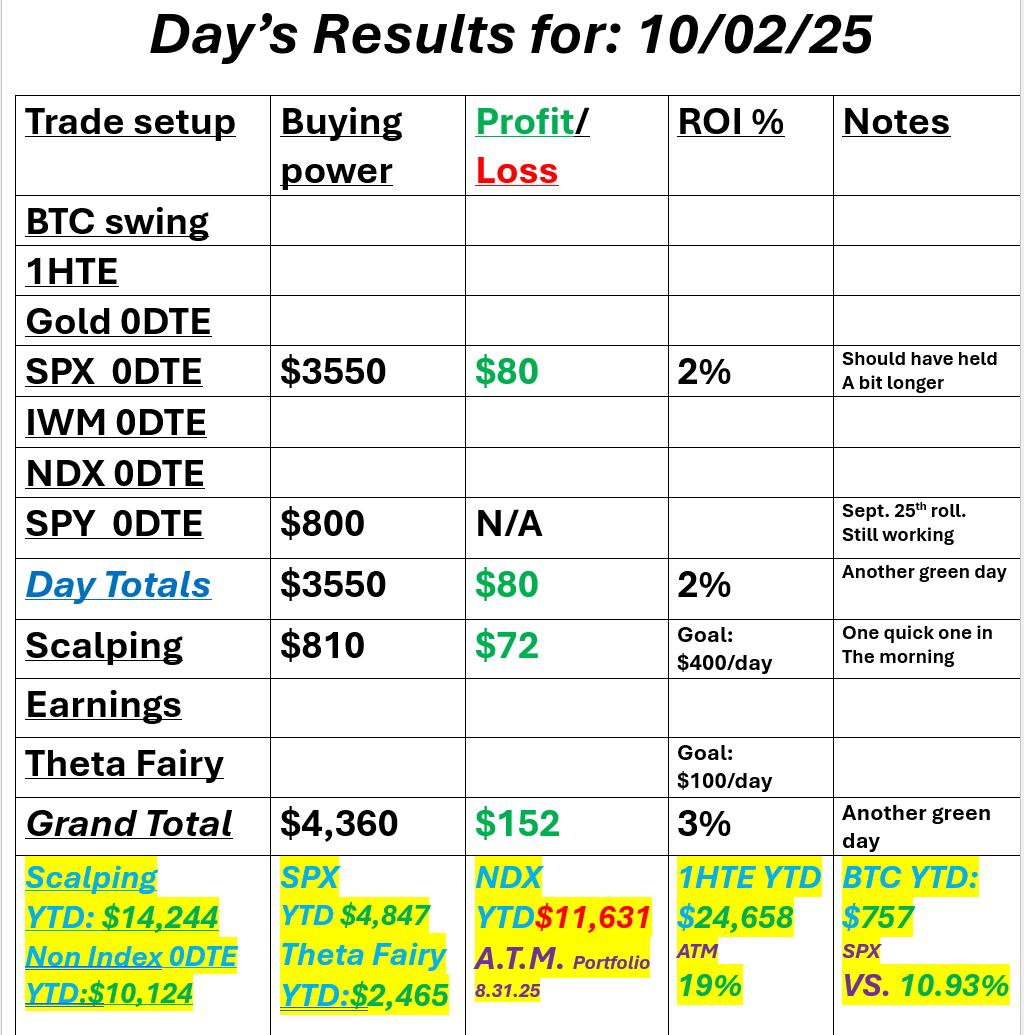

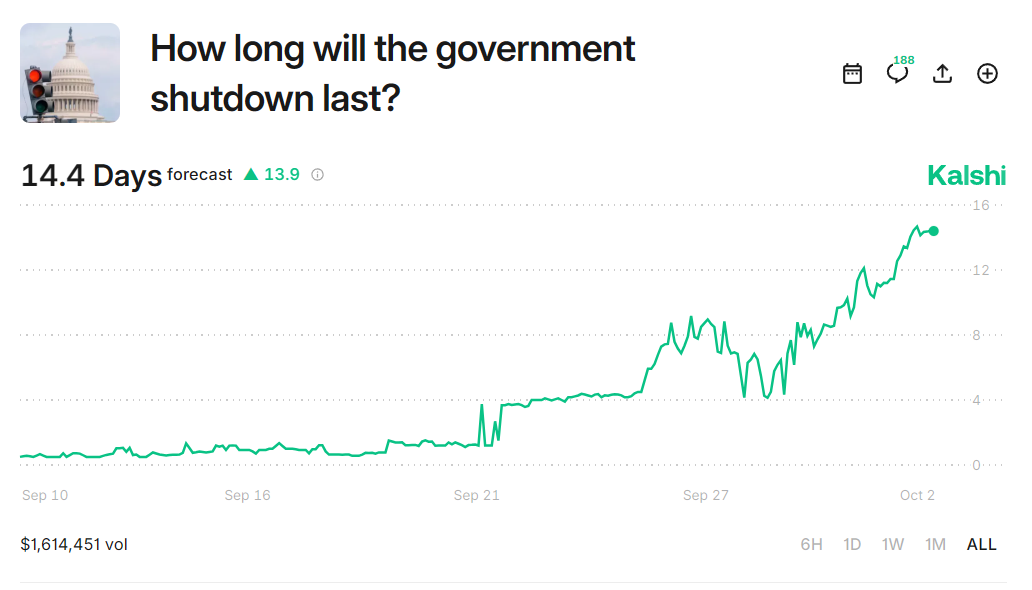

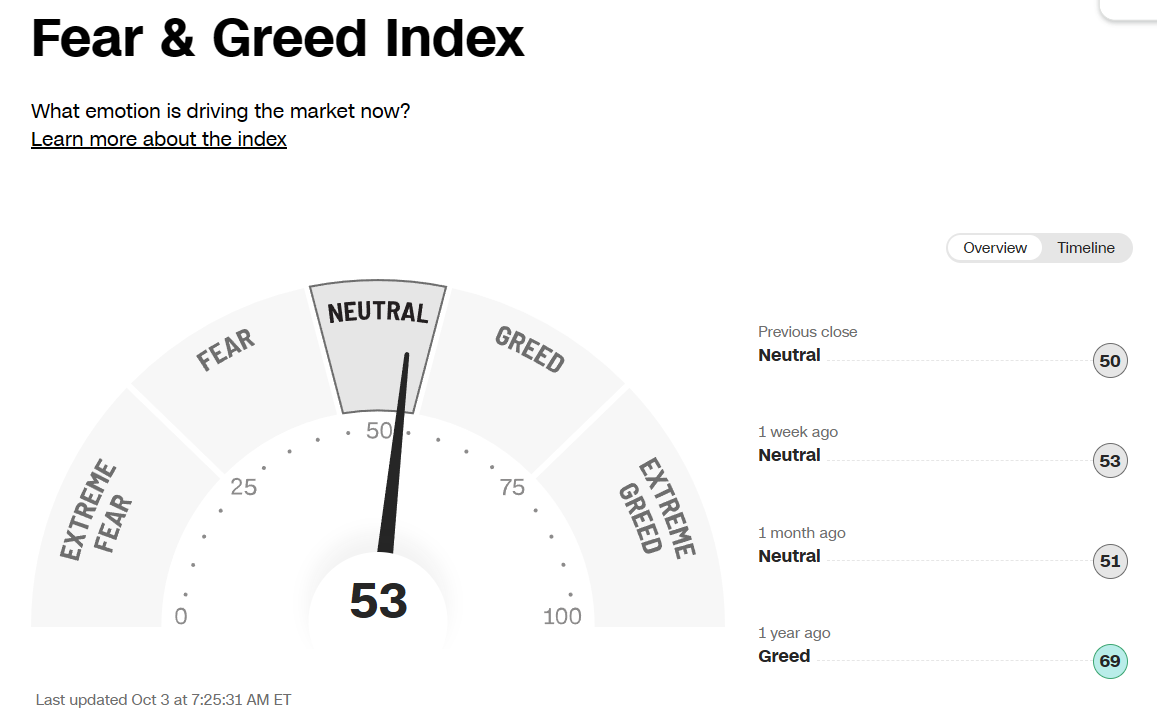

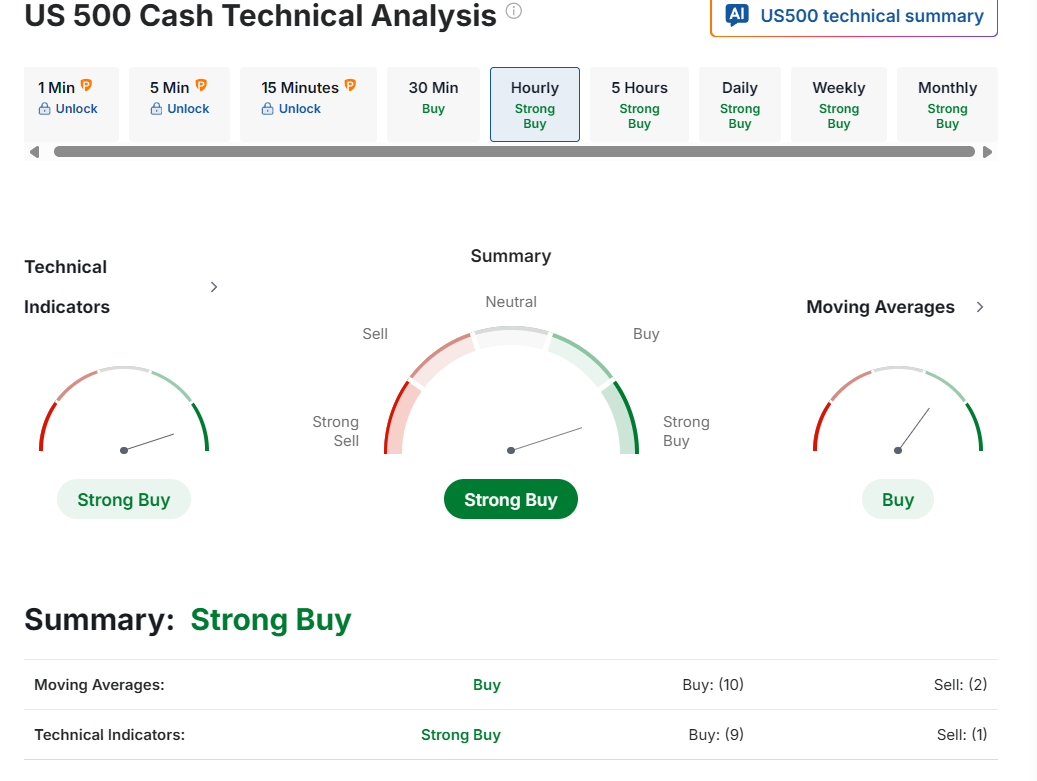

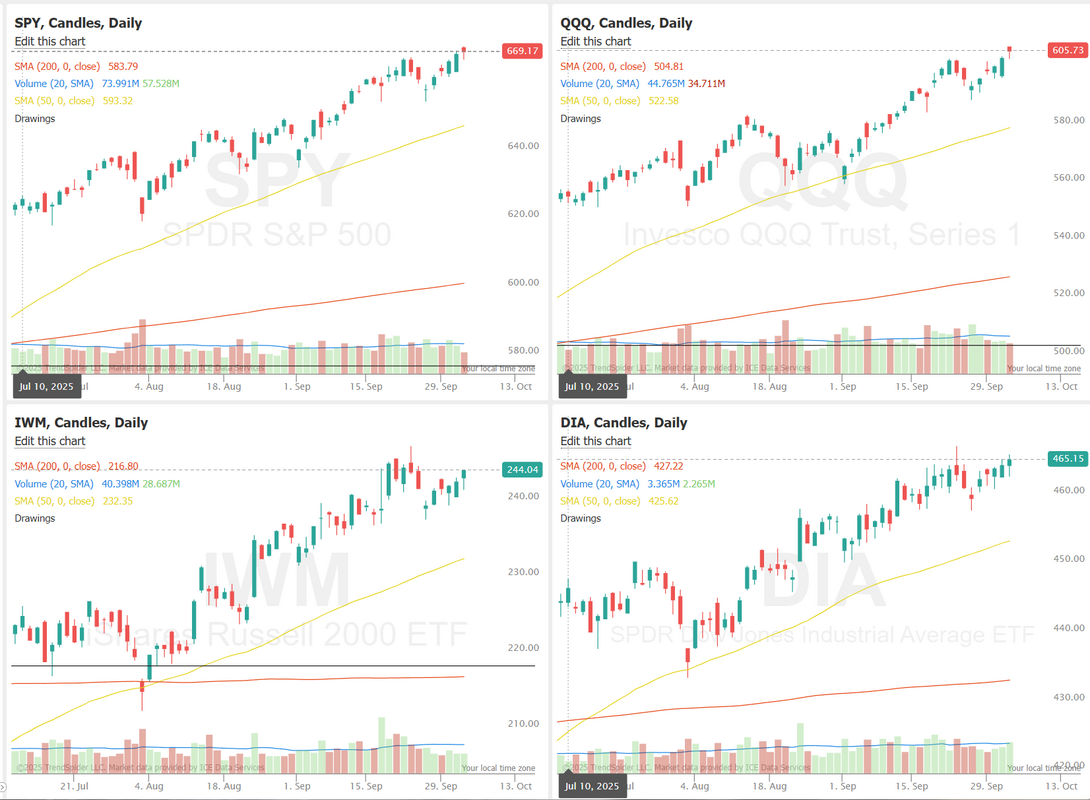

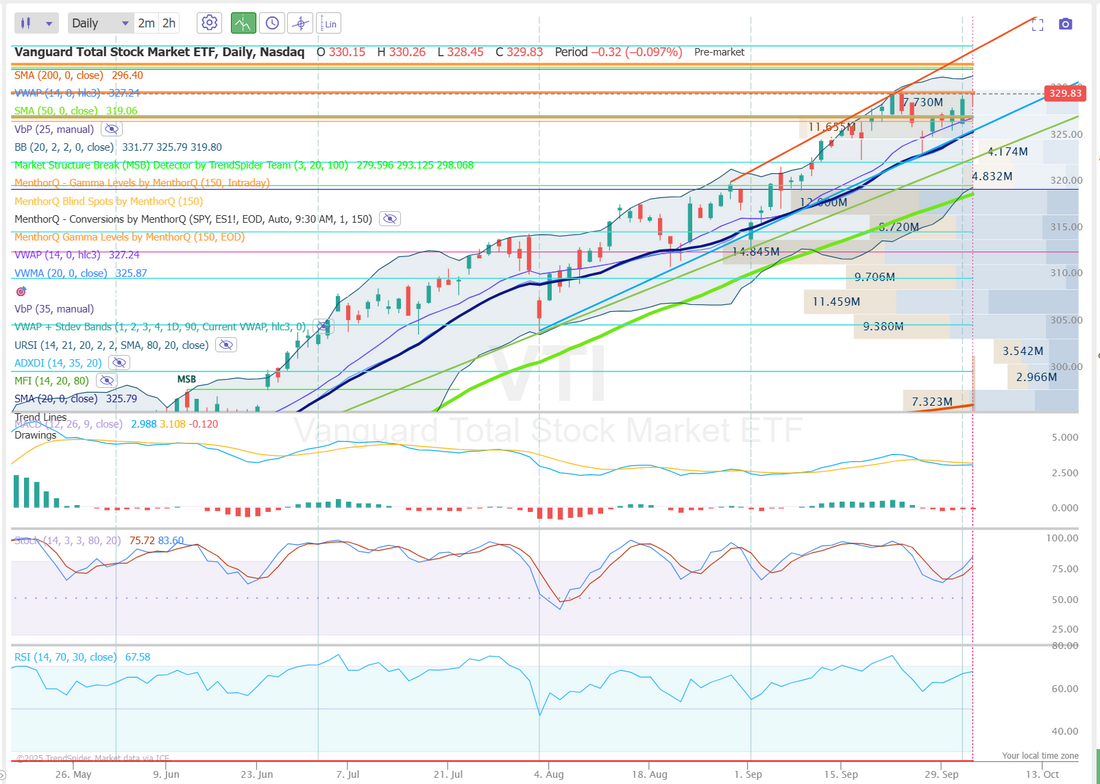

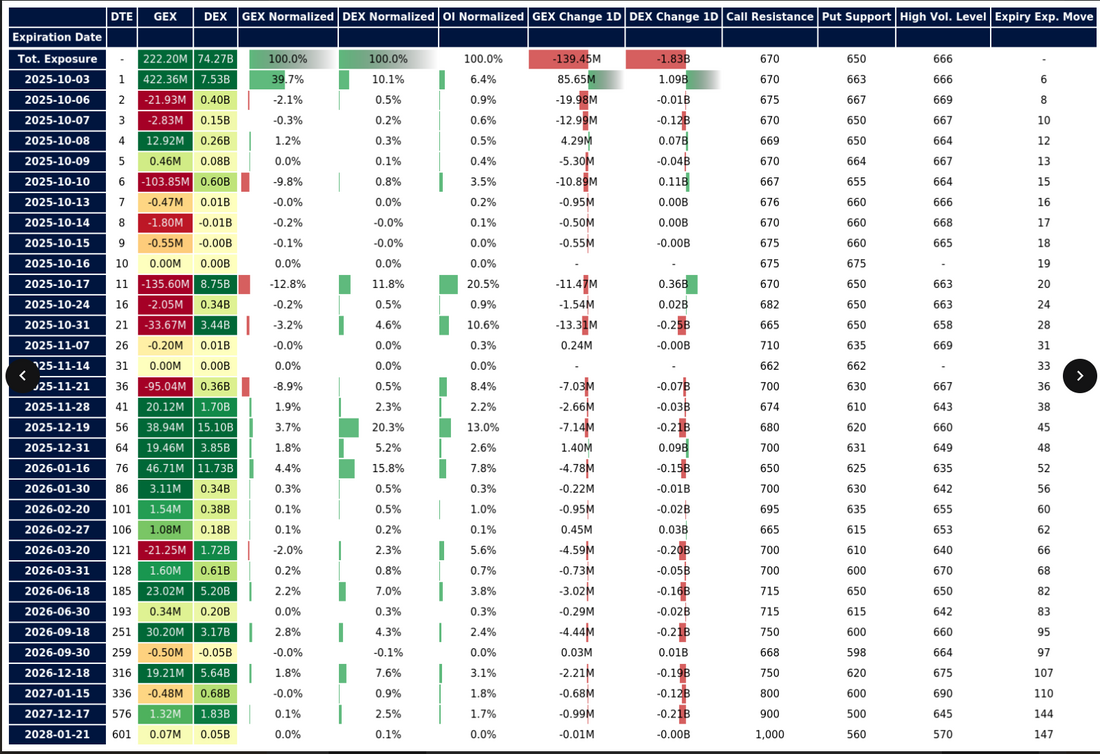

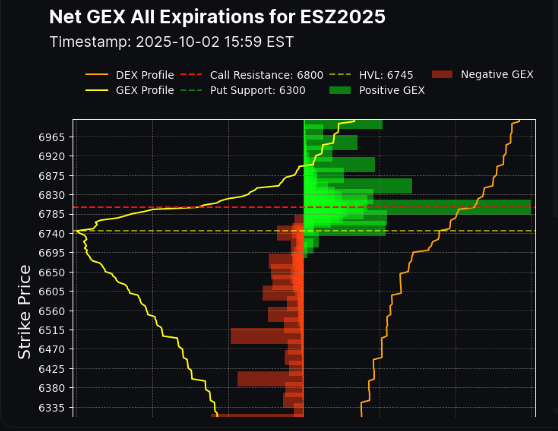

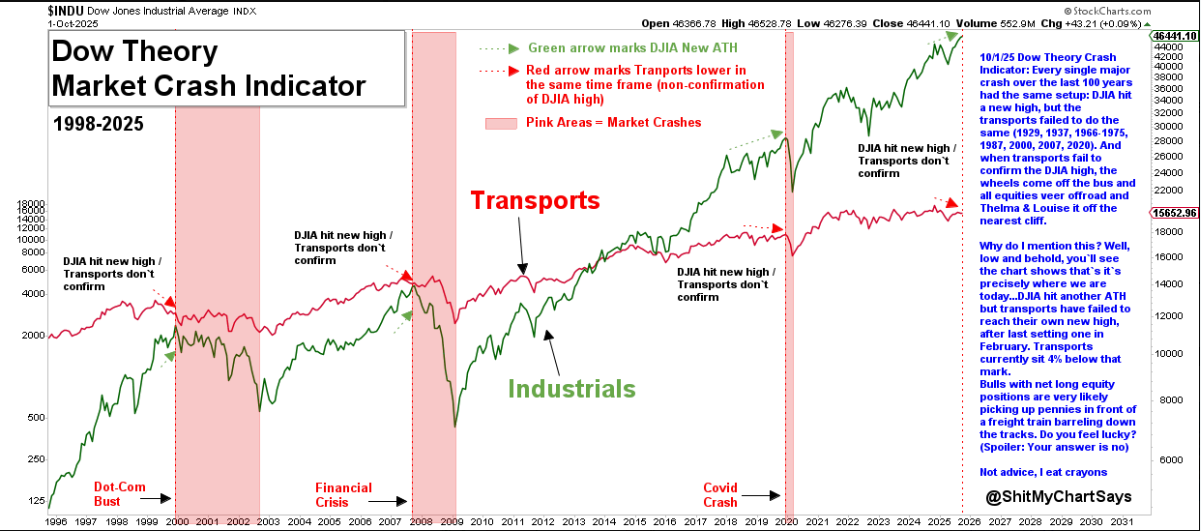

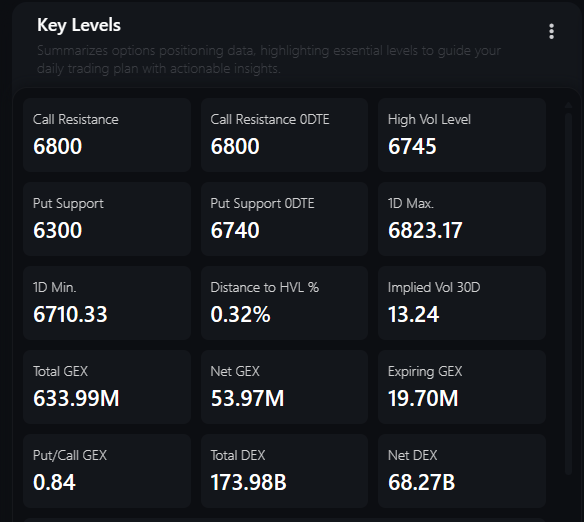

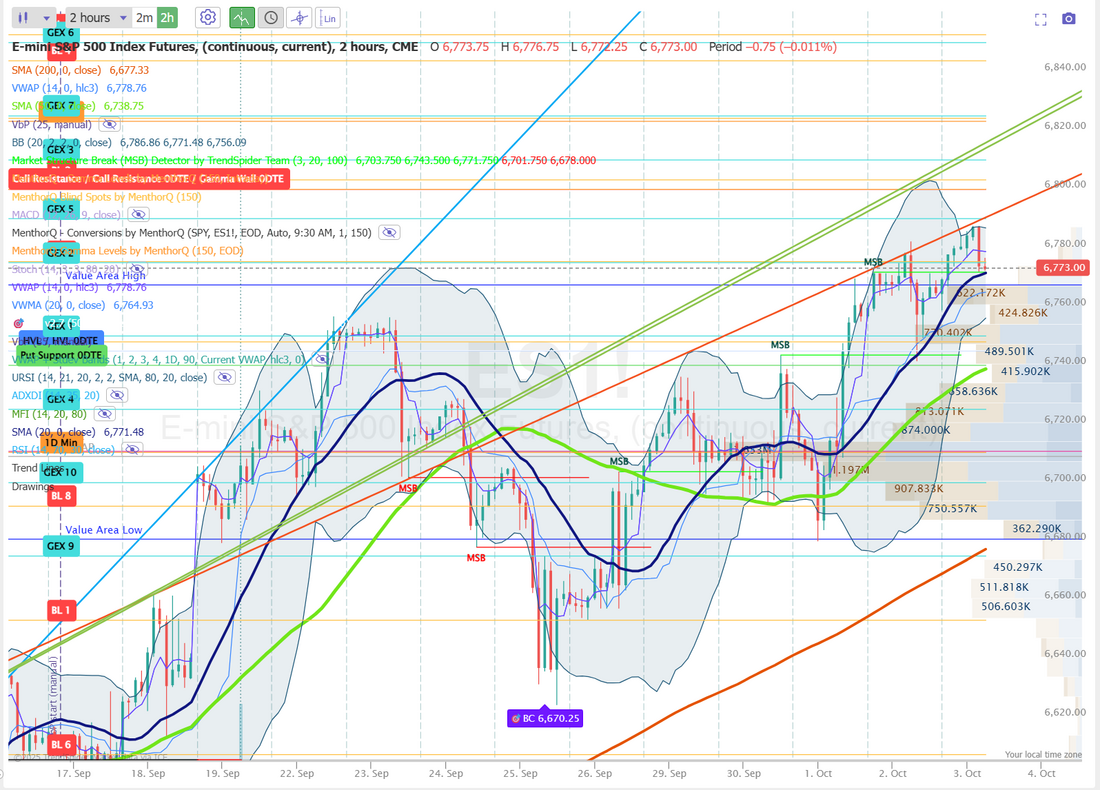

What is your longest win streak?This week we set a goal of consistency over profit. We are looking to make money EVERY SINGLE DAY, with no regard to the amount. It's been an interesting experiment. We are incorporating some training modules from the great Jessie Livermore each week as well. On next Mondays blog I'll post our metrics. What was the avg. buying power used. How much did we make. ROI, etc. We can then judge if our actions are worth while. Yesterday was another green day for us. Here's a look at the trades. With the Govt. still shut down we have no NFP data to trade off today. How long will the shut down last? There are some interesting stats coming our of Kalshi. The fear and greed index is basically asleep! Technicals are still firmly bullish Markets continue to sit perched up on their ATH's. Some would say, "Priced to perfection." If we look at the VTI (which is my favorite gauge when we say, what is the "market" doing?) It looks like we've got some big Gamma walls working above current prices as potential resistance areas. MACD is flat. RSI and Stoch are overstretched to the upside. I'm looking for some weakness soon. The SPX chart with seasonality scoring shows the index continuing its steady climb toward fresh highs, but the short-term seasonality score has been hovering near neutral after a recent dip into negative territory. This suggests that while the broader trend remains supportive, near-term conditions could be more mixed, with seasonality not providing a strong tailwind. Traders may want to stay alert for short bursts of volatility or potential consolidation before momentum reasserts itself. In the short term, monitoring whether the seasonality score can turn back positive could help confirm alignment with the ongoing price uptrend. The SPY option data highlights concentrated short-term exposure, with notable gamma build-ups around the October 3rd expiration, showing strong positive GEX levels that may act as stabilizers near current price zones. However, deeper into October, negative GEX spikes (e.g., October 17th and November 21st) suggest areas where dealer positioning could amplify volatility rather than dampen it. Key resistance levels appear clustered near 670–675, while put support aligns closer to 650, defining a near-term range. With several large expirations approaching, short-term flows may dictate price action, especially if open interest shifts accelerate around these strike zones. GEX levels are pretty strong at the 6800 level today. That will likely be where I start my trades for the day. December Nasdaq 100 E-Mini futures (NQZ25) are trending up +0.31% this morning as another round of major AI deals and partnerships boosted sentiment. Japan’s Hitachi formed a partnership with OpenAI on energy and related infrastructure. Also, Fujitsu expanded its collaboration with Nvidia. In addition, Bloomberg reported that Global Infrastructure Partners was in advanced talks to acquire Aligned Data Centers, targeting a major beneficiary of the AI spending boom. Investors are welcoming a wave of AI alliances, betting that the billions flowing into the sector will turn into profits. Optimism surrounding AI is outweighing concerns about the U.S. government shutdown, which has entered its third day. U.S. Treasury Secretary Scott Bessent cautioned on Thursday that the shutdown could be “a hit to growth.” In yesterday’s trading session, Wall Street’s major indices ended in the green, with the S&P 500 and Nasdaq 100 notching new record highs. Fair Isaac (FICO) jumped over +17% and was the top percentage gainer on the S&P 500 after introducing new pricing models that will enable credit report providers to directly access FICO scores. Also, chip stocks advanced on AI optimism after South Korea’s Samsung Electronics and SK Hynix partnered with OpenAI, with Intel (INTC) and Advanced Micro Devices (AMD) rising more than +3%. In addition, Celanese (CE) climbed about +7% after Citi upgraded the stock to Buy from Neutral with a price target of $53. On the bearish side, Occidental Petroleum (OXY) slid more than -7% and was among the top percentage losers on the S&P 500 after agreeing to sell its chemical division, OxyChem, for $9.7 billion to Berkshire Hathaway. Data from the outplacement firm Challenger, Gray & Christmas released on Thursday showed that companies announced plans to add 117,313 jobs last month, down 71% from a year earlier and marking the weakest September for hiring intentions since 2011. Separate data from Revelio Labs showed that employment rose by about 60,000 in September, marking an improvement from the previous month. Chicago Fed President Austan Goolsbee said on Thursday that new data from his staff indicates the labor market remains stable. “I think it indicates some steadiness in the labor market, and I think the underlying economy is still growing pretty solidly,” Goolsbee said. He reiterated that rates could be lowered “a fair amount” if policymakers gain confidence that inflation is moving back toward the Fed’s 2% target. Also, Dallas Fed President Lorie Logan said she will approach further rate cuts with caution as inflation risks continue to outweigh the threat of higher unemployment. “My forecast has a little bit slower of a normalization of the policy path in order to make sure we get all the way to 2%. So it will take some time,” Logan said. Meanwhile, U.S. rate futures have priced in a 97.8% chance of a 25 basis point rate cut at October’s monetary policy meeting. On the trade front, Treasury Secretary Scott Bessent predicted a “pretty big breakthrough” in the next round of trade talks with China. In light of the government shutdown, the publication of September’s nonfarm payrolls report, average hourly earnings, and unemployment rate, originally set for today, will likely be delayed. Still, the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will be released today. Economists expect the September ISM services index to be 51.8 and the S&P Global services PMI to be 53.9, compared to the previous values of 52.0 and 54.5, respectively. In addition, market participants will parse comments today from New York Fed President John Williams, Chicago Fed President Austan Goolsbee, Dallas Fed President Lorie Logan, Fed Vice Chair Philip Jefferson, and Fed Governor Stephen Miran. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.092%, up +0.10%. Dow Theory Crash Indicator: Every single major crash over the last 100 years had the same setup: DJIA hit a new high, but the transports failed to do the same (1929, 1937, 1966-1975, 1987, 2000, 2007, 2020). And when transports fail to confirm the DJIA high, the wheels come off the bus and all equities veer offroad and Thelma & Louise it off the nearest cliff. Why do I mention this? Well, low and behold, you`ll see the chart shows that`s it`s precisely where we are today...DJIA hit another ATH but transports have failed to reach their own new high, after last setting one in February. Transports currently sit 4% below that mark. Bulls with net long equity positions are very likely picking up pennies in front of a freight train barreling down the tracks. Do you feel lucky? One other interesting stat. Since the inception of the VIX there has never been 5 consecutive days where the VIX rose along with $SPX. Today was the 4th. I.V. rising as markets rise is one of the strangest things happening in todays market. Our training line up for next week: Monday we'll focus on ETF's. What are they? How do they work? How can we trade them? How can you build a watchlist and search and sort through them all? Weds. and Thurs. We'll be continuing our review of Jessie Livermore and his key take aways for trading. Please tune in at 2:00 P.M. EDT on those days. My lean or bias today is more neutral. We've got a lot of positive Gamma which could keep us contained. I'm looking to start the day with an Iron fly, if that's the case. Let's take a look at our intra-day levels on /ES: 6775, 6790, 6799, 6803 are resistance zones. 6767, 6749, 6744, 6740, 6710 are support zones. There is heavy resistance at 6803 and heavy support at 6710. It's likely we trade between these levels today. NOTE: I'll be placing what I believe to be, a very high probability trade on when the Govt. shutdown will end today. It carry's a 15% potential ROI. I'll place the trade in the 1HTE channel for you all to look at. See what you think. See you all in the live trading room shortly! Let's make it a great day and have a great weekend!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |