|

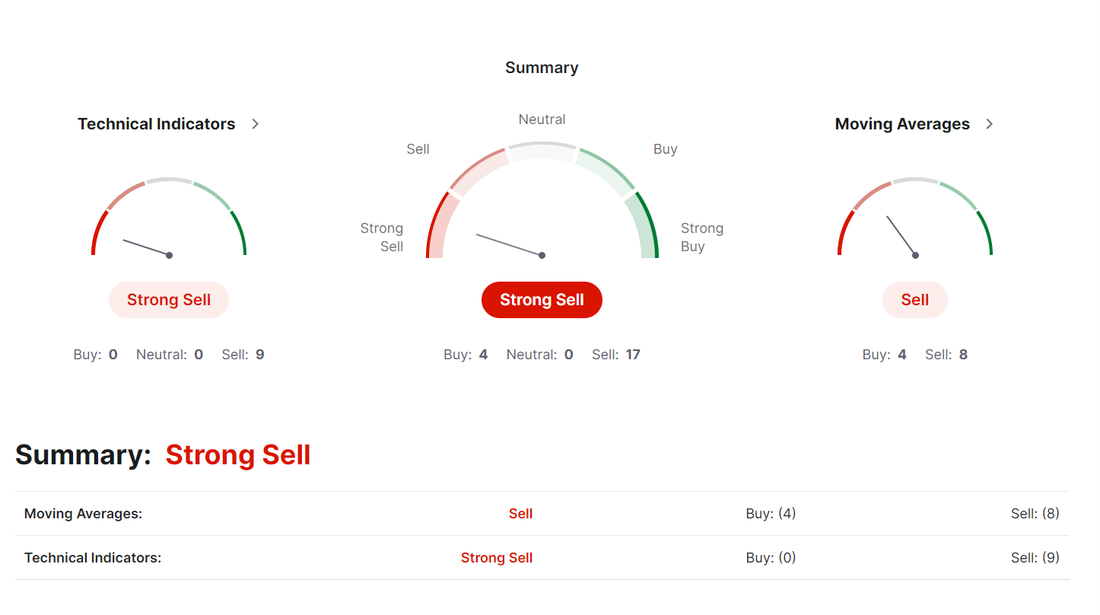

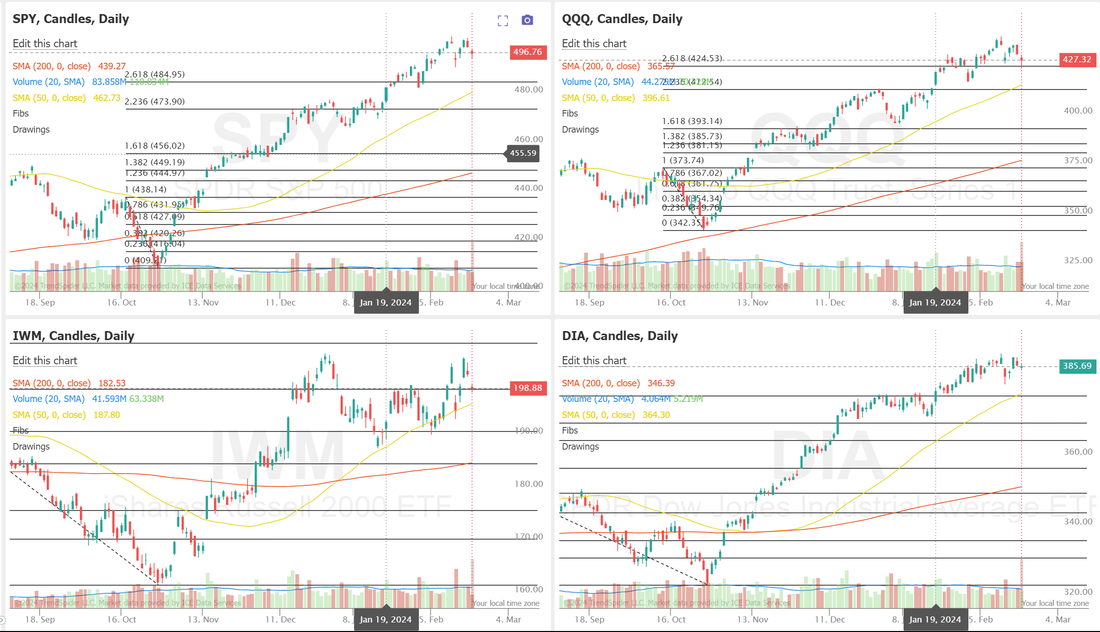

We had a rock solid day yesterday. My net liq bumped by $5,000 dollars. Most everything we touched worked. We had four, yes FOUR successful 0DTE setups. Two traditional setups with NDX/SPX and two event contracts. Those are just exceptional products to trade and we are looking to expand those more. Scalping brought in another $850 dollars so it was just one of those perfect days. Today is an interesting day. We've got FOMC minutes from the Jan. meeting being released today as well as the much anticipated and awaited NVDA earnings after the close. We've pulled out bond ladders in anticipation of the FED release and will reapply them tomorrow. Wednesday 21st February 14:00 ET FOMC Meeting Minutes for the January 31st Meeting The FOMC (Federal Open Market Committee) Meeting minutes provide comprehensive records of the discussions and decisions undertaken during the committee’s meetings, which are pivotal in determining U.S. monetary policy. These minutes detail deliberations on economic indicators such as inflation, employment, and overall economic growth, guiding the FOMC’s decisions on interest rates and other monetary policy tools. Released approximately three weeks following each meeting, the minutes offer insights into the perspectives of committee participants, including governors and Federal Reserve Bank presidents, outlining their assessments of economic conditions and the rationale behind any policy adjustments. What to Expect If the deliberations have hawkish undertones, or mention holding rates for longer than anticipated, this could result in Dollar strength and US stock weakness. On the other hand, talks on rate cuts may result in the inverse occurring. Any comments from Fed officials that contradict the current projections held by members and published in the SEP could also affect the markets. Technicals are now becoming more intrenched with sell signals NVDA is looking for about a 10% Move after hours Pre-Market U.S. Stock Movers Palo Alto Networks Inc (PANW) tumbled about -23% in pre-market trading after the cybersecurity company cut its full-year revenue and billings guidance. SolarEdge Technologies Inc (SEDG) plunged over -15% in pre-market trading after the company issued lower-than-expected Q1 revenue guidance. Teladoc Inc (TDOC) slumped more than -20% in pre-market trading after the telehealth and telemedicine services provider reported mixed Q4 results and provided disappointing Q1 and FY24 guidance. Keysight Technologies Inc (KEYS) slid over -5% in pre-market trading after the company offered below-consensus Q2 guidance. Amazon.com Inc (AMZN) gained more than +1% in pre-market trading after S&P Dow Jones Indices said on Tuesday that the e-commerce giant will replace Walgreens Boots Alliance Inc. in the Dow Jones Industrial Average effective next week. The Wendy’s Co (WEN) fell over -1% in pre-market trading after JPMorgan downgraded the stock to Neutral from Overweight with a price target of $19. While markets continue to stall here, and most indices are flashing sell, they haven't really rolled over yet. I don't usually issue price levels on FOMC days or days like this in general, be it NFP or CPI etc. These days are driven by Algos and computerized high frequency trading. Today we have the added catalyst of NVDA which won't come until after the bell. The bias is clearly bearish. #1. I believe the FOMC minutes will reveal that we aren't ready for a rate cut yet but may confirm that we can still get three in this year. #2. I believe NVDA will continue on its recent path of "buy the rumor, sell the news" as it's done so often after earnings. Both of these could be bearish.

We only have LYFT, MSTR?, NVDA?, ORCL, Event Contract 0DTE on the trade docket today. After NVDA earnings the floodgates will open back up for most of our "normal" trade setups. Tomorrow we'll be looking at /MCL, /ZN, PYPL, PLTR, RUT, FSLR, WYNN, GLD, DWAC, SMCI, /ZC, VTI setups again.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |