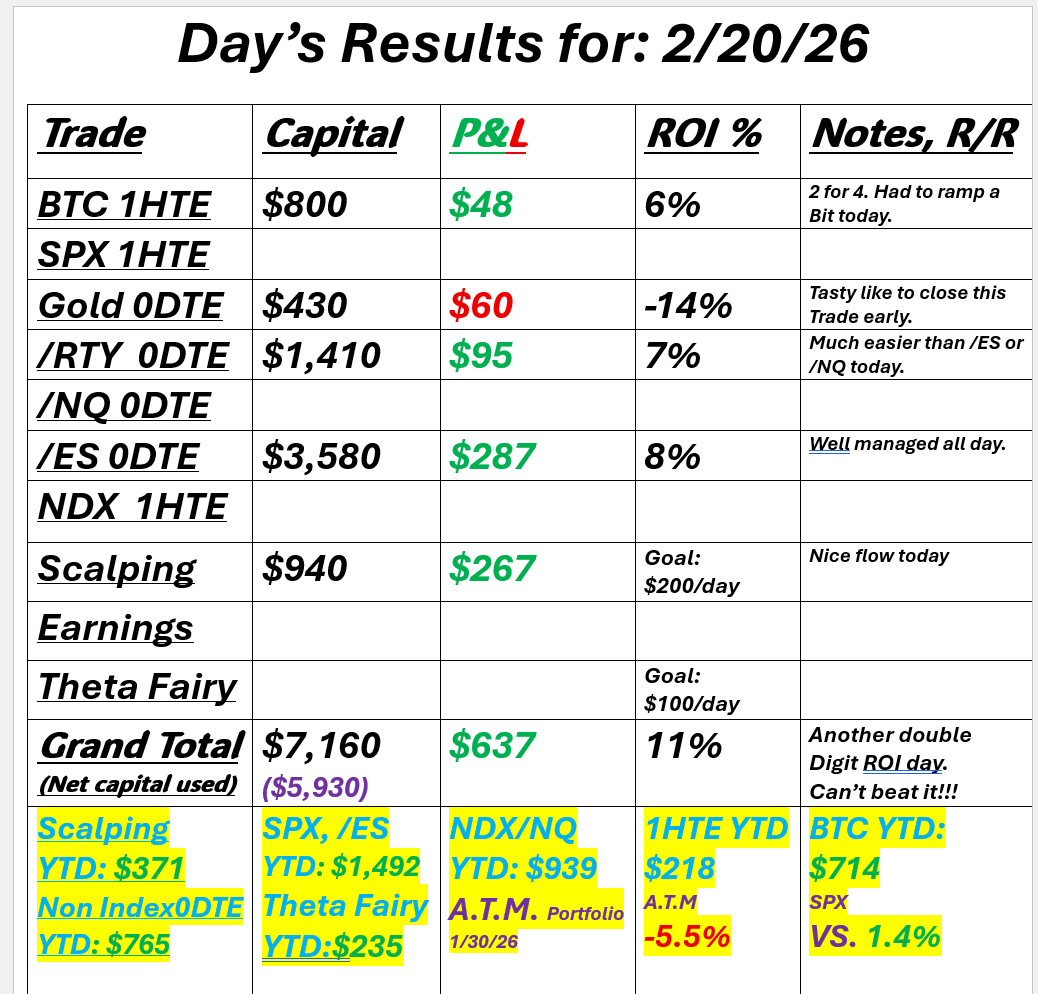

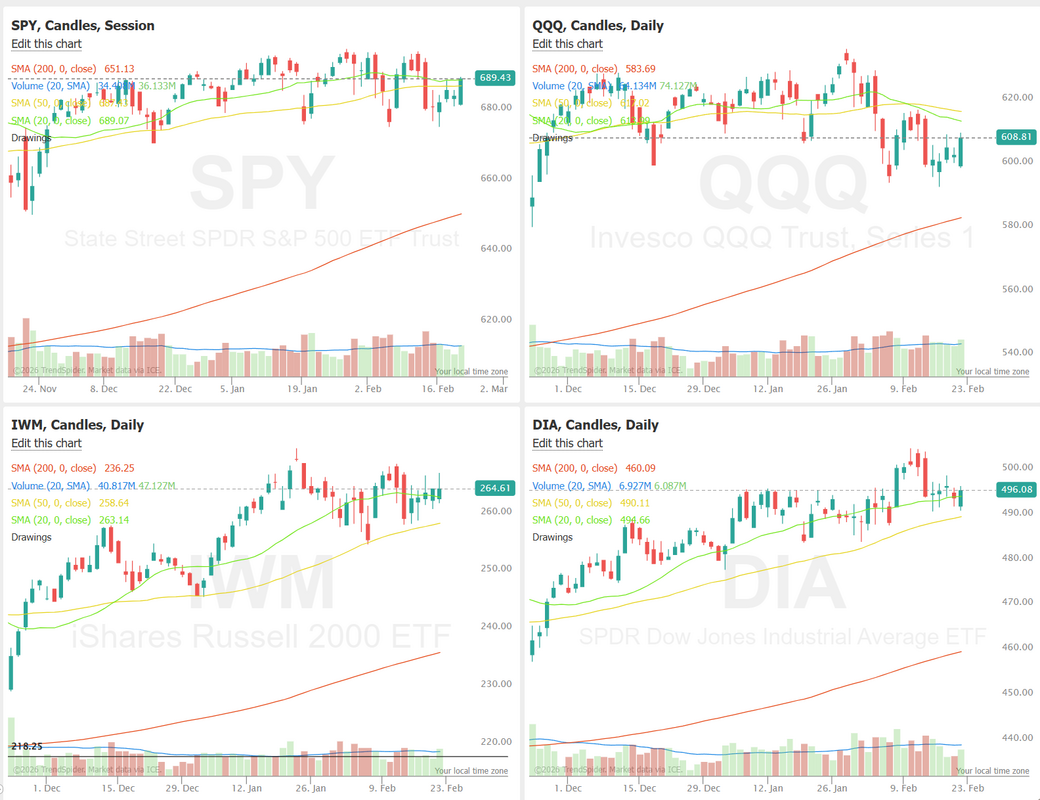

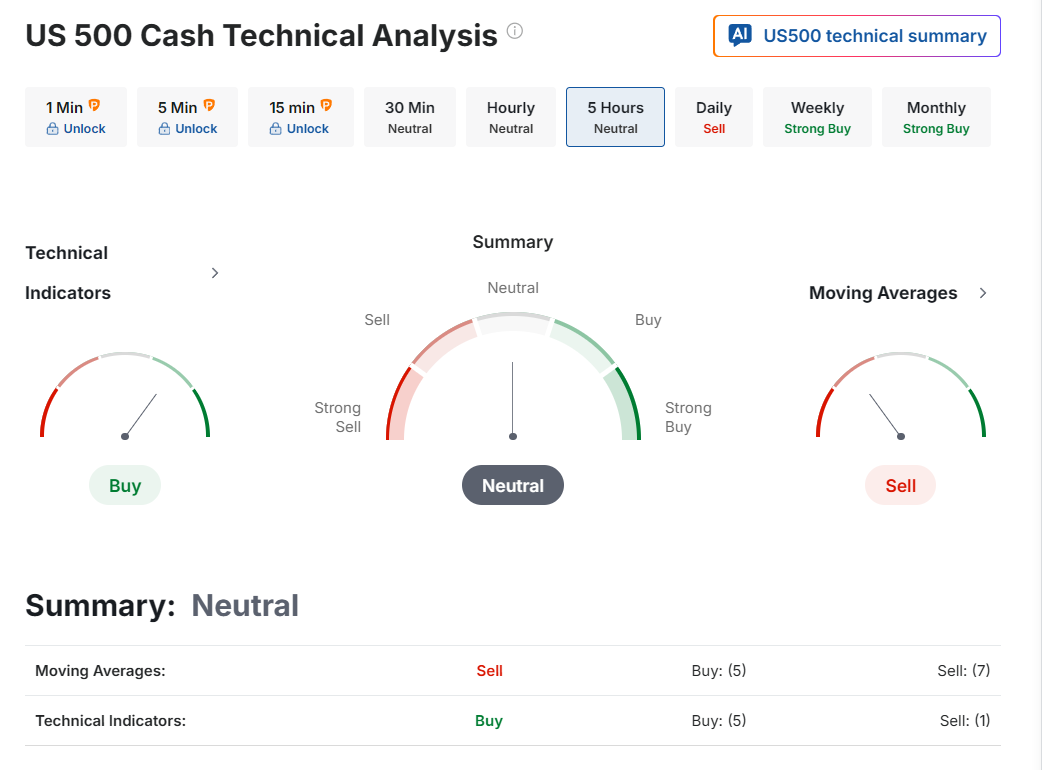

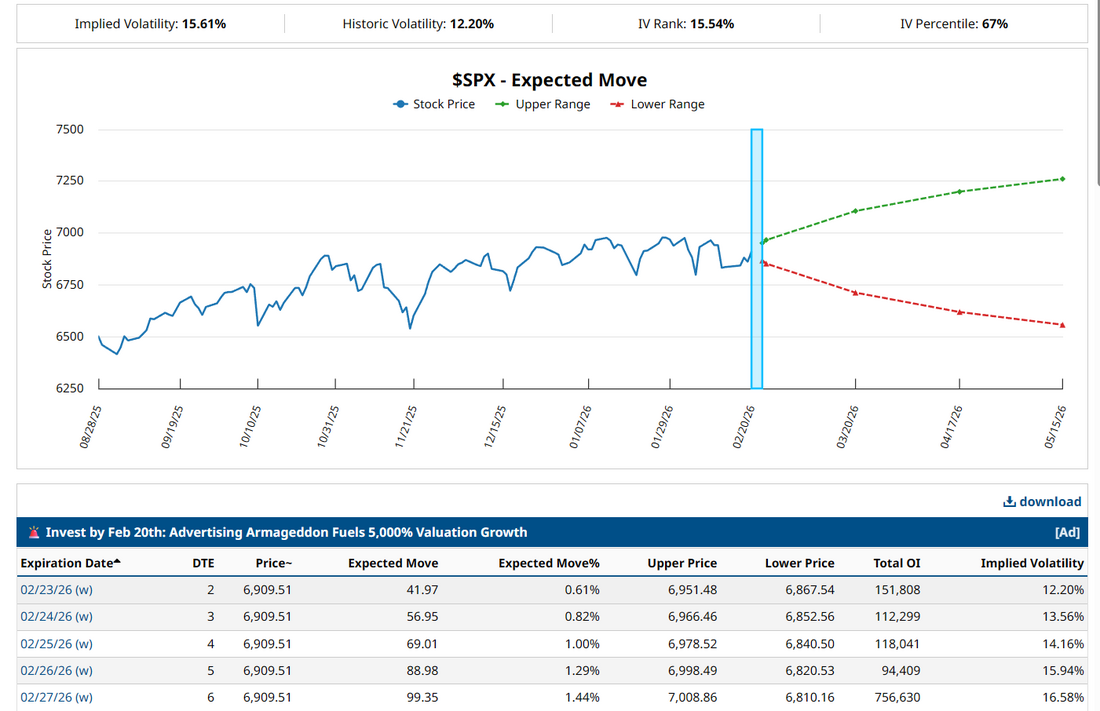

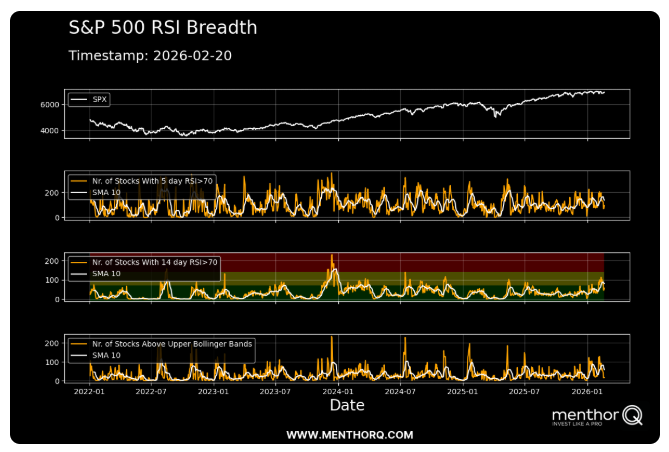

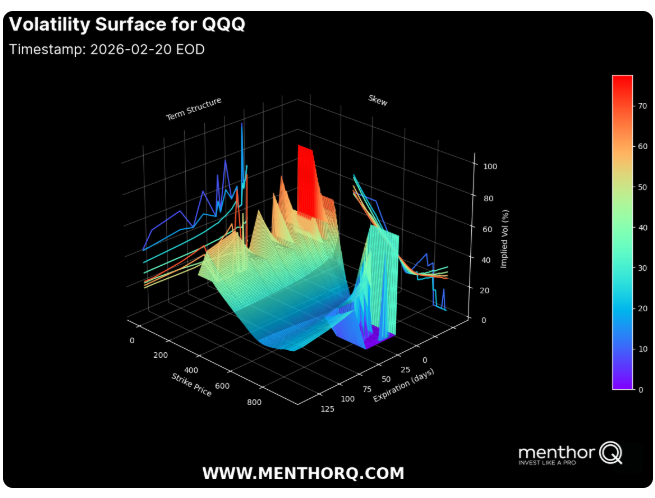

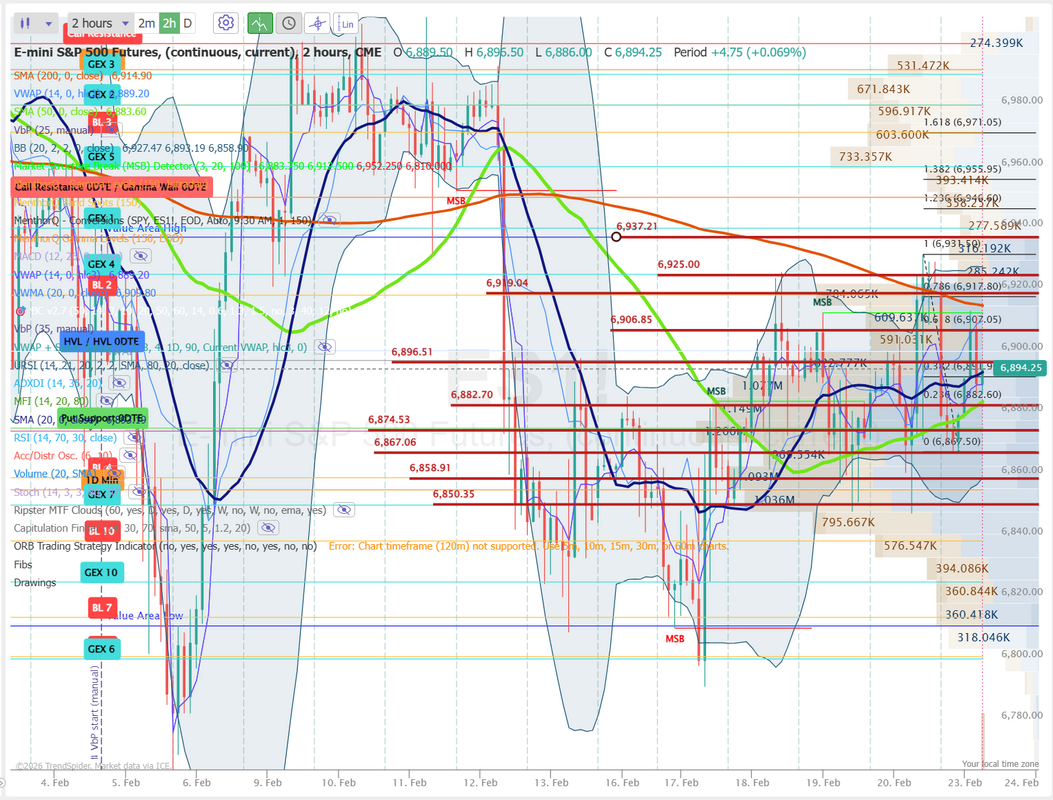

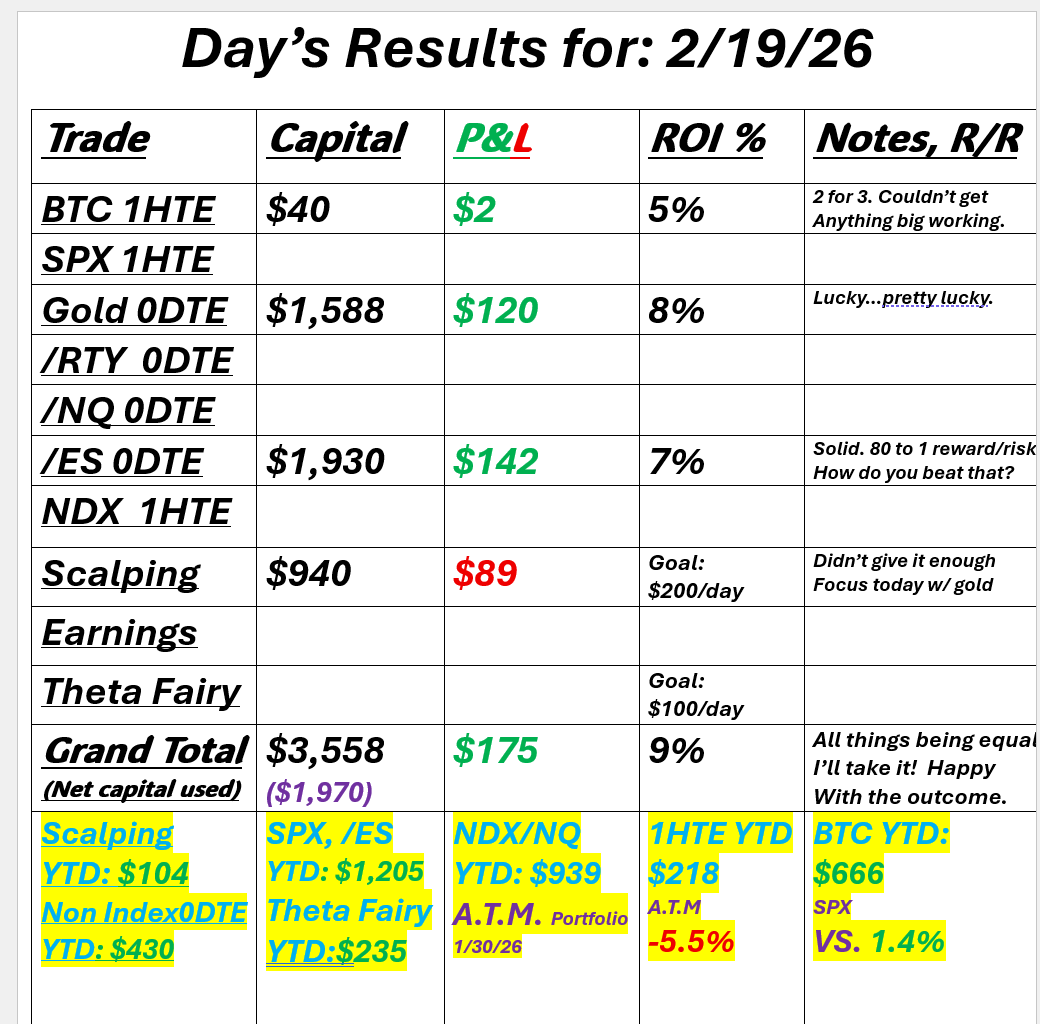

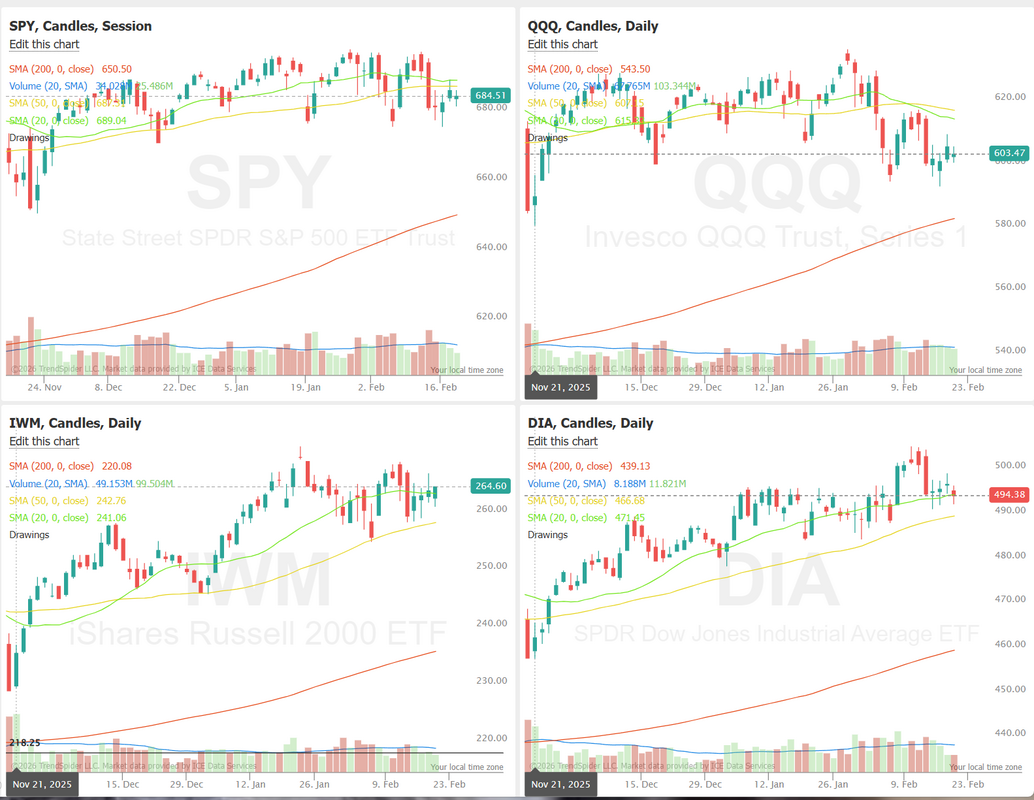

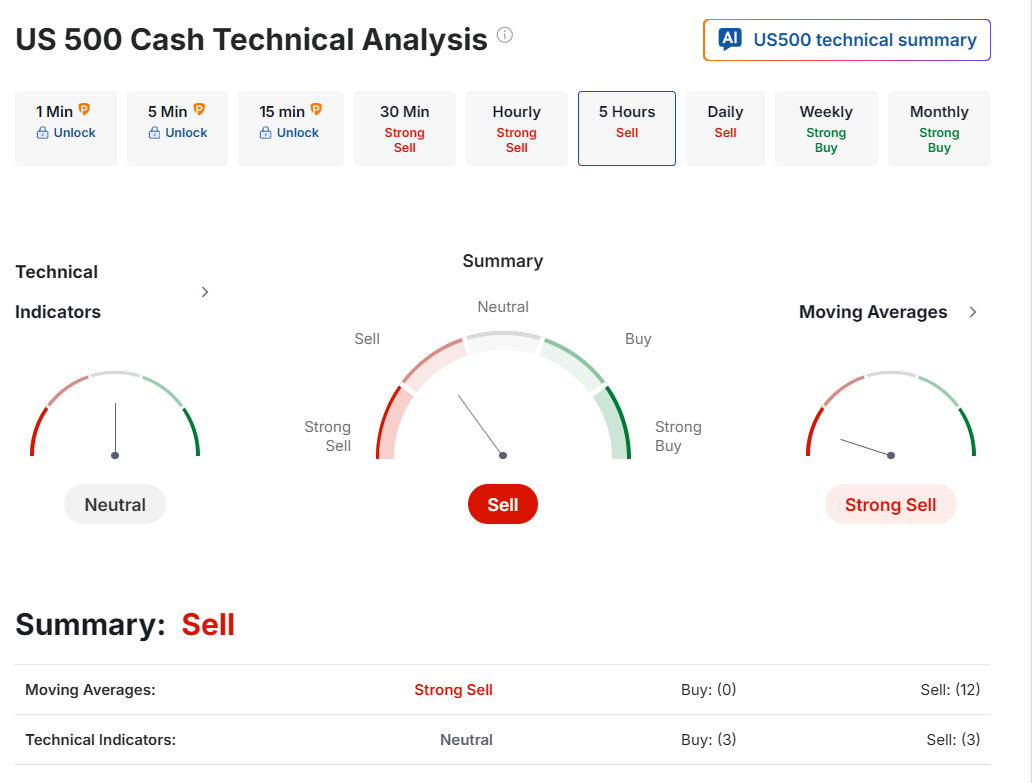

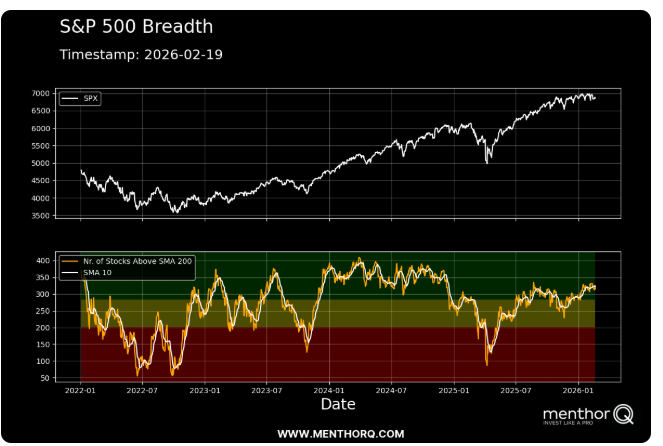

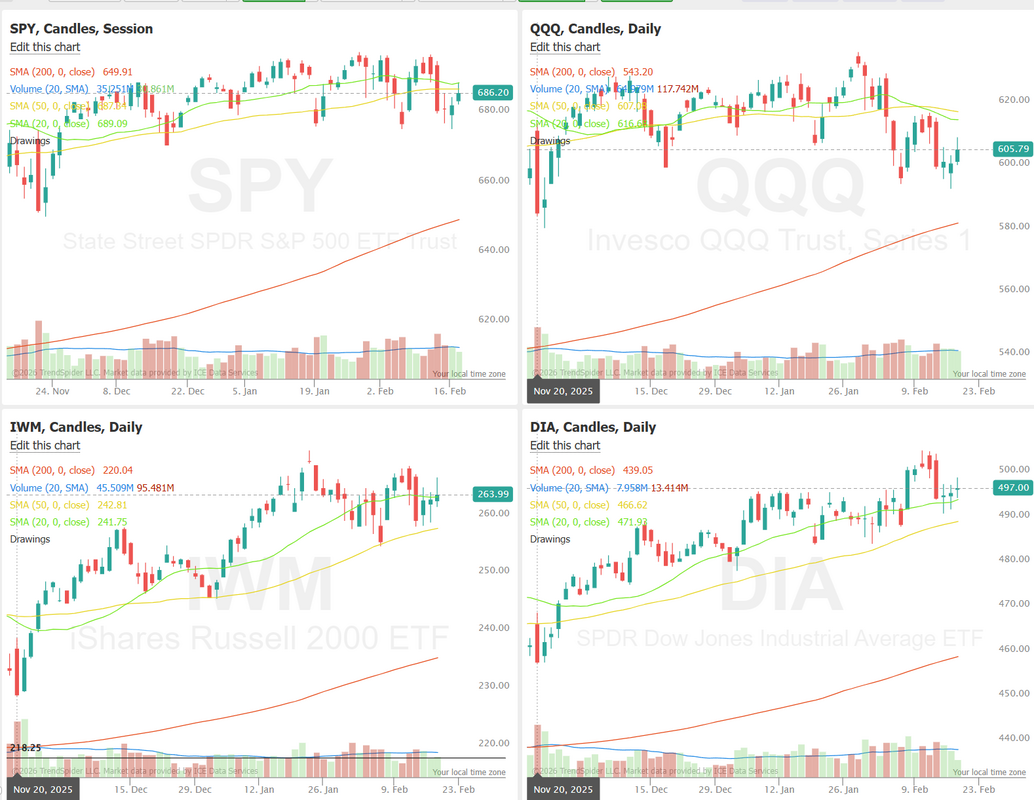

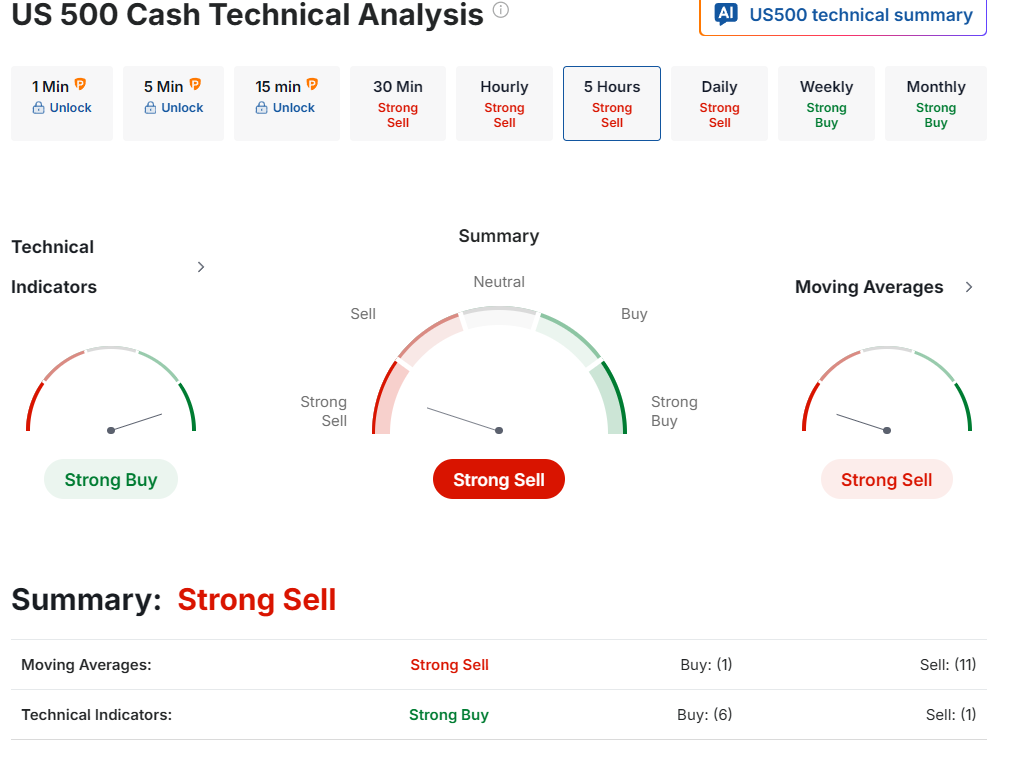

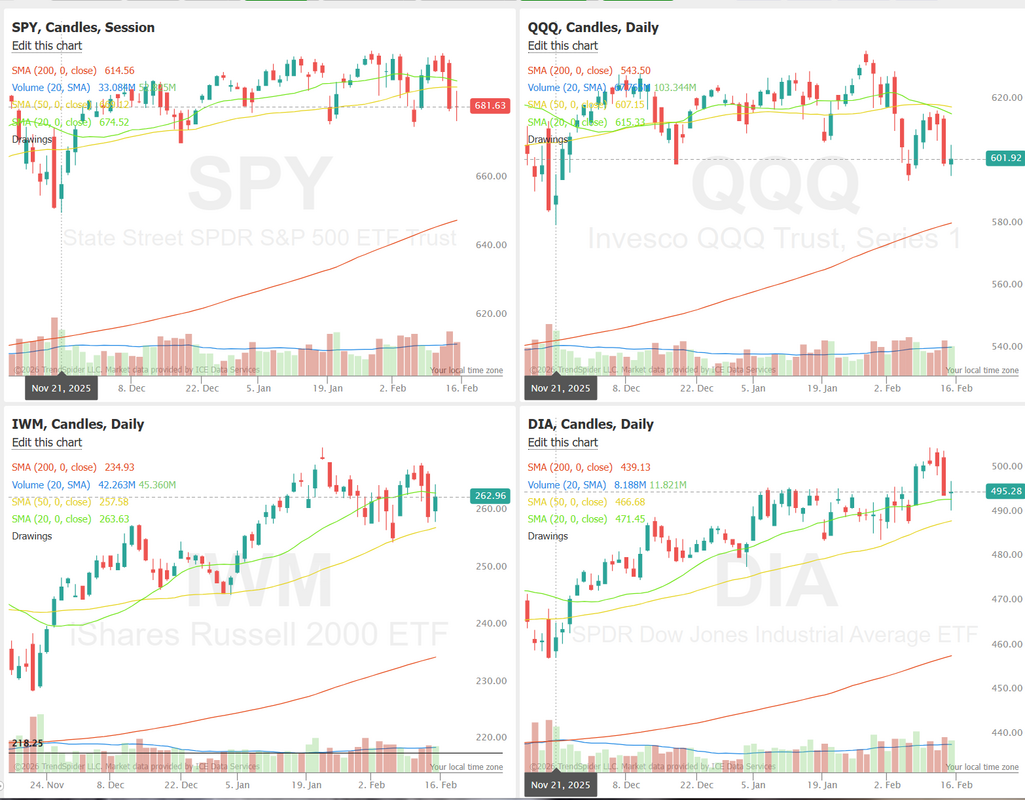

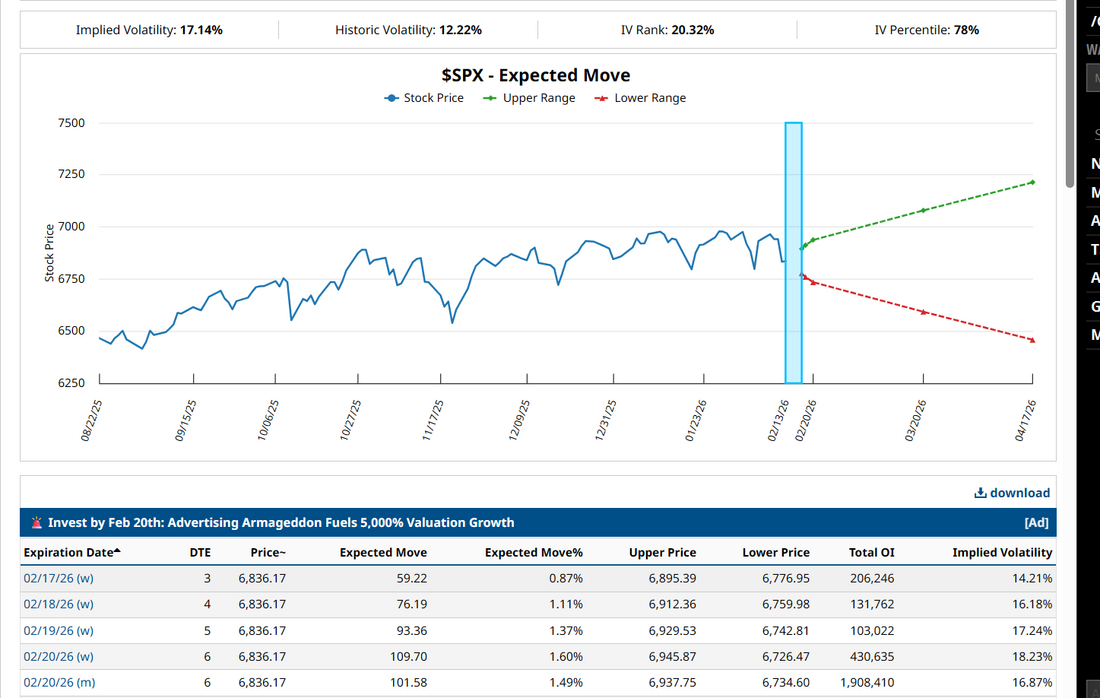

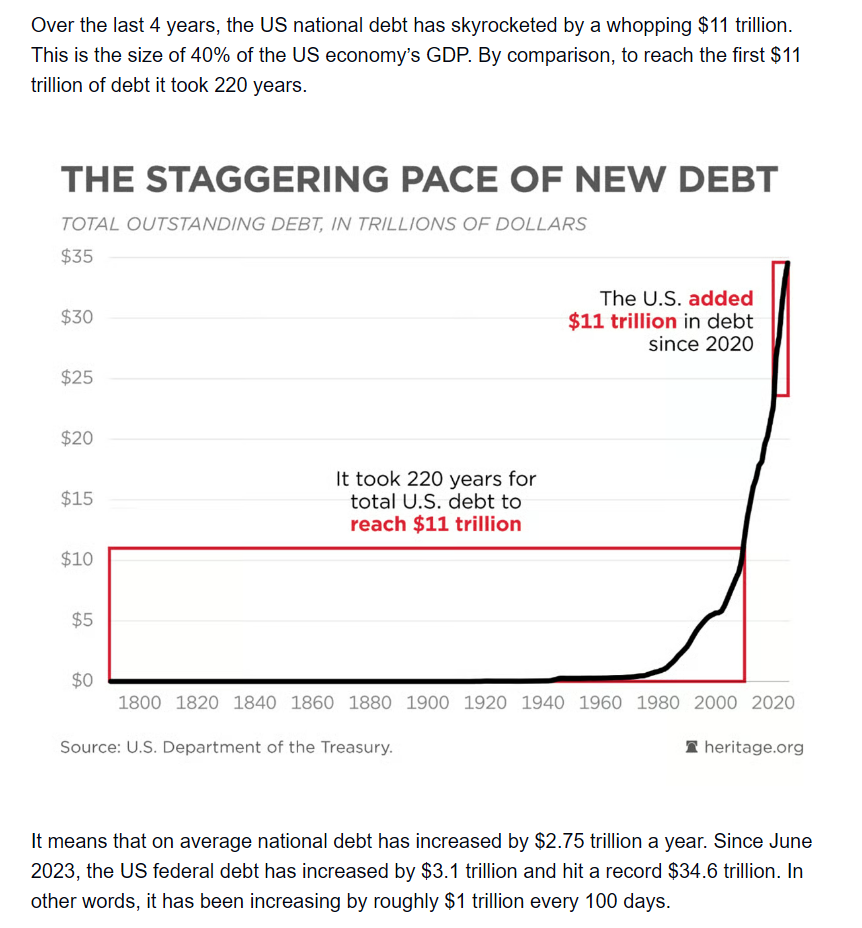

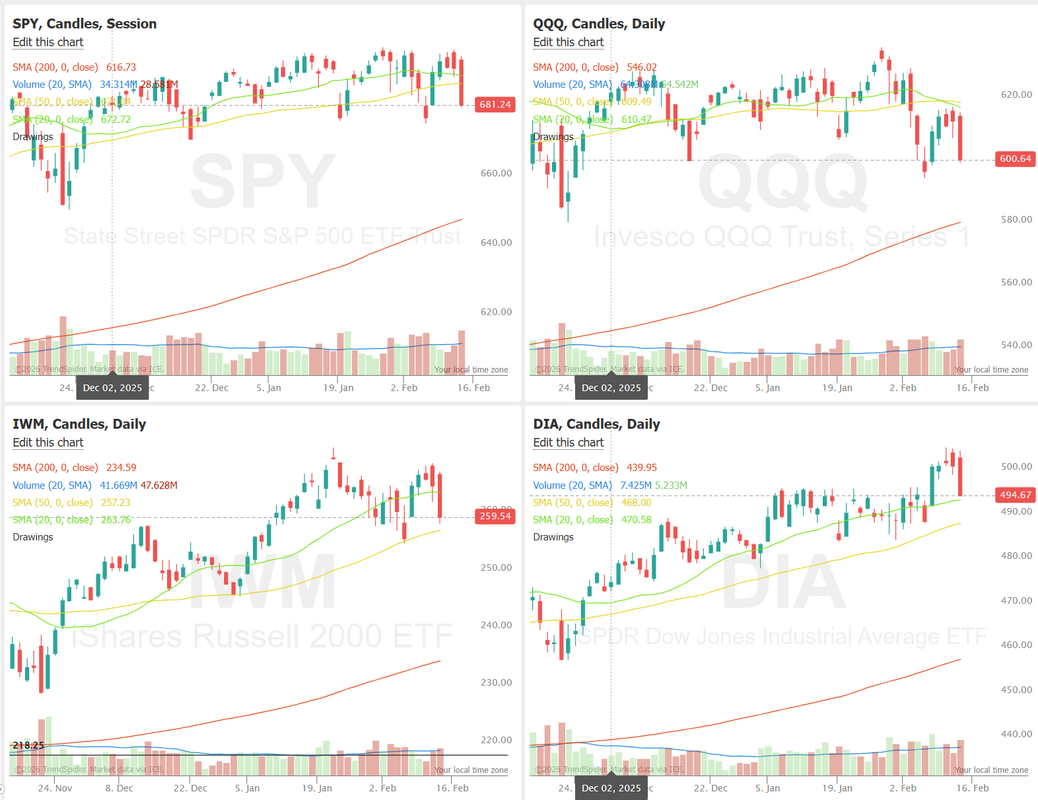

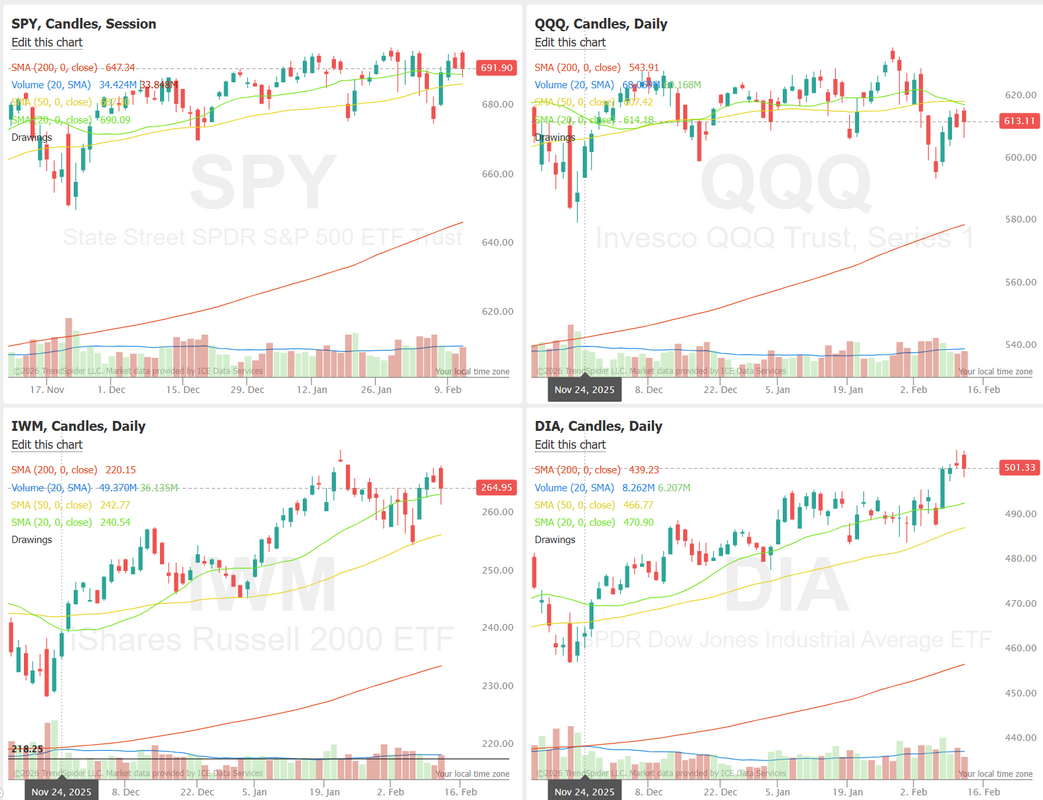

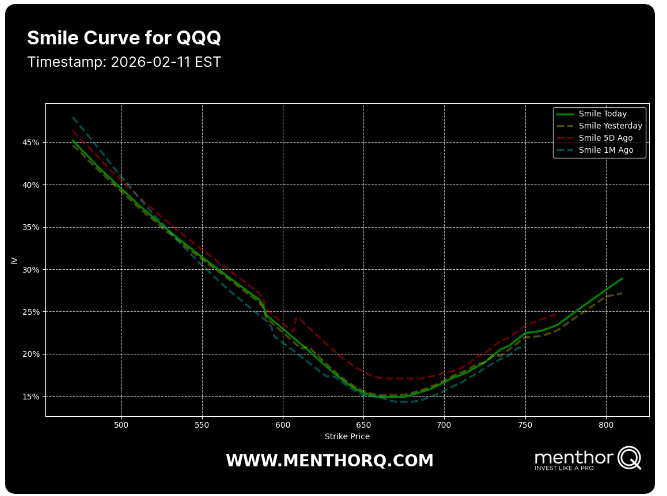

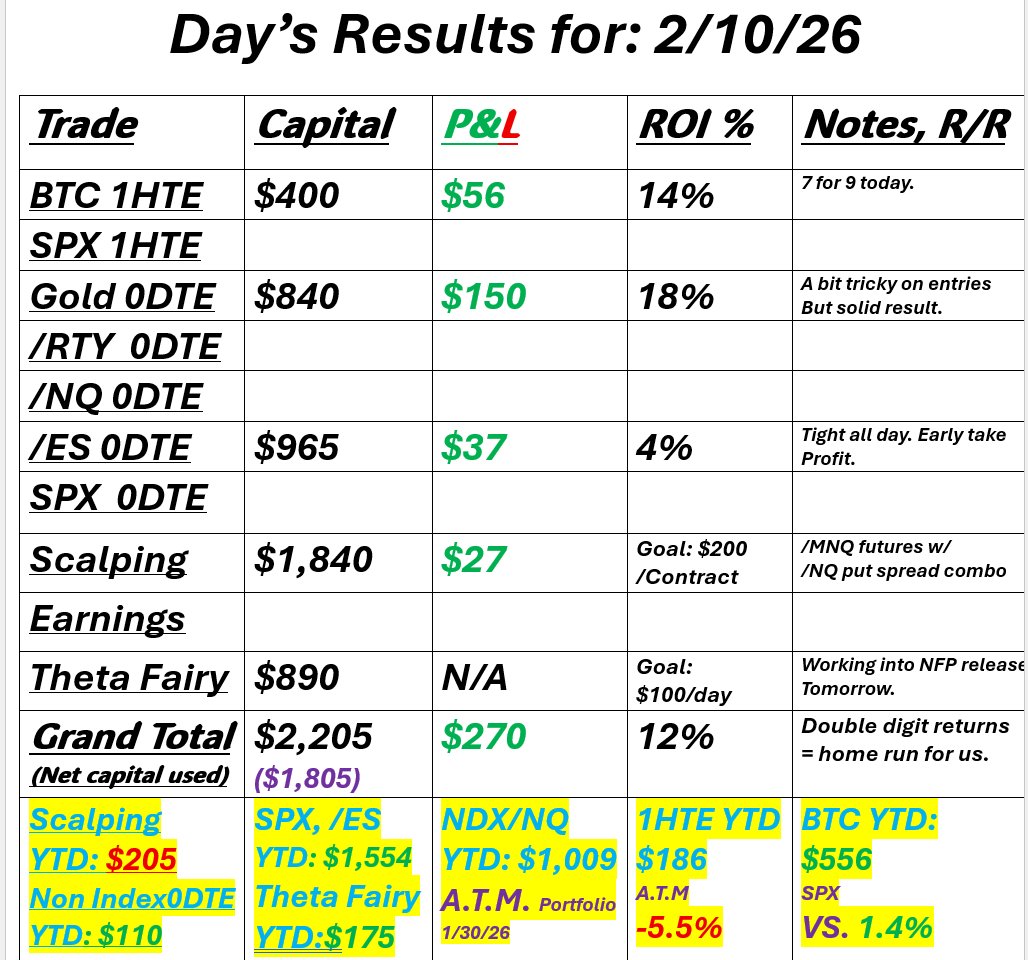

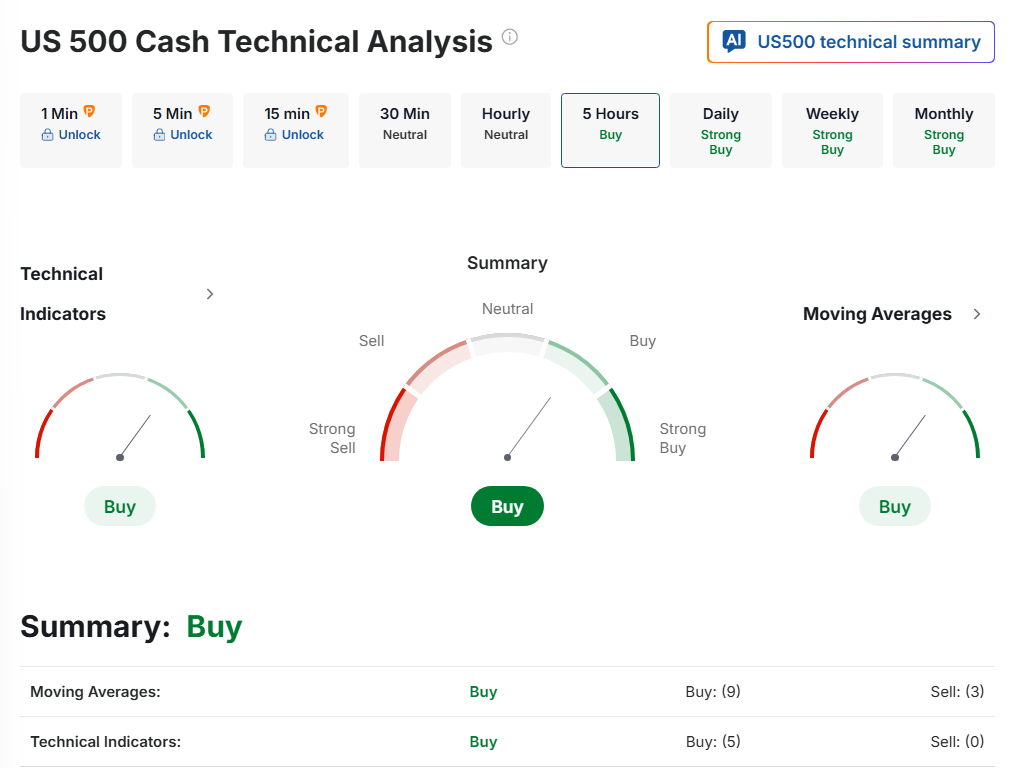

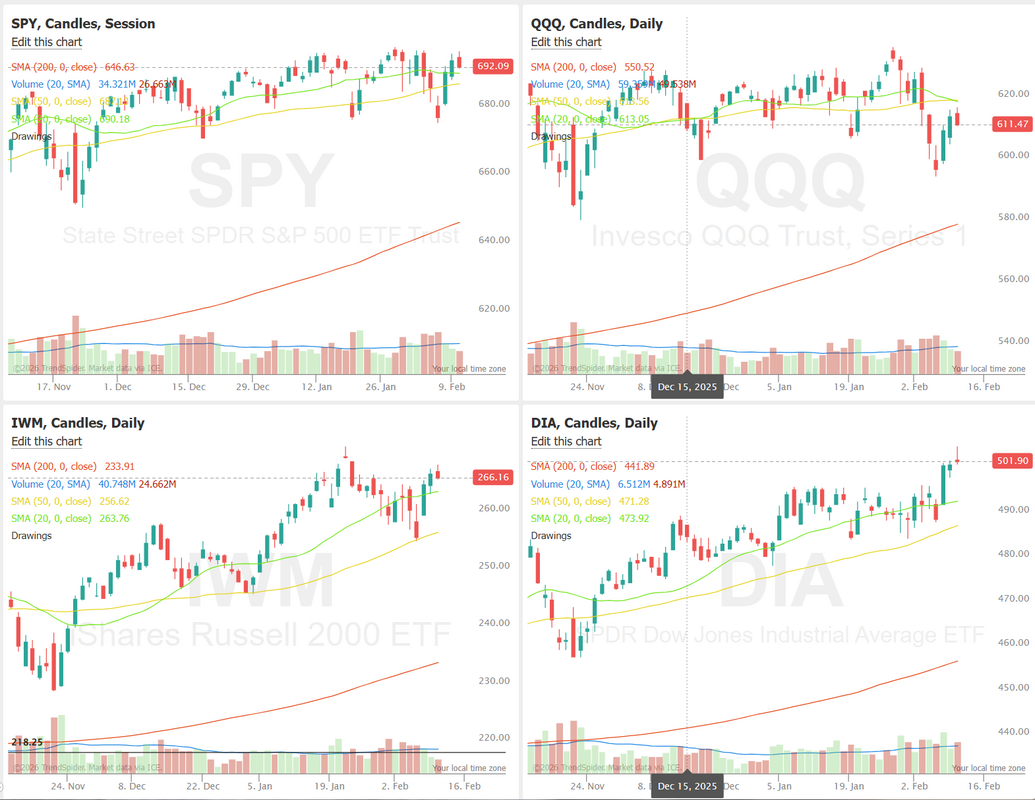

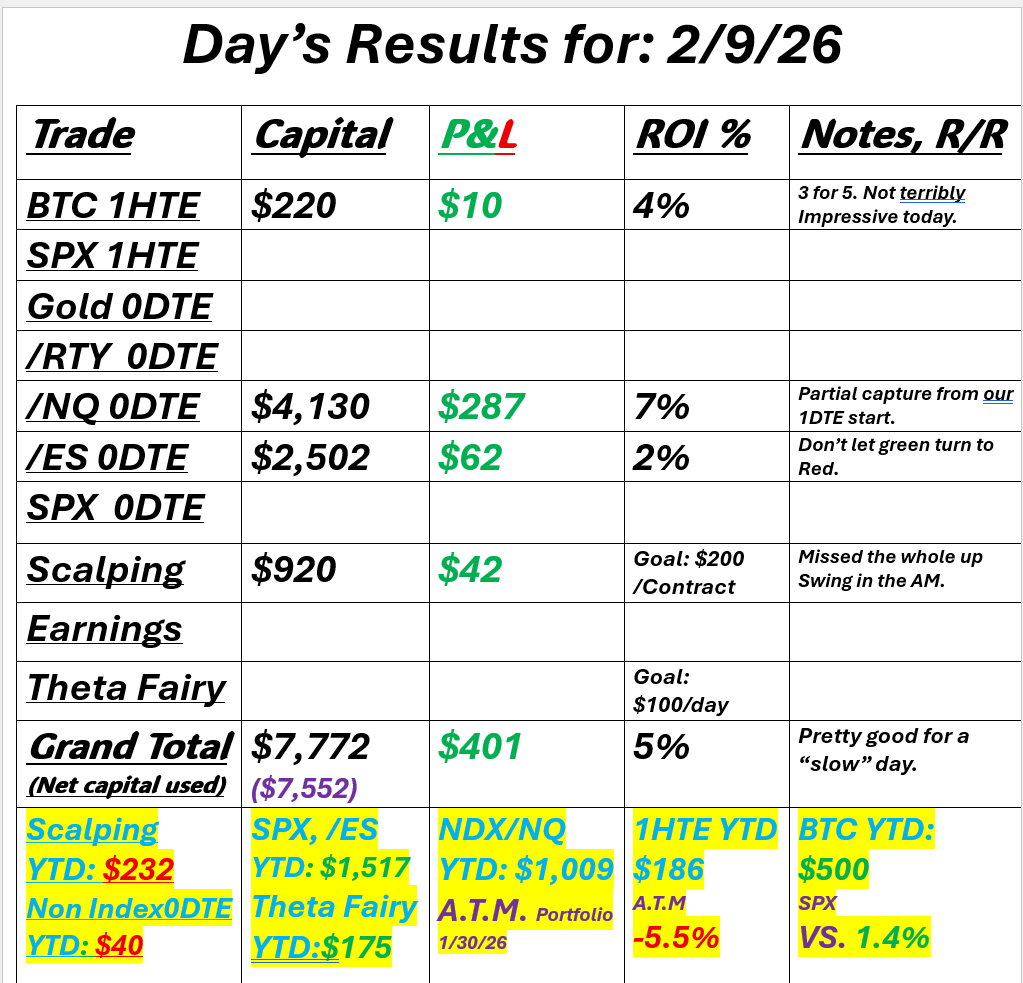

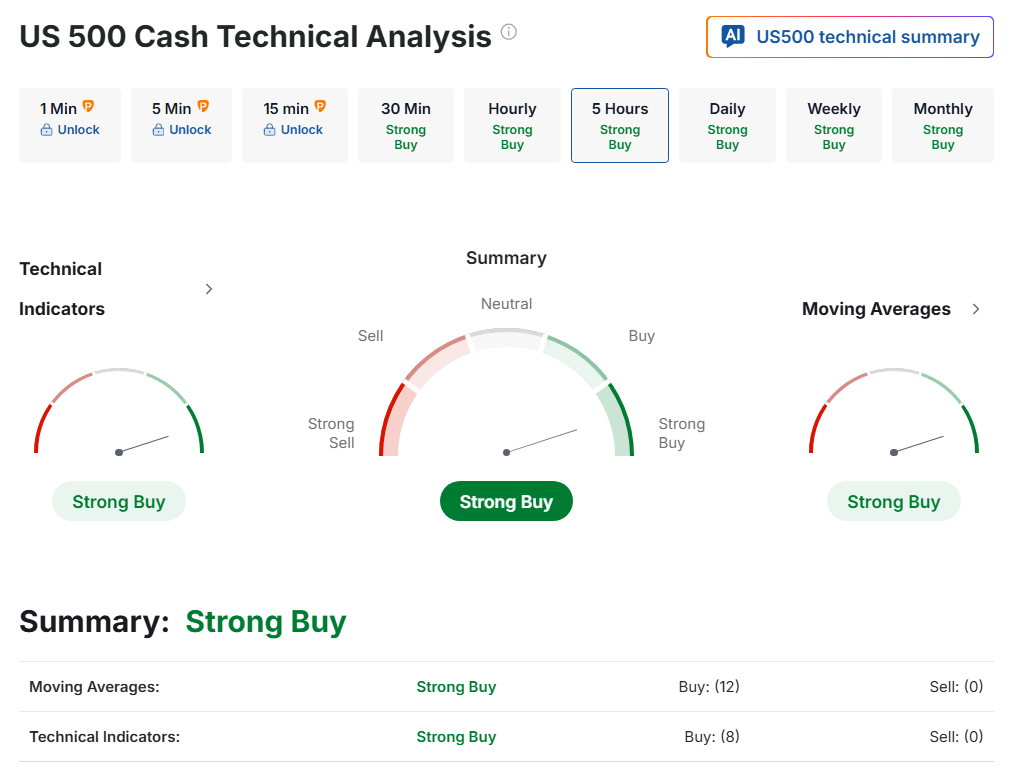

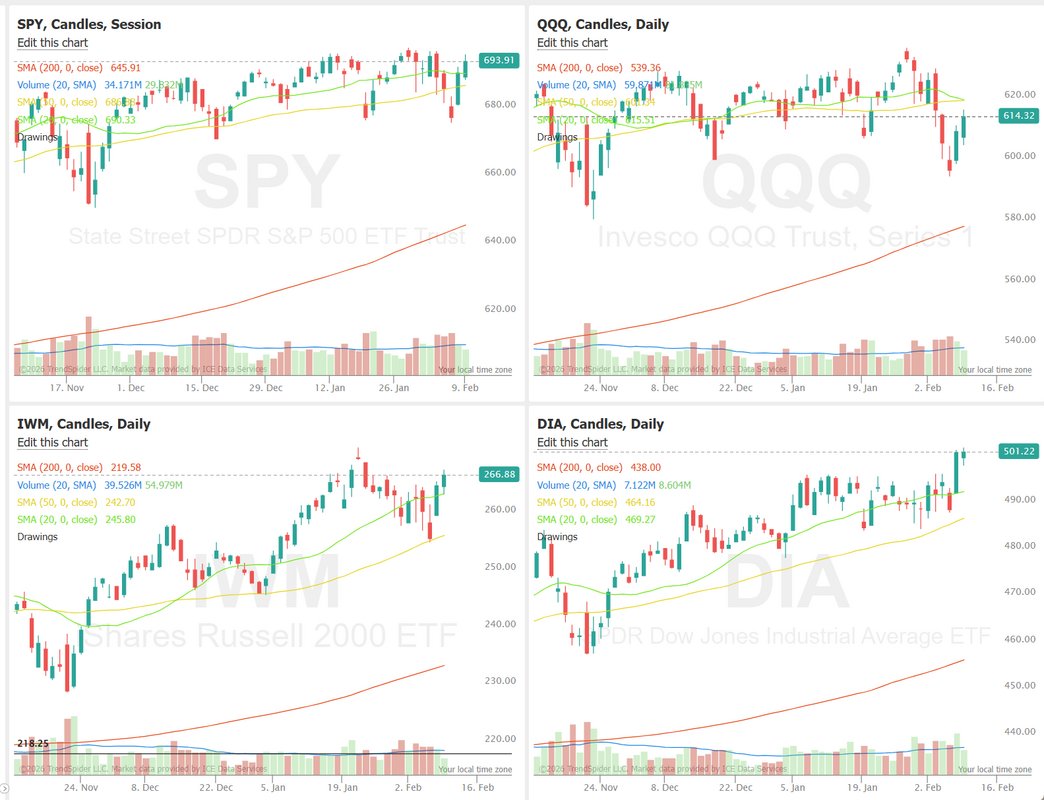

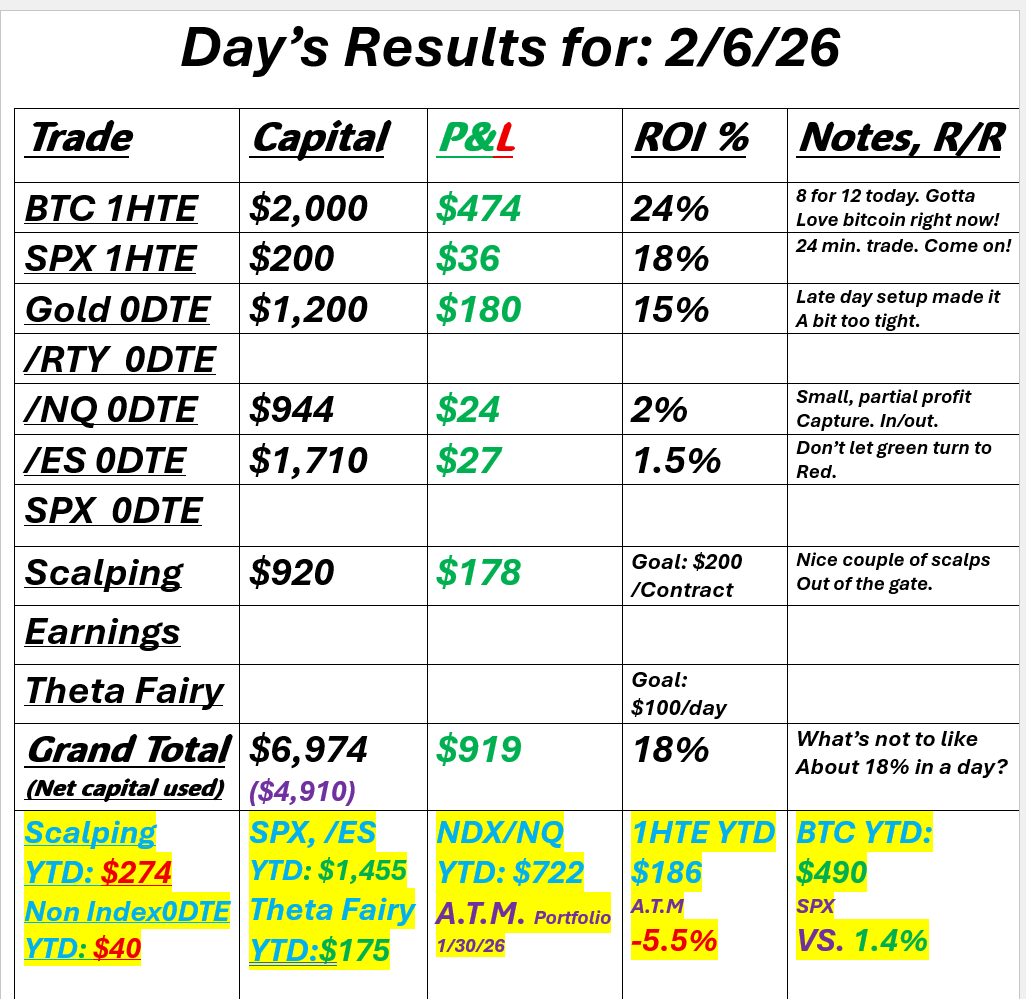

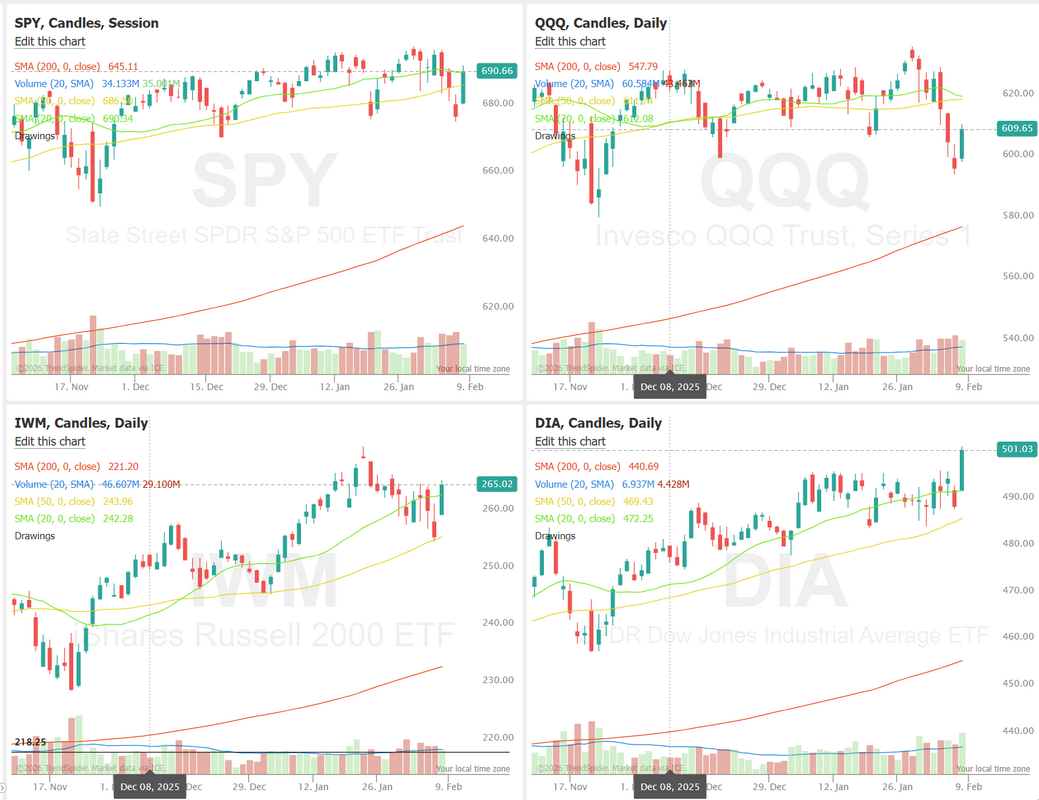

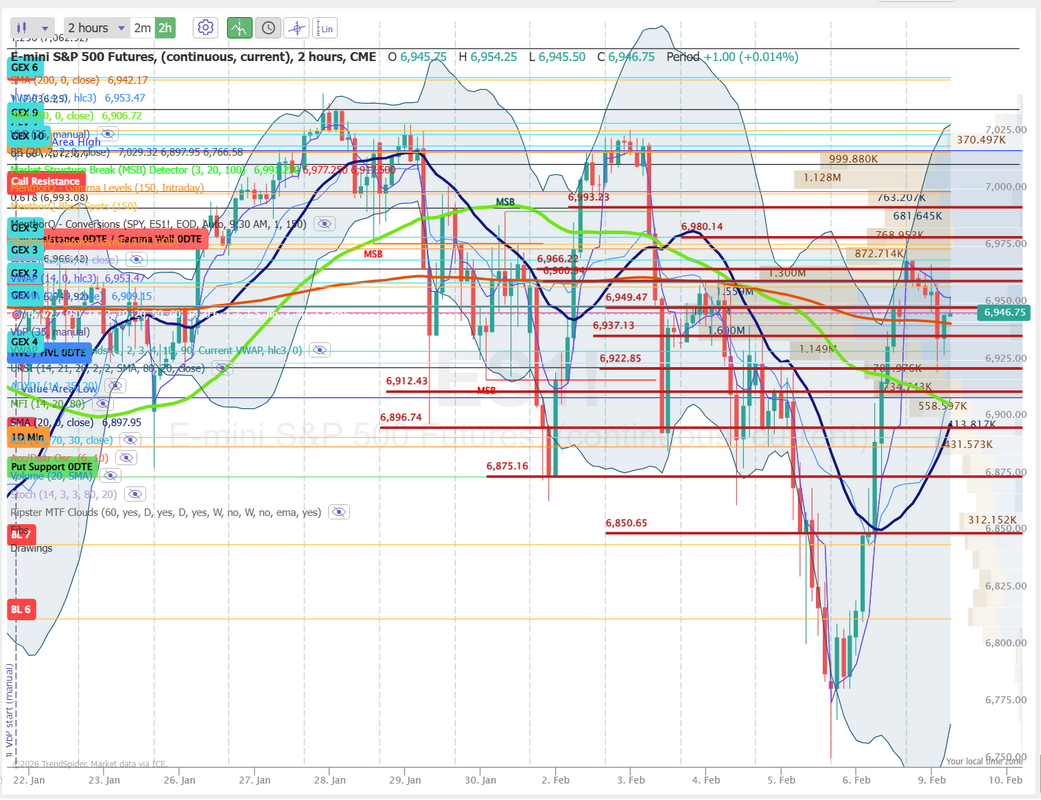

Geo politics rattling the cageWelcome back to a new trading week! Let's see..what's going on? Iran and the U.S. are close to a deal (or close to war). Mexico is at war with the cartel. Tariffs rescinded (oh, never mind, they are back on!) New York is now a communist state. Bottom line, it's a crazy, uncertain time, which is great for trading! We had a really solid trading day last Friday. Here's a look at our results. Let's take a look at the markets. All the indices held their ground on Friday. It could have really solidified a bearish trend had they not. We've got a straight neutral reading this morning on technicals. There's a lot of headline news to digest. March S&P 500 E-Mini futures (ESH26) are down -0.48%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.65% this morning, pointing to a lower open on Wall Street as heightened uncertainty about U.S. trade policy dampened sentiment. U.S. President Donald Trump on Saturday said he would raise global tariffs to 15% from 10%, a day after the Supreme Court struck down his “reciprocal” tariffs. “I, as President of the United States of America, will be, effective immediately, raising the 10% Worldwide Tariff on Countries, many of which have been “ripping” the U.S. off for decades, without retribution (until I came along!), to the fully allowed, and legally tested, 15% level,” Trump said in a Truth Social post. Notably, the 15% global tariffs are imposed under Section 122 of the 1974 Trade Act and are permitted to remain in effect for 150 days. Mr. Trump also cautioned that additional tariffs would follow. Uncertainty surrounding U.S. trade policy is adding another layer of complexity to markets already unsettled by concerns over AI disruption and U.S.-Iran tensions. Investor focus this week is on an earnings report from chip giant Nvidia, whose results have become a barometer for the AI trade, a fresh batch of U.S. economic data, and remarks from Federal Reserve officials. In Friday’s trading session, Wall Street’s major equity averages closed higher. Most members of the Magnificent Seven stocks advanced, with Alphabet (GOOGL) climbing over +4% to lead gainers in the Nasdaq 100 and Amazon.com (AMZN) rising more than +2% to lead gainers in the Dow. Also, chip stocks gained ground, with Lam Research (LRCX) rising over +3% and Analog Devices (ADI) advancing more than +2%. In addition, Corning (GLW) surged over +7% and was the top percentage gainer on the S&P 500 after UBS raised its price target on the stock to $160 from $125. On the bearish side, cybersecurity software stocks sank after Anthropic PBC rolled out a new security feature in its Claude AI model, with Cloudflare (NET) slumping more than -8%, and CrowdStrike Holdings (CRWD) sliding over -7% to lead losers in the Nasdaq 100. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, rose +0.4% m/m and +3.0% y/y in December, stronger than expectations of +0.3% m/m and +2.9% y/y. Also, the U.S. Bureau of Economic Analysis, in its initial estimate of Q4 GDP growth, said the economy grew at a +1.4% annualized rate, weaker than expectations of +2.8%. In addition, U.S. December personal spending rose +0.4% m/m, in line with expectations, and personal income grew +0.3% m/m, in line with expectations. Finally, the University of Michigan’s U.S. February consumer sentiment index was revised lower to 56.6, weaker than expectations of 56.9. Bret Kenwell, U.S. investment analyst at eToro, said the core PCE report underscores the uneven nature of the inflation battle. “It’s not the direction that investors or the Fed want to see,” he said, pointing out that core PCE has now increased for three straight months. Separately, Stephen Coltman, head of macro at 21Shares, described the combination of softer growth and firmer inflation as “unwelcome.” Atlanta Fed President Raphael Bostic said on Friday that it is prudent to keep rates “mildly restrictive” to bring inflation back to the 2% level and that current Fed policy is 25-50 basis points above neutral. Also, Dallas Fed President Lorie Logan said she was “cautiously optimistic” that the current monetary policy stance indicates “we’re on a path for inflation to come back down toward our target.” U.S. rate futures have priced in a 95.9% chance of no rate change and a 4.1% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. All eyes will be on Nvidia (NVDA) this week, as the semiconductor giant prepares to report its fourth-quarter and fiscal-year results on Wednesday. Investors anticipate that the company will beat Wall Street’s expectations and provide strong guidance for the current quarter. However, analysts said there may be little the company can do or say to meaningfully lift its shares amid growing skepticism about AI at the moment. Retailers such as Home Depot (HD), The TJX Companies (TJX), and Lowe’s (LOW), along with notable companies like Salesforce (CRM), Intuit (INTU), Dell Technologies (DELL), and CoreWeave (CRWV), are also set to release their quarterly results this week. Market watchers will also keep a close eye on several U.S. economic data releases this week amid uncertainty about the timing of the Fed’s next interest rate cut. The U.S. Producer Price Index for January will be the main highlight, providing further insight into the outlook for inflation. Other noteworthy data releases include the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., the Richmond Fed Manufacturing Index, Initial Jobless Claims, Construction Spending, and the Chicago PMI. In addition, market participants will parse comments from a slew of Fed officials. Fed Governors Christopher Waller and Lisa Cook, along with Chicago Fed President Austan Goolsbee, Atlanta Fed President Raphael Bostic, Boston Fed President Susan Collins, Richmond Fed President Tom Barkin, Kansas City Fed President Jeff Schmid, and St. Louis Fed President Alberto Musalem, are scheduled to speak this week. Meanwhile, President Trump’s annual State of the Union address on Tuesday will also attract attention. Investors will monitor the address for signals on trade and other policy priorities ahead of this year’s midterm elections. “Tomorrow’s State of the Union will likely define how far Trump wants to go with the tariff rhetoric,” said Andrea Gabellone, head of global equities at KBC Securities. Today, investors will focus on U.S. Factory Orders data, which is set to be released in a couple of hours. Economists expect this figure to drop -0.4% m/m in December, following a +2.7% m/m jump in November. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.077%, down -0.29%. Todays training is another good one. Today we'll focus on a trading approach that you can use for 0DTE trading that takes just a few minutes to set up and then you're done for the day! No monitoring. No sitting in front of the computer all day. No adjustments. It's called "sizing for zero". Be sure to tune in. It will be worth your time. SPY ended the week higher at 689.43 (+1.13%), finishing right where it opened the prior week. Despite the choppy price action, there was still opportunity for intraday traders using the new ORB tools. With tariff headlines hitting on Friday, 5-minute ORB traders were able to capture a 3R move as SPY rallied 5 points following the opening range breakout. The Nasdaq tracked closely with the S&P 500 last week, as QQQ closed at $608.81 (+1.15%) despite the heavy news flow. However, the 5-minute opening range breakout produced only a 2R move based on a stop beneath the opening range low. With NVDA earnings on deck, its reaction could drive QQQ decisively in either direction. Small caps lagged last week, with IWM closing at $264.61 (+0.63%). While the ETF has steadily outperformed large caps in 2026, momentum paused over the past week. Despite that consolidation, the 5-minute opening range breakout strategy delivered, allowing traders to capture a 3R move in less than 10 minutes. Expected move for the week on SPX is 1.48%. Decent enough and that should give us some premium to work with. SPX remains near recent highs, while short-term RSI breadth measures have moderated. The number of stocks with 5-day and 14-day RSI readings above 70 has declined from recent peaks, and the count of names trading above their upper Bollinger Bands has also eased. This configuration reflects elevated index levels alongside cooling short-term momentum participation. Breadth readings are no longer expanding and have shifted toward mid-range levels relative to recent extremes. At present, price stability coexists with a reduction in overbought breadth conditions, indicating a transition from expansionary momentum to a more balanced internal structure. QQQ’s ATM term structure shows a relatively stable and gently upward-sloping curve, with front-end implied volatility cooling compared to five days ago while longer-dated vols remain anchored near the low 20% area. This suggests near-term event premium has faded somewhat, but the market still prices steady medium-term uncertainty. On the smile, downside strikes remain bid with a pronounced put skew, while upside calls are comparatively flatter, indicating continued demand for protection over speculative upside. Overall, q-option positioning reflects a market that is less panicked than earlier in the week but still defensively tilted, with downside hedges carrying richer implied volatility than at-the-money or upside strikes. Let's take a look at the intraday levels we'll be working off for today's 0DTE entries. 6896 seems to be the "line in the sand" this morning. 6906, 6919, 6925, 6937 are resistance levels. 6885, 6874, 6867, 6858, 6850 are support levels. Let's have a strong start to the week! Scalping could be good today. I'll see you all in the live trading room shortly!

0 Comments

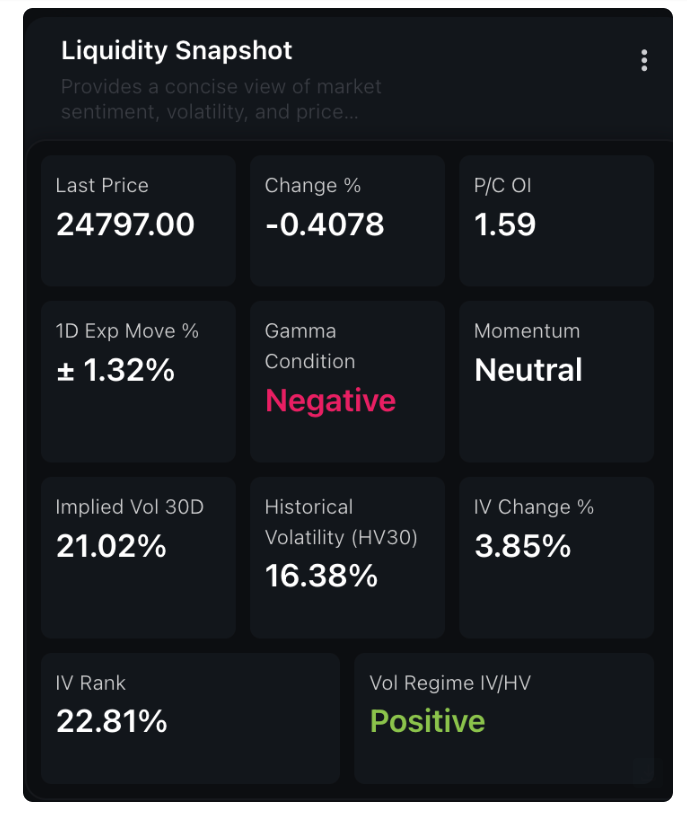

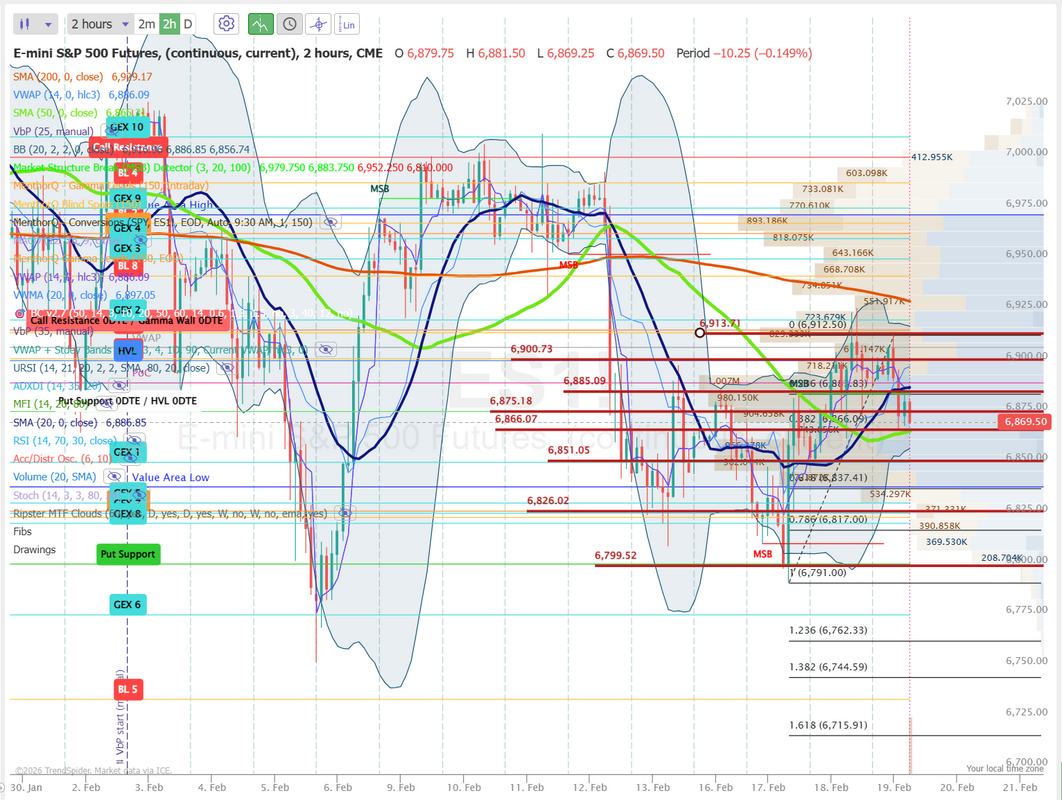

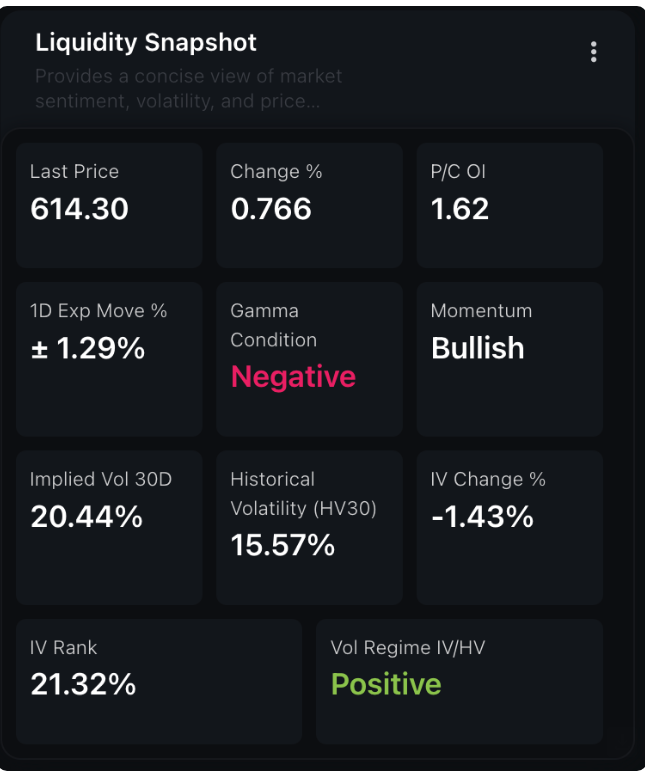

How often do you trade scared?I have to say, I probably have as many losing trades as the next guy but one thing I stand on is that I rarely if ever, trade scared. I've always been surprised at how many people do. BTW, we just finished up part three of an excellent training on systems and risk management yesterday. If you haven't watched the video and downloaded the power point I'd highly recommend it. Anyways...I was trading a bit scared yesterday morning. We had a rolled gold trade on and I was worried about Iran and the possibility of bombs dropping. In hindsight, even though we were able to pull a small profit, it wasn't a great setup. Control what you can and let the rest sort itself out. That trade took most of my focus and price action was "yucky" all day so we didn't get much working. Let's take a look at the markets. Did you gain any insight about future direction from yesterdays market? Yeah...me neither. We start today with a slightly bearish lean. March S&P 500 E-Mini futures (ESH26) are trending down -0.21% this morning as investors assess the potential impact of conflict in the Middle East and await a raft of U.S. economic data, with particular attention on the Fed’s favorite inflation gauge and the first estimate of fourth-quarter GDP. The U.S. military is deploying a wide range of forces in the Middle East, including two aircraft carriers, fighter jets, and refueling tankers. U.S. President Donald Trump said Iran had no more than 15 days to strike a deal over its nuclear program or “really bad things” would happen. The Wall Street Journal reported that President Trump is considering an initial limited strike on military or government sites in Iran to pressure it into meeting his demands for a nuclear deal. Market participants are also bracing for a potential Supreme Court ruling on President Trump’s sweeping tariffs. In yesterday’s trading session, Wall Street’s major indexes ended in the red. EPAM Systems (EPAM) tumbled over -17% and was the top percentage loser on the S&P 500 after the software design company issued soft FY26 revenue growth guidance. Also, chip stocks slid, with Microchip Technology (MCHP) and Texas Instruments (TXN) dropping more than -2%. In addition, Booking Holdings (BKNG) slumped more than -6% and was the top percentage loser on the Nasdaq 100 after the company posted weaker-than-expected Q4 EPS. On the bullish side, Omnicom Group (OMC) jumped over +15% and was the top percentage gainer on the S&P 500 after the marketing conglomerate reported better-than-expected Q4 revenue. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell by -23K to 206K, compared with the 223K expected. Also, the U.S. Philly Fed manufacturing index rose to a 5-month high of 16.3 in February, stronger than expectations of 7.5. At the same time, the U.S. December trade deficit widened to -$70.3 billion, weaker than expectations of -$55.5 billion. In addition, U.S. pending home sales unexpectedly fell -0.8% m/m in January, weaker than expectations of +1.4% m/m. Minneapolis Fed President Neel Kashkari said on Thursday that interest rates are currently probably near “neutral”—the level where they neither restrain nor stimulate the economy. Also, San Francisco Fed President Mary Daly said that monetary policy is “in a good place.” Meanwhile, U.S. rate futures have priced in a 94.0% probability of no rate change and a 6.0% chance of a 25 basis point rate cut at the next central bank meeting in March. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.9% y/y in December, compared to +0.2% m/m and +2.8% y/y in November. The U.S. Commerce Department’s advance estimate of fourth-quarter gross domestic product will also be closely monitored today. Economists forecast that U.S. economic growth slowed to a still-solid 2.8% annualized pace after expanding in the previous quarter at the fastest rate in two years. U.S. Personal Spending and Personal Income data will be released today. Economists expect December Personal Spending to rise +0.4% m/m and Personal Income to grow +0.3% m/m, compared to the November figures of +0.5% m/m and +0.3% m/m, respectively. Preliminary U.S. purchasing managers’ surveys will come in today. Economists expect the February S&P Global Manufacturing PMI to be 52.4 and the S&P Global Services PMI to be 53.0, compared to the previous values of 52.4 and 52.7, respectively. U.S. New Home Sales data for December will be reported today. Notably, the release will also incorporate the November figures. Economists expect December’s new home sales to be 732K. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists anticipate that the final February figure will be revised lower to 56.9 from the preliminary reading of 57.3. In addition, market participants will be looking toward speeches from Atlanta Fed President Raphael Bostic and Dallas Fed President Lorie Logan. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.070%, down -0.17%. With PCE and a potential ruling on Tariffs I'll wait until those are know before working a 0DTE today. SPX remains near record highs, with breadth measures showing approximately 300+ stocks trading above their 200-day moving averages. This reflects broad participation across the index rather than concentration in a limited group of names. The breadth reading currently sits within the upper range of its recent distribution, indicating sustained internal strength relative to prior consolidation phases. Price continues to hold within its elevated structure, while breadth remains stable following recent expansion. At present, the index reflects a configuration of elevated price levels supported by broadly positive participation metrics. NDX liquidity conditions reflect a modest decline in price (-0.40%) alongside a put/call open interest ratio of 1.59, indicating relatively heavier put positioning. Gamma is currently negative, which historically corresponds with greater sensitivity to intraday price movements around concentrated strike levels. Thirty-day implied volatility (21.02%) remains above historical volatility (16.38%), while IV Rank at 22.8% places current volatility levels in the lower portion of their one-year distribution. Momentum indicators are neutral, and the current IV/HV relationship reflects options pricing that exceeds recent realized movement. Overall, the options structure shows defined positioning concentrations without extreme volatility expansion relative to longer-term ranges. Let's take a look at the markets to get us started this morning. Intraday levels are 6877, 6885, 6875, 6900 as resistance with 6870, 6860, 6851, 6838 working as support levels. Looking at the bigger picture on the daily chart with the VTI we have NO signal. Our technicals look like they want to turn bullish but haven't...yet. Price action is muted and still below the 20/50DMA. We need some more movement to get a trend going. With PCE, Two FED speakers and a potential ruling on tariffs this morning we'll wait a bit to get our first 0DTE started. See you all in the live trading room shortly.

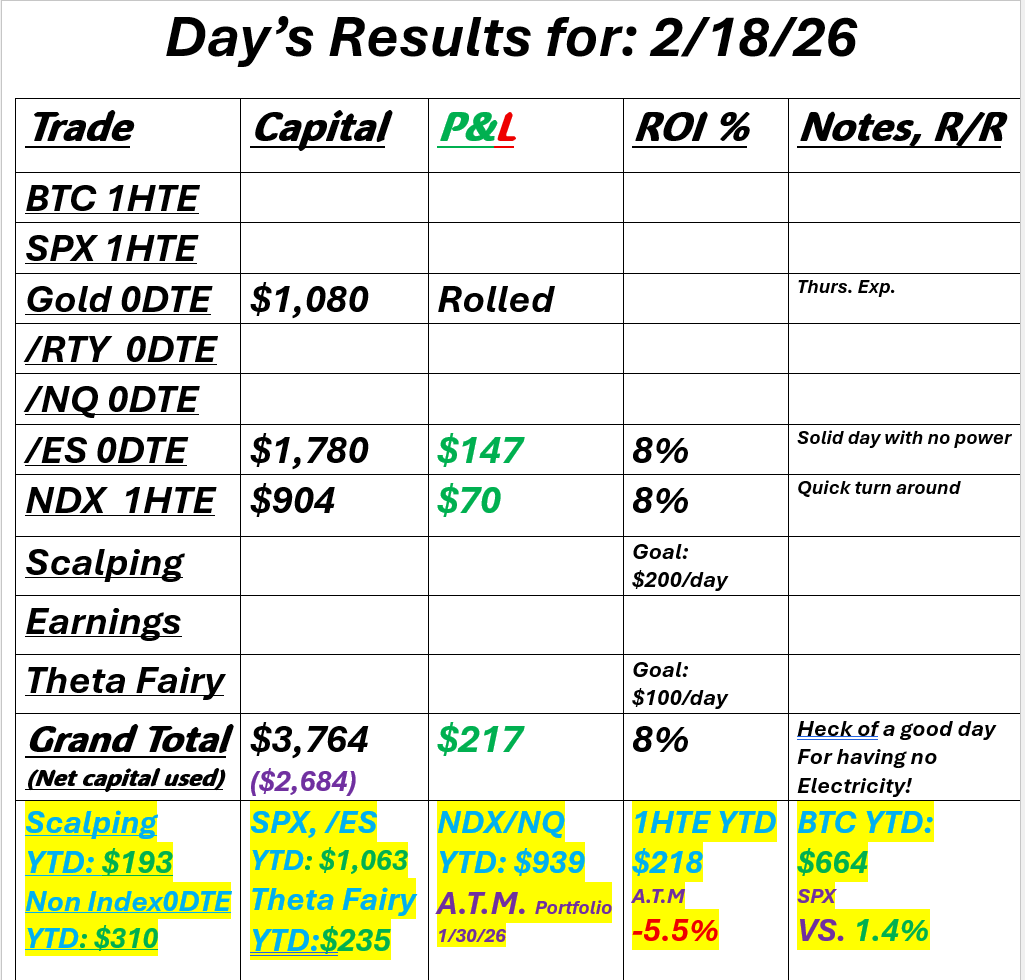

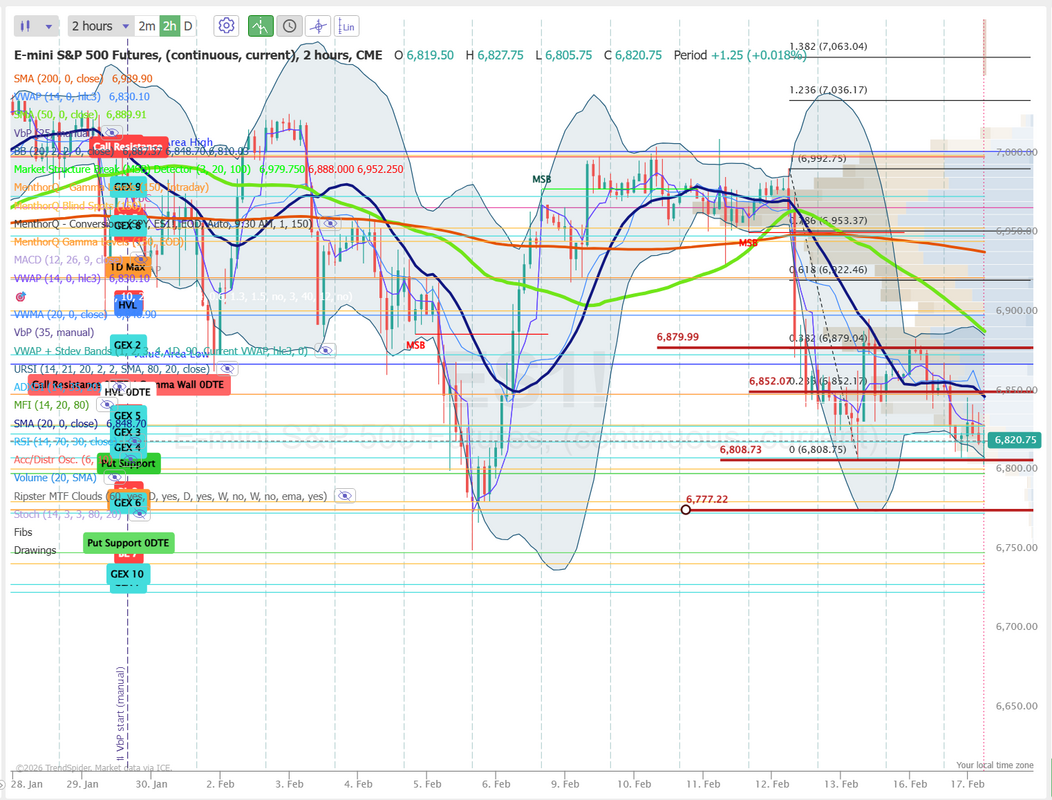

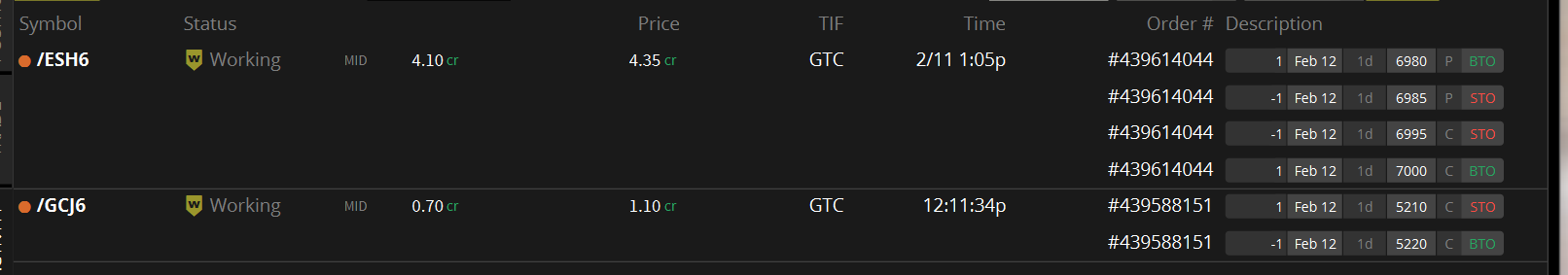

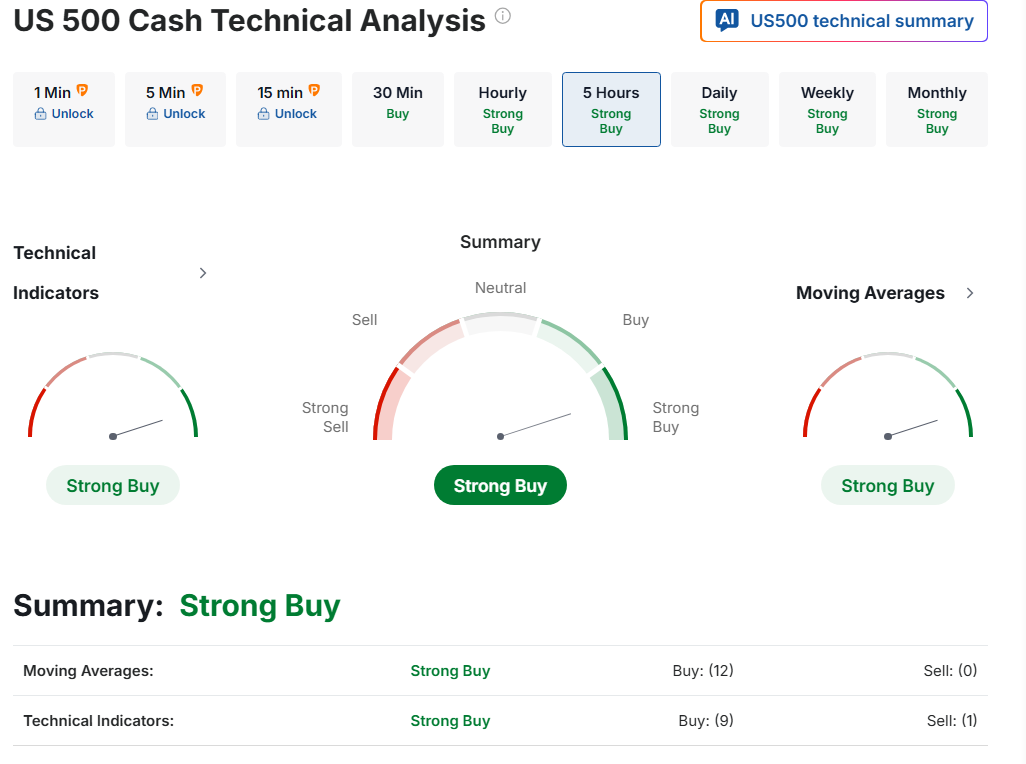

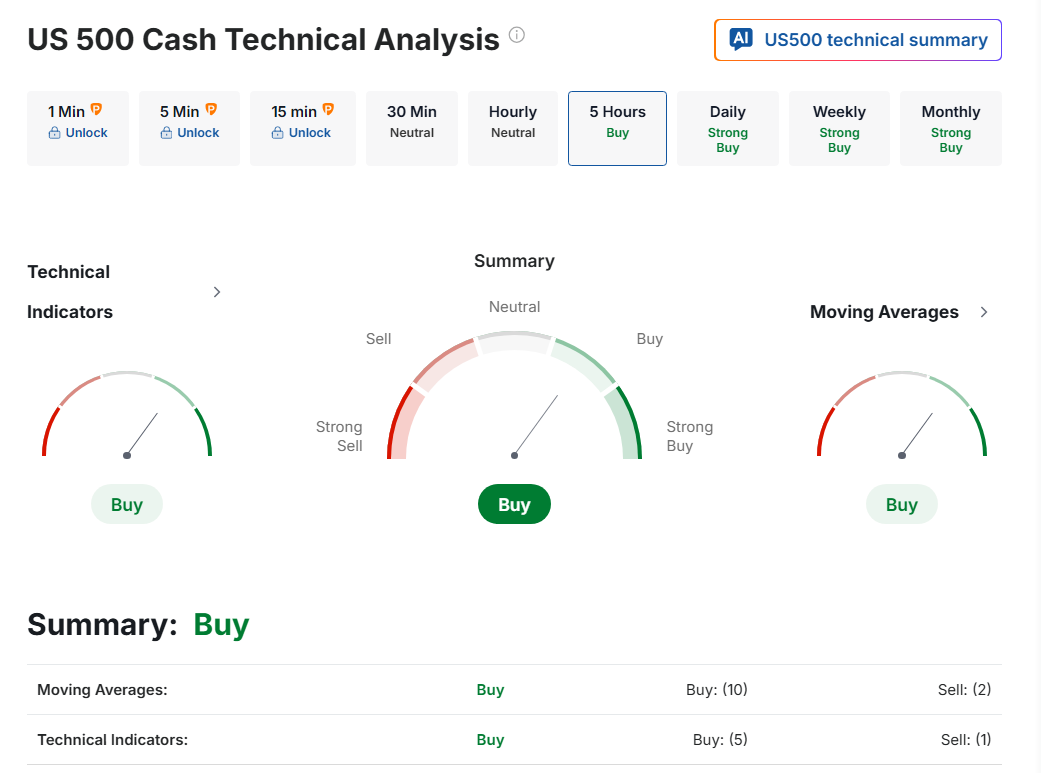

Iran and TariffsGood morning traders! Yesterday was a bit of a technical challenge for me. Our power was knocked out late in the evening so I lacked my screens and signals and was just trading off my laptop battery and tethered mobile phone for most of the day. We were still able to get some trades done so all in all, I'm pretty happy the day wasn't a waste. We did roll our gold calls up and out to today so that will be our primary focus this morning. Here's a look at our truncated day yesterday. The next few days in the market could get interesting. Depending on who you listen to, the US and Iran are either close to a breakthrough agreement or...ready to go to war. Negotiations are ongoing and most media reports show progress however there is a massive build up of weaponry going on from the US, right on Iran's doorstep. Combine this with the potential (Just potential at this point) for a supreme court ruling this Friday on tariffs. I'm keeping some powder dry going into the weekend. Let's take a look at the markets. We've had a couple green days in a row. Is it meaningful? Does it tell us anything? I don't think so. We are still in a "Lower lows and lower highs" trend. Markets gone no where this year with the QQQ's actually down. That could (should?) change soon. The technicals this morning are a bit bearish with futures pointed down, as I type. March S&P 500 E-Mini futures (ESH26) are down -0.32%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.36% this morning, pointing to a lower open on Wall Street as worries about a potential conflict between the U.S. and Iran dampened sentiment. Investors remain on edge about the prospect of U.S. military intervention in Iran, even as talks on Tehran’s nuclear program in Geneva showed signs of progress. The Wall Street Journal reported on Wednesday that the U.S. has assembled its largest air power presence in the Middle East since the 2003 invasion of Iraq and is in a position to strike Iran. The head of the United Nations nuclear watchdog warned on Thursday that the window for a diplomatic deal on Iran’s atomic program is closing. The price of WTI crude rose above $66 a barrel. Also adding to the negative sentiment on Thursday was renewed caution about the outlook for AI. Most members of the Magnificent Seven stocks edged lower in pre-market trading. Investors now await a new round of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from retail giant Walmart. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. Global Payments (GPN) surged over +16% and was the top percentage gainer on the S&P 500 after the financial software provider issued above-consensus FY26 adjusted EPS guidance. Also, most chip stocks advanced, with Micron Technology (MU) rising more than +5% and Applied Materials (AMAT) gaining over +2%. In addition, Palantir Technologies (PLTR) rose more than +1% after Mizuho upgraded the stock to Outperform from Neutral. On the bearish side, Palo Alto Networks (PANW) slumped over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the cybersecurity firm cut its full-year adjusted EPS guidance. Economic data released on Wednesday showed that U.S. durable goods orders fell -1.4% m/m in December, stronger than expectations of -1.8% m/m, while core durable goods orders, which exclude transportation, climbed +0.9% m/m, stronger than expectations of +0.3% m/m. Also, U.S. December housing starts rose +6.2% m/m to a 5-month high of 1.404 million, stronger than expectations of 1.310 million, and building permits, a proxy for future construction, rose +4.3% m/m to a 9-month high of 1.448 million, stronger than expectations of 1.400 million. In addition, U.S. industrial production rose +0.7% m/m in January, stronger than expectations of +0.4% m/m. “In the context of a data-dependent Committee, the incoming economic data justified last month’s pause on the journey to neutral,” said Ian Lyngen at BMO Capital Markets. “The open question is: how high is the bar to resume rate cuts?” Meanwhile, the minutes of the Federal Open Market Committee’s January 27-28 meeting, released on Wednesday, showed that “several” policymakers suggested the central bank may have to raise rates if inflation remains above their target. “Several participants indicated that they would have supported a two-sided description of the committee’s future interest-rate decisions, reflecting the possibility that upward adjustments to the target range for the federal funds rate could be appropriate if inflation remains at above-target levels,” according to the FOMC minutes. The minutes also showed that a “vast majority of participants judged that downside risks to employment had moderated in recent months while the risk of more persistent inflation remained.” Several officials saw scope for additional rate cuts if inflation eased as anticipated, though most said progress on inflation could be slower than generally forecast. U.S. rate futures have priced in a 94.1% chance of no rate change and a 5.9% chance of a 25 basis point rate cut at the March FOMC meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 223K, compared to last week’s number of 227K. The U.S. Philadelphia Fed Manufacturing Index will also be closely watched today. Economists anticipate that the Philly Fed manufacturing index will stand at 7.5 in February, compared to last month’s value of 12.6. U.S. Trade Balance data will be released today. Economists forecast that the trade deficit will narrow to -$55.5 billion in December from -$56.8 billion in November. The National Association of Realtors’ pending home sales data will be reported today. Economists expect the January figure to rise +1.4% m/m following a -9.3% m/m drop in December. The Conference Board’s Leading Economic Index for the U.S. will come in today. Economists expect the December figure to drop -0.2% m/m, compared to the previous number of -0.3% m/m. The EIA’s weekly crude oil inventories report will be released today as well. Economists estimate this figure to be 1.7 million barrels, compared to last week’s value of 8.5 million barrels. In addition, market participants will parse comments today from Atlanta Fed President Raphael Bostic, Fed Vice Chair for Supervision Michelle Bowman, Minneapolis Fed President Neel Kashkari, and Chicago Fed President Austan Goolsbee. On the earnings front, notable companies such as Walmart (WMT), Deere & Company (DE), Newmont (NEM), and Copart (CPRT) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.094%, up +0.34%. Today we'll finish up this series on risk management. Tune in early today. We'll try to get it done a bit earlier than normal. Let's take a look at the intraday levels we'll be working off today. 6875, 6885, 6900, 6914 are resistance levels. 6866, 6851, 6820, 6800 are support levels. Game plan for today is to get our Gold 0DTE that was rolled over from yesterday to the finish line first. It expires at 11:30 am MST. After that we'll focus on our next 0DTE for the day. It could be either /ES or /NQ depending on the remaining premiums available. We'll also focus on scalping and 1HTE's. See you all in the live trading room shortly!

The AI rotation trade is still in progressWelcome back to another holiday shortened trading week. The theme in the market continues to be the sector rotation caused by the AI revaluation. Matthew Tuttle did an excellent overview of the Goldman Sachs pairs trade. I'll post that here: Goldman’s desk introduced a Software Pair Trade:

Goldman’s key point: the long basket’s growth expectations have materially improved since 2023, while the “AI-exposed” bucket is closer to stagnation. That’s the whole trade: separate the AI winners from the AI casualties… inside software itself. Our Take: This Is the “Software Civil War” Here’s the cleanest way to think about it: Two types of software exist now: 1) AI Tollbooths (the winners) These businesses sit in the path of AI traffic. When AI adoption rises, they don’t lose seats… they gain:

AI doesn’t replace them. AI makes them necessary. 2) AI-Replaceables (the losers) These companies sell software that is basically:

When agents get good enough, these products don’t always die… but they often get:

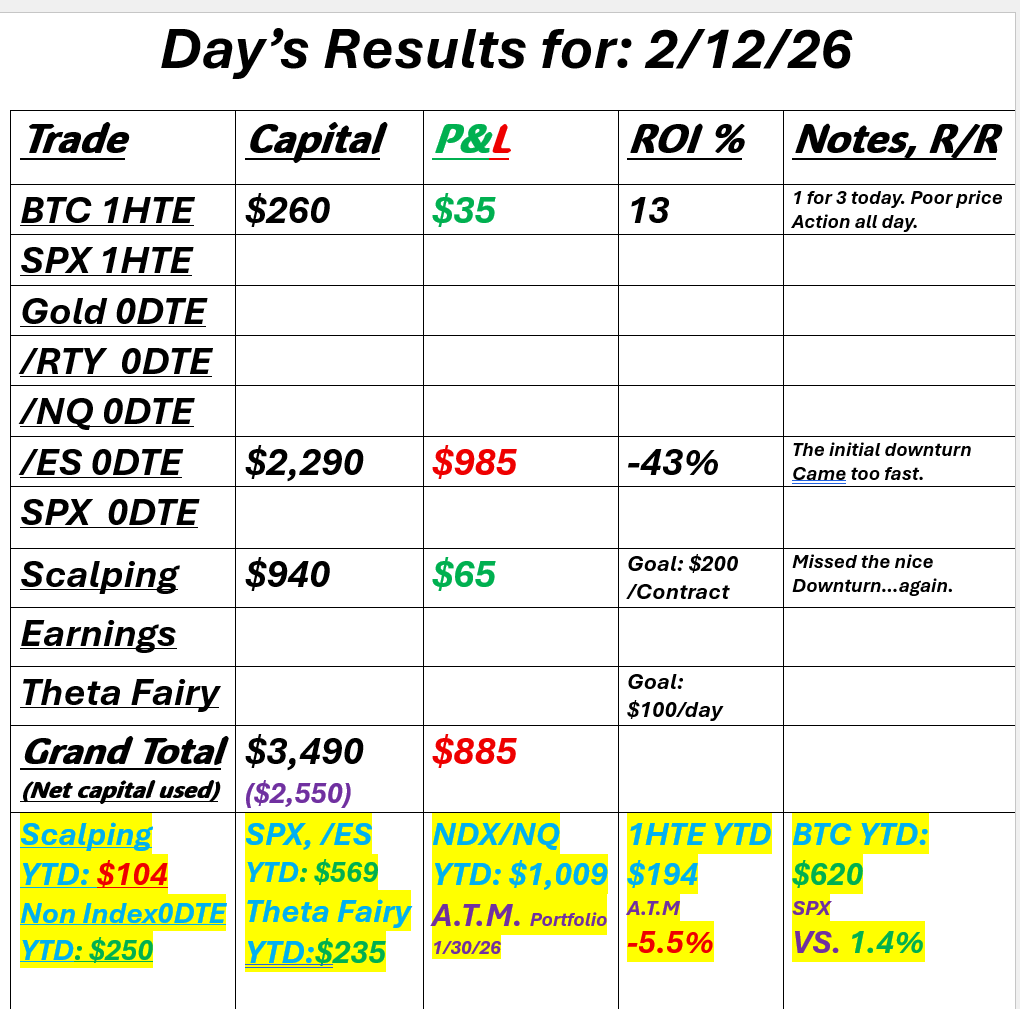

Winners and Losers Watchlist (Symbols) Important: Goldman isn’t publishing basket constituents publicly anymore, so the lists below are our translation of the framework into actionable tickers (not “Goldman’s official basket members”). I’m a client of Goldman so I could get the basket if I wanted it, but then I couldn’t write about it, and that’s no fun. Winners: “AI Tollbooths” to Own / Overweight Edge + Security + Trust (AI traffic creates more attack surface):

Observability (agents create chaos; someone must measure reality):

Data + Database Gravity (hard to rip out; harder to replicate):

“High-consequence” software (compliance + accountability):

Losers: “AI-Replaceables” to Short / Avoid / Underweight Seat-based workflow apps with weak data gravity (risk of “feature-ization”):

Marketplaces / outsourcing exposure (if AI reduces labor-hours demand):

IT services / outsourcing (if enterprises internalize work via agents):

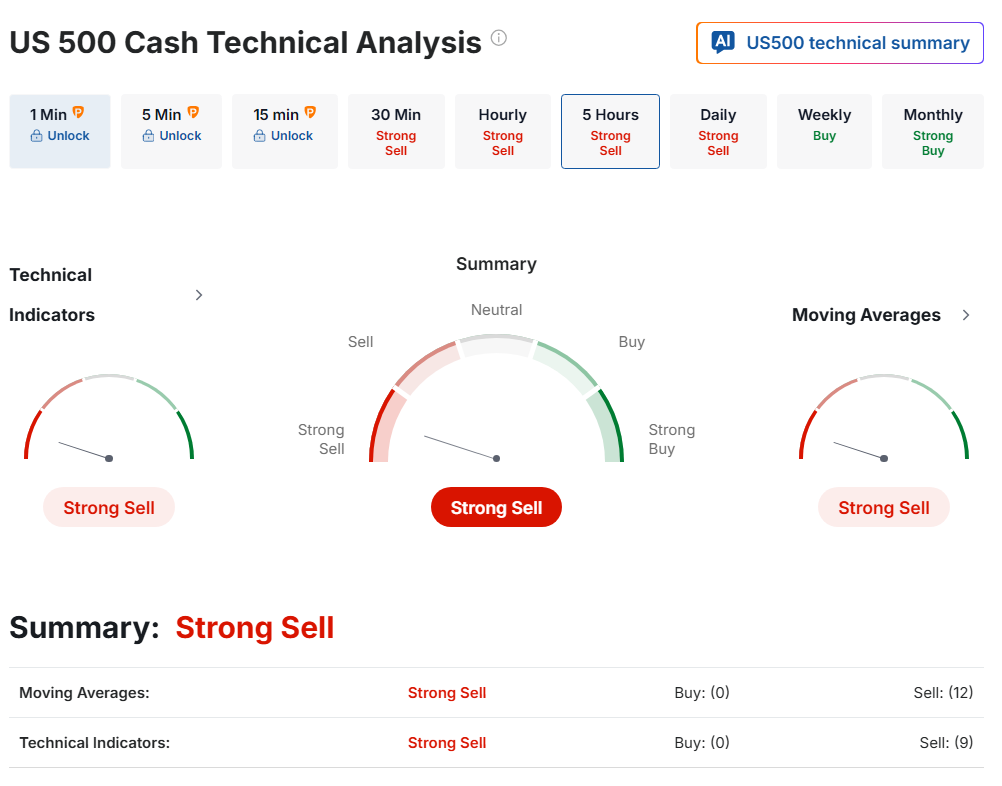

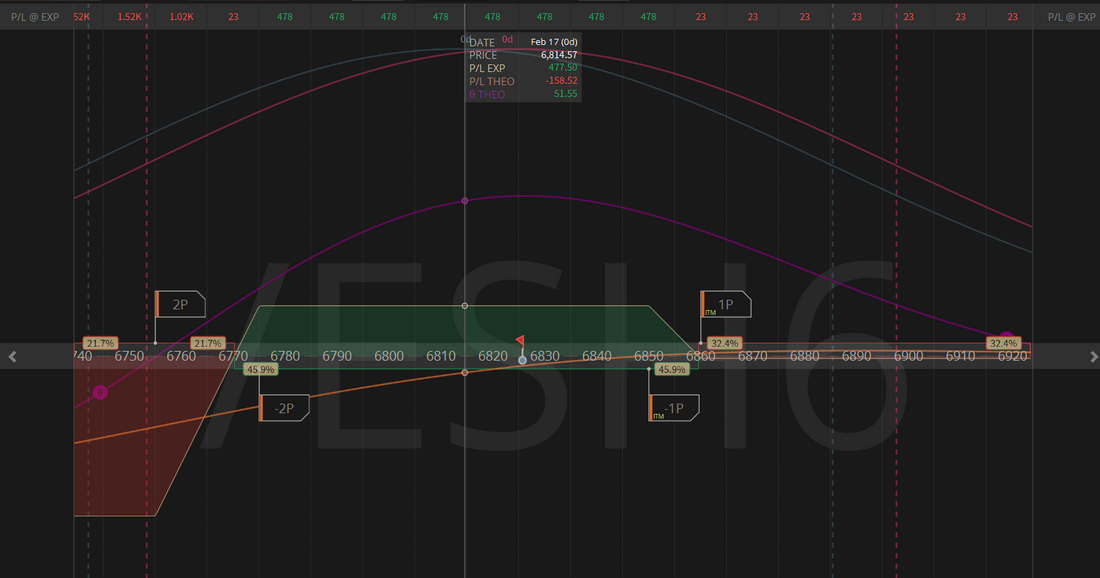

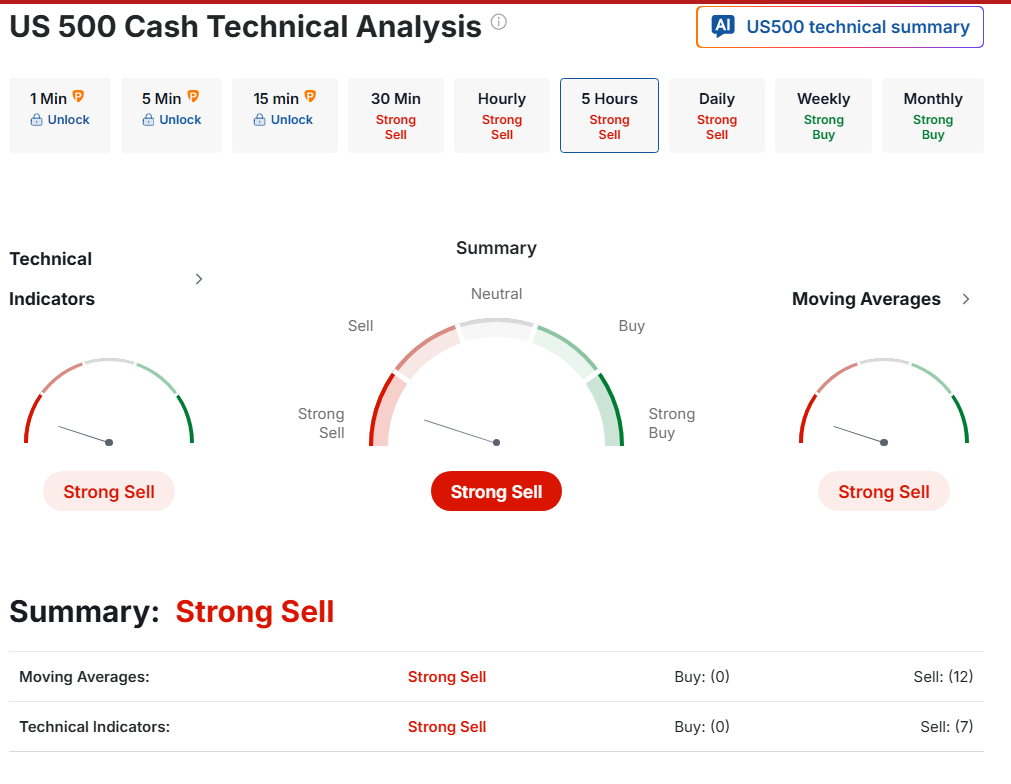

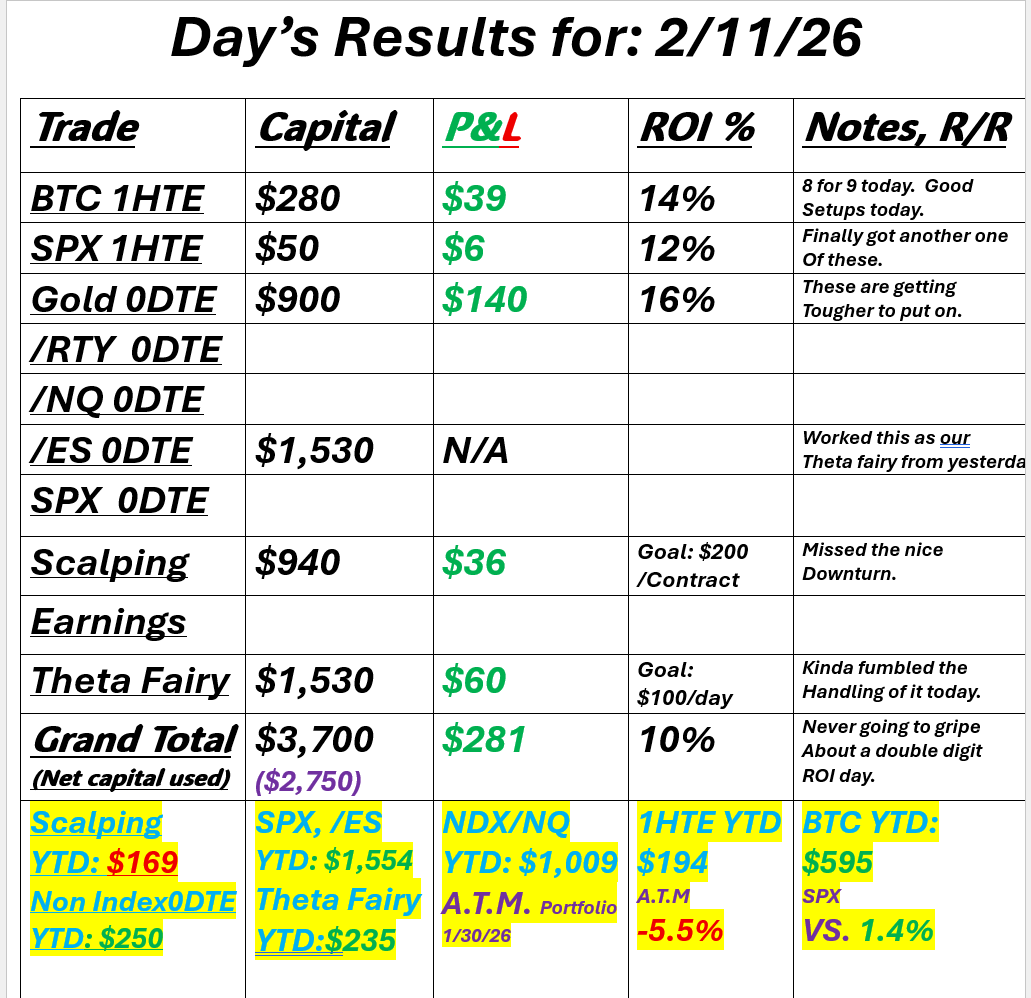

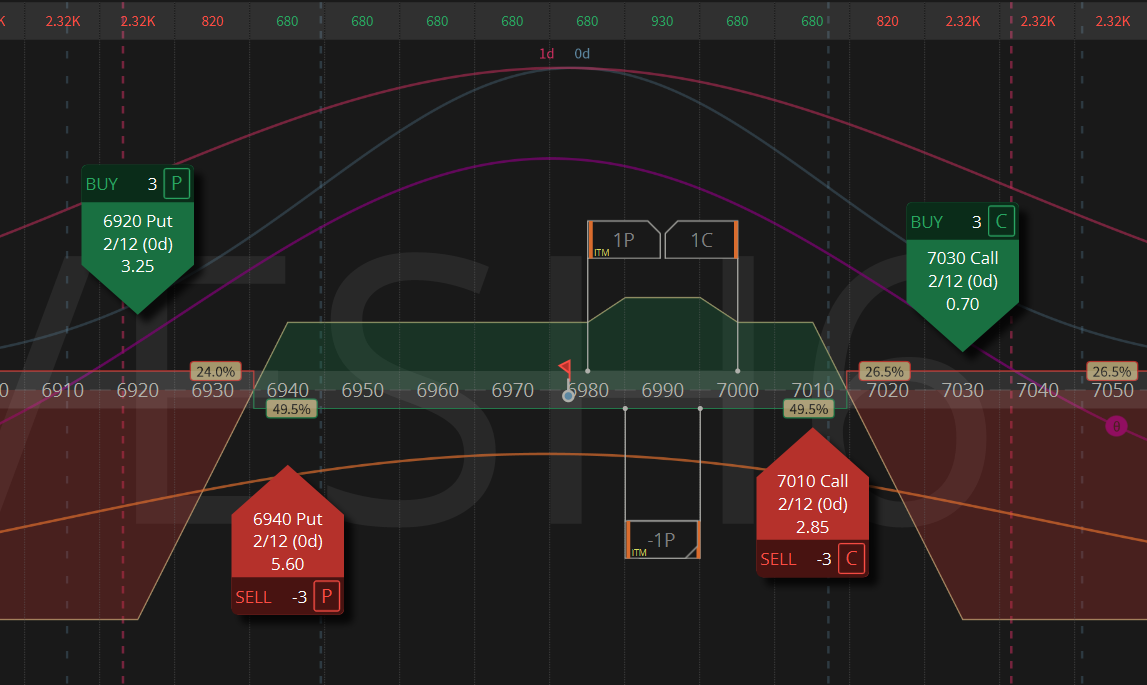

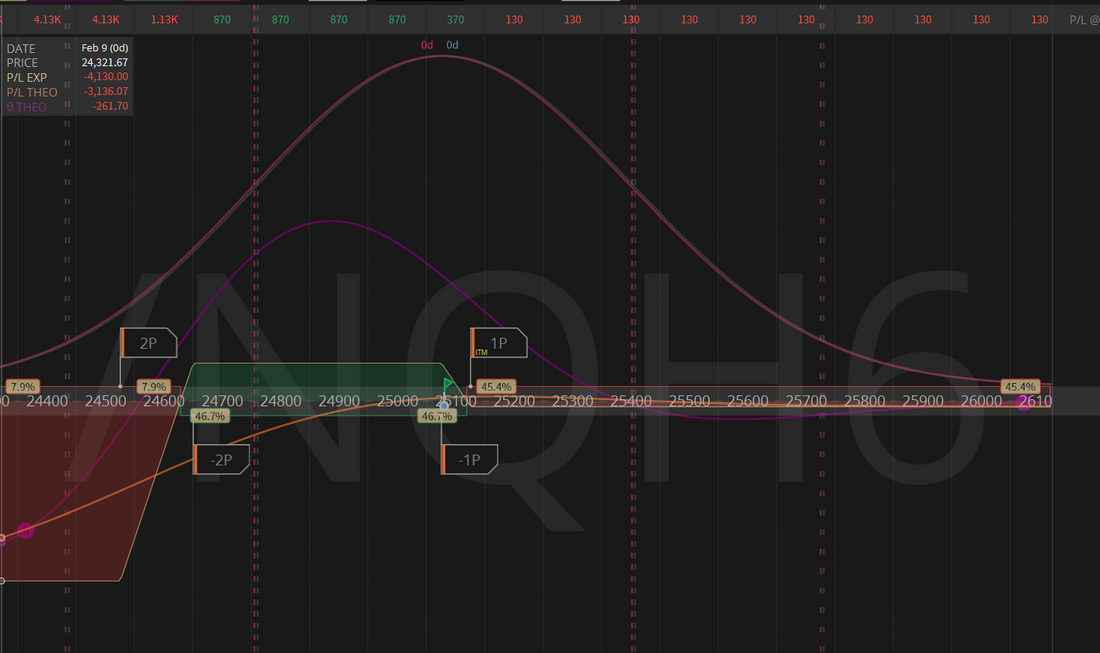

There's a lot to process there, but these types of pairs trades are my favorite. We had an excellent result from our trading last Friday. It was one of the best daily ROI's we've ever had. It was an excellent use of capital. Here's a look at our results.  Let's take a look at the markets: Thursday was a bit of a blood bath, and we wanted to see if bulls would show up on Friday. They tried but couldn't really break the trend. We continue to sell strangles on the RUT. It's been a solid producer for us in the ATM portfolio. Technicals continue to lean to the sell side this morning. A 1.49% expected move the this shortened week isn't bad. We could have some movement this week! Let's hope it's to the downside. LOL March S&P 500 E-Mini futures (ESH26) are down -0.40%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.85% this morning, pointing to a lower open on Wall Street after the long weekend as concerns around AI continue to weigh on sentiment. Investors remain concerned about companies’ swelling AI budgets as well as the technology’s potential to disrupt industries beyond the tech sector. There is “lingering anxiety about whether AI spending will be profitable enough, concerns about competition, and a broader de-risking from the most crowded trades after a very strong run,” according to Aneeka Gupta at WisdomTree. Investor focus this week is on a flurry of U.S. economic data, with particular attention on the PCE inflation reading and the advance estimate of fourth-quarter GDP, the minutes of the Federal Reserve’s latest policy meeting, and earnings reports from several high-profile companies. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Software stocks climbed, with CrowdStrike Holdings (CRWD) rising over +4% and ServiceNow (NOW) gaining more than +3%. Also, cryptocurrency-exposed stocks popped after the price of Bitcoin rose more than +4%, with Coinbase Global (COIN) jumping over +16% to lead gainers in the S&P 500 and Strategy (MSTR) surging more than +8% to lead gainers in the Nasdaq 100. In addition, Applied Materials (AMAT) advanced over +8% after the largest U.S. supplier of chipmaking gear posted better-than-expected FQ1 results and issued surprisingly strong FQ2 guidance. On the bearish side, Constellation Brands (STZ) slumped more than -8% and was the top percentage loser on the S&P 500 after the alcoholic beverage company said Nicholas Fink would succeed Bill Newlands as CEO. The U.S. Bureau of Labor Statistics report released on Friday showed that consumer prices rose +0.2% m/m in January, weaker than expectations of +0.3% m/m and the smallest gain since July. On an annual basis, headline inflation eased to +2.4% in January from +2.7% in December, weaker than expectations of +2.5%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.3% m/m and +2.5% y/y in January, in line with expectations. “For the Fed, [the CPI report] probably doesn’t change much in the near term,” said James McCann at Edward Jones. “We do see scope for further easing later this year. However, this is contingent on a more convincing decline in inflation towards target with the urgency for additional cuts lower now that downside risks in the labor market have seemingly eased.” Chicago Fed President Austan Goolsbee said on Friday that the central bank could lower interest rates further if inflation is on course to hit its 2% target, but that is not currently the case. “Right now, we are not on a path back to 2%. We’re kind of stuck at 3%, and that’s not acceptable,” Goolsbee said. U.S. rate futures have priced in a 92.2% chance of no rate change and a 7.8% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. In this holiday-shortened week, the December reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight, as investors continue to gauge the timing of the next interest rate cut. The advance estimate of U.S. gross domestic product for the fourth quarter will also be closely watched, encompassing a period that included the longest-ever federal government shutdown. Other noteworthy data releases include U.S. Durable Goods Orders, Core Durable Goods Orders, Housing Starts, Building Permits, Industrial Production, Manufacturing Production, the Philly Fed Manufacturing Index, Initial Jobless Claims, Trade Balance, Pending Home Sales, the Conference Board’s Leading Economic Index, Personal Spending, Personal Income, the S&P Global Manufacturing PMI (preliminary), the S&P Global Services PMI (preliminary), New Home Sales, and the University of Michigan’s Consumer Sentiment Index. Market participants will also be monitoring the Fed’s minutes from the January 27-28 meeting, set for release on Wednesday, to assess the debate between officials who support keeping rates steady and those who advocate for rate cuts. The FOMC left interest rates unchanged last month following three consecutive cuts at the end of 2025. “The January minutes will likely detail the arguments that support a wait-and-see approach versus those that could support rate cuts, consistent with the different viewpoints expressed by various FOMC policymakers since the meeting,” according to HSBC analysts. In addition, market watchers will scrutinize remarks from a host of Fed officials. Fed Governor Michael Barr, San Francisco Fed President Mary Daly, Fed Vice Chair for Supervision Michelle Bowman, Atlanta Fed President Raphael Bostic, Minneapolis Fed President Neel Kashkari, Chicago Fed President Austan Goolsbee, and Dallas Fed President Lorie Logan are scheduled to speak this week. Fourth-quarter corporate earnings season is winding down, but several notable companies are due to report this week, including Walmart (WMT), Palo Alto Networks (PANW), Cadence Design Systems (CDNS), Analog Devices (ADI), Booking Holdings (BKNG), Deere & Company (DE), and Constellation Energy (CEG). Meanwhile, quarterly 13F filings detailing the holdings and transactions of Berkshire Hathaway and other major investors are set to begin appearing this week, shedding light on fourth-quarter portfolio changes. Today, investors will focus on the New York Fed-compiled Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists expect the February figure to come in at 6.4, compared to 7.7 in January. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.028%, down -0.59%. SPY ended the week in the red at $681.75 (-1.28%), as its weekly Bollinger Band Width approaches its lowest level seen in nearly a year, indicating tightening price action. Despite persistent weakness in tech, price continues to find support at the middle band, suggesting the broader trend remains intact for now. With a multi-month squeeze in play, traders are watching closely to see which direction the compression ultimately resolves. Tech remained under pressure last week, with QQQ closing at $601.92 (-1.27%). A weekly TTM Squeeze has been in play since November, marking the first such signal since the setup that preceded the early 2025 bear market. With NVDA accounting for nearly 9% of the index and set to report earnings at the end of February, its results could be the primary catalyst that determines where price moves next. Small caps showed relative strength last week, with IWM closing down slightly at $262.96 (-0.78%). Its Bollinger Band Width is expanding rather than compressing, as the index pushes higher and builds on its ~6% year-to-date gain. With price continuing to test the upper Bollinger Band, traders are watching closely to see whether this leadership can persist or begin to fade. We are already off to a fast start today with 1HTE's on Bitcoin already working and a 0DTE on the /ES that has a wonderful R/R ratio. Here's a look at our initial setup. We'll look to build around this as our foundation for today. I know we talk about this all the time but as some point this will become a factor. Let's take a look at the intraday levels for our 0DTE entries. I have two main support/resistance levels that are particularly important for our 0DTE today. 6852 and 6880 are resistance with 6808 and 6777 working as support levels. 6777 is key for us today as that's close to our short put leg on our /ES 0DTE. I'll see you all shortly in the live trading room and scalping feed!

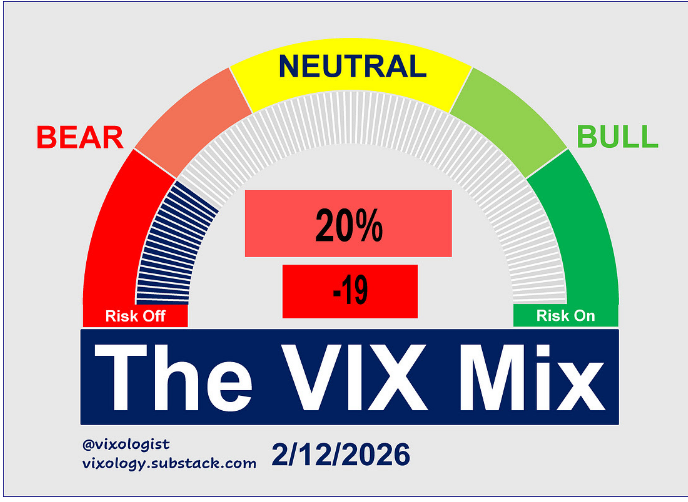

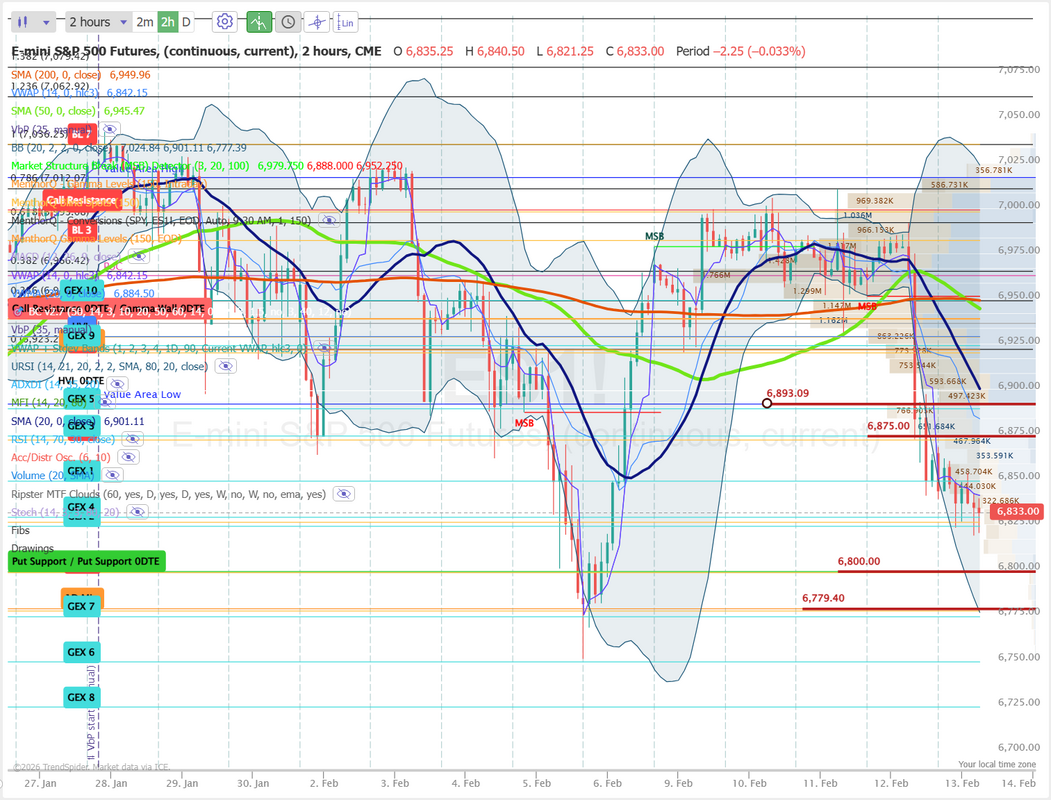

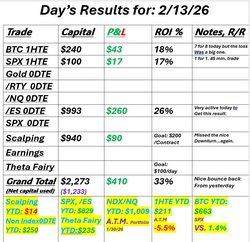

Friday the 13th and CPI dayI'm not superstitious but...just saying. Do we have a real change of directions starting? We have talked the last few days about shorting the DIA. Looks like yesterday would have been a good entry for that trade. A tame CPI release could step in to save the bulls but its starting to look a bit weak. I had a losing day yesterday on my main 0DTE. I couldn't get out fast enough on the initial downward move. I adjusted four times throughout the day but it wasn't enough. Here's a look at my results. Gold fell 3% alongside equities, which is not how a clean risk-off tape behaves. That was deleveraging, not rotation. WTI crude slipped to $62.74 after the IEA cut its demand forecast and maintained its call for a deep supply glut this year. Bitcoin dropped to roughly $65,000, confirming cross-asset deleveraging. Thursday was the ugliest session of 2026. The Dow shed 669 points. The S&P lost 1.57%. The Nasdaq fell 2.03%. All seven Mag 7 names closed red. Cisco (CSCO) lost 12%. Apple (AAPL) lost 5%. Technicals are decidedly bearish before CPI release. The "VIX mix" is moving into the risk off zone. It would be nice if we could get some real selling pressure. Bear markets are easier for us to find setups in. The S&P 500 Index ($SPX) (SPY) on Thursday closed down -1.57%, the Dow Jones Industrial Average ($DOWI) (DIA) closed down -1.34%, and the Nasdaq 100 Index ($IUXX) (QQQ) closed down -2.04%. March E-mini S&P futures (ESH26) fell -1.55%, and March E-mini Nasdaq futures (NQH26) fell -2.02%. Stock indexes gave up an early advance and sold off sharply on Thursday as the Magnificent Seven technology stocks retreated, weighing on the broader market. Also, Cisco Systems fell more than -12% after saying that higher memory-chip prices are expected to eat into its profitability. In addition, trucking and logistics companies fell sharply amid the threat of AI on future earnings. Lower bond yields were supportive of stocks, as the 10-year T-note yield fell to a 2.25-month low of 4.10% after weekly jobless claims fell less than expected and Jan existing home sales fell more than expected to a 16-month low. US weekly initial unemployment claims fell -5,000 to 227,000, showing a slightly weaker labor market than expectations of 223,000. US Jan existing home sales fell -8.4% m/m to a 16-month low of 3.91 million, weaker than expectations of 4.5 million. The markets this week will focus on corporate earnings results and economic news. On Friday, Jan CPI is expected to be up +2.5% y/y, and Jan core CPI is expected to be up +2.5% y/y. Q4 earnings season is in full swing, as more than two-thirds of the S&P 500 companies have reported earnings results. Earnings have been a positive factor for stocks, with 76% of the 358 S&P 500 companies that have reported beating expectations. According to Bloomberg Intelligence, S&P earnings growth is expected to climb by +8.4% in Q4, marking the tenth consecutive quarter of year-over-year growth. Excluding the Magnificent Seven megacap technology stocks, Q4 earnings are expected to increase by +4.6%. The markets are discounting a 9% chance for a -25 bp rate cut at the next policy meeting on March 17-18. Overseas stock markets settled mixed on Thursday. The Euro Stoxx 50 fell from a new all-time high and closed down by -0.40%. China’s Shanghai Composite closed up +0.05%. Japan’s Nikkei Stock 225 fell from a record high and closed down by -0.02%. CPI will likely be our driver today so I'll look at some of the major /ES intraday levels. 6875 and 6893 are resistance with 6800 and 67709 working as support. Today could be a decent directional day so I'll look initially for a debit setup. See you all shortly!

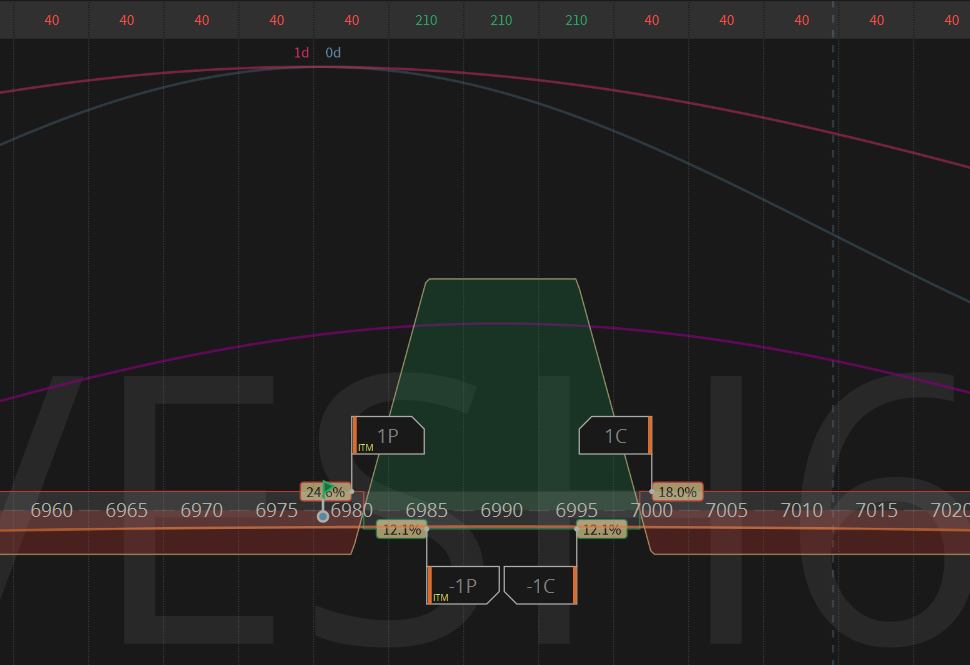

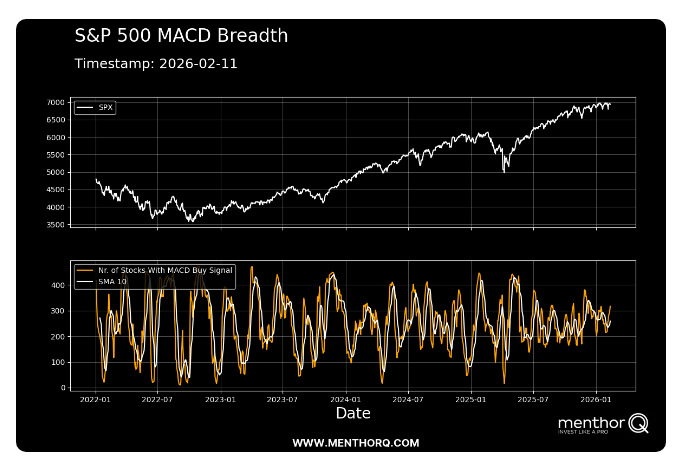

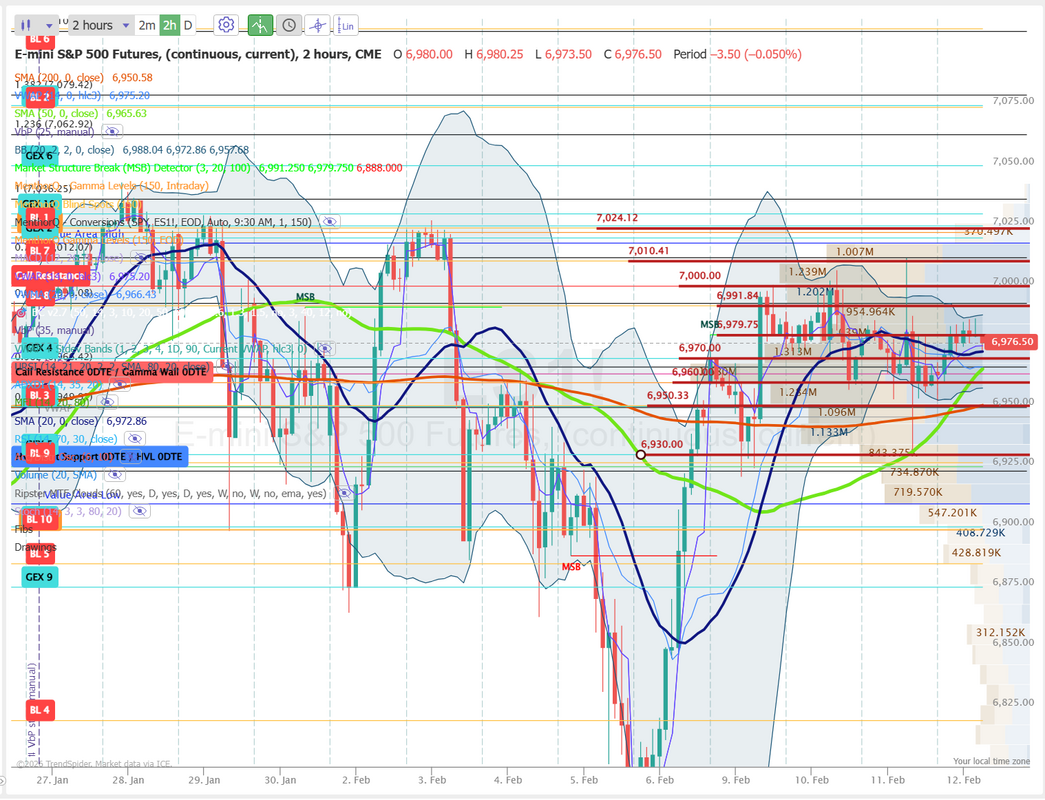

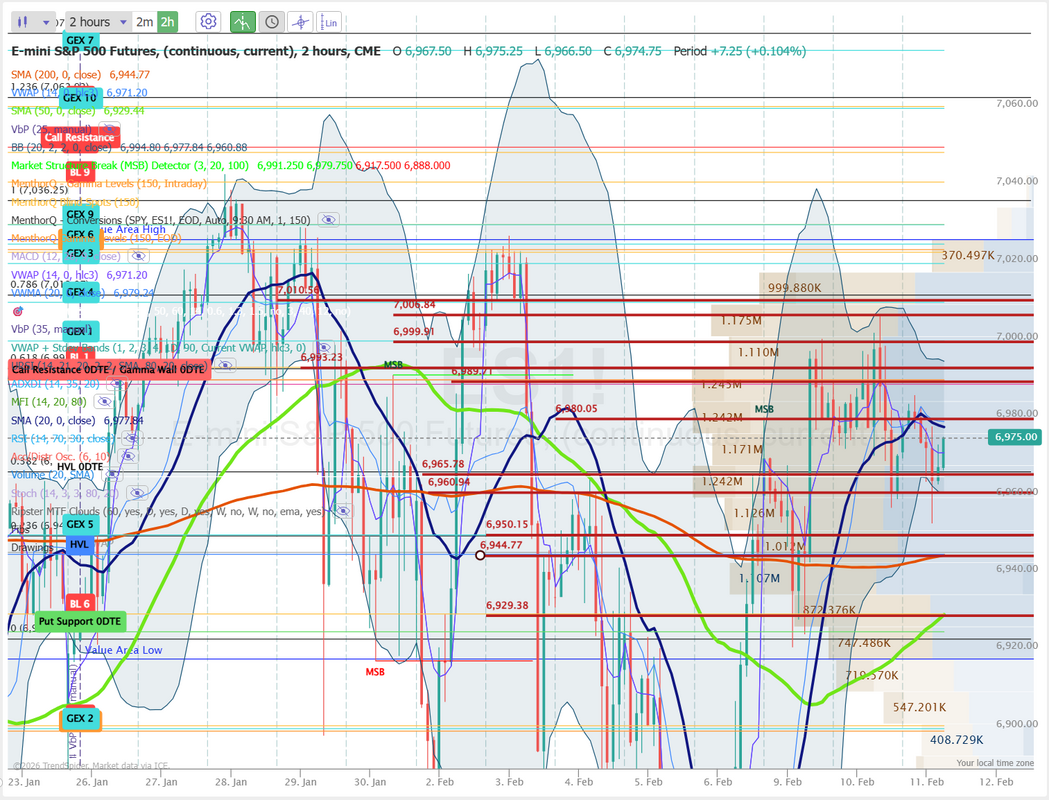

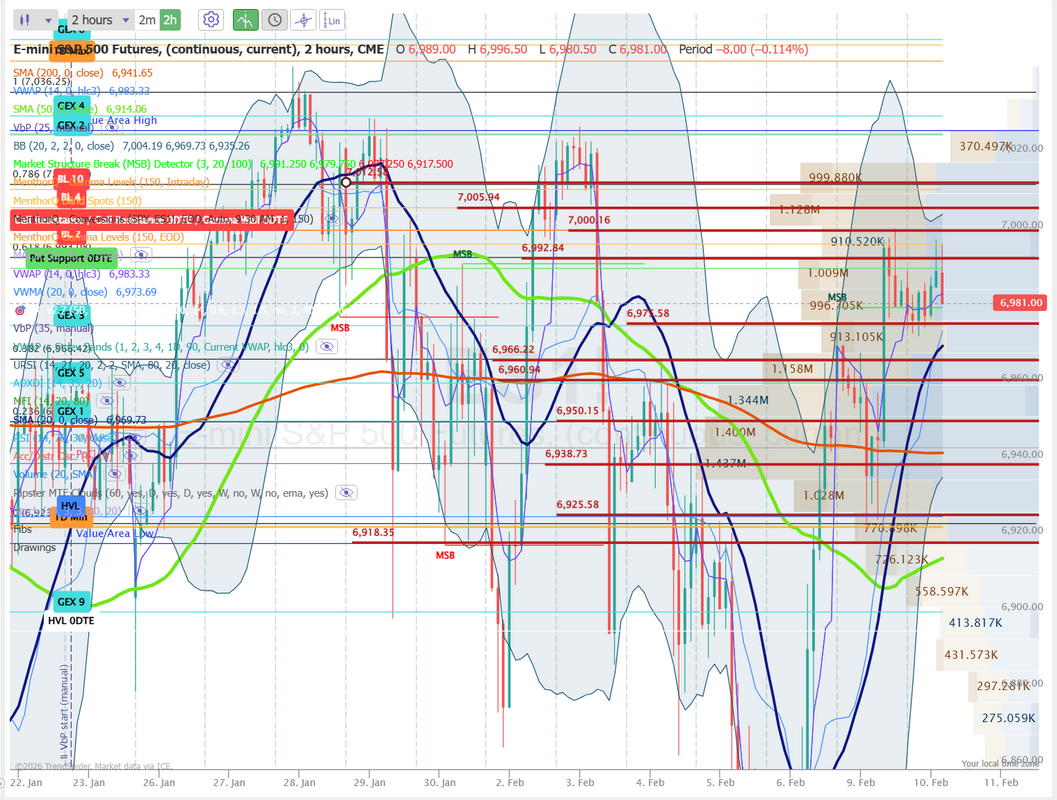

Success usually comes quick.One of the attributes of our (and most peoples) trades are that you first have to develop a bias or premise. If you aren't bullish, bearish or neutral it's going to be pretty hard to setup a trade. The other attribute we see over and over is that IF you're right, you're usually right (and your trade idea is validated) quickly. If you're still battling your trade and the trading session is almost over, your chances of success diminish. We've seen this play out every day this week. We haven't really hit any homeruns but everyday has been profitable and maybe more interesting, we've been done in just a few hours. Nobody complains about shortened work days! Yesterday was a continuation of this theme for us. Here's a look at our shortened trading session. We also have two working trade entries for Gold and /ES If we get these filled we'll be off to the races for todays trades. Let's take a look at the markets to start us off today. Technicals continue to be supportive. The interest rate sensitive IWM backed off. QQQ remains weak and I'm continuing to look for an entry on a DIA short. March S&P 500 E-Mini futures (ESH26) are up +0.33%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.23% this morning, pointing to a higher open on Wall Street as strong U.S. jobs data boosted optimism about the nation’s economic outlook. Investors now await U.S. jobless claims data and a new wave of corporate earnings reports. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed. Software stocks sank, with Atlassian (TEAM) sliding over -6% and Intuit (INTU) falling more than -5%. Also, real estate services stocks slumped amid concerns that the latest wave of AI applications and tools could disrupt the industry, with Cushman & Wakefield (CWK) tumbling over -13% and CBRE Group (CBRE) plunging more than -12% to lead losers in the S&P 500. In addition, Mattel (MAT) plummeted over -24% after the toymaker posted downbeat results for the crucial holiday quarter and provided disappointing FY26 adjusted EPS guidance. On the bullish side, chip stocks climbed, led by a more than +9% jump in Micron Technology (MU) after CFO Mark Murphy said the company had begun volume production and shipments of its next-generation high-bandwidth memory chips. The U.S. Labor Department’s report on Wednesday showed that nonfarm payrolls rose by 130K in January, much stronger than expectations of 66K. Also, the U.S. unemployment rate unexpectedly fell to 4.3% in January, stronger than expectations of no change at 4.4%. In addition, U.S. January average hourly earnings rose +0.4% m/m and +3.7% y/y, stronger than expectations of +0.3% m/m and +3.6% y/y. President Trump lauded the figures in a social media post on Wednesday and said the U.S. should have the lowest interest rates in the world. “GREAT JOBS NUMBERS, FAR GREATER THAN EXPECTED!” Mr. Trump wrote. “[Wednesday’s] employment report was a 10 out of 10 with positive surprises across the board,” said Peter Graf at Amova Asset Management Americas. “It should quell recent concerns about growth, but puts incoming Fed Chair Warsh in the hot seat — it will be even harder to persuade the FOMC members to go along with the president’s mandate to cut rates.” Kansas City Fed President Jeff Schmid said on Wednesday that the central bank should keep rates at a “somewhat restrictive” level, as he voiced continued concerns about inflation remaining too high. “In my view, further rate cuts risk allowing high inflation to persist even longer,” Schmid said. U.S. rate futures have priced in a 94.1% chance of no rate change and a 5.9% chance of a 25 basis point rate cut at the March monetary policy meeting. Meanwhile, President Trump’s tariff policies faced their strongest political setback yet as the Republican-led U.S. House passed legislation aimed at ending the president’s levies on Canadian imports. Today, investors will focus on U.S. Initial Jobless Claims data, set to be released in a couple of hours. Economists expect this figure to be 222K, compared to last week’s number of 231K. The National Association of Realtors’ existing home sales data will also be released today. Economists foresee this figure coming in at 4.16 million in January, compared to 4.35 million in December. On the earnings front, notable companies such as Applied Materials (AMAT), Arista Networks (ANET), Airbnb (ABNB), and Coinbase Global (COIN) are scheduled to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.168%, down -0.10%. Todays training will finish up part III of risk management with the focus on money management and the law of large numbers. Make sure to download the powerpoint for your reference library after we finish today! This market is wound tighter than a $10 dollar banjo at an East Texas wedding! Look, there are two types of market volatility...expanding and contracting. We're wound up pretty tight right now. Expansion ALWAYS follows contraction. At some point well get another directional change but for now, we'll start today with our /ES trade that filled last night. This is an incredibly low risk setup which can be built on in many different ways today. Here's an example. I'll try to be a bit more patient with our setup today. I jumped the gun a bit yesterday. SPX remains near recent highs, while MACD breadth reflects a more measured internal backdrop. The number of stocks registering MACD buy signals has rebounded into the mid-range of its recent distribution but remains below prior expansion peaks seen during stronger participation phases. The 10-day average of MACD buy signals has turned higher, indicating improvement from recent lows, though breadth levels are not yet extended relative to historical highs. At current levels, price and breadth are no longer deeply oversold nor broadly overheated. Participation has recovered from prior weakness but remains moderate compared to earlier periods of stronger momentum expansion. This reflects an environment where internal strength has improved, yet remains selective rather than broad-based. QQQ’s volatility smile remains well-defined, with elevated implied volatility on the downside relative to at-the-money strikes, signaling persistent demand for put protection. The front-end of the curve is broadly in line with yesterday but still below levels seen five days ago and one month ago, suggesting some moderation in tail hedging despite the bid for downside skew. At-the-money IV is hovering in the mid-teens, while deep out-of-the-money puts remain priced at a notable premium, reflecting a cautious tone beneath the surface. Overall, the curve points to a market that is stable near spot but still willing to pay up for protection against sharper downside moves. Let's take a look at our /ES intraday levels for 0DTE setups. 6980, 6992, 7000, 7010 are resistance levels with 6970, 6960, 6945, 6930 support levels. I look forward to seeing you all in the live trading room shortly. We'll have a great wrap up to our training this week and should have a nice shot at profits on our /ES 0DTE.

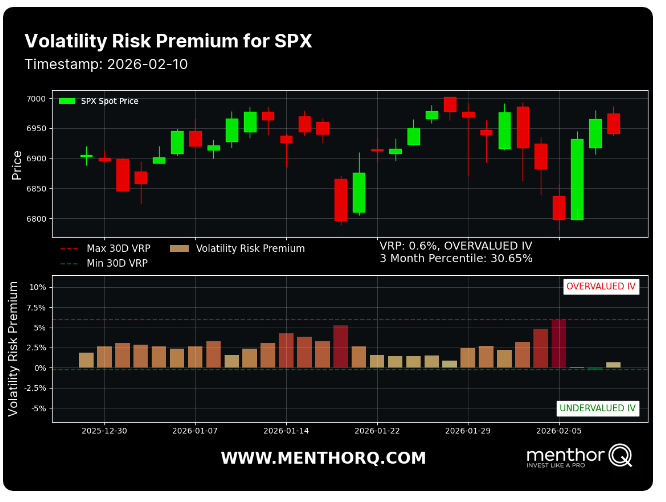

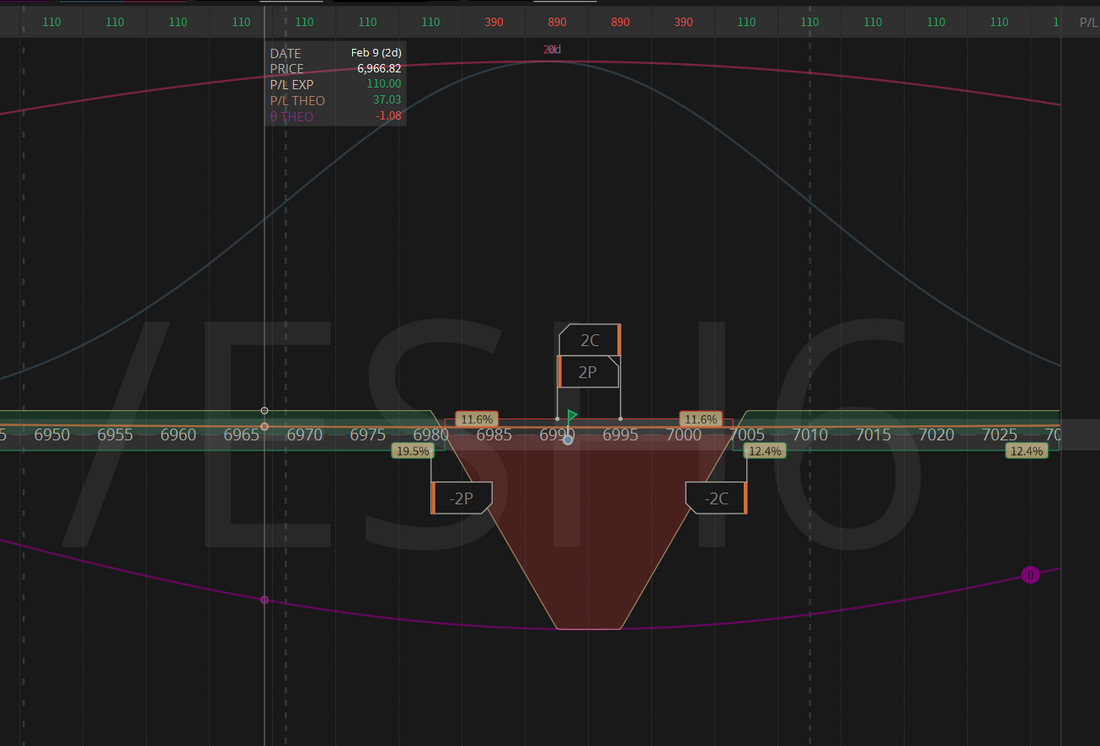

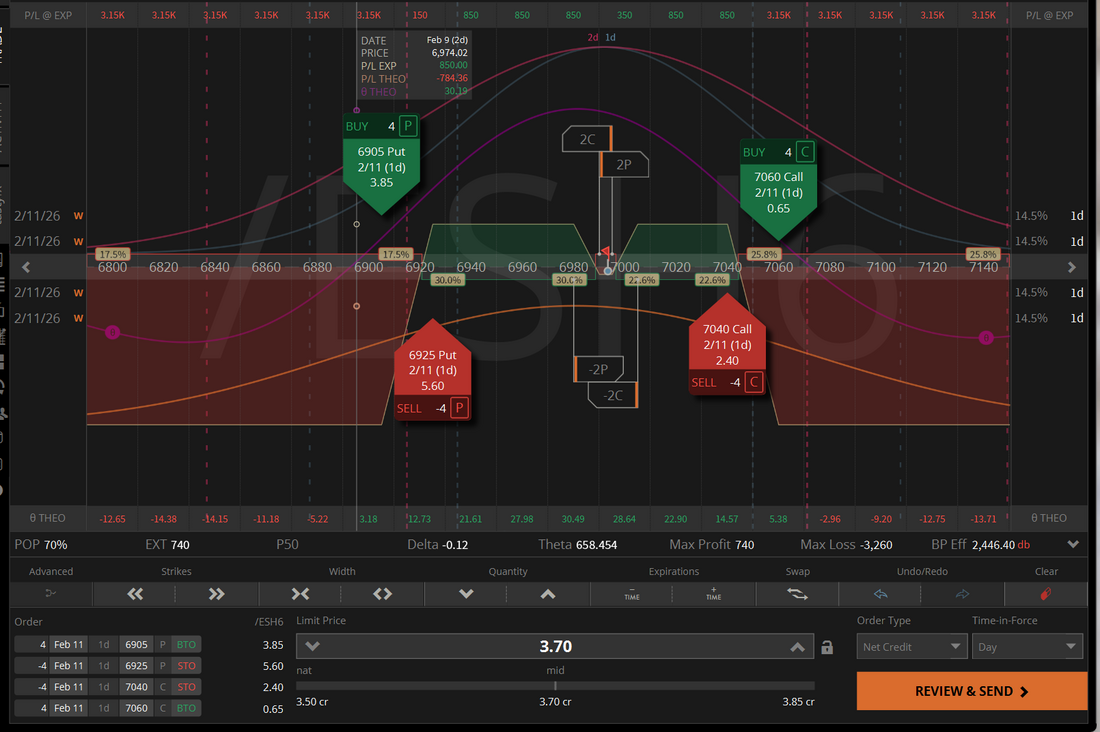

The continuing, evolving AI storyAI disruption fears are rippling far beyond big tech, triggering sharp selloffs in wealth managers, insurers, and software firms as investors reassess potential competitive risks. A new tax-strategy tool from startup Altruist contributed to declines of 7% or more in shares of Charles Schwab Corp., Raymond James Financial Inc., and LPL Financial Holdings Inc., with weakness extending to several European peers. It will be interesting to see where we land with AI over the next few years. I'm old enough to remember the amazing technology breakthrough of the fax machine! This will be transformative. Starting with some 1DTE setups yesterday helped us once again, get to green quickly and have a short day. We were done in a few hours and called it a day. Here's a look at what we worked on yesterday. Let's take a look at the markets this morning. We are holding to a slight buy mode technically but we've got NFP incoming so that could easily change. The DIA finally stalled out. We are back up at these "nose bleed" levels on the others. I may look at taking a small short in the DIA today. March S&P 500 E-Mini futures (ESH26) are trending up +0.10% this morning as investors await the release of the U.S. nonfarm payrolls report, which is crucial for shaping expectations about the Federal Reserve’s interest-rate path. In yesterday’s trading session, Wall Street’s major indexes closed mixed. S&P Global (SPGI) slumped over -9% and was the top percentage loser on the S&P 500 after the ratings agency posted weaker-than-expected Q4 adjusted EPS and issued below-consensus FY26 adjusted EPS guidance. Also, AI-infrastructure stocks retreated, with Western Digital (WDC) sliding over -8% to lead losers in the Nasdaq 100 and Seagate Technology Holdings (STX) falling more than -6%. In addition, wealth-management stocks sank amid concerns about the disruptive impact of a new AI tool designed to create tax strategies, with Raymond James Financial (RJF) and LPL Financial Holdings (LPLA) slumping over -8%. On the bullish side, Datadog (DDOG) surged more than +13% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company reported stronger-than-expected Q4 results. Economic data released on Tuesday showed that U.S. retail sales were unchanged m/m in December, weaker than expectations of +0.4% m/m, and core retail sales, which exclude motor vehicles and parts, were unchanged m/m, weaker than expectations of +0.3% m/m. Also, the U.S. Q4 employment cost index rose +0.7% q/q, weaker than expectations of +0.8% q/q. In addition, the U.S. import price index rose +0.1% m/m in December, in line with expectations. “The latest news on consumer spending did little to change the outlook for another rate cut by the Federal Reserve, still priced in the Fed funds futures market for the next such move at the June 17 meeting,” said Gary Schlossberg, global strategist at Wells Fargo Investment Institute. Cleveland Fed President Beth Hammack said on Tuesday that interest rates could remain on hold for an extended period while officials assess incoming economic data. “Rather than trying to fine-tune the funds rate, I’d prefer to err on the side of patience as we assess the impact of recent rate reductions and monitor how the economy performs,” Hammack said. Also, Dallas Fed President Lorie Logan said she is hopeful inflation will continue to ease, though it would take “material” weakness in the labor market for her to back further interest rate cuts. Meanwhile, U.S. rate futures have priced in a 78.4% probability of no rate change and a 21.6% chance of a 25 basis point rate cut at the next FOMC meeting in March. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. The report was originally scheduled for release last Friday, but was delayed due to the partial government shutdown. Notably, the report will include revisions to job growth for the year through March 2025, which are expected to show a significant markdown in the pace of hiring. Economists, on average, forecast that January Nonfarm Payrolls will come in at 66K, compared to the December figure of 50K. A weak print “would undoubtedly push the Fed closer to a cut,” particularly if Friday’s inflation data come in soft, according to Scope Markets’ Joshua Mahony. A survey conducted by 22V Research showed that 42% of investors expect the key jobs report to be “risk on,” 37% said “mixed/negligible,” and 21% “risk off.” Investors will also focus on U.S. Average Hourly Earnings data. Economists expect the January figures to be +0.3% m/m and +3.6% y/y, compared to +0.3% m/m and +3.8% y/y in December. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will remain steady at 4.4% in January. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -0.2 million barrels, compared to last week’s value of -3.5 million barrels. In addition, market participants will parse comments today from Kansas City Fed President Jeff Schmid, Fed Vice Chair for Supervision Michelle Bowman, Cleveland Fed President Beth Hammack, and Dallas Fed President Lorie Logan. On the earnings front, prominent companies such as Cisco Systems (CSCO), McDonald’s (MCD), T-Mobile US (TMUS), Shopify (SHOP), and AppLovin (APP) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.129%, down -0.39%. SPX has rebounded from the 6,780–6,800 region and is currently trading within the 6,940–6,970 area. Recent price activity places the index between prior support near 6,800 and resistance levels just below 7,000, areas that have previously attracted notable supply and demand. The volatility risk premium has compressed to approximately 0.6% and now sits near the lower end of its recent range. This indicates that implied volatility has moderated relative to realized volatility following the recent spike. At present, SPX remains positioned within a defined range established by recent highs and lows, with price activity reflecting stabilization after the earlier pullback. NDX has recovered from its recent decline toward the 24,500 area and is currently trading back above 25,000. Despite the rebound, 1-month skew remains elevated with a pronounced put bias, and its 3-month percentile reading near 89% indicates sustained demand for downside protection relative to recent history. The persistence of elevated skew alongside improving price levels reflects continued asymmetry in options positioning. Risk reversals remain tilted toward puts, suggesting that protective structures remain in place even as price stabilizes. This configuration highlights an options market that is pricing downside sensitivity more heavily than upside extension in the near term. Our training today will be part II on risk management. Come join us today. This is another keeper. We've already got several trades working this morning. We are profitable on our 1HTE's so far. Our Gold 0DTE is already up and running. We'll see how NFP affects that but its green right now. We also have an interesting theta fairy start to our day, which we put on last night, in preparation for NFP release. It's likely we will build on this today. Possibly with an Iron condor wrap. Wednesday

Let's take a look at todays /ES levels. There's not much movement as the market awaits NFP numbers. 6980, 6990, 6993, 7000, 7006 are resistance levels. 6966, 6961, 6950, 6945, 6929 are support levels. We've got plenty to keep us busy today! I'll see you all shortly in the live trading room!

Boring is good too.Yesterday was a pretty staid, boring day. That's all right. We crave movement but boring can offer opportunities as well. We were able to finish our trading early and take the rest of the day off. Here's a look at our day. Let's take a look at the markets. We start the day with the bullish bias holding. We've had a couple bullish days in a row now. Can the bulls keep it going today? We've got a gold 0DTE already working this morning and it looks pretty solid. We've also started a very small, bullish fly on /ES . I believe there's a good chance we don't have much movement today. March S&P 500 E-Mini futures (ESH26) are up +0.14%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.12% this morning, pointing to further gains on Wall Street, while investors await a slew of U.S. economic data, with particular attention on the retail sales report, remarks from Federal Reserve officials, and a new round of corporate earnings reports. Lower bond yields today are supporting stock index futures. The 10-year T-note yield fell two basis points to 4.18%. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Most members of the Magnificent Seven stocks advanced, with Microsoft (MSFT) rising over +3% and Meta Platforms (META) gaining more than +2%. Also, chip stocks climbed, with Broadcom (AVGO) and Advanced Micro Devices (AMD) rising more than +3%. In addition, AppLovin (APP) surged over +13% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Capitalwatch, a self-described independent news organization, withdrew its earlier allegations against the company. On the bearish side, Kyndryl Holdings (KD) tanked more than -54% after the company reported downbeat FQ3 results and its Chief Financial Officer, David Wyshner, exited the firm amid a review of its accounting practices. “When markets sell off like certain areas in tech have, there’s often knee-jerk rallies,” said Sameer Samana at Wells Fargo Investment Institute. “Time will tell if we need a retest or if enough value was created.” Fed Governor Stephen Miran said on Monday that interest rates should be set lower than their current level. “I do think it’s appropriate to have significantly lower policy rates than we do,” Miran said. Meanwhile, U.S. rate futures have priced in an 82.3% chance of no rate change and a 17.7% chance of a 25 basis point rate cut at the next central bank meeting in March. On the trade front, the U.S. and Bangladesh struck a deal on Monday under which the U.S. will cut its so-called reciprocal tariff to 19%, after previously lowering it from 37% to 20%, and grant a new exemption for textile products. Today, all eyes are on the U.S. Retail Sales report, which is set to be released in a couple of hours. Economists, on average, forecast that Retail Sales will show a +0.4% m/m increase in December after the +0.6% m/m gain a month earlier. Investors will also focus on U.S. Core Retail Sales, which rose +0.5% m/m in November. Economists expect the December figure to rise +0.3% m/m. The U.S. Employment Cost Index will be released today. Economists expect this figure to come in at +0.8% q/q in the fourth quarter, the same as in the third quarter. U.S. Import and Export Price Indexes will be released today as well. Economists anticipate the import price index to rise +0.1% m/m and the export price index to rise +0.1% m/m in December, compared to the previous figures of +0.4% m/m and +0.5% m/m, respectively. In addition, market participants will be looking toward speeches from Cleveland Fed President Beth Hammack and Dallas Fed President Lorie Logan. On the earnings front, notable companies such as Coca-Cola (KO), Gilead Sciences (GILD), CVS Health (CVS), Robinhood Markets (HOOD), Cloudflare (NET), and Ford (F) are set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.180%, down -0.33%. SPX remains in a short-term uptrend, though momentum dynamics have become more uneven. The Momentum Score has rebounded from a recent dip back toward the upper range, indicating buyers remain present, but repeated pullbacks from elevated readings suggest that upside progress has been less consistent than earlier in the move. Recent price behavior shows increasing two-way activity near highs, with momentum fluctuating rather than accelerating. This pattern reflects a market that is still trending upward but experiencing more frequent pauses as participation and follow-through vary across sessions. The QQQ liquidity snapshot reflects a market with bullish price performance alongside structurally sensitive positioning. Momentum is flagged as bullish and the ETF is higher on the day, while the gamma condition remains negative, indicating that dealer hedging flows may respond in a pro-cyclical manner to price changes in the very short term. The one-day expected move remains around ±1.3%, and put/call open interest at 1.62 points to ongoing demand for downside protection. Implied volatility remains above realized volatility, though recent compression suggests some repricing of near-term risk. Taken together, the options landscape describes an environment where price movements can develop quickly before encountering positioning or liquidity-related constraints. Key Economic Events, Company Highlights and Q-Webinars Tuesday

Let's take a look at our intraday /ES levels for 0DTE placement. 6993, 7000, 7006, 7012 are resistance levels. 6976, 6966, 6960, 6950 are support levels. We've already got a good Gold 0DTE working and we'll keep working 1HTE's as long as we can. Let's make another great day happen! See you all in the live trading room shortly.

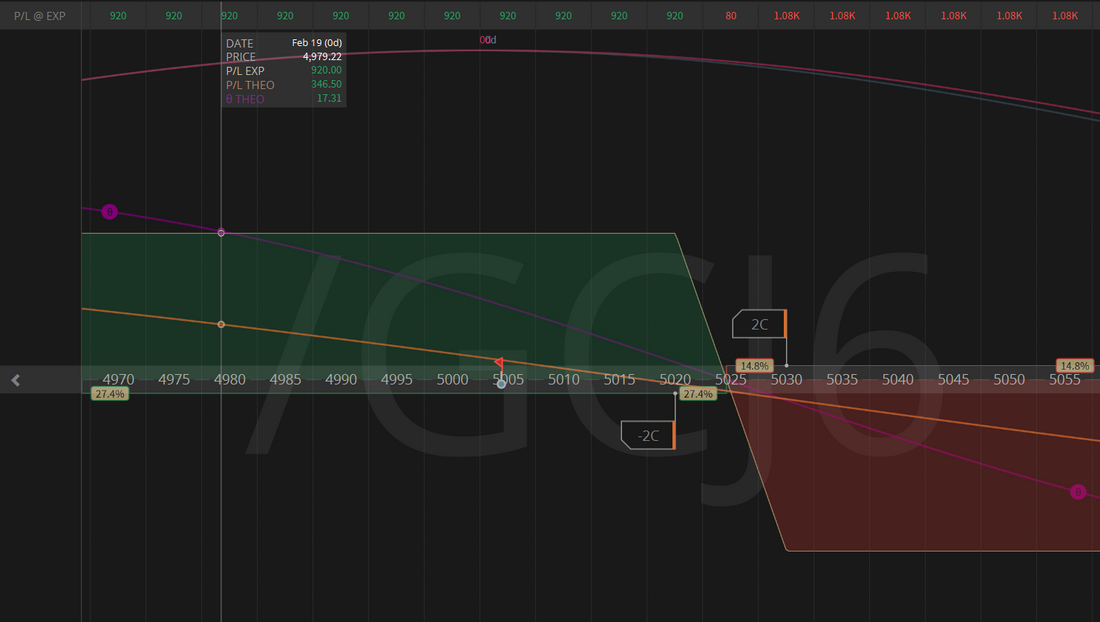

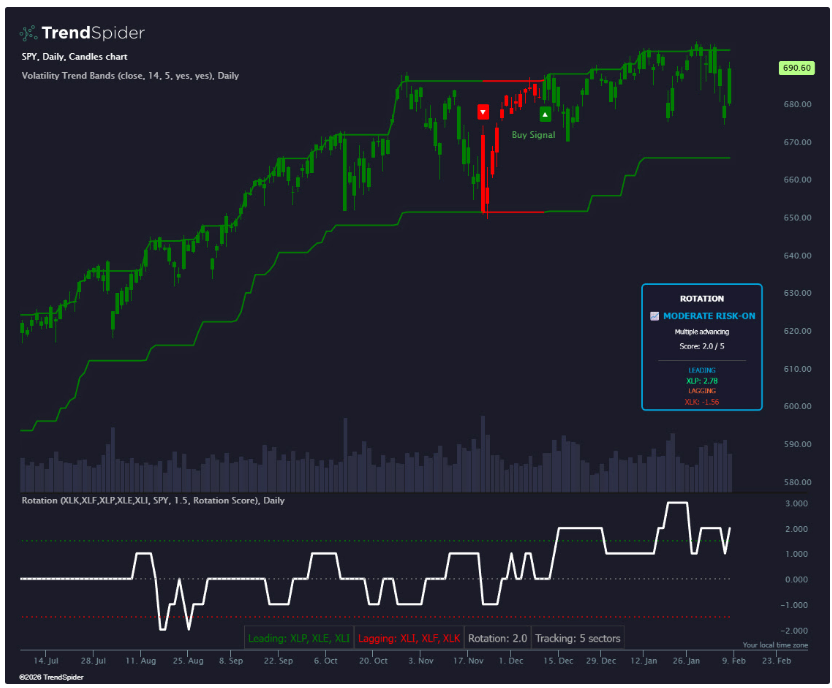

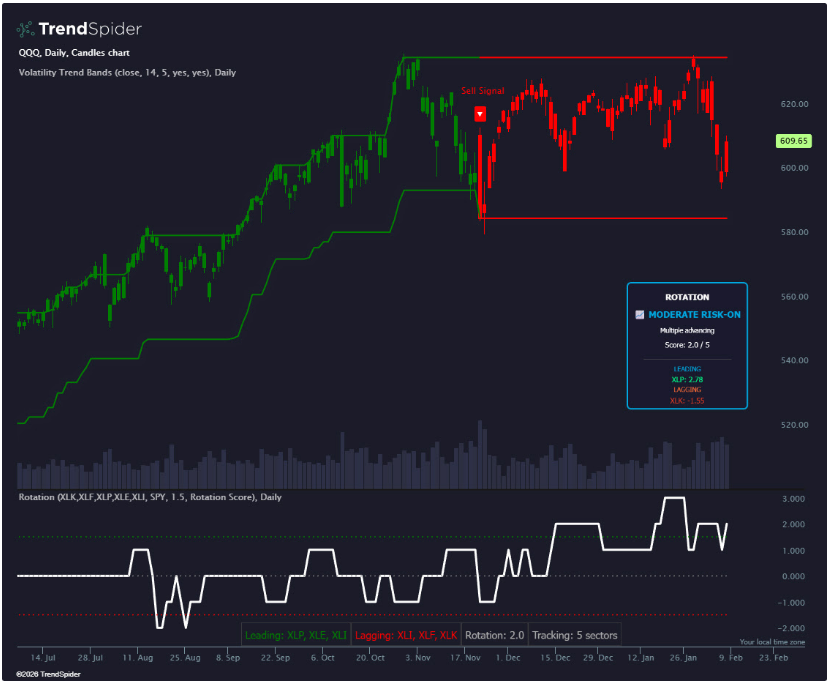

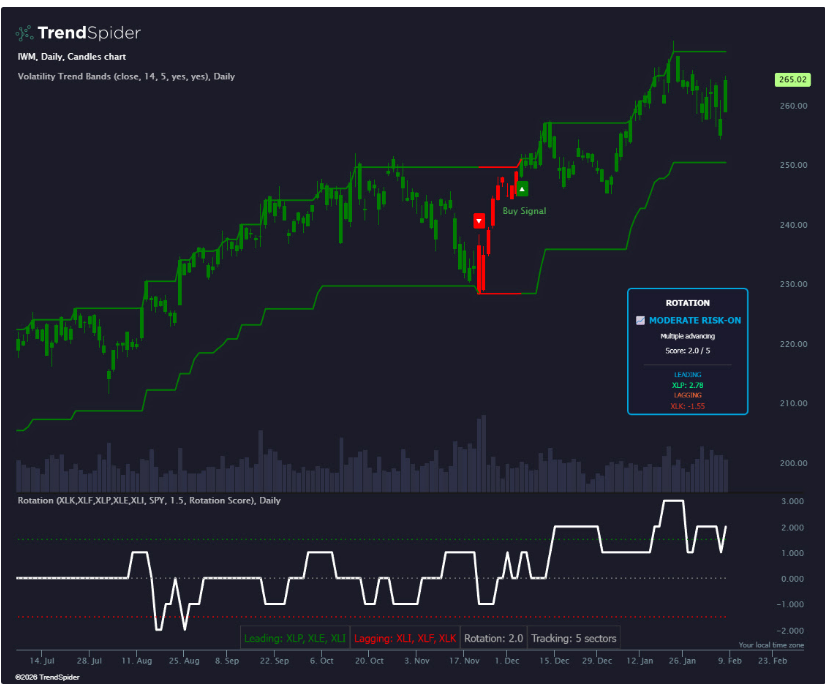

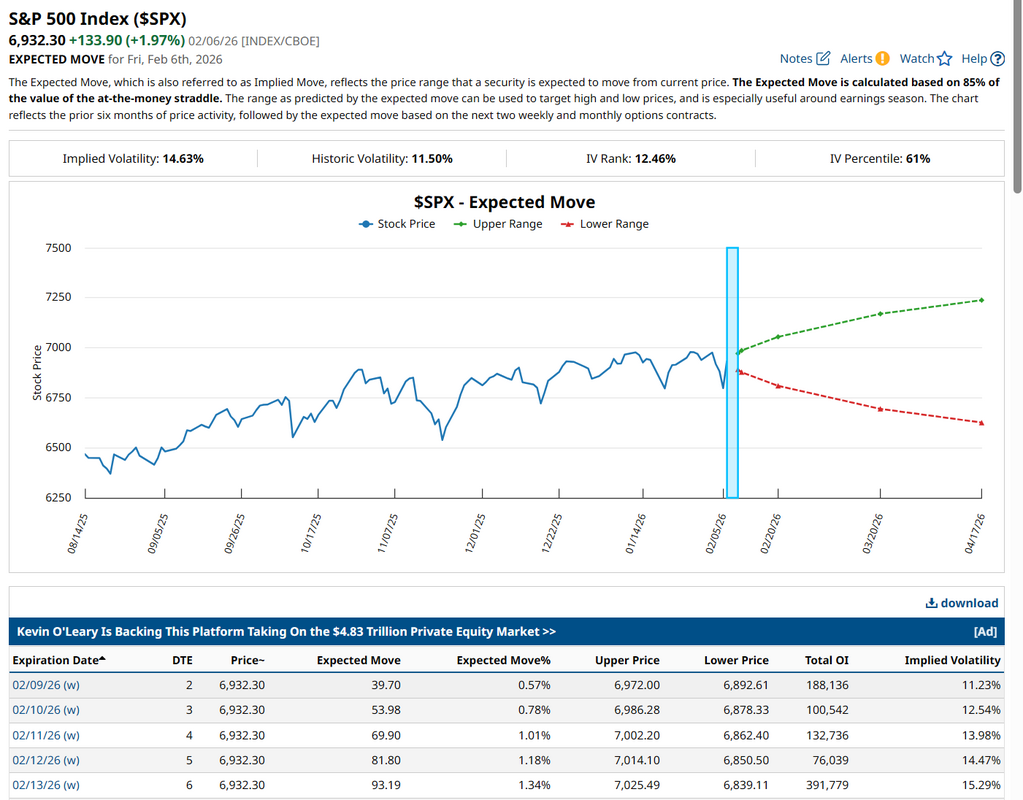

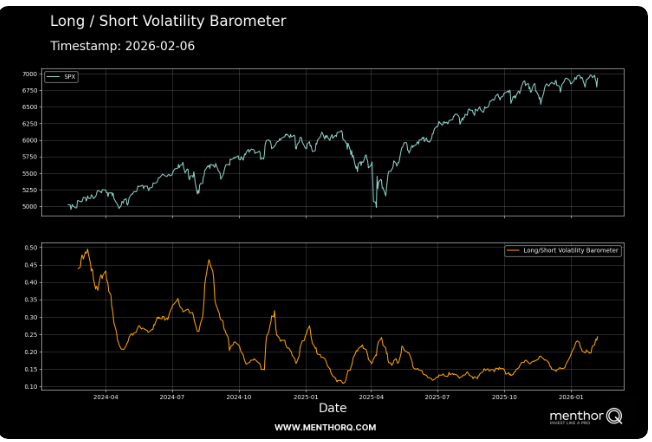

1DTE's can be helpfulWelcome back traders to a new week! This past week was a crazy one but we had a solid week of profits. One thing I've noticed over our trades from last week was not only the fact that every day was profitable but they were pretty easy days. The one main reason I can attribute that to is the liberal use of 1DTE's. We got an early start to most days with a 1DTE that morphed into our 0DTE's. We've got another one already working this morning. It's got a pretty solid risk/reward ratio. Our Friday went well for us. Here's a look at the day. It was a busy one. Let's take a look at the markets: Slight technical buy mode to start us off today. Markets rebounded Friday. The SPY is back to the 20DMA and the DIA actually rocketed to a new ATH. March S&P 500 E-Mini futures (ESH26) are down -0.25%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.46% this morning, pointing to a lower open on Wall Street as rising Treasury yields curbed investors’ risk appetite. The 10-year T-note yield rose three basis points to 4.23% after Bloomberg reported that Chinese regulators had told financial institutions to scale back their U.S. Treasury holdings, citing concerns about concentration risks and market volatility. Treasury yields also tracked a rise in Japanese government bond yields following a historic election victory by Prime Minister Sanae Takaichi. This week, investors will focus on key U.S. economic data, including monthly employment and inflation figures, comments from Federal Reserve officials, and earnings reports from a slew of high-profile companies. In Friday’s trading session, Wall Street’s major equity averages closed sharply higher, with the Dow notching a new all-time high. Chip stocks rallied after Nvidia CEO Jensen Huang told CNBC that demand for AI is “incredibly high,” with ARM Holdings (ARM) surging over +11% and Nvidia (NVDA) climbing more than +7% to lead gainers in the Dow. Also, cryptocurrency-exposed stocks soared after the price of Bitcoin surged more than +11%, with Strategy (MSTR) jumping over +26% to lead gainers in the Nasdaq 100 and MARA Holdings (MARA) rising more than +22%. In addition, Bill Holdings (BILL) popped over +37% after the financial services firm raised its full-year guidance and Bloomberg reported that Hellman & Friedman was in talks to acquire the company. On the bearish side, Amazon.com (AMZN) slid more than -5% and was the top percentage loser on the Dow and Nasdaq 100 after the e-commerce and technology giant unveiled plans to spend $200 billion this year on AI infrastructure. “Investors are rising to the occasion and aggressively buying the dip in stocks,” said Jose Torres at Interactive Brokers. “Basement ‘animal spirits’ are offering value hunters opportunities to accumulate shares amid a general sense on Wall Street that the selling has gone too far.” Economic data released on Friday showed that the University of Michigan’s preliminary U.S. consumer sentiment index unexpectedly rose to a 6-month high of 57.3 in February, stronger than expectations of 55.0. Also, U.S. consumer credit rose by $24.05 billion in December, stronger than expectations of $9 billion. Fed Vice Chair Philip Jefferson said on Friday he is “cautiously optimistic” about the U.S. economic outlook, suggesting that strong productivity growth could help bring inflation back to the central bank’s 2% target. “I expect the disinflationary process to resume this year once increased tariffs pass through more fully to prices,” Jefferson said. With the central bank “strongly committed to returning inflation to its target, the risk of such a one-time shift leading to sustained inflation is likely to be low,” he said. “This implies that there is more leeway for the supply side of the economy to evolve without the need for precautionary monetary policy restraint.” Atlanta Fed President Raphael Bostic said, “What I’ve learned is that we really don’t want to have inflation. Once inflation gets entrenched in people’s minds, it changes how the economy evolves, and it’s one of the reasons why I think that we need to keep our policy in a restrictive posture so that we get inflation back to 2%. That’s paramount.” He also brushed aside recent downbeat reports on hiring and layoffs, saying he does not anticipate a significant deterioration in the labor market. U.S. rate futures have priced in an 84.2% probability of no rate change and a 15.8% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. This week, delayed U.S. jobs and inflation data will be the main highlights, as investors assess when the Fed is likely to lower interest rates again. The January jobs report is set to be released on Wednesday after being delayed from February 6th due to the partial government shutdown. Notably, the report will include revisions to job growth for the year through March 2025, which are expected to show a significant markdown in the pace of hiring. The January CPI data will be released on Friday, delayed from February 11th, with investors seeking further evidence that inflation is on a downward trend to pave the way for rate cuts in the months ahead. U.S. retail sales data for December will also attract attention, as market participants watch to see whether American consumers sustained their spending momentum during the holiday shopping season. Other noteworthy data releases include the U.S. Employment Cost Index, Import and Export Price Indexes, Initial Jobless Claims, and Existing Home Sales. Market watchers will also parse comments from a slew of Fed officials. Fed Governors Christopher Waller and Stephen Miran, along with Atlanta Fed President Raphael Bostic, Cleveland Fed President Beth Hammack, Dallas Fed President Lorie Logan, and Fed Vice Chair for Supervision Michelle Bowman, are scheduled to speak this week. Fourth-quarter corporate earnings season continues in full flow, and investors await fresh reports from prominent companies this week, including Applied Materials (AMAT), ON Semiconductor (ON), Arista Networks (ANET), Cisco Systems (CSCO), McDonald’s (MCD), The Coca-Cola Company (KO), T-Mobile US (TMUS), Shopify (SHOP), AppLovin (APP), Gilead Sciences (GILD), CVS Health (CVS), Robinhood Markets (HOOD), and Ford (F). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.230%, up +0.64%. SPY ended the week nearly flat at $690.62 (-0.20%), despite all of the volatility in single names. The Volatility Trend Bands remains in a buy signal that began on December 10th, when the mid-band shifted from a falling to a rising trend. Due to the index’s diversification, the rotation into consumer staples and energy has had a limited impact on overall S&P 500 price action. The tech-heavy Nasdaq did not hold up nearly as well, with QQQ closing the week at $609.65 (-1.97%). The Sector Rotation Matrix is showing continued weakness in technology, while QQQ remains in a sell signal on the Volatility Trend Bands. Most large-cap tech earnings triggered sharp sell-offs, intensifying the rotation out of tech and into energy and consumer staples. Small-caps led the charge last week, with IWM closing higher at $265.02 (+2.07%). While this may appear counterintuitive during a flight-to-safety style rotation, roughly 50% of IWM is allocated to healthcare, industrials, energy, and consumer staples, sectors that are benefiting from the rotation and supporting the December 4th buy signal on the Volatility Trend Bands. 1.34% expected move this week. That's pretty decent I.V. to start us off. The SPX remains near recent highs, while the long/short volatility barometer has begun to rise from historically low levels, indicating a change in volatility positioning after an extended period of suppression. Similar transitions in the past have coincided with shifts in market behavior, as volatility demand increases from compressed conditions. At current levels, price and volatility indicators reflect a market that is adjusting from a low-volatility environment toward a more dynamic regime. When volatility metrics move higher from depressed readings, price action has often displayed greater variability, with intraday ranges expanding and directional moves becoming less uniform. From a structural perspective, the interaction between elevated price levels and rising volatility demand highlights a change in underlying market conditions rather than a directional signal. Monitoring whether volatility measures continue to rise or stabilize may help contextualize how price responds as the market transitions away from the prior low-volatility regime. This week's training series will kick off today with a three (or four) Part series on risk management components. This should be another great one. Please tune in. Let's take a look at the intraday /ES levels. 6950, 6960, 6967, 6980, 6993 are resistance levels. 6937, 6922, 6913, 6897 are support levels. We've already got our 0DTE up and running. We'll look to work around it today, if necessary. See you shortly.

Are you scared or excited?I talked to a good friend yesterday who has done a good job building his portfolio. He's moved everything to treasuries. There's a palpable fear in the marketplace. I suggested that this isn't the time to "give up". It's a time to really grow your account and take advantage of this volatility. We have three distinct buckets that we put our money into. #1 Scalping. #2. ATM portfolio. #3. Day trading. Each is specifically designed to benefit from A) Volatility and B) Down-trending markets. I would suggest that we remember the old adage...every trade is a winner, for someone. Our portfolios and results have been very solid this past week because we embrace the downside. My friend said the market was getting "ugly". I view it as beautiful. Scared of the market? Invest in things that are "in the market but not of the market". In our ATM portfolio, we have positions in things like Bond futures, Corn, Oil, and currencies. These have all been incredibly stable during this downturn. We had a really solid day yesterday. It was a fun day of trading BTC and once again, we got a jump on our other setups starting early. We've done the same this morning. Most of our trades for the day are already working and profitable. Here's a look at our day. Let's take a look at the markets. Well, the selloff was fun but now it may be done? We are back to key support levels in most all of the indices we track. Let's all just collectively keep the faith that the bears can keep it going. Technicals are still bearish. March S&P 500 E-Mini futures (ESH26) are up +0.58%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.69% this morning, rebounding after days of heavy selling as investors stepped in to buy the dip. Investors also digest an earnings report from Amazon.com (AMZN). Shares of the e-commerce and technology giant slumped over -7% in pre-market trading after it unveiled plans to spend $200 billion this year on AI infrastructure, a sharp increase that outpaced revenue growth in its cloud unit. That stoked concerns that its massive AI bet may fail to pay off over the long term. At the same time, companies tied to the AI buildout got a boost from Amazon’s blowout capex plans, with Nvidia (NVDA) and Broadcom (AVGO) rising over +3% in pre-market trading. Investors are now awaiting the release of the University of Michigan’s preliminary reading on U.S. consumer sentiment and comments from a Federal Reserve official. In yesterday’s trading session, Wall Street’s major indices ended in the red. Most members of the Magnificent Seven stocks slumped, with Amazon.com (AMZN) and Microsoft (MSFT) falling over -4%. Also, cryptocurrency-exposed stocks sank after the price of Bitcoin tumbled more than -12%, with MARA Holdings (MARA) plummeting over -18%, and Strategy (MSTR) plunging over -17% to lead losers in the Nasdaq 100. In addition, Qualcomm (QCOM) slid over -8% after the largest maker of smartphone processors issued below-consensus FQ2 guidance. On the bullish side, McKesson Corp. (MCK) jumped more than +16% and was the top percentage gainer on the S&P 500 after the drug wholesaler posted upbeat FQ3 results and raised its full-year adjusted EPS guidance. A Labor Department report released on Thursday showed that the U.S. JOLTs job openings unexpectedly fell to a 5-1/4-year low of 6.542 million in December, weaker than expectations of 7.200 million. Also, the number of Americans filing for initial jobless claims in the past week rose by +22K to an 8-week high of 231K, compared with the 212K expected. “The latest labor figures reiterate that the U.S. jobs market is not firing on all cylinders, a risk the Fed and investors will have to take seriously should further deterioration occur,” said Bret Kenwell at eToro. “Volatility could persist, particularly if near-term uncertainty increases.” Meanwhile, Atlanta Fed President Raphael Bostic said on Thursday that inflation remains his primary concern, reiterating that a still-strong labor market gives the central bank room to keep interest rates modestly restrictive. “It’s important that our policy stay at a moderately restrictive posture, because that is a posture that increases the likelihood that we will get inflation back to our 2% target,” Bostic said. U.S. rate futures have priced in an 83.3% chance of no rate change and a 16.7% chance of a 25 basis point rate cut at the March FOMC meeting. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary February figure will stand at 55.0, compared to 56.4 in January. The Fed’s Consumer Credit report will also be released today. Economists expect the U.S. Consumer Credit to be $9 billion in December, compared to the previous figure of $4.23 billion. In addition, market participants will be anticipating a speech from Fed Vice Chair Philip Jefferson. Earlier this week, the Bureau of Labor Statistics said the January jobs report will be published on Wednesday, February 11th. The report was originally scheduled for release today, but was delayed due to the partial government shutdown. On the earnings front, notable companies like Philip Morris International (PM), Biogen (BIIB), and Centene (CNC) are set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.191%, down -0.40%. SPX price remains near recent highs, while the momentum score has declined from previously elevated levels toward the lower end of its recent range. This change reflects a reduction in short-term upside momentum rather than a break in the broader trend. In similar historical conditions, market behavior has often involved more range-bound activity as momentum indicators recalibrate. Recent price action suggests increased sensitivity around nearby technical levels, with shorter-term moves occurring within a narrower context compared to earlier in the rally. Let's take a look at the fear and greed index. It's still not fearful enough to really merit jumping back into longs. That being said, the last week of price action really hasn't been that bad. It's more a reallocation from tech to other sectors. Let's take a look at the /ES intraday levels for today. We are getting a bit of a bounce this morning off the selloff of last night. 6875, 6896, 6912, 6923 are resistance. 6850, 6826, 6800, 6775 are support. 6850 is the critical demarcation point for me today. We already have our /ES 0DTE working this morning. Premiums are great. Each contract offers a 25% max potential profit for today. It's been a solid week for us. Let's finish it off strong today folks! See you all in the live trading room.

|

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |