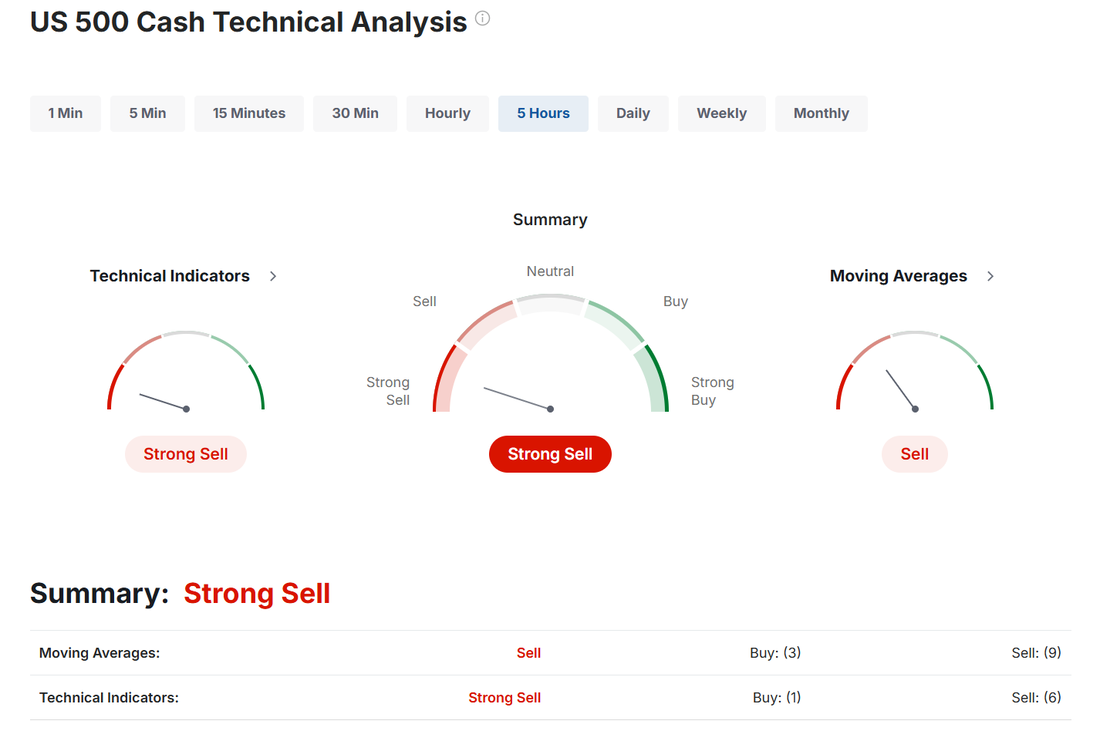

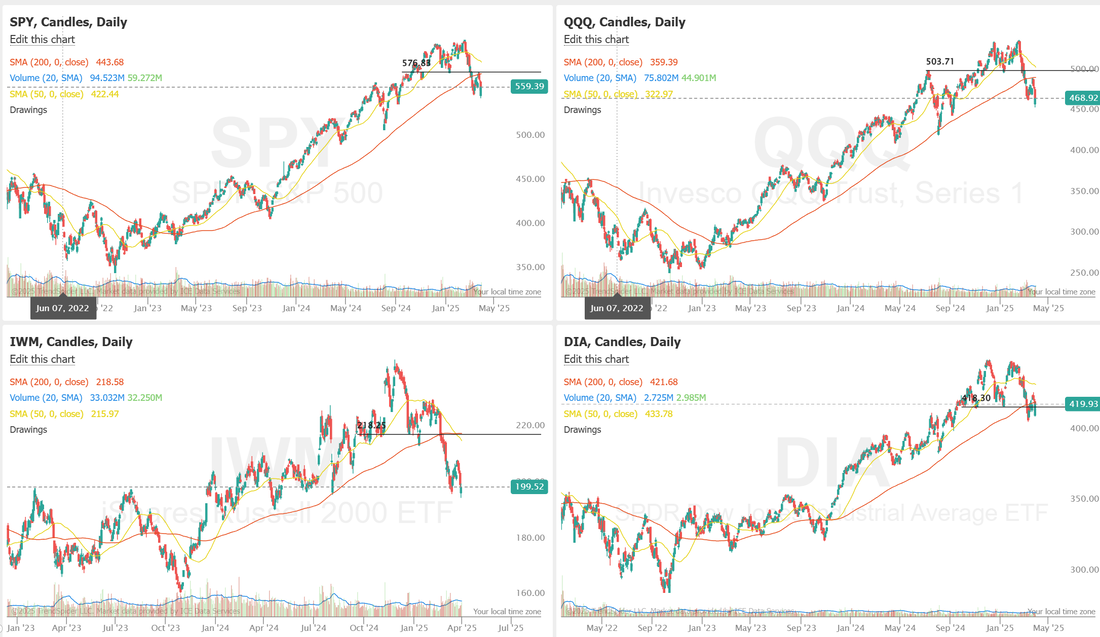

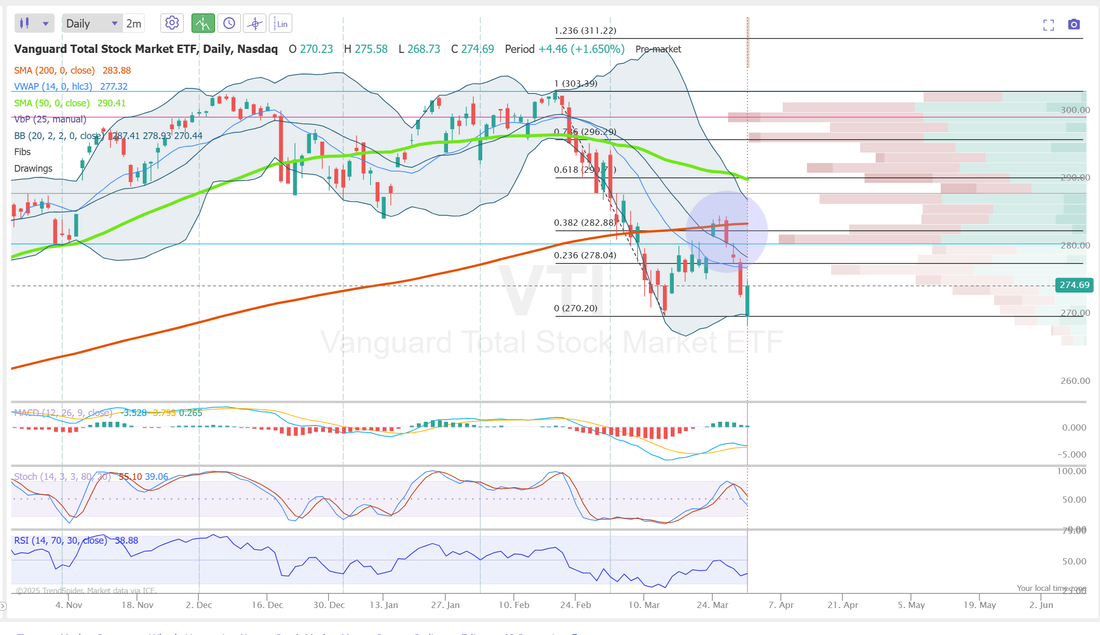

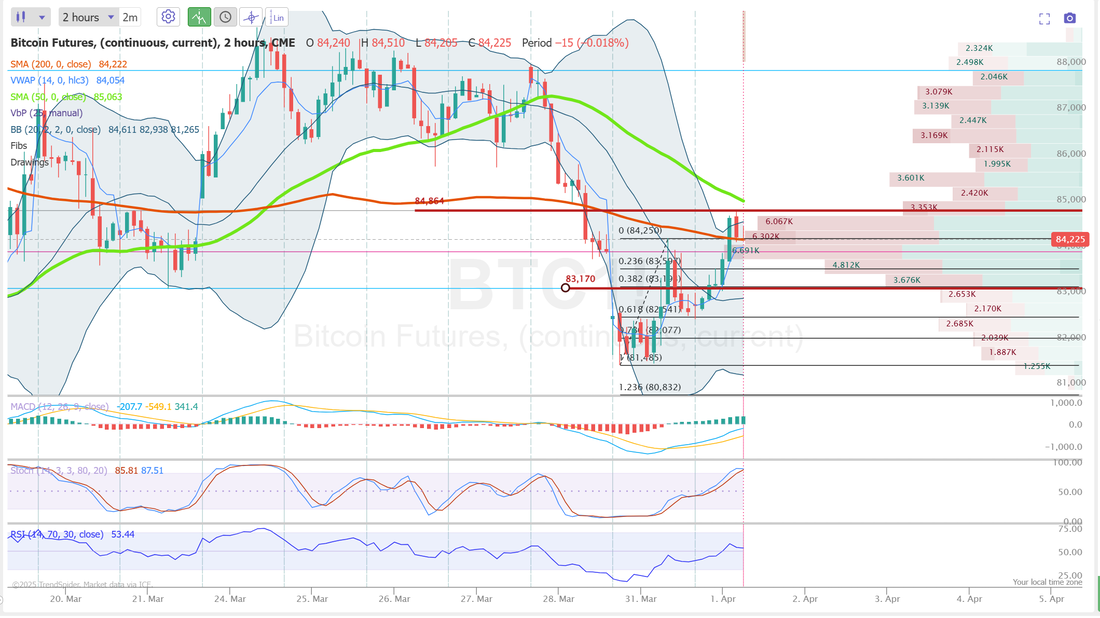

The moves are big...no joke.Welcome back traders. I know it's April 1st but it's no joke. The market moves are something we havent seen in a long time. We were just talking early this morning in the live trading room how important it is in times like this to have something that is stable. Our ATM asset allocation portfolio continues to make money as the market loses. Diversification will save you in times like this and having something that can make money as markets go down is a big part of that. We were oh so close...again on our SPX 0DTE yesterday. The risk managment is on point but we just haven't been able to land on a big profit zone. All we can really do in a market like this is make sure our risk is in check. The results will be what they will be. Here's a look at my day yesterday. We'll work the same approach today. We've got $1,600 or extrinsic on a 2DTE expriation in our scalping setup. That served us well yesterday. Let's see what we can do with that today. If the markets can build today like they did yesterday we may be able to get $400+ out of another roll up and out. That would be an easy way to profits today. The notorious JPM collar trade: The JPM Collar (June 30th Exp): Short 5880 Call Long 5290 Put Short 4460 Put What This Suggests JPM Expects: 1. They’re Not Expecting a Big Rally Above 5880 By selling the 5880 call, they are capping upside. This usually means: “We’re okay missing out on further gains above this level.” It implies a neutral to slightly bullish view — but not euphoric. So: they don’t expect SPX to go way above 5880 before June 30. 2. They Want Protection Starting Around 5290 Buying the 5290 put signals concern about a moderate correction. They’re willing to pay for insurance if SPX falls below current levels. This means: “We’re preparing for a potential pullback or downside volatility.” 3. They’re Willing to Take Some Tail Risk Below 4460 Selling the 4460 put reduces cost — but opens risk if SPX crashes hard. This implies: “We don’t think SPX is going below 4460 — and if it does, we’ll take the hit.” So they’re betting that: A crash below 4460 is unlikely Or if it happens, they’re okay absorbing that risk (possibly because they have other hedges) This had generally been a good guide for what plays out and what the "big boys" are doing with their money. This was the worst quarter for the Nasdaq since Q2 2022, down 11%. The $DOW fell 1.28% for the quarter. At the moment, the $SPY is down 4.32% YTD, with 25% of the year done now. As I said...it's a good time to look at our ATM asset allocation portfolio if you haven't already done so. It's a "calm in the storm". Let's take a look at the markets today: Sell mode is still working. Bulls tried a few times yesterday but didn't acomplish much. All the major indices we track and trade continue to sit on the "cliff". There's a lot of downside potential below it if the bulls can't hold this level. I continue to watch the 270 level on VTI. As long as that level holds, I continue to hold my long /MNQ in our scalping program and cover it with a /NQ credit spread. It faught well yesterday. My lean or bias today is still neutral. We need to either recapture our upper resistance level or lose the cliff to get this market moving again. Yesterdays 100+ intra-day swing in the SPX ended up being nothing at the end of the day. Directional moves will come. When? We don't know. We'll keep our effort focused again today. I'll continue to work the /MNQ, /NQ scalp. BITO cover. 1HTE, BTC trades, 0DTE focused on SPX. Let's take a look at the intra-day levels: /ES: We do have some pretty solid levels today. 5633 is the first resistance with 5664 next. 5612 is first support with 5583 next. BTC: Bitcoin gave us one 1HTE yesterday before we lost the premium. Let's hope we can get more out of it today. The support area seems to be holding. 84,864 is resistance with 83,170 working as support. Let's try to be patient with our SPX entry. Work our /MNQ scalp to maximize it's potential and squeeze as much as we can out of the 1HTE's today. See you all in the live trading room!

0 Comments

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |