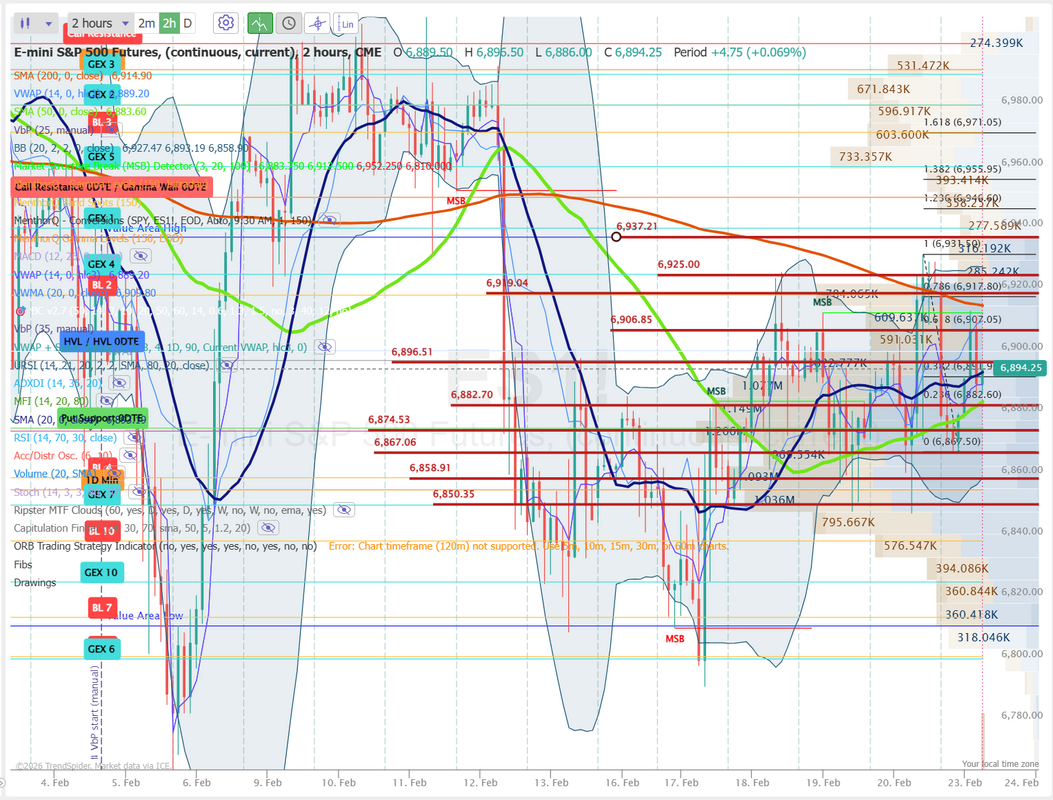

Another beautiful day in the neighborhood.I'm not sure if I've mentioned this but, we love down markets. There really is no better trading environment. Price action was all over the map though so we took our ball (profits) and went home early. Here's a look at what we were able to grab. We've also got a big today with our ATM portfolio. Most of our positions expire today. It could put us in a position where we absolutely leap frog the SP500 YTD by maybe as much as 300%! Today will be big. You know what I love about down markets? It really separates out those that are tactical and those that are just lucky. This famous quote by investor Warren Buffett means that weaknesses, risks, and poor management in businesses or investments are only exposed during downturns, recessions, or market corrections. When the economy is booming ("rising tide"), weak strategies are hidden, but when the market slows, the lack of preparation is revealed. Let's take a look at the markets this morning. The bulls stepped in again late yesterday to stop what could have been a big slide. The markets sure feel weak and bearish but the "buy the dip" bulls continue to show up. Not a surprise that sell mode technically is still engaged. It's a big day for our ATM portfolio, as I mentioned yesterday. We've already rolled our oil position. Both our currency positions look set for max profit gains. Now we just need to see if our Russell trade can make it to a fully profitable exit today or it carries over to next week. BTW, our trade automation feature is getting closer to an official rollout. Soon you'll be able to participate in our ATM portfolio or our 0DTE and Scalping trades through an auto bot. I'll keep you updated as we get closer to the official launch date. March S&P 500 E-Mini futures (ESH26) are trending down -0.53% this morning as Treasury yields continued to rise after another surge in oil prices stoked concerns that the Middle East conflict would drive inflation higher. The 10-year T-note yield rose three basis points to 4.17%. The price of WTI crude climbed more than +5% after data showed maritime traffic through the Strait of Hormuz had come to a near standstill. Also, Qatar’s energy minister told the Financial Times that the conflict could compel Gulf energy exporters to shut down production within weeks, a move that might push oil toward $150 a barrel. Oil prices initially edged lower after U.S. Treasury Secretary Scott Bessent announced a temporary measure to ease pressure on oil supply stemming from the conflict. Investors are now turning their attention to the key U.S. jobs report. In yesterday’s trading session, Wall Street’s major indices ended in the red. Chip stocks sank, with Analog Devices (ADI) and Lam Research (LRCX) sliding over -3%. Also, airline stocks slumped as crude oil prices continued their advance, with Alaska Air Group (ALK) falling over -9% and Southwest Airlines (LUV) dropping more than -6%. In addition, Corning (GLW) slid over -6% after Broadcom CEO Hock Tan played down the near-term prospects for optical networking in AI data centers. On the bullish side, The Trade Desk (TTD) jumped over +18% and was the top percentage gainer on the S&P 500 after The Information reported that OpenAI had held early discussions about growing its advertising business with the company. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims was unchanged last week at 213K, compared with the 215K expected. Also, U.S. Q4 nonfarm productivity rose +2.8% q/q, stronger than expectations of +1.9% q/q, and unit labor costs rose +2.8% q/q, stronger than expectations of +2.0% q/q. In addition, the U.S. import price index rose +0.2% m/m in January, weaker than expectations of +0.3% m/m. Richmond Fed President Tom Barkin said on Thursday that the central bank’s response to the Middle East conflict will hinge on the duration of its impact on the economy. “Textbook monetary policy would be you look through a short-term shock, but you don’t look through a long-term shock, and I think that’s a lot of the assessment people are going to have to make,” Barkin said. Also, Fed Vice Chair for Supervision Michelle Bowman said the labor market is showing further signs of stabilization, signaling she may support holding rates unchanged at the central bank’s next meeting. Meanwhile, U.S. rate futures have priced in a 97.3% chance of no rate change and a 2.7% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. Investors currently anticipate just one rate cut by the Fed in 2026, compared with three earlier this year. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that February Nonfarm Payrolls will come in at 58K, compared to the January figure of 130K. Investors will also focus on U.S. Average Hourly Earnings data. Economists expect the February figures to be +0.3% m/m and +3.7% y/y, compared to +0.4% m/m and +3.7% y/y in January. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will remain steady at 4.3% in February. U.S. Retail Sales and Core Retail Sales data will be closely monitored today. Economists anticipate that retail sales will drop -0.3% m/m and core retail sales will rise +0.1% m/m in January, compared to the previous figures of unchanged m/m for both. The Fed’s Consumer Credit report will be released today as well. Economists expect the U.S. Consumer Credit to be $12.4 billion in January, compared to the previous figure of $24.05 billion. In addition, market participants will hear perspectives from Fed Governor Christopher Waller, Chicago Fed President Austan Goolsbee, San Francisco Fed President Mary Daly, Philadelphia Fed President Anna Paulson, Kansas City Fed President Jeff Schmid, Boston Fed President Susan Collins, and Cleveland Fed President Beth Hammack throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.169%, up +0.51%. Let's take a look at today's /ES levels for 0DTE entries. 6803, 6825, 6833, 6842 are resistance levels. 6794, 6775, 6758, 6748 are support levels. NFP just hit. Initial market reaction is bearish. Let's see if there are any brave bulls that are willing to step into the fire this morning. Let's finish the week off strong. Today should present ample opportunities for us! See you in the live trading room shortly.

0 Comments

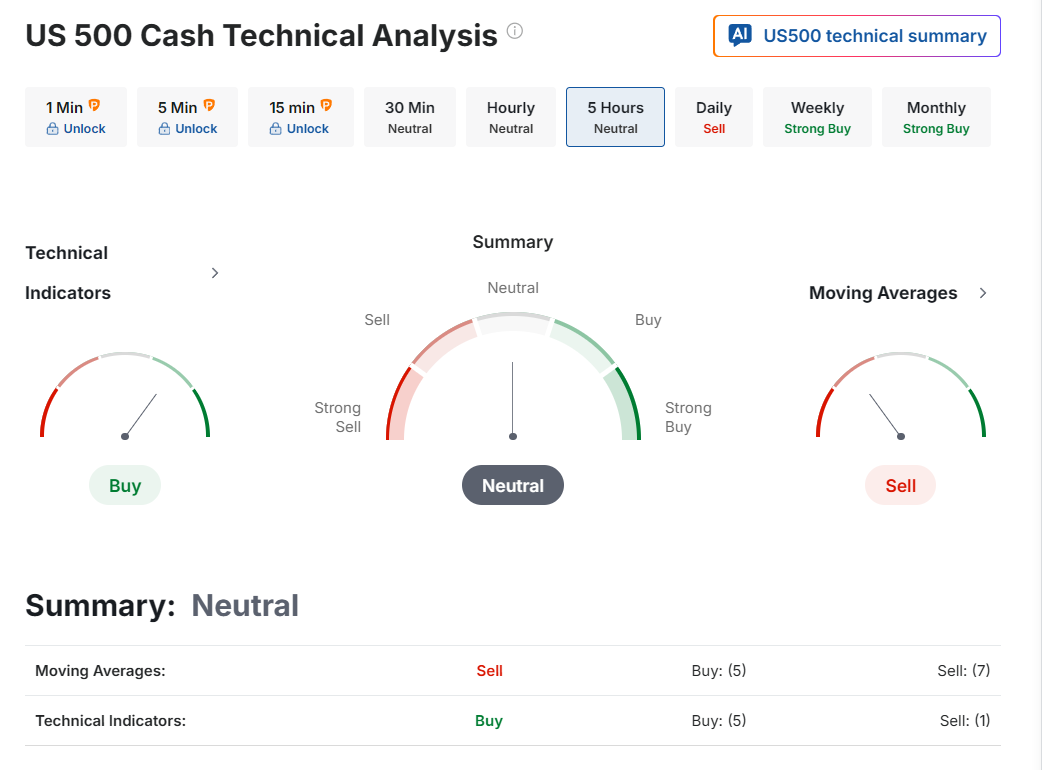

Bull trap or buy the dip?Markets stabilized yesterday. Does that mean the "buy the dip" is back in play or is this just a bull trap? I think its still too early to know. I do know I prefer the down to up markets. I just couldn't get anything really working yesterday. Risk was in check but the profits weren't. Here's a look at my day. Let's take a look at the markets Bulls fought back yesterday. This puts us back at some key resistance on most of the indices. Futures are back down this morning. I'm leaning more to a bull trap scenario. We start today with a neutral technical rating. That just means it's anybody's guess for direction today. March S&P 500 E-Mini futures (ESH26) are down -0.01%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.03% this morning as investors weigh a report that Iran recently signaled its willingness to give up its uranium stockpiles. The state-run Islamic Republic News Agency quoted Deputy Foreign Minister Majid Takht-Ravanchi as saying that Iran had told the U.S. in earlier talks it was ready to relinquish its stockpiles of highly enriched uranium for “something good in return.” Takht-Ravanchi made the remarks in a late Wednesday interview, the report said. Some positive corporate news is supporting stock index futures, with Broadcom (AVGO) climbing over +6% in pre-market trading after the semiconductor designer reported stronger-than-expected FQ1 results, issued above-consensus FQ2 revenue guidance, and CEO Hock Tan said AI chip sales are expected to exceed $100 billion next year. Also, Veeva Systems (VEEV) surged more than +11% in pre-market trading after the life sciences cloud solutions provider posted upbeat Q4 results and issued strong FY27 guidance. However, higher bond yields today are weighing on stock index futures. The 10-year T-note yield rose two basis points to 4.12% as investors worried that soaring energy prices from the Middle East conflict could fuel inflation. The price of WTI crude climbed more than +2% on Thursday amid growing disruptions to energy markets caused by the conflict. Investors now await a new round of U.S. economic data. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. Chip stocks climbed, with Intel (INTC) and Advanced Micro Devices (AMD) rising over +5%. Also, cryptocurrency-exposed stocks rallied after Bitcoin climbed more than +7%, with Coinbase Global (COIN) jumping more than +14% and Strategy (MSTR) surging over +10% to lead gainers in the Nasdaq 100. In addition, Moderna (MRNA) soared about +16% and was the top percentage gainer on the S&P 500 after the vaccine maker said it would pay $950 million to resolve patent litigation with Arbutus Biopharma and Genevant Sciences related to its Covid-19 shot. On the bearish side, GitLab (GTLB) slid over -6% after the provider of software development tools issued disappointing FY27 guidance. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 63K in February, stronger than expectations of 50K. Also, the U.S. ISM services index unexpectedly rose to 56.1 in February, stronger than expectations of a decline to 53.5. At the same time, the U.S. February S&P Global services PMI was revised downward to 51.7 from the preliminary reading of 52.3. “Investors interpreted the positive ISM services index, coupled with a softer price sub-index, as reasons to be optimistic that the U.S. economy could remain resilient amid geopolitical tensions,” Commerzbank Research analysts said. Fed Governor Stephen Miran said on Wednesday he believes it remains appropriate to continue cutting interest rates, as it is too early to assess the impact of the Middle East conflict on the U.S. economy. “Thus far, the evidence from events over the weekend hasn’t led me to change any of my forecasts for the labor market, for inflation,” Miran said. At the same time, Cleveland Fed President Beth Hammack said it was too early to assess the economic impact of the conflict and supported keeping interest rates unchanged for “quite some time.” Meanwhile, the Fed said on Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity expanded at a “slight to moderate pace” across most districts in recent weeks, although a growing number reported flat or declining activity. The report noted that in many districts “sales were dampened by economic uncertainty, increased price sensitivity and lower-income consumers pulling back on spending.” The report also said that employment levels were generally stable, while wages increased at a modest or moderate pace in most regions. In addition, eight of the Fed’s 12 districts reported moderate inflation. U.S. rate futures have priced in a 97.3% chance of no rate change and a 2.7% chance of a 25 basis point rate cut at the March FOMC meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 215K, compared to last week’s number of 212K. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q4 Unit Labor Costs to be +2.0% q/q and Nonfarm Productivity to be +1.9% q/q, compared to the third-quarter numbers of -1.9% q/q and +4.9% q/q, respectively. U.S. Import and Export Price Indexes will be released today as well. Economists anticipate the import price index to rise +0.3% m/m and the export price index to rise +0.3% m/m in January, compared to the previous figures of +0.1% m/m and +0.3% m/m, respectively. In addition, market participants will be looking toward a speech from Fed Vice Chair for Supervision Michelle Bowman. On the earnings front, prominent companies such as Costco Wholesale (COST), Marvell Technology (MRVL), Ciena (CIEN), and Kroger (KR) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.122%, up +0.96%. Todays educational training will focus on. 21 Questions for a Trading Plan. How to build your personalized plan. We sit on a streak of 35 trading days since our last bullish reading for the Mix. The uptrend of the S&P 500 appears to be tired and an 80%+ reading for the VIX Mix looks to be miles away. Unfortunately, this is no time to relax. Equity markets rebounded yesterday and our measures of volatility also improved. However, we ain’t out of the woods from what I watch. The VIX Mix picked up seven points but that was only enough to inch out of the “bear” slice into the “bearish” slice. 15 of 17 underlying components are in the red and none are bullish. Let's take a look at the intraday /ES levels for 0DTE trading today. 6870, 6882, 6900, 6916 are resistance levels. 6852, 6841, 6832, 6822 are support. Let's get some green today folks. I'm thinking another broken wing butterfly to get us started but lets see how we open up. See you in the live trading room shortly.

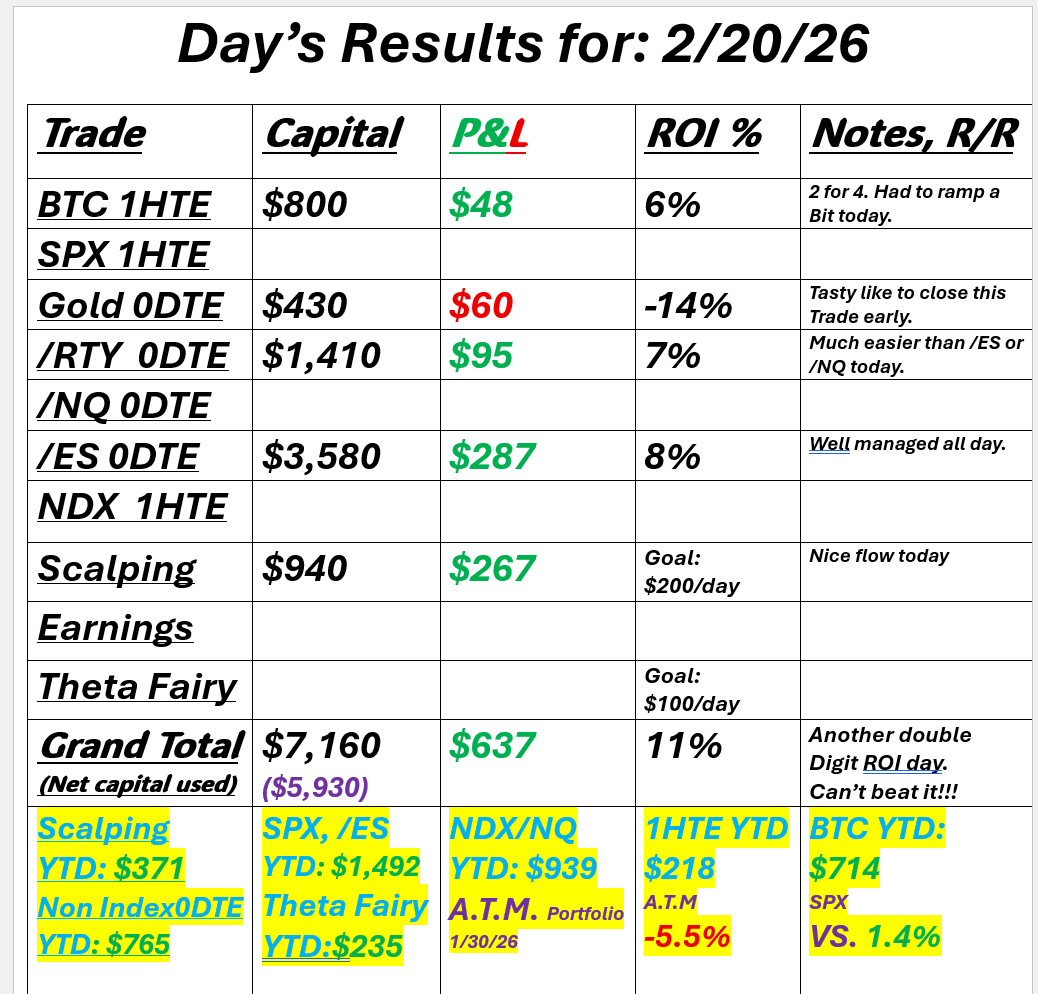

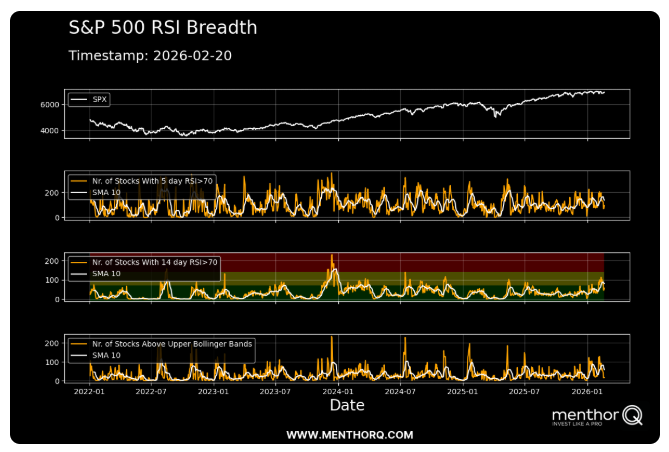

Have we found equilibrium?Markets gyrated wildly again yesterday. Futures this morning are relatively flat and stable. Is it finally time for the bulls to show their hand? I guess that's why we show up everyday...to find out! We had another solid day yesterday. I'll say it again. All things being equal, I prefer a down market to trade in. All good things do come to an end though. Here's a look at our day. I spent a good portion of the day baby sitting my open positions and never got anything working with scalping. That was probably a mistake. Let's take a look at the markets this morning. We're still sitting on a slight sell signal to start the morning. The trend continues to be down, with lots of green candles. How's that work? We start the day low and work our way back up. Bulls really are trying to hold it all together. March S&P 500 E-Mini futures (ESH26) are down -0.01%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.09% this morning, giving up earlier gains after U.S. Treasury Secretary Scott Bessent said a proposed 15% global tariff could take effect this week. Stock index futures initially moved higher after The New York Times reported on Wednesday that operatives from Iran’s Ministry of Intelligence used backchannels to reach out to the Central Intelligence Agency a day after the U.S.-Israeli attacks began. However, the report said U.S. officials were doubtful that either the Trump administration or Iran was ready for an off-ramp. WTI crude gave up earlier gains to trade near $75 a barrel following the report. President Trump said on Tuesday the U.S. would offer insurance guarantees and naval escorts to ensure safe passage for oil tankers and other vessels through the Strait of Hormuz, steps aimed at preventing a potential energy crisis caused by the conflict. “This is welcome news, but clearly it won’t happen overnight,” said ING analysts. Investors are also awaiting the U.S. ADP employment report as well as an earnings report from semiconductor designer Broadcom. In yesterday’s trading session, Wall Street’s major indexes ended in the red. Chip stocks sank, with Micron Technology (MU) slumping about -8% to lead losers in the Nasdaq 100 and KLA Corp. (KLAC) sliding more than -6%. Also, mining stocks plummeted as gold and silver prices retreated, with Hecla Mining (HL) tumbling over -11% and Coeur Mining (CDE) plunging more than -10%. In addition, MongoDB (MDB) cratered over -22% after the document database company issued weak guidance for FQ1 adjusted EPS and FY27 revenue. On the bullish side, Best Buy (BBY) climbed more than +7% after the electronics retailer reported better-than-expected Q4 adjusted EPS. New York Fed President John Williams said on Tuesday that further rate cuts would be appropriate if inflation continues to ease once the bulk of the tariff impact has faded. “If inflation follows the path I expect, further reductions in the federal funds rate will eventually be warranted to prevent monetary policy from inadvertently becoming more restrictive,” Williams said. Speaking at a separate event, Williams said the impact of the Middle East conflict on financial markets had so far been “reasonably muted,” adding that oil prices had risen, though not yet “in a dramatic way.” Minneapolis Fed President Neel Kashkari, who had penciled in one rate cut this year, said the attacks on Iran have made him less confident in that outlook. “Now, with the geopolitical events, we need to get a lot more data in,” Kashkari said. He added that the key question for inflation at the moment is how persistent higher energy prices will be. Meanwhile, U.S. rate futures have priced in a 97.3% probability of no rate change and a 2.7% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. Today, investors will focus on the U.S. ADP private payrolls report, which is set to be released in a couple of hours. Economists, on average, forecast that the February ADP Nonfarm Employment Change will stand at 50K, compared to the January figure of 22K. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will also be closely monitored today. Economists expect the February ISM services index to be 53.5 and the S&P Global services PMI to be 52.4, compared to the previous values of 53.8 and 52.7, respectively. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be 3.0 million barrels, compared to last week’s value of 16.0 million barrels. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. On the earnings front, notable companies such as Broadcom (AVGO), Veeva Systems (VEEV), and Okta (OKTA) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.081%, up +0.62%. For today's training, we'll jump into some finer points on the overview of these books that we started on Monday. Come join us! Investors now hold the most put protection in history! This is considered a bullish signal. Pretty chunky backwardation in the VIX curve now...most since last Nov...not fool-proof, but it's usually a good indicator of sentiment reaching an extreme and thus signalling a potential market turning point... SPX breadth remains constructive, though participation has moderated in the short term. The number of stocks trading above their 20- and 50-day moving averages is holding in the mid-range of recent observations rather than at the highest expansion levels, indicating steady but not accelerating participation across the index. Shorter-term breadth, measured by the percentage of stocks above the 5-day moving average, has shown more variability, reflecting ongoing sector rotation beneath the surface of the broader index. This combination of stable intermediate breadth and more volatile short-term participation reflects a market environment where internal activity is rotating rather than expanding broadly. Let's take a look at our intraday /ES levels. 6857, 6871, 6882, 6911 are resistance levels. 6833, 6812, 6801, 6775 are support. NOTE: These levels seem a bit more "fluid" this morning. It's likely we'll be adjusting these as the day gets started. Stay tuned in the chat room for updates. This market downturn sure has been good to us. Let's see if we can keep our win streak alive today! See you all shortly in the live trading room.

Well, that worked our as planned.We waited for the bombs to drop. We entered our longs on the drop and anticipated the retrace. It went well for us and we were done right after our Gold trade expired. Here's a look at our day. We also made some good progress on our ATM portfolio last month. The market came down. Our values came up. We should have a good shot of getting ahead of the market this week if our setups flow. Let's take a look at the markets this morning. Volatility is still in play (thankfully). The price action is grand. Technicals are still pegged to sell mode. Let's hope that continues for the foreseeable future. Bulls put up a valiant effort yesterday to recover the early selling but they've got another wave of sellers to deal with this morning. March S&P 500 E-Mini futures (ESH26) are trending down -1.77% this morning as the Middle East conflict has entered its fourth day with no signs of de-escalation, driving oil prices higher and stoking inflation concerns. Israel targeted sites in Tehran and Beirut early on Tuesday, while Iran struck the U.S. Embassy in the Saudi capital of Riyadh, prompting President Trump to pledge retaliation. Also, Israel deployed troops into southern Lebanon, where the Iran-backed Hezbollah militia is based. President Trump maintained there was no fixed timeline, while Secretary of State Marco Rubio warned that “the hardest hits are yet to come.” The price of WTI crude surged more than +7%, adding to yesterday’s gains as concerns over access to the vital Strait of Hormuz intensified after an Iranian commander threatened to set fire to ships attempting to pass through. U.S. Treasury yields climbed on Tuesday amid concerns that higher oil prices would feed into inflation, potentially delaying or derailing further Fed rate cuts. The International Monetary Fund said on Tuesday that attacks by the U.S. and Israel on Iran, and Tehran’s response, have made the global economic outlook more uncertain, though it is still too early to assess the impact. “That impact will depend on the extent and duration of the conflict,” the IMF said. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. Defense stocks advanced following the U.S.-Israeli strikes on Iran, with Northrop Grumman (NOC) rising over +6% to lead gainers in the S&P 500 and RTX Corp. (RTX) gaining more than +4%. Also, energy stocks climbed as the price of WTI crude jumped more than +6%, with Marathon Petroleum (MPC) and Valero Energy (VLO) advancing over +5%. In addition, cryptocurrency-exposed stocks gained after Bitcoin rose more than +5%, with Strategy (MSTR) climbing over +6% to lead gainers in the Nasdaq 100 and Coinbase Global (COIN) advancing more than +5%. On the bearish side, AES Corp. (AES) plunged over -17% and was the top percentage loser on the S&P 500 after the clean-energy company agreed to be acquired by a consortium led by BlackRock’s GIP and EQT for $15 per share. “Uncertainty about oil prices may play a big role in determining broader market sentiment,” said Chris Larkin at E*Trade from Morgan Stanley. “There are more questions than answers right now, but a stabilizing energy picture could have a positive ripple effect, while concerns about a longer-term disruption could have the opposite.” Economic data released on Monday showed that the U.S. February ISM manufacturing index fell to 52.4, stronger than expectations of 51.7. At the same time, the ISM’s gauge of prices paid for manufacturing inputs climbed to 70.5 in February, the quickest pace since 2022, fueling concerns about a resurgence of inflation and leading traders to scale back their bets on Fed rate cuts. Meanwhile, U.S. rate futures have priced in a 97.2% chance of no rate change and a 2.8% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. Today, investors will focus on earnings reports from several high-profile companies. Cybersecurity firm CrowdStrike (CRWD), along with prominent retailers Ross Stores (ROST), Target (TGT), and Best Buy (BBY), are scheduled to report their quarterly results. Market participants will also parse comments today from New York Fed President John Williams and Minneapolis Fed President Neel Kashkari. The U.S. economic data slate is mainly empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.100%, up +1.21%. Can we just pause for a moment to give thanks to this awesome price action? The cash markets haven't even opened yet and we could call it a day right now and be happy with our results. Our /ES 0DTE trade is almost to our take profit level. Our Gold 0DTE is close as well. It certainly takes the pressure off when you are starting the day already sitting on some great profits! Let's take a look at our intraday levels on /ES. 6798, 6815, 6831, 6845, 6837 are resistance. 6775, 6768, 6750, 6735, 6714 are support. It looks like another beautiful day for us traders. The seeds we sowed yesterday are bringing a bountiful harvest to us this morning. Enjoy the day! See you in the live trading room shortly!

Right on scheduleThis morning shouldn't be a surprise to anyone who follows our trading room. We've been hoarding cash and preparing for this for almost two weeks. We also know how this "should" play out. Here's a synopsis of how the markets reacted this morning. Short-Term Outlook (Next 1-2 Weeks)

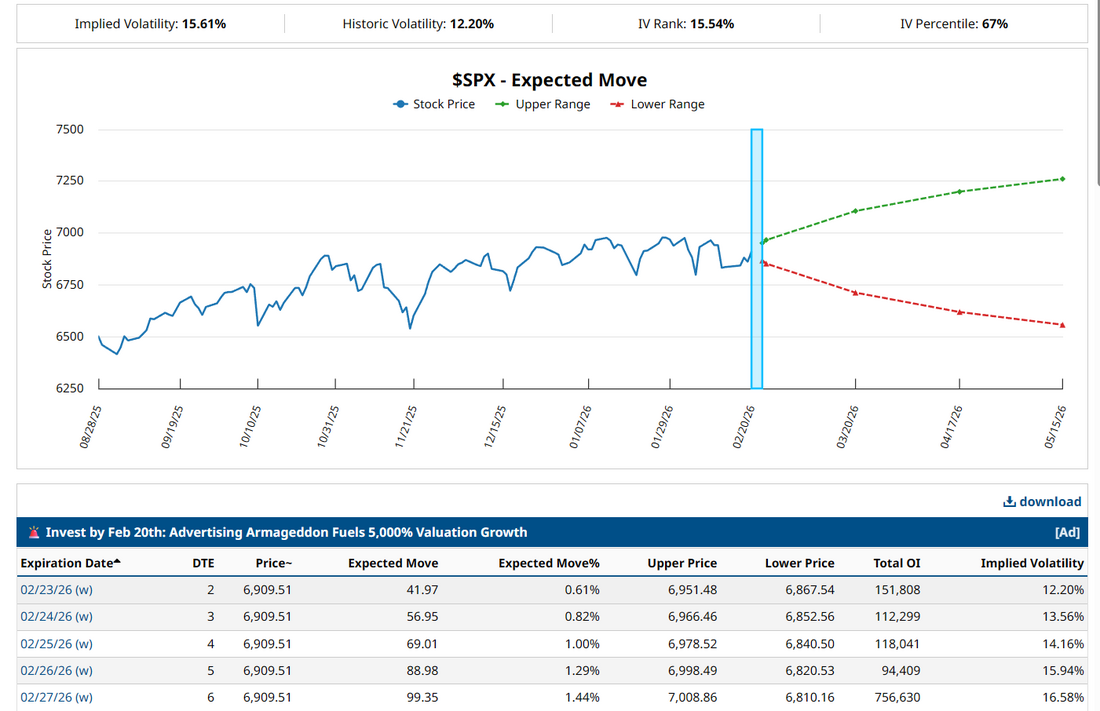

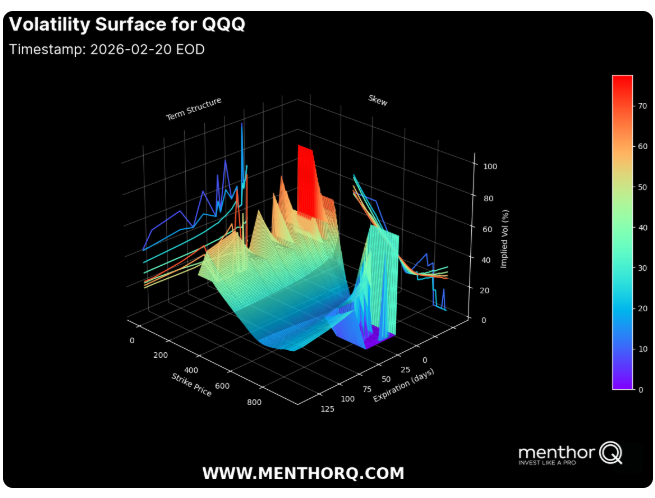

We know the play book here. Risk off for a bit then the "buy the dip" comes back in. We have been waiting for today. We'll play Gold and /ES in our 0DTE trading room and Oil in our ATM portfolio. Todays an exciting one! We had a stellar day on Friday. Basically, everything we touched turned to gold (including our gold trade) Let's look at the markets. Indices stabilized Friday, with no directional help being given. No surprise. Technicals are flashing sell signals this morning. March S&P 500 E-Mini futures (ESH26) are down -1.05%, and March Nasdaq 100 E-Mini futures (NQH26) are down -1.44% this morning as sentiment took a hit after the U.S. and Israel exchanged deadly strikes with Iran across the Middle East. On Saturday, the U.S. and Israel carried out a coordinated military strike on Iran. U.S. President Donald Trump said the military operation began after Iran refused to commit to renouncing nuclear weapons, even though Tehran has repeatedly maintained it is not pursuing them. Iran’s supreme leader was killed in U.S.-Israeli airstrikes, escalating a conflict that is spreading across the oil-rich Middle East. Iran quickly retaliated with strikes on Israel, U.S. military bases throughout the region, and Persian Gulf nations, including the financial hub of Dubai. On the third day of the conflict, U.S. and Israeli forces continued their strikes on Iran, while Israel also targeted Hezbollah positions in Lebanon. President Trump said the bombing campaign in Iran would continue, potentially for weeks, and urged the nation’s leaders to capitulate. The price of WTI crude jumped more than +7% after the conflict effectively closed the Strait of Hormuz. Safe-haven assets attracted strong demand, with gold climbing to nearly $5,400 an ounce and the dollar posting its biggest gain in almost a month. Beyond the Middle East conflict, investors are looking ahead to a slew of U.S. economic data, with a particular focus on Friday’s nonfarm payrolls report, earnings reports from several high-profile companies, and remarks from Federal Reserve officials this week. In Friday’s trading session, Wall Street’s major equity averages ended in the red. Bank stocks slumped amid investor unease following the recent collapse of U.K. mortgage firm Market Financial Solutions Ltd., with Goldman Sachs (GS) sinking over -7% and Morgan Stanley (MS) falling more than -6%. Also, chip stocks extended their declines, with Nvidia (NVDA) sliding over -4% and NXP Semiconductors N.V. (NXPI) dropping more than -2%. In addition, software stocks sank, with Atlassian (TEAM) falling over -5% and Datadog (DDOG) slipping more than -3%. On the bullish side, Dell Technologies (DELL) jumped over +21% and was the top percentage gainer on the S&P 500 after the tech hardware maker posted upbeat Q4 results and issued strong FY27 AI server revenue guidance. Economic data released on Friday showed that the U.S. producer price index for final demand rose +0.5% m/m and +2.9% y/y in January, stronger than expectations of +0.3% m/m and +2.6% y/y. Also, the core PPI, which excludes volatile food and energy costs, rose +0.8% m/m and +3.6% y/y in January, stronger than expectations of +0.3% m/m and +3.0% y/y. At the same time, the U.S. Chicago PMI unexpectedly rose to 57.7 in February, stronger than expectations of 52.0. In addition, U.S. December construction spending rose +0.3% m/m, stronger than expectations of +0.2% m/m. “For the past month the market has been worried about [AI] disruption and its impact on the labor market, so inflation hasn’t been top of mind, but [Friday’s] inflation readings could give the Fed another reason to be more patient with rate cuts and wait until the second half of the year before making any changes,” said Chris Zaccarelli at Northlight Asset Management. Investors will be closely watching the U.S. February Nonfarm Payrolls report this week amid uncertainty over when the Fed is likely to deliver its next interest rate cut. U.S. rate futures currently are not pricing in a rate cut before July at the earliest. Economists said it would probably take a notably weak number to significantly shift rate-cut expectations. “Our view is that it would take quite a lot to get the Fed thinking about an imminent rate cut,” ING economists said. U.S. retail sales data for January will also attract attention. Other noteworthy data releases include ADP Nonfarm Employment Change, the S&P Global Services PMI, the S&P Global Composite PMI, the ISM Non-Manufacturing PMI, the Trade Balance, Initial Jobless Claims, the Import Price Index, the Export Price Index, Unit Labor Costs (preliminary), Nonfarm Productivity (preliminary), Average Hourly Earnings, the Unemployment Rate, and Consumer Credit. Market watchers will also focus on earnings reports from several high-profile companies. Semiconductor leaders Broadcom (AVGO) and Marvell Technology (MRVL), as well as cybersecurity firm CrowdStrike (CRWD), along with several prominent retailers such as Costco Wholesale (COST), Target (TGT), and Best Buy (BBY), are scheduled to report their quarterly results this week. In addition, the Fed will release its Beige Book survey of regional business contacts this week, providing anecdotal insight into economic conditions across the country. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. Market participants will also parse comments from a host of Fed officials, including Williams, Kashkari, Bowman, Daly, Paulson, and Hammack, throughout the week. Meanwhile, Apple has hinted at a “big week” of new product launches, beginning Monday morning. The iPhone maker is expected to unveil several new products, potentially including the iPhone 17e and a lower-cost MacBook, over several days. Today, investors will focus on the U.S. ISM Manufacturing PMI, set to be released in a couple of hours. The survey will be closely monitored for insights into the state of the U.S. economy. Economists project the February ISM manufacturing index to be 51.7, compared to the previous value of 52.6. The U.S. S&P Global Manufacturing PMI will also be released today. Economists forecast that the final February figure will be unrevised at 51.2. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.962%, up +0.10%. Let's look at the expected move for the week in SPX. 1.50% Yes! That should give us some premium to work with. I pointed this out a couple of weeks ago but worth revisiting... it's not healthy. We're about 2% off all-time highs. Feels fine. Looks calm. Nothing to see here. But look at this chart. These red dots — each one represents a day where 115 or more individual stocks fell at least 7% in a single session within an 8-day rolling window. These are blowups happening under the surface. And you see these clusters of red dots? They typically happen when the market is in a severe drawdown, -34% on average. So, now what. Today's training will be another good one. Today we'll be focusing on the 10 Books That Train Your Brain to Think in Numbers (While Most People Avoid Math) These are great additions to any traders knowledge bank. SPX remains near recent highs, with breadth improving as approximately 300+ stocks trade above their 200-day moving averages. This marks a recovery from prior lower-zone readings and reflects broader participation compared to the earlier dip. Current breadth levels sit in the mid-range relative to recent history and remain below the stronger 350–400 zone that has accompanied broader expansion phases in the past. The index is therefore positioned with improved but not extreme participation. At present, price structure remains elevated while breadth reflects stabilization rather than broad overextension. QQQ’s volatility surface shows a pronounced front-end bid, with elevated implied volatility concentrated in near-term expirations and deeper out-of-the-money strikes, reflecting demand for short-dated protection and event-sensitive hedging. The skew remains firm, as downside strikes carry meaningfully higher implied vols than at-the-money levels, signaling persistent tail-risk pricing. Further out the curve (2–4 months), vols normalize and flatten, suggesting the market views current uncertainty as more tactical than structural. Overall, the surface points to cautious short-term positioning and active gamma flows in the front week, while longer-dated expectations remain comparatively anchored. This reflects options positioning dynamics only, not financial advice. PEC+ recently announced a modest output increase of approximately 206,000 barrels per day amid heightened geopolitical risk following US–Israeli strikes on Iran and ongoing concerns surrounding the Strait of Hormuz. Crude prices have rebounded from the mid-50s/low-60s range into the mid-60s during this period of elevated risk sensitivity. Q-CTA positioning has shifted back into positive territory after a prolonged period of choppy and lighter exposure, indicating that systematic trend-following allocations have increased alongside the recent price recovery. Current positioning levels are positive but not at historical extremes relative to prior trend phases. Overall, commodity positioning reflects renewed but measured systematic participation rather than stretched allocation conditions. Let's take a look at our intraday levels for today's 0DTE entries. 6825, 6839, 6850, 6859 are resistance levels. 6817, 6804, 6800, 6778 are support levels. Today should give us all we want for potential. Now it's up to us to capitalize. We've already got a gold and /ES 0DTE working so we'll look to build off those today. See you all in the live trading room shortly!

When do trend again?This year has been a whole lot of nothing. Talk about range bound! At some point we know that consolidation WILL lead to expansion and a new trend (bullish or bearish) will take hold. For now, we just trade the chop. One day down...another day up. It's hard to find meaning in the price action. NVDA sold off just as I predicted but not soon enough for my short scalps. The market got hit hard in the morning session but rebounded into the close. Does the red day mean more bearishness or does the bulls fighting back at the close mean we are going to push higher? Right now I favor the downside odds. Here's a look at our day yesterday. It wasn't huge but we finished green and considering I started the scalping day in the hole and the nasty price action, I have to say, I'm pretty darn happy with our day. Here's a look at it. We've already got one 0DTE working this morning on Gold. It's nicely profitable already. We've got a working entry on the put side that looks likely to NOT fill. Let's take a look at the markets. As mentioned above, We are going nowhere fast. (Or slow). We need the SPY to break below 677, I believe, to get some real selling to take hold. Technicals are bearish to start us off this morning. We finished up another excellent training session yesterday on the book "First loser wins". Next week should be some more really great training. Be sure to tune in on Monday , Weds. and Thrus. live zoom sessions for those. March S&P 500 E-Mini futures (ESH26) are trending down -0.41% this morning as investors continue to trim exposure to risky assets at the end of a volatile month. The price of WTI crude rose over +2% as investors remained wary of potential supply risks in the Middle East, even after positive signals from nuclear talks between the U.S. and Iran on Thursday. Negotiations between the two countries will resume next week. Investors are now turning their attention to crucial U.S. producer inflation data. In yesterday’s trading session, Wall Street’s major indices closed mixed. Chip stocks sank, weighed down by a more than -5% drop in Nvidia (NVDA) after the chipmaker’s stronger-than-expected Q4 results and Q1 guidance failed to reassure investors seeking clarity on AI. Also, Universal Health Services (UHS) tumbled over -11% and was the top percentage loser on the S&P 500 after the company posted downbeat Q4 results. In addition, The Trade Desk (TTD) slid more than -4% after the advertising technology company provided below-consensus Q1 revenue guidance. On the bullish side, software stocks climbed, with Atlassian (TEAM) rising over +8% to lead gainers in the Nasdaq 100 and Datadog (DDOG) advancing more than +5%. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose by +4K to 212K, compared with the 217K expected. The report indicated that layoffs remain relatively low. Meanwhile, UBS said on Friday that it had lowered its recommended allocation to U.S. equities to Neutral. Strategists Andrew Garthwaite and Marc El Koussa pointed to factors such as the relatively lower sensitivity of U.S. corporate earnings to global growth, elevated valuations, a trend of funds diversifying away from the U.S., and downside risks to the dollar. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. The PPI will provide further insight into the outlook for inflation. Economists, on average, forecast that the U.S. January PPI will stand at +0.3% m/m and +2.6% y/y, compared to the previous figures of +0.5% m/m and +3.0% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect January figures to be +0.3% m/m and +3.0% y/y, compared to +0.7% m/m and +3.3% y/y in December. The U.S. Chicago PMI will be released today. Economists forecast the February figure at 52.0, compared to the previous value of 54.0. The U.S. Construction Spending report for December will be released today as well. The report was originally scheduled for release on February 2nd, but was delayed due to the fallout from the longest-ever government shutdown. Notably, the release will also incorporate the November figures. Economists expect construction spending to rise +0.2% m/m in December. U.S. rate futures have priced in a 96.1% chance of no rate change and a 3.9% chance of a 25 basis point rate cut at next month’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.989%, down -0.70%. The IWM is the only index that's having any strength so far this year. It continues to be a primary focus for us in our ATM portfolio. The Hindenburg Omen, an indicator that correctly detected the 1987 and 2008 stock market crashes, has been triggered for the 5th time over the last month We are entering a "risk off" environment. Let's take a look at our key intraday levels on /ES for todays setups. It looks like we've got some pretty solid levels to work off today. 6886, 6893, 6900, 6925 are resistance levels. 6870, 6857, 6850, 6835 are support levels. PPI is out. Higher than forecast. Does that change the probability of rate cuts? See you all in the live trading room shortly! Let's finish the day and week green!

Waiting on Iran dispositionMore Iranian discussions ongoing today. Trump has extended the timeframe out to next week before deciding on military action. Will they achieve a resolution today? I highly doubt it. Keep this is your back pocket. We know the knee jerk reaction and subsequent buying that happens when these military events occur. We had two big earnings reports yesterday. NVDA and CRM. Pre market this morning they both appear to be playing out as we thought yesterday. NVDA is flat and CRM is down. Not enough movement out of NVDA to really move the futures. We had a good training session yesterday on sizing for zero and that's exactly how our 0DTE played out. Fortunately our Gold 0DTE worked out better than expected and allowed us a slight positive on our day trades. Unfortunately I went big on my scalping with three contracts and of course, that seems to be the days that I'm on the wrong side of the market. It took away all my scalping profits from the last two months. We'll be back at it today (with a smaller position size). Here's a look at my day: We have an initial structure of our 0DTE for today already working. We'll continue to build this out today but so far here's what we have. March S&P 500 E-Mini futures (ESH26) are down -0.05%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.09% this morning, pointing to a muted open on Wall Street as investors digest earnings from AI bellwether Nvidia, while nuclear talks between the U.S. and Iran have begun. Nvidia (NVDA) rose about +0.6% in pre-market trading after the chipmaker posted stronger-than-expected Q4 results and provided Q1 revenue guidance that smashed Wall Street expectations. However, investors delivered a muted response to the chip giant’s results as doubts lingered over whether strong AI sales can be sustained. Investor attention is now squarely on a third round of high-stakes nuclear talks between the U.S. and Iran in Geneva. The semi-official Iranian Students’ News Agency reported that the two sides are holding negotiations through mediator Oman at its embassy in Geneva. U.S. President Donald Trump had set a March 1-6 deadline for Tehran to reach an agreement and has threatened military strikes if it does not comply. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Axon Enterprise (AXON) jumped over +17% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the maker of Taser stun guns reported upbeat Q4 results and provided strong FY26 revenue growth guidance. Also, cryptocurrency-exposed stocks rallied after Bitcoin climbed more than +7%, with Coinbase Global (COIN) surging over +13% and Strategy (MSTR) gaining more than +8%. In addition, software stocks advanced, with Thomson Reuters (TRI) climbing over +10% and Intuit (INTU) rising more than +6%. On the bearish side, GoDaddy (GDDY) plunged over -14% and was the top percentage loser on the S&P 500 after the domain registrar and web hosting company issued below-consensus FY26 revenue guidance. Kansas City Fed President Jeff Schmid on Wednesday repeated his concerns about inflation but stopped short of outlining how monetary policy should respond. “I think we have work to do on the inflation side of things,” Schmid said. “I think we’re in a pretty good place for employment,” he added. Also, St. Louis Fed President Alberto Musalem said he believes the current U.S. policy rate setting appropriately balances prevailing economic risks. Meanwhile, U.S. rate futures have priced in a 98.0% probability of no rate change and a 2.0% chance of a 25 basis point rate cut at the next FOMC meeting in March. In tariff news, U.S. Trade Representative Jamieson Greer said on Wednesday that President Trump will sign a directive in the coming days raising his global tariff to 15% “where appropriate” and is seeking “continuity” with countries that have reached trade deals. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 217K, compared to last week’s number of 206K. Also, Fed Vice Chair for Supervision Michelle Bowman is set to testify today before the Senate Committee on Banking, Housing, and Urban Affairs at a hearing titled “Update from the Prudential Regulators.” On the earnings front, high-profile companies such as Intuit (INTU), Monster Beverage (MNST), Dell Technologies (DELL), Vistra (VST), and CoreWeave (CRWV) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.047%, down -0.05%. Today's training will circle back to a book that we've reviewed before. Today I want to hit on some points that we didn't stress in the last review. It's a great book and a recommended read for any serious trader. The last three times the monthly RSI hit 75+, the following month was red. And it was red by -5%, -11%, and -5%, respectively. Are we due for one an overdue pullback in March now that we currently hit a monthly RSI of 75+? US Federal Budget Deficit as a % of GDP... 1950s: -0.4% 1960s: -0.7% 1970s: -1.9% 1980s: -3.8% 1990s: -2.1% 2000s: -2.3% 2010s: -4.8% 2020s: -8.3% The trend is NOT our friend here folks. Let's take a look at the markets this morning. Bullish technicals after yesterdays big push up. Gap up and strong bullish day yesterday. It puts most of the key indices back to key levels. Can bulls continue to push today? Let's take a look at the intraday /ES levels. 6963, 6984, 7000, 7020 are resistance levels with 6950, 6942, 6927, 6911 working as support levels. Our /ES 0DTE this morning currently is showing $25 risk for a potential $475 profit. That's a good starting point for today. Let's see what we can do to continue working it today. I'll see you all shortly in the live trading room.

All eyes on Nvidia this afternoonNVDA reports it's earnings today after the close. It's likely to be a market moving event. We are looking at it as a possible trigger to either get a 1DTE /ES entry started for tomorrow or a Theta fairy entry so stay with us after the close to get that trade started. We had another strong day yesterday with everything we touched making money. Our ROI was double digits which is a home run day for us. Here's a look at the results. Let's take a look at the markets. Yesterday continued the theme of back and forth. Nearly two months into the new year and markets have essentially gone nowhere. Futures are green this morning after Trumps state of the Union address. We have bullish bias to start the trading session. March Nasdaq 100 E-Mini futures (NQH26) are trending up +0.17% this morning as investors look ahead to an earnings report from chip giant Nvidia, whose results have become a barometer for the AI trade. In yesterday’s trading session, Wall Street’s major indexes closed higher. Software stocks advanced, led by a more than +11% surge in Thomson Reuters (TRI) after the company said its legal-and-compliance platform, CoCounsel, has topped 1 million users. Also, Advanced Micro Devices (AMD) climbed more than +8% to lead chipmakers higher after Meta Platforms said it will deploy 6 gigawatts of data center capacity powered by the company’s processors. In addition, Keysight Technologies (KEYS) jumped over +23% and was the top percentage gainer on the S&P 500 after the electronics test equipment manufacturer posted upbeat FQ1 results and provided strong FQ2 guidance. On the bearish side, Expeditors International of Washington (EXPD) slumped more than -7% and was the top percentage loser on the S&P 500 after the company reported weaker-than-expected Q4 operating income. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index rose to 91.2 in February, stronger than expectations of 87.4. At the same time, the U.S. December S&P/CS HPI Composite - 20 n.s.a. rose +1.4% y/y, stronger than expectations of +1.3% y/y. In addition, the U.S. Richmond Fed manufacturing index fell to -10 in February, weaker than expectations of -8. Chicago Fed President Austan Goolsbee said on Tuesday that additional rate cuts hinge on progress in bringing down inflation. He also said the tariffs ruling “could bring relief to the inflation side” of the Fed’s mandate. Also, Atlanta Fed President Raphael Bostic said inflation has “stalled out” over the past 12 to 18 months at a level that remains “unacceptably” above the Fed’s 2% target. In addition, Boston Fed President Susan Collins said, “I think that it’s quite likely that it will be appropriate to hold the current range for some time. After 175 basis points of easing over the past year and a half, we are at mildly restrictive, perhaps quite close to neutral already.” U.S. rate futures have priced in a 98.0% chance of no rate change and a 2.0% chance of a 25 basis point rate cut at the next central bank meeting in March. Investors currently do not anticipate a rate cut until at least midyear. Meanwhile, President Trump, in his address to Congress, reaffirmed his commitment to tariffs but did not announce any new policies. The president voiced confidence that foreign countries would honor their trade agreements and even predicted that the U.S. would generate so much revenue that it could “substantially replace the modern day system of income tax.” Investors are keenly awaiting Nvidia’s fourth-quarter earnings report, scheduled for release after the market close. Wall Street analysts and investors are bullish heading into the report, expecting the chipmaker to beat expectations and deliver strong guidance for the current quarter. The report will come after a period of muted share performance, as investors rotated out of megacap stocks. “We see no reason for Nvidia not to report a good quarter, at least maintaining the current trajectory of 50%+ growth,” said Gil Luria at D.A. Davidson. “Its main customers, Amazon, Google, Microsoft, and Meta have maintained or increased significant capex growth guidance for this year that easily supports this trajectory.” Retailers such as The TJX Companies (TJX) and Lowe’s (LOW), along with prominent companies like Salesforce (CRM), Synopsys (SNPS), Snowflake (SNOW), and Zoom Communications (ZM), are also set to report their quarterly figures today. Market participants will also hear perspectives from Richmond Fed President Tom Barkin, Kansas City Fed President Jeff Schmid, and St. Louis Fed President Alberto Musalem throughout the day. On the economic data front, investors will focus on the EIA’s weekly crude oil inventories report, set to be released in a couple of hours. Economists expect this figure to be 1.8 million barrels, compared to last week’s value of -9.0 million barrels. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.052%, up +0.47%. SPX remains near recent highs, while MACD breadth reflects a moderate level of participation. The number of stocks registering fresh MACD buy signals has been moving sideways rather than expanding, indicating stable but not accelerating internal momentum. Current breadth readings sit below prior expansion peaks, suggesting participation has neither broadened significantly nor deteriorated materially in recent sessions. Price continues to trade within its elevated structure while momentum indicators reflect consolidation rather than extension. This configuration highlights a period of internal stabilization within an otherwise firm price environment. NDX 1-month skew remains in pronounced put-bias territory, with the 25D risk reversal positioned near the upper end of its recent three-month range and around the 97th percentile. This reflects elevated relative demand for downside protection compared to upside call exposure. Implied volatility remains asymmetrically priced toward downside strikes, while at-the-money volatility is comparatively stable. The persistence of elevated skew indicates continued emphasis on hedging activity within the near-term tenor. Overall, the volatility surface reflects concentrated downside convexity demand without a broad repricing of longer-dated volatility expectations. NVDA will become the focus after the close today. Let's take a look at some numbers. I.V. is 96.87% which is high but not necessarily for an earnings event. Expected move is between 205-182.5. That's a pretty tight range based on past moves. Premium skew is to the downside. The stock has been range bound between 105 and 180 going back to late last year. What am I anticipating? NVDA's numbers should be stellar, once again. Margins are great and they are selling everything they can make and their making it as fast as they can. It's not really complicated. The question is how the stock will react. I think we will, once again, get a buy the rumor, sell the news event. There is a repricing of the AI trade. NVDA's stock reaction will be an ratification of that. It's not an expensive stock with a PEG ratio below .50 Regardless of the move, it should create some entry opportunities for us this afternoon. Stay tuned. Let's take a look at our intraday /ES levels for our 0DTE entries today. I should mention, we got a fill on our Gold entry late yesterday. That (now) 0DTE is profitable. I want to lock in that profit as soon as possible this morning. 6930, 6951, 6968 are resistance levels with 6917, 6901, 6885, 6875 working as support levels. Todays training will continue from Mondays start on sizing to zero as a trading strategy. This is another good one that should go into your trading library. Come join us! We are already starting today with some working trades. We have a short scalp on. Our Gold trade is profitable. We'll see what we can do with 1HTE's on BTC this morning. Price action is a bit harder today. See you all soon in the live trading room. Let's make some money!

Netflix and EarnI had a losing /ES 0DTE trade yesterday, and that also compounded the fact that I didn't get much else working. The trade was close, but that's how it goes sometimes. Not to take defeat lightly, I set up the laptop. Got the wife and dogs on the couch, and we traded BTC with the 1HTE setups while watching Netflix before going to bed. That was enough to get us green on the day. Don't say I never go the extra mile to give us the best shot at profits that I can! Hopefully today's "work day" is a bit shorter. Here's a look at the day's results. Let's take a look at the markets. We essentially continue to go nowhere. Weakness in AI stocks continues to weigh on the QQQ's. Technicals aren't great going into this mornings session. March S&P 500 E-Mini futures (ESH26) are down -0.04%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.21% this morning as sentiment remains cautious following yesterday’s selloff on Wall Street triggered by concerns over the disruptive impact of AI. Investors are awaiting U.S. President Donald Trump’s State of the Union address, a new round of U.S. economic data, and comments from Federal Reserve officials. In yesterday’s trading session, Wall Street’s main stock indexes ended in the red. International Business Machines (IBM) plunged over -13% and was the top percentage loser on the S&P 500 and Dow after AI startup Anthropic said its Claude Code tool could be deployed to modernize a programming language used on IBM systems. Also, shares of big banks and other financial services firms slumped after a report from Citrini Research ignited fresh concerns about the economic fallout from AI, with Capital One Financial (COF) sliding more than -8% and JPMorgan Chase (JPM) dropping over -4%. In addition, software stocks sank, with Datadog (DDOG) tumbling more than -11% to lead losers in the Nasdaq 100 and Atlassian (TEAM) plunging over -9%. On the bullish side, PayPal Holdings (PYPL) climbed more than +5% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Bloomberg reported that the company was attracting takeover interest from potential buyers. “The AI disruption story probably hasn’t run its course yet,” said Chris Larkin at E*Trade from Morgan Stanley. Economic data released on Monday showed that U.S. factory orders fell -0.7% m/m in December, weaker than expectations of -0.4% m/m. Fed Governor Christopher Waller said on Monday that his decision on whether to back an interest rate cut at the central bank’s March meeting will depend on upcoming labor-market data. “If these data support the idea of an improvement in the labor market in January that continued in February, along with additional progress toward 2% inflation, that could result in my outlook turning a bit more positive and my view of appropriate monetary policy may tilt toward a pause at our upcoming meeting,” Waller said. U.S. rate futures have priced in a 95.9% probability of no rate change and a 4.1% chance of a 25 basis point rate cut at the March FOMC meeting. Meanwhile, President Trump’s new 10% global tariffs took effect on Tuesday. An official directive has not yet been issued to implement the 15% levies Trump threatened over the weekend. The White House is preparing a formal order to raise the global tariff rate to 15%, according to an administration official. Today, market participants will closely watch President Trump’s annual State of the Union address for signals on trade and other policy priorities ahead of this year’s midterm elections. On the economic data front, investors will focus on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the February CB Consumer Confidence index will stand at 87.4, compared to last month’s figure of 84.5. The U.S. S&P/CS HPI Composite - 20 n.s.a. will also be reported today. Economists expect the December figure to ease to +1.3% y/y from +1.4% y/y in November. The U.S. Richmond Fed Manufacturing Index will be released today. Economists foresee this figure coming in at -8 in February, compared to the previous value of -6. U.S. Wholesale Inventories data will be released today as well. Economists anticipate that the final December figure will be unrevised at +0.2% m/m. In addition, market participants will be looking toward speeches from Fed Governors Christopher Waller and Lisa Cook, along with Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic, Boston Fed President Susan Collins, and Richmond Fed President Tom Barkin. On the earnings front, home improvement chain Home Depot (HD), as well as notable companies like Constellation Energy (CEG), Keurig Dr. Pepper (KDP), Workday (WDAY), and HP Inc. (HPQ), are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.033%, up +0.17%. SPX remains range-bound just below the 7,000 level following several attempts to extend higher. Recent price candles reflect reduced directional expansion and increased overlap, consistent with consolidation behavior. The Option Score has declined toward the lower end of its recent distribution (near 1), indicating a moderation in short-term options flow intensity compared to prior elevated readings. Price continues to trade within the established 6,800–7,000 range, with recent highs and prior swing lows defining the current structural boundaries. At present, the index reflects consolidation within an elevated range rather than directional expansion. Bitcoin has declined from the 120k region to below $63,000, representing a drawdown of roughly 50% from its October peak. The magnitude of the move marks one of the larger retracement phases within the broader multi-month cycle. The Q-Crypto Risk On/Off indicator is currently positioned near the zero line and has shifted into slightly negative territory. This reflects a transition from earlier persistent risk-on readings to more balanced or defensive derivatives positioning. Options pricing continues to show elevated sensitivity to downside strikes relative to upside convexity, while overall volatility remains responsive to shifts in global liquidity and macro conditions. The current structure reflects reduced directional momentum compared to earlier expansion phases. uesday

Let's take a look at our intraday price levels. 6857, 6871, 6880, 6894, 6909 are resistance levels. 6850, 6833, 6825, 6818, 6810 are support levels. Alright traders! Let's get some green again today but try to cut our work load down! See you shortly.

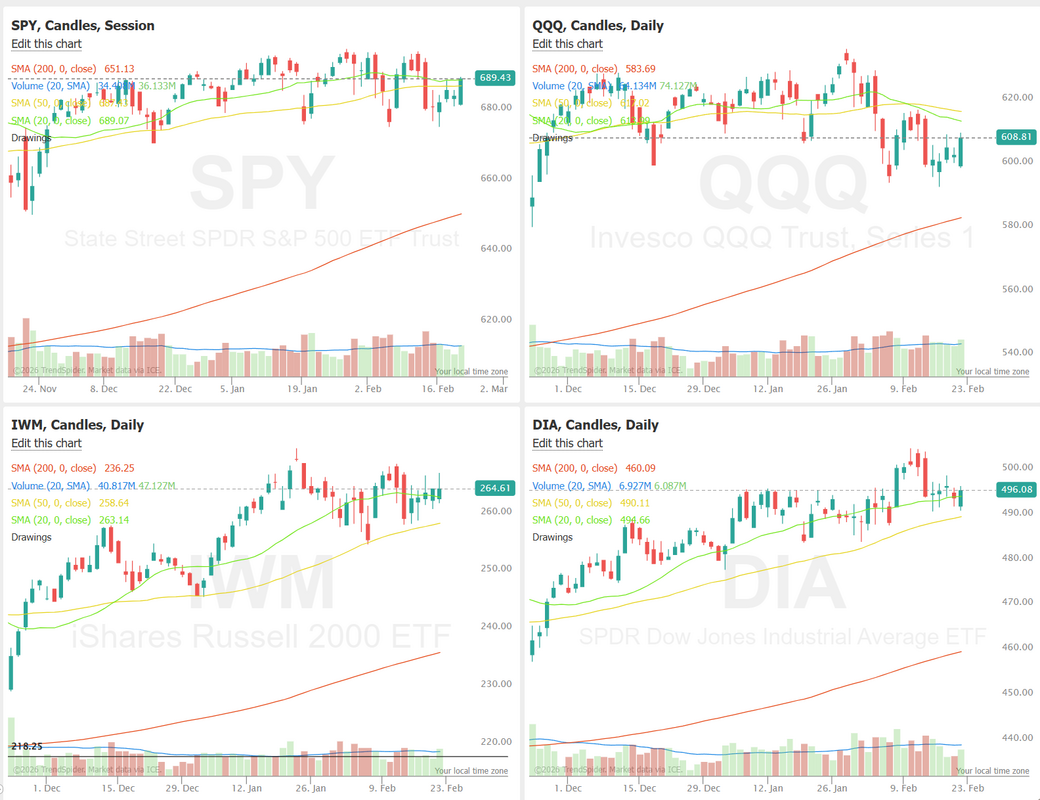

Geo politics rattling the cageWelcome back to a new trading week! Let's see..what's going on? Iran and the U.S. are close to a deal (or close to war). Mexico is at war with the cartel. Tariffs rescinded (oh, never mind, they are back on!) New York is now a communist state. Bottom line, it's a crazy, uncertain time, which is great for trading! We had a really solid trading day last Friday. Here's a look at our results. Let's take a look at the markets. All the indices held their ground on Friday. It could have really solidified a bearish trend had they not. We've got a straight neutral reading this morning on technicals. There's a lot of headline news to digest. March S&P 500 E-Mini futures (ESH26) are down -0.48%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.65% this morning, pointing to a lower open on Wall Street as heightened uncertainty about U.S. trade policy dampened sentiment. U.S. President Donald Trump on Saturday said he would raise global tariffs to 15% from 10%, a day after the Supreme Court struck down his “reciprocal” tariffs. “I, as President of the United States of America, will be, effective immediately, raising the 10% Worldwide Tariff on Countries, many of which have been “ripping” the U.S. off for decades, without retribution (until I came along!), to the fully allowed, and legally tested, 15% level,” Trump said in a Truth Social post. Notably, the 15% global tariffs are imposed under Section 122 of the 1974 Trade Act and are permitted to remain in effect for 150 days. Mr. Trump also cautioned that additional tariffs would follow. Uncertainty surrounding U.S. trade policy is adding another layer of complexity to markets already unsettled by concerns over AI disruption and U.S.-Iran tensions. Investor focus this week is on an earnings report from chip giant Nvidia, whose results have become a barometer for the AI trade, a fresh batch of U.S. economic data, and remarks from Federal Reserve officials. In Friday’s trading session, Wall Street’s major equity averages closed higher. Most members of the Magnificent Seven stocks advanced, with Alphabet (GOOGL) climbing over +4% to lead gainers in the Nasdaq 100 and Amazon.com (AMZN) rising more than +2% to lead gainers in the Dow. Also, chip stocks gained ground, with Lam Research (LRCX) rising over +3% and Analog Devices (ADI) advancing more than +2%. In addition, Corning (GLW) surged over +7% and was the top percentage gainer on the S&P 500 after UBS raised its price target on the stock to $160 from $125. On the bearish side, cybersecurity software stocks sank after Anthropic PBC rolled out a new security feature in its Claude AI model, with Cloudflare (NET) slumping more than -8%, and CrowdStrike Holdings (CRWD) sliding over -7% to lead losers in the Nasdaq 100. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, rose +0.4% m/m and +3.0% y/y in December, stronger than expectations of +0.3% m/m and +2.9% y/y. Also, the U.S. Bureau of Economic Analysis, in its initial estimate of Q4 GDP growth, said the economy grew at a +1.4% annualized rate, weaker than expectations of +2.8%. In addition, U.S. December personal spending rose +0.4% m/m, in line with expectations, and personal income grew +0.3% m/m, in line with expectations. Finally, the University of Michigan’s U.S. February consumer sentiment index was revised lower to 56.6, weaker than expectations of 56.9. Bret Kenwell, U.S. investment analyst at eToro, said the core PCE report underscores the uneven nature of the inflation battle. “It’s not the direction that investors or the Fed want to see,” he said, pointing out that core PCE has now increased for three straight months. Separately, Stephen Coltman, head of macro at 21Shares, described the combination of softer growth and firmer inflation as “unwelcome.” Atlanta Fed President Raphael Bostic said on Friday that it is prudent to keep rates “mildly restrictive” to bring inflation back to the 2% level and that current Fed policy is 25-50 basis points above neutral. Also, Dallas Fed President Lorie Logan said she was “cautiously optimistic” that the current monetary policy stance indicates “we’re on a path for inflation to come back down toward our target.” U.S. rate futures have priced in a 95.9% chance of no rate change and a 4.1% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. All eyes will be on Nvidia (NVDA) this week, as the semiconductor giant prepares to report its fourth-quarter and fiscal-year results on Wednesday. Investors anticipate that the company will beat Wall Street’s expectations and provide strong guidance for the current quarter. However, analysts said there may be little the company can do or say to meaningfully lift its shares amid growing skepticism about AI at the moment. Retailers such as Home Depot (HD), The TJX Companies (TJX), and Lowe’s (LOW), along with notable companies like Salesforce (CRM), Intuit (INTU), Dell Technologies (DELL), and CoreWeave (CRWV), are also set to release their quarterly results this week. Market watchers will also keep a close eye on several U.S. economic data releases this week amid uncertainty about the timing of the Fed’s next interest rate cut. The U.S. Producer Price Index for January will be the main highlight, providing further insight into the outlook for inflation. Other noteworthy data releases include the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., the Richmond Fed Manufacturing Index, Initial Jobless Claims, Construction Spending, and the Chicago PMI. In addition, market participants will parse comments from a slew of Fed officials. Fed Governors Christopher Waller and Lisa Cook, along with Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic, Boston Fed President Susan Collins, Richmond Fed President Tom Barkin, Kansas City Fed President Jeff Schmid, and St. Louis Fed President Alberto Musalem, are scheduled to speak this week. Meanwhile, President Trump’s annual State of the Union address on Tuesday will also attract attention. Investors will monitor the address for signals on trade and other policy priorities ahead of this year’s midterm elections. “Tomorrow’s State of the Union will likely define how far Trump wants to go with the tariff rhetoric,” said Andrea Gabellone, head of global equities at KBC Securities. Today, investors will focus on U.S. Factory Orders data, which is set to be released in a couple of hours. Economists expect this figure to drop -0.4% m/m in December, following a +2.7% m/m jump in November. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.077%, down -0.29%. Todays training is another good one. Today we'll focus on a trading approach that you can use for 0DTE trading that takes just a few minutes to set up and then you're done for the day! No monitoring. No sitting in front of the computer all day. No adjustments. It's called "sizing for zero". Be sure to tune in. It will be worth your time. SPY ended the week higher at 689.43 (+1.13%), finishing right where it opened the prior week. Despite the choppy price action, there was still opportunity for intraday traders using the new ORB tools. With tariff headlines hitting on Friday, 5-minute ORB traders were able to capture a 3R move as SPY rallied 5 points following the opening range breakout. The Nasdaq tracked closely with the S&P 500 last week, as QQQ closed at $608.81 (+1.15%) despite the heavy news flow. However, the 5-minute opening range breakout produced only a 2R move based on a stop beneath the opening range low. With NVDA earnings on deck, its reaction could drive QQQ decisively in either direction. Small caps lagged last week, with IWM closing at $264.61 (+0.63%). While the ETF has steadily outperformed large caps in 2026, momentum paused over the past week. Despite that consolidation, the 5-minute opening range breakout strategy delivered, allowing traders to capture a 3R move in less than 10 minutes. Expected move for the week on SPX is 1.48%. Decent enough and that should give us some premium to work with. SPX remains near recent highs, while short-term RSI breadth measures have moderated. The number of stocks with 5-day and 14-day RSI readings above 70 has declined from recent peaks, and the count of names trading above their upper Bollinger Bands has also eased. This configuration reflects elevated index levels alongside cooling short-term momentum participation. Breadth readings are no longer expanding and have shifted toward mid-range levels relative to recent extremes. At present, price stability coexists with a reduction in overbought breadth conditions, indicating a transition from expansionary momentum to a more balanced internal structure. QQQ’s ATM term structure shows a relatively stable and gently upward-sloping curve, with front-end implied volatility cooling compared to five days ago while longer-dated vols remain anchored near the low 20% area. This suggests near-term event premium has faded somewhat, but the market still prices steady medium-term uncertainty. On the smile, downside strikes remain bid with a pronounced put skew, while upside calls are comparatively flatter, indicating continued demand for protection over speculative upside. Overall, q-option positioning reflects a market that is less panicked than earlier in the week but still defensively tilted, with downside hedges carrying richer implied volatility than at-the-money or upside strikes. Let's take a look at the intraday levels we'll be working off for today's 0DTE entries. 6896 seems to be the "line in the sand" this morning. 6906, 6919, 6925, 6937 are resistance levels. 6885, 6874, 6867, 6858, 6850 are support levels. Let's have a strong start to the week! Scalping could be good today. I'll see you all in the live trading room shortly!

|

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |