|

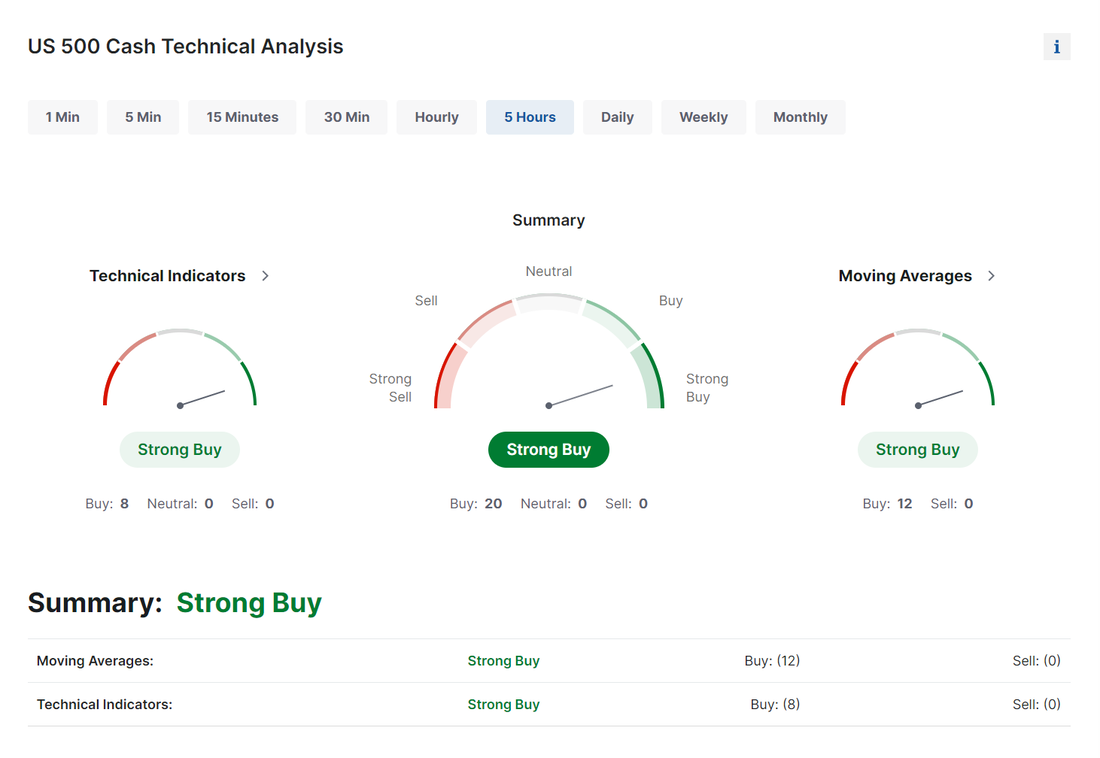

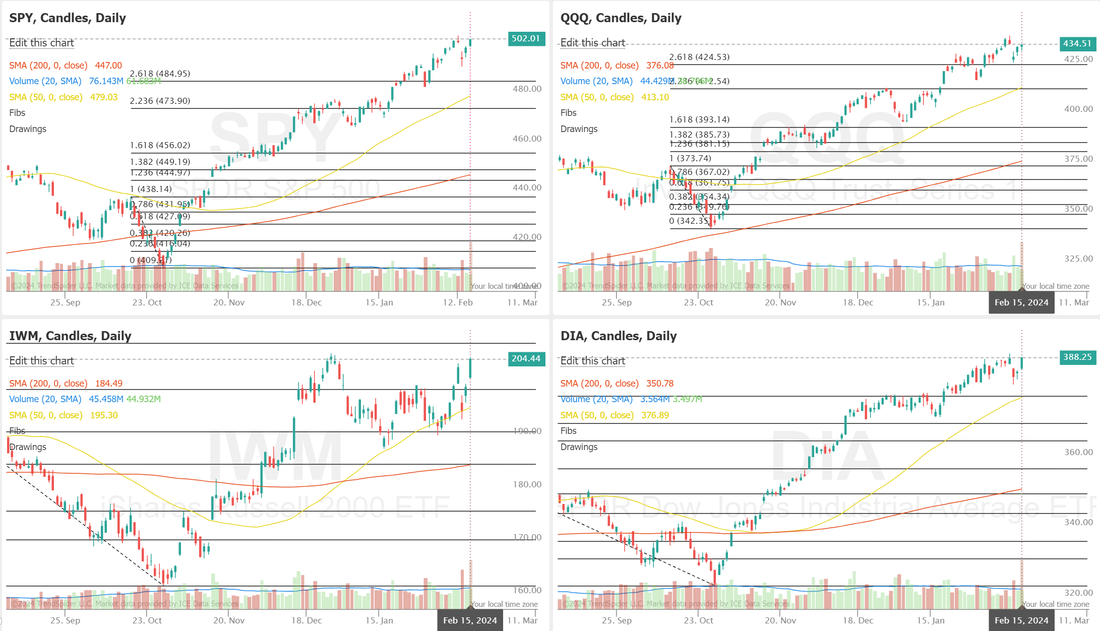

We had another solid day yesterday. We made money on all three 0DTE setups including the event contract. We are still in the SPX call roll. NVDA (of all things!) was our biggest help yesterday. We are just three trading days away from NVDA earnings, which should bring some relief to that setup. We are still firmly in the bullish technical camp: We do have some potential news catalysts today: Friday 16th February 08:30 ET US PPI The US Producer Price Index measures the average change over time in the selling prices received by domestic producers for their output. It is an economic indicator that reflects the direction of inflationary pressures at the producer level. PPI is used to assess inflation trends in the early stages of the production process, providing insights into potential changes in consumer prices, making it a leading indicator. What to Expect Higher-than-expected producer prices can point to the potential for these price increases on the supply side to be passed down to the consumer side and become reflected in CPI, which would be a headwind for the Fed’s goal of returning inflation to target. This would be likely to cause weakness in US stocks and strength in the dollar, as traders would likely push back bets on when the Fed would start cutting interest rates this year. US Housing Starts US Housing Starts is an economic indicator that measures the number of new residential construction projects that have begun on a monthly basis. The data includes both single-family and multi-family housing units. Housing starts are considered a key indicator of economic health, as increased construction activity is associated with economic growth. Rising housing starts can signify a robust real estate market and increased consumer confidence. Conversely, a decline in housing starts may indicate economic challenges or a slowdown in the housing sector. What to Expect This data is unlikely to move the markets on its own unless there is a large deviation from expectations. However, it can still paint a picture of consumer confidence, as higher-than-expected housing starts would indicate high demand for homes, which is one of the largest investments the average American will make. 10:00 ET University of Michigan Sentiment The University of Michigan Consumer Sentiment Index measures the confidence of US consumers in the economy. It is based on a survey that assesses consumers’ perceptions and expectations regarding their personal finances, business conditions, and overall economic prospects. A higher sentiment index indicates increased confidence, which can positively impact consumer spending and economic activity, while a lower index may suggest reduced confidence and potential economic caution. What to Expect The last University of Michigan report was received as ‘Fed Friendly’ because it showed higher than expected consumer sentiment but also showed downward revisions to consumers’ 1- and 5-year inflation expectations. This outlined the case for a soft landing, with consumers having confidence in the economy, as well as the view that inflation was on track to reach the Fed’s target. A result like this again would be likely to cause strength in US stocks and weakness in the dollar, as it may cause traders to push forward their bets on Fed interest rate cuts this year. FED speak We also have two FED members speaking today. Price action is most decidedly bullish but it also puts us right back up to resistance. Can the indices push above this substantive level? The trade docket for today is the same as most Fridays. We will be looking to book profits where we can and clean up the portfolio for the week. CCL, COIN, DASH, DKNG, IWM, LYFT, MSTR, NDX/SPX/Event contract 0DTE's, QQQ, ROKU, DWAC, VTI all on the potential trade docket for today. All our earnings trades look solid going into the open. Intra-day levels for me: /ES: 5066/5089/5101/5124 to the upside. 5047/5029/5018/5008 to the downside. /NQ: 18071/18167/18254/18327 to the upside. 17969/17922/17852/17820 to the downside. We are headed into a three day trading weekend! Enjoy the time off!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |