|

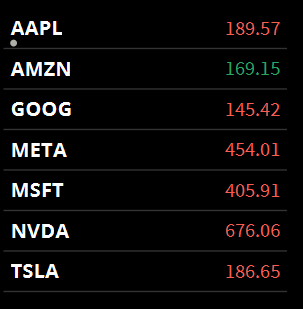

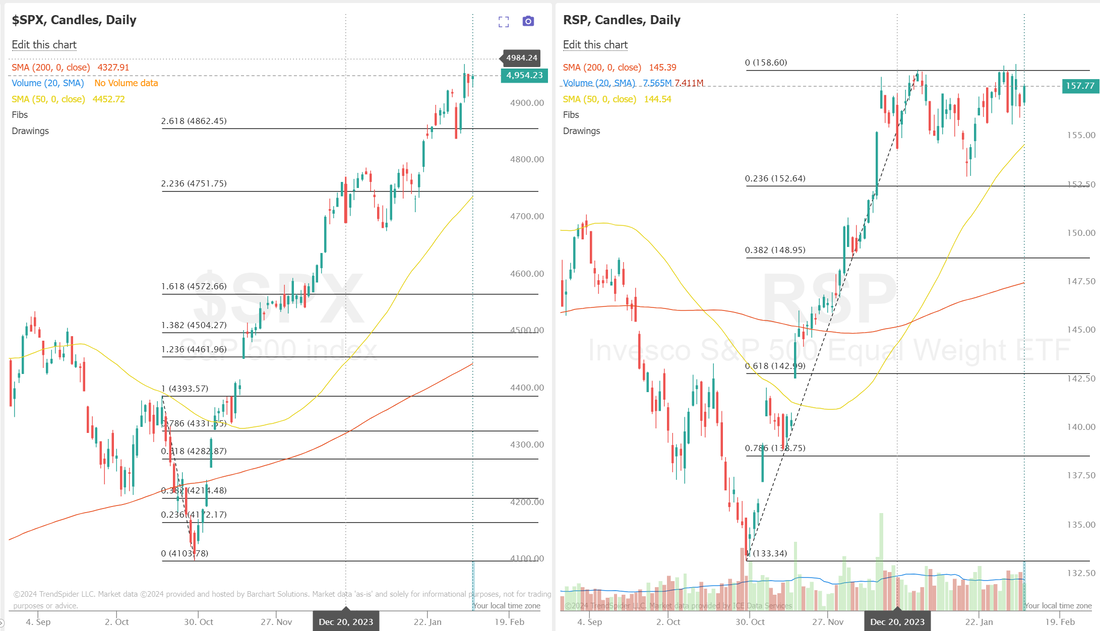

We had a nice....somewhat boring day yesterday. I was on the wrong side of scalping all day so that didn't help but our FOUR! 0DTE's all brought in profits and NVDA, which hurt us on Monday, helped us yesterday for a solid overall result. Futures are flat to down this morning as we await more interest rate info and earnings season continues. PLTR popped more than 30% yesterday and our setup played nicely into that. Fed Mester said she's not in a hurry to start reducing interest rates and it will most likely happen "later this year". US futures have us at a 21.5% chance of a cut at the March meeting and 53% chance at the May meeting. We've got DIS, UBER, CVS, FOXA, MCK and PYPL all reporting today. We've already got plays going on DIS an PYPL. We'll also be watching crude oil inventory levels today and may potentially adding to our oil ladder. The market is expecting 1,700M compared to last weeks 1,234M level. China continues to pump stimulus into their economy. Our FXI trade in our ATM program looks solid here. Markets continue to hold their bullish bias: From a price action standpoint, we continue to just churn sideways on the /ES And the sideways action is enduring even longer in the /NQ We've got a couple 1DTE SPX/NDX call side setups working They look pretty good for us right now. Keep an eye on the "magnificent seven" as they start to diverage from the bullish action You can see the divergence if you compared the equal weighted vs. cap weighted SP500 Intra day levels for me: /ES; 4977/4983/4998/5005 to the upside. 4972/4965/4960/4954 to the downside.

/NQ; 17697/17712/17740/17769 to the upside. 17677/17653/17619/17592 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |