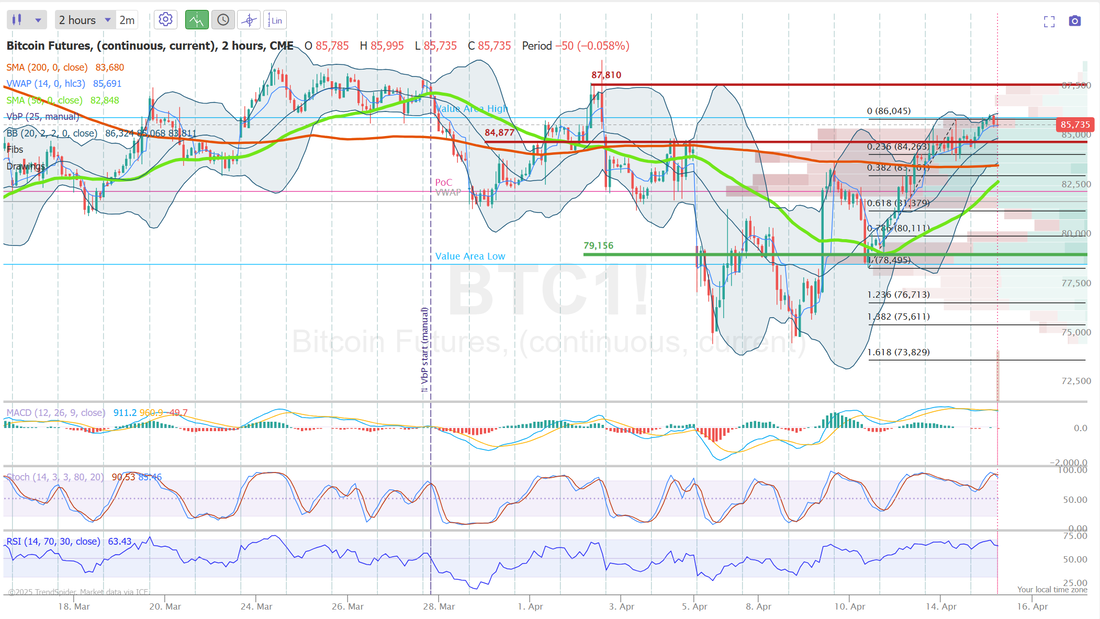

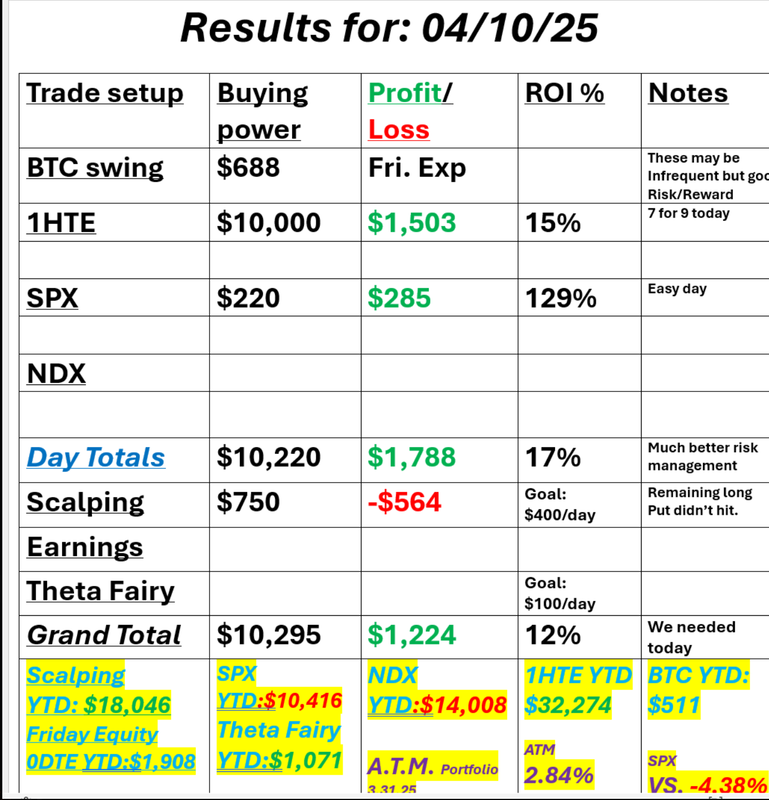

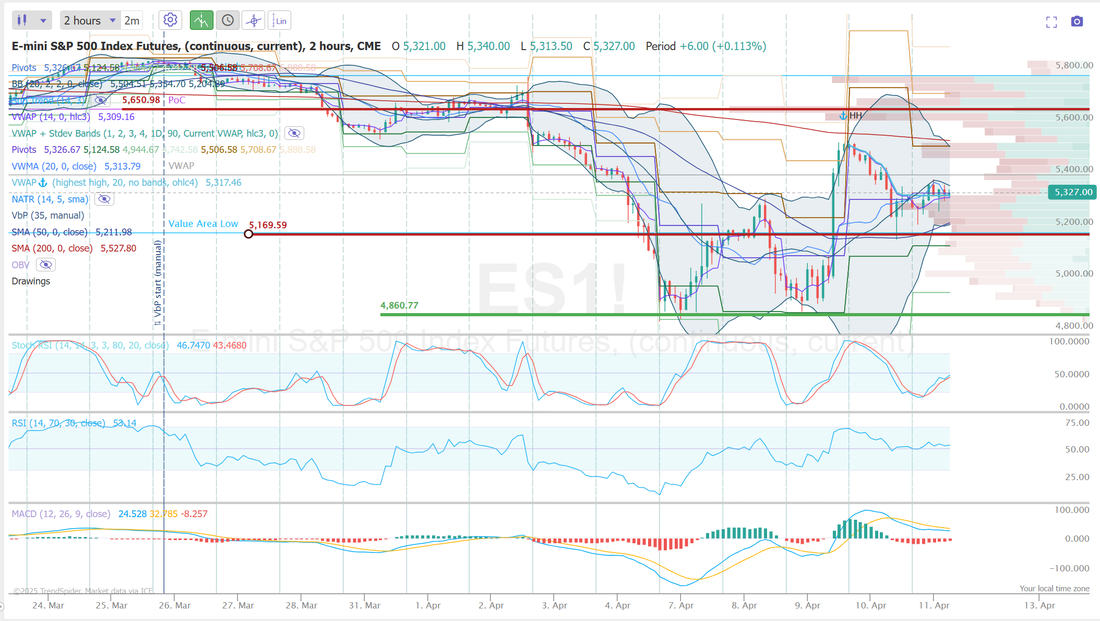

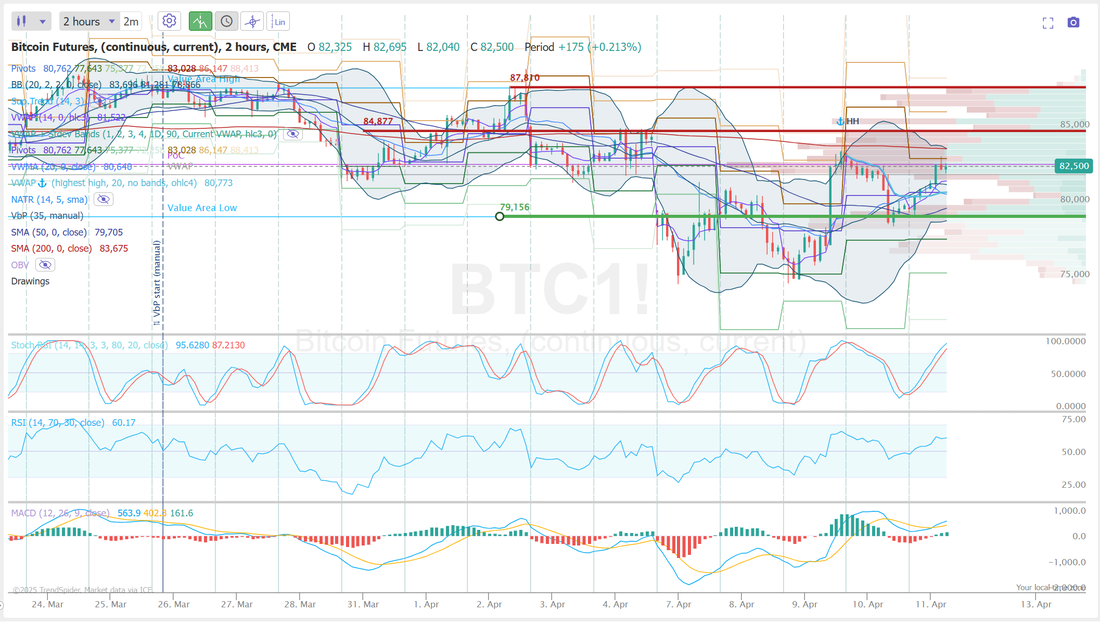

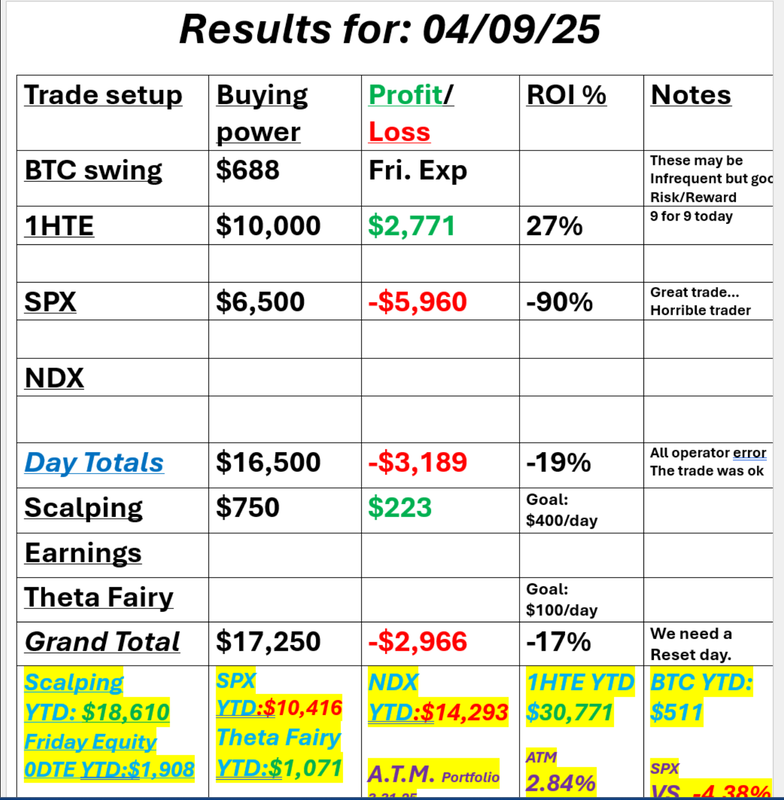

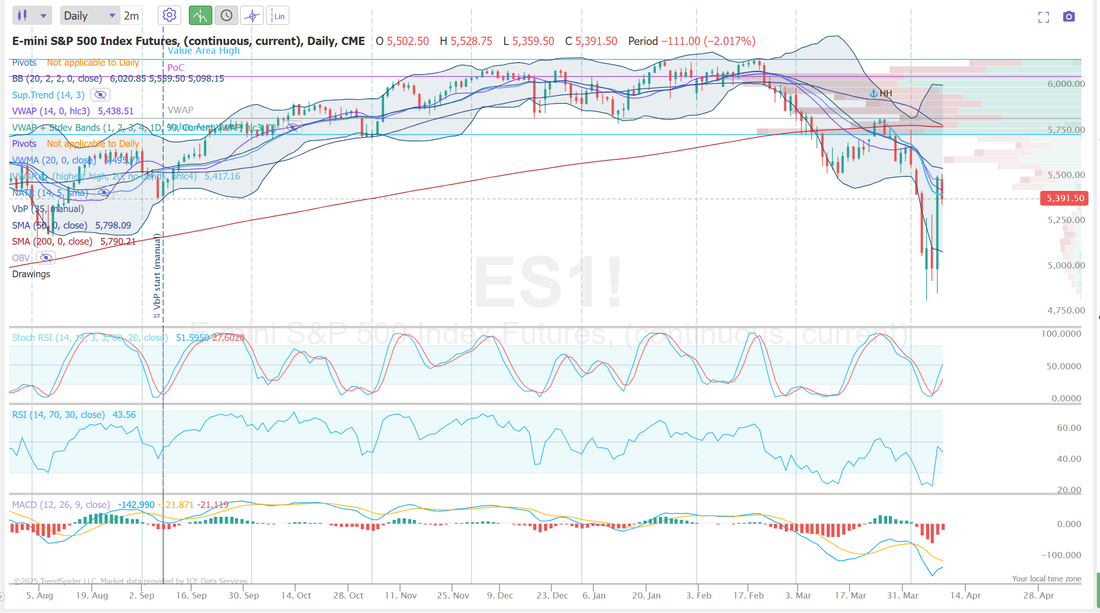

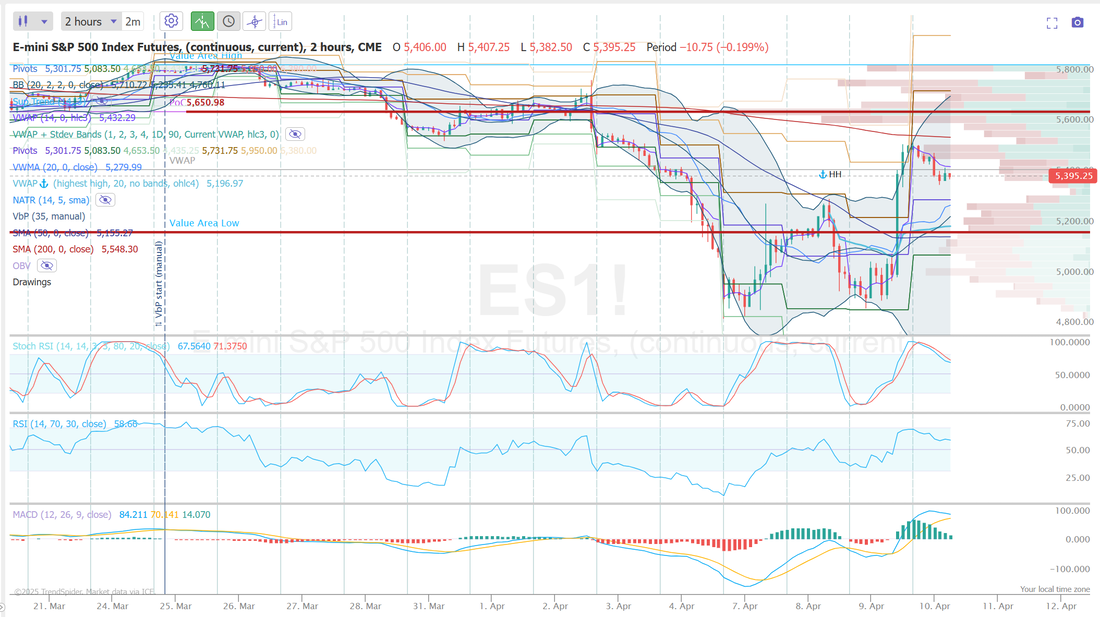

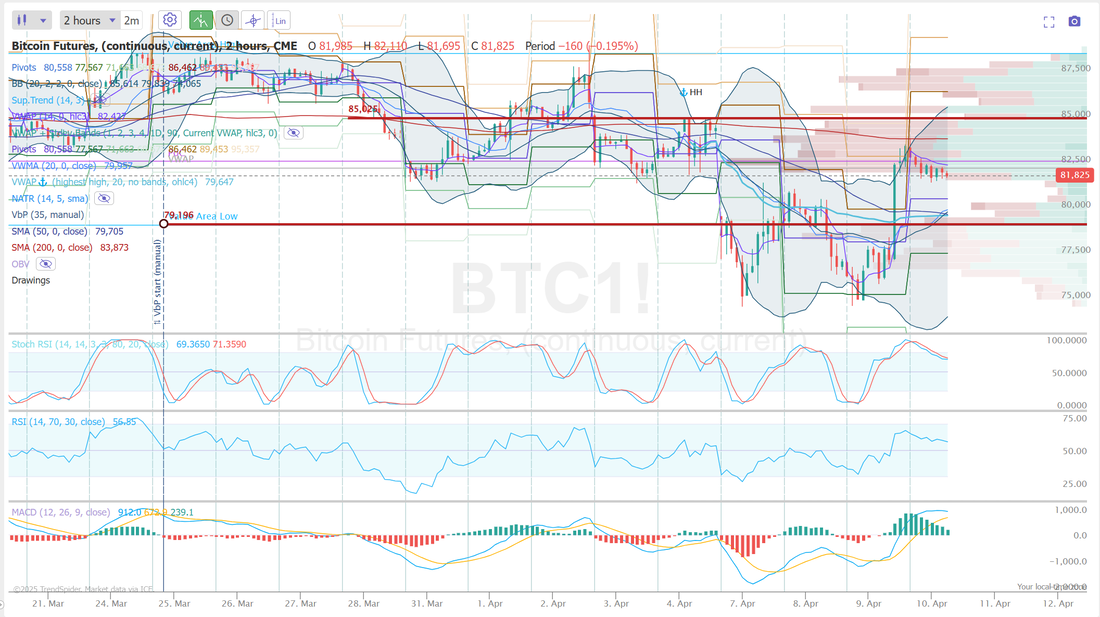

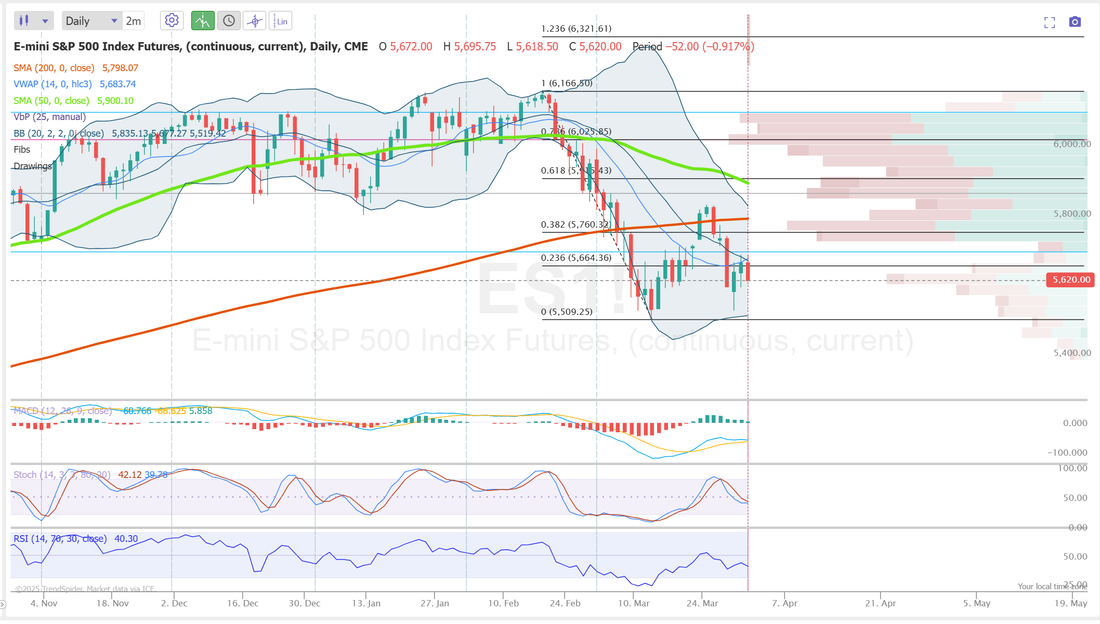

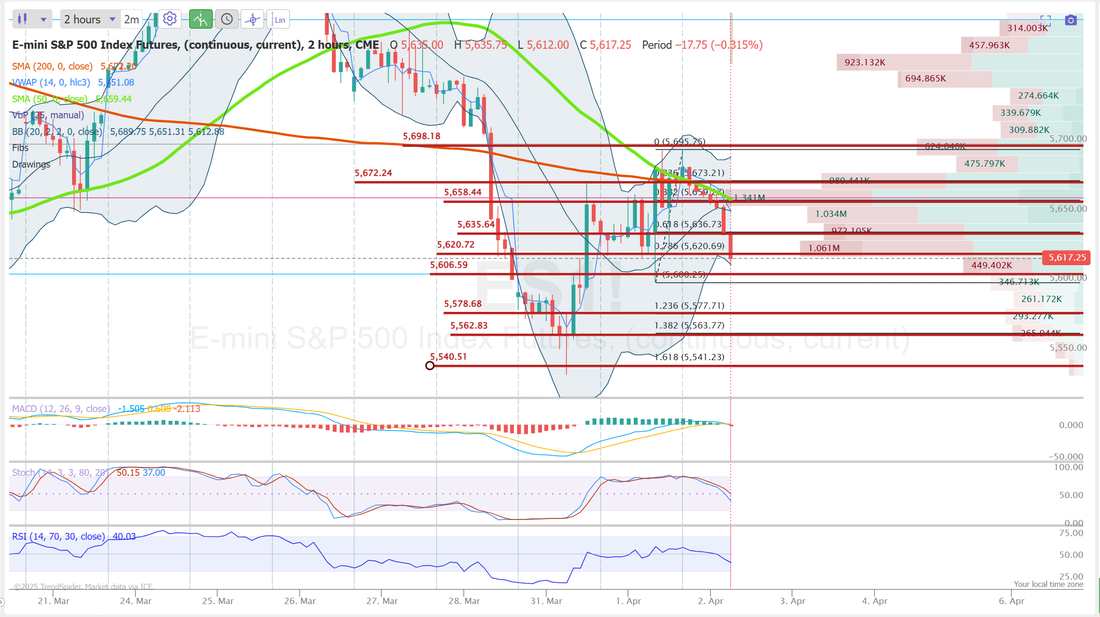

Has calm returned?It may be a bit early to call it. I.V. is still elevated and 5min. candles are still looking pretty big on our daily charts but yesterday seemed about as "normal" a day as we've had in a while. If you want unique results you'll need unique setups. They don't work all the time...nothing does but I do pride myself on the setups we use. Our daily combination of scalping setups with 1HTE's and our approach to 0DTE IS UNIQUE. When it works it's a thing of beauty. Yesterday was beautiful. Our 0DTE consisted of a bearish debit spread. A bullish debit spread. An Iron Condor. A broken wing butterfly and an Iron Fly. All this and we only used $1,450 dollar of capital for $835 of profit. See our results below: $1,000 a day profit is absolutely possible. Lot's of traders do it but I don't think we've ever had this type of gain on this small of capital allocation. It was a really gratifying day. We have now adding working an long Iron fly into our setup near the close and I'm hopeful it will continue to pay off as it did for us yesterday. Let's take a look at the markets: Yesterdays push up flipped the tecnicals to positive. Will it hold? Too early to tell but I'm thinking we have a good chance to give some of yesterdays gains back today. This last week really saved the indices however, it just brings us back to a previous consolidation zone. Let's be clear. The overall trend is still down. June S&P 500 E-Mini futures (ESM25) are up +0.05%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.14% this morning, pointing to a muted open on Wall Street, while investors await U.S. economic data, quarterly reports from more big banks, and remarks from Federal Reserve officials. Stock index futures initially posted solid gains amid hopes for more U.S. tariff exemptions after President Donald Trump floated a possible pause in auto tariffs. President Trump stated on Monday that he is considering possible temporary exemptions for his tariffs on imported vehicles and parts to provide auto companies additional time to set up U.S. manufacturing. “I’m looking at something to help car companies with it. They’re switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time, because they’re going to make them here,” Trump told reporters in the Oval Office. At the same time, the U.S. moved ahead with plans to impose tariffs on semiconductor and pharmaceutical imports by launching trade investigations led by the Commerce Department. In yesterday’s trading session, Wall Street’s major indexes closed in the green. Apple (AAPL) rose over +2% following a U.S. tariff exemption for a range of consumer electronics. Also, automobile stocks gained ground after President Trump said he was “looking at something to help some of the car companies,” with Ford (F) climbing more than +4% and General Motors (GM) rising over +3%. In addition, Palantir Technologies (PLTR) advanced more than +4% after NATO acquired an AI-powered military system from the company. On the bearish side, DaVita (DVA) slid about -3% after disclosing a ransomware incident that encrypted certain parts of its network. “The worst may be over, but the coast is not clear. The 90-day pause on reciprocal tariffs and further concessions over the weekend lessen the near-term probability of a recession, but uncertainty remains high, the Fed is on hold, and back-end rates are a headwind,” said Michael Wilson at Morgan Stanley. Fed Governor Christopher Waller stated on Monday that he anticipates the impact of tariffs on inflation to be temporary. Still, Waller described the new tariff policy as “one of the biggest shocks to affect the U.S. economy in many decades.” Should there be a minor tariff impact on prices, rate cuts would “very much” be considered for the latter half of 2025, he said. Meanwhile, U.S. rate futures have priced in an 81.0% chance of no rate change and a 19.0% chance of a 25 basis point rate cut at May’s monetary policy meeting. First-quarter corporate earnings season is gathering pace, with investors awaiting reports today from major U.S. banks such as Bank of America (BAC) and Citigroup (C) as well as prominent companies like Johnson & Johnson (JNJ), Interactive Brokers (IBKR), and United Airlines Holdings (UAL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on U.S. Export and Import Price Indexes, set to be released in a couple of hours. Economists anticipate the export price index to be +0.1% m/m and the import price index to be +0.1% m/m in March, compared to the previous figures of +0.1% m/m and +0.4% m/m, respectively. The Empire State Manufacturing Index will also be reported today. Economists foresee this figure coming in at -12.80 in April, compared to -20.00 in March. In addition, market participants will be anticipating speeches from Richmond Fed President Tom Barkin and Fed Governor Lisa Cook. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.360%, down -0.09%. My bia or lean today is bearish. I've been thinking back to the crash of 2008. There were so many, "rip your face off" short covering rallies during that downturn. This last week has be great for the bulls but the big picture is still down. I continue to hold my short /MNQ futures postion and cash flow it daily. Same as yesterday. Scalping could yield us a home run today if we can get the cover on at the right time of day. 1HTE's look good today. We already have one working. 0DTE on SPX. We'll work our magic with our multi step process again today. Let's take a look at the intra-day levels: /ES: I don't see us getting above resistance today which is 5498. Support is 5403 with 5352 below that. BTC: Bitcoin gave us only one setup yesterday. It was a nice one but not much return. Today is looking better. We've already got one 1HTE working with a nice 10% ROI potential. Let's see how many we can get today. 87,810 is resistance with 84,877 working as support. It should be an interesting day. The premium is there to have a blow out day with scalping. Likewise with our SPX. In other words, the market looks like it's offering itself up on a platter for us today. Now it's up to us to get our entries and exits right. See you all in the live trading room shortly.

0 Comments

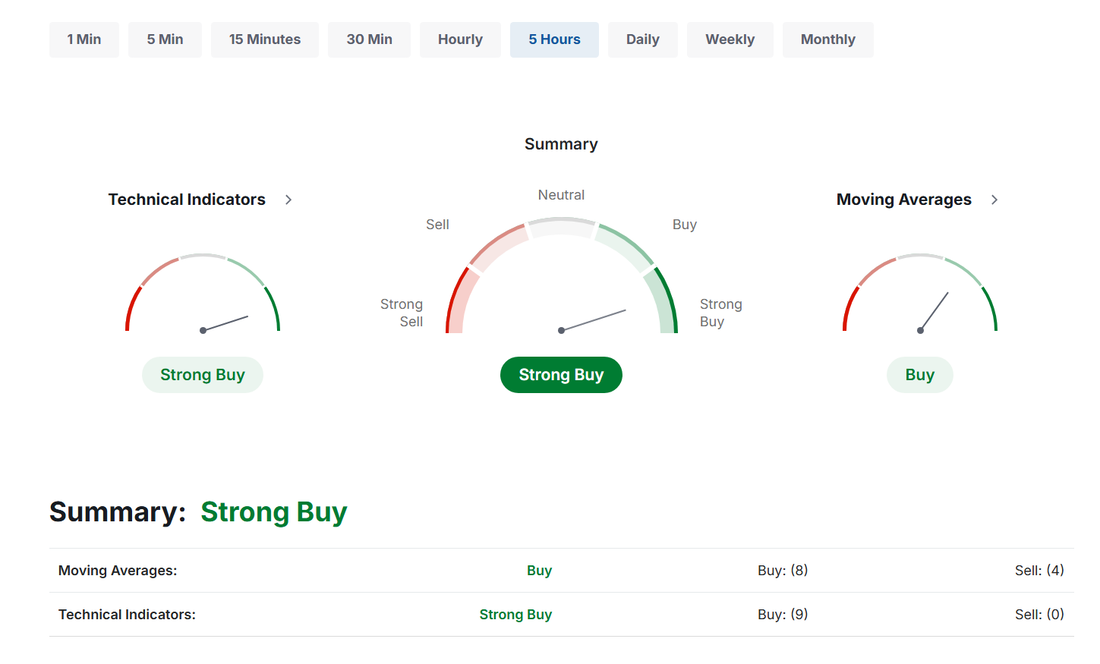

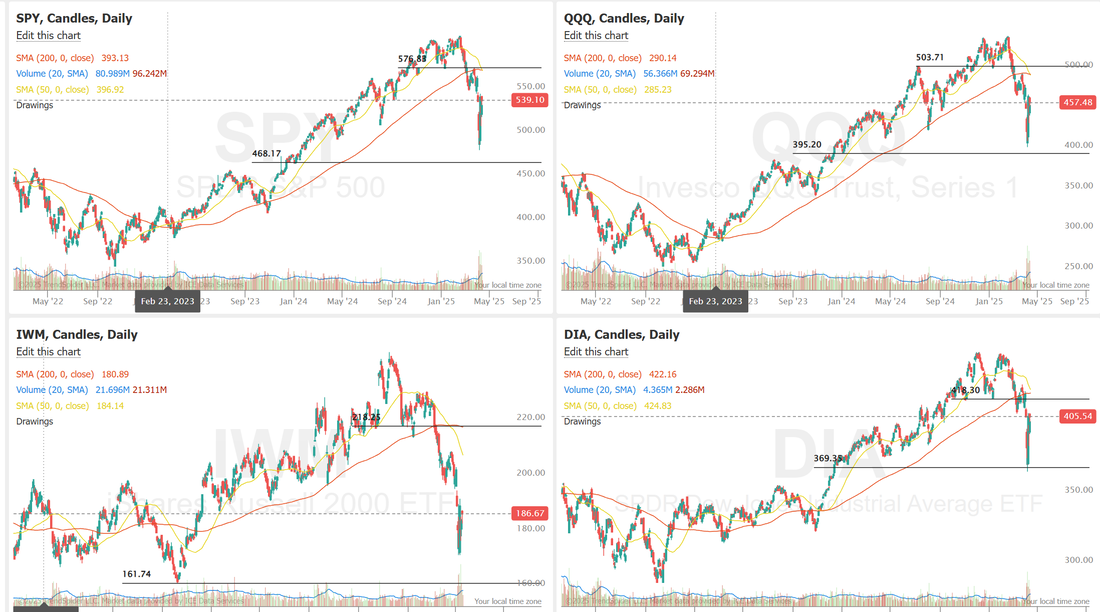

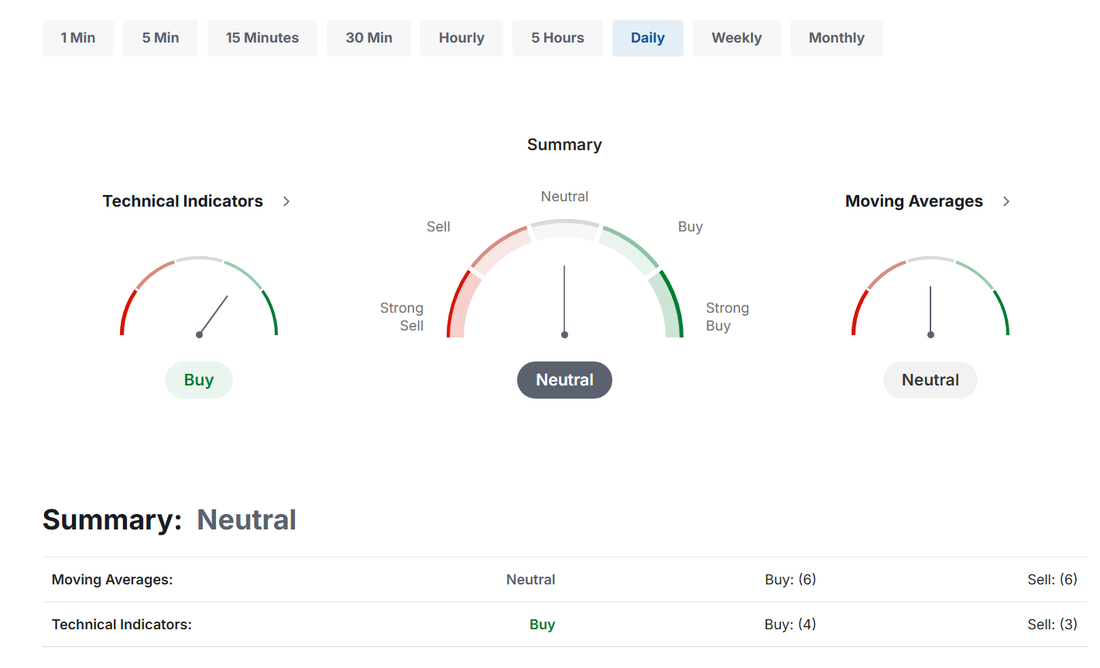

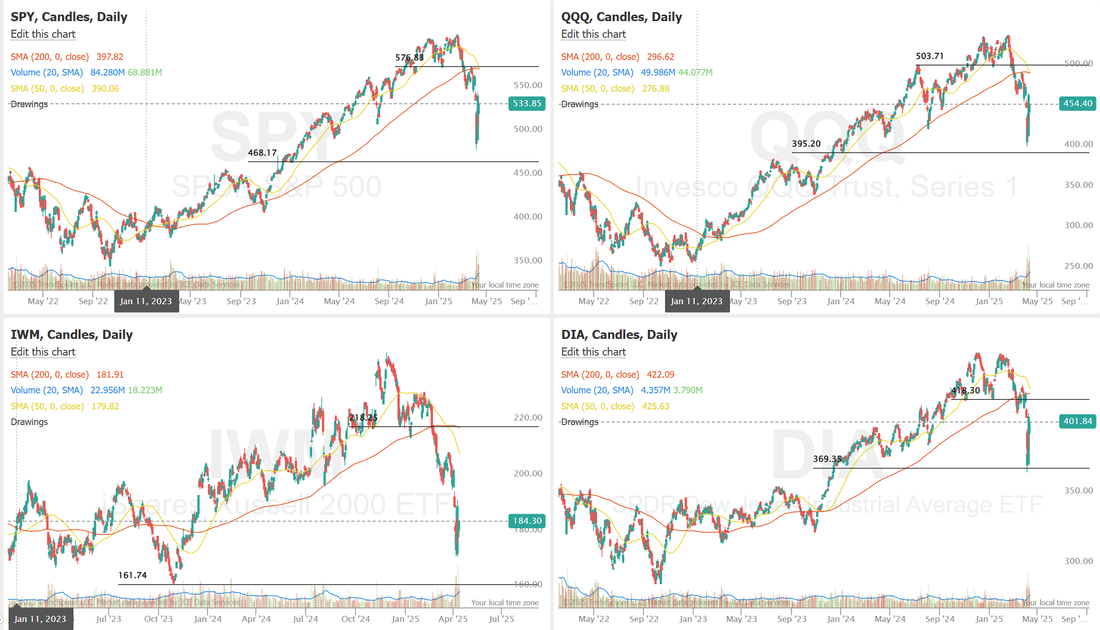

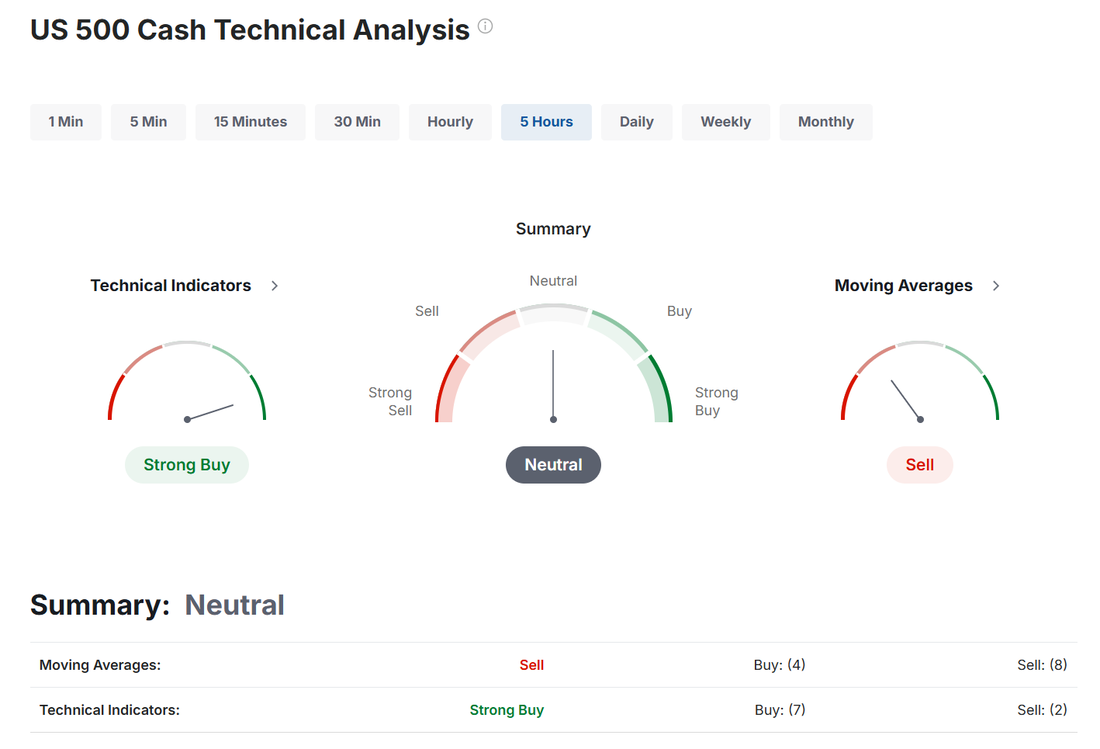

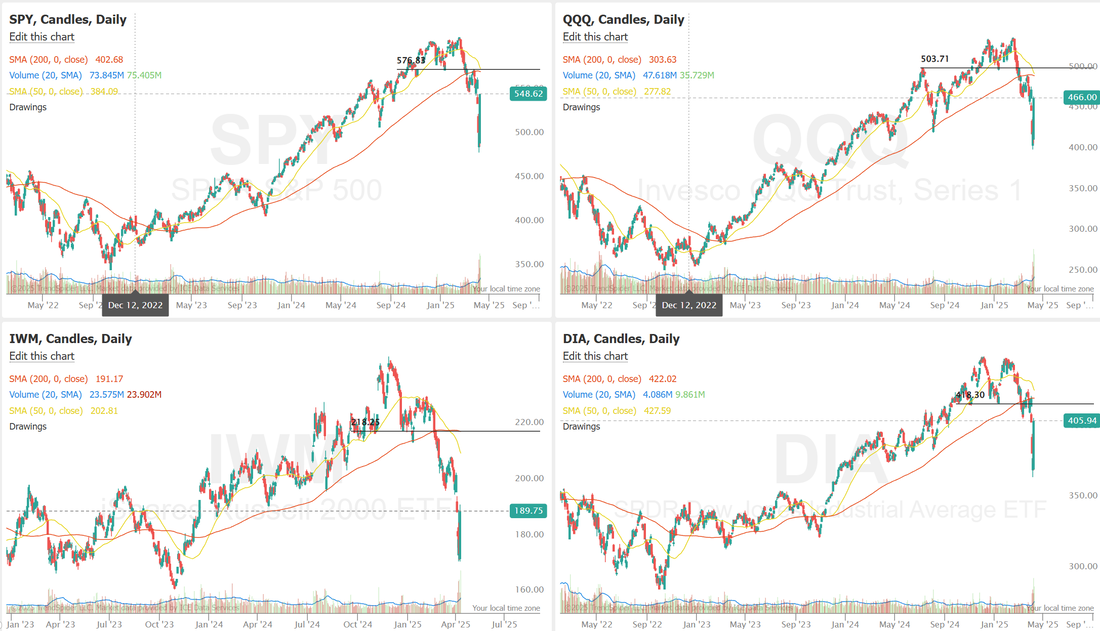

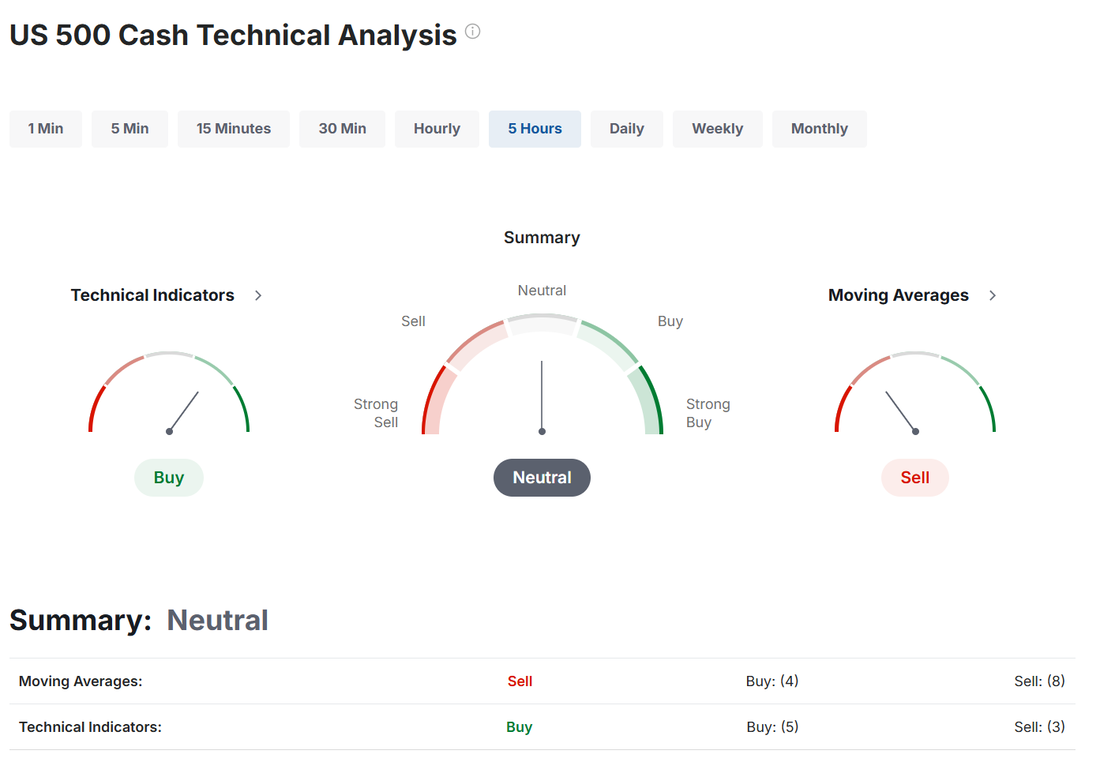

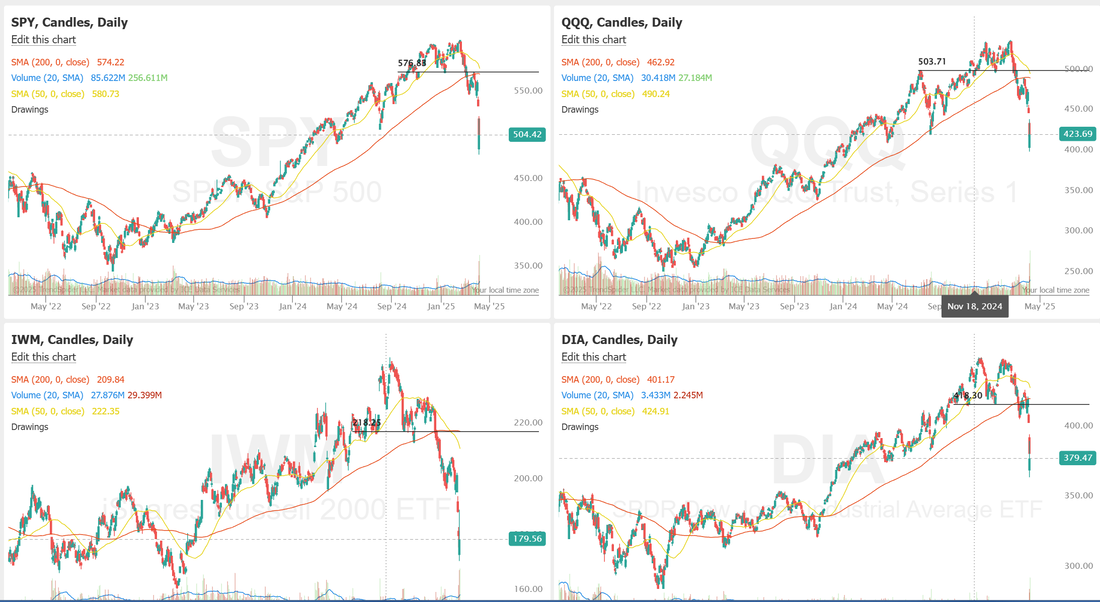

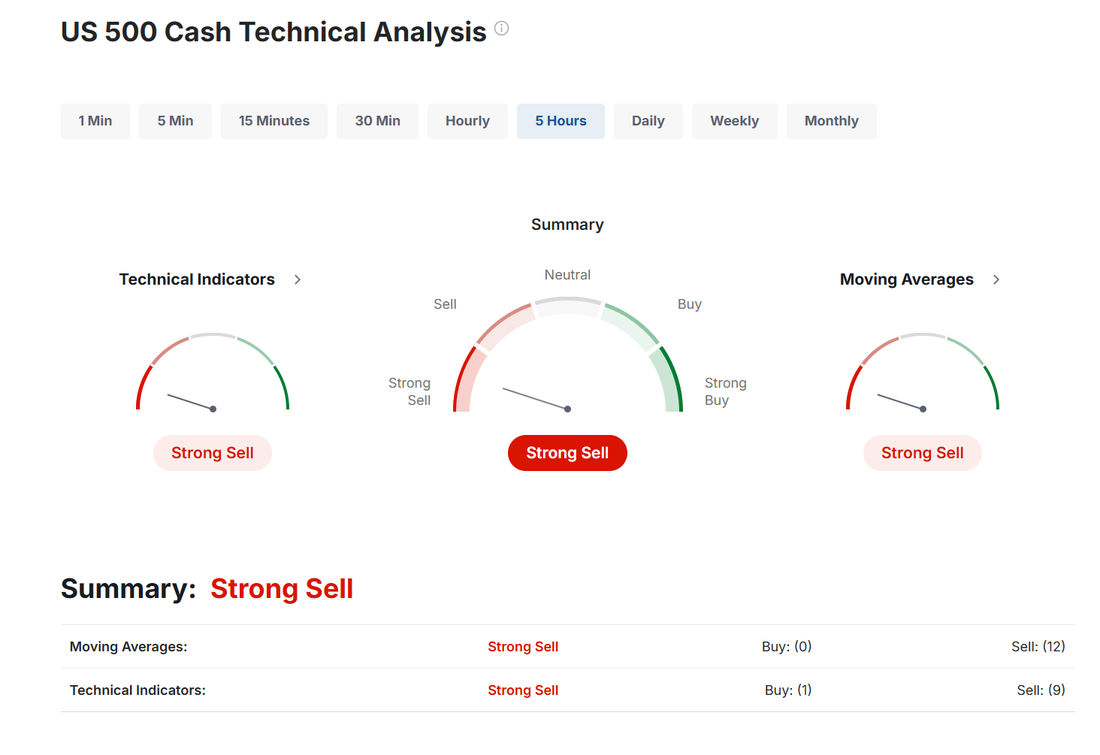

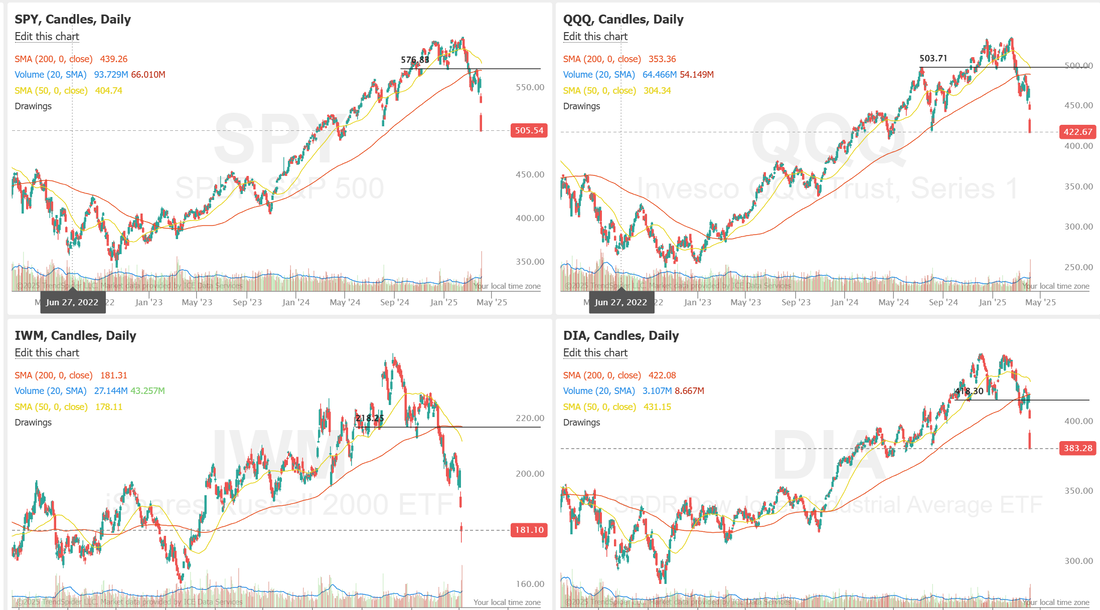

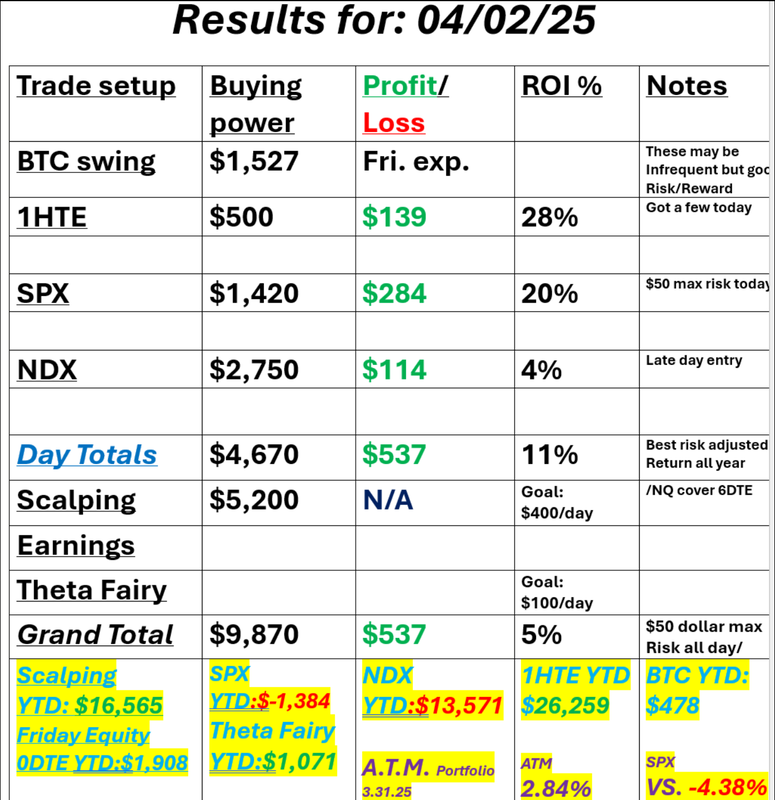

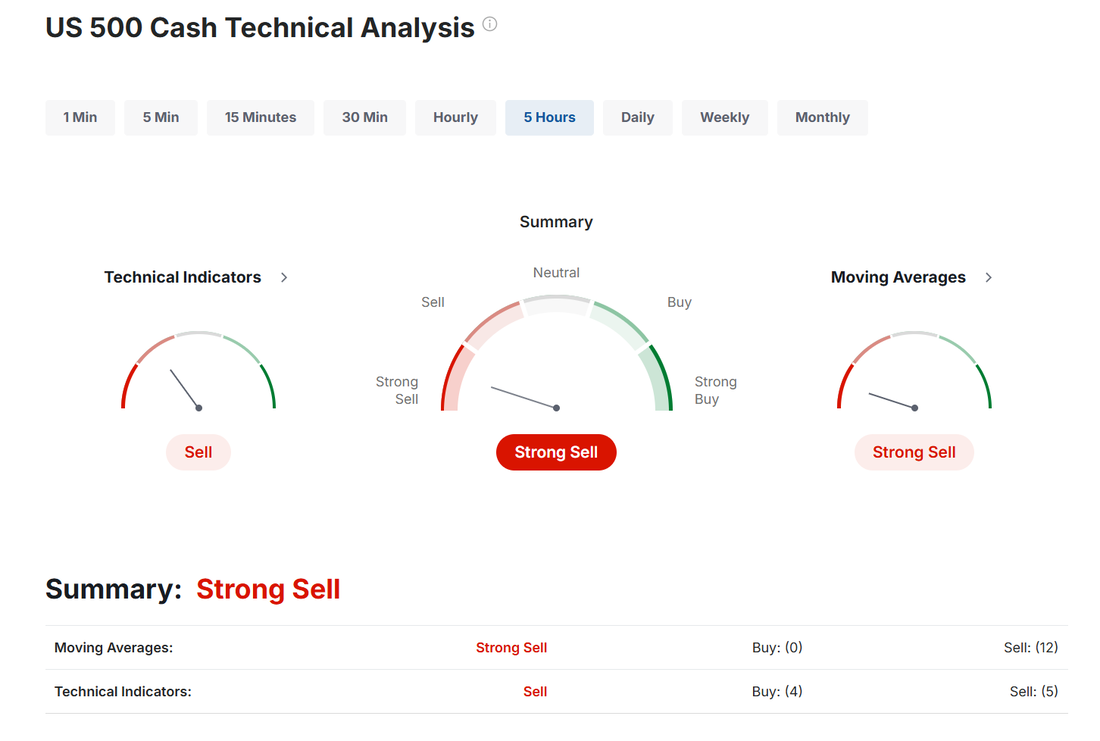

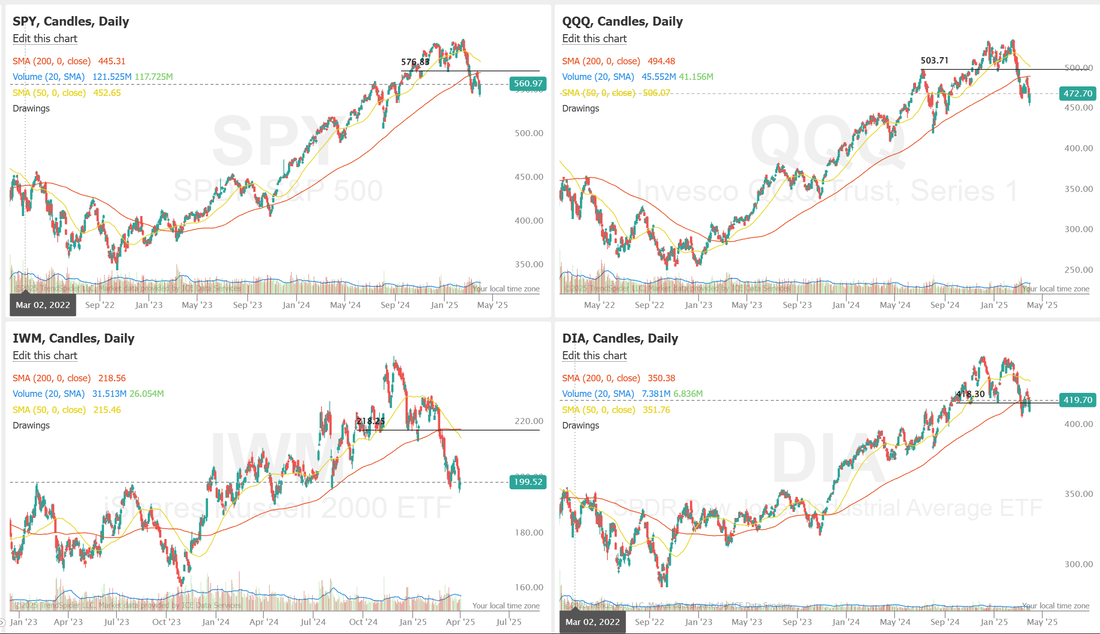

Uncertainty...it's tough to trade.Welcome back traders! It's a new, holiday shortened week. One thing we look at each day as we prepare to trade is the Technical matrix from investing.com. It combines a dozen different indicators and gives us a technical reading for the day. Bullish, Bearish or Neutral. Our best days are bearish as it generally provides the best premium. Bullish is fine as well. Neutral days? I hate them. The market hates a vacuum. It creates uncertainty and that makes it tough to find levels that you have confidence in. Right now there's a lot of uncertainty in this market. The moves are big and hard to see coming. We've had an approach that is working by keeping a low cost debit trade at the core of our setup. It's very asymmetric so the risk is low and the potential profit is solid. Unfortunately they haven't really hit for us. We'll keep the same approach today. Risk management first. Profit second. Even though Friday was a slow day for us, it all added up at the end of the day to a decent finish. Here's a look at our day last Friday. Let's look at the markets: On the smaller time frames we are leaning slightly bullish today but on the daily it's stuck in the dreaded neutral rating. That means don't be surprised with whatever we get today out of the market. There's still a lot of damage the market needs to repair to get a clear bullish trend but some of the damage has been stanched. Those support levels from last years Aug./Sept. zone seem to be holding. June S&P 500 E-Mini futures (ESM25) are up +1.24%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.69% this morning, pointing to a strong open on Wall Street after U.S. President Donald Trump paused import duties on various consumer electronics. Sentiment got a boost after the Trump administration exempted smartphones, laptop computers, hard drives, computer processors and memory chips, as well as flat-screen displays, from its so-called reciprocal tariffs. The exclusions, published late Friday by U.S. Customs and Border Protection, reduce the scope of the levies by excluding the products from President Trump’s 125% China tariff and his baseline 10% global tariff on nearly all other countries. Still, the White House stated that the pause in the duties is temporary and part of the longstanding strategy to implement a distinct, targeted levy on the sector. Trump on Sunday vowed to unveil new tariffs on semiconductors over the next week. This week, investors look ahead to earnings reports from a stellar lineup of companies, key economic data releases, and remarks from Federal Reserve Chair Jerome Powell and other Fed officials. In Friday’s trading session, Wall Street’s major equity averages ended higher. The Magnificent Seven stocks advanced, with Apple (AAPL) rising over +4% to lead gainers in the Dow and Nvidia (NVDA) gaining more than +3%. Also, gold mining stocks rallied after the price of gold hit a new all-time high, with AngloGold Ashanti (AU) surging over +10% and Newmont (NEM) climbing more than +7%. In addition, JPMorgan Chase (JPM) rose +4% after the biggest U.S. bank posted better-than-expected Q1 results and raised its FY25 net interest income forecast. On the bearish side, U.S. semiconductor stocks slumped after the China Semiconductor Association stated that chip tariffs would be based on the location of manufacture, not the shipping origin, with Texas Instruments (TXN) sliding over -5% to lead losers in the S&P 500 and Nasdaq 100. “Markets remain emotionally charged. Markets are still searching for footing amid unresolved trade tensions, earnings uncertainty, and macroeconomic headwinds,” said Mark Hackett at Nationwide. Economic data released on Friday showed that the U.S. producer price index for final demand came in at -0.4% m/m and +2.7% y/y in March, weaker than expectations of +0.2% m/m and +3.3% y/y. Also, the core PPI, which excludes volatile food and energy costs, arrived at -0.1% m/m and +3.3% y/y in March, weaker than expectations of +0.3% m/m and +3.6% y/y. In addition, the University of Michigan’s U.S. consumer sentiment index fell to a 2-3/4 year low of 50.8 in April, weaker than expectations of 54.0. The Financial Times reported on Friday that Boston Fed President Susan Collins stated the central bank “would absolutely be prepared” to use its capabilities to stabilize financial markets if conditions turn disorderly. Collins noted that “markets are continuing to function well” and that “we’re not seeing liquidity concerns overall.” At the same time, she added that the Fed “does have tools to address concerns about market functioning or liquidity should they arise.” Other Fed officials - Kashkari, Musalem, and Williams - on Friday continued to voice concerns over the impact of U.S. tariff policy on the economy and prices. U.S. rate futures have priced in a 79.3% probability of no rate change and a 20.7% chance of a 25 basis point rate cut at the conclusion of the Fed’s May meeting. First-quarter corporate earnings season heats up this week, with results expected from several more big banks, including Goldman Sachs (GS), Bank of America (BAC), and Citigroup (C). Also, major companies like Netflix (NFLX), UnitedHealth (UNH), Johnson & Johnson (JNJ), Abbott Laboratories (ABT), Travelers (TRV), CSX Corporation (CSX), Charles Schwab (SCHW), American Express (AXP), and DR Horton (DHI) are set to post quarterly results this week. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. Market watchers will also be closely monitoring the U.S. March Retail Sales figures this week for indications of how American consumers are responding to President Trump’s trade policies. Economists expect retail sales to be “very strong,” pointing out that consumers made major purchases before the imposition of tariffs. Other noteworthy data releases include the U.S. Export Price Index, the Import Price Index, the Empire State Manufacturing Index, Industrial Production, Manufacturing Production, Business Inventories, Crude Oil Inventories, Building Permits (preliminary), Housing Starts, Initial Jobless Claims, and the Philadelphia Fed Manufacturing Index. In addition, Fed Chair Jerome Powell will provide his assessment of the economy in a speech on Wednesday before the Economic Club of Chicago. A host of other Fed officials will also be making appearances throughout the week, including Barkin, Waller, Harker, Bostic, Cook, Hammack, Schmid, Barr, and Daly. Meanwhile, the U.S. stock markets will be closed on Friday in observance of Good Friday. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.443%, down -1.11%. Let's take a look at the expected moves for this shortened week. That's some absolutely amazing I.V. kicking off the week. SPY closed the week at $533.94 (+5.71%) after reversing at the key 2021 high pivot. The RSI hit its lowest level since 2022, triggering a bright green signal on the Combined RSI Ensemble Indicator, which indicated deeply oversold conditions across three lengths. The sharp bounce that followed suggests a potential short-term bottom is in place—for now. QQQ closed the week at $454.40 (+7.51%), fueled by a historic rebound midweek. Monday saw the highest single-day volume since 2022, while Wednesday delivered QQQ’s second-best day ever, closing up over 12% following the real tariff pause news. Despite the surge, QQQ remains more than 15% below its all-time highs, leaving bulls to debate whether this marks a durable low or just a sharp bounce. IWM closed the week at $184.36 (+1.80%), continuing to lag behind its large-cap peers. It maintained above its 2022 range low, giving small-cap investors relief it didn’t break key support. Despite cooler inflation data, which typically benefits rate-sensitive names, IWM’s muted reaction suggests investors remain cautious on small caps amid broader macro uncertainty. My lean or bias today is bearish. Futures are up strong right now, as I type with the hope that tariffs will be less severe but Trump has stated that more will be incoming. I'd prefer to play the counter trend today. Trade docket today is the same as every day lately. #1. 1HTE's. #2. Scalping with /MNQ and /NQ cover. #3. 0DTE SPX. #4. Adding to our BITO trade. One thing this I.V. has given us is the fact that we still have a reasonable shot at $1,000+ income each day IF our debits hit. Our buying power usage is down but the profit potential is still there. SPX and NDX are still down about 10% YTD. We may still be out be a few weeks out before we get some clarity. I'll see you all in the live trading room shortly!

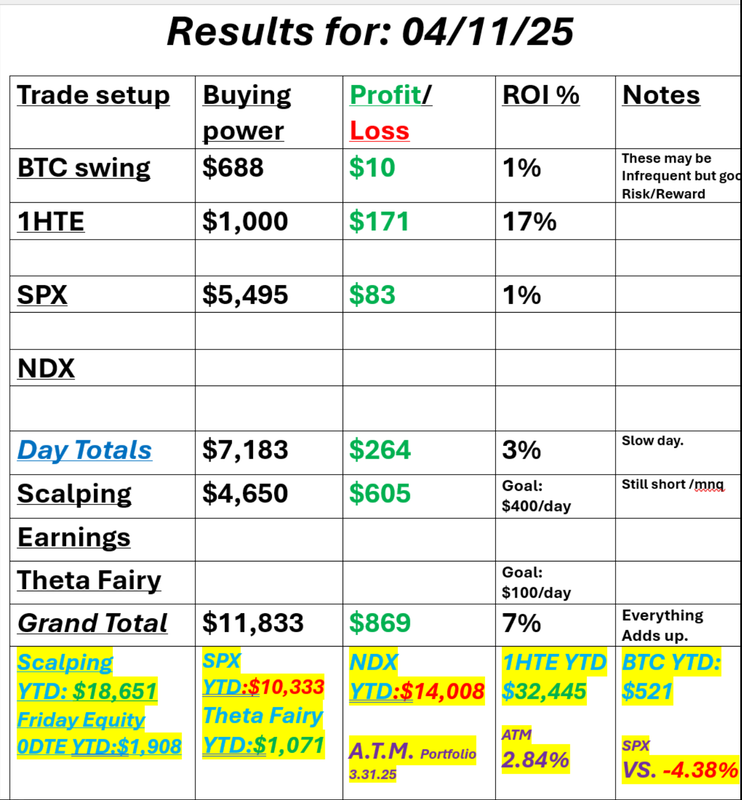

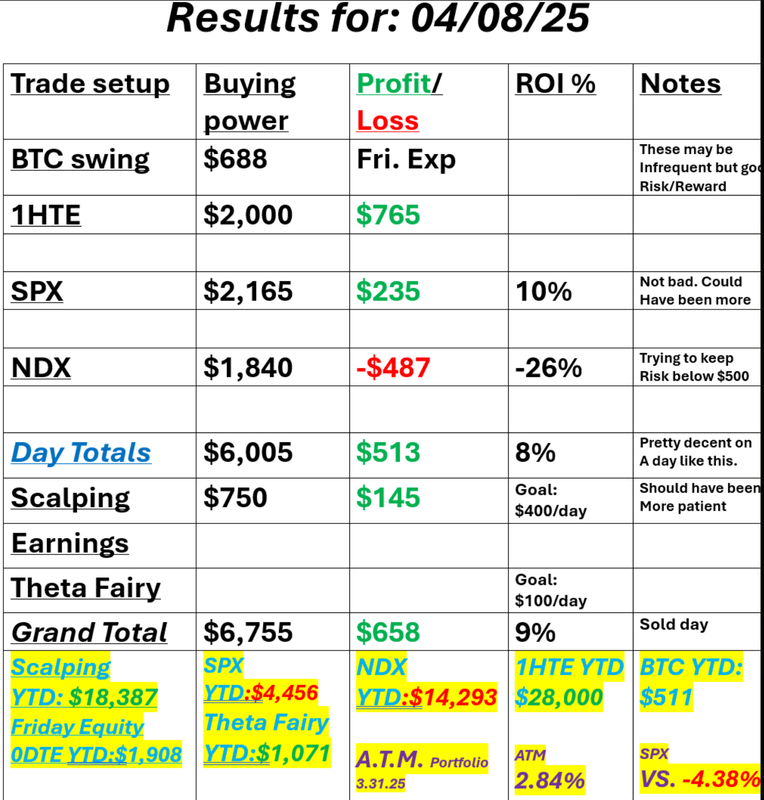

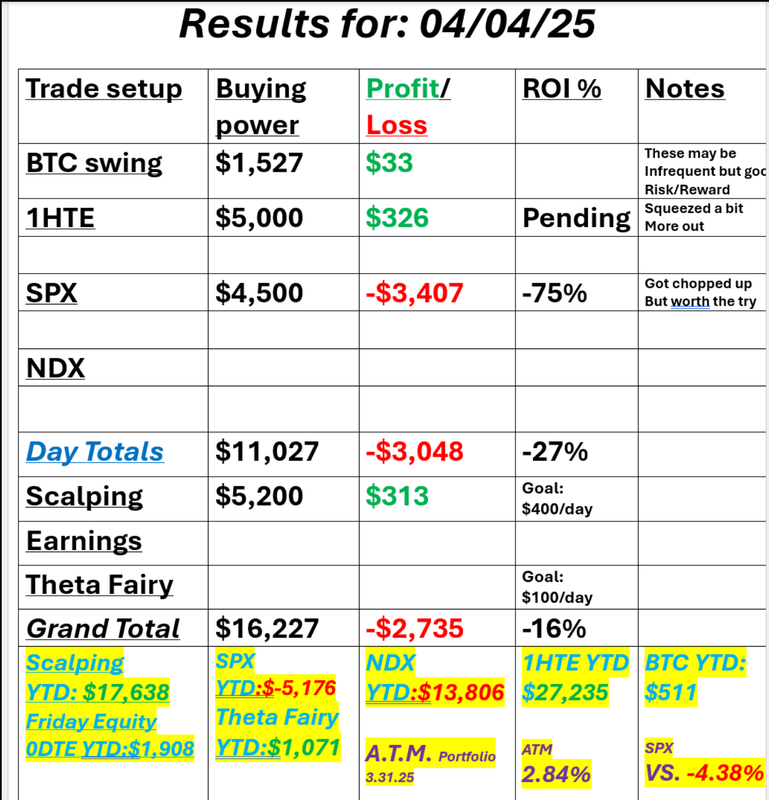

Respite care dayGood Friday to you all! For some (myself included) the weekend can't come fast enough! These are some crazy times for sure. I've been at this for over four decades. I was on Wallstreet for the 1987 crash. The 2000 tech bubble burst and the financial melt down of 2008. These times don't come along often but they certainly test you when they do. I needed a reset day yesterday. A repite day, if you will. We traded small. Took risks that would not be a big deal to us, if they didn't work and guess what? We did better with that approach profit wise as well. Here'a a look at our day. I'll be out of the office today at a 2 day mastermind but should (hopefully) have the ability to get my laptop in. This will allow us to still trade today. I'm looking at four trades today. BITO. We need to generate a bit more income from it today. /MNQ scalp. We have a short futures on for today and may add an /NQ cover, if needed. SPX 0DTE. I'll attempt to start us off today with up to three butterflies or (more likely) very slightly broken butterflies. Each one hopefully around $300 buying power for a total capital commitment of less than $1,000 dollars. This should accomplish three things: #1. Give us enough profit potential that we will be happy with the result, if it works. #2. Keep our risk low, once again. #3. Allow us the ability to fix it, later in the day, with relative ease, should it not work. I'd also like to continue our experiment yesterday with the "Range" BTC hourly setups. Yesterday was successful but with "only" 10-13% profit potential I'm still not sure how best to scale the losers. Let's look at the market news: June S&P 500 E-Mini futures (ESM25) are trending up +0.69% this morning as investors await crucial U.S. producer inflation data and earnings reports from some of the biggest U.S. banks. U.S. equity futures initially moved sharply higher, attempting to rebound from yesterday’s selloff on Wall Street. Later, stock index futures briefly turned lower after China raised tariffs on all U.S. goods to 125% from 84%, effective April 12th. The move came after the White House clarified on Thursday that, including a 20% levy imposed earlier this year, total tariffs on China now stand at 145%. China stated it would not match any additional tariff hikes from the U.S., but affirmed it would continue to retaliate against perceived U.S. offenses. However, stock index futures erased losses and continued to rise as investors appeared to shrug off the latest escalation in the U.S.-China trade war. In yesterday’s trading session, Wall Street’s major indices closed in the red. The Magnificent Seven stocks retreated, with Tesla (TSLA) sliding over -7% and Meta Platforms (META) falling more than -6%. Also, chip stocks slumped, with Microchip Technology (MCHP) plunging over -13% to lead losers in the Nasdaq 100 and ON Semiconductor (ON) dropping more than -11%. In addition, CarMax (KMX) tumbled -17% after the company posted weaker-than-expected FQ4 EPS. On the bullish side, Enact Holdings (ACT) rose more than +4% after S&P Dow Jones Indices announced that the stock would join the S&P SmallCap 600 Index, effective April 16th. The U.S. Bureau of Labor Statistics report released on Thursday showed that consumer prices slipped -0.1% m/m in March, weaker than expectations of +0.1% m/m. On an annual basis, headline inflation eased to +2.4% in March from +2.8% in February, weaker than expectations of +2.5% and the smallest increase in 6 months. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.1% m/m and +2.8% y/y in March, weaker than expectations of +0.3% m/m and +3.0% y/y. In addition, the number of Americans filing for initial jobless claims in the past week rose +4K to 223K, in line with expectations. “Healthy drop in inflation or big fall drop in demand?” said Bret Kenwell at eToro. “While the Fed will want more than one data point to just justify its next rate cut, [yesterday’s] CPI numbers are certainly a step in the right direction. Unfortunately, the trade-war rhetoric over the last month has muddied the economic waters. Is inflation moving sustainably lower, or did businesses and consumers pull in the reins as they brace for an economic slowdown?” Kansas City Fed President Jeff Schmid stated on Thursday that he would prioritize curbing inflation if policymakers are forced to balance their goal of price stability against their mandate for full employment. Also, Dallas Fed President Lorie Logan said, “To sustainably achieve both of our dual-mandate goals, it will be important to keep any tariff-related price increases from fostering more persistent inflation. For now, I believe the stance of monetary policy is well positioned.” In addition, Chicago Fed President Austan Goolsbee described tariffs as a “stagflationary shock” that places the central bank’s objectives of price stability and full employment in conflict with each other. U.S. rate futures have priced in a 63.6% chance of no rate change and a 36.4% chance of a 25 basis point rate cut at the next central bank meeting in May. Meanwhile, the first-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), and Morgan Stanley (MS), slated to report their quarterly results today. BlackRock (BLK) and Fastenal (FAST) are other prominent companies scheduled to deliver their quarterly updates today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. March PPI will come in at +0.2% m/m and +3.3% y/y, compared to the previous figures of unchanged m/m and +3.2% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect March figures to be +0.3% m/m and +3.6% y/y, compared to February’s numbers of -0.1% m/m and +3.4% y/y. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists estimate the preliminary April figure will stand at 54.0, compared to 57.0 in March. In addition, market participants will hear perspectives from St. Louis Fed President Alberto Musalem and New York Fed President John Williams throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.407%, up +0.34%. Sentiment Wall Street’s elation gave way to dread, with a drop in US stock market futures, oil, and the currency indicating concern that the trade war will cause long-term damage to the American economy. S&P 500 futures fell, predicting a reversal from Wednesday’s nearly 10% gain. The Dollar declined for the third consecutive day. Brent crude fell below $64 per barrel. Bonds rose, while investors sought protection in gold, the Swiss franc, and the Yen. While investors hailed Trump’s promise to suspend certain tariffs, which boosted US equities to a historic one-day surge, traders are now focussing on the implications of an economic slump and protracted volatility. Consumer inflation data is coming later today, and a Treasury auction of 30-year bonds will be closely monitored for any signs of concern about owning US debt. Meanwhile, European and Asian markets rose as investors caught up with Wall Street’s bounce the day before. Docket 08:30 ET US CPI for March YoY – Forecast: 2.5% | Prior: 2.8% | Range: 2.8% / 2.5% MoM – Forecast: 0.1% | Prior: 0.2% | Range: 0.3% / 0% Core YoY – Forecast: 3% | Prior: 3.1% | Range: 3.1% / 2.9% Core MoM – Forecast: 02.3% | Prior: 0.2% | Range: 0.5% / 0.2% US Weekly Jobless Claims Initial Claims – Forecast: 223k | Prior: 219k | Range: 230k / 215k Continued Claims – Forecast: 1.884M | Prior: 1.903M | Range: 1.92M / 1.86M 11:30 ET US sells $85 bln 4-Week Bills 12:00 ET US EIA Short Term Energy Outlook Report 13:00 ET US sells $22 bln 30-Year Bonds Speakers 09:00 ET BoE’s Breeden speaks at a Market News International event on “UK economic and financial stability prospects.” 09:30 ET Fed’s Logan gives welcome remarks at a Dallas Fed event called “Outlook for North American Trade and Immigration.” 10:00 ET Fed’s Bowman has her nomination hearing in front of the Senate Banking Committee for the position of vice chair for supervision. Text & Q&A are expected. Fed’s Schmid speaks on the economic outlook and monetary policy at an event in Kansas City. No indication whether a text is expected, but there will be a Q&A. 11:00 ET Trump participates in a Cabinet Meeting (Closed Press) 12:00 ET Fed’s Harker speaks on fintech at an event at the Philadelphia Fed. Text is expected, but no Q&A. Fed’s Goolsbee speaks at the Economic Club of New York. No indication whether a text is expected, but there will be a Q&A. ECB’s Donnery at Delphi Economic Forum X SNB’s Tschudin Speaks at a Money Market event in Zurich 12:30 ET Trump participates in a Swearing-In Ceremony for the Solicitor General 16:00 ET Trump participates in a Bill Signing Let's take a look at the markets: With PPI today I would imagine it will start the price action movement. There's no reason to believe today won't have swings and the neutral rating technically to start us off suggests as much. Our bullish lines (top lines) on the charts...the level we would declare us back to bullishness is now a long ways away. I added the new support lines (bottom lines) today. A couple observations. #1. It would be a pretty sizable drawdown to get us there. #2. The DIA is almost there right now. #3. The next levels down are wayyyyy down. We'd be going back to 2023 levels. Let's look at the intra-day levels for our /ES and BTC. /ES: As we've seen lately, the levels are really far apart. It's an accurate reflection of the wild price action we are getting but it does make it hard to pinpoint key, intra-day levels for us to trade off of. On the /ES I'm keying in on 5169 as an important support. If that holds and the market likes PPI...and we don't get some additional crazy tariff news (I know this is asking a lot) we could push as high as 5650. 4860 is the support level below 5169, if we lose that level. BTC: Bitcoin was good to us again yesterday. I'm going to continue working the range trades today. Let's see how that goes. Resistance is at 84,877 and then 87,810 with support at 79,156. I look forward to trading with you all again today in the live trading room. Let's see if we can replicate yesterday. Low risk, low stress type day.

Self realizationGood morning traders! Trading has it's ups and downs. Not every day is sunshine and roses. Almost every day we have some trade setup that isn't working or loses money. That's fine. It's how trading works and as long as the overall day is profitable we're happy. Some days are losing days overall but as long as we did our best and traded well we take it in stride. Yesterday was NOT one of those days. We had an absolutely beautiful SPX 0DTE working. I had $4,950 capital committed and was up $1,250 dollars and didn't lock it in. There was still over $1,000 of extrinsic left and the trade looked perfect. Then came the reversal on the Trump tariff news. It just crushed the calls. There are lots of justifications we (I) can make on losing days...Unexpected Trump news, etc. but the reality is I should have pulled a trade that was that profitable and called it a day. We don't need better setups or trades. I just need to do better on my profit taking. I'm going to use today as a reset day. One small 0DTE and focus most of our effort today on our 1HTE's with bitcoin. Those are working well for us. Here's a look at my day yesterday: Let's take a look at the markets: Yesterdays monster rally brought us right back to those consolidation zones established last year around April. Is it meaningful? I don't think so. Bear markets tend to have violent retraces just like yesterdays. It doesn't really change the overall bearish outlook. une S&P 500 E-Mini futures (ESM25) are down -2.20%, and June Nasdaq 100 E-Mini futures (NQM25) are down -2.33% this morning, pointing to a sharp pullback on Wall Street after yesterday’s historic rally, while investors brace for the release of crucial U.S. inflation data. After $10 trillion was erased from global equity markets, U.S. President Donald Trump announced a 90-day pause on most of his sweeping reciprocal tariffs. Countries affected by the higher reciprocal duties that took effect Wednesday will now be taxed at the earlier 10% baseline rate applied to other nations, except for China, which remains subject to a 125% tariff. This sparked a massive rally on Wall Street, with the benchmark S&P 500 notching its largest daily gain since 2008 and the tech-heavy Nasdaq 100 posting its biggest one-day surge since 2001. Still, numerous strategists cautioned investors against buying the dip in equities due to the risks that lie ahead. “The damage has been done. They’ve opened Pandora’s box, and they can’t undo what’s been done in one statement. We would definitely be a bit more of a seller at this point,” said Colin Graham, head of multi-asset strategies at Robeco Groep. The minutes of the Federal Open Market Committee’s March 18-19 meeting, released Wednesday, showed that officials were worried about tariffs. They referenced President Trump’s trade policy 18 times in the minutes, a sharp increase from just one mention in January’s minutes. “Participants assessed that uncertainty around the economic outlook had increased, with almost all participants viewing risks to inflation as tilted to the upside and risks to employment as tilted to the downside,” according to the FOMC minutes. Also, some officials outlined a possible “stagflation” scenario, in which inflation rises while the economy either stagnates or contracts. “Some participants observed, however, that the committee may face difficult tradeoffs if inflation proved to be more persistent while the outlook for growth and employment weakened,” the minutes said. In yesterday’s trading session, Wall Street’s major indexes ended sharply higher. The Magnificent Seven stocks rallied, with Tesla (TSLA) soaring over +22% and Nvidia (NVDA) climbing more than +18%. Also, chip stocks spiked, with Microchip Technology (MCHP) soaring over +27% to lead gainers in the S&P 500 and Nasdaq 100 and Arm Holdings (ARM) rising more than +24%. In addition, Delta Air Lines (DAL) surged over +23% after the airline posted better-than-expected Q1 results. Economic data released on Wednesday showed that U.S. wholesale inventories came in at +0.3% m/m in February, compared to expectations of +0.4% m/m. Minneapolis Fed President Neel Kashkari stated on Wednesday that the central bank is less likely to cut interest rates in the face of tariffs due to their inflationary impact, even if the economy starts to weaken. “The hurdle to change the federal funds rate one way or the other has increased due to tariffs,” Kashkari wrote in an essay. Meanwhile, U.S. rate futures have priced in an 81.2% probability of no rate change and an 18.8% chance of a 25 basis point rate cut at the May FOMC meeting. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. March CPI will come in at +0.1% m/m and +2.5% y/y, compared to the previous numbers of +0.2% m/m and +2.8% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.0% y/y in March, compared to February’s figures of +0.2% m/m and +3.1% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 223K, compared to last week’s number of 219K. In addition, market participants will be looking toward speeches from Fed officials Logan, Schmid, Goolsbee, and Harker. First-quarter corporate earnings season begins in earnest on Friday, with major banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Morgan Stanley (MS) set to report their quarterly results. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.283%, down -2.57%. I'm using today as a re-set day. Yesterday was very frustrating. When trades don't work, they don't work and that's fine. It's how it goes sometimes but when I make an "operator error" like yesterday it's frustrating. Today I'm going to do a very small SPX 0DTE and mainly focus on our 1HTE Bitcoin setups. We'll be back at it full force tomorrow. Let's take a look at /ES and BTC levels for today: /ES: Yesterdays rally brought us back to a key support level from Sept. of last year. On the intra-day basis the zone is wide. 5650 is resistance and 5174 is support. It's a wide zone folks. It may or may not be helpful for us today. BTC: Bitcoin was kind to us yesterday. It wasn't enough to get us profitable overall but it really helped. 85,000 is resistance wit 79,000 support. That's our range today. Let's see how many 1HTE's we can pull off. Yesterday was a bummer folks. We are in interesting times. Be safe. Trade small. Let's see if we can put up some green today.

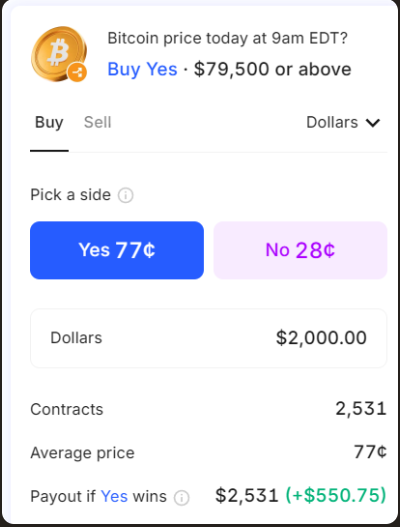

ReciprocationTariffs continue to be the main focus of the markets. We've now moved from the initial shock of them becoming a reality to the next phase which seems to be the reciprocation coming back to the U.S. How high will tariffs go? How long will they last? These are all questions the market and it's participants would like to know. Bad news is not the biggest issue for the stock market. Uncertaintly is and that's where we sit today as I watch the futures bounce from positive to negative. That's not unusual and happens frequently. The size of the moves? That's a different story. Our trading plan continues to prove itself valuable. #1. Trade small. #2. Trade fewer trades. #3. Shorten the duration of trades (we aren't going out past a day trade at this point). #4. Utilize debit (directional) trades as initial anchor positions. #5. Focus on what is working. Yesterday wasn't as smooth for us as we would have liked but our risk was always in check. (We try to keep less than $500 dollars at risk in each setup.) It was a profitable day for us. Our 1HTE Bitcoin trades certainly have been a safe haven for us in these wild times. They allow us to tighten our time horizion to 40 min. in some cases. It's also one of the few places where you can trade small ($20 dollar trades anyone?) and still have 20%-100% ROI potential. If you want unique results you need to be doing unique setups. We have trades no one else is focusing on. Take a look at our day yesterday. As I said...it wasn't the cleanest day but it worked out for us. All in all I'd say yesterday was a home run for us, considering the trading enviroment right now. une S&P 500 E-Mini futures (ESM25) are trending down -1.42% this morning as U.S. President Donald Trump’s sweeping tariffs came into effect and China hiked tariffs on U.S. goods. U.S. equity futures point to another volatile session on Wall Street. Stock index futures initially plunged after President Trump’s so-called reciprocal tariffs came into force today, intensifying concerns about their impact on U.S. economic growth. The measures include a 104% tariff on Chinese imports. Later, stock index futures briefly turned positive after China’s Ministry of Commerce stated that the nation was open to dialogue with the U.S., while noting it possessed “abundant means” to retaliate against the Trump administration’s tariffs. Stock index futures faced renewed selling pressure after China raised tariffs on goods imported from the U.S. to 84%, set to take effect on April 10th. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the red. The Magnificent Seven stocks slumped, with Apple (AAPL) sliding nearly -5% and Tesla (TSLA) falling more than -4%. Also, chip stocks retreated, with ON Semiconductor (ON) tumbling nearly -9% and Intel (INTC) dropping more than -7%. In addition, RPM International (RPM) plunged over -9% after the building materials company reported weaker-than-expected FQ3 results. On the bullish side, health insurance stocks surged following the federal government’s announcement of an estimated $25 billion increase in payments to 2026 Medicare Advantage health plans, with Humana (HUM) climbing over +10% to lead gainers in the S&P 500 and UnitedHealth Group (UNH) rising more than +5% to lead gainers in the Dow. “The fundamental reason for the drawdown has been policy uncertainty - it’s functionally impossible to put in a bottom until that fundamental reason has been resolved, or at least until there is directional clarity on it,” said Scott Ladner at Horizon Investments. Chicago Fed President Austan Goolsbee stated on Tuesday that tariffs are “way bigger” than he had expected, and policymakers might not be able to wait for the economic impact to be reflected in government data; instead, they should actively engage with businesses to assess the effects in real time. “We just lived through and learned what happens when inflation is raging out of control,” Goolsbee said in an interview with Illinois Public Radio. Also, San Francisco Fed President Mary Daly said the central bank has the flexibility to wait before making any interest rate adjustments as it monitors the effects of trade policy changes. “So, with growth good and policy in a good place, we’ve built the time and the ability to just tread slowly and tread carefully,” she said. U.S. rate futures have priced in a 51.5% chance of no rate change and a 48.5% chance of a 25 basis point rate cut at May’s monetary policy meeting. Meanwhile, market watchers are keenly awaiting the U.S. consumer inflation report for March on Thursday and the start of the first-quarter earnings season on Friday. Today, investors will closely monitor the publication of the Federal Reserve’s minutes from the March 18-19 meeting. With expectations mounting that the Fed will support the economy by cutting rates at least four times this year, starting in June, the minutes could shed light on how justified those expectations may be. On the economic data front, investors will focus on U.S. Wholesale Inventories data, which is set to be released in a couple of hours. Economists expect the final February figure to be +0.4% m/m, compared to the January figure of +0.8% m/m. U.S. Crude Oil Inventories data will also be released today. Economists foresee this figure standing at 2.200M, compared to last week’s value of 6.165M. In addition, market participants will be anticipating a speech from Richmond Fed President Tom Barkin. On the earnings front, Delta Air Lines (DAL) is set to report its Q1 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.363%, up +2.42%. While markets are still volatile, they continue to hang out around the consolidaiton zone of April 2024. My bias or lean today: I'm going to go out on a limb ans say bullish. Futures are down -85 points as I type on the /ES. No idea if we can get to positive or not but I think we've got a decent shot at trending higher today off these overnight lows. Regardless of what we get our approach of focusing on risk management first and profit second seems to be working for us. Our trade docket today is the same as everyday lately: #1. Scalping with QQQ's. #2. 1HTE on Bitcoin (we've got an early start on that already today) #3. SPX 0DTE. Probably skip NDX for now. Trading levels are becoming harder to trade off of with these big moves. Let's focus on the /ES for today. 5156 is resistance with 4872 working as support. If we lose 4872 there is lots more downside potential. We'll map it out in the live trading room as the day progresses. Now is the time folks. This is a traders market. Opportunity is there. If you are not aligned with our trading members in our trading group, working together on unique, risk managment type setups then I'd recommend you either join us or join someones team. Do trade alone. Having a team to bounce your ideas off of has never been so valuable. Let's see if we can pull another green day for us today! See you all in the live trading room shortly. Let's make it a profitable day.

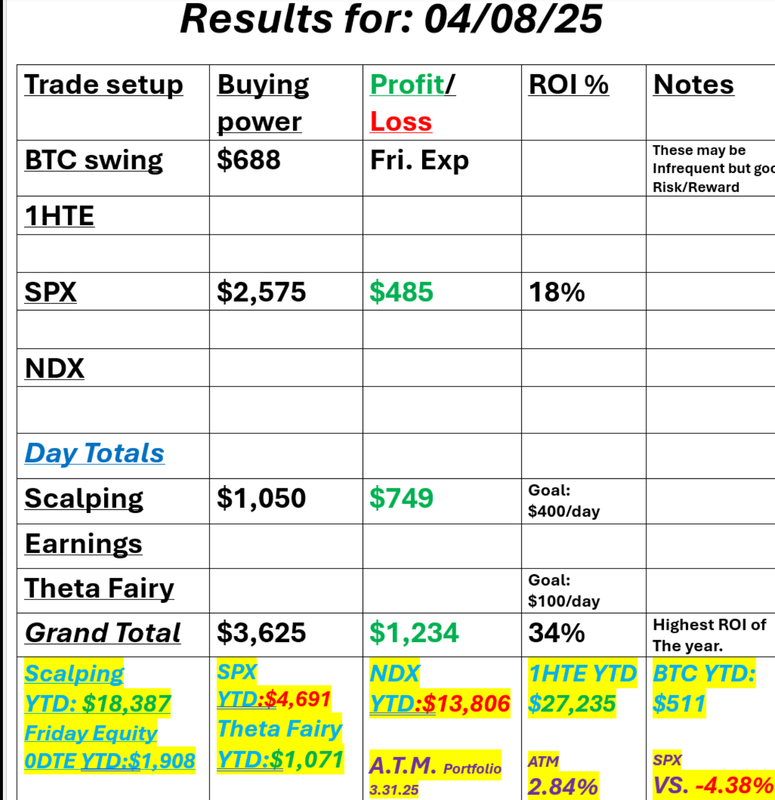

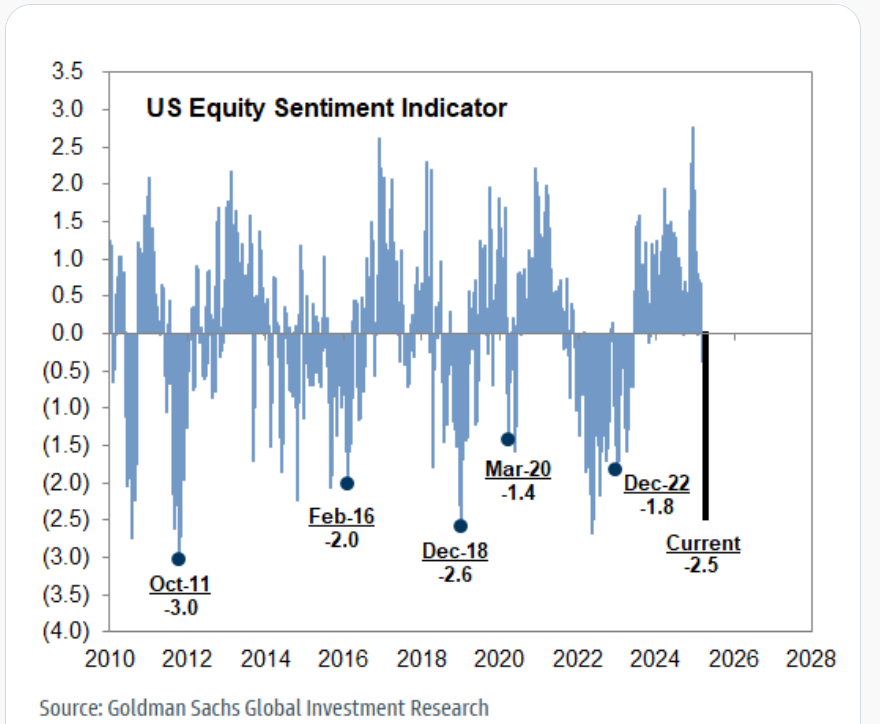

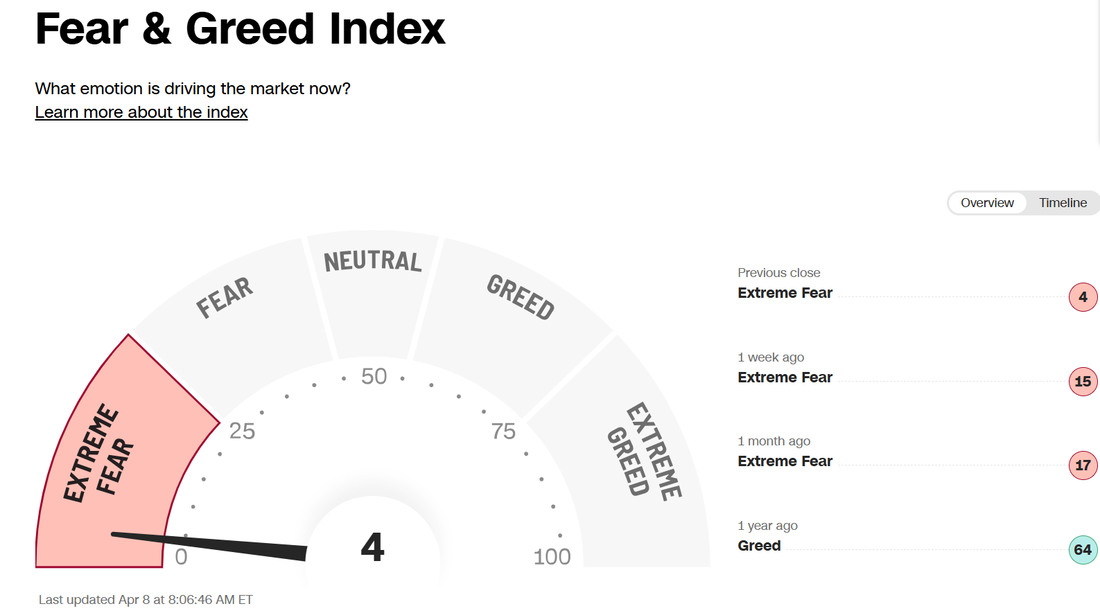

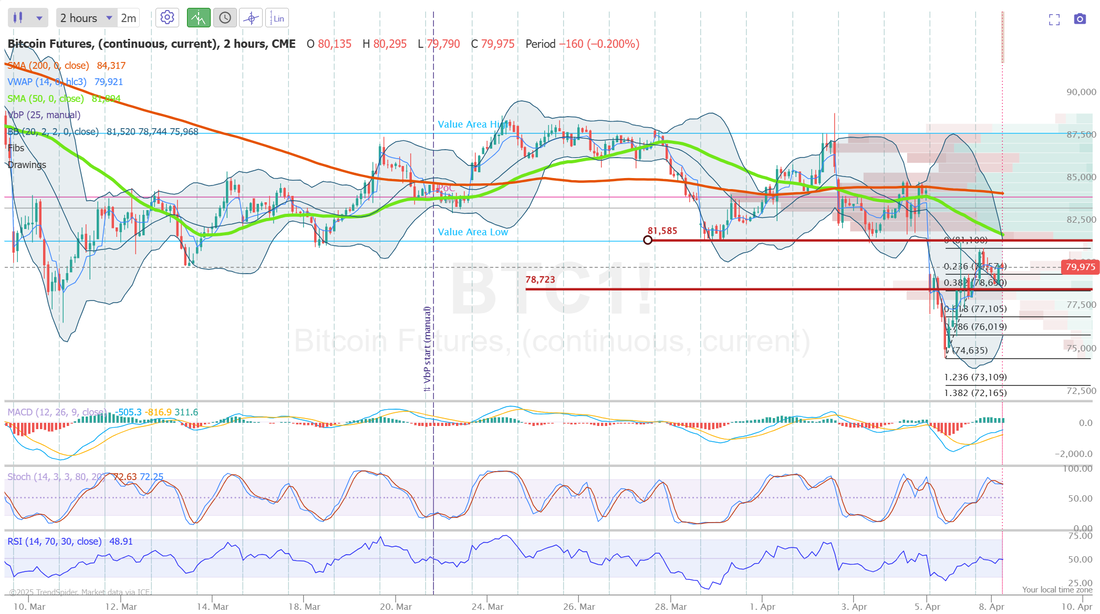

Melting ice cubes.U.S. Treasury Secretary Bessent kicked off the upward push in futures with the comment, "Tariffs will be a melitng ice cube if successful". We spent quite a bit of time in our trading room yesterday talking about where the tariffs may be going and what their true purpose was. I believe they are just that. Tools to extract better terms. We'll see but so far this morning the futures are loving it. We had a perfect day yesterday. Stress free and what was most interesting, it was our highest ROI day of the year. Never have we ever deployed less capital for a $1,000+ profit day. I've said it over and over but UNFORTUNATELY the markets will stabilze as some point and all this wonderful premium will disappear as quickly as it showed up. A long, protracted bear market is best for us (bigger moves, better premium). Yesterday was a big snap back and today looks strong, out of the gate but I wouldn't write off the bears just yet. Here's a look at our easy day yesterday. I'm not sure that we've ever had a 34% ROI day before. Sure, we've had some directional debit setups hit for a 200%+ gain but directional trades aside, it was a stellar (and easy) day. I'm super proud of how we've managed this downturn. Moving mostly to cash. Trading small. Reducing the number of trades we do. My only regret is that we seriously talked about leaving a long QQQ call on in the scalping room. That would have been a nice start to our day...if we would have. Woulda, coulda, shouda I guess. Let's take a look at the markets. They are certainly interesting right now. We'be quickly moved from full sell mode yesterday to a slight sell mode earlier this morning (as I posted our ATM portfolio) now to a neutral stance. Today surely has the makings for a pivot type day. For now the April lows of last year seem to be holding. June S&P 500 E-Mini futures (ESM25) are up +1.50%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.28% this morning, pointing to a modest recovery on Wall Street as investors seek dip-buying opportunities while waiting for clarity on how U.S. President Donald Trump’s trade policies will play out. President Trump made a series of remarks on Monday regarding his proposed tariffs on global trading partners. However, he provided scant detail about what he wants in return for reducing tariffs or whether he intends to offer any relief at all. Investors took some comfort after Japan pushed ahead with talks on a potential tariff deal. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. Some of the Magnificent Seven stocks continued to fall, with Apple (AAPL) dropping over -3% and Tesla (TSLA) slumping more than -2%. Also, energy stocks tumbled after the price of WTI crude fell to a 4-year low, with Schlumberger (SLB) and Occidental Petroleum (OXY) sliding over -4%. In addition, Caterpillar (CAT) fell more than -2% after UBS downgraded the stock to Sell from Neutral with a price target of $243. On the bullish side, chip stocks gained ground, with Broadcom (AVGO) and Micron Technology (MU) climbing over +5%. Economic data released on Monday showed that U.S. consumer credit unexpectedly fell -$0.81B in February, weaker than expectations of +$15.20B. Fed Governor Adriana Kugler stated on Monday that President Trump’s trade policy currently has more significant implications for inflation than for economic growth. Kugler said that consumers’ actions to buy goods before recently announced tariffs take effect may be bolstering economic activity in early 2025, while there are indications that the trade policy changes are beginning to exert upward pressure on prices. “The takeaway is that I view, right now, inflation as being more pressing as far as the effects of tariffs that we’re already seeing,” she said. Kugler also noted that policymakers “have to be very careful in how we navigate this period.” Chicago Fed President Austan Goolsbee said during an interview on CNN, “The anxiety is if these tariffs are as big as what are threatened on the U.S. side, and if there’s massive retaliation, and then if there’s counter retaliation again, it might send us back to the kind of conditions that we saw in ‘21 and ‘22, when inflation’s raging out of control.” U.S. rate futures have priced in a 71.4% probability of no rate change and a 28.6% chance of a 25 basis point rate cut at the next FOMC meeting in May. Meanwhile, market watchers are keenly awaiting U.S. inflation data, the Fed’s minutes from the March meeting, and the start of the first-quarter earnings season this week. Investors also continue to assess the potential economic impact of Trump’s tariffs and remain alert for any announcements of retaliatory measures. On Friday, China retaliated against new U.S. tariffs by imposing a 34% tariff on all U.S. imports beginning April 10th. Trump on Monday threatened to slap “ADDITIONAL Tariffs on China of 50%, effective April 9th,” if Beijing fails to retract its retaliatory tariffs by April 8th. “For now, it looks like news out of Washington will continue to drive the market’s swings, one way or the other. Some notable lows over the past few decades have been preceded by similar levels of volatility, although it’s always impossible to know when prices will eventually find their bottom,” said Chris Larkin at E*Trade from Morgan Stanley. The U.S. economic data slate is largely empty on Tuesday. However, investors will focus on a speech from San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.170%, up +0.31%. Are you a contrarian trader? US stock market sentiment has rarely been this BAD: Goldman's US equity sentiment indicator dropped to -2.5 on Friday, the lowest since the December 2018 sell-off. In the past, such a negative reading triggered two-week positive returns. Time for a short-term bounce? The feat and greed index is pinned as well. I forget this guys name but he seems to have good instincts. Who knows? It's still too early to tell. One solid day along with futures being up this morning don't undo all the damage that started last Thursday. Our trade docket will continue along the same path for the foreseeable future. #1. Try to get as many 1HTE Bitcoin trades packed into the day as possible. To say these have been amazing for us is a huge understatement and I proud to say, I don't know anywhere else where you can get these hourly setups. #2. Scalping: I'll continue to focus on the QQQ's for today. If this isn't a great scalping market I don't know what is. #3. 0DTE's. We weren't able to get an NDX working yesterday but our plan is always to start with an SPX setup and then look to add an NDX later in the day. My lean or bias today is for more bullish price action. I said yesterday, when futures were printing big red numbers that I thought we could reverse with some bullish price action. We didn't have the phrase, "meliting ice cubes" but our thoughts went in the same direction. I think today could be more of the same. Really it's still anyones guess. Look at how news driven the market was yesterday Let's take a look at our intra-day levels. Our levels from yesterday were spot on and that gave us a lot of confidence in entering our strikes. /ES: Admttedly these levels are incredibly wide. It doesn't help that futures are already up 120+ points as I type. 5312 is first resistance with 5409 next. 5194 is first support with 5052 next. /NQ: I'm a bit more narrowly focused here with resistance at 18,380 and support at 17,643. BTC: We weren't able to get any setups working yesterday and that hurt our overall profit potential. Bitcoin is usually pretty good to use and we've come to depend on some daily income from it. The range is tight this morning with resistance at 81,585 and support at 78,723. We've got a good sized 1HTE working right now that expires in 10 min. If that hits for the $550 profit that is its potential we may be done for the day. By the way. If you are looking for ways to take your trading to a higher level you may want to come trade the 1HTE's with us. Again...I don't know where else you can go and get these hourly setups.

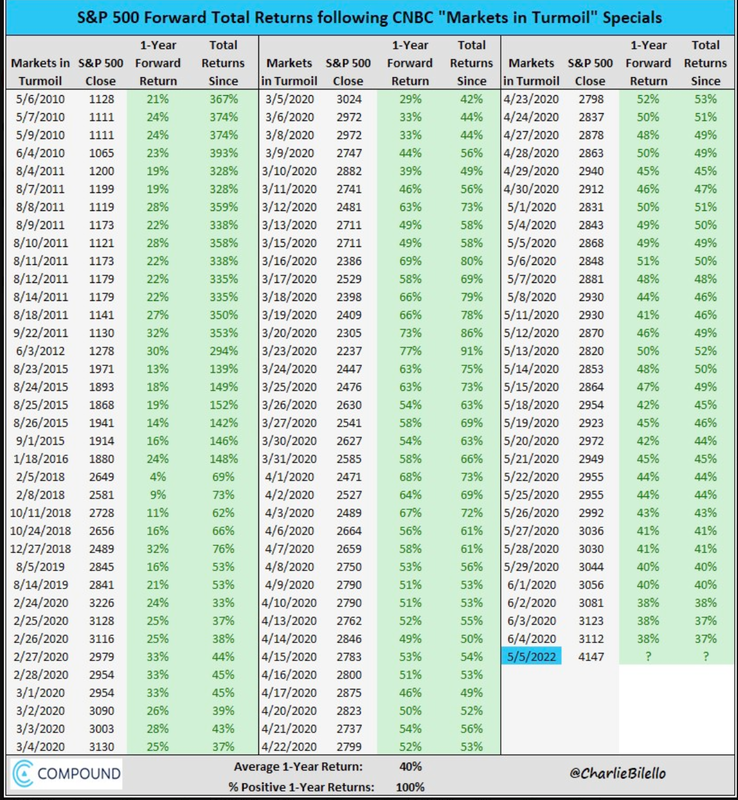

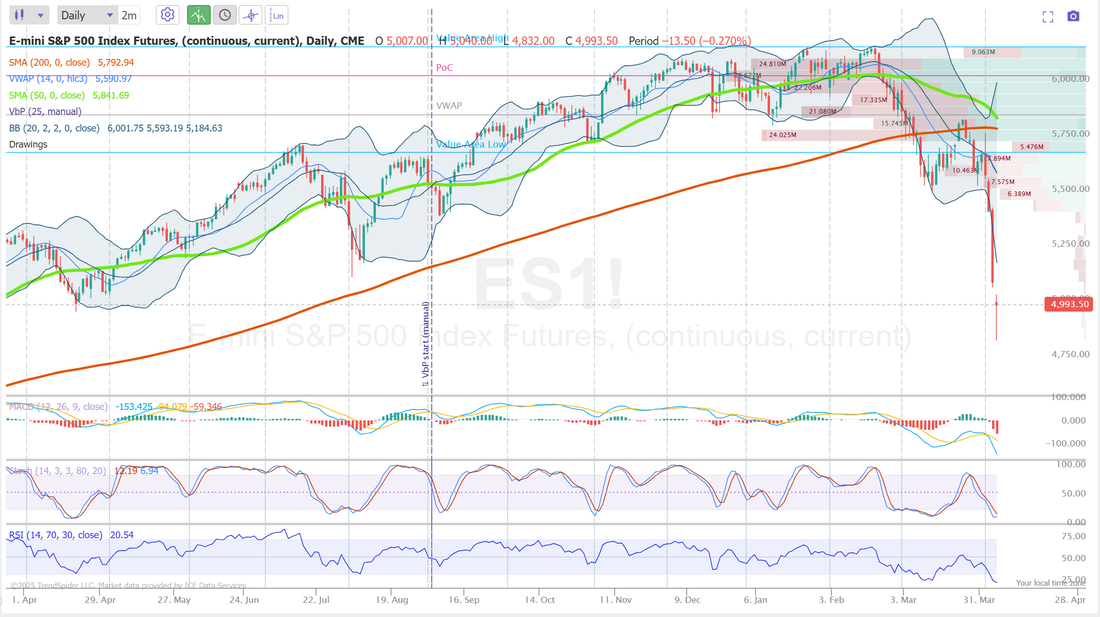

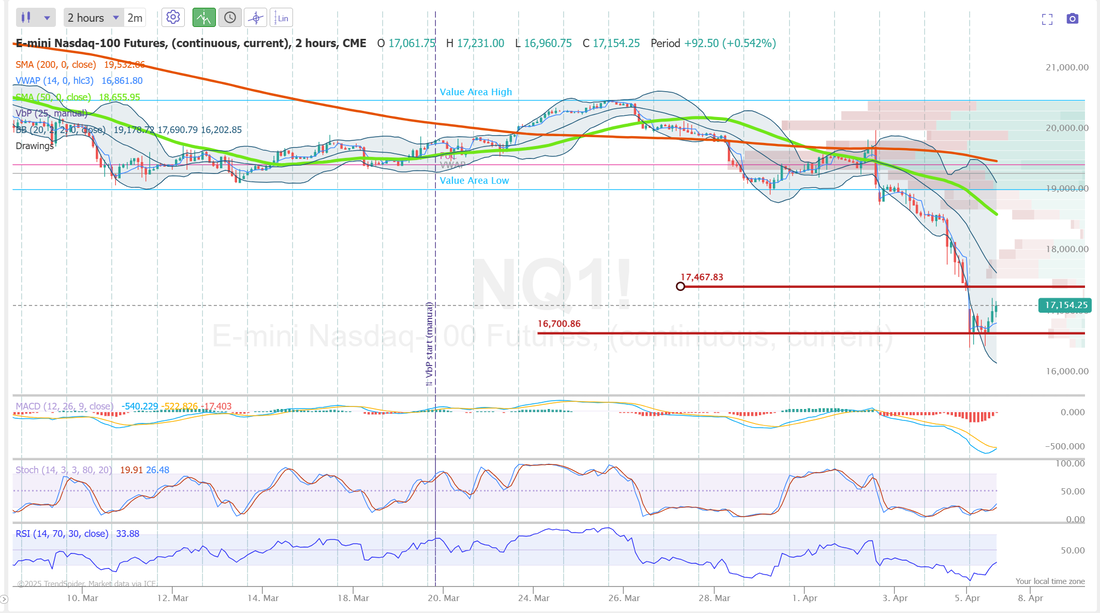

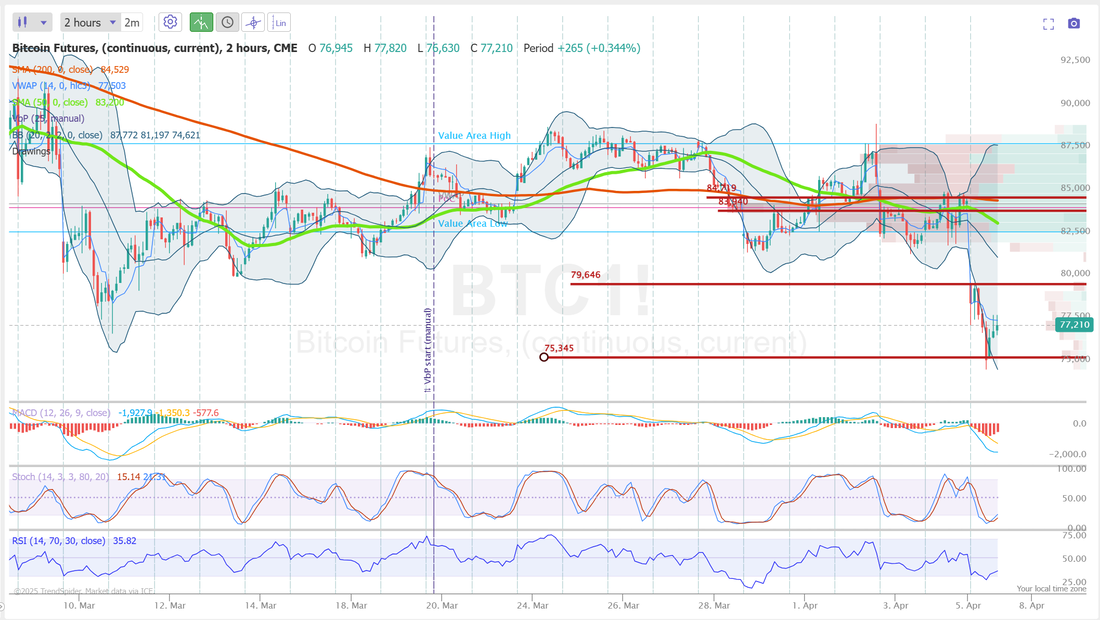

I look forward to seeing you all in the live trading room shortly. Recency biasWelcome back traders! It's a new week but it looks a lot like last week. Futures are getting hit again this morning with reciprocal tariffs. Friday it was China and today it's the U.K. Fallout from tariffs are continuing. We got cautious when we lost the 200DMA a while ago and have been about 90% in cash and focusing soley on our short term trades, I.E., 0DTE's on SPX, Scalping the QQQ's and 1HTE's on Bitcoin. That's served us well but not everyone was as cautious. Why? Well, it's called recency bias. We think that whatever is currently happening will continue for ever. That markets had back to back years of amazing results. We simply assume (maybe even subconsciously) that will continue. That's the main reason so many traders have been caught out here. Like wise now, everyone thinks we're going to zero. This too shall pass. In fact, I think we rebound today from futures selloff this morning. We've already come back 50% from Sunday nights drop. As for us here in our live trading room we'll continue to trade small and stay focused on short term trades. Remember....cash is a position. Our results were'n't great on Friday. They could have been if I'd just walked away with our first locked in gain of the day but, the risk/reward was strong enough (premium, as you can imagine is amazing) that I thought it was worth a shot and continuing to trade. Here's a look at my day from Friday. As I said last week, embrace the downward directional bias. Trade with the trend and enjoy the amazing premium we now have to work with. There's a great chance today will, once again, become a trend day. Let's be patient. No need to jump on anything right away. Trade docket for today: #1. Trade small. #2. Focus on short term setups. We'll do an SPX 0DTE today and mayber an NDX later in the day. We'll try to work the 1HTE Bitcoin setups IF the premium is there and we'll focus on QQQ's in the scalping room today. June S&P 500 E-Mini futures (ESM25) are down -3.29%, and June Nasdaq 100 E-Mini futures (NQM25) are down -3.81% this morning as worries over the economic fallout of U.S. President Donald Trump’s sweeping tariffs continue to weigh on sentiment. President Trump, speaking to reporters on Sunday aboard Air Force One following a weekend of golf in Florida, repeatedly stood by the sweeping tariffs announced last week. He said that “sometimes you have to take medicine to fix something.” Also, U.S. Treasury Secretary Scott Bessent on Sunday adopted a defiant stance amid the global stock market sell-off triggered by new U.S. tariffs, asserting that the measures are necessary and dismissing concerns that they will lead to a U.S. recession. “We get these short-term market reactions from time to time. The market consistently underestimates Donald Trump,” he said. Investor focus this week is on key U.S. inflation data, the publication of the minutes of the Federal Reserve’s latest policy meeting, and the start of the first-quarter earnings season. In Friday’s trading session, Wall Street’s major equity averages closed sharply lower, with the S&P 500 and Nasdaq 100 falling to 11-month lows and the Dow dropping to a 9-month low. The Magnificent Seven stocks slumped, with Tesla (TSLA) plunging over -10% and Nvidia (NVDA) sliding more than -7%. Also, chip stocks sold off, with Micron Technology (MU) tumbling more than -12% and Intel (INTC) sinking over -11%. In addition, GE HealthCare Technologies (GEHC) dropped nearly -16% and was the top percentage loser on the S&P 500 after China launched an anti-dumping probe into imports of a type of medical X-ray tube from the U.S. On the bullish side, retailers linked to tariffs on Southeast Asian imports advanced after Vietnam and Cambodia indicated a readiness to negotiate tariff levels, with Nike (NKE) climbing +3% to lead gainers in the Dow and Lululemon Athletica (LULU) rising over +3%. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls climbed 228K in March, stronger than expectations of 137K. At the same time, the U.S. March unemployment rate unexpectedly edged up to 4.2%, weaker than expectations of no change at 4.1%. In addition, U.S. average hourly earnings rose +0.3% m/m and +3.8% y/y in March, compared to expectations of +0.3% m/m and +3.9% y/y. Fed Chair Jerome Powell stated on Friday that the economic impact of new tariffs is likely to be significantly larger than anticipated, with potential effects such as slower growth and higher inflation, and noted that the central bank was in no rush to adjust interest rates. “While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent,” Powell said. Meanwhile, U.S. rate futures have priced in a 51.6% chance of no rate change and a 48.4% chance of a 25 basis point rate cut at the conclusion of the Fed’s May meeting. First-quarter earnings season kicks off this week, with big banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Morgan Stanley (MS) set to release their earnings reports on Friday. BlackRock (BLK) and Delta Air Lines (DAL) are among other major names scheduled to deliver quarterly updates during the week. On the economic data front, the U.S. consumer inflation report for March will be the main highlight this week. The reading could provide insights into the prospects of interest rate reductions as dark clouds gather over the U.S. economy following President Trump’s tariff announcements. Other noteworthy data releases include the U.S. PPI, the Core PPI, Initial Jobless Claims, Crude Oil Inventories, Wholesale Inventories, and the University of Michigan’s Consumer Sentiment Index (preliminary). Also, investors will closely monitor the release of the Federal Reserve’s minutes from the March 18-19 meeting on Wednesday. With expectations mounting that the Fed will support the economy by cutting rates five times this year, starting in June, the minutes could shed light on how justified those expectations may be. “While investors are hoping that the Federal Reserve comes to the rescue, it’s unclear how a few potential rate cuts this year will undo the economic damage that these tariffs are likely to cause, said Emily Bowersock Hill at Bowersock Capital Partners. In addition, a slew of Fed officials will be making appearances throughout the week, including Kugler, Daly, Barkin, Logan, Bowman, Goolsbee, Harker, Musalem, and Williams. Today, investors will focus on U.S. Consumer Credit data, which is set to be released in a couple of hours. Economists expect this figure to be $15.20B in February, compared to the previous figure of $18.08B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.953%, down -0.95%. I think it would be fool hardy to come into today with a lean or bias. The market is searching for levels here and we'll just sit back and let it work. What makes it harder now is that while this is clearly a bearish defined trend, there can be violent retraces upwards. In the big picture it doesn't change the overall bearish bias (unless it's enough to push us back above the 200DMA) but they can come out of nowhere. I think today could be one of those days. Don't be surprised if we push higher off these lows in the futures and IF we do, don't think it's an "all clear" signal and everything is back to bullishness. What if you invested in the S&P500 every time the US. news channel CNBC reported that the stock market was in turmoil? In that case... your average return after 1 year is equal to 40% with a win rate of 100%. Only 10 tech companies dominate the S&P 500 today This is even more extreme than during the peak of the Dot Com bubble High concentration is a risk that should NOT be overlooked… This concentration is adding to the big swings. Find value elsewhere. There are lots of "babies being thrown out with the bathwater" here. One last thought I'll leave with you today: Don't fight what the market gives us. Trade with the trends. Let's take a look at the market's. No surprise. Technicals are smashed to sell mode. Markets are now back to a key support level established in April 2024 Let's take a look at our intra-day levels: /ES: Futures are rebounding this morning after Sundays selloff. This April 2024 support level looks pretty substantial. Will it hold today? Hard to know but, I think we've got a good chance. I'm looking for some bullish moves off these lows. /NQ: Nasdaq is actually rebounding stronger than /ES this morning. We were down 800+ points earlier. Now down "only" -393 as I type. That April 2024 consolidation level is a key level for /NQ as well. /ES intra-day levels: 5097 to the upside. This would retrace the Sunday evening gap down. 4875 to the downside. That would equate to the Sunday evening low. /NQ intra-day levels: Similar look to /ES. 17,467 is resistance and would be a "gap fill" from Sunday nights sell off. 16,700 is support which equates to Sunday nights low. BTC: Bitcoin is getting whacked, just like equities. Down $7,000 this morning to the $77,000 range. Similar pattern to equities. 79,646 is resistance with 75,345 working as support. One last thought. Focus on what we can control. We can't control the market but we can control our risk levels. See you all in the live trading room shortly!

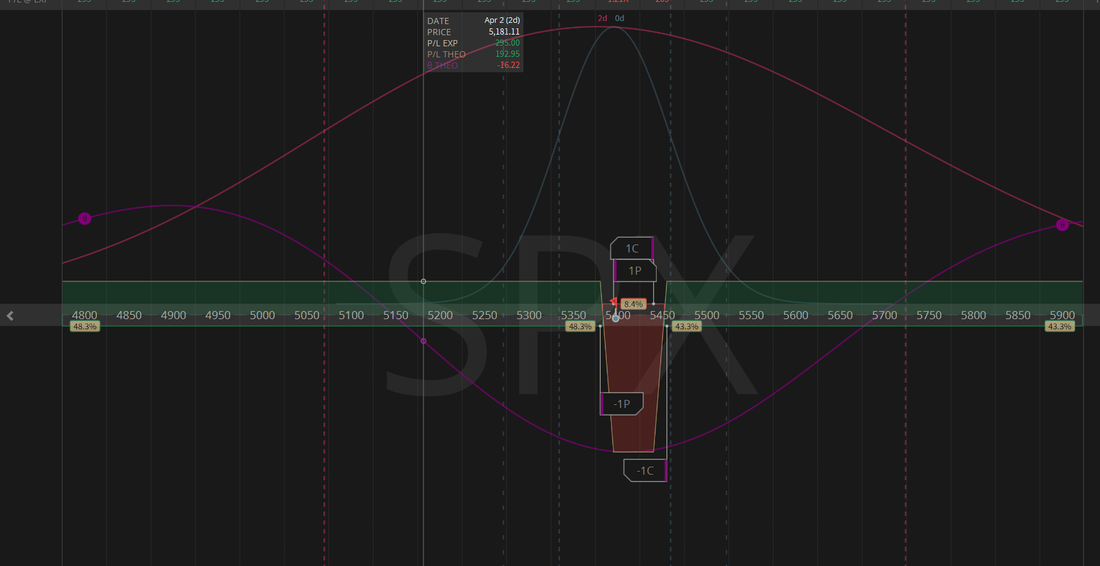

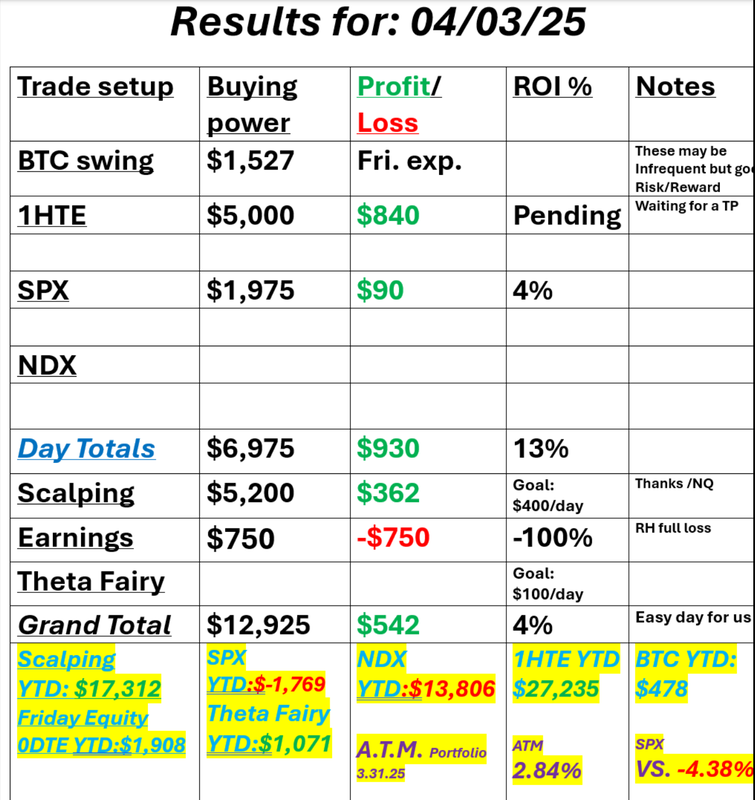

Don't worry...be happy.Good Friday to you all! As I start todays blog I want to be crystal clear! This is not a brag session. There is rarely a single day that goes by that we don't have a losing trade. (We had one yesterday go to full loss, RH) but...yesterday was an easy, pretty much risk free session for us and we made money. I've been at this since 1987. I've seen more crashes than most. We've been planning for this event for two months now. Pulling in our horns, Limiting our number of trades. Adding downside hedges. Trading smaller, Building Long vol instead of short vol trades, etc. Today should be the same for us. Futures are down another -3%+ as I type and we will open this morning with a nice profit. Check out our SPX trade that we will be starting the day with. Easy money in a market like this. The best advise I can give is the exact same I've been giving for two months now. Embrace downside moves and big volitility. That's where the best traders make the easy money. Here's a look at our day yesterday. The BTC trade is still pending as Kalshi isn't open yet to book the profit but it's up nicely to start the day. June S&P 500 E-Mini futures (ESM25) are down -2.33%, and June Nasdaq 100 E-Mini futures (NQM25) are down -2.71% this morning, pointing to a continued selloff on Wall Street following U.S. President Donald Trump’s announcement of sweeping tariffs, while investors await the key U.S. payrolls report and remarks from Federal Reserve Chair Jerome Powell. President Trump on Wednesday unveiled the most aggressive U.S. tariffs in a century, fueling fears of an escalating trade war and economic slowdown. Economists anticipate that the tariffs will drive prices and dampen economic growth, potentially even triggering a recession. JPMorgan has raised the likelihood of a global recession this year to 60%. In addition, UBS Global Wealth Management downgraded U.S. equities to Neutral from Attractive and lowered its year-end S&P 500 target by nearly 10% to 5,800, cautioning that reciprocal tariffs could trigger more market volatility. Stock futures losses deepened after China retaliated against new U.S. tariffs. Beijing will impose a 34% tariff on all U.S. imports beginning April 10th, according to the official Xinhua News Agency. In yesterday’s trading session, Wall Street’s major indices closed sharply lower, with the S&P 500, Nasdaq 100, and Dow falling to 6-1/2 month lows. Apple (AAPL) sank over -9% after President Trump announced sweeping tariffs, as the iPhone maker manufactures its devices in China and other Asian countries. Also, chip stocks sold off, with Microchip Technology (MCHP) tumbling more than -16% to lead losers in the Nasdaq 100 and Micron Technology (MU) plunging over -16%. In addition, RH (RH) plummeted more than -40% after the luxury home furnishing company posted downbeat Q4 results and provided disappointing FY25 revenue guidance. On the bullish side, Lamb Weston Holdings (LW) surged about +10% and was the top percentage gainer on the S&P 500 after the frozen potato giant reported better-than-expected FQ3 results and reaffirmed its FY25 guidance. “Market uncertainty is likely to remain elevated in the weeks ahead, as investors consider likely downgrades to consensus US economic and earnings growth forecasts, the risk of a tit-for-tat escalation in tariffs, and the potential scope for tariffs announced to be negotiated down,” said Solita Marcelli at UBS Global Wealth Management. Economic data released on Thursday showed that the U.S. ISM services index fell to a 9-month low of 50.8 in March, weaker than expectations of 53.0. Also, the U.S. trade deficit stood at -$122.70B in February, wider than expectations of -$122.50B. At the same time, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -6K to a 7-week low of 219K, compared with the 225K expected. In addition, the final estimate of the U.S. March S&P Global services PMI was revised higher to 54.4 from the 54.3 preliminary reading. Fed Vice Chair Philip Jefferson stated on Thursday that interest rates are well-positioned to manage competing risks despite significant uncertainty in the economic outlook due to major changes in U.S. policies on trade, immigration, and regulation. Jefferson noted that there might be a “modest softening” in the labor market this year, and ongoing uncertainty could dampen economic activity. Still, he said that “there is no need to be in a hurry to make further policy rate adjustments,” as officials await more clarity on the economic impact of President Trump’s policies. Also, Fed Governor Lisa Cook said, “Amid growing uncertainty and risks to both sides of our dual mandate, I believe it will be appropriate to maintain the policy rate at its current level while continuing to vigilantly monitor developments that could change the outlook.” U.S. rate futures have priced in a 68.4% probability of no rate change and a 31.6% chance of a 25 basis point rate cut at the May meeting. Meanwhile, Fed Chair Jerome Powell is set to deliver a speech on the economic outlook at the Society for Advancing Business Editing and Writing Annual Conference later today. Also, Fed Governor Christopher Waller and Fed Vice Chair for Supervision Michael Barr will speak today. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that March Nonfarm Payrolls will come in at 137K, compared to February’s figure of 151K. U.S. Average Hourly Earnings data will also be closely watched today. Economists expect March figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.3% m/m and +4.0% y/y. The U.S. Unemployment Rate will be reported today as well. Economists forecast that this figure will remain steady at 4.1% in March. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.947%, down -2.66%. Todays blog will be short and sweet. We will focus on #1. Booking our profit at the open on our SPX. #2. Continue to cashflow our /NQ scalp. #3. Book the profit on the 1HTE and see if we can add more. #4. Look for a potential new setup in SPX to possibly double dip. Let's look at the market levels on /ES: Looking at the daily chart you can see we are back to some key levels going back to the Aug. 2024 lows. I think we've finally found a decent support zone. Will it hold? Who knows. As traders we don't really care but I think it's got a shot. I'd say we've got a fair shot at moving up today. I'm not saying a green day. Just up from the -180 slide in the /ES futures, as I type. On the intra-day chart it's really impossible to see any levels. We've moved too far, too fast. On day's like yesterday and today, it's nice to have a trading community where we are building trades to take advantage of current market conditions. Let's bank some more profits today!!!!! See you all in the live trading room. Should be easy pickings today.

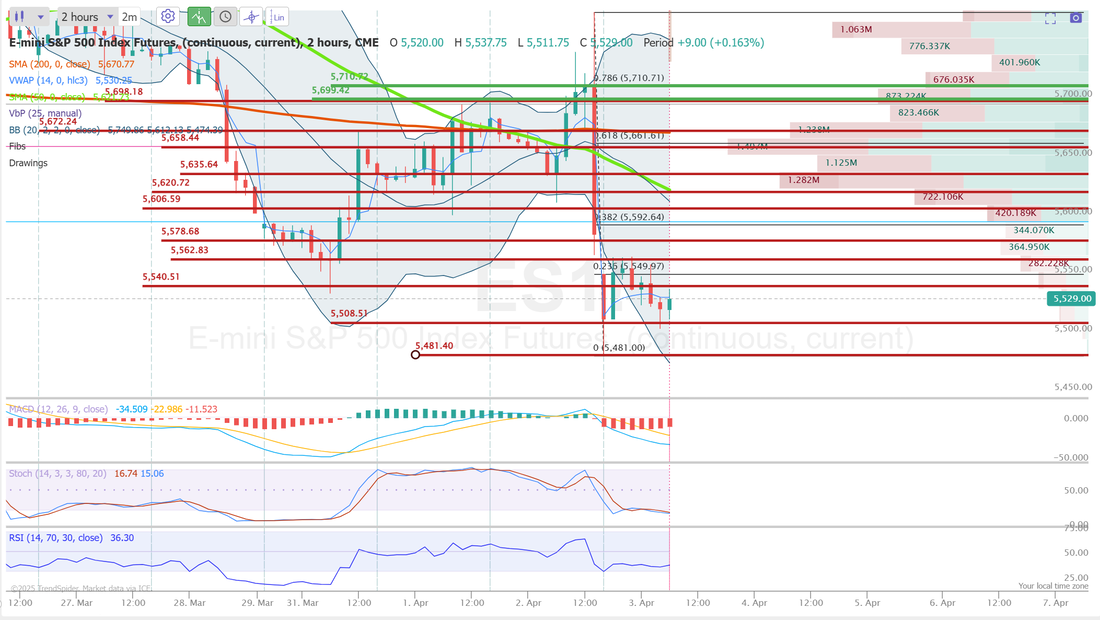

"Success is where preparation meets opportunity"Welcome back traders! I love the saying, "It's not what you trade, it's who trades it that matters." What you trade, what setups you choose, what the market does, etc. None of that is ultimately as important as you...the trader and how you manage it. We've been scaling our trading down. Tightening our risk management. Putting on a big hedge in our scalping room, all in preparation for a day like yesterday (and what looks like today). It's almost indescribable how gratifying it was last night, watching the futures crash and watching our accounts go up! We should start the day up about $1,400 dollars thanks to our hedge and siting mostly in cash. The value of our trading community isn't the trades we offer up each day. It's the people and the exchange of ideas and the focus it brings to trading with a plan. Who know's what trading will look like today but it's gratifying to know we've got some cash to put to work and some profits to start us off with. Yesterday was interesting and a bit of a precursor to today. Premium was "strange". Price action was "strange". We, once agian, focused our primary efforts on risk management. It got a bit higher than our $500 dollar goal. At one point I had $775 at risk but we ultimately lived to fight another day. This is how close we got on the SPX. Another day of solid risk management while still having great return potential. How does our asset allocation passive, long term investment portfolio, The ATM program look this morning? Great. Our over performance, compared to the SP500 just keeps growing. As I say, have a plan and stick to it. Take a look at our results from yesterday: One of the hardest things to do as a trader is to stick to your plan when, A: It's not working. B: Everyone else around you is making money doing the opposite. Your payoff eventually comes due. As one of our trading members said yesterday, "You don't know who's swimming naked until the tide goes out." You'll see that today. I'm not sure what percentage of traders are starting off today with their portfolios up but we certainly are! June S&P 500 E-Mini futures (ESM25) are down -3.09%, and June Nasdaq 100 E-Mini futures (NQM25) are down -3.42% this morning, pointing to a sharply lower open on Wall Street as sweeping tariffs announced by U.S. President Donald Trump fueled fears of an escalating trade war and economic slowdown. President Trump on Wednesday unveiled the most aggressive U.S. tariffs in a century as he intensifies his push to reshape world trade. Trump said that a baseline 10% tariff would be imposed on almost all U.S. imports starting April 5th. Also, numerous countries would be hit with additional “reciprocal” tariffs, including total duties of 54% on China, 46% on Vietnam, and 20% on the European Union. The higher tariffs on targeted countries, which will replace - not supplement - the 10% baseline rate, are scheduled to take effect on April 9th, according to the White House. The announcement stoked a global risk-off mood, with gold reaching new highs and the 10-year Treasury yield falling to its lowest level in over five months as investors flocked to haven assets. “The tariff plans provided significantly more clarity than many investors likely had expected,” wrote Michael Zezas, global head of fixed-income research and public policy strategy at Morgan Stanley. “However, the magnitude of the tariffs announced by the White House suggest that the downside risks to global growth have increased relatively to what was already priced by markets.” Investors now await a new round of U.S. economic data and remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Tesla (TSLA) climbed over +5% and was the top percentage gainer on the Nasdaq 100 after Politico reported that President Trump had told his inner circle that Elon Musk would soon step back from his government role and return to his businesses. Also, Caesars Entertainment (CZR) advanced more than +5% after Raymond James added the stock to its “Analyst Current Favorites” list. In addition, DoorDash (DASH) rose over +3% after announcing a partnership with Domino’s Pizza, where orders placed on DoorDash’s Marketplace will be delivered by Domino’s drivers. On the bearish side, nCino (NCNO) tumbled more than -19% after the cloud-based software company posted weaker-than-expected Q4 adjusted EPS and issued below-consensus FY26 guidance. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 155K in March, easily topping the 118K consensus. Also, U.S. factory orders rose +0.6% m/m in February, stronger than expectations of +0.5% m/m. Fed Governor Adriana Kugler said on Wednesday, “I will support maintaining the current policy rate for as long as these upside risks to inflation continue [pointing to government policy changes], while economic activity and employment remain stable. Going forward, I will carefully assess incoming data, the evolving outlook, and changes in the balance of risks.” Meanwhile, U.S. rate futures have priced in a 78.1% chance of no rate change and a 21.9% chance of a 25 basis point rate cut at May’s monetary policy meeting. Today, investors will focus on the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI, set to be released in a couple of hours. Economists forecast the March ISM services index to be 53.0 and the S&P Global services PMI to be 54.1, compared to the previous values of 53.5 and 51.0, respectively. U.S. Initial Jobless Claims data will also be closely monitored today. Economists expect this figure to be 225K, compared to last week’s number of 224K. U.S. Trade Balance data will be released today as well. Economists foresee this figure standing at -$122.50B in February, compared to -$131.40B in January. In addition, market participants will hear perspectives from Fed Vice Chair Philip Jefferson and Fed Governor Lisa Cook throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.054%, down -3.36%. Let's jump right to the levels for our /ES today. We'll focus on a SPX 0DTE and look for an NDX later in the day. Levels, levels and more levels. All of our levels from yesterday as still in play today so I'll focus on two new ones. 5508 support and 5481 support. I'll be trading off these levels today. I do want to look briefly at the /NQ. Not neccessarily for a 0DTE setup in the NDX, rather, we've got a nicely profitable hedge going with a big credit call spread on /NQ in our scalping room and we want to add the put side today. I've said my plan was to hold a long /MNQ futures position and cash flow it with a Credit call spread hedge on the /NQ. That's primarily what will be responsible for starting us off today with immediate profits. I wanted to hold the long /MNQ as long as we stayed above the March 13th, low of 19,106. We are below that today so depending on how the day goes. I'll either dispose of that position and lock in our gain or continue to hold but that 19,106 level is the trigger. Let's get it on folks! I'm super excited to get this day started. See you all in the live trading room!

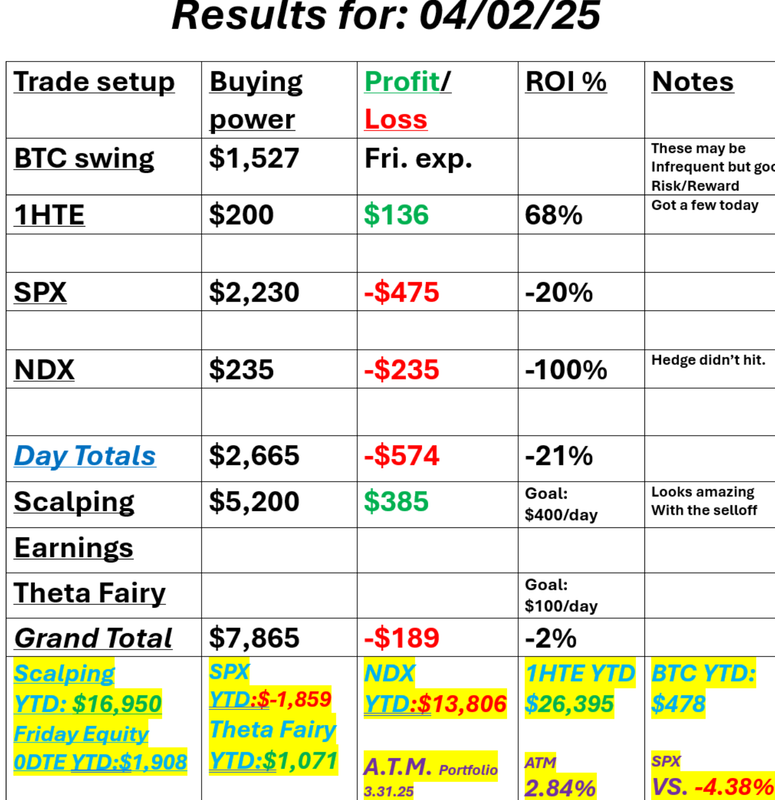

Debits or credits?Good morning traders! Welcome to "Liberation day"...whatever that may mean. It could be a big day. I'm watching 5620 on /ES. That's been a key support level. If we lose that it could be "look out below". We had a great day yesterday. We didn't make our $1,000/day goal but it was our best risk adjusted day all year. Our risk never went above $50 dollars all day. Granted we hit each entry pretty much perfect but it was gratifying, nonetheless. One of the first decisions an option trader needs to make is "Debit or credit?" Debits are pure directional plays. They have much lower probability of success but better risk/reward. Credit trades can be built with incredible probabilites of success of have worse risk/reward. I.V. also factors in. When I.V. is high options are expensive. Generally you want to sell expensive options and buy cheap ones. We've found our best success lately is a combination of both debit and credits setups with butterflies or broken wing butterflies adding nice profit zones. Here's a look at our day: Let's take a look at some of the market metrics: Sell signals all across the board. The bigger picture is starting to look more and more bearish. One quick note here: We love bearish markets. They are unquestionably the best for us. They offer bigger moves and larger premiums as I.V. spikes. If you are stuck in the idea that you want markets to go up you are short changing yourself of a better opportunity. I'm parking my long term money in our A.T.M. program which works like a hedge fund and can profit from down moves and in my trading account I'm trading small each day. Find a plan that works for you in a bear market. Don't complain...adjust. June S&P 500 E-Mini futures (ESM25) are trending down -1.01% this morning as risk sentiment took a hit ahead of U.S. President Donald Trump’s sweeping tariffs announcement. President Trump is set to announce his reciprocal tariff plan at an event in the White House Rose Garden just as U.S. stock markets close at 4 p.m. The White House said on Tuesday that reciprocal tariffs would become effective immediately after Trump announces them, heightening concerns about the economic impact of a trade war. Bloomberg reported that several proposals are being considered, including a tiered tariff system featuring a series of flat rates for countries, along with a more tailored reciprocal plan. Also, a recently announced 25% tariff on auto imports is set to take effect at 12:01 a.m. Washington time on April 3rd. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. Tesla (TSLA) rose over +3% after Wells Fargo added the stock to its Q2 Tactical Ideas list. Also, PVH Corp. (PVH) surged more than +18% after the company reported better-than-expected Q4 results, issued above-consensus FY25 guidance, and said it plans to enter $500 million accelerated share repurchase agreements. In addition, Crowdstrike (CRWD) gained over +2% after Stephens initiated coverage of the stock with an Overweight rating and a price target of $450. On the bearish side, Johnson & Johnson (JNJ) slumped over -7% and was the top percentage loser on the S&P 500 and Dow after a federal judge in Texas rejected the company’s third attempt to use the bankruptcy of one of its units to resolve baby powder cancer claims. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings fell to 7.568M in February, weaker than expectations of 7.690M. Also, the U.S. ISM manufacturing index fell to a 4-month low of 49.0 in March, weaker than expectations of 49.5, while the ISM prices paid sub-index rose to a 2-3/4 year high of 69.4, stronger than expectations of 64.6. At the same time, the U.S. March S&P Global manufacturing PMI was revised upward to 50.2, beating the consensus of 49.8. In addition, U.S. construction spending rose +0.7% m/m in February, stronger than expectations of +0.3% m/m. Richmond Fed President Tom Barkin stated on Tuesday that President Trump’s tariffs could drive up both inflation and unemployment, posing a significant challenge for the central bank. Barkin noted that a tariff-driven price shock could lead to a “cage match” between a frustrated consumer unwilling to pay more and a goods and services provider who “really believes” they must pass on increases. Regarding the labor market, the Richmond Fed chief said, “If you are a company that can’t raise prices, then your margin goes down. You’re going to start working on operational efficiencies, and that means headcount.” Also, Chicago Fed President Austan Goolsbee cautioned about the adverse effects of any pullback in consumer spending or business investment stemming from tariff-related uncertainty. “If the consumer stops spending or business stops investing because they’re uncertain or they’re afraid where we’re headed, that would be a bit of a mess,” Goolsbee said in an interview on Fox News. Meanwhile, U.S. rate futures have priced in an 85.5% probability of no rate change and a 14.5% chance of a 25 basis point rate cut at the May FOMC meeting. On the economic data front, investors will focus on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the March ADP Nonfarm Employment Change will stand at 118K, compared to the February figure of 77K. U.S. Factory Orders data will also be reported today. Economists foresee this figure coming in at +0.5% m/m in February, compared to the previous number of +1.7% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -0.400M, compared to last week’s value of -3.341M. In addition, market participants will be anticipating a speech from Fed Governor Adriana Kugler. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.174%, up +0.43%. My lean or bias today is bearish. We lose 5620 on /ES and down we go. Nuff said. Very focused trade docket today: We'll look to work the put side of our /NQ scalp for additional income. 1HTE's on BTC for as long as we can find setups. 0DTE on SPX initially and NDX later in the day. RH earnings trade and we'll look again at a re-entry on LULU. Let's look at the /ES today and focus primarily on it. What do we see on the daily chart? Trend? Down. We are in a huge low vol node which means movement (substantial) is coming. Below the 200DMA. MACD, STOC, RSI etc. all flashing sell signals. As I type this we just went below the 5620 level (very bearish) but the big double whammy that could be coming, if bulls can't step in in the Mar. 13th. 5508 key support. IF we get back down there we also have a good chance that the 50DMA (green line) crosses down through the 200DMA (red line). That my friends is a death cross. Below the 200DMA and a death cross? That's the biggest bearish signal I know. I'm not saying it will happen. Just be prepared. On an intra-day basis we will place our trades based on multiple levels. 5620 is really key. Bulls absolutely need to hold this level. Resistance levels above are 5635, 5658, 5672, 5698. If we lose 5620 the first support below is 5606 then 5578, 5562, 5540. Our goal (my my suggestion to you) is to focus today on risk management and let the profit or loss fall where it may. I'll see you all in the live trading room shortly. Let's have a repeat of yesterday. That would be nice.

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |