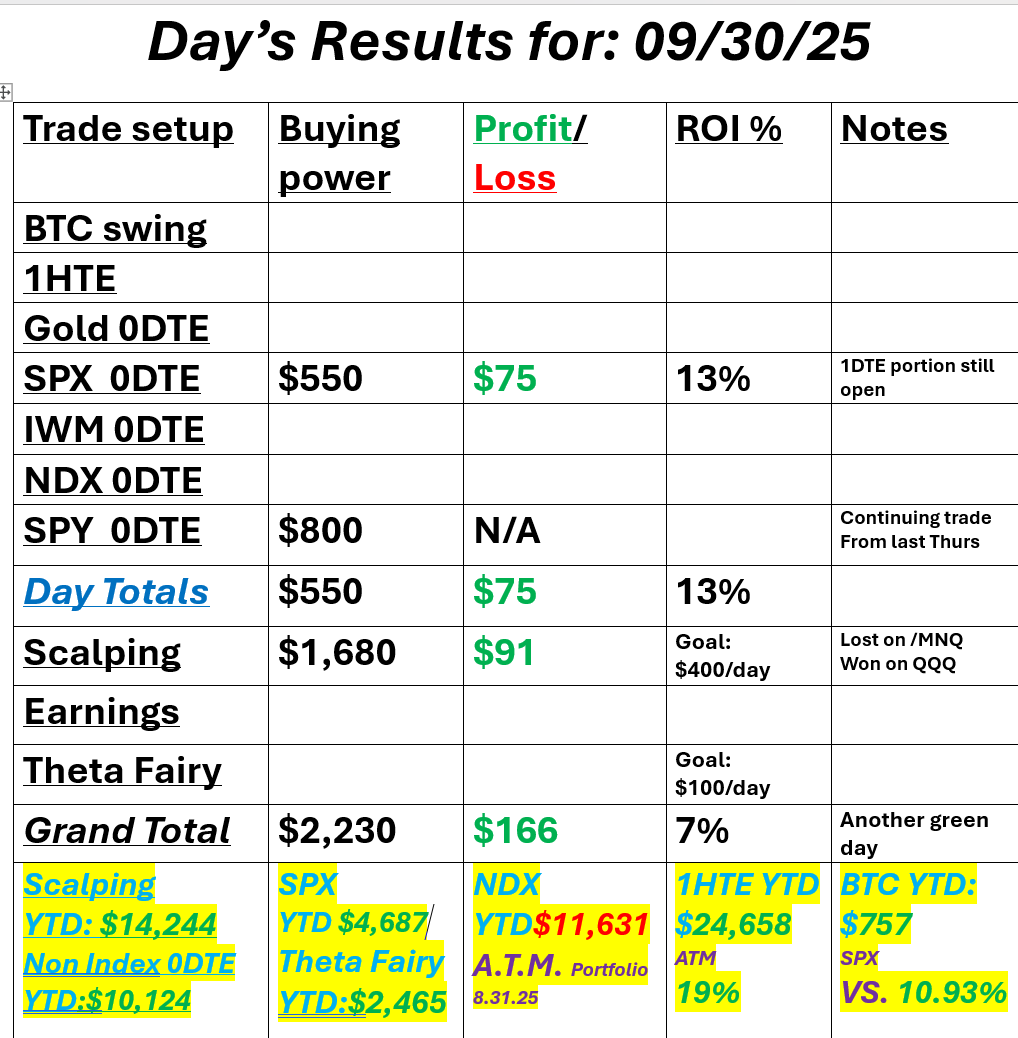

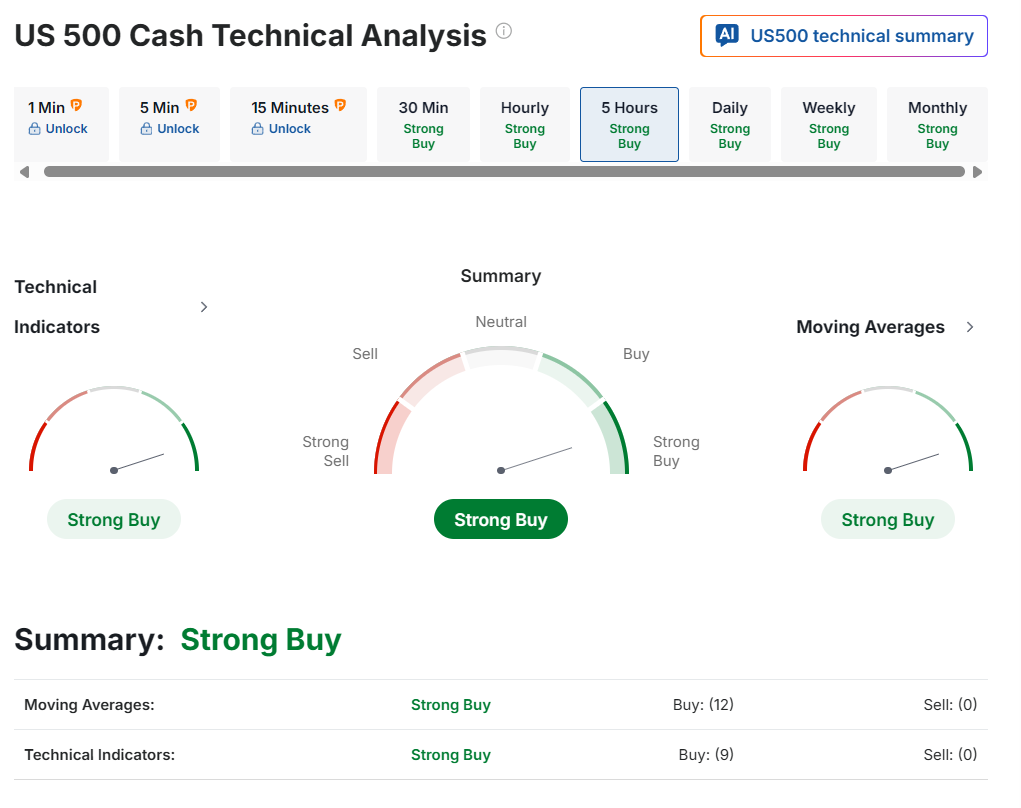

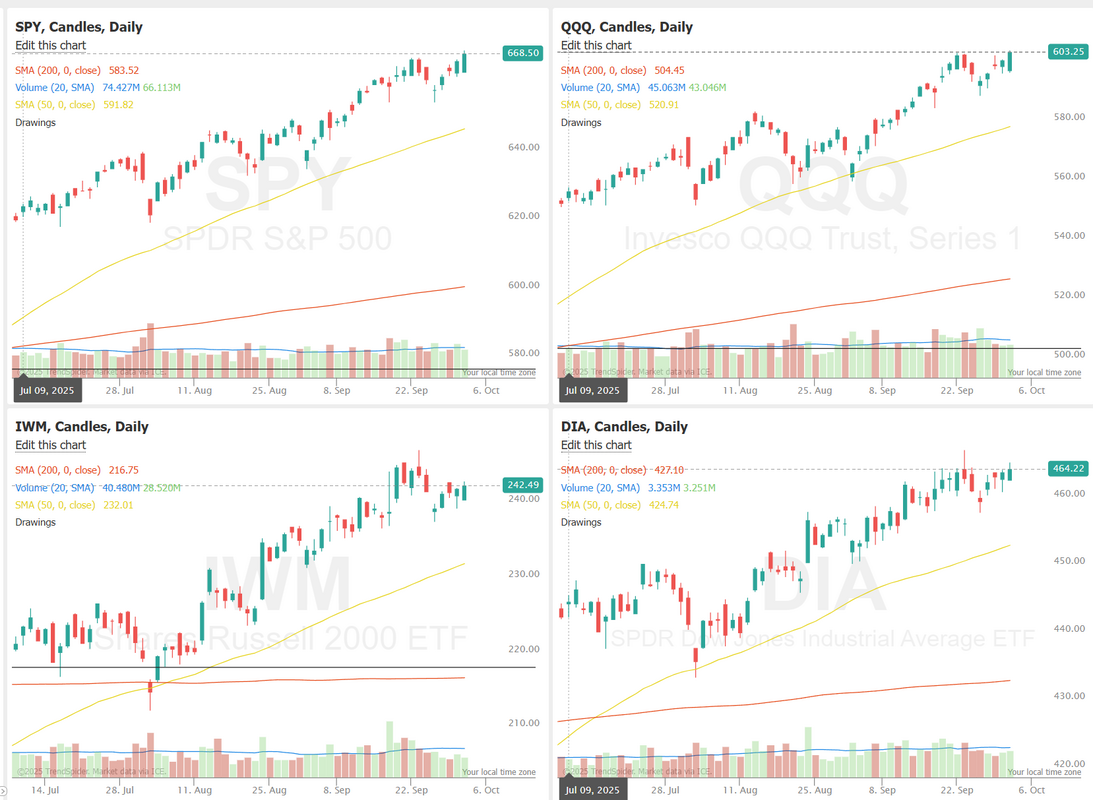

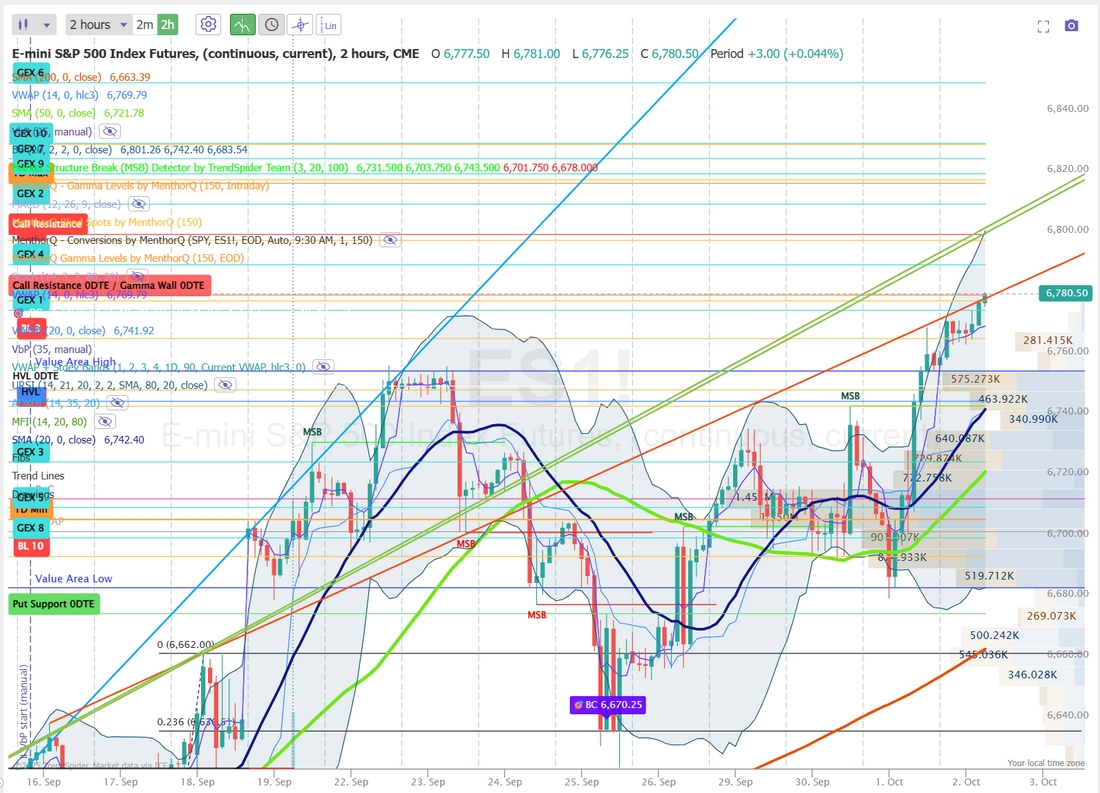

What shutdown?We got the Govt. shutdown, much as the predictive markets had implied and guess what? Mr. Market didn't seem to care. It looked like a text book reaction. Futures sell off on the news and the indices fight back as the day progresses. I got caught on the wrong side (short) on my initial /MNQ scalps but later flipped to QQQ calls and it worked out. We had a combination 0DTE/1DTE SPX trade. The 0DTE portion finished fully profitable. We'll need to likely work our 1DTE (now 0DTE) remaining parts today. Here's a look at my day. Let's take a look at this market. Nothing seems to be able to stop it's advance. Technicals are bullish. Futures are solidly green, as I type. Anyone up for some new ATH's? After 3 solid down days, where it looked like a rollover we a real possibility, we've had five consecutive days of strong finishes to not only push us back above that previous level but also take us to new ATH's. December S&P 500 E-Mini futures (ESZ25) are up +0.14%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.32% this morning, buoyed by hopes for Federal Reserve interest-rate cuts and optimism surrounding artificial intelligence. Futures on the Nasdaq 100 outperformed after a deal propelled OpenAI to become the world’s most valuable startup, boosting AI optimism. OpenAI’s valuation jumped to $500 billion after current and former employees sold roughly $6.6 billion worth of stock. The ChatGPT owner also reached agreements with South Korea’s Samsung Electronics and SK Hynix to supply chips for its Stargate project, lifting chip-related stocks worldwide. However, gains in U.S. equity futures are limited as the U.S. government shutdown continues. In a shutdown, government offices continue essential functions, but nonessential tasks are halted, paychecks are suspended, and many workers are furloughed until Congress passes new funding. The impact on both individuals and the economy hinges on whether the shutdown lasts for days or weeks, and on whether the White House proceeds with its plans to fire workers during the funding lapse. At a White House press conference on Wednesday, Vice President JD Vance said he does not expect the shutdown to last long, adding that layoffs will occur if it extends for days or weeks. Key economic data that the Fed would normally take into account for policy is likely to be delayed, including Friday’s jobs report. A prolonged shutdown could also delay the release of U.S. inflation data scheduled for mid-October. Chicago Fed President Austan Goolsbee said on Wednesday that the absence of official data during the U.S. government shutdown will make it more difficult for policymakers to interpret the economy. The Fed is “going into a period where you’re trying to figure out: Is this a transition?” Goolsbee said. “And if you’re not going to get the data, it’s just that much harder.” “The U.S. shutdown remains a huge story, and there’s still no sign of a climbdown from either side,” Deutsche Bank said. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher, with the S&P 500 and Nasdaq 100 notching new record highs. AES Corp. (AES) surged over +16% and was the top percentage gainer on the S&P 500 after the Financial Times reported that BlackRock’s Global Infrastructure Partners was nearing a $38 billion deal to buy the company. Also, pharmaceutical stocks extended their rally on optimism after Pfizer’s deal with the White House, with Biogen (BIIB) climbing more than +10% to lead gainers in the Nasdaq 100 and AstraZeneca Plc (AZN) rising over +9%. In addition, Nike (NKE) advanced more than +6% after the world’s largest sportswear company posted better-than-expected FQ1 results. On the bearish side, Corteva (CTVA) slumped over -9% and was the top percentage loser on the S&P 500 after the company said it would split its seed and pesticide businesses into two separate companies. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls unexpectedly fell -32K in September, weaker than expectations of +52K and the largest decline in 2-1/2 years. At the same time, the U.S. ISM manufacturing index rose to a 7-month high of 49.1 in September, stronger than expectations of 49.0. Also, the U.S. September S&P Global manufacturing PMI remained unrevised at 52.0, in line with expectations. “Investors have been conditioned to buy the dip. The economic data was not good, but it was not horrible either, and it is enough to solidify a rate cut this month despite the hawkish tone that we have heard recently from most Fed governors,” said Joe Gilbert, portfolio manager at Integrity Asset Management. “In the absence of further government data, the market has fully baked in an October cut, which is positive on the margin for the markets as interest rates appear on a glide path lower.” Meanwhile, U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month. In other news, Fed Governor Lisa Cook will stay at the central bank until at least January after the Supreme Court issued a notice on Wednesday delaying a ruling on her termination. Today, investors will focus on speeches from Dallas Fed President Lorie Logan and Chicago Fed President Austan Goolsbee. In light of the government shutdown, the publication of weekly jobless claims and August factory orders data, originally set for today, will likely be delayed. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.095%, down -0.32%. My lean or bias today is slightly bullish. Everything certainly seems to continue to lean that way. We are five days into a bullish run so it is getting a bit long in the tooth. Jessie Livermore is considered one of the greatest, most famous, or possibly infamous traders to ever have lived. He made (and lost) millions back in a time where millions was a lot! I'm going to start sharing some video trainings from his teachings, when we have time on our zoom sessions. Todays training segment has some tremendous wisdom. The video runs about 30 min. in length. Please tune in at 2:00 EDT. Sometimes it seems so easy to spot bubbles and then...when not only does the bubble not pop but actually grows, you wonder what you are missing? As I was contemplating this conundrum yesterday, look what popped into my news feed. America Online was once worth $222 BILLION back in 1999. That is the equivalent of almost $500 BILLION today when adjusted for inflation. Today, AOL got sold for $1.4B… From $500B to $1.4B. All bubbles pop...eventually but you all know the saying. The market can stay irrational longer than you can stay solvent. We've got some new support/resistance levels to look at today as the market keeps pushing higher. Let's take a look at the /ES intra-day levels. 6780, 6791, 6798, 6810 are new resistant zones. 6775, 6766, 6755, 6749 are support zones. I look forward to seeing you all in the live trading room shortly. Having another good training session and getting some good trades working today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |