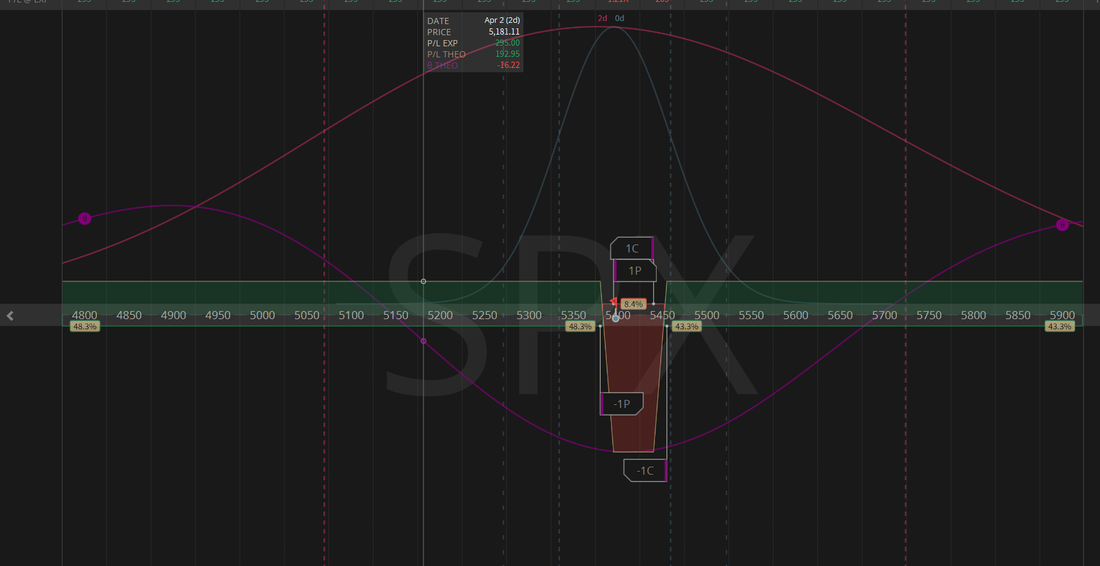

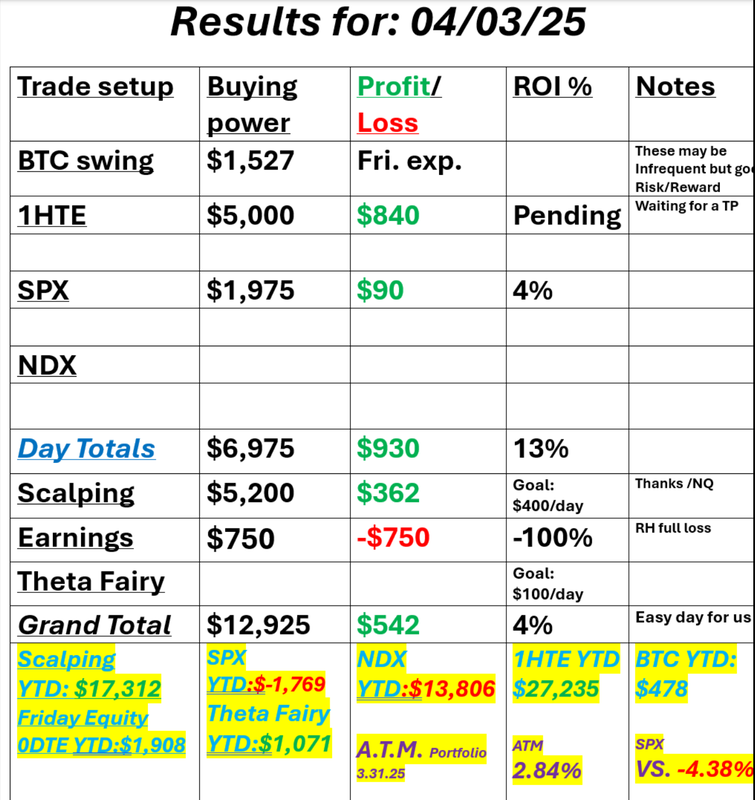

Don't worry...be happy.Good Friday to you all! As I start todays blog I want to be crystal clear! This is not a brag session. There is rarely a single day that goes by that we don't have a losing trade. (We had one yesterday go to full loss, RH) but...yesterday was an easy, pretty much risk free session for us and we made money. I've been at this since 1987. I've seen more crashes than most. We've been planning for this event for two months now. Pulling in our horns, Limiting our number of trades. Adding downside hedges. Trading smaller, Building Long vol instead of short vol trades, etc. Today should be the same for us. Futures are down another -3%+ as I type and we will open this morning with a nice profit. Check out our SPX trade that we will be starting the day with. Easy money in a market like this. The best advise I can give is the exact same I've been giving for two months now. Embrace downside moves and big volitility. That's where the best traders make the easy money. Here's a look at our day yesterday. The BTC trade is still pending as Kalshi isn't open yet to book the profit but it's up nicely to start the day. June S&P 500 E-Mini futures (ESM25) are down -2.33%, and June Nasdaq 100 E-Mini futures (NQM25) are down -2.71% this morning, pointing to a continued selloff on Wall Street following U.S. President Donald Trump’s announcement of sweeping tariffs, while investors await the key U.S. payrolls report and remarks from Federal Reserve Chair Jerome Powell. President Trump on Wednesday unveiled the most aggressive U.S. tariffs in a century, fueling fears of an escalating trade war and economic slowdown. Economists anticipate that the tariffs will drive prices and dampen economic growth, potentially even triggering a recession. JPMorgan has raised the likelihood of a global recession this year to 60%. In addition, UBS Global Wealth Management downgraded U.S. equities to Neutral from Attractive and lowered its year-end S&P 500 target by nearly 10% to 5,800, cautioning that reciprocal tariffs could trigger more market volatility. Stock futures losses deepened after China retaliated against new U.S. tariffs. Beijing will impose a 34% tariff on all U.S. imports beginning April 10th, according to the official Xinhua News Agency. In yesterday’s trading session, Wall Street’s major indices closed sharply lower, with the S&P 500, Nasdaq 100, and Dow falling to 6-1/2 month lows. Apple (AAPL) sank over -9% after President Trump announced sweeping tariffs, as the iPhone maker manufactures its devices in China and other Asian countries. Also, chip stocks sold off, with Microchip Technology (MCHP) tumbling more than -16% to lead losers in the Nasdaq 100 and Micron Technology (MU) plunging over -16%. In addition, RH (RH) plummeted more than -40% after the luxury home furnishing company posted downbeat Q4 results and provided disappointing FY25 revenue guidance. On the bullish side, Lamb Weston Holdings (LW) surged about +10% and was the top percentage gainer on the S&P 500 after the frozen potato giant reported better-than-expected FQ3 results and reaffirmed its FY25 guidance. “Market uncertainty is likely to remain elevated in the weeks ahead, as investors consider likely downgrades to consensus US economic and earnings growth forecasts, the risk of a tit-for-tat escalation in tariffs, and the potential scope for tariffs announced to be negotiated down,” said Solita Marcelli at UBS Global Wealth Management. Economic data released on Thursday showed that the U.S. ISM services index fell to a 9-month low of 50.8 in March, weaker than expectations of 53.0. Also, the U.S. trade deficit stood at -$122.70B in February, wider than expectations of -$122.50B. At the same time, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -6K to a 7-week low of 219K, compared with the 225K expected. In addition, the final estimate of the U.S. March S&P Global services PMI was revised higher to 54.4 from the 54.3 preliminary reading. Fed Vice Chair Philip Jefferson stated on Thursday that interest rates are well-positioned to manage competing risks despite significant uncertainty in the economic outlook due to major changes in U.S. policies on trade, immigration, and regulation. Jefferson noted that there might be a “modest softening” in the labor market this year, and ongoing uncertainty could dampen economic activity. Still, he said that “there is no need to be in a hurry to make further policy rate adjustments,” as officials await more clarity on the economic impact of President Trump’s policies. Also, Fed Governor Lisa Cook said, “Amid growing uncertainty and risks to both sides of our dual mandate, I believe it will be appropriate to maintain the policy rate at its current level while continuing to vigilantly monitor developments that could change the outlook.” U.S. rate futures have priced in a 68.4% probability of no rate change and a 31.6% chance of a 25 basis point rate cut at the May meeting. Meanwhile, Fed Chair Jerome Powell is set to deliver a speech on the economic outlook at the Society for Advancing Business Editing and Writing Annual Conference later today. Also, Fed Governor Christopher Waller and Fed Vice Chair for Supervision Michael Barr will speak today. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that March Nonfarm Payrolls will come in at 137K, compared to February’s figure of 151K. U.S. Average Hourly Earnings data will also be closely watched today. Economists expect March figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.3% m/m and +4.0% y/y. The U.S. Unemployment Rate will be reported today as well. Economists forecast that this figure will remain steady at 4.1% in March. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.947%, down -2.66%. Todays blog will be short and sweet. We will focus on #1. Booking our profit at the open on our SPX. #2. Continue to cashflow our /NQ scalp. #3. Book the profit on the 1HTE and see if we can add more. #4. Look for a potential new setup in SPX to possibly double dip. Let's look at the market levels on /ES: Looking at the daily chart you can see we are back to some key levels going back to the Aug. 2024 lows. I think we've finally found a decent support zone. Will it hold? Who knows. As traders we don't really care but I think it's got a shot. I'd say we've got a fair shot at moving up today. I'm not saying a green day. Just up from the -180 slide in the /ES futures, as I type. On the intra-day chart it's really impossible to see any levels. We've moved too far, too fast. On day's like yesterday and today, it's nice to have a trading community where we are building trades to take advantage of current market conditions. Let's bank some more profits today!!!!! See you all in the live trading room. Should be easy pickings today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |