|

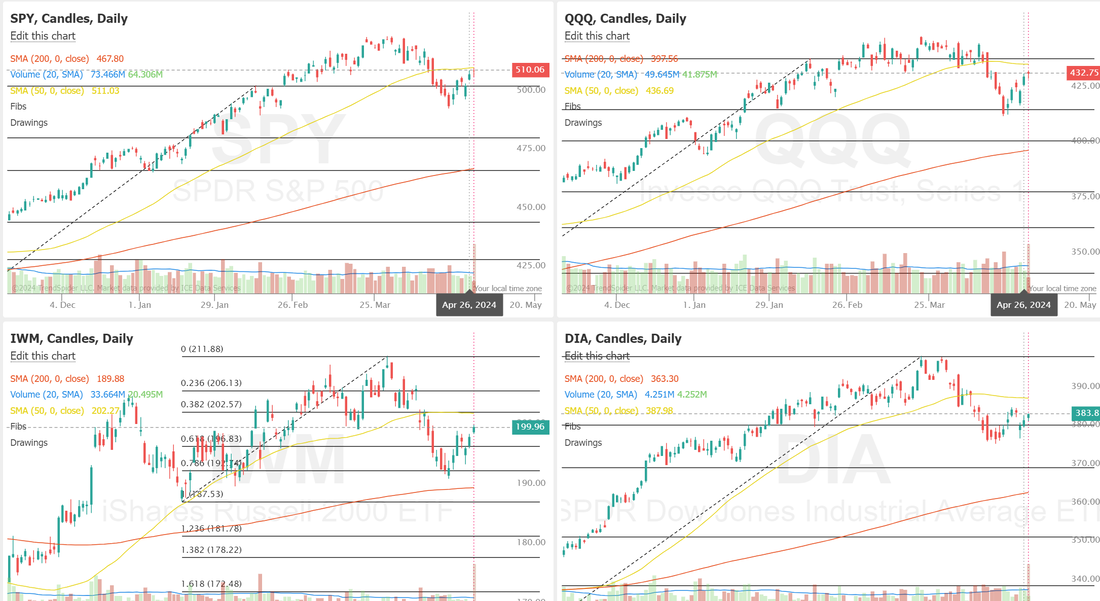

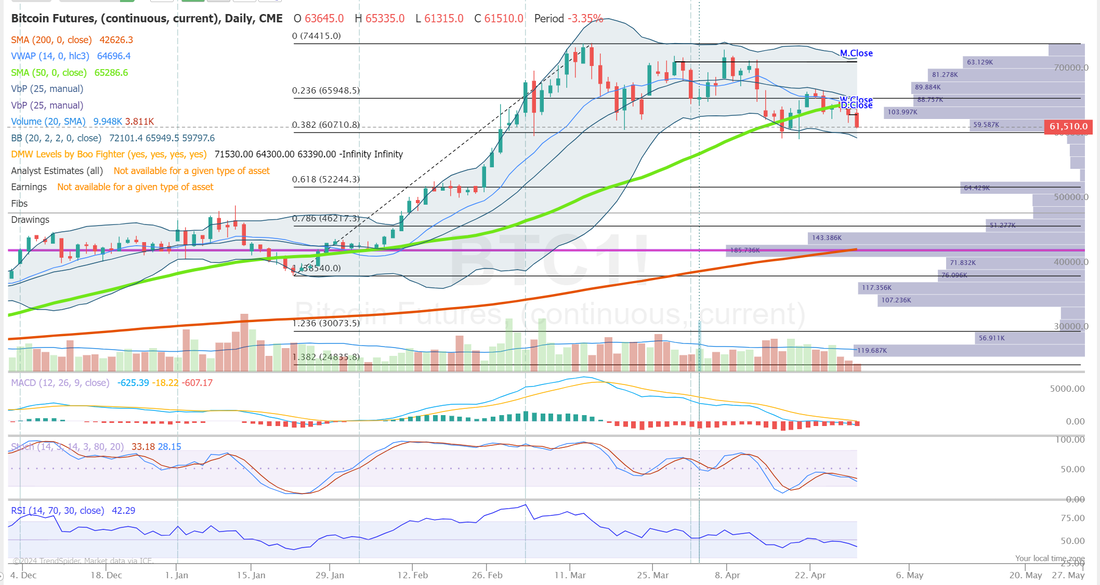

Every once in a while, I find so much gratitude for what trading has provided me in my life. Yesterday I had a friend need some help so I was away from my computer most of the day but I took my laptop and after a few stops by the side of the road, we were still able to get most of our trades done and all four 0DTE's. They all made money. SPX 4%. NDX 12% Bitcoin 11% and Event contract NDX 4%. All told, we deployed about 11k of capital for $1,090 of total profit. Lets look at the market: Buy mode is still in place. All four of the indices we trade are trying to continue this push higher. The news catalysts for the day: Sentiment Stock markets fell and the dollar rose on the last day of the month amid concerns that the Federal Reserve would maintain its hawkish messaging at its meeting on Wednesday. The euro outperformed, and the region’s government bonds fell, after data showed that the Bloc’s largest economies performed better than expected in Q1. The yen fell in line with its peers. Docket 08:30 ET Canadian GDP MoM for February Median Forecast: 0.3% | Prior: 0.6% | Range: 0.6% / 0.2% 10:00 ET US CB Consumer Confidence for April Median Forecast: 104 | Prior: 104.7 | Range: 108.5 / 101 Earnings 16:00 ET Amazon Q1 2024 Earnings Est Rev: $142.57B Est EPS: $0.82 16:05 ET Starbucks Q1 2024 Earnings Est Rev: $9.13B Est EPS: $0.80 16:15 ET AMD Q1 2024 Earnings Est Rev: $5.44B Est EPS: $0.61 Our trade docket for today: PYPL, MSTR, AMZN, AMD, /MCL?, PARA, SBUX? SPX/NDX/Event contract NDX/Bitcoin 0DTE's. Right now all signs point bullish but we do have FOMC and NFP coming up this week. I belive those will both be potential catalysts to the downside. I'm leaning bearish for the rest of the week. Intra-day levels for me: /ES; 5155/5171/5194/5230 to the downside. 5131/5122/5104/5072 to the downside. /NQ; 17927/17948/18028/18185 to the upside. 17865/17841/17774/17729 to the downside. Bitcoin; 64,050 is consolidation. 71383 is resistance. 60564 is a cliff of support. If that breaks the next support is all the way down at 52,029. We'll be in our scalping room today. Lets see if we can get another profitable session under our belt. Have a great day folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |