Buying stocks at a discount

ULTA Beauty Is the largest beauty retailer in the U.S. I don't know that from any deep analytical research. My wife reminds me every time we shop there and that happens frequently. Apparently though, our household purchases have not been enough to drive the stock higher. In fact it's been beaten up pretty good this year.

While it hasn't performed well, as of late, there are some interesting developments that make me interested in starting a long position. First of all, it is the proverbial 800lb. gorilla in the room. With a market cap of 16 billion dollars and 1,300 stores nationwide its a big mover in the XRT (the retail ETF), however it's lagged in performance.

There are several things to like about ULTA at these levels. The first in the data we pull from SEC form 4, Insider buys. One of the biggest myths around insider buying is that it is illegal. Nothing could be further from the truth! Insider buying and selling is completely legal...as long as it is scheduled and reported! Most retail investors don't know that you can track what insiders do with their company's stock. It's certainly no guarantee but when a corporate insider puts up their own money to buy their companies stock, it should carry some weight. Conversely, when an insider is dumping shares, while there may be a valid reason, it's usually a red flag. Kecia Stedman, the C.E.O. of ULTA just bought $500,000 dollars of ULTA stock. It wasn't a stock open exercise, she reached into her own pocket and plunked down her own money. That's a big bet on a companies future. Theoretically know one on the face of this planet should know the current status and potential of that company better than the C.E.O.

What's also interesting is the price level she entered her position at. VWAP. (volume-weighted average price). If you're not familiar with VWAP here's a link to a description

What's also interesting is the price level she entered her position at. VWAP. (volume-weighted average price). If you're not familiar with VWAP here's a link to a description

This level also has some other large technical analysis indicators that flashed a buy. #1. Double bottom formation. These are usually high probability buy setups https://www.investopedia.com/terms/d/doublebottom.asp

#2. It's formed a nice reverse, head and shoulders pattern https://www.investopedia.com/terms/h/head-shoulders.asp

#2. It's formed a nice reverse, head and shoulders pattern https://www.investopedia.com/terms/h/head-shoulders.asp

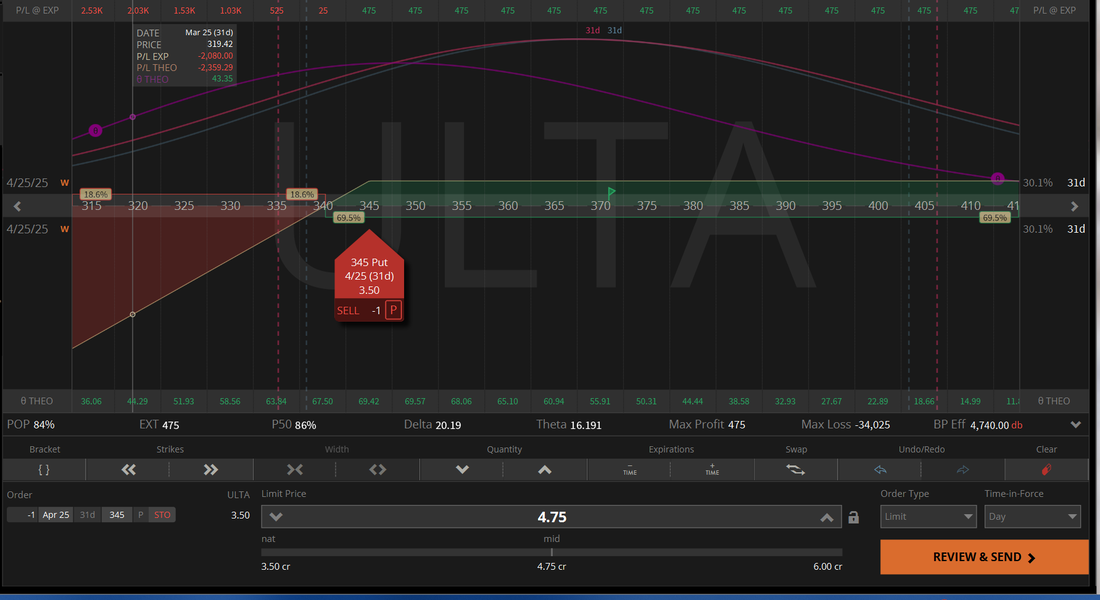

Suffice it to say, this 345 level, in hindsight would have been a great place to establish a long position. Unfortunately the stock is now trading at 370! Wouldn't it be wonderful if we could build a trade entry that would allow us to enter a position on this 370shr. stock at the discounted price of 345? What if we could set that trade up with not the $37,000 dollars it would cost to buy 100 shares. Not the $19,000 is would cost using margin but just $4,740 dollars deposit! We would initiate this "deposit" by selling one Apr25 345P.

What are the possible outcomes of this 31 day long investment? Well....let's think about this. ULTA stock can only do three things over the next month. Go up. Go down. Stay the same. Let's examine each potential outcome. By selling a put at 345 we are committing ourselves to buy 100 shares at the price of 345 so if the stock goes up, no one is going to want to sell us their more valuable shares for our asking price of 345. That means our option we sold them will expire worthless and we get to keep all the money we made from selling that option. We made $475 dollars. That's on an investment of $4,740. I didn't go to math college but I'd estimate that's pretty close to a 10% return on capital in a one month period of time! That's 120% annualized. Not too bad for a "failed trade" right? What are the chances that ULTA doesn't come down to our asking price in the next month? Statistically 84%. That's a pretty high probability of a 10% profit!

What if the stock stays the same? Well, we know it's going to move some right? As long as the stock stays above 345 it can fluctuate all it wants. It doesn't matter, the result is the same. We keep all the $475 dollars of premium we brought in and lock in a 10% profit for the month.

What if the stock stays the same? Well, we know it's going to move some right? As long as the stock stays above 345 it can fluctuate all it wants. It doesn't matter, the result is the same. We keep all the $475 dollars of premium we brought in and lock in a 10% profit for the month.

What if the stock goes down? Well, if it drops below 345 (our agreed upon price) we will be assigned our 100 long shares. Think about it this way. No one knows the future but is it better to buy the stock today at its current price of 370 or wait a month and buy if for 345 AND, get paid 10% return for the wait? Yes! not only would be get the stock at a discounted price but we'd keep our $475 income.

If we are assigned our stock at 345 what would we do? My target profit zone would correlate with the 200DMA of 382. That would be a $3,700 profit PLUS the $475 initial income for a total potential of $4,175 profit! Sounds great? We could potentially make it even better! Once we own the shares we could start cash flowing them with covered calls but that's a conversation for later!

If we are assigned our stock at 345 what would we do? My target profit zone would correlate with the 200DMA of 382. That would be a $3,700 profit PLUS the $475 initial income for a total potential of $4,175 profit! Sounds great? We could potentially make it even better! Once we own the shares we could start cash flowing them with covered calls but that's a conversation for later!