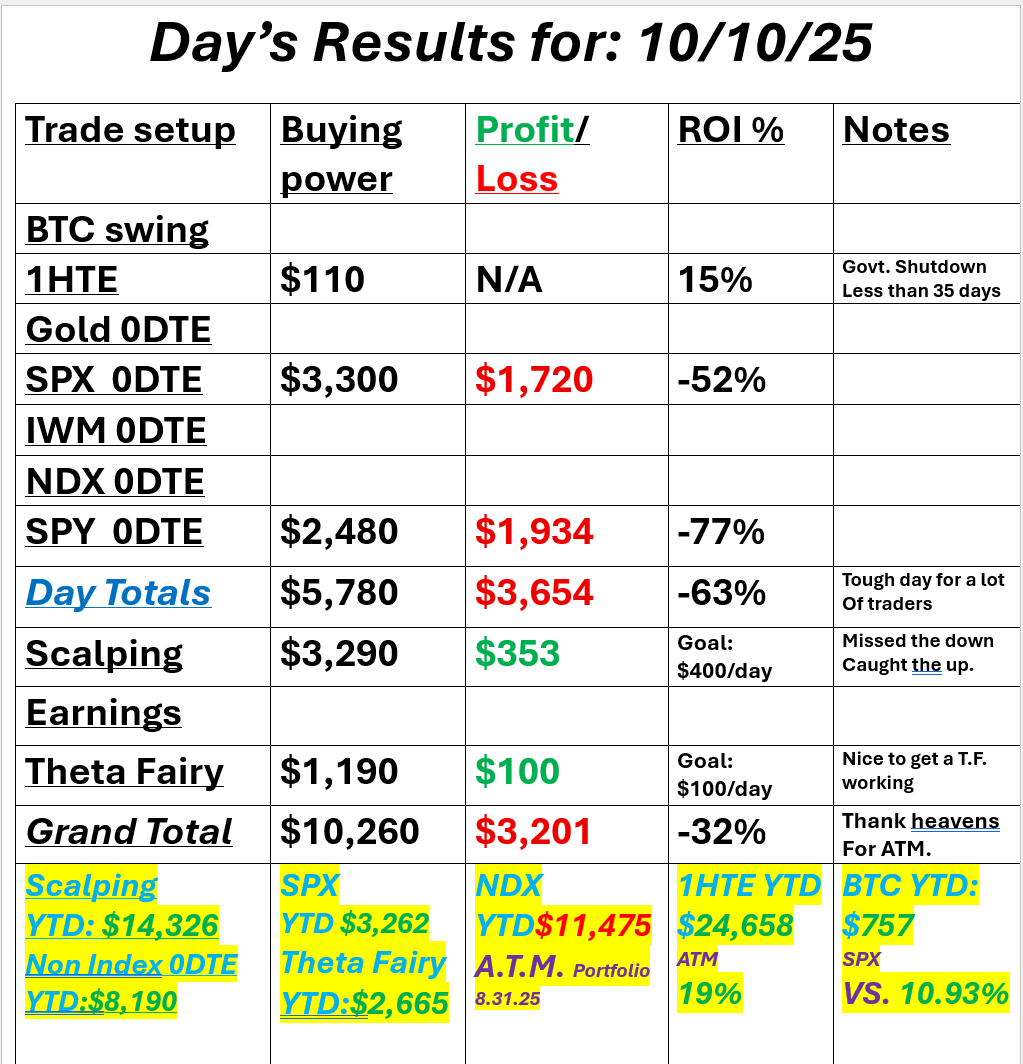

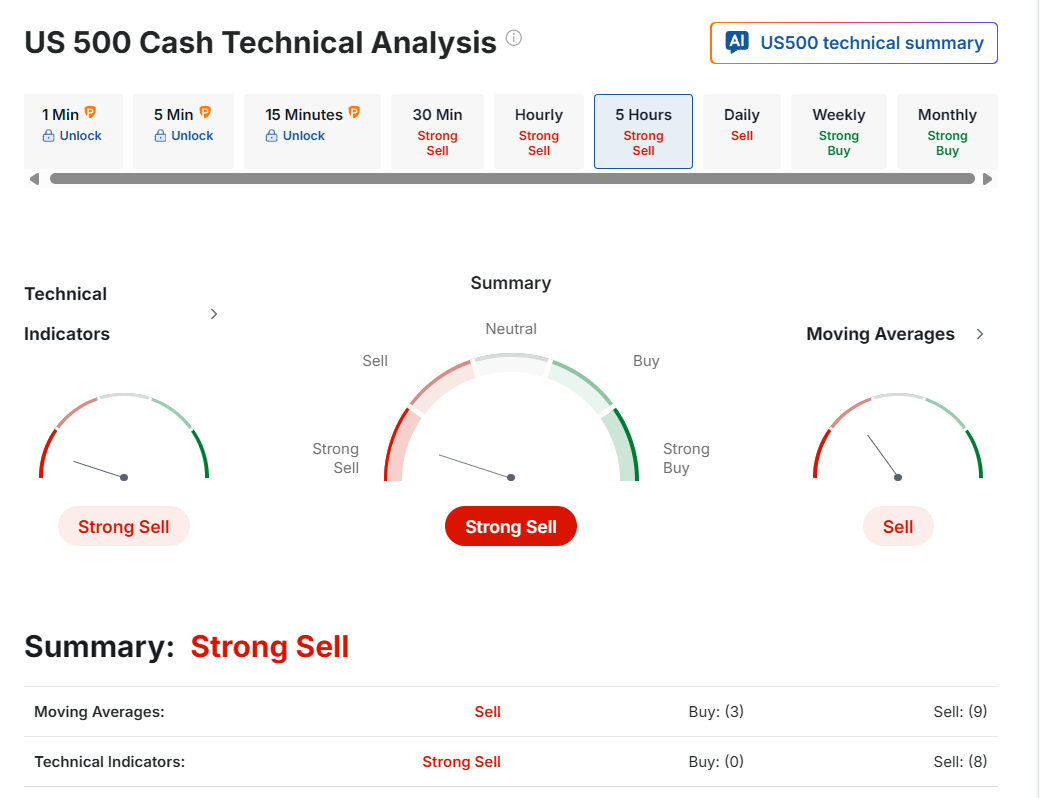

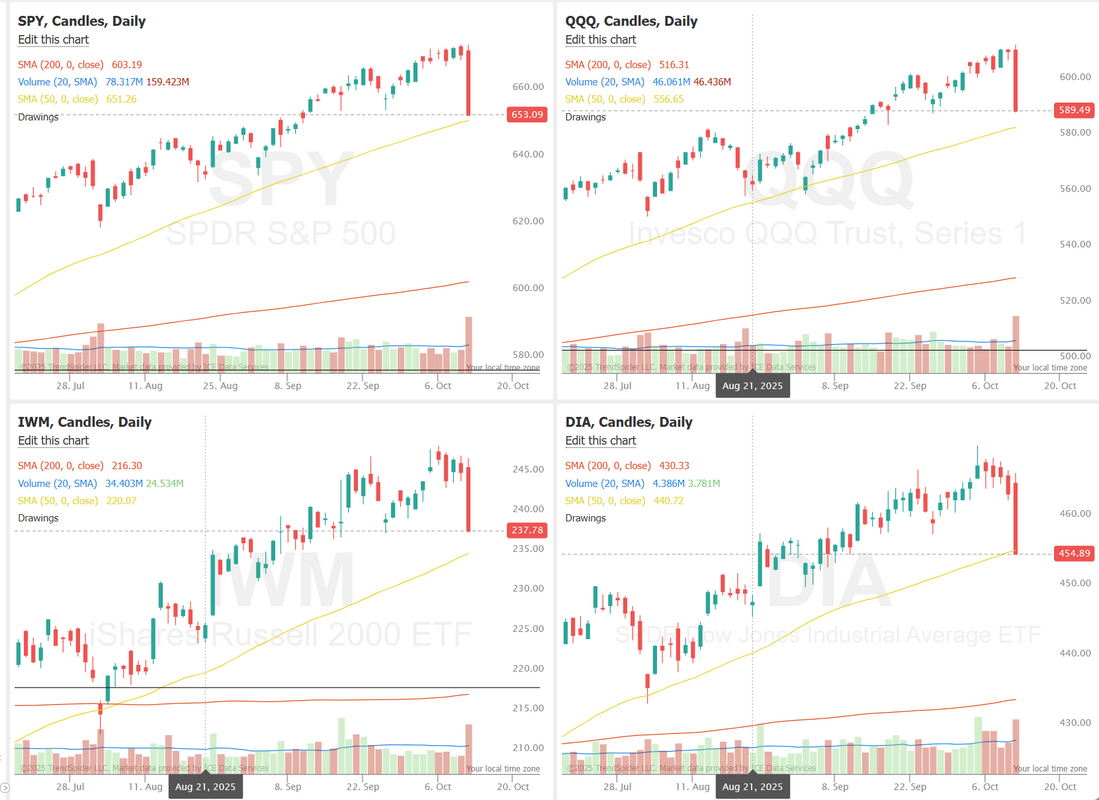

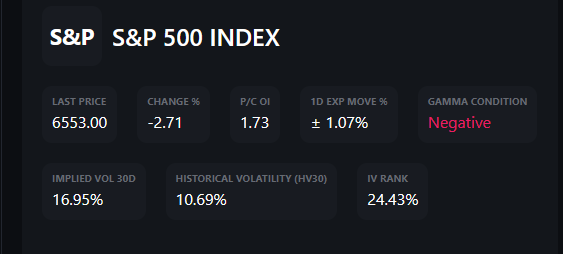

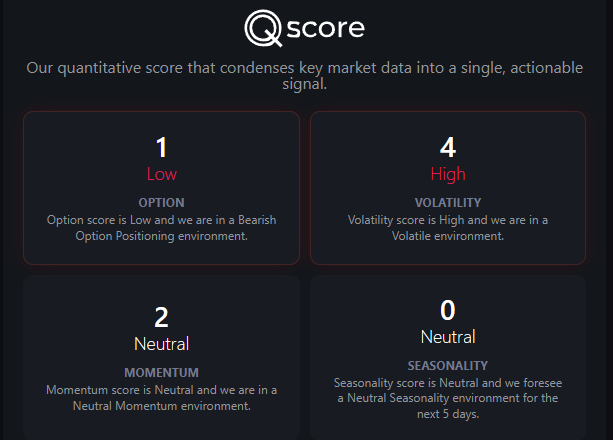

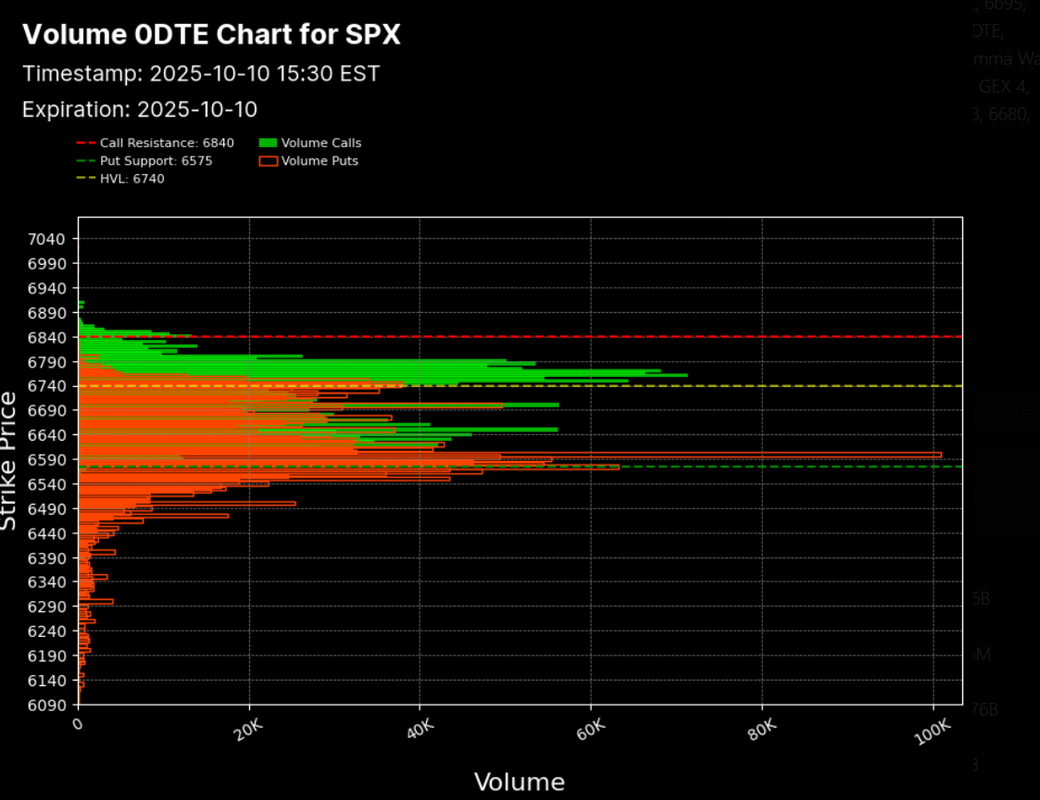

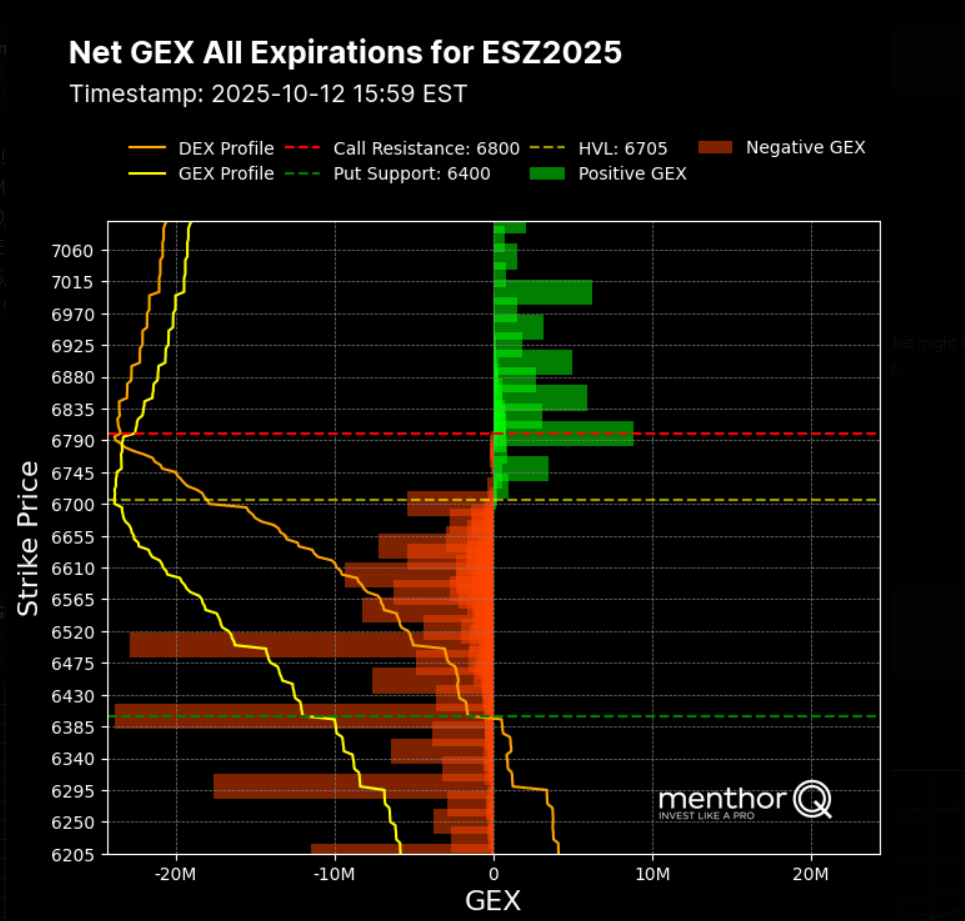

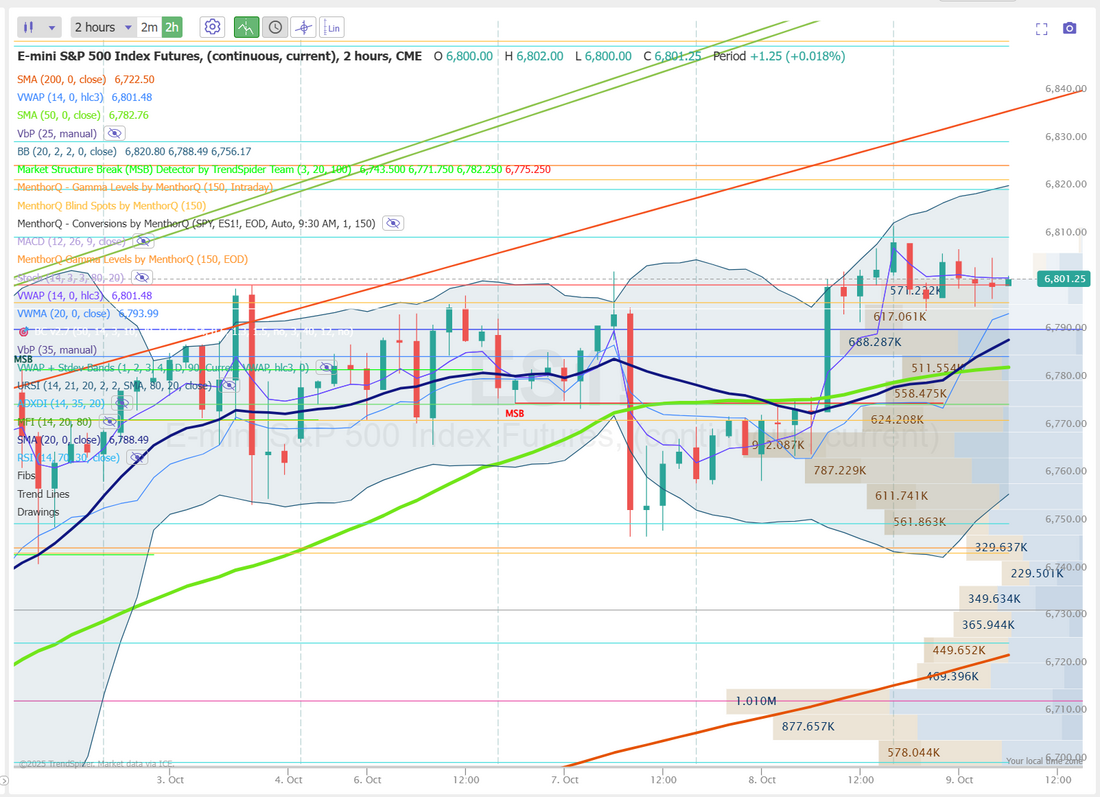

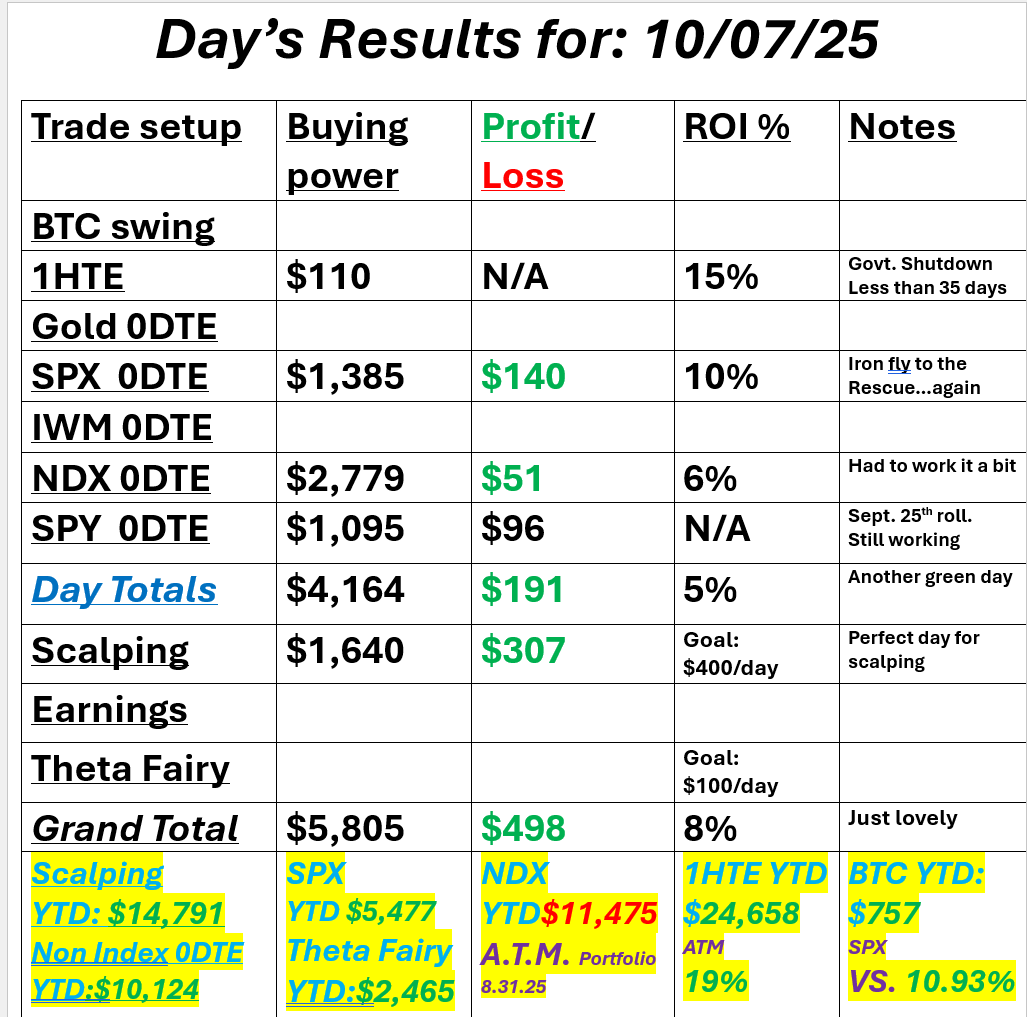

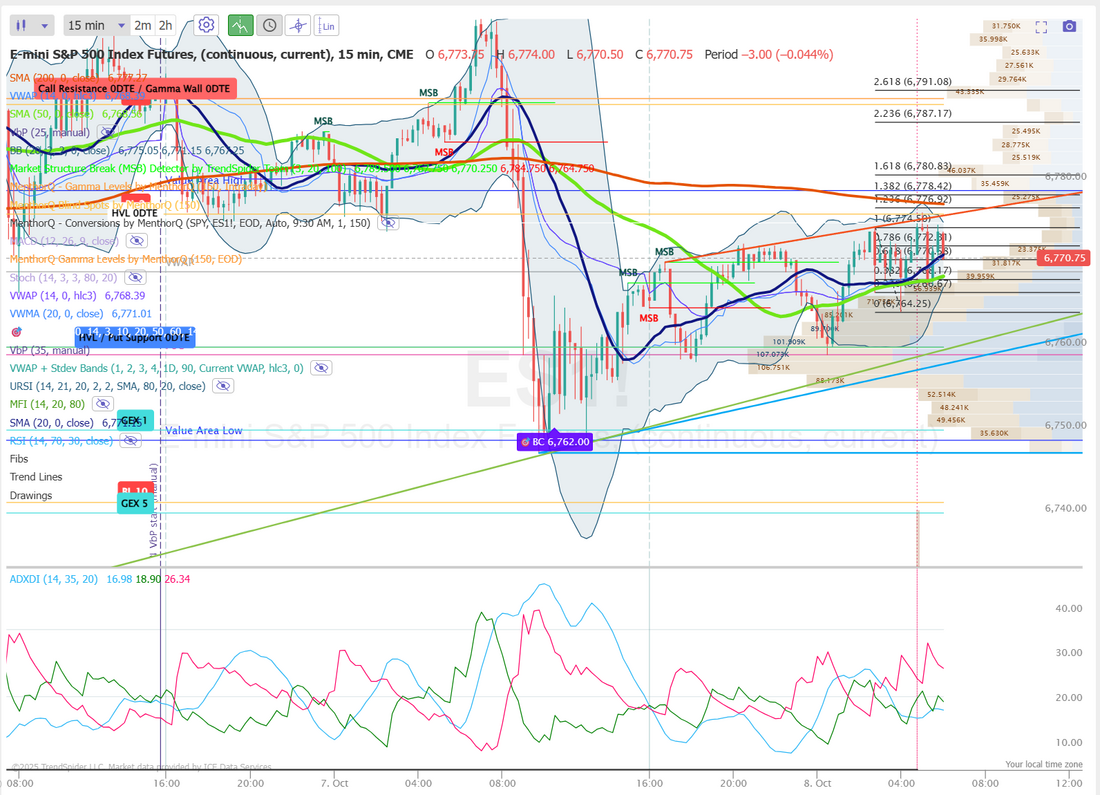

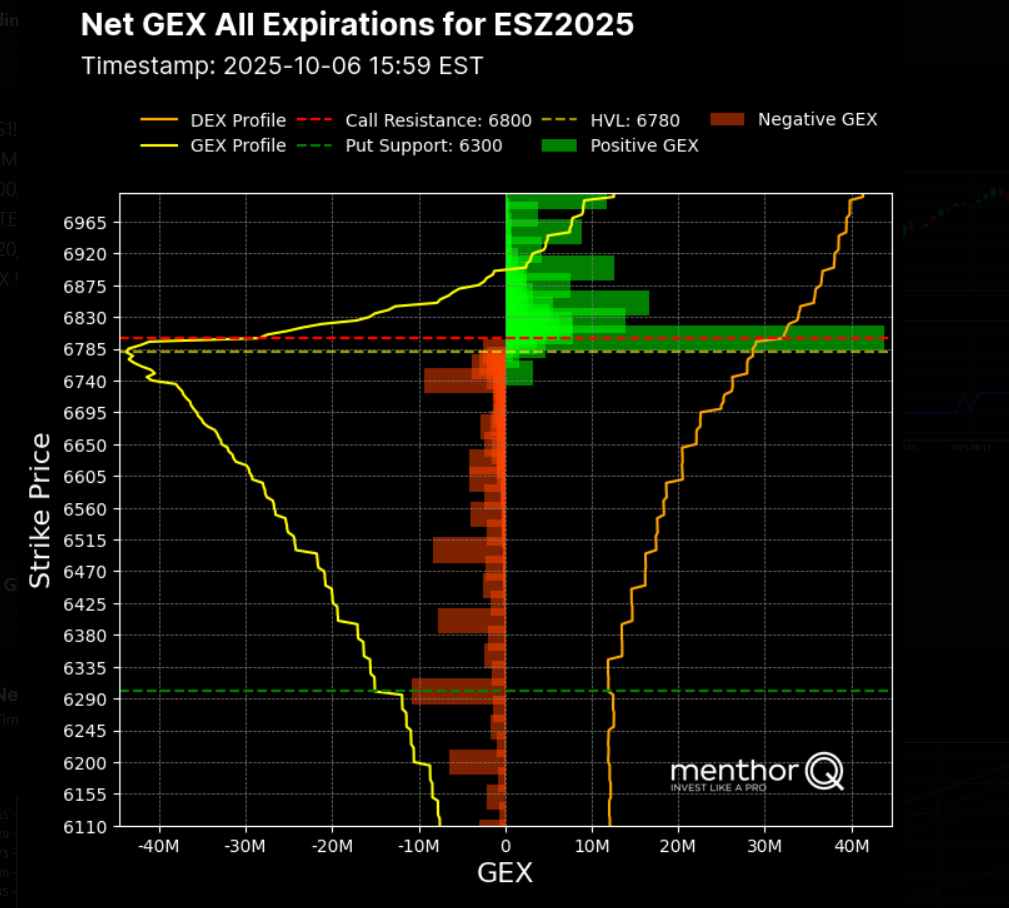

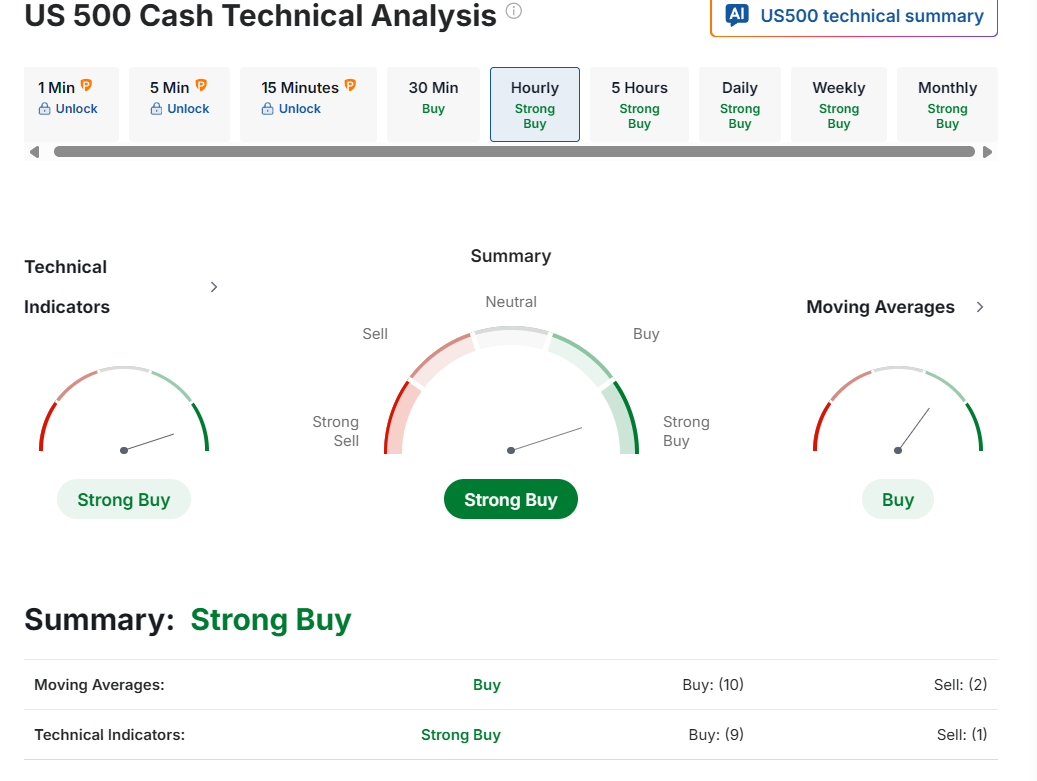

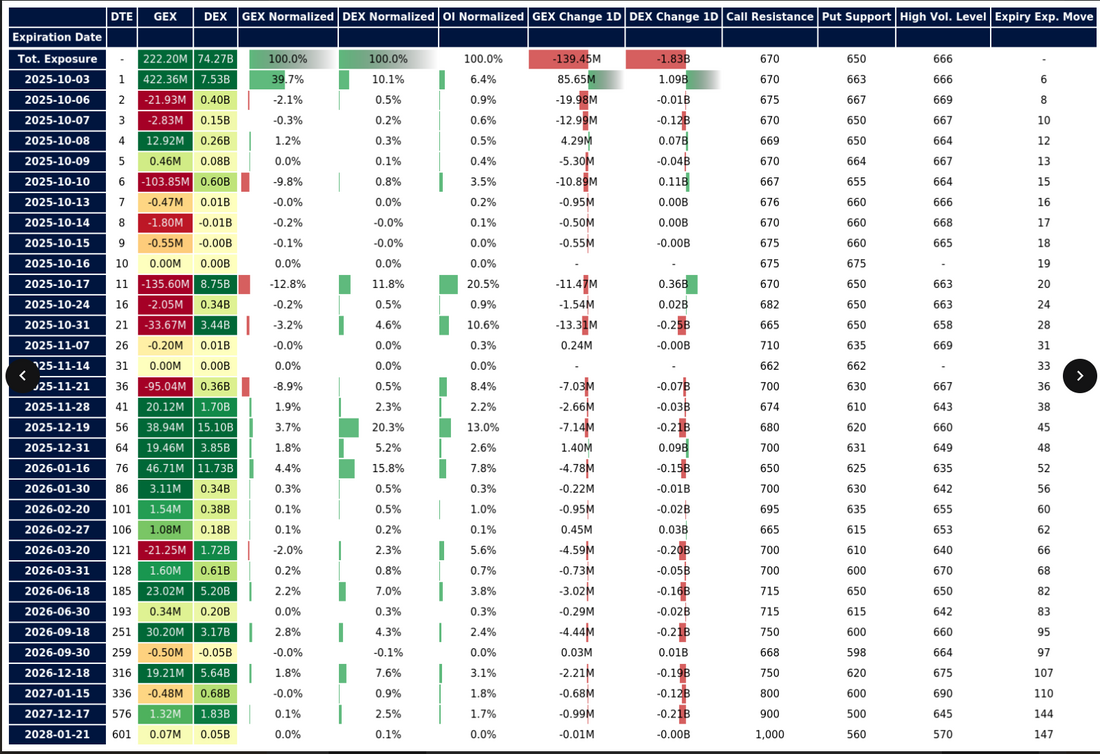

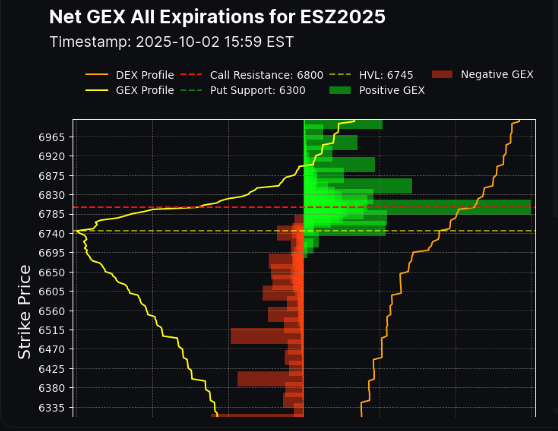

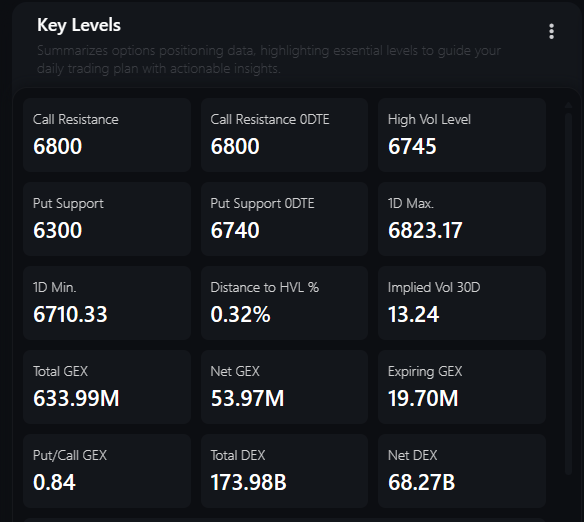

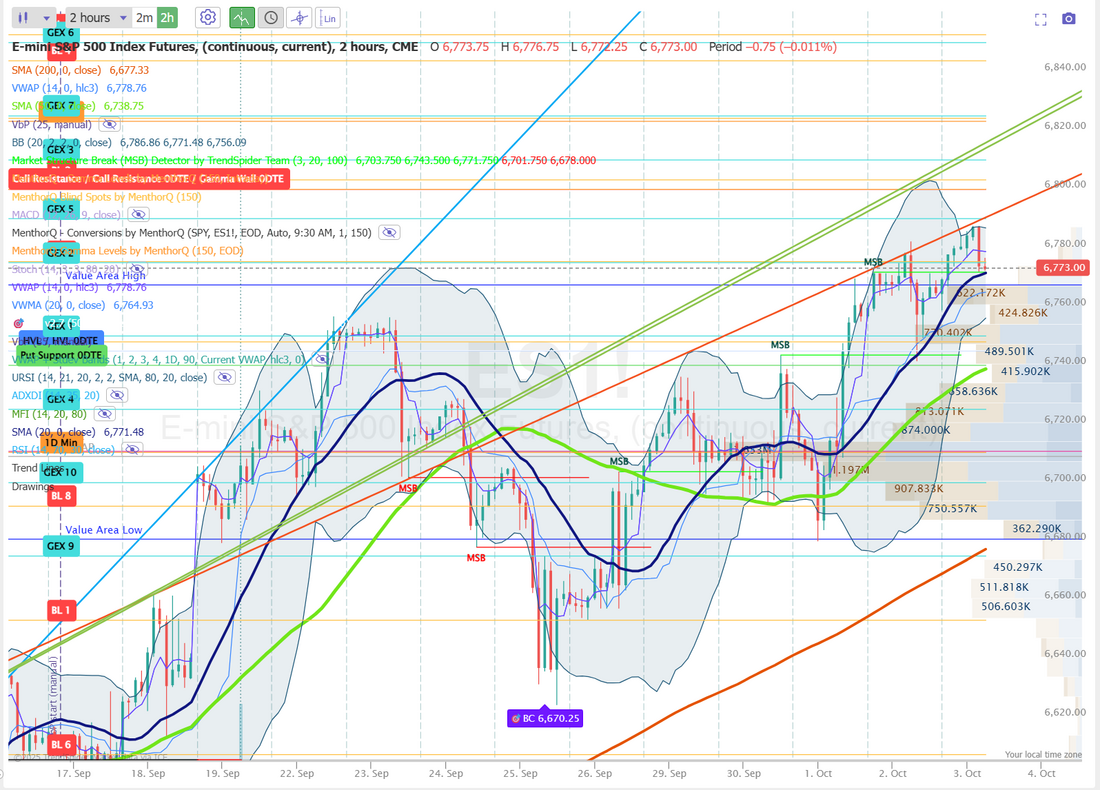

Never mind?Friday was quite the rout. It certainly caught me out. Luckily, our ATM portfolio held up well with our bearish plays working well, and our Scalping went well, but otherwise it was tough. I saw a post this morning on Trump's book, The Art of the Deal. It is mentioned, if you haven't read it you should! We deride Trump for "TACO'ing" but this is and has been his approach most of his life. Make big threats, then find some solution. It's worked remarkably well for him over time. While futures are up "bigly" this morning, there is still a lot of repair needed for bulls to get back in charge. We are into a heavy negative GEX environment (more on that in a minute), the like we haven't seen since the "liberation day" period of early April. Negative GEX creates uncertainty and likely bigger moves. This is a much harder environment to trade. Here's a look at my day from Friday: Let's get into the markets: In spite of futures being up sharply this morning the damage has been done technically. The hit was big on Friday. It's unlikely that it all get's fixed in one day. The SPX volatility chart shows a sharp pullback in price following a steady multi-week climb, suggesting a short-term sentiment shift as volatility expectations recalibrate higher. The Volatility Risk Premium (VRP) sits around 5.6%, indicating that implied volatility remains overvalued relative to realized volatility, a sign that traders are paying up for downside protection amid uncertainty. With the 3-month percentile still elevated near 80%, volatility pricing may stay firm in the short term, especially if macro or geopolitical risks persist. In the near future, monitoring how SPX behaves around recent support levels could help gauge whether this selloff is a brief shakeout or the start of a deeper volatility-driven correction. The NDX skew chart shows a clear rise in downside hedging activity as the index itself moves lower. The one-month skew has shifted toward a strong put bias, signaling that options traders are increasingly paying up for downside protection. This elevated skew typically reflects growing short-term caution as volatility expectations climb alongside price weakness. With the NDX trending down, sentiment appears defensive, and option markets are pricing in further uncertainty until stabilization or a rebound signal emerges. GEX is heavy negative. This usually creates bigger moves. More volatility and less predictability. The Quant score was heavily damaged on Friday. Volume levels were really spread out on Friday GEX levels for the /ES are more spread out than we've seen all year. I have no lean or bias today. There's too much built in volatility this morning to make an educated judgement call. December S&P 500 E-Mini futures (ESZ25) are up +1.38%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +1.84% this morning, signaling a rebound from Friday’s sell-off on Wall Street as sentiment improved after U.S. President Donald Trump softened his stance on tariff threats against Beijing. President Trump said in a Truth Social post on Sunday that he wants to help China, not hurt it, signaling openness to negotiations and a possible easing of tensions. “Don’t worry about China, it will all be fine!” Trump said. He added that Chinese President Xi Jinping “had a bad moment,” referring to China’s decision last week to impose export controls on rare earth materials. On Friday, Mr. Trump announced an additional 100% tariff on China and export controls on “any and all critical software” starting November 1st, just hours after threatening to cancel his upcoming meeting with President Xi Jinping. That followed China’s move to impose new port fees on U.S. ships, launch an antitrust probe into Qualcomm, and introduce broad new restrictions on exports of rare earths and other critical materials. China’s Ministry of Commerce said on Sunday that the U.S. should refrain from threatening it with higher tariffs and called for further talks to address unresolved trade issues, warning that it will not hesitate to retaliate if Washington continues its actions against Beijing. This week, investors will focus on developments surrounding the U.S. government shutdown, remarks from Federal Reserve Chair Jerome Powell and other Fed officials, as well as the start of the third-quarter earnings season. In Friday’s trading session, Wall Street’s major equity averages closed sharply lower. The Magnificent Seven stocks slumped, with Tesla (TSLA) sliding over -5% and Amazon.com (AMZN) falling more than -4% to lead losers in the Dow. Also, chip stocks sank, with Arm Holdings (ARM) plunging over -9% and ON Semiconductor (ON) dropping more than -8%. In addition, Venture Global (VG) plummeted over -24% after the natural gas exporter unexpectedly lost an arbitration dispute with its customer, BP. On the bullish side, Applied Digital (APLD) surged more than +16% after the company reported better-than-expected FQ1 results and signed a new lease agreement with CoreWeave. Economic data released on Friday showed that the University of Michigan’s preliminary U.S. consumer sentiment index fell to a 5-month low of 55.0 in October, but still came in above expectations of 54.1. Also, the University of Michigan’s U.S. October year-ahead inflation expectations unexpectedly fell to 4.6%, compared to expectations of no change at 4.7%, while 5-year implied inflation expectations remained unchanged at 3.7%, in line with expectations. Fed Governor Christopher Waller said on Friday that “the labor market is weak,” adding that he would back quarter-point rate cuts at each of the Fed’s two remaining meetings this year. Also, St. Louis Fed President Alberto Musalem said, “Looking ahead, I am open-minded about a potential further reduction in interest rates to provide further insurance against labor market weakening.” Meanwhile, U.S. rate futures have priced in a 97.8% chance of a 25 basis point rate cut and a 2.2% chance of no rate change at the Fed’s monetary policy committee meeting later this month. Investor attention remains on developments surrounding the U.S. government shutdown, which has entered its third week. An administration official said last week that the U.S. Bureau of Labor Statistics would bring some furloughed employees back to release the September inflation report. The BLS announced on Friday that it would publish the CPI report on October 24th, instead of the originally scheduled date of October 15th. The shutdown delayed the release of the key U.S. jobs report for September, and the timing of its publication, along with other official economic data, remains unclear. Therefore, Fed-compiled industrial and manufacturing production figures could serve as the key U.S. data highlights of the week, alongside the New York and Philadelphia Fed surveys. Market participants will also pay close attention to Fed Chair Jerome Powell’s speech on the economic outlook and monetary policy at the National Association for Business Economics Annual Meeting on Tuesday. A host of other Fed officials will also be making appearances throughout the week, including Waller, Barr, Miran, Paulson, Collins, Musalem, Bowman, Bostic, Schmid, Barkin, and Kashkari. In addition, the Fed will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. Third-quarter corporate earnings season kicks off this week, with big banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), and Citigroup (C) set to release their earnings reports on Tuesday, followed by Bank of America (BAC) and Morgan Stanley (MS) on Wednesday. Johnson & Johnson (JNJ), Abbott Labs (ABT), BlackRock (BLK), Charles Schwab (SCHW), Progressive (PGR), and American Express (AXP) are among other major names scheduled to deliver quarterly updates during the week. Although PepsiCo (PEP) and Delta Air Lines (DAL) started the third-quarter reporting period last week, results from big banks have traditionally marked the unofficial start of the earnings season. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. The bond market is closed today for the Columbus Day holiday. During Fridays meltdown, our ATM portfolio held the line just fine and our protective shorts and bearish SPY positions all profited. After Fridays sell off I think it will be beneficial to do a training on some hedges and setup you can employee to protect against downside. We'll spend some time going over several different setups today. Tune in at 12:00 pm MDT. SPY finished the week lower, closing at $653.02 (-2.42%), as bears stepped in with conviction. For the first time since February, price broke below the 4-hour mint green LinkLine channel support, signaling a potential shift in short-term momentum. Adding to the pressure, the Kalshi Indicator reflected a sharp shift in sentiment, with odds of the S&P 500 finishing the year between 6,400 and 6,599 nearly doubling to 14% after Friday’s selloff. Let's take a look at the intra-day levels... for what they are worth. Remember. Today is a day to remain flexible. Cut losses early. Resistance levels are 6687, 6701, 6706, 6723, 6739. Support levels are 6662, 6644, 6637, 6625. Big...wide levels today. I look forward to seeing you all in our zoom today. The training should be beneficial as well as our trading opportunities today.

0 Comments

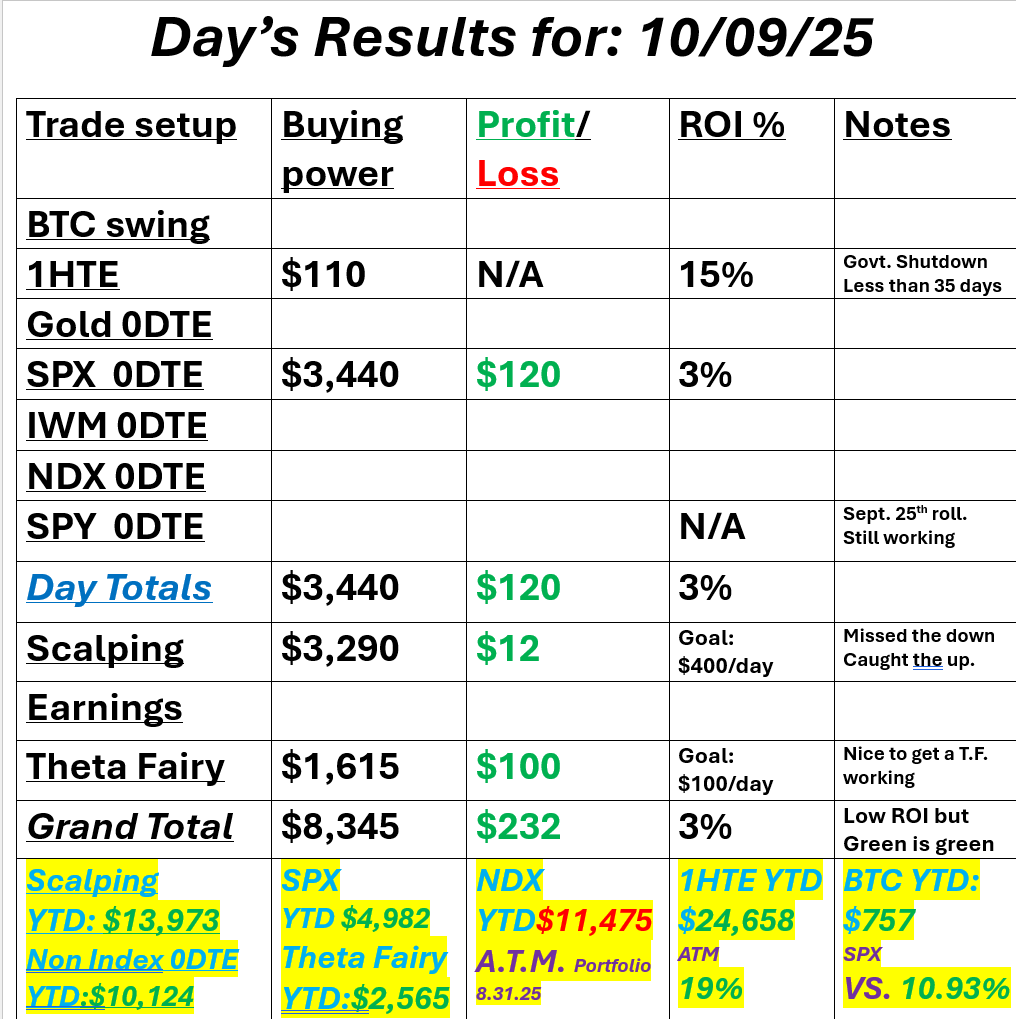

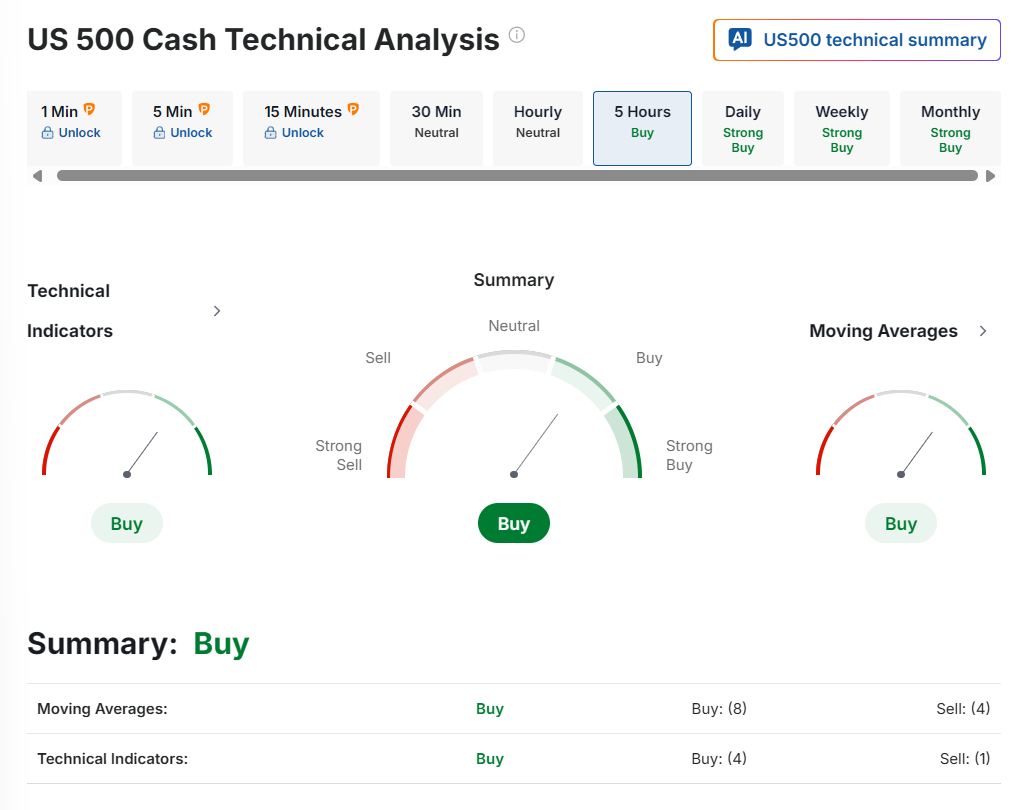

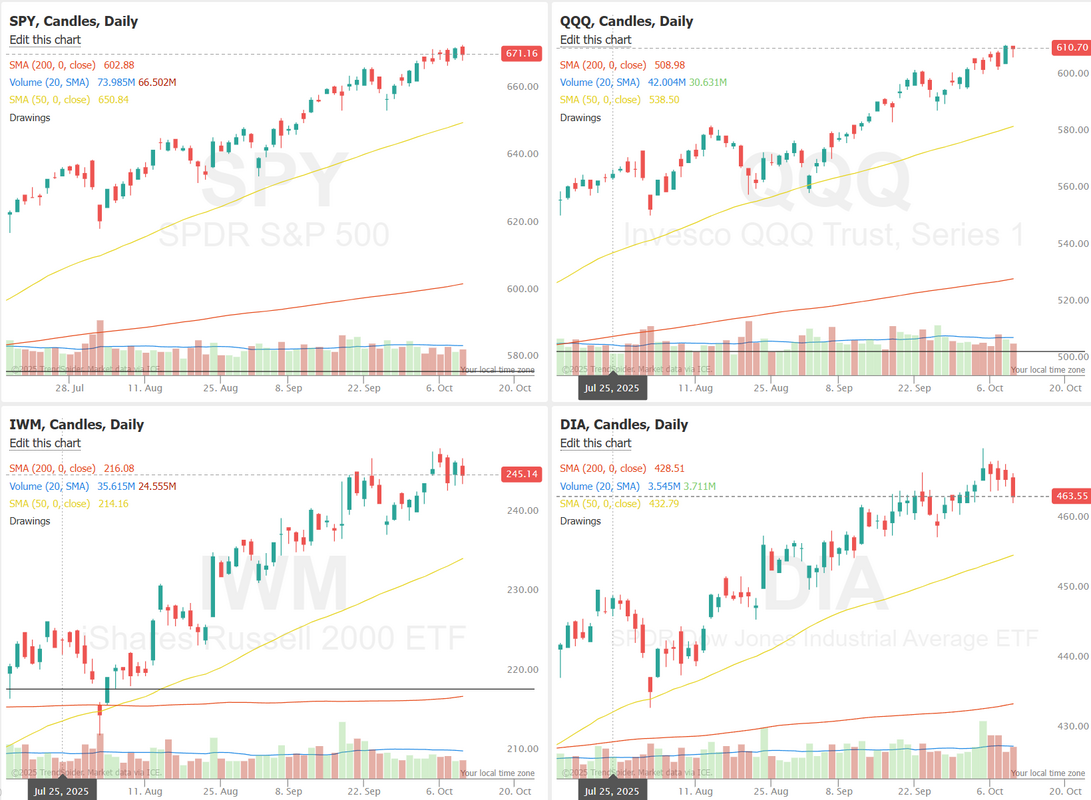

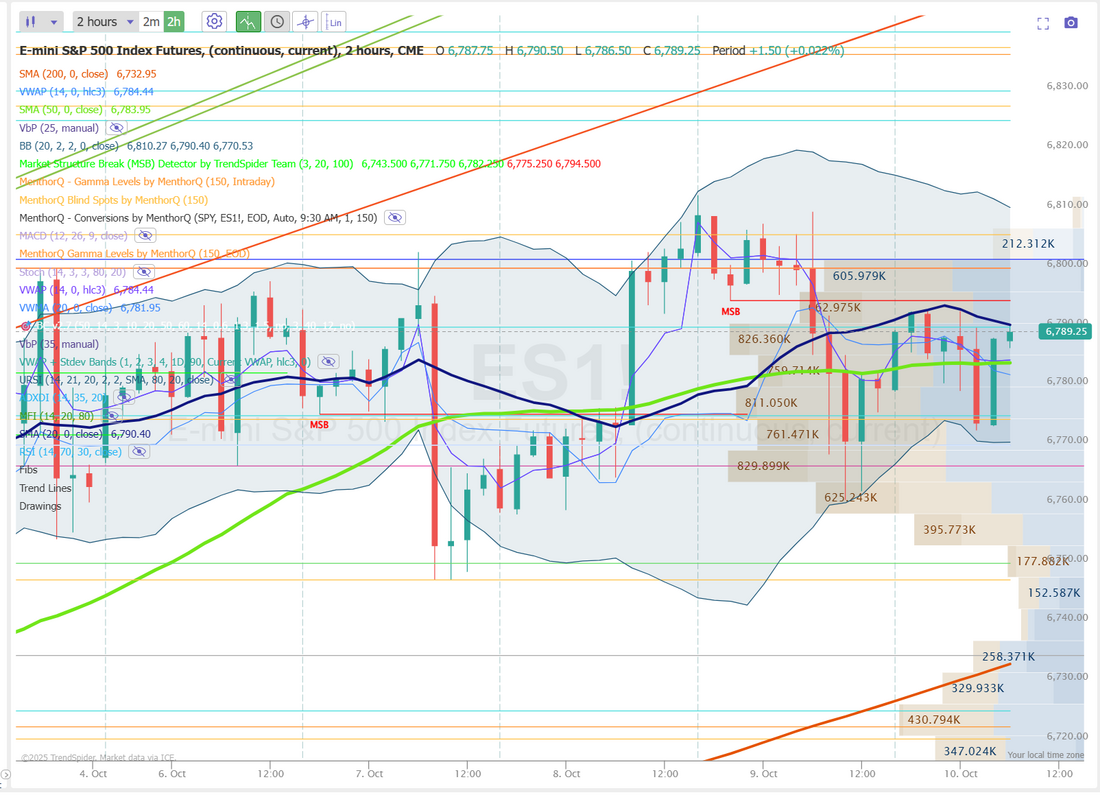

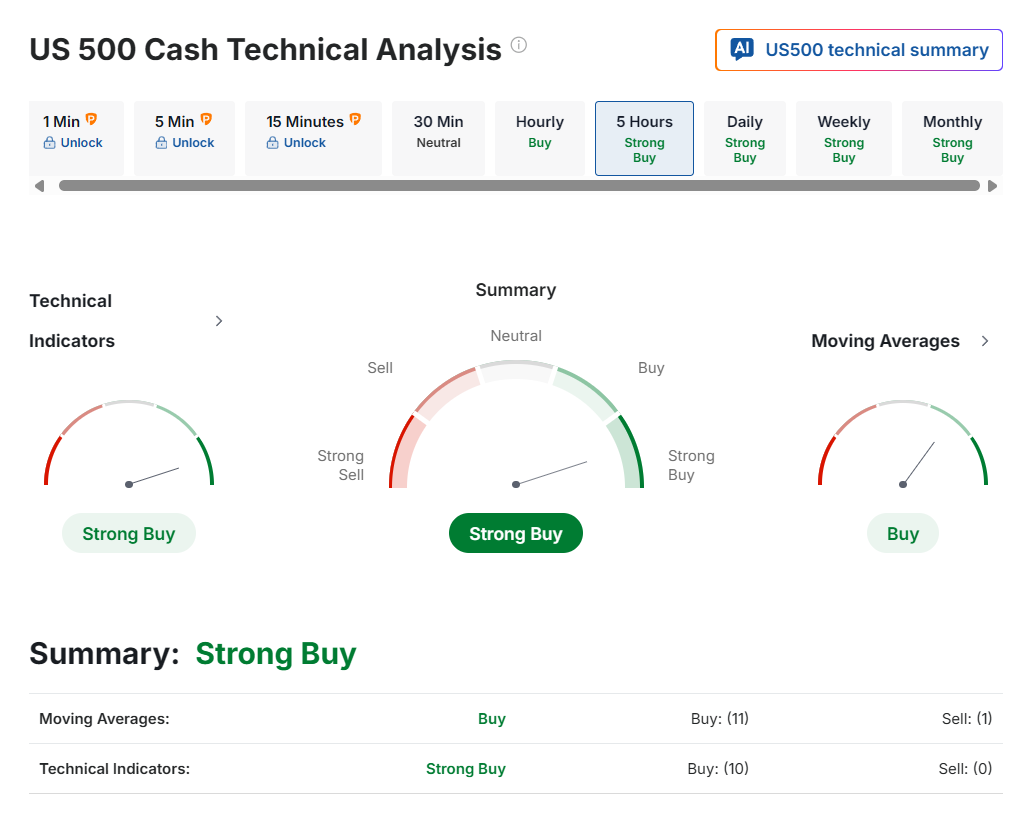

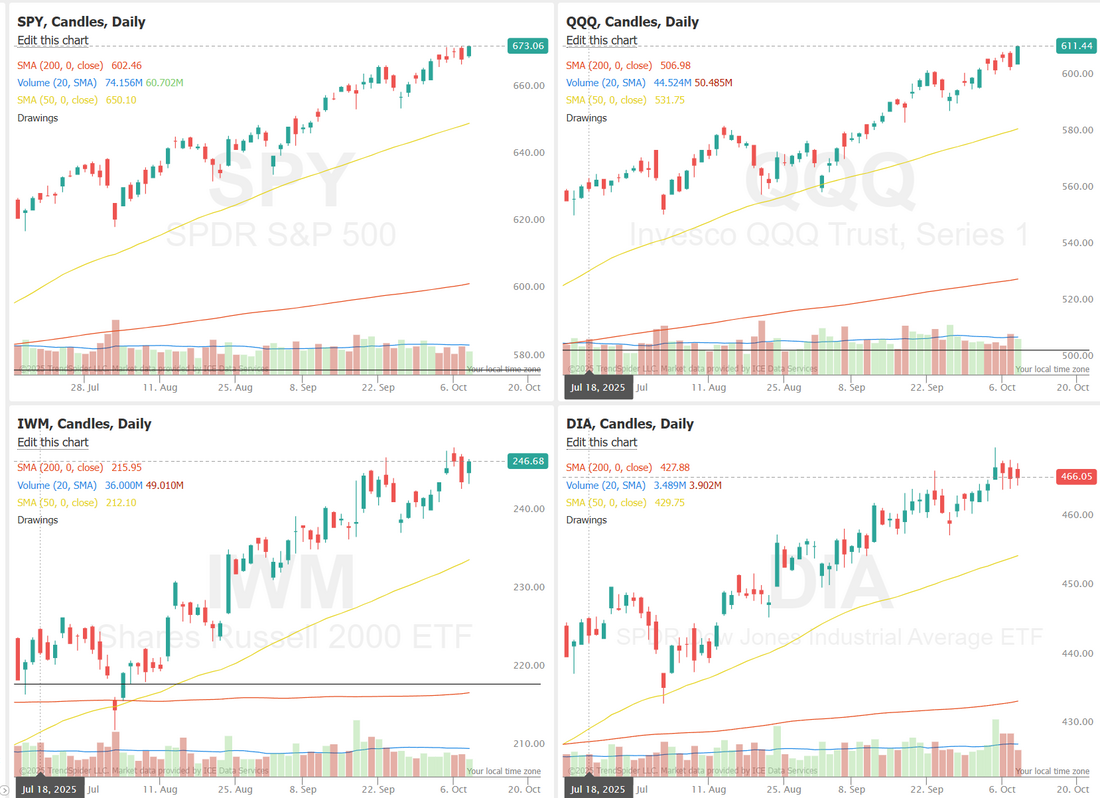

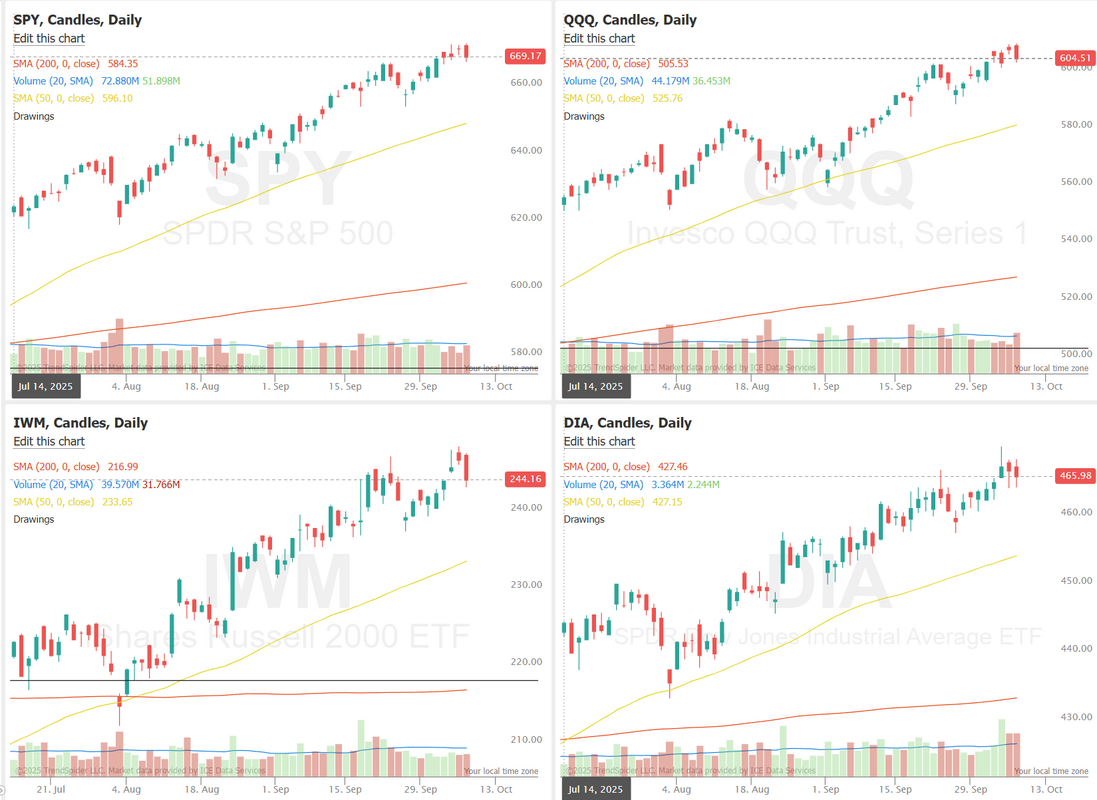

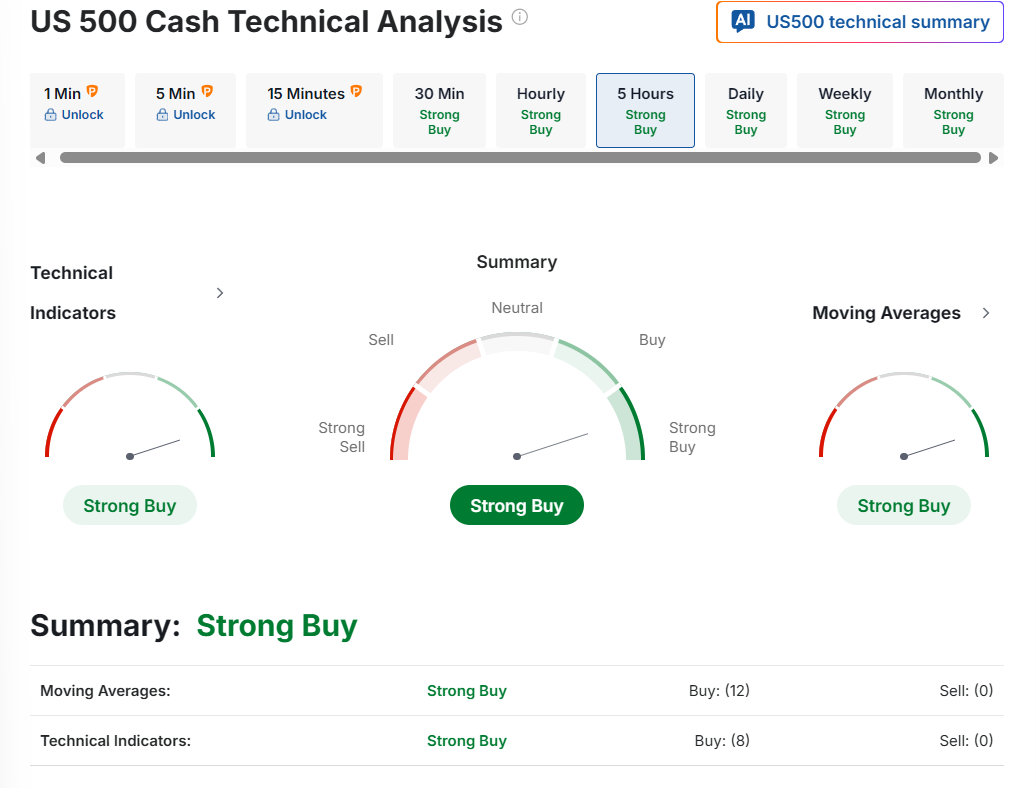

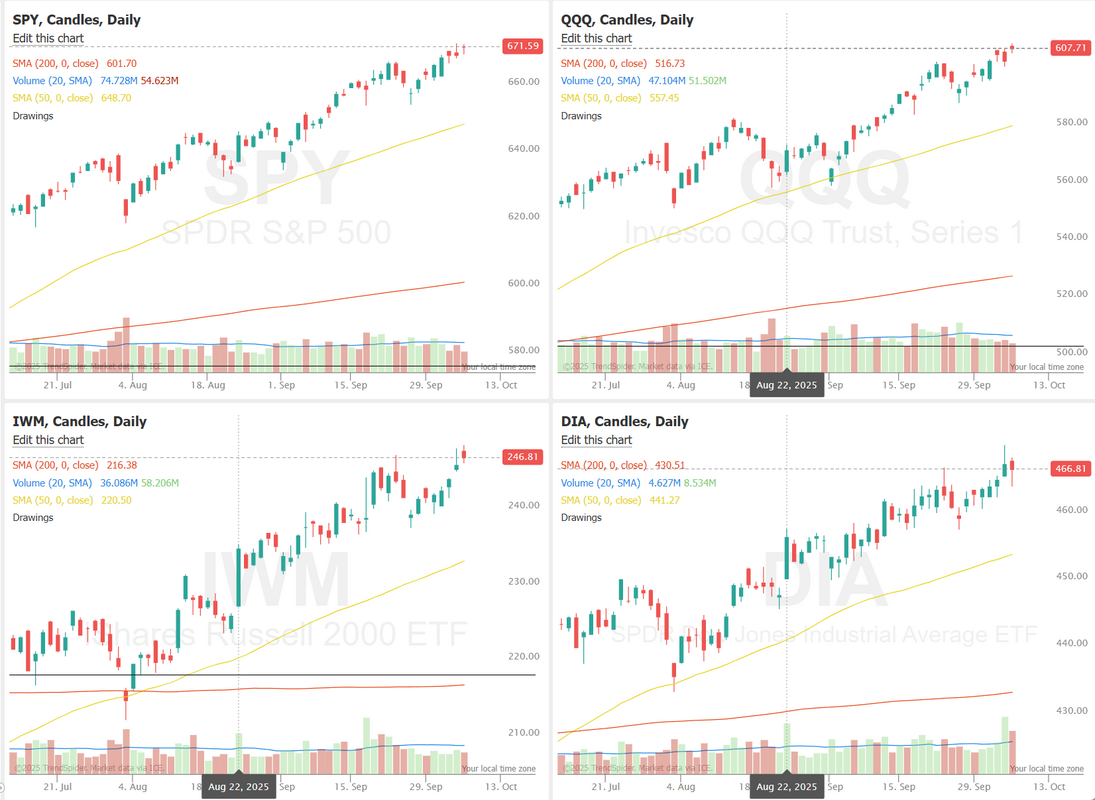

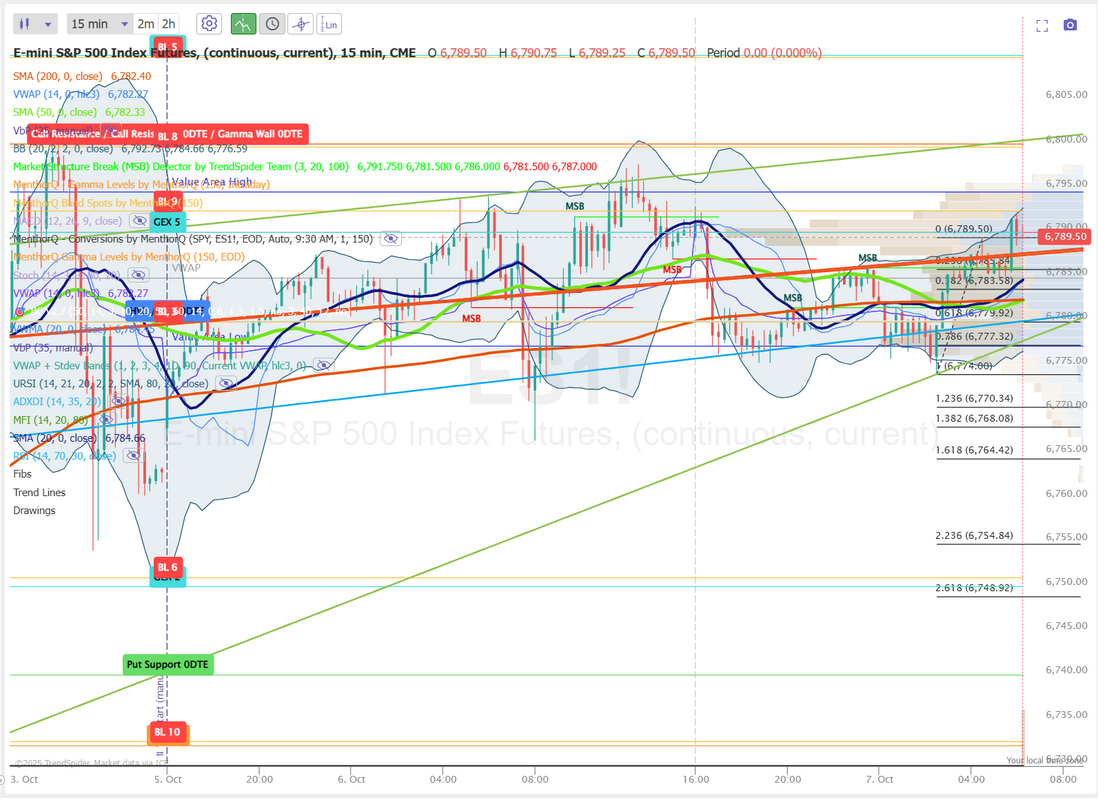

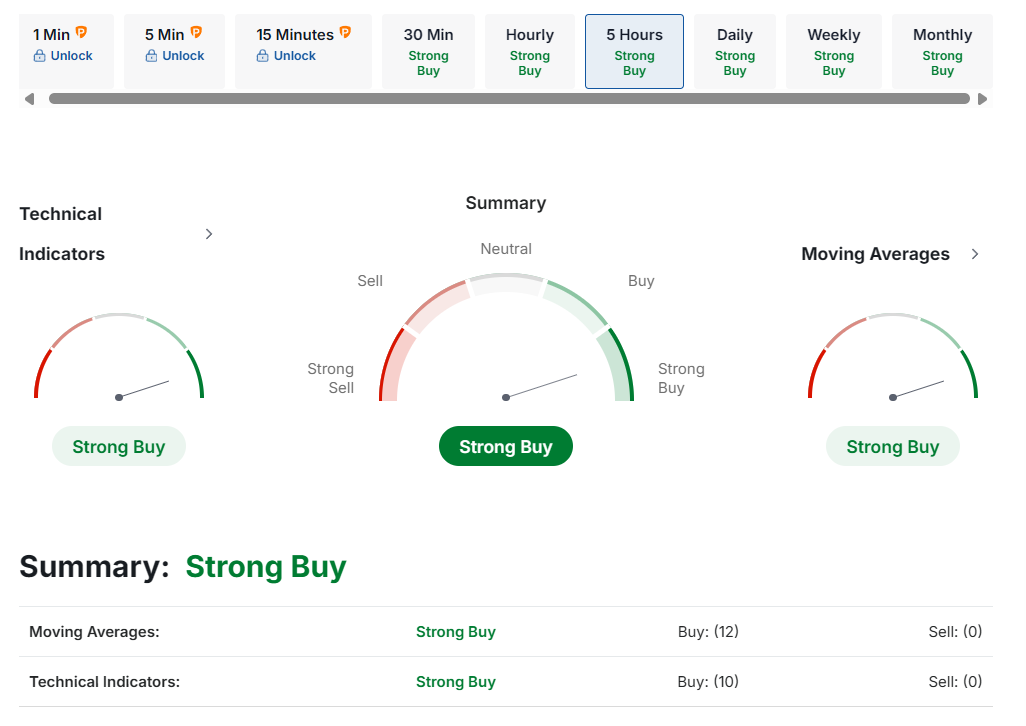

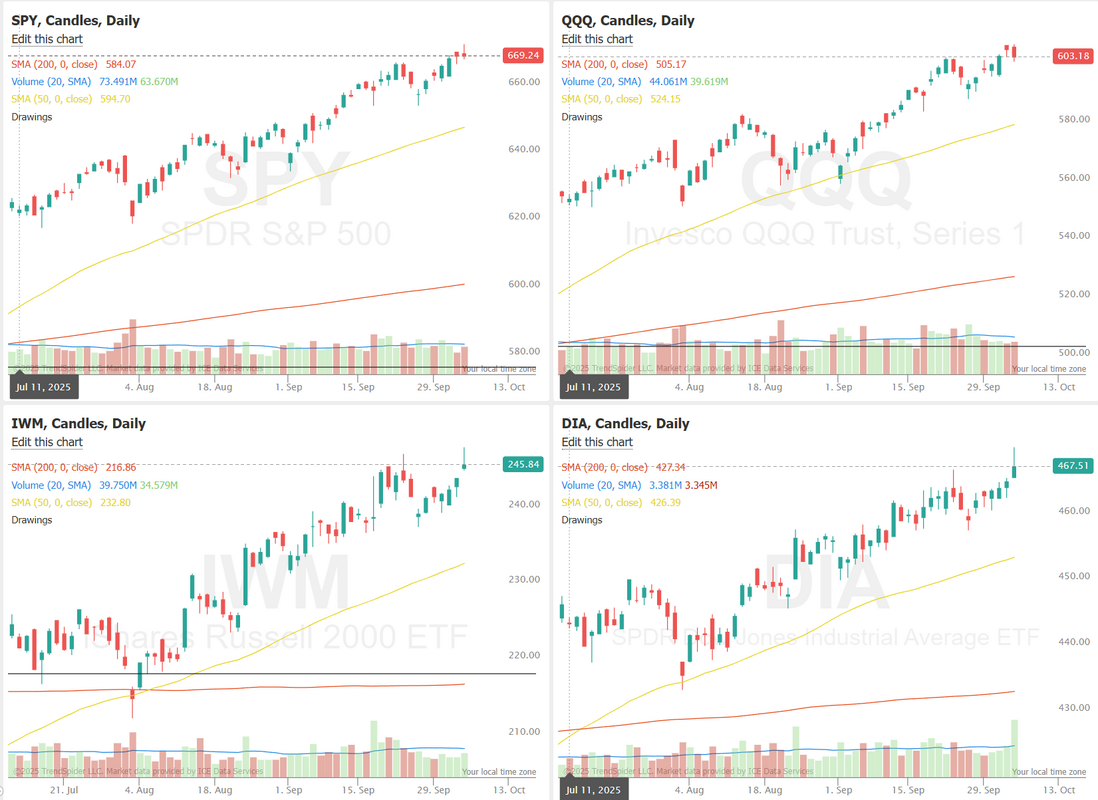

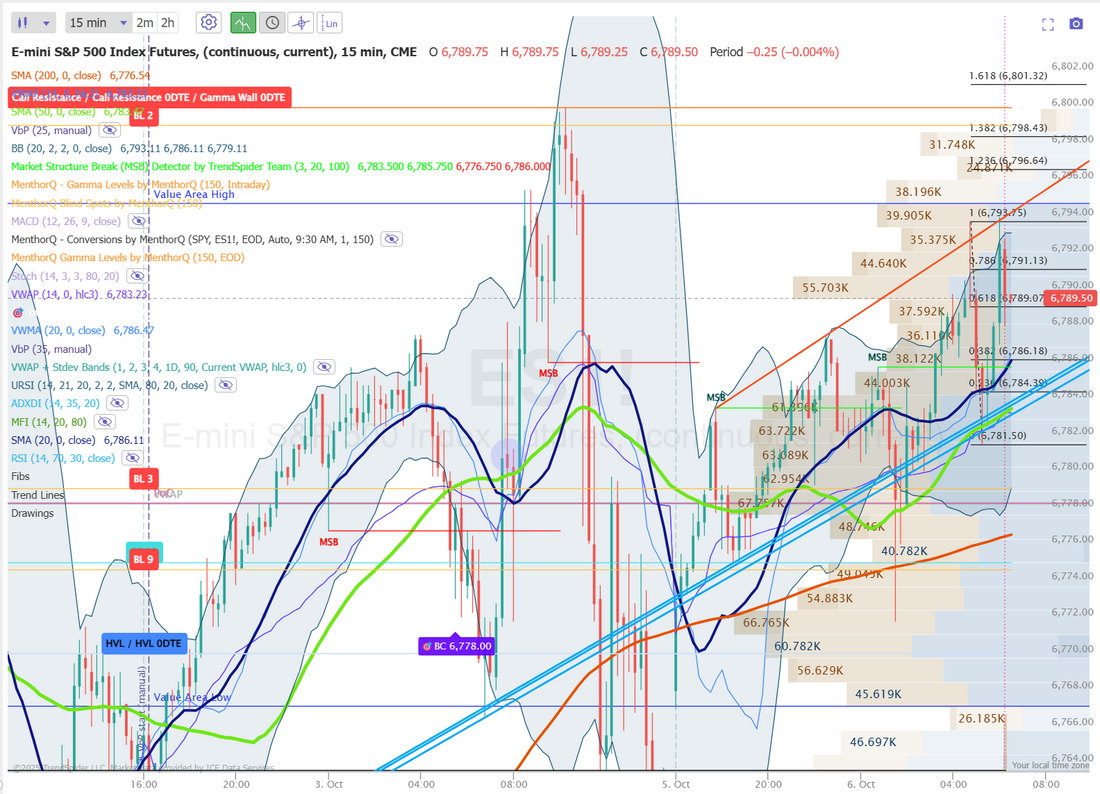

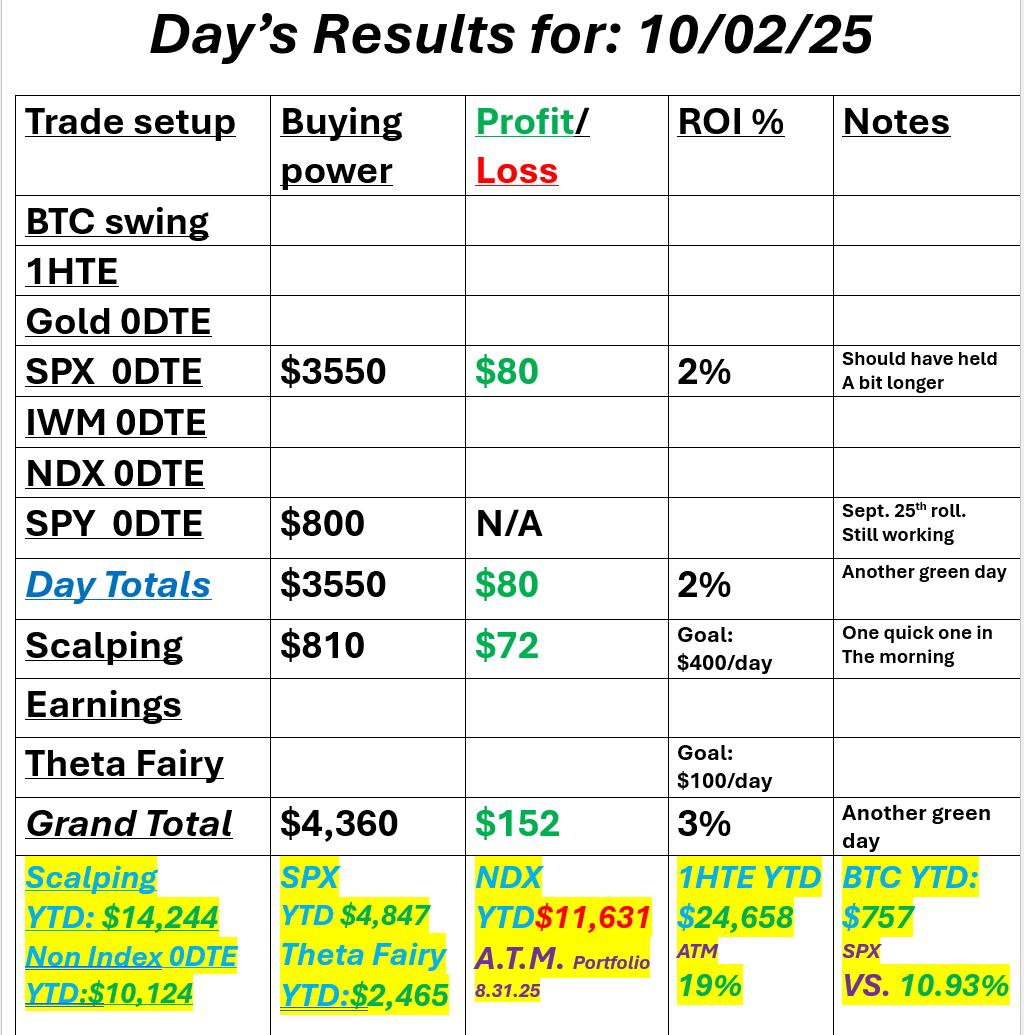

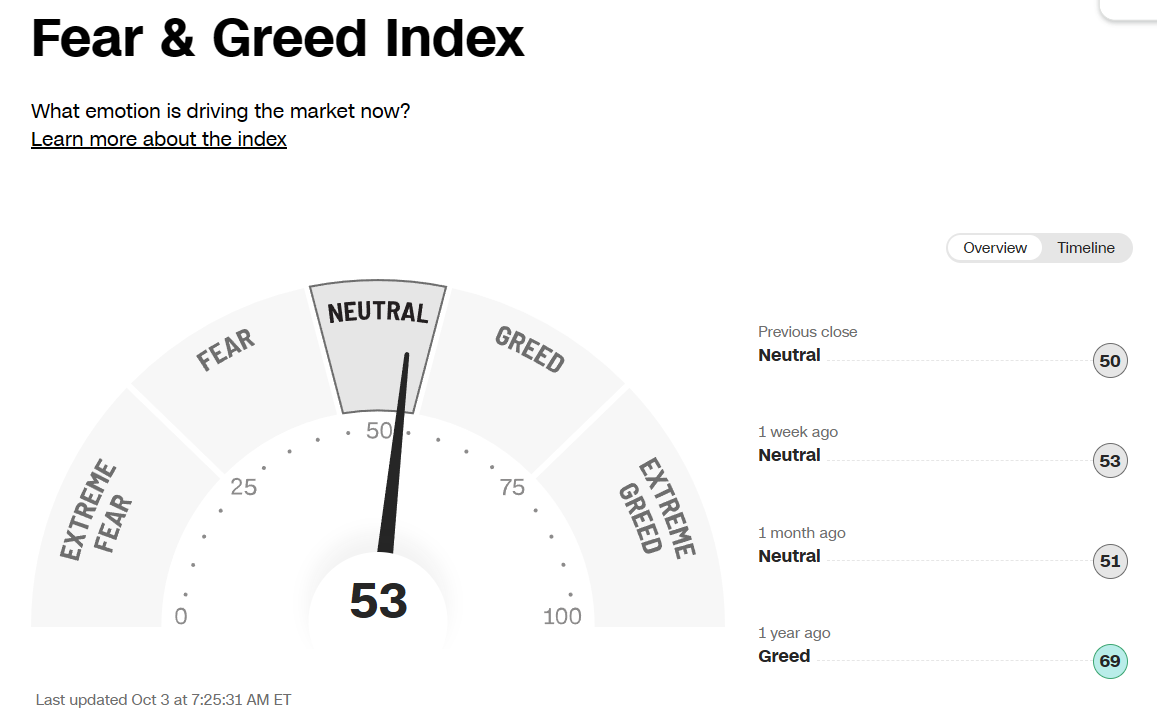

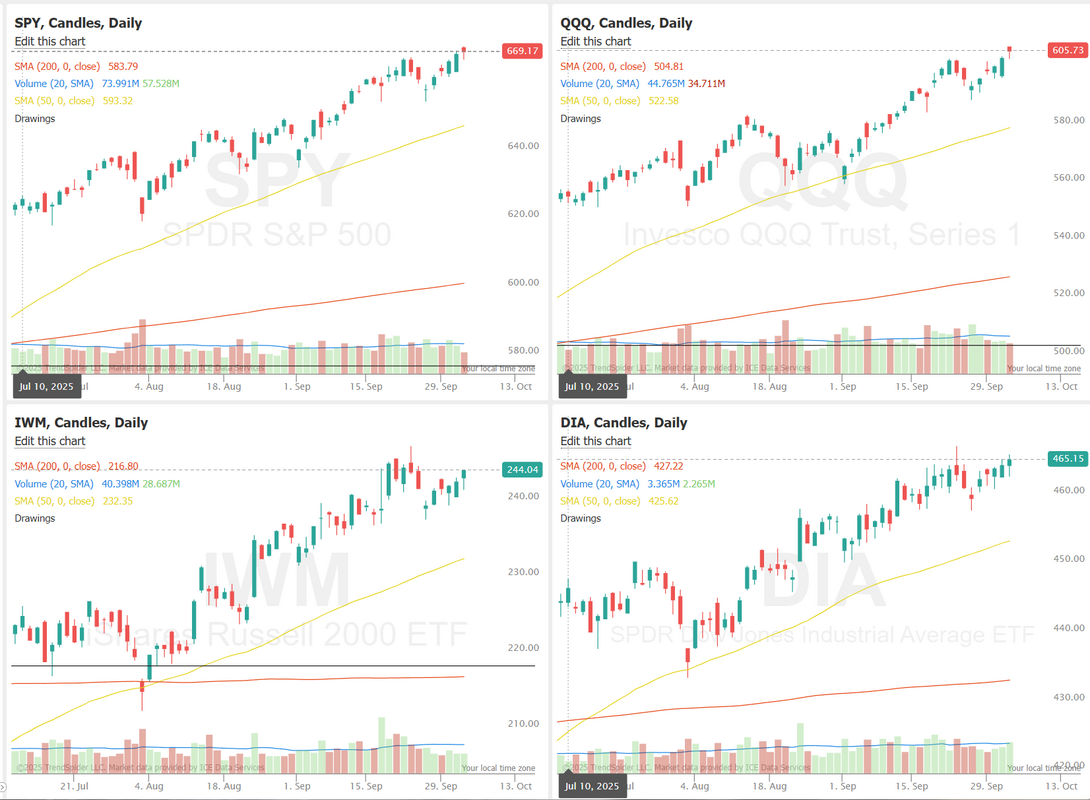

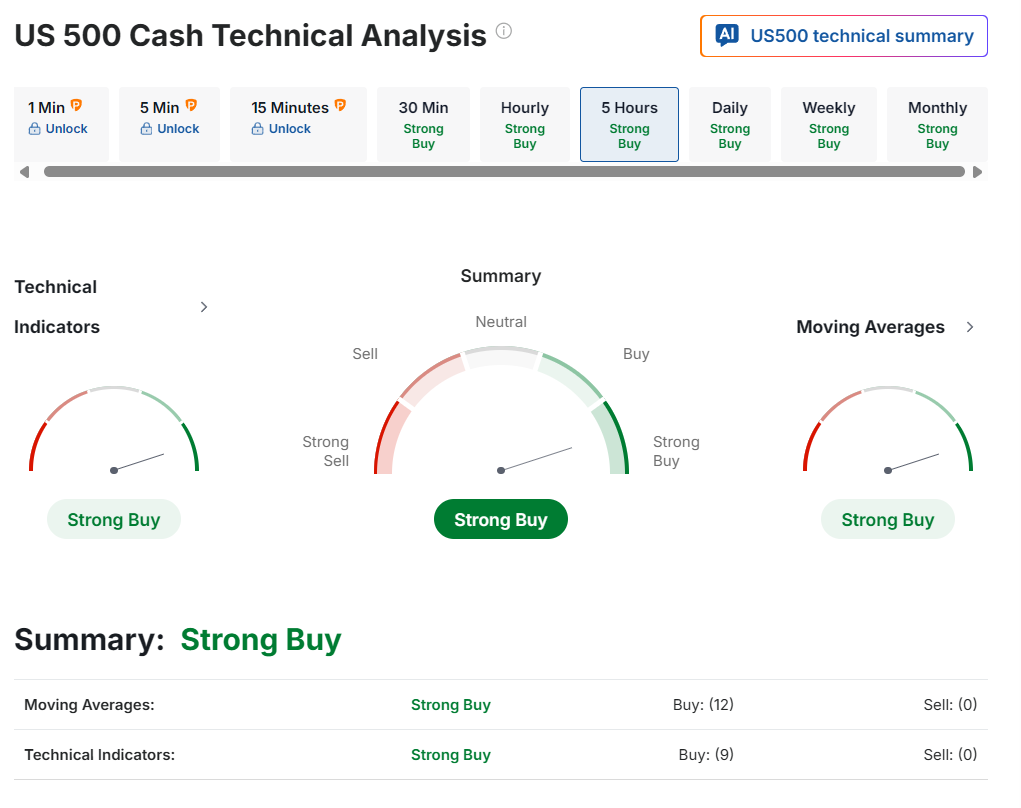

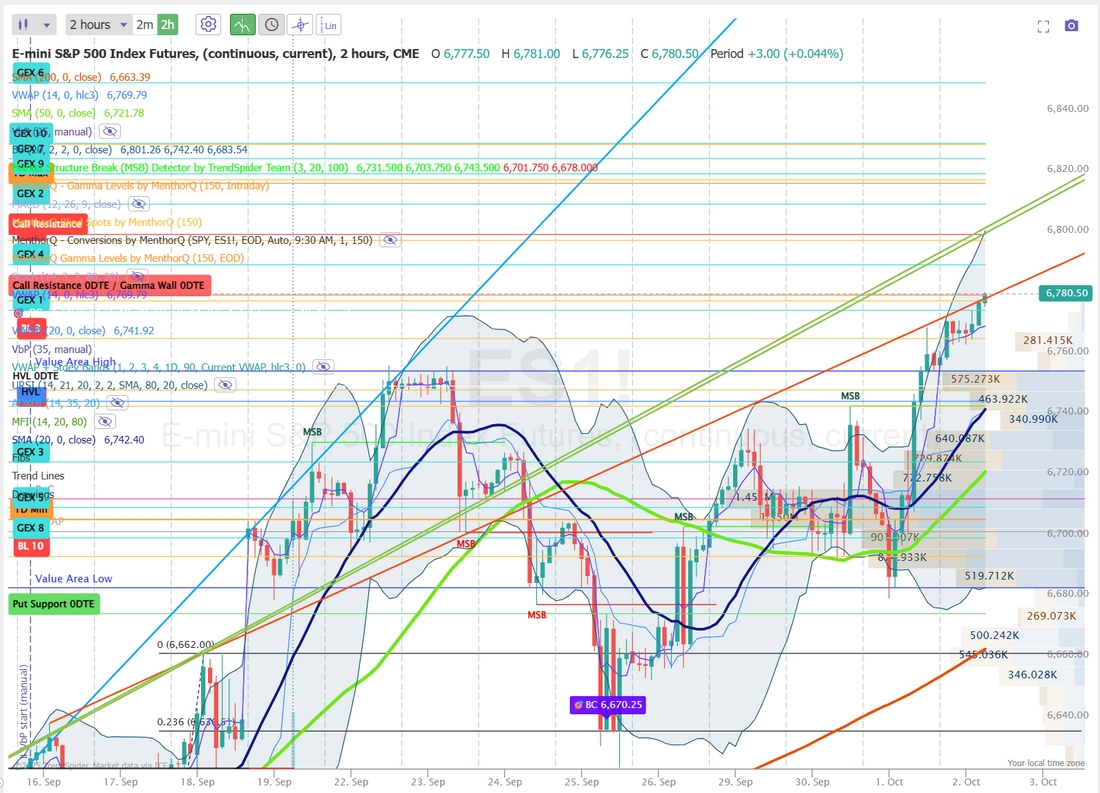

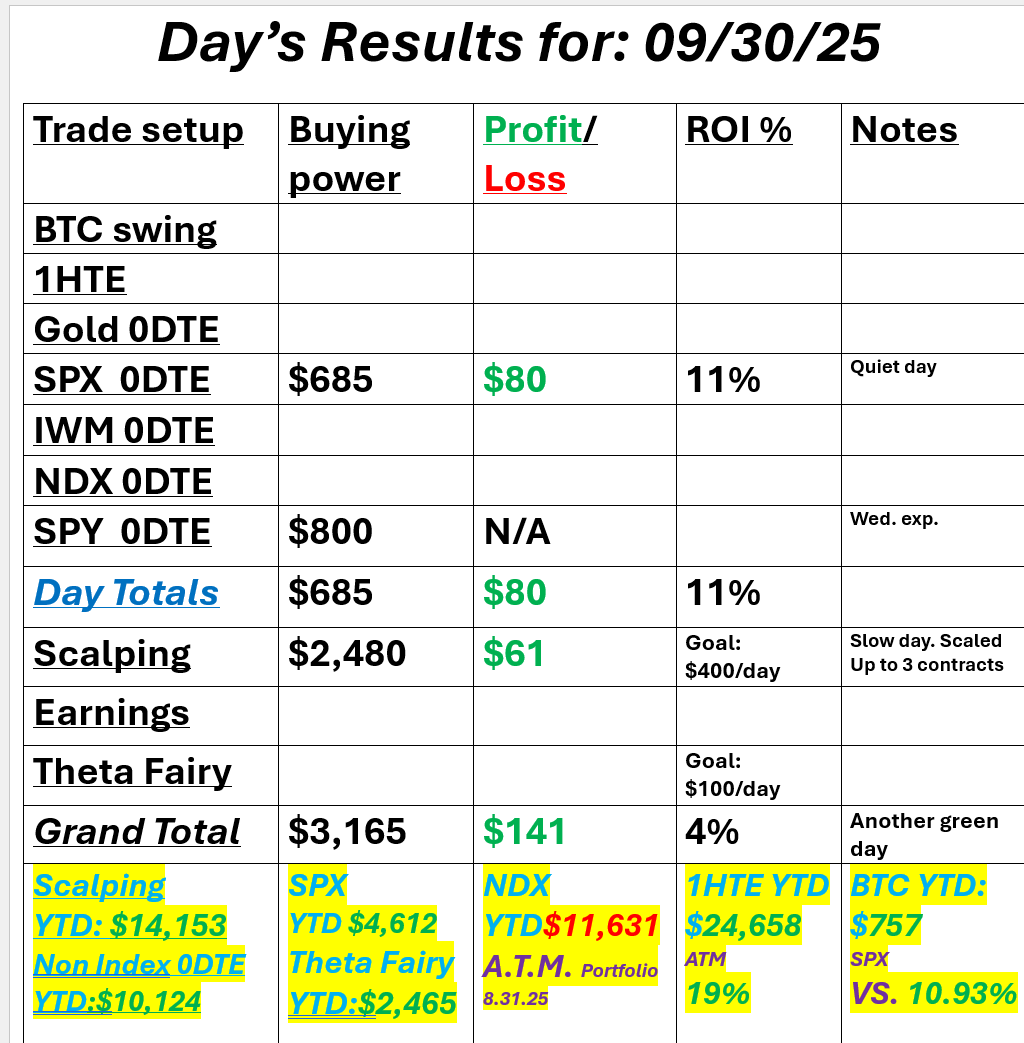

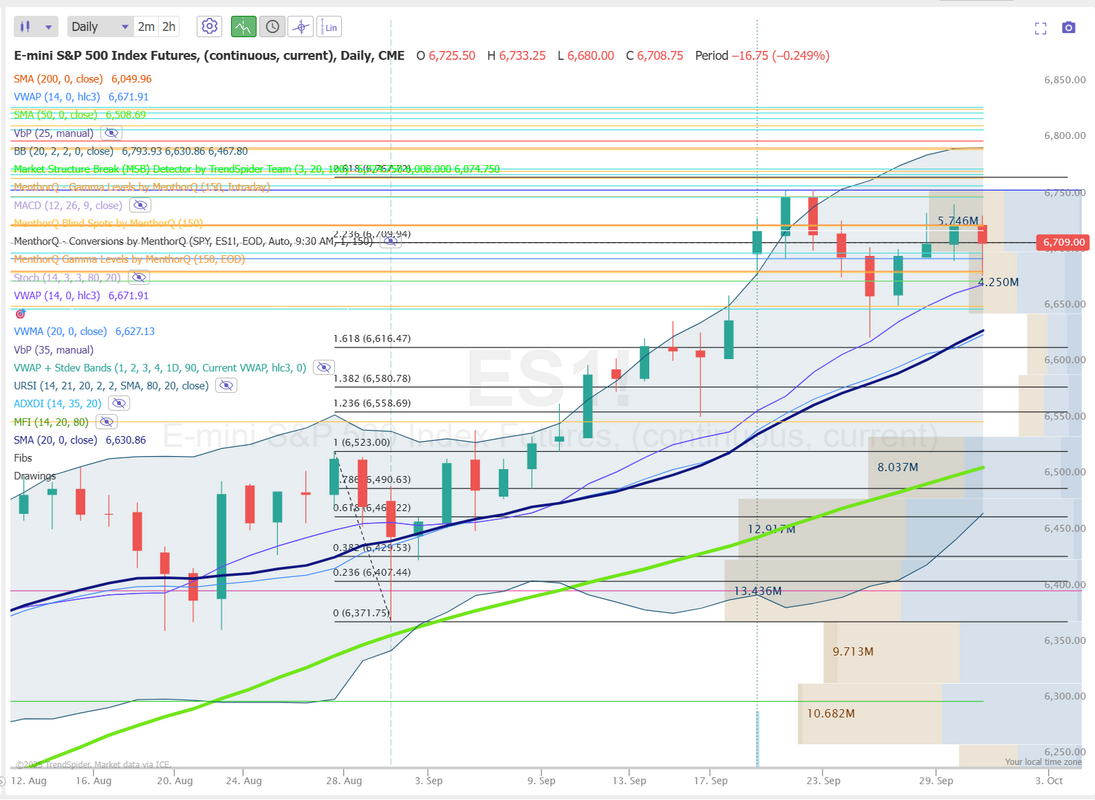

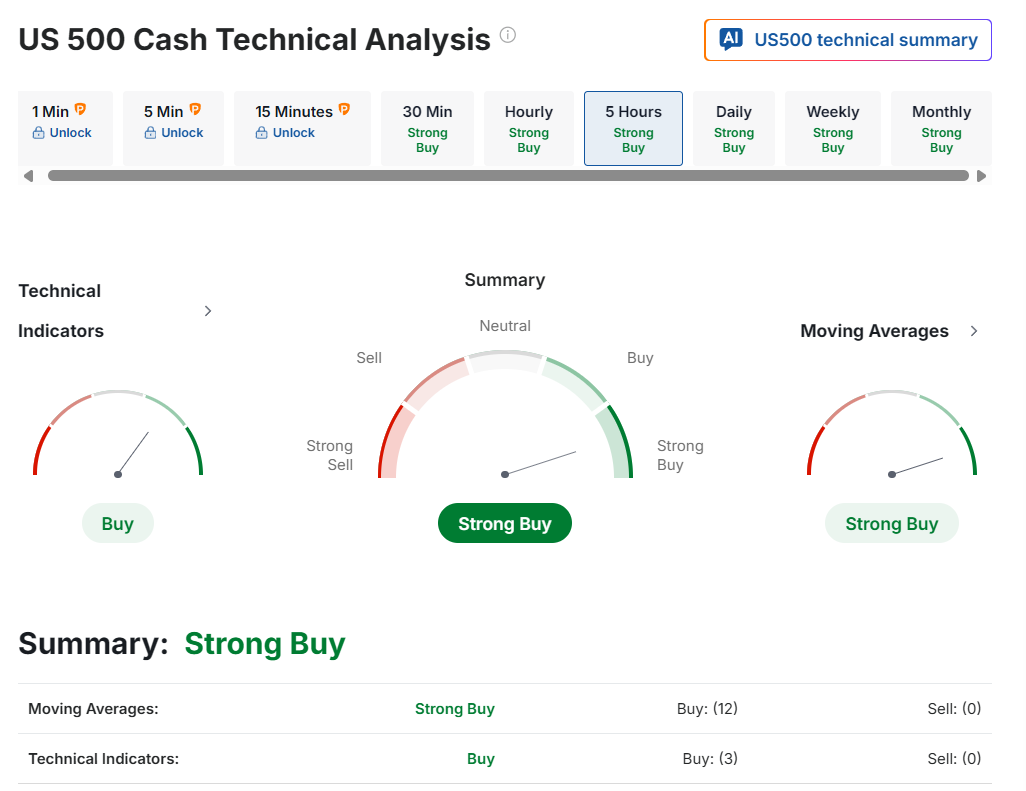

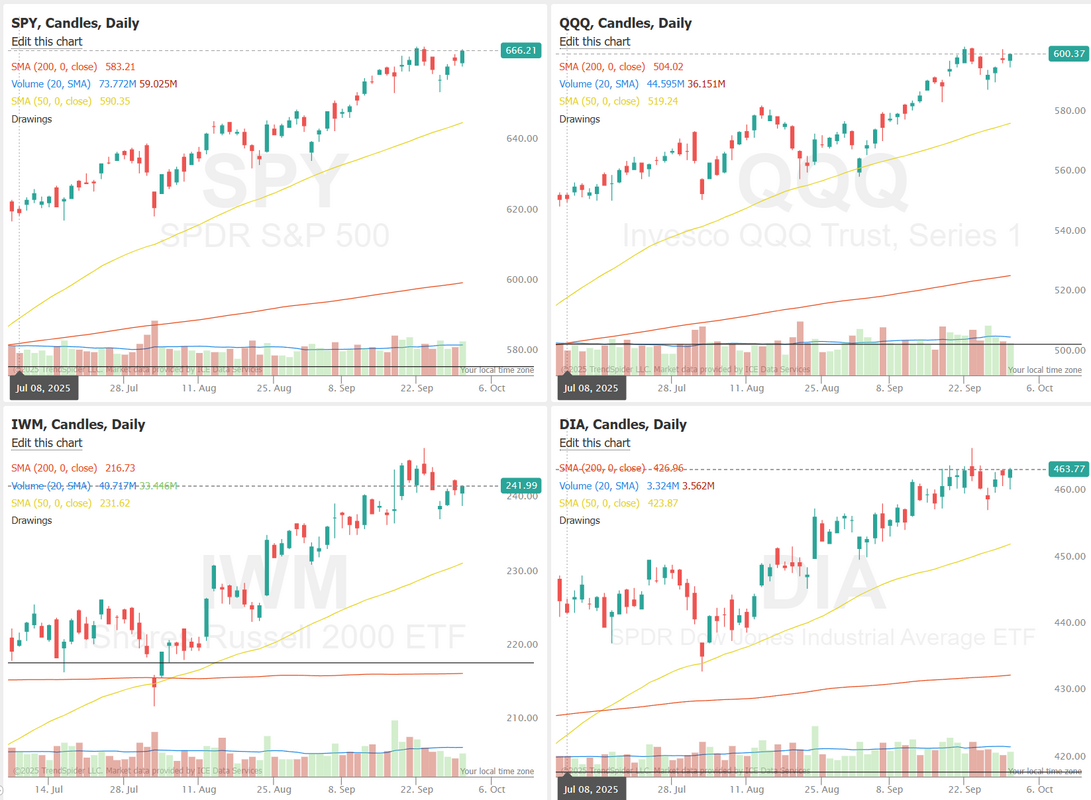

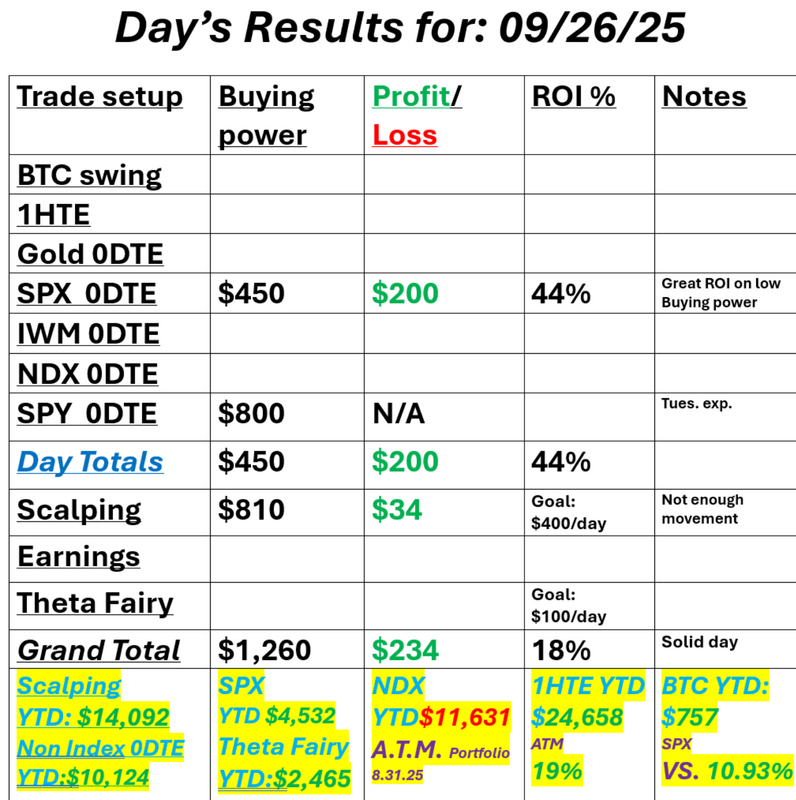

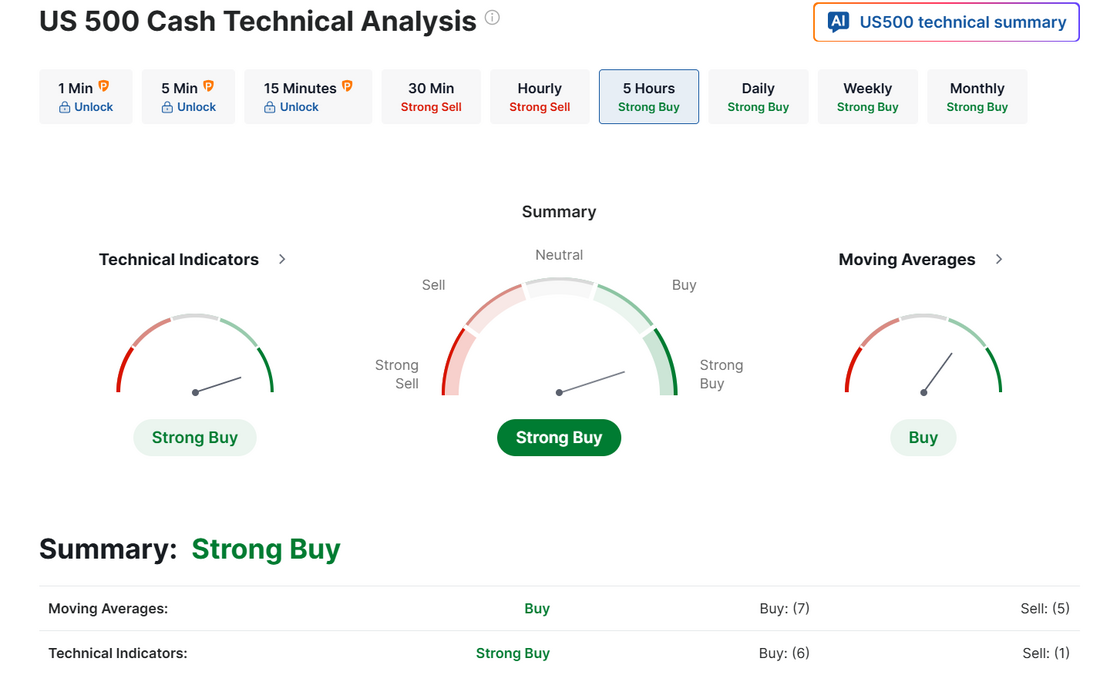

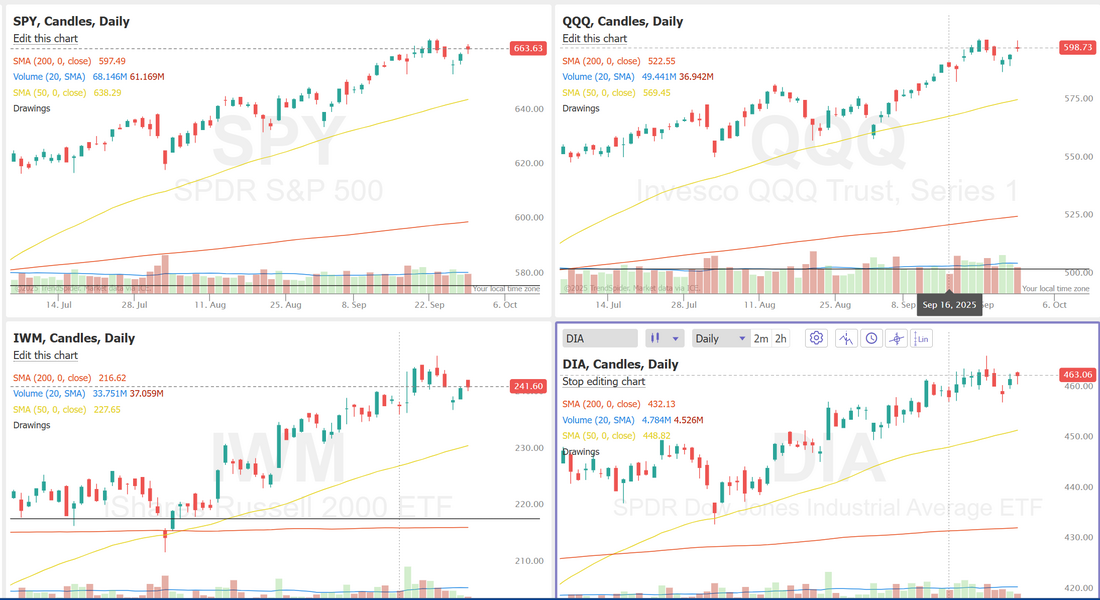

How long do we flat line?Markets keep consolidating at this ATH range. It's been eight days since we've really had a directional move. At some point we'll get back to it. The question is, higher or lower? We had a good day yesterday considering it was a half day for me. Another Doctor appt. and more tests. Still nothing conclusive. Life is fun! Here's a look at our day. It was nice to get a Theta fairy working again. We've got another one working this morning that should hit for us as well. Let's take a look at the markets. Bulls keep hanging on! Weakness is rearing it's head in the IWM and DIA. December S&P 500 E-Mini futures (ESZ25) are trending up +0.10% this morning, attempting to end the up-and-down week on a positive note, while investors await the release of the University of Michigan’s preliminary reading on U.S. consumer sentiment and remarks from Federal Reserve officials. Lower bond yields today are supporting U.S. equity futures. In yesterday’s trading session, Wall Street’s major indices closed in the red. Most semiconductor and AI infrastructure stocks retreated, with Dell Technologies (DELL) sliding over -5% to lead losers in the S&P 500 and Micron Technology (MU) falling more than -2%. Also, PulteGroup (PHM) slumped more than -4% to lead homebuilders lower after CFRA downgraded the stock to Sell from Hold. In addition, AZZ Inc. (AZZ) dropped over -4% after the metal coatings and welding services company posted downbeat Q2 results. On the bullish side, Delta Air Lines (DAL) climbed more than +4% after the carrier reported upbeat Q3 results and firmed up its annual earnings guidance. Fed Governor Michael Barr said on Thursday that officials should proceed carefully with further interest rate cuts, stressing that tariffs could lead to persistent inflation. Policymakers “should be cautious about adjusting policy so that we can gather further data, update our forecasts, and better assess the balance of risks,” Barr said. At the same time, New York Fed President John Williams said he supports additional rate cuts this year to help safeguard the labor market. “The risks of a further slowdown in the labor market are something I’m very focused on,” Williams said. U.S. rate futures have priced in a 94.6% chance of a 25 basis point rate cut and a 5.4% chance of no rate change at October’s monetary policy meeting. Meanwhile, the U.S. government shutdown has entered its tenth day, with no resolution in sight. The shutdown appears set to extend into next week, as the Senate wrapped up late Thursday and is not scheduled to return until Tuesday. Still, an administration official said late Thursday that some furloughed federal employees would return to work to publish U.S. inflation data for September next week. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary October figure will stand at 54.1, compared to 55.1 in September. Market participants will also parse comments today from Chicago Fed President Austan Goolsbee and St. Louis Fed President Alberto Musalem. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.117%, down -0.84%. Trading today: We'll look to use some of the 3X leveraged ETF's we trained on earlier this week for some potential 0DTE's. My lean of bias today is slightly bullish. That's how the Technicals and futures seem to be lined up. Let's take a look at our intra-day levels: 6794, 6800, 6806, 6812 are resistance zones. 6784, 6775, 6769, 6766 are support zones. Let's have a strong finish to the week! See you all shortly!

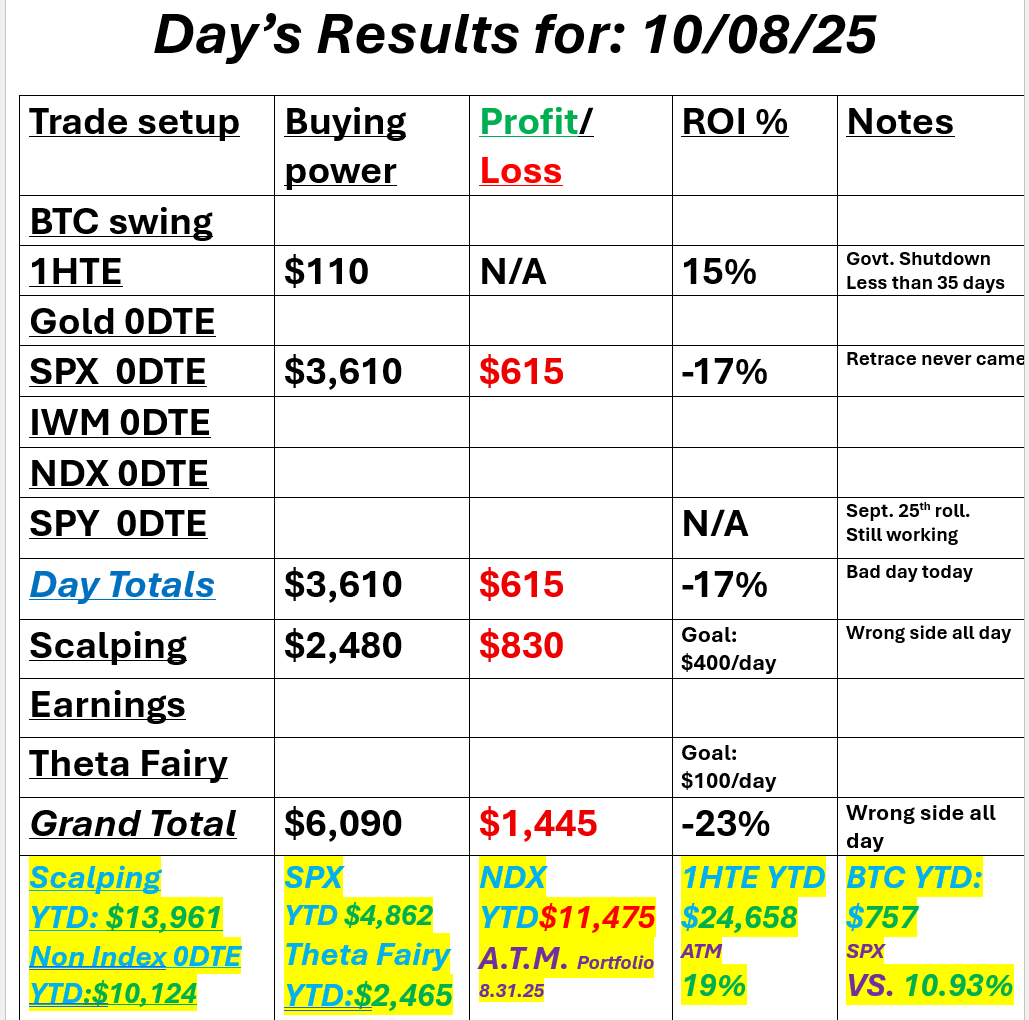

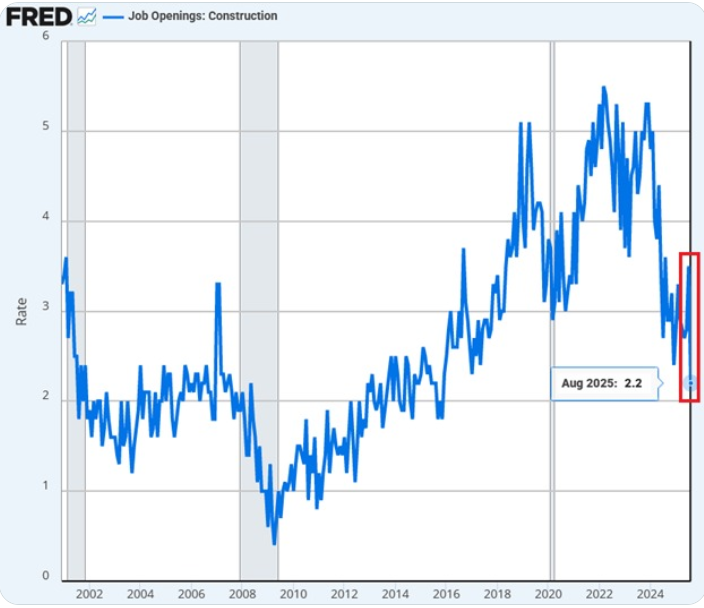

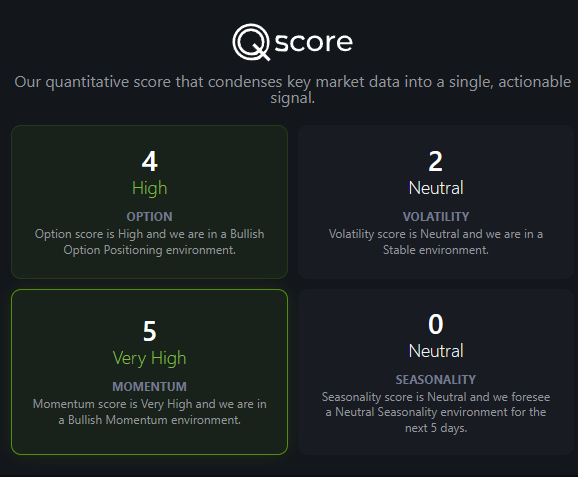

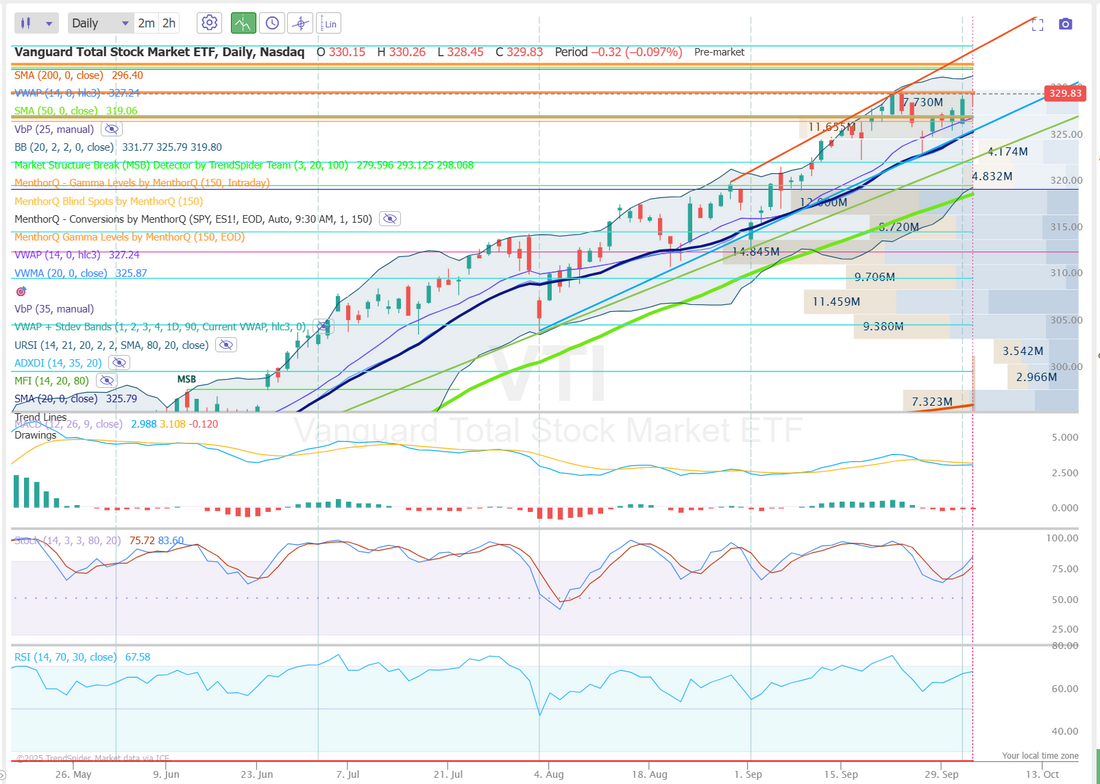

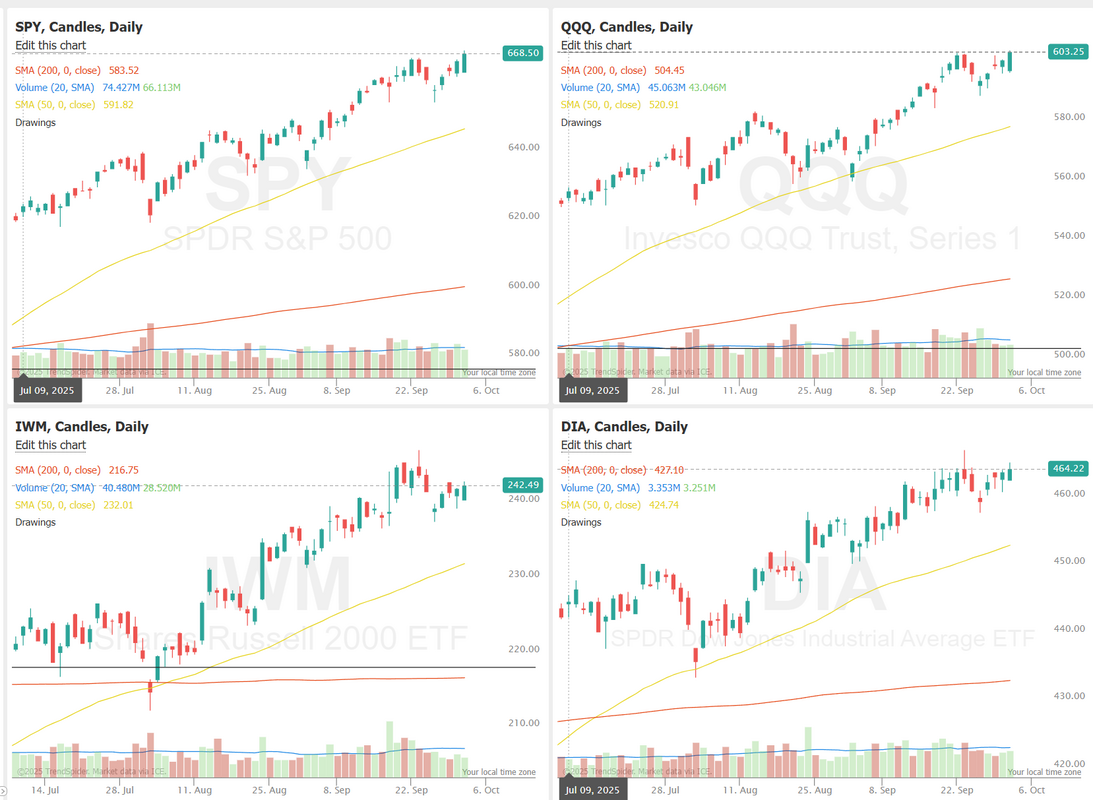

Peace in the Middle East?News finally broke of a cease fire agreement and hostage release. Let's all pray this is a step towards ending all the killing. Humans killing other humans has to be the low point of humanity. Well, the market push up yesterday caught me off. As you know from yesterdays blog, I was looking for a more neutral day and instead we got bullishness. I was basically on the wrong side of the market all day with both my scalps and my SPX. It was costly. We were able to get a Theta fairy trade working overnight which looks set to score for us this morning so there is one little bright spot. Here's a look at my trades. NOTE: I'm back to the doctors today for an echocardiogram. I'll be heading out right at the start of power hour, so that's a great incentive to be wrapped up by then! Let's take a look at the markets: Buy mode just doesn't seem to want to go away. The IWM and DIA didn't really participate yesterday but the SPY and especially the QQQ's really rocked higher December S&P 500 E-Mini futures (ESZ25) are up +0.01%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.03% this morning, steadying after yesterday’s gains as investors shift their focus to the third-quarter earnings season. Soda and snack maker PepsiCo (PEP) and carrier Delta Air Lines (DAL) are among the companies starting the U.S. third-quarter reporting period today, with major Wall Street banks such as Goldman Sachs (GS) and Citigroup (C) set to report next week. Tesla (TSLA) will be the first of the Magnificent Seven group to report on October 22nd, followed by Alphabet (GOOGL), Microsoft (MSFT), and Meta Platforms (META) on October 29th. In yesterday’s trading session, Wall Street’s major indexes ended mostly higher, with the S&P 500 and Nasdaq 100 notching new record highs. Most members of the Magnificent Seven stocks advanced, with Nvidia (NVDA) rising over +2% and Amazon.com (AMZN) gaining more than +1%. Also, Advanced Micro Devices (AMD) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after DZ Bank upgraded the stock to Buy from Hold with a $250 price target. In addition, Confluent (CFLT) climbed more than +7% after Reuters reported that the company was exploring a sale. On the bearish side, Fair Isaac (FICO) slumped over -9% and was the top percentage loser on the S&P 500 after rival Equifax announced it was “responding to FICO’s monopoly-like doubling of their mortgage credit score prices to $10 in 2026” by cutting VantageScore 4.0 mortgage credit scores by more than 50% from Fair Isaac’s 2026 prices to $4.50 through the end of 2027. “With price-to-earnings ratios for today’s tech giants still well below those of the tech firms at the peak of the dotcom bubble, we think the bull market remains intact,” said Mark Haefele at UBS Global Wealth Management. The minutes of the Federal Open Market Committee’s September 16-17 meeting, released on Wednesday, showed that policymakers were open to further interest rate cuts this year, though many voiced caution over still-elevated inflation. “Most judged that it likely would be appropriate to ease policy further over the remainder of this year,” according to the FOMC minutes. At the same time, the minutes showed “a majority of participants emphasized upside risks to their outlooks for inflation.” While policymakers acknowledged that labor market risks had increased, many also believed a sharp decline in employment was unlikely. Officials reiterated that they would weigh risks to both inflation and employment when determining their next policy move. “Participants stressed the importance of taking a balanced approach in promoting the committee’s employment and inflation goals,” the minutes said. New York Fed President John Williams said in an interview with The New York Times published on Thursday that he supports more rate cuts this year to help safeguard the labor market. U.S. rate futures have priced in a 94.6% probability of a 25 basis point rate cut and a 5.4% chance of no rate change at the next FOMC meeting in October. Meanwhile, the U.S. government shutdown has entered its ninth day, with no resolution in sight. On Wednesday, lawmakers once again failed to pass a bill to reopen the government, with no lawmakers changing their positions. Republicans still push for a continuing resolution that maintains current spending levels through November 21st, while Democrats are demanding the inclusion of an extension for healthcare subsidies set to expire at year-end. In geopolitical news, President Trump said Israel and Hamas have agreed to a deal that would release all Israeli hostages held in the Gaza Strip, marking a major step toward peace after two years of conflict in the Palestinian territory. Today, Fed Chair Jerome Powell will deliver pre-recorded welcoming remarks at a Fed Community Bank Conference. Treasury Secretary Scott Bessent and Fed Vice Chair for Supervision Michelle Bowman are set to participate in a “fireside chat” at the event. Fed Governor Michael Barr and San Francisco Fed President Mary Daly will also speak today. In light of the government shutdown, the publication of weekly jobless claims and final August wholesale inventories data, originally set for today, will likely be delayed. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.138%, up +0.10%. My lean or bias today is once again neutral. That means I'll likely start with another Iron fly. The construction industry is deteriorating rapidly: US job openings in construction dropped -115,000 in August, to 188,000, the lowest since May 2017. This marks the second-largest monthly decline in data going back to January 2001. Since December 2023, the number of available vacancies in construction has plummeted -265,000, or -58.5%. As a result, the construction job openings rate fell to 2.2%, the lowest since November 2015. Such weakness this century has only been seen during 2008 and 2001. The construction industry needs help. The S&P 500 continues to show steady upward momentum, with the momentum score maintaining elevated levels around 4–5, signaling sustained strength in short-term buying pressure. Price action remains in a constructive uptrend, with minor pullbacks being quickly absorbed as the index consolidates near recent highs. This persistence in positive momentum suggests that market sentiment remains confident, with traders potentially favoring continuation plays as long as the SPX holds above recent support zones. However, short-term overextension could lead to brief pauses or profit-taking, making the next few sessions key for confirming whether the trend can extend or cool off slightly. Thursday

Let's take a look at our intra-day /ES levels: 6800 was a key consolidation zone yesterday. It continues to be in play today. We are largely bullish above it and bearish below it. Resistance lies at 6810, 6820, 6822, 6825, 6830. Support falls to 6796, 6791, 6785, 6774, 6771. I look forward to seeing you all in the live trading room shortly. I've got some ground to make up from yesterday.

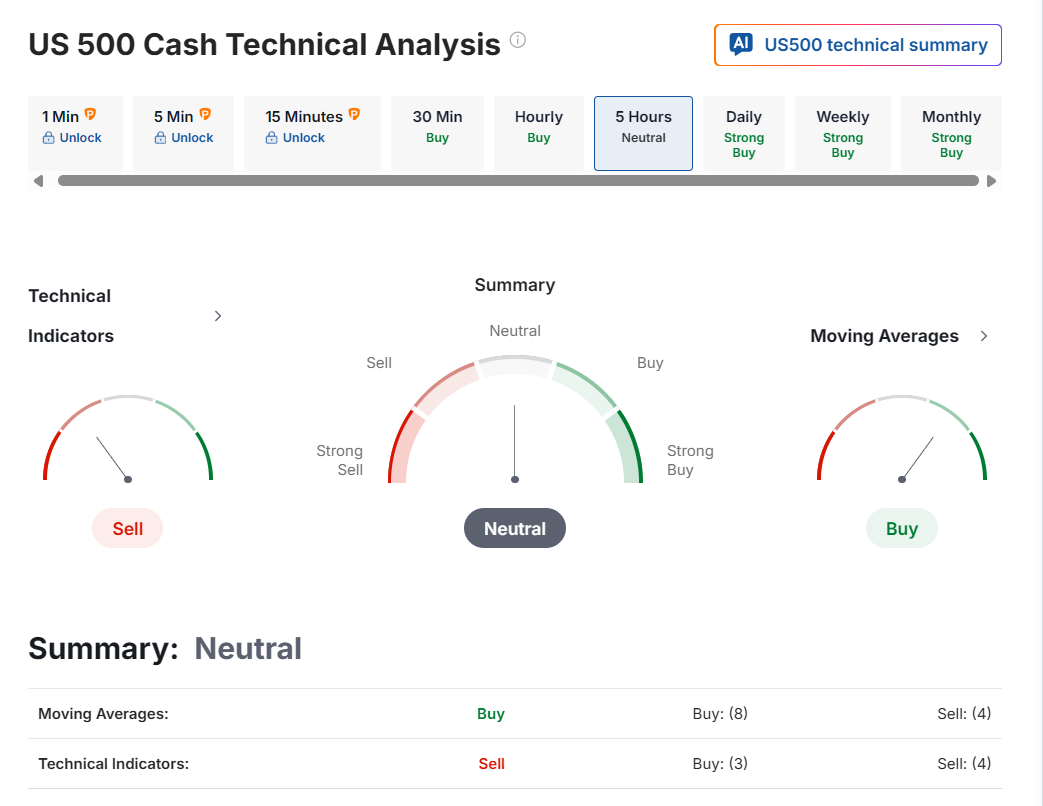

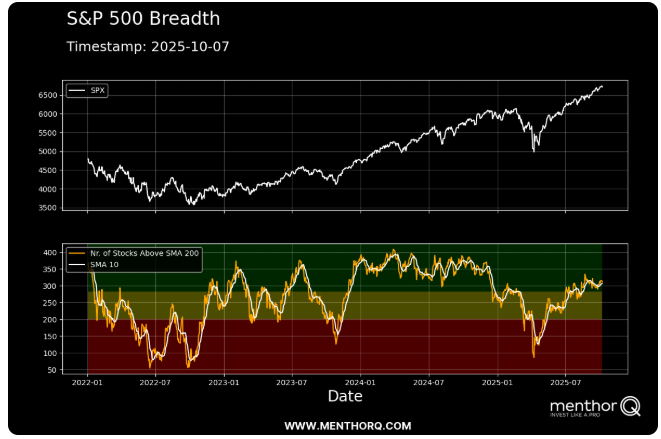

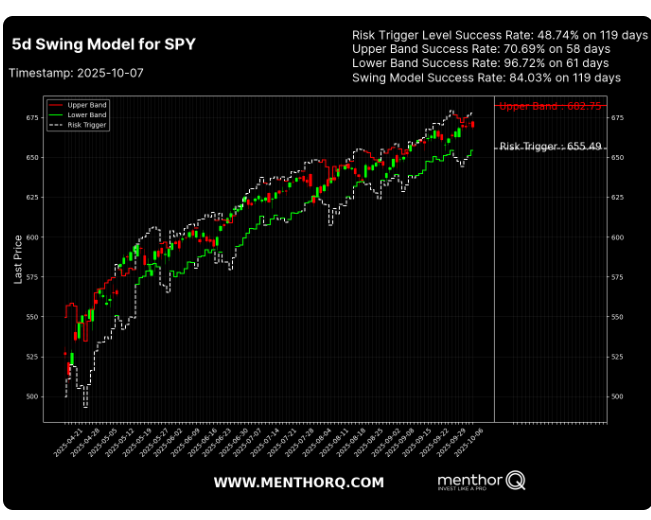

FOMC minutes todayIt's been strange trading without economic data. The Shutdown enters it's second week. We do get FOMC minutes today which will be interesting. Lot's of varied opinions right now by FED members. Futures are looking for a 90%+ chance for another rate cut upcoming. I'm not that sure. We had another solid day's result yesterday. I had to cut out early for a doctors appt. but it still worked out. My bias yesterday was flat to down and that's exactly what we got. We don't need the market to do exactly what I think it will do. We are flexible enough to adjust our strategy intra-day but, it sure helps when it does! Here's a look at our day: Let's take a look at the market: Neutral rating technically to start the day. These days are always interesting and sometimes hard to trade. Is the down turn finally here? Let's not get too excited. It's just a couple of days of weakness. We can always hope, though! The latest S&P 500 breadth chart shows a steady rebound in market participation, with the number of stocks trading above their 200-day moving average climbing toward the upper end of its recent range. This broadening trend suggests improving internal strength beneath the index’s advance, signaling that more sectors are contributing to the upside rather than just a few large caps. In the short term, maintaining this breadth above the key mid-zone threshold would support continued momentum, while any sharp decline could hint at early signs of exhaustion or consolidation risk. Overall, the near-term setup favors monitoring breadth sustainability as a gauge of market resilience. The SPY 5-day swing model shows the index trading near its upper band at around 682.75, suggesting short-term momentum remains strong but potentially stretched. The swing model success rate of 84% over recent periods indicates solid reliability in identifying short-term turning points, while the lower band at 655.49 acts as an important near-term support zone. With the upper band success rate near 71%, the market could face resistance if upward momentum stalls. In the short term, traders may look for potential consolidation or a cooling period if prices remain near the upper band, while sustained strength above the risk trigger would reinforce the ongoing bullish tone. December S&P 500 E-Mini futures (ESZ25) are trending up +0.15% this morning, signaling a partial rebound from yesterday’s losses, while investors await the Federal Reserve’s September meeting minutes and remarks from central bank officials. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the red. Chip stocks retreated, with Lam Research (LRCX) and Applied Materials (AMAT) sliding more than -5%. Also, homebuilder stocks slumped after Evercore ISI downgraded the sector to In-Line from Outperform, with D.R. Horton (DHI) falling more than -6% and PulteGroup (PHM) dropping over -4%. In addition, Aehr Test Systems (AEHR) plunged more than -17% after the maker of semiconductor equipment swung to a quarterly loss on a GAAP basis and declined to reinstate its formal guidance. On the bullish side, Applovin (APP) climbed over +7% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Citigroup advised buying the stock following a sell-off triggered by a report of an SEC probe into the company’s data-collection practices. “A period of consolidation would not come as a surprise after such a strong recent run, but we believe the equity rally is underpinned by solid fundamentals that should continue to support the market,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. Economic data released on Tuesday showed that U.S. consumer credit rose by just $0.36 billion in August, weaker than expectations of $12.90 billion. Fed Governor Stephen Miran reiterated on Tuesday that his view of tariffs having only a limited impact on inflation supports the case for the Fed to continue easing policy. At the same time, Minneapolis Fed President Neel Kashkari warned that sharp interest rate cuts would risk fueling inflation. He also noted that “some of the data that we’re looking at is sending some stagflationary signals.” U.S. rate futures have priced in a 94.6% chance of a 25 basis point rate cut and a 5.4% chance of no rate change at the October FOMC meeting. The World Trade Organization on Tuesday slashed its 2026 forecast for global merchandise trade volume growth to 0.5% from 1.8%, citing the anticipated lagged effects of U.S. President Donald Trump’s tariffs. “The outlook for next year is bleaker...I am very concerned,” Director-General Ngozi Okonjo-Iweala told reporters in Geneva. Meanwhile, the U.S. government shutdown has entered its eighth day, with no resolution in sight. JPMorgan CEO Jamie Dimon said on Tuesday that while the shutdown is a poor way to manage the federal government, it is unlikely to hurt the stock market in the long term. Today, market watchers will pay close attention to the publication of the Fed’s minutes from the September 16-17 meeting for insights into policymakers’ appetite for another rate cut. The FOMC cut interest rates last month for the first time this year, though subsequent public comments from various officials suggest there is division over how urgently further action should be taken. “Any insights on the future policy rate path and views [on] the double-sided risks to employment and inflation will be closely watched by market participants,” HSBC economists said in a note. Also, market participants will hear perspectives from St. Louis Fed President Alberto Musalem, Fed Governor Michael Barr, Chicago Fed President Austan Goolsbee, Dallas Fed President Lorie Logan, and Minneapolis Fed President Neel Kashkari throughout the day. On the economic data front, investors will focus on U.S. Crude Oil Inventories data, set to be released in a couple of hours. Economists expect this figure to be 0.4 million, compared to last week’s value of 1.8 million. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.117%, down -0.34%. My lean or bias today is similar to yesterday. I'm looking for a neutral type day. I'll likely start our SPX 0DTE with another Iron Fly. When (if ever) will the horrible job market start effecting the stock market? Also, How much real impact will A.I. have over the next five years? Today's training with Jessie Livermore will focus on 9 Trading Sins That Guarantee Failure Join us at 12:00 MDT on our live Zoom feed. Let's take a look at our intra-day /ES levels: Today is much like yesterday, with lots of levels clustered very close together. This happens on neutral-rated days. 6774, 6777, 6779, 6780, 6787, and 6790 are all resistance lines. 6770, 6768, 6766, 6764, 6760, 6759 are support lines. I look forward to seeing you all in the live trading room shortly!

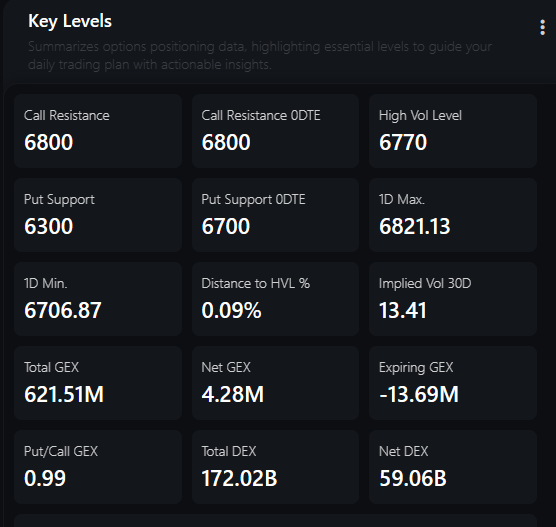

"Blow off top"The great (one of the greatest, IMHO) trader Paul Tudor Jones gave an interview yesterday with CNBC and outlined how we are set for a big upward surge, followed by a crash. Much like 1999. Billionaire hedge fund manager Paul Tudor Jones believes the conditions are set for a powerful surge in stock prices before the bull market tops out. “My guess is that I think all the ingredients are in place for some kind of a blow off,” Jones said Monday on CNBC’s “Squawk Box.” “History rhymes a lot, so I would think some version of it is going to happen again. If anything, now is so much more potentially explosive than 1999.” The founder and chief investment officer of Tudor Investment said today’s market is reminiscent of the setup leading up to the burst of the dot-com bubble in late 1999, with dramatic rallies in technology shares and heightened speculative behavior. Jones said the circular deals or vendor financing happening in the artificial intelligence space today also made him “nervous.” The tech-heavy Nasdaq Composite has bounced 55% from its April bottom to consecutive record highs. The rally has been driven by megacap tech giants, which have invested billions in AI and are being valued richly on the potential of this emerging era. Is he right? Who knows? I know he's a much more successful trader than I! The thing with crashes is, you can't see them coming until your already in it. Interesting times for sure. We had another solid day yesterday. We also setup a 1DTE NDX trade that will be our starting point for this morning. Here's a look at our day. Let's take a look at the markets: Bullish bias hasn't changed. We continue to be seemingly glued to the ATH's. The S&P 500 continues to grind higher, showing steady price strength with minimal volatility spikes, as reflected in the low and stable volatility score. Recent candles indicate sustained buying interest, with pullbacks quickly absorbed and no major volatility shocks disrupting the uptrend. This subdued volatility environment suggests that short-term market sentiment remains controlled and supportive of gradual continuation, though traders should stay alert for any sudden uptick in volatility that could hint at a near-term reversal or consolidation phase. December S&P 500 E-Mini futures (ESZ25) are down -0.04%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.01% this morning, taking a breather after hitting fresh records in the prior session, while the deadlock between Republicans and Democrats in Washington continues. The U.S. government shutdown has entered its seventh day, with no resolution in sight. President Trump appeared to question the possibility of talks with Democrats to end the shutdown after the Senate failed for a fifth time late Monday to pass a short-term funding bill. The Senate voted 52-42 to advance a House-passed stopgap bill that would keep the government funded through November 21st. However, Republicans need 60 votes, while holding only 53 seats. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed, with the S&P 500 and Nasdaq 100 notching new record highs. Advanced Micro Devices (AMD) jumped over +23% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after announcing a deal with OpenAI to roll out AI infrastructure, which the company said could bring in tens of billions of dollars in new revenue. Also, Tesla (TSLA) climbed more than +5% after the electric vehicle maker shared a video on Sunday teasing an October 7th event. In addition, Comerica (CMA) surged over +13% after Fifth Third Bancorp agreed to buy the regional lender for about $10.9 billion in stock. On the bearish side, Applovin (APP) tumbled more than -14% and was the top percentage loser on the S&P 500 and Nasdaq 100 after Bloomberg reported that the SEC was probing the company’s data-collection practices. “We’re in a self-fulfilling rally — earnings are strong and getting stronger, investors are shrugging off a lack of data, and even a government shutdown can’t shake their confidence,” said Mark Hackett at Nationwide. “And with half of the past decade’s returns typically coming in Q4, the main story right now is momentum.” Kansas City Fed President Jeff Schmid said on Monday that policymakers should continue pressing against inflation, which has remained persistently high. “With inflation still too high, monetary policy should lean against demand growth to allow the space for supply to grow and relieve price pressures in the economy,” Schmid said. He reiterated that interest rates remain only “slightly restrictive,” a stance he described as appropriate. Meanwhile, U.S. rate futures have priced in a 92.5% probability of a 25 basis point rate cut and a 7.5% chance of no rate change at the conclusion of the Fed’s October meeting. On the trade front, President Trump is scheduled to meet with Canadian Prime Minister Mark Carney later today. The Canadian Prime Minister is pushing for tariff relief in key sectors, including autos and steel. In light of the government shutdown, the publication of August trade data, originally set for today, will likely be delayed. Still, the Fed’s Consumer Credit report will be released today. Since the Fed isn’t financed through the congressional appropriations process, it continues its schedule as planned. Economists expect the U.S. Consumer Credit to stand at $12.90 billion in August, compared to the previous figure of $16.01 billion. In addition, market participants will be looking toward speeches from Fed officials Bostic, Bowman, Miran, and Kashkari. On the earnings front, spice and condiments manufacturing firm McCormick & Company (MKC) is set to report its quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.173%, up +0.17%. The last time the Nasdaq was up for seven months in a row was in 2017. My lean or bias today is neutral to slightly bearish. Me thinketh its time for a pause. This means I'll likely start our SPX 0DTE today with another Iron Fly. The Quant score is still firmly bullish There is a huge skew between Gamma resistance at 6800 and put support all the way down at 6300. Let's take a look at intra-day /ES levels: Levels continue to be closely grouped as the market consolidates around the ATH. 6792, 6795, 6800 (Big gamma wall there), 6809, 6820 are all resistance zones. 6789, 6786, 6783, 6779, 6777, 6773 are support zones. We had a good training session yesterday on ETF's and supplied a list of 3X leveraged ETF's that we will look at to trade 0DTE on. This should open up more opportunities for us each day. Tomorrow we'll listen to Jessie Livermore teachings. Come join us at 12:00 MDT on our live zoom feed. I look forward to seeing you all in the live trading room shortly!

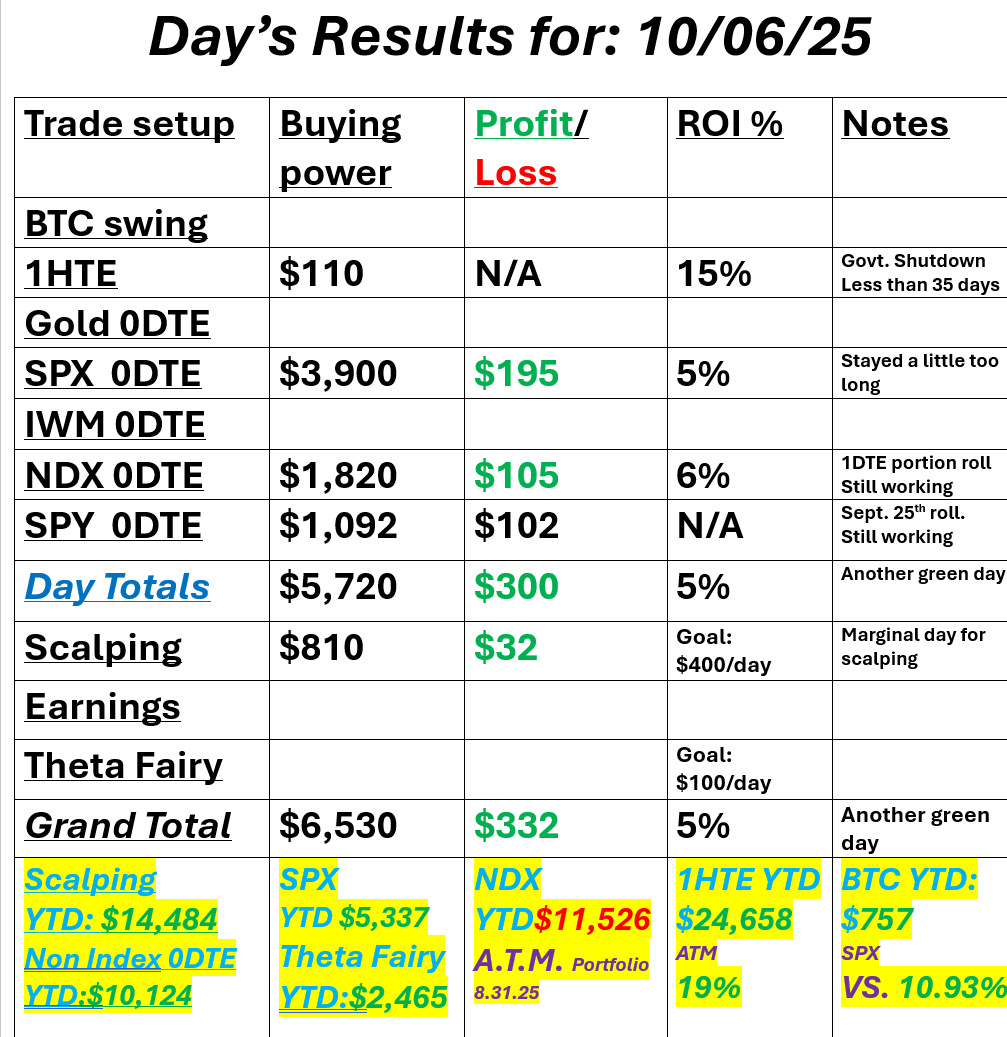

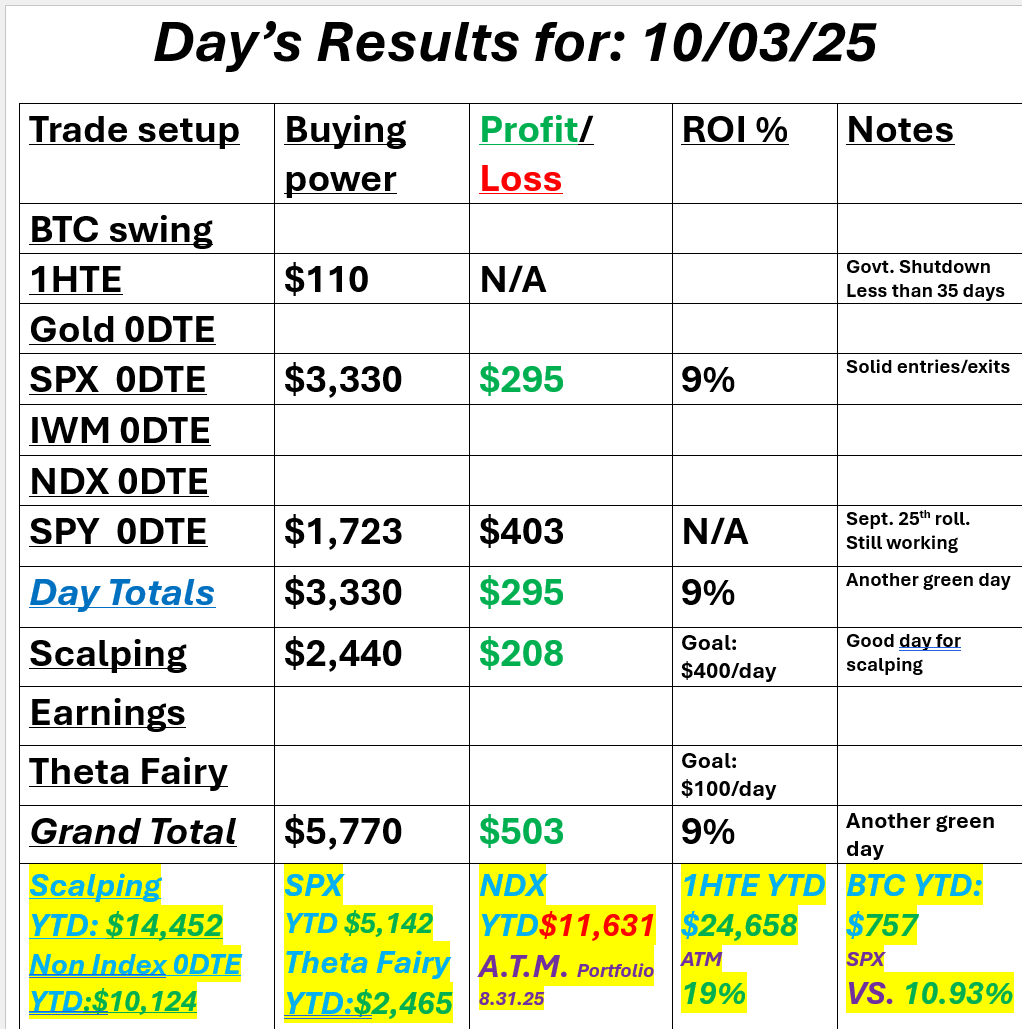

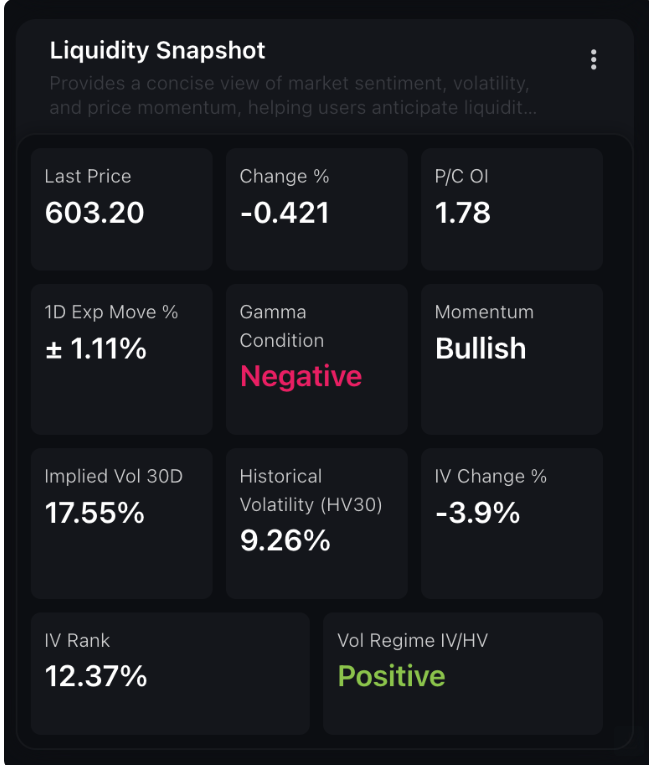

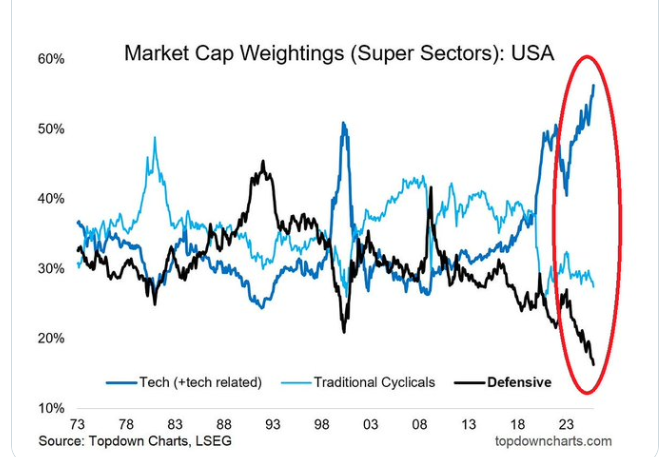

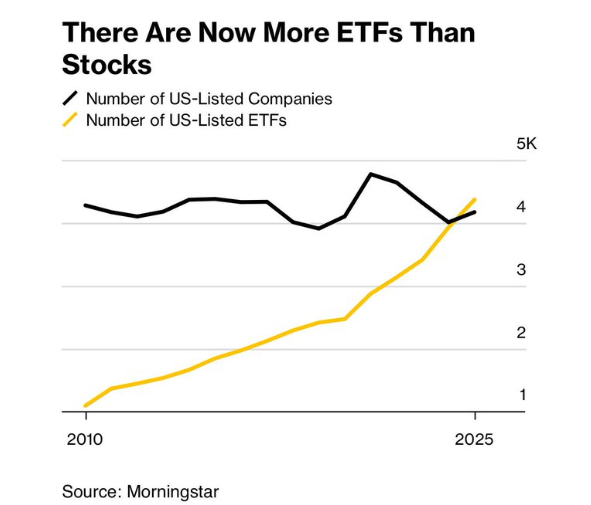

Bulls continue to pushIn spite of the Govt. shut down and some concerning valuation levels, the market just keeps pushing. Futures are up again this morning, as I type. Be prepared. We won't have a lot of our economic data to trade off until our fearless leaders decide to go back to work but once they do, it will be like flood gates opening up. Lots of data to parse through. We had another solid day of results on Friday. See below: We set a goal last week to make finishing green every day the priority, regardless of the dollar amount. Here's a review of how it went. The most buying power used was $5,770. The lowest was $1,260. Our avg. Buying power used per day was $3,351.. Every day was profitable. (SPY trade is still in progress) The biggest profit was $503, with the smallest $141. Our avg. daily profit was $239 a day. All told, our avg. buying power used was $3,351 for a total weekly profit of $1,196. That's almost a 36% return for the week! I'd say mission accomplished! Let's take a look at the markets to start the new week. Technicals are bullish. Not a big surprise. Markets are not rolling over. They aren't pushing higher. They are just hanging out at ATH'S. Something will shake loose eventually. The S&P 500’s volatility risk premium (VRP) has climbed to 6.6%, placing it near the 97th percentile over the past three months, which signals a notable stretch in implied volatility levels relative to realized movement. This “overvalued IV” setup indicates that option prices are rich compared to recent realized volatility a condition that often precedes short-term cooling or consolidation as the market digests elevated expectations. With spot prices hovering near recent highs, traders may interpret this as a sign of heightened hedging activity or short-term caution building into the market. In the near term, watch for potential shifts in sentiment if volatility begins to compress, as that could open room for a modest pullback or volatility normalization phase. The QQQ liquidity snapshot shows a slightly soft tape with prices down 0.42% but overall bullish momentum holding steady. Despite the pullback, the positive volatility regime (IV/HV) indicates implied volatility remains elevated compared to realized volatility, suggesting traders are still pricing in short-term movement potential. The negative gamma condition points to higher sensitivity to market swings intraday volatility could expand if selling pressure builds. Meanwhile, implied volatility (17.55%) is easing by nearly 4%, hinting at a moderation in hedging demand. With a put/call open interest ratio of 1.78, positioning still leans cautiously defensive, but the market’s underlying tone remains constructive in the short term. SPY ended last week in the green at $669.21 (+1.06%) to kick off October. Zooming out to the monthly chart, September marked SPY’s strongest performance since June, completely defying its typically bearish seasonality. The Combined RSI Ensemble Indicator ended the month with a yellow candle, signaling that at least one RSI length has crossed above 80 and may be entering overbought territory. QQQ also rose last week and closed at $603.18 (+0.91%), printing its highest RSI reading since December 2021. The monthly candle for October is printing orange on the RSI Ensemble, signaling that two RSI lengths are now in overbought territory. With both tech and hard assets like silver pushing higher, the question now is which trend will outlast the other. The small-cap IWM performed the best among the major indexes last week, closing at $245.83 (+1.48%). Unlike its large-cap peers, the RSI Ensemble has remained neutral for months, shown by a steady run of gray candles. With large caps entering overbought territory and rate cuts underway, a rotation into small caps could be gaining traction. US technology stocks now account for a record 56% of total US stock market cap. At the same time, defensive stocks make up just 16%, AN ALL-TIME LOW. This has NEVER happened. December S&P 500 E-Mini futures (ESZ25) are up +0.36%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.55% this morning, pointing to a higher open on Wall Street as investors wager that a resilient economy and further rate cuts from the Federal Reserve will continue to underpin corporate earnings. However, gains in equity futures are limited as the U.S. government shutdown extends into another week. Higher bond yields today are also limiting gains in stock index futures. This week, investors will focus on developments surrounding the government shutdown, the minutes of the Fed’s latest policy meeting, and comments from Fed officials. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Humana (HUM) surged over +10% and was the top percentage gainer on the S&P 500, extending Thursday’s gains after it reaffirmed its full-year earnings guidance. Also, Rumble (RUM) jumped more than +15% after announcing a partnership with Perplexity to integrate the company’s AI tools to improve video discovery on its platform. In addition, USA Rare Earth (USAR) climbed over +14% after CEO Barbara Humpton told CNBC that the company was “in close communication” with the White House. On the bearish side, Palantir Technologies (PLTR) slid more than -7% and was the top percentage loser on the S&P 500 and Nasdaq 100 following a report that the company’s battlefield communications system had serious flaws, a claim the company denied. Economic data released on Friday showed that the U.S. ISM services index fell to a 4-month low of 50.0 in September, weaker than expectations of 51.8. At the same time, the U.S. September S&P Global services PMI was revised higher to 54.2 from the preliminary reading of 53.9. Chicago Fed President Austan Goolsbee reiterated on Friday that policymakers should move cautiously with rate cuts as they navigate pressure to balance their inflation and employment goals. Also, Dallas Fed President Lorie Logan stated that the central bank remains further from achieving its inflation target than its maximum employment goal and reiterated that officials should take a cautious approach to cutting interest rates. In addition, Fed Vice Chair Philip Jefferson said, “With respect to the path of the policy rate going forward, I will continue to evaluate the appropriate stance of monetary policy based on the incoming data, the evolving outlook, and the balance of risks.” Finally, Fed Governor Stephen Miran said he would revise his inflation outlook if housing costs were to jump unexpectedly. U.S. rate futures have priced in a 94.6% chance of a 25 basis point rate cut and a 5.4% chance of no rate change at the Fed’s monetary policy committee meeting later this month. Investor attention this week will center on developments surrounding the U.S. government shutdown, with tensions likely to rise if President Trump proceeds with his threat to fire, rather than furlough, federal workers. If the shutdown continues, official U.S. economic data will likely be delayed, including August trade data on Tuesday and weekly jobless claims on Thursday. However, several noteworthy economic releases are still anticipated, including the University of Michigan’s preliminary Consumer Sentiment Index and the Fed’s Consumer Credit report. Should the shutdown end, delayed official data such as the September jobs report could be released during the week. Market watchers will also parse the Fed’s minutes from the September 16-17 meeting, set for release on Wednesday, for insights into policymakers’ appetite for another rate cut. The FOMC cut interest rates last month for the first time this year, though subsequent public comments from various officials suggest there is division over how urgently further action should be taken. “Any insights on the future policy rate path and views [on] the double-sided risks to employment and inflation will be closely watched by market participants,” HSBC economists said in a note. Fed Chair Jerome Powell will deliver pre-recorded welcoming remarks at the Community Bank Conference on Thursday. Treasury Secretary Scott Bessent and Fed Vice Chair for Supervision Michelle Bowman are set to participate in a “fireside chat” at the event. Also, Kansas City Fed President Jeff Schmid, Atlanta Fed President Raphael Bostic, Fed Governor Stephen Miran, Minneapolis Fed President Neel Kashkari, Fed Governor Michael Barr, San Francisco Fed President Mary Daly, Chicago Fed President Austan Goolsbee, and St. Louis Fed President Alberto Musalem will be making appearances throughout the week. In addition, several notable companies, including soda and snack maker PepsiCo (PEP), carrier Delta Air Lines (DAL), Corona and Modelo parent Constellation Brands (STZ), and spice and condiments manufacturing firm McCormick & Company (MKC), are set to report their quarterly figures this week. Meanwhile, e-commerce giant Amazon (AMZN) will host its Prime Big Deal Days sales event on October 7th-8th. Also, ChatGPT maker OpenAI will hold its DevDay developer conference later today, which analysts say may feature new announcements and updates. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.150%, up +0.73%. Todays training will focus on ETF's. What are they? How do they compare to Mutual funds? How can you find the best ETF's for you? Let's take a look at the /ES intra-day levels we'll be focused on today. Gamma is still positive (unlike /NQ) which should mean contained movement today. Intra-day levels. 6800 is still in play as heavy resistance. Levels today are extremely close! I'm sure we may be modifying these as the day progresses. 6789, 6791, 6794, 6798, 6800 are resistance levels. 6786, 6784, 6781, 6778, 6776 are support levels. Again...very tight levels. We'll keep on top of any new levels that may appear today, in the live zoom. NOTE: On possible trading/scheduling issue this week (or today?) I've been have breathing issues the past few weeks. It seems to be getting worse. With already having high blood pressure and diabetes my wife is a little concerned and will likely try this morning to get me into my cardiologist ASAP. She's already told me, "Your getting the first available appointment regardless if the market is open!" So...just be aware. I may need to cut out of one of our trading sessions early. Sorry for that. I'll see you all in the live trading room shortly!

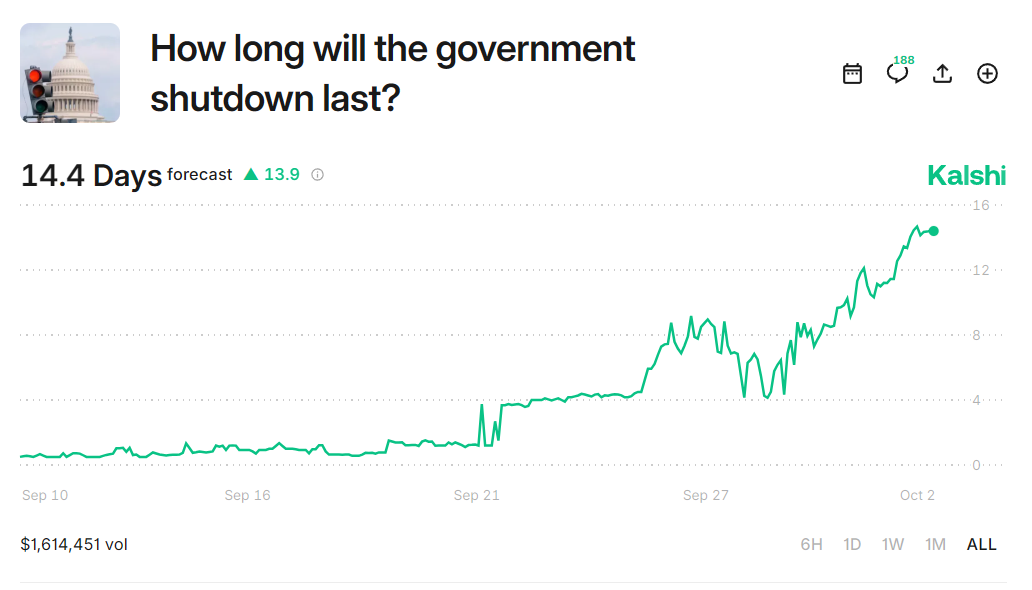

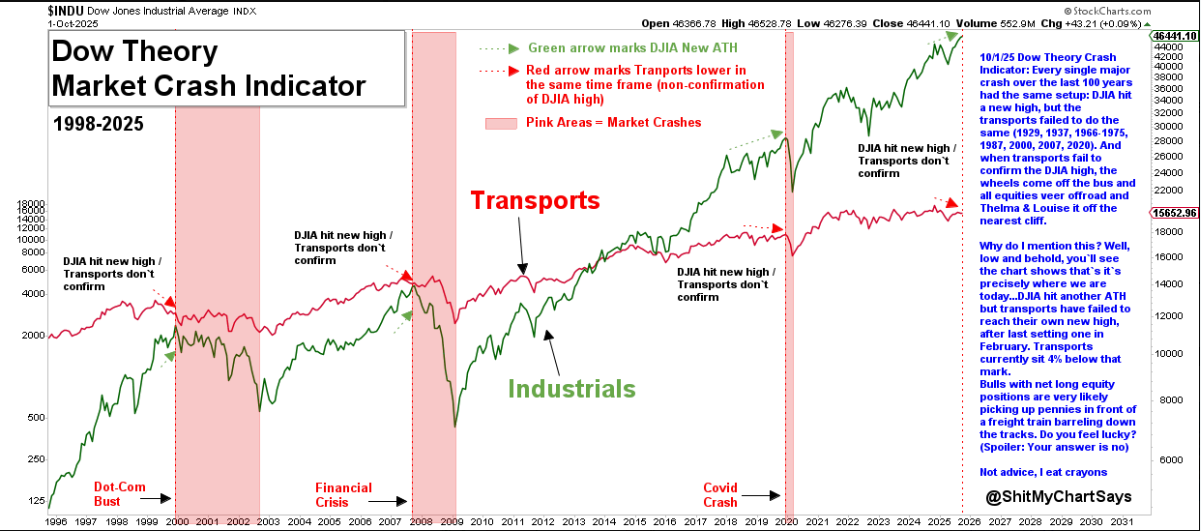

What is your longest win streak?This week we set a goal of consistency over profit. We are looking to make money EVERY SINGLE DAY, with no regard to the amount. It's been an interesting experiment. We are incorporating some training modules from the great Jessie Livermore each week as well. On next Mondays blog I'll post our metrics. What was the avg. buying power used. How much did we make. ROI, etc. We can then judge if our actions are worth while. Yesterday was another green day for us. Here's a look at the trades. With the Govt. still shut down we have no NFP data to trade off today. How long will the shut down last? There are some interesting stats coming our of Kalshi. The fear and greed index is basically asleep! Technicals are still firmly bullish Markets continue to sit perched up on their ATH's. Some would say, "Priced to perfection." If we look at the VTI (which is my favorite gauge when we say, what is the "market" doing?) It looks like we've got some big Gamma walls working above current prices as potential resistance areas. MACD is flat. RSI and Stoch are overstretched to the upside. I'm looking for some weakness soon. The SPX chart with seasonality scoring shows the index continuing its steady climb toward fresh highs, but the short-term seasonality score has been hovering near neutral after a recent dip into negative territory. This suggests that while the broader trend remains supportive, near-term conditions could be more mixed, with seasonality not providing a strong tailwind. Traders may want to stay alert for short bursts of volatility or potential consolidation before momentum reasserts itself. In the short term, monitoring whether the seasonality score can turn back positive could help confirm alignment with the ongoing price uptrend. The SPY option data highlights concentrated short-term exposure, with notable gamma build-ups around the October 3rd expiration, showing strong positive GEX levels that may act as stabilizers near current price zones. However, deeper into October, negative GEX spikes (e.g., October 17th and November 21st) suggest areas where dealer positioning could amplify volatility rather than dampen it. Key resistance levels appear clustered near 670–675, while put support aligns closer to 650, defining a near-term range. With several large expirations approaching, short-term flows may dictate price action, especially if open interest shifts accelerate around these strike zones. GEX levels are pretty strong at the 6800 level today. That will likely be where I start my trades for the day. December Nasdaq 100 E-Mini futures (NQZ25) are trending up +0.31% this morning as another round of major AI deals and partnerships boosted sentiment. Japan’s Hitachi formed a partnership with OpenAI on energy and related infrastructure. Also, Fujitsu expanded its collaboration with Nvidia. In addition, Bloomberg reported that Global Infrastructure Partners was in advanced talks to acquire Aligned Data Centers, targeting a major beneficiary of the AI spending boom. Investors are welcoming a wave of AI alliances, betting that the billions flowing into the sector will turn into profits. Optimism surrounding AI is outweighing concerns about the U.S. government shutdown, which has entered its third day. U.S. Treasury Secretary Scott Bessent cautioned on Thursday that the shutdown could be “a hit to growth.” In yesterday’s trading session, Wall Street’s major indices ended in the green, with the S&P 500 and Nasdaq 100 notching new record highs. Fair Isaac (FICO) jumped over +17% and was the top percentage gainer on the S&P 500 after introducing new pricing models that will enable credit report providers to directly access FICO scores. Also, chip stocks advanced on AI optimism after South Korea’s Samsung Electronics and SK Hynix partnered with OpenAI, with Intel (INTC) and Advanced Micro Devices (AMD) rising more than +3%. In addition, Celanese (CE) climbed about +7% after Citi upgraded the stock to Buy from Neutral with a price target of $53. On the bearish side, Occidental Petroleum (OXY) slid more than -7% and was among the top percentage losers on the S&P 500 after agreeing to sell its chemical division, OxyChem, for $9.7 billion to Berkshire Hathaway. Data from the outplacement firm Challenger, Gray & Christmas released on Thursday showed that companies announced plans to add 117,313 jobs last month, down 71% from a year earlier and marking the weakest September for hiring intentions since 2011. Separate data from Revelio Labs showed that employment rose by about 60,000 in September, marking an improvement from the previous month. Chicago Fed President Austan Goolsbee said on Thursday that new data from his staff indicates the labor market remains stable. “I think it indicates some steadiness in the labor market, and I think the underlying economy is still growing pretty solidly,” Goolsbee said. He reiterated that rates could be lowered “a fair amount” if policymakers gain confidence that inflation is moving back toward the Fed’s 2% target. Also, Dallas Fed President Lorie Logan said she will approach further rate cuts with caution as inflation risks continue to outweigh the threat of higher unemployment. “My forecast has a little bit slower of a normalization of the policy path in order to make sure we get all the way to 2%. So it will take some time,” Logan said. Meanwhile, U.S. rate futures have priced in a 97.8% chance of a 25 basis point rate cut at October’s monetary policy meeting. On the trade front, Treasury Secretary Scott Bessent predicted a “pretty big breakthrough” in the next round of trade talks with China. In light of the government shutdown, the publication of September’s nonfarm payrolls report, average hourly earnings, and unemployment rate, originally set for today, will likely be delayed. Still, the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will be released today. Economists expect the September ISM services index to be 51.8 and the S&P Global services PMI to be 53.9, compared to the previous values of 52.0 and 54.5, respectively. In addition, market participants will parse comments today from New York Fed President John Williams, Chicago Fed President Austan Goolsbee, Dallas Fed President Lorie Logan, Fed Vice Chair Philip Jefferson, and Fed Governor Stephen Miran. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.092%, up +0.10%. Dow Theory Crash Indicator: Every single major crash over the last 100 years had the same setup: DJIA hit a new high, but the transports failed to do the same (1929, 1937, 1966-1975, 1987, 2000, 2007, 2020). And when transports fail to confirm the DJIA high, the wheels come off the bus and all equities veer offroad and Thelma & Louise it off the nearest cliff. Why do I mention this? Well, low and behold, you`ll see the chart shows that`s it`s precisely where we are today...DJIA hit another ATH but transports have failed to reach their own new high, after last setting one in February. Transports currently sit 4% below that mark. Bulls with net long equity positions are very likely picking up pennies in front of a freight train barreling down the tracks. Do you feel lucky? One other interesting stat. Since the inception of the VIX there has never been 5 consecutive days where the VIX rose along with $SPX. Today was the 4th. I.V. rising as markets rise is one of the strangest things happening in todays market. Our training line up for next week: Monday we'll focus on ETF's. What are they? How do they work? How can we trade them? How can you build a watchlist and search and sort through them all? Weds. and Thurs. We'll be continuing our review of Jessie Livermore and his key take aways for trading. Please tune in at 2:00 P.M. EDT on those days. My lean or bias today is more neutral. We've got a lot of positive Gamma which could keep us contained. I'm looking to start the day with an Iron fly, if that's the case. Let's take a look at our intra-day levels on /ES: 6775, 6790, 6799, 6803 are resistance zones. 6767, 6749, 6744, 6740, 6710 are support zones. There is heavy resistance at 6803 and heavy support at 6710. It's likely we trade between these levels today. NOTE: I'll be placing what I believe to be, a very high probability trade on when the Govt. shutdown will end today. It carry's a 15% potential ROI. I'll place the trade in the 1HTE channel for you all to look at. See what you think. See you all in the live trading room shortly! Let's make it a great day and have a great weekend!

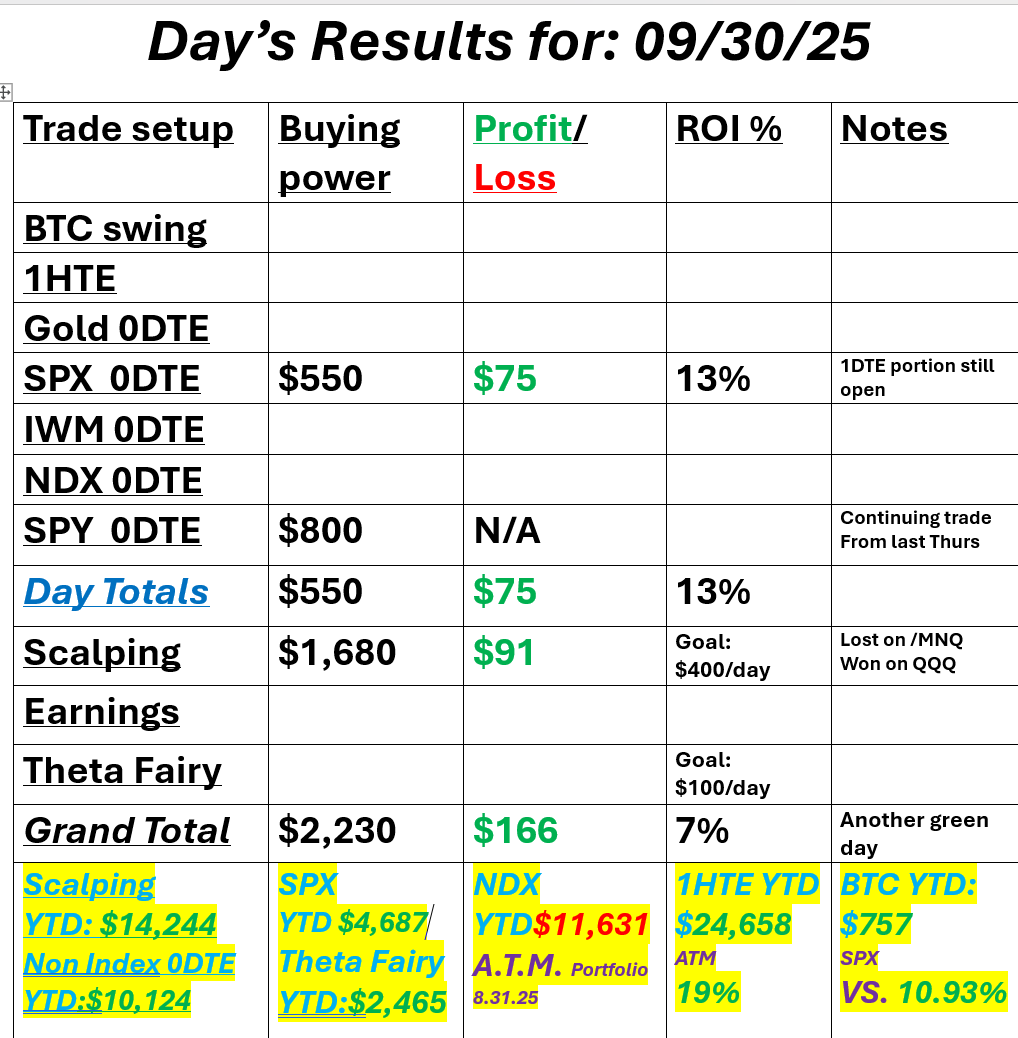

What shutdown?We got the Govt. shutdown, much as the predictive markets had implied and guess what? Mr. Market didn't seem to care. It looked like a text book reaction. Futures sell off on the news and the indices fight back as the day progresses. I got caught on the wrong side (short) on my initial /MNQ scalps but later flipped to QQQ calls and it worked out. We had a combination 0DTE/1DTE SPX trade. The 0DTE portion finished fully profitable. We'll need to likely work our 1DTE (now 0DTE) remaining parts today. Here's a look at my day. Let's take a look at this market. Nothing seems to be able to stop it's advance. Technicals are bullish. Futures are solidly green, as I type. Anyone up for some new ATH's? After 3 solid down days, where it looked like a rollover we a real possibility, we've had five consecutive days of strong finishes to not only push us back above that previous level but also take us to new ATH's. December S&P 500 E-Mini futures (ESZ25) are up +0.14%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.32% this morning, buoyed by hopes for Federal Reserve interest-rate cuts and optimism surrounding artificial intelligence. Futures on the Nasdaq 100 outperformed after a deal propelled OpenAI to become the world’s most valuable startup, boosting AI optimism. OpenAI’s valuation jumped to $500 billion after current and former employees sold roughly $6.6 billion worth of stock. The ChatGPT owner also reached agreements with South Korea’s Samsung Electronics and SK Hynix to supply chips for its Stargate project, lifting chip-related stocks worldwide. However, gains in U.S. equity futures are limited as the U.S. government shutdown continues. In a shutdown, government offices continue essential functions, but nonessential tasks are halted, paychecks are suspended, and many workers are furloughed until Congress passes new funding. The impact on both individuals and the economy hinges on whether the shutdown lasts for days or weeks, and on whether the White House proceeds with its plans to fire workers during the funding lapse. At a White House press conference on Wednesday, Vice President JD Vance said he does not expect the shutdown to last long, adding that layoffs will occur if it extends for days or weeks. Key economic data that the Fed would normally take into account for policy is likely to be delayed, including Friday’s jobs report. A prolonged shutdown could also delay the release of U.S. inflation data scheduled for mid-October. Chicago Fed President Austan Goolsbee said on Wednesday that the absence of official data during the U.S. government shutdown will make it more difficult for policymakers to interpret the economy. The Fed is “going into a period where you’re trying to figure out: Is this a transition?” Goolsbee said. “And if you’re not going to get the data, it’s just that much harder.” “The U.S. shutdown remains a huge story, and there’s still no sign of a climbdown from either side,” Deutsche Bank said. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher, with the S&P 500 and Nasdaq 100 notching new record highs. AES Corp. (AES) surged over +16% and was the top percentage gainer on the S&P 500 after the Financial Times reported that BlackRock’s Global Infrastructure Partners was nearing a $38 billion deal to buy the company. Also, pharmaceutical stocks extended their rally on optimism after Pfizer’s deal with the White House, with Biogen (BIIB) climbing more than +10% to lead gainers in the Nasdaq 100 and AstraZeneca Plc (AZN) rising over +9%. In addition, Nike (NKE) advanced more than +6% after the world’s largest sportswear company posted better-than-expected FQ1 results. On the bearish side, Corteva (CTVA) slumped over -9% and was the top percentage loser on the S&P 500 after the company said it would split its seed and pesticide businesses into two separate companies. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls unexpectedly fell -32K in September, weaker than expectations of +52K and the largest decline in 2-1/2 years. At the same time, the U.S. ISM manufacturing index rose to a 7-month high of 49.1 in September, stronger than expectations of 49.0. Also, the U.S. September S&P Global manufacturing PMI remained unrevised at 52.0, in line with expectations. “Investors have been conditioned to buy the dip. The economic data was not good, but it was not horrible either, and it is enough to solidify a rate cut this month despite the hawkish tone that we have heard recently from most Fed governors,” said Joe Gilbert, portfolio manager at Integrity Asset Management. “In the absence of further government data, the market has fully baked in an October cut, which is positive on the margin for the markets as interest rates appear on a glide path lower.” Meanwhile, U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. In other news, Fed Governor Lisa Cook will stay at the central bank until at least January after the Supreme Court issued a notice on Wednesday delaying a ruling on her termination. Today, investors will focus on speeches from Dallas Fed President Lorie Logan and Chicago Fed President Austan Goolsbee. In light of the government shutdown, the publication of weekly jobless claims and August factory orders data, originally set for today, will likely be delayed. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.095%, down -0.32%. My lean or bias today is slightly bullish. Everything certainly seems to continue to lean that way. We are five days into a bullish run so it is getting a bit long in the tooth. Jessie Livermore is considered one of the greatest, most famous, or possibly infamous traders to ever have lived. He made (and lost) millions back in a time where millions was a lot! I'm going to start sharing some video trainings from his teachings, when we have time on our zoom sessions. Todays training segment has some tremendous wisdom. The video runs about 30 min. in length. Please tune in at 2:00 EDT. Sometimes it seems so easy to spot bubbles and then...when not only does the bubble not pop but actually grows, you wonder what you are missing? As I was contemplating this conundrum yesterday, look what popped into my news feed. America Online was once worth $222 BILLION back in 1999. That is the equivalent of almost $500 BILLION today when adjusted for inflation. Today, AOL got sold for $1.4B… From $500B to $1.4B. All bubbles pop...eventually but you all know the saying. The market can stay irrational longer than you can stay solvent. We've got some new support/resistance levels to look at today as the market keeps pushing higher. Let's take a look at the /ES intra-day levels. 6780, 6791, 6798, 6810 are new resistant zones. 6775, 6766, 6755, 6749 are support zones. I look forward to seeing you all in the live trading room shortly. Having another good training session and getting some good trades working today!

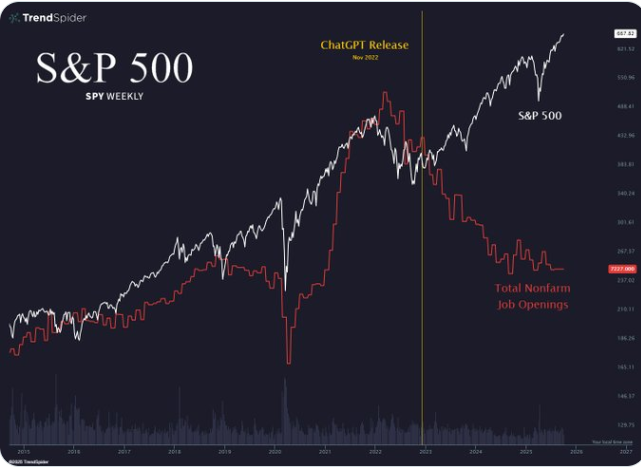

The shut down is herePredictive markets like Kalsi were right, once again. We got the predicted shutdown. Futures tanked initially and are working their way back, as I type. What does this mean? Is it another crack in this bull market that can get a true bearish trend going? Or is it a buy the dip opportunity? I must confess. I am not a "buy the dip" type trader. Every retrace. Every weakness. Every red day to me looks like the potential for a reversal. I don't worry too much about up trends but downtrends? Those are what I mostly focus on. This shutdown is an exception. We've looked at the historical shut down data here in this blog a few days ago. We know the numbers and probabilities. Generally speaking, any sell off related to Govt. shutdowns has been a wonderful buying opportunity. Will the market finish green today? Still way too early to tell but my bet is we shake this off. That being said...I'd still prefer a selloff! LOL. Yesterday was a very slow day. We are hyper focused this week on consistency vs. dollar profit and one of our main mantras, "Don't let green turn to red" We didn't get much working yesterday but we were able to stay green on everything. That's our goal this week... Profits every day. Here's a look at our day. We got ADP numbers that were a bit of a shock to the futures. PMI will come out shortly...then nothing. No NFP this week until we get the Govt. open. Let's take a look at the market. Yesterday was somewhat flat. We continue to bounce around our ATH's. Buy mode is still holding on. The market needs "something". Something to fuel the bulls to greater ATH's or something to get the bears engaged again. We're just treading water here. December S&P 500 E-Mini futures (ESZ25) are trending down -0.56% this morning as sentiment took a hit after the U.S. government shut down for the first time in seven years. The U.S. government shut down after a midnight funding deadline as the White House and lawmakers failed to reach a spending deal. The shutdown is expected to pause some federal services and place hundreds of thousands of federal employees on furlough. The Congressional Budget Office estimates that roughly 750,000 employees will be furloughed, costing $400 million per day in lost compensation, which could curb spending and negatively impact the economy. Notably, key economic data will not be released during the shutdown, with Thursday’s weekly jobless claims and Friday’s payrolls report immediately at risk. However, ADP private payroll figures and the ISM manufacturing PMI are still scheduled for release later today. “Government shutdowns in the U.S. are rarely market-moving in and of themselves, but the timing matters. This one comes at a point where the Fed is data-dependent. The absence of clean data can increase volatility,” said Nina Stanojevic, investment specialist at St James’s Place. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Pfizer (PFE) climbed over +6% and was the top percentage gainer on the S&P 500 after CEO Albert Bourla said the company secured a three-year exemption from President Trump’s proposed tariffs on pharmaceuticals in a deal that would reduce some of its U.S. drug prices by up to 85%. Also, CoreWeave (CRWV) surged more than +11% after announcing a $14.2 billion AI cloud-computing deal with Meta Platforms. In addition, EchoStar (SATS) rose over +3% after Bloomberg reported that Verizon was in talks with the company about purchasing some of its wireless spectrum. On the bearish side, Albemarle (ALB) slumped more than -6% and was the top percentage loser on the S&P 500 following news that China approved the restart of the CATL mine, which had been halted since August. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings rose to 7.227 million in August, stronger than expectations of 7.190 million. Also, the U.S. July S&P/CS HPI Composite - 20 n.s.a. eased to +1.8% y/y from +2.2% y/y in June (revised from +2.1% y/y), stronger than expectations of +1.7% y/y. At the same time, the U.S. Conference Board’s consumer confidence index fell to a 5-month low of 94.2 in September, weaker than expectations of 96.0. In addition, the U.S. Chicago PMI unexpectedly fell to 40.6 in September, weaker than expectations of 43.4. Fed Vice Chair Philip Jefferson on Tuesday cautioned that the central bank is confronting a weakening labor market at the same time as inflation pressures rise, complicating the monetary policy outlook. Still, he said, “The unemployment rate could edge a bit higher this year before moving back down next year,” adding that he expects “the disinflation process to resume after this year and inflation to return to the 2% target in the coming years.” Also, Boston Fed President Susan Collins said additional rate cuts could be appropriate this year, given a weaker labor market, but emphasized that officials must remain vigilant against the risk of persistent inflation. “It may be appropriate to ease the policy rate a bit further this year, but the data will have to show that,” Collins said. In addition, Dallas Fed President Lorie Logan said officials should exercise caution in considering further rate cuts while inflation remains above target and the labor market remains relatively balanced. Meanwhile, U.S. rate futures have priced in a 94.6% chance of a 25 basis point rate cut and a 5.4% chance of no rate change at the next FOMC meeting in October. Today, investors will focus on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. In light of the government shutdown, the report may serve as the only broad, nationwide measure of job growth until Bureau of Labor Statistics operations resume. Economists, on average, forecast that the September ADP Nonfarm Employment Change will stand at 52K, compared to the August figure of 54K. The U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI will also be closely monitored today. Economists expect the September ISM manufacturing index to be 49.0 and the S&P Global manufacturing PMI to be 52.0, compared to the previous values of 48.7 and 53.0, respectively. U.S. Construction Spending data will be reported today. Economists forecast the August figure at -0.1% m/m, the same as in July. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be 1.5 million, compared to last week’s value of -0.6 million. In addition, market participants will be anticipating speeches from Richmond Fed President Tom Barkin and Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.153%, up +0.12%. We had a good training session on Monday this week, and one component was breadth analysis with multiple time frames. That got a lot of good feedback, and I wanted to expand on that by adding the $TICK into the mix. We may have time today (dependent on whether we do a 0DTE or 1DTE entry) to review that further. If not, we'll do it on tomorrow's Zoom. Please make sure to tune in and ask questions. These sessions are beneficial for helping us all become better traders. The SPX chart shows spot prices trending near recent highs while the Volatility Risk Premium (VRP) has climbed to 5.4%, placing implied volatility in the “overvalued” zone with a 3-month percentile above 90%. This combination suggests that option premiums remain elevated relative to realized volatility, a sign of cautious positioning in the near term. In the short run, such stretched VRP readings often coincide with market hesitation, where either consolidation or sharper moves can occur as traders recalibrate risk. Monitoring whether the VRP sustains above 5% or begins to compress will be key for gauging the momentum behind this rally’s next step. There are now officially more ETF's than there are stocks! I want to go over some of the most interesting ETF's to put on your watch list in one of the next training sessions. Let's look at our intra-day levels on /ES. After the initial selloff, Futures are trying to push higher. 6715, 6720, 6726, 6737 are resistance zones. 6707, 6700, 6694, 6683 are support zones. I look forward to seeing you all shortly in our live trading room!

Consistency over profitWe had a good training session yesterday talking about the difference between shooting for big dollar profits vs. consistently being profitable. The quote we used was, "It's harder to make $50-$100 dollars a day, every day, for the rest of your life than making $10,000 dollars in a few hours." It's absolutely true. Once again this week, we are working on our consistency over profit amount. We had a good start yesterday were we deployed very little capital and still had a solid day. Here's a look at our results. Let's take a look at the markets. Buy mode still clinging on. Not much to take out of yesterdays session. It didn't really help the bull or bear case. December S&P 500 E-Mini futures (ESZ25) are down -0.23%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.14% this morning as investors grew anxious with the deadline to avert a U.S. government shutdown approaching. Democratic leaders and President Trump engaged in last-minute talks on Monday but failed to reach a deal to prevent a shutdown. U.S. lawmakers have until midnight to pass a federal spending bill. Vice President JD Vance said he thinks the U.S. government is headed toward a shutdown. Many federal operations will pause, and nonessential employees will be furloughed or fired in the event of a shutdown. Notably, Friday’s payroll report will be postponed if the Department of Labor follows an operational contingency plan outlined earlier this year. Later today, investors will focus on the latest reading on U.S. job openings and comments from Federal Reserve officials. In yesterday’s trading session, Wall Street’s main stock indexes closed higher. Chip stocks advanced, with GlobalFoundries (GFS) and Micron Technology (MU) rising over +4%. Also, Applovin (APP) climbed more than +6% and was the top percentage gainer on the Nasdaq 100 after Phillip Securities initiated coverage of the stock with an Accumulate rating and $725 price target. In addition, Merus N.V. (MRUS) jumped nearly +36% after Genmab agreed to acquire the company for about $8 billion in cash. On the bearish side, Carnival (CCL) slid about -4% even as the company posted better-than-expected FQ3 results and raised its full-year adjusted EPS guidance. Economic data released on Monday showed that U.S. pending home sales climbed +4.0% m/m in August, stronger than expectations of +0.2% m/m and the biggest increase in 5 months. Cleveland Fed President Beth Hammack told CNBC’s Squawk Box Europe on Monday that the U.S. central bank must keep a restrictive monetary policy stance to bring inflation down to its 2% target. “My forecast is that we’re going to remain above target for probably the next one to two years, and not really getting back down to our objective of 2% until the end of 2027 or early 2028,” Hammack said. At the same time, St. Louis Fed President Alberto Musalem said he is open to additional interest rate cuts, but emphasized that policymakers should proceed carefully, with inflation still above the central bank’s target. In addition, New York Fed President John Williams said that inflation risks have diminished, while employment risks have increased. However, he did not indicate whether he might support another rate cut in October. Meanwhile, U.S. rate futures have priced in a 90.3% probability of a 25 basis point rate cut and a 9.7% chance of no rate change at the next central bank meeting in October. In tariff news, President Trump signed a proclamation on Monday to impose 10% tariffs on imported timber and lumber and 25% tariffs on upholstered wooden furniture products and kitchen cabinets, effective October 14th. Tariffs on furniture products will increase to 30% at the beginning of 2026, and tariffs on cabinets will rise to 50%, according to an executive order. Today, all eyes are on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the August JOLTs Job Openings will arrive at 7.190 million, compared to the July figure of 7.181 million. Investors will also focus on the U.S. Conference Board’s Consumer Confidence Index, which came in at 97.4 in August. Economists expect the September figure to be 96.0. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today. Economists expect the July figure to ease to +1.7% y/y from +2.1% y/y in June. The U.S. Chicago PMI will be released today as well. Economists forecast the September figure at 43.4, compared to the previous value of 41.5. In addition, market participants will hear perspectives from Fed Vice Chair Philip Jefferson, Boston Fed President Susan Collins, Chicago Fed President Austan Goolsbee, and Dallas Fed President Lorie Logan throughout the day. On the earnings front, shoemaker Nike (NKE) and payroll processing firm Paychex (PAYX) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.130%, down -0.27%. My lean or bias today is slightly bearish. There's no real technical signal that's bearish but we do have the Government shutdown potential hanging over the market. If we do get a bullish day I think it will be somewhat subdued. The SPX chart shows prices holding near recent highs after a steady climb, but the option score has been fluctuating sharply, dipping into low territory multiple times through September. This suggests that while spot prices remain resilient, options positioning indicates uncertainty and shifting sentiment in the short term. Traders may want to keep an eye on whether the option score stabilizes above mid-levels, which would support continued momentum, or if repeated drops signal a potential short-term pullback. The near-term action looks poised for choppiness as positioning catches up with price levels. Let's take a look at the intra-day levels. They haven't changed too much from yesterday's levels. 6710, 6713, 6725, 6738 are resistance zones with 6699, 6694, 6682, 6675 working as support. Let's see if we can bring our winning streak to two days in a row! See you all shortly.

|

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |