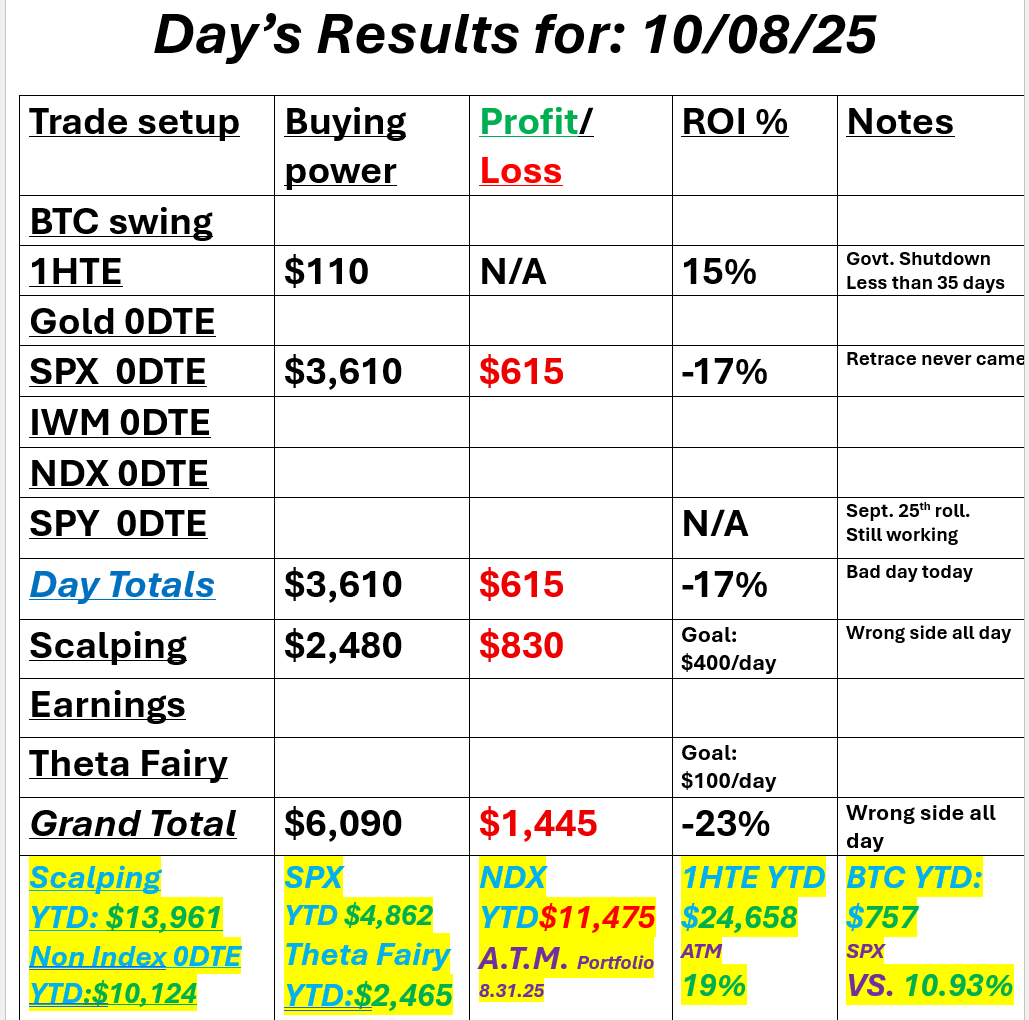

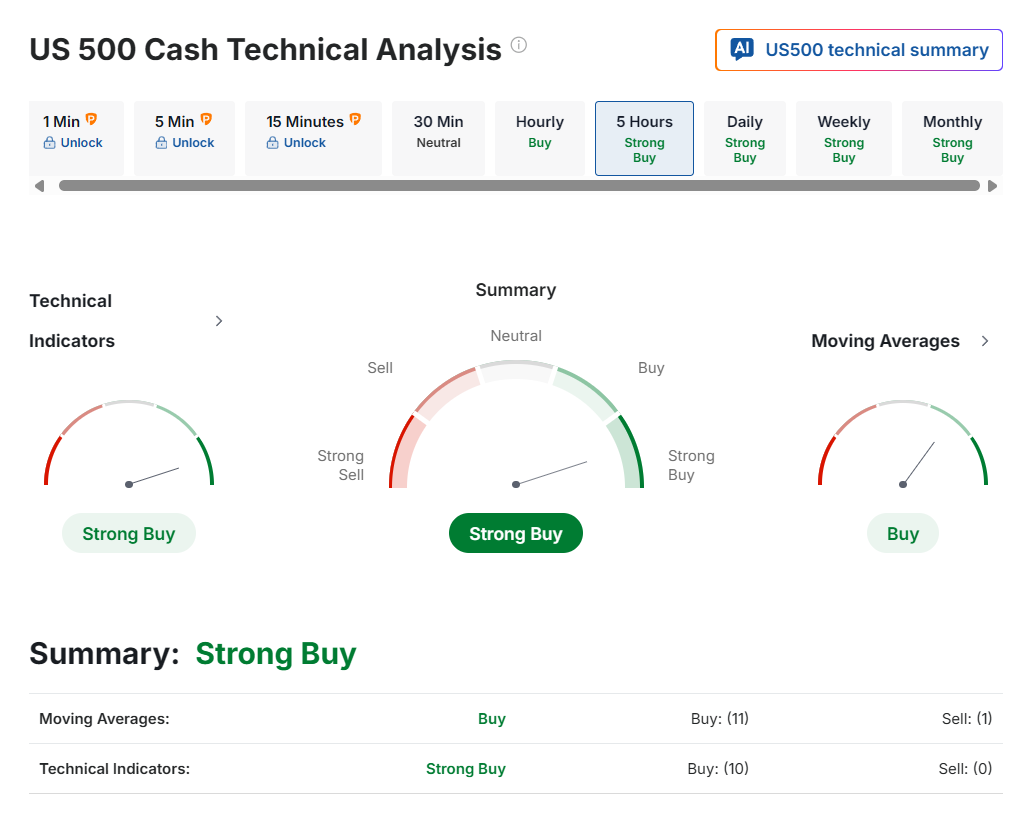

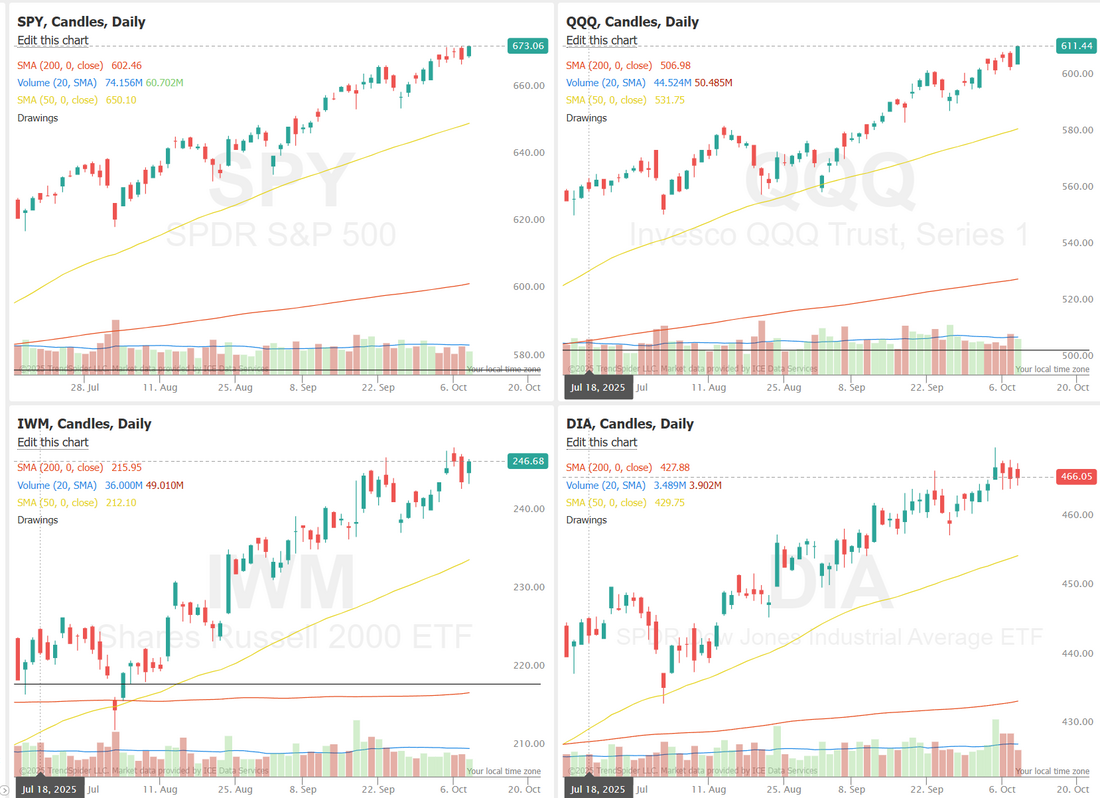

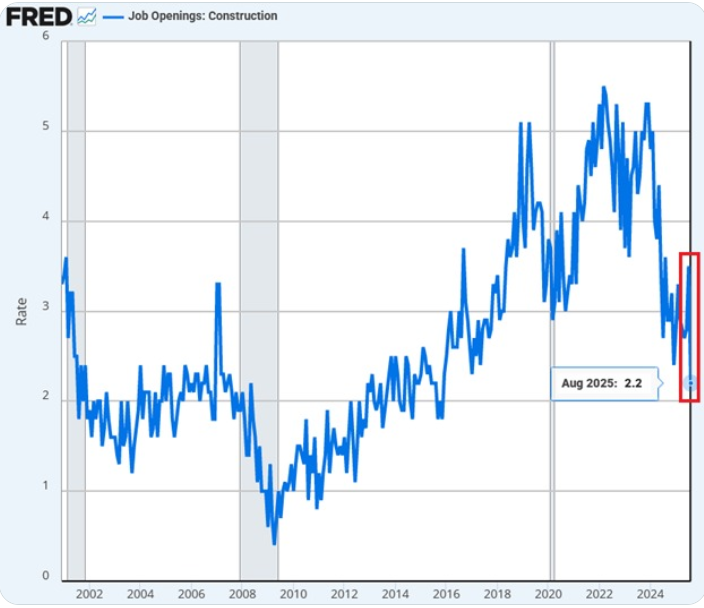

Peace in the Middle East?News finally broke of a cease fire agreement and hostage release. Let's all pray this is a step towards ending all the killing. Humans killing other humans has to be the low point of humanity. Well, the market push up yesterday caught me off. As you know from yesterdays blog, I was looking for a more neutral day and instead we got bullishness. I was basically on the wrong side of the market all day with both my scalps and my SPX. It was costly. We were able to get a Theta fairy trade working overnight which looks set to score for us this morning so there is one little bright spot. Here's a look at my trades. NOTE: I'm back to the doctors today for an echocardiogram. I'll be heading out right at the start of power hour, so that's a great incentive to be wrapped up by then! Let's take a look at the markets: Buy mode just doesn't seem to want to go away. The IWM and DIA didn't really participate yesterday but the SPY and especially the QQQ's really rocked higher December S&P 500 E-Mini futures (ESZ25) are up +0.01%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.03% this morning, steadying after yesterday’s gains as investors shift their focus to the third-quarter earnings season. Soda and snack maker PepsiCo (PEP) and carrier Delta Air Lines (DAL) are among the companies starting the U.S. third-quarter reporting period today, with major Wall Street banks such as Goldman Sachs (GS) and Citigroup (C) set to report next week. Tesla (TSLA) will be the first of the Magnificent Seven group to report on October 22nd, followed by Alphabet (GOOGL), Microsoft (MSFT), and Meta Platforms (META) on October 29th. In yesterday’s trading session, Wall Street’s major indexes ended mostly higher, with the S&P 500 and Nasdaq 100 notching new record highs. Most members of the Magnificent Seven stocks advanced, with Nvidia (NVDA) rising over +2% and Amazon.com (AMZN) gaining more than +1%. Also, Advanced Micro Devices (AMD) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after DZ Bank upgraded the stock to Buy from Hold with a $250 price target. In addition, Confluent (CFLT) climbed more than +7% after Reuters reported that the company was exploring a sale. On the bearish side, Fair Isaac (FICO) slumped over -9% and was the top percentage loser on the S&P 500 after rival Equifax announced it was “responding to FICO’s monopoly-like doubling of their mortgage credit score prices to $10 in 2026” by cutting VantageScore 4.0 mortgage credit scores by more than 50% from Fair Isaac’s 2026 prices to $4.50 through the end of 2027. “With price-to-earnings ratios for today’s tech giants still well below those of the tech firms at the peak of the dotcom bubble, we think the bull market remains intact,” said Mark Haefele at UBS Global Wealth Management. The minutes of the Federal Open Market Committee’s September 16-17 meeting, released on Wednesday, showed that policymakers were open to further interest rate cuts this year, though many voiced caution over still-elevated inflation. “Most judged that it likely would be appropriate to ease policy further over the remainder of this year,” according to the FOMC minutes. At the same time, the minutes showed “a majority of participants emphasized upside risks to their outlooks for inflation.” While policymakers acknowledged that labor market risks had increased, many also believed a sharp decline in employment was unlikely. Officials reiterated that they would weigh risks to both inflation and employment when determining their next policy move. “Participants stressed the importance of taking a balanced approach in promoting the committee’s employment and inflation goals,” the minutes said. New York Fed President John Williams said in an interview with The New York Times published on Thursday that he supports more rate cuts this year to help safeguard the labor market. U.S. rate futures have priced in a 94.6% probability of a 25 basis point rate cut and a 5.4% chance of no rate change at the next FOMC meeting in October. Meanwhile, the U.S. government shutdown has entered its ninth day, with no resolution in sight. On Wednesday, lawmakers once again failed to pass a bill to reopen the government, with no lawmakers changing their positions. Republicans still push for a continuing resolution that maintains current spending levels through November 21st, while Democrats are demanding the inclusion of an extension for healthcare subsidies set to expire at year-end. In geopolitical news, President Trump said Israel and Hamas have agreed to a deal that would release all Israeli hostages held in the Gaza Strip, marking a major step toward peace after two years of conflict in the Palestinian territory. Today, Fed Chair Jerome Powell will deliver pre-recorded welcoming remarks at a Fed Community Bank Conference. Treasury Secretary Scott Bessent and Fed Vice Chair for Supervision Michelle Bowman are set to participate in a “fireside chat” at the event. Fed Governor Michael Barr and San Francisco Fed President Mary Daly will also speak today. In light of the government shutdown, the publication of weekly jobless claims and final August wholesale inventories data, originally set for today, will likely be delayed. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.138%, up +0.10%. My lean or bias today is once again neutral. That means I'll likely start with another Iron fly. The construction industry is deteriorating rapidly: US job openings in construction dropped -115,000 in August, to 188,000, the lowest since May 2017. This marks the second-largest monthly decline in data going back to January 2001. Since December 2023, the number of available vacancies in construction has plummeted -265,000, or -58.5%. As a result, the construction job openings rate fell to 2.2%, the lowest since November 2015. Such weakness this century has only been seen during 2008 and 2001. The construction industry needs help. The S&P 500 continues to show steady upward momentum, with the momentum score maintaining elevated levels around 4–5, signaling sustained strength in short-term buying pressure. Price action remains in a constructive uptrend, with minor pullbacks being quickly absorbed as the index consolidates near recent highs. This persistence in positive momentum suggests that market sentiment remains confident, with traders potentially favoring continuation plays as long as the SPX holds above recent support zones. However, short-term overextension could lead to brief pauses or profit-taking, making the next few sessions key for confirming whether the trend can extend or cool off slightly. Thursday

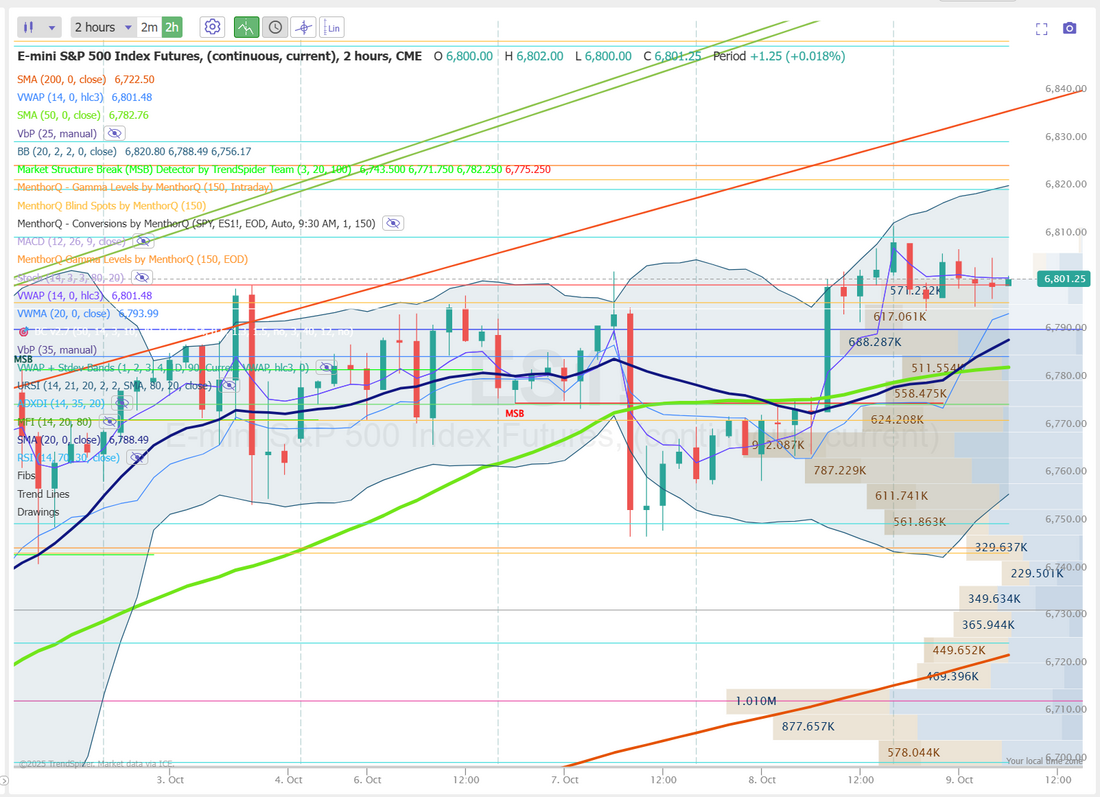

Let's take a look at our intra-day /ES levels: 6800 was a key consolidation zone yesterday. It continues to be in play today. We are largely bullish above it and bearish below it. Resistance lies at 6810, 6820, 6822, 6825, 6830. Support falls to 6796, 6791, 6785, 6774, 6771. I look forward to seeing you all in the live trading room shortly. I've got some ground to make up from yesterday.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |