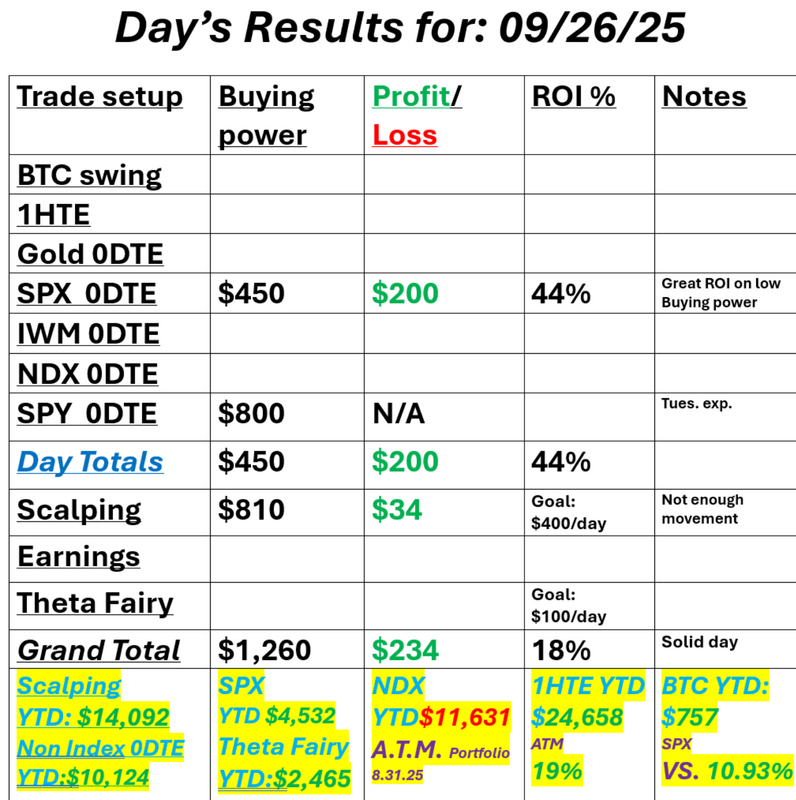

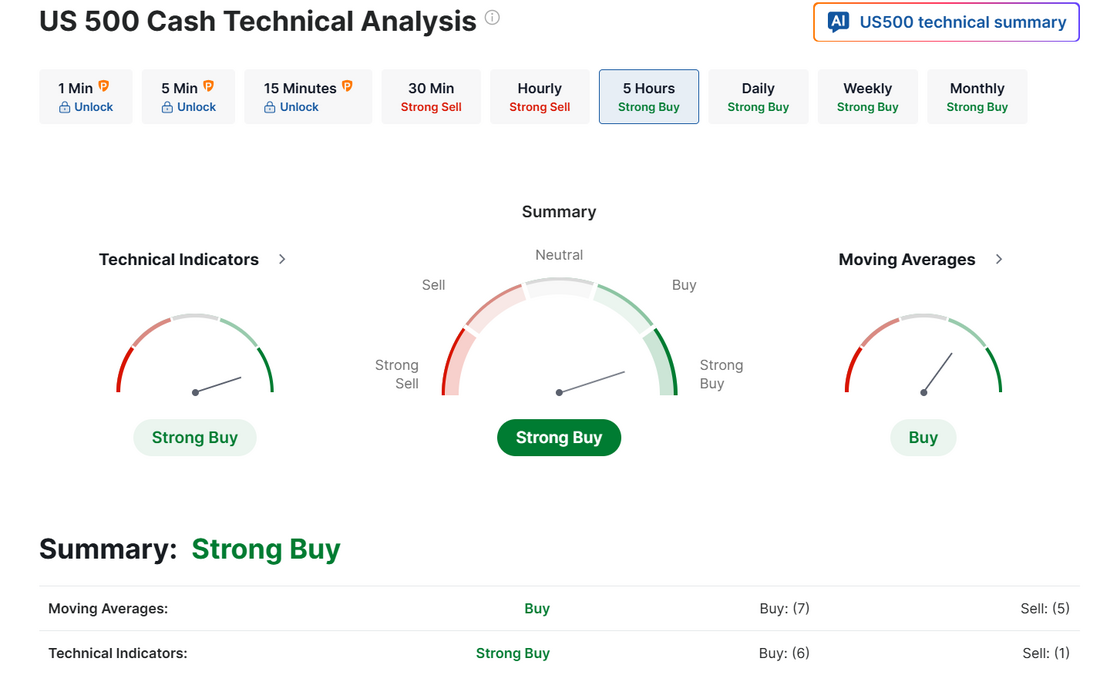

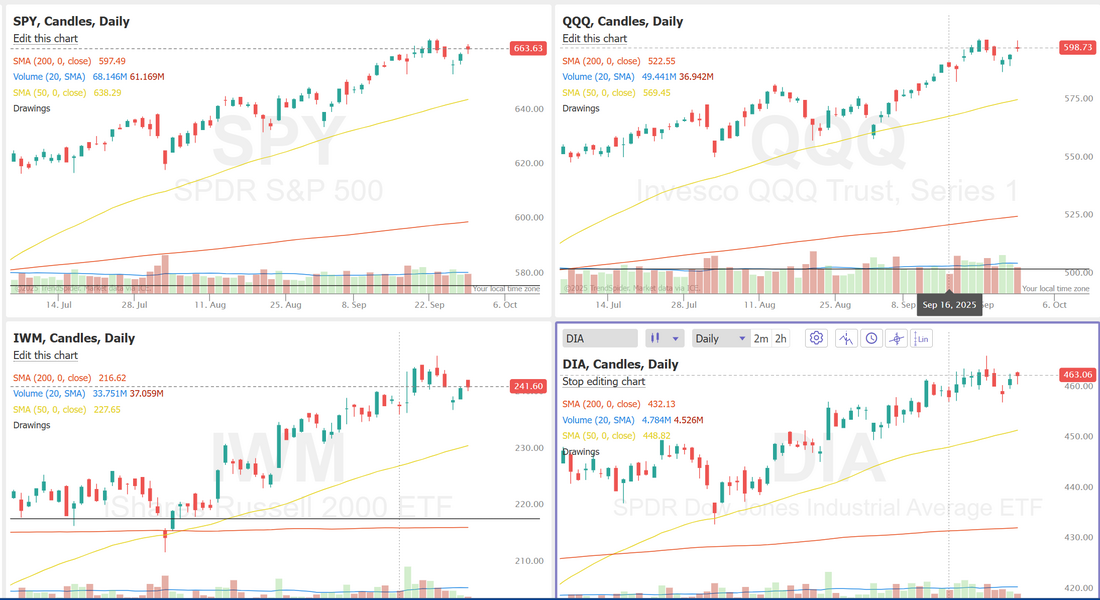

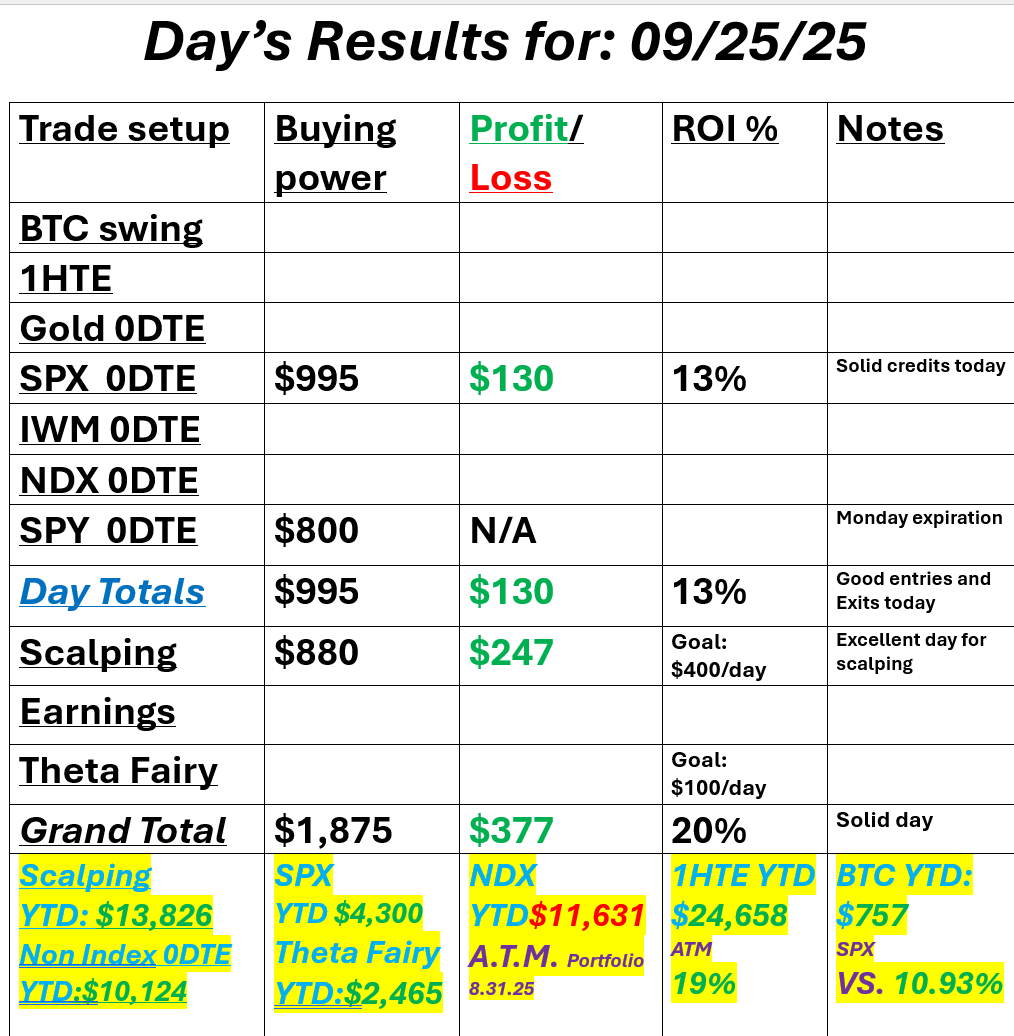

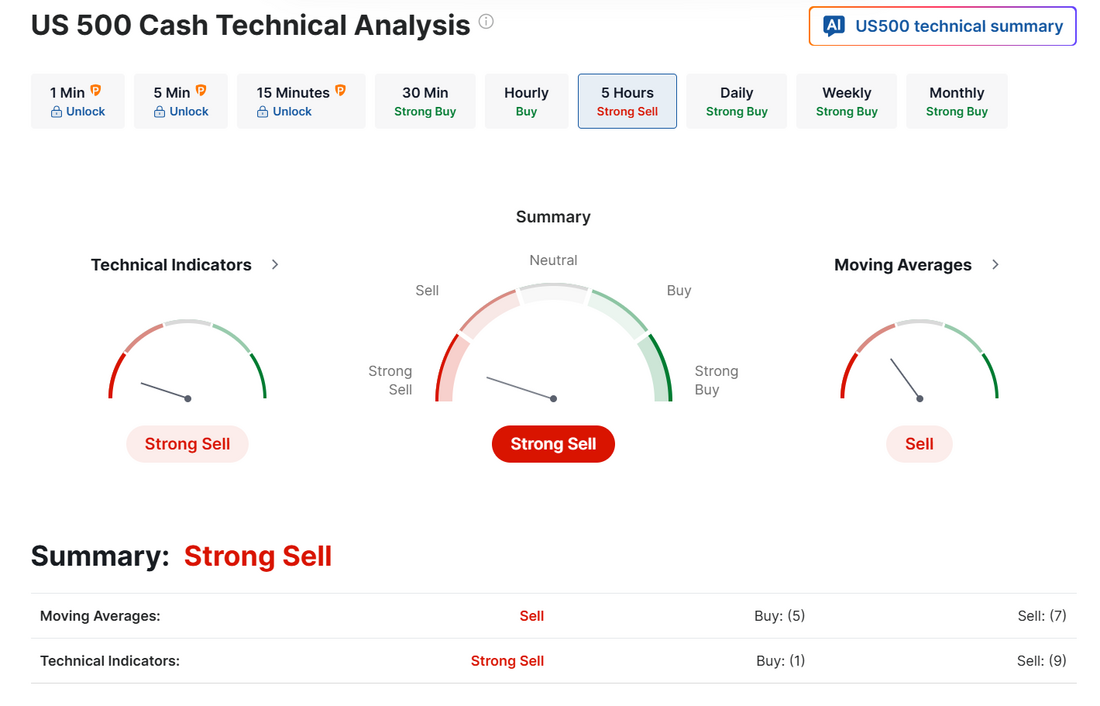

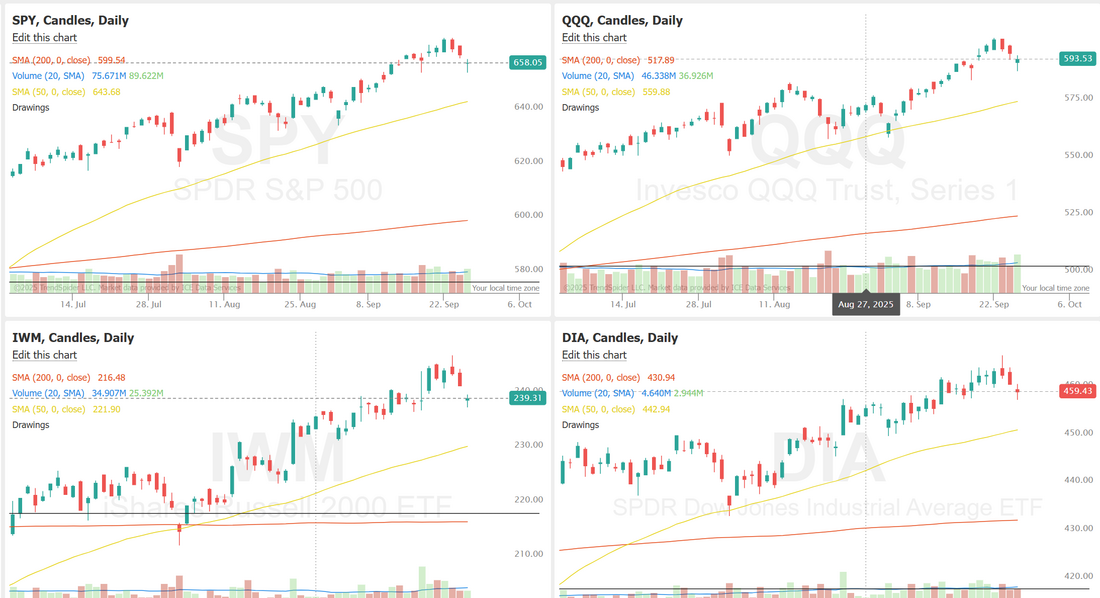

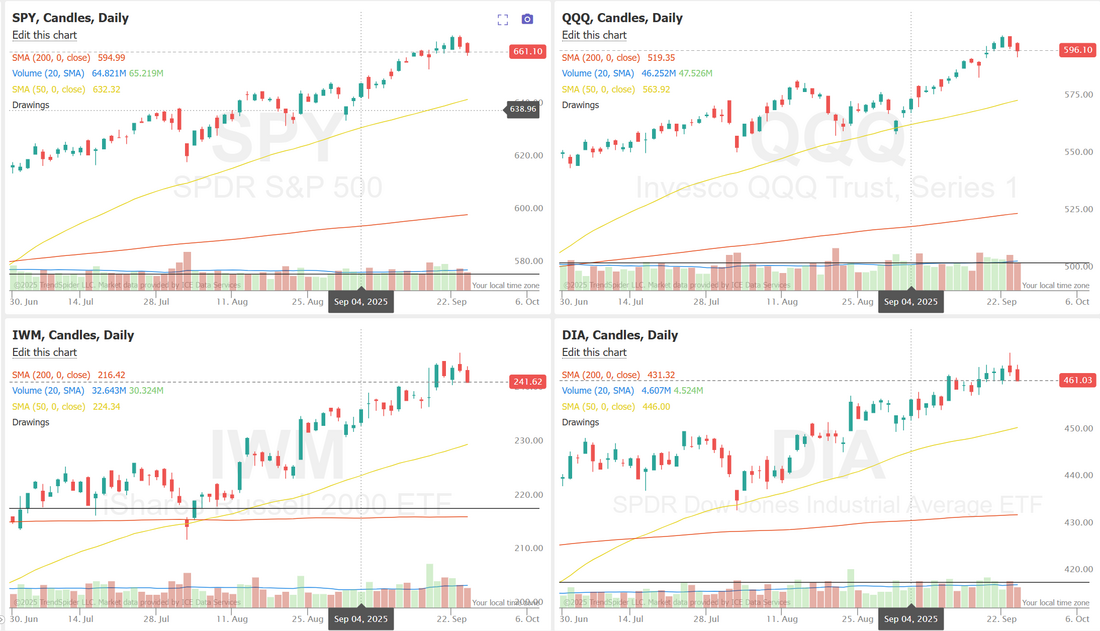

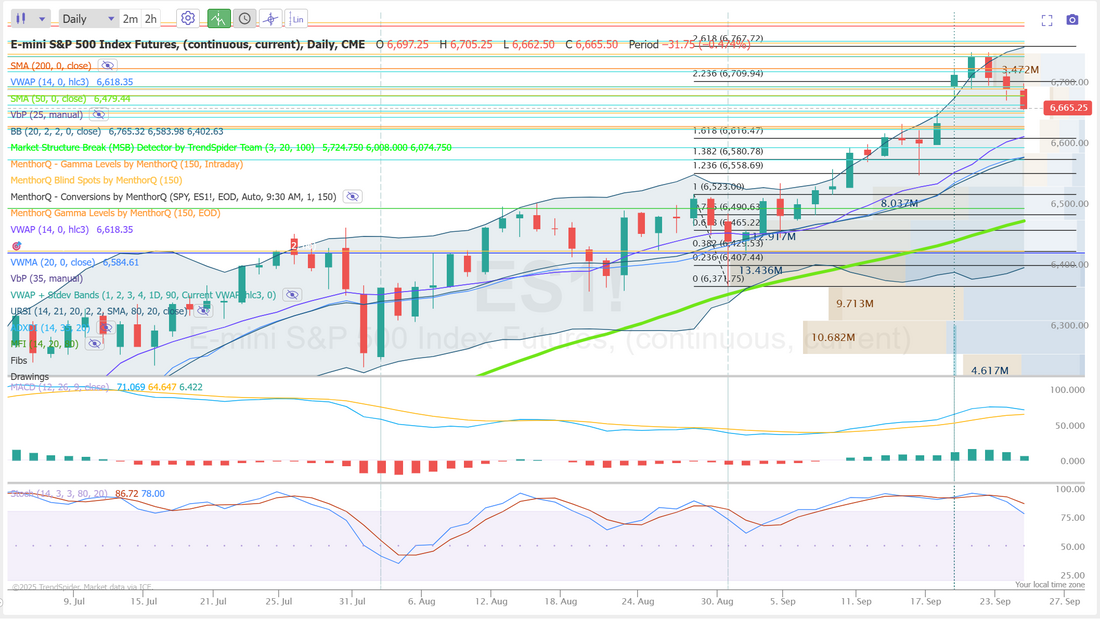

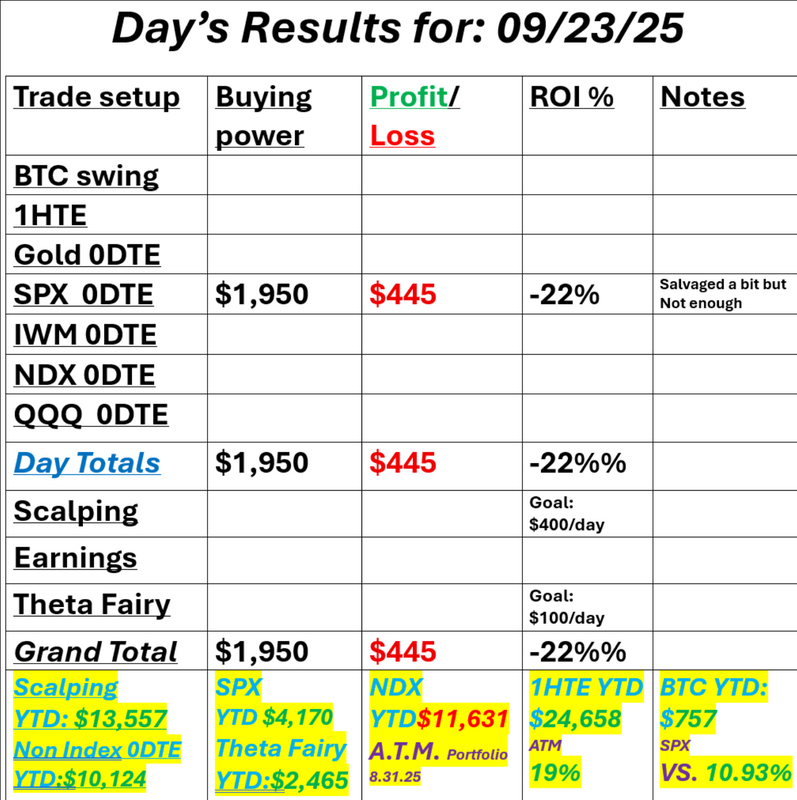

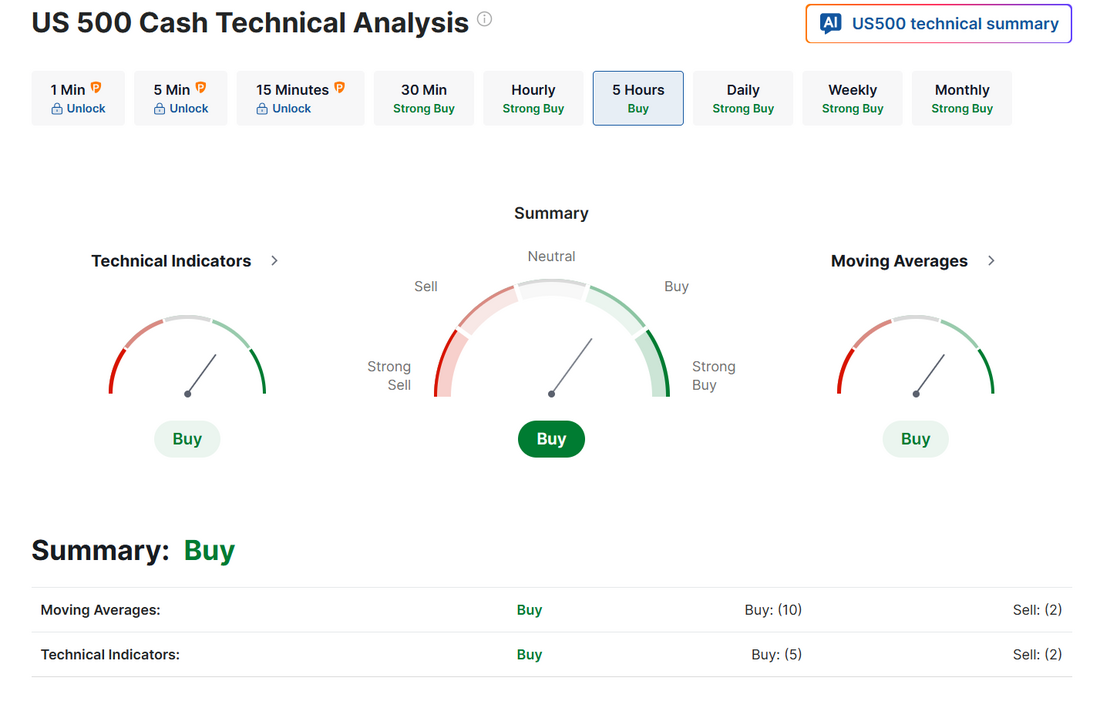

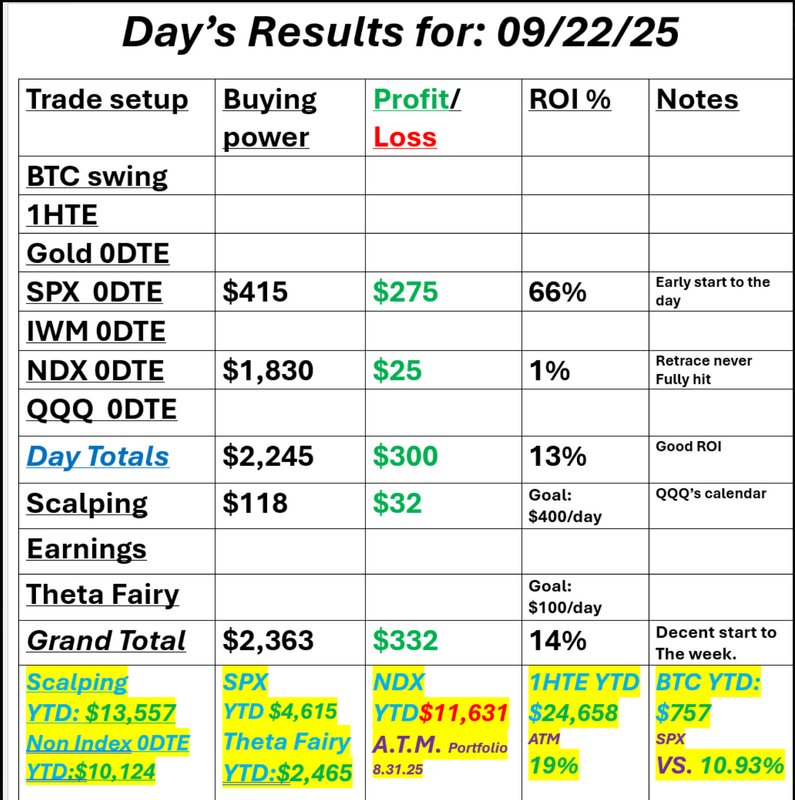

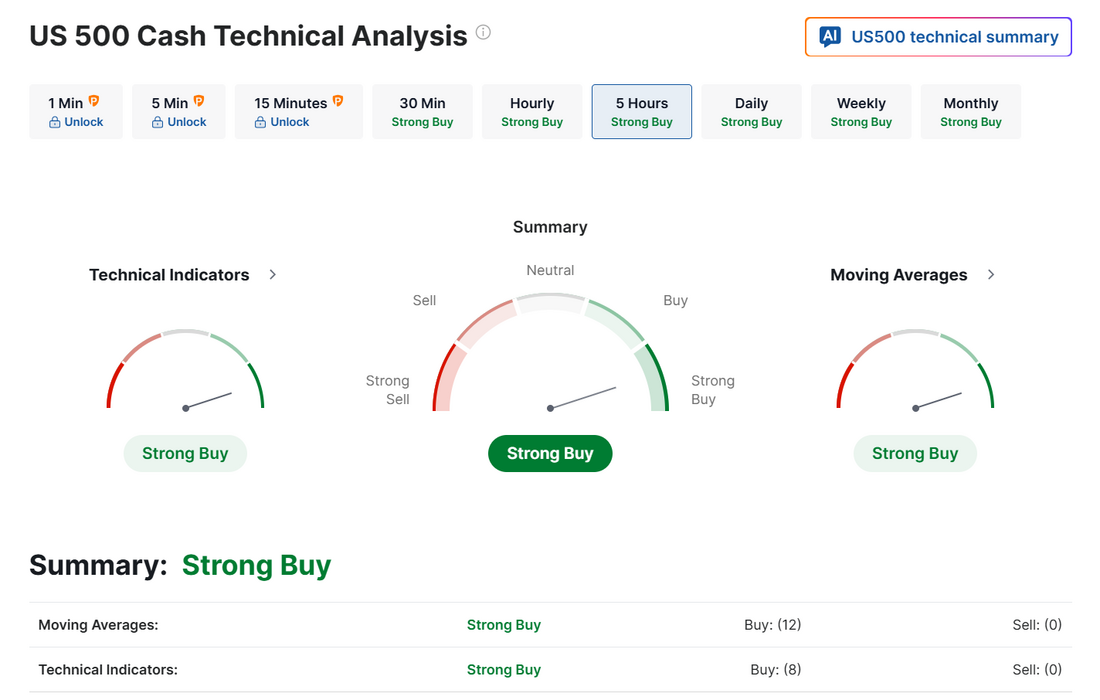

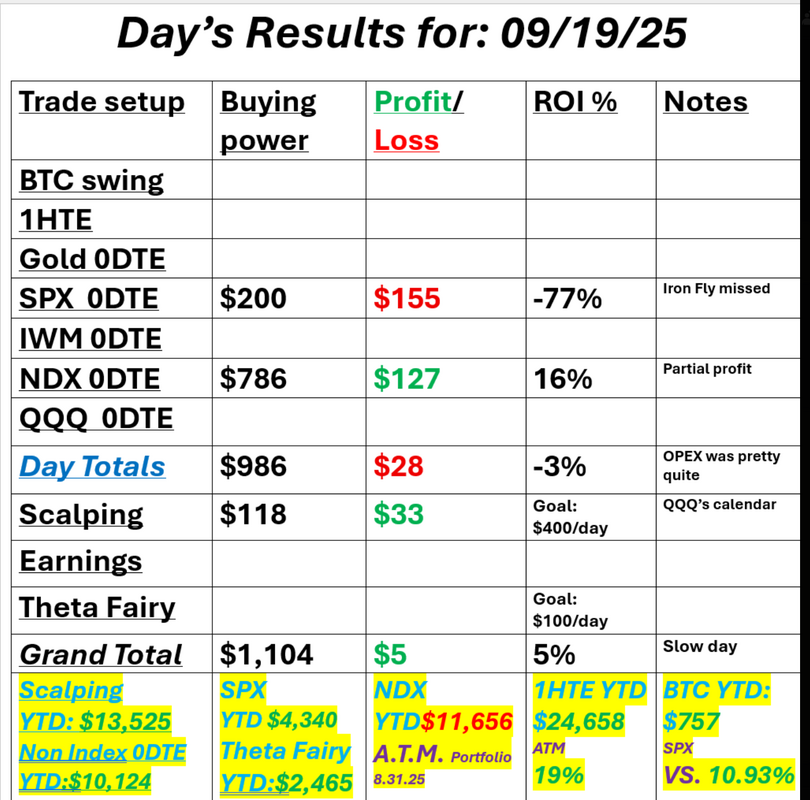

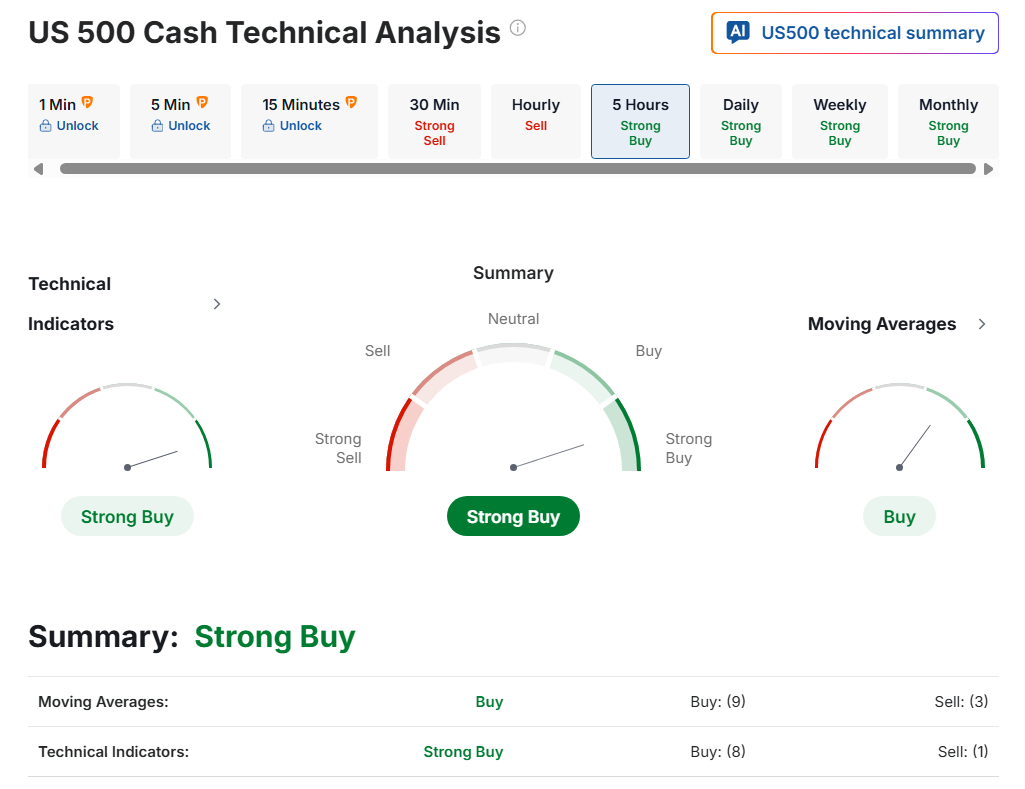

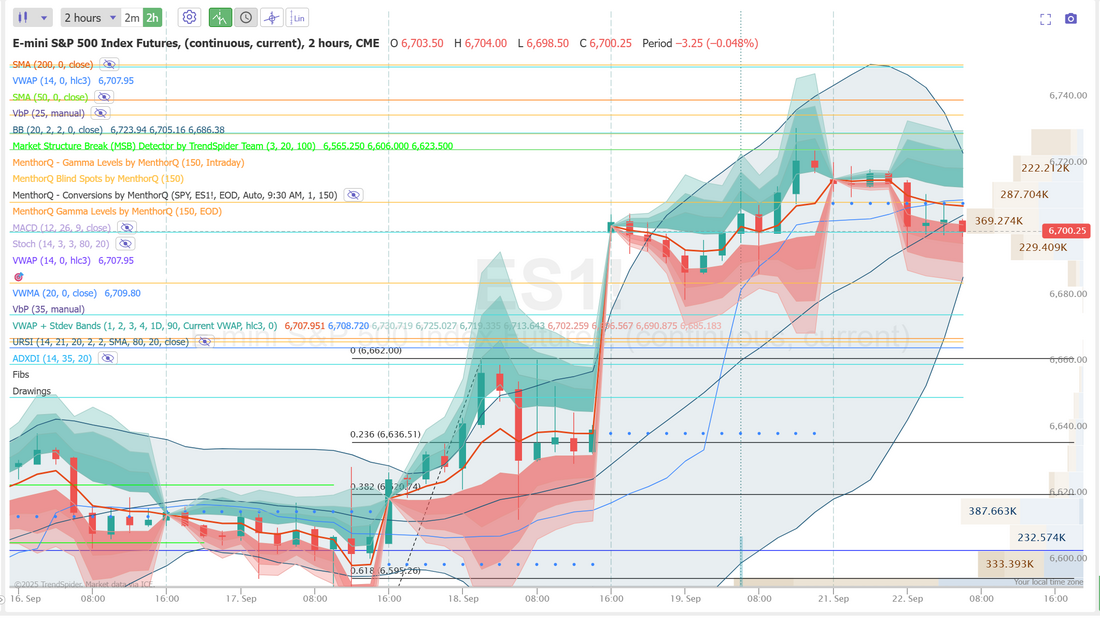

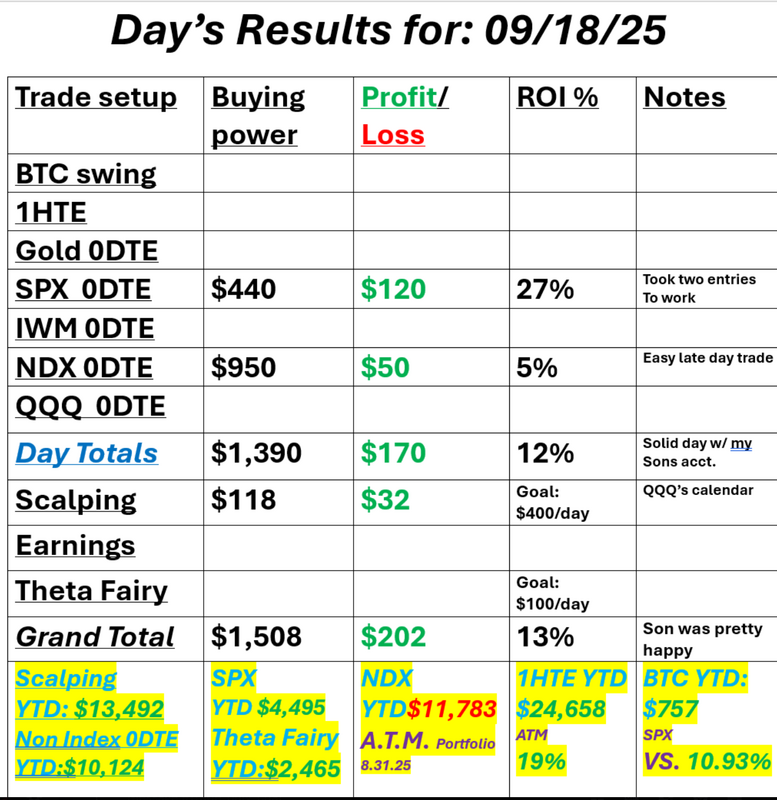

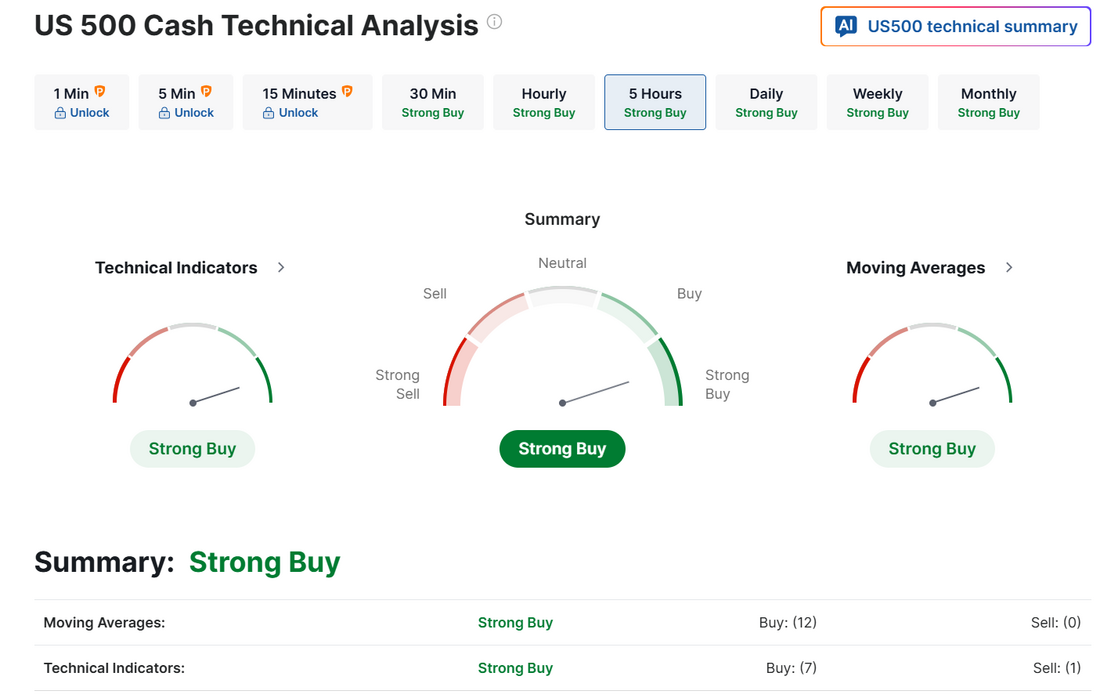

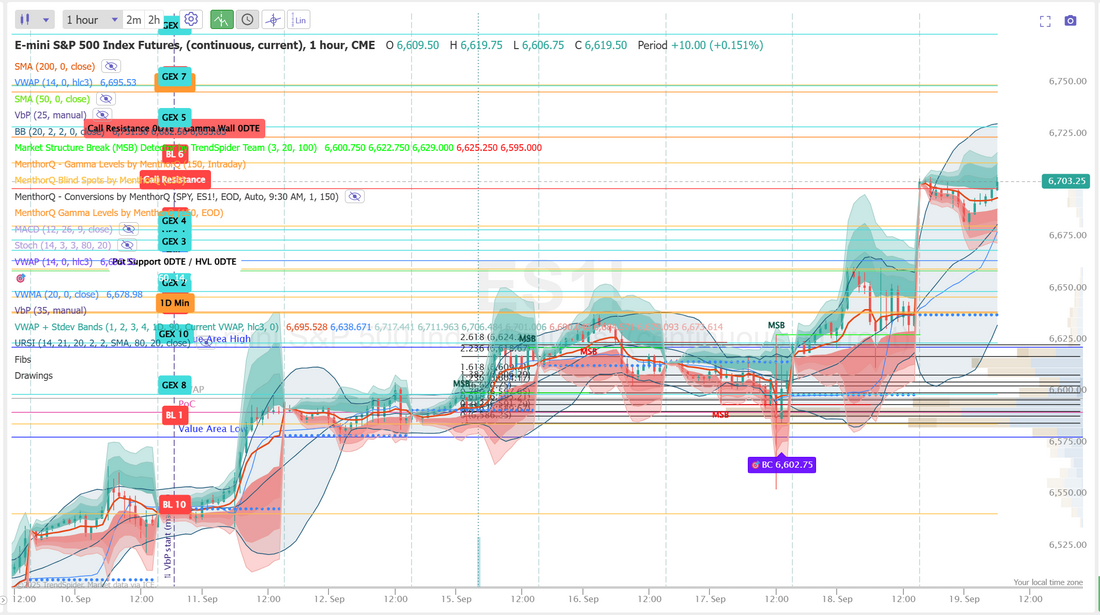

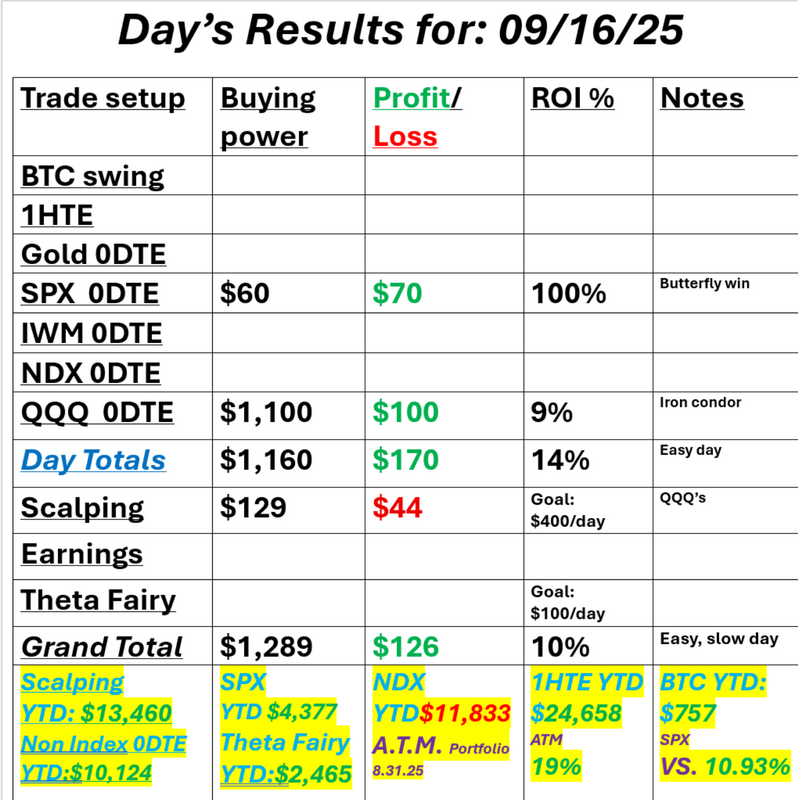

Consistency over profitWe had a good training session yesterday talking about the difference between shooting for big dollar profits vs. consistently being profitable. The quote we used was, "It's harder to make $50-$100 dollars a day, every day, for the rest of your life than making $10,000 dollars in a few hours." It's absolutely true. Once again this week, we are working on our consistency over profit amount. We had a good start yesterday were we deployed very little capital and still had a solid day. Here's a look at our results. Let's take a look at the markets. Buy mode still clinging on. Not much to take out of yesterdays session. It didn't really help the bull or bear case. December S&P 500 E-Mini futures (ESZ25) are down -0.23%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.14% this morning as investors grew anxious with the deadline to avert a U.S. government shutdown approaching. Democratic leaders and President Trump engaged in last-minute talks on Monday but failed to reach a deal to prevent a shutdown. U.S. lawmakers have until midnight to pass a federal spending bill. Vice President JD Vance said he thinks the U.S. government is headed toward a shutdown. Many federal operations will pause, and nonessential employees will be furloughed or fired in the event of a shutdown. Notably, Friday’s payroll report will be postponed if the Department of Labor follows an operational contingency plan outlined earlier this year. Later today, investors will focus on the latest reading on U.S. job openings and comments from Federal Reserve officials. In yesterday’s trading session, Wall Street’s main stock indexes closed higher. Chip stocks advanced, with GlobalFoundries (GFS) and Micron Technology (MU) rising over +4%. Also, Applovin (APP) climbed more than +6% and was the top percentage gainer on the Nasdaq 100 after Phillip Securities initiated coverage of the stock with an Accumulate rating and $725 price target. In addition, Merus N.V. (MRUS) jumped nearly +36% after Genmab agreed to acquire the company for about $8 billion in cash. On the bearish side, Carnival (CCL) slid about -4% even as the company posted better-than-expected FQ3 results and raised its full-year adjusted EPS guidance. Economic data released on Monday showed that U.S. pending home sales climbed +4.0% m/m in August, stronger than expectations of +0.2% m/m and the biggest increase in 5 months. Cleveland Fed President Beth Hammack told CNBC’s Squawk Box Europe on Monday that the U.S. central bank must keep a restrictive monetary policy stance to bring inflation down to its 2% target. “My forecast is that we’re going to remain above target for probably the next one to two years, and not really getting back down to our objective of 2% until the end of 2027 or early 2028,” Hammack said. At the same time, St. Louis Fed President Alberto Musalem said he is open to additional interest rate cuts, but emphasized that policymakers should proceed carefully, with inflation still above the central bank’s target. In addition, New York Fed President John Williams said that inflation risks have diminished, while employment risks have increased. However, he did not indicate whether he might support another rate cut in October. Meanwhile, U.S. rate futures have priced in a 90.3% probability of a 25 basis point rate cut and a 9.7% chance of no rate change at the next central bank meeting in October. In tariff news, President Trump signed a proclamation on Monday to impose 10% tariffs on imported timber and lumber and 25% tariffs on upholstered wooden furniture products and kitchen cabinets, effective October 14th. Tariffs on furniture products will increase to 30% at the beginning of 2026, and tariffs on cabinets will rise to 50%, according to an executive order. Today, all eyes are on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the August JOLTs Job Openings will arrive at 7.190 million, compared to the July figure of 7.181 million. Investors will also focus on the U.S. Conference Board’s Consumer Confidence Index, which came in at 97.4 in August. Economists expect the September figure to be 96.0. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today. Economists expect the July figure to ease to +1.7% y/y from +2.1% y/y in June. The U.S. Chicago PMI will be released today as well. Economists forecast the September figure at 43.4, compared to the previous value of 41.5. In addition, market participants will hear perspectives from Fed Vice Chair Philip Jefferson, Boston Fed President Susan Collins, Chicago Fed President Austan Goolsbee, and Dallas Fed President Lorie Logan throughout the day. On the earnings front, shoemaker Nike (NKE) and payroll processing firm Paychex (PAYX) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.130%, down -0.27%. My lean or bias today is slightly bearish. There's no real technical signal that's bearish but we do have the Government shutdown potential hanging over the market. If we do get a bullish day I think it will be somewhat subdued. The SPX chart shows prices holding near recent highs after a steady climb, but the option score has been fluctuating sharply, dipping into low territory multiple times through September. This suggests that while spot prices remain resilient, options positioning indicates uncertainty and shifting sentiment in the short term. Traders may want to keep an eye on whether the option score stabilizes above mid-levels, which would support continued momentum, or if repeated drops signal a potential short-term pullback. The near-term action looks poised for choppiness as positioning catches up with price levels. Let's take a look at the intra-day levels. They haven't changed too much from yesterday's levels. 6710, 6713, 6725, 6738 are resistance zones with 6699, 6694, 6682, 6675 working as support. Let's see if we can bring our winning streak to two days in a row! See you all shortly.

0 Comments

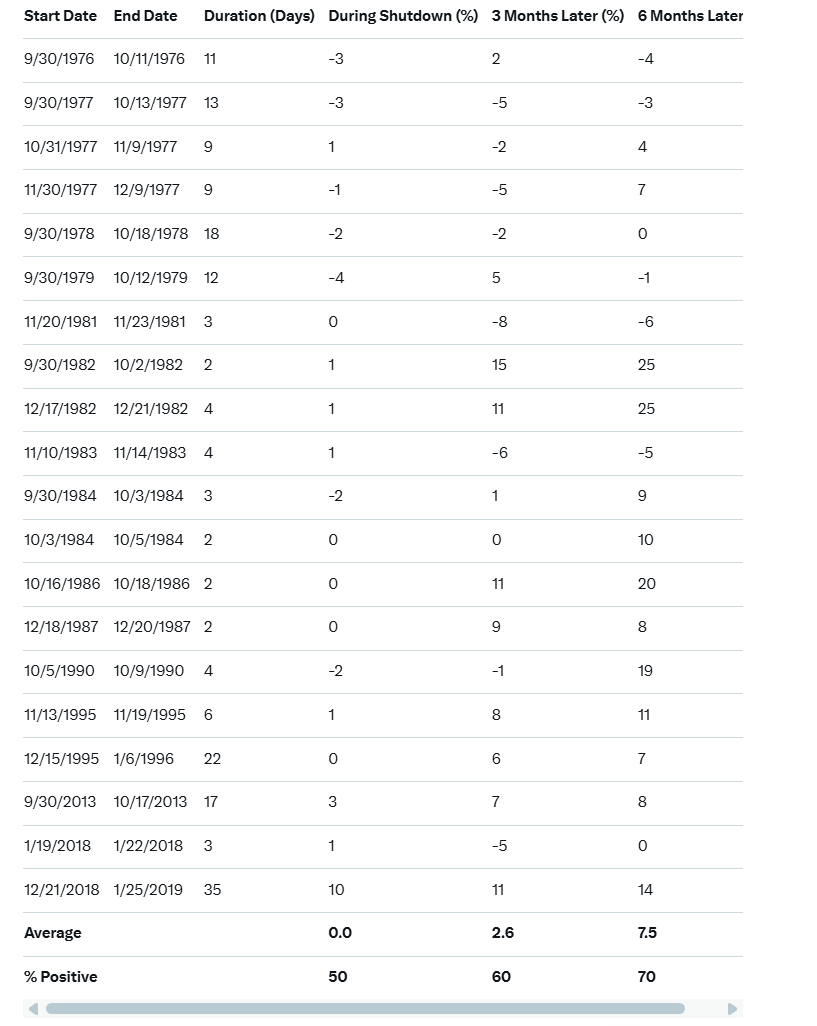

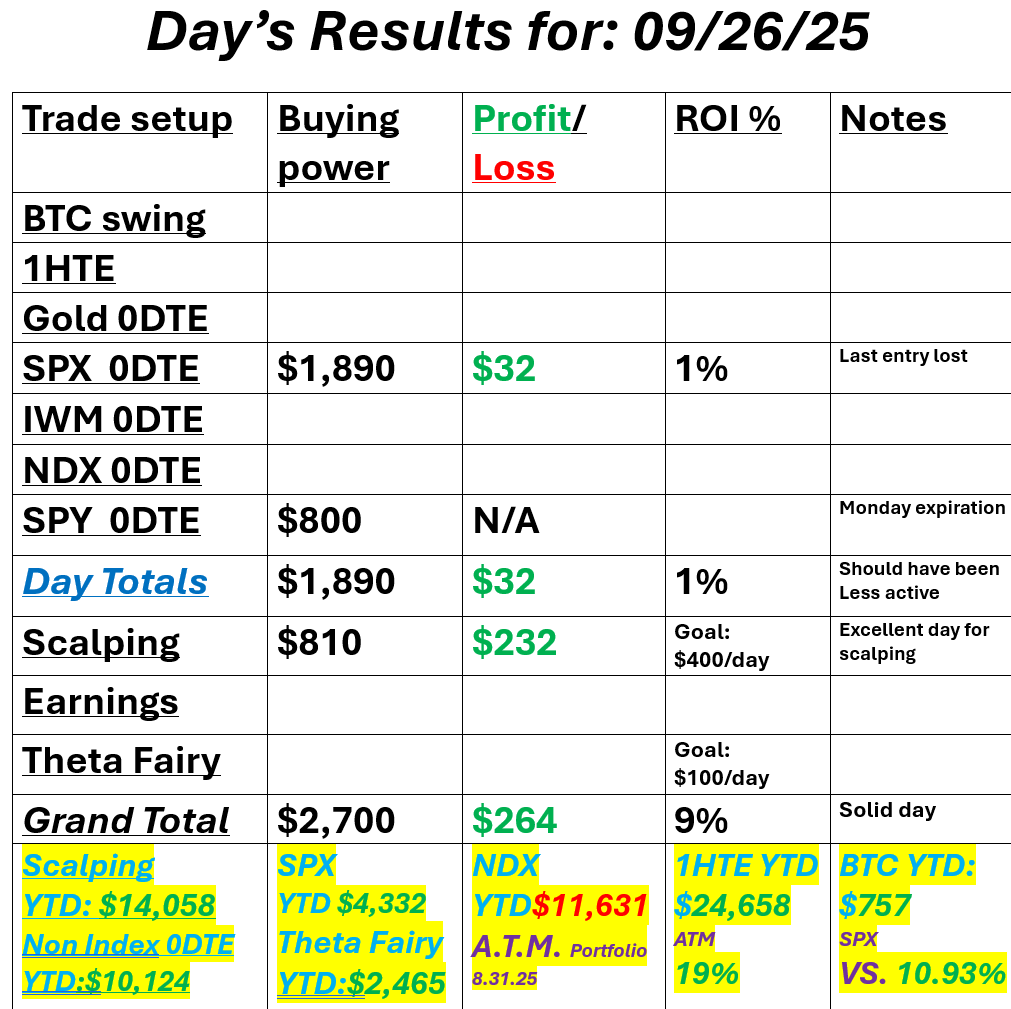

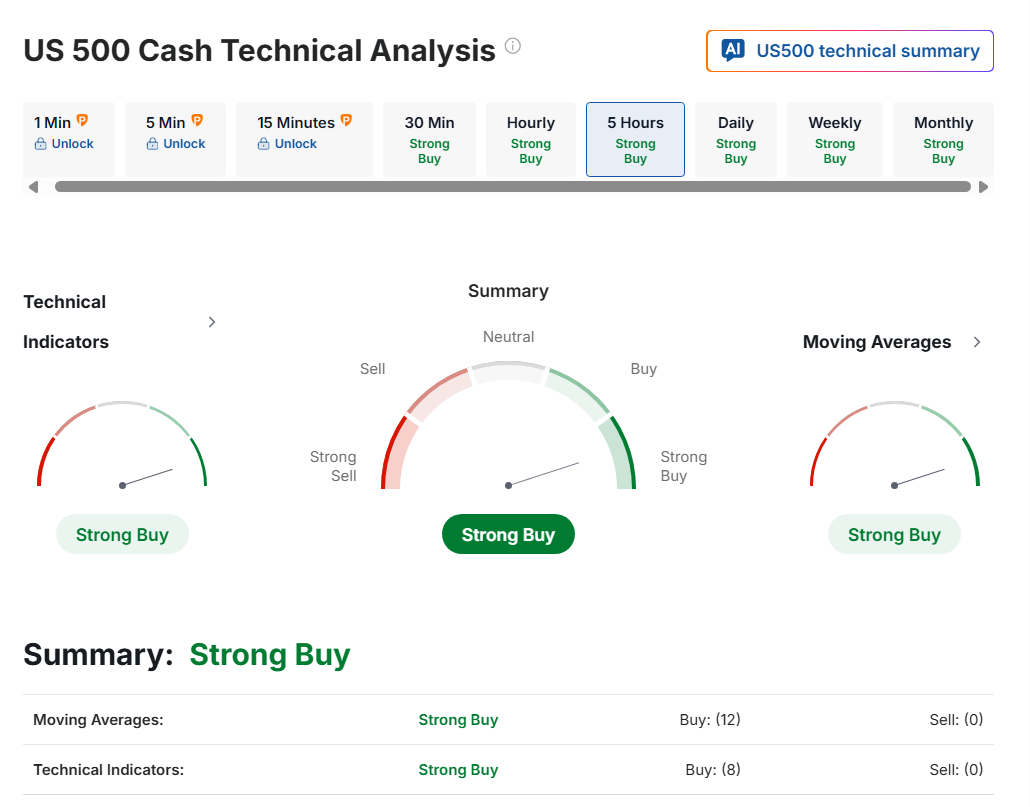

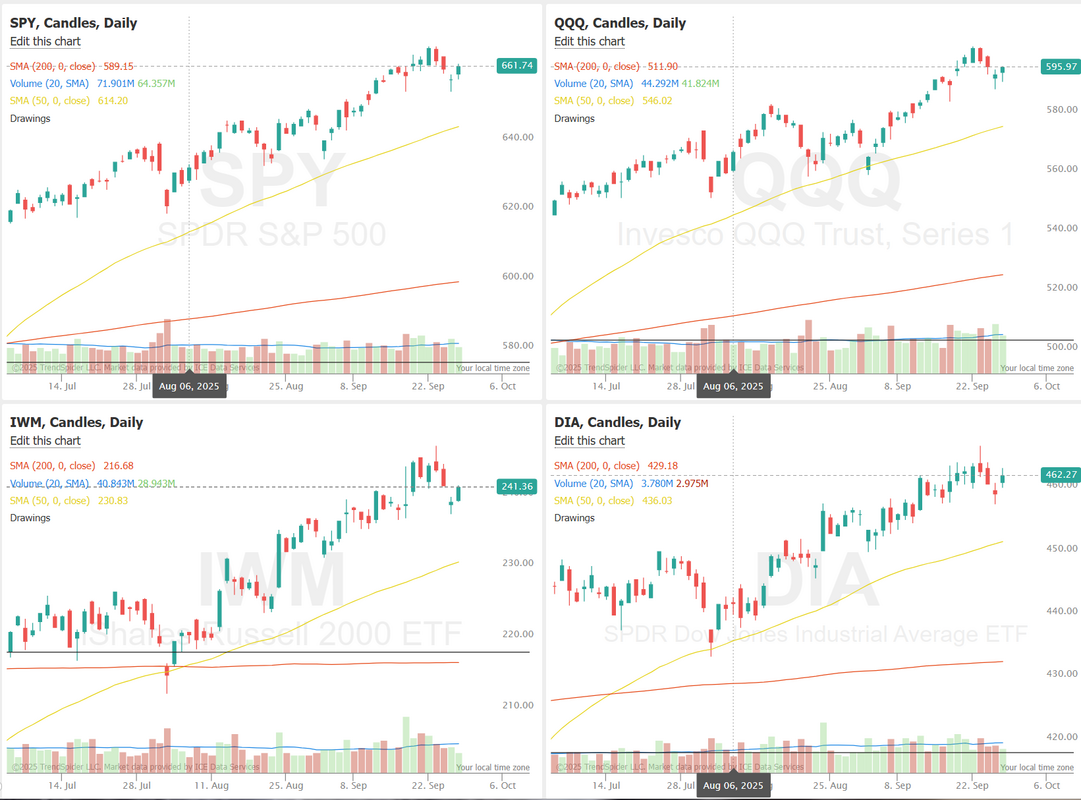

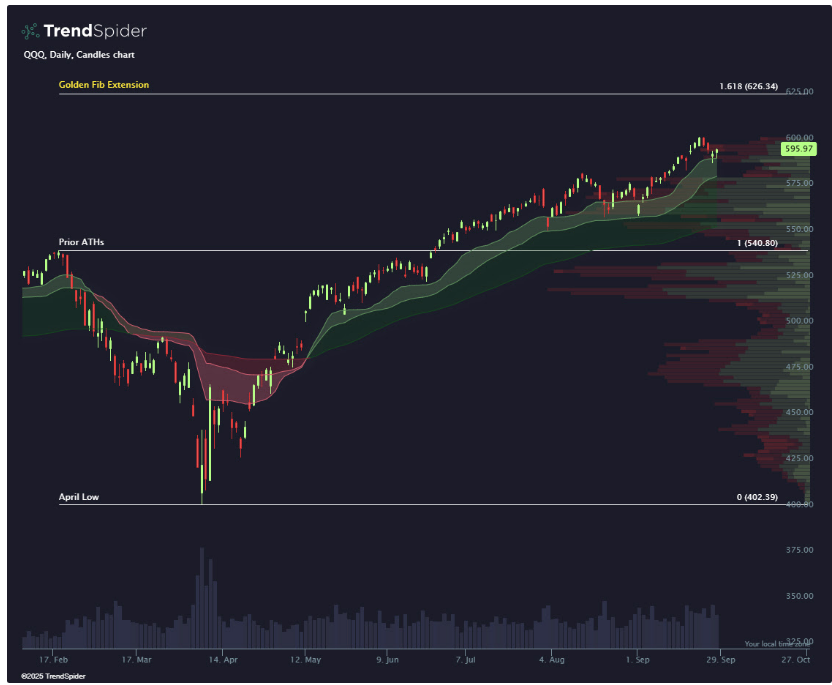

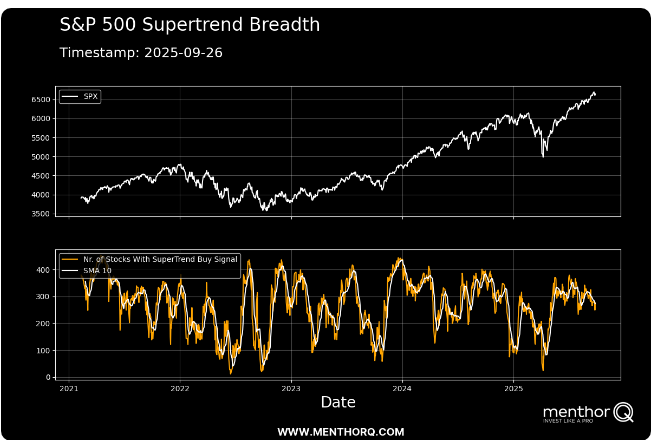

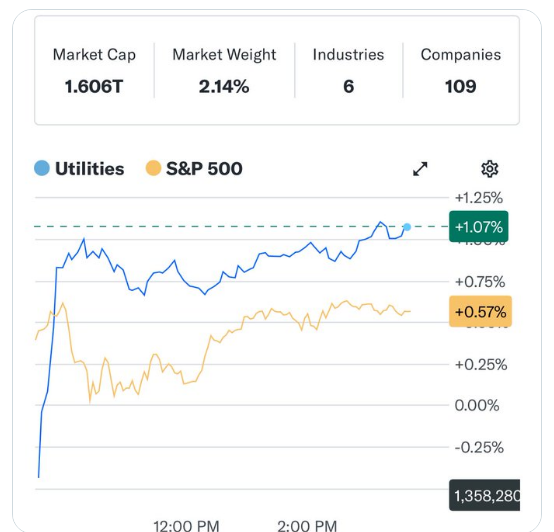

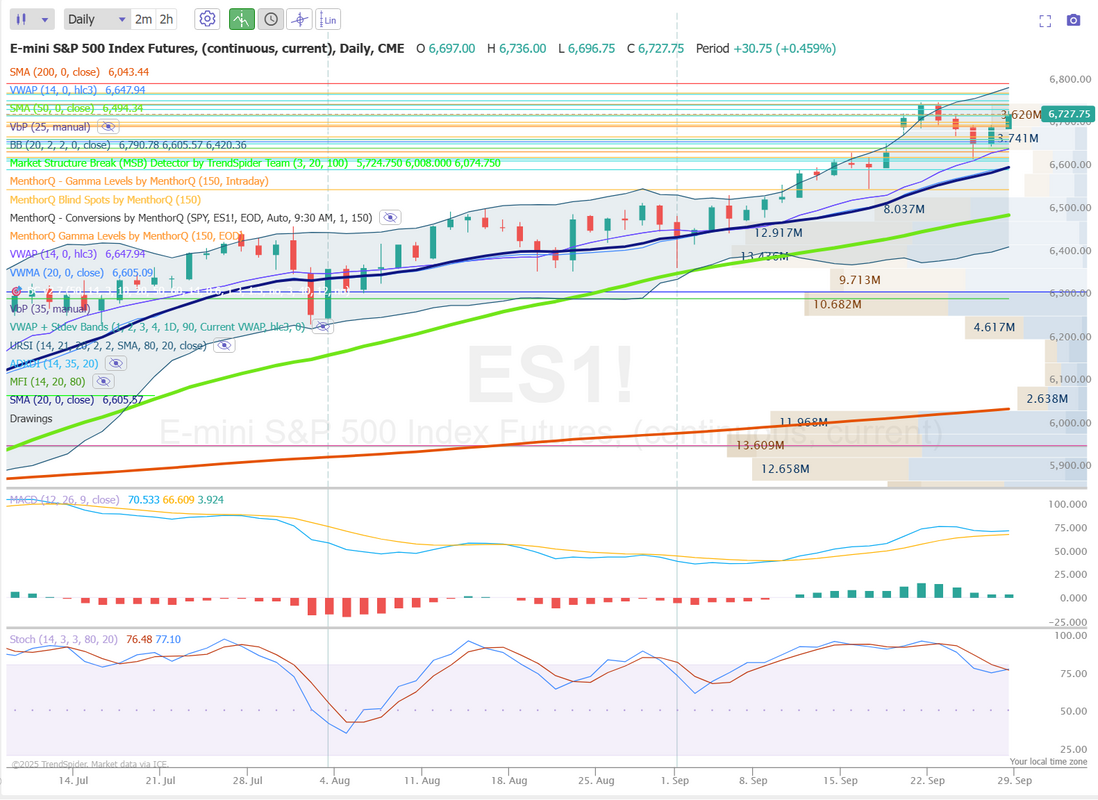

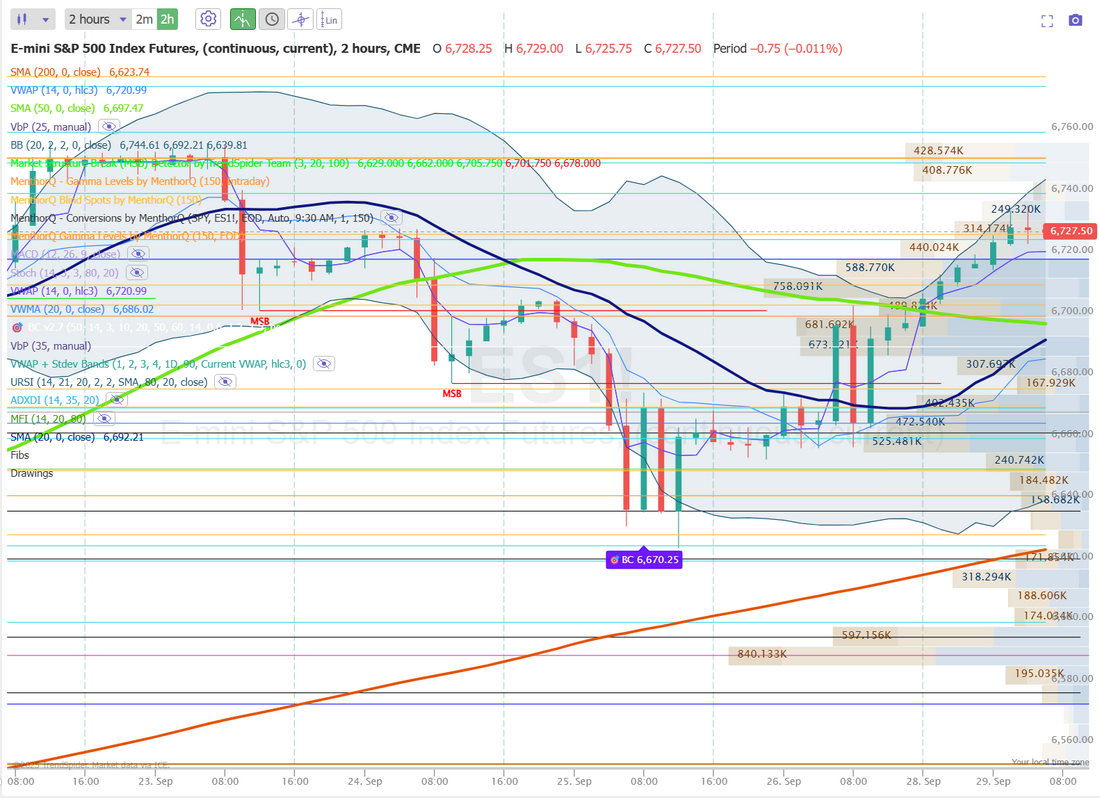

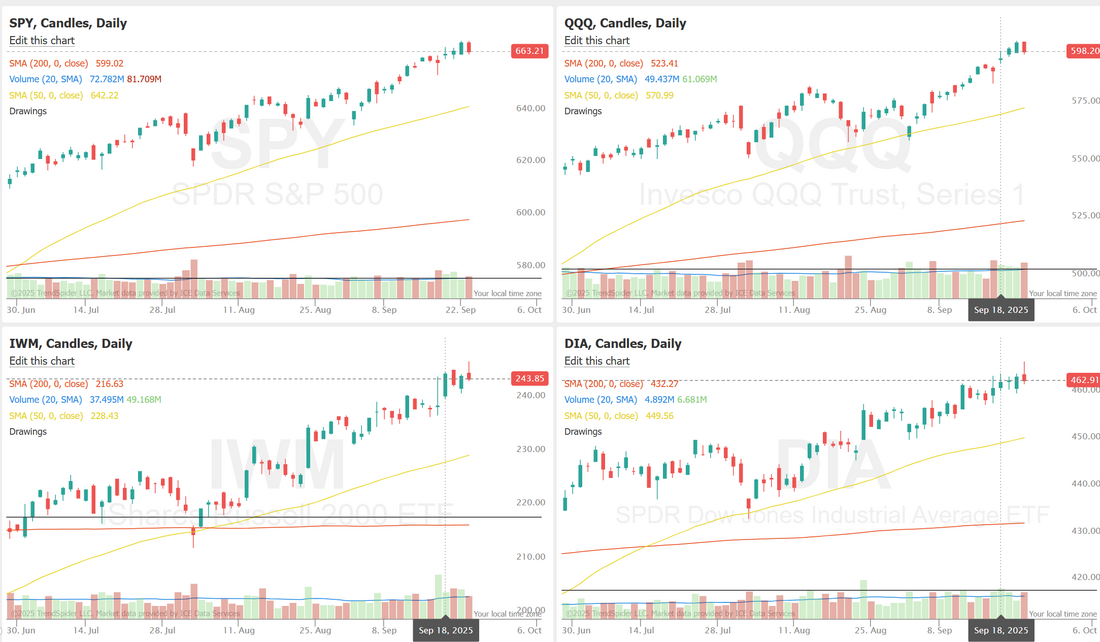

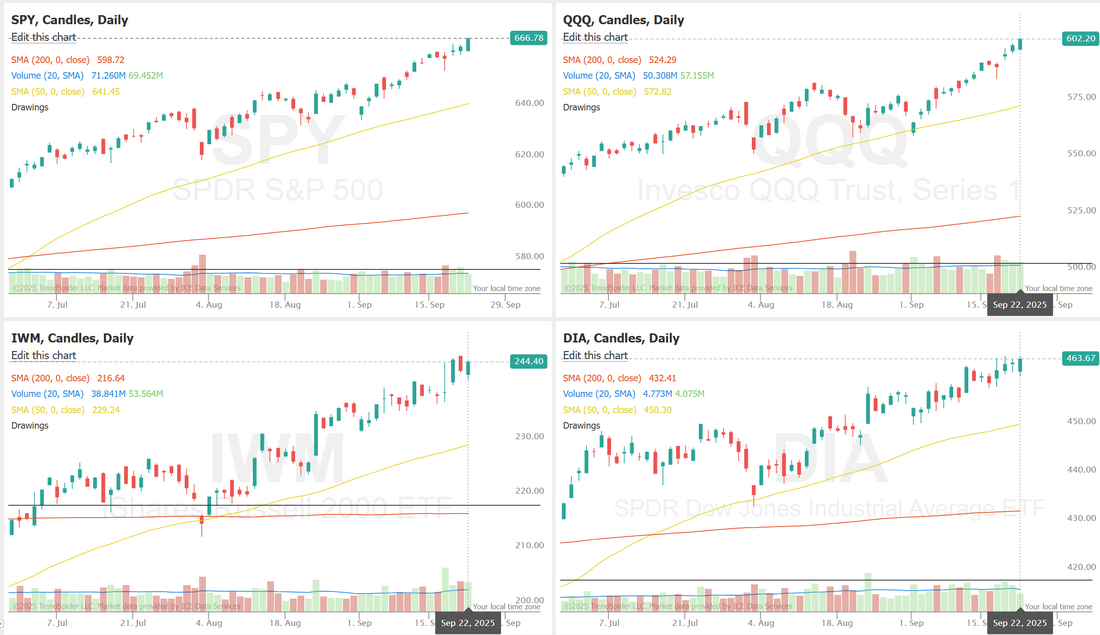

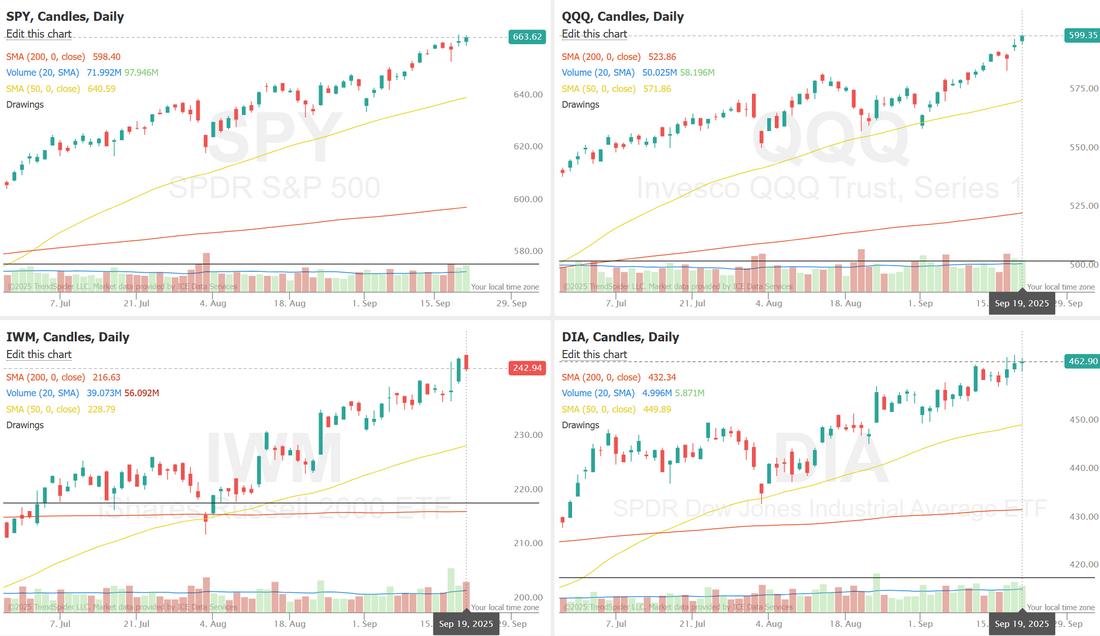

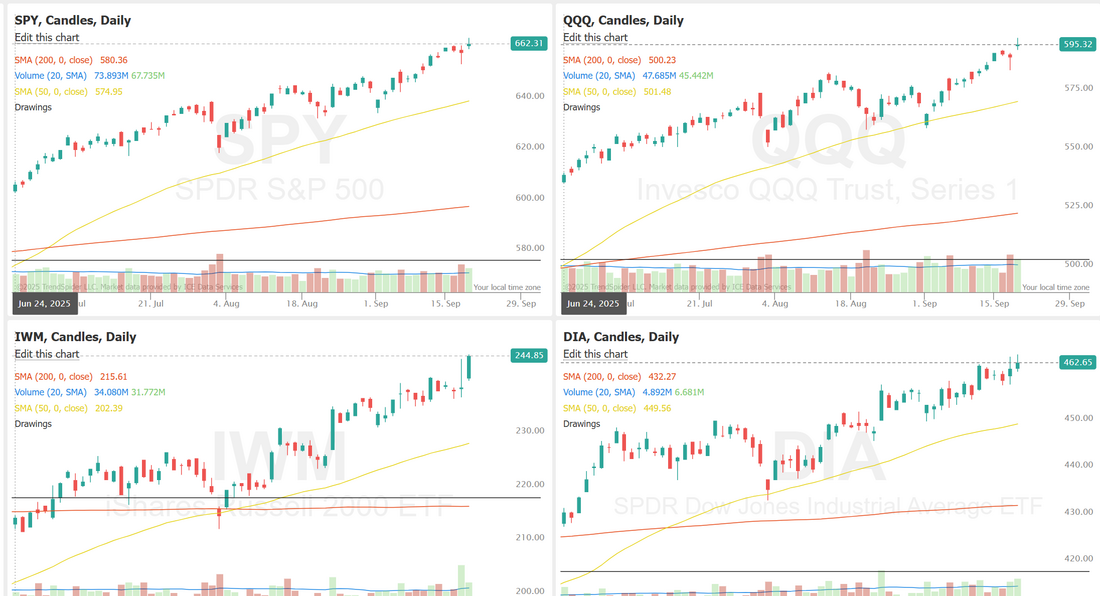

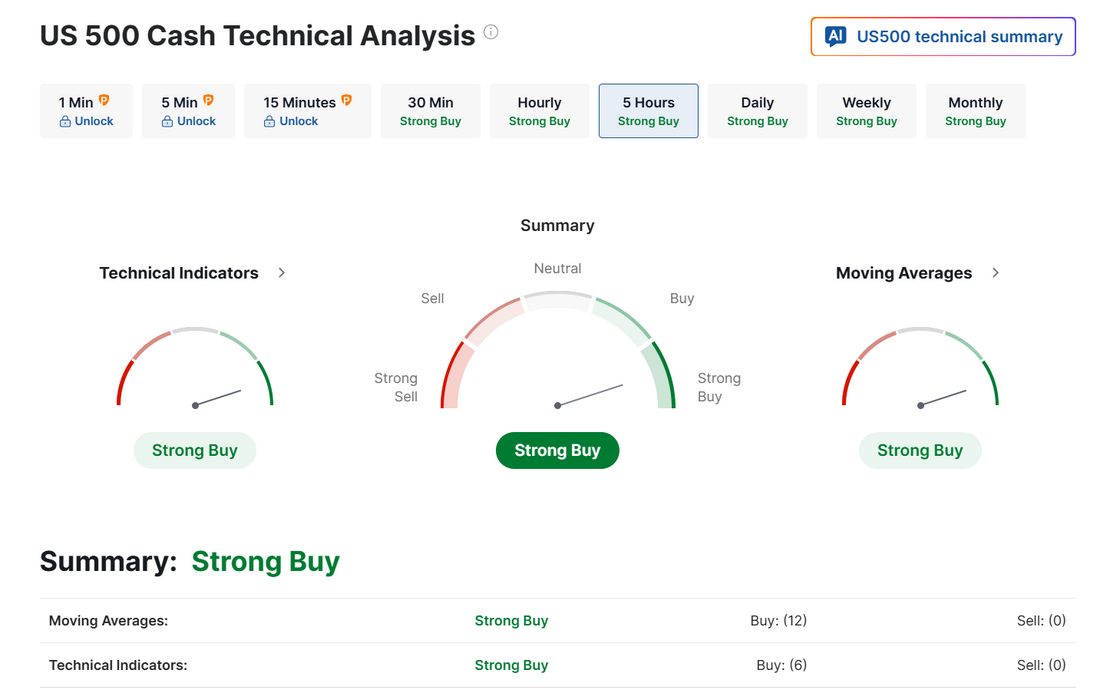

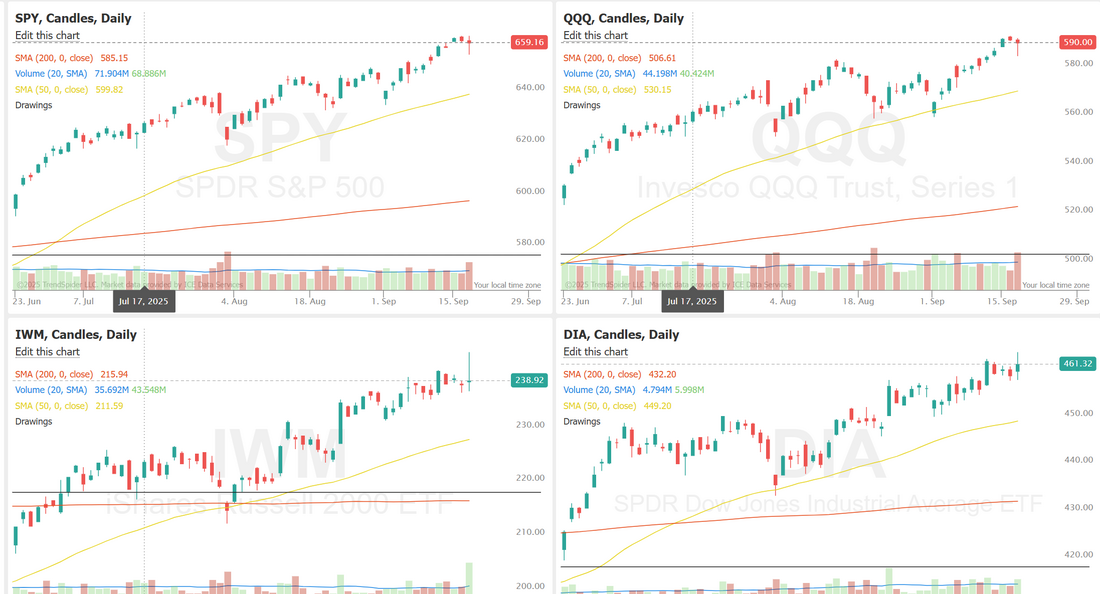

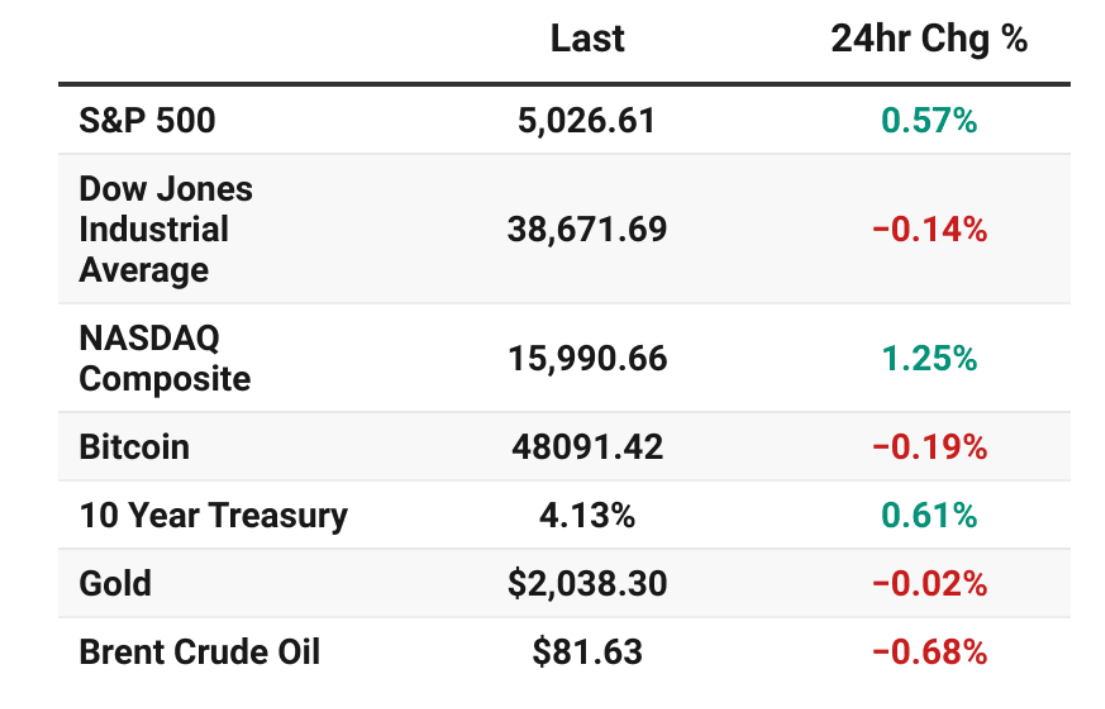

Shut downs. Rebounds. Tesla salesThese are just a few of the news items we are watching this week. After three decisive down days and a losing week last week for the markets, they are looking to rebound. Can the bulls take back over? We aren't far from our ATH's. Futures are up strongly this morning. We also have Tesla car sales results Weds. The stock has really stretched itself in the last two weeks. The numbers should be bad. How the market interprets that, though? That's anyone's guess. Musk has done a good job of moving focus away from autos to Robo taxis, Robots and A.I. We've also got a government shutdown looming. We've gotten used to the last-minute brinkmanship that comes with these events, only for them to be solved at the last moment. This time may be different. Both sides of the aisle seem willing to let this happen. What will that do to the markets? Here's a look at how that has historically played out. Historically, the U.S. stock market, as measured by the S&P 500, has shown remarkable resilience to federal government shutdowns, with performance during these events averaging near zero percent and often turning positive in the months following resolution. Since 1976, there have been 20 shutdowns lasting at least one day, with an average duration of about 8 days. The median return during these periods has been effectively flat (0%), though outcomes vary by event—ranging from declines of around 4% in some cases to gains exceeding 10% in others. Longer shutdowns (e.g., 10+ days) have occasionally coincided with slightly more negative median returns of about -2%, but post-shutdown rebounds are common, with average gains of 2.6% three months later and 7.5% six months later across all events.To illustrate, here's a table summarizing S&P 500 total returns for all 20 shutdowns since 1976, based on data through early 2019 (the most recent major event): Shorter shutdowns (1-3 days, which account for over half of all events) tend to have negligible impact, while the longest—the 35-day 2018-2019 shutdown—saw the S&P 500 rise 10.3% amid broader market momentum. Economic effects are typically temporary, trimming GDP growth by 0.1-0.2% per week of closure, but markets often "look through" the noise, prioritizing fundamentals like earnings and interest rates over political gridlock.A slightly different dataset focusing on 10 notable shutdowns since 1981 (excluding very brief ones) shows an average during-return of 1.5% and a median of 0.5%, with 12-month post-shutdown gains averaging 19.1%. Notable outliers include the 1995-1996 events (totaling 27 days across two), where markets were flat during but gained 18-23% over the following year.In the current environment as of September 2025, with a potential shutdown looming over funding disputes, historical patterns suggest limited lasting damage—though some analysts note the weaker economic backdrop could amplify short-term volatility compared to past cycles. Overall, shutdowns have rarely derailed bull markets and have even coincided with gains in resilient periods. We had an O.K. day on Friday. My last SPX entry lost but over all we were profitable again on the day. Here's a look at the day. Let's take a look at the markets to start this new week. Technicals are back to bullish! Bulls came fighting back on Friday. Futures are up this morning. SPY ended the week mostly unchanged at $661.82 (-0.27%), continuing to hold above key support. Price has bounced several times off the Short line of the Dynamo Cloud Indicator, a trend-following tool that combines volatility-adjusted moving averages with momentum to visualize trend direction and strength. If SPY remains above the green cloud, bulls may be eyeing the next major target near the 1.618 Fibonacci extension. QQQ fell slightly to $595.97 (-0.56%), holding up well even as inflation-sensitive assets like gold and silver posted strong gains. The ETF has repeatedly found support at the Long line of the Dynamo Cloud Indicator, signaling that bullish momentum remains intact. With tech holding firm amid shifting macro currents, traders are left wondering whether inflation risk is already priced in or if pressure is quietly building under the surface. IWM was the weakest of the major indexes this week, closing at $241.34 (-0.66%). Despite leading the decline, the small-cap ETF didn’t even retest the Short line of the Dynamo Cloud, underscoring the strength of its recent uptrend. The trend remains bullish, but reclaiming resistance near the recent all-time highs will be critical for small-cap bulls to maintain momentum. The SPX supertrend breadth chart shows that the index remains near recent highs, while the number of stocks generating buy signals has been trending lower. This indicates that fewer individual stocks are participating in the rally compared to earlier periods. The divergence between index levels and breadth readings highlights current market dynamics: the index continues to perform strongly overall, but the underlying participation appears narrower. December S&P 500 E-Mini futures (ESZ25) are up +0.48%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.63% this morning, pointing to a higher open on Wall Street as Treasury yields moved lower, while investors await U.S. President Donald Trump’s high-stakes meeting with congressional leaders to prevent a government shutdown. Top congressional leaders will meet with President Trump at the White House one day before federal funding lapses if the two parties fail to agree on a short-term spending bill. Republicans aim to pass a seven-week stopgap spending bill before negotiating any deals, while Democrats are demanding billions in healthcare funding before agreeing to a GOP plan. Raising the stakes, White House budget director Russ Vought directed agencies to prepare lists of employees to fire if funding lapses, going beyond the temporary furloughs and missed paychecks seen in past shutdowns. This week, investors also look ahead to remarks from Federal Reserve officials as well as a slew of U.S. economic data, with a particular focus on Friday’s nonfarm payrolls report. However, in the event of a federal government shutdown, the jobs report will be postponed if the Department of Labor follows an operational contingency plan outlined earlier this year. In Friday’s trading session, Wall Street’s major equity averages ended in the green. Electronic Arts (EA) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after The Wall Street Journal reported that the company was in advanced talks to go private in a roughly $50 billion deal. Also, chip stocks rallied after The Wall Street Journal reported that the Trump administration was considering a policy requiring U.S. firms to manufacture domestically as many chips as they import, with GlobalFoundries (GFS) climbing more than +8% and Intel (INTC) rising over +4%. In addition, Paccar (PCAR) advanced more than +5% after President Trump announced a 25% tariff on imports of heavy trucks. On the bearish side, Costco Wholesale (COST) fell over -2% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the bulk retailer reported weaker-than-expected FQ4 U.S. comparable sales growth. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, rose +0.2% m/m and +2.9% y/y in August, in line with expectations. Also, U.S. August personal spending climbed +0.6% m/m, stronger than expectations of +0.5% m/m, and personal income rose +0.4% m/m, stronger than expectations of +0.3% m/m. “Despite another month of elevated inflation, [Friday’s] PCE report was in-line across the board. That gives investors some relief that the current status quo will remain intact, and that the Fed will remain on track to cut rates two more times this year,” said Bret Kenwell at eToro. Richmond Fed President Tom Barkin said on Friday that although both unemployment and inflation have diverged from the targets, he sees only limited risk of further deterioration. At the same time, Fed Vice Chair for Supervision Michelle Bowman reaffirmed her stance that officials should act “decisively and proactively to address decreasing labor market dynamism and emerging signs of fragility.” Cleveland Fed President Beth Hammack told CNBC’s Squawk Box Europe on Monday that the U.S. central bank must keep a restrictive monetary policy stance to bring inflation down to its 2% target. “It’s a challenging time for monetary policy. We are being challenged on both sides of our mandate,” Hammack said. U.S. rate futures have priced in an 89.3% chance of a 25 basis point rate cut and a 10.7% chance of no rate change at the conclusion of the Fed’s October meeting. The U.S. September Nonfarm Payrolls report will be the main highlight this week. Recent soft labor market data prompted the Fed to lower interest rates at its latest meeting, and many expect additional rate cuts in the coming months. HSBC analysts anticipate another “soft” nonfarm payrolls report, which they say would effectively “rubber stamp” a rate cut in October. Analysts also noted that any revisions to prior data will be scrutinized following significant downward revisions in recent months. Ahead of the key jobs report, additional insights into the health of the U.S. labor market will come from the JOLTs Job Openings, ADP Nonfarm Employment Change, and Initial Jobless Claims. Other noteworthy data releases include the U.S. Conference Board’s Consumer Confidence Index, the Chicago PMI, the S&P/CS HPI Composite - 20 n.s.a., the S&P Global Manufacturing PMI, the ISM Manufacturing PMI, Construction Spending, Factory Orders, Average Hourly Earnings, the S&P Global Services PMI, the ISM Non-Manufacturing PMI, and the Unemployment Rate. Market participants will also parse comments from a slew of Fed officials. Fed Vice Chair Philip Jefferson, Fed Governor Christopher Waller, Cleveland Fed President Beth Hammack, New York Fed President John Williams, St. Louis Fed President Alberto Musalem, Atlanta Fed President Raphael Bostic, Boston Fed President Susan Collins, Chicago Fed President Austan Goolsbee, and Dallas Fed President Lorie Logan are scheduled to speak this week. In addition, several notable companies, including shoemaker Nike (NKE), cruise ship operator Carnival (CCL), payroll processing firm Paychex (PAYX), and snack maker ConAgra Brands (CAG), are slated to release their quarterly results this week. Today, investors will focus on U.S. Pending Home Sales data, which is set to be released in a couple of hours. Economists expect the August figure to rise +0.2% m/m following a -0.4% m/m drop in July. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.143%, down -1.05%. Friday was a strong save for the bulls but... volume was down 35% and Utilities had most of the strength. Not a great look if you're bullish. My lean or bias today is bullish. It looks like the bulls have found a support area they'd like to protect. Futures are up this morning. We have some FED talk but not much else that should stand in the bulls way. We've got our weekly training session scheduled for today at 12:00 pm MDT. Today's focus will be on building consistency in your results. Please join us on the live zoom feed to participate! Let's take a look at our intra-day levels on /ES: The daily chart doesn't tell us much. Price action is bullish but MACD and Stoch are neutral to slightly overstretched. Looking at the 2hr. chart. 6741 is first resistance zone. 6752 in next and key. This is were we were "stuck" in the market when the down turn started. A break above this would be very bullish. 6760 is the next level above that. 6725, 6719, 6710, 6699 are the support zones. It's always a pleasure to be back with you all trading a new week. I'll see you in the live trading room shortly!

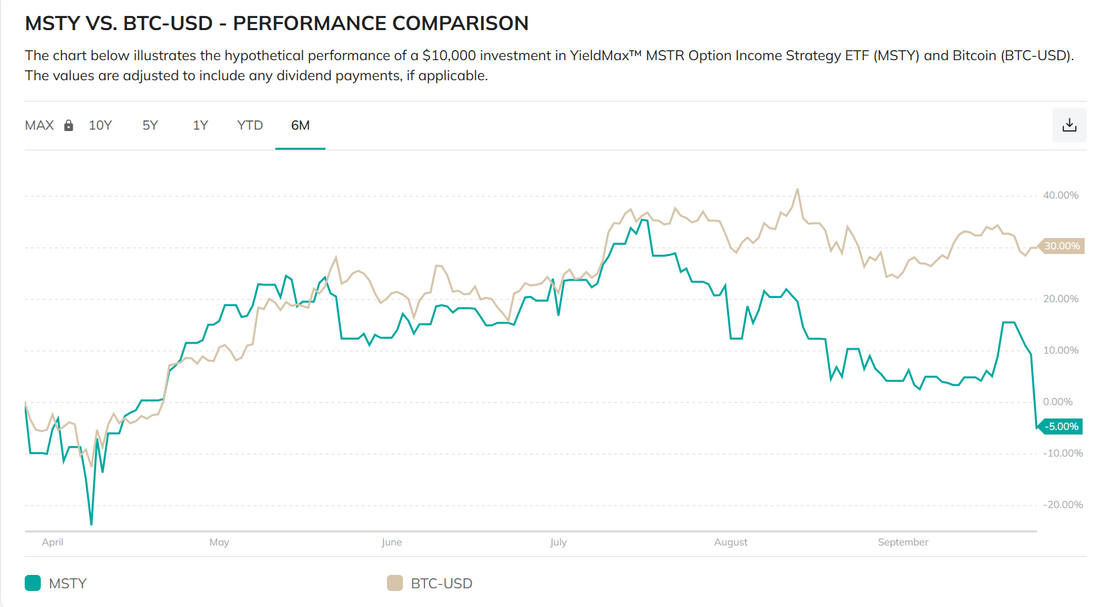

What leads us up, leads us down.Cracks are starting to show in the market. They're not big. Nothing major but it's starting. Will it build into something bigger? Who knows but what leads us up leads us down. A.I., Tech. All the stuff that's held us higher is now carrying us lower. My favorite trade of the last six months, that I've shared many, many times with our trading room members is the "Short MYST, Long BTC" trade. Was there ever a better short than the ponzi scheme MSTY? It's been easy money. Junk like MSTY can't survive in sane markets. It's needs to be frothy. When you see scams like this perpetrated on gullible retail investors it's usually a sign were at a top. We had a picture perfect day yesterday. I've always said a perfect day contains #1. Big moves. #2. Preferably down. The best markets are down ones. Bigger moves. Better premium. Let's take a look at the markets: We've had three glorious days to the downside. 6615 is really where bears need to take us to really make something of this. Otherwise its just a blip in an otherwise clean bull run. We are still holding to a slight sell signal, but just barely. The bears are trying. We've got PCE today which could determine todays outcome. December S&P 500 E-Mini futures (ESZ25) are trending up +0.03% this morning as investors weigh U.S. President Donald Trump’s latest tariff salvo and await the release of the Federal Reserve’s first-line inflation gauge for clues on the central bank’s next policy move. After a stretch of calm on the tariff front, U.S. President Donald Trump announced a fresh round of sectoral tariffs set to take effect on October 1st. President Trump said pharmaceutical companies would face a 100% tariff on branded or patented drugs. “Starting October 1st, 2025, we will be imposing a 100% Tariff on any branded or patented Pharmaceutical Product, unless a Company IS BUILDING their Pharmaceutical Manufacturing Plant in America,” Trump posted on Truth Social. Also, imported heavy trucks will face a 25% tariff, kitchen cabinets and bathroom vanities will be hit with a 50% duty, and upholstered furniture imports will be taxed at 30%. In yesterday’s trading session, Wall Street’s major indices closed lower. CarMax (KMX) tumbled over -20% and was the top percentage loser on the S&P 500 after the used-car seller posted downbeat Q2 results. Also, chip stocks lost ground, with Arm Holdings (ARM) and ON Semiconductor (ON) falling more than -2%. In addition, Oracle (ORCL) slumped over -5% after Rothschild & Co. Redburn initiated coverage of the stock with a Sell rating and $175 price target. On the bullish side, Intel (INTC) surged over +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 following reports that Apple and TSMC were among the companies the chipmaker had approached about investments or manufacturing partnerships. The U.S. Bureau of Economic Analysis said on Thursday that Q2 GDP growth was revised higher to +3.8% (q/q annualized) in its third estimate, stronger than expectations of no change at +3.3%. Also, U.S. durable goods orders unexpectedly rose +2.9% m/m in August, stronger than expectations of -0.3% m/m, while core durable goods orders, which exclude transportation, unexpectedly rose +0.4% m/m, stronger than expectations of -0.1% m/m. In addition, U.S. existing home sales fell -0.2% m/m to 4.00 million in August, stronger than expectations of 3.96 million. Finally, the number of Americans filing for initial jobless claims in the past week fell by -14K to a 2-month low of 218K, compared with the 233K expected. “We agree that the economy is strong and growing, but a lot of that good news is already priced in. Where we have our largest concern is with valuations,” said Chris Zaccarelli at Northlight Asset Management. Fed Governor Stephen Miran said on Thursday that the central bank risks harming the economy if it does not act quickly to cut interest rates. Also, Fed Governor Michelle Bowman said that inflation is close enough to the central bank’s 2% target to justify additional rate cuts given the weakening labor market. At the same time, Chicago Fed President Austan Goolsbee voiced continued concerns about tariff-driven inflation and opposed any push for “front-loading” multiple interest rate cuts. In addition, Kansas City Fed President Jeff Schmid indicated that policymakers may not need to cut interest rates again in the near term. Meanwhile, U.S. rate futures have priced in an 87.7% chance of a 25 basis point rate cut and a 12.3% chance of no rate change at the October FOMC meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.9% y/y in August, compared to the previous figures of +0.3% m/m and +2.9% y/y. “If we were to see an uptick, that could worry investors that the Fed’s rate cut expectations are too ambitious, and that they may need to establish more of a wait-and-see approach on rates,” said Paul Stanley at Granite Bay Wealth Management. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate August Personal Spending to rise +0.5% m/m and Personal Income to grow +0.3% m/m, compared to the July figures of +0.5% m/m and +0.4% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists expect the final September figure to be revised slightly higher to 55.5 from the preliminary reading of 55.4. In addition, market participants will parse comments today from Richmond Fed President Tom Barkin, Fed Governor Michelle Bowman, and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.170%, down -0.10%. Let's look at our intra-day levels on /ES. 6678, 6690, 6701 are resistance zones. 6661, 6651, 6636 are support zones. Let's have a good day folks! See you in the live trading room shortly!

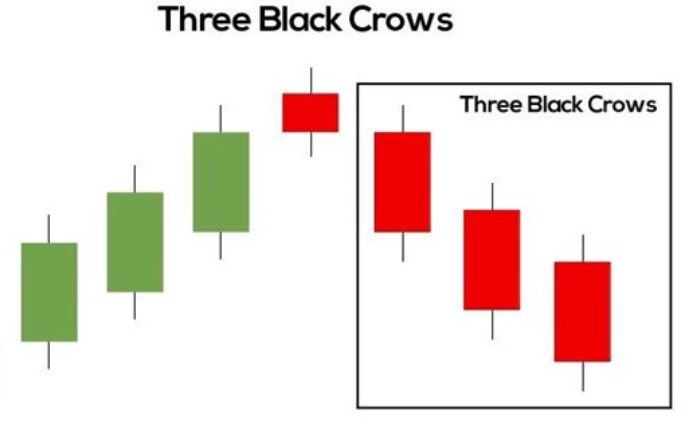

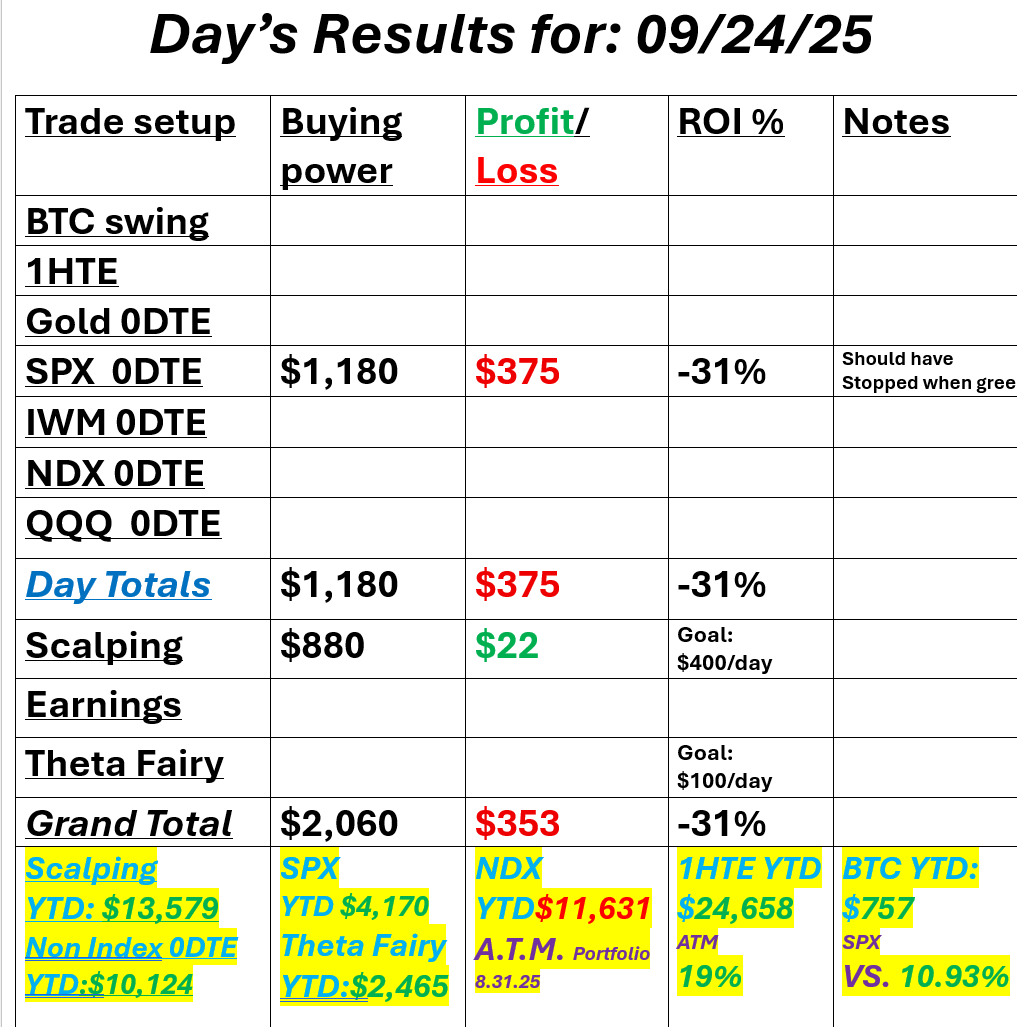

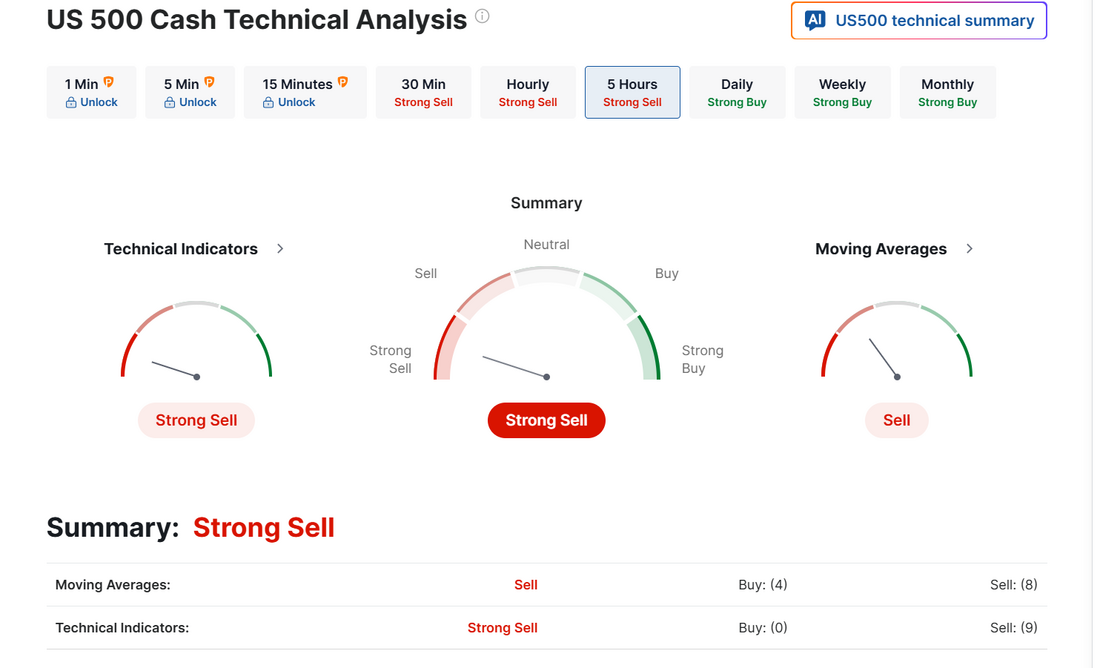

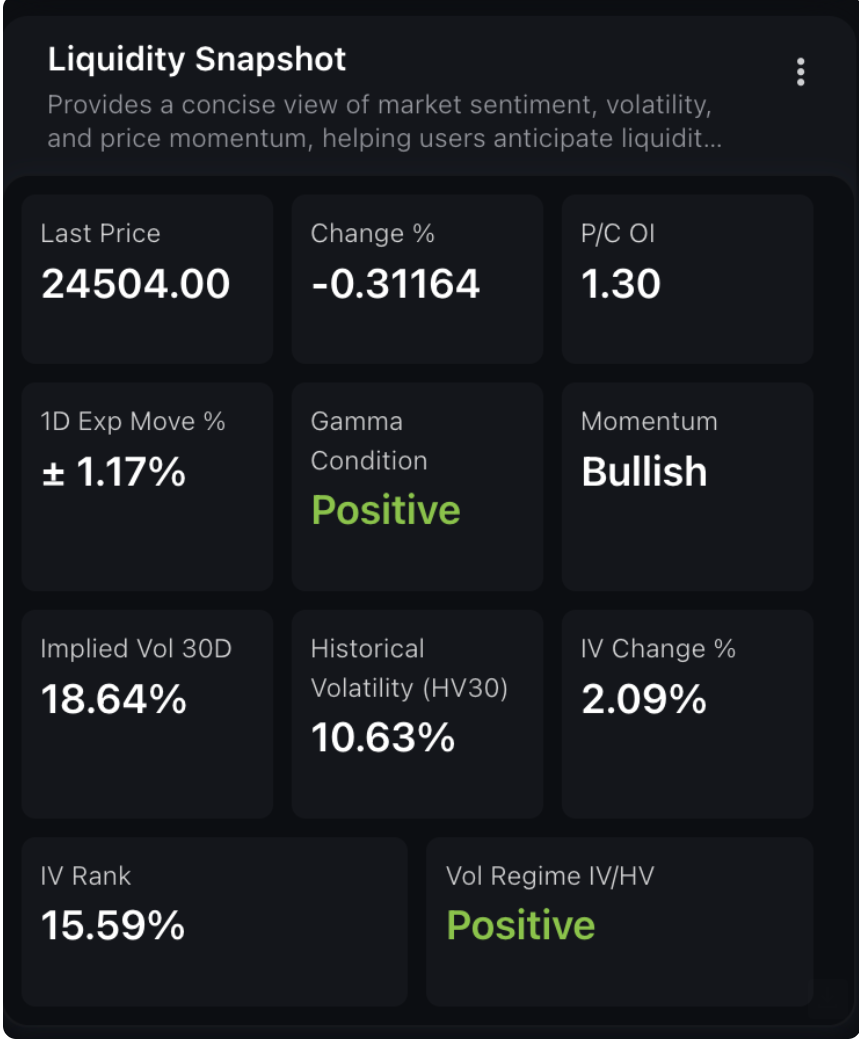

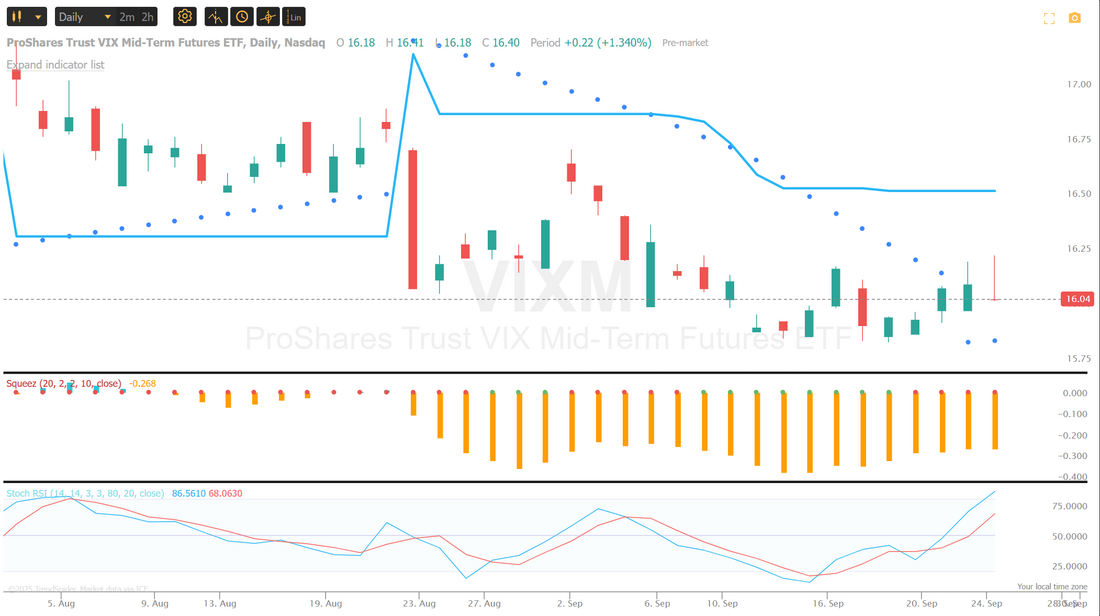

"Three black crows"When you get three successive down days where the lows of the day surpass the previous days low, you get a "three black crows" signal. It's bearish. Today could be the completion of that pattern. There's lots of day left so it's too early to tell but the bearish retrace we've been wanting could be at our doorsteps. One of our key mantras is " Don't let green turn to red". I did that yesterday. We should of just stopped with the profit we had. Here's a look at my day: Let's take a look at the new market dynamic. Today is a key day. Another red day today and we've got an official trend going. We've got a rare "sell" signal forming. December S&P 500 E-Mini futures (ESZ25) are down -0.28%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.40% this morning, pointing to more weakness on Wall Street after two days of losses, while investors await a fresh batch of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from bulk retailer Costco. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the red. Freeport-McMoRan (FCX) tumbled nearly -17% and was the top percentage loser on the S&P 500 after the miner cut its Q3 copper and gold sales guidance and declared force majeure on contracted copper supplies from its Grasberg mine in Indonesia. Also, Bloom Energy (BE) plunged more than -10% after Jefferies downgraded the stock to Underperform from Hold with a price target of $31. In addition, Adobe (ADBE) fell over -2% after Morgan Stanley downgraded the stock to Equal Weight from Overweight. On the bullish side, Marvell Technology (MRVL) climbed more than +7% and was the top percentage gainer on the Nasdaq 100 after the semiconductor company’s board authorized a new $5 billion share repurchase program. Economic data released on Wednesday showed that U.S. new home sales unexpectedly surged +20.5% m/m to a 3-1/2-year high of 800K in August, stronger than expectations of 650K. Meanwhile, U.S. Treasury Secretary Scott Bessent on Wednesday voiced disappointment that Fed Chair Jerome Powell has not clearly outlined an agenda for lowering interest rates. “Rates are too restrictive; they need to come down,” Bessent said in an interview on Fox Business. “I’m a bit surprised that the chair hasn’t signaled that we have a destination before the end of the year of at least 100 to 150 basis points.” San Francisco Fed President Mary Daly said on Wednesday that more interest rate cuts will likely be needed, but noted that policymakers should proceed carefully. “It is likely that further policy adjustments will be needed as we work to restore price stability while providing needed support to the labor market,” Daly said. U.S. rate futures have priced in a 91.9% probability of a 25 basis point rate cut and an 8.1% chance of no rate change at October’s monetary policy meeting. Today, all eyes are focused on the U.S. Commerce Department’s final estimate of gross domestic product. Economists expect the U.S. economy to expand at an annual rate of 3.3% in the second quarter. Investors will also focus on U.S. Durable Goods Orders and Core Durable Goods Orders data. Economists expect August Durable Goods Orders to drop -0.3% m/m and Core Durable Goods Orders to fall -0.1% m/m, compared to the prior figures of -2.8% m/m and +1.1% m/m, respectively. U.S. Existing Home Sales data will be reported today. Economists foresee this figure coming in at 3.96 million in August, compared to 4.01 million in July. U.S. Wholesale Inventories data will come in today. Economists forecast the preliminary August figure at +0.2% m/m, compared to +0.1% m/m in July. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 233K, compared to last week’s number of 231K. In addition, market participants will hear perspectives from Chicago Fed President Austan Goolsbee, Kansas City Fed President Jeff Schmid, New York Fed President John Williams, Fed Governor Michelle Bowman, Fed Governor Michael Barr, Dallas Fed President Lorie Logan, and San Francisco Fed President Mary Daly throughout the day. On the earnings front, notable companies such as Costco (COST), Accenture (ACN), Jabil Circuit (JBL), and CarMax (KMX) are set to report their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.140%, down -0.19%. The SPX remains near recent highs around the 6,650 level, but the latest pullback alongside a dip in the option score hints at waning short-term conviction. Option sentiment has generally held in the mid-to-upper range over the past month, providing support to the broader trend, but recent fluctuations suggest choppier positioning as traders reassess momentum. In the short term, price action around 6,600–6,650 will be key in gauging whether this consolidation turns into a stronger push higher or if volatility re-emerges with a test of lower support levels. The NDX liquidity snapshot shows a last price of 24,504 with a modest dip on the day, though overall conditions remain constructive. A positive gamma backdrop combined with bullish momentum indicates that options positioning may help stabilize price action in the near term. Implied volatility at 18.64% sits notably above historical volatility of 10.63%, reflecting heightened demand for protection or speculative positioning, while a low IV rank of 15.59% suggests volatility is still relatively contained compared to longer-term levels. With the 1-day expected move at ±1.17%, short-term flows could remain active, especially as traders react to shifts in volatility pricing. $VIX up 3 days in a row… so far. Has not done 4 green days in a row since the heart of the April tariffs crash. Just something to think about and keep an eye on. Has anyone else noticed, as prices go higher and continue to hit new ATH's, momentum is starting to swing downward? We had a good training yesterday on ADX. It's one of our favorite indicators for intra-day trading. I'm looking forward to next Monday. We'll have a whole new topic to train on. Please join us on the live zoom feed then. Let's take a look at the new levels that have formed in the /ES. I don't know about you, but for me that's a pretty clean looking sell signal we've developed on the daily chart. Looking at the intra-day levels: 6670, 6678, 6685, 6702 are new resistance zones. 6662, 6656, 6649, 6636 are support zones. I always say, " a perfect day for us involves lots of movement...preferably down." That looks like what we may get today! I look forward to seeing you all in the live trading room shortly.

"Fairly highly valued"Well...thanks for that Mr. Powell. We had our day all mapped out yesterday. We waited through the first two FED speakers. We waited through the PMI release. I calculated that Powell would stick to the same script as his FOMC testimony and we'd get a rally. I put on a bullish debit in anticipation. I should have waited. He DID largely stick to the script UNTIL it got the the Q&A. Powell is asked about the stock market nearly every time he speaks and he ALWAYS says, "we don't comment on the stock market". Well, he certainly did yesterday! Calling it "fairly highly valued". That's an indirect way of saying it's over priced and needs to come down. Come down it did. I had about $1,300 at risk and was able to scale another bullish debit into the setup before the close to cut the loss but it still finished red. Overall I'm happy I was able to mitigate the risk but upset I didn't just wait it out. Today is a new day. Here's a look at my day. Let's take a look at the markets. It felt like a big drawdown in the moment but that's only because we haven't gone down in a while. All that really happened yesterday was a give back of the previous days gains. Could this be a turning point in the market? Sure. For me, unless we get some confirmed additional weakness today I'd say it's back to business as usual for the bulls. Technicals moved to neutral after yesterdays selloff but are back to a slight buy signal to start the morning. It will be interesting to see if bears can make something out of yesterdays price action today. We will be going 108 consecutive days without having back to back closes below the 20 day moving average on SPX. I don't think that's a record but it is a rare feat. How much longer can the bulls hold court? December Nasdaq 100 E-Mini futures (NQZ25) are trending up +0.30% this morning as optimism over artificial intelligence was reinforced by Alibaba’s pledge to boost spending and an upbeat forecast from Micron Technology. U.S.-listed shares of Alibaba Group (BABA) surged over +9% in pre-market trading after the Chinese e-commerce giant announced it would boost AI spending beyond its initial $53 billion target and released its largest AI language model to date. Also, Micron Technology (MU) rose over +1% in pre-market trading after the largest U.S. maker of computer memory chips posted upbeat FQ4 results and issued above-consensus FQ1 guidance. In yesterday’s trading session, Wall Street’s major indexes closed lower. The Magnificent Seven stocks retreated, with Amazon.com (AMZN) sliding over -3% to lead losers in the Dow and Nvidia (NVDA) falling more than -2%. Also, Vistra Corp. (VST) dropped over -6% and was among the top percentage losers on the S&P 500 after Jefferies downgraded the stock to Hold from Buy. In addition, Firefly Aerospace (FLY) plunged more than -15% after the rocket developer posted weaker-than-expected Q2 results. On the bullish side, McKesson (MCK) climbed over +6% after the healthcare services company raised its FY26 adjusted EPS guidance. Economic data released on Tuesday showed that the U.S. S&P Global manufacturing PMI fell to 52.0 in September, weaker than expectations of 52.2. Also, the U.S. September S&P Global services PMI fell to 53.9, weaker than expectations of 54.0. In addition, the U.S. Richmond Fed manufacturing index unexpectedly fell to -17 in September, weaker than expectations of -5. Fed Chair Jerome Powell said on Tuesday that risks remain for both the labor market and inflation, reiterating that policymakers likely face a difficult path ahead as they consider additional rate cuts. “Near-term risks to inflation are tilted to the upside and risks to employment to the downside — a challenging situation,” Powell said. The Fed chief did not indicate whether he might support a rate cut at the central bank’s next meeting. “Powell doesn’t want to antagonize the White House, but he’s not rolling over either,” said David Russell at TradeStation. “He’s keeping his options open in case price pressures increase. Powell’s not trying to sound hawkish, but he’s trying to dodge some of the forceful demand for aggressive cuts.” Also speaking on Tuesday, Chicago Fed President Austan Goolsbee said policymakers should remain cautious about further rate cuts as inflation is above the central bank’s target and rising. Atlanta Fed President Raphael Bostic echoed remarks from his Chicago counterpart, saying he anticipates more inflation coming. At the same time, Fed Governor Michelle Bowman said, “Now that we have seen many months of deteriorating labor market conditions, it is time for the FOMC to act decisively and proactively to address decreasing labor market dynamism and emerging signs of fragility.” Meanwhile, U.S. rate futures have priced in a 94.1% chance of a 25 basis point rate cut and a 5.9% chance of no rate change at the October FOMC meeting. Today, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that August new home sales will stand at 650K, compared to 652K in July. U.S. Crude Oil Inventories data will also be released today. Economists expect this figure to be 0.8 million, compared to last week’s value of -9.3 million. In addition, market participants will be anticipating a speech from San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.110%, down -0.24%. Today we'll have our training class on ADX and ATR that we missed on Monday. Come join us around 12:00 pm MDT. The SPX continues to grind higher toward fresh highs, with volatility risk premium (VRP) climbing to 5.6%, placing implied volatility in the “overvalued” zone relative to realized moves. The elevated VRP suggests options markets are pricing in more risk than spot action has delivered, which can sometimes precede periods of consolidation or choppier trading. In the short term, keeping an eye on whether VRP remains stretched or begins to compress will be important for gauging if momentum can extend cleanly higher or if markets pause to digest recent gains. Let's take a look at our intra-day /ES levels. Levels are tightly clustered this morning. 6730, 6732, 6734, 6750, 6753 are all resistance zones with 6734 being a big trigger zone for bulls. Resistance zones are 6723, 6718, 6715, 6700, 6695. I'll see you all in our live trading room shortly!

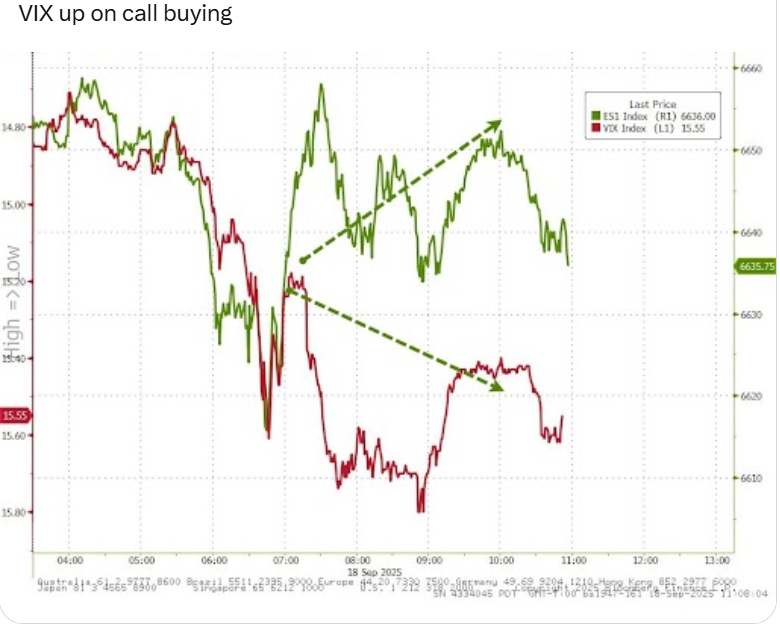

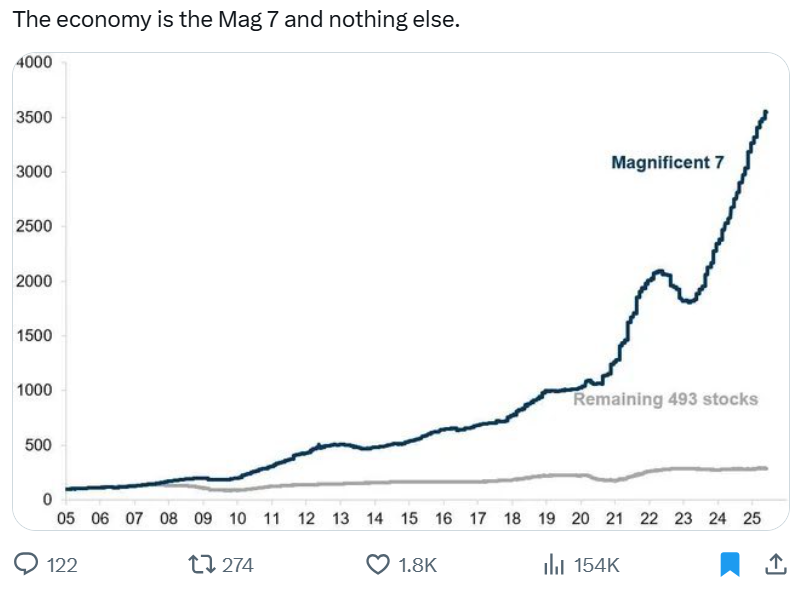

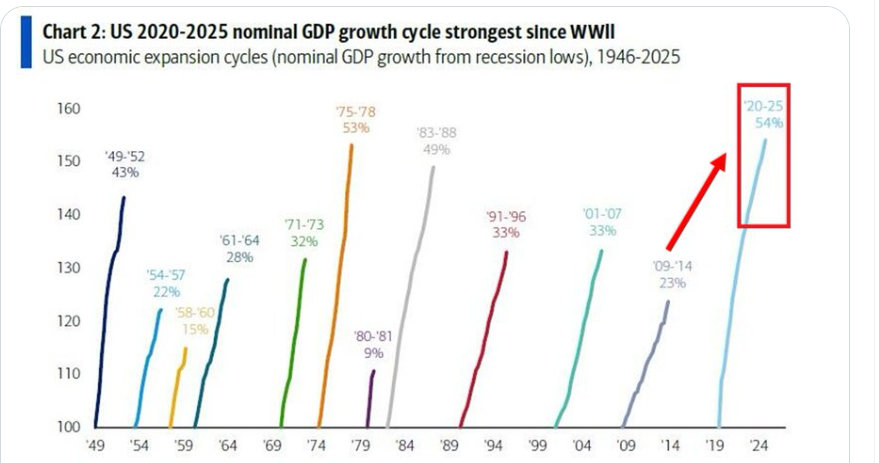

FED speak dayA couple FED members as well as Powell will be speaking this morning. That might add some spice to the day. We've also got PMI data incoming. I don't expect we'll see any change in Powells stance than what he laid out during his FOMC speech. We had a good day yesterday. We worked an NDX bearish retracement that "kinda" worked but we never really got a retrace. We bailed on it before we got too close to the close. Yesterday in our live trading room we talked about a documentary on trading and the idea that it's harder to make $50-$100 dollars a day consistently every day for the rest of your life than it is to make $10,000 dollars in one day! Consistency is hard! Our goal this week is to be green every day. It's a big goal. Let's take a look at the market: Technicals are still bullish. New ATH's again anyone? December S&P 500 E-Mini futures (ESZ25) are down -0.04%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.06% this morning as investors remain on the sidelines ahead of a speech from Federal Reserve Chair Jerome Powell and U.S. business activity data. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green, with the S&P 500, Dow, and Nasdaq 100 posting new record highs. Nvidia (NVDA) rose over +3% after the chipmaker announced plans to invest up to $100 billion in OpenAI to support new data centers and other AI infrastructure. Also, Teradyne (TER) surged more than +12% and was the top percentage gainer on the S&P 500 after Susquehanna raised its price target on the stock to $200 from $133. In addition, Applied Materials (AMAT) climbed over +5% and was the top percentage gainer on the Nasdaq 100 after Morgan Stanley upgraded the stock to Overweight from Equal Weight with a price target of $209. On the bearish side, Kenvue (KVUE) slumped more than -7% and was the top percentage loser on the S&P 500 after the Washington Post reported that the Trump administration plans to link the active ingredient in Tylenol to autism. Fed Governor Stephen Miran said on Monday that interest rates are currently too high and argued for cutting them aggressively in the coming months to safeguard the labor market. At the same time, St. Louis Fed President Alberto Musalem said he supported last week’s rate cut but sees limited scope for further reductions amid elevated inflation. Also, Atlanta Fed President Raphael Bostic said he was comfortable with last week’s rate cut but sees little justification for further easing this year. In addition, Cleveland Fed President Beth Hammack said she remains firmly focused on inflation and that policymakers should be careful with interest rate cuts to avoid overheating the economy. U.S. rate futures have priced in an 89.8% probability of a 25 basis point rate cut and a 10.2% chance of no rate change at the next FOMC meeting in October. Meanwhile, the Organization for Economic Cooperation and Development said on Tuesday that the U.S. and global economies are expected to slow less sharply this year than previously forecast, but will continue to lose momentum in 2026 as higher tariffs increasingly weigh on activity. The U.S. economy is now projected to expand by 1.8% this year, up from the 1.6% forecast in June, and 1.5% next year, unchanged from the previous forecast. The global economy is projected to grow by 3.2% this year, up from the 2.9% projected in June, and 2.9% next year, unchanged from the previous forecast. Today, investors will focus on a speech from Fed Chair Jerome Powell. Mr. Powell is set to speak on the economic outlook at an event at the Greater Providence Chamber of Commerce. Also, Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic, and Fed Governor Michelle Bowman will speak today. “Fedspeak this week will highlight the wide dispersion of views on the Committee,” said Oscar Munoz at TD Securities. “We do not expect Powell to change his tone from his FOMC press conference.” On the economic data front, investors will monitor preliminary U.S. purchasing managers’ surveys, as they will provide updates on activity in the manufacturing and services sectors. Economists expect the September S&P Global Manufacturing PMI to be 52.2 and the S&P Global Services PMI to be 54.0, compared to the previous values of 53.0 and 54.5, respectively. The U.S. Richmond Fed Manufacturing Index will also be released today. Economists foresee this figure coming in at -5 in September, compared to last month’s value of -7. On the earnings front, chipmaker Micron Technology (MU) and auto parts seller AutoZone (AZO) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.127%, down -0.48%. Oh boy. VIX is climbing on bullish market price action! This is pretty rare. Market concentration continues. I know most of my thoughts lately have been focused on a market being vastly overvalued. Here's some good economic news. US nominal GDP has grown 54% since the 2020 low, marking the strongest economic expansion since World War 2. This surpasses the 53% growth recorded in 1975-1978. It also corresponds to an average annual nominal GDP increase of 6%, indicating rapid expansion. By comparison, the post-2008 Financial Crisis recovery saw ~23% nominal growth until 2014. In other words, in Dollar terms, the US economy has grown twice as fast as it did after emerging from 2008. The US economy is experiencing a historic run. It's tough right now for me to have a lean or bias today. Futures are flat. FED speak and PMI could create some directional movement today. Let's be patient today and see how the morning develops. Let's take a look at our intra-day levels. No, the chart is not broken. We've been flatlining since yesterday. 6750 seems to be the resting point. An upward move has 6759, 6765, 6775, as resistance zones. 6730, 6717, 6700 are support zones. Patience is the key today. Bowman speaking kicks us off the PMI then Bostic speaks then Powell. We may need to wait quite a bit before jumping in. As always, price action will dictate. I'll see you all shortly!

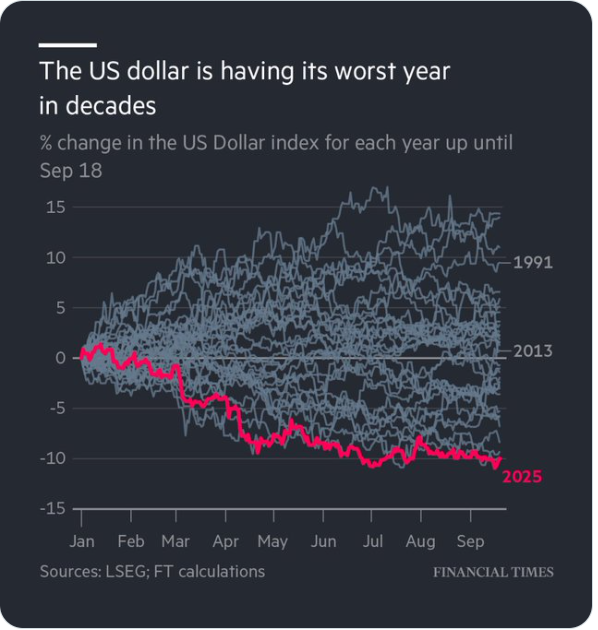

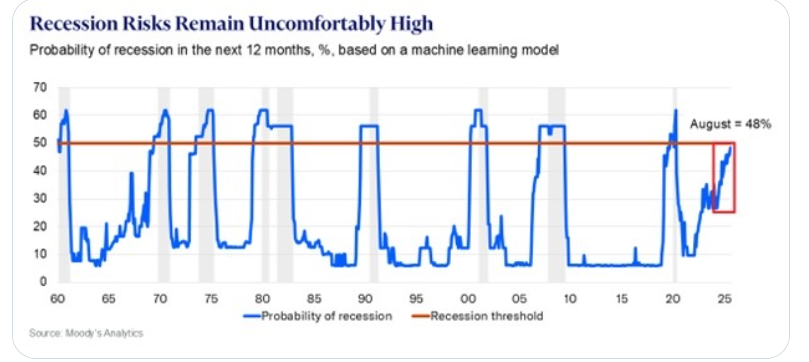

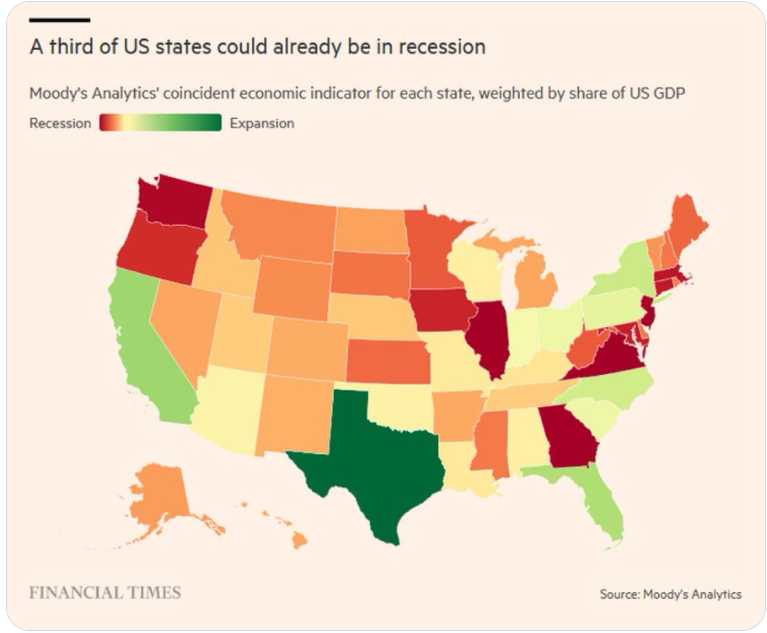

PMI, GDP, PCE all incoming this week.We've got an alphabet soup of economic reports incoming this week. Not to mention Jobless claims. We've also got lots of FED speak in the next couple days including Powell on Tues. Futures are pointing to a 92% probability of another 25 bp cut next time around. This weeks readings should add a bit more clarity (or confusion) to the potential of more rate cuts. Friday was pretty quite for me. With no movement in the morning I put on an Iron fly on SPX. It was the right trade but I left it on too long and ended up in the red on it. Scalping and NDX were small trades. I think today may finally offer us up a trend day which would be very welcome. Here's a look at my Friday. Let's take a look at the market and what we are looking for in this new week: Technicals are leaning bullish but the 1 hour timeframe has turned bearish. Watch for a potential reversal today. Strong may not be the word to use for the recent price action. It's been almost relentless in it's climb higher. We are 14 trading days now into this current run up on SPX and NDX. It seems every day is a new ATH. The SPX continues to edge higher toward fresh highs, but the seasonality score has recently slipped back into negative territory after holding neutral-to-positive for much of early September. This shift suggests that short-term seasonal patterns may be less supportive over the coming sessions, even as price action remains firm. In the near term, traders may want to watch whether the index can sustain its upward momentum against this seasonal headwind, as further weakness in the score could signal a period of consolidation or slower gains. SPY ended the week at a record $663.70 (+0.62%). The RSI Ensemble shows slightly oversold conditions, a setup that has often preceded brief pullbacks. The Polymarket Indicator is showing 65% odds of two additional cuts before year-end, raising the question of whether easing can push toward $700 or if consolidation comes first. QQQ led the major indexes, closing at a new high of $599.35 (+1.85%). The RSI Ensemble is now leaning overbought, suggesting that internals may be becoming stretched even as price grinds higher. Tech leadership is intact, but extended readings could make the next phase of the rally more volatile. IWM climbed to $242.98 (+1.58%), its first record close in nearly a year. The breakout follows the Fed’s 25bps cut, a meaningful tailwind for rate-sensitive small caps. If the move holds, the group may continue to outpace larger peers into year-end. Let's take a look at the implied moves for the week. "DEAD" is the word I'd use to describe this weeks I.V. Maybe this week is a good one to put on your weekly Iron condor and then come back on Friday? December S&P 500 E-Mini futures (ESZ25) are down -0.30%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.35% this morning, pointing to a slightly lower open on Wall Street as investors look for fresh catalysts to drive equities already trading at record highs. This week, investors will focus on remarks from Federal Reserve Chair Jerome Powell and other Fed officials as well as the release of the Fed’s preferred inflation gauge and other key economic data. In Friday’s trading session, Wall Street’s major equity averages closed higher, with the S&P 500, Dow, and Nasdaq 100 notching new record highs. The Magnificent Seven stocks advanced, with Apple (AAPL) rising over +3% and Tesla (TSLA) gaining more than +2%. Also, Oracle (ORCL) climbed over +4% after Bloomberg reported that the company was in talks with Meta Platforms for a cloud computing deal worth about $20 billion. In addition, FedEx (FDX) rose more than +2% after the logistics giant posted better-than-expected FQ1 results and reinstated its full-year guidance. On the bearish side, Lennar (LEN) fell over -4% after the homebuilder reported downbeat FQ3 results and issued below-consensus FQ4 home deliveries guidance. “A Fed easing cycle in a non-recessionary environment has historically helped support stocks, and we see further gains underpinned by AI, earnings, and consumption,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. Minneapolis Fed President Neel Kashkari said on Friday that he supported the FOMC’s decision to cut interest rates and penciled in two more cuts this year. Separately, Fed Governor Stephen Miran told CNBC that his decision to dissent from fellow policymakers’ rate move was based on his view that tariffs have not had a significant impact on inflation. Meanwhile, U.S. rate futures have priced in a 91.9% chance of a 25 basis point rate cut and an 8.1% chance of no rate change at the conclusion of the Fed’s October meeting. A highly anticipated phone call on Friday between U.S. President Donald Trump and Chinese leader Xi Jinping ended with both leaders agreeing to continue discussions. President Trump said he made progress on many key issues and will meet Xi on the sidelines of the Asia-Pacific Economic Cooperation Summit in South Korea next month. This week, the August reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight, as investors continue to assess the extent to which tariffs have driven up inflation. If evidence continues to indicate that the impact is limited, this could be seen as clearing the way for additional rate cuts. Preliminary purchasing managers’ surveys for September will also be closely monitored, as they will provide updates on activity in the manufacturing and services sectors. Other noteworthy data releases include U.S. GDP (third estimate), the Richmond Fed Manufacturing Index, New Home Sales, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Wholesale Inventories (preliminary), Existing Home Sales, Personal Income, Personal Spending, and the University of Michigan’s Consumer Sentiment Index. Fed Chair Jerome Powell will deliver a speech on the economic outlook in Rhode Island on Tuesday. A host of other Fed officials will also be making appearances throughout the week, including Williams, Barkin, Musalem, Hammack, Miran, Bowman, Bostic, Daly, Goolsbee, Barr, and Logan. In addition, several notable companies, including chipmaker Micron Technology (MU), bulk retailer Costco (COST), advisory firm Accenture (ACN), and auto parts seller AutoZone (AZO), are set to report their quarterly figures this week. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.131%, down -0.22%. The collapse of the U.S. dollar (and how it's affecting gold) is unprecedented. This trend is not getting a lot of media attention. It should. My wife and I outfitted our house with solar last year. Honestly the return or ROI on it is not great. Maybe 5% a year? For us it's more of a hedge against future price hikes. Does anyone think electricity will be cheaper in a decade? Moody's on a US recession: The probability of a recession within the next 12 months jumped to 48% in August, the highest since the 2020 pandemic. This is according to Moody’s Analytics’ leading economic indicator, which uses extensive economic data and a machine learning model. Historically, such a high probability has never occurred outside of recessions. This comes as US job market conditions have deteriorated significantly over the last few months. Additionally, the BLS revised non-farm payrolls down by -911,000 for the 12 months ending March 2025, marking the largest annual downward revision on record. Moody’s also said that a third of U.S. states are now in recession, accounting for 33% of the economy. That means the national data is masking deep local pain in key regions. For now, California, Texas, and New York are keeping the broader economy from sliding further. The "heavy truck" indicator has generally been pretty darn accurate. Look. I don't want to be "that guy" that screams "crash" from the rooftops for a decade and then when if finally comes claims he was right! I do, however think that there are plenty of signs for us to be cautious here. Todays training session will focus on the difference between ATR and ADX. Many traders think of them as similar but they are in fact, very different. We use ADX daily in our scalping efforts. Let's take a look at the intra-day levels on /ES: 6709, 6725, 6730, 6736, 6751 are resistance zones. 6700, 6685, 6674, 6664, 6650 are support zones. My lean or bias today in bearish. When we start going into week three of a continuous run (this time to the upside) I think the odds are good we take a pause or retrace. Futures seem to imply it as well. I look forward to seeing you all in the live trading room for our setups today as well as our training session.

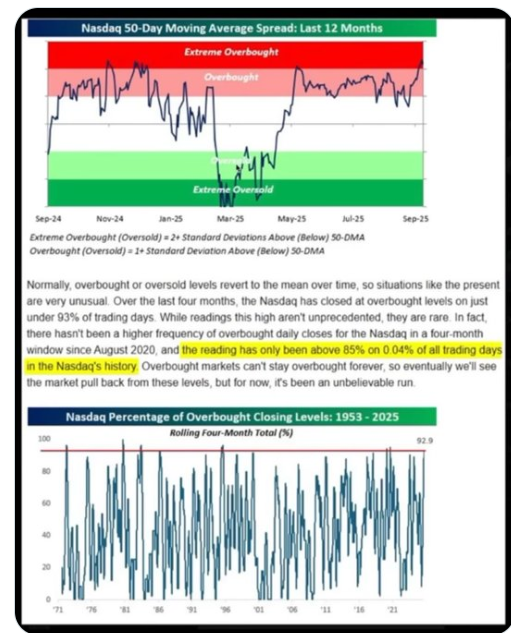

How much higher?The market got it's rate cut and certainly seems to like it. We continue to hit new ATH's over and over. How much more gas in the tank do the bulls have? Who knows? Certainly I don't. I had a reality check with my emotions yesterday as my wife and I talked to a good friend who got a life insurance payout. She needs the income from it to support herself and was asking if putting it all into the market right now was a good idea. I had a visceral reaction! These valuation levels are getting scary. If you've been around long enough to have gone through the 2000 tech bubble burst and 2008 financial crisis you too may have some PTSD! This article I read early this morning is a good read. Keep some powder dry folks. That's all I'll say. https://www.telegraph.co.uk/business/2025/09/18/a-stock-market-crash-may-be-just-around-the-corner/ Nasdaq has closed “overbought” on more than 90% of days in the last 4 months. That’s only happened 0.04% of the time in history. When markets get this stretched, volatility doesn’t disappear ~ it’s actually building up kinetic energy. Japan’s stock market falls -2.5% as Japanese bond yields extend their run into record territory. Japan is just a glimpse of what will happen to the U.S. if we do not solve our deficit spending crisis. It might just be my optics but everything I see right now points to an overvalued market. We had a solid day yesterday. It was a small capital allocation as I have been trading in my sons small $2,000 acct. He's home for a week and wanted to see what we could do. I think he's pretty happy with the results and it also shows we don't need to use $10,000 dollars every day to get good results. Let's take a look at the markets as they continue to climb and climb. Not surprisingly, technicals remain bullish. What can you say? The Russell especially is on fire! September S&P 500 E-Mini futures (ESU25) are trending up +0.17% this morning, extending yesterday’s gains, while investors await a phone call between U.S. President Donald Trump and Chinese President Xi Jinping. Trump and Xi are scheduled to speak at 9 a.m. Washington time, or 9 p.m. in Beijing. The conversation is expected to decide TikTok’s future and could also help ease trade tensions between the world’s two largest economies. “A deal for the social media app might act as a catalyst for improving the relationship between the two largest economies amid an ongoing trade war,” according to Danske Bank strategists. In yesterday’s trading session, Wall Street’s major indices ended in the green, with the S&P 500, Nasdaq 100, and Dow notching new record highs. Intel (INTC) jumped over +22% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Nvidia said it would invest $5 billion in the chipmaker as part of a partnership to jointly develop PC and data center chips. Also, CrowdStrike Holdings (CRWD) surged more than +12% after the cybersecurity company gave a strong fiscal 2027 forecast for net new annual recurring revenue growth. In addition, 89bio (ETNB) spiked over +85% after Roche agreed to acquire the company for $3.5 billion. On the bearish side, FactSet Research Systems (FDS) plunged more than -10% and was the top percentage loser on the S&P 500 after the company posted weaker-than-expected FQ4 adjusted EPS and issued soft FY26 guidance. Economic data released on Thursday showed that the U.S. Philly Fed manufacturing index rose to an 8-month high of 23.2 in September, stronger than expectations of 1.7. Also, the number of Americans filing for initial jobless claims in the past week fell by -33K to 231K, compared with the 241K expected. At the same time, the Conference Board’s leading economic index for the U.S. fell -0.5% m/m in August, weaker than expectations of -0.2% m/m. “The Federal Reserve is cutting interest rates during a time when stocks are at record highs and the economy is still growing. This dynamic is bullish for stocks,” said Robert Schein at Blanke Schein Wealth Management. U.S. rate futures have priced in a 91.9% probability of a 25 basis point rate cut and an 8.1% chance of no rate change at the next central bank meeting in October. Meanwhile, Wall Street is bracing for a quarterly event known as “triple-witching,” during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. According to data from SpotGamma, options tied to about $6.3 trillion in stocks and equity indexes are set to expire today, making the September expiration one of the three largest triple-witching events on record. However, market watchers are largely downplaying its significance. “The quarterly option expiry is increasingly becoming a non-event, especially when volatility is low,” said Garrett DeSimone, head quant at OptionMetrics. “So don’t expect big price jumps [on] the Monday post expiry.” The U.S. economic data slate is empty on Friday. However, investors will likely focus on a speech from San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.122%, up +0.46%. My lean or bias today is bullish because...well, because what else can you be? This ride will stop at some point and reverse. It always does. The unanswerable questions are when and by how much? We shared some insightful training Monday of this week and yesterday. Mondays are usually the designated days for our trainings. I'm not sure what will be on the agenda for this coming Monday but I'm sure it will be helpful! Be sure to tune into the zoom feed then! The SPX continues to edge higher toward fresh highs, but the seasonality score has recently slipped back into negative territory after holding neutral-to-positive for much of early September. This shift suggests that short-term seasonal patterns may be less supportive over the coming sessions, even as price action remains firm. In the near term, traders may want to watch whether the index can sustain its upward momentum against this seasonal headwind, as further weakness in the score could signal a period of consolidation or slower gains. Let's take a look at our intra-day levels for today on /ES: NOTE: We are rolling over now to the Dec. Futures contract. That is the /ESZ5. Note the difference in levels. Charts will look more "normalzed" after a full days trading data is compiled. 6712, 6725, 6730, 6746 are resistance zones. 6699, 6681, 6675, 6671, 6660 are support. Keep in mind Volume profile level on the 15 min. chart is around 6095.

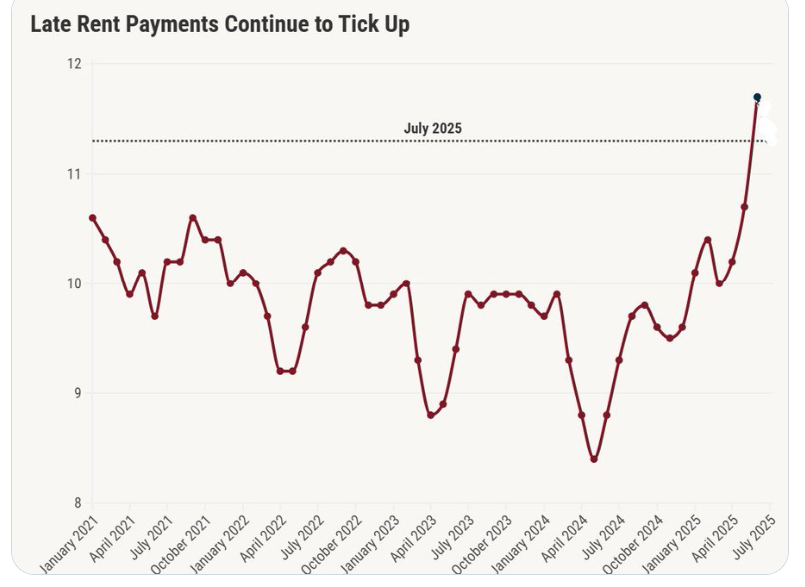

I look forward to seeing you all in the live trading room shortly. Let's have a great finish to the week! Now what?Well, we got our 25bp rate cut that most expected. What does that mean going forward now? Markets fluctuated yesterday but ended relatively flat. Futures are up this morning. We do have jobless claims incoming this morning but the market seems to like the cut so far. It will be interesting to see how the rest of the year pans out. The market has baked in two more cuts this year yet 10 FED members are looking for two rate cuts. 7 are looking for zero. 2 are looking for one. That doesn't seem like a lock on two more cuts to me. We'll see. That's why we show up each day. We had no results yesterday as we placed a 1DTE trade that we'll continue to work today. Let's take a look at the markets price action. Technicals are holding bullish. Markets are hanging on to the ATH zone. September S&P 500 E-Mini futures (ESU25) are up +0.84%, and September Nasdaq 100 E-Mini futures (NQU25) are up +1.10% this morning, pointing to a sharply higher open on Wall Street after the Federal Reserve cut interest rates for the first time since December and signaled more reductions could follow soon. As widely expected, the Federal Reserve cut interest rates yesterday. The Federal Open Market Committee voted 11-1 to lower the target range for the Fed funds rate by a quarter percentage point to 4.00%-4.25%. Newly sworn-in Governor Stephen Miran was the only policymaker to dissent, favoring a larger half-point rate cut. In a post-meeting statement, policymakers said the unemployment rate had “edged up but remains low,” adding that “downside risks to employment have risen.” At the same time, officials acknowledged that inflation has “moved up and remains somewhat elevated.” Policymakers also updated their economic projections and now anticipate two more quarter-point cuts this year. They project one quarter-point cut in 2026 and another in 2027. At a press conference, Chair Jerome Powell emphasized the Fed’s dual mandate challenges, noting that inflation pressures persist while labor-market data weakens, meaning “there’s no risk-free path” forward. Mr. Powell struck a cautious tone on the outlook for additional rate moves, saying the Fed was now in a “meeting-by-meeting situation.” In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed. Nvidia (NVDA) fell over -2% and was the top percentage loser on the Dow after the Financial Times reported that China’s internet watchdog had banned the country’s biggest technology firms from buying Nvidia’s AI chips. Also, Uber Technologies (UBER) slid nearly -5% and was among the top percentage losers on the S&P 500 after rival Lyft and Alphabet’s Waymo announced plans to expand their fully autonomous ride-hailing service to Nashville in 2026. In addition, General Mills (GIS) dropped about -0.8% after the company posted weaker-than-expected FQ1 revenue. On the bullish side, Workday (WDAY) climbed more than +7% and was the top percentage gainer on the Nasdaq 100 after activist investor Elliott Investment Management disclosed a $2 billion stake in the company. Economic data released on Wednesday showed that U.S. August housing starts fell -8.5% m/m to 1.307 million, weaker than expectations of 1.370 million, while building permits, a proxy for future construction, unexpectedly fell -3.7% m/m to a 5-1/4-year low of 1.312 million, weaker than expectations of 1.370 million. Meanwhile, U.S. rate futures have priced in an 89.8% chance of a 25 basis point rate cut and a 10.2% chance of no rate change at the next FOMC meeting in October. Today, investors will focus on the U.S. Philadelphia Fed Manufacturing Index, which is set to be released in a couple of hours. Economists anticipate that the Philly Fed manufacturing index will stand at 1.7 in September, compared to last month’s value of -0.3. U.S. Initial Jobless Claims data will also be closely monitored today. Investors will be watching to see whether the prior week’s jump was a harbinger of a sustained downturn in the labor market or was merely a one-off. Economists estimate this figure will come in at 241K, compared to last week’s number of 263K. The Conference Board’s Leading Economic Index for the U.S. will be released today as well. Economists expect the August figure to drop -0.2% m/m, compared to the previous number of -0.1% m/m. On the earnings front, notable companies such as FedEx (FDX), Lennar (LEN), and Darden Restaurants (DRI) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.047%, down -0.74%. The SPX continues to grind higher, now holding near the top of its recent range, with the momentum score firmly elevated at 5. This marks one of the strongest readings over the past few months, signaling sustained buying pressure despite intermittent pullbacks along the way. In the short term, this consistent momentum suggests that dips may find support quickly, though traders will want to monitor if the score can remain at these elevated levels any sharp downtick could hint at waning strength and open the door for consolidation. This isn't a good sign of how consumers are doing. The most absurd number in CPI? According to the US Government, the cost of health insurance has declined 20% over the last 5 years. Are CPI numbers really accurate? I don't think so. Let's take a look at the intra-day market levels. We've got some new levels to watch today: 6669, 6675, 6686 are upside resistance. 6649, 6628, 6625, 6608 are support. Big levels with big potential moves. I look forward to seeing you all in the live trading room shortly!

FOMC day is hereDo we get a rate cut as most believe? Is it the 25bp that's expected or a more aggressive 50bp? Most important (probably) will be what Powell says about the future. How hawkish or dovish he'll be. This will set the stage for the next two potential decisions for the rest of this year. Regardless of all this, it should be a good day for traders with ample movement to trade. The options market is implying a .07% move for the day. Come trade with us. These days are usually pretty good. My lean or bias yesterday was for a neutral day will little movement and that's exactly what we got. We traded small and it was a successful and non eventful day. We placed a 0DTE on the QQQ's which expired fully profitable and a butterfly on the SPX which doubled in value. See our results below: September S&P 500 E-Mini futures (ESU25) are up +0.01%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.04% this morning as investors refrain from making any big bets ahead of a highly anticipated Federal Reserve interest rate decision. Stock index futures’ subdued tone reflects investor caution over how the Fed will signal the interest-rate path, with a quarter-point cut at this meeting and three more by April already priced in. In yesterday’s trading session, Wall Street’s major indexes ended slightly lower. Warner Bros. Discovery (WBD) slumped over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after TD Cowen downgraded the stock to Hold from Buy. Also, Rocket Lab (RKLB) tumbled more than -12% after the rocket launch company announced a $750 million at-the-market equity offering. In addition, Dave & Buster’s Entertainment (PLAY) plunged over -16% after the arcade-restaurant operator posted downbeat Q2 results. On the bullish side, chip stocks gained ground, with ON Semiconductor (ON) rising more than +3% to lead gainers in the Nasdaq 100 and Marvell Technology (MRVL) advancing over +2%. Economic data released on Tuesday showed that U.S. retail sales climbed +0.6% m/m in August, stronger than expectations of +0.2% m/m, and core retail sales, which exclude motor vehicles and parts, grew +0.7% m/m, stronger than expectations of +0.4% m/m. Also, U.S. August industrial production unexpectedly rose +0.1% m/m, stronger than expectations of -0.1% m/m, and manufacturing production unexpectedly rose +0.2% m/m, stronger than expectations of -0.2% m/m. In addition, the U.S. import price index unexpectedly rose +0.3% m/m in August, stronger than expectations of -0.2% m/m. “The American consumer appears to be in good spirits. That’s good news for the economy, but it may heighten debate over how aggressively the Fed needs to cut rates,” said Ellen Zentner at Morgan Stanley Wealth Management. Today, all eyes are focused on the Federal Reserve’s monetary policy decision. The Federal Open Market Committee is widely expected to cut the Fed funds rate by 25 basis points to a range of 4.00% to 4.25%. Market watchers will follow Chair Jerome Powell’s post-policy meeting press conference for any indications on how quickly rates may fall from here. Following recent data painting a picture of a slowing labor market, U.S. money markets have almost fully priced in follow-up rate cuts in October and December. Market participants will also closely parse the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which will offer key guidance on how policymakers expect the interest-rate path to unfold over the next few years. The equity options market is predicting about a 0.7% move after the Fed meeting, matching the second-lowest expected swing in the past 18 months, according to data from Susquehanna International Group. A survey conducted by 22V Research revealed that 43% of respondents are leaning “risk-on” in reaction to the Fed meeting, 31% said “mixed/negligible,” and 26% said “risk-off.” On the economic data front, investors will focus on U.S. Building Permits (preliminary) and Housing Starts data, set to be released in a couple of hours. Economists expect August Building Permits to be 1.370 million and Housing Starts to be 1.370 million, compared to the prior figures of 1.362 million and 1.428 million, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be 1.400 million, compared to last week’s value of 3.939 million. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.014%, down -0.25%. With today being FOMC we don't try to map out levels or create bias. We'll sit on our hands until Powell speaks and try to ride the trend. I do think we have a decent shot at getting a retrace today. I'll see you all in the live trading room shortly.

|

Archives

December 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |