|

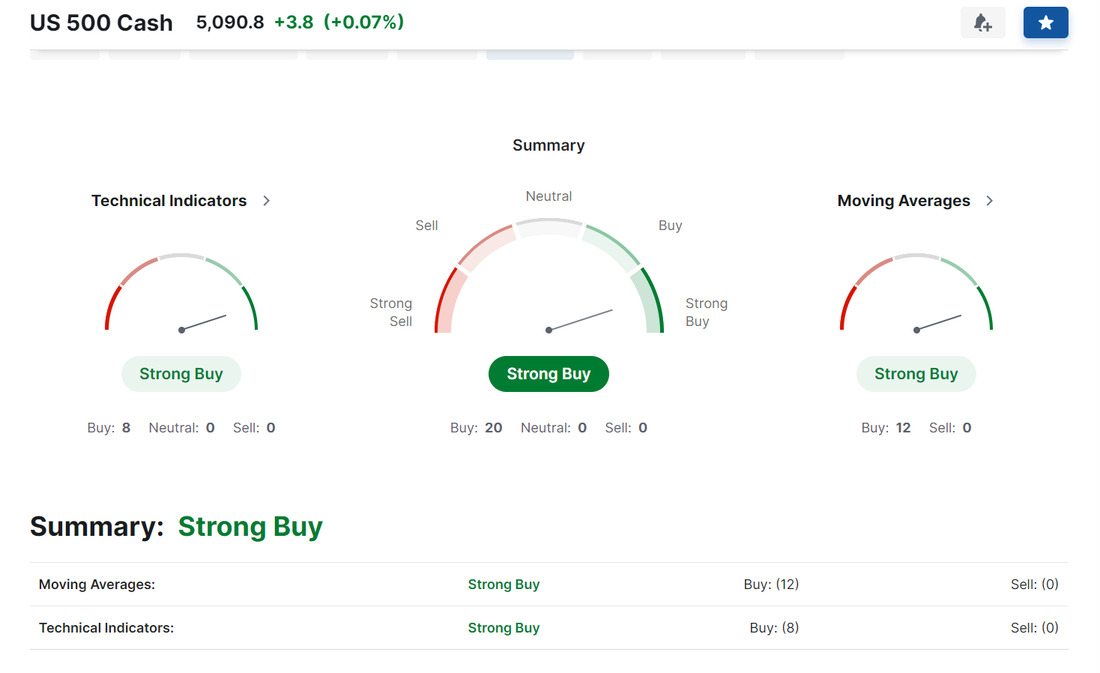

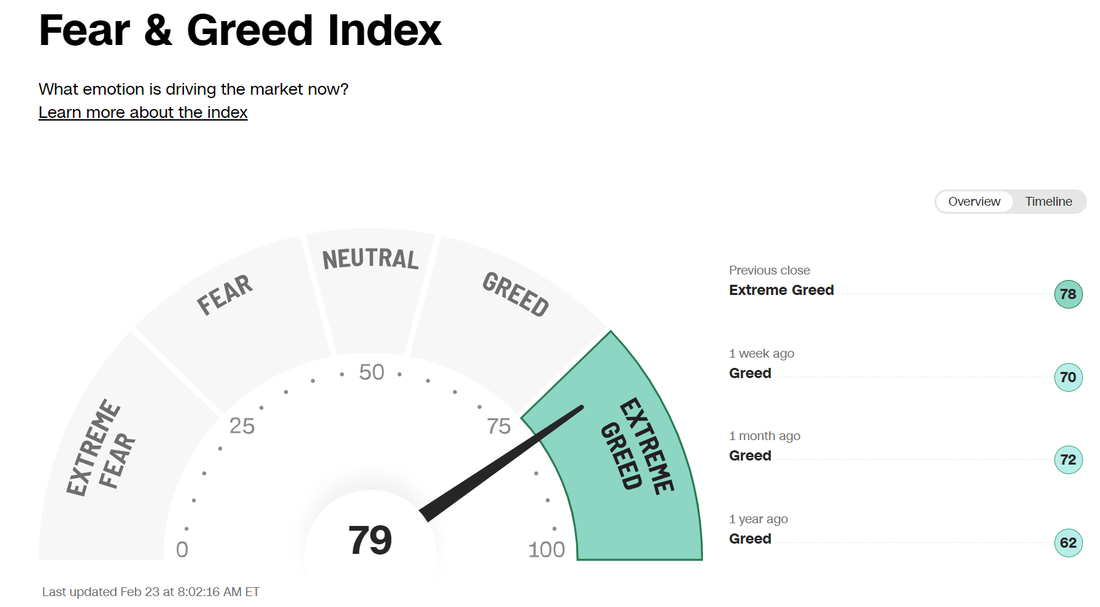

Well, yesterday was an interesting day. We knew the NVDA earnings announcment was going to move things...one way or the other. It certainly did. We measure our success based on the movement of our Net liq (or account value) In theory, we could do 10 trades, 9 are losers and 1 is a winner but, If our net liq goes up, we call it a success. In this regard, yesterday was horrible for me. My net liq got hit pretty good with the NVDA move and yet, our trades, for the most part look solid. There's just a lot of extrinsic sitting out there that needs to move into our pockets. We'll continue to work them today and patiently wait for that theta decay. Markets are full on buy mode now: Oh, and also, congrats... we are back to full "risk on" mode: We don't have any major, planned news catalysts for the day.

Our trade docket for the day consists of; SPX/NDX/Event contract 0DTE's, /ZN, DIA, GLD, MSTR, NVDA, RIVN, SMCI and some possible additions of our normal weekly credit strangles we took off earlier this week. The futures are slightly green. Maybe a little hangover from the NVDA party of yesterday, which was the biggest one day rally we've had this year. Levels for me today: /ES: 5108/5118/5128/5135 to the upside. 5095/5091/5072/5067 to the downside /NQ: 18101/18165/18327/18377 to the upside. 18067/18019/17951/17907 to the downside

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |