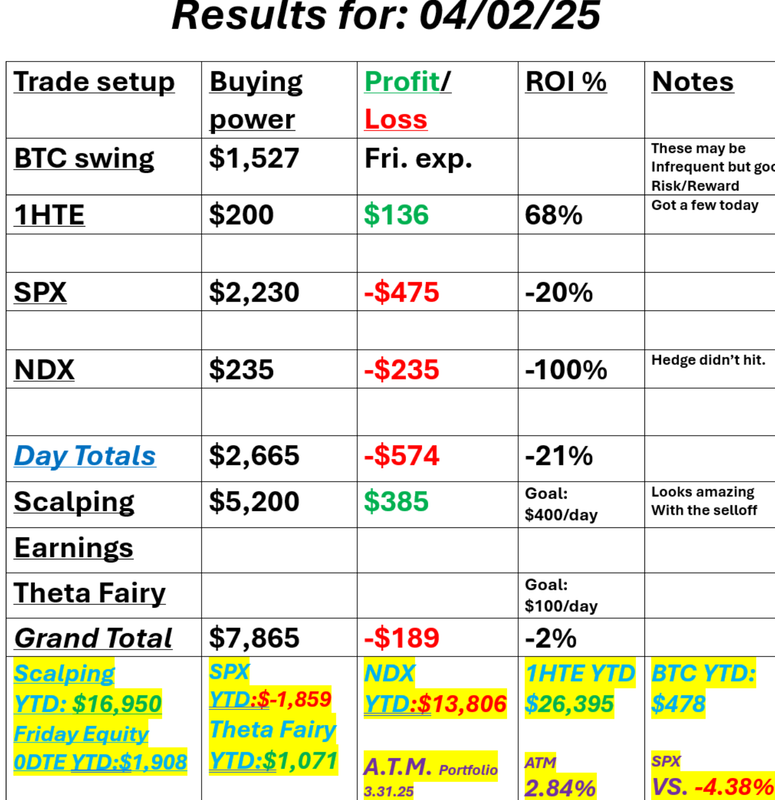

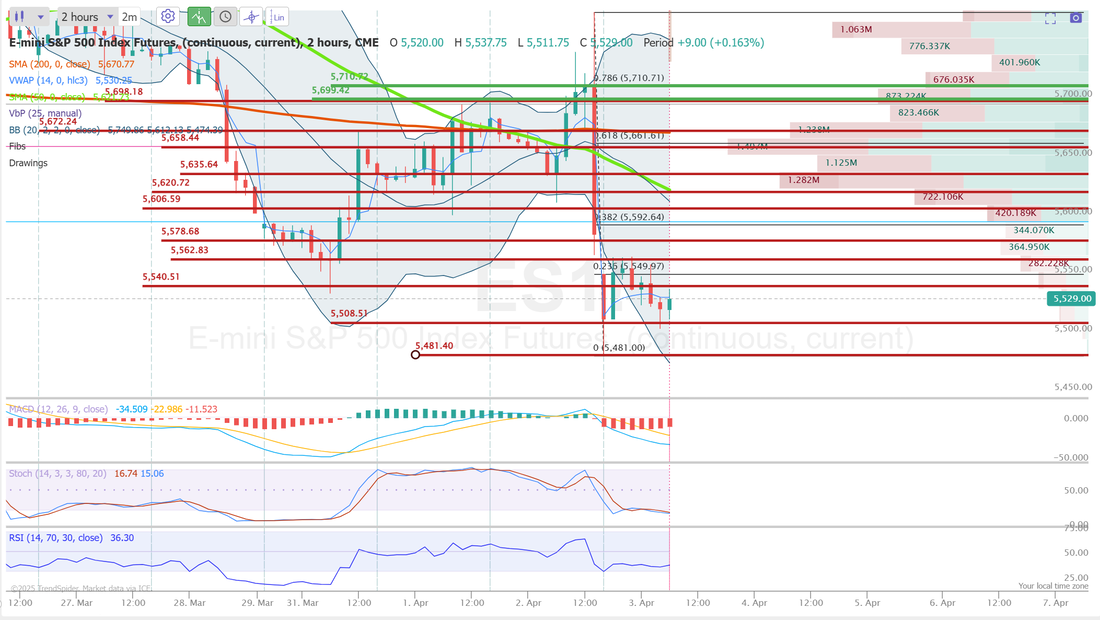

"Success is where preparation meets opportunity"Welcome back traders! I love the saying, "It's not what you trade, it's who trades it that matters." What you trade, what setups you choose, what the market does, etc. None of that is ultimately as important as you...the trader and how you manage it. We've been scaling our trading down. Tightening our risk management. Putting on a big hedge in our scalping room, all in preparation for a day like yesterday (and what looks like today). It's almost indescribable how gratifying it was last night, watching the futures crash and watching our accounts go up! We should start the day up about $1,400 dollars thanks to our hedge and siting mostly in cash. The value of our trading community isn't the trades we offer up each day. It's the people and the exchange of ideas and the focus it brings to trading with a plan. Who know's what trading will look like today but it's gratifying to know we've got some cash to put to work and some profits to start us off with. Yesterday was interesting and a bit of a precursor to today. Premium was "strange". Price action was "strange". We, once agian, focused our primary efforts on risk management. It got a bit higher than our $500 dollar goal. At one point I had $775 at risk but we ultimately lived to fight another day. This is how close we got on the SPX. Another day of solid risk management while still having great return potential. How does our asset allocation passive, long term investment portfolio, The ATM program look this morning? Great. Our over performance, compared to the SP500 just keeps growing. As I say, have a plan and stick to it. Take a look at our results from yesterday: One of the hardest things to do as a trader is to stick to your plan when, A: It's not working. B: Everyone else around you is making money doing the opposite. Your payoff eventually comes due. As one of our trading members said yesterday, "You don't know who's swimming naked until the tide goes out." You'll see that today. I'm not sure what percentage of traders are starting off today with their portfolios up but we certainly are! June S&P 500 E-Mini futures (ESM25) are down -3.09%, and June Nasdaq 100 E-Mini futures (NQM25) are down -3.42% this morning, pointing to a sharply lower open on Wall Street as sweeping tariffs announced by U.S. President Donald Trump fueled fears of an escalating trade war and economic slowdown. President Trump on Wednesday unveiled the most aggressive U.S. tariffs in a century as he intensifies his push to reshape world trade. Trump said that a baseline 10% tariff would be imposed on almost all U.S. imports starting April 5th. Also, numerous countries would be hit with additional “reciprocal” tariffs, including total duties of 54% on China, 46% on Vietnam, and 20% on the European Union. The higher tariffs on targeted countries, which will replace - not supplement - the 10% baseline rate, are scheduled to take effect on April 9th, according to the White House. The announcement stoked a global risk-off mood, with gold reaching new highs and the 10-year Treasury yield falling to its lowest level in over five months as investors flocked to haven assets. “The tariff plans provided significantly more clarity than many investors likely had expected,” wrote Michael Zezas, global head of fixed-income research and public policy strategy at Morgan Stanley. “However, the magnitude of the tariffs announced by the White House suggest that the downside risks to global growth have increased relatively to what was already priced by markets.” Investors now await a new round of U.S. economic data and remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Tesla (TSLA) climbed over +5% and was the top percentage gainer on the Nasdaq 100 after Politico reported that President Trump had told his inner circle that Elon Musk would soon step back from his government role and return to his businesses. Also, Caesars Entertainment (CZR) advanced more than +5% after Raymond James added the stock to its “Analyst Current Favorites” list. In addition, DoorDash (DASH) rose over +3% after announcing a partnership with Domino’s Pizza, where orders placed on DoorDash’s Marketplace will be delivered by Domino’s drivers. On the bearish side, nCino (NCNO) tumbled more than -19% after the cloud-based software company posted weaker-than-expected Q4 adjusted EPS and issued below-consensus FY26 guidance. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 155K in March, easily topping the 118K consensus. Also, U.S. factory orders rose +0.6% m/m in February, stronger than expectations of +0.5% m/m. Fed Governor Adriana Kugler said on Wednesday, “I will support maintaining the current policy rate for as long as these upside risks to inflation continue [pointing to government policy changes], while economic activity and employment remain stable. Going forward, I will carefully assess incoming data, the evolving outlook, and changes in the balance of risks.” Meanwhile, U.S. rate futures have priced in a 78.1% chance of no rate change and a 21.9% chance of a 25 basis point rate cut at May’s monetary policy meeting. Today, investors will focus on the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI, set to be released in a couple of hours. Economists forecast the March ISM services index to be 53.0 and the S&P Global services PMI to be 54.1, compared to the previous values of 53.5 and 51.0, respectively. U.S. Initial Jobless Claims data will also be closely monitored today. Economists expect this figure to be 225K, compared to last week’s number of 224K. U.S. Trade Balance data will be released today as well. Economists foresee this figure standing at -$122.50B in February, compared to -$131.40B in January. In addition, market participants will hear perspectives from Fed Vice Chair Philip Jefferson and Fed Governor Lisa Cook throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.054%, down -3.36%. Let's jump right to the levels for our /ES today. We'll focus on a SPX 0DTE and look for an NDX later in the day. Levels, levels and more levels. All of our levels from yesterday as still in play today so I'll focus on two new ones. 5508 support and 5481 support. I'll be trading off these levels today. I do want to look briefly at the /NQ. Not neccessarily for a 0DTE setup in the NDX, rather, we've got a nicely profitable hedge going with a big credit call spread on /NQ in our scalping room and we want to add the put side today. I've said my plan was to hold a long /MNQ futures position and cash flow it with a Credit call spread hedge on the /NQ. That's primarily what will be responsible for starting us off today with immediate profits. I wanted to hold the long /MNQ as long as we stayed above the March 13th, low of 19,106. We are below that today so depending on how the day goes. I'll either dispose of that position and lock in our gain or continue to hold but that 19,106 level is the trigger. Let's get it on folks! I'm super excited to get this day started. See you all in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |