|

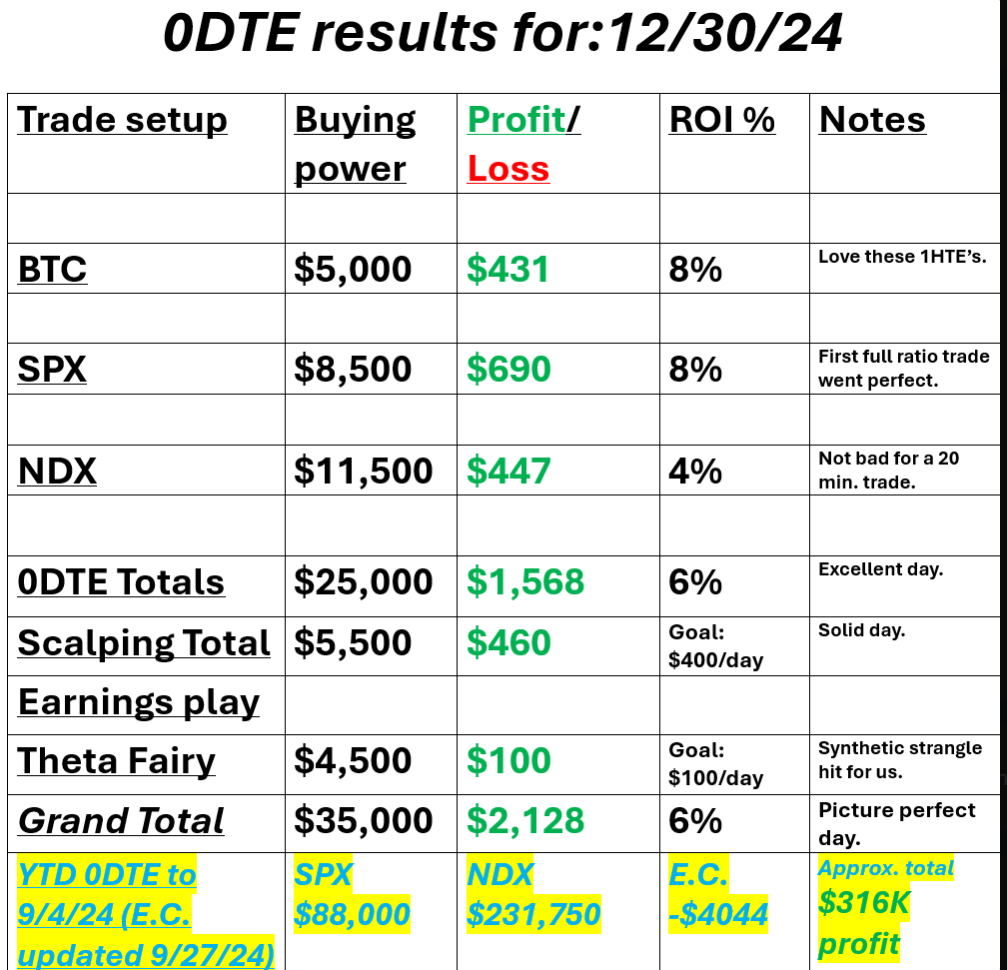

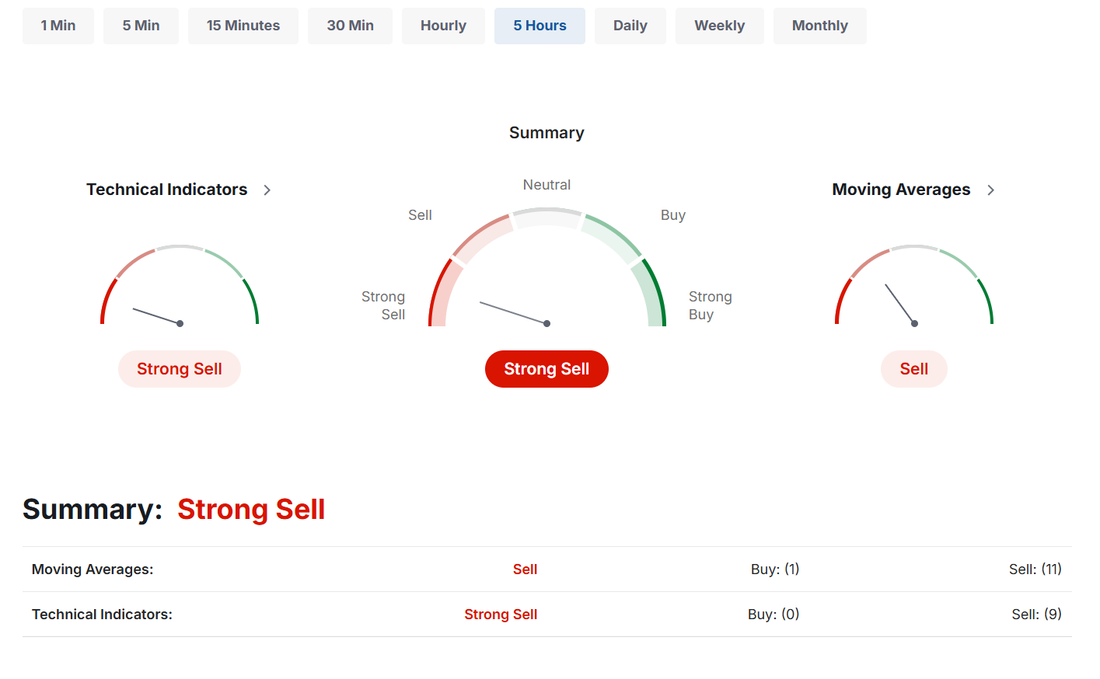

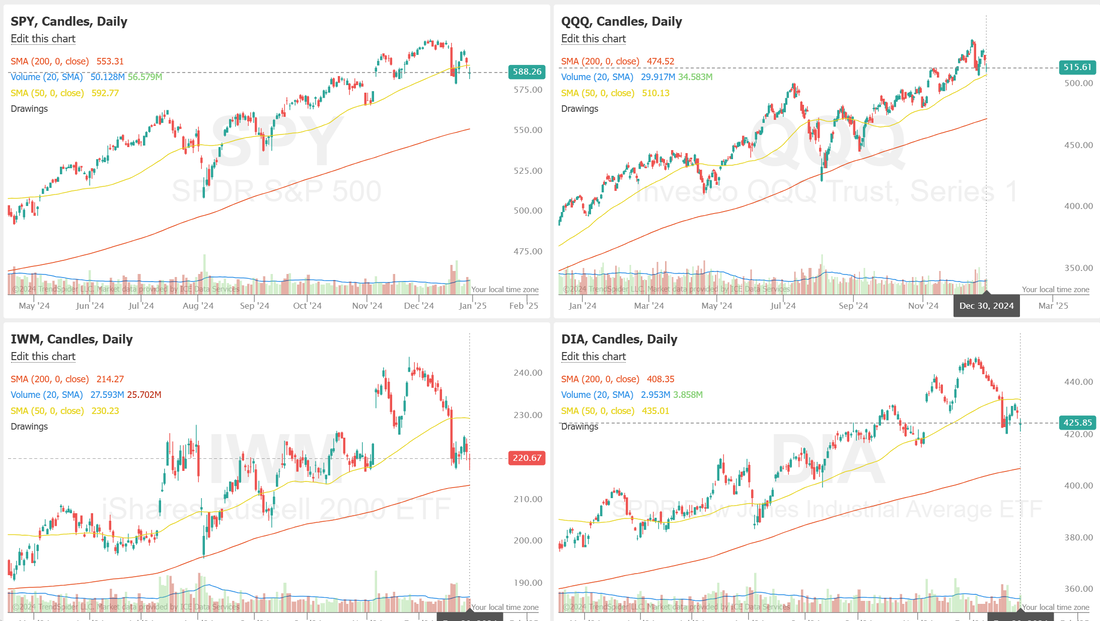

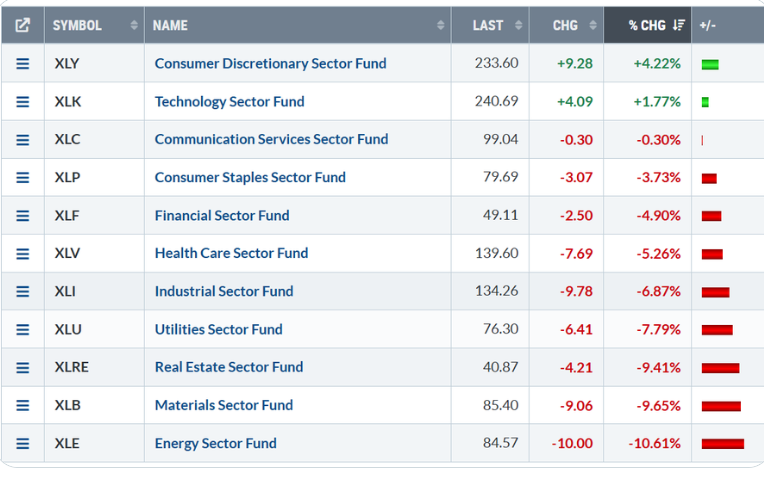

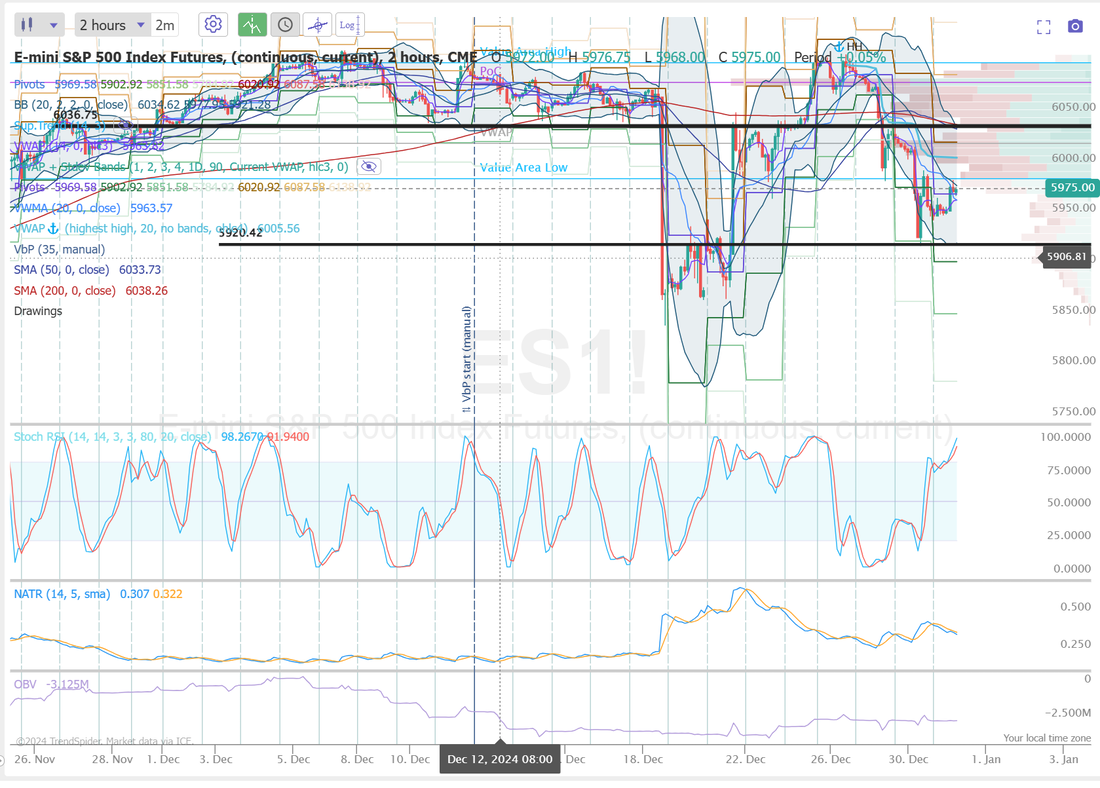

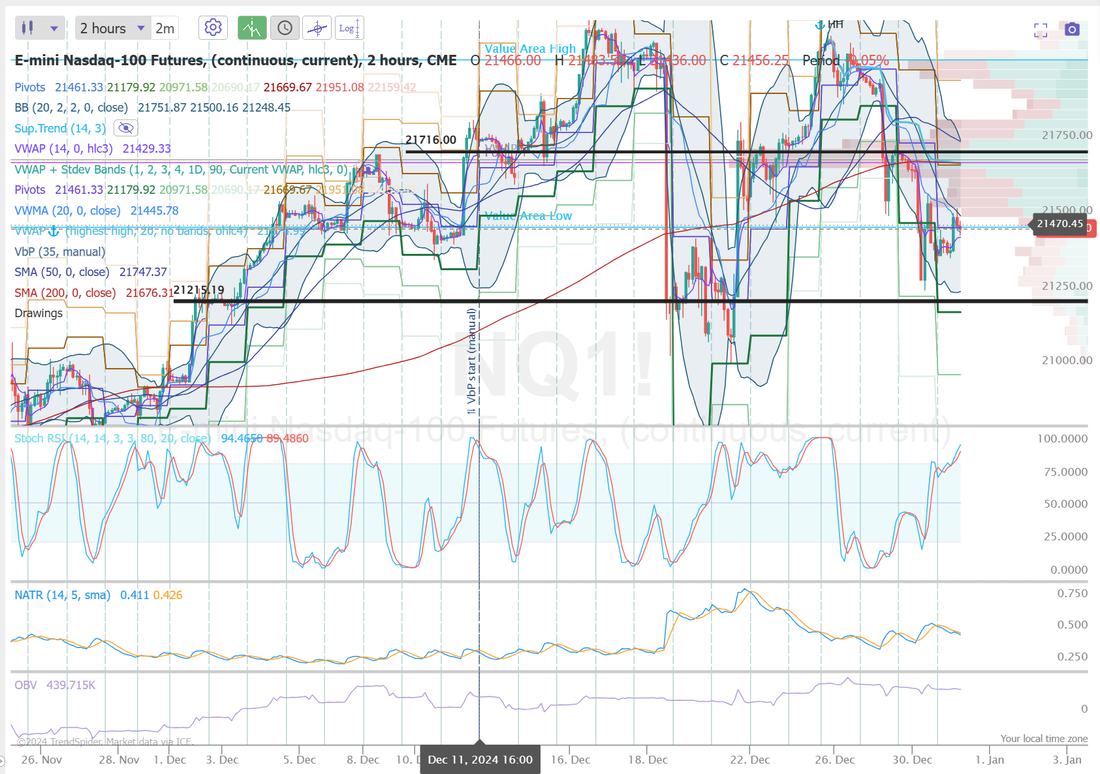

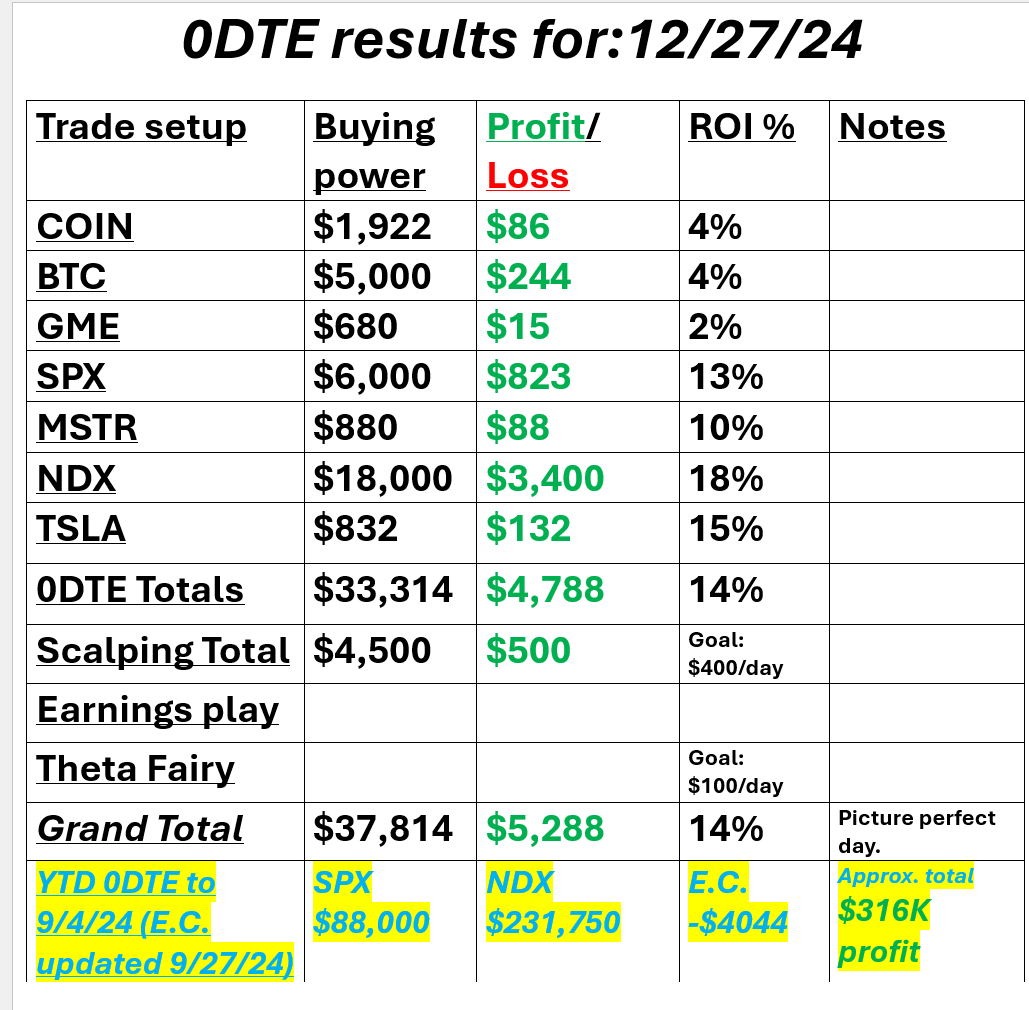

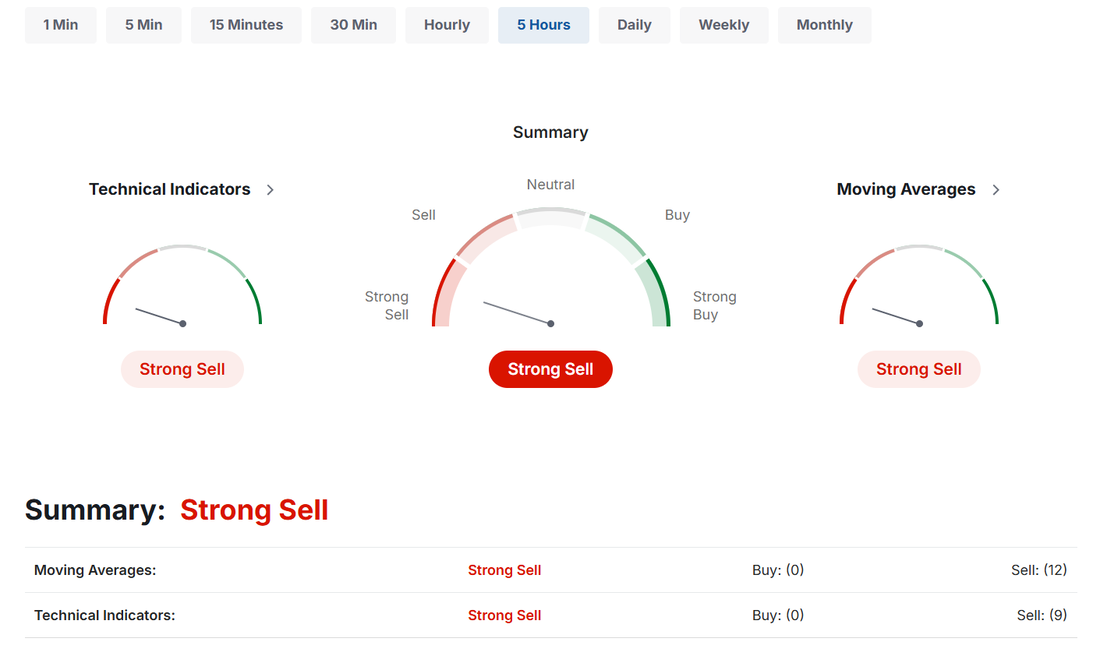

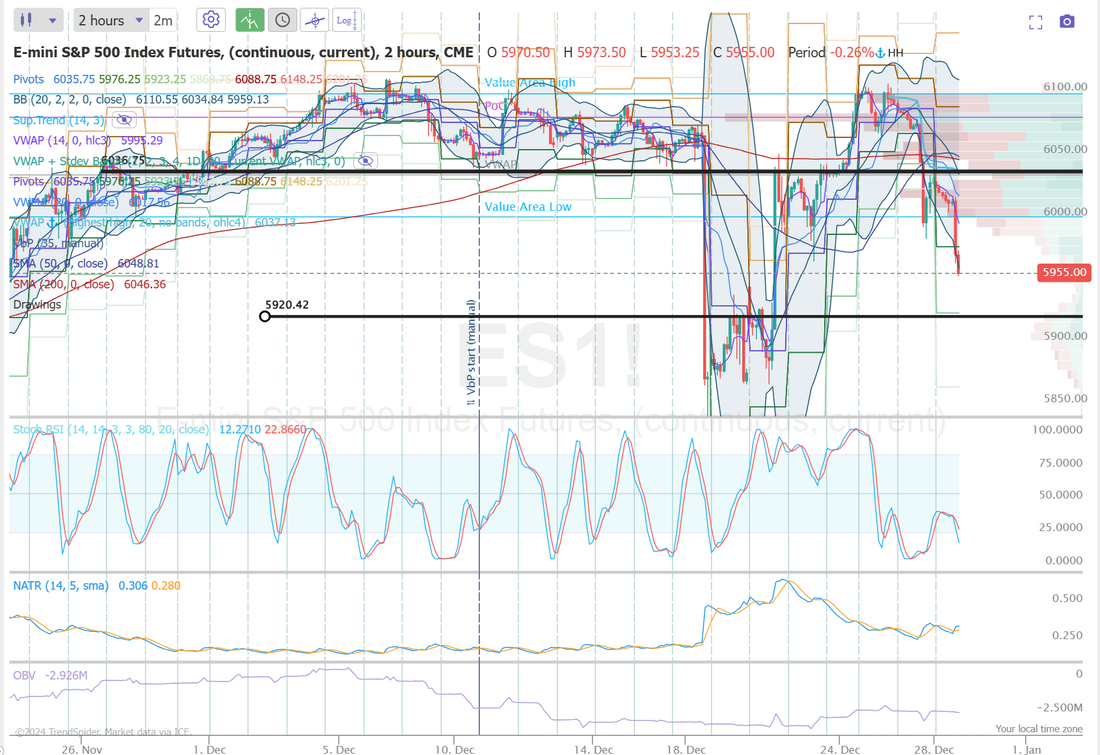

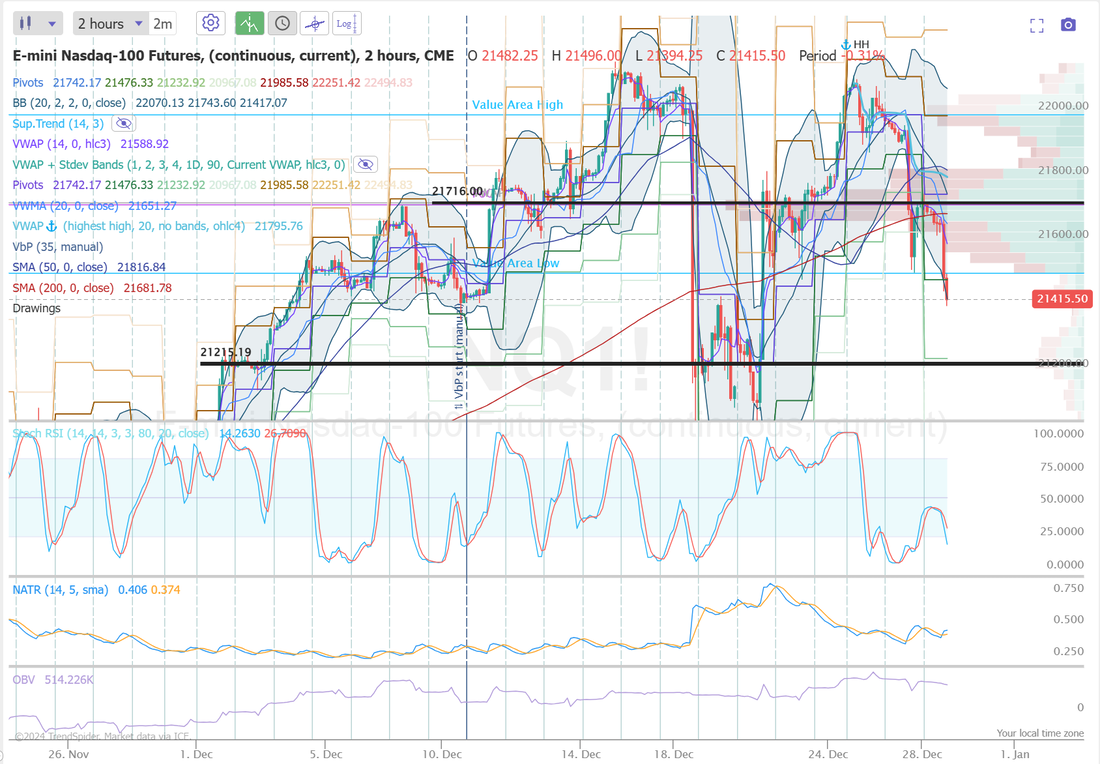

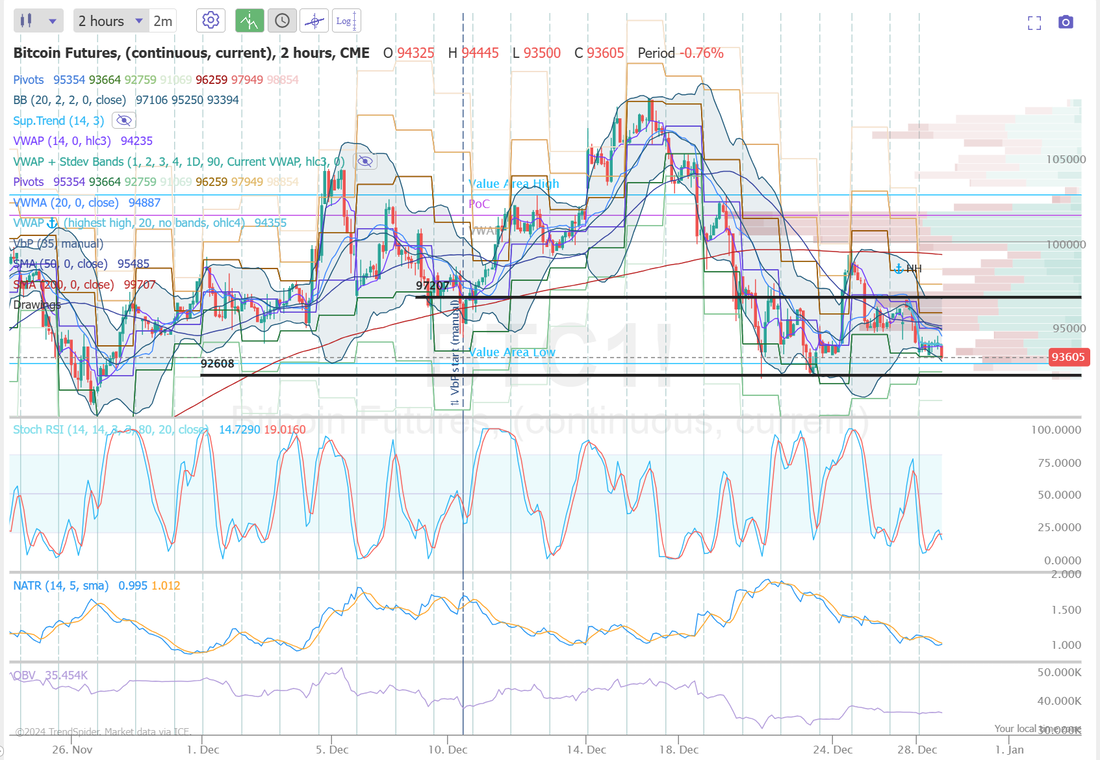

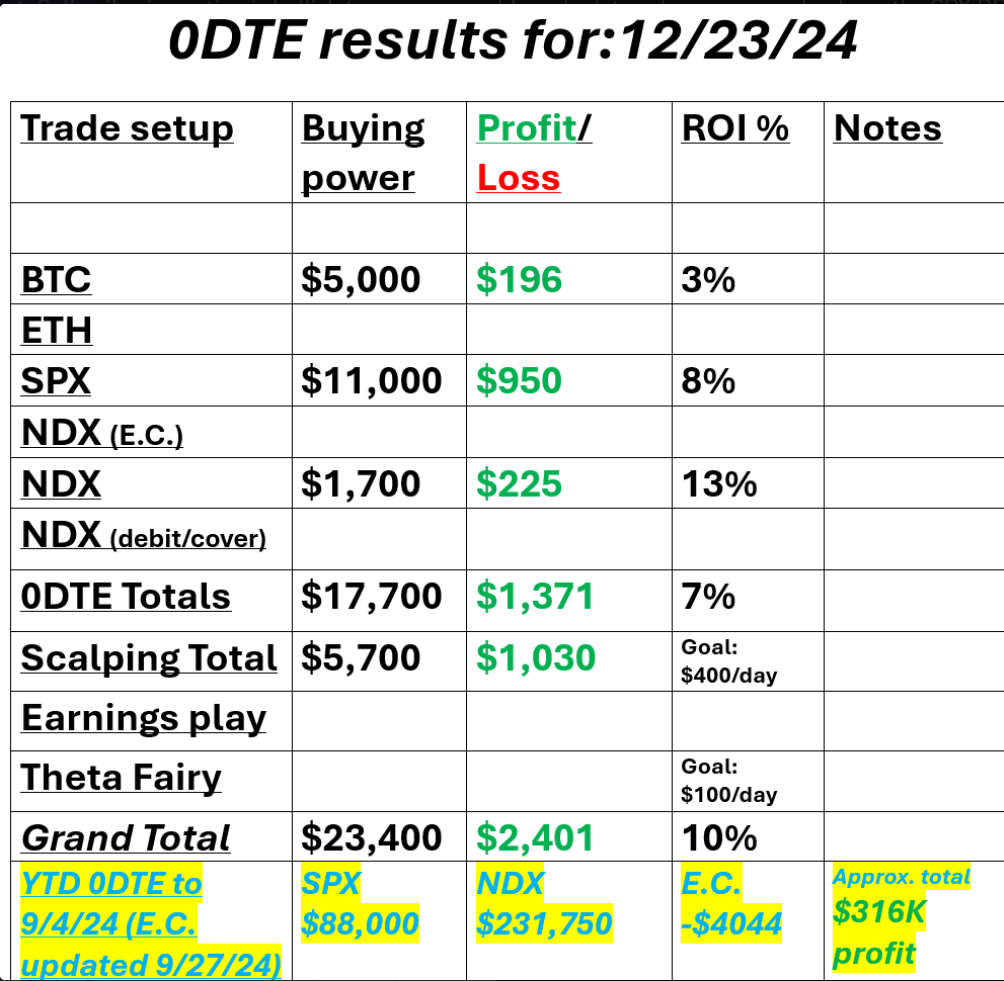

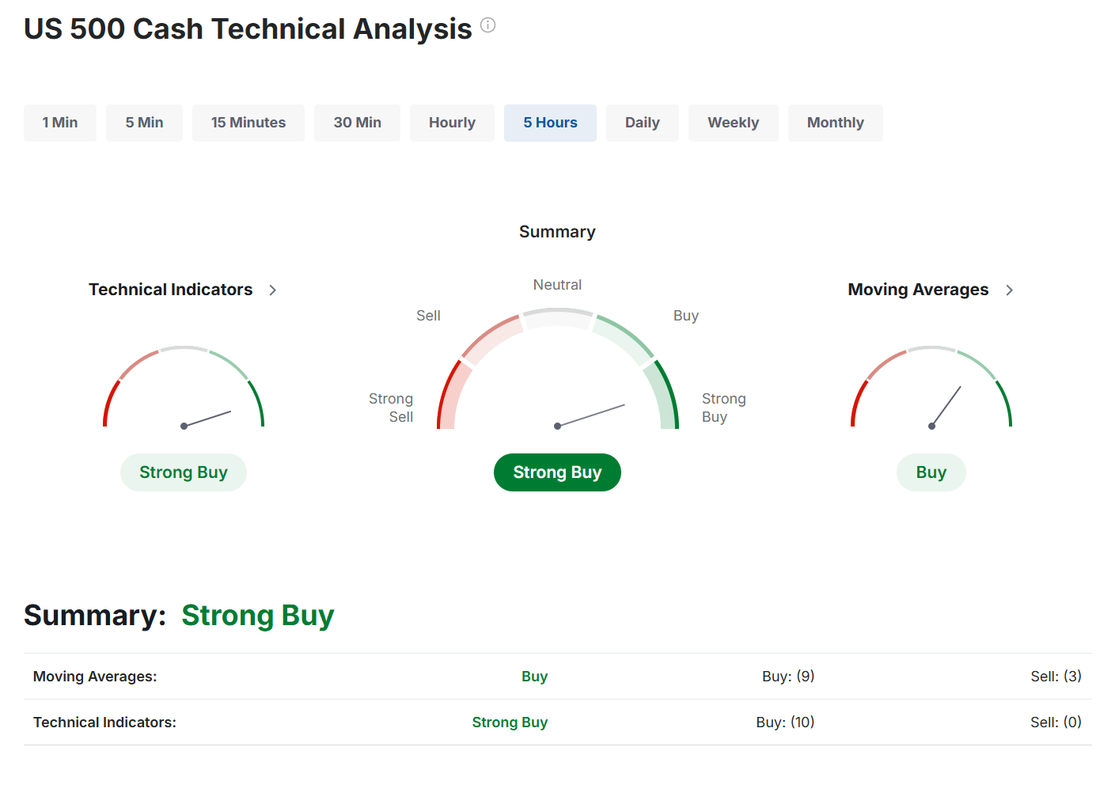

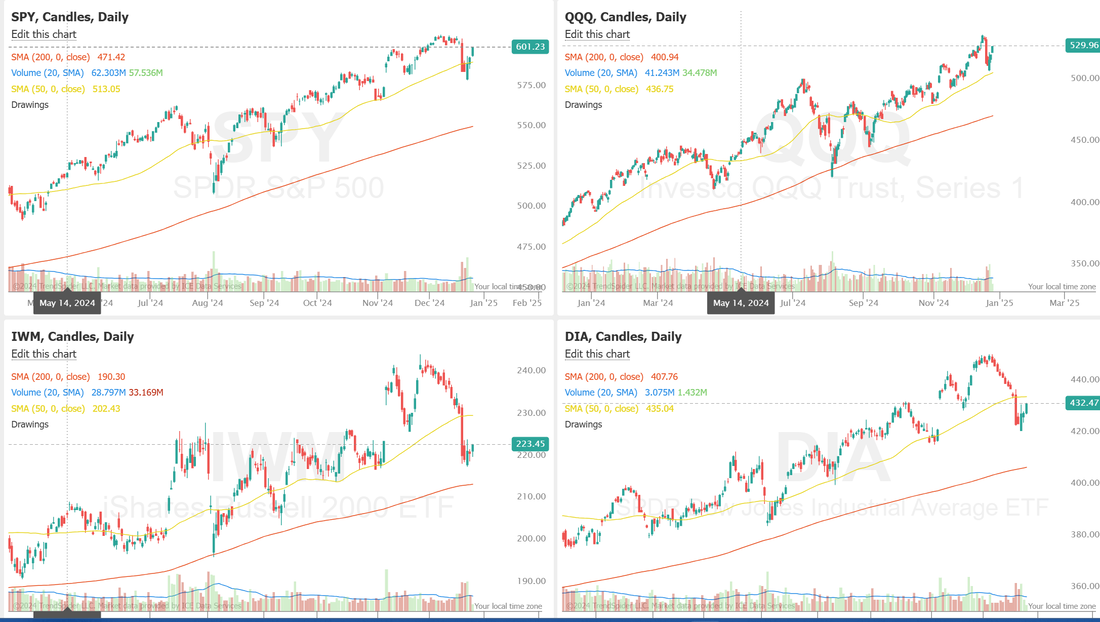

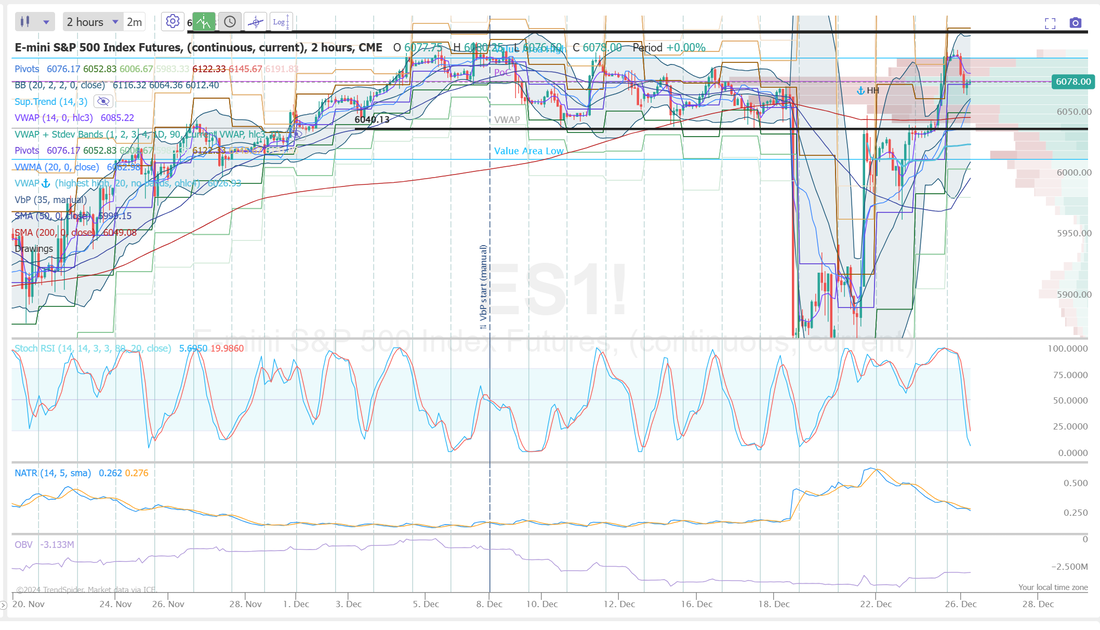

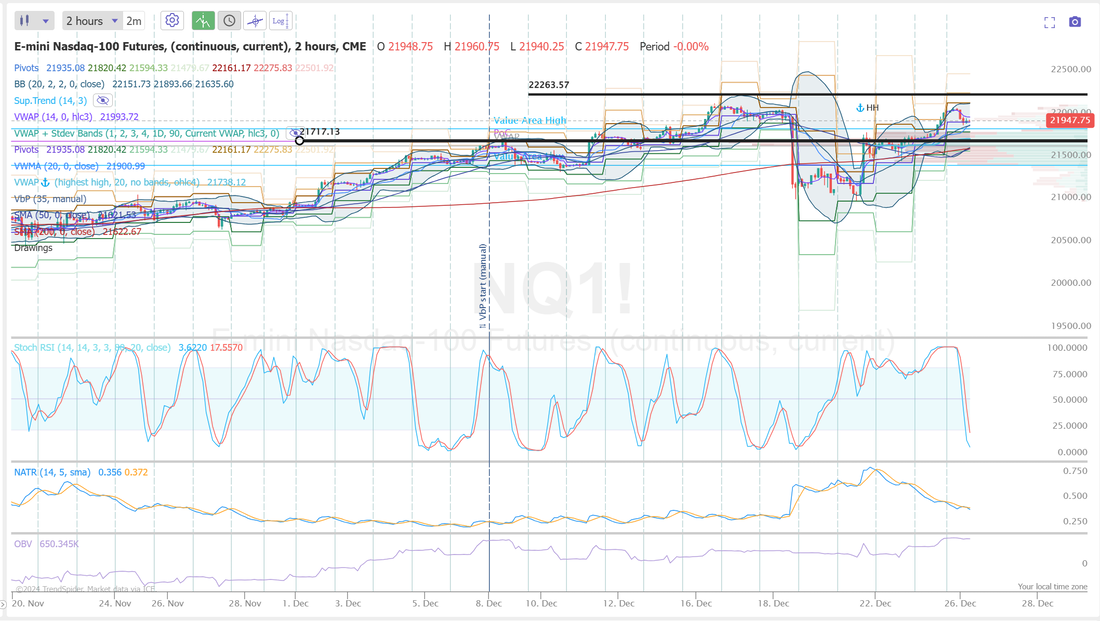

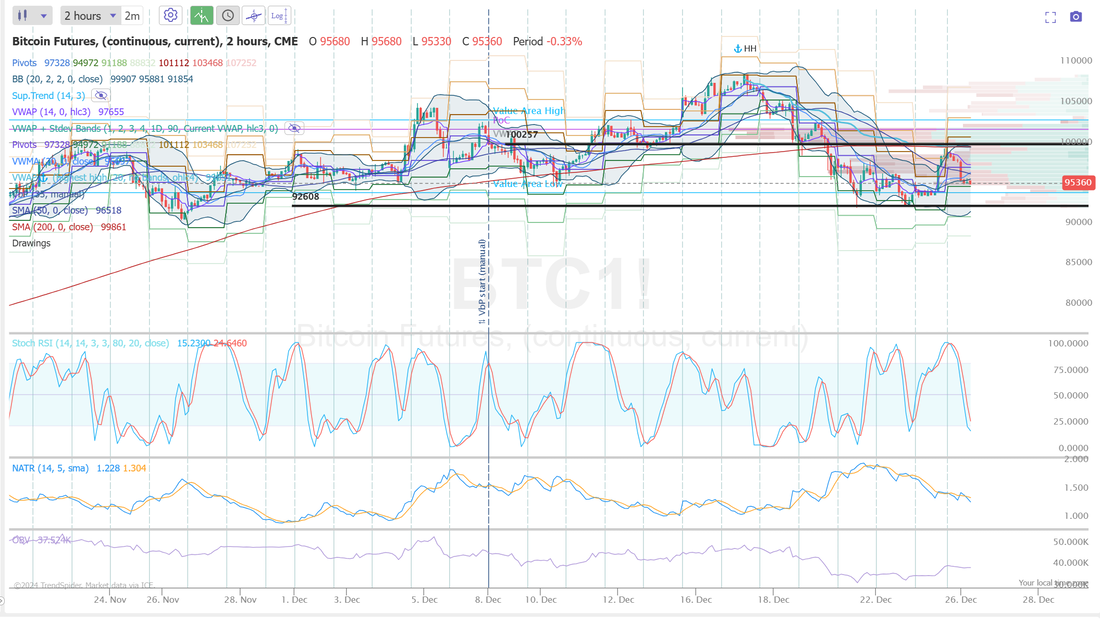

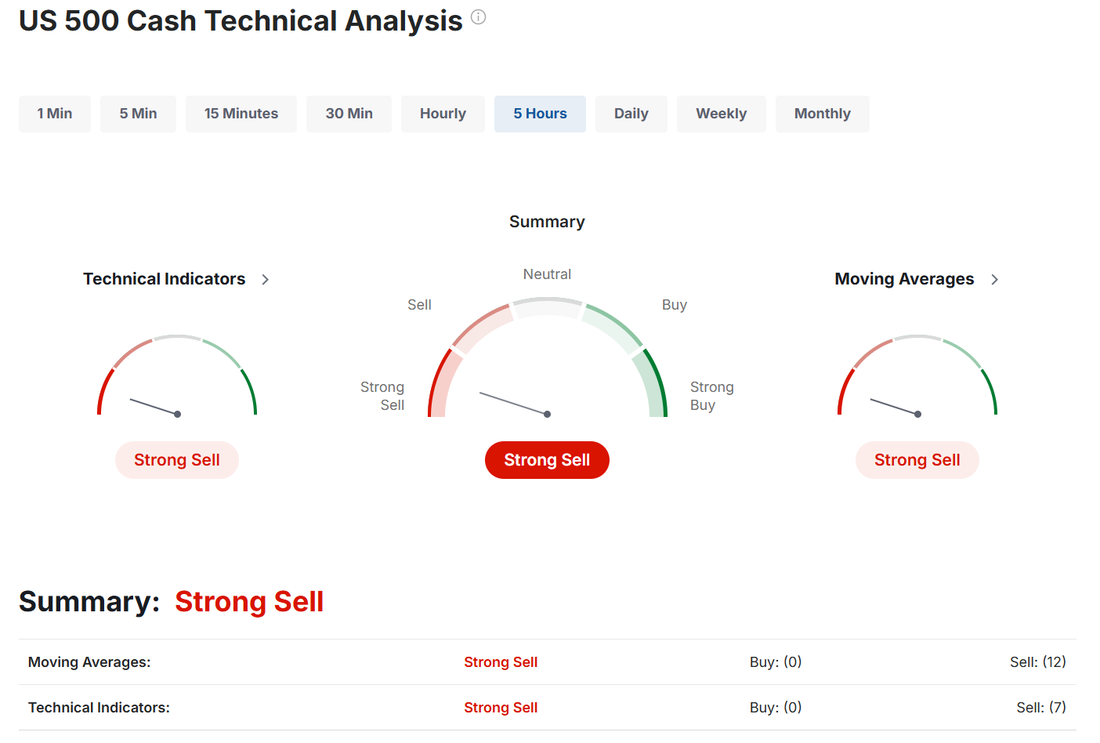

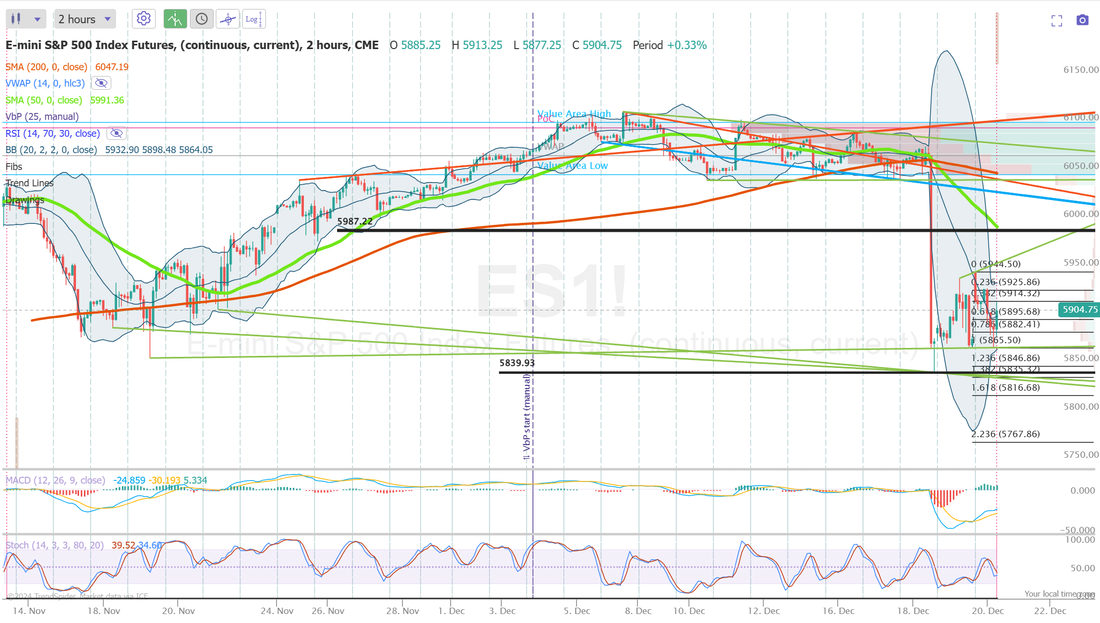

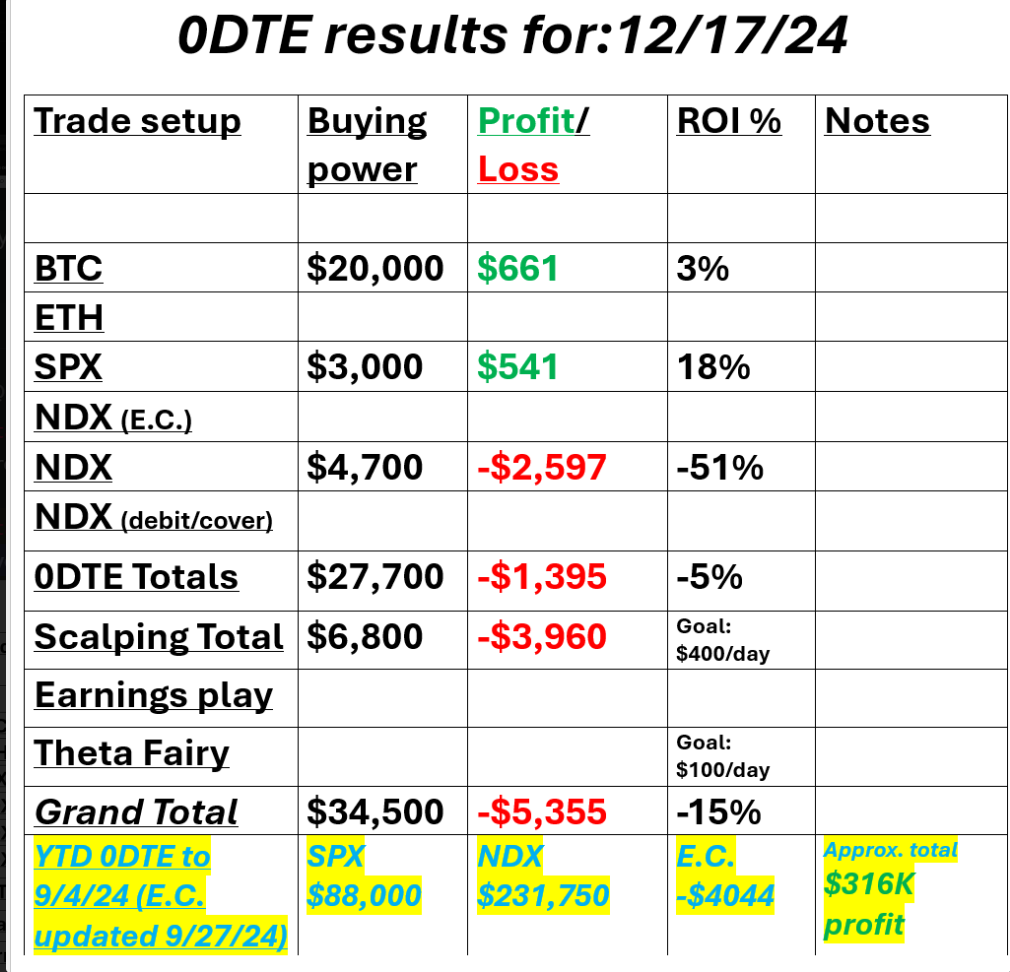

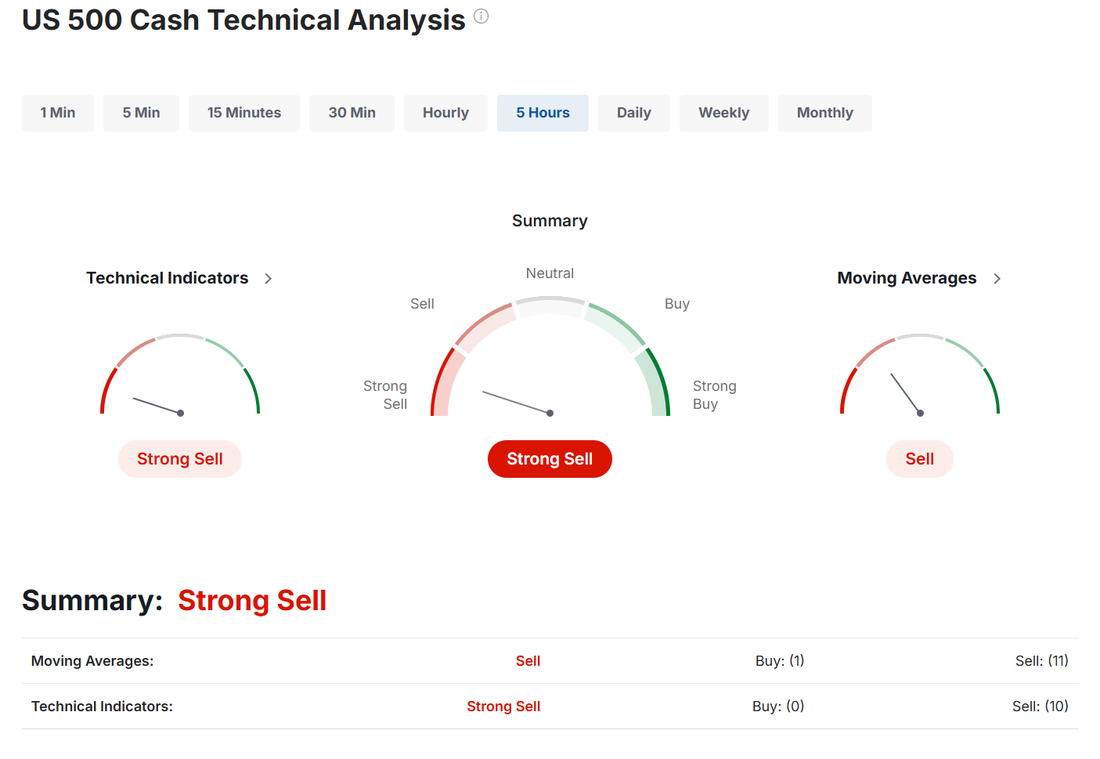

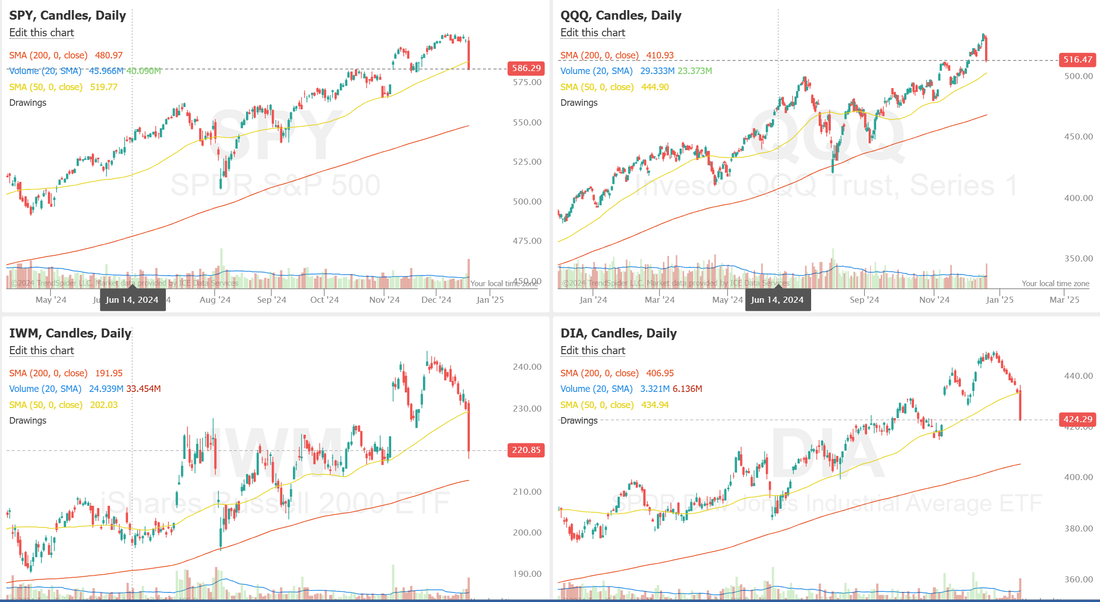

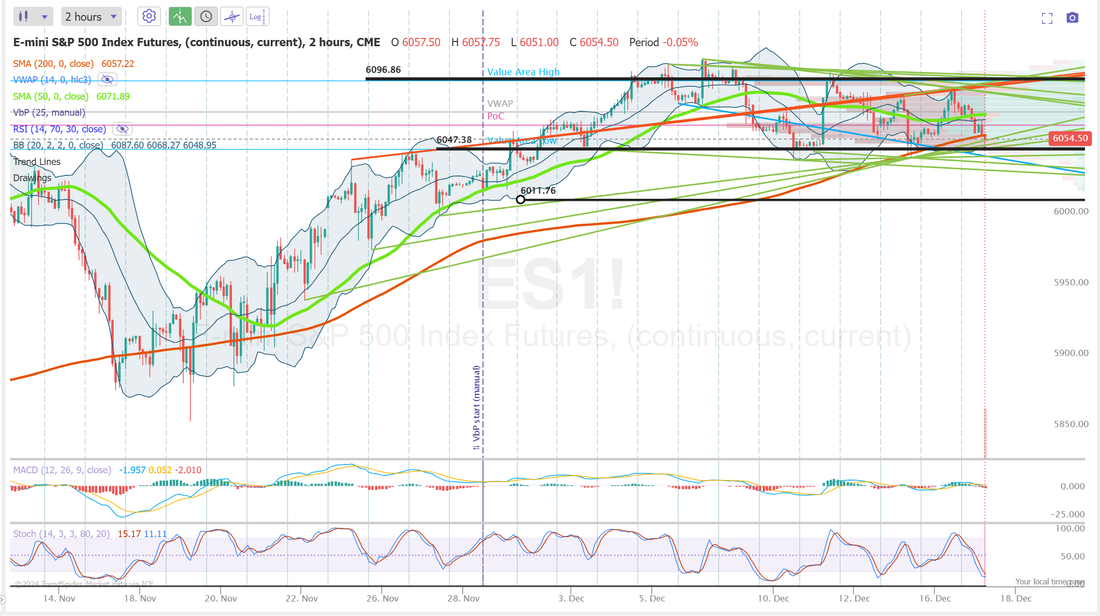

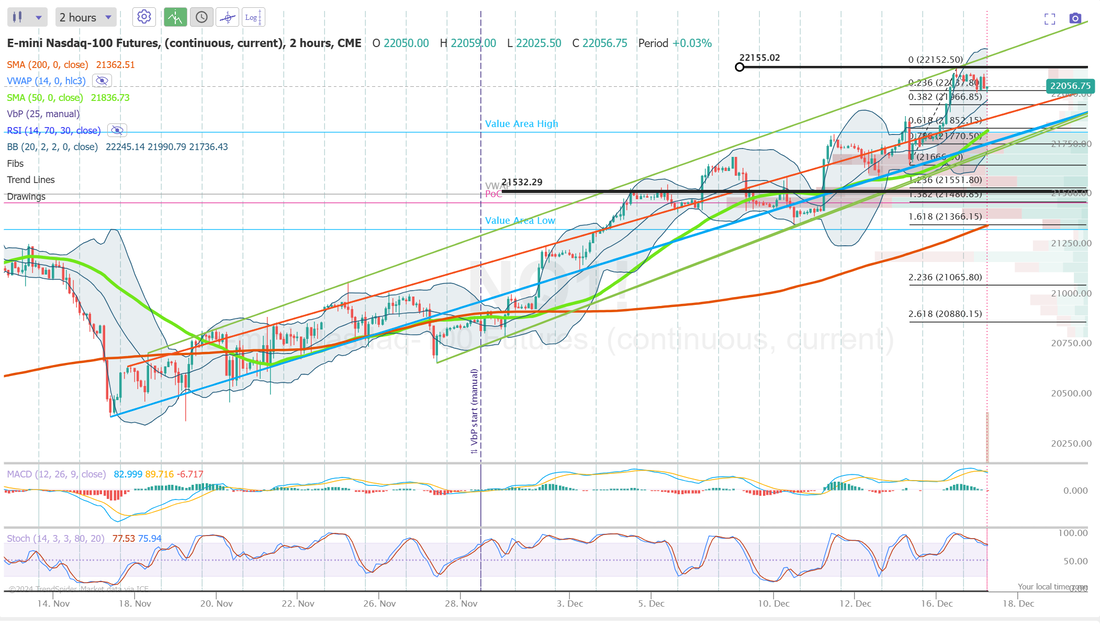

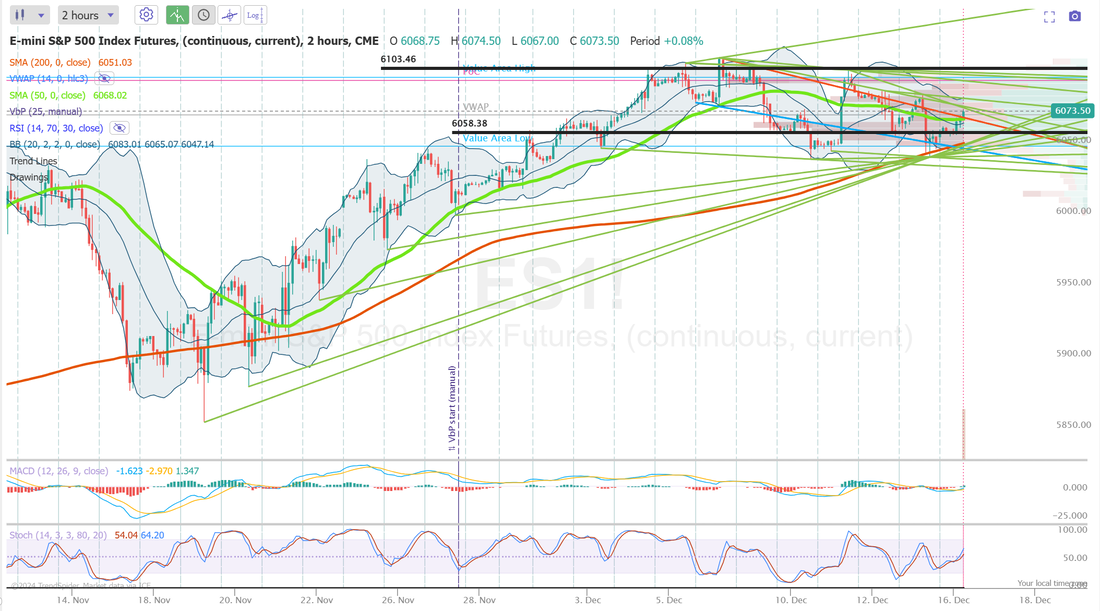

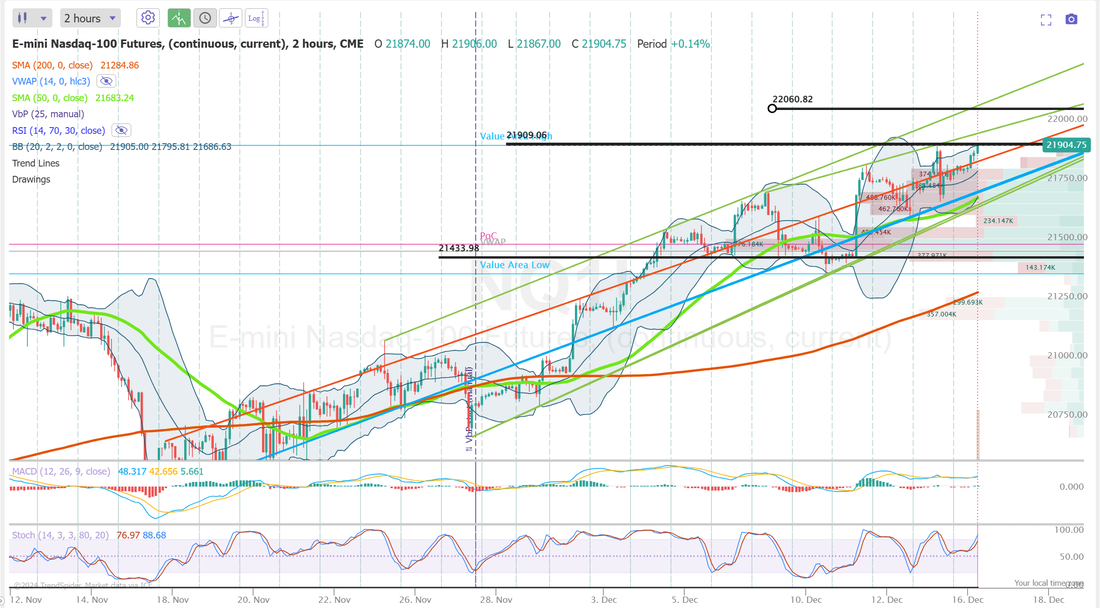

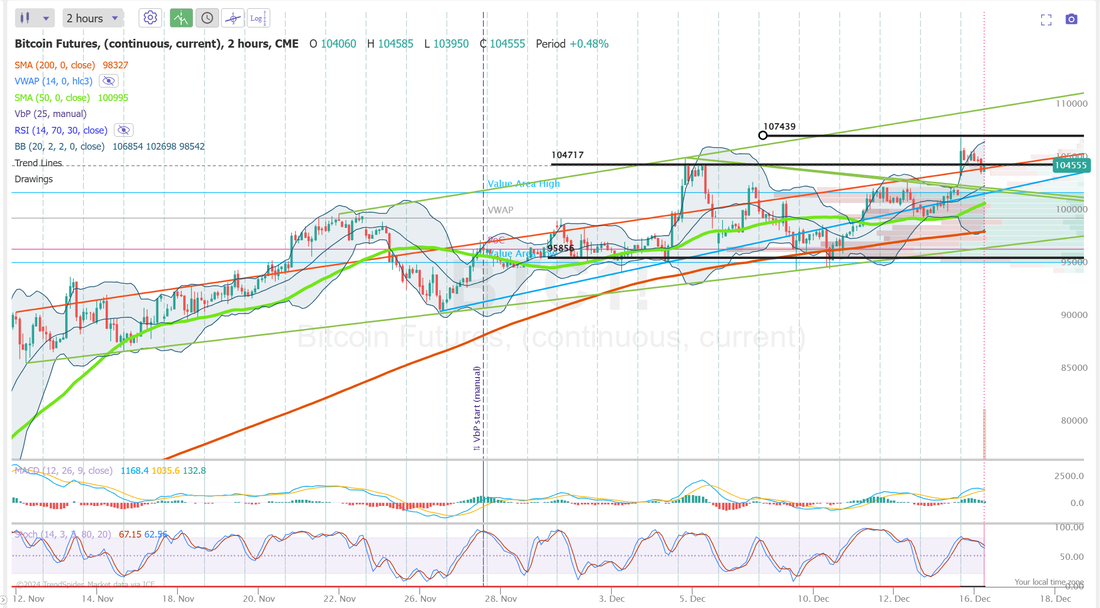

Welcome to the last trading day of the year! Happy New year! We talked about goals in our zoom yesterday and I put out a quarter million dollar goal for our day trade results for next year. We'll be tracking our progress here in the blog on a daily and monthly basis. We have put on some modified ratio 0DTE trades over the past week but yesterday was probably the first "offical day" setup. It performed as expected. Super high P.O.P. of 95%+. Low stress, Low work requirement. High consistency. The rest of this week is very low volume and I'll also be up in the mountians with my family until next Monday with limited internet. That means no Zoom feed on Thurs. but we'll be trading both Thurs. and Friday with a primary focus on the 0DTE ratio trades and the 1HTE Bitcoin setups. Take a look at our results from yesterday. I'm thrilled with how things went. Let's take a look at the markets. Sell mode is still got a firm grip on the market. Yesterday was a strange day but maybe typical of the holiday week. Low volume and erradic moves. We started the day with a big selloff and worked to climb back all day. Our levels held perfectly and it made for an easy day. My lean of bias for today is still slightly bearish. We are back down to some decent support levels but the pressure still seems down. March S&P 500 E-Mini futures (ESH25) are up +0.26%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.30% this morning, pointing to a positive start on Wall Street in the final trading session of 2024. In yesterday’s trading session, Wall Street’s main stock indexes ended lower, with the benchmark S&P 500, the blue-chip Dow, and the tech-heavy Nasdaq 100 falling to 1-week lows. Mega-cap technology stocks retreated, with Tesla (TSLA) dropping over -3% and Meta Platforms (META) sliding more than -1%. Also, chip stocks came under pressure, with Micron Technology (MU) and On Semiconductor (ON) slumping over -3%. In addition, MicroStrategy (MSTR) plunged more than -8% and was the top percentage loser on the Nasdaq 100 after the company disclosed that it had bought 2,138 bitcoins for $209 million in the past week. On the bullish side, American Airlines (AAL) rose over +1% after Raymond James upgraded the stock to Outperform from Market Perform with a $24 price target. Economic data released on Monday showed that the U.S. Chicago PMI unexpectedly fell to a 7-month low of 36.9 in December, missing the 42.7 consensus. At the same time, U.S. November pending home sales climbed +2.2% m/m, stronger than expectations of +0.9% m/m. Meanwhile, the U.S. stock and bond markets will be closed on Wednesday for the New Year’s Day holiday. Also, the U.S. bond market will close early at 2 p.m. Eastern Time today for New Year’s Eve. Optimism about interest rate cuts, enhancements in corporate profitability due to artificial intelligence integration, and expectations that President-elect Donald Trump’s policies could stimulate economic growth have driven much of this year’s gains on Wall Street. The benchmark S&P 500 index has been in a bull market for over two years and is set to finish its second consecutive year with gains exceeding +20%. The blue-chip Dow and tech-heavy Nasdaq 100 indexes are poised to end 2024 higher by about +13% and +26%, respectively. “Investors are looking forward to two big things [next year]: whether Trump’s policies are going to be pro-growth or not, and if the Fed is going to continue injecting easy money into the system,” said Adam Sarhan, chief executive at 50 Park Investments. U.S. rate futures have priced in an 88.8% chance of no rate change and an 11.2% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. Today, investors will focus on the U.S. S&P/CS HPI Composite - 20 n.s.a., which is set to be released in a couple of hours. Economists forecast this figure to be +4.1% y/y in October, compared to +4.6% y/y in September. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.521%, down -0.53%. Our trade docket for the rest of the week will be light and primarily focused on the 0DTE ratio trades and 1HTE Bitcoin setups. The goal of $1,000 a day in profits is the target for us going into 2025. Some days will be better...some days will be worse but that's the goal. 251 trading days in the year. Let's shoot for a $250,000 year. Todays focus: /ES (Theta fairy), /MNQ (Scalping) /NG, ODTE ratio trades, 1HTE Bitcoin setups. The S&P 500 is currently off -1.6% in December, but under the hood it's a bloodbath. I would bet we can count on one hand, maybe only a few fingers, the number of months where 6 or more sectors fell -5% or worse with the S&P 500 not even down -2%. $spy US equity funds saw a -$35.3 BILLION net outflow last week, the largest weekly outflow since December 2022. This is a sharp contrast to the ~$14 billion of weekly net INFLOWS seen since Fed interest rate cuts began. What does this mean as we head into 2025? Let's look at our key intra-day levels for todays setups: /ES: Our levels for today are exactly the same as yesterday. Our 5920 support held perfectly and 6036 remains resistance. Will 5920 be tested again today? /NQ: Also working the same levels as yesterday with 21716 resistance and 21215 working as support. BTC: Bitcoin gave us two nice setups yesterday. While resistance of 97,207 is the same as yesterday, it looks much more vunerable and with a little bullishness we could easily push to 99,000. 92,608 continues to look like a solid support and it's from that side of the trade that we will most likely trade today. We are getting closer to a take profit on our Theta fairy. That would be a nice start to our day. I'll see you all in the trading room shortly.

0 Comments

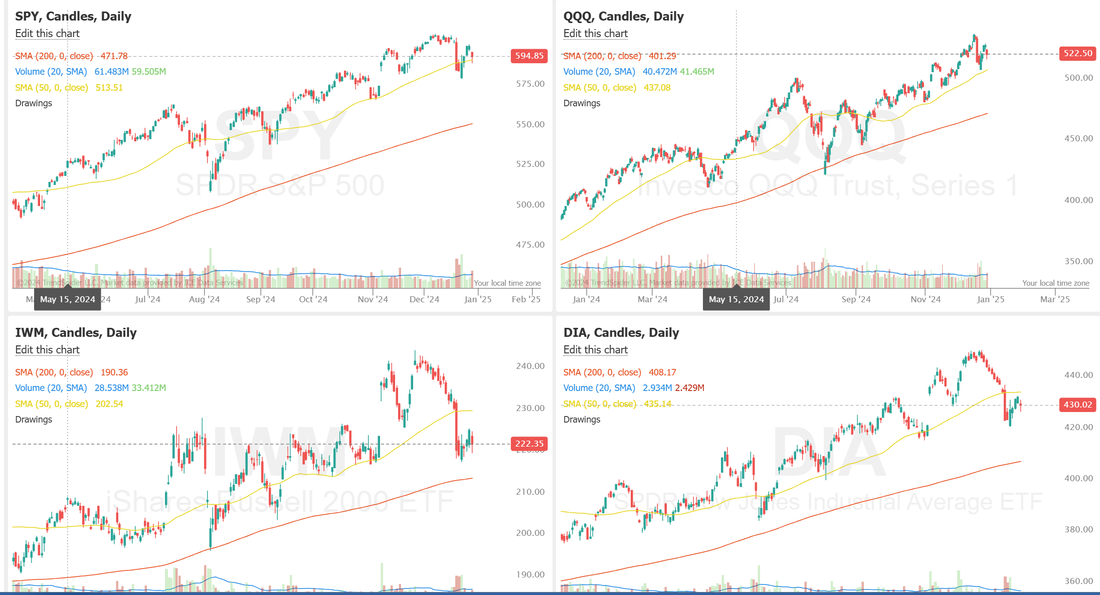

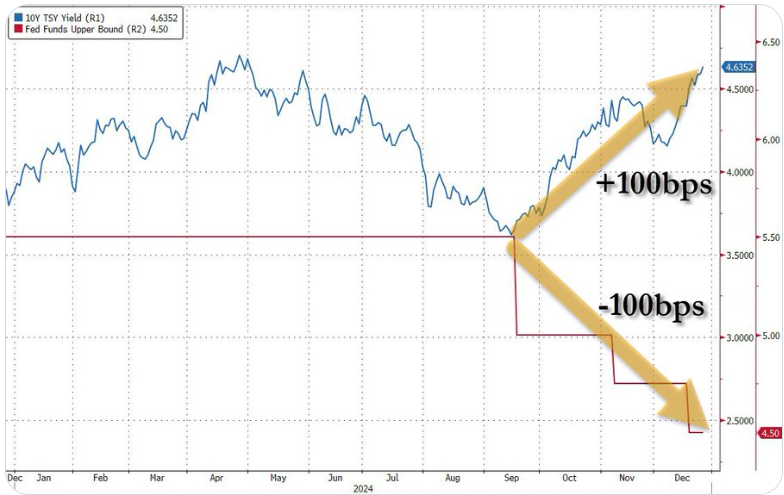

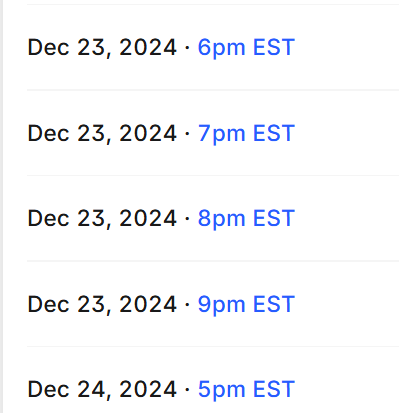

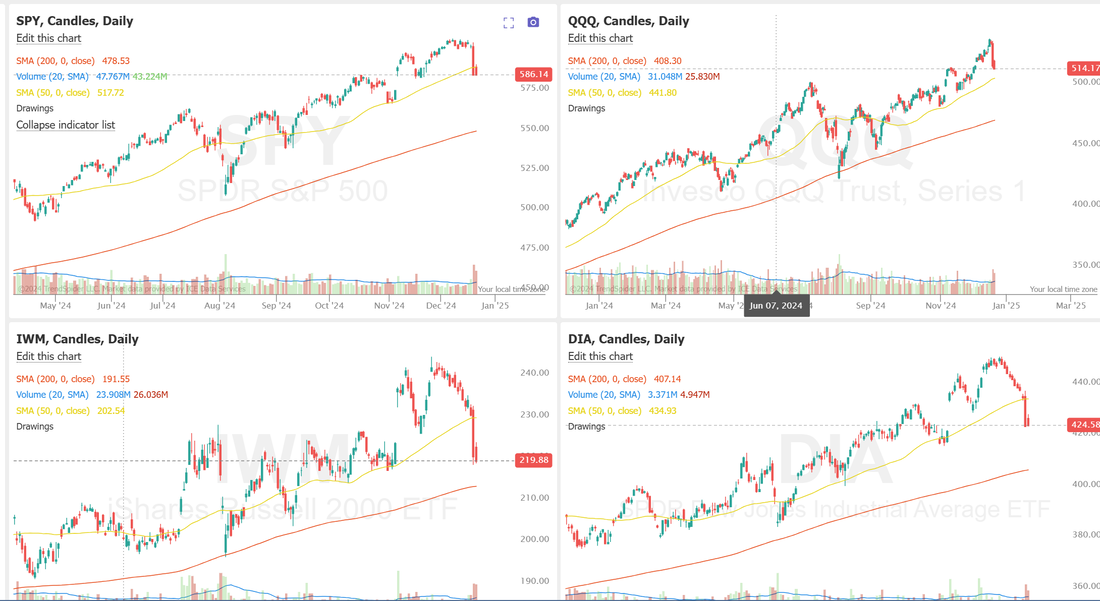

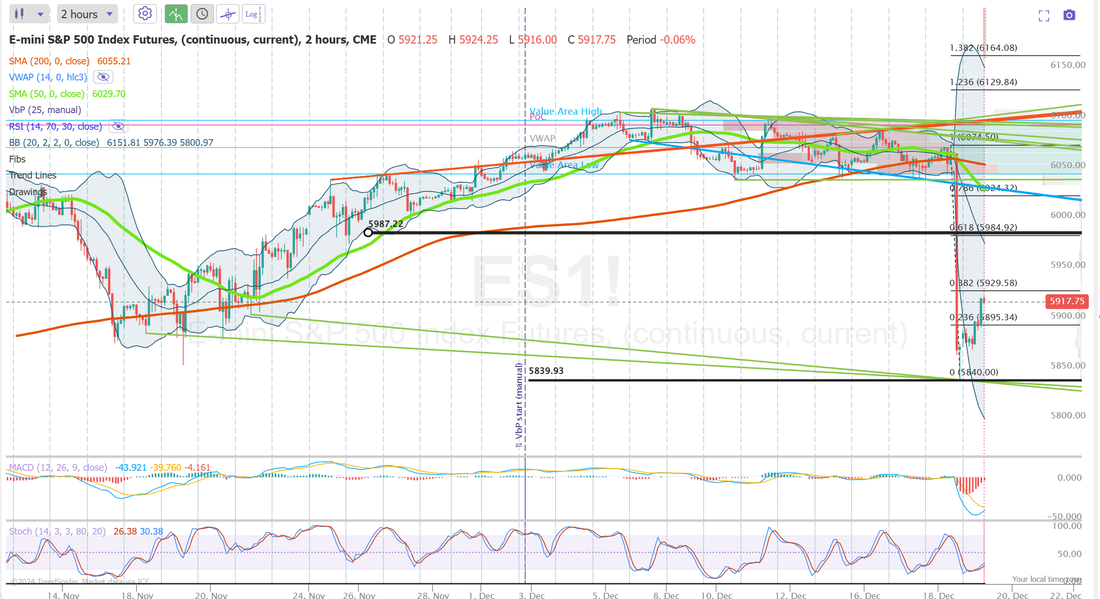

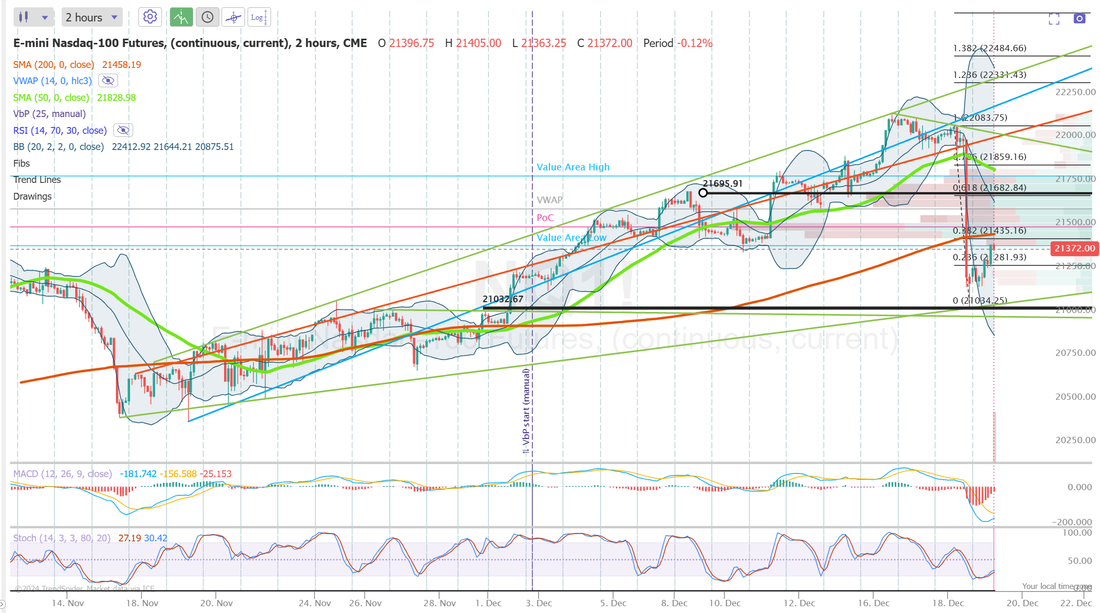

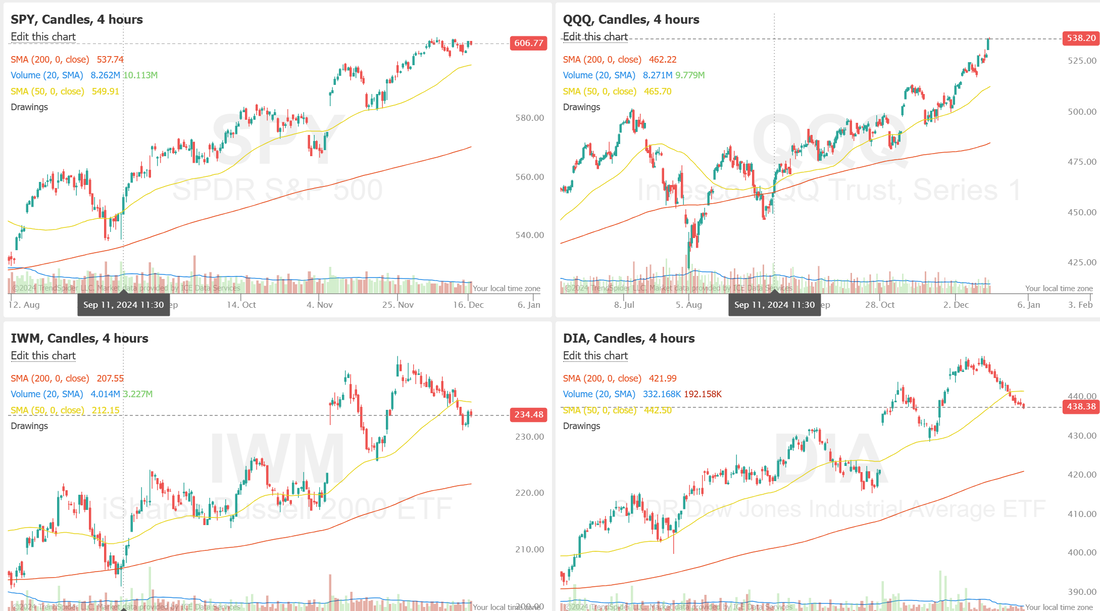

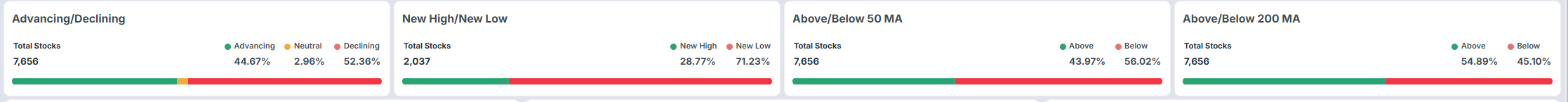

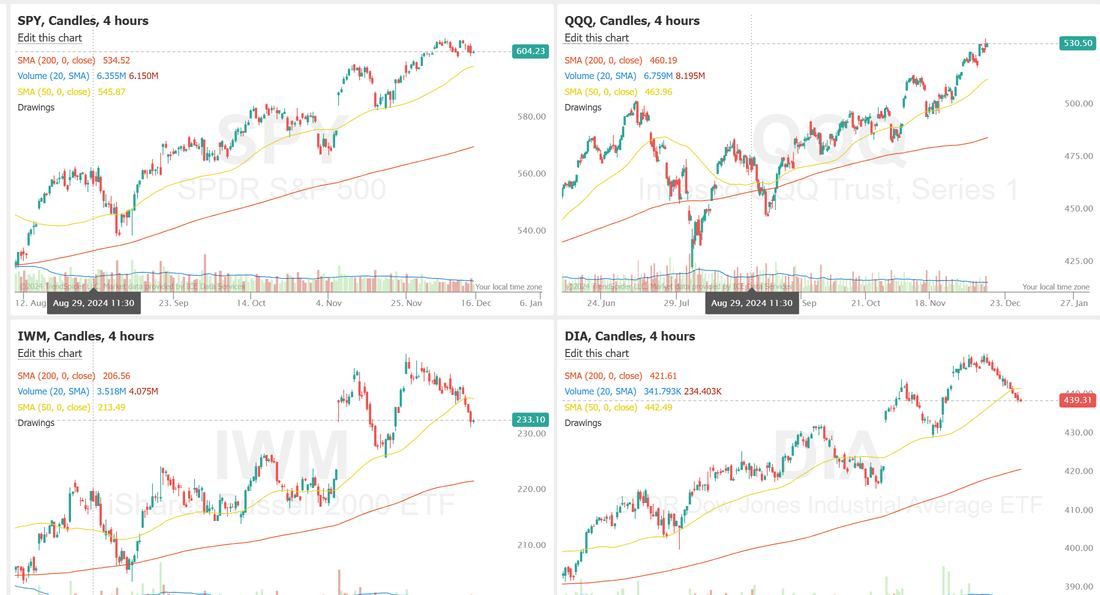

Welcome back traders to the last few days of 2024. Markets look to continue the profit taking instead of the "Santa rally" that so many were hoping for. We had a stellar day last Friday. Our results are below: Let's take a look at the markets: Sell mode continues. The SPY is now threatening to join the IWM and DIA, trading down below their 50DMA. March S&P 500 E-Mini futures (ESH25) are down -0.22%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.20% this morning, adding to Friday’s declines on Wall Street, as market participants reduced positions amid uncertainty heading into year-end. In Friday’s trading session, Wall Street’s major equity averages closed in the red. Mega-cap technology stocks slumped, with Tesla (TSLA) sliding nearly -5% to lead losers in the Nasdaq 100 and Nvidia (NVDA) dropping over -2% to lead losers in the Dow. Also, Netflix (NFLX) fell more than -2% after receiving mixed reviews for its new release, “Squid Game Season 2,” which debuted on Thursday. In addition, Viracta Therapeutics (VIRX) tumbled over -32% after announcing the termination of its ongoing Nana-val trial and that its board has begun a process to explore strategic options. On the bullish side, Lamb Weston Holdings (LW) rose over +2% and was the top percentage gainer on the S&P 500 after a filing showed that activist investor Jana Partners is working with a sixth executive to advocate for changes at the French fry maker. “[It] feels like there is quite a bit of profit-taking across the board. We are more than two years into a pretty strong bull market ... so it’s really not surprising to see some people taking their profits and rebalancing their portfolios ahead of the new year,” said Michael Reynolds, vice president of investment strategy at Glenmede. Economic data released on Friday showed that the U.S. November trade deficit widened to -$102.86B from -$98.26B in October, a larger deficit than expectations of -$101.30B. Also, U.S. wholesale inventories unexpectedly fell -0.2% m/m in November, compared to expectations of a +0.1% m/m increase. Meanwhile, U.S. rate futures have priced in an 88.8% chance of no rate change and an 11.2% chance of a 25 basis point rate cut at the next central bank meeting in January. The U.S. stock and bond markets will be closed on Wednesday for the New Year’s Day holiday. Also, the U.S. bond market will close early at 2 p.m. Eastern Time on Tuesday for New Year’s Eve. In this holiday-shortened week, investors will be eyeing several economic data releases, including the U.S. S&P/CS HPI Composite - 20 n.s.a., Initial Jobless Claims, the S&P Global Manufacturing PMI, Construction Spending, Crude Oil Inventories, and the ISM Manufacturing PMI. Market participants will also focus on remarks from Richmond Fed President Tom Barkin on Friday. Today, all eyes are on the U.S. Chicago PMI, which is set to be released in a couple of hours. Economists forecast that the Chicago PMI will stand at 42.7 in December, compared to last month’s value of 40.2. U.S. Pending Home Sales data will be released today as well. Economists expect the November figure to be +0.9% m/m, compared to the previous figure of +2.0% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.596%, down -0.50%. Some things I'm thinking about today: If the S&P 500 closes this 7-day trading period in the red, it would make history. This would mark the 3rd time since 1950 with back-to-back losses in the "Santa Claus" rally period. In 2023, the S&P 500 lost -0.9% during this period and it is now down -0.1% since December 24. The first time in history when 100bps of rate cuts raised 10Y yields by 100bps. What does this mean? I'm not sure anyone knows but one thing is for sure. The bond market isn't buying what the FED is selling. Bonds have a much better track record for accuracy than the FED does. Trade docket: ADP, CAG, TDG, RJF, UPS, BABA, 0DTE, 1HTE. Let's take a look at the intra-day levels. /ES: New key levels for us today with this mornings selloff. 6037 resistance with 5920 support. /NQ: Resistance now at 21716 with support at 21215 BTC: Bitcoin continues to show weakness below the key 100,000 level. Resitance now at 97,208 and support is close at 92,608. If we lose this support much stronger weakness could prevail. My lean or bias today is bearish. It seems like the year end profit taking is still pushing the markets. See you all in the trading room today. I'm excited to build another 0DTE ratio trade with you live on the zoom feed this morning and set some 2025 income goals for ourselves!

Welcome back traders! Merry and Happy Christmas eve! We had a solid day yesterday with everything clicking. See our results below: We have a shortened trading session today before the Holiday break so todays blog will be short and sweet. /MNQ scalping, /NG, LEN?, LRN?, NUKK, SPX 0DTE only and 1HTE BTC March S&P 500 E-Mini futures (ESH25) are up +0.14%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.18% this morning ahead of a holiday-shortened pre-Christmas trading session. The U.S. stock markets will close early at 1 p.m. Eastern Time today and remain closed on Wednesday in observance of the Christmas holiday. In yesterday’s trading session, Wall Street’s main stock indexes ended higher. Qualcomm (QCOM) rose over +3% after a U.S. federal jury ruled that the company’s central processors are properly licensed under its agreement with Arm Holdings. Also, chip stocks advanced, with GlobalFoundries (GFS) and Broadcom (AVGO) climbing more than +5%. In addition, Eli Lilly (LLY) gained over +3% after the FDA approved the company’s weight-loss drug Zepbound for moderate-to-severe obstructive sleep apnea in adults with obesity. On the bearish side, Walmart (WMT) dropped more than -2% and was the top percentage loser on the Dow after the Consumer Financial Protection Bureau filed a lawsuit against the retail giant and financial technology firm Branch for allegedly “taking advantage” of over one million delivery drivers. Economic data released on Monday showed that the U.S. Conference Board’s consumer confidence index unexpectedly fell to 104.7 in December, weaker than expectations of 112.9. Also, U.S. November durable goods orders slipped -1.1% m/m, weaker than expectations of -0.3% m/m, while core durable goods orders, which exclude transportation, fell -0.1% m/m, weaker than expectations of +0.3% m/m. In addition, U.S. new home sales rose +5.9% m/m to 664K in November, just below the consensus estimate of 666K. “The economic outlook is deteriorating,” said Neil Dutta at Renaissance Macro Research. “This was true before the Fed’s December confab and remains true after. The risk of the Fed flip-flopping is quite high.” Meanwhile, U.S. rate futures have priced in a 91.4% chance of no rate change and an 8.6% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. Today, investors will focus on the U.S. Richmond Fed Manufacturing Index, which is set to be released in a couple of hours. Economists estimate this figure to come in at -10 in December, compared to last month’s value of -14. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.594%, down -0.11%. Simple day today with just a few hours of opportunity. I hope you all have a great Christmas. See you all Thursday.

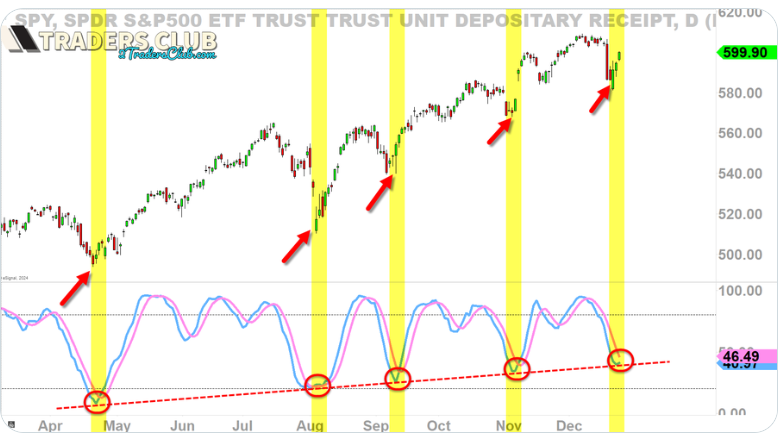

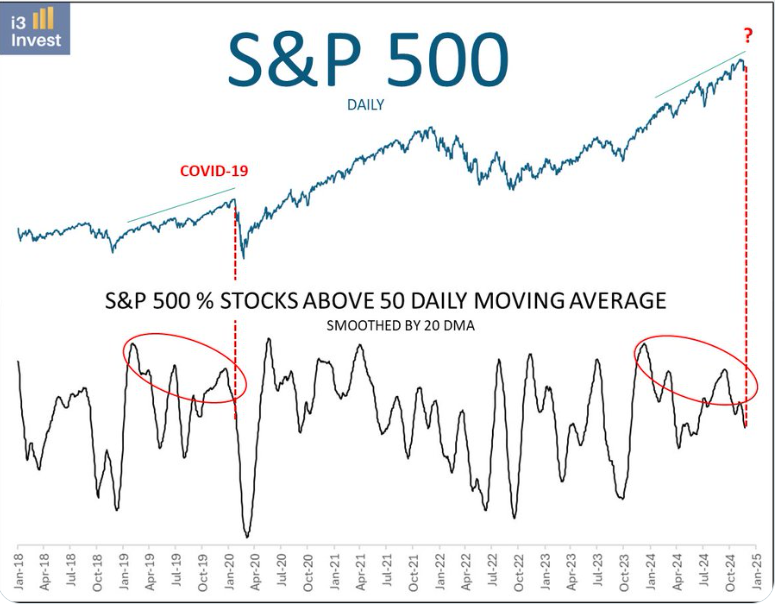

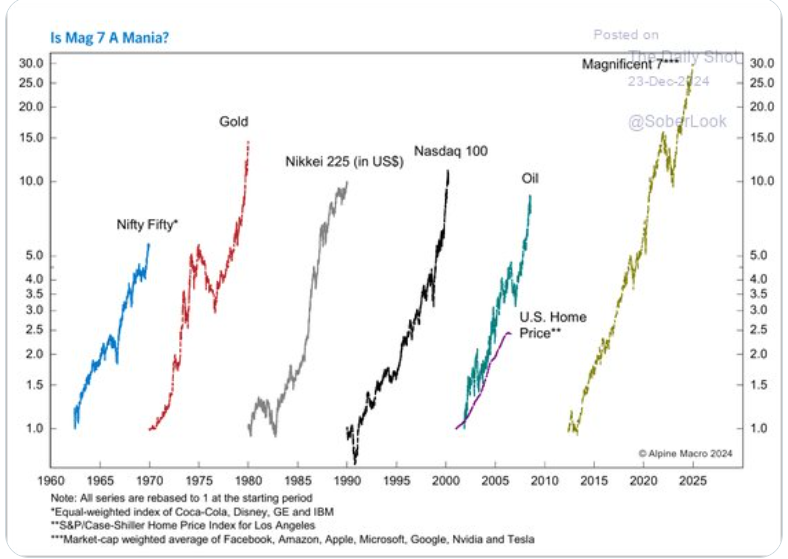

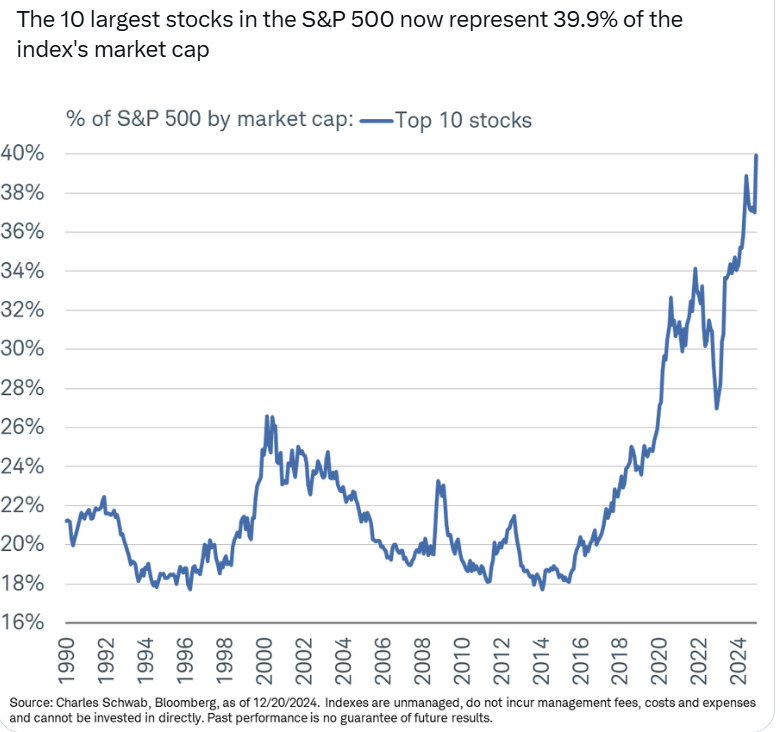

Welcome back traders! I hope you all had a wonderful Christmas and were able to celebrate with family and friends. That's ultimately the greatest asset we can ever possess. We are back at it today and even though our trade docket will be light for the rest of the week, today is a HUGE day for us. My net liq is already up over $7,000 this morning just on our futures positions. We have a big /NQ cover on our /MNQ short position. Our Dec. Nat gas position could yield $5,000 of profit today and our /SI position expires today as is very close to a take profit. Let's take a look at the market. The Santa Claus rally seems to be the real deal. Sure, IWM and DIA are still struggling below their 50DMA but everything else looks pretty solid and techs are back participating. March S&P 500 E-Mini futures (ESH25) are down -0.45%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.52% this morning as Treasury yields climbed after cash trading resumed following the Christmas holiday, with investors turning their attention to U.S. jobless claims numbers due later today. In Tuesday’s trading session, Wall Street’s three main equity benchmarks closed in the green. All the Magnificent 7 megacap technology stocks advanced, with Tesla (TSLA) climbing over +7% to lead gainers in the S&P 500. Also, chip stocks extended gains after the Biden administration launched a probe into Chinese chips, with Broadcom (AVGO) rising more than +3% and Advanced Micro Devices (AMD) gaining over +1%. In addition, NeueHealth (NEUE) soared more than +74% after the company announced that it had agreed to be taken private by New Enterprise Associates in a $1.3 billion deal. “Santa Claus rally could still be alive, with strong seasonality into the end of the year,” said London Stockton at Ned Davis Research. A Santa Claus rally refers to the consistent gains observed in the stock market over the final five trading days of December and the first two trading days of January. Since 1950, the S&P 500 has delivered average and median returns of 1.3% during this period, significantly exceeding the market’s average seven-day gain of 0.3%, according to Adam Turnquist at LPL Financial. Economic data released on Tuesday showed that the U.S. Richmond Fed manufacturing index came in at -10 in December, in line with expectations. Meanwhile, U.S. rate futures have priced in a 91.4% chance of no rate change and an 8.6% chance of a 25 basis point rate cut at the next central bank meeting in January. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists estimate this figure will come in at 223K, compared to last week’s 220K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.621%, up +0.72%. Most major markets in Europe remain closed today. Trade docket today (and tomorrow) should be pretty light but that doesn't mean we won't have profit potential. We'll be scalping with /MNQ and /NQ. Our big trade today is Dec. Nat Gas. We could have a 4K+ payoff today. /SI is also expiring today and we have a good shot at a profit. I'll also try to get more NUKK shorts on. We'll continue to work the current SPX 0DTE. Once we get a clean exit on it we'll start with our SPX ratio trades. We'll also see if we can get some BTC 1HTE trades on. Some things I'm thinking about today: It certainly looks like we are getting a bullish signal. However, divergence is still strong. I would also be remiss if I didn't mention that bubbles DO happen. To make things more scary, we are in a "concentration bubble". My lean or bias today is neutral. Light vol day. Price action may be jerky but I imagine we have a good shot at staying inside the current chop zone. Let's take a look at todays intra-day levels. /ES: We've been toying with the ATH level for four weeks now. 6120 is todays resistance with 6040 acting as support. /NQ : 22,263 is current resistance with 21705 acting as an important support. This is also VWAP on the 2hr. chart. BTC: Bitcoin continues to channel in the same chop zone for the last 10 days. 100,252 is still resistance with 92,601 acting as support. This consolidating chop zone action makes it tougher to get solid 1HTE trades on but we'll give it our best shot today. I'll see you all (or at least those who are still trading this week) in the zoom shortly!

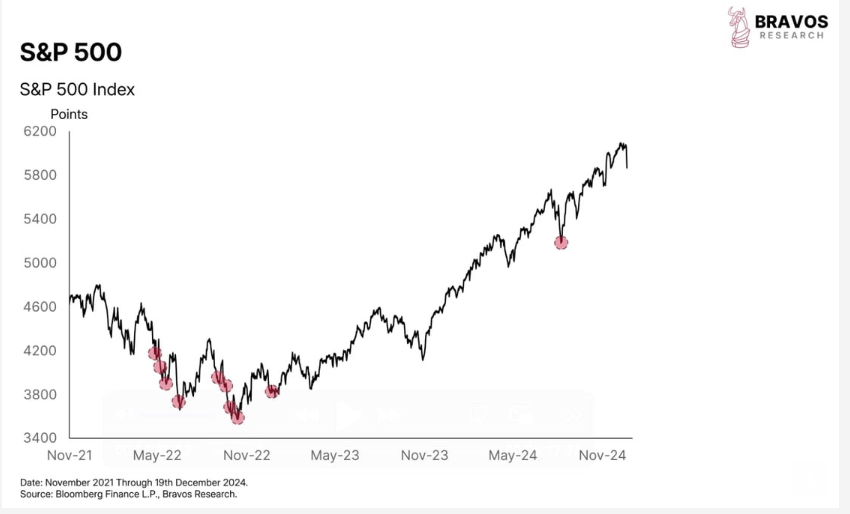

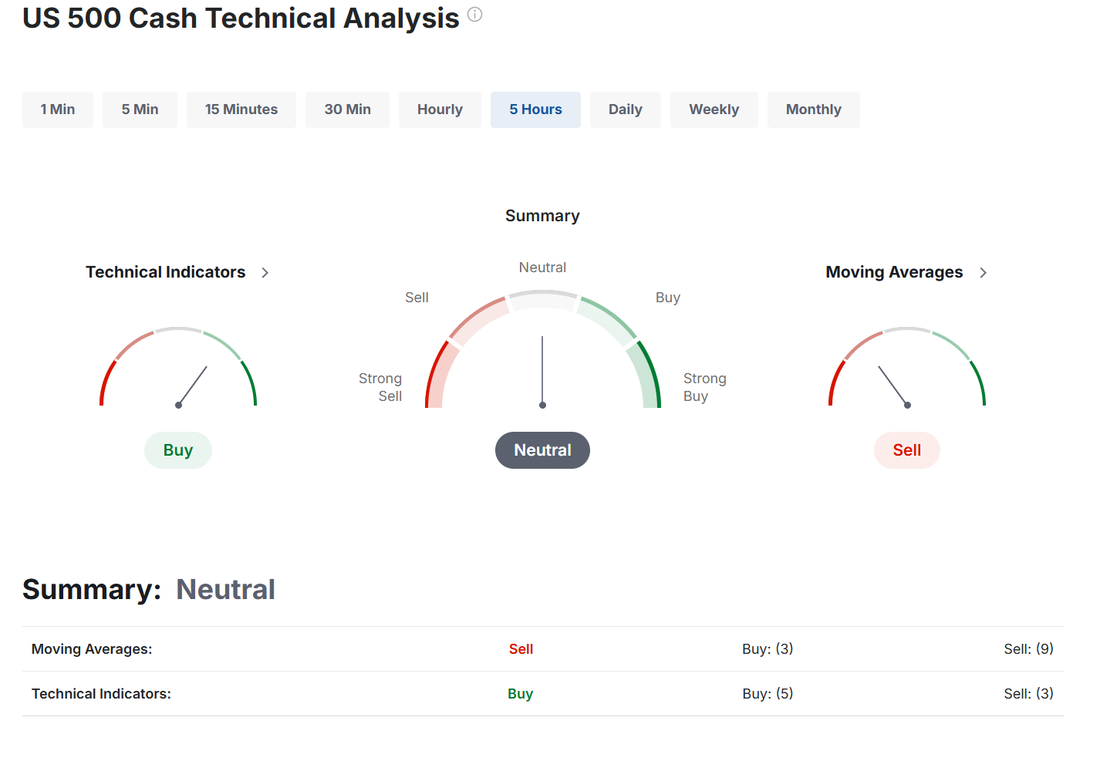

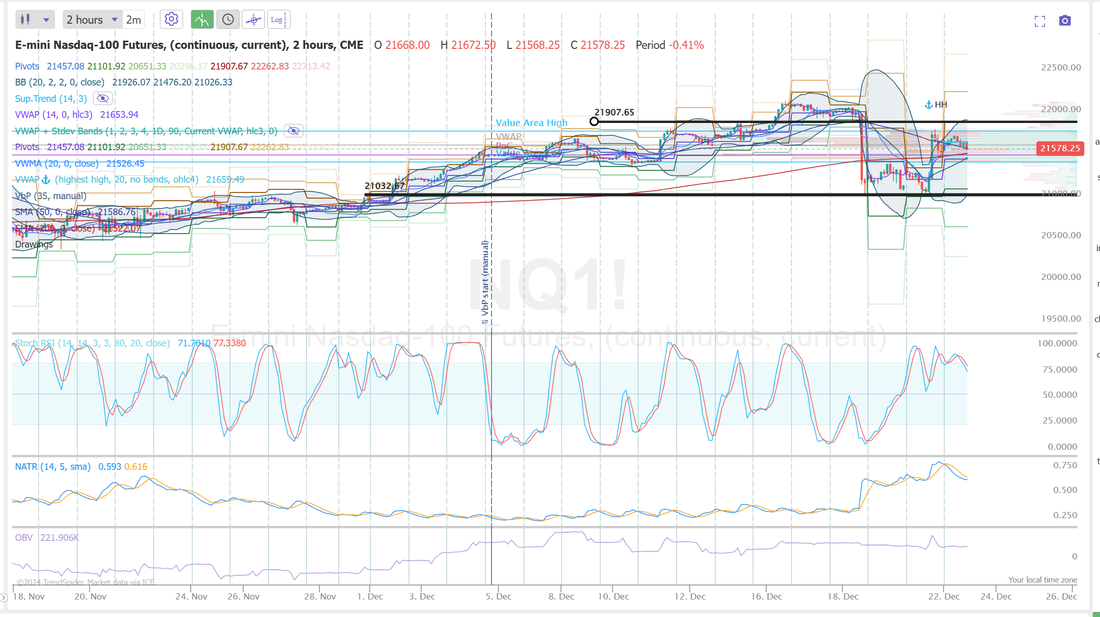

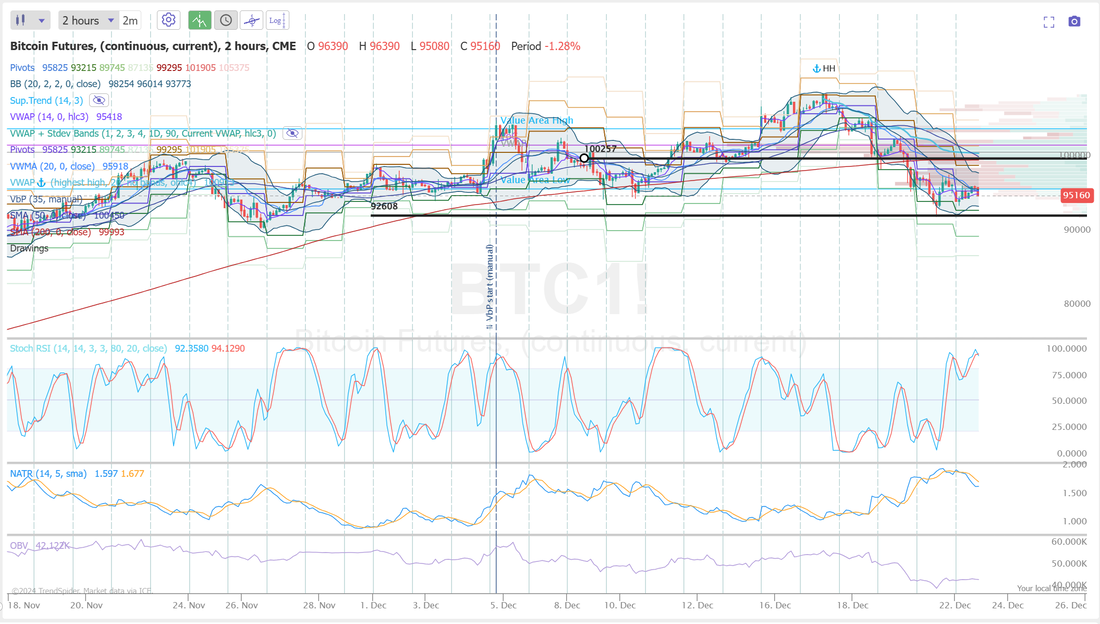

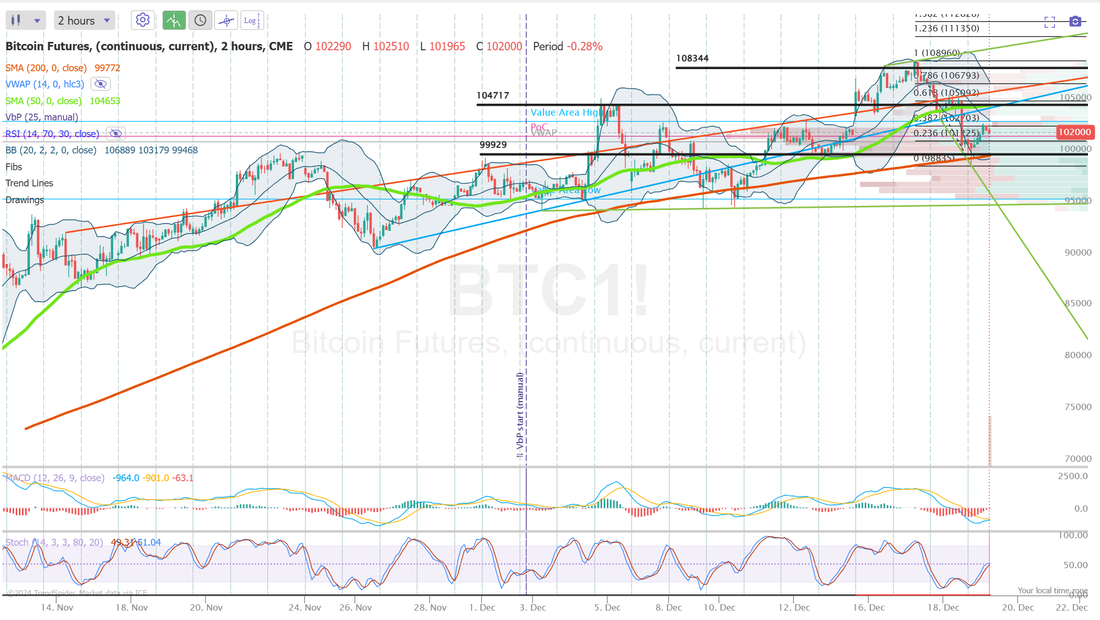

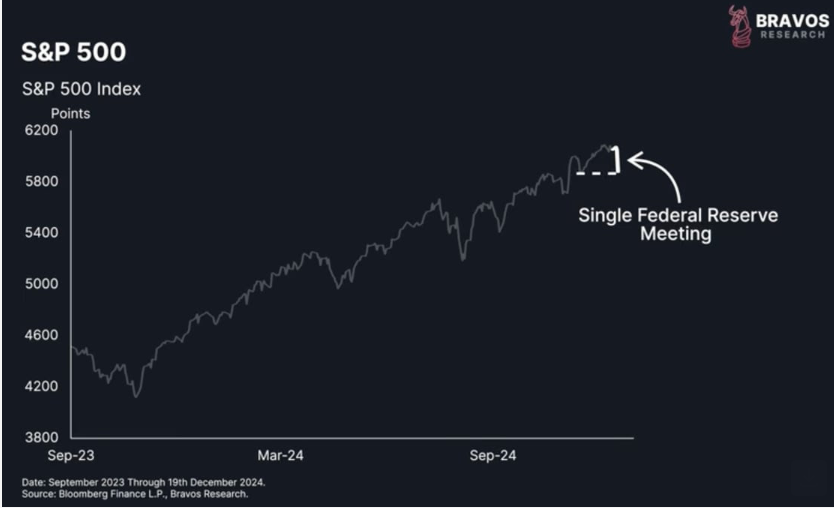

Good morning traders! Welcome back to a holiday shortened trading week. I hope everyone is set for Christmas. Markets are closed Weds.but we'll be trading Thurs. and Fri. They can be light volume or heavy volume, depending on price action. I feel like we are at a possible turning point or inflextion point in the markets. Here's some data from the great Bravos research. The US stock market just erased 2 months of gains in a single day, dropping 3% after the Federal Reserve meeting. In just 1 hour, Fed Chairman Jerome Powell managed to kill all the market's built-up complacency and greed.  This correction's speed is particularly noteworthy. Looking back over recent years, such rapid declines often spark comparisons to the 2022 bear market. Our results from last Friday were mixed with some positives. We close out our BWB and BF on SPX at a loss. Down -$4,200 which was not what we wanted but, we did bring in a substantial amount of income off of those over the past week. The bright spot was our 1HTE's on Bitcoin. 5 trades. 4 wins/ 1 loss for a total of just under $1,300 of income for the day. It will likely take a few months of trading these to find the most appropriate setups. We've already learned that, while you can trade it all day long, the first four hours are yielding us the best setups. We've yet to establish position sizing or income goals for this trade. We'll keep collecting data and update it on the website 1HTE.com as we aquire it. I believe there is a good chance we could generate $400 dollars a day consistently. This would be a nice add to our exsisting scalping program. Let's take a look at the markets: We start off the day with a neutral rating. These are tough days to predict so I won't! No bias or lean for me today other than to repeat...I wouldn't be surprised to see us rollover here and continue the downward, post- FOMC move. Neutral rated days don't usually last long before we get some directional bias back but in many ways todays rating makes a lot of sense. As you can see, all the indices we track and trade are now right back to previous consolidation zones. If we hung out here for a few days it would make sense. If we used this level as a spring board to go higher, I don't think anyone would be surprised and if we continued to roll over and head down I think we'd all say, "I saw that coming" so....neutral is an appropriate rating for today. The key question now is: how long will the selling persist? After a sharp and significant correction on Wednesday and Thursday, the markets saw a strong bounce on Friday, but it remains to be seen whether this is the start of a sustained recovery or just a temporary reprieve. Let’s take a closer look at the charts and assess how things are shaping up as we head into Christmas week. The SPY took the lightest hit this week, closing at $591.15 (–2.17%). After slicing through the 50-SMA on Wednesday, Thursday’s attempt to reclaim it hit a wall, and Friday’s sharp rebound stalled at the same level. Next week sets the stage for a showdown: a successful reclaim of the 50-SMA could keep buyers in the game, but failure might hand control back to sellers, with the 100-SMA at $573 squarely in sight. Though the QQQ took a bigger hit than the SPY, closing the week at $518.66 (-2.24%), its setup appears far more constructive. Despite the sharp correction, it never traded below the 50-SMA and ended the week with a strong close above this key level—signaling buyers remain firmly in control for now. IWM took the brunt of this week’s correction, filling the election gap and closing sharply lower at $221.92 (-4.79%). After breaking below both the 50-SMA and 100-SMA on Wednesday, Friday’s impressive rally still fell short of reclaiming either level—leaving price with plenty of ground to make up next week. One benefit to last weeks sell off is that I.V. has returned! It's not what it should be (IMHO) but, it's better than we've had as of late. Let's look at our intra-day levels for 0DTE. /ES: 6049 is new resistance with 5889 support. NQ: We've got a pretty wide range on Nasdaq which may not help us much today. 21,907 resistance with 21,032 support. BTC: Bitcoin has lost some of its mojo after the hawkish FED words last week. Back down below the ever important 100,000 mark. 100,256 is now resistance with 92,608 acting as support. /NG, /MNQ scalping, LEN?, LEVI, LRN, MRNA, FSLR, SHOP, PYPL, ODTE's, 1HTE's. No earnings trades for this whole week. We may have a shot at some Theta fairys however, if premium holds up. See you all in the trading room shortly.

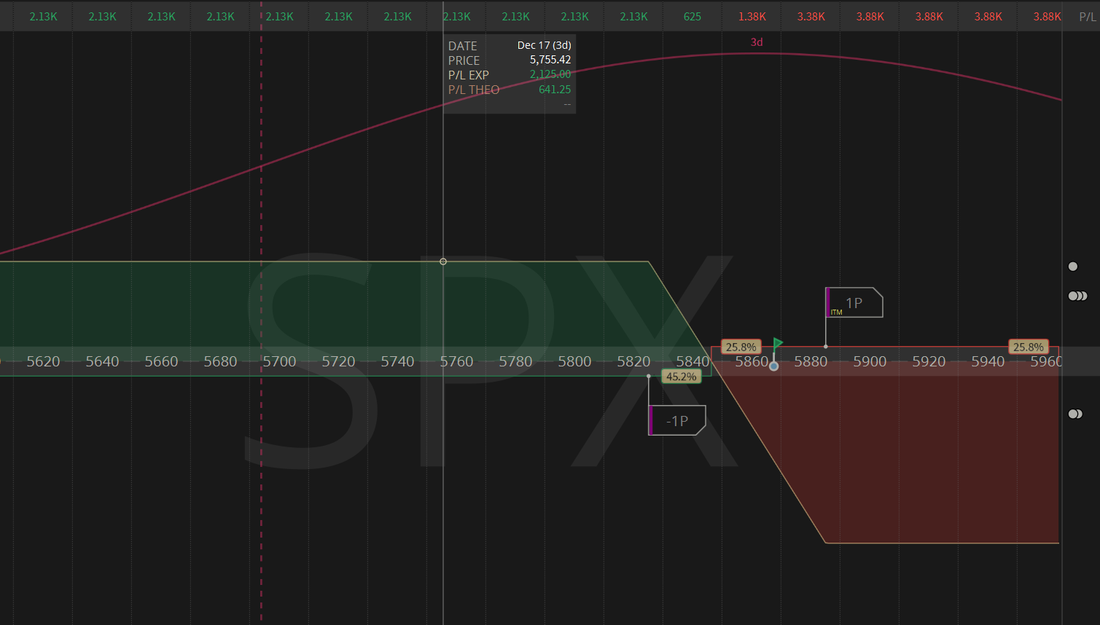

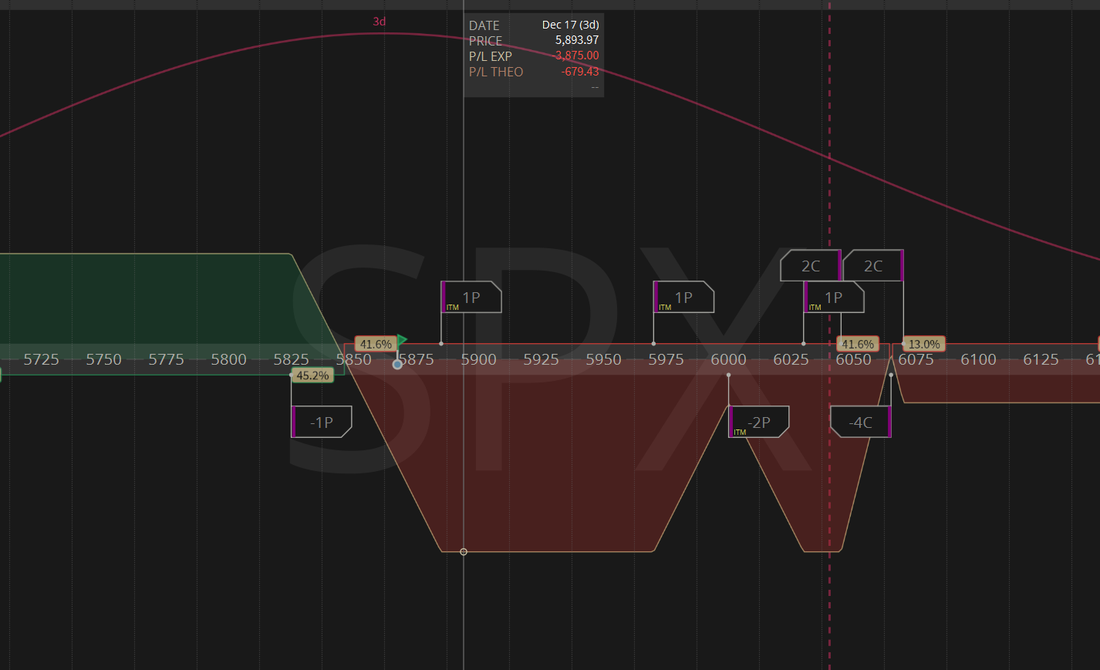

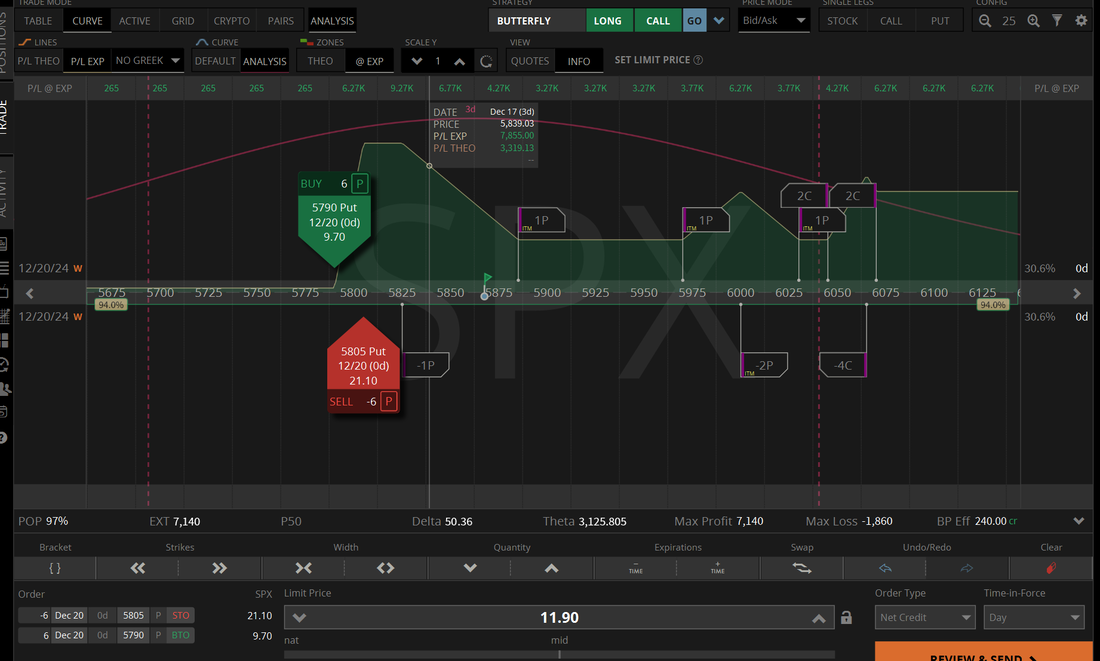

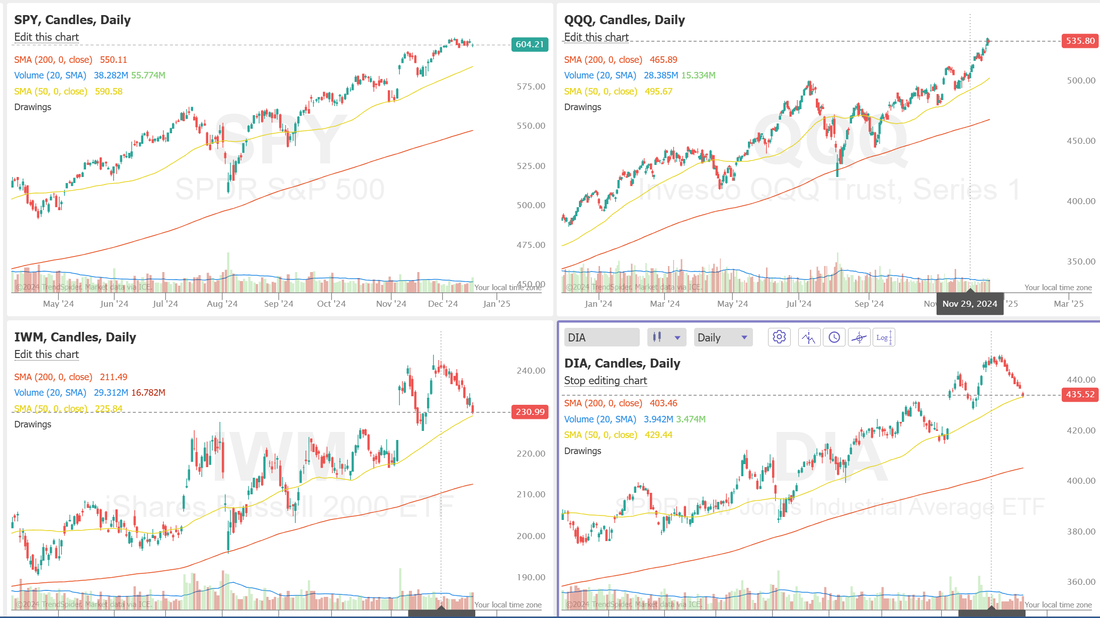

Welcome to Friday, once again! This week flew by. We had a productive day yesterday but it was a little different. We set up a bearish SPX trade going into today and that should cash flow our whole SPX position today. It could be as much as a $4,000 profit after we finish working it. We also started working with the 1HTE trades on Bitcoin. We've still got a lot of work to do. I'd like to get 10 full days of trading data before we start implementing a plan and setting expectations. This is a quick review of our results that I posted to twitter yesterday. Scaling, Position sizing and stop losses are what we need to get a handle on. Our fist day test went well but it needs to generate at least $200 a day to make it worth it. Bookmark the website 1HTE.com as we'll be adding more data as we build out the trading system. Let's take a look at the markets. Sell mode is back! Will it hold? It certainly looks like it right now. The only major index still hovering above it's 50DMA is the QQQ. Granted, The SPY, IWM and DIA are sitting on new support levels but there's no way around it. Things look bearish. CTGO, GNK, ICFI, MU, LEN, MSTR, MRNA, 0DTE with SPX, 1HTE's on Bitcoin. December S&P 500 E-Mini futures (ESZ24) are trending down -0.80% this morning as risk sentiment took a hit on worries about a possible U.S. government shutdown, while investors awaited the Federal Reserve’s first-line inflation gauge for fresh clues on its policy outlook. The United States faced renewed political uncertainty on Thursday evening after the Republican-led House rejected a temporary funding plan supported by President-elect Donald Trump. Dozens of Republican lawmakers opposed the deal to fund the government for three months and suspend the U.S. debt ceiling for two years, with less than 24 hours remaining before a U.S. government shutdown. In yesterday’s trading session, Wall Street’s major indices ended mixed. Lamb Weston Holdings (LW) tumbled over -20% and was the top percentage loser on the S&P 500 after the company posted downbeat FQ2 results and cut its annual adjusted EPS guidance. Also, Micron Technology (MU) plunged more than -16% and was the top percentage loser on the Nasdaq 100 after the memory maker issued below-consensus FQ2 guidance. In addition, Lennar (LEN) slid over -5% after the homebuilder reported weaker-than-expected FQ4 results and offered a soft FQ1 new orders forecast. On the bullish side, Darden Restaurants (DRI) surged more than +14% and was the top percentage gainer on the S&P 500 after posting upbeat FQ2 results and boosting its 2025 sales guidance. The U.S. Commerce Department said Thursday that the Q3 GDP growth estimate was revised upward to 3.1% (q/q annualized) in its final print, stronger than expectations of no change at 2.8%. Also, U.S. November existing home sales rose +4.8% m/m to an 8-month high of 4.15M, stronger than expectations of 4.09M. In addition, the Conference Board’s leading economic index for the U.S. unexpectedly rose +0.3% m/m in November, stronger than expectations of -0.1% m/m and the largest increase in 2-3/4 years. At the same time, the U.S. Philadelphia Fed manufacturing index unexpectedly fell to a 20-month low of -16.4 in December, weaker than expectations of 2.9. Finally, the number of Americans filing for initial jobless claims in the past week fell by -22K to 220K, compared with the 229K consensus. “This week’s data show the economy is set to end 2024 on a solid note, which is fortunate since we’ll have to contend with heightened policy uncertainty and possibly greater challenges in 2025. We think the Fed maintains an easing bias, but the bar for rate cuts just got higher,” Oren Klachkin, an economist at Nationwide, said in a note. U.S. rate futures have priced in an 89.3% probability of no rate change and a 10.7% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. Meanwhile, Wall Street is preparing for a quarterly event known as triple witching, during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. About $6.5 trillion worth of options tied to individual stocks, indexes, and exchange-traded funds are set to expire today, according to an estimate from derivatives analytical firm Asym 500. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.9% y/y in November, compared to the previous figures of +0.3% m/m and +2.8% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate November Personal Spending to be +0.5% m/m and Personal Income to be +0.4% m/m, compared to October’s figures of +0.4% m/m and +0.6% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists estimate this figure to arrive at 74.1 in December, compared to 71.8 in November. In addition, market participants will be looking toward a speech from San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.547%, down -0.50%. My bias or lean today is bearish. This rollover looks serious. Yes, we are sitting back on support/consolidation levels for SPY, IWM and DIA but the trend right now is down. While we have serveral trades to work today, our main focus will be on the SPX. Here's what we currently have. This would give us a $2,100 net proift as is if it finishes in ITM. Right now it looks good. Adding a credit put spread could juice it up to a $4,000 profit. Regardless...the opportunity for us to have a great day is in our hands. We just need to manage it correctly. Let's take a look at our intra-day levels on /ES and Bitcoin since we don't have NDX options today with the third Friday of the month expirations. /ES: Levels from yesterday, admittedly wide, are still in play. 5987 is resistance with 5947 acting as support. This is a heavy consolidation zone. I wouldn't read too much into any movement that does NOT take us out of this zone. BTC: We will continue to build history and data with trading the 1HTE's today. Three key levels I'm focusing on today. 103,204 looks like resistance with 92,349 working as support. 97,554 is the current consolidation area. As I've mentioned. We have a good shot at a $4,000+ profit day today. Let's see if we can NOT screw it up! LOL. See you all in the trading room!

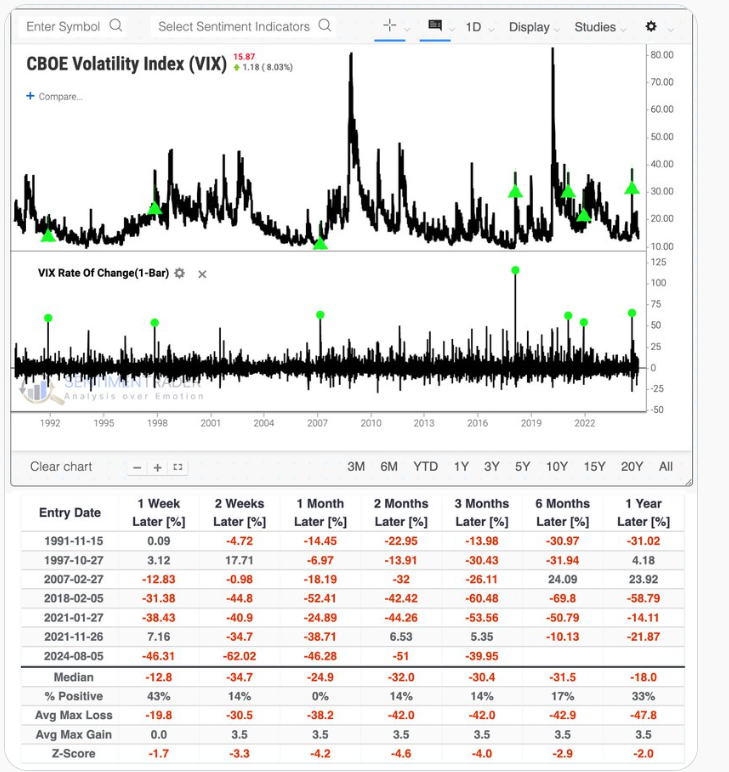

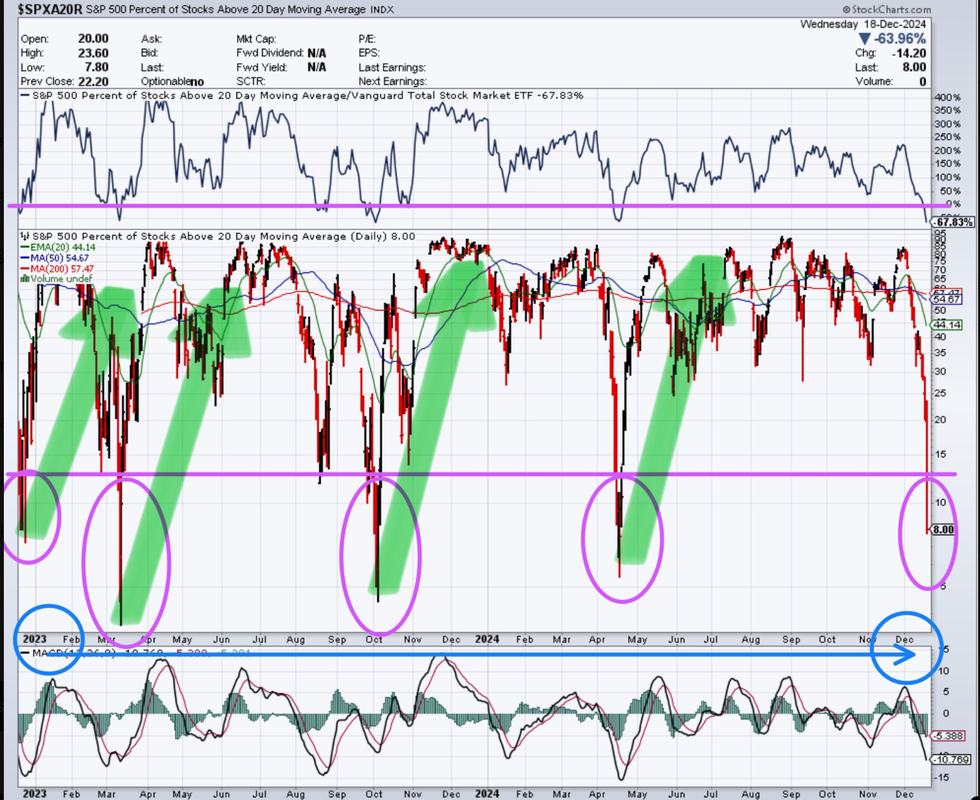

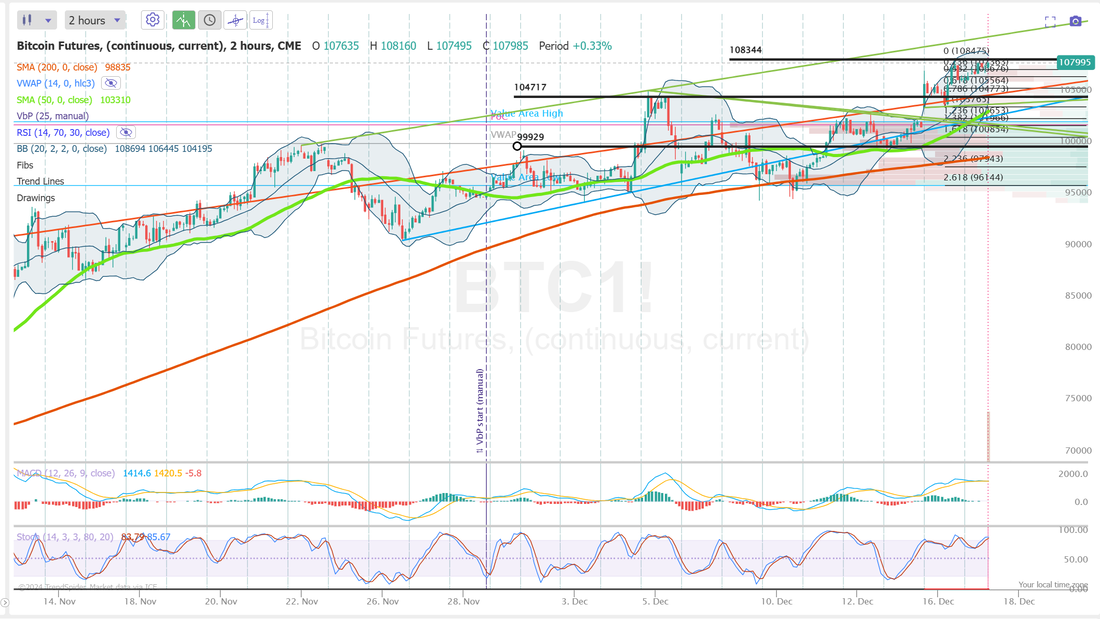

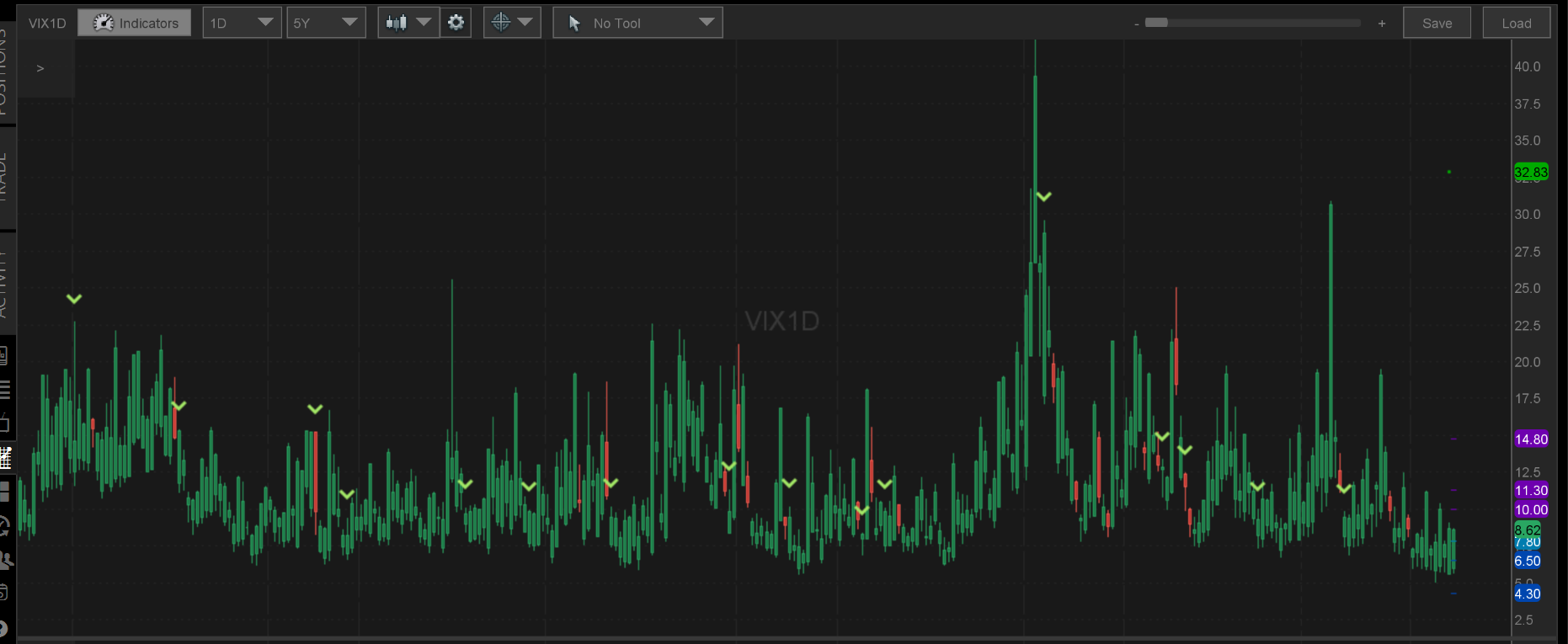

Welcome back to the post mortem on the FOMC day! It wasn't a good day for Powell. Hawkish sentiment pushed this bull market right into a nice little correction. futures are up as I type but...the damage may be done. Is this going to be a hard stop bounce or are we now in a correction phase? Hard to say yet. My short puts got run over in my scalp and my NDX. See my results below: Let's take a look at the markets and what yesterdays down move has done. Probably not a surprise that the indicators have flipped to sell mode. We now have three of the four indices that we trade, down below the 50DMA. This is bearish. A note from Capital Group. "Remember when the Bee Gees’ "Stayin’ Alive" was the biggest hit on the radio? If so, you were around the last time the Dow Jones Industrial Average had a nine-day losing streak, which was reached Tuesday. The only exchange-traded fund to track the oldest stock market benchmark, the SPDR Dow Jones Industrial Average ETF (DIA), fell another 2.6% Wednesday on inflation concerns, extending the longest stretch of consecutive losses for the index since 1978." I've been talking about the divergence in the market for a long time. Take a look at these. Every time the VIX jumped by 50% in a single session, it plunged over the next month. Every. Single. Time. Is this going to be different? Seems like it could be, but we all know the danger of "this time is different." In the last TWO YEARS, anytime the S&P 500 has had ALL of its stocks below their respective 20 DAY MOVING AVERAGE on this indicator below 10, and we’re at 8 , we have had the bottom of every correction and pullback and it led to SIGNIFICANT rallies, will this time be different? BREAKING: The S&P 500 falls sharply after the Fed cuts rates by 25 basis points, but raises inflation forecast. The Fed reduced their outlook from 3 to 2 rate cuts in 2025 and raised inflation expectations from 2.1% to 2.5%. Inflation is back. My lean or bias today is bullish: Futures are up. Even if this is the start of a bearish down leg, we almost always have a knee jerk reaction the next day and get some relief. Trade docket: /SI, /ZW, LEN, LEVI, MRNA?, NKE, FDX, MU, 0DTE's. December S&P 500 E-Mini futures (ESZ24) are up +0.40%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.52% this morning, partially rebounding from yesterday’s dramatic selloff after the Federal Reserve forecast fewer interest rate cuts next year, while investors awaited a raft of U.S. economic data and an earnings report from the world’s largest shoemaker Nike. As widely expected, the Federal Reserve lowered its benchmark interest rate by a quarter percentage point yesterday. The Federal Open Market Committee voted 11-1 to reduce the federal funds rate to a range of 4.25% to 4.50%, marking its third consecutive rate cut. The central bank stated that while inflation has moved closer to the 2% target, it remains “somewhat elevated,” and labor market conditions have “generally eased.” The Fed’s updated Summary of Economic Projections showed that officials now anticipate the benchmark rate reaching a range of 3.75% to 4.00% by the end of 2025, implying only two quarter-percentage-point cuts, compared to the four cuts projected in September. “In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the committee will carefully assess incoming data, the evolving outlook, and the balance of risks,” the FOMC’s statement said. At a press conference, Fed Chair Jerome Powell reiterated that the central bank would exercise greater caution as it considers further adjustments to the policy rate. He also stated that interest rates continue to “meaningfully” restrain economic activity and that the committee is “on track to continue to cut.” “Dots are hawkish even relative to what were fairly hawkish expectations going in - it’s taking much longer to get to ‘neutral’ - in fact it doesn’t get there in the forecast horizon,” said Scott Ladner of Horizon Investments. In yesterday’s trading session, Wall Street’s major indexes closed sharply lower. Heico (HEI) slumped over -8% after reporting weaker-than-expected FQ4 revenue. Also, mega-cap technology stocks retreated, with Tesla (TSLA) plunging more than -8% and Amazon.com (AMZN) falling over -4%. In addition, General Mills (GIS) slid more than -3% after the Cheerios maker lowered its full-year adjusted EPS forecast. On the bullish side, Jabil Inc. (JBL) climbed over +7% and was the top percentage gainer on the S&P 500 after the electronic circuit manufacturing company posted better-than-expected FQ1 results and raised its full-year guidance. Economic data released on Wedensday showed that U.S. housing starts unexpectedly fell -1.8% m/m to 1.289M in November, weaker than expectations of 1.350M. Also, U.S. building permits, a proxy for future construction, rose +6.1% m/m to a 9-month high of 1.505M in November, stronger than expectations of 1.430M. In addition, the U.S. Q3 current account deficit was a record -$310.9B, wider than expectations of -$286.0B. Today, all eyes are on the Commerce Department’s final estimate of gross domestic product, which is set to be released in a couple of hours. Economists, on average, forecast that U.S. GDP growth will stand at +2.8% q/q in the third quarter, compared to the second-quarter figure of +3.0% q/q. Investors will also focus on the U.S. Philadelphia Fed Manufacturing Index, which came in at -5.5 in November. Economists expect the December figure to be 2.9. U.S. Existing Home Sales data will be released today. Economists foresee this figure to stand at 4.09M in November, compared to 3.96M in October. U.S. Initial Jobless Claims data will be reported today. Economists estimate this figure will be 229K, down from last week’s 242K. The Conference Board’s Leading Economic Index for the U.S. will be released today as well. Economists expect the November figure to be -0.1% m/m, compared to the previous number of -0.4% m/m. Meanwhile, notable companies like Nike (NKE), FedEx (FDX), Accenture (ACN), Cintas (CTAS), and Darden Restaurants (DRI) are set to report their quarterly results today. U.S. rate futures have priced in a 91.4% probability of no rate change and an 8.6% chance of a 25 basis point rate cut at the next central bank meeting in January. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.530%, up +0.64%. Let's take a look at the intra-day 0DTE levels: /ES: Well. We've been looking for a new trading range. Here it is. 5987 is the new resistance with 5839 working as support. Wide levels for the /NQ: 21,690 is resistance with 21,032 acting as support. A couple key levels on BTC. 104,717 is first resistance with 108,344 above that. 99,979 is support. We are getting close to the 1HTE options rollout. It will start on Bitcoin and eventually work into SPX/NDX as liquidity builds. It may be live today. I'll be sure to let you know if we can start trading them.

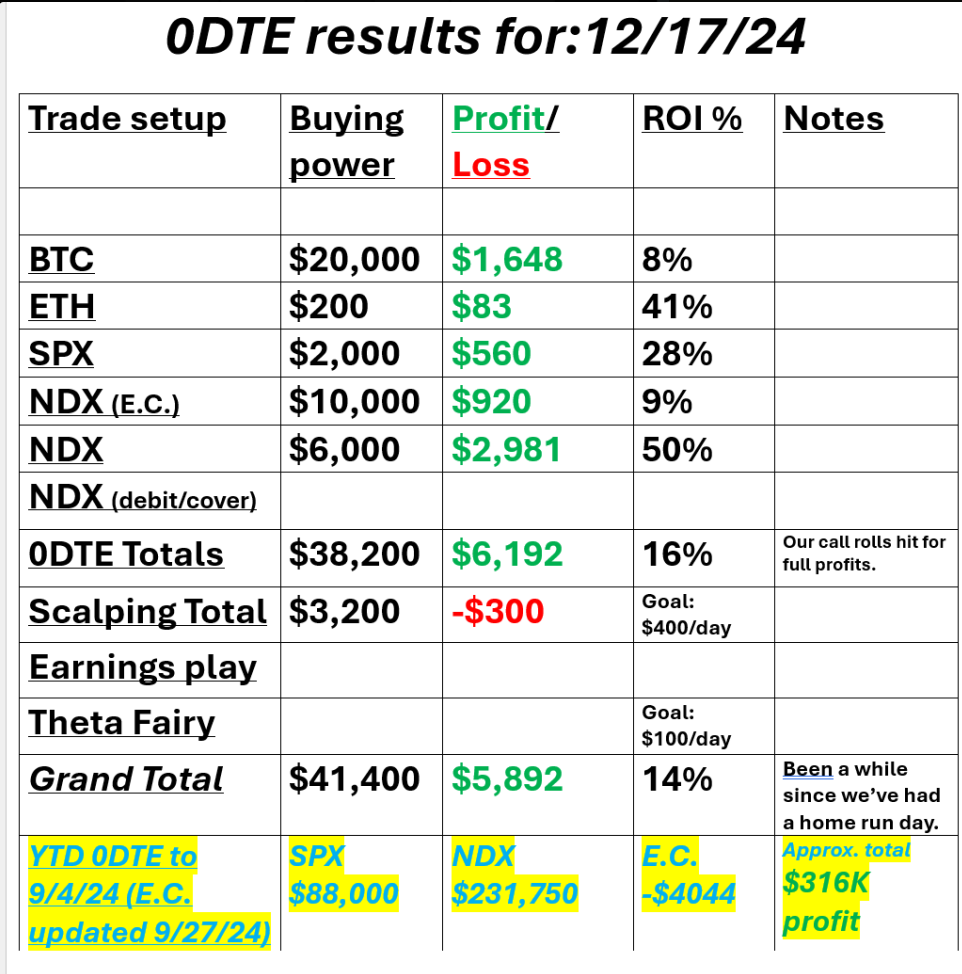

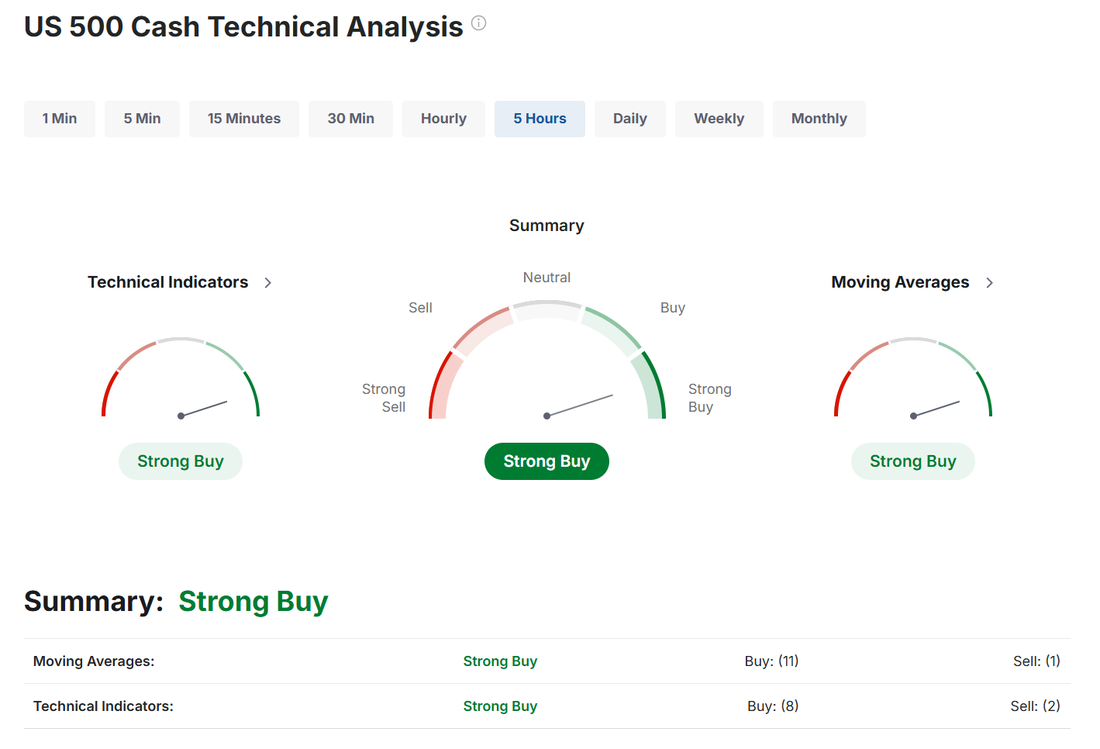

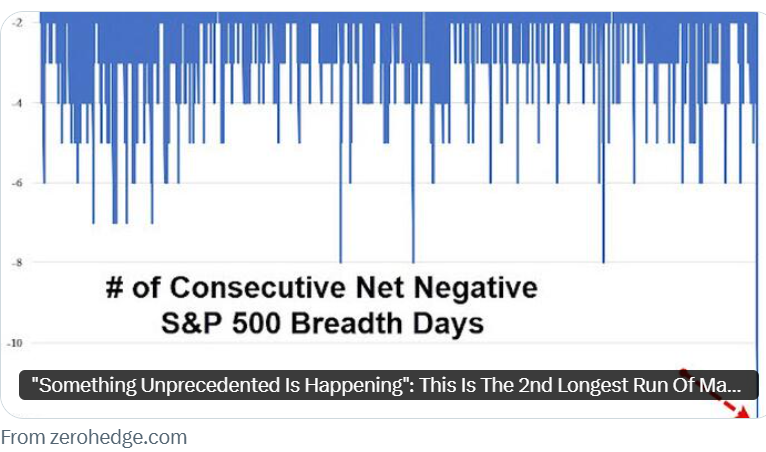

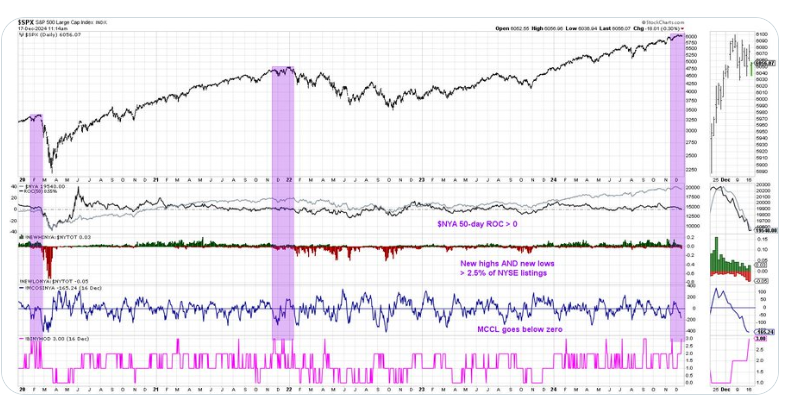

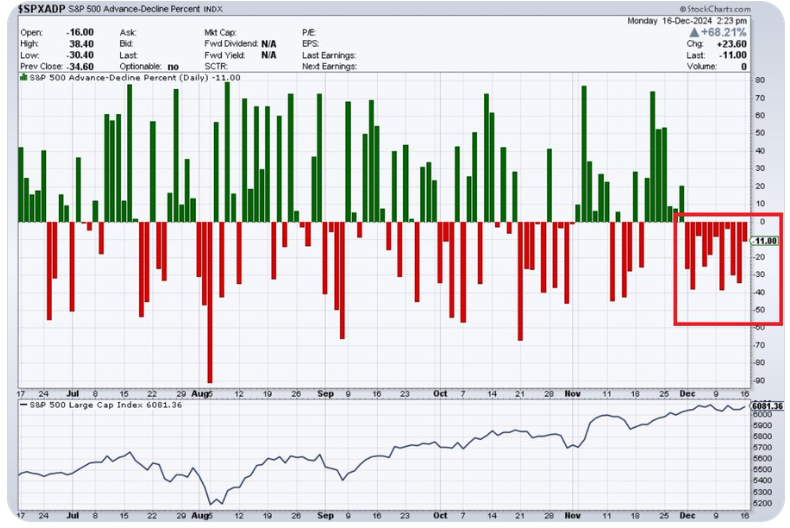

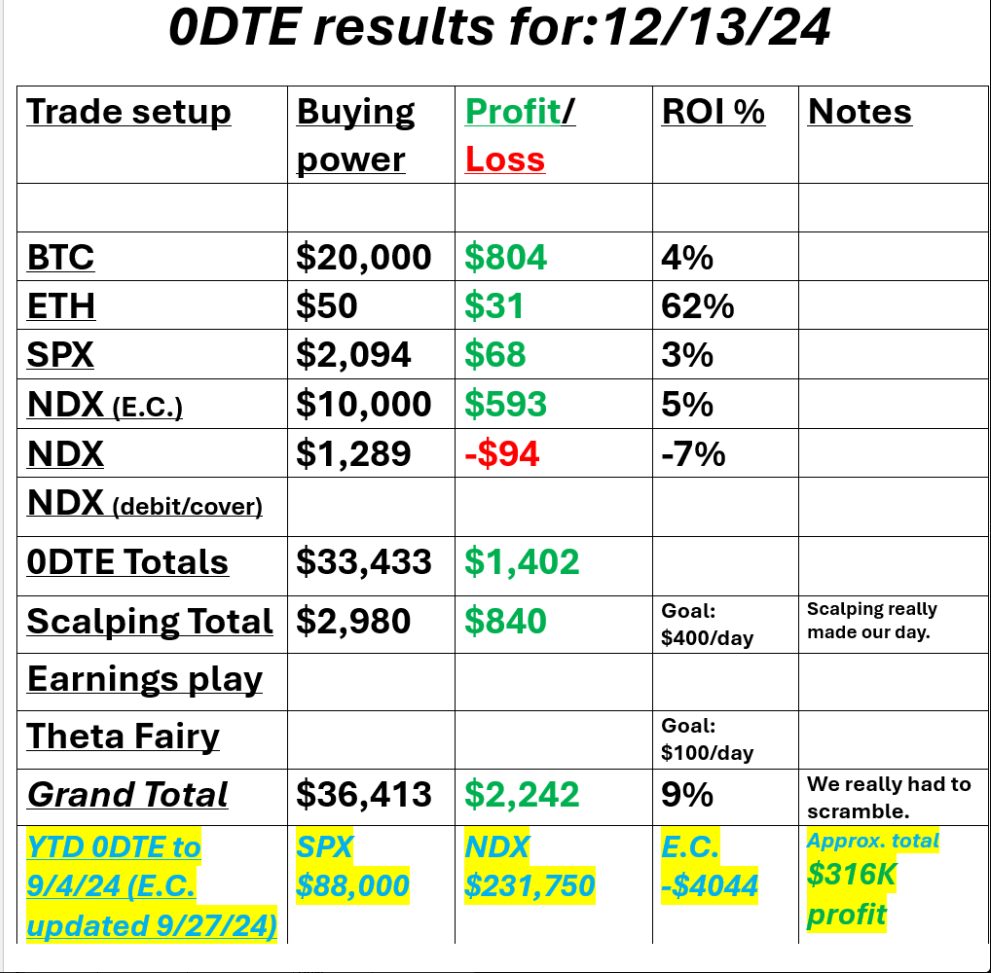

See you all in the trading room. Welcome back to FOMC day! We had a rare home run yesterday with everything clicking for us. Check out our results below: We've already got two 0DTE's working this morning. Our goal will be to pull them at a profit prior to FOMC and then we pounce once again and double dip. Also...big news! The regulators have FINALLY approved the 1 hour to expiration trades! It's been a regulatory nightmare and took almost a year longer than planned but they are very close to being rolled out to a few select platforms in the U.S. and we are one of the lucky ones! If you're not already signed up for Kalshi so you can trade these, now it the time! There's no cost and you can trade with twenty bucks if you like so there's no reason to not get set up to take advantage. Frankly, I'm not sure what the best way to trade them is. It will be a learning opportunity for us all. Grab your spot below: In other big news...I'm continuing to work on an autotrade bot that will automate 0DTE setups and most of our weekly trades! If you have wanted to trade 0DTE's but havent been able to because of screen time limitations we may have a fix for you! I'll chat about this more on the zoom today. I'm very excited about this. December S&P 500 E-Mini futures (ESZ24) are up +0.22%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.26% this morning as investors looked ahead to the Federal Reserve’s final policy decision of the year. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the red. Managed care stocks came under pressure after Pfizer CEO Albert Bourla said U.S. President-elect Donald Trump is “very committed” to reforming the pharmacy benefit manager industry, with Humana (HUM) plunging over -10% to lead losers in the S&P 500 and CVS Health (CVS) falling more than -5%. Also, chip stocks lost ground, with Marvell Technology (MRVL) slumping over -10% to lead losers in the Nasdaq 100 and Broadcom (AVGO) sliding nearly -4%. In addition, Red Cat Holdings (RCAT) dropped over -7% after reporting weaker-than-expected FQ2 results. On the bullish side, Pfizer (PFE) climbed more than +4% and was the top percentage gainer on the S&P 500 after the drugmaker reaffirmed its 2024 guidance and provided a better-than-expected 2025 adjusted EPS forecast. Also, Tesla (TSLA) gained over +3% and was the top percentage gainer on the Nasdaq 100 after Mizuho upgraded the stock to Outperform from Neutral with a $515 price target. Economic data released on Tuesday showed that U.S. retail sales climbed +0.7% m/m in November, beating the +0.6% m/m consensus. Also, U.S. November core retail sales, which exclude motor vehicles and parts, edged up +0.2% m/m, weaker than expectations of +0.4% m/m. In addition, U.S. industrial production unexpectedly fell -0.1% m/m in November, weaker than expectations of +0.3% m/m, while manufacturing production rose +0.2% m/m, weaker than expectations of +0.5% m/m. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. Fed officials are widely expected to lower interest rates by a quarter percentage point, but the trajectory for the following months is less clear. While the U.S. economy remains resilient, the prospect of inflationary import tariffs proposed by the incoming Donald Trump administration may cause policymakers to reconsider the pace of future interest rate cuts. Market watchers will closely follow the central bank’s quarterly “dot plot” in its Summary of Economic Projections and Chair Jerome Powell’s post-decision press conference. “Whether [today’s] Fed decision is positive, negative or neutral for stocks and bonds likely won’t be determined by any actual rate cut, but instead by what the FOMC says about cuts in 2025,” wrote Tom Essaye, president and founder of Sevens Report and a former Merrill Lynch trader. On the earnings front, notable companies like Micron Technology (MU), Lennar (LEN), General Mills (GIS), and Jabil Circuit (JBL) are scheduled to report their quarterly figures today. On the economic data front, investors will focus on U.S. Building Permits (preliminary) and Housing Starts data, set to be released in a couple of hours. Economists forecast November Building Permits to be 1.430M and Housing Starts to be 1.350M, compared to the prior figures of 1.419M and 1.311M, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be -1.600M, compared to last week’s value of -1.425M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.407%, up +0.50%. Let's take a brief look at the markets before FOMC. The technicals are still bullish but... There are different stories going on, depending on what index you choose to look at. SPY is stalled at ATH's, IWM and DIA are in one their longest losing streaks in a while. Just clinging to their 50DMA's. Its only the QQQ's that continue to climb and climb. Internally this market looks tired. Take a look at a few things I'm thinking about today. "Something Unprecedented Is Happening": This Is The 2nd Longest Run Of Market Bad Breadth In 100 Years We now have a CONFIRMED Hindenburg Omen after two bearish signals occurred within one month. The last two times this has occurred for $SPX: Dec 2021 and Feb 2020. Tune in today's episode of CHART THIS for a deeper discussion and implications of this rare but powerful bearish signal! https://buff.ly/3P04dTh S&P 500 Value Stocks have declined for 11 consecutive trading days, the longest losing streak in history Over the last 11 trading days STRAIGHT, more stocks of the S&P 500 finished lower than closed higher each day, the longest streak in 28 YEARS. The US stock market is absolutely weak under the surface. Time for a pullback? I have no bias or lean on FOMC days and we don't look at levels because the Algos will drive the markets today. We just look to jump on a trend, if one develops. Trade docket today: We already have two 0DTE's working. We should have a good shot at booking profits on those before FOMC. We'll then look to re-enter new setups. We'll continue to work our Nat gas trade. PLTR?, MU, LEN earnings setups. BTC and ETH 0DTE's. See you all in the zoom shortly. I'm excited to talk about the 1HTE trades and auto trading.

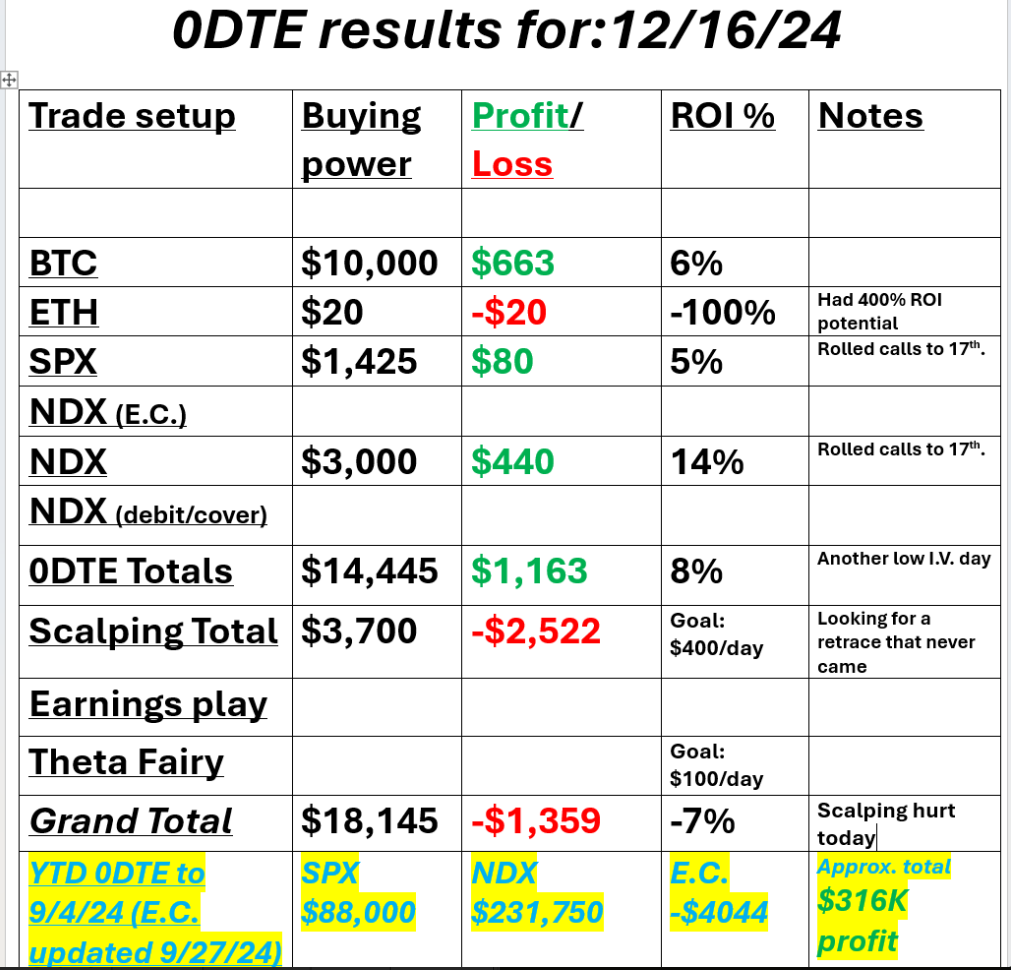

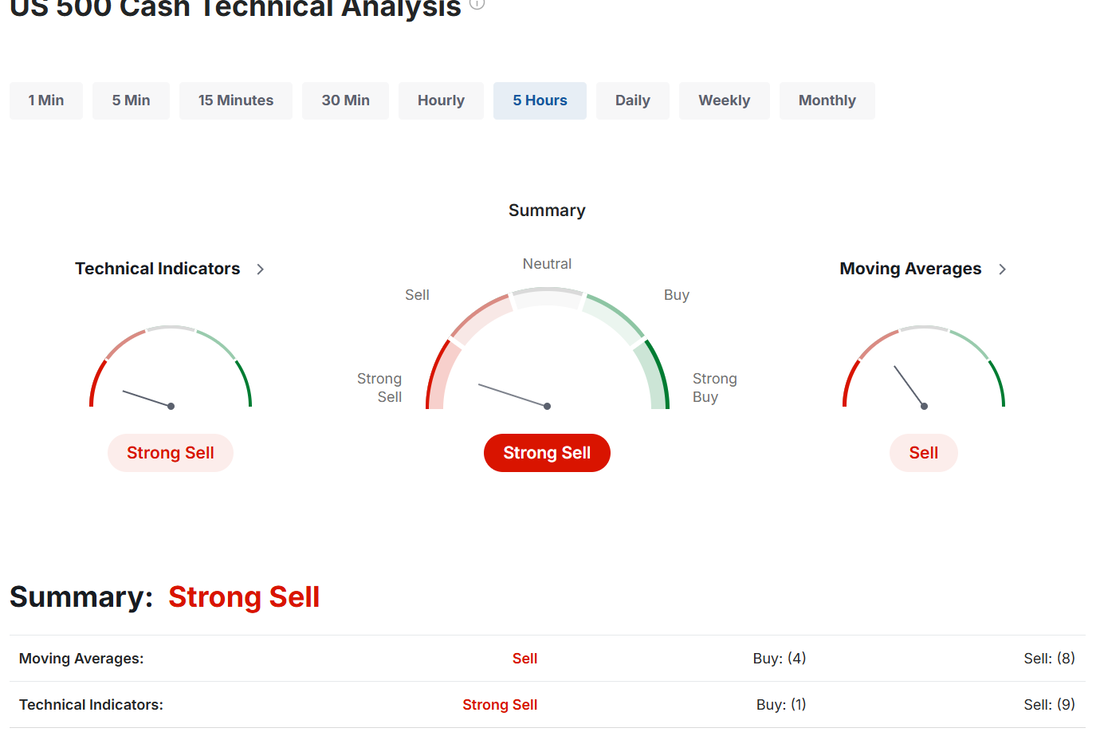

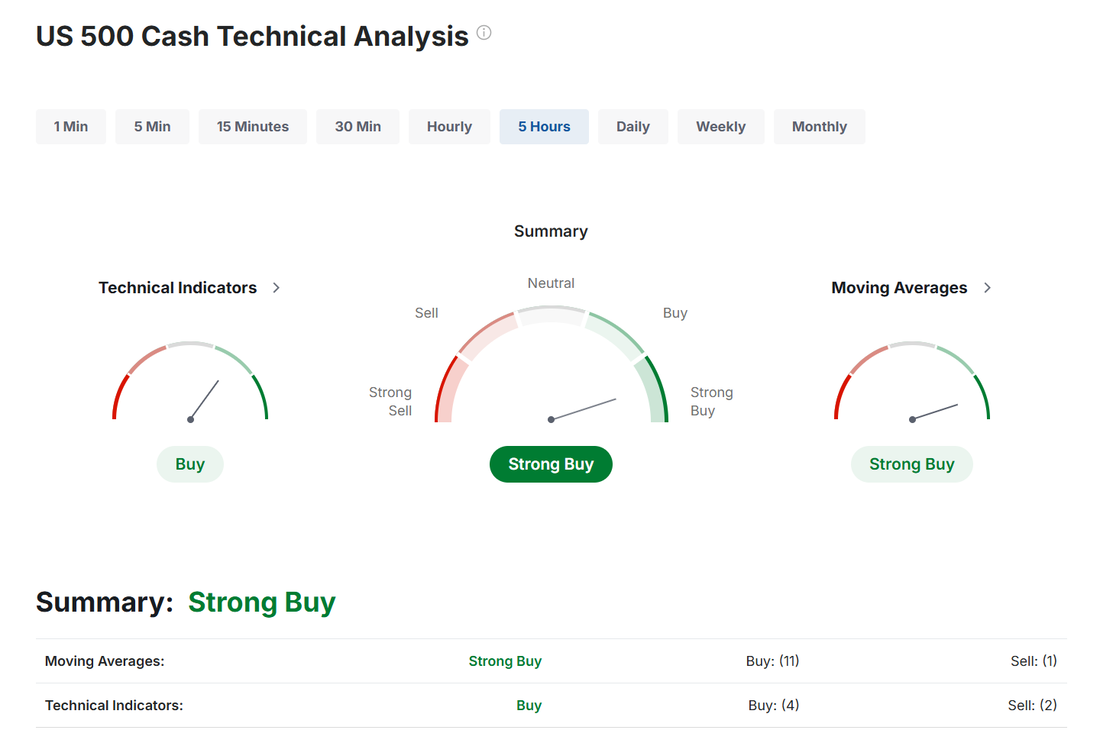

Welcome back traders! Well?...another day of low I.V. Our day trades were fine. We rolled the call sides of both the NDX and SPX and those look like they should cash flow well today so we may have a bit of a gift coming this session. Scalping killed my yesterday so we'll look for better results today. It feels like we are topping here. More on that lower down. Here's my results from yesterday. We have about $3,400 of potential profits today on our rolled calls so hopefully we can get a bigger score today than we've been getting. Let's take a look at the markets and see where we think today's trend will take us. We've got a sell mode signal coming into today. We've had a few of these and EVERY SINGLE ONE has been a "buy the dip" opportunity. One of these times is going to be a clear "change of direction" signal. Will today be that day? Who knows? We've got FOMC tomorrow. I do think we are getting close to a retrace. You could make the argument that the markets been in decline for over a week now. SPY is stuck and can't go higher. DIA and IWM are in a clear downtrend with the DIA in one of it's longest downtrends in recent time. It's the tech heavy QQQ's that keep exploding to new ATH's every day, it seems. I've mentioned this before. The market internals don't look great. December S&P 500 E-Mini futures (ESZ24) are trending down -0.45% this morning as investors braced for the start of the Federal Reserve’s two-day policy meeting while also awaiting a new batch of U.S. economic data, with a particular focus on the retail sales report. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed, with the tech-heavy Nasdaq 100 notching a new all-time high and the blue-chip Dow posting a 3-week low. Broadcom (AVGO) climbed over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100, extending last Friday’s rally after it reported better-than-expected FQ4 adjusted EPS and provided upbeat FQ1 revenue guidance. Also, Tesla (TSLA) gained more than +6% after Wedbush Securities raised its price target on the stock to $515 from $400. In addition, Honeywell International (HON) rose over +3% and was the top percentage gainer on the Dow after saying it’s exploring a separation of its aerospace business. On the bearish side, Super Micro Computer (SMCI) slumped more than -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after Nasdaq announced that the stock would be removed from the tech-heavy index later this month. Economic data released on Monday showed that the U.S. S&P Global manufacturing PMI fell to 48.3 in December, weaker than expectations of 49.4. Also, the Empire State manufacturing index came in at 0.20 in December, weaker than expectations of 6.40. At the same time, the U.S. December S&P Global services PMI unexpectedly rose to 58.5, stronger than expectations of 55.7. The Federal Reserve kicks off its two-day meeting later in the day. While Fed officials are widely expected to cut interest rates by a quarter percentage point on Wednesday, the trajectory for the following months is less clear. Market watchers will closely follow the central bank’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC member forecasts regarding the path of interest rates, and Chair Jerome Powell’s post-decision press conference. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that November Retail Sales will stand at +0.6% m/m, compared to the October figure of +0.4% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.1% m/m in October. Economists foresee the November figure to be +0.4% m/m. U.S. Industrial Production and Manufacturing Production data will be released today as well. Economists forecast November Industrial Production at +0.3% m/m and Manufacturing Production at +0.5% m/m, compared to October’s figures of -0.3% m/m and -0.5% m/m, respectively. “Near-term momentum may depend on what Fed Chair Powell says after the announcement, and whether retail sales or the PCE Price Index catch the market off guard,” said Chris Larkin, managing director of trading and investing at E*Trade from Morgan Stanley. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.423%, up +0.53%. My lean or bias today is bearish. Futures are down. That's not news. They've been down most mornings lately and have come roaring back either by the open or later in the day. There's very little buying happening right now. We would benefit greatly today with a down day. Trade docket for today: Super simple. We'll continue to be more proactive and work our Nat gas position once again. MRNA, 0DTE's. Tomorrow we'll get some earnings setups. If we can get our 0DTE's to the finish line today it will be a very successful day. We don't need much else. One thing I'm thinking about today: P/E ratios. Take a look at where we are at. Compare that to historical levels. You tell me. Are we overvalued? Once we get an exit on our current 0DTE's I believe it's time to switch over to some bearish debit anchors. Let's take a look at our intra-day levels for 0DTE. /ES: While we are still inside the "chop zone" that I've laid out for over a week now, we are sitting right on top of the support level of 6047. A drop below that could trigger a sell all the way down to 6011. Resistance is up at 6096. /NQ: The Nasdaq just keeps on keeping on. Every day seems like another new ATH. As I type this the /NQ futures are down 50 points. If we can shake that off and push above current resistance at 22,155 then I'll tip my hat to the bulls. It's been an impressive run as all the other indices languish or retrace. Support is all the way down at 21,532. BTC: There are three key levels I'm watching on Bitcoin today. 108,344 is now near term resistance. The bulls want to run. Can they make a new ATH today? It's got a fair chance however, the longer the upward run and the more intense it becomes, the more I look for that "break" and a retrace. Thank heavens for Bitcoin. I never thought I'd say this but it's been our most reliable source of profit lately for our 0DTE's. Support levels for me are 104,717 first then the ever important 100,000 level. Today's a big one for us with our 0DTE's. Firstly, we could book a nice profit if the market stays down and our rolled calls hit for a full profit but secondly, With FOMC incoming tomorrow it would be nice to start tomorrow with a fresh, clean slate.

I'll see you all in the trading rooms shortly. Let's make some money today! Welcome back traders! New week...same old low I.V.! That may change this week though. We had our extended family Christmas get together yesterday. The Christmas season is in full swing. I love this time of year. I hope you all have a wonderful holiday season. Let's take a look at our results from last Friday. On the surface, the numbers look good and "normal" for a successful day for us but oh man!...We had to stretch to get it done. If it weren't for scalping and the Event contracts we wouldn't have much to show. We've got FOMC coming up Weds. and that could just be the catalyst we need to get things moving again. Let's take a look at the markets as we start this new week. After recording some weakness for the first time in weeks, we get some strength to start off the week. This week brings the highly anticipated FOMC meeting, with the markets currently pricing in a 97% probability of a 25 basis point rate cut. The question remains: will this be sufficient to revitalize the underperforming indexes, or are we poised for a deeper market downturn? Let’s dig into the charts and see where things ended up. The SPY continued to show signs of weakness, failing to put in a new high on Wednesday and closing the week lower, at $604.21 (–0.60%). With the GoNoGo Squeeze oscillator at the zero line and the next horizontal support level just below, bulls will be hoping for price stabilization in the coming sessions. A break below the zero line, coupled with a loss of the horizontal support, would signal a significant shift in momentum and the potential for a more pronounced downside correction. The QQQ took the lead again this week, but only closing slightly higher at $530.53 (+0.76%). In comparison to its peers, the chart appears notably more constructive, with the GoNoGo Squeeze oscillator line well above the zero level and the price comfortably above the nearest horizontal support level. The index’s reaction to next week’s FOMC decision could provide significant insight into the overall market’s resilience as we head into the final weeks of the year. Unfortunately for small-cap bulls, IWM was yet again the weakest index of the group, closing notably lower at $233.07 (-2.47%). The orange grid on the GoNoGo Squeeze indicator has now hit the max compression reading, suggesting that the next move will be a powerful one. With this in mind, keep an eye on the blue oscillator line, as the direction it breaks will be a strong indication of where price is headed next. If that move is lower, all eyes will be on the summer highs, around $225. Let's take a look at the expected moves for the week. The expected move in the SPY is still almost 40% lower than we would like for selling options. The QQQ's are better. We may focus our 0DTE's today on the NDX instead of the SPX. Once I.V. pops above 14 the selling of options should carry a viable risk/reward. That's not happening today! Our trade docket today is fairly light for a Monday. It will pick up Weds. with FOMC release. MRNA, /NG, PLTR, /MCL, /ZN?, 0DTE's. We've also got eight potential earnings trade setups this week. My lean or bias is bullish today. The trend is your freind, until it isn't. Right now that's up for the SPX and NDX. There is however, a divergence in the major indices with the DIA and IWM continuing to roll over. While our major focus is on the SPX and NDX, keep an eye on the DIA and IWM. If they continue to roll over from here they could build enough momentum to drag everything else with them. Let's take a look at our intra-day levels. Today may be another day like Friday where we really need the Event contracts to pull their weight. /ES: We continue to be stuck in the same chop zone. 6103 is resistance with 6058 still acting as support. It's weak support but support, nonetheless. /NQ: The Nasdaq has shown some incredible strength lately. We are pushing on the closest resistance of 21909 as we speak. The next resistance is up at 22060. Support continues to be 21434. BTC: Bitcoin popped to another ATH. Will it hold or retrace? 104,717 is the resistance area its hovering around right now. 107,439 is next. Support is down at 98,388. I look forward to seeing you all in the live trading room shortly!

|

Archives

December 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |