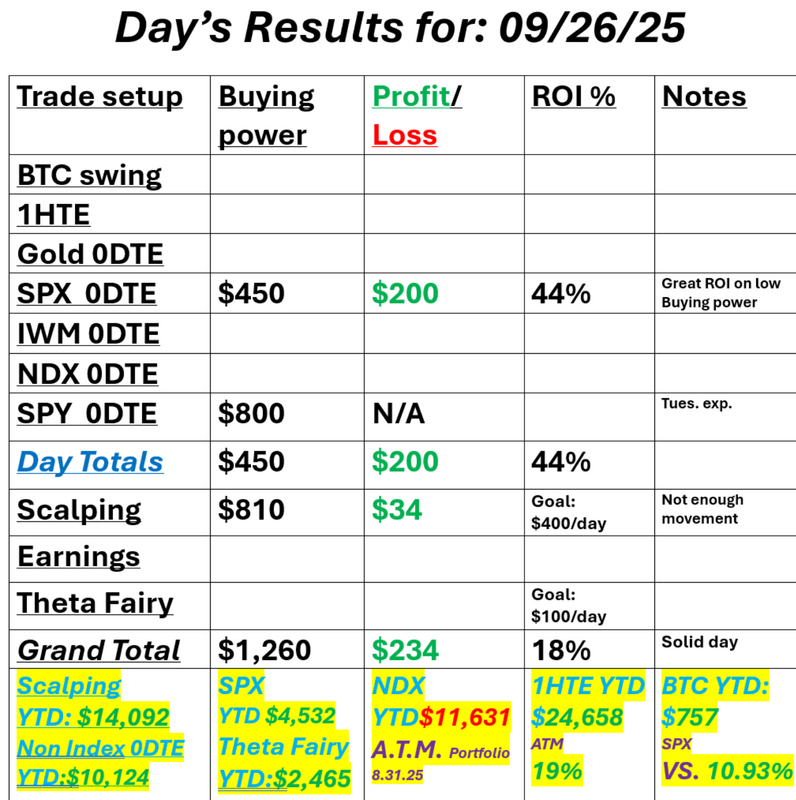

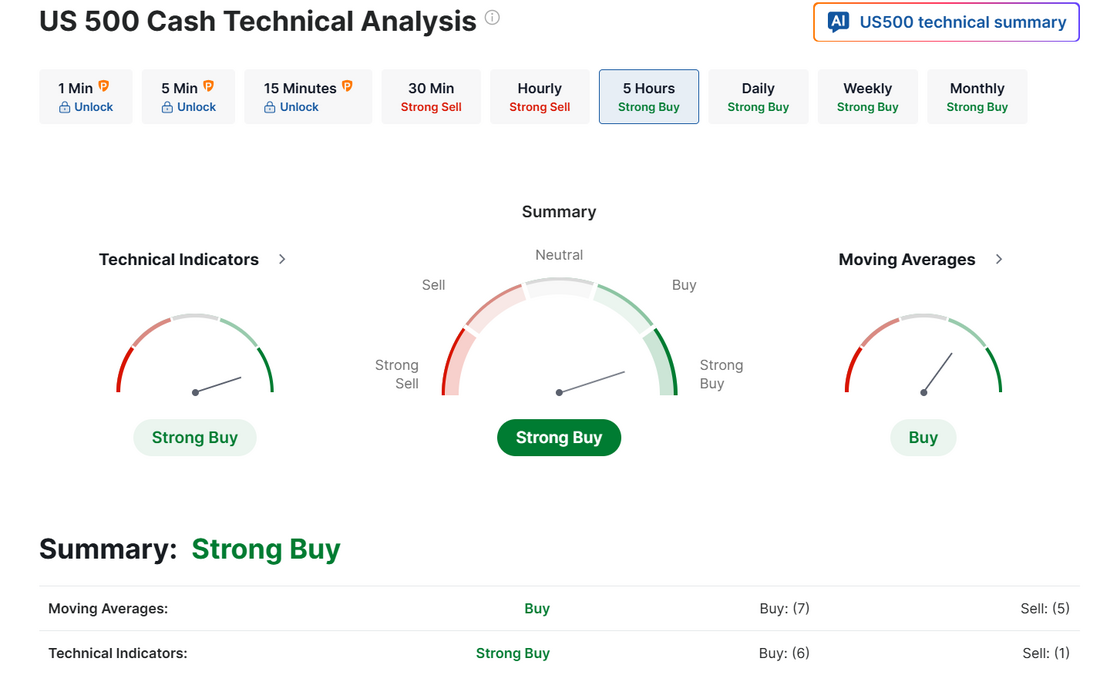

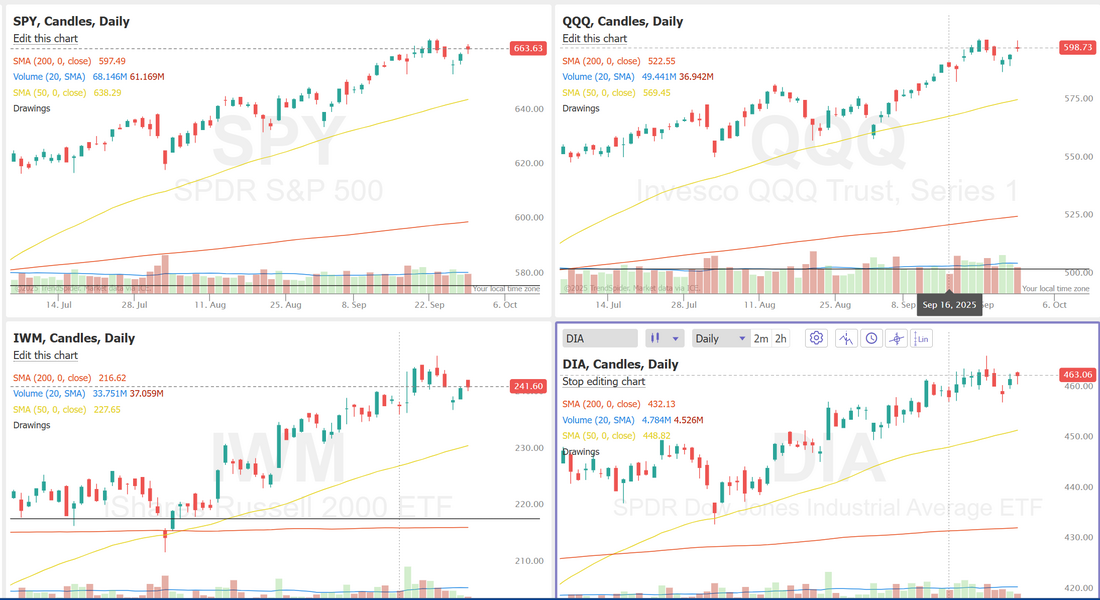

Consistency over profitWe had a good training session yesterday talking about the difference between shooting for big dollar profits vs. consistently being profitable. The quote we used was, "It's harder to make $50-$100 dollars a day, every day, for the rest of your life than making $10,000 dollars in a few hours." It's absolutely true. Once again this week, we are working on our consistency over profit amount. We had a good start yesterday were we deployed very little capital and still had a solid day. Here's a look at our results. Let's take a look at the markets. Buy mode still clinging on. Not much to take out of yesterdays session. It didn't really help the bull or bear case. December S&P 500 E-Mini futures (ESZ25) are down -0.23%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.14% this morning as investors grew anxious with the deadline to avert a U.S. government shutdown approaching. Democratic leaders and President Trump engaged in last-minute talks on Monday but failed to reach a deal to prevent a shutdown. U.S. lawmakers have until midnight to pass a federal spending bill. Vice President JD Vance said he thinks the U.S. government is headed toward a shutdown. Many federal operations will pause, and nonessential employees will be furloughed or fired in the event of a shutdown. Notably, Friday’s payroll report will be postponed if the Department of Labor follows an operational contingency plan outlined earlier this year. Later today, investors will focus on the latest reading on U.S. job openings and comments from Federal Reserve officials. In yesterday’s trading session, Wall Street’s main stock indexes closed higher. Chip stocks advanced, with GlobalFoundries (GFS) and Micron Technology (MU) rising over +4%. Also, Applovin (APP) climbed more than +6% and was the top percentage gainer on the Nasdaq 100 after Phillip Securities initiated coverage of the stock with an Accumulate rating and $725 price target. In addition, Merus N.V. (MRUS) jumped nearly +36% after Genmab agreed to acquire the company for about $8 billion in cash. On the bearish side, Carnival (CCL) slid about -4% even as the company posted better-than-expected FQ3 results and raised its full-year adjusted EPS guidance. Economic data released on Monday showed that U.S. pending home sales climbed +4.0% m/m in August, stronger than expectations of +0.2% m/m and the biggest increase in 5 months. Cleveland Fed President Beth Hammack told CNBC’s Squawk Box Europe on Monday that the U.S. central bank must keep a restrictive monetary policy stance to bring inflation down to its 2% target. “My forecast is that we’re going to remain above target for probably the next one to two years, and not really getting back down to our objective of 2% until the end of 2027 or early 2028,” Hammack said. At the same time, St. Louis Fed President Alberto Musalem said he is open to additional interest rate cuts, but emphasized that policymakers should proceed carefully, with inflation still above the central bank’s target. In addition, New York Fed President John Williams said that inflation risks have diminished, while employment risks have increased. However, he did not indicate whether he might support another rate cut in October. Meanwhile, U.S. rate futures have priced in a 90.3% probability of a 25 basis point rate cut and a 9.7% chance of no rate change at the next central bank meeting in October. In tariff news, President Trump signed a proclamation on Monday to impose 10% tariffs on imported timber and lumber and 25% tariffs on upholstered wooden furniture products and kitchen cabinets, effective October 14th. Tariffs on furniture products will increase to 30% at the beginning of 2026, and tariffs on cabinets will rise to 50%, according to an executive order. Today, all eyes are on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the August JOLTs Job Openings will arrive at 7.190 million, compared to the July figure of 7.181 million. Investors will also focus on the U.S. Conference Board’s Consumer Confidence Index, which came in at 97.4 in August. Economists expect the September figure to be 96.0. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today. Economists expect the July figure to ease to +1.7% y/y from +2.1% y/y in June. The U.S. Chicago PMI will be released today as well. Economists forecast the September figure at 43.4, compared to the previous value of 41.5. In addition, market participants will hear perspectives from Fed Vice Chair Philip Jefferson, Boston Fed President Susan Collins, Chicago Fed President Austan Goolsbee, and Dallas Fed President Lorie Logan throughout the day. On the earnings front, shoemaker Nike (NKE) and payroll processing firm Paychex (PAYX) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.130%, down -0.27%. My lean or bias today is slightly bearish. There's no real technical signal that's bearish but we do have the Government shutdown potential hanging over the market. If we do get a bullish day I think it will be somewhat subdued. The SPX chart shows prices holding near recent highs after a steady climb, but the option score has been fluctuating sharply, dipping into low territory multiple times through September. This suggests that while spot prices remain resilient, options positioning indicates uncertainty and shifting sentiment in the short term. Traders may want to keep an eye on whether the option score stabilizes above mid-levels, which would support continued momentum, or if repeated drops signal a potential short-term pullback. The near-term action looks poised for choppiness as positioning catches up with price levels. Let's take a look at the intra-day levels. They haven't changed too much from yesterday's levels. 6710, 6713, 6725, 6738 are resistance zones with 6699, 6694, 6682, 6675 working as support. Let's see if we can bring our winning streak to two days in a row! See you all shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |