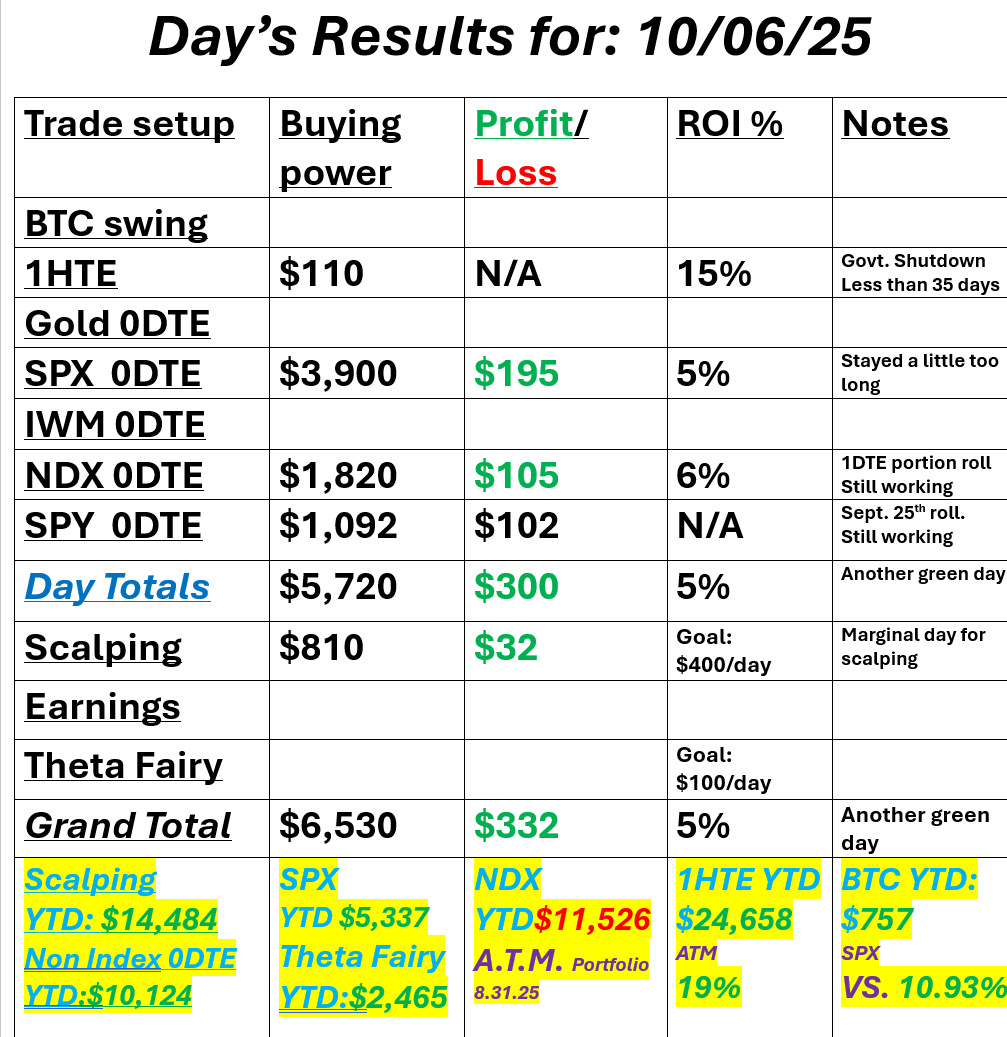

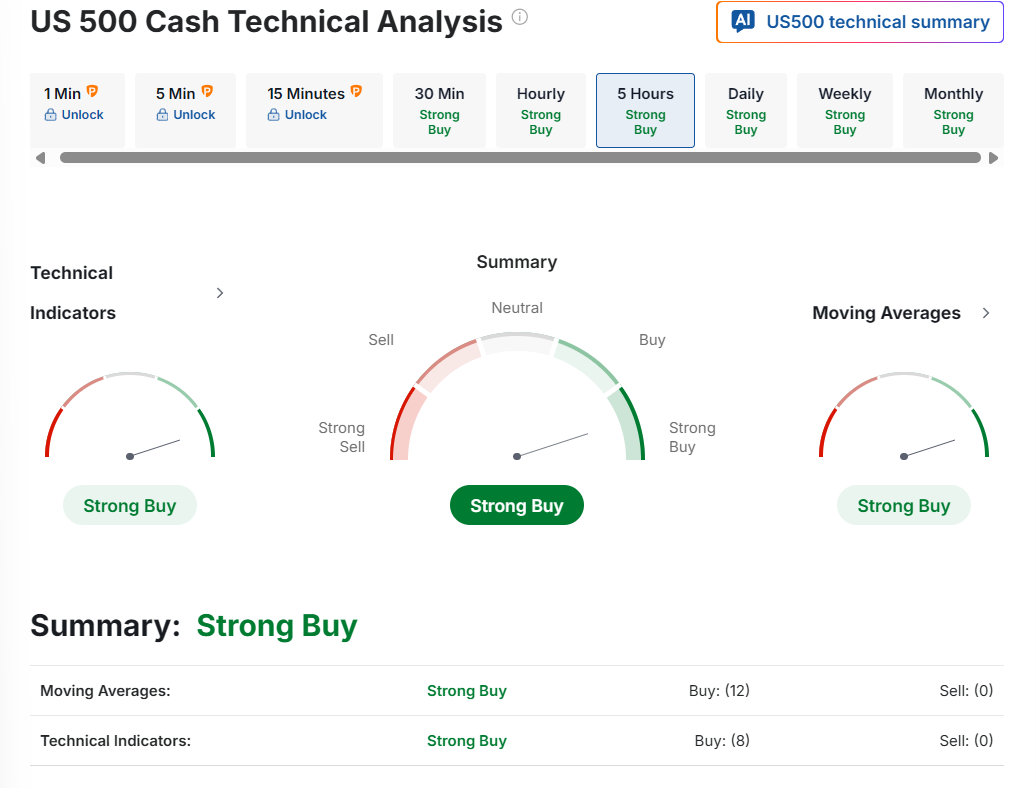

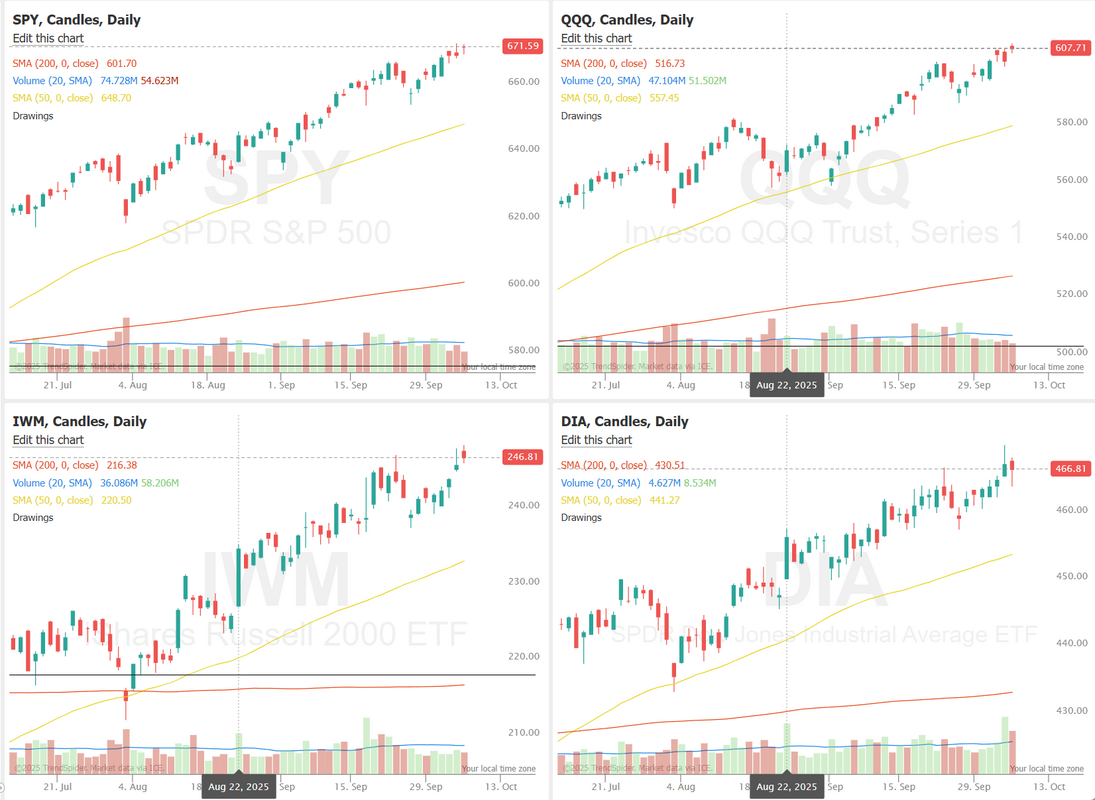

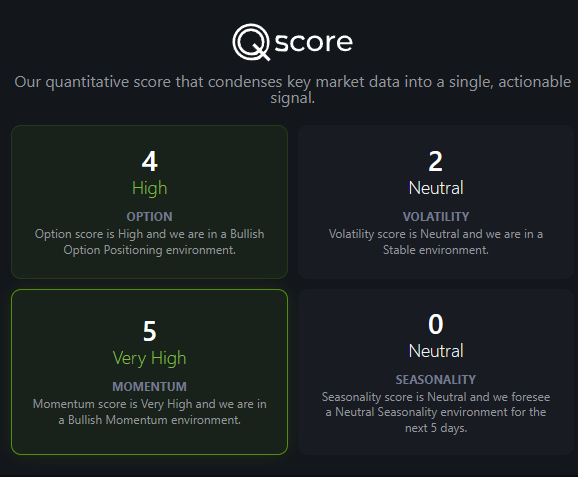

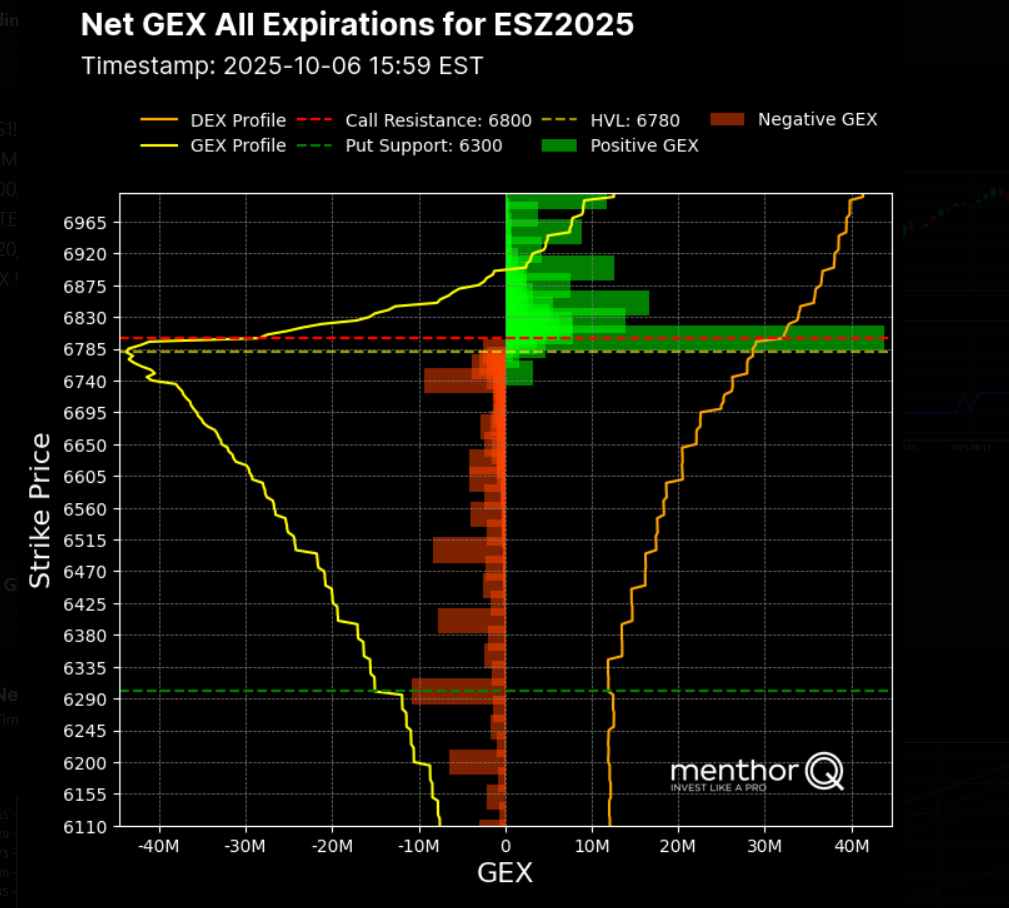

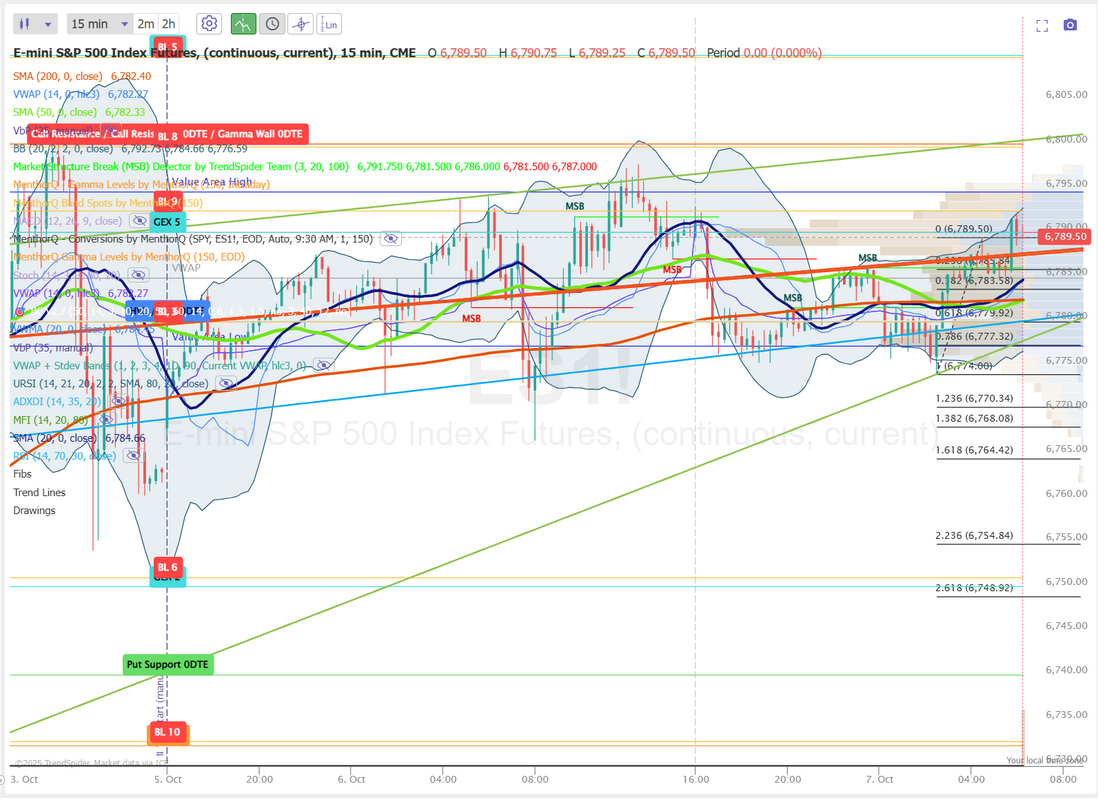

"Blow off top"The great (one of the greatest, IMHO) trader Paul Tudor Jones gave an interview yesterday with CNBC and outlined how we are set for a big upward surge, followed by a crash. Much like 1999. Billionaire hedge fund manager Paul Tudor Jones believes the conditions are set for a powerful surge in stock prices before the bull market tops out. “My guess is that I think all the ingredients are in place for some kind of a blow off,” Jones said Monday on CNBC’s “Squawk Box.” “History rhymes a lot, so I would think some version of it is going to happen again. If anything, now is so much more potentially explosive than 1999.” The founder and chief investment officer of Tudor Investment said today’s market is reminiscent of the setup leading up to the burst of the dot-com bubble in late 1999, with dramatic rallies in technology shares and heightened speculative behavior. Jones said the circular deals or vendor financing happening in the artificial intelligence space today also made him “nervous.” The tech-heavy Nasdaq Composite has bounced 55% from its April bottom to consecutive record highs. The rally has been driven by megacap tech giants, which have invested billions in AI and are being valued richly on the potential of this emerging era. Is he right? Who knows? I know he's a much more successful trader than I! The thing with crashes is, you can't see them coming until your already in it. Interesting times for sure. We had another solid day yesterday. We also setup a 1DTE NDX trade that will be our starting point for this morning. Here's a look at our day. Let's take a look at the markets: Bullish bias hasn't changed. We continue to be seemingly glued to the ATH's. The S&P 500 continues to grind higher, showing steady price strength with minimal volatility spikes, as reflected in the low and stable volatility score. Recent candles indicate sustained buying interest, with pullbacks quickly absorbed and no major volatility shocks disrupting the uptrend. This subdued volatility environment suggests that short-term market sentiment remains controlled and supportive of gradual continuation, though traders should stay alert for any sudden uptick in volatility that could hint at a near-term reversal or consolidation phase. December S&P 500 E-Mini futures (ESZ25) are down -0.04%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.01% this morning, taking a breather after hitting fresh records in the prior session, while the deadlock between Republicans and Democrats in Washington continues. The U.S. government shutdown has entered its seventh day, with no resolution in sight. President Trump appeared to question the possibility of talks with Democrats to end the shutdown after the Senate failed for a fifth time late Monday to pass a short-term funding bill. The Senate voted 52-42 to advance a House-passed stopgap bill that would keep the government funded through November 21st. However, Republicans need 60 votes, while holding only 53 seats. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed, with the S&P 500 and Nasdaq 100 notching new record highs. Advanced Micro Devices (AMD) jumped over +23% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after announcing a deal with OpenAI to roll out AI infrastructure, which the company said could bring in tens of billions of dollars in new revenue. Also, Tesla (TSLA) climbed more than +5% after the electric vehicle maker shared a video on Sunday teasing an October 7th event. In addition, Comerica (CMA) surged over +13% after Fifth Third Bancorp agreed to buy the regional lender for about $10.9 billion in stock. On the bearish side, Applovin (APP) tumbled more than -14% and was the top percentage loser on the S&P 500 and Nasdaq 100 after Bloomberg reported that the SEC was probing the company’s data-collection practices. “We’re in a self-fulfilling rally — earnings are strong and getting stronger, investors are shrugging off a lack of data, and even a government shutdown can’t shake their confidence,” said Mark Hackett at Nationwide. “And with half of the past decade’s returns typically coming in Q4, the main story right now is momentum.” Kansas City Fed President Jeff Schmid said on Monday that policymakers should continue pressing against inflation, which has remained persistently high. “With inflation still too high, monetary policy should lean against demand growth to allow the space for supply to grow and relieve price pressures in the economy,” Schmid said. He reiterated that interest rates remain only “slightly restrictive,” a stance he described as appropriate. Meanwhile, U.S. rate futures have priced in a 92.5% probability of a 25 basis point rate cut and a 7.5% chance of no rate change at the conclusion of the Fed’s October meeting. On the trade front, President Trump is scheduled to meet with Canadian Prime Minister Mark Carney later today. The Canadian Prime Minister is pushing for tariff relief in key sectors, including autos and steel. In light of the government shutdown, the publication of August trade data, originally set for today, will likely be delayed. Still, the Fed’s Consumer Credit report will be released today. Since the Fed isn’t financed through the congressional appropriations process, it continues its schedule as planned. Economists expect the U.S. Consumer Credit to stand at $12.90 billion in August, compared to the previous figure of $16.01 billion. In addition, market participants will be looking toward speeches from Fed officials Bostic, Bowman, Miran, and Kashkari. On the earnings front, spice and condiments manufacturing firm McCormick & Company (MKC) is set to report its quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.173%, up +0.17%. The last time the Nasdaq was up for seven months in a row was in 2017. My lean or bias today is neutral to slightly bearish. Me thinketh its time for a pause. This means I'll likely start our SPX 0DTE today with another Iron Fly. The Quant score is still firmly bullish There is a huge skew between Gamma resistance at 6800 and put support all the way down at 6300. Let's take a look at intra-day /ES levels: Levels continue to be closely grouped as the market consolidates around the ATH. 6792, 6795, 6800 (Big gamma wall there), 6809, 6820 are all resistance zones. 6789, 6786, 6783, 6779, 6777, 6773 are support zones. We had a good training session yesterday on ETF's and supplied a list of 3X leveraged ETF's that we will look at to trade 0DTE on. This should open up more opportunities for us each day. Tomorrow we'll listen to Jessie Livermore teachings. Come join us at 12:00 MDT on our live zoom feed. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |