What does a great trade look like?I think defining it could (or should) be easy. Executing it? That's tougher. In my mind a great trade is simply based around risk/reward. Let's talk risk first. We try so hard to minimize it, reduce it, even eliminate it but I think that is a flawed approach. We want risk! We need risk. Without risk we get no reward. There is a reason why we can make 200% more in 6 hrs. than you can make all year, at the bank with a C.D. The former has risk. The latter does not. The key is to maximize your reward potential while holding your risk to an acceptable level. What's acceptable? Well, that varies from trader to trader. I try to keep our risk around $500 dollar per 0DTE entry. I believe yesterdays SPX 0DTE met the qualifications well. It had over $2,000 of max profit potential with a max risk of approx. $565. Those are ratios we can work with. We didn't hit our $2,000 max potential but it was an easy day of trading without stress. Do yourself a favor. Focus on risk first and profit second. Here's a look at our day. If every day was like this is would be amazing. Our risk never got above $220 dollars. A couple items of note today: I've got, what should be, my last eye appt. this morning at 10:30 A.M. MDT so there we be a little break in the zoom feed today. I'll take my laptop with me so hopefully the break is minimal. We'll also have a training later today on the lessons from one of my favorite trading books of all time: Tom Hougarrds "Best loser wins". I've got a copy of the book for each of you and I've put a power point together to hit the bullet points. Let's take a look at the markets: Buy signal is still holding, although futures are selling off this morning. We are trying to get above a key consolidation level but all the work of the last four days is getting tested this morning with the futures and ADP employment numbers. VTI may be one of the best gauges. We've got five days of bullish action. It's at a key level BUT...most of the technicals look stretched here. Most going into overbought zones. une S&P 500 E-Mini futures (ESM25) are trending down -0.30% this morning as investors cautiously await a barrage of U.S. economic data, including the Fed’s favorite inflation gauge and the first estimate of first-quarter GDP, as well as earnings reports from “Magnificent Seven” companies Microsoft and Meta. Some negative corporate news is weighing on stock index futures, with Super Micro Computer (SMCI) tumbling over -14% in pre-market trading after the artificial intelligence server maker reported weaker-than-expected preliminary FQ3 results. Also, Starbucks (SBUX) slid over -6% in pre-market trading after the coffee chain posted weaker-than-expected FQ2 results. See Next: $158 Billion Market, 200% Growth, and 10 Patents — This Pre-IPO Stock Has It All Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.On the trade front, U.S. President Donald Trump on Tuesday signed two executive orders intended to ease the impact of his auto tariffs, while his Commerce Secretary Howard Lutnick told CNBC that the U.S. had reached its first trade deal with an undisclosed country. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. SBA Communications (SBAC) climbed over +6% and was the top percentage gainer on the S&P 500 after raising its full-year revenue guidance. Also, Honeywell International (HON) advanced more than +5% and was the top percentage gainer on the Dow after the industrial conglomerate reported stronger-than-expected Q1 results and raised the lower end of its full-year adjusted EPS guidance. In addition, Cadence Design Systems (CDNS) rose over +5% and was the top percentage gainer on the Nasdaq 100 after the company lifted its full-year guidance. On the bearish side, NXP Semiconductors N.V. (NXPI) slumped more than -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the semiconductor firm announced a new chief executive officer and warned it was navigating “a very uncertain environment” due to tariffs. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings fell to a 6-month low of 7.192M in March, weaker than expectations of 7.490M. Also, the U.S. Conference Board’s consumer confidence index fell to a nearly 5-year low of 86.0 in April, weaker than expectations of 87.7. In addition, the U.S. February S&P/CS HPI Composite - 20 n.s.a. eased to +4.5% y/y from +4.7% y/y in January, weaker than expectations of +4.6% y/y. “Many are still calling for a recession and even lower equity levels, but we think the ‘Trump put’ is real for equities while the ‘Fed put’ is real for the economy. And while tops and bottoms are hard to recognize as they are happening, we think the worst is behind us,” said Andrew Brenner at NatAlliance Securities. Meanwhile, U.S. rate futures have priced in a 92.3% probability of no rate change and a 7.7% chance of a 25 basis point rate cut at May’s monetary policy meeting. First-quarter corporate earnings season rolls on, with investors looking forward to fresh reports from major companies today, including Microsoft (MSFT), Meta Platforms (META), Qualcomm (QCOM), Caterpillar (CAT), and KLA Corp. (KLAC). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, all eyes are on the Commerce Department’s first estimate of gross domestic product, set to be released in a couple of hours. Economists, on average, forecast that U.S. GDP growth will stand at +0.2% q/q in the first quarter, compared to the fourth-quarter figure of +2.4% q/q. Investors will also focus on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge. Economists expect the core PCE price index to be +0.1% m/m and +2.6% y/y in March, compared to the previous figures of +0.4% m/m and +2.8% y/y. The U.S. ADP Nonfarm Employment Change data will be closely monitored today. Economists foresee the April figure coming in at 114K, compared to the March figure of 155K. U.S. Personal Spending and Personal Income data will be reported today. Economists anticipate March Personal Spending to be +0.6% m/m and Personal Income to be +0.4% m/m, compared to February’s figures of +0.4% m/m and +0.8% m/m, respectively. The U.S. Employment Cost Index will be released today. Economists expect this figure to arrive at +0.9% q/q in the first quarter, matching the fourth quarter’s figure. U.S. Pending Home Sales data will come in today. Economists forecast the March figure at +0.9% m/m, compared to the previous figure of +2.0% m/m. The U.S. Chicago PMI will be released today as well. Economists expect this figure to come in at 45.9 in April, compared to the previous value of 47.6. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.161%, down -0.31%. Trade docket today: No 1HTE's today. We need move movement. We have META and MSFT earnings trades later today. Scalping is already working with a long /MNQ and /NQ cover. We'll try to get both a SPX and NDX 0DTE today. Same as yesterday. Focus on SPX with a late day entry on NDX. My bias of lean today is more neutral. Futures are down -50 points on /ES and -250 on /NQ as I type. We are still waiting for PCE numbers which will be the big one for this morning. The futures are already unhappy about the poor GDP numbers out this morning. PCE could really send us moving up or down when it comes out. My key level...once again, is 5554 on /ES above is bullish. Below is bearish. We are below it now. I think the market will have a tough time going higher today and I don't think we get much additional downside than what the futures are already giving us. Let's take another look at the /ES intra-day levels and talk about our plan for today: One the daily chart is sure looks bearish. A rejection of my key level and indicators rolling over. On an intra-day basis 5523 is current resistance with 5492 support. I'll update these levels as the day moves on, inside discord. With futures down now over -70 points on /ES, as I type that means we've got great premium today. I'm looking forward to seeing you all in the zoom shortly.

0 Comments

Trend or consolidation day?This is my only question this morning as we get ready to start our trading. We menitoned in the trading room last Friday that the day felt "normal". Since "Liberation day" we haven't had that. Yesterday felt the same. Basically we finished flat on the day. This is a really critical question for me because, while these big moves have been tricky to trade, the directional setups, like debit spreads and long calls and puts have been the best risk/reward. That wasn't the case last Friday nor was it the case yesterday. A simple Iron Condor would have produced nice gains with little work. I've been talking about the key 5554 level on /ES for a few days now. That's a big demarcation point for me. Above is bullish. Below is bearish. We were essentially sitting on it yesterday and guess what? As I type this we are sitting on it again. I got chopped up yesterday. I had a small profit a couple of times in scalping but ultimately finished in the red at the end of the day. The risk was well controlled however. That wasn't the case with my SPX 0DTE. We have a goal of keeping our risk to $500 dollars each day. That's pretty hard in this market. I got to over $2,200 risk mid day. We put on an agressive adjustment with long calls and that really saved the day. We bought at $5 and sold at $22. It helped but I still ended down $595 on the day. 1HTE's worked for a bit but I'm still not happy with the premium we are getting. The plan for today is to wait a bit in the morning as see if we can get a trend going. I'd much rather put on a directioanal trade in this type of market but we may have another flat day. Let's take a look at the markets. Not much has changed since yesterday. Bullish bias is holding on. From a trend standpoint nothing was achieved yesterday. June S&P 500 E-Mini futures (ESM25) are down -0.21%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.24% this morning, pointing to a muted open on Wall Street as investors await the latest reading on U.S. job openings and a new round of corporate earnings reports. Stock index futures initially moved higher on signs of easing trade tensions. U.S. President Donald Trump is expected to soften the impact of his auto tariffs by removing some levies on foreign parts used in cars and trucks manufactured in the U.S. Imported automobiles would also receive a reprieve from separate tariffs on aluminum and steel, a White House official said Monday. The official announcement is expected to be made later today. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. Boeing (BA) rose over +2% and was the top percentage gainer on the Dow after Bernstein upgraded the stock to Outperform from Market Perform with a price target of $218. Also, Progressive (PGR) advanced more than +1% after BofA upgraded the stock to Buy from Neutral with a price target of $312. In addition, Amplify Energy (AMPY) climbed over +8% after announcing the termination of its merger agreement with Juniper Capital Advisors. On the bearish side, Nvidia (NVDA) slid more than -2% and was the top percentage loser on the Dow after the Wall Street Journal reported that China’s Huawei Technologies was preparing to test its latest and most powerful AI processor, aiming to replace some higher-end products of the U.S. chip giant. “We expect a choppy market in the intermediate term that could be rangebound until clarity is achieved on what effect tariffs have on corporate earnings, which as of now remains very unclear,” said Brian Buetel at UBS Wealth Management. First-quarter corporate earnings season is in full swing, with investors looking ahead to new reports from prominent companies today, including Visa (V), Coca-Cola (KO), Booking (BKNG), Pfizer (PFE), Altria (MO), Starbucks (SBUX), and PayPal (PYPL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, all eyes are focused on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the March JOLTs Job Openings will arrive at 7.490M, compared to the February figure of 7.568M. Investors will also focus on the U.S. Conference Board’s Consumer Confidence Index, which came in at 92.9 in March. Economists expect the April figure to be 87.7. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today. Economists foresee the February figure coming in at +4.6% y/y, compared to +4.7% y/y in January. U.S. Wholesale Inventories data will be released today as well. Economists forecast the preliminary March figure at +0.6% m/m, compared to +0.3% m/m in February. U.S. rate futures have priced in a 91.1% chance of no rate change and an 8.9% chance of a 25 basis point rate cut at the conclusion of the Fed’s May meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.236%, up +0.47%. The Jobs report should be the main catalyst this morning in the futures market. My bias or lean today: I don't really have one. I think that key 5554 /ES level will drive me today. Above I'm bullish. Below I'm bearish. Futures are down slightly as I type but JOLTS numbers are not out yet and could change that. I'll give the market a half hour to open and start trading then set my initial entries at that point. I'm going to focus on Scalping today with possibly going back to the /MNQ. 1HTE's don't look that appealing right now. I'll check back on those later today. 0DTE focus will be on SPX. I'm shooting for a $2,000 profit day so I may up my buying power a bit from yesterday. We've been using a low amount lately. As mentioned above, I'll wait approx. 30 min. after the cash open to establish my first entry. The levels for intra-day trading today are exactly the same as yesterday! The key level being 5554 on /ES. All I'm really interested in is whether we can get a direcitional move going today. Let's be patient and focus on our risk management today. That could be starting with bigger buying power commitments and pulling legs early if they aren't working. Let's have a great day. I'll see you all in the trading room shortly!

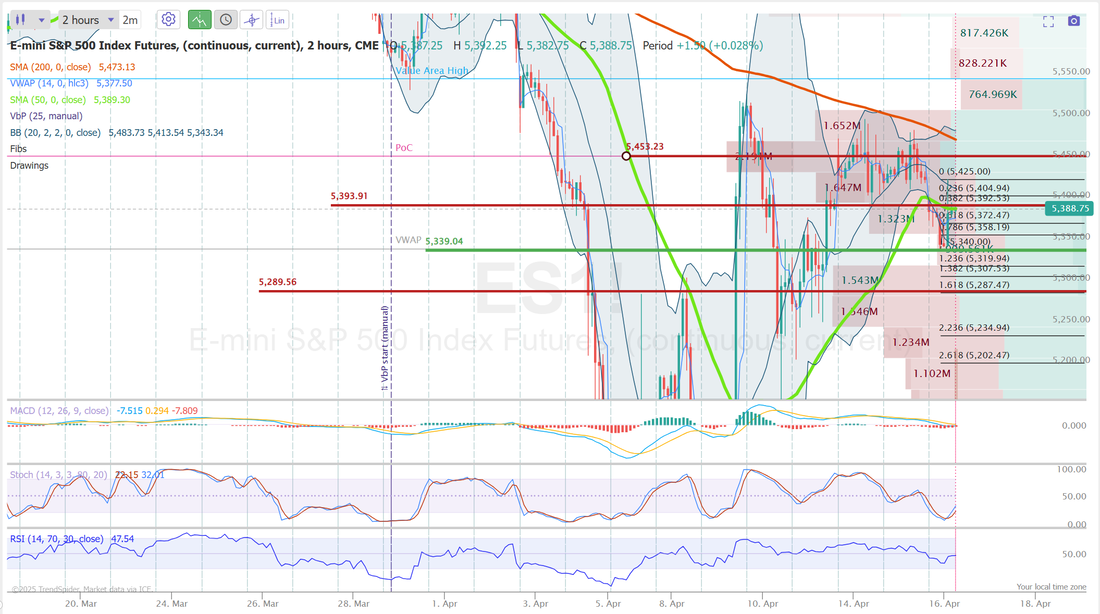

Inflection pointGood morning traders and welcome to a new trading week. We were able to finish strong last week, which is always a nice way to go into the weekend. Markets have had a strong four day run to the upside. It certainly seems like the bulls want back in but is it too soon to declare a change of direction. My key area on /ES is right around where we are as I type. The 5532 level. It was a key level in July, August and September of last year. It was where the the massive selloff of this year, which started in Feb stopped. It's also the level that let go this month when liberation day liberated the bulls of any gains. We are back there now. I think this is a key level. Above I'm bullish. Below I'm bearish. Friday, as I mentioned, was a strong day for us. Nothing really knocked it out of the park for us but all combined we were very close to our $1,000+ profit day which we seek. The Nat gas trade was not quite as juicy as last months but it was still a solid risk/reward. We'll look forward to next months setup. These have been nice plays and it's all about the setup. Here's a look at our day on Friday. Let's take a look at the markets: After four days ups we've got a buy signal to start the week. On a bigger scale picture we are right in the middle of the big support/resistance areas. Futures are fairly flat, as I type. It certainly looks like bulls want to push higher. It's tenative but I'll go with a slightly bullish bias or lean this morning to start off our trading. une S&P 500 E-Mini futures (ESM25) are down -0.11%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.16% this morning as investors look ahead to earnings reports from some of the biggest tech heavyweights as well as key economic data, including the jobs report, the Fed’s favorite inflation gauge, and the first estimate of first-quarter GDP. Investors are also keeping an eye out for any signs of progress in U.S. trade negotiations after President Trump indicated that another delay to his higher so-called “reciprocal” tariffs was unlikely. , Wall Street’s major equity averages closed higher. The Magnificent Seven stocks rallied, with Tesla (TSLA) climbing over +9% and Nvidia (NVDA) rising more than +4%. Also, Alphabet (GOOGL) gained over +1% after the Google parent reported stronger-than-expected Q1 results. In addition, Charter Communications (CHTR) surged more than +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted better-than-expected Q1 results. On the bearish side, T-Mobile US (TMUS) plunged over -11% and was the top percentage loser on the Nasdaq 100 after the carrier reported fewer-than-expected new wireless phone subscribers in Q1. Also, Intel (INTC) slumped more than -6% after the struggling chipmaker gave a disappointing Q2 revenue forecast. “Markets have staged an impressive recovery. While fears of a 2008- or 2020-style crisis are fading, the road back to record highs won’t be easy. Markets are showing resilience, but still face the same persistent challenges, including tariff uncertainty and signs of an economic slowdown,” said Mark Hackett at Nationwide. Economic data released on Friday showed that the University of Michigan’s U.S. April consumer sentiment index was unexpectedly revised upward to 52.2 from the preliminary reading of 50.8, stronger than expectations of 50.6. First-quarter corporate earnings season continues in full force, and investors await fresh reports from high-profile companies this week, including Apple (AAPL), Amazon.com (AMZN), Microsoft (MSFT), Meta Platforms (META), Visa (V), Coca-Cola (KO), Pfizer (PFE), Qualcomm (QCOM), Caterpillar (CAT), Eli Lilly (LLY), Mastercard (MA), McDonald’s (MCD), Exxon Mobil (XOM), and Chevron (CVX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. Market watchers will also closely monitor a slew of key U.S. economic data this week. The first estimate of U.S. first-quarter gross domestic product will show how much the expectation of trade tariffs affected the economy between January and March. The April Nonfarm Payrolls report and the latest reading of the core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will similarly attract attention. Other noteworthy data releases include the U.S. JOLTs Job Openings, the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., ADP Nonfarm Employment Change, the Employment Cost Index, the Chicago PMI, Pending Home Sales, Personal Spending, Personal Income, Initial Jobless Claims, the ISM Manufacturing PMI, the S&P Global Manufacturing PMI, Construction Spending, Average Hourly Earnings, Factory Orders, and the Unemployment Rate. Interest-rate setters are in a media blackout period before the May 6-7 policy meeting, so they are prohibited from making public comments this week. U.S. rate futures have priced in a 93.1% probability of no rate change and a 6.9% chance of a 25 basis point rate cut at next week’s monetary policy meeting. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.260%, down -0.14%. The SPY ended on a positive note at $550.64 (+4.61%), breaking above a descending broadening wedge identified by TrendSpider’s automated chart pattern recognition. While bulls are seeing some positive signs, the YTD volume profile shows SPY pulling into a high volume node area, which may act as resistance. With the overall trend still down, upticks are guilty until proven innocent, raising the question if the current momentum is enough to break the overhead supply. QQQ led the major indexes last week, finishing above its all-time-high anchored VWAP at $472.56 (+6.42%). As Q1 earnings continue to roll out, the tech-heavy ETF’s next move will largely depend on results from market giants like $AAPL, $MSFT, and $AMZN. With key earnings hitting just as the index approaches potential high-volume node resistance, the stage is set for a major move. Small-caps finished the week in last place at $194.12 (+4.05%). It is trading inside a low volume node, where price tends to move quickly. Positioned at the top of a descending broadening wedge, the ETF has multiple catalysts setting up for a significant move. However, potential resistance looms overhead at its swing high anchored VWAP, a key level that may act as a magnet for selling pressure as traders look to exit near breakeven. Let's take a look at the weekly expected moves. Once again, the I.V. in SPX is not much lower than NDX. I'll continue to focus my day trades on the SPX with potential late day entries on NDX. Trade docket today: I'll focus on our 1HTE BTC trades, SPX 0DTE with a potential late day entry on NDX, Restarting our BITO trade. Later in the week we'll have AAPL, AMZN, MSFT, META, MA potential earings setups. Let's take a look at some key levels for /ES today as that will be my primary focus today. 5554 is the key metric to watch today. That was a major level back on Mar. 31st. as a support level and Apr 2nd as a resistance level. We are sitting on that very level as I type. Above there is a lot of upside, up to 5680 and beyond. Support sits at 5515 then 5487. I'm always primed for a new week of opportunities. I look forward to seeing you all in the live trading room shortly.

Three days in a row= bullish?Good Friday traders! Well... I couldn't have been more wrong about yesterday. I thought we'd get a repeat of Weds. and get a retrace. That didn't happen. In fact, if you use an audible order flow tool like tick strike you probably had quite the headache at the end of the day. I haven't heard buy (and some sell) orders of that magnitued in a long, long time. It was a very solid day for the bulls. This makes three solid days in a row. Generally that constitues a "trend" for me. So...are we back? Is this the start of a bullish trend. I have two thoughts. #1. Too early to tell. #2. Today could be a key day. Take a look at the /ES level I've been saying all month would be the area where I'd go bullish. The 5500 level is key for me. It coincides with previous key levels. I think above is bullish. Below we stay bearish. We are sitting right on that level as I type. I don't have a bias or lean today because I do think we'll have a potentially big move but whether it's up or down really depends on how we handle the 5500 level. Our Trade docket focus is a bit different today as well. We'll focus our 0DTE efforts initially on our Nat Gas trade that we build yesterday. Each month we get a crack at this unique setup. I called last months setup the best trade I'd ever seen with a 99.5% POP. It was allmost like "free money". Todays isn't as good. Really, no trade ever will be. Those risk/reward opportunities rarely happen but....it's still a good one. I've got about 5K invested and we are looking for at least a $500 profit on it today. If we can get an early exit on it before the close we'll look to add an SPX and NDX 0DTE as well. June S&P 500 E-Mini futures (ESM25) are down -0.32%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.35% this morning as mixed signals on U.S.-China trade relations weighed on investors’ risk appetite. U.S. President Donald Trump said on Thursday that his administration was engaged in trade discussions with China, while Chinese Foreign Ministry spokesman Guo Jiakun stated that Beijing is not holding tariff negotiations with the U.S. and warned Washington against misleading the public about the talks. At the same time, Bloomberg News reported on Friday that China is considering suspending its 125% tariff on U.S. imports of medical equipment and certain industrial chemicals such as ethane. See Next: Think It's Too Late to Invest in the Booming AI Sector? This One’s Still Under-The-Radar Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.Investors also parsed a mixed bag of corporate earnings reports. Intel (INTC) slumped more than -6% in pre-market trading after the struggling chipmaker gave a disappointing Q2 revenue forecast. At the same time, Alphabet (GOOGL) climbed over +5% in pre-market trading after the Google parent reported stronger-than-expected Q1 results. U.S. equity futures initially moved higher as investors cheered forecast-beating quarterly results from Alphabet and the prospect of earlier-than-expected interest rate cuts from the Federal Reserve. In yesterday’s trading session, Wall Street’s major indices ended in the green. The Magnificent Seven stocks advanced, with Nvidia (NVDA) and Tesla (TSLA) rising over +3%. Also, ServiceNow (NOW) surged more than +15% and was the top percentage gainer on the S&P 500 after the software company reported solid Q1 results and issued above-consensus Q2 subscription revenue guidance. In addition, Texas Instruments (TXN) climbed over +6% after the analog chipmaker posted upbeat Q1 results and provided strong Q2 guidance. On the bearish side, Fiserv (FI) plunged more than -18% and was the top percentage loser on the S&P 500 after the payment technology company reported weaker-than-expected Q1 adjusted revenue. Economic data released on Thursday showed that U.S. durable goods orders jumped +9.2% m/m in March, stronger than expectations of +2.1% m/m, while core durable goods orders, which exclude transportation, were unchanged m/m, weaker than expectations of +0.3% m/m. Also, the number of Americans filing for initial jobless claims in the past week rose +6K to 222K, in line with expectations. In addition, U.S. existing home sales fell -5.9% m/m to a 6-month low of 4.02M in March, weaker than expectations of 4.14M. Fed Governor Christopher Waller said on Thursday that he would support interest rate cuts if elevated tariff levels begin to hurt the labor market. “I would expect more rate cuts, and sooner, once I started seeing some serious deterioration in the labor market,” he said. Also, Cleveland Fed President Beth Hammack said, “If we have clear and convincing data by June, then I think you’ll see the committee move if we know which way is the right way to move at that point in time.” Meanwhile, U.S. rate futures have priced in a 93.3% chance of no rate change and a 6.7% chance of a 25 basis point rate cut at the May FOMC meeting. On the earnings front, notable companies like AbbVie (ABBV), Colgate-Palmolive (CL), HCA Healthcare (HCA), Charter Communications (CHTR), and Schlumberger (SLB) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists expect the final April figure to be revised lower to 50.6 from the preliminary reading of 50.8. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.301%, down -0.09%. Docket 09:45 ET US S&P Manufacturing PMI Flash Forecast 49, Previous 50.2 Range 50 / 48 US S&P Services PMI Flash Forecast 52.6, Previous 54.4 Range 54 / 51 US S&P Composite PMI Flash Forecast 52, Previous 53.5 Range 54.6 / 51.5 10:00 ET US New Home Sales – Units Forecast 0.685M, Previous 0.676M Range 0.709M / 0.65M 10:30 ET EIA Crude Oil Inventories Forecast 1.55M, Previous 0.515M Range 4M / -0.4M EIA Distillate Inventories Forecast -0.65M, Previous -1.851M Range 1.5M / -2M EIA Gasoline Inventories Forecast -1.4M, Previous -1.958M Range 0.5M / -3M 14:00 ET Fed’s Beige Book Speakers & Events 09:00 ET Fed’s Goolsbee Speaks. Opening remarks at Economic Stability Summit. Text and Q&A TBD 09:30 ET Fed’s Musalem Speaks. Opening remarks at Fed Listens event. Text and Q&A TBD 09:35 ET Fed’s Waller Speaks. Opening remarks at Fed Listens event. Text expected. No Q&A 12:00 ET ECB’s Knot speaks at PIIE Let's look at Nat gas levels as thats our main focus today. /NG: Nat gas has been obliterated lately, along with a lot of commodities, ever since "Liberation" day. Its dropped about 55%! They call it the "Widow maker" for a reason. This is a huge move. It's makes it a bit tricky to trade with this pattern but it also makes it attractive for a long here. We are just looking for cash flow today but a cash secured put sale later on could be a nice risk/reward, looking to take assignment and then cash flow with covered calls. On an intra-day basis: 2.90, 2.92, 2.94. 2.97 are resistance with 2.88, 2.85, 2.83, 2.81, 2.79 support. Our trade makes money anywhere below 3 and above 2.82. We will most likely work it a bit to create a wider profit zone on the downside. See you all in the live trading room. Let's make it a great day!

Gap up + Close at low = BrearishWe had a monster open yesterday with a massive push up. I called for a retrace as it just looked like short covering to me vs. actual economic improvements. Sure enough, we got selling all day long, ultimately closing near the lows of the day. The record books will show positive closes for the indices yesterday but the price action was decidedly bearish. Despite an inside candle week we had last week, the market is still skittish. Within a two-hour window we had Trump say a China deal was close and Secretary Bessent saying it may take up to 3 years to get a deal! I've said this multiple times...this is a bear market. In bear markets we can and will get violent snapback rallys. That was yesterday. Nothing was fixed. There was no forward progress economically produced. It was simply a short covering induced rally. Futures are flat to weak this morning and fundamentally there is no valid reason to go anywhere but down. Could we get a news flash that pumps the markets up again? Of course! That's what makes is so tricky now. We had a pretty solid day yesterday. Our Credit call spread on /NQ got blown out of the water yesterday morning but we made some back scalping the QQQ's. Everything else went picture perfect for us. Butterflies were cheap yesterday and we added a couple to our SPX 0DTE and one hit so that was a home run for us. When you can throw on a trade for $80 dollars that can give you $900 dollar profit potential (and you're $80 dollars is coming out of your profits, not your pocket) it makes sense to do it, no matter how low the probabilities. Here's a look at our day yesterday: Let's take a look at the markets: Yesterdays rally sent the technicals back to buy mode. We are now smack dab in the middle of my big support/resistance levels. This means if you want to make your case for bullish or bearish bias I'll probably accept it. The overall trend is down with big upward corrections. It's all just noise and chop here. At some point these levels on this chart will get broken, either to the upside or downside. That will give the market some certainty. My bias or lean today is bearish. Yesterday's positive finish was a very bearish looking day to me. You have to allow for some crazy news catalyst that pops up and throws a wrench into your plan but it's hard to be bullish with the tecnhncal and economic backdrop we currently have. Trade docket for today: We've got our IBM and MRK earnings trades from yesterday that should be profitable at the open. We'll be adding GOOG, ABBV, INTC earnings trades today. We'll also try to get our unique Nat Gas 1DTE trade setup today. It's not looking as perfect as last months but we may still be able to put something together. We'll focus scalping on the QQQ's again and look to get our main 0DTE SPX on and possibly a small, late day NDX 0DTE, much like yesterday. June S&P 500 E-Mini futures (ESM25) are down -0.59%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.79% this morning as mixed signals from the Trump administration prompted investors to temper their expectations for swift progress in resolving the U.S.-China tariff dispute. U.S. President Donald Trump indicated that the U.S. is going to have a fair deal with China, adding late Wednesday that the country could be assigned a new tariff rate within the next two to three weeks. At the same time, U.S. Treasury Secretary Scott Bessent stated that President Trump has not proposed removing U.S. tariffs on China on a unilateral basis. Also, China’s Commerce Ministry said on Thursday that no negotiations have taken place on economic and trade matters, and urged the U.S. to remove all unilateral tariffs if it truly aims to resolve problems between the two nations. In yesterday’s trading session, Wall Street’s major indexes closed sharply higher. Tesla (TSLA) climbed over +5% after CEO Elon Musk said he would “significantly” scale back his involvement in the Department of Government Efficiency. Also, chip stocks rallied on hopes for easing U.S.-China trade tensions, with Marvell Technology (MRVL) rising more than +6% and GlobalFoundries (GFS) gaining over +4%. In addition, Boeing (BA) advanced more than +6% and was the top percentage gainer on the Dow after the beleaguered planemaker reported a narrower-than-expected Q1 loss. On the bearish side, Enphase Energy (ENPH) tumbled over -15% and was the top percentage loser on the S&P 500 after reporting downbeat Q1 results and issuing weak Q2 revenue guidance. Economic data released on Wednesday showed that the U.S. S&P Global manufacturing PMI unexpectedly rose to 50.7 in April, stronger than expectations of 49.0. Also, U.S. March new home sales rose +7.4% m/m to a 6-month high of 724K, stronger than expectations of 684K. At the same time, the U.S. S&P Global services PMI fell to 51.4 in April, weaker than expectations of 52.8. Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity was little changed in recent weeks, with uncertainty surrounding international trade widespread across all districts. Tariffs were mentioned 107 times in the Fed report, more than twice the count recorded in the previous Beige Book. The report stated that the outlook in several regions “worsened considerably” as economic uncertainty grew. “Prices increased across districts, with six characterizing price growth as modest and six characterizing it as moderate, similar to the previous report,” according to the Beige Book. The report also said that employment was little changed to up slightly. Cleveland Fed President Beth Hammack said on Wednesday during a Q&A session after her speech that she does not support making any adjustments to interest rates. “There’s still a lot of uncertainty around how policies are going to play out and what those impacts are going to be. This is not a good time to be preemptive. This is a good time to sit and wait and watch,” Hammack said. U.S. rate futures have priced in a 93.9% probability of no rate change and a 6.1% chance of a 25 basis point rate cut at the next FOMC meeting in May. First-quarter corporate earnings season continues in full flow, and investors look forward to fresh reports from major companies today, including Alphabet (GOOGL), Procter & Gamble (PG), T-Mobile US (TMUS), Merck (MRK), PepsiCo (PEP), Gilead (GILD), and Intel (INTC). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, all eyes are focused on U.S. Durable Goods Orders and Core Durable Goods Orders data, set to be released in a couple of hours. Economists forecast March Durable Goods Orders at +2.1% m/m and Core Durable Goods Orders at +0.3% m/m, compared to the prior figures of +0.9% m/m and +0.7% m/m, respectively. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 222K, compared to last week’s number of 215K. U.S. Existing Home Sales data will be released today as well. Economists foresee the March figure standing at 4.14M, compared to 4.26M in February. In addition, market participants will be anticipating a speech from Minneapolis Fed President Neel Kashkari. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.349%, down -0.87%. Let's take a look at the intra-day levels: /ES: There was some constructive work done by the bulls yesterday. My key level of 5356 turned from resistance to support. The key level for bulls today is now 5411. A push above that could keep the bulls in the game. 5500 is the next level higher. If we lose 5346 the next level down is 5323. /NQ: Our approach yesterday worked well. We waited until the last 25 min. of the day to get a trade working. It still gave us an 18% ROI. Low time exposure seems to be key when trading the Nasdaq lately. Looking at the 2hr. chart, the /NQ could go anywhere today. It's stuck right at a critical level. 18,810 is the key. Above could be bullish. Below should be bearish. We're sitting on that level right now, as I type. 19,096 is resistance with 18,601 working as support. A break out today could send us far above (or below) these levels. BTC: Bitcoin has had quite a run the last few days. It's widened out the trading range with 94,764 as resistance and 89,763 support. It's a wide range and doesn't really help us in finding entries today for our 1HTE's. Let's see if we can replicate yesterdays success with a similar approach today. I'll see you all in the live trading room shortly.

China/Powell/Musk/CeasfireAll the news catalyst came together last night to explode the futures higher. Talk of China/US being "nice" to each other, Trump saying he would not fire Powell. Musk saying he'd backout of Governmental duties and last but not least, talk of a cease fire in the Russia/Ukraine war. All this seems to have coalesed to explode the futures higher. Is this the turning point in this bearish trend? Maybe. Maybe not. It's a big move with /ES up 133 and /NQ up 540 as I type this. If we take a look at the daily chart on /ES, it's clearly a massive move. We rarely get a gap (up or down) on futures. It's one of the reasons most traders use them vs. the SPX for technical analysis. What sticks out to me most here is the fact that we are now back to the support level of Sept. 2024. We've tried to break above this level a half dozen times this month. Each effort has failed. It's a bit depressing to say but it looks like we may still need to wait to see if this push up is for real. A push above 5562 on /ES would confirm to me that the bulls are back. I'm reminded of something I was taught many years ago. #1. Never read too much into a one day move (up or down) in terms of the overall trend. #2. Remember, the big, massive moves (either up or down) usually happen in bearish markets. In healthy bull markets we usually get more predictable, calm moves. I had a bearish /NQ posiiton left from my scalping last night and closed that early this morning for a $1,175 loss. I've re-established a short /MNQ when the market was up 500+ points this morning. I think the chance we give some of this gain back is real. Let's look at my day yesterday. I tried three debit setups on SPX and only one worked. I hit my risk level of $500 dollars pretty quick so I was done. I needed one more to hit. That was fine. I ended up with a -$600+ loss on SPX, which is managable but I took a big overnight swing on BTC that lost. We've had a great year trading BTC and I was playing with some house money but it still hurts. The BTC/dollar decoupling is amazing to watch play out. It's too early to tell but BTC could be ready to launch back above that key 100K level. I'll go back to our smaller entries and Martingale scaling. That seems to work quite well for these 1HTE setups. Here's a look at the day for me: Let's take a look at this "new" market and see if it's really new or more of the same old stuff. Our technicals on the 5hr. chart have turned bullish. No surprise there. But on the weekly we are still bearish. Just slightly but bearish, none the less. Remember...one day doesn't usually mean much. Let's take a look at the daily chart agian to hone in on a couple key levels. The red line (5569) would be the level I'm watching closely. If we can recapture that then I think we can start to talk bullish markets and setups. Right now we are back to a key support level we established in Sept. of last year. As I mentioned above, we've tried several times this month to break above it and haven't succeeded. Until we do it's hard for me to get too bullish. It's so hard to express a bias or lean currently. In a "best case" scenario it's always a guess. It may be an educated guess, but a guess, none the less. You need to form one otherwise how to you trade? Still...right now we are completely driven by news catalysts. The problem with that is we don't know when they will apprear. We love trading the dreaded FOMC days because we know its coming and when! Right now it feels like we are walking in a mine field, just waiting for an unexploded mine to go off. We don't know when or where it is. Never the less, I'm going to put my money where my mouth is and day we are either flat of retace a bit today. I will be waiting a few hours this morning before starting our day trades. I don't think this is a day you want to rush in. Also...keep in mind, when I say flat to down I'm using the current 500+ point surge level on /NQ as the starting point. Obvioulsy it looks like we'll open very bullish. June S&P 500 E-Mini futures (ESM25) are up +2.01%, and June Nasdaq 100 E-Mini futures (NQM25) are up +2.51% this morning, extending yesterday’s rally as sentiment got a boost after the Trump administration’s move to alleviate some of the tensions unsettling investors. Investors found relief after U.S. President Donald Trump said he doesn’t plan to fire Federal Reserve Chair Jerome Powell. Also, hopes for easing U.S.-China trade tensions further boosted risk appetite. President Trump told reporters on Tuesday that U.S. tariffs of 145% on Chinese goods will be reduced “substantially” if the two sides can reach a deal. “We’re going to be very nice and they’re going to be very nice, and we’ll see what happens,” Trump said. Futures linked to the tech-heavy Nasdaq 100 outperformed as Tesla (TSLA) climbed over +6% in pre-market trading, even after the EV maker reported disappointing Q1 results, as CEO Elon Musk said he would “significantly” scale back his involvement in the Department of Government Efficiency. Investors now gear up for U.S. business activity data and the next round of corporate earnings reports. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Equifax (EFX) surged more than +13% and was the top percentage gainer on the S&P 500 after the company reported stronger-than-expected Q1 results and provided solid Q2 guidance. Also, the Magnificent Seven stocks advanced, with Tesla (TSLA) rising over +4% and Amazon.com (AMZN) gaining more than +3%. In addition, 3M Company (MMM) climbed over +8% and was the top percentage gainer on the Dow after the industrial conglomerate posted better-than-expected Q1 results and reaffirmed its FY25 adjusted EPS guidance. On the bearish side, Northrop Grumman (NOC) plunged more than -12% and was the top percentage loser on the S&P 500 after the aerospace and defense company cut its FY25 adjusted EPS guidance. Economic data released on Tuesday showed that the U.S. Richmond Fed manufacturing index fell to a 5-month low of -13 in April, weaker than expectations of -6. Minneapolis Fed President Neel Kashkari said on Tuesday that the uncertainty surrounding Trump’s tariff policy could lead to an economic pullback and a potential recession if no resolution is reached. “The last two months have been the sharpest reduction of confidence in the ten years I’ve been at the Fed, except for March 2020 when Covid hit,” Kashakri said. He also emphasized that the independence of the Fed’s monetary policy is fundamental and crucial to achieving better economic outcomes. Separately, Fed Governor Adriana Kugler stated that tariffs are likely to exert upward pressure on prices and have a bigger economic impact than initially anticipated. Meanwhile, U.S. rate futures have priced in a 92.6% chance of no rate change and a 7.4% chance of a 25 basis point rate cut at the conclusion of the Fed’s May meeting. First-quarter corporate earnings season rolls on, with investors awaiting new reports from notable companies today, including Philip Morris (PM), IBM (IBM), AT&T (T), ServiceNow (NOW), Texas Instruments (TXN), and Boeing (BA). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, which is set to be released in a couple of hours. Economists, on average, forecast that the April Manufacturing PMI will come in at 49.0, compared to last month’s value of 50.2. Investors will also focus on the U.S. S&P Global Services PMI, which stood at 54.4 in March. Economists expect the preliminary April figure to be 52.8. U.S. New Home Sales data will be reported today. Economists foresee this figure coming in at 684K in March, compared to 676K in February. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be 1.600M, compared to last week’s value of 0.515M. In addition, market participants will be looking toward speeches from Chicago Fed President Austan Goolsbee and Fed Governor Christopher Waller. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book will offer insight into the extent to which government policy and uncertainty are affecting business decisions. The report is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.341%, down -1.09%. Docket 09:45 ET US S&P Manufacturing PMI Flash Forecast 49, Previous 50.2 Range 50 / 48 US S&P Services PMI Flash Forecast 52.6, Previous 54.4 Range 54 / 51 US S&P Composite PMI Flash Forecast 52, Previous 53.5 Range 54.6 / 51.5 10:00 ET US New Home Sales – Units Forecast 0.685M, Previous 0.676M Range 0.709M / 0.65M 10:30 ET EIA Crude Oil Inventories Forecast 1.55M, Previous 0.515M Range 4M / -0.4M EIA Distillate Inventories Forecast -0.65M, Previous -1.851M Range 1.5M / -2M EIA Gasoline Inventories Forecast -1.4M, Previous -1.958M Range 0.5M / -3M 14:00 ET Fed’s Beige Book Speakers & Events 09:00 ET Fed’s Goolsbee Speaks. Opening remarks at Economic Stability Summit. Text and Q&A TBD 09:30 ET Fed’s Musalem Speaks. Opening remarks at Fed Listens event. Text and Q&A TBD 09:35 ET Fed’s Waller Speaks. Opening remarks at Fed Listens event. Text expected. No Q&A 12:00 ET ECB’s Knot speaks at PIIE 13:15 ET BoE’s Gov. Bailey Speaks at Institute of International Finance. No text. Q&A expected 14:00 ET BoE’s Breeden Speaks at IMF on Monetary Policy and Financial Stability In Inflationary Times. No text. Q&A expected Trade docket for today: It looks like we'll get a take profit early on our ISRG earnings trade. We'll try to get an IBM and MRK earnings setup on today. We delayed our GLD/SLV pairs trade yesterday. We'll start the today. I think we can get both a SPX and NDX 0DTE on today but I'll be patient on entries. No real benefit on rushing in today. Simple credit spreads may be all we need today, if we can time them right. We've waited patiently for our next Nat gas trade. Today is really the day to do it. We'll look at it. I'd like it to be around 5K in buying power and right now it's looking closer to 8,5K. We'll talk about it in our zoom session. Let's take a look at the intra-day charts and see if we can find some key levels to trade off today. It's always a bit tough when you have this big of a move pre-market but I think we've got a couple good levels to look at today. 5474 is the key level for me to start the day. This is the first resistance level for us today. It's also the approx. level that has been rejected all month. Every time we get there we retrace. If this really is a bullish switch then the bulls will want to get above and hold that level. Turning 5474 from resistance to support would be big. 5558 would be the next target for bulls. 5356 is first support with 5297 next. These are really wide levels, as you could expect, with the pre-market move we've had. We'll try to refine these more as the day progresses. /NQ: We've got a similar pattern to the /ES. 19,151 is the next resistance. It correlates with the highs of the month and has been heavy resistance. My eyes are on 18,787. Bears will need to get back below that to get any meaningful retrace today. BTC: Bitcoin has had a major decoupling from both the dollar and equities. The push up has been big and fast. If we can clear 94,784 there's no reason to think we can't continue pushing higher. Support looks like 89,703. I look forward to seeing you all in the live trading room. Today looks chock full of potential. It's on us now to find the right entries. Premium should be good enough that simple credit spreads could do the job for us today. Let's be patient. I'll probaly wait until our zoom session starts to look at entries. See you all soon!

All that glittersGold just hit another ATH. The dollar is crashing. Bitcoin is decoupling. Bonds are moving. It's an interesting time to be a trader. One thing is sure. Everyday brings something new to focus on. Today we start our Gold/Silver pairs trade. With the index well above 100 this is a wonderful opportunity to put on a non-equity correlated pairs trade. Our day yesterday was fine. It could have easily been a $1,000+ dollar profit day but I kept our SPX on all day. One interesting stat that keeps repeating is the fact that many of our trading members pull our initial SPX 0DTE early in the day when it gets to around 50-60% profit capture and about 95% of the time, they end up doing better than I who sits and works it the rest of the day. Being out before the power hour is always a good idea but now more than ever! Here's a look at my day yesterday. Let's take a look at the markets: The selling was strong yesterday with Trump jawboning Powell. It's nothing new and meaningless, in the big picture but the market doesn't need much to set it off. Futures are up this morning, as you would expect after a sell off but... I think we go lower today. My bias or lean today is bearish. 5221 is a key level on/es and if we lose that (we are sitting on it as I type) I don't see why the bearishness doesn't continue. une S&P 500 E-Mini futures (ESM25) are up +0.98%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.05% this morning, signaling a rebound from yesterday’s sell-off on Wall Street, while investors await comments from Federal Reserve officials and a raft of corporate earnings reports, with a particular focus on results from “Magnificent Seven” member Tesla. Investors also remain focused on trade talks. The U.S. said it has made “significant progress” toward a bilateral trade agreement with India following talks between Vice President JD Vance and Indian Prime Minister Narendra Modi on Monday. At the same time, Thailand said that ministerial-level talks that were scheduled for this week have been postponed. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply lower. Tesla (TSLA) slumped over -5% after Reuters reported that the production launch of the company’s more affordable vehicles had been delayed, and Wedbush analyst Dan Ives warned of a “code red” moment ahead of its Q1 earnings. Also, Nvidia (NVDA) slid more than -4% after Reuters reported that Huawei plans to start mass deliveries of an advanced AI chip to Chinese customers as soon as next month. In addition, Salesforce (CRM) fell over -4% after DA Davidson downgraded the stock to Underperform from Neutral with a price target of $200. On the bullish side, Netflix (NFLX) rose more than +1% after the streaming giant posted better-than-expected Q1 results and provided solid Q2 guidance. Economic data released on Monday showed that the Conference Board’s leading economic index for the U.S. fell -0.7% m/m in March, weaker than expectations of -0.5% m/m and the largest decline in 17 months. Chicago Fed President Austan Goolsbee said on Monday that the central bank requires more time to assess the net impact of President Trump’s policies. “The impact of tariffs on the macroeconomy could potentially be modest. We don’t know what the impact on the supply chain is going to be, so I think we want to be a little more of a steady hand and try to figure out the through line before we’re jumping to action,” Goolsbee said in comments to CNBC. Meanwhile, U.S. rate futures have priced in an 89.5% chance of no rate change and a 10.5% chance of a 25 basis point rate cut at May’s monetary policy meeting. First-quarter corporate earnings season is in full swing. Investors will be closely monitoring earnings reports today from prominent companies like Tesla (TSLA), GE Aerospace (GE), Verizon (VZ), Intuitive Surgical (ISRG), RTX Corp. (RTX), Lockheed Martin (LMT), and 3M Company (MMM). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on the U.S. Richmond Fed Manufacturing Index, which is set to be released in a couple of hours. Economists estimate this figure will stand at -6 in April, compared to the previous value of -4. In addition, market participants will hear perspectives from Fed Vice Chair Philip Jefferson, Philadelphia Fed President Patrick Harker, Minneapolis Fed President Neel Kashkari, and Fed Governor Adriana Kugler throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.414%, up +0.20%. Not to mention we've got a lot of FED speak today as well as Tesla earnings, after the bell. Sentiment The dollar held near a 16-month low after Trump’s threat to fire Fed’s Powell shook confidence in the US currency the previous day. Most US Treasuries slid, led by shorter maturities, on lingering worries about the Fed’s independence. The 2-Yr Treasury yield climbs 3 BPS to 3.79%. Markets are pricing a 70% possibility that the Fed will deliver a 25 BPS cut in June, with the risk of two or three more cuts by year end. Gold pushed past $3,500 an ounce for the first time before paring some gains, amid a flight from US equities, bonds and the dollar. According to people familiar with the matter, BoJ officials see little need to change their present stance of gradually lifting interest rates for now, despite uncertainties stemming from US tariffs. Docket US to sell $69 bln of 2 Yr Notes Speakers & Events 09:00 ET Fed’s Jefferson speaks at Economic Mobility Summit. Text expected, no Q&A 09:30 ET Fed’s Harker Speaks Economic Mobility Summit. No text or Q&A 10:00 ET ECB’s president Lagarde speaks on CNBC 13:00 ET ECB’s de Guindos Speaks at MIT/ICADE Finance Club in Madrid 13:40 ET Fed’s Kashkari speaks in moderated discussion at US Chamber of Commerce Global Summit. No text. Q&A expected 14:30 ET Fed’s Barkin speaks in fireside chat at RVA Big Dipper Innovation Summit. No text. Q&A expected 16:00 ET ECB’s Knot speaks at Bretton Woods Committee Annual Spring Summit. Text and Q&A TBD Earnings 16:10 ET Tesla Q1 2025 Earnings Estimates: EPS $0.44, Rev: $21.43B If you want to know what a bearish market looks like, this is it. Can a bear market have vicious snap backs and short covering rallys? Sure. Heck, we may get one today but, it doesn't alter the overall bearish nature of the market. Keep an eye on the DIA for signs of a rebound. It's been particularly hammered. Trade docket for today could be busy. We'll focus our 0DTE efforts again on SPX. We have an end of day BTC trade working and I"ll likely DCA and continue to work that today. Our VZ earnings trade could come off today and we have ISGR, ENPH, BA, T, NEM as potential new earnings setups. We'll also start our SLV/GLD pairs trade today. We've got quite a bit of unrealized profit sitting in our /MNQ scalp. We'll continue to work that today. Let's take a look at the intra-day levels for trading today on /ES and BTC. /ES: The 1hr. chart seems to be giving me the best levels for today. 5255 is first resistance with 5305 next. 5222 is THE KEY level for me today. We are sitting on it right now and below it could open up the bearishness I'm anticipating. The next level down would be 5178. The BTC decoupling from the dollar and equities is something to behold. It's in a tight range on the 1Hr. chart with 88,875 resistance and 88,109 support. I've got an end of day "stay below 89,000" setup already working going into this mornings session. We'll be picky today on our earnings trades and try to pick the best setups. I look forward to seeing you all in the live trading room!

Inside candle weekWelcome back traders. I hope you all had a good Easter break. Both my Mother-in-law and my Mom had some bad health issues over the weekend. It's just a reminder to us what's really important in life. Tell the ones you love how much they mean to you. We had an inside candle last week on the weekly charts. That's the first one in a month. Inside candles are tricky. Does it mean that the crazy moves and high volatility are done with? Maybe. It can also mean that its just a consolidation and a pause before the next storm. Futures aren't dissapointing this morning with the /NQ down almost 300 points. Thurs. was a bust for me. I had an SPX roll from Weds. If that would have hit it would have been a solid day but not only did it not hit but I added to the losses with some churning positions early in the day. Scalping continues to work well. In addition to our profits from Thurs. we're sitting on about $1,400 of unrealized profits now on our short /MNQ. I'll likely keep working this position until the market finds a bottom. Here's a look at my day last Thurs. We are off to a better start today, as I mentioned, with our first 1HTE trade looking good for a 7% ROI and scalping already cash flowing nicely today with our short. Let's get into our trade docket for today and this week. We are back to some of our regular trades this week so make a note of the upcoming dates. Todays docket will focus on our 1HTE BTC trades, SPX 0DTE and Scalping on our short /MNQ but things will pick up this week. Tomorrow will start a GLD/SLV pairs trade (tune in to zoom today to see the setup). We should also have a good chance at the same amazing Nat Gas trade that we had last month. I'm not sure it will be a 99.5% POP but it should be close. That setup could come as early as tomorrow but likely Weds. We'll also look to trade TSLA, GOOG, PM, IBM, VZ, T, ISRG, BA, MRK, ABBV, INTC earnings this week. une S&P 500 E-Mini futures (ESM25) are down -1.09%, and June Nasdaq 100 E-Mini futures (NQM25) are down -1.23% this morning, pointing to a sharply lower open on Wall Street as U.S. President Donald Trump’s threats to fire Federal Reserve chief Jerome Powell weighed on sentiment. On Friday, National Economic Council Director Kevin Hassett stated that President Trump is examining whether he’s able to fire Powell. A day earlier, Trump posted on social media that Powell’s removal “cannot come fast enough,” while ramping up pressure on the central bank to lower interest rates. Such remarks have stoked worries about the Fed’s independence, dampening investor sentiment. This week, investors look ahead to key U.S. economic data releases, remarks from Federal Reserve officials, and a slew of corporate earnings reports, with a particular focus on results from “Magnificent Seven” stalwarts Tesla and Alphabet. In Thursday’s trading session, Wall Street’s major equity averages ended mixed. UnitedHealth Group (UNH) plummeted over -22% and was the top percentage loser on the Dow and S&P 500 after the managed care giant posted downbeat Q1 results and cut its FY25 adjusted EPS guidance. Also, chip stocks lost ground, with Nvidia (NVDA) and Broadcom (AVGO) sliding more than -2%. In addition, Alcoa (AA) slumped about -7% after reporting weaker-than-expected Q1 revenue and cautioning that tariff-related costs are expected to increase significantly. On the bullish side, Eli Lilly (LLY) surged more than +14% and was the top percentage gainer on the S&P 500 after the company posted Phase 3 trial results for its oral GLP-1 drug, orforglipron, that met primary and key secondary endpoints. Economic data released on Thursday were mixed. The U.S. Philly Fed manufacturing index tumbled to a 2-year low of -26.4 in April, weaker than expectations of 2.2. Also, U.S. March housing starts fell -11.4% m/m to 1.324M, weaker than expectations of 1.420M, while building permits, a proxy for future construction, unexpectedly rose +1.6% m/m to 1.482M, stronger than expectations of 1.450M. In addition, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -9K to a 2-month low of 215K, compared with the 225K expected. New York Fed President John Williams stated on Friday that the U.S. economy is in a “very good place,” and he does not see the need to adjust interest rates “any time soon.” “We need to make sure that any one-time changes in prices don’t pass through into more persistent, higher inflation,” Williams said during an interview on Fox Business. Meanwhile, U.S. rate futures have priced in an 89.0% probability of no rate change and an 11.0% chance of a 25 basis point rate cut at the next central bank meeting in May. First-quarter corporate earnings season kicks into high gear this week, with investors awaiting fresh reports from major companies such as Tesla (TSLA), Alphabet (GOOGL), Philip Morris (PM), IBM (IBM), Verizon (VZ), AT&T (T), T-Mobile US (TMUS), Intuitive Surgical (ISRG), Lockheed Martin (LMT), Boeing (BA), GE Aerospace (GE), 3M (MMM), Thermo Fisher Scientific (TMO), ServiceNow (NOW), Texas Instruments (TXN), The Procter & Gamble Company (PG), Merck&Co (MRK), PepsiCo (PEP), AbbVie (ABBV), Gilead (GILD), Bristol-Myers Squibb (BMY), Intel (INTC), and Colgate-Palmolive (CL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. Market watchers will also be closely monitoring the preliminary U.S. purchasing managers’ surveys for April for indications of how businesses are responding to President Trump’s announcement of sweeping tariffs. Other noteworthy data releases include the U.S. Richmond Fed Manufacturing Index, New Home Sales, Crude Oil Inventories, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Existing Home Sales, and the University of Michigan’s Consumer Sentiment Index. “The PMI report will be very interesting amid the growth concerns from the trade uncertainty that could show up in lower new orders,” Danske Bank analysts said in a note. In addition, the Fed will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book will offer insight into the extent to which government policy and uncertainty are affecting business decisions. Notably, the report is published two weeks before each meeting of the policy-setting Federal Open Market Committee. A host of Fed officials will be making appearances throughout the week, including Goolsbee, Jefferson, Harker, Kashkari, Kugler, Waller, and Hammack. Today, investors will focus on the Conference Board’s Leading Economic Index for the U.S., which is set to be released in a couple of hours. Economists expect the March figure to be -0.5% m/m, compared to the previous number of -0.3% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.336%, up +0.21%. Major European markets are closed today in observance of Easter Monday. Let's take a look at the technicals to start off the week. You can really make a case for continued bearishness or bullishness, depending on the time frame you look at. With an inside weekly candle it does look like the market is bottoming and getting ready to form a buy signal. The weekly chart is not a "full blown" buy signal but it's getting there. The daily chart? Well, that still looks pretty bearish. In fact, it's flashing a slight sell signal this morning. Technicals are, not surprisingly, bearish with the /ES down -60+ and /NQ down -260+ as I type. It's really a battle today. Bullish longer term. Bearish near term. Futures hammered down this morning. I'm going to look for more of a neutral day today unless we get a news catalyst...which is incredibly likely. Do we get some good news on a deal with China? That would be bullish. Does Trump continue to jawbone the FED? That's largely what's sending futures down this morning. That would be bearish. We also have a ton of big earnings reports out this week. Lots of FED speak this week as well. Let's look at some market internals: Markets calmed down a bit last week, as the major indices printed an inside weekly candle, even amid rising geopolitical headwinds. Semiconductor stocks took a hit after news broke that U.S. chipmakers would face fresh export restrictions to China, dragging the market lower midweek and confirming another lower high. Later that day, Fed Chair Powell warned that the tariffs could stoke inflation and weigh on economic growth, causing the markets to slide. His comments prompted a sharp rebuke from former President Trump, who called for Powell’s removal. The SPY closed the week at $526.41 (-1.39%), printing an inside candle on the weekly chart for the first time all year. The RSI With Seasonality Indicator showed an oversold reading during a historically strong week, allowing traders to take a breather. The SPY is stabilizing at its 100-day EMA, but as we know too well, volatility can reemerge from a single headline. Semiconductor volatility hit QQQ last week as it closed down at $444.10 (-2.27%), driven by the new chip export restrictions to China. However, even though the bullish momentum stalled, the QQQ has shown strong support at the 2022 highs. Paired with an oversold weekly RSI, tech traders will be watching key Q1 earnings reports as a gauge for strength in the sector Small-cap investors caught some relief last week as IWM closed higher at $186.48 (+1.18%), and has a strong 70% historical win rate coming up this week. Unlike its large-cap peers, the IWM has already been trading in its 2022 range, and is much further below its all-time high. With volatility declining and small-caps starting to outperform, traders are left wondering if this is potentially a sign of a risk-on environment. Expected moves for the week: Volatility is still sky high. With the expected move of the SPY not much less than QQQ I think I'll stick to the SPX for our 0DTE's this week. Let's take a look at the intra-day levels: /ES: With futures down this morning, we are smack dab in the middle of a range. 5298 is first resistance with 5342 next. 5221 is first support with 5178 next. /NQ: Nasdaq is a bit weaker than SPX right now. 18,318 is first resistance with 18,542 next. 17,984 is first support with 17,754 next. Our trigger for rolling out and down our /MNQ cover is 18,063 level. BTC: Bitcoin hit for a 7% profit this morning on our 1HTE. We may be able to get a few of these on today. Extremely interesting price action this morning in BTC. A huge decoupling from the dollar. We'll spend some time looking at this in zoom today. 88,000 is resistance with 86,969 first support and 86,089 next. I'll see you all in the live trading room shortly!

PeaceGood Thursday to you all! As we prepare to finish off this holiday shortened trading week I want to wish all of you peace and joy in your life. Whether you are Christian or not, Good Friday and Easter can be a time for all of us to reflect on the blessings life gives us. I'm grateful for the many friends I've made through trading. I'm also grateful that I'm only three, budget smashing payments away from completing my payments to the trading compound in Costa rica that I've been working on for over a year to provide us a place to come and trade and enjoy each others company. I am really looking forward to that. Let's get into our day yesterday. We sowed a lot of seeds yesterday. Now we need to harvest. With the big sell off from Powells speech we needed to roll our /NQ covers on our short /MNQ futures position out and down to today. Those are currently 260 points OTM and up $900 dollars with $800 extrinsic. It's likely we could get a $1,700 payday today from our bearish scalp. Our SPX brought in a bit of income from the broken wing butterflies which kept my debit to just -$1,450. We rolled the ITM puts to today and with futures up this morning we have lots of options. We could turn it into a completely risk-free box spread which would lock in a $800 gain and then continue to work to hopefully get more than $1,450 out of it. We'll see how the day opens up but it looks like a solid roll. Sometimes a roll is just kicking the can down the road because you just didn't want to pull the band-aid off! This roll looks pretty good. It's tough to get a completely risk-free box trade on but they are pretty neat when you can. The risk graph looks different when you have no risk! Here's a look at our day yesterday. June S&P 500 E-Mini futures (ESM25) are up +0.59%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.02% this morning as positive signals from the first round of U.S.-Japan trade talks boosted sentiment. U.S. President Donald Trump said there was “big progress” in talks to secure a deal for Japan. This fueled optimism that deals can be struck to avoid higher tariffs on U.S. trading partners. .-Japan trade talks will continue to be closely monitored, not just for their bilateral implications, but also as a potential framework for how the U.S. may approach trade relationships with other allies,” said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management. Futures linked to the tech-heavy Nasdaq 100 outperformed as U.S. chip stocks gained ground in pre-market trading after the world’s biggest contract chipmaker, Taiwan Semiconductor Manufacturing Co., reported better-than-expected Q1 profit and provided an upbeat Q2 sales forecast. Investors now look ahead to a fresh batch of U.S. economic data and an earnings report from streaming giant Netflix. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed lower. Nvidia (NVDA) sank over -6% and was the top percentage loser on the Dow after the Trump administration barred the company from selling its H20 chip in China. Also, J.B. Hunt Transport Services (JBHT) slid more than -7% and was the top percentage loser on the S&P 500 after the transportation and logistics company logged lower Q1 profit and revenue. In addition, Advanced Micro Devices (AMD) slumped over -7% and was the top percentage loser on the Nasdaq 100 after the company said it expects to face charges of up to $800 million after the U.S. government limited exports of its MI308 chip to China. On the bullish side, Travelers Cos. (TRV) rose more than +1% and was the top percentage gainer on the Dow after the insurer posted better-than-expected Q1 core EPS. Economic data released on Wednesday showed that U.S. retail sales jumped +1.4% m/m in March, stronger than expectations of +1.3% m/m. Also, U.S. March core retail sales, which exclude motor vehicles and parts, rose +0.5% m/m, stronger than expectations of +0.4% m/m. In addition, U.S. industrial production fell -0.3% m/m in March, weaker than expectations of -0.2% m/m, while manufacturing production rose +0.3% m/m, in line with expectations. Fed Chair Jerome Powell said on Wednesday that the central bank needs to make sure tariffs do not lead to a more persistent rise in inflation. “Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem,” Powell said. The Fed chair reiterated that policymakers are in no hurry to cut interest rates when he said, “For the time being, we are well positioned to wait for greater clarity before considering any adjustments to our policy stance.” Also, Cleveland Fed President Beth Hammack said there is a strong rationale for policymakers to keep interest rates steady until more clarity emerges on how tariffs and other policy changes will affect the U.S. economy. “Many had assumed that the Fed would prioritize the labor side of the mandate if forced to choose, but he suggested that price stability is necessary to maintain a healthy labor market,” said Adam Phillips, managing director of investments at EP Wealth Advisors. U.S. rate futures have priced in an 86.5% chance of no rate change and a 13.5% chance of a 25 basis point rate cut at the May FOMC meeting. First-quarter corporate earnings season picks up pace, and investors look forward to new reports from prominent companies today, including Netflix (NFLX), UnitedHealth Group (UNH), Charles Schwab (SCHW), and DR Horton (DHI). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on the U.S. Philadelphia Fed Manufacturing Index, which is set to be released in a couple of hours. Economists, on average, forecast that the April Philly Fed manufacturing index will stand at 2.2, compared to last month’s value of 12.5. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 225K, compared to last week’s number of 223K. U.S. Building Permits (preliminary) and Housing Starts data will be released today as well. Economists expect March Building Permits to be 1.450M and Housing Starts to be 1.420M, compared to the prior figures of 1.459M and 1.501M, respectively. Meanwhile, the U.S. stock markets will be closed tomorrow in observance of Good Friday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.314%, up +0.82%. Our task today is pretty straightforward. Squeeze as much as we can out of the SPX. Hopefully more than $1,450 so we can have an overall profit. Lock in the /NQ gain on our scalp or, roll it out and down if we get more bearish price action today. If we book our scalp profit today we'll need to assess our short /MNQ and whether we want to continue being short over the extended weekend. Let's look at the markets: Theres really no resolution to the big question of when the bulls will return. Technicals are still bearish. Surprise, surprise. I'll likely continue to hold our short scalping position into next week. I was bullish yesterday off the lows of the futures session and that worked until Powell started speaking. Shocker. I'm leaning bullish again today. Our SPX put roll from yesterday needs to finish above 5290 for max profits so we would benefit with a slightly bullish day. If we drop again today that's ok too. We would increase our profit potential on our short Scalp and could turn the SPX into a risk-free box spread and then work some more legs into it. I'm looking at the 1HTE's this morning and there is just not enough movement to get good risk/reward so I'll skip those today. We aren't working the NDX today as there are no options so I'll focus on the /ES. /ES: Surprise! Levels today are the exact same we had yesterday. The market churns higher then lower but there's no real change in directional bias. 5339 is VWAP on the 2hr. chart and a key level. If we can stay above that level it would be a much easier day for us with our rolled SPX puts. Next up on resistance would be 5393. Support is all the way down at 5262. That would neccesitate another roll, out and down on our short /MNQ scalp cover. We rolled a lot of potential profit yesterday into today. Let's see how much of it we can actually put in our wallets today. I look forward to seeing you all in the trading room shortly.