|

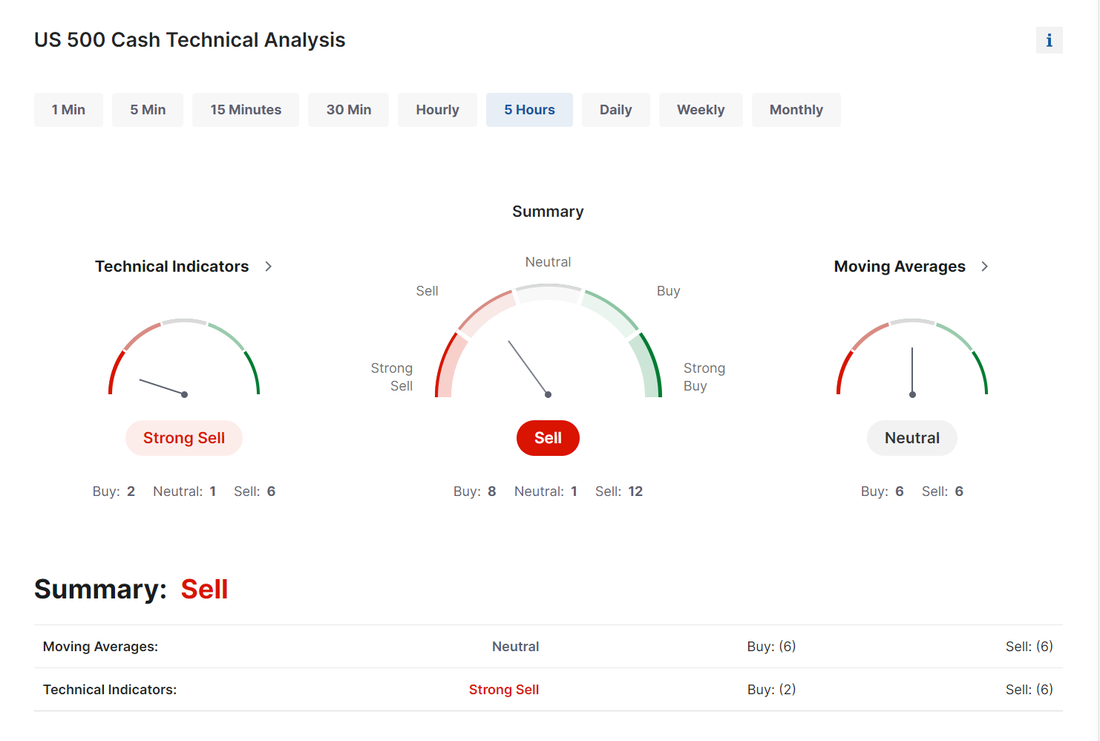

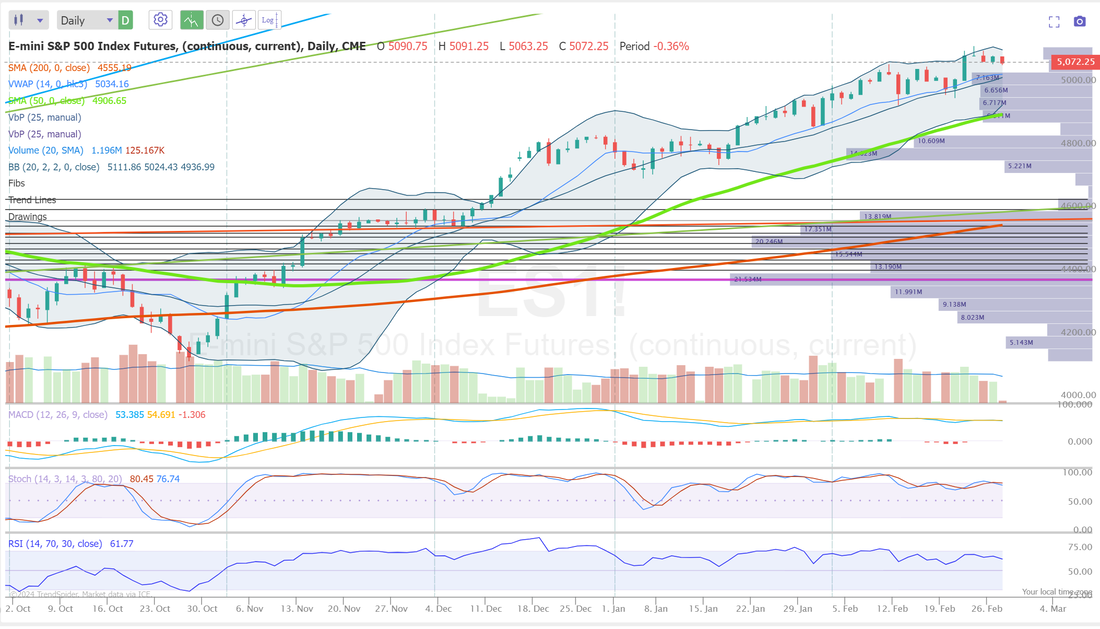

Welcome back traders. We had a really solid, overall day yesterday. My net liq was up $8,300. It certainly pointed to the importance of a well diversified portfolio. We had four 0DTE's once again. The more shots you take, the easier it will be to hit a target. Our standard SPX/NDX setups both went out with 10%+ returns on 80% capture rates. Our third NDX standard 0DTE made a whopping $36 dollar profit but...It had a crazy good insurance protective inner leg and could have hit for $1,100 profit IF we retraced going into the close. It didn't (obviously) but the risk/reward was fantastic. We will look to add another version of that setup today. Our non standard, event contract 0DTE also hit for a full profit of 3% ROI. All told is about $800 profit on 11K of buying power. We scalp QQQ 0DTE options every Tues/Thurs. and yesterday was no exception. We banked an impressive $1,479 gross profit on our first scalp. Our daily goal is $500-$1000 profit and when we get above $1,000 profit we stop so as not to give it back. Scalping yesterday lasted a whopping 7.41 minutes! Last Thurs. we scalped all day and didn't make any progress. Yesterday we grabbed a runner right out of the gate. You never know with scalping. You just need to commit to doing it consistently. We continue to be right on track to hit our $50,000 yearly scalping income goal, using 5K of capital and trading twice a week. If you are searching for ways to boost your income potential. Diversify your cash flow sources and gain a little more control over your results you might want to try our scalping program. We have a couple news catalysts today that could be market drivers. We are keen to add another ladder to our oil setup today so we'll be watching oil. Wednesday 28th February 08:30 ET US GDP Q4 Second Estimate US GDP refers to the Gross Domestic Product. GDP is a key indicator of the economic health and performance of a country and represents the total value of all goods and services produced within the country’s borders during a specific period. The fourth-quarter GDP figure provides insights into the growth rate or contraction of the economy during the final three months of the year. It’s an essential data point for policymakers, economists, and investors, offering information on overall economic activity, consumption, investment, government spending, and net exports. What to Expect Although a strong GDP figure will help cement a soft landing it could also have negative implications for monetary policy. Market participants will need to balance out these risks when assessing what this data means for US stocks and the dollar. “We expect real growth to be trimmed by 0.2 percentage points to a 3.1% annual rate. The slower pace reflects the downward revisions to November and December retail sales.” Morgan Stanley wrote in a note. 10:30 ET Weekly EIA Crude Oil Inventories The US Weekly Energy Information Administration Crude Oil Inventories report provides information on the total stockpile of crude oil in the United States. It includes data on the changes in crude oil inventories, indicating whether there has been an increase or decrease in the amount of oil held in storage. This report assesses supply and demand dynamics in the oil market and can influence oil prices. What to Expect A significant buildup in inventories may indicate oversupply, putting downward pressure on prices, while a decline may suggest increased demand, potentially impacting prices in the opposite direction. We've been trying to roll over for a few days now. With yesterdays price action we are back to, what has become rare...a sell signal technical rating. However, as much as I'd love to see us get bearish (we need the extra I.V.), let's not jump on the downside bandwagon just yet. We are still sitting right around the all time highs on most indices. We've spent the last three weeks banging our head on resistance with the /NQ. The /ES has spent the last three days clocking in weakness but maybe more important than the very slight move down is the absolute disappearing act of buying volume. Its drying up. I'm not a huge "bitcoin guy" but I am long ETH and Bitcoin. It's important to track this big upside push because even if you're not a big "bitcoin guy/gal", there are lots of equity underlyings that are being pulled up with this runup. Are they setting up for some nice shorting opportunities? I think so. Fed Governor Michelle Bowman on Tuesday repeated her anticipation that inflation will further decrease with interest rates held at current levels but emphasized that it’s too soon to initiate rate cuts. “Should the incoming data continue to indicate that inflation is moving sustainably toward our 2% goal, it will eventually become appropriate to gradually lower our policy rate to prevent monetary policy from becoming overly restrictive. In my view, we are not yet at that point,” Bowman said.

Meanwhile, U.S. rate futures have priced in a 0.5% chance of a 25 basis point rate cut at the March FOMC meeting and a 20.8% probability of a 25 basis point rate cut at May’s monetary policy meeting. Pre-Market U.S. Stock Movers Beyond Meat Inc (BYND) soared about +56% in pre-market trading after the company reported better-than-expected Q4 revenue, propelled by strong international sales. eBay Inc (EBAY) climbed over +3% in pre-market trading after the company topped Q4 revenue and gross merchandising volume expectations, gave a positive Q1 outlook, and authorized an additional $2 billion stock repurchase program. Coupang Inc (CPNG) gained more than +8% in pre-market trading after the company reported upbeat Q4 results. First Solar Inc (FSLR) rose over +4% in pre-market trading after reporting stronger-than-expected Q4 EPS and issuing in-line full-year guidance. Urban Outfitters Inc (URBN) plunged more than -9% in pre-market trading after the company posted weaker-than-expected Q4 results. Annovis Bio Inc (ANVS) slumped over -8% in pre-market trading after Brookline downgraded the stock to Hold from Buy with a $9 price target. We've got trades on EBAY and FSLR oh, and BYND! I told you yesterday to look for that BYND trade. If we open up today close to pre market pricing, that trade should hit for a 100%+ one day return. Our trade docket today is a tad lighter than yesterday: CRM, SNOW, MARA, AI, AMC (all earnings trades), /MCL, BYND, EBAY, SPX/NDX/Event contract 0DTE's. My intra-day levels: /ES; 5077/5082/5091/5103 to the upside. 5067/5061/5050/5039 to the downside. /NQ; 17990/18043/18073/18117 to the upside. 17906/17853/17793/17692 to the downside. Thanks for following! I'd love it if you could take a quick moment and shoot me a comment on anything in specific that you'd like to see added to the daily report. If there is some data set that you find valuable I'd love to add that to our overview.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |