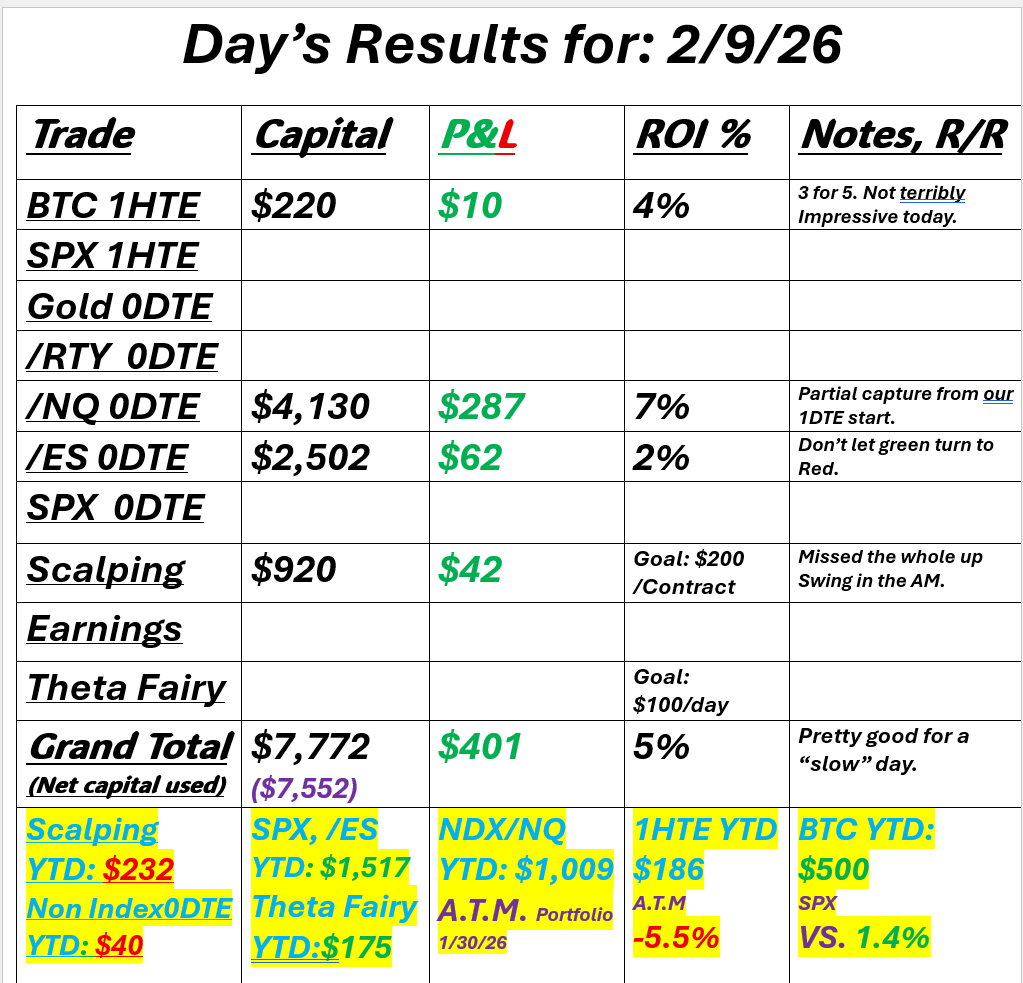

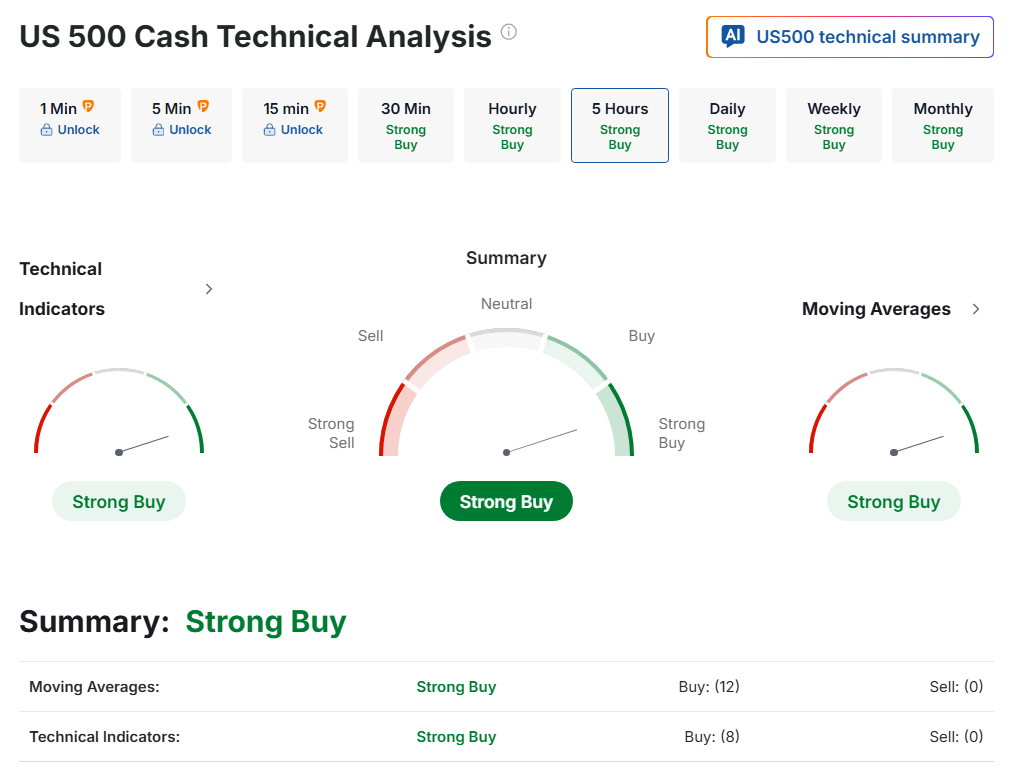

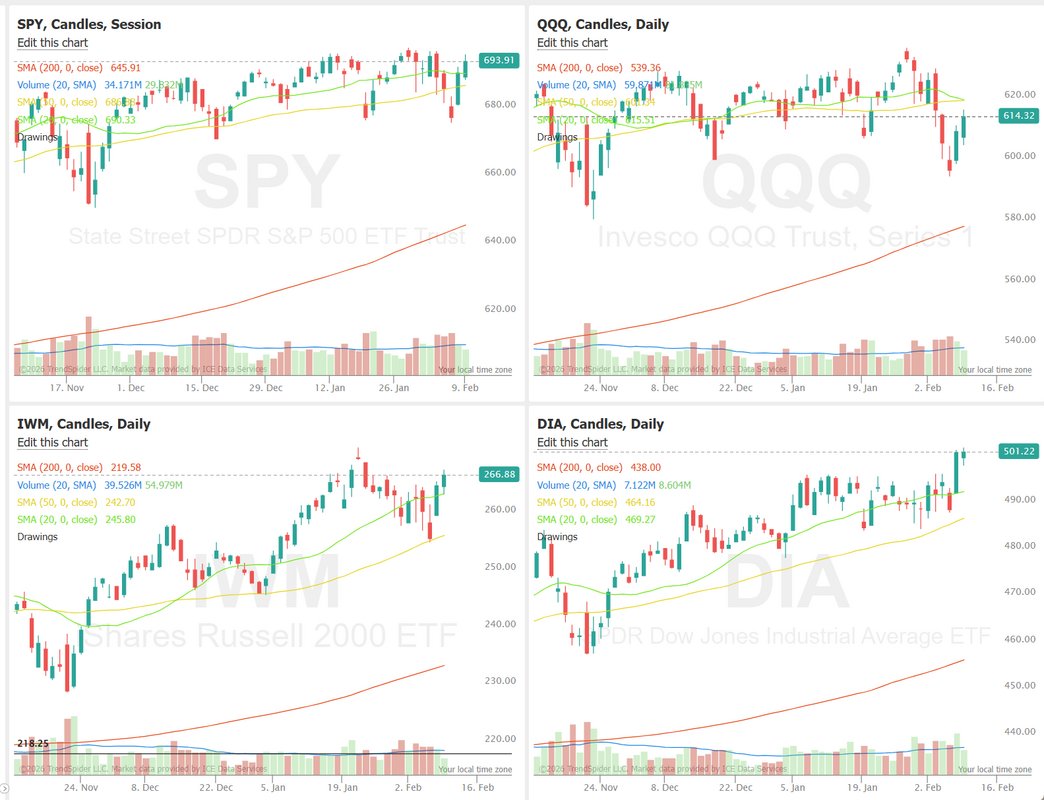

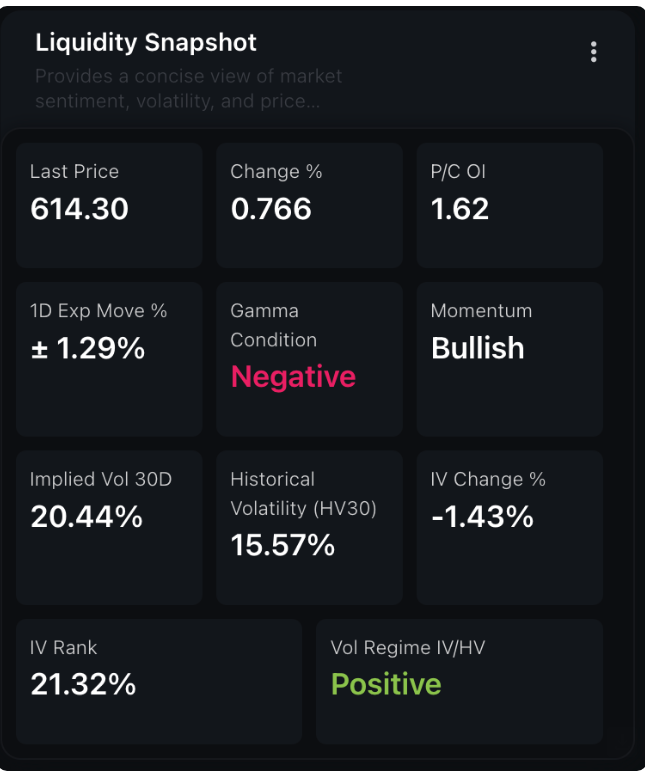

Boring is good too.Yesterday was a pretty staid, boring day. That's all right. We crave movement but boring can offer opportunities as well. We were able to finish our trading early and take the rest of the day off. Here's a look at our day. Let's take a look at the markets. We start the day with the bullish bias holding. We've had a couple bullish days in a row now. Can the bulls keep it going today? We've got a gold 0DTE already working this morning and it looks pretty solid. We've also started a very small, bullish fly on /ES . I believe there's a good chance we don't have much movement today. March S&P 500 E-Mini futures (ESH26) are up +0.14%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.12% this morning, pointing to further gains on Wall Street, while investors await a slew of U.S. economic data, with particular attention on the retail sales report, remarks from Federal Reserve officials, and a new round of corporate earnings reports. Lower bond yields today are supporting stock index futures. The 10-year T-note yield fell two basis points to 4.18%. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Most members of the Magnificent Seven stocks advanced, with Microsoft (MSFT) rising over +3% and Meta Platforms (META) gaining more than +2%. Also, chip stocks climbed, with Broadcom (AVGO) and Advanced Micro Devices (AMD) rising more than +3%. In addition, AppLovin (APP) surged over +13% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Capitalwatch, a self-described independent news organization, withdrew its earlier allegations against the company. On the bearish side, Kyndryl Holdings (KD) tanked more than -54% after the company reported downbeat FQ3 results and its Chief Financial Officer, David Wyshner, exited the firm amid a review of its accounting practices. “When markets sell off like certain areas in tech have, there’s often knee-jerk rallies,” said Sameer Samana at Wells Fargo Investment Institute. “Time will tell if we need a retest or if enough value was created.” Fed Governor Stephen Miran said on Monday that interest rates should be set lower than their current level. “I do think it’s appropriate to have significantly lower policy rates than we do,” Miran said. Meanwhile, U.S. rate futures have priced in an 82.3% chance of no rate change and a 17.7% chance of a 25 basis point rate cut at the next central bank meeting in March. On the trade front, the U.S. and Bangladesh struck a deal on Monday under which the U.S. will cut its so-called reciprocal tariff to 19%, after previously lowering it from 37% to 20%, and grant a new exemption for textile products. Today, all eyes are on the U.S. Retail Sales report, which is set to be released in a couple of hours. Economists, on average, forecast that Retail Sales will show a +0.4% m/m increase in December after the +0.6% m/m gain a month earlier. Investors will also focus on U.S. Core Retail Sales, which rose +0.5% m/m in November. Economists expect the December figure to rise +0.3% m/m. The U.S. Employment Cost Index will be released today. Economists expect this figure to come in at +0.8% q/q in the fourth quarter, the same as in the third quarter. U.S. Import and Export Price Indexes will be released today as well. Economists anticipate the import price index to rise +0.1% m/m and the export price index to rise +0.1% m/m in December, compared to the previous figures of +0.4% m/m and +0.5% m/m, respectively. In addition, market participants will be looking toward speeches from Cleveland Fed President Beth Hammack and Dallas Fed President Lorie Logan. On the earnings front, notable companies such as Coca-Cola (KO), Gilead Sciences (GILD), CVS Health (CVS), Robinhood Markets (HOOD), Cloudflare (NET), and Ford (F) are set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.180%, down -0.33%. SPX remains in a short-term uptrend, though momentum dynamics have become more uneven. The Momentum Score has rebounded from a recent dip back toward the upper range, indicating buyers remain present, but repeated pullbacks from elevated readings suggest that upside progress has been less consistent than earlier in the move. Recent price behavior shows increasing two-way activity near highs, with momentum fluctuating rather than accelerating. This pattern reflects a market that is still trending upward but experiencing more frequent pauses as participation and follow-through vary across sessions. The QQQ liquidity snapshot reflects a market with bullish price performance alongside structurally sensitive positioning. Momentum is flagged as bullish and the ETF is higher on the day, while the gamma condition remains negative, indicating that dealer hedging flows may respond in a pro-cyclical manner to price changes in the very short term. The one-day expected move remains around ±1.3%, and put/call open interest at 1.62 points to ongoing demand for downside protection. Implied volatility remains above realized volatility, though recent compression suggests some repricing of near-term risk. Taken together, the options landscape describes an environment where price movements can develop quickly before encountering positioning or liquidity-related constraints. Key Economic Events, Company Highlights and Q-Webinars Tuesday

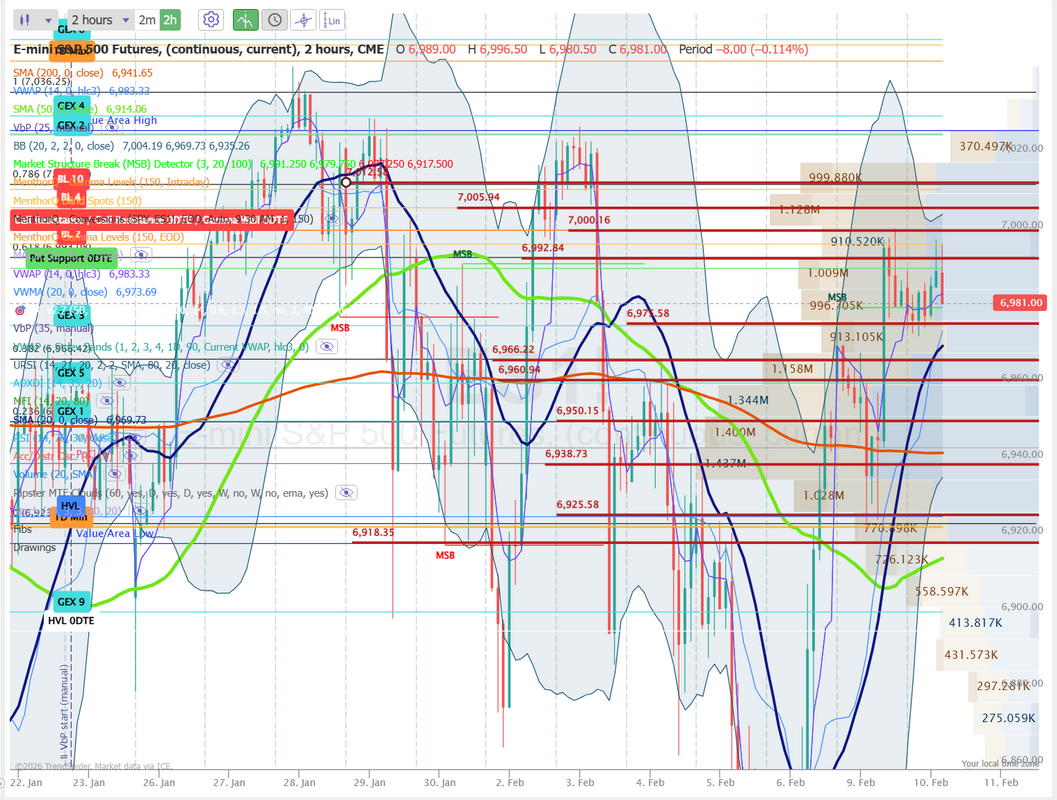

Let's take a look at our intraday /ES levels for 0DTE placement. 6993, 7000, 7006, 7012 are resistance levels. 6976, 6966, 6960, 6950 are support levels. We've already got a good Gold 0DTE working and we'll keep working 1HTE's as long as we can. Let's make another great day happen! See you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |