|

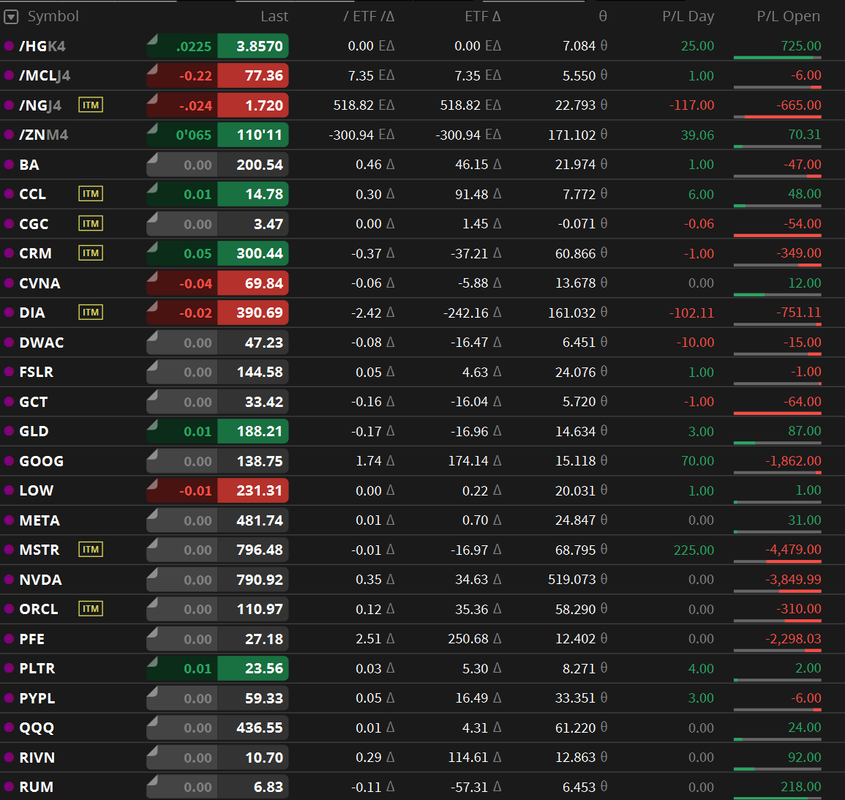

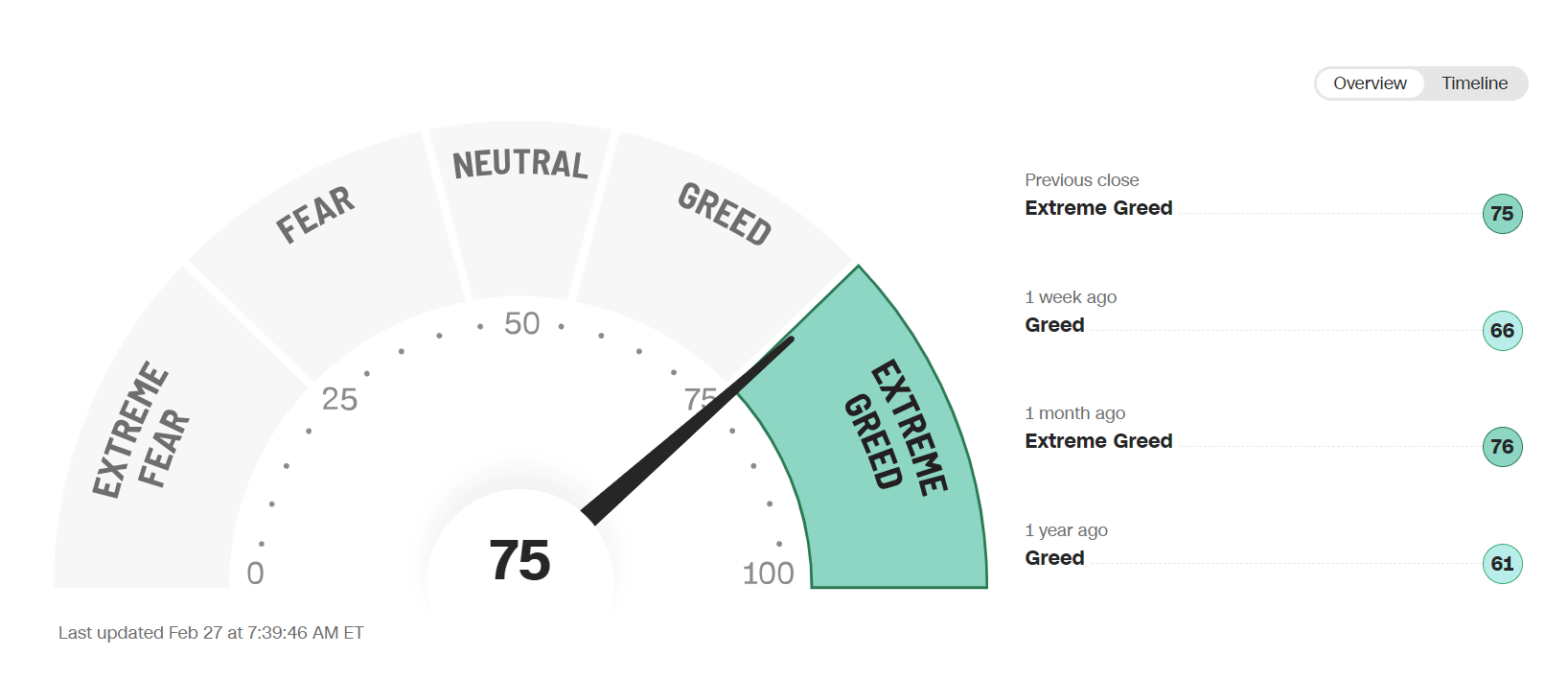

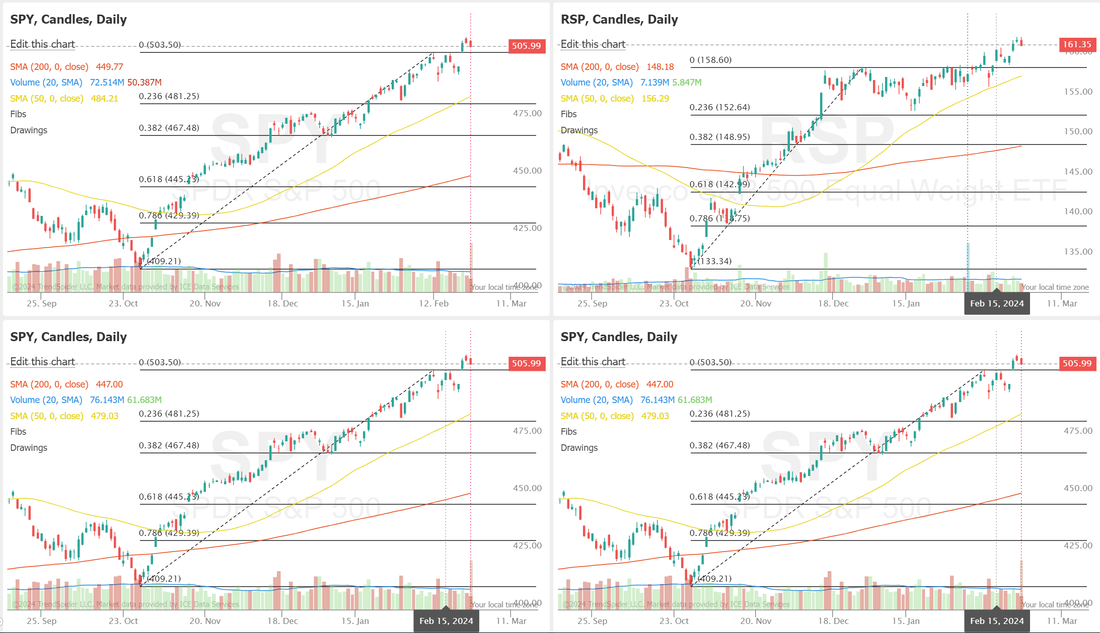

We had a solid day yesterday. All four of our 0DTE's went out at full profits. Two standard and two event contracts. The SPX event contract was a 25% ROI. MSTR and GOOG were the two sore spots for us. Most important is we got most of our freed up buying power back to work. We are loaded up with a full model portfolio. We have several earnings trades that should be profitable exits for us today. We'll replace those with EBAY and BYND setups for today. Rinse repeat on these earnings trades. The trade docket for today looks like this: /HG, /NG, BA, CRM, GOOG?, LOW, MSTR, NVDA?, SMCI?, U, ZM, SPY/NDX/Event contract 0DTE's, IWM and EBAY and BYND earnings setups, as I mentioned. We are now clinging to a buy signal in the market after yesterdays soft close. This market is still very much a "risk on" enviroment. The last two trading days have presented some weakness in this bull push. Can the sellers continue to push the market down today or will the bulls hold? The 2 hr. candle chart on /ES shows we've been trying (mostly unsuccessfully) to roll over since Feb. 23rd. We've got several earnings trades today but BYND is the most intersting to me. I think we've got a great initial entry setup for it today. Here's the data set on it. Intra-day levels for me: /ES: 5095/5100/5107/5121* (key level. ATH) to the upside. 5081/5072* (key level. low of yesterday)/5047. /NQ: 18059/18091/18110/18140* (key level. recent high) to the upside. 17999/17961/17927/17852* (key support area) to the downside. Today, all eyes are focused on U.S. CB Consumer Confidence data in a couple of hours. Economists, on average, forecast that February CB Consumer Confidence will stand at 114.8, compared to the previous figure of 114.8.

Also, investors will likely focus on U.S. Durable Goods Orders data, which stood at 0.0% m/m in December. Economists foresee the January figure to be -4.9% m/m. The U.S. S&P/CS HPI Composite - 20 n.s.a. will come in today. Economists expect December’s figure to be +6.0% y/y, compared to the previous number of +5.4% y/y. U.S. Core Durable Goods Orders data will also be closely watched today. Economists estimate this figure to come in at +0.2% m/m in January, compared to the previous value of +0.6% m/m. The U.S. Richmond Manufacturing Index will be reported today as well. Economists expect February’s figure to be -4, compared to the previous value of -15.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |