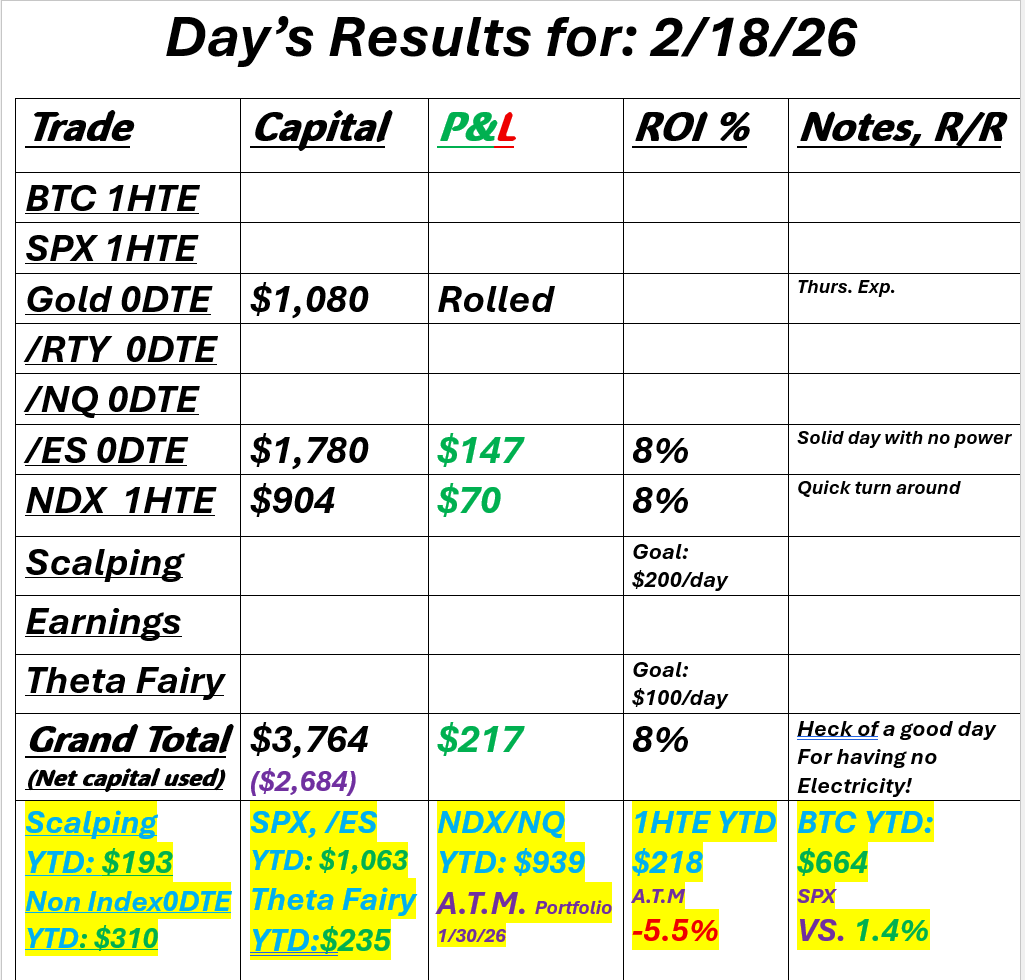

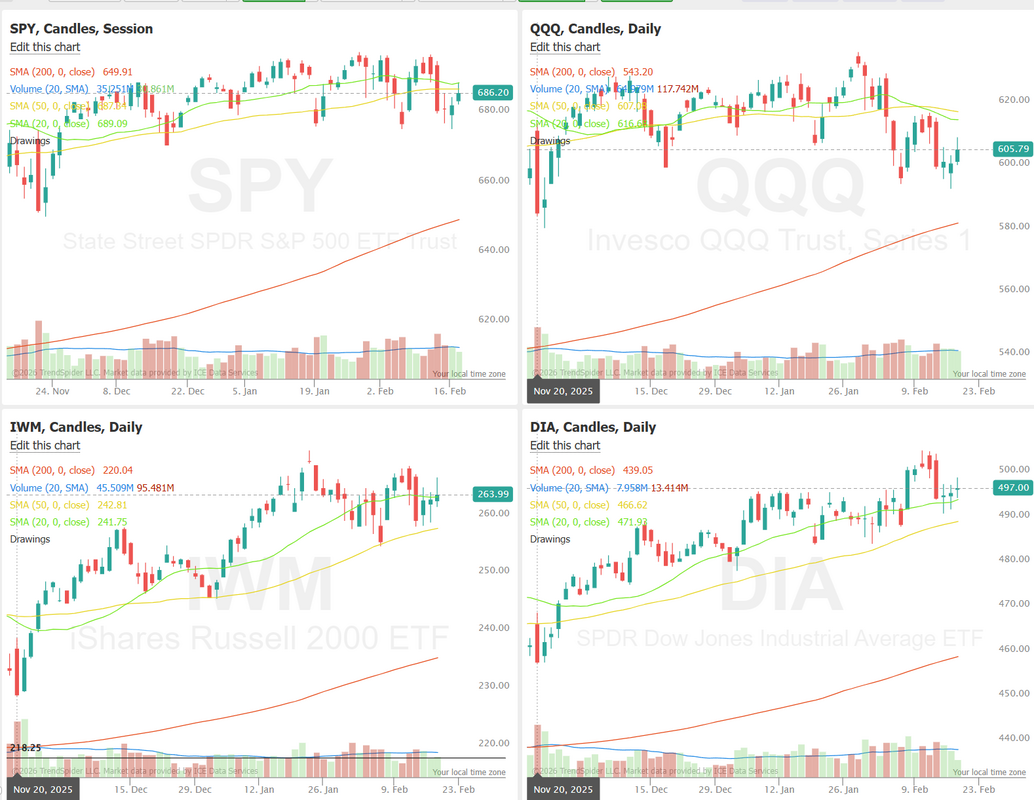

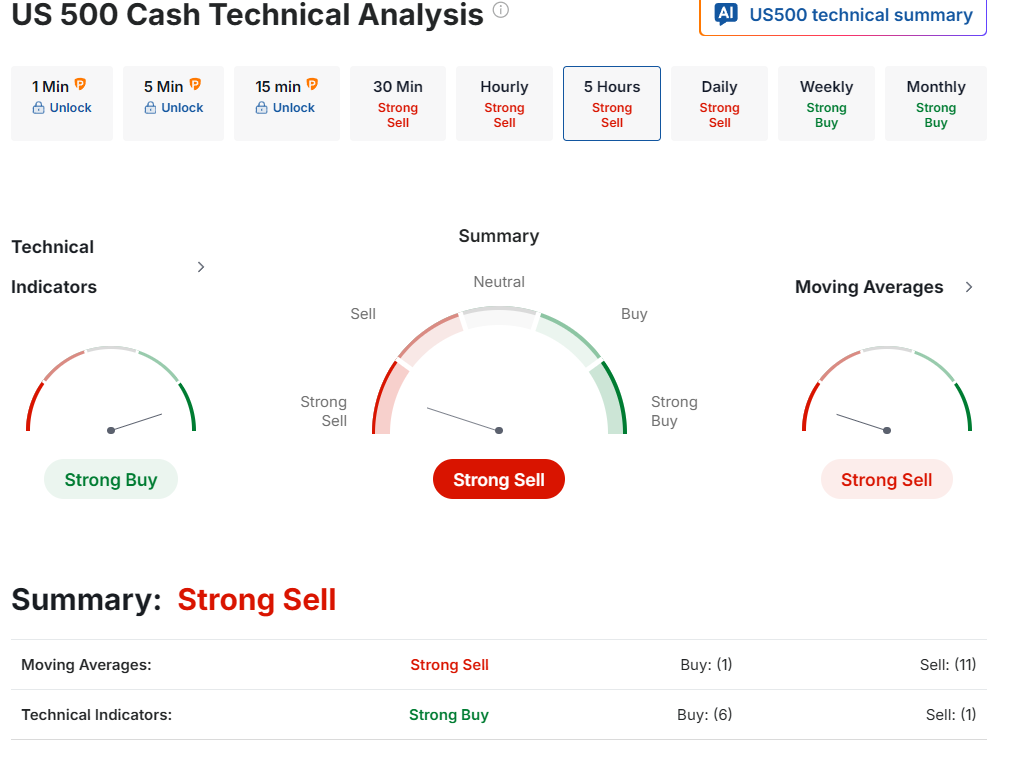

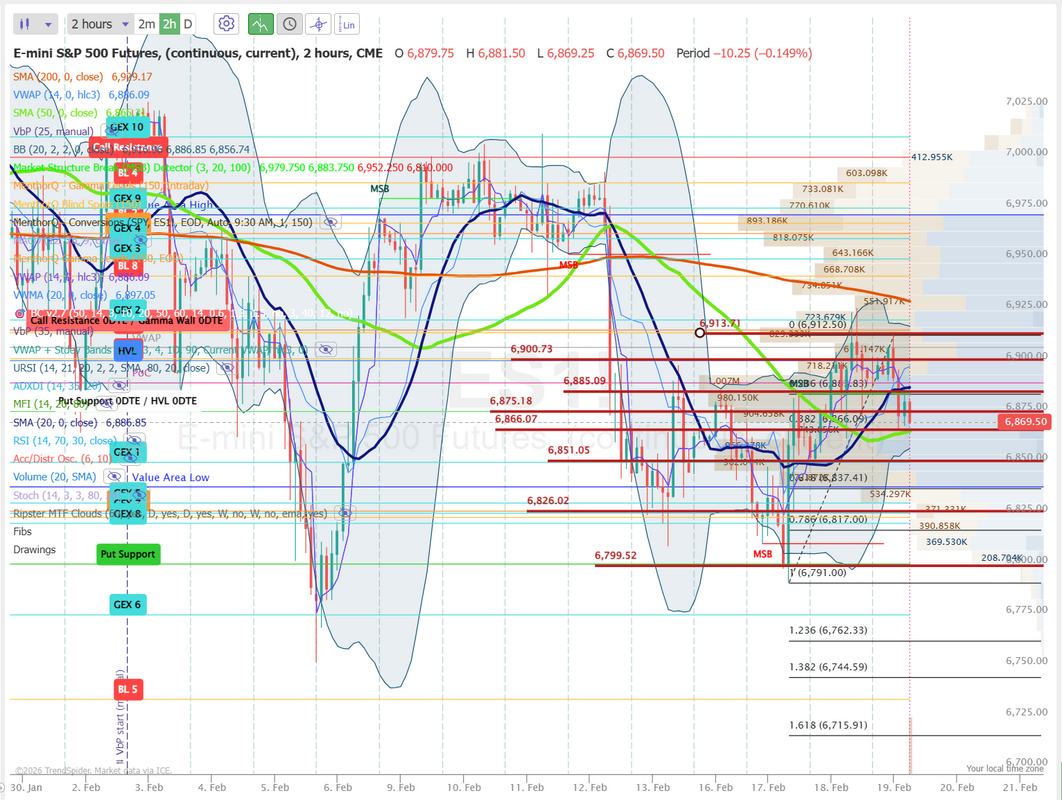

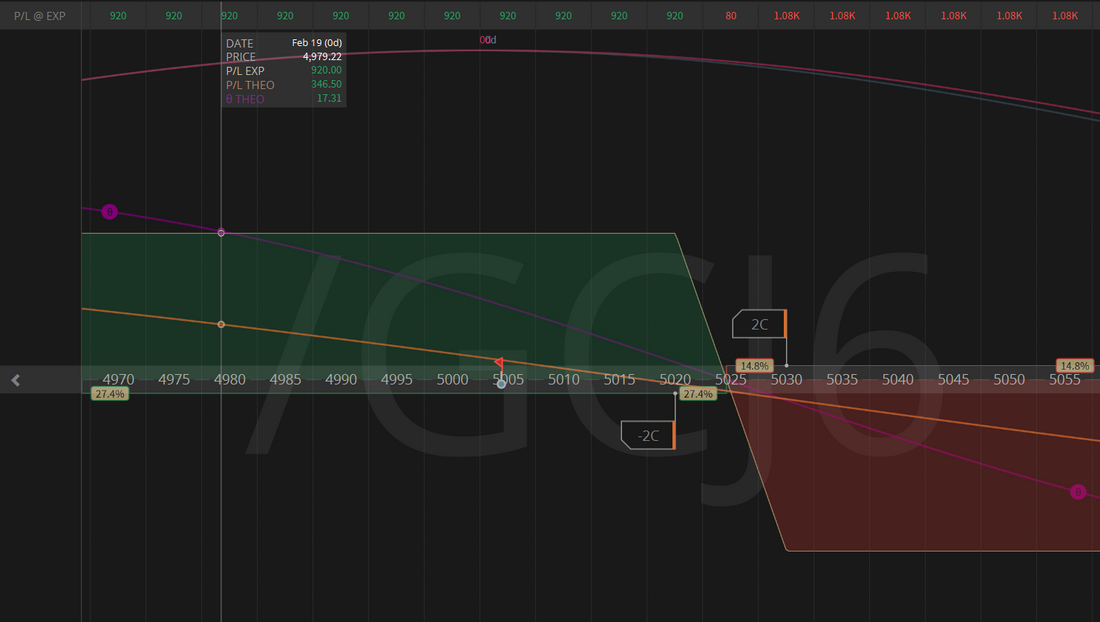

Iran and TariffsGood morning traders! Yesterday was a bit of a technical challenge for me. Our power was knocked out late in the evening so I lacked my screens and signals and was just trading off my laptop battery and tethered mobile phone for most of the day. We were still able to get some trades done so all in all, I'm pretty happy the day wasn't a waste. We did roll our gold calls up and out to today so that will be our primary focus this morning. Here's a look at our truncated day yesterday. The next few days in the market could get interesting. Depending on who you listen to, the US and Iran are either close to a breakthrough agreement or...ready to go to war. Negotiations are ongoing and most media reports show progress however there is a massive build up of weaponry going on from the US, right on Iran's doorstep. Combine this with the potential (Just potential at this point) for a supreme court ruling this Friday on tariffs. I'm keeping some powder dry going into the weekend. Let's take a look at the markets. We've had a couple green days in a row. Is it meaningful? Does it tell us anything? I don't think so. We are still in a "Lower lows and lower highs" trend. Markets gone no where this year with the QQQ's actually down. That could (should?) change soon. The technicals this morning are a bit bearish with futures pointed down, as I type. March S&P 500 E-Mini futures (ESH26) are down -0.32%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.36% this morning, pointing to a lower open on Wall Street as worries about a potential conflict between the U.S. and Iran dampened sentiment. Investors remain on edge about the prospect of U.S. military intervention in Iran, even as talks on Tehran’s nuclear program in Geneva showed signs of progress. The Wall Street Journal reported on Wednesday that the U.S. has assembled its largest air power presence in the Middle East since the 2003 invasion of Iraq and is in a position to strike Iran. The head of the United Nations nuclear watchdog warned on Thursday that the window for a diplomatic deal on Iran’s atomic program is closing. The price of WTI crude rose above $66 a barrel. Also adding to the negative sentiment on Thursday was renewed caution about the outlook for AI. Most members of the Magnificent Seven stocks edged lower in pre-market trading. Investors now await a new round of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from retail giant Walmart. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. Global Payments (GPN) surged over +16% and was the top percentage gainer on the S&P 500 after the financial software provider issued above-consensus FY26 adjusted EPS guidance. Also, most chip stocks advanced, with Micron Technology (MU) rising more than +5% and Applied Materials (AMAT) gaining over +2%. In addition, Palantir Technologies (PLTR) rose more than +1% after Mizuho upgraded the stock to Outperform from Neutral. On the bearish side, Palo Alto Networks (PANW) slumped over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the cybersecurity firm cut its full-year adjusted EPS guidance. Economic data released on Wednesday showed that U.S. durable goods orders fell -1.4% m/m in December, stronger than expectations of -1.8% m/m, while core durable goods orders, which exclude transportation, climbed +0.9% m/m, stronger than expectations of +0.3% m/m. Also, U.S. December housing starts rose +6.2% m/m to a 5-month high of 1.404 million, stronger than expectations of 1.310 million, and building permits, a proxy for future construction, rose +4.3% m/m to a 9-month high of 1.448 million, stronger than expectations of 1.400 million. In addition, U.S. industrial production rose +0.7% m/m in January, stronger than expectations of +0.4% m/m. “In the context of a data-dependent Committee, the incoming economic data justified last month’s pause on the journey to neutral,” said Ian Lyngen at BMO Capital Markets. “The open question is: how high is the bar to resume rate cuts?” Meanwhile, the minutes of the Federal Open Market Committee’s January 27-28 meeting, released on Wednesday, showed that “several” policymakers suggested the central bank may have to raise rates if inflation remains above their target. “Several participants indicated that they would have supported a two-sided description of the committee’s future interest-rate decisions, reflecting the possibility that upward adjustments to the target range for the federal funds rate could be appropriate if inflation remains at above-target levels,” according to the FOMC minutes. The minutes also showed that a “vast majority of participants judged that downside risks to employment had moderated in recent months while the risk of more persistent inflation remained.” Several officials saw scope for additional rate cuts if inflation eased as anticipated, though most said progress on inflation could be slower than generally forecast. U.S. rate futures have priced in a 94.1% chance of no rate change and a 5.9% chance of a 25 basis point rate cut at the March FOMC meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 223K, compared to last week’s number of 227K. The U.S. Philadelphia Fed Manufacturing Index will also be closely watched today. Economists anticipate that the Philly Fed manufacturing index will stand at 7.5 in February, compared to last month’s value of 12.6. U.S. Trade Balance data will be released today. Economists forecast that the trade deficit will narrow to -$55.5 billion in December from -$56.8 billion in November. The National Association of Realtors’ pending home sales data will be reported today. Economists expect the January figure to rise +1.4% m/m following a -9.3% m/m drop in December. The Conference Board’s Leading Economic Index for the U.S. will come in today. Economists expect the December figure to drop -0.2% m/m, compared to the previous number of -0.3% m/m. The EIA’s weekly crude oil inventories report will be released today as well. Economists estimate this figure to be 1.7 million barrels, compared to last week’s value of 8.5 million barrels. In addition, market participants will parse comments today from Atlanta Fed President Raphael Bostic, Fed Vice Chair for Supervision Michelle Bowman, Minneapolis Fed President Neel Kashkari, and Chicago Fed President Austan Goolsbee. On the earnings front, notable companies such as Walmart (WMT), Deere & Company (DE), Newmont (NEM), and Copart (CPRT) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.094%, up +0.34%. Today we'll finish up this series on risk management. Tune in early today. We'll try to get it done a bit earlier than normal. Let's take a look at the intraday levels we'll be working off today. 6875, 6885, 6900, 6914 are resistance levels. 6866, 6851, 6820, 6800 are support levels. Game plan for today is to get our Gold 0DTE that was rolled over from yesterday to the finish line first. It expires at 11:30 am MST. After that we'll focus on our next 0DTE for the day. It could be either /ES or /NQ depending on the remaining premiums available. We'll also focus on scalping and 1HTE's. See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |