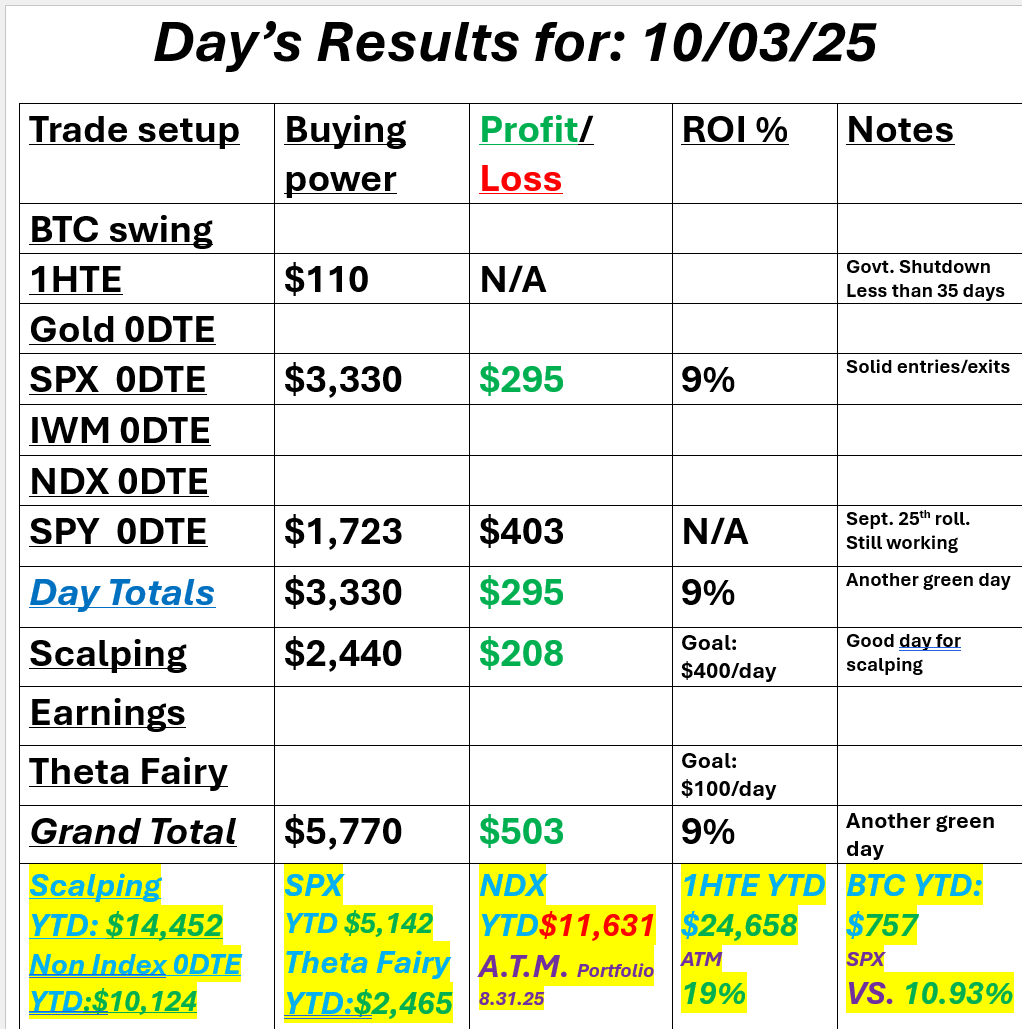

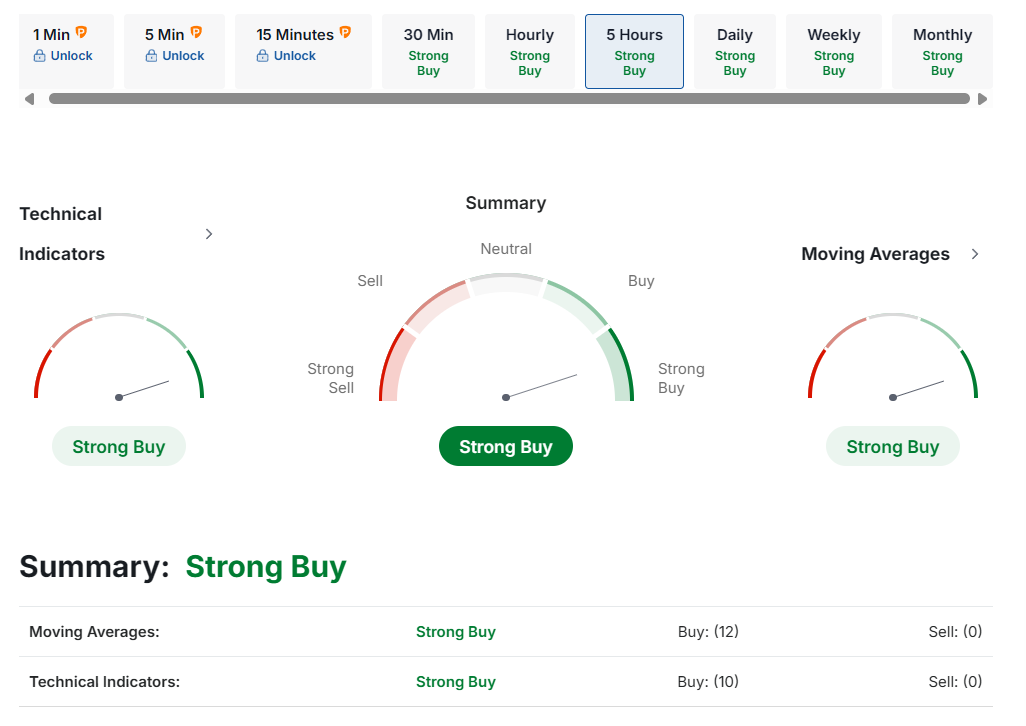

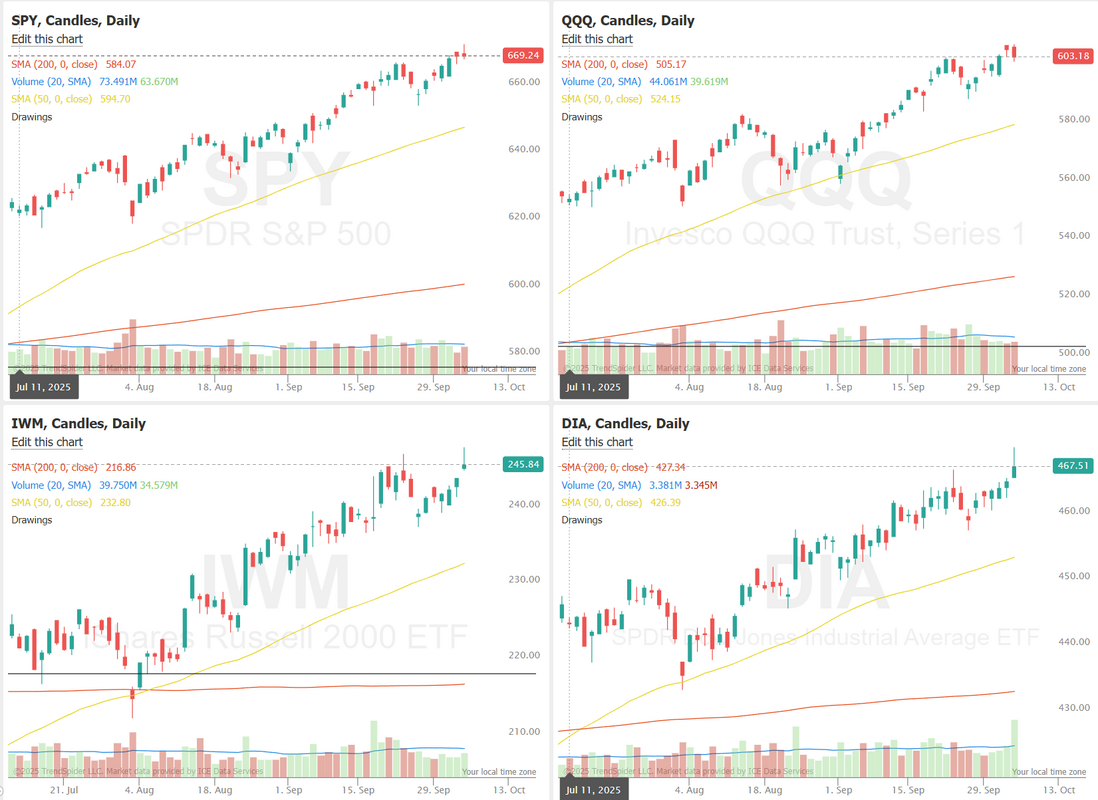

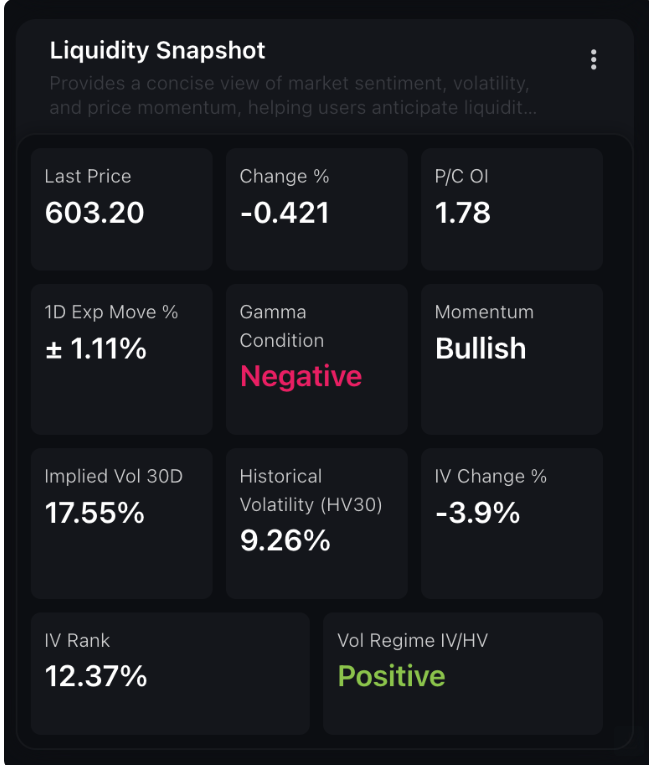

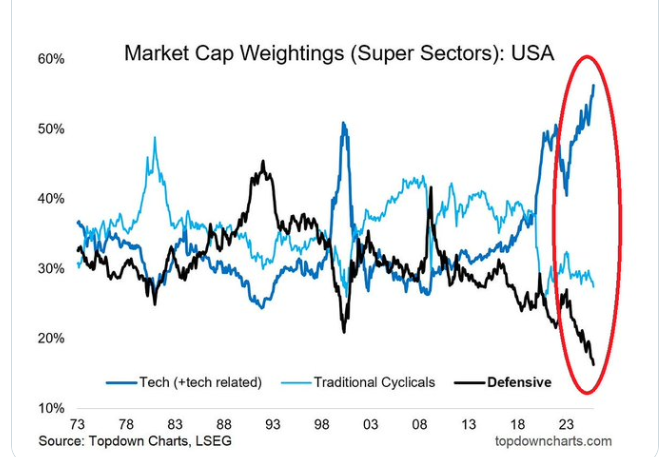

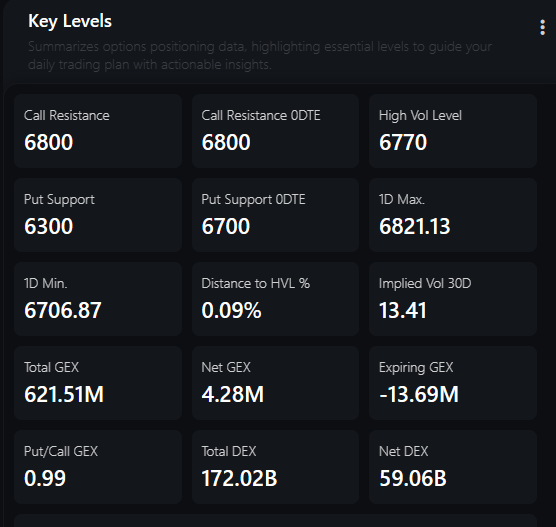

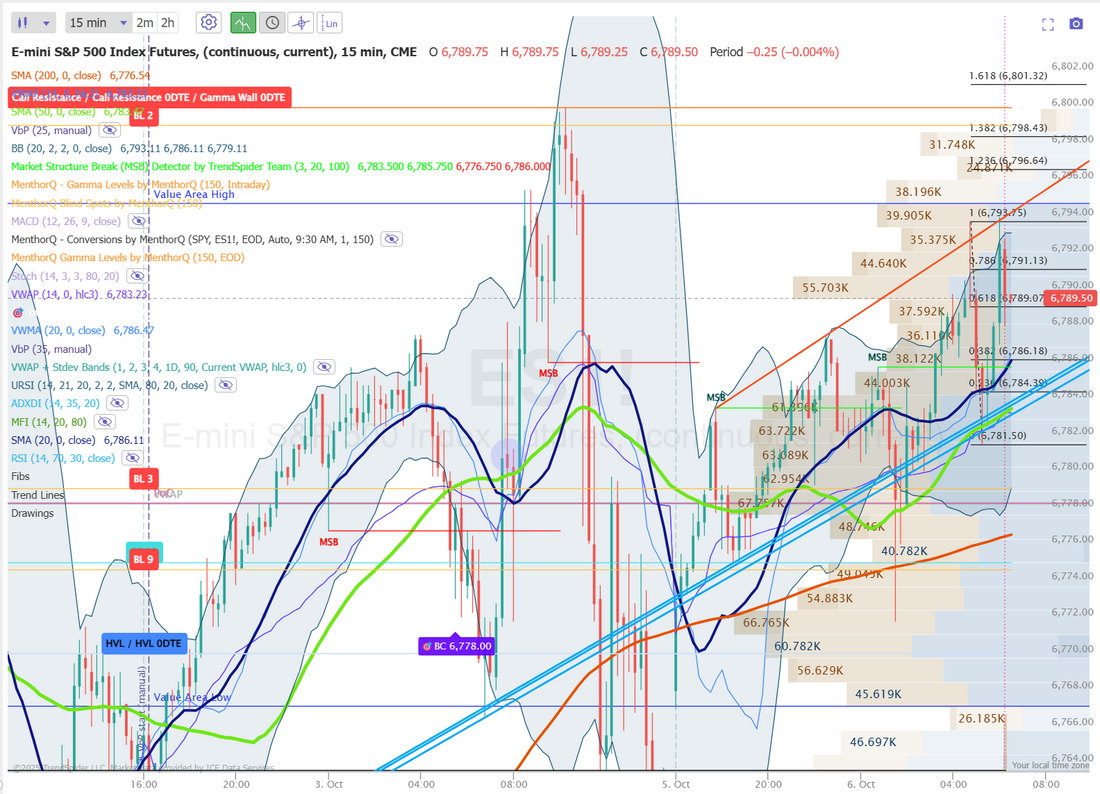

Bulls continue to pushIn spite of the Govt. shut down and some concerning valuation levels, the market just keeps pushing. Futures are up again this morning, as I type. Be prepared. We won't have a lot of our economic data to trade off until our fearless leaders decide to go back to work but once they do, it will be like flood gates opening up. Lots of data to parse through. We had another solid day of results on Friday. See below: We set a goal last week to make finishing green every day the priority, regardless of the dollar amount. Here's a review of how it went. The most buying power used was $5,770. The lowest was $1,260. Our avg. Buying power used per day was $3,351.. Every day was profitable. (SPY trade is still in progress) The biggest profit was $503, with the smallest $141. Our avg. daily profit was $239 a day. All told, our avg. buying power used was $3,351 for a total weekly profit of $1,196. That's almost a 36% return for the week! I'd say mission accomplished! Let's take a look at the markets to start the new week. Technicals are bullish. Not a big surprise. Markets are not rolling over. They aren't pushing higher. They are just hanging out at ATH'S. Something will shake loose eventually. The S&P 500’s volatility risk premium (VRP) has climbed to 6.6%, placing it near the 97th percentile over the past three months, which signals a notable stretch in implied volatility levels relative to realized movement. This “overvalued IV” setup indicates that option prices are rich compared to recent realized volatility a condition that often precedes short-term cooling or consolidation as the market digests elevated expectations. With spot prices hovering near recent highs, traders may interpret this as a sign of heightened hedging activity or short-term caution building into the market. In the near term, watch for potential shifts in sentiment if volatility begins to compress, as that could open room for a modest pullback or volatility normalization phase. The QQQ liquidity snapshot shows a slightly soft tape with prices down 0.42% but overall bullish momentum holding steady. Despite the pullback, the positive volatility regime (IV/HV) indicates implied volatility remains elevated compared to realized volatility, suggesting traders are still pricing in short-term movement potential. The negative gamma condition points to higher sensitivity to market swings intraday volatility could expand if selling pressure builds. Meanwhile, implied volatility (17.55%) is easing by nearly 4%, hinting at a moderation in hedging demand. With a put/call open interest ratio of 1.78, positioning still leans cautiously defensive, but the market’s underlying tone remains constructive in the short term. SPY ended last week in the green at $669.21 (+1.06%) to kick off October. Zooming out to the monthly chart, September marked SPY’s strongest performance since June, completely defying its typically bearish seasonality. The Combined RSI Ensemble Indicator ended the month with a yellow candle, signaling that at least one RSI length has crossed above 80 and may be entering overbought territory. QQQ also rose last week and closed at $603.18 (+0.91%), printing its highest RSI reading since December 2021. The monthly candle for October is printing orange on the RSI Ensemble, signaling that two RSI lengths are now in overbought territory. With both tech and hard assets like silver pushing higher, the question now is which trend will outlast the other. The small-cap IWM performed the best among the major indexes last week, closing at $245.83 (+1.48%). Unlike its large-cap peers, the RSI Ensemble has remained neutral for months, shown by a steady run of gray candles. With large caps entering overbought territory and rate cuts underway, a rotation into small caps could be gaining traction. US technology stocks now account for a record 56% of total US stock market cap. At the same time, defensive stocks make up just 16%, AN ALL-TIME LOW. This has NEVER happened. December S&P 500 E-Mini futures (ESZ25) are up +0.36%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.55% this morning, pointing to a higher open on Wall Street as investors wager that a resilient economy and further rate cuts from the Federal Reserve will continue to underpin corporate earnings. However, gains in equity futures are limited as the U.S. government shutdown extends into another week. Higher bond yields today are also limiting gains in stock index futures. This week, investors will focus on developments surrounding the government shutdown, the minutes of the Fed’s latest policy meeting, and comments from Fed officials. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Humana (HUM) surged over +10% and was the top percentage gainer on the S&P 500, extending Thursday’s gains after it reaffirmed its full-year earnings guidance. Also, Rumble (RUM) jumped more than +15% after announcing a partnership with Perplexity to integrate the company’s AI tools to improve video discovery on its platform. In addition, USA Rare Earth (USAR) climbed over +14% after CEO Barbara Humpton told CNBC that the company was “in close communication” with the White House. On the bearish side, Palantir Technologies (PLTR) slid more than -7% and was the top percentage loser on the S&P 500 and Nasdaq 100 following a report that the company’s battlefield communications system had serious flaws, a claim the company denied. Economic data released on Friday showed that the U.S. ISM services index fell to a 4-month low of 50.0 in September, weaker than expectations of 51.8. At the same time, the U.S. September S&P Global services PMI was revised higher to 54.2 from the preliminary reading of 53.9. Chicago Fed President Austan Goolsbee reiterated on Friday that policymakers should move cautiously with rate cuts as they navigate pressure to balance their inflation and employment goals. Also, Dallas Fed President Lorie Logan stated that the central bank remains further from achieving its inflation target than its maximum employment goal and reiterated that officials should take a cautious approach to cutting interest rates. In addition, Fed Vice Chair Philip Jefferson said, “With respect to the path of the policy rate going forward, I will continue to evaluate the appropriate stance of monetary policy based on the incoming data, the evolving outlook, and the balance of risks.” Finally, Fed Governor Stephen Miran said he would revise his inflation outlook if housing costs were to jump unexpectedly. U.S. rate futures have priced in a 94.6% chance of a 25 basis point rate cut and a 5.4% chance of no rate change at the Fed’s monetary policy committee meeting later this month. Investor attention this week will center on developments surrounding the U.S. government shutdown, with tensions likely to rise if President Trump proceeds with his threat to fire, rather than furlough, federal workers. If the shutdown continues, official U.S. economic data will likely be delayed, including August trade data on Tuesday and weekly jobless claims on Thursday. However, several noteworthy economic releases are still anticipated, including the University of Michigan’s preliminary Consumer Sentiment Index and the Fed’s Consumer Credit report. Should the shutdown end, delayed official data such as the September jobs report could be released during the week. Market watchers will also parse the Fed’s minutes from the September 16-17 meeting, set for release on Wednesday, for insights into policymakers’ appetite for another rate cut. The FOMC cut interest rates last month for the first time this year, though subsequent public comments from various officials suggest there is division over how urgently further action should be taken. “Any insights on the future policy rate path and views [on] the double-sided risks to employment and inflation will be closely watched by market participants,” HSBC economists said in a note. Fed Chair Jerome Powell will deliver pre-recorded welcoming remarks at the Community Bank Conference on Thursday. Treasury Secretary Scott Bessent and Fed Vice Chair for Supervision Michelle Bowman are set to participate in a “fireside chat” at the event. Also, Kansas City Fed President Jeff Schmid, Atlanta Fed President Raphael Bostic, Fed Governor Stephen Miran, Minneapolis Fed President Neel Kashkari, Fed Governor Michael Barr, San Francisco Fed President Mary Daly, Chicago Fed President Austan Goolsbee, and St. Louis Fed President Alberto Musalem will be making appearances throughout the week. In addition, several notable companies, including soda and snack maker PepsiCo (PEP), carrier Delta Air Lines (DAL), Corona and Modelo parent Constellation Brands (STZ), and spice and condiments manufacturing firm McCormick & Company (MKC), are set to report their quarterly figures this week. Meanwhile, e-commerce giant Amazon (AMZN) will host its Prime Big Deal Days sales event on October 7th-8th. Also, ChatGPT maker OpenAI will hold its DevDay developer conference later today, which analysts say may feature new announcements and updates. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.150%, up +0.73%. Todays training will focus on ETF's. What are they? How do they compare to Mutual funds? How can you find the best ETF's for you? Let's take a look at the /ES intra-day levels we'll be focused on today. Gamma is still positive (unlike /NQ) which should mean contained movement today. Intra-day levels. 6800 is still in play as heavy resistance. Levels today are extremely close! I'm sure we may be modifying these as the day progresses. 6789, 6791, 6794, 6798, 6800 are resistance levels. 6786, 6784, 6781, 6778, 6776 are support levels. Again...very tight levels. We'll keep on top of any new levels that may appear today, in the live zoom. NOTE: On possible trading/scheduling issue this week (or today?) I've been have breathing issues the past few weeks. It seems to be getting worse. With already having high blood pressure and diabetes my wife is a little concerned and will likely try this morning to get me into my cardiologist ASAP. She's already told me, "Your getting the first available appointment regardless if the market is open!" So...just be aware. I may need to cut out of one of our trading sessions early. Sorry for that. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |