|

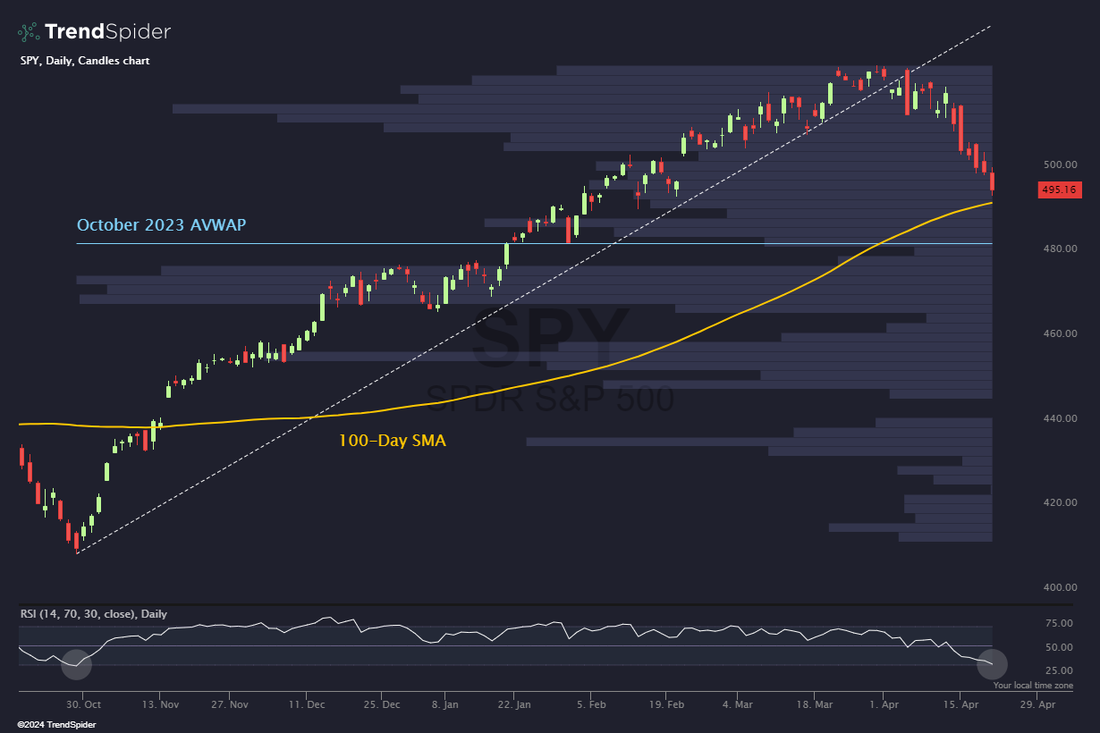

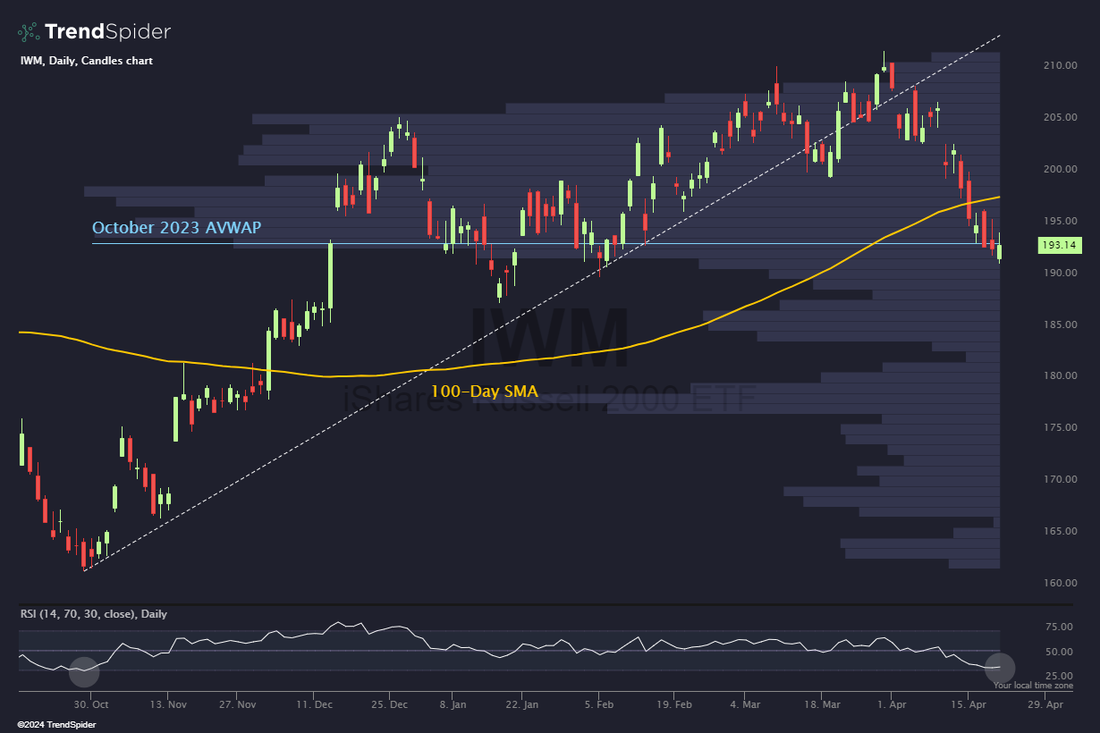

Welcome back traders! We had a pretty solid finish to our week last Friday with NVDA being the main pain point. We skipped our planned Theta fairy setup for the overnight Vampire trade. That worked well with the hedge portion adding $600 profit to the $200 original credit. It was nice to wake up to $800 bucks in our pocket before the day even gets started. All four of our 0DTE setups, including Bitcoin hit for profits. Almost $1,900 profit with 12k of buying power used. Lets look at the market: There's been a lot of talk about the "magnificent seven" holding the market up and when they give out, look out below. That's happening now and you can see, "The market" is really just a proxy for a few, very large cap stocks If you believe, "the trend is your friend" then you are currently bearish. All the major indices are pointed down with the IWM quickly approaching the 200DMA. The DIA is showing some bottoming. After blowing through the February gap, the SPY ETF closed the week at $495.16 (-3.07%). Just below lies the 100-day SMA and the October 2023 AVWAP, which could act as a powerful area of support in the weeks to come. RSI is also nearly oversold for the first time in half a year. Much like the SPY ETF, the QQQ ETF sliced through the February gap and closed at $414.65 (-5.39%). Meanwhile, the RSI is flashing its first oversold reading since those same lows, suggesting this move could be overdone in the near term. Despite failing below the 100-day SMA and the October 2023 AVWAP, the small caps IWM held up fairly well this week and closed at $193.14 (-2.79%). With RSI flattening out just above an oversold reading, could this index see a short-term bounce next week? We still have some pretty decent I.V. heading into this new week of trading. As is the case every Monday, our trading docket is full today: /ES (theta fairy), /MCL, /ZN, BA, CCL, DIA, GLD, GOOG, LULU, MSTR, SPX/NDX/Event contract/Bitcoin 0DTE's, NVDA, ORCL, PFE?, SPY/QQQ, XBI, CRM, SHOP, META?, PYPL, PLTR, VTI? My lean today is bullish: My intra-day levels: /ES; 5043/5056/5072/5083 to the upside. 5015/5008/4990/4965 to the downside. /NQ: 17350/17379/17462/17561 to the upside. 17213/17122/17103/16994 to the downside. Bitcoin: 66066 is consolidation zone. 74515 is resistance. 60624 is support. In Friday’s trading session, Wall Street’s major averages closed mixed, with the benchmark S&P 500 dropping to a 1-3/4 month low and the tech-heavy Nasdaq 100 falling to a 3-month low. Netflix (NFLX) plunged over -9% after the streaming giant provided weaker-than-expected Q2 revenue guidance and said it would stop reporting quarterly subscriber data. Also, chip stocks retreated after Taiwan Semiconductor Manufacturing Co. lowered its 2024 revenue growth outlook for the chip industry, with Advanced Micro Devices (AMD) falling more than -5% and Micron Technology (MU) sliding over -4%. In addition, Ulta Beauty (ULTA) dropped more than -2% after Jefferies downgraded the stock to Hold from Buy with a price target of $438. On the bullish side, Paramount Global (PARA) climbed more than +13% and was the top percentage gainer on the S&P 500 following a New York Times report indicating that Sony’s movie studio division is in discussions with Apollo Global Management about making a joint takeover bid for the company. Also, American Express (AXP) rose over +6% and was the top percentage gainer on the Dow after the credit card issuer topped quarterly profit estimates.

Chicago Fed President Austan Goolsbee remarked on Friday that progress on inflation has stalled, meriting a pause to permit incoming data to offer further clarity on how the economy evolves. “You never want to make too much of any one month’s data, especially inflation, which is a noisy series, but after three months of this, it can’t be dismissed. Right now, it makes sense to wait and get more clarity before moving,” Goolsbee said. Meanwhile, U.S. rate futures have priced in a 1.9% chance of a 25 basis point rate cut at May’s monetary policy meeting and a 15.0% probability of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. In other news, market participants and observers perceive higher-than-expected interest rates in the face of persistent inflation as the most significant threat to financial stability, the Fed said in its semiannual Financial Stability Report published Friday. First-quarter earnings season kicks into full gear, and investors await fresh reports from major global companies this week, including Tesla (TSLA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOGL), Boeing (BA), PepsiCo (PEP), Visa (V), Intel (INTC), Texas Instruments (TXN), IBM (IBM), UPS (UPS), General Motors (GM), Ford Motor (F), Caterpillar (CAT), Exxon Mobil (XOM), and Abbvie (ABBV). According to LSEG data, analysts estimate aggregate S&P 500 earnings to grow 2.9% year-over-year in Q1, compared with an expected rise of 5.1% on April 1st. On the economic data front, the March reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight in the coming week. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. GDP (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Building Permits, New Home Sales, Richmond Manufacturing Index, Durable Goods Orders, Core Durable Goods Orders, Crude Oil Inventories, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Spending, Personal Income, and Michigan Consumer Sentiment.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |