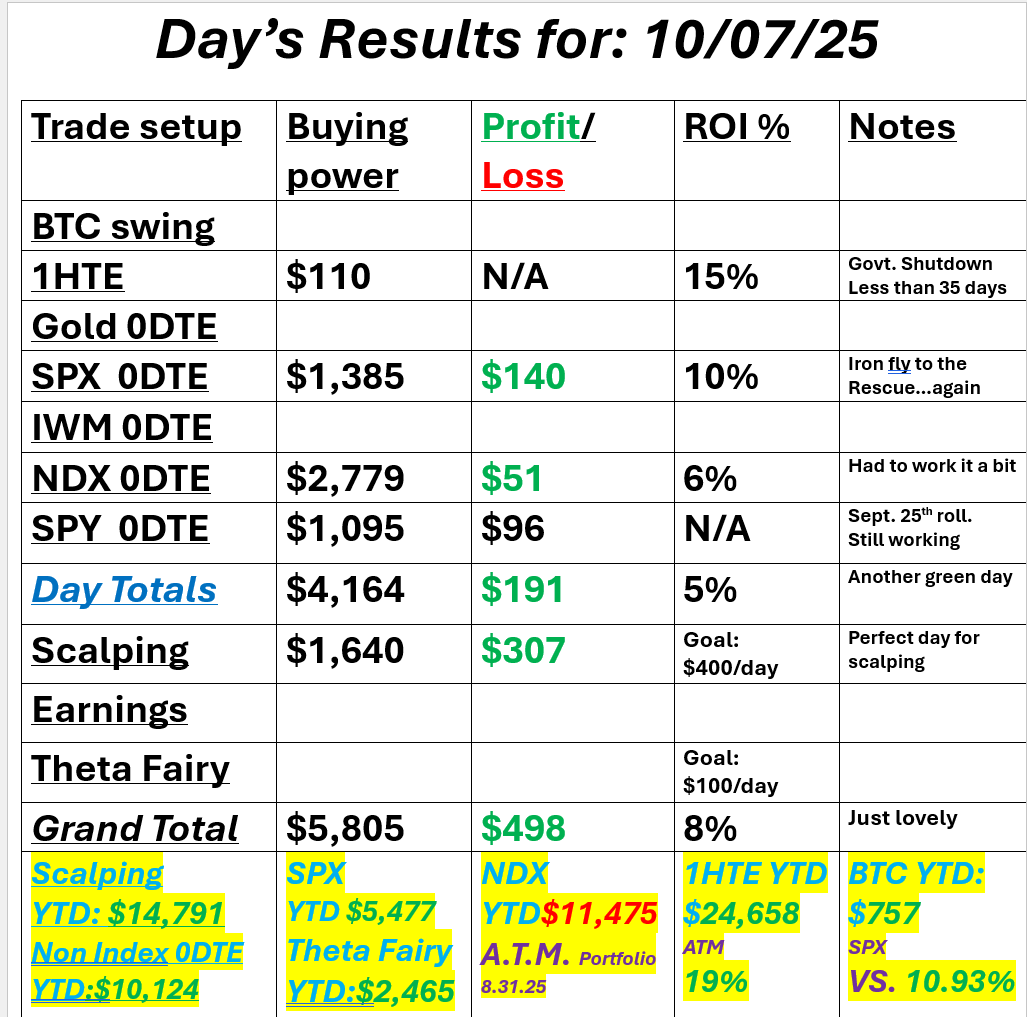

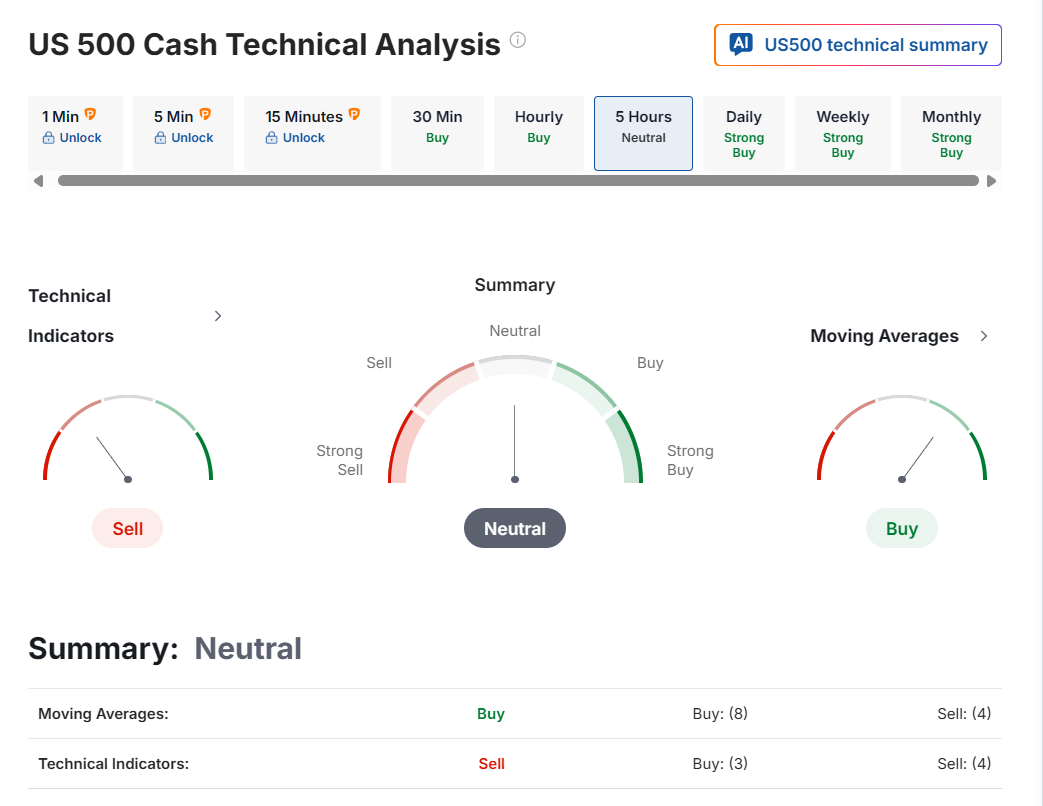

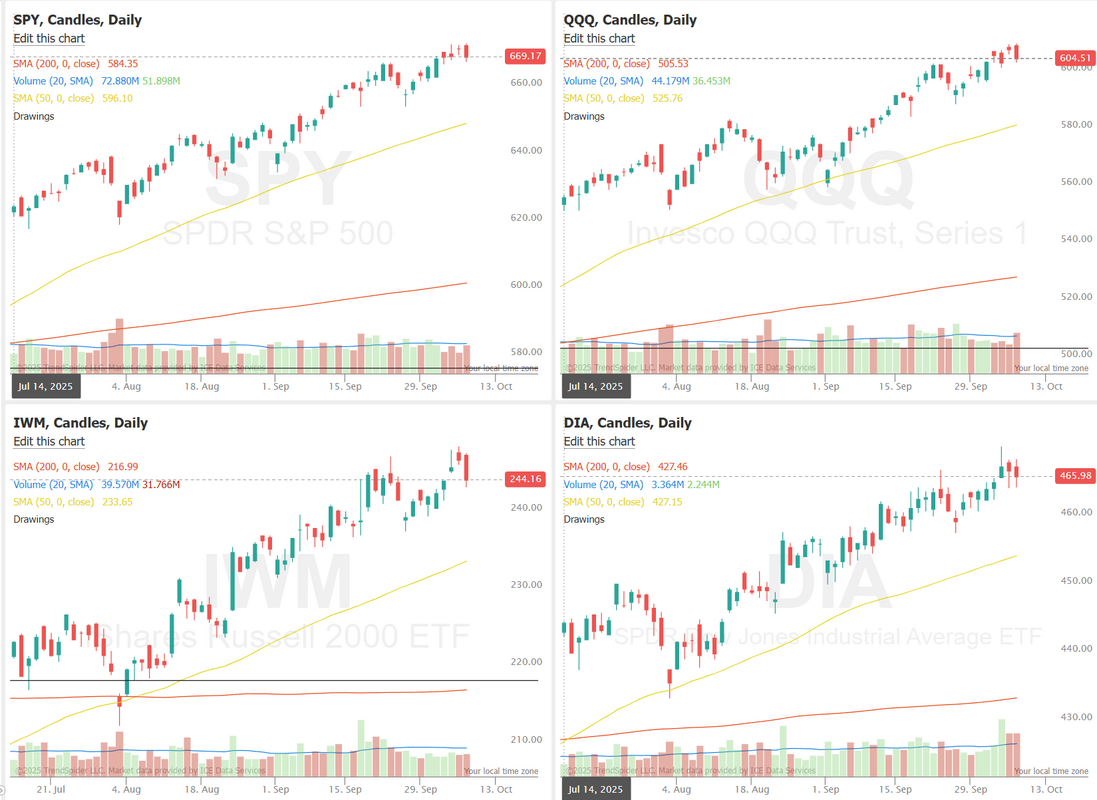

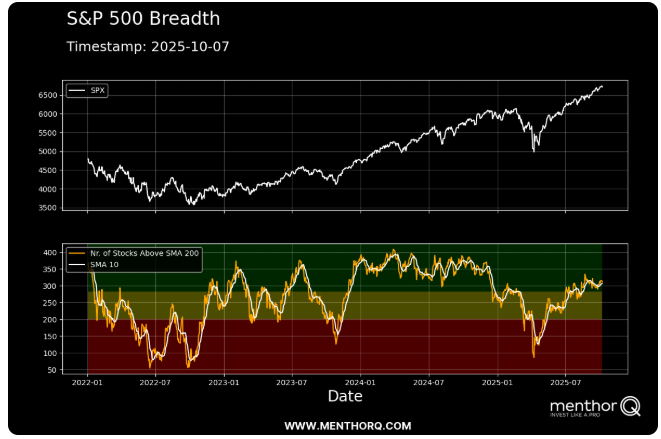

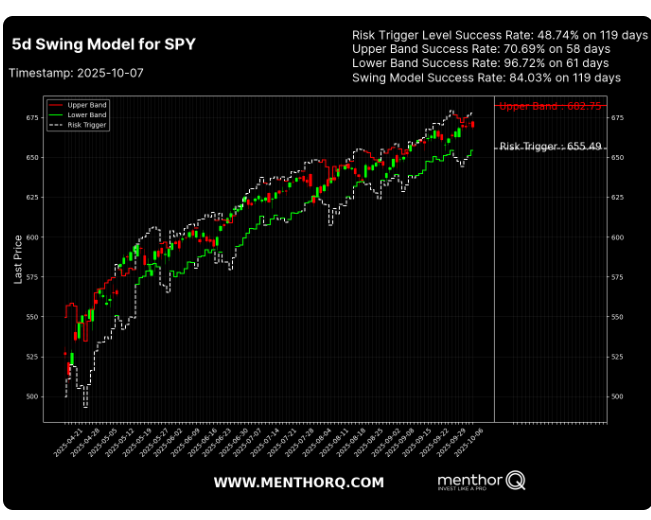

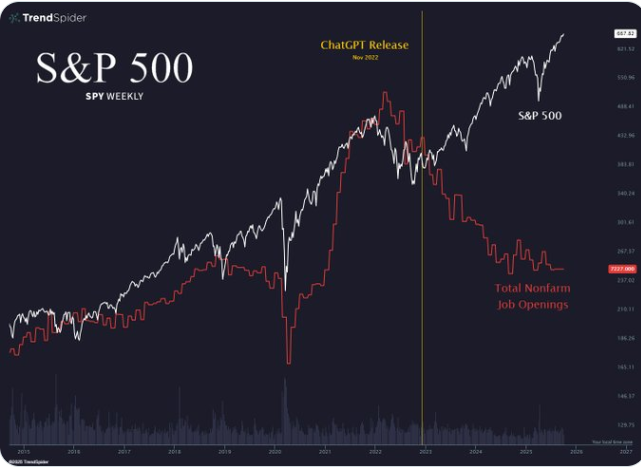

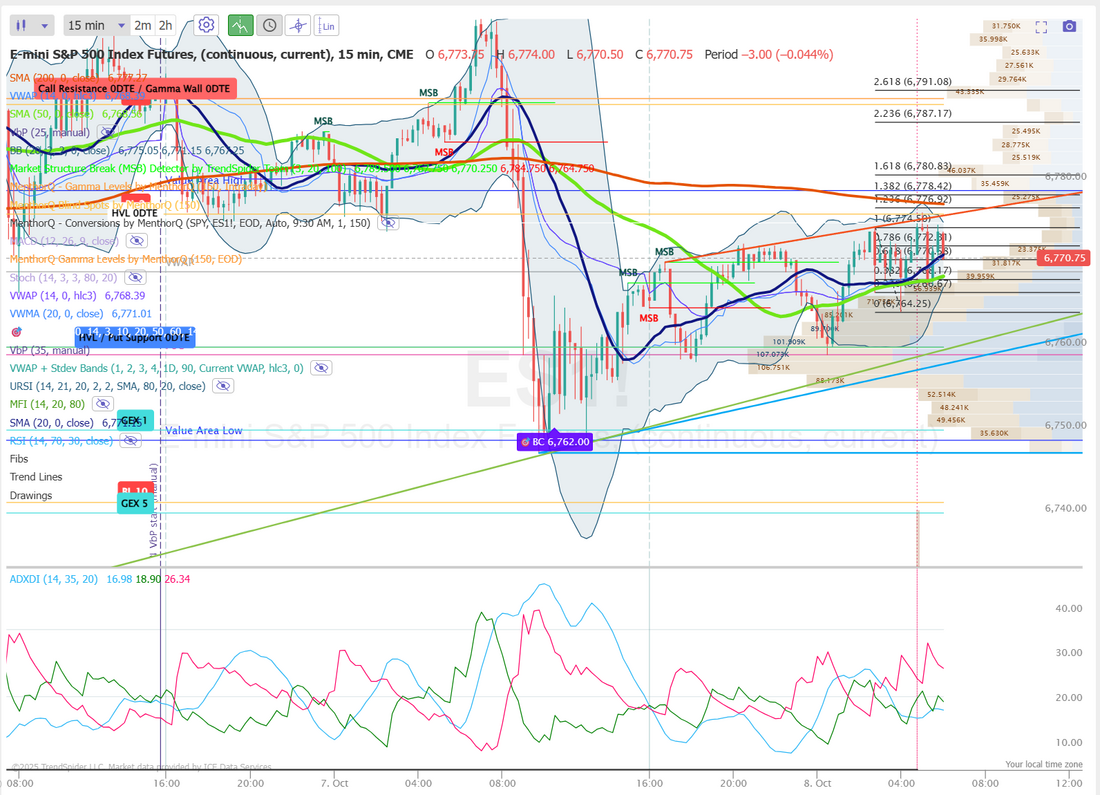

FOMC minutes todayIt's been strange trading without economic data. The Shutdown enters it's second week. We do get FOMC minutes today which will be interesting. Lot's of varied opinions right now by FED members. Futures are looking for a 90%+ chance for another rate cut upcoming. I'm not that sure. We had another solid day's result yesterday. I had to cut out early for a doctors appt. but it still worked out. My bias yesterday was flat to down and that's exactly what we got. We don't need the market to do exactly what I think it will do. We are flexible enough to adjust our strategy intra-day but, it sure helps when it does! Here's a look at our day: Let's take a look at the market: Neutral rating technically to start the day. These days are always interesting and sometimes hard to trade. Is the down turn finally here? Let's not get too excited. It's just a couple of days of weakness. We can always hope, though! The latest S&P 500 breadth chart shows a steady rebound in market participation, with the number of stocks trading above their 200-day moving average climbing toward the upper end of its recent range. This broadening trend suggests improving internal strength beneath the index’s advance, signaling that more sectors are contributing to the upside rather than just a few large caps. In the short term, maintaining this breadth above the key mid-zone threshold would support continued momentum, while any sharp decline could hint at early signs of exhaustion or consolidation risk. Overall, the near-term setup favors monitoring breadth sustainability as a gauge of market resilience. The SPY 5-day swing model shows the index trading near its upper band at around 682.75, suggesting short-term momentum remains strong but potentially stretched. The swing model success rate of 84% over recent periods indicates solid reliability in identifying short-term turning points, while the lower band at 655.49 acts as an important near-term support zone. With the upper band success rate near 71%, the market could face resistance if upward momentum stalls. In the short term, traders may look for potential consolidation or a cooling period if prices remain near the upper band, while sustained strength above the risk trigger would reinforce the ongoing bullish tone. December S&P 500 E-Mini futures (ESZ25) are trending up +0.15% this morning, signaling a partial rebound from yesterday’s losses, while investors await the Federal Reserve’s September meeting minutes and remarks from central bank officials. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the red. Chip stocks retreated, with Lam Research (LRCX) and Applied Materials (AMAT) sliding more than -5%. Also, homebuilder stocks slumped after Evercore ISI downgraded the sector to In-Line from Outperform, with D.R. Horton (DHI) falling more than -6% and PulteGroup (PHM) dropping over -4%. In addition, Aehr Test Systems (AEHR) plunged more than -17% after the maker of semiconductor equipment swung to a quarterly loss on a GAAP basis and declined to reinstate its formal guidance. On the bullish side, Applovin (APP) climbed over +7% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Citigroup advised buying the stock following a sell-off triggered by a report of an SEC probe into the company’s data-collection practices. “A period of consolidation would not come as a surprise after such a strong recent run, but we believe the equity rally is underpinned by solid fundamentals that should continue to support the market,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. Economic data released on Tuesday showed that U.S. consumer credit rose by just $0.36 billion in August, weaker than expectations of $12.90 billion. Fed Governor Stephen Miran reiterated on Tuesday that his view of tariffs having only a limited impact on inflation supports the case for the Fed to continue easing policy. At the same time, Minneapolis Fed President Neel Kashkari warned that sharp interest rate cuts would risk fueling inflation. He also noted that “some of the data that we’re looking at is sending some stagflationary signals.” U.S. rate futures have priced in a 94.6% chance of a 25 basis point rate cut and a 5.4% chance of no rate change at the October FOMC meeting. The World Trade Organization on Tuesday slashed its 2026 forecast for global merchandise trade volume growth to 0.5% from 1.8%, citing the anticipated lagged effects of U.S. President Donald Trump’s tariffs. “The outlook for next year is bleaker...I am very concerned,” Director-General Ngozi Okonjo-Iweala told reporters in Geneva. Meanwhile, the U.S. government shutdown has entered its eighth day, with no resolution in sight. JPMorgan CEO Jamie Dimon said on Tuesday that while the shutdown is a poor way to manage the federal government, it is unlikely to hurt the stock market in the long term. Today, market watchers will pay close attention to the publication of the Fed’s minutes from the September 16-17 meeting for insights into policymakers’ appetite for another rate cut. The FOMC cut interest rates last month for the first time this year, though subsequent public comments from various officials suggest there is division over how urgently further action should be taken. “Any insights on the future policy rate path and views [on] the double-sided risks to employment and inflation will be closely watched by market participants,” HSBC economists said in a note. Also, market participants will hear perspectives from St. Louis Fed President Alberto Musalem, Fed Governor Michael Barr, Chicago Fed President Austan Goolsbee, Dallas Fed President Lorie Logan, and Minneapolis Fed President Neel Kashkari throughout the day. On the economic data front, investors will focus on U.S. Crude Oil Inventories data, set to be released in a couple of hours. Economists expect this figure to be 0.4 million, compared to last week’s value of 1.8 million. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.117%, down -0.34%. My lean or bias today is similar to yesterday. I'm looking for a neutral type day. I'll likely start our SPX 0DTE with another Iron Fly. When (if ever) will the horrible job market start effecting the stock market? Also, How much real impact will A.I. have over the next five years? Today's training with Jessie Livermore will focus on 9 Trading Sins That Guarantee Failure Join us at 12:00 MDT on our live Zoom feed. Let's take a look at our intra-day /ES levels: Today is much like yesterday, with lots of levels clustered very close together. This happens on neutral-rated days. 6774, 6777, 6779, 6780, 6787, and 6790 are all resistance lines. 6770, 6768, 6766, 6764, 6760, 6759 are support lines. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |