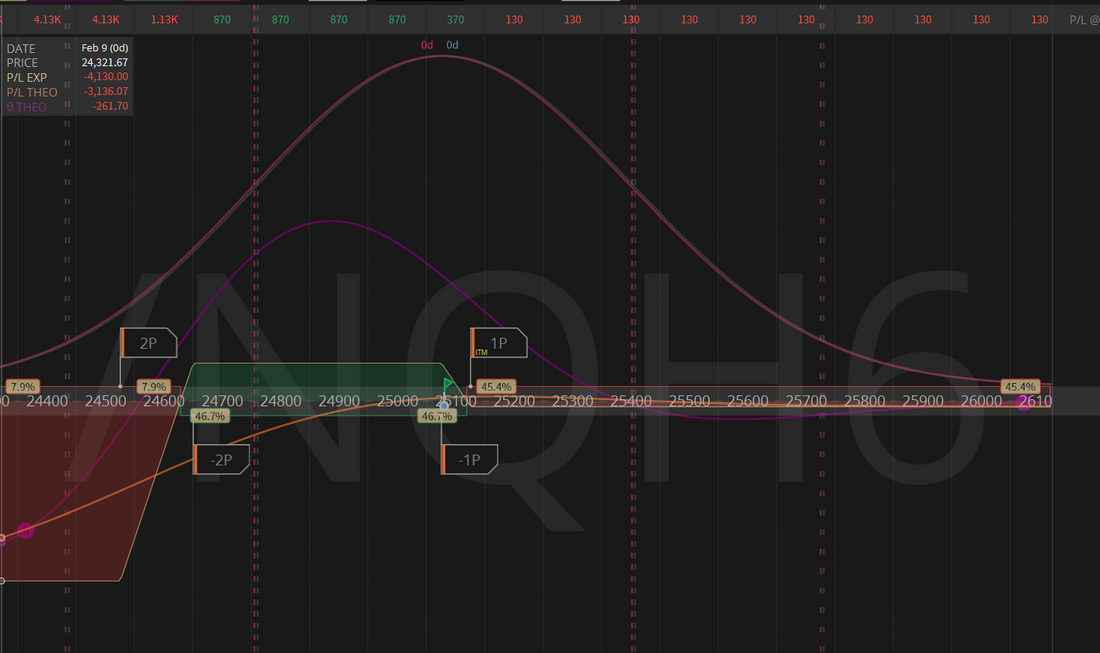

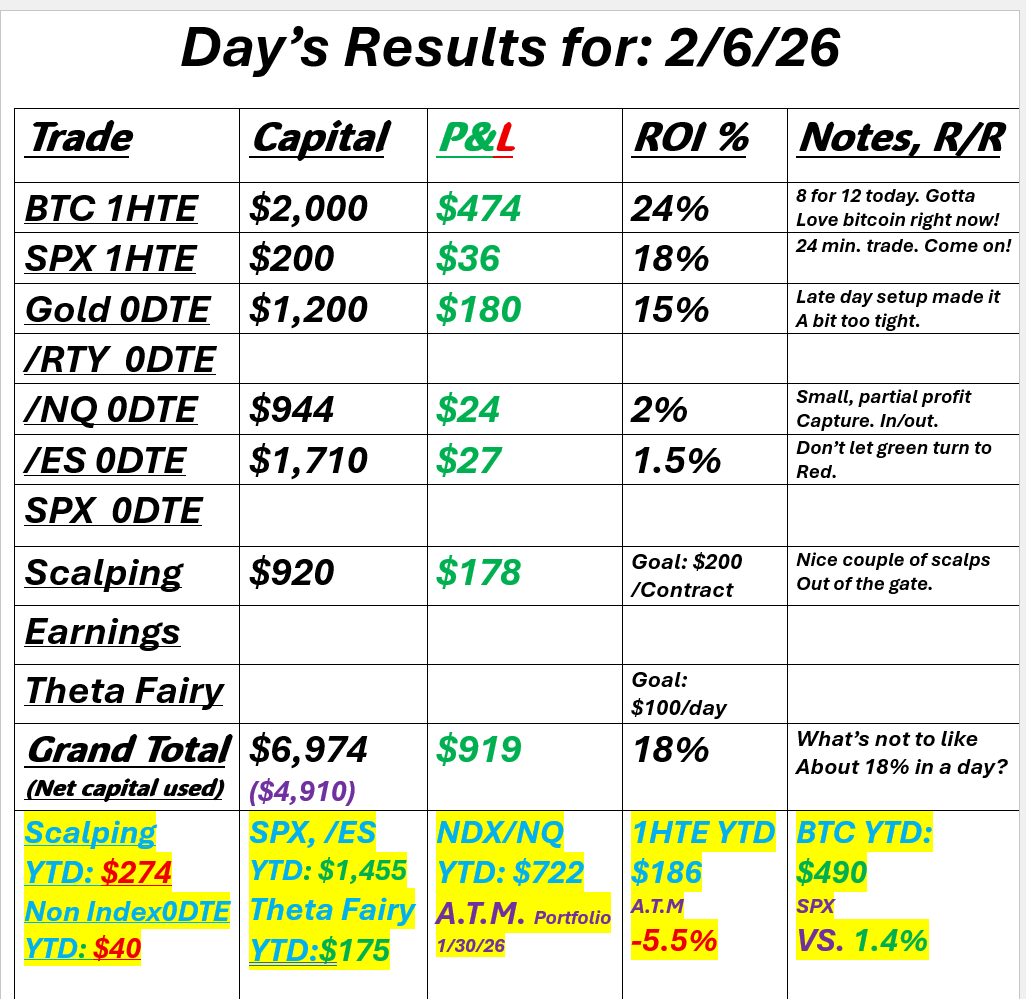

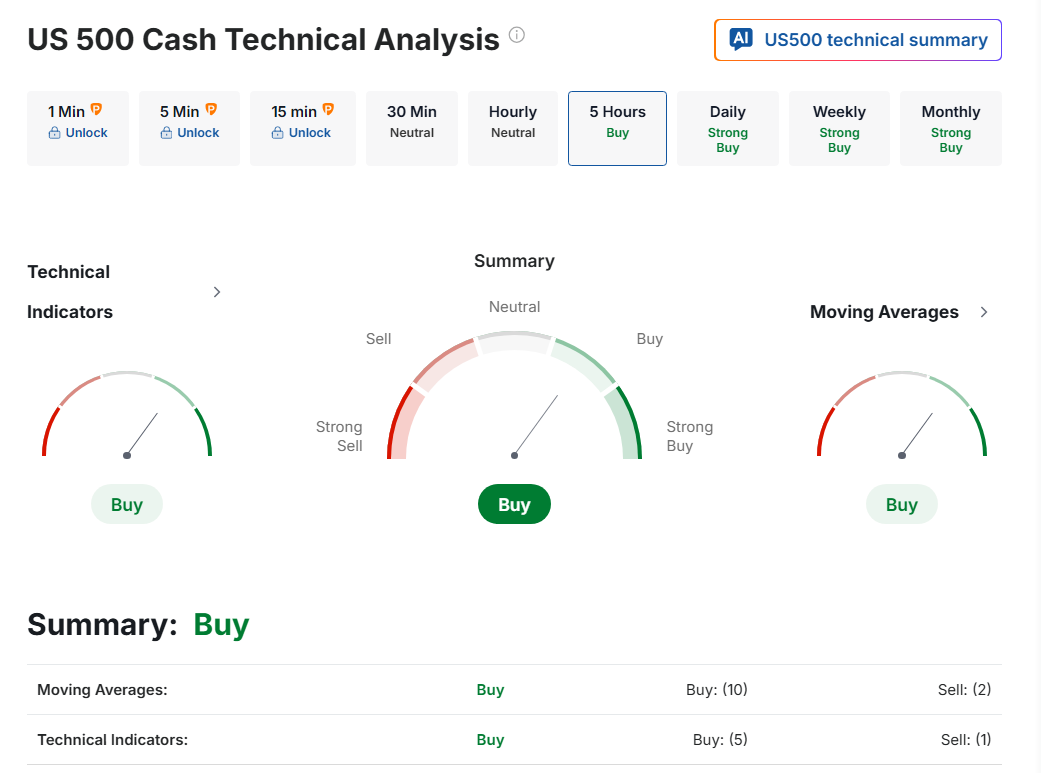

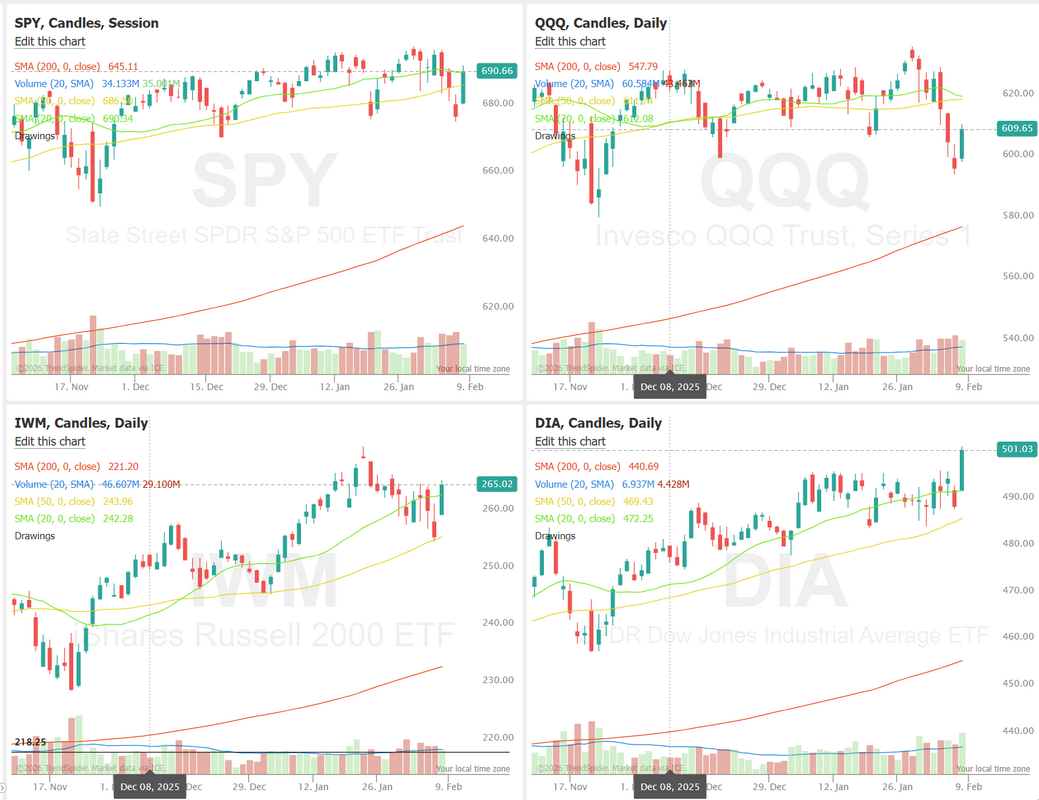

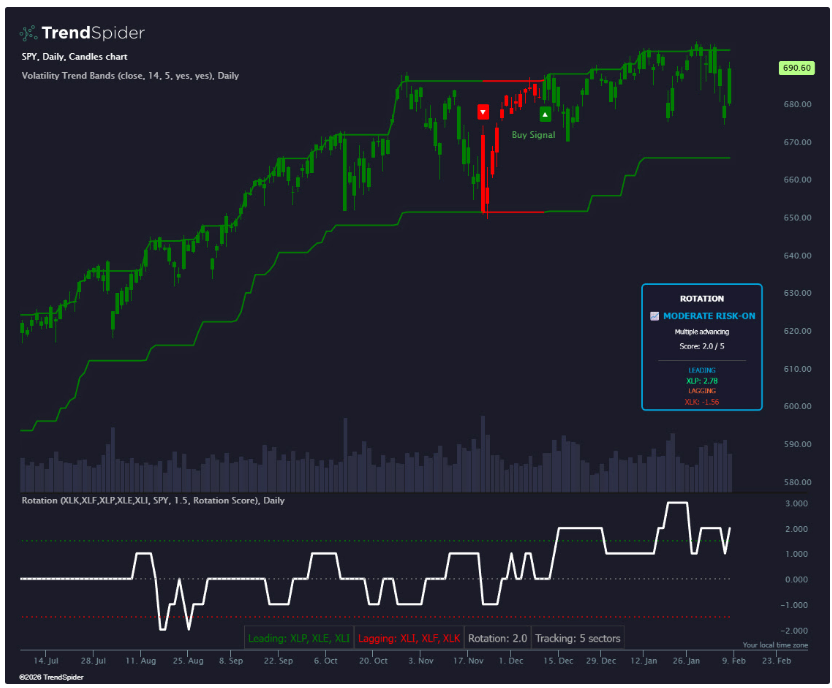

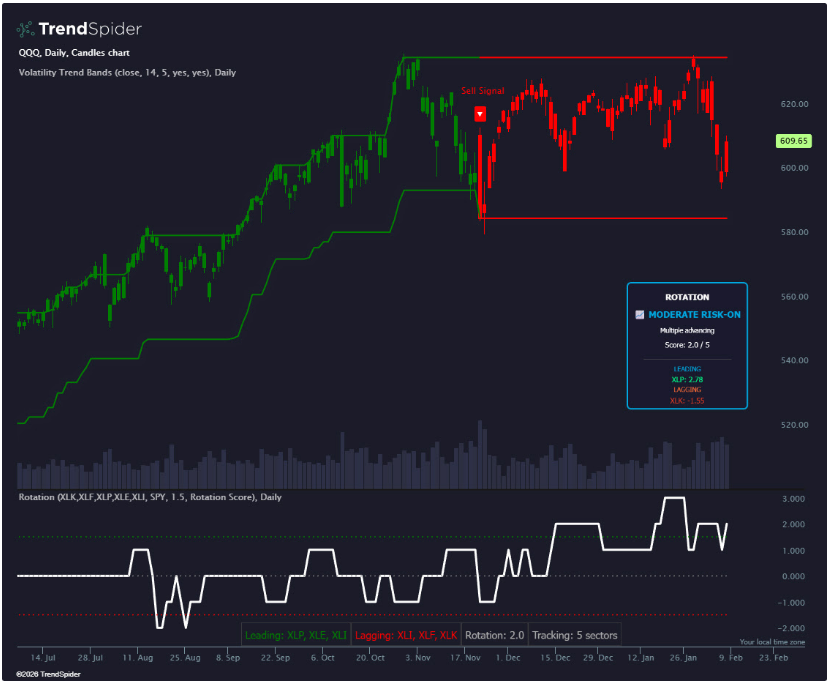

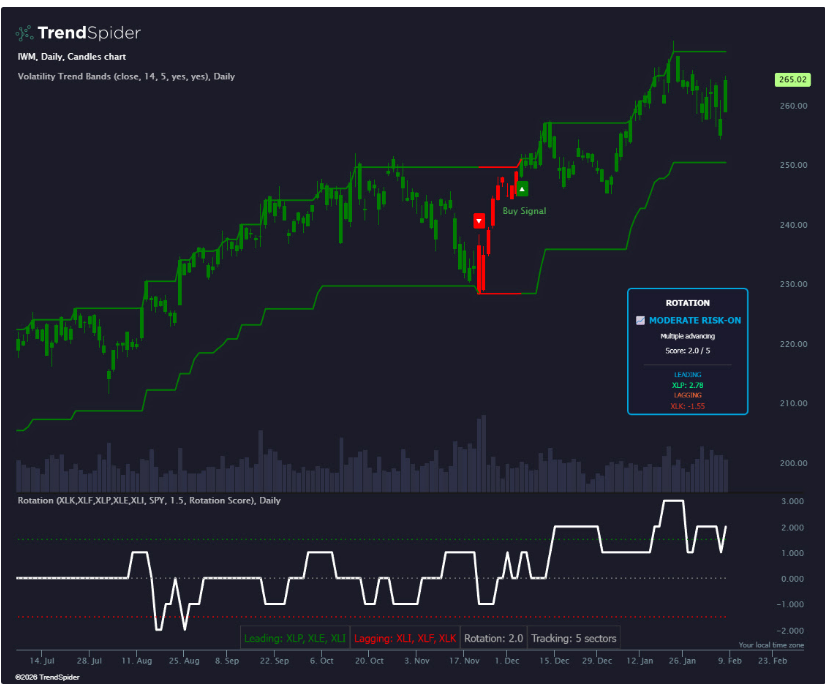

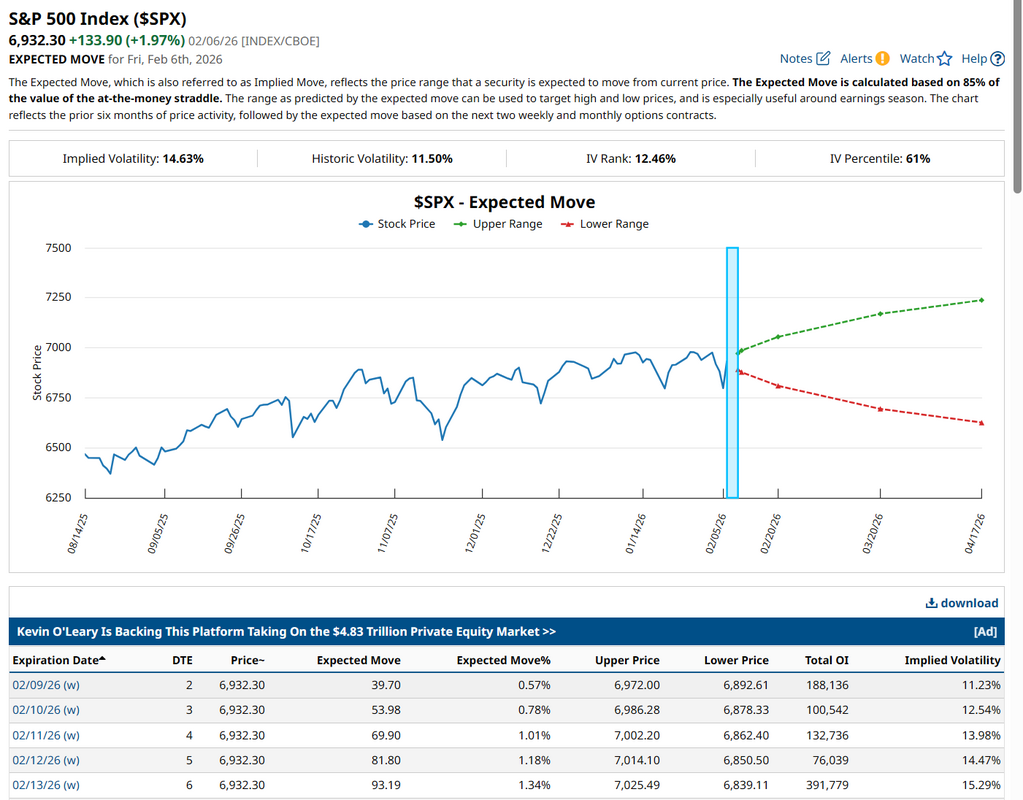

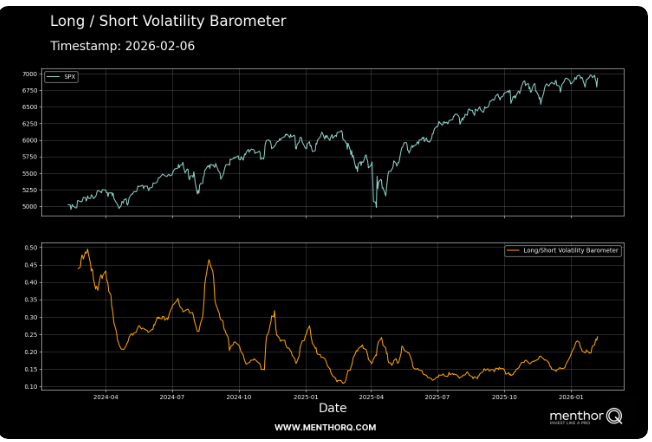

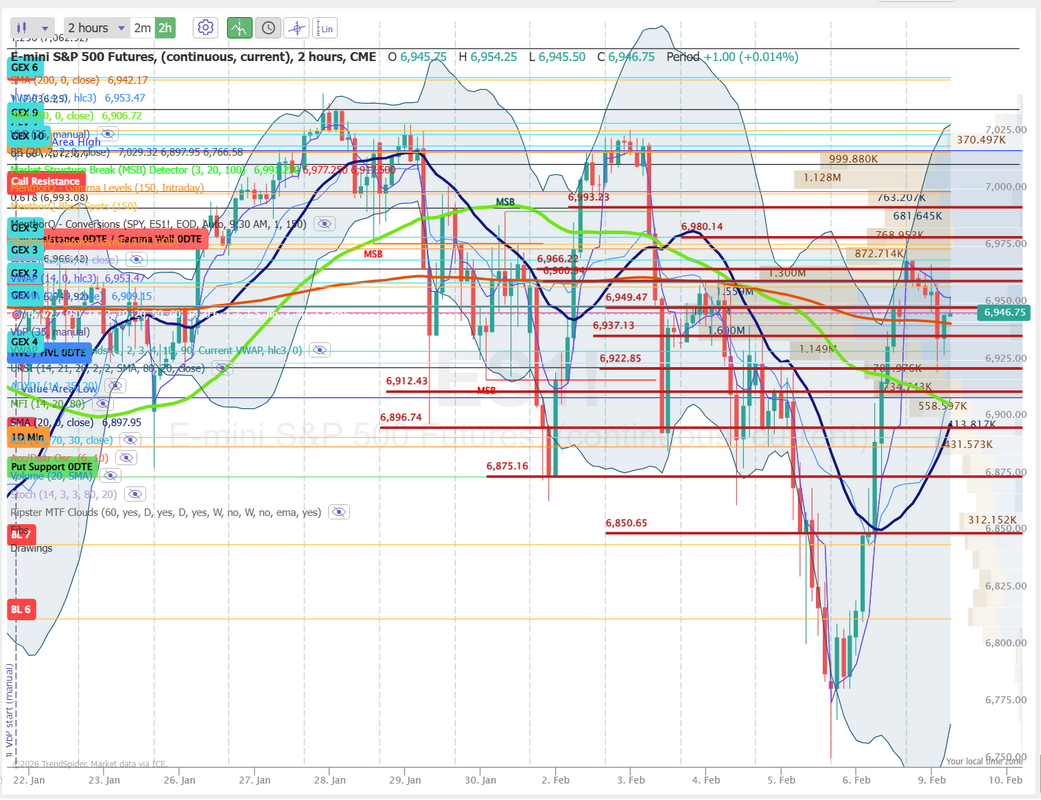

1DTE's can be helpfulWelcome back traders to a new week! This past week was a crazy one but we had a solid week of profits. One thing I've noticed over our trades from last week was not only the fact that every day was profitable but they were pretty easy days. The one main reason I can attribute that to is the liberal use of 1DTE's. We got an early start to most days with a 1DTE that morphed into our 0DTE's. We've got another one already working this morning. It's got a pretty solid risk/reward ratio. Our Friday went well for us. Here's a look at the day. It was a busy one. Let's take a look at the markets: Slight technical buy mode to start us off today. Markets rebounded Friday. The SPY is back to the 20DMA and the DIA actually rocketed to a new ATH. March S&P 500 E-Mini futures (ESH26) are down -0.25%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.46% this morning, pointing to a lower open on Wall Street as rising Treasury yields curbed investors’ risk appetite. The 10-year T-note yield rose three basis points to 4.23% after Bloomberg reported that Chinese regulators had told financial institutions to scale back their U.S. Treasury holdings, citing concerns about concentration risks and market volatility. Treasury yields also tracked a rise in Japanese government bond yields following a historic election victory by Prime Minister Sanae Takaichi. This week, investors will focus on key U.S. economic data, including monthly employment and inflation figures, comments from Federal Reserve officials, and earnings reports from a slew of high-profile companies. In Friday’s trading session, Wall Street’s major equity averages closed sharply higher, with the Dow notching a new all-time high. Chip stocks rallied after Nvidia CEO Jensen Huang told CNBC that demand for AI is “incredibly high,” with ARM Holdings (ARM) surging over +11% and Nvidia (NVDA) climbing more than +7% to lead gainers in the Dow. Also, cryptocurrency-exposed stocks soared after the price of Bitcoin surged more than +11%, with Strategy (MSTR) jumping over +26% to lead gainers in the Nasdaq 100 and MARA Holdings (MARA) rising more than +22%. In addition, Bill Holdings (BILL) popped over +37% after the financial services firm raised its full-year guidance and Bloomberg reported that Hellman & Friedman was in talks to acquire the company. On the bearish side, Amazon.com (AMZN) slid more than -5% and was the top percentage loser on the Dow and Nasdaq 100 after the e-commerce and technology giant unveiled plans to spend $200 billion this year on AI infrastructure. “Investors are rising to the occasion and aggressively buying the dip in stocks,” said Jose Torres at Interactive Brokers. “Basement ‘animal spirits’ are offering value hunters opportunities to accumulate shares amid a general sense on Wall Street that the selling has gone too far.” Economic data released on Friday showed that the University of Michigan’s preliminary U.S. consumer sentiment index unexpectedly rose to a 6-month high of 57.3 in February, stronger than expectations of 55.0. Also, U.S. consumer credit rose by $24.05 billion in December, stronger than expectations of $9 billion. Fed Vice Chair Philip Jefferson said on Friday he is “cautiously optimistic” about the U.S. economic outlook, suggesting that strong productivity growth could help bring inflation back to the central bank’s 2% target. “I expect the disinflationary process to resume this year once increased tariffs pass through more fully to prices,” Jefferson said. With the central bank “strongly committed to returning inflation to its target, the risk of such a one-time shift leading to sustained inflation is likely to be low,” he said. “This implies that there is more leeway for the supply side of the economy to evolve without the need for precautionary monetary policy restraint.” Atlanta Fed President Raphael Bostic said, “What I’ve learned is that we really don’t want to have inflation. Once inflation gets entrenched in people’s minds, it changes how the economy evolves, and it’s one of the reasons why I think that we need to keep our policy in a restrictive posture so that we get inflation back to 2%. That’s paramount.” He also brushed aside recent downbeat reports on hiring and layoffs, saying he does not anticipate a significant deterioration in the labor market. U.S. rate futures have priced in an 84.2% probability of no rate change and a 15.8% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. This week, delayed U.S. jobs and inflation data will be the main highlights, as investors assess when the Fed is likely to lower interest rates again. The January jobs report is set to be released on Wednesday after being delayed from February 6th due to the partial government shutdown. Notably, the report will include revisions to job growth for the year through March 2025, which are expected to show a significant markdown in the pace of hiring. The January CPI data will be released on Friday, delayed from February 11th, with investors seeking further evidence that inflation is on a downward trend to pave the way for rate cuts in the months ahead. U.S. retail sales data for December will also attract attention, as market participants watch to see whether American consumers sustained their spending momentum during the holiday shopping season. Other noteworthy data releases include the U.S. Employment Cost Index, Import and Export Price Indexes, Initial Jobless Claims, and Existing Home Sales. Market watchers will also parse comments from a slew of Fed officials. Fed Governors Christopher Waller and Stephen Miran, along with Atlanta Fed President Raphael Bostic, Cleveland Fed President Beth Hammack, Dallas Fed President Lorie Logan, and Fed Vice Chair for Supervision Michelle Bowman, are scheduled to speak this week. Fourth-quarter corporate earnings season continues in full flow, and investors await fresh reports from prominent companies this week, including Applied Materials (AMAT), ON Semiconductor (ON), Arista Networks (ANET), Cisco Systems (CSCO), McDonald’s (MCD), The Coca-Cola Company (KO), T-Mobile US (TMUS), Shopify (SHOP), AppLovin (APP), Gilead Sciences (GILD), CVS Health (CVS), Robinhood Markets (HOOD), and Ford (F). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.230%, up +0.64%. SPY ended the week nearly flat at $690.62 (-0.20%), despite all of the volatility in single names. The Volatility Trend Bands remains in a buy signal that began on December 10th, when the mid-band shifted from a falling to a rising trend. Due to the index’s diversification, the rotation into consumer staples and energy has had a limited impact on overall S&P 500 price action. The tech-heavy Nasdaq did not hold up nearly as well, with QQQ closing the week at $609.65 (-1.97%). The Sector Rotation Matrix is showing continued weakness in technology, while QQQ remains in a sell signal on the Volatility Trend Bands. Most large-cap tech earnings triggered sharp sell-offs, intensifying the rotation out of tech and into energy and consumer staples. Small-caps led the charge last week, with IWM closing higher at $265.02 (+2.07%). While this may appear counterintuitive during a flight-to-safety style rotation, roughly 50% of IWM is allocated to healthcare, industrials, energy, and consumer staples, sectors that are benefiting from the rotation and supporting the December 4th buy signal on the Volatility Trend Bands. 1.34% expected move this week. That's pretty decent I.V. to start us off. The SPX remains near recent highs, while the long/short volatility barometer has begun to rise from historically low levels, indicating a change in volatility positioning after an extended period of suppression. Similar transitions in the past have coincided with shifts in market behavior, as volatility demand increases from compressed conditions. At current levels, price and volatility indicators reflect a market that is adjusting from a low-volatility environment toward a more dynamic regime. When volatility metrics move higher from depressed readings, price action has often displayed greater variability, with intraday ranges expanding and directional moves becoming less uniform. From a structural perspective, the interaction between elevated price levels and rising volatility demand highlights a change in underlying market conditions rather than a directional signal. Monitoring whether volatility measures continue to rise or stabilize may help contextualize how price responds as the market transitions away from the prior low-volatility regime. This week's training series will kick off today with a three (or four) Part series on risk management components. This should be another great one. Please tune in. Let's take a look at the intraday /ES levels. 6950, 6960, 6967, 6980, 6993 are resistance levels. 6937, 6922, 6913, 6897 are support levels. We've already got our 0DTE up and running. We'll look to work around it today, if necessary. See you shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |