|

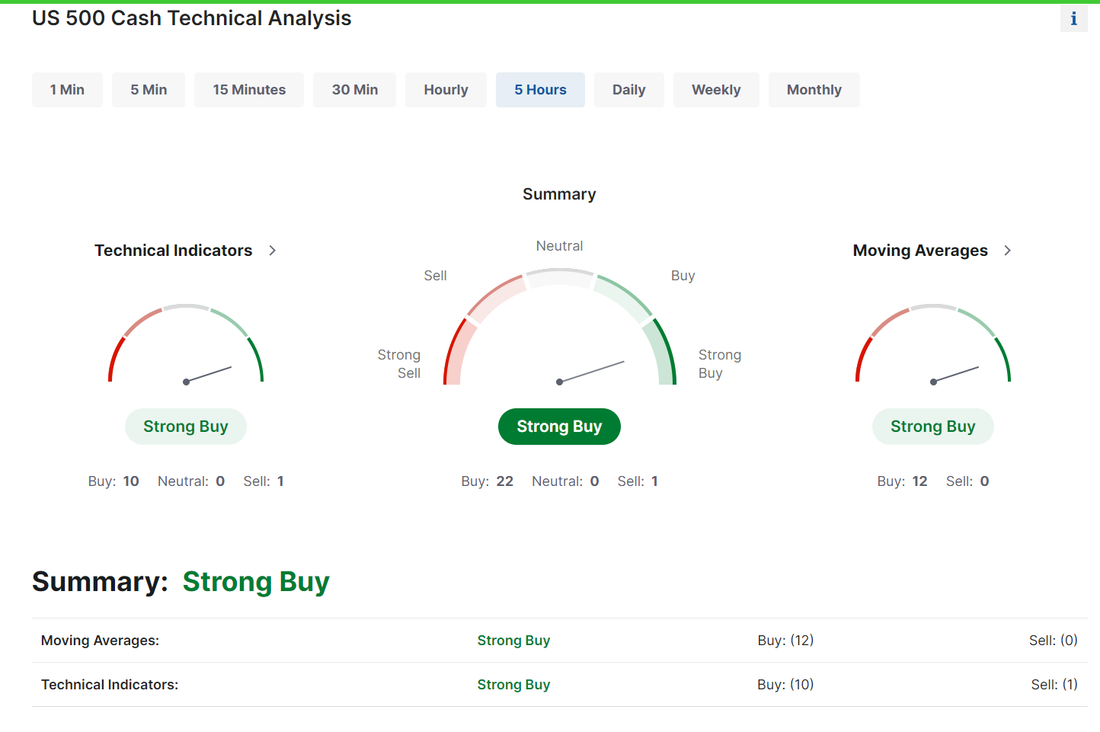

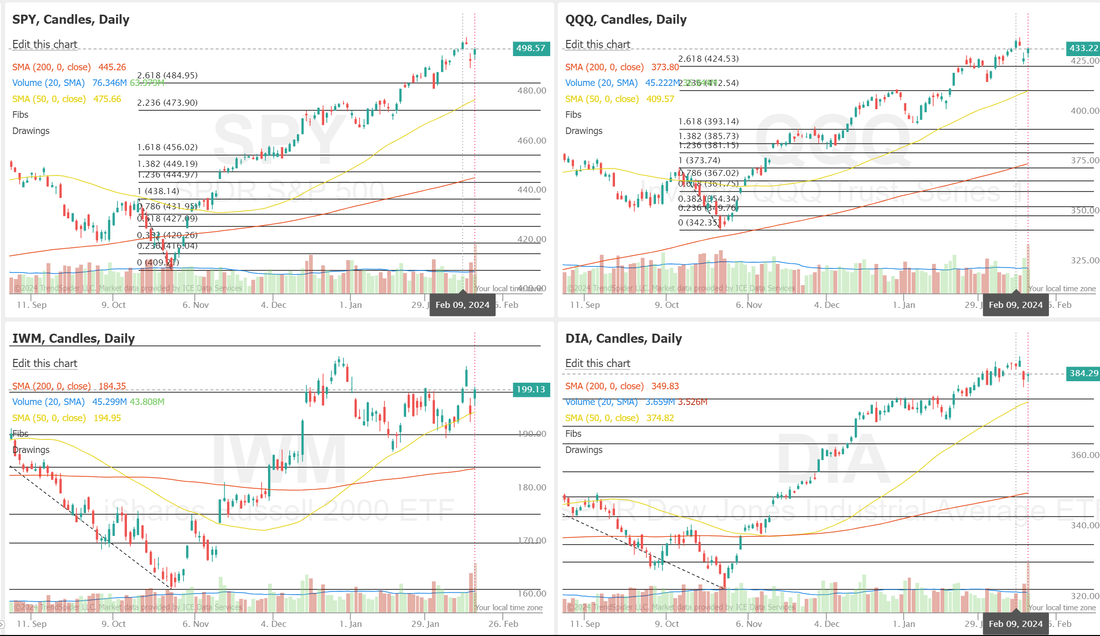

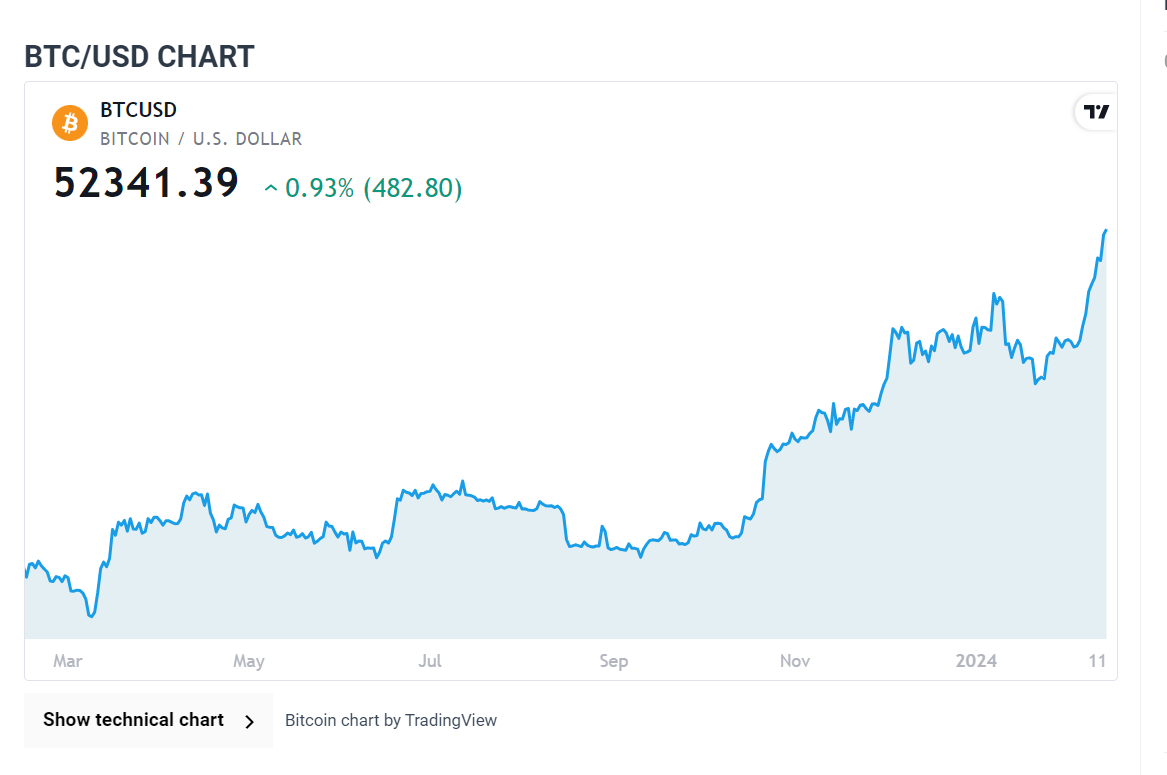

Yesterday ended up being a solid green day for us but could have been so much better. We made money on all three of our 0DTE setups but all three could have yielded so much more. We may have gotten the answer to our question posed after the CPI dump. Is this a 'buy the dip" or "sell the rip" event? I said the way we traded yesterday and maybe more importantly, how we closed the day would be the tell. Well...it certainly looks like it was a "buy the dip" opportunity and we are back to full on bullish. That's important for us because we need to re-apply our VTI swing trade. The sell rating only lasted a few hours. The neutral rating only lasted a day. We are now firmly back to bullish price action. All our major indices continue to trudge higher: We have a fairly busy trade docket today: IWM, LYFT, META, ORCL, PFG, QQQ, SPX/NDX/Event contract 0DTE's, SPY, TWLO, WYNN?, /MCL?, /ZN?, DIA, GLD and multiple earnings potentials ROKU, DKNG, COIN, DASH, AMT, and last but not least, our VTI swing trade. Our two earnings trades from yesterday (TWLO and CSCO) both look good for profits today. We have jobless claims as well as earnings and retail sales numbers to drive todays market: Thursday 15th February 08:30 ET US Retail Sales US Retail Sales is a metric that quantifies the total revenue generated by retail establishments in the United States, encompassing various sectors like automotive, electronics, clothing, and general merchandise. Compiled and reported monthly by the US Census Bureau, this data serves as an indicator of consumer spending patterns, offering valuable insights into the health of the economy. What to Expect Rising retail sales are generally associated with economic expansion and increased consumer confidence, while a decline may signal an economic contraction. As this may have implications for the future of inflation, a weak reading may result in US stocks strengthening and the dollar weakening. US Weekly Initial & Continued Jobless Claims The US Weekly Initial Jobless Claims and Continued Jobless Claims are economic indicators that provide insights into the labor market’s health. Initial Jobless Claims represent the number of individuals who filed for unemployment benefits for the first time during a specific week. It serves as an indicator of the pace of layoffs and helps economists assess the overall health of the job market. A lower number of initial claims suggests a stronger job market. Continued Jobless Claims reflect the number of individuals who continue to receive unemployment benefits. It gives an indication of ongoing unemployment and the ability of workers to find new employment. A decreasing trend in continued claims may suggest improving employment conditions. What to Expect If jobless claims come in higher than expected, it could indicate weakness in the jobs market, which could be a potential downside inflation catalyst. In this case, stocks would likely strengthen and the dollar would weaken, as it could be an indicator that inflation will come down closer to the Fed’s target and push forward bets on rate cuts this year. However, traders are also attentive to the risk of recession, and if unemployment is too high, this could be an early sign of a potential hard landing if continued across multiple weeks. We also have some speakers today but that shouldn't be too much of a potential catalyst: Speakers 08:50 ET BoE’s Mann speaks as a panellist at the 40th Annual National Association for Business Economics (NABE) Economic Policy Conference in Washington on “Labor, investment and technology: assess the drivers of productivity growth”. 13:00 ET ECB’s Nagel gives a speech on Stability and prosperity in Europe at Munich Europe Conference. 13:15 ET Fed’s Waller gives remarks on the dollar’s international role at the Global Interdependence Center and University of the Bahamas Conference in Nassau, Bahamas. Both text and Q&A are expected. 13:40 ET RBNZ’s Orr will speak about “the changing drivers of inflation over the past couple of years and the shift from transitory to more stubborn underlying inflation” at NZ Economics Forum. Bitcoin continues to soar. Pulling a lot of the crypto space with it. On the subject of the never ending FED watch, we got the following statements yesterday: Chicago Fed President Austan Goolsbee stated on Wednesday that even if inflation data ticked slightly higher for a few months, it would still align with the trajectory toward the central bank’s 2% target, cautioning against delaying rate cuts for too long. “Rate cuts should be tied to confidence in being on a path toward the target. More data like we have seen in the past six months would indicate that path, but that’s probably too stringent,” Goolsbee said in a prepared speech at the Council on Foreign Relations in New York. At the same time, Fed Vice Chair for Supervision Michael Barr stated that U.S. policymakers need to see more data indicating inflation is returning to target levels before considering lowering interest rates. Meanwhile, U.S. rate futures have priced in a 10.5% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting and a 36.9% chance of a 25 basis point rate cut at May’s monetary policy meeting. Intra-day levels for me:

/ES: 5038 on the upside and 5017 on the downside. This is a very tight "chop zone" for me today. Anything inside this range has no directional bias confirmation to me. 5038/5066* (yesterdays high) /5098/5116 to the upside. 5017/4986/4966/4937* (recent low) to the downside. /NQ: 17928/17965/18019/18069 to the upside. 17873/17837/17795/17743 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |