|

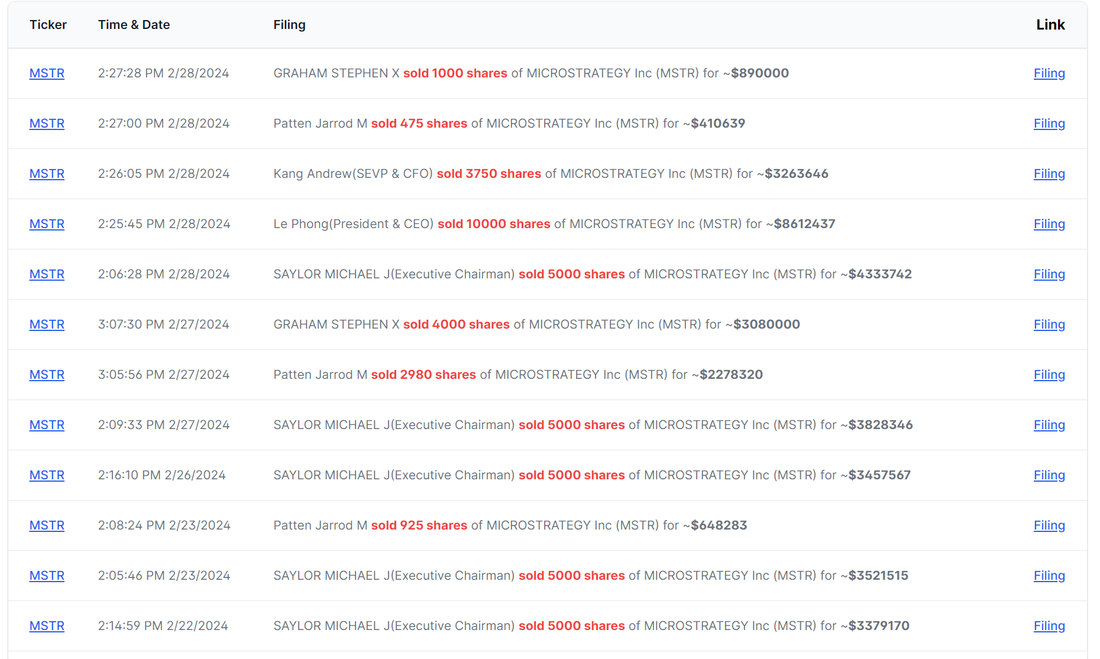

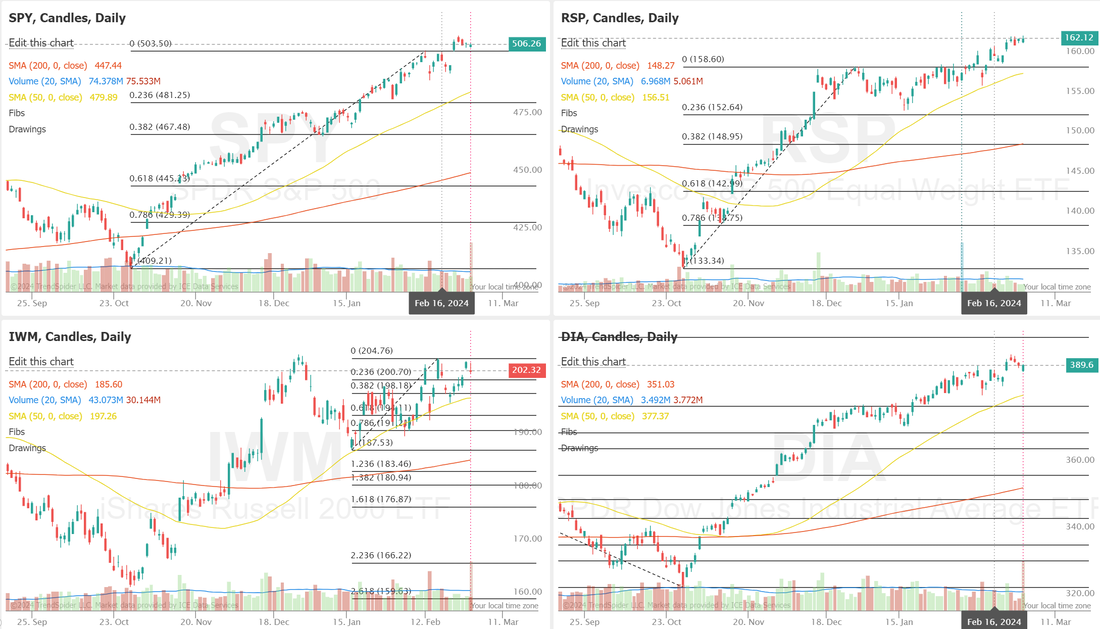

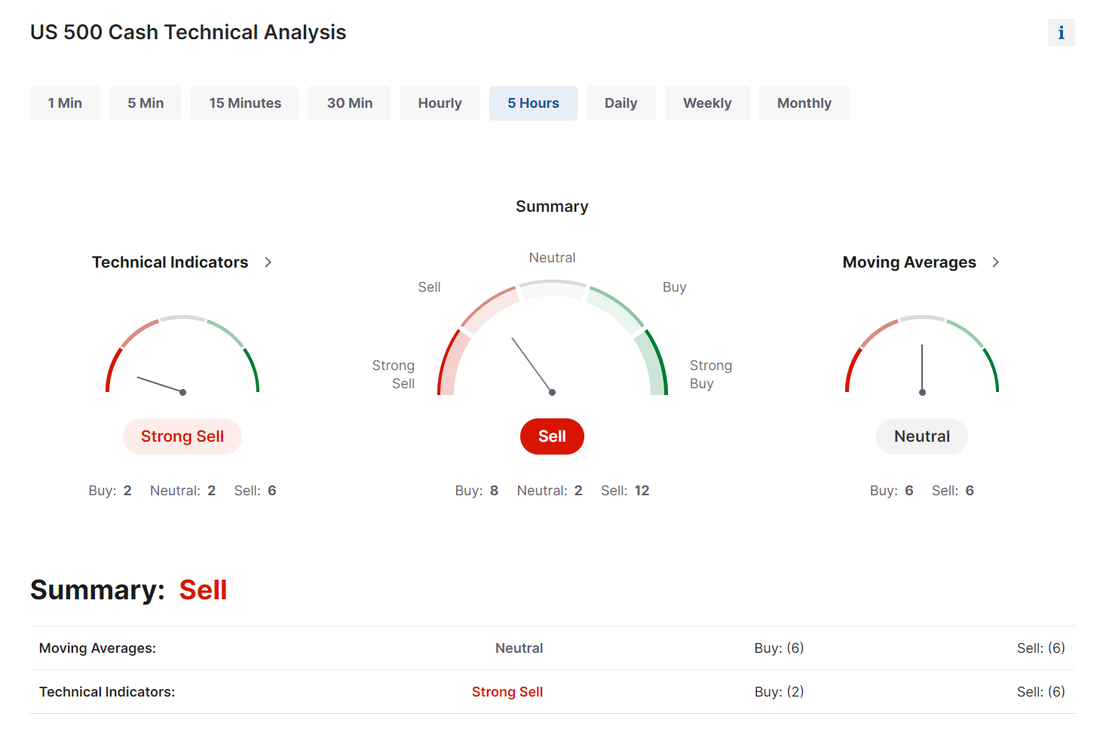

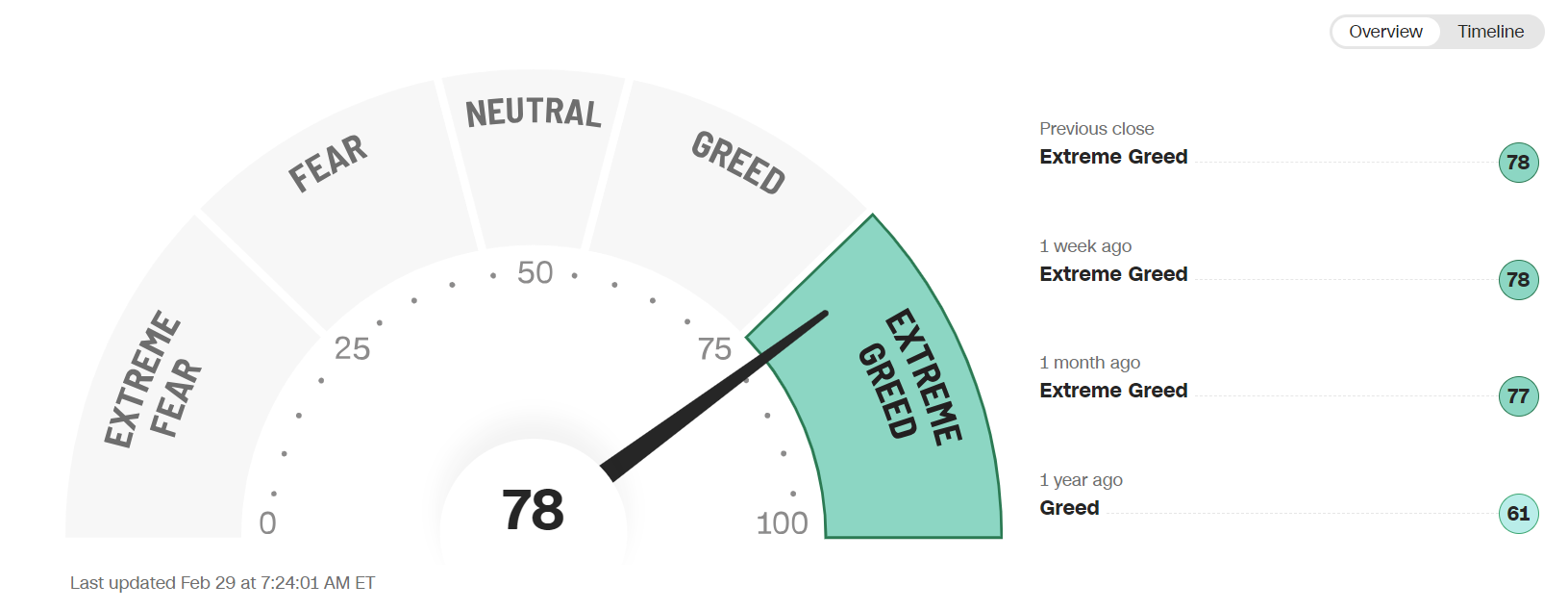

We had, what I'd call, a rock solid day yesterday. We try to have a broadly diversified model portfolio with varying strategies and underlyings as well as always carrying short positons regardless of market direction. This gives us a fighting chance each day for profits and it smoothes our the portfolio fluctuations. My net liq was up $2,162 yesterday. We had all three of our 0DTE's hit for profit. Between the three I had $10,312 capital commited and brought in $1,215 in profits. Our Event contract 0DTE was the biggest winner. If you are not trading event contract 0DTE's or are unfamiliar with them, I prepared a short tutorial of how they may help you up your "edge" in 0DTE trading. Earnings season has been hot and heavy for us and yesterday was no exception. CRM, SNOW, MARA, AI, AMC were our setups going into the close yesterday. They ALL look like nice wins for us this morning. Congrats on those wins. The Bitcoin charge continues: For me, one of the most intersting underlyings related to Bitcoin is MSTR. To say it's gone parabolic is an understatment. What you may not be aware of, is the fact that MSTR currently has the second most SEC form 4 insider sell numbers of any company on the U.S. exchanges. This is just a partial list of insiders who are dumping the stock Sell at the high...buy at the low, or so they say. That's the way to make money. We are in an MSTR trade now that we are chasing. I believe it will work out the same as our much scourned SMCI trade, which we exited yesterday at a massive profit. On to the market for today: PCE and Jobless claims should be our new catalyst for today. Thursday 29th February 08:30 ET US PCE Price Index for January The US Personal Consumption Expenditures Price Index is a measure of inflation that tracks changes in the prices of goods and services purchased by consumers throughout the US. It is released monthly by the Bureau of Economic Analysis and is considered a key indicator of inflationary trends. The PCE Price Index is closely watched by policymakers at the Federal Reserve, as it helps them assess whether inflation is rising or falling relative to their target. Unlike other measures of inflation, such as the Consumer Price Index (CPI), the PCE Price Index includes data on personal consumption expenditures, which covers a broader range of goods and services and is based on more comprehensive data sources. The basket of goods measured in the PCE report is also variable based on consumer spending habits, making it a better representation of how much more consumers are actually spending on their shopping and services. What to Expect Higher-than-expected inflation indicates that the Fed may need to keep rates higher for longer to bring inflation sustainably back to its 2% target, which would be likely to cause markets to pull back their bets on Fed rate cuts this year. This would cause strength in US stocks, and weakness in the dollar. Unicredit wrote in a note that they think the acceleration seen last month is mostly due to monthly volatility and one-offs. “We are expecting the PCE to be more elevated versus recent months as well. Not only were the CPI components that feed directly into the PCE up, but healthcare costs and financial costs available in the PPI were also up.” noted Societe Generale. US Weekly Initial & Continued Jobless Claims The US Initial Jobless Claims report provides data on the number of individuals who filed for unemployment benefits for the first time during the previous week. It serves as an indicator of the labor market’s health, with higher numbers indicating increased layoffs and economic instability, while lower numbers suggest a stronger job market. Continued Jobless Claims, on the other hand, represent the number of individuals who remain on unemployment benefits after their initial claim. What to Expect Employment is one of the Fed’s mandates, however, FOMC officials have mentioned that they do see a higher unemployment rate being in line with their goal back to 2% inflation. This means that Jobless Claims coming in higher than expected, suggesting higher unemployment, would be likely to be read by the Fed as good news for inflation’s return to target. This scenario could cause US stocks to strengthen and the dollar to weaken. Futures continue to be weak. Lets be clear, the market isn't rolling over here but its also stopped its recent forward progress. We continue to ask, is this just a consolidation pause to build energy for the next launch higher or, will the bears be able to rest control and definatively change the market bias? Futures are certainly trying to get this sell signal to develop into something substantive. The one thing I've learned doing this for 40 years is the saying, "Buy when others are fearful and sell when others are greedy" hold merit and works over the long haul. Guess where we are now? Our trade docket for today is busy:

CRM, SNOW, MARA, AI, AMC, DIA, GOOG, MSTR, ZM, SPX/NDX/Event contract 0DTE's, /MCL, NVDA, Three potential insider trade setups with WM, ORLY, EXAS and an interesting setup on VKTX and its counterpart ETF, XBI as well as three potential new earnings plays with DELL, ESTC, SOUN. WE'll also be in our live scalping room again today. I doubt will make $1,479 profit in 7.41 mins. like last time but...that's why we step up to the plate. You gotta be 'in it to win it". My intra-day levels are: /ES; 5073/5080/5086/5093* (key resistance level) to the upside. 5059* (key support)/5051/5039/5027 to the downside. /NQ; 17908/17958/17995/18042* (key resistance area) to the upside. 17853/17823* (key support)/17771/17759 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |