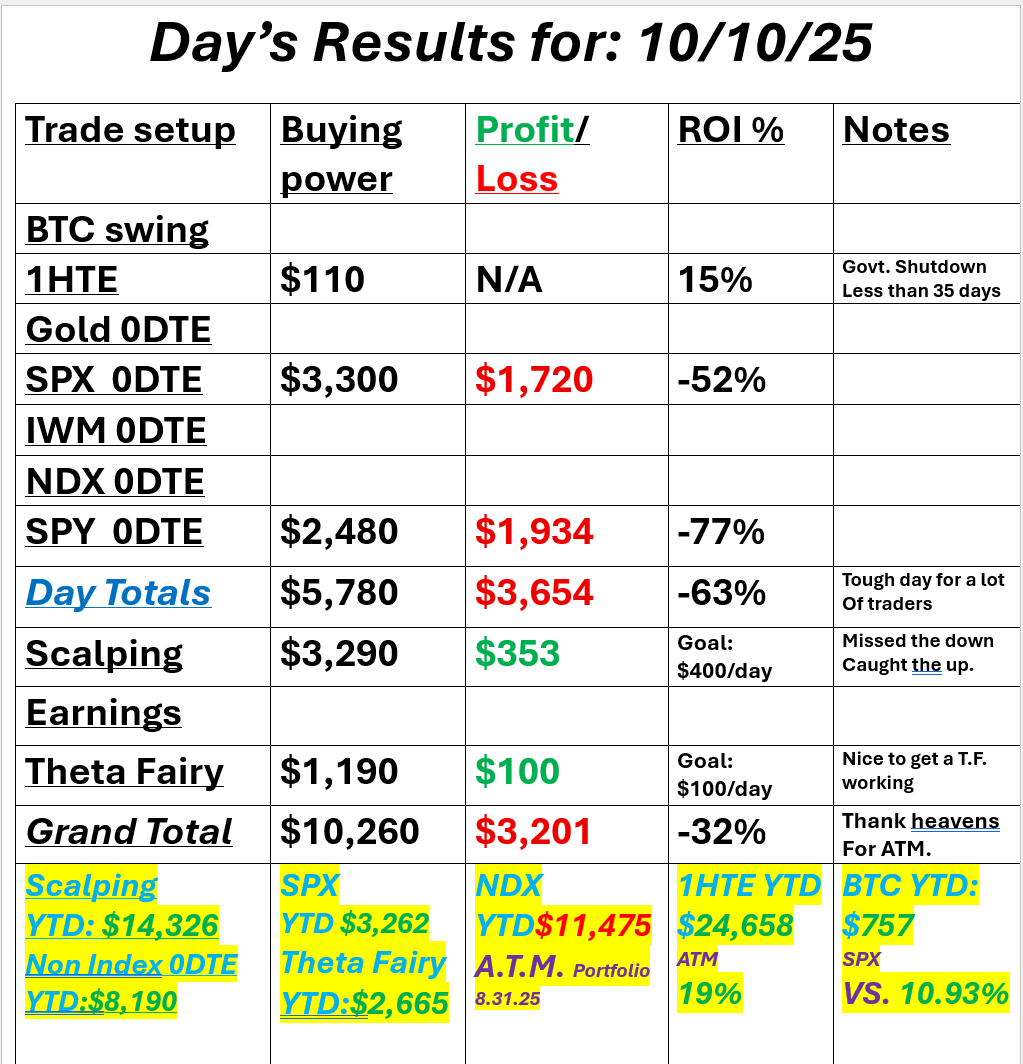

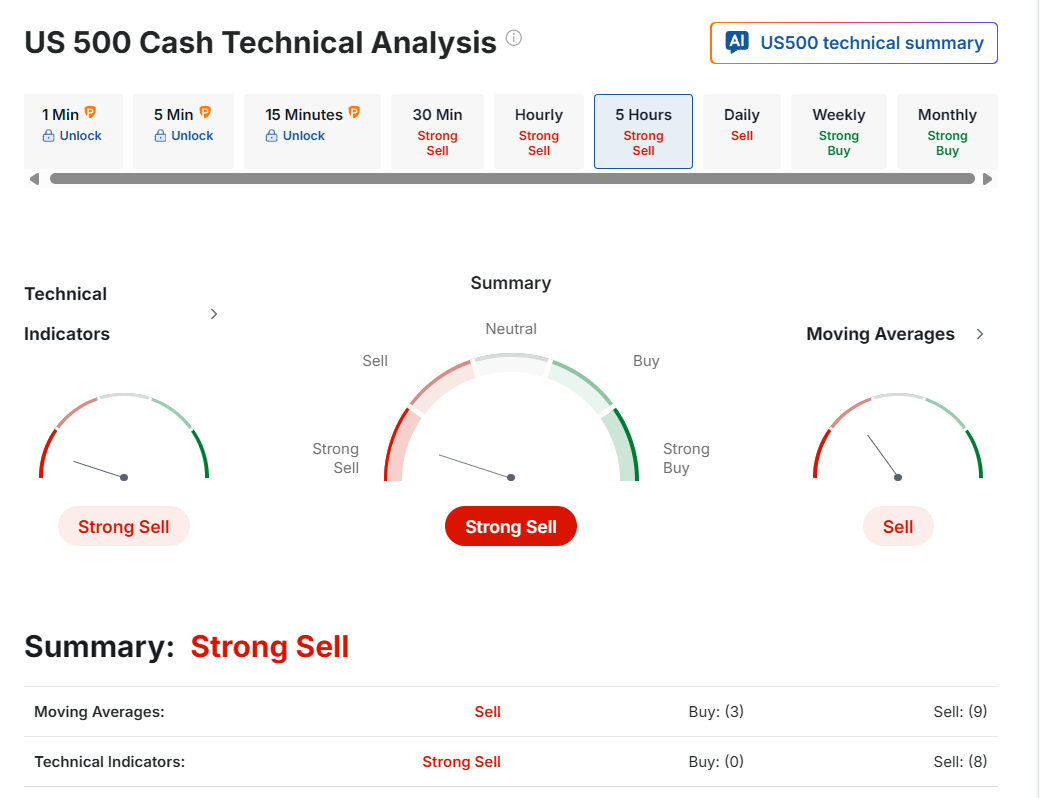

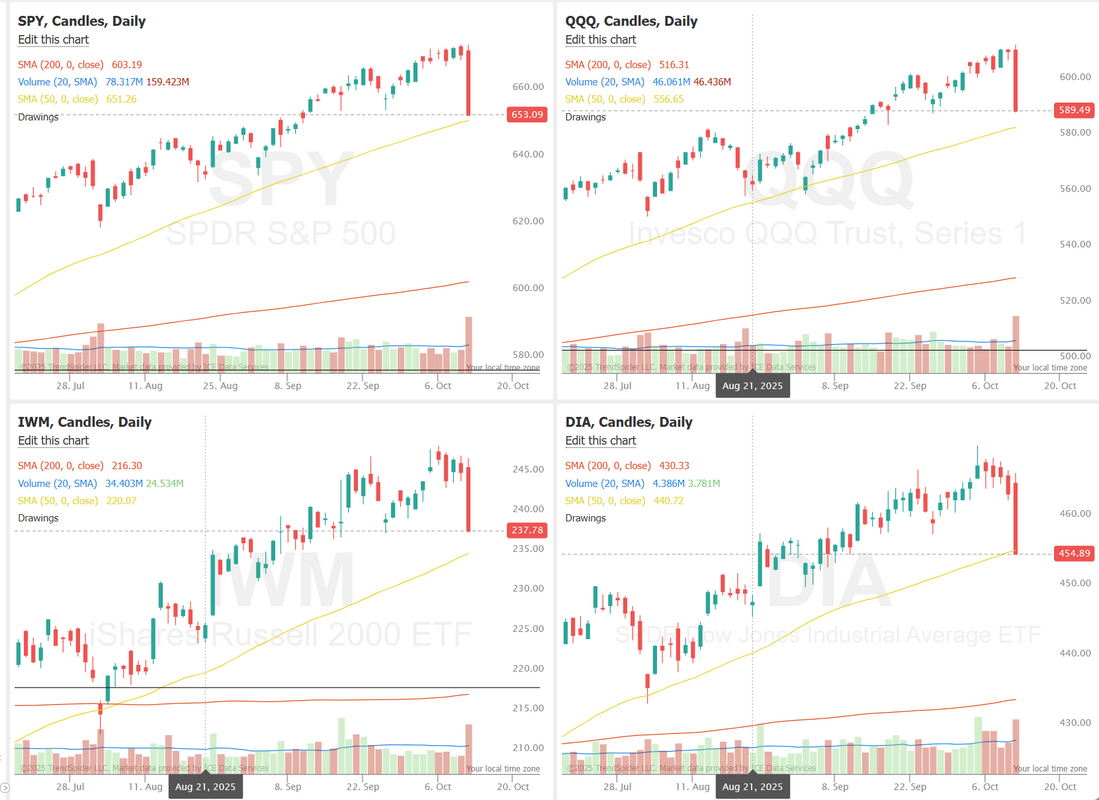

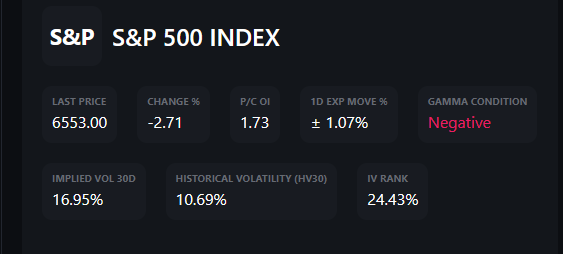

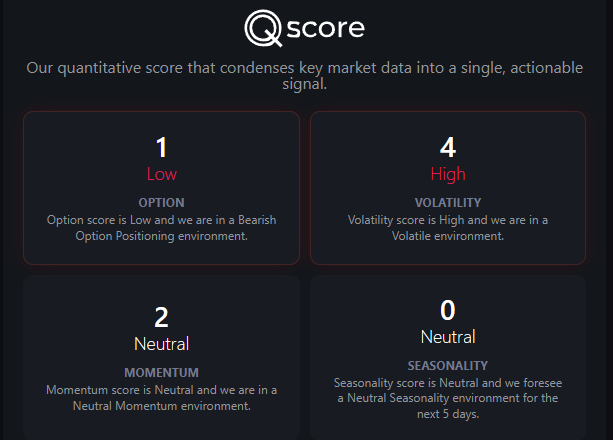

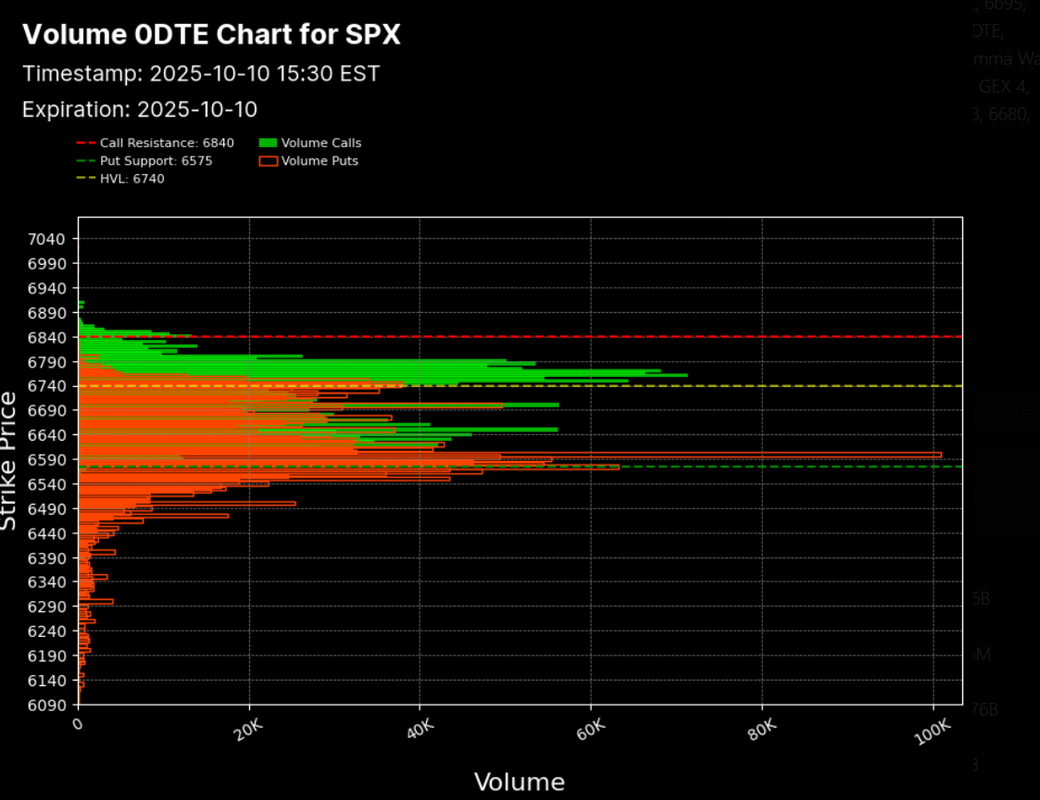

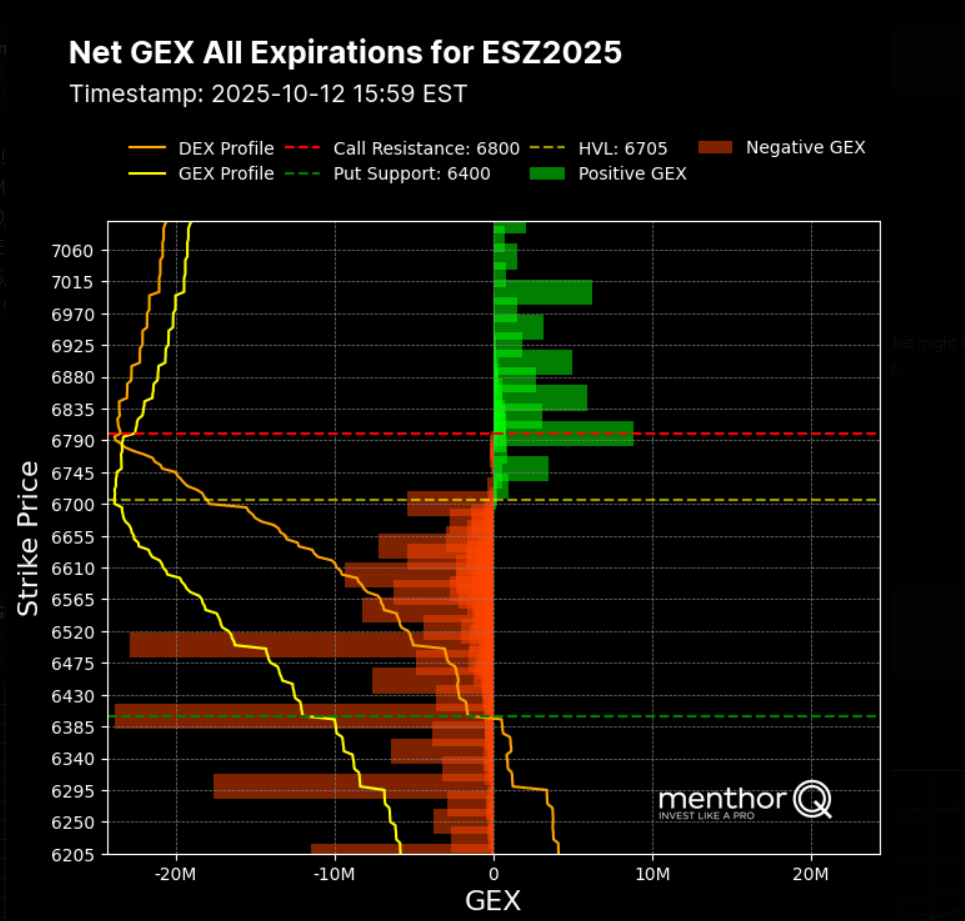

Never mind?Friday was quite the rout. It certainly caught me out. Luckily, our ATM portfolio held up well with our bearish plays working well, and our Scalping went well, but otherwise it was tough. I saw a post this morning on Trump's book, The Art of the Deal. It is mentioned, if you haven't read it you should! We deride Trump for "TACO'ing" but this is and has been his approach most of his life. Make big threats, then find some solution. It's worked remarkably well for him over time. While futures are up "bigly" this morning, there is still a lot of repair needed for bulls to get back in charge. We are into a heavy negative GEX environment (more on that in a minute), the like we haven't seen since the "liberation day" period of early April. Negative GEX creates uncertainty and likely bigger moves. This is a much harder environment to trade. Here's a look at my day from Friday: Let's get into the markets: In spite of futures being up sharply this morning the damage has been done technically. The hit was big on Friday. It's unlikely that it all get's fixed in one day. The SPX volatility chart shows a sharp pullback in price following a steady multi-week climb, suggesting a short-term sentiment shift as volatility expectations recalibrate higher. The Volatility Risk Premium (VRP) sits around 5.6%, indicating that implied volatility remains overvalued relative to realized volatility, a sign that traders are paying up for downside protection amid uncertainty. With the 3-month percentile still elevated near 80%, volatility pricing may stay firm in the short term, especially if macro or geopolitical risks persist. In the near future, monitoring how SPX behaves around recent support levels could help gauge whether this selloff is a brief shakeout or the start of a deeper volatility-driven correction. The NDX skew chart shows a clear rise in downside hedging activity as the index itself moves lower. The one-month skew has shifted toward a strong put bias, signaling that options traders are increasingly paying up for downside protection. This elevated skew typically reflects growing short-term caution as volatility expectations climb alongside price weakness. With the NDX trending down, sentiment appears defensive, and option markets are pricing in further uncertainty until stabilization or a rebound signal emerges. GEX is heavy negative. This usually creates bigger moves. More volatility and less predictability. The Quant score was heavily damaged on Friday. Volume levels were really spread out on Friday GEX levels for the /ES are more spread out than we've seen all year. I have no lean or bias today. There's too much built in volatility this morning to make an educated judgement call. December S&P 500 E-Mini futures (ESZ25) are up +1.38%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +1.84% this morning, signaling a rebound from Friday’s sell-off on Wall Street as sentiment improved after U.S. President Donald Trump softened his stance on tariff threats against Beijing. President Trump said in a Truth Social post on Sunday that he wants to help China, not hurt it, signaling openness to negotiations and a possible easing of tensions. “Don’t worry about China, it will all be fine!” Trump said. He added that Chinese President Xi Jinping “had a bad moment,” referring to China’s decision last week to impose export controls on rare earth materials. On Friday, Mr. Trump announced an additional 100% tariff on China and export controls on “any and all critical software” starting November 1st, just hours after threatening to cancel his upcoming meeting with President Xi Jinping. That followed China’s move to impose new port fees on U.S. ships, launch an antitrust probe into Qualcomm, and introduce broad new restrictions on exports of rare earths and other critical materials. China’s Ministry of Commerce said on Sunday that the U.S. should refrain from threatening it with higher tariffs and called for further talks to address unresolved trade issues, warning that it will not hesitate to retaliate if Washington continues its actions against Beijing. This week, investors will focus on developments surrounding the U.S. government shutdown, remarks from Federal Reserve Chair Jerome Powell and other Fed officials, as well as the start of the third-quarter earnings season. In Friday’s trading session, Wall Street’s major equity averages closed sharply lower. The Magnificent Seven stocks slumped, with Tesla (TSLA) sliding over -5% and Amazon.com (AMZN) falling more than -4% to lead losers in the Dow. Also, chip stocks sank, with Arm Holdings (ARM) plunging over -9% and ON Semiconductor (ON) dropping more than -8%. In addition, Venture Global (VG) plummeted over -24% after the natural gas exporter unexpectedly lost an arbitration dispute with its customer, BP. On the bullish side, Applied Digital (APLD) surged more than +16% after the company reported better-than-expected FQ1 results and signed a new lease agreement with CoreWeave. Economic data released on Friday showed that the University of Michigan’s preliminary U.S. consumer sentiment index fell to a 5-month low of 55.0 in October, but still came in above expectations of 54.1. Also, the University of Michigan’s U.S. October year-ahead inflation expectations unexpectedly fell to 4.6%, compared to expectations of no change at 4.7%, while 5-year implied inflation expectations remained unchanged at 3.7%, in line with expectations. Fed Governor Christopher Waller said on Friday that “the labor market is weak,” adding that he would back quarter-point rate cuts at each of the Fed’s two remaining meetings this year. Also, St. Louis Fed President Alberto Musalem said, “Looking ahead, I am open-minded about a potential further reduction in interest rates to provide further insurance against labor market weakening.” Meanwhile, U.S. rate futures have priced in a 97.8% chance of a 25 basis point rate cut and a 2.2% chance of no rate change at the Fed’s monetary policy committee meeting later this month. Investor attention remains on developments surrounding the U.S. government shutdown, which has entered its third week. An administration official said last week that the U.S. Bureau of Labor Statistics would bring some furloughed employees back to release the September inflation report. The BLS announced on Friday that it would publish the CPI report on October 24th, instead of the originally scheduled date of October 15th. The shutdown delayed the release of the key U.S. jobs report for September, and the timing of its publication, along with other official economic data, remains unclear. Therefore, Fed-compiled industrial and manufacturing production figures could serve as the key U.S. data highlights of the week, alongside the New York and Philadelphia Fed surveys. Market participants will also pay close attention to Fed Chair Jerome Powell’s speech on the economic outlook and monetary policy at the National Association for Business Economics Annual Meeting on Tuesday. A host of other Fed officials will also be making appearances throughout the week, including Waller, Barr, Miran, Paulson, Collins, Musalem, Bowman, Bostic, Schmid, Barkin, and Kashkari. In addition, the Fed will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. Third-quarter corporate earnings season kicks off this week, with big banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS), and Citigroup (C) set to release their earnings reports on Tuesday, followed by Bank of America (BAC) and Morgan Stanley (MS) on Wednesday. Johnson & Johnson (JNJ), Abbott Labs (ABT), BlackRock (BLK), Charles Schwab (SCHW), Progressive (PGR), and American Express (AXP) are among other major names scheduled to deliver quarterly updates during the week. Although PepsiCo (PEP) and Delta Air Lines (DAL) started the third-quarter reporting period last week, results from big banks have traditionally marked the unofficial start of the earnings season. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. The bond market is closed today for the Columbus Day holiday. During Fridays meltdown, our ATM portfolio held the line just fine and our protective shorts and bearish SPY positions all profited. After Fridays sell off I think it will be beneficial to do a training on some hedges and setup you can employee to protect against downside. We'll spend some time going over several different setups today. Tune in at 12:00 pm MDT. SPY finished the week lower, closing at $653.02 (-2.42%), as bears stepped in with conviction. For the first time since February, price broke below the 4-hour mint green LinkLine channel support, signaling a potential shift in short-term momentum. Adding to the pressure, the Kalshi Indicator reflected a sharp shift in sentiment, with odds of the S&P 500 finishing the year between 6,400 and 6,599 nearly doubling to 14% after Friday’s selloff. Let's take a look at the intra-day levels... for what they are worth. Remember. Today is a day to remain flexible. Cut losses early. Resistance levels are 6687, 6701, 6706, 6723, 6739. Support levels are 6662, 6644, 6637, 6625. Big...wide levels today. I look forward to seeing you all in our zoom today. The training should be beneficial as well as our trading opportunities today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |