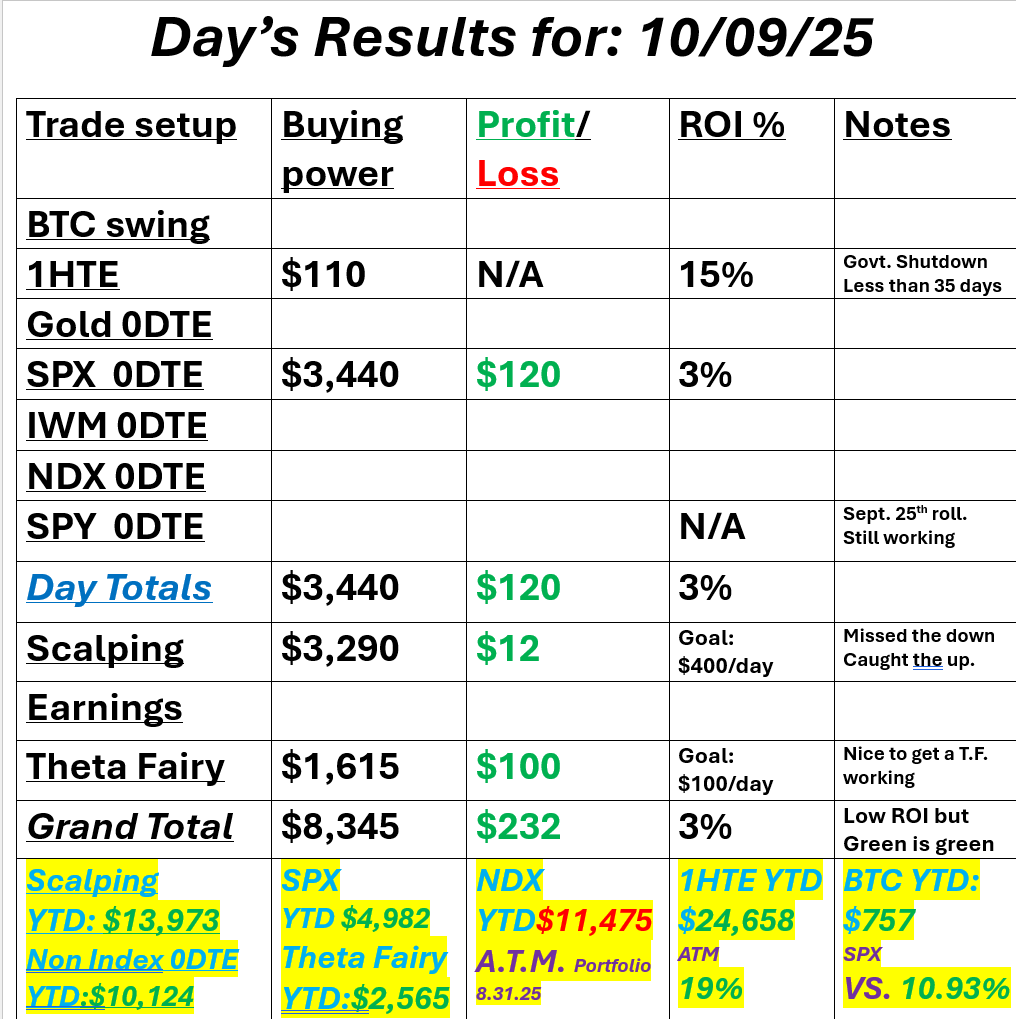

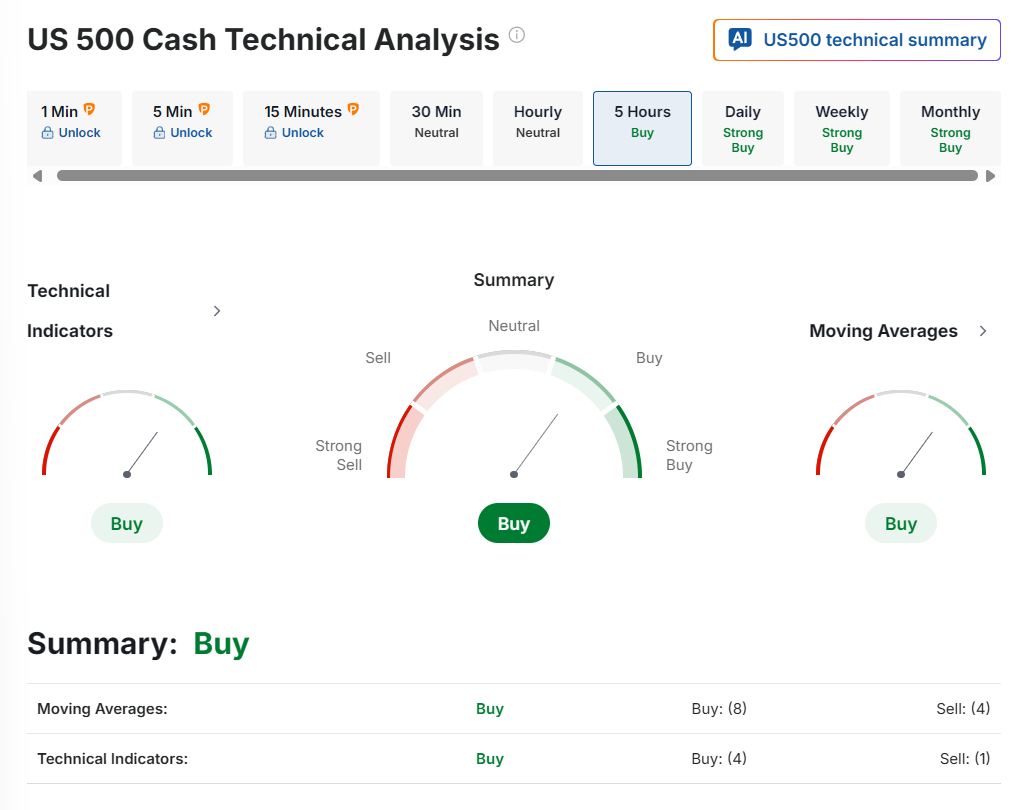

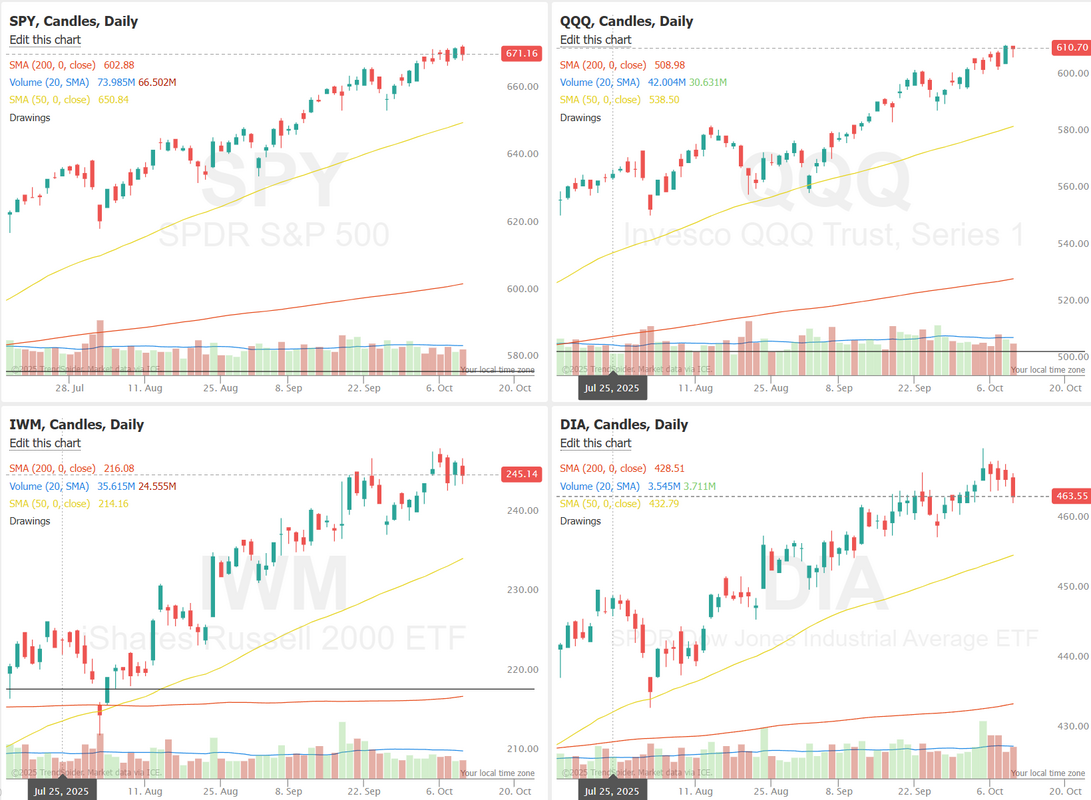

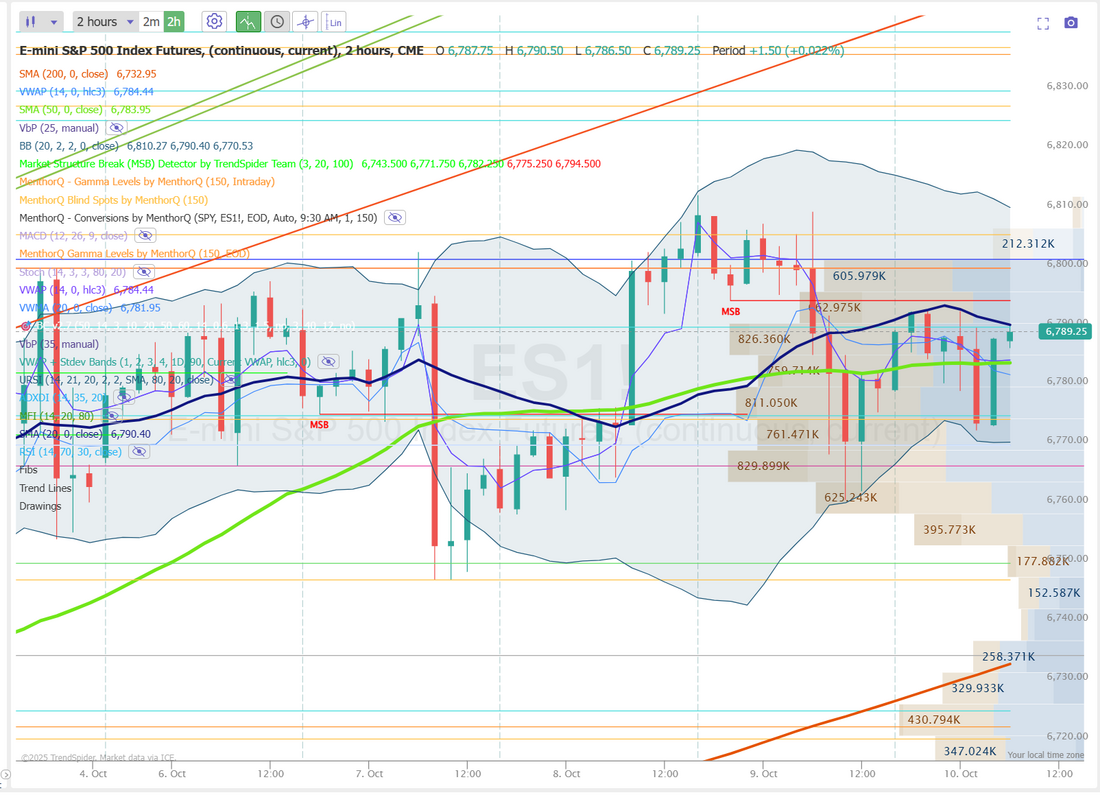

How long do we flat line?Markets keep consolidating at this ATH range. It's been eight days since we've really had a directional move. At some point we'll get back to it. The question is, higher or lower? We had a good day yesterday considering it was a half day for me. Another Doctor appt. and more tests. Still nothing conclusive. Life is fun! Here's a look at our day. It was nice to get a Theta fairy working again. We've got another one working this morning that should hit for us as well. Let's take a look at the markets. Bulls keep hanging on! Weakness is rearing it's head in the IWM and DIA. December S&P 500 E-Mini futures (ESZ25) are trending up +0.10% this morning, attempting to end the up-and-down week on a positive note, while investors await the release of the University of Michigan’s preliminary reading on U.S. consumer sentiment and remarks from Federal Reserve officials. Lower bond yields today are supporting U.S. equity futures. In yesterday’s trading session, Wall Street’s major indices closed in the red. Most semiconductor and AI infrastructure stocks retreated, with Dell Technologies (DELL) sliding over -5% to lead losers in the S&P 500 and Micron Technology (MU) falling more than -2%. Also, PulteGroup (PHM) slumped more than -4% to lead homebuilders lower after CFRA downgraded the stock to Sell from Hold. In addition, AZZ Inc. (AZZ) dropped over -4% after the metal coatings and welding services company posted downbeat Q2 results. On the bullish side, Delta Air Lines (DAL) climbed more than +4% after the carrier reported upbeat Q3 results and firmed up its annual earnings guidance. Fed Governor Michael Barr said on Thursday that officials should proceed carefully with further interest rate cuts, stressing that tariffs could lead to persistent inflation. Policymakers “should be cautious about adjusting policy so that we can gather further data, update our forecasts, and better assess the balance of risks,” Barr said. At the same time, New York Fed President John Williams said he supports additional rate cuts this year to help safeguard the labor market. “The risks of a further slowdown in the labor market are something I’m very focused on,” Williams said. U.S. rate futures have priced in a 94.6% chance of a 25 basis point rate cut and a 5.4% chance of no rate change at October’s monetary policy meeting. Meanwhile, the U.S. government shutdown has entered its tenth day, with no resolution in sight. The shutdown appears set to extend into next week, as the Senate wrapped up late Thursday and is not scheduled to return until Tuesday. Still, an administration official said late Thursday that some furloughed federal employees would return to work to publish U.S. inflation data for September next week. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary October figure will stand at 54.1, compared to 55.1 in September. Market participants will also parse comments today from Chicago Fed President Austan Goolsbee and St. Louis Fed President Alberto Musalem. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.117%, down -0.84%. Trading today: We'll look to use some of the 3X leveraged ETF's we trained on earlier this week for some potential 0DTE's. My lean of bias today is slightly bullish. That's how the Technicals and futures seem to be lined up. Let's take a look at our intra-day levels: 6794, 6800, 6806, 6812 are resistance zones. 6784, 6775, 6769, 6766 are support zones. Let's have a strong finish to the week! See you all shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |