|

Back to another Friday! Crazy how fast this week has gone for me. Let's all get out of the house this weekend and do something! We had a solid day yesterday, once again. I was on the wrong side of two big scalps which hurt me there but we are up $1,100 this morning so that should get us a better result to finish off the month. We couldn't quite make it a full month without a losing day. Close! Oh so close. Here's our results below: We've brought in almost $30,000 of profit this month including the 1HTE's. Its been a great start to the year. Let's take a look at the market and what's moving it. The Dow is certainly pushing on its ATH's but the rest of the indices are still stuck. We were finally able to get some weekly setups back on our oil faithful SPY/QQQ/IWM. Hopefully next week we'll be able to continue those. The news that moved us, first down, then up late yesterday and apparently into this morning was the word "tariff". They look like they are coming. Maybe Saturday at the earliest. Is it a bluff? A bargining tool? We'll know when the markets open next Monday. PCE is out this morning and that could shake things up as well. March S&P 500 E-Mini futures (ESH25) are up +0.46%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.73% this morning as solid earnings from Apple and Intel buoyed sentiment, while investors geared up for the release of the Federal Reserve’s first-line inflation gauge. Apple (AAPL) rose over +3% in pre-market trading after the iPhone maker reported upbeat FQ1 results and offered reassuring FQ2 revenue guidance. Also, Intel (INTC) gained more than +2% in pre-market trading after reporting better-than-expected Q4 revenue. Investors are also preparing for President Donald Trump’s tariff announcement this weekend. Trump stated that he would enact his threat to impose 25% tariffs on imports from Canada and Mexico on February 1st, citing the flow of fentanyl and substantial trade deficits as key reasons for his decision. He also threatened China with tariffs but did not specify a level. In yesterday’s trading session, Wall Street’s major indices ended in the green. International Business Machines (IBM) surged nearly +13% and was the top percentage gainer on the Dow after the IT giant posted upbeat Q4 results and provided strong FY25 revenue growth guidance. Also, Lam Research (LRCX) climbed more than +7% and was the top percentage gainer on the Nasdaq 100 after the semiconductor equipment firm reported better-than-expected FQ2 results and offered an upbeat FQ3 forecast. In addition, Tesla (TSLA) advanced over +2% after the EV maker revealed plans to start robotaxi operations and projected a “return to growth in 2025.” On the bearish side, United Parcel Service (UPS) tumbled more than -14% and was the top percentage loser on the S&P 500 after the shipping giant issued below-consensus FY25 revenue guidance. Also, Microsoft (MSFT) slumped over -6% and was the top percentage loser on the Dow after the tech giant reported weaker-than-expected FQ2 Intelligent Cloud revenue and said its cloud-computing business will continue to grow slowly in FQ3. The U.S. Bureau of Economic Analysis, in its initial estimate of Q4 GDP growth, said on Thursday that the economy grew at a +2.3% annualized rate, weaker than expectations of +2.7%. Also, U.S. December pending home sales plunged -5.5% m/m, weaker than expectations of no change and marking the biggest drop in 5 months. At the same time, the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -16K to 207K, compared with the 224K consensus. “Overall, the economy is on firm footing heading into 2025, which should support risk assets given the strong linkage between economic growth and corporate profits,” said Josh Jamner at ClearBridge Investments. Meanwhile, U.S. rate futures have priced in an 84.0% chance of no rate change and a 16.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. On the earnings front, notable companies like Exxon Mobil (XOM), AbbVie (ABBV), Chevron (CVX), Colgate-Palmolive (CL), and Charter Communications (CHTR) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.8% y/y in December, compared to the previous figures of +0.1% m/m and +2.8% y/y. Investors will also focus on the U.S. Employment Cost Index, which came in at +0.8% q/q in the third quarter. Economists expect the fourth-quarter figure to be +0.9% q/q. U.S. Personal Spending and Personal Income data will be closely monitored today. Economists anticipate December Personal Spending to be +0.5% m/m and Personal Income to be +0.4% m/m, compared to November’s figures of +0.4% m/m and +0.3% m/m, respectively. The U.S. Chicago PMI will be released today as well. Economists estimate this figure to arrive at 40.3 in January, compared to the previous value of 36.9. In addition, market participants will be looking toward a speech from Fed Governor Michelle Bowman. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.534%, up +0.49%. The trade docket is busy today. Our take profit already hit for last nights Theta fairy. So nice to start the day off with $100 dollars in our pocket. We'll keep scalping with what we setup yesterday and this morning. There's another $1,000 additional potential there. AAPL, ABBV, ALTR, ASUR, CAVA, CRNX, GCBC, GE, IWM , LENZ, SPY/QQQ, QTTB, SUM, TEAM, TSLA, V, VALU, XOM, 1HTE, 0DTE's with SPX, NDX and possibly NVDA and MSTR. Let's take a look at our intra-day key levels. /ES: Levels continue to slid up. Resistance is now at 6152 with support at 6077 /NQ: Levels are sliding up as well. 21,985 is now resistance with 21,583 acting as support. BTC: Bitcoin is a bit more nuanced. It's be volatile but seems to come back to its current chop zone going back almost a week. It's current level (as I type) is sitting right at PoC on the 2hr. chart so who knows? We may stick here all day. $106,412 is resistance with $107,486 above that. $103,877 is support. It's close. A break below that could be bearish.

0 Comments

Welcome to Thursday, or what we call "FOMC hang over day"! I have to start off todays blog with this...I don't hype up what we do or what we've built here. I'm not the guy screaming about get rich quick or guarantees of profits. I actually try to downplay the opportunity but my gosh!... We've had one heck of a great month and I do think it's at least partially attributed to our unique setups. Who else has our earnings results? We intented the Theta fairy. We pioneered 1HTE's on Bitcoin. Our approach and order entry to trading 0DTE's is something I haven't seen anyone else do. Our scalping program hasn't had a single losing day this month and is on track for over $120,000 APR. Our passive, asset allocation portfolio is up almost 9% this month. I want to knock on wood and hopefully I'm not ruining our stellar run but man...I'm just proud of what we've done here. Here's our results from yesterday: Let's take a look at the markets. Buy mode is trying to get a foot hold. Markets are still pinching. A big move could be incoming. The IWM finally seems to be stabilizing. That means we'll be back on our IWM millionaire maker trade today. March Nasdaq 100 E-Mini futures (NQH25) are trending up +0.54% this morning as investors digested earnings reports from big U.S. tech companies. Tesla (TSLA) gained over +2% in pre-market trading despite reporting weaker-than-expected Q4 results, as the EV maker revealed plans to begin robotaxi operations and projected a “return to growth in 2025.” Also, Meta Platforms (META) rose about +2% in pre-market trading after the social media and tech giant reported better-than-expected Q4 results and CEO Mark Zuckerberg said that 2025 would be a “really big year” for AI, though light Q1 revenue guidance capped gains. At the same time, Microsoft (MSFT) fell more than -3% in pre-market trading after the tech giant reported FQ2 Intelligent Cloud revenue that missed analyst expectations and said its cloud-computing business will continue to grow slowly in FQ3. Investors now look ahead to fresh U.S. economic data, including the first estimate of fourth-quarter GDP and jobless claims figures, along with a slew of corporate earnings reports, with a particular focus on results from “Magnificent Seven” member Apple. As widely expected, the Federal Reserve kept interest rates unchanged yesterday. The Federal Open Market Committee voted unanimously to maintain the federal funds rate in a range of 4.25%-4.50%, following a string of rate cuts last year. In a post-meeting statement, officials reiterated that inflation remains “somewhat elevated” but omitted a reference to its progress toward their 2% target. Later, Fed Chair Jerome Powell clarified that the reference to inflation was merely an effort to shorten the sentence, rather than convey any significant message. At a press conference, Powell stated that officials are in no hurry to lower interest rates, adding that the central bank is pausing to observe further progress on inflation. “With our policy stance significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance,” he said. In yesterday’s trading session, Wall Street’s major indexes closed lower. Packaging Corp. (PKG) fell over -9% and was the top percentage loser on the S&P 500 after the maker of cardboard boxes issued below-consensus Q1 EPS guidance. Also, Nvidia (NVDA) slid more than -4% and was the top percentage loser on the Dow and Nasdaq 100 after Bloomberg reported that Trump administration officials were exploring additional curbs on the company’s chip sales to China. In addition, Danaher (DHR) slumped over -9% after the life sciences firm posted weaker-than-expected Q4 adjusted EPS. On the bullish side, F5 Inc. (FFIV) climbed more than +11% and was the top percentage gainer on the S&P 500 after the company reported upbeat FQ1 results and provided a strong FQ2 revenue forecast. Economic data released on Wednesday showed that preliminary U.S. wholesale inventories fell -0.5% m/m in December, stronger than expectations of +0.2% m/m. Meanwhile, U.S. rate futures have priced in an 82.0% probability of no rate change and an 18.0% chance of a 25 basis point rate cut at the next central bank meeting in March. My bias or lean today is bullish. While futures are up this morning we do have jobless claims and GDP which could create some movement. We are also working into a tight consolidation zone so a breakout WILL be coming. What direction? That's a guess at this point. Trade docket is busy today: /MNQ scalping, Theta Fairy, IWM, SPY/QQQ, AAPL, V, ABBV, XOM, TEAM, /NG, IBM, LEVI, META, MSFT, 1HTE, 0DTE's, TSLA. Let's take a look at our intra-day levels: /ES: Zones have tightened after FOMC. 6126 is still resistance with support sliding up to 6035. /NQ: Likewise, ranges are tightening. 21,797 is still resistance with support moving up to 21,487. BTC: Bitcoin firmed up nicely yesterday afternoon. I'm looking at three key levels today. 105,638 is close and, I believe, a key demarcation level. Above is bullish. Below is bearish. Resistance above that level is pretty substantial at 107,103 with support moving up to 102,673. I look forward to seeing you all in the live trading room shortly!

Welcome back to FOMC day! We had another excellent day yesterday. It's been quite a month for us. I generally budget 10K of buying power for our scalping efforts and an additional 10K for our 1HTE's. We have more than doubled that money in the 1HTE's and are close to doubling it in scalping. That's $20,000 of income this month just with those two strategies. These are also strategies and setups you won't get anywhere else. It's also important to note, you don't need to day trade to have good potential. Our passive ATM portfolio is up almost 6% for the month. That's an annualized APR of 72%. Will we make 72% this year? Uh...probably not! Impressive none the less. Here's our overall results from yesterday. Today's blog is short and sweet. We have FOMC today. For those of you that are new to our trading room it's worthwhile to review how we approach it. We have a bunch of earnings trades today and hopefully at least one 1HTE. We also have a "Extrinsic rich" Theta fairy working this morning. Other than that, we sit on our hands for most of the day until the FOMC minutes drop. We usually get a bit of a flutter at that point but its Powells testimony one half hour later that usually gets things moving. CME futures and analysts are predicting no rate cut so eyes will be on future looking statements. About 20-35 min. into Powells testimony is when we look to get our 0DTE's started. This is also when our scalping with the QQQ's starts. Today is about patience and discipline and sitting on our hands. I do want to review our "game changer" calendar setups we are using with our scalping so if you can tune in to the zoom today, please do. I've got two live examples I put on last night to illustrate. Trade docket for today: MSFT, META, TSLA, IBM, WM, LEVI?, VFC, CAVA, 1HTE, 0DTE's, /ES (Theta fairy). No bias or lean today. No levels. We try to stay open minded and just trade what we see later today.

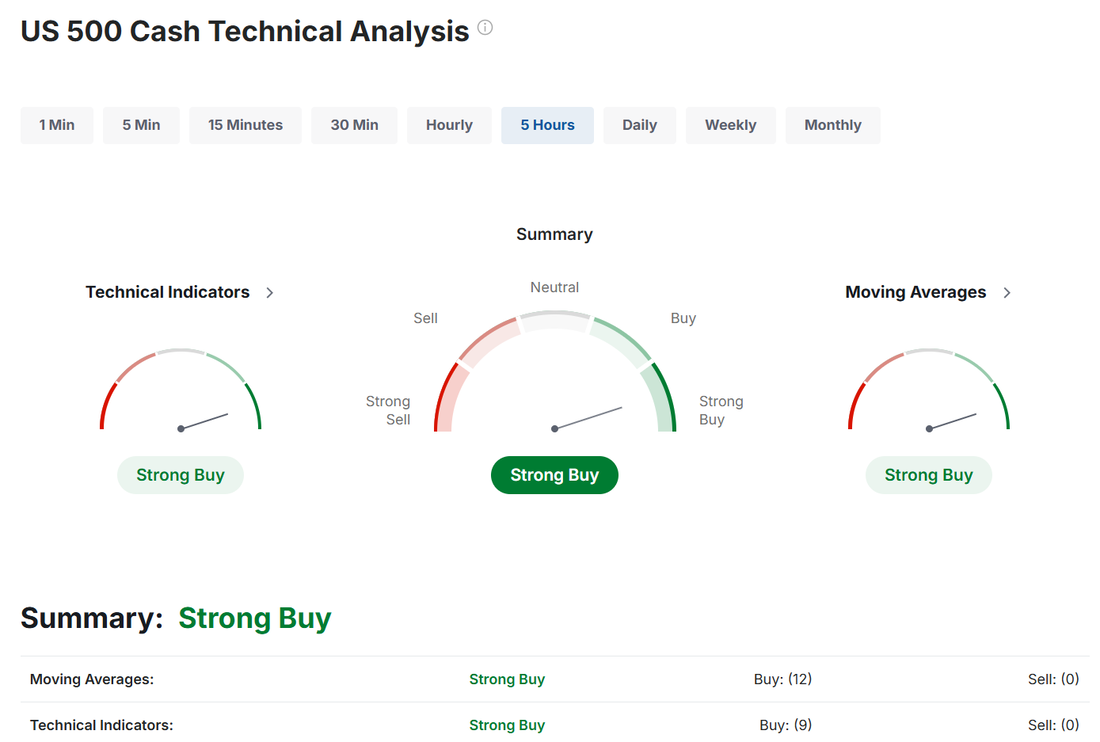

See you all in the trading room shortly! Welcome back traders! What an amazing day yesterday. It was an absolute home run. Now, to give us credit, we did corrrectly read the bearish flip on Friday and positioned ourselves coming into Monday with a bearish NDX setup. On the other hand, we clearly weren't expecting the kind of sell of we got. It was fantastic and we had a blowout success with all our trades. Scalping continues to kill it. We haven't had a single losing day all month and are right on pace for our $100,000 a year income goal. See our results below: Let's take a look at the markets: Neutral rating to start out the day but there's some very bullish price action that happened under the surface yesterday that I'll share down below. Intra-day the selloff might have seemed monumental but big picture? Meh... Nvidia's market cap fell $593 billion today, which was by far the largest single-day decline for any company in history. The loss in value was bigger than the market cap of 487 companies in the S&P 500. Remember folks...one stock does not make a market...in the long term. This is what is MOST interesting to me and why I'm very bullish right now. Believe it or not, market breadth actually improved today. 64% of S&P 500 stocks are now trading above their 200 Day moving average, the most since December 13 Trade docket today: /MNQ scalping continues. SBUX, ASML, DHR, MSCI earnings. 1HTE, 0DTE's, 10DTE NDX trade. JBLU, BA. March S&P 500 E-Mini futures (ESH25) are up +0.09%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.16% this morning, stabilizing after yesterday’s dramatic selloff, while investors awaited the start of the Federal Reserve’s two-day policy meeting as well as a flurry of U.S. economic data and corporate earnings reports. The dollar strengthened after U.S. President Donald Trump said he preferred significantly larger across-the-board tariffs than the 2.5% reportedly favored by new Treasury Secretary Scott Bessent. Trump also stated that he would soon impose tariffs on foreign-produced semiconductors, pharmaceuticals, and certain metals to encourage manufacturers to produce domestically. “I have it in my mind what it’s going to be but I won’t be setting it yet, but it’ll be enough to protect our country,” Trump told reporters Monday night. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed, with the benchmark S&P 500 sliding to a 1-week low and the tech-heavy Nasdaq 100 slumping to a 1-1/2 week low. Chip stocks tumbled after the emergence of Chinese startup DeepSeek sparked concerns about the potential demand for the most advanced chips and data centers, with Nvidia (NVDA) plunging nearly -17% to lead losers in the Dow and Broadcom (AVGO) sinking more than -17%. Also, nuclear power stocks, anticipated to benefit from rising demand driven by energy-intensive data centers for AI technology development, came under pressure, with Vistra Corp. (VST) plummeting over -28% to lead losers in the S&P 500 and Constellation Energy (CEG) dropping more than -20%. In addition, SoFi Technologies (SOFI) fell over -10% after the lender issued below-consensus full-year adjusted EBITDA guidance. On the bullish side, AT&T (T) climbed more than +6% after the company posted upbeat Q4 results. Economic data released on Monday showed that U.S. new home sales rose +3.6% m/m to 698K in December, stronger than expectations of 669K. “What was shaping up to be a big week in the markets got even bigger with the disruption in the AI space,” said Chris Larkin at E*Trade from Morgan Stanley. “That could make this week’s megacap tech earnings even more critical to market sentiment.” The Federal Reserve kicks off its two-day meeting later in the day. After cutting rates three times in late 2024, Fed officials are widely expected to keep them unchanged on Wednesday, given signs of a strong U.S. economy. Market watchers will likely focus on Fed Chair Jerome Powell’s post-policy meeting press conference for any additional clues about when interest rates might be lowered further. Fourth-quarter corporate earnings season is in full swing, with investors awaiting new reports from notable companies today, including General Motors (GM), Starbucks (SBUX), Lockheed Martin (LMT), Stryker (SYK), Royal Caribbean (RCL), and RTX Corp. (RTX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, all eyes are focused on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the January CB Consumer Confidence index will stand at 105.7, compared to last month’s figure of 104.7. Also, investors will focus on the U.S. S&P/CS HPI Composite - 20 n.s.a. Economists expect the November figure to be +4.2% y/y, unchanged from October. U.S. Durable Goods Orders and Core Durable Goods Orders data will be closely monitored today. Economists forecast December Durable Goods Orders at +0.3% m/m and Core Durable Goods Orders at +0.4% m/m, compared to the prior figures of -1.2% m/m and -0.2% m/m, respectively. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists estimate this figure to come in at -13 in January, compared to the previous value of -10. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.559%, up +0.68%. My bias or lean today: Bullish. We had a handful, and I mean just a handful (mostly A.I. stocks) that lead the market down. Bullish breadth was actually pretty good. We've got some bullish scalps setup for today which are already cash flowing for us. Let's take a look at intra-day levels: /ES: levels are going to be a bit wider today with the movement we've just had. Resistance is 6127 with support at 5996. /NQ: Once again, working with wide ranges. 21,780 as resistance with 21,018 acting as support. BTC: We'll have to see the price action today on Bitcoin. We've had a fantastic couple of days with our 1HTE's but today may be tougher. Resistance is still at 105,37 with support tightening up to 98,737. Another busy day in the trading room. I look forward to seeing you all there!

Welcome to Monday or should I say "profit day"? Let's talk about my mistake on Friday before we talk about our adjustment which should more than bail us out today. Our goal this year is risk management and consistency over profits. One thing we've learned with our three stage 0DTE entries is the longer you wait to add each stage the better it's worked out. I didn't wait long enough on our NDX on Friday. I had $700 at risk in stage one. That would have been a really nice profit if it hit (which it did) and not a big risk if it didn't but I got antsy and added the ratio too quickly. It wasn't needed. I needed to be more patient. We put on a bearish adjustment which should be more than enough to bring us right back into a nice profit this morning but...you can't depend on the /NQ being down 800 points every time you screw up. We'll take our profit at the open and count our blessings and try to do better today. We've already got our long scalps working and those are already profitable so there's no excuses if we don't have a banner day today. Here's my results from Friday. If we can open up with a $9,000 profit on our NDX adjustment that would get us going today. Keep on crashing market! Not surprising with the futures selling off this morning that our technicals are bearish. March S&P 500 E-Mini futures (ESH25) are down -2.43%, and March Nasdaq 100 E-Mini futures (NQH25) are down -3.78% this morning as worries mount that a cheaper artificial intelligence model from China could challenge the supremacy of U.S. technology. Chinese artificial intelligence lab DeepSeek’s latest chatbot threatened to disrupt U.S. firms’ dominance in AI, triggering a global selloff in the tech sector. DeepSeek announced that it developed AI models nearly on par with American rivals, despite using inferior chips and less data. This has raised questions about the lofty valuations of AI-related stocks and Silicon Valley’s business model, which relies heavily on extensive research and development spending. On Monday, DeepSeek’s AI Assistant surpassed ChatGPT to become the highest-rated free application on the U.S. Apple App Store. “While it remains to be seen if DeepSeek will prove to be a viable, cheaper alternative in the long term, initial worries are centered on whether U.S. tech giants’ pricing power is being threatened,” said Jun Rong Yeap, a market strategist at IG Asia. U.S. President Donald Trump’s weekend spat with Colombia further contributed to the bearish sentiment. Trump initially announced sweeping tariffs on the country but abruptly reversed course after reaching a deal on the return of deported migrants. Investors now look ahead to earnings reports from some of the biggest tech heavyweights, the Federal Reserve’s interest rate decision, as well as the release of the Fed’s favorite inflation gauge and other key economic data later in the week. In Friday’s trading session, Wall Street’s major equity averages ended lower. Texas Instruments (TXN) slumped over -7% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the analog chipmaker gave a lackluster Q1 forecast. Also, CF Industries Holdings (CF) slid more than -7% after JPMorgan Chase downgraded the stock to Underweight from Neutral with a price target of $75. In addition, CSX Corp. (CSX) fell over -2% after reporting weaker-than-expected Q4 revenue. On the bullish side, Meta Platforms (META) rose more than +1% after CEO Mark Zuckerberg said the company plans to invest up to $65 billion in AI projects in 2025. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index was revised downward to 71.1 in January, weaker than expectations of 73.3. At the same time, the U.S. January S&P Global manufacturing PMI rose to 50.1, stronger than expectations of 49.8 and the fastest pace of expansion in 7 months. Also, U.S. existing home sales rose +2.2% m/m to a 10-month high of 4.24M in December, stronger than expectations of 4.19M. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage this week. After cutting rates three times in late 2024, Fed officials are widely expected to keep them unchanged on Wednesday, given signs of a strong U.S. economy. Market watchers’ focus will center on any additional clues about whether and when interest rates might be lowered further. U.S. rate futures currently price in slightly less than two interest rate cuts this year, with the first expected no earlier than June. Fourth-quarter earnings season shifts into high gear, and investors await fresh reports from high-profile companies this week, including Apple (AAPL), Tesla (TSLA), Microsoft (MSFT), Meta Platforms (META), AT&T (T), T-Mobile US (TMUS), Starbucks (SBUX), ServiceNow (NOW), IBM (IBM), Intel (INTC), Lam Research (LRCX), Visa (V), Mastercard (MA), Caterpillar (CAT), Comcast (CMCSA), United Parcel Service (UPS), Altria (MO), Exxon Mobil (XOM), Chevron (CVX), AbbVie (ABBV), Lockheed Martin (LMT), and General Motors (GM). On the economic data front, the December reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. Investors will also be monitoring a spate of other economic data releases, including U.S. GDP (first estimate), the Conference Board’s Consumer Confidence Index, Durable Goods Orders, Core Durable Goods Orders, the S&P/CS HPI Composite - 20 n.s.a., the Richmond Fed Manufacturing Index, Goods Trade Balance, Wholesale Inventories (preliminary), Crude Oil Inventories, Initial Jobless Claims, Pending Home Sales, the Employment Cost Index, Personal Income, Personal Spending, and the Chicago PMI. In addition, Fed Governor Michelle Bowman will deliver brief remarks on the economy and perspectives on mutual and community banks on Friday. Today, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists foresee this figure to stand at 669K in December, compared to 664K in November. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.534%, down -1.93%. Heavens knows we've got plenty of earnings and economic catalysts this week to keep it interesting. We've got some I.V. coming back into the markets today with the futures selloff. It would be best for us if we keep crashing this morning. Don't rebound until we can grab our NDX profit. My bias or lean today is slightly bullish. Now, let me quantify that! /NQ futures were down over 1,000 points when we put on our long /MNQ scalp and we are already "up" 200 points from there so when I say bullish, yes, we'll probably finish in the red today but up off the lows of early morning. The damage looks bad but in reality its just sucked out the last weeks positive days. Let's look at the charts below. All today's done so far is take us back to Jan. 17th. Just a "flesh wound" Let's hope we can score a nice victory on our bearish NDX setup at the open and cruise on our long /MNQ scalp to a nicely profitable day. Trade docket today is going to focus on our /MNQ scalp. That could yield a massive gain. I don't remember our last losing day scalping and I don't intend to have one today. VIX or short vol trade of some kind. BA earnings JBLU earnings, BTC swing trade. GME?, We may add to a few of our long pairs setups. 1HTE, 0DTE's. We already booked out profit on Nat gas. That was a $3,400 profit. Let's look at our intra-day levels: /ES: 6075 is new resistance with 5947 working as support. /NQ: 21,556 is new resistance with 20,756 working as support. BTC: We've got a long swing trade already working this morning that is just working into the green. 105,280 is new resistance with 96,740 working as support. Let's have a great day today folks and hope we don't rebound too much before we can cash out of our NDX trade.

Welcome to Friday! I need to go to the DMV, take my dog to the Vet and pay bills so the weekend is welcome! Yesterday was sooooo good. I'm starting to sound like a broken record but our focus on "consistency over profits" has been spot on. Focus on risk management and let the profits (or losses) fall where they may. Here's our results from yesterday. Of special note are the scalping and 1HTE results of almost $16,000 profit month to date. That's a run rate of $200,000 profit per annum. It's unlikely we hit that but our results are above our expectations. Fridays focus is #1. Locking in gains for the week. #2. Freeing up buying power for next week. #3. De-risking the portfolio. /MNQ, /NQ scalping, /MCL, /SI?, /ZN, /ZW, DJT, GE, IBIT, NFLX, TXN, UNP, VZ, 1HTE, 0DTE's. This is a trading room. We do a lot of "day trades" or "0DTE's". They are flashy and get a lot of attention but not everyone is able (or wants) to stare at a screen all day. I make a focused effort to make sure there are profit opportunities for everyone, regardless of what you're looking for. I wanted to highlight some of our longer term, weekly trades for this past week. We had five weeklies on oil, silver, 10yr. bonds, wheat and bitcoin. They yielded 6%, 7%, 4%, 4% and 7% returns for us this week. I'm super proud of those results and that fact that we are putting up these opportunities each week is something you should take a look at if you haven't yet. March S&P 500 E-Mini futures (ESH25) are trending down -0.21% this morning, taking a breather after the benchmark index scaled a fresh peak, while investors geared up for U.S. business activity data. In yesterday’s trading session, Wall Street’s major indexes closed in the green, with the benchmark S&P 500 notching a new all-time high and the blue-chip Dow posting a 6-week high. GE Aerospace (GE) climbed over +6% after the maker of jet engines posted upbeat Q4 results, issued solid FY25 adjusted EPS guidance, and announced a $7 billion stock buyback plan. Also, Union Pacific (UNP) advanced more than +5% after the railroad operator reported better-than-expected Q4 EPS. In addition, Netflix (NFLX) gained over +3% after Wolfe Research upgraded the stock to Outperform from Peer Perform with a price target of $1,100. On the bearish side, Electronic Arts (EA) tumbled more than -16% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company reported weaker-than-expected preliminary FQ3 results and cut its full-year net bookings guidance. Also, chip stocks lost ground, with Arm Holdings (ARM) slumping over -7% and Micron Technology (MU) sliding more than -4%. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose +6K to a 6-week high of 223K, compared with the 221K expected. “Jobless claims may have surprised slightly to the upside, but they were well within the modest range established in recent months,” said Chris Larkin at E*Trade from Morgan Stanley. “Employment continues to highlight US economic outperformance.” At the World Economic Forum in Davos, Switzerland, U.S. President Donald Trump called on OPEC to reduce crude prices and said he would push for interest rate cuts. Trump stated he would demand an immediate reduction in rates, which he claimed had increased deficits and led to what he described as economic calamity under the Biden administration. Meanwhile, U.S. rate futures have priced in a 99.5% chance of no rate change at next week’s monetary policy meeting. On the earnings front, notable companies like American Express (AXP), Verizon (VZ), NextEra Energy (NEE), and HCA Healthcare (HCA) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, which is set to be released in a couple of hours. Economists, on average, forecast that the January Manufacturing PMI will come in at 49.8, compared to last month’s value of 49.4. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 56.8 in December. Economists expect the preliminary January figure to be 56.4. U.S. Existing Home Sales data will be reported today. Economists foresee this figure to stand at 4.19M in December, compared to the previous number of 4.15M. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists estimate this figure to arrive at 73.3 in January, compared to 74.0 in December. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.635%, down -0.04%. We've got a modified theta fairy working order going into PMI release. Normally we need to deploy 15K of capital to get our $100 profit. This one is only using $850 dollars. We'll know about one half hour after the open if we get a fill. My bias or lean: I nailed it again yesterday. It looked like a much lower open but volume profies and high node areas suggested we would go higher. We did and that helped us nail our profits. Futures are slightly lower as I type but it will most likely be PMI and sentiment readings 30 mins. after the cash open that determine our movement today. Barring any surprises I'm more neutral today. Small speculators or what is commonly referred to as "The dumb money" are all in! Generally a sign of a top. Conversly, insiders or "The smart money" is showing the lowest buying interest in quite a while. Warren Buffet indicator hits AN ALL-TIME HIGH US stock market to GDP ratio reached 207%, exceeding the previous record of 200% set before the 2022 bear market. The ratio is also WELL above the 2000 Dot-Com Bubble top. By comparison, 20-year average is 120%... What do I take away from all this? There's nothing to imply a crash is coming. (There rarely is). I do think it implies that returns may be muted this year. That's amazing for us. In particular I think our A.T.M. passive asset allocation portfolio has a great chance to vastly outperform the SP500. Let's take a look at the key intra-day levels for us today. /ES: We are building a little bit of lopsided risk to the downside. Our upside resistance is back at ATH's at 6156. It's close. I believe even with bullish price action today our upside may be limited. Downside is plentiful. 6102 is the biggest support zone. /NQ has been a bit more subdued than /ES. 22,100 is resistance with 21,876 working as support. BTC: We had one of our biggest profits yesterday with our 1HTE. I can almost guarantee you that will NOT happen today. It was a confluence of price action and Trump signing an executive order to establish a crypto strategic reserve. Things are much calmer this morning. $107,520 is resistance with support at $103,000. We'll see what we can find but I won't push it today if we can't get a clean entry with a decent risk/reward. I'm looking forward to seeing you all in the live trading room. We've got a lot of profits we need to lock in today.

Welcome back traders! I had a lot of gratitude in my heart yesterday. I had an eye appt. that took up a good part of the trading day. As I was sitting in the waiting room another patient complained that they had to take off work to come to their appt. and they were losing money. We had a $3,000 profit day, mostly while I was getting my eyes poked. It doesn't always work that way and stock/option trading is anything but "passive" but it's still a great opportunity for all of us. I also want to mention that I think I'll be adding a short video commentary each day to the blog. Sometimes a verbal report can provide better insight than text. It will take a bit to get the "video studio" back up and running so hopefully next week. I can't even express how happy I've been with our risk management this year. It may seem strange to get so excited on certain days where we trade all day and deploy 30K-40K of capital and make $300 bucks but its not about reward soley but rather risk/reward. Our goal this year is consistency. We are on track this month for $8,000 of profit in our scalping program, which is great and right on track with our annual goal of $100,000 of income but I'm most proud of the consistency of our results. A lot of this comes from LOWERING our profit goals. Hitting singles and doubles vs. aiming for home runs. Here's our results from yesterday. I would be remiss if I didn't point out our 1HTE results as well. If you want results that are different than the masses you need to do something different. I'm super proud of the fact that we do trades and setups that no one else has. Let's take a look at the market. Bullish bias is continuing with three strong days in the books. SPY and QQQ are fast approaching their ATH's. "Every trade makes money"! That's a bold statement but it's factual. The market is a zero-sum game. For every winner there's a loser. If you lost money in a trade you can assure yourself there was someone on the other side of that trade that made what you lost. In this sense, every trade makes money...for someone. Credit trades are tough today. I.V. is low. Generally you want to buy options when they are cheap and sell options when they are expensive. The problem with debit trades is they are directional in nature. You have to pick a direction and then you need to be right! Broken wing butterflies are a nice mix and have worked well for us. Here's a look at our SPX from yesterday. We made $800 profit on $3,000 of buying power. Now that's great but it would actually have been a better example if it would have lost money. Our risk was about $80 dollars in this trade. It also clocked in at about 93% POP. Focus on risk management first and let the profit (or loss) fall where it may. March S&P 500 E-Mini futures (ESH25) are down -0.20%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.49% this morning, taking a breather after a strong rally this week, with investors turning their attention to U.S. President Donald Trump’s speech at the World Economic Forum in Davos and a new round of corporate earnings reports. In yesterday’s trading session, Wall Street’s main stock indexes ended higher, with the benchmark S&P 500 rising to a new record high and the blue-chip Dow and tech-heavy Nasdaq 100 notching 5-week highs. Netflix (NFLX) surged nearly +10% and was the top percentage gainer on the S&P 500 after the streaming giant reported stronger-than-expected Q4 results, raised its 2025 revenue guidance, and announced a $15 billion boost to its share repurchase program. Also, Oracle (ORCL) climbed more than +6% following the announcement of the $500 billion “Stargate” AI infrastructure project. In addition, Procter & Gamble (PG) gained over +1% after the company posted better-than-expected FQ2 results. On the bearish side, Johnson & Johnson (JNJ) fell nearly -2% after reporting weaker-than-expected Q4 MedTech sales. Economic data released on Wednesday showed that the Conference Board’s leading economic index for the U.S. fell -0.1% m/m in December, in line with expectations. Meanwhile, market participants are looking ahead to U.S. President Donald Trump’s keynote address at the World Economic Forum in Davos, Switzerland, later in the day. They will listen closely for further details on Trump’s plans to introduce tariffs on goods imported to the U.S. “Markets are reacting positively to the initial wave of Trump policies, with investors showing enthusiasm reminiscent of the run-up to the election as they breathe a sigh of relief over the tariff announcements and the early stages of earnings season,” said Mark Hackett at Nationwide. The fourth-quarter earnings season picks up pace, and investors await new reports from notable companies today, including GE Aerospace (GE), Texas Instruments (TXN), Union Pacific (UNP), American Airlines (AAL), Intuitive Surgical (ISRG), Elevance Health (ELV), and CSX Corp. (CSX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists forecast this figure to arrive at 221K, compared to last week’s number of 217K. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be -0.1M, compared to last week’s value of -2.0M. U.S. rate futures have priced in a 99.5% chance of no rate change at next week’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.632%, up +0.72%. I also want to spend some time today in our zoom talking about our weekly trades. Not everyone can or even wants to day trade. We've got you covered. Each week we put up a bunch of weekly trades that can generate 4% or better returns each week. Let's spend some time today going over them. Trade docket has been super heavy the last two days so we are pretty loaded up. Today I'll focus on our scalping with /MNQ, /NQ. /MCL, /NG, AA, NFLX, UNP, TXN, VZ, 1HTE, 0DTE's. My bias or lean yesterday was spot on. I was looking for a bullish day with the potential for a retrace later in the day. That played out to a T and allowed us to score an above avg. return on our SPX setup. Futures are down this morning but I'm still going with a very slight bullish bias which will be reflected in our first tranches in our 0DTE's. The stock market's CAPE ratio is clocking in at 37.0. It has only been higher than this twice in history. Good luck out there. We may be holding near ATH's but this market ain't cheap. Let's take a look at our intra-day levels: /ES: Levels have slid up just a bit with resistance now at 6134 and resistance at 6080. /NQ: I've got three critical levels today. 21,870 is right below current levels and could be the "trigger" for todays price action. Above is bullish. Below is bearish. Resistance is at 22,099 with support at 21,745. BTC: Bitcoin continues to offer us some great opportunities. We've brought in almost $8,000 in profits this month with our 1HTE setups. Thre key levels for me today. $101,255 is a key support we are sitting on right now. If we lose this level the next level down is $99,838 which would be a signal for me to long again. Resistance is all the way up at $107,700. We are working 4DTE swing trades currently using IBIT. This trade gives us a 7% a week potential gain. This, ontop of our 1HTE's means we have enough weekly profit potential just in bitcoin to make a nice living. I look forward to seeing you all in our live trading room shortly! Let's see if we can put a four figure profit in our pockets, once again but more important. Lets keep risk in check and take a profit (or loss) as it comes.

Welcome back traders! We had an epic day yesterday. Our Nat gas trade looks like it will finish out with about $4,000 in profit and our 1HTE's killed it yesterday. When these hit they hit harder than any thing else that we trade. Where else can you get 15% return potential in 20 mins. time? Scalping continues to perform. We are right on track for our $100,000 yearly income goal. Here's our results below. Let's take a look at the markets: Bullish price action continues to build. While we still churn inside a wide chop zone, there were some significant achievments yesterday. Three of the four major indices are now firmly above their 50DMA with the IWM close. March Nasdaq 100 E-Mini futures (NQH25) are trending up +0.82% this morning as optimism over more artificial intelligence spending under Donald Trump and strong quarterly results from Netflix boosted sentiment. U.S. President Donald Trump announced Tuesday billions of dollars in private-sector investments aimed at building artificial intelligence infrastructure in the United States. OpenAI, SoftBank, and Oracle announced plans to create a new company, named Stargate, which will develop “the physical and virtual infrastructure to power the next generation of AI,” including data centers around the country. The companies will initially invest $100 billion in the project, with additional firms expected to join the venture, bringing total investment in the program up to $500 billion over the coming years. The project is expected to create over 100,000 jobs, with construction already in progress in Texas. “We’re starting off with tremendous investment coming into our country at levels that nobody’s really ever seen before,” Trump said at the White House. Netflix (NFLX) surged over +14% in pre-market trading after the streaming giant reported stronger-than-expected Q4 results, raised its 2025 revenue guidance, and announced a $15 billion boost to its share repurchase program. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green, with the S&P 500 notching a 1-month high, the Dow notching a 5-week high, and the Nasdaq 100 notching a 2-week high. Vistra Corp. (VST) surged over +8% and was the top percentage gainer on the S&P 500 after Evercore ISI resumed coverage of the stock with an Outperform rating and a price target of $202. Also, 3M Company (MMM) climbed more than +4% and was the top percentage gainer on the Dow after the industrial conglomerate posted better-than-expected Q4 adjusted EPS. In addition, Moderna (MRNA) gained over +5% after the drugmaker secured a $590 million government contract to accelerate the development of its bird flu vaccine. On the bearish side, Walgreens Boots Alliance (WBA) slumped more than -9% and was the top percentage loser on the S&P 500 after the U.S. Justice Department sued the company for allegedly contributing to the opioid crisis. Also, Apple (AAPL) slid over -3% and was the top percentage loser on the Dow after Jefferies downgraded the stock to Underperform from Hold with a price target of $200.75. “For the first time this year, bulls have some momentum to work with,” said Chris Larkin at E*Trade from Morgan Stanley. “Stocks are coming off their biggest up week in more than two months, as traders embraced cooler-than-expected inflation data and strong earnings from big banks. With a light economic calendar this week, earnings may dictate whether the S&P 500 can post back-to-back up weeks for the first time since early December.” The fourth-quarter earnings season is gathering pace, with investors awaiting reports from notable companies today, including Procter & Gamble (PG), Johnson & Johnson (JNJ), Abbott Laboratories (ABT), Kinder Morgan (KMI), and Travelers (TRV). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on the Conference Board’s Leading Economic Index for the U.S., which is set to be released in a couple of hours. Economists expect the December figure to be -0.1% m/m, compared to the previous number of +0.3% m/m. U.S. rate futures have priced in a 99.5% probability of no rate change at next week’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.570%, down -0.09%. Another busy day for us. /MNQ scalping. /NG, ASUR, DJT, LRN, NFLX, QTTB, UAL, AA, UNP, GE, AAPL, MRK, CRNX, JSPR, MNRO, VALU, LENZ, AROC, CDRE, FET, GME. Let's take a look at our intra-day levels: /ES: New levels today are 6131 resistance with 6079 support. /NQ: 22,067 is new resistance with 21,781 support. BTC: Bitcoin is in play! Our 1HTE's yesterday were epic. Levels are about the same as yesterday. $109,935 resistance with $102,072 acting as support. My lean or bias today continues to be bullish but with a small caveat. Futures are up sharply, largely attributable to the blow out NFLX earnings. I think there's a decent chance we retrace some today but I still think we finish green. See you all in the trading room shortly. No Zoom today as I've got an eye appointment. That also means probably no QQQ scalps today. I'll focus on our /MNQ setup.

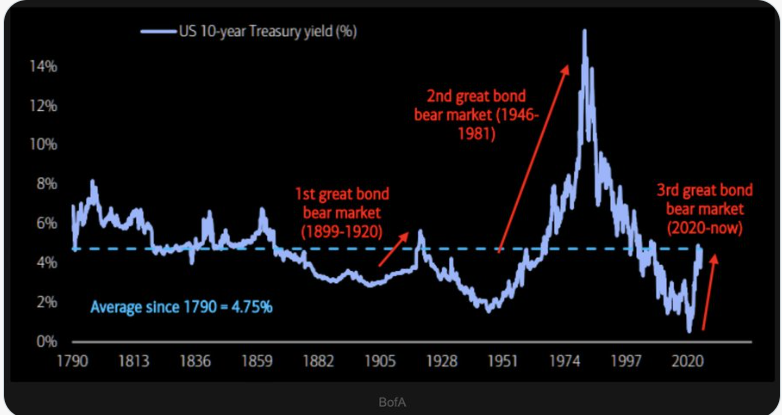

Welcome back traders to ANOTHER holiday shortened trading week. I have to say, I don't mind the break. We didn't get out of the house yesterday because it was crazy cold but it was nice, regardless. We had a fantastic day Friday. It doesn't look like it on paper but our net liq was up 4K, largely on our Nat gas profits. We also started the day in a $2,600 hole from the Vampire trade. Our diversified approach with butterflies and scalps made up for it. I've also been pleased with our Friday equity 0DTE's. They don't add much to the profit equation but they've been pretty consistant and add some always needed diversification. Here's a look at our Friday results. President-elect Trump is now officially President Trump. The executive orders are already flying. It allowed us enough premium to get a nice Theta fairy setup last night. It's not quite to our take profit target this morning but it looks solid. We still need a much higher VIX than we have to hope for daily setups but if we can grab a few here and there and bring in an extra $10,000 in yearly income from them I think most of us would still be happy. Speaking of Trump; I'm not an expert on politics but I do know this...if we as a people unite with a singular goal of improving all of our lots in life, we will be more successful than if we go it alone. I'm grateful every day for all our trading members and our collaborative effort to help each other profit. I'm very optimistic about 2025. Markets are looking higher this morning. Let's take a look at the technicals. Bullish sentiment starts of the week. While the rebound of the last four trading session looks real and our critical support lines held, all it's really done is keep us inside the current "chop zone". In fact, if you pull out a bit farther on the chart, we are still making lower lows and lower highs...the very definition of a down trend. It's hard to make much of our current levels other than our critical support area (black lines) seems strong. he SPY ETF had a strong week fueled by CPI and PPI, and managed to close just shy of this month’s high at $597.58 (+2.93%) Our ‘RSI, MACD Confluence’ custom indicator, which uses candle coloring to visualize RSI and MACD strength, shows momentum has swung back in the bulls favor for the first time since all-time highs. How do we know? Friday’s daily candle has turned green. The QQQ ETF closed the week at $521.74 (+2.87%), showing slight lag in bullish momentum compared to its peers. Our ‘RSI, MACD Confluence’ indicator printed a neutral (white) candle on Friday, signaling that momentum isn’t fully aligned yet. While RSI closed above 50, the MACD has yet to cross above its signal line. The IWM led the pack this week, closing strong at $225.46 (+3.95%). Price gapped above a key High Volume Node (HVN) and came within earshot of its monthly high. The ‘RSI,MACD Confluence‘ indicator confirmed bullish momentum with a green candle, signaling alignment in both RSI and MACD. Nothing special or exciting I.V. wise in this shortened trading week. We will work to get our weekly SPY/QQQ trades going today but the IWM may give us our best "bang for our buck". My lean or bias today: Ever so slightly bullish. Yes, futures are up and yes, technicals are bullish. I'm not sure how much upside we have here and a slight retrace after the excitement of the inauguration wouldn't be a surprise. Trade docket could be busy today: Our Theta fairy (/ES) is still working and open. /ZN, IBIT, /ZW, /SI, /MNQ, SPY/QQQ/IWM 3DTE's, 1HTE, 0DTE's, Scalping with /MNQ,/NQ,QQQ. NFLX, UAL, JNJ, HAL potential earnings trades. MU re-entry and DJT? Current systematic equity positioning is at the 90th percentile, indicating high equity exposure. This could result in limited upside potential, elevated risk levels, and an increased likelihood of market reversal U.S. Treasuries are entering the 6th year of the 3rd Great Bond Bear Market of the last 240 years! The last two lasted 21 years and 35 years, respectively. Let's take a look at our intra-day levels for our 0DTE setups. /ES: Levels are coiled tightly. 6058 is the first resistance. We are sitting right on it as I type. 6078 and 6098 are next. 6046 is first support with 6027 next. /NQ: 21,757 is first resistance. 21,828 is next. Support is 21,524. BTC: Wild ride for Bitcoin yesterday and into today. I probably missed some nice swing trades yesterday by simply not paying attention. After hitting a new ATH it retraced and now it's bouncing back. The new ATH has really stretched the resistance level to a nice round $110,000. First suppor is close at $101,943 with the next level down at $98,241. We've got a jam packed day of potential trades ahead of us. I'm excited to get back after it with all of you. See you shortly in the live trading room!

Good morning and happy Friday to all you wonderful traders out there! I know I mentioned this over and over yesterday in our live zoom feed but holy smokes, I'm so happy with our trading lately. I was thrilled with our results Weds. We barely squeaked out a profit but...our risk management was on point. Sometimes with dynamic trading and adjustments you don't get a great initial result but you "planted seeds" for the future. We did that on Weds. and it paid off for us in spades yesterday. See our results below: "Process over profits". Let's just "trade to trade well" and let the profits (or losses) fall where they may. If we do our job well things tend to work out over time. Our goal this year is "Consistency over cash". We don't need home runs to have a great year. We have a busy day ahead of use. Let's look at our trade docket before we get into the markets. Trade docket today could be busy. We've had some good success deploying 0DTE equity setups on Fridays. We've already started our day with an overnight Vampire trade that expires at the open. That could kick off our day with a $368 dollar profit. We are up and running with our first scalp entry with a long /MNQ. That's already profitable. 1HTE on Bitcoin, 0DTE's on SPX. No NDX today as there are no option expirations for it on the third Fri. of each month. MSTR, TSLA, UNH, SMCI, NVDA are all potential 0DTE opportunities today. Let's look at the markets for today. The boys (sorry...bulls) are back in town! It sure looked to me like the market wanted to go higher late yesterday. It didn't but the bulls were trying. Futures are popping this morning. It looks like a bullish day. March S&P 500 E-Mini futures (ESH25) are up +0.35%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.48% this morning, pointing to a positive opening on Wall Street as Treasury yields edged lower, while investors awaited fresh data on the U.S. housing market and manufacturing sector. Investors are also focusing on President-elect Donald Trump’s inauguration on Monday and how his plans for higher tariffs, tax cuts, and stringent measures on undocumented migrants will impact equities. In yesterday’s trading session, Wall Street’s major indices closed in the red. UnitedHealth Group (UNH) slid over -6% and was the top percentage loser on the S&P 500 and Dow after reporting weaker-than-expected Q4 revenue. Also, Texas Instruments (TXN) slumped more than -5% and was the top percentage loser on the Nasdaq 100 after Bloomberg reported that China is probing allegations of the U.S. dumping lower-end chips and unfairly subsidizing its chipmakers. In addition, U.S. Bancorp (USB) fell over -5% after the bank reported weaker-than-expected Q4 total average deposits. On the bullish side, chip stocks advanced after Taiwan Semiconductor Manufacturing Co. reported a record quarterly profit and provided strong Q1 revenue guidance, with Applied Materials (AMAT) and KLA Corp (KLAC) climbing more than +4%. Economic data released on Thursday showed that U.S. retail sales grew +0.4% m/m in December, missing the +0.6% m/m consensus, while core retail sales, which exclude motor vehicles and parts, increased +0.4% m/m, weaker than expectations of +0.5% m/m. Also, the number of Americans filing for initial jobless claims in the past week rose by 14K to 217K, compared with the 210K expected. At the same time, the U.S. January Philadelphia Fed manufacturing index jumped to a 3-3/4 year high of 44.3, stronger than expectations of -5.0. Also, the U.S. import price index unexpectedly rose +0.1% m/m in December, stronger than expectations of -0.1% m/m. “In the coming weeks, the fourth-quarter earnings season will provide investors with an opportunity to shift some attention from macro to micro data,” said David Lefkowitz at UBS Global Wealth Management. Fed Governor Christopher Waller said on Thursday that the U.S. central bank might cut interest rates again in the first half of 2025 if inflation data remain favorable. “The inflation data we got [on Wednesday] was very good,” Waller said in an appearance on CNBC. “If we continue getting numbers like this, it’s reasonable to think rate cuts could happen in the first half of the year,” he said, noting that he wouldn’t completely dismiss the possibility of a cut in March. Meanwhile, U.S. rate futures have priced in a 97.3% chance of no rate change and a 2.7% chance of a 25 basis point rate cut at January’s monetary policy meeting. On the earnings front, notable companies like Truist Financial (TFC), Schlumberger (SLB), Fastenal (FAST), State Street (STT), and Regions Financial (RF) are scheduled to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.5% increase in quarterly earnings for Q4 compared to the previous year. On the economic data front, investors will focus on U.S. Building Permits (preliminary) and Housing Starts data. Economists expect December Building Permits to be 1.460M and Housing Starts to be 1.330M, compared to the prior figures of 1.493M and 1.289M, respectively. U.S. Industrial Production and Manufacturing Production data will be released today as well. Economists forecast December Industrial Production at +0.3% m/m and Manufacturing Production at +0.2% m/m, compared to November’s figures of -0.1% m/m and +0.2% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.596%, down -0.22%. Let's look at the intra-day levels: Good news and bad news. If you are wanting bullish price action, we've held above those critical support levels I've mapped out. on the charts below. Bad news is it's just put us back into big consolidation zones, once again. Really now clear trend here in the bigger picture. /ES: 6042 is my resistance target for today with 5981 acting as support. I think today could be a perfect day for a broken wing butterfly. /NQ: 21,543 is first resistance with 21,693 next. 21,342 is support. BTC: Well...I just missed out on what appears to be a wonderful swing trade yesterday. We are back to pushing upward to that lofty $109,000 ATH. We also weren't able to get a 1HTE on yesterday. We've brought in $3,700 dollars of profit on these this month. I think today will give us another good shot at those. I've got three critical levels I'm watching today. $103,260 is the first. We are sitting on it right now. It's a demarcation point. Above is bullish. Below is bearish. $105,730 is resistance with $98,283 acting as new support. My lean or bias today is bullish: This market is wanting to go higher. I look forward to seeing you all in the live trading room today. Let's make some money. I don't think $1,000+ dollars of profit today is a big goal with what we already have working.

|

Archives

December 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |