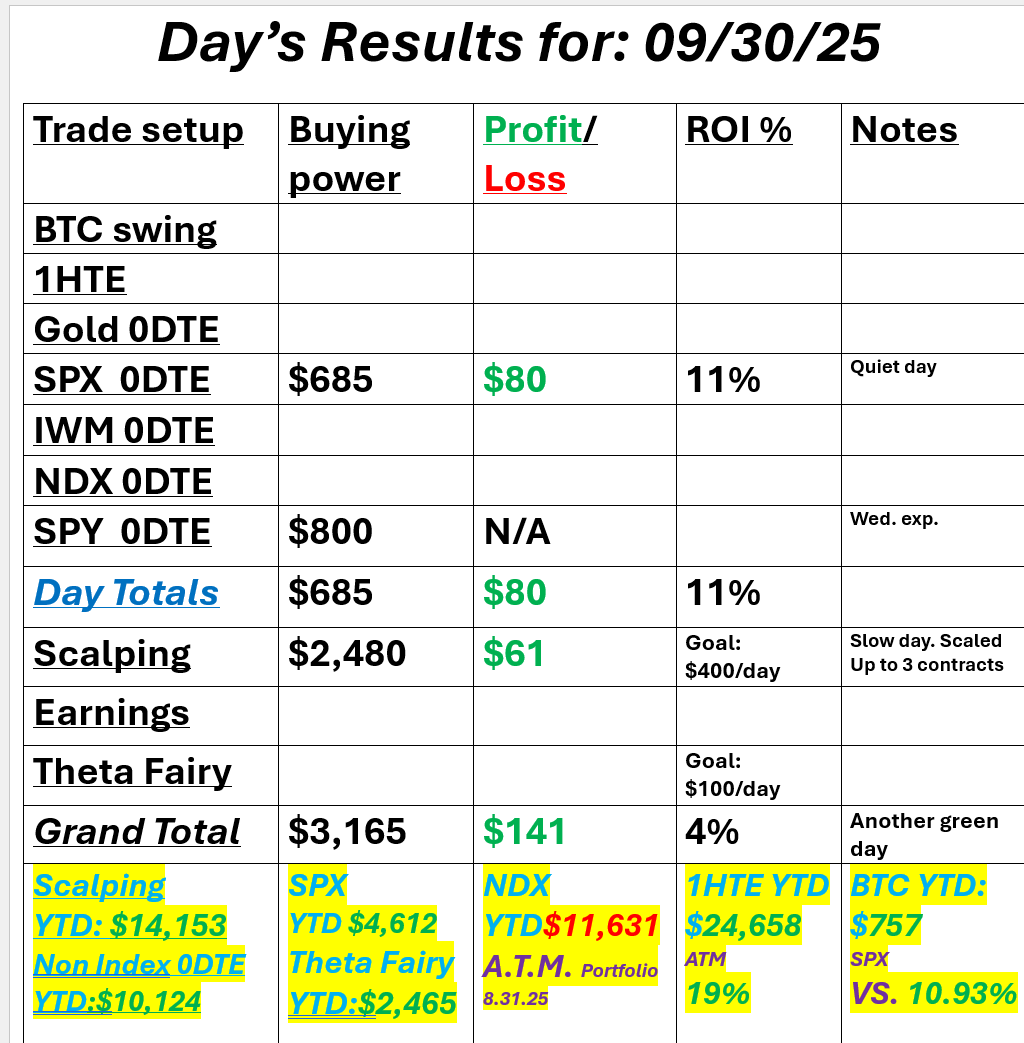

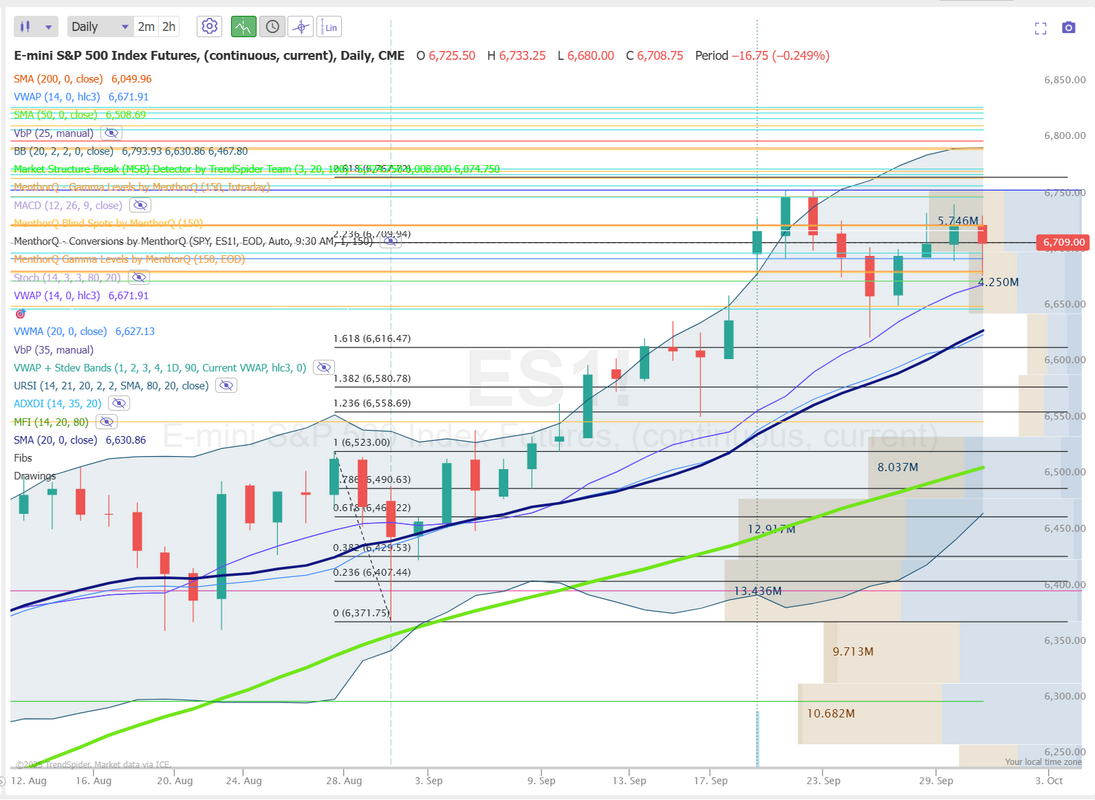

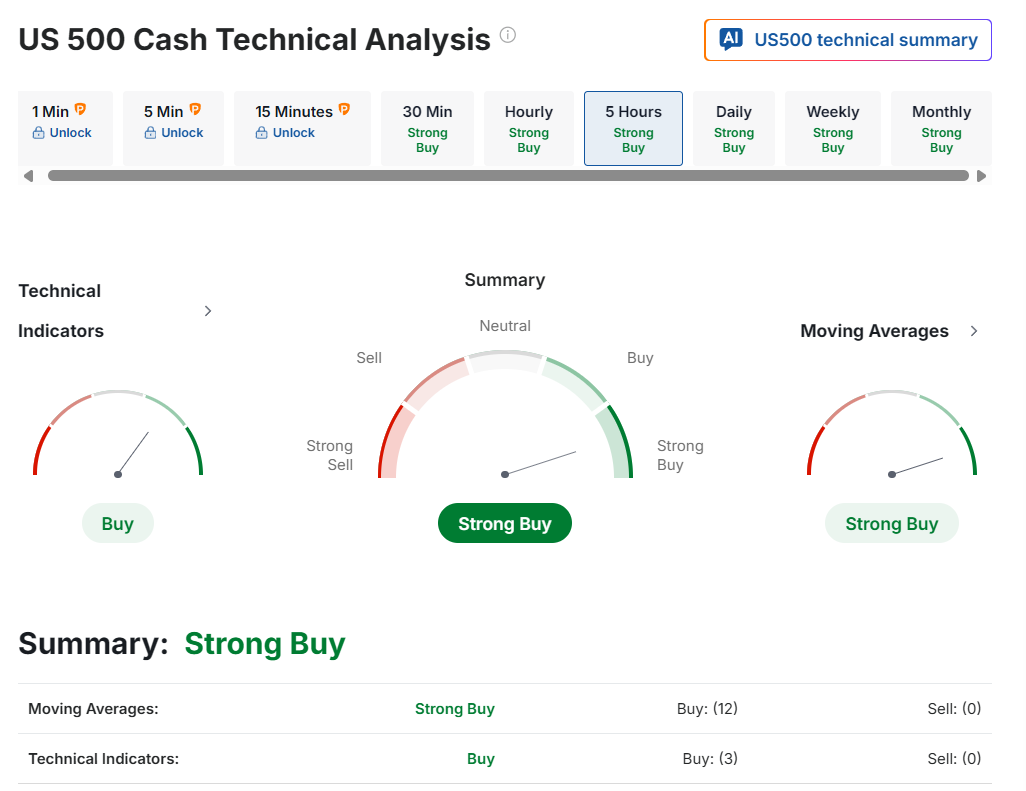

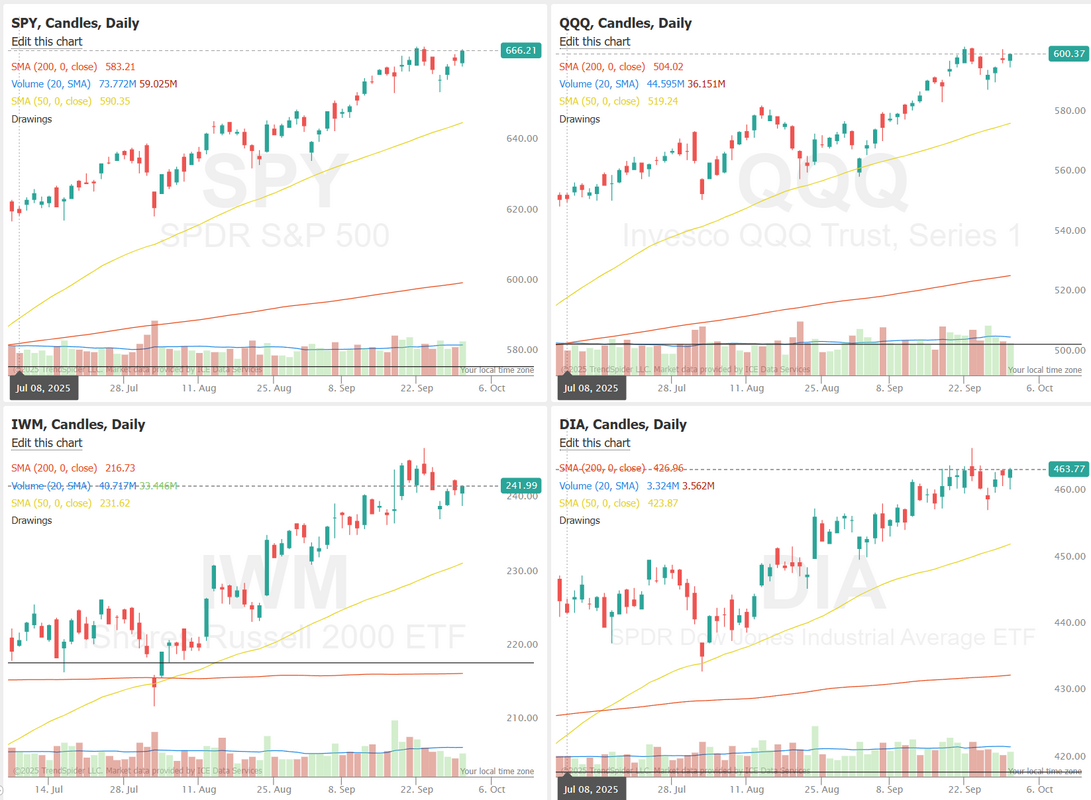

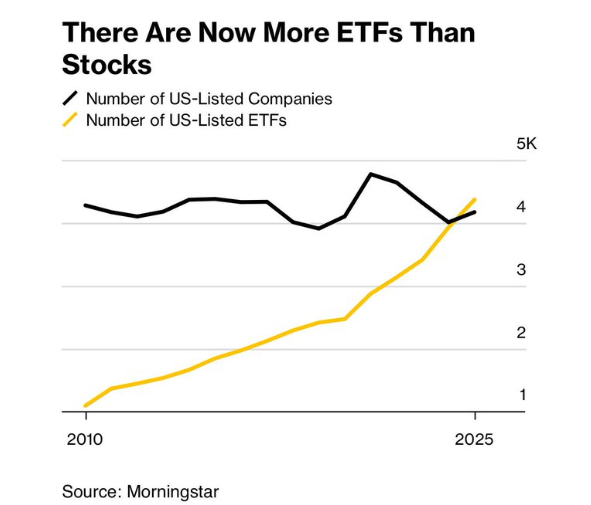

The shut down is herePredictive markets like Kalsi were right, once again. We got the predicted shutdown. Futures tanked initially and are working their way back, as I type. What does this mean? Is it another crack in this bull market that can get a true bearish trend going? Or is it a buy the dip opportunity? I must confess. I am not a "buy the dip" type trader. Every retrace. Every weakness. Every red day to me looks like the potential for a reversal. I don't worry too much about up trends but downtrends? Those are what I mostly focus on. This shutdown is an exception. We've looked at the historical shut down data here in this blog a few days ago. We know the numbers and probabilities. Generally speaking, any sell off related to Govt. shutdowns has been a wonderful buying opportunity. Will the market finish green today? Still way too early to tell but my bet is we shake this off. That being said...I'd still prefer a selloff! LOL. Yesterday was a very slow day. We are hyper focused this week on consistency vs. dollar profit and one of our main mantras, "Don't let green turn to red" We didn't get much working yesterday but we were able to stay green on everything. That's our goal this week... Profits every day. Here's a look at our day. We got ADP numbers that were a bit of a shock to the futures. PMI will come out shortly...then nothing. No NFP this week until we get the Govt. open. Let's take a look at the market. Yesterday was somewhat flat. We continue to bounce around our ATH's. Buy mode is still holding on. The market needs "something". Something to fuel the bulls to greater ATH's or something to get the bears engaged again. We're just treading water here. December S&P 500 E-Mini futures (ESZ25) are trending down -0.56% this morning as sentiment took a hit after the U.S. government shut down for the first time in seven years. The U.S. government shut down after a midnight funding deadline as the White House and lawmakers failed to reach a spending deal. The shutdown is expected to pause some federal services and place hundreds of thousands of federal employees on furlough. The Congressional Budget Office estimates that roughly 750,000 employees will be furloughed, costing $400 million per day in lost compensation, which could curb spending and negatively impact the economy. Notably, key economic data will not be released during the shutdown, with Thursday’s weekly jobless claims and Friday’s payrolls report immediately at risk. However, ADP private payroll figures and the ISM manufacturing PMI are still scheduled for release later today. “Government shutdowns in the U.S. are rarely market-moving in and of themselves, but the timing matters. This one comes at a point where the Fed is data-dependent. The absence of clean data can increase volatility,” said Nina Stanojevic, investment specialist at St James’s Place. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Pfizer (PFE) climbed over +6% and was the top percentage gainer on the S&P 500 after CEO Albert Bourla said the company secured a three-year exemption from President Trump’s proposed tariffs on pharmaceuticals in a deal that would reduce some of its U.S. drug prices by up to 85%. Also, CoreWeave (CRWV) surged more than +11% after announcing a $14.2 billion AI cloud-computing deal with Meta Platforms. In addition, EchoStar (SATS) rose over +3% after Bloomberg reported that Verizon was in talks with the company about purchasing some of its wireless spectrum. On the bearish side, Albemarle (ALB) slumped more than -6% and was the top percentage loser on the S&P 500 following news that China approved the restart of the CATL mine, which had been halted since August. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings rose to 7.227 million in August, stronger than expectations of 7.190 million. Also, the U.S. July S&P/CS HPI Composite - 20 n.s.a. eased to +1.8% y/y from +2.2% y/y in June (revised from +2.1% y/y), stronger than expectations of +1.7% y/y. At the same time, the U.S. Conference Board’s consumer confidence index fell to a 5-month low of 94.2 in September, weaker than expectations of 96.0. In addition, the U.S. Chicago PMI unexpectedly fell to 40.6 in September, weaker than expectations of 43.4. Fed Vice Chair Philip Jefferson on Tuesday cautioned that the central bank is confronting a weakening labor market at the same time as inflation pressures rise, complicating the monetary policy outlook. Still, he said, “The unemployment rate could edge a bit higher this year before moving back down next year,” adding that he expects “the disinflation process to resume after this year and inflation to return to the 2% target in the coming years.” Also, Boston Fed President Susan Collins said additional rate cuts could be appropriate this year, given a weaker labor market, but emphasized that officials must remain vigilant against the risk of persistent inflation. “It may be appropriate to ease the policy rate a bit further this year, but the data will have to show that,” Collins said. In addition, Dallas Fed President Lorie Logan said officials should exercise caution in considering further rate cuts while inflation remains above target and the labor market remains relatively balanced. Meanwhile, U.S. rate futures have priced in a 94.6% chance of a 25 basis point rate cut and a 5.4% chance of no rate change at the next FOMC meeting in October. Today, investors will focus on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. In light of the government shutdown, the report may serve as the only broad, nationwide measure of job growth until Bureau of Labor Statistics operations resume. Economists, on average, forecast that the September ADP Nonfarm Employment Change will stand at 52K, compared to the August figure of 54K. The U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI will also be closely monitored today. Economists expect the September ISM manufacturing index to be 49.0 and the S&P Global manufacturing PMI to be 52.0, compared to the previous values of 48.7 and 53.0, respectively. U.S. Construction Spending data will be reported today. Economists forecast the August figure at -0.1% m/m, the same as in July. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be 1.5 million, compared to last week’s value of -0.6 million. In addition, market participants will be anticipating speeches from Richmond Fed President Tom Barkin and Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.153%, up +0.12%. We had a good training session on Monday this week, and one component was breadth analysis with multiple time frames. That got a lot of good feedback, and I wanted to expand on that by adding the $TICK into the mix. We may have time today (dependent on whether we do a 0DTE or 1DTE entry) to review that further. If not, we'll do it on tomorrow's Zoom. Please make sure to tune in and ask questions. These sessions are beneficial for helping us all become better traders. The SPX chart shows spot prices trending near recent highs while the Volatility Risk Premium (VRP) has climbed to 5.4%, placing implied volatility in the “overvalued” zone with a 3-month percentile above 90%. This combination suggests that option premiums remain elevated relative to realized volatility, a sign of cautious positioning in the near term. In the short run, such stretched VRP readings often coincide with market hesitation, where either consolidation or sharper moves can occur as traders recalibrate risk. Monitoring whether the VRP sustains above 5% or begins to compress will be key for gauging the momentum behind this rally’s next step. There are now officially more ETF's than there are stocks! I want to go over some of the most interesting ETF's to put on your watch list in one of the next training sessions. Let's look at our intra-day levels on /ES. After the initial selloff, Futures are trying to push higher. 6715, 6720, 6726, 6737 are resistance zones. 6707, 6700, 6694, 6683 are support zones. I look forward to seeing you all shortly in our live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |