|

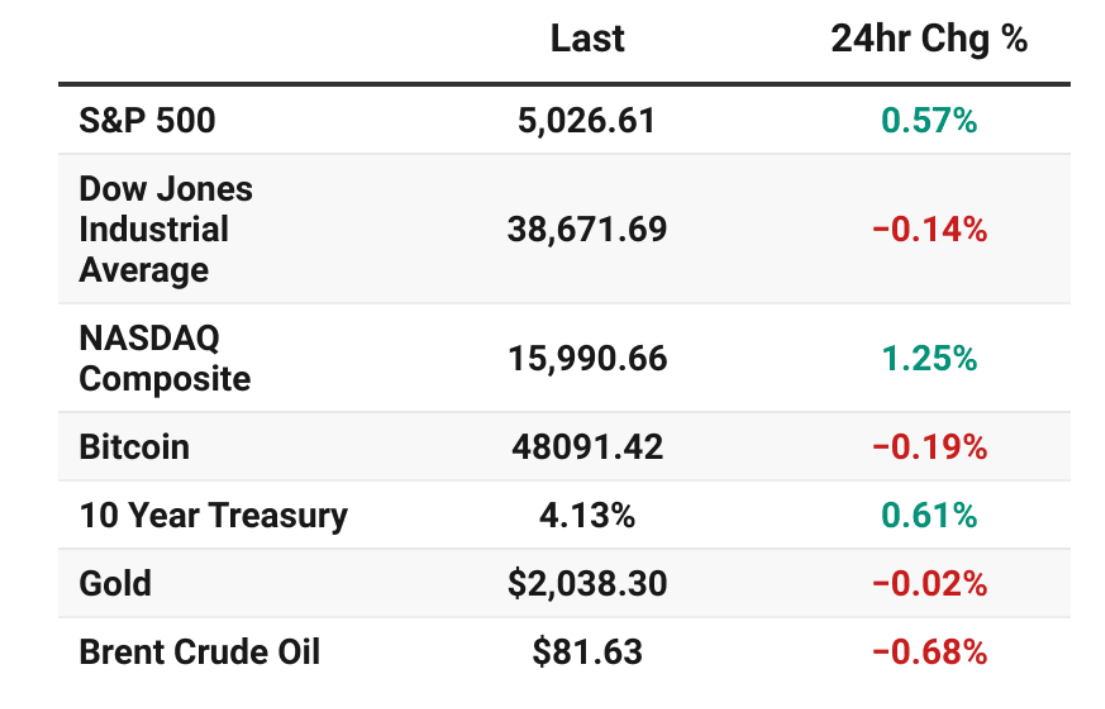

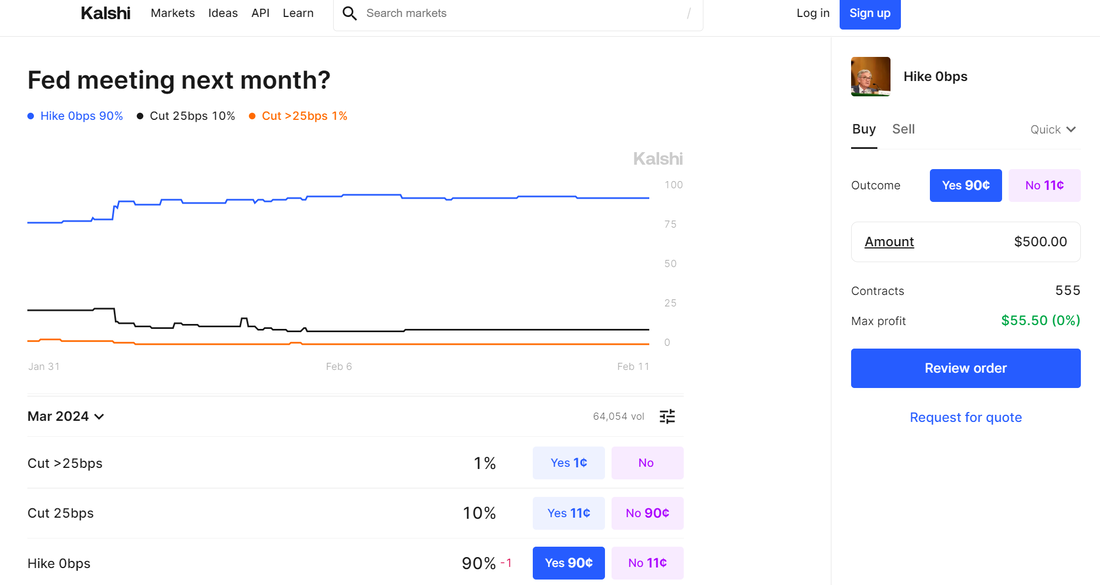

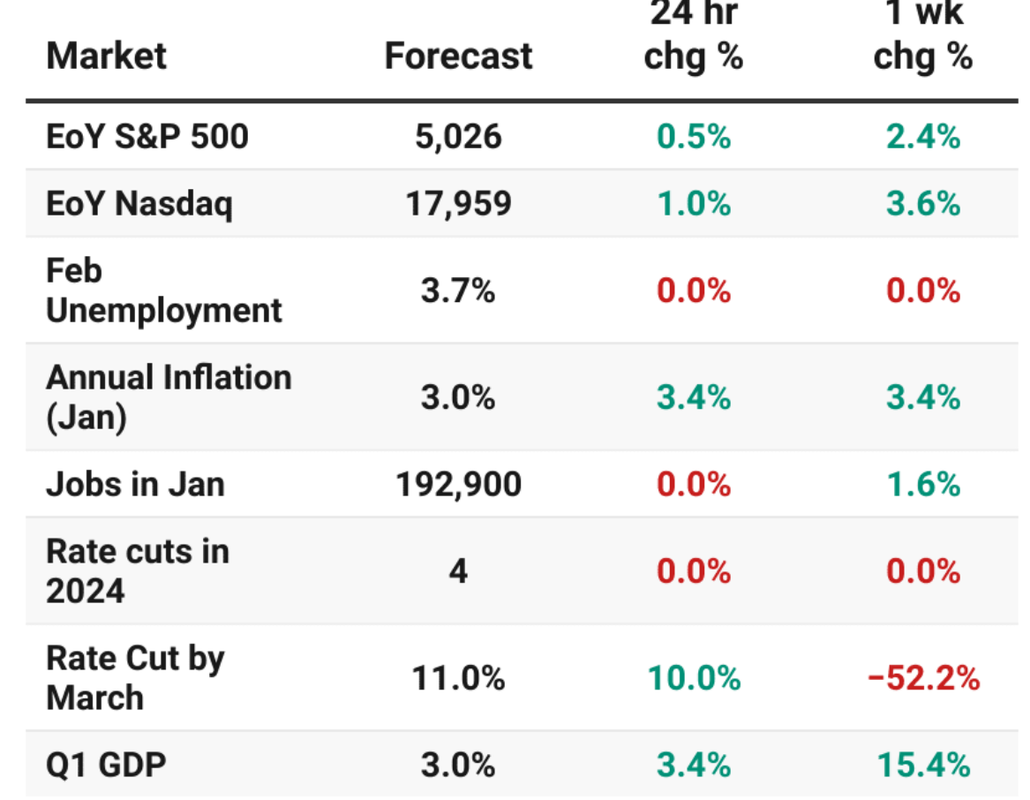

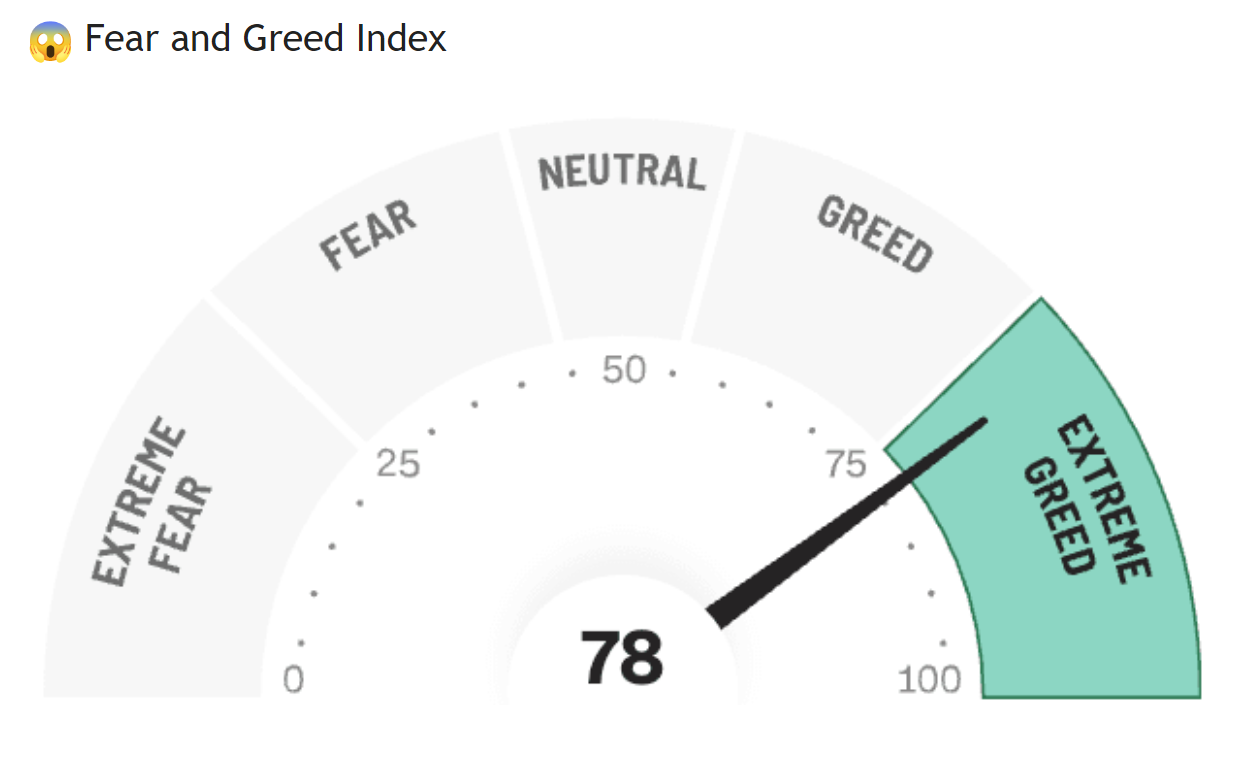

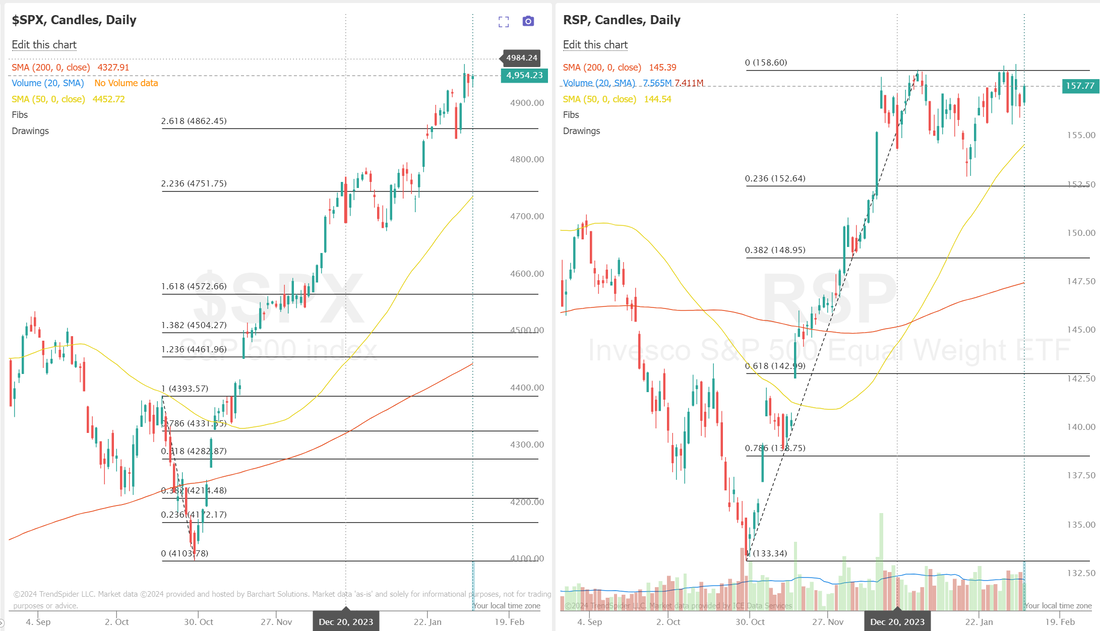

Happy Valentines day! Fortunately my wife thinks this is a made up holiday so there's not much pressure on me! Yesterday was a solid day for us. We had three "normal" 0DTE's hit for profits and our Event contract 0DTE hit for a 12% Return. I'll say it again, if you are not trading event contracts, you're missing out on a tremendous product to help create "edge" in your trading results. Our scalping also kicking in about $1,700 of profit on the day. I'll give you another push on it as well. We are on track for $50,000 of income this year, scalping twice a week with $5,000 of capital. We said yesterday morning the CPI can and does have as big an effect on the markets as FOMC. That was certainly the case yesterday. CPI came in hot...it took the diminishing chance of a March rate cut right off the table. We are playing this with an event contract which pays 10% Return if we get NO rate cut. It's already up 7% now, after the hot CPI. The DOW posted its biggest one day percentage drop in nearly 11 months. We put earnings trades on ABNB, HOOD, LYFT, MGM, UPST, Z and they ALL look set to take profit on this morning. Earnings continue today with CSCO, OXY, TWLO on our radar for potential setups. We will also be working our MSTR and Oil positions today as well as our normal 0DTE's “While the door for a March cut had already been effectively shut given the recent Fed commentary and the jobs reports, the Fed has now locked the door and lost the key,” said Greg Wilensky at Janus Henderson Investors. Meanwhile, U.S. rate futures have priced in an 8.5% chance of a 25 basis point rate cut at the March FOMC meeting and a 38.7% probability of a 25 basis point rate cut at the May FOMC meeting. Pre-Market U.S. Stock Movers Upstart Holdings Inc (UPST) tumbled over -19% in pre-market trading after the company issued weaker-than-expected Q1 revenue guidance. Robinhood Markets Inc (HOOD) climbed more than +13% in pre-market trading after the company posted upbeat Q4 results. LYFT Inc (LYFT) soared over +17% in pre-market trading after the ride-hailing firm topped quarterly profit estimates and said it would generate positive free cash flow for the first time in 2024. Airbnb Inc (ABNB) slumped more than -5% in pre-market trading despite reporting Q4 revenue that surpassed expectations and issuing strong Q1 revenue guidance. HP Inc (HPQ) rose about +1% in pre-market trading after HSBC upgraded the stock to Buy from Hold with a price target of $33. Citigroup Inc (C) gained over +1% in pre-market trading after Piper Sandler upgraded the stock to Overweight from Neutral with a price target of $63. Our main news catalyst for today will be Oil inventory: Wednesday 14th February 10:30 ET US Weekly EIA Crude Oil Inventories The US Weekly Energy Information Administration Crude Oil Inventories report provides information on the total stockpile of crude oil in the United States. It includes data on the changes in crude oil inventories, indicating whether there has been an increase or decrease in the amount of oil held in storage. This report is crucial for assessing supply and demand dynamics in the oil market and can influence oil prices. What to Expect A significant buildup in inventories may indicate oversupply, putting downward pressure on prices, while a decline may suggest increased demand, potentially impacting prices in the opposite direction. For just a second, we got a technical sell signal in the market. That's moved back to the dreaded neutral zone today. The question now is: #1. Is this a "buy the dip" opportunity or #2. Is this the start of a change of directional bias. My lean is the former. We have a long, rolled SPX setup we'll continue to work today that could be a $5,000 payoff if I'm right. One good thing about yesterdays selloff is that the 'extreme greed" bubble has popped. We are now just stuck in "greed". Still a lot of "risk on" going on here: For the week, Real estate continues to get beaten up the most with it's interest rate sensitivity. We also continue to get divergences with more and more stocks dropping below their 50-200 DMA respectively Fibonacci lines tell the story of yesterday and this mornings price action Intra day levels for me:

/ES: 4986 (bulls must hold this level)/5017/5021/5038 to the upside. 4986 (bears need to push below)/4967/4936/4921 to the downside. /NQ: 17766 (bulls must hold this)/ 17900/17995/18125 to the upside. 17766 (bears need to break this) /17681/17597/17539 to the downside.

1 Comment

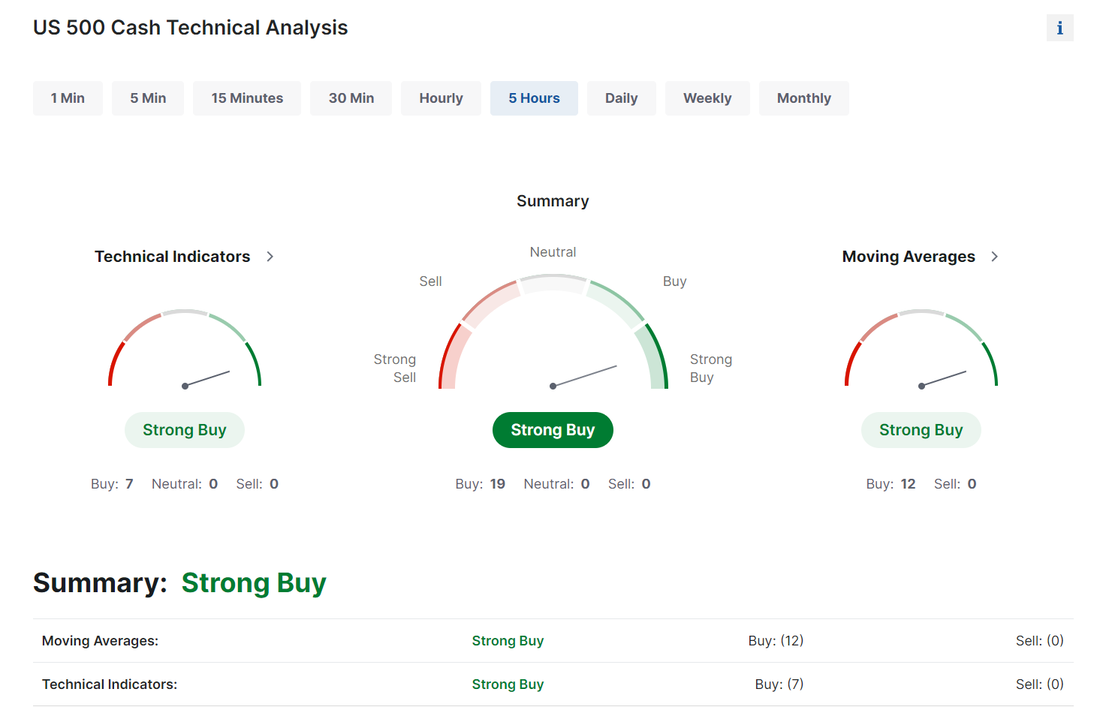

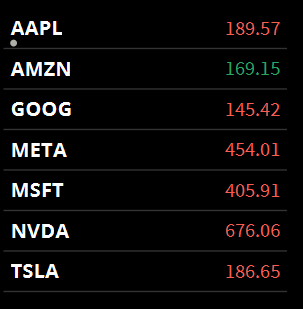

It was a tough day for me yesterday with both the NVDA push requiring an adjustment and the NDX 0DTE going out at a loss. Most of our positions to start today look well positiioned and we should have a relatively light day with CCL, DDOG, IWM, MSTR, SPX/NDX 0DTE, VTI as the only trades on the docket today. We are trying to roll over here. Technicals have shifted to the dreaded neutral rating. These days can be tough to trade as the market seeks directional bias. Last weeks money flows are always interesting to track. Crypto mining and digital currency ETF's had the most inflow with the VOO and SPY expieriencing the most outflow. The top 10 inflows are seen below: Most of the "magnificent seven" tech stocks got hit yesterday as well and contined weakness in TSLA. Futures continue to demonstrate weakness this morning coming into the all important CPI release. CPI can be as market moving as an FOMC day. The market is bracing for, and pricing in the greater chance of no FED rate cut in March. Fed Governor Michelle Bowman reiterated on Monday that the Federal Reserve’s benchmark lending rate is in a good place to exert downward pressure on inflation and stated that she does not view rate cuts as appropriate “in the immediate future.” Also, Richmond Fed President Thomas Barkin cautioned that U.S. businesses, accustomed to raising prices in recent years, may continue to fan inflation. Meanwhile, U.S. rate futures have priced in a 15.5% chance of a 25 basis point rate cut at the next central bank meeting in March and a 55.9% probability of at least a 25 basis point rate cut at May’s policy meeting. Now does not look like the time to be greedy. If CPI comes in hot this might be the catalyst that turn this market. Its certainly trying to roll over here. Intra day levels for me:

/ES: 5005-5045 is the new 'chop zone". Price action between these levels is just noise and not helpful for developing directional bias. 5031/5044/5053/5066 to the upside. 5020/5013/5005/4981 to the downside. /NQ: 17910/17960/17992/18041 to the upside. 17802/17751/17690/17643 to the downside. Welcome back to a fresh new week of trading! Mondays are usually our busiest day of the week as we set up our weekly strategies. We have /ZN, /MCL, /MNQ, DAL?, DIA, DWAC, FSLR, GLD, GOOG, IWM, MSTR, NDX/SPX 0DTE's, NVDA, PFE?, PLTR, PYPL, WYNN, SPY/QQQ 4DTE's, RUT all on the trade docket today. Price action from Friday was muted with the NDX being the big mover:

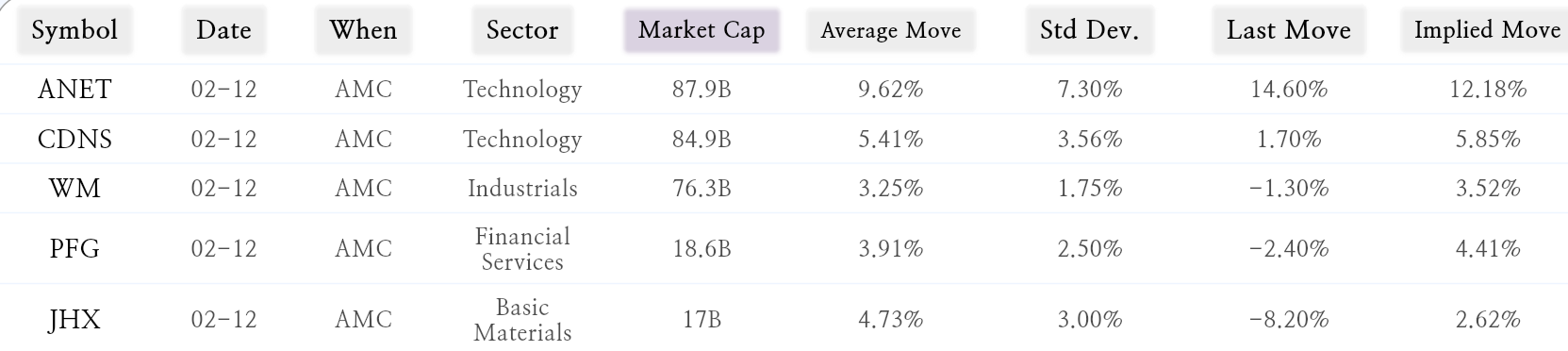

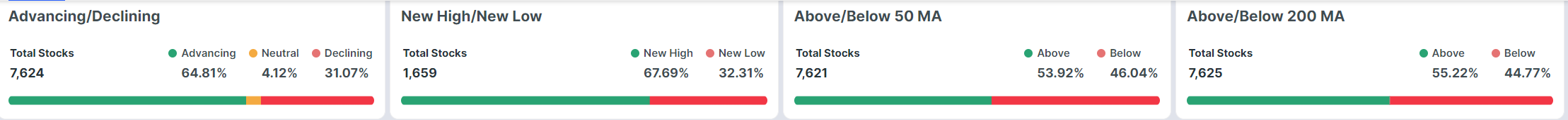

We talk alot about looking for trades that have "edge" in them. 21% of traders still think the Fed will cut rates in March. The event contracts we trade through Kalshi is much closer to reality with just a 10% chance. We will be setting this trade up today. If you'd like to trade one of the best platforms out there (IMHO) that can help you create "edge" then check it out. Sign up is free. Here are some of the positions we are looking at taking: The market sure looks healthy right now but... the old mantra of "buy when blood runs in the street and sell when everyone is making money hand of fist" makes us cautious here. For this week we are looking at a 1% Implied move in SPY and 13% I.V. Just plain, downright horrible for credit sellers! Earnings season continues and we've got a few underlyings we will be looking to trade today: While the market internals are all still solidly bullish... There is a divergence starting to appear with more and more stocks dropping below their 50-200DMA If you are a "reversion to the mean" type trader you may want to look at a pairs trade on Tech and Utilities. Last weeks price action saw Tech scream higher and Utilities got pretty beat up. One very interesting aspect of Techs surge (and the SPX in general) is NVDA. It's massive surge this year accounts for a full 1.25% of the SPX total YTD return of 5%. NVDA has earning coming up and if the past is a predictor of the future, we'll see a pop or surge out of earnings...then a retrace. The indices are "priced to perfection" right now. It wouldn't take much to flip directional bias. Let's take a look at some technicals: Finding nearly perfect support at the 1.618 Fibonacci extension, the SPY closed at $501.20 (+1.38%) and logged the strongest weekly RSI reading it has seen since September 2021. After several weeks of struggling to break away from the top of the ascending channel, the QQQ ETF managed to turn this previous resistance into support, pushing powerfully through the 2.0 Fibonacci extension and closing the week at $437.05 (+1.88%). Closing at $199.34 (+2.56%), the IWM continues to flash signs of late-stage Wyckoff accumulation, finding support at the 200-Wk SMA, putting in a higher low at the last point of supply and breaking out of the flag pattern it has been in since the beginning of the year. We just finished up five full weeks of gains for the market. Can it make it 6 this week? The run looks strong but every run, including this one, takes a pause in best case and retraces in worst case. The longer we hold the uptrend, the bigger the % sell of becomes.

Intra day levels for me: /ES: 5046/5055/5067/5075 to the upside. 5038/5031/5021/5013 to the downside. /NQ: 18068/18167/18330/18377 to the upside. 18006/17965/17899/17793 to the downside. We had a pretty solid day yesterday with all three of our 0DTE setups cash flowing. Our event contract was especially nice. If you are not trading event contracts with us I'd highly recommend you check them out. They can provide quite an edge in your results. We had a full day of scalping. We are now moving to the 1DTE QQQ expirations later in the day. That's helped with gamma as the 0DTE options get to the end of their lifespan. There was just a small profit with scalping but I'm happy with our risk management. The Market continues to set records with the SP 500. It hit a record high for the ninth time this year. The Dow hit its 10th record close this year. The SP 500 has been chasing the 5000 level for a couple days now. We did hit it yesterday very briefly. All eyes are on that important psychological level today. The "thousand" mark levels are always big in terms of psychology. We hit the 3000 level on 7/12/2019. The 4000 level on 4/1/2021 and possibly today 2/9/2024 we break the 5000 level. The Nasdaq is still chasing its past years November high but it too is getting close. Trends are all still bullish: Taking a look at the major indices, there's really not too much to discuss. The trend is clear. It's up! Its the interest rate sensitive RUT/IWM that is the only laggard. One of my all time favorite trade setups is a simple montly swing trade on the VTI. We are off to a nice start this year with this setup and I'm hopeful that the 36%-50% APR ROI potential will be there for us come the end of this year. My intra day levels for our 0DTE trading: /ES: 5020/5036/5050* (big level)/5055 to the upside. 5016/5005/4998/4987 to the downside. /NQ: 17939/17969/18000* (big level)/18025 to the upside. 17875/17852/17804/17753 to the downside. By the way. If you're interested in expanding your trading game, you may want to see what we are doing with scalping. Our goal this year is to generate $50,000 of profit with $5,000 of trading capital. We are a little behind on our goal so far this year but still very close!

We had an O.K. day yesterday. We brought in some cash flow from the put sides of our 0DTE's but are still working the call sides. NVDA, which seems to giveth and taketh, tooketh yesterday. We'll be in there working that setup once again today. We have a pretty busy trade docket today with : /MCL, /ZN, DIA, GLD?, META?, NDX/SPX 0DTE's, NVDA, PLTR, PYPL, QQQ/SPY, RUM?, SBUX?,TXT?, WYNN, FSLR an event contract on SP500 and possible pairs trade. Bullish price action yesterday set the tone all day. Futures are flat to slightly down as I type. DIS hit its turn around goal on top and bottom line earnings yesterday and looks to pop +6% pre market. Fed Govenor Kugler said Wednesday that although inflation is displaying clear indications of deceleration, she is not prepared to lower rates yet. Seems rate cuts may be further out than some have hoped but this sentiment is not taking the wind out of the markets sails, just yet. Futures are now pricing in a 18.5% chance of a rate cut at the next meeting and a 63.4% chance at the May meeting. Asian markets continue to rebound on China stimulus. Markets continue to be pegged to the buy mode with our technicals. We have finally cleared some heavy resistance on both the /ES and /NQ The key question today is, can the markets turn this resistance break into solid support and continue higher or do we stall here?

My key intra day levels are: /ES; 5016/5026/5036/5050 to the upside. 5005/4998/4987/4980 to the downside. /NQ; 17842/17862/17888/17901 to the upside. 17790/17748/17706/17676 to the downside. We had a nice....somewhat boring day yesterday. I was on the wrong side of scalping all day so that didn't help but our FOUR! 0DTE's all brought in profits and NVDA, which hurt us on Monday, helped us yesterday for a solid overall result. Futures are flat to down this morning as we await more interest rate info and earnings season continues. PLTR popped more than 30% yesterday and our setup played nicely into that. Fed Mester said she's not in a hurry to start reducing interest rates and it will most likely happen "later this year". US futures have us at a 21.5% chance of a cut at the March meeting and 53% chance at the May meeting. We've got DIS, UBER, CVS, FOXA, MCK and PYPL all reporting today. We've already got plays going on DIS an PYPL. We'll also be watching crude oil inventory levels today and may potentially adding to our oil ladder. The market is expecting 1,700M compared to last weeks 1,234M level. China continues to pump stimulus into their economy. Our FXI trade in our ATM program looks solid here. Markets continue to hold their bullish bias: From a price action standpoint, we continue to just churn sideways on the /ES And the sideways action is enduring even longer in the /NQ We've got a couple 1DTE SPX/NDX call side setups working They look pretty good for us right now. Keep an eye on the "magnificent seven" as they start to diverage from the bullish action You can see the divergence if you compared the equal weighted vs. cap weighted SP500 Intra day levels for me: /ES; 4977/4983/4998/5005 to the upside. 4972/4965/4960/4954 to the downside.

/NQ; 17697/17712/17740/17769 to the upside. 17677/17653/17619/17592 to the downside. Yesterday was a solid day for most all of our positions, save NVDA. It continues to push so...we'll continue to adjust. We are getting closer and closer to earnings release and that should provide some relief on our buying power requirements as I.V. drops. The markets were soft yesterday and look to start today off on the same foot. Technicals are still bullish. Weakness was fairly well dispersed across the board...save for NVDA. We don't have any planned, major news catalysts for today. We continue to sit near our ATH's on all the major indices, with the exception of the RUT/IWM. This interest rate sensitive index continues to have headwinds with interest rates rising again The 2 hr. charts give us a better view of the current action. We are at the same level today on /NQ as we were on Jan. 24th. We are at the same level on /ES as we were on Jan. 29th. There's substantial resistance going on here. A clean break higher and a hold above these levels is needed for bulls to continue this upward journey, otherwise, a reversal is starting to look more likely. Intraday levels for me: /ES: 4963/4971/4979/4997 to the upside. 4957/4944/4937/4933* (key level. drops us back into the chop zone) to the downside.

/NQ: 17767/17798/17846/17866 to the upside. 17635/17599/17554/17502 to the downside. Welcome back to a new week of trading opportunities! Futures are down slightly as I type and Treasury yields are rising. We got some hawkish talk from Chair Powell over the weekend. Fed Govenor Bowman as stated that interest rates should be held at their current level and it's premature to look to a rate cut. One analyst put it best, "I think we can officially kiss a March rate-cut goodbye and more than likely a May." -Alex McGrath. US futures have priced in a 15.5% chance of a cut in March and a 53.8% chance in May. While the probabilites are coming down and being priced in, they may still be too optimistic. Earnings last week were generally strong. We are still working both our GOOG and META trades but generally speaking it was a solid week for earnings and a solid result for us. On the earnings front this week we have some big names coming: MCD, CAT, LLY, F, AMGN, DIS, UBER, PYPL, CVS, PM, COP, and PEP are some of the ones we have on our radar to trade. We have FED's Bostic and Goolsbee speaking today and Bostics comments can often be market moving. The expected move and I.V. in the SPY is not too different from last week. We had a successful last week on the SPY using the expected move as our starting points for our trade setup. This past week continued to show a slight rotation out of Tech and Real estate and into the consumer sectors. The heat map from last week shows balanced price action. Open interest walls are growing and tightening. This usually is a pre cursor to a big, directonal move. The /NQ continues to bang its head against the high we hit on Jan. 24th. While the /ES have been stonger. Breaking out of the chop zone its been stuck in. Intra day levels for me:

/ES. 4980/4999/5011/5022 to the upside. 4969/4952/4941/4932 to the downside. /NQ. 17776/17800/17838/17866 to the upside. 17700/17657/17582/17463 to the downside. Yesterday's result was marred with both of our 0DTE call side's needing to be rolled. Our bond position was pressed as well be looks better coming into expiration today. Our AAPL, AMZN and META earnings trades all look positive as well. With generally positive earnings the futures have continued up overnight. We do have NFP out this morning and that could be a market catalyst: With the bullish price action of the last day the technicals have flipped right back to bullish. In one clean sweep the /ES was able to reverse right back into our "chop zone" and push through it to the upside. This creates a whole new opportunity to hit higher highs. Price action looks fairly bullish today with NFP being the only thing standing potentially in the way of the bulls.

Intra day levels for me on /ES: 4963/4978/4993/5000 to the upside. 4960/4941/4933/4925 to the downside. Intra day levels for me on /NQ: 17648/17693/17728/17783 to the upside. 17544/17482/17438/17386 to the downside. |

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |