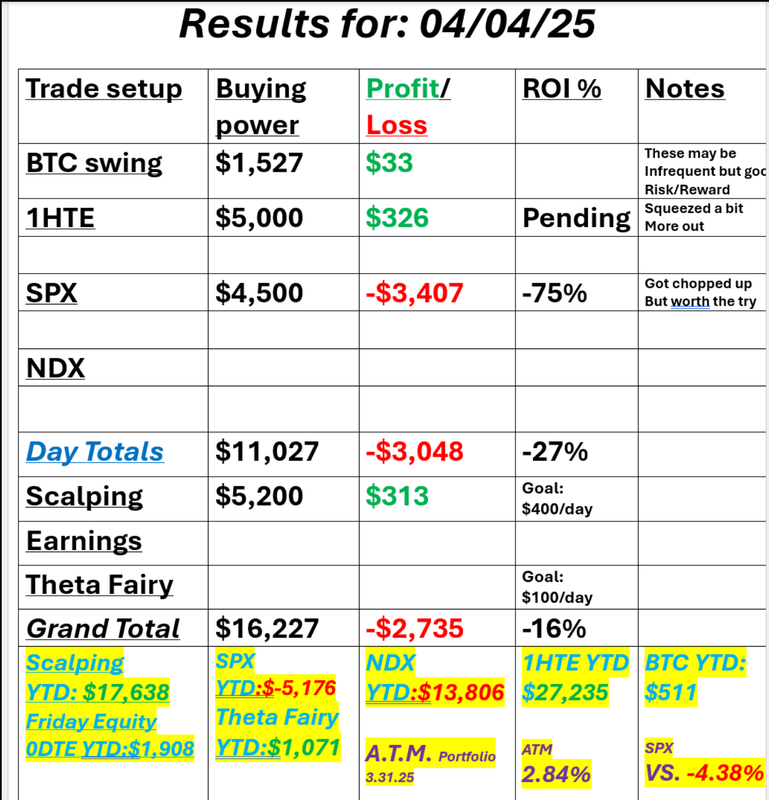

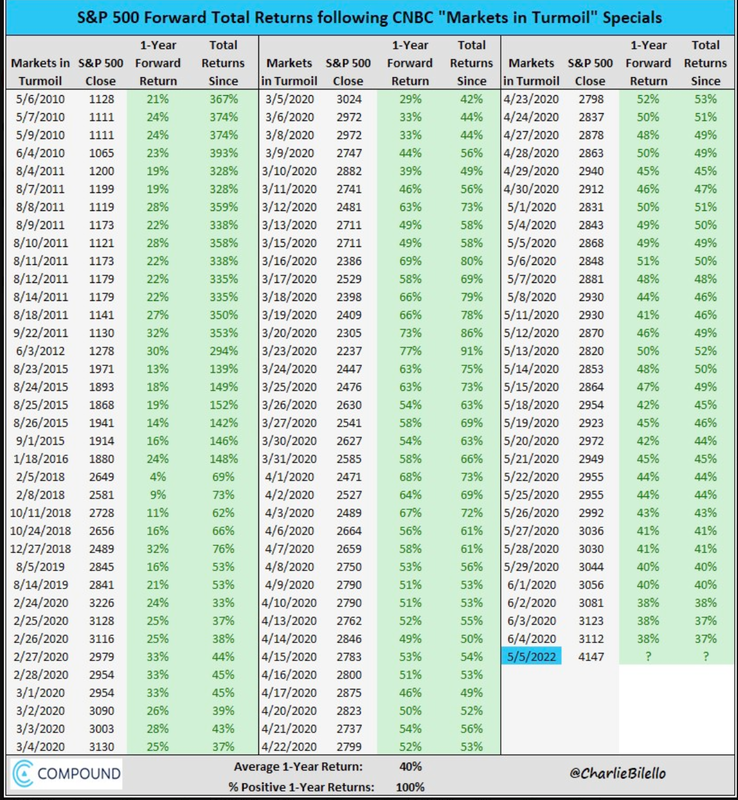

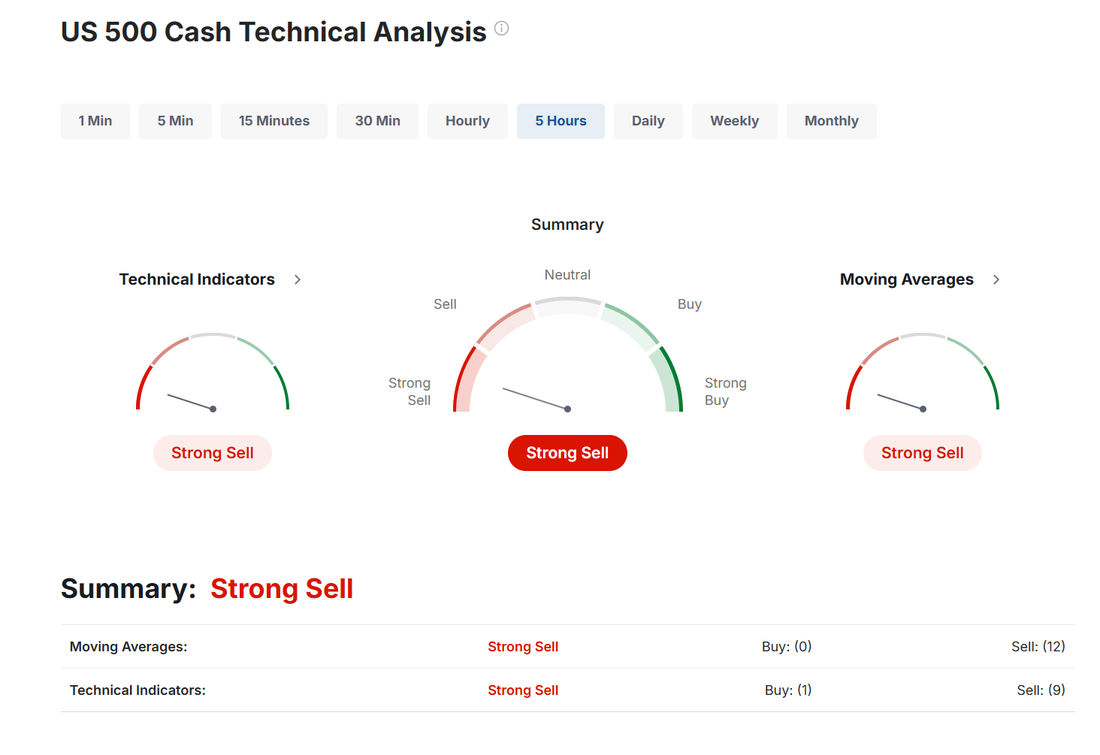

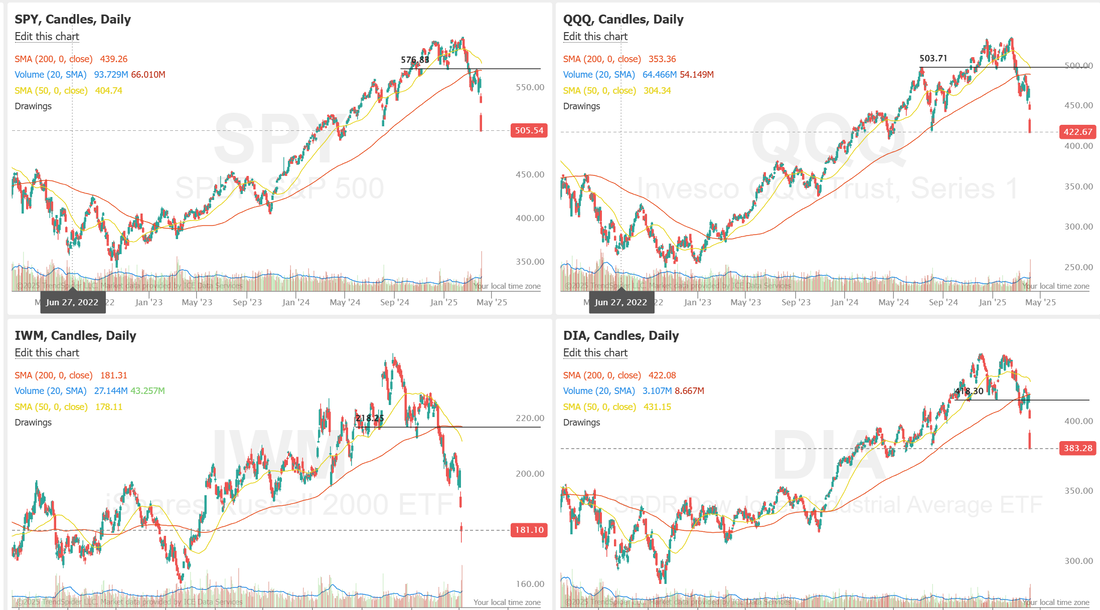

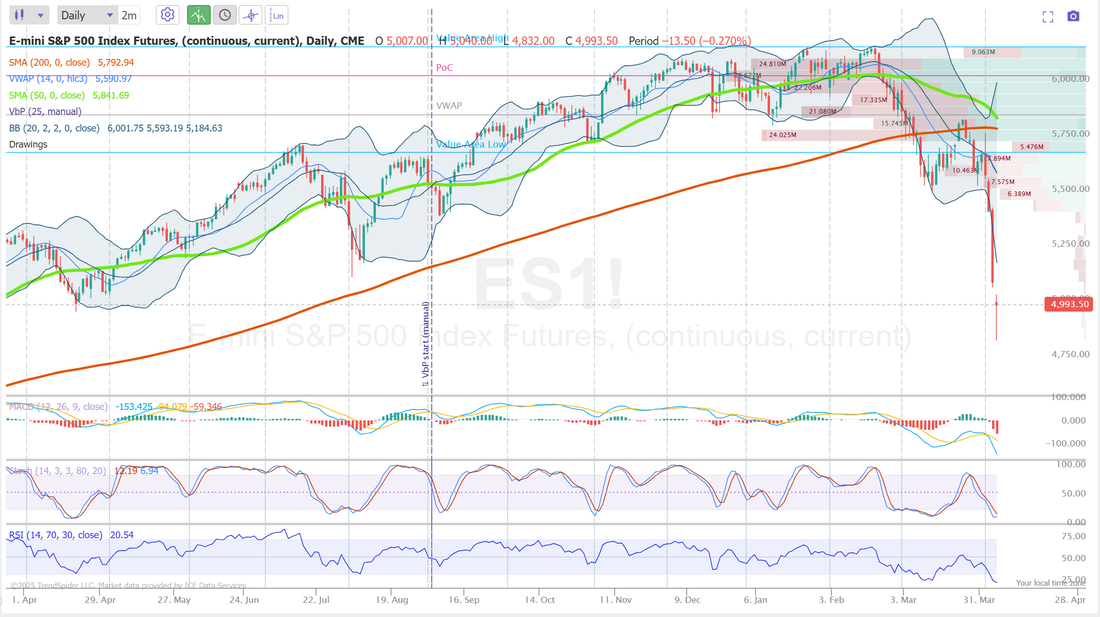

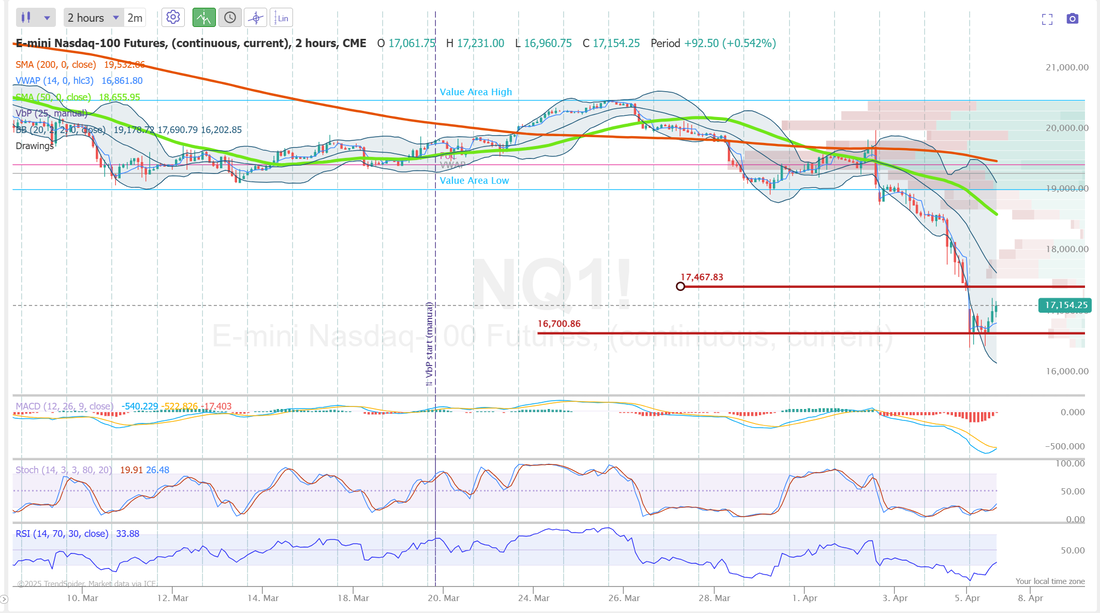

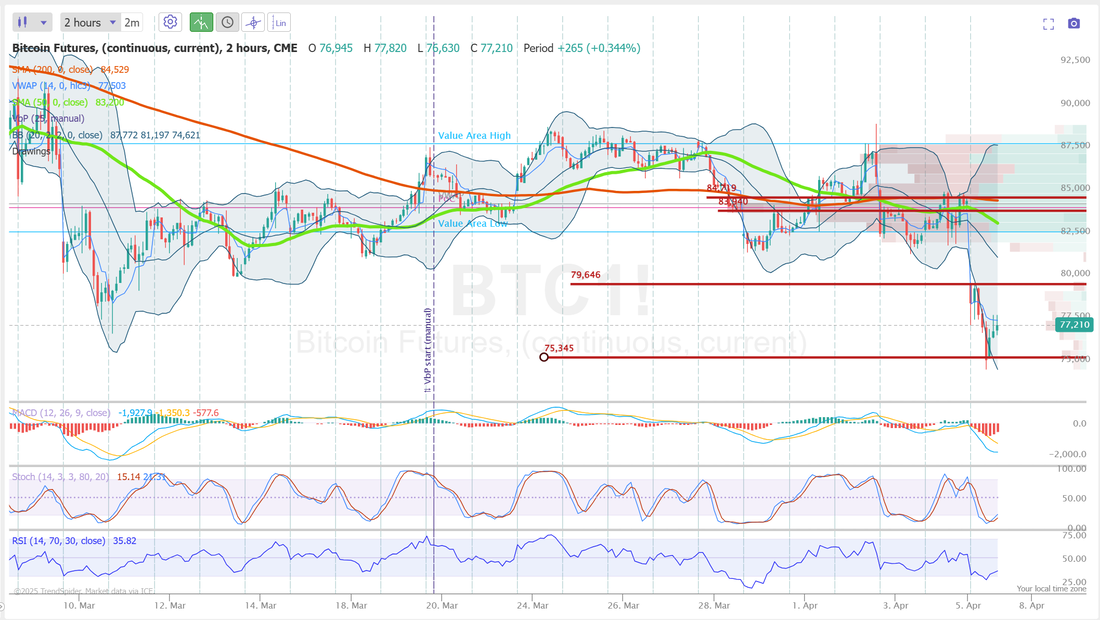

Recency biasWelcome back traders! It's a new week but it looks a lot like last week. Futures are getting hit again this morning with reciprocal tariffs. Friday it was China and today it's the U.K. Fallout from tariffs are continuing. We got cautious when we lost the 200DMA a while ago and have been about 90% in cash and focusing soley on our short term trades, I.E., 0DTE's on SPX, Scalping the QQQ's and 1HTE's on Bitcoin. That's served us well but not everyone was as cautious. Why? Well, it's called recency bias. We think that whatever is currently happening will continue for ever. That markets had back to back years of amazing results. We simply assume (maybe even subconsciously) that will continue. That's the main reason so many traders have been caught out here. Like wise now, everyone thinks we're going to zero. This too shall pass. In fact, I think we rebound today from futures selloff this morning. We've already come back 50% from Sunday nights drop. As for us here in our live trading room we'll continue to trade small and stay focused on short term trades. Remember....cash is a position. Our results were'n't great on Friday. They could have been if I'd just walked away with our first locked in gain of the day but, the risk/reward was strong enough (premium, as you can imagine is amazing) that I thought it was worth a shot and continuing to trade. Here's a look at my day from Friday. As I said last week, embrace the downward directional bias. Trade with the trend and enjoy the amazing premium we now have to work with. There's a great chance today will, once again, become a trend day. Let's be patient. No need to jump on anything right away. Trade docket for today: #1. Trade small. #2. Focus on short term setups. We'll do an SPX 0DTE today and mayber an NDX later in the day. We'll try to work the 1HTE Bitcoin setups IF the premium is there and we'll focus on QQQ's in the scalping room today. June S&P 500 E-Mini futures (ESM25) are down -3.29%, and June Nasdaq 100 E-Mini futures (NQM25) are down -3.81% this morning as worries over the economic fallout of U.S. President Donald Trump’s sweeping tariffs continue to weigh on sentiment. President Trump, speaking to reporters on Sunday aboard Air Force One following a weekend of golf in Florida, repeatedly stood by the sweeping tariffs announced last week. He said that “sometimes you have to take medicine to fix something.” Also, U.S. Treasury Secretary Scott Bessent on Sunday adopted a defiant stance amid the global stock market sell-off triggered by new U.S. tariffs, asserting that the measures are necessary and dismissing concerns that they will lead to a U.S. recession. “We get these short-term market reactions from time to time. The market consistently underestimates Donald Trump,” he said. Investor focus this week is on key U.S. inflation data, the publication of the minutes of the Federal Reserve’s latest policy meeting, and the start of the first-quarter earnings season. In Friday’s trading session, Wall Street’s major equity averages closed sharply lower, with the S&P 500 and Nasdaq 100 falling to 11-month lows and the Dow dropping to a 9-month low. The Magnificent Seven stocks slumped, with Tesla (TSLA) plunging over -10% and Nvidia (NVDA) sliding more than -7%. Also, chip stocks sold off, with Micron Technology (MU) tumbling more than -12% and Intel (INTC) sinking over -11%. In addition, GE HealthCare Technologies (GEHC) dropped nearly -16% and was the top percentage loser on the S&P 500 after China launched an anti-dumping probe into imports of a type of medical X-ray tube from the U.S. On the bullish side, retailers linked to tariffs on Southeast Asian imports advanced after Vietnam and Cambodia indicated a readiness to negotiate tariff levels, with Nike (NKE) climbing +3% to lead gainers in the Dow and Lululemon Athletica (LULU) rising over +3%. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls climbed 228K in March, stronger than expectations of 137K. At the same time, the U.S. March unemployment rate unexpectedly edged up to 4.2%, weaker than expectations of no change at 4.1%. In addition, U.S. average hourly earnings rose +0.3% m/m and +3.8% y/y in March, compared to expectations of +0.3% m/m and +3.9% y/y. Fed Chair Jerome Powell stated on Friday that the economic impact of new tariffs is likely to be significantly larger than anticipated, with potential effects such as slower growth and higher inflation, and noted that the central bank was in no rush to adjust interest rates. “While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent,” Powell said. Meanwhile, U.S. rate futures have priced in a 51.6% chance of no rate change and a 48.4% chance of a 25 basis point rate cut at the conclusion of the Fed’s May meeting. First-quarter earnings season kicks off this week, with big banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Morgan Stanley (MS) set to release their earnings reports on Friday. BlackRock (BLK) and Delta Air Lines (DAL) are among other major names scheduled to deliver quarterly updates during the week. On the economic data front, the U.S. consumer inflation report for March will be the main highlight this week. The reading could provide insights into the prospects of interest rate reductions as dark clouds gather over the U.S. economy following President Trump’s tariff announcements. Other noteworthy data releases include the U.S. PPI, the Core PPI, Initial Jobless Claims, Crude Oil Inventories, Wholesale Inventories, and the University of Michigan’s Consumer Sentiment Index (preliminary). Also, investors will closely monitor the release of the Federal Reserve’s minutes from the March 18-19 meeting on Wednesday. With expectations mounting that the Fed will support the economy by cutting rates five times this year, starting in June, the minutes could shed light on how justified those expectations may be. “While investors are hoping that the Federal Reserve comes to the rescue, it’s unclear how a few potential rate cuts this year will undo the economic damage that these tariffs are likely to cause, said Emily Bowersock Hill at Bowersock Capital Partners. In addition, a slew of Fed officials will be making appearances throughout the week, including Kugler, Daly, Barkin, Logan, Bowman, Goolsbee, Harker, Musalem, and Williams. Today, investors will focus on U.S. Consumer Credit data, which is set to be released in a couple of hours. Economists expect this figure to be $15.20B in February, compared to the previous figure of $18.08B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.953%, down -0.95%. I think it would be fool hardy to come into today with a lean or bias. The market is searching for levels here and we'll just sit back and let it work. What makes it harder now is that while this is clearly a bearish defined trend, there can be violent retraces upwards. In the big picture it doesn't change the overall bearish bias (unless it's enough to push us back above the 200DMA) but they can come out of nowhere. I think today could be one of those days. Don't be surprised if we push higher off these lows in the futures and IF we do, don't think it's an "all clear" signal and everything is back to bullishness. What if you invested in the S&P500 every time the US. news channel CNBC reported that the stock market was in turmoil? In that case... your average return after 1 year is equal to 40% with a win rate of 100%. Only 10 tech companies dominate the S&P 500 today This is even more extreme than during the peak of the Dot Com bubble High concentration is a risk that should NOT be overlooked… This concentration is adding to the big swings. Find value elsewhere. There are lots of "babies being thrown out with the bathwater" here. One last thought I'll leave with you today: Don't fight what the market gives us. Trade with the trends. Let's take a look at the market's. No surprise. Technicals are smashed to sell mode. Markets are now back to a key support level established in April 2024 Let's take a look at our intra-day levels: /ES: Futures are rebounding this morning after Sundays selloff. This April 2024 support level looks pretty substantial. Will it hold today? Hard to know but, I think we've got a good chance. I'm looking for some bullish moves off these lows. /NQ: Nasdaq is actually rebounding stronger than /ES this morning. We were down 800+ points earlier. Now down "only" -393 as I type. That April 2024 consolidation level is a key level for /NQ as well. /ES intra-day levels: 5097 to the upside. This would retrace the Sunday evening gap down. 4875 to the downside. That would equate to the Sunday evening low. /NQ intra-day levels: Similar look to /ES. 17,467 is resistance and would be a "gap fill" from Sunday nights sell off. 16,700 is support which equates to Sunday nights low. BTC: Bitcoin is getting whacked, just like equities. Down $7,000 this morning to the $77,000 range. Similar pattern to equities. 79,646 is resistance with 75,345 working as support. One last thought. Focus on what we can control. We can't control the market but we can control our risk levels. See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |