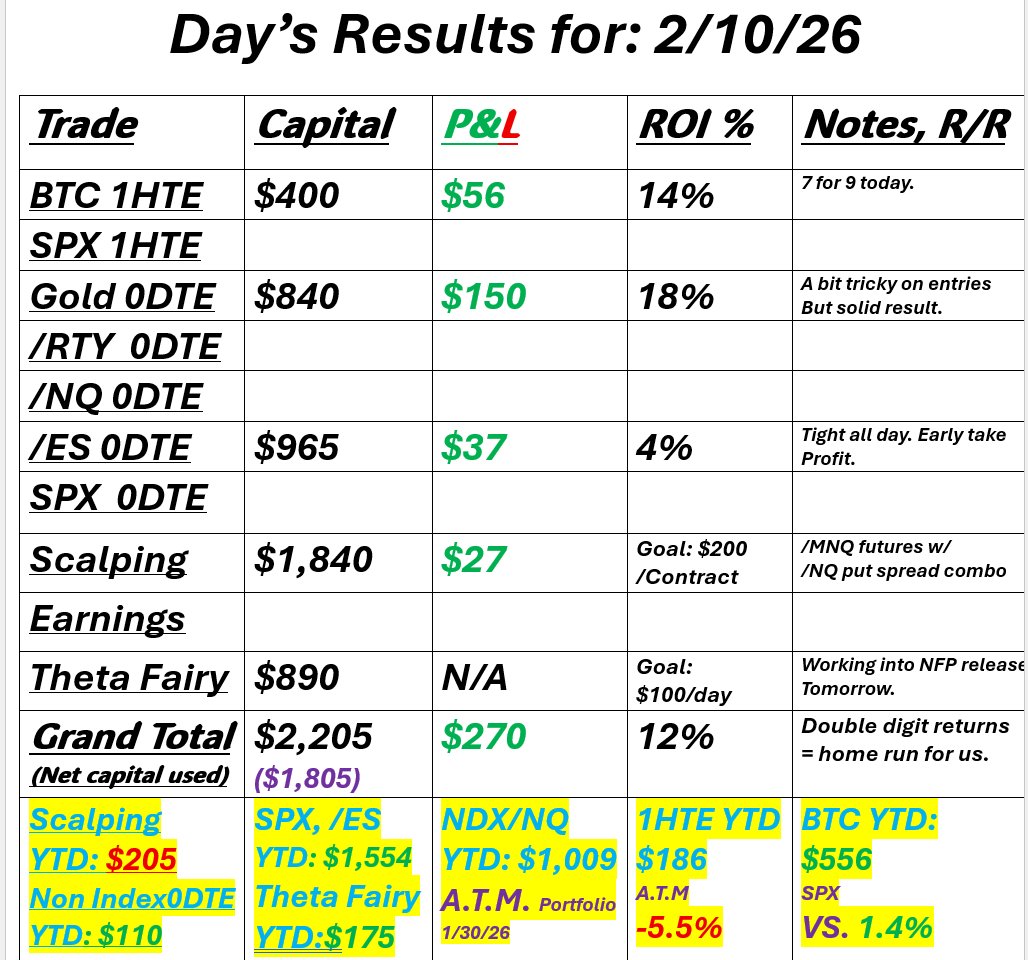

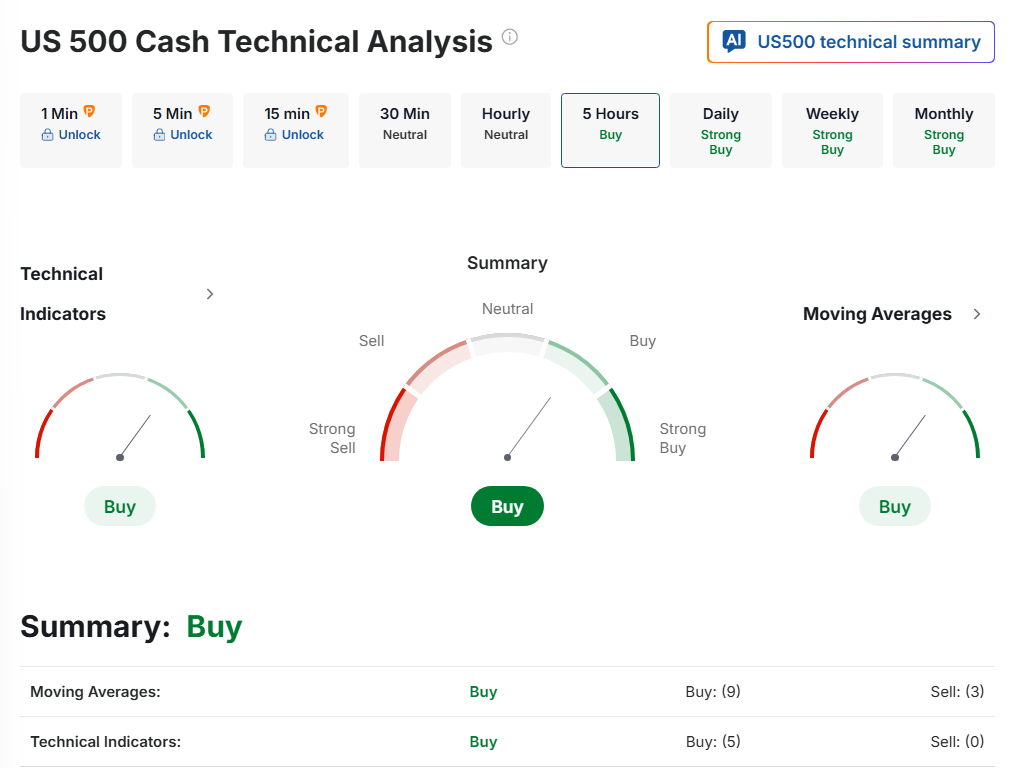

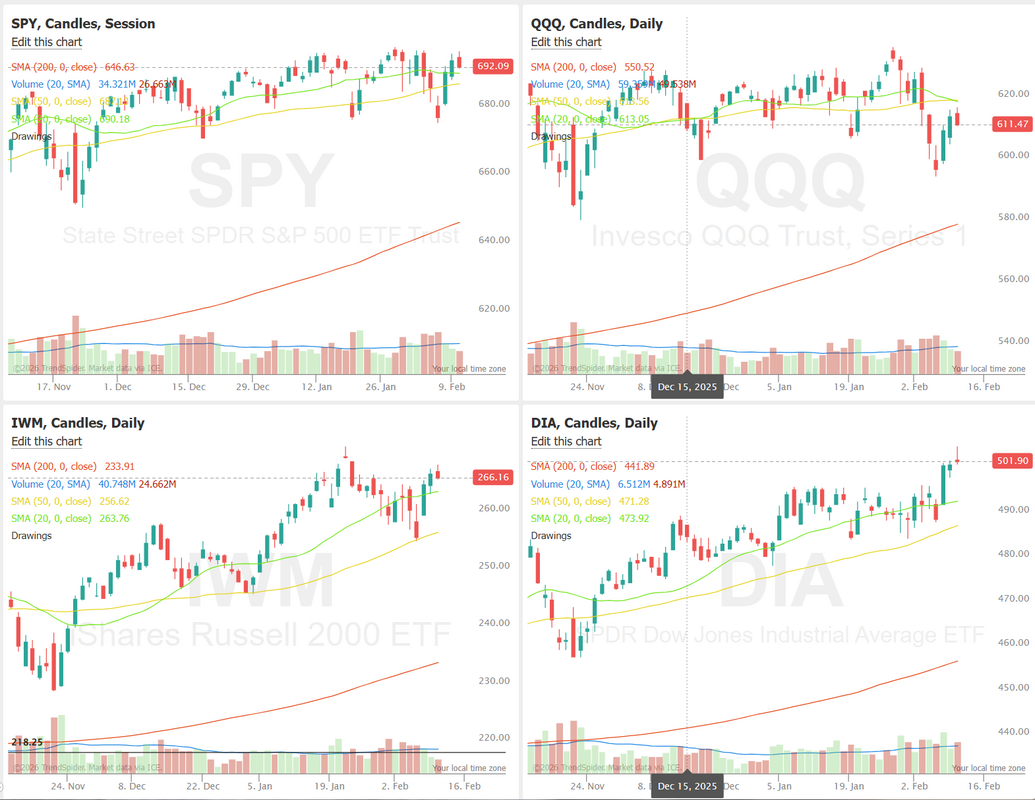

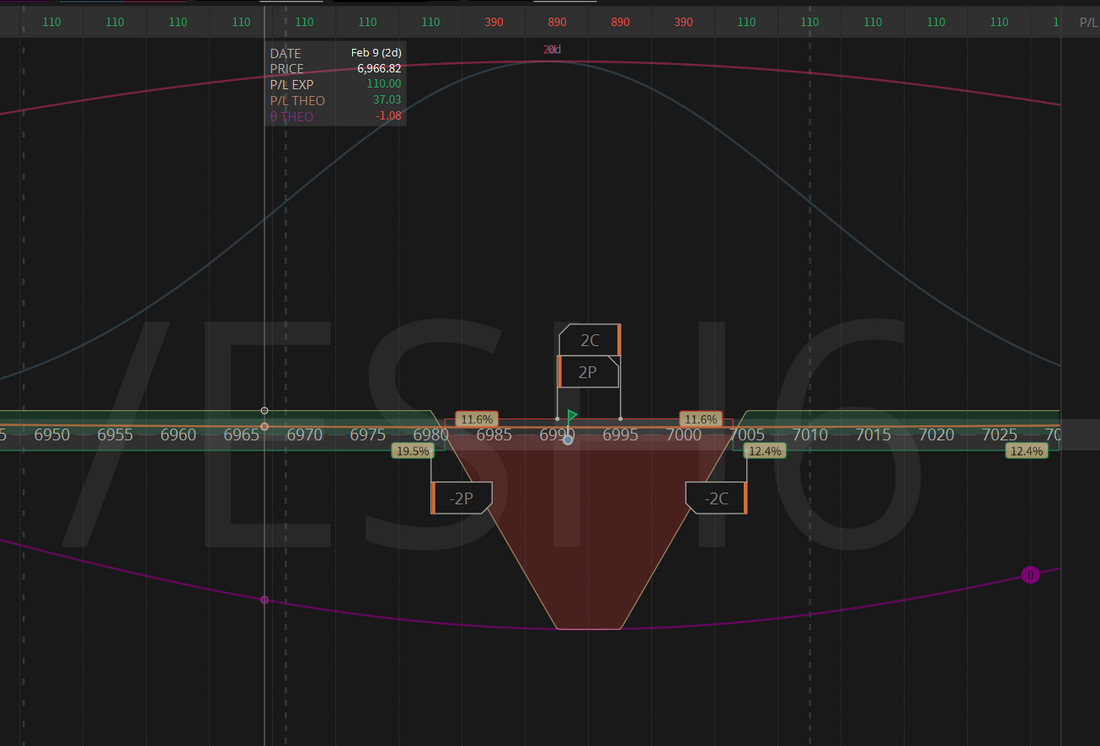

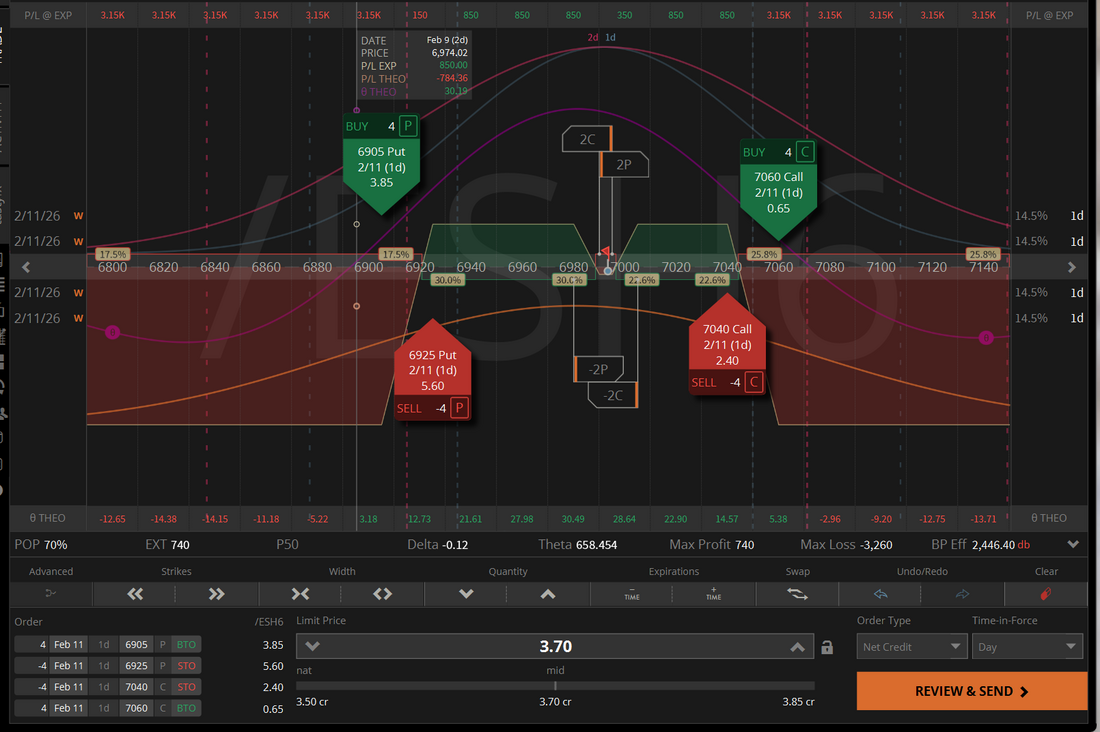

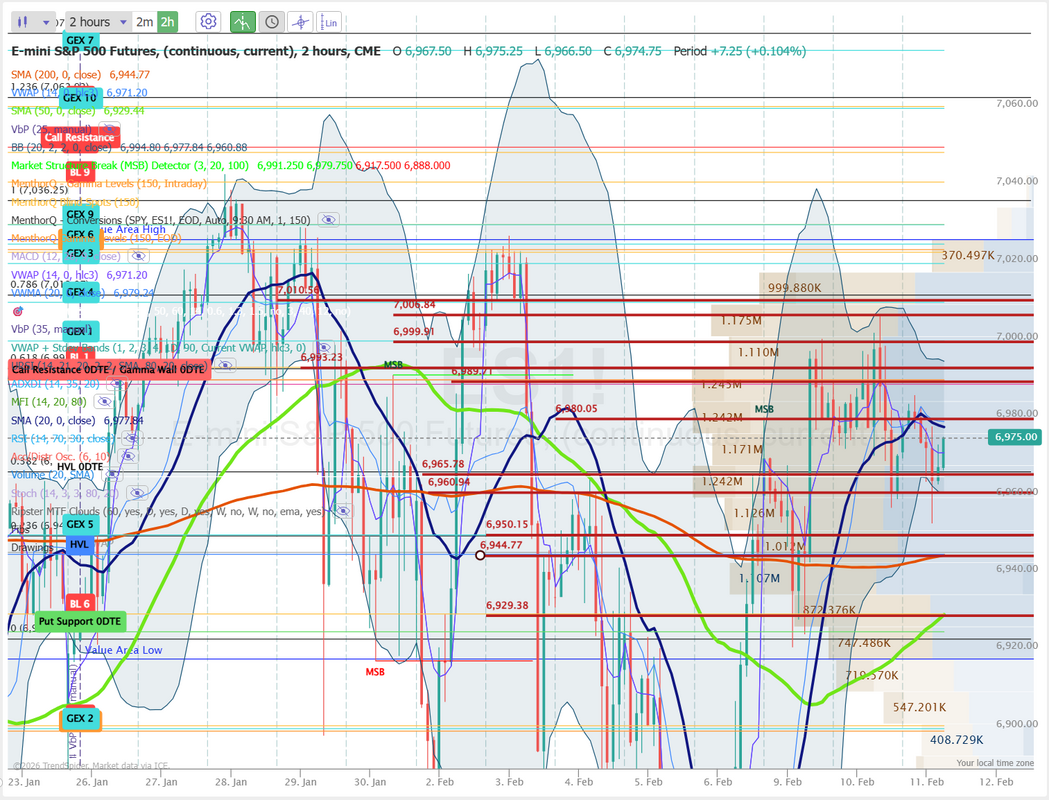

The continuing, evolving AI storyAI disruption fears are rippling far beyond big tech, triggering sharp selloffs in wealth managers, insurers, and software firms as investors reassess potential competitive risks. A new tax-strategy tool from startup Altruist contributed to declines of 7% or more in shares of Charles Schwab Corp., Raymond James Financial Inc., and LPL Financial Holdings Inc., with weakness extending to several European peers. It will be interesting to see where we land with AI over the next few years. I'm old enough to remember the amazing technology breakthrough of the fax machine! This will be transformative. Starting with some 1DTE setups yesterday helped us once again, get to green quickly and have a short day. We were done in a few hours and called it a day. Here's a look at what we worked on yesterday. Let's take a look at the markets this morning. We are holding to a slight buy mode technically but we've got NFP incoming so that could easily change. The DIA finally stalled out. We are back up at these "nose bleed" levels on the others. I may look at taking a small short in the DIA today. March S&P 500 E-Mini futures (ESH26) are trending up +0.10% this morning as investors await the release of the U.S. nonfarm payrolls report, which is crucial for shaping expectations about the Federal Reserve’s interest-rate path. In yesterday’s trading session, Wall Street’s major indexes closed mixed. S&P Global (SPGI) slumped over -9% and was the top percentage loser on the S&P 500 after the ratings agency posted weaker-than-expected Q4 adjusted EPS and issued below-consensus FY26 adjusted EPS guidance. Also, AI-infrastructure stocks retreated, with Western Digital (WDC) sliding over -8% to lead losers in the Nasdaq 100 and Seagate Technology Holdings (STX) falling more than -6%. In addition, wealth-management stocks sank amid concerns about the disruptive impact of a new AI tool designed to create tax strategies, with Raymond James Financial (RJF) and LPL Financial Holdings (LPLA) slumping over -8%. On the bullish side, Datadog (DDOG) surged more than +13% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company reported stronger-than-expected Q4 results. Economic data released on Tuesday showed that U.S. retail sales were unchanged m/m in December, weaker than expectations of +0.4% m/m, and core retail sales, which exclude motor vehicles and parts, were unchanged m/m, weaker than expectations of +0.3% m/m. Also, the U.S. Q4 employment cost index rose +0.7% q/q, weaker than expectations of +0.8% q/q. In addition, the U.S. import price index rose +0.1% m/m in December, in line with expectations. “The latest news on consumer spending did little to change the outlook for another rate cut by the Federal Reserve, still priced in the Fed funds futures market for the next such move at the June 17 meeting,” said Gary Schlossberg, global strategist at Wells Fargo Investment Institute. Cleveland Fed President Beth Hammack said on Tuesday that interest rates could remain on hold for an extended period while officials assess incoming economic data. “Rather than trying to fine-tune the funds rate, I’d prefer to err on the side of patience as we assess the impact of recent rate reductions and monitor how the economy performs,” Hammack said. Also, Dallas Fed President Lorie Logan said she is hopeful inflation will continue to ease, though it would take “material” weakness in the labor market for her to back further interest rate cuts. Meanwhile, U.S. rate futures have priced in a 78.4% probability of no rate change and a 21.6% chance of a 25 basis point rate cut at the next FOMC meeting in March. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. The report was originally scheduled for release last Friday, but was delayed due to the partial government shutdown. Notably, the report will include revisions to job growth for the year through March 2025, which are expected to show a significant markdown in the pace of hiring. Economists, on average, forecast that January Nonfarm Payrolls will come in at 66K, compared to the December figure of 50K. A weak print “would undoubtedly push the Fed closer to a cut,” particularly if Friday’s inflation data come in soft, according to Scope Markets’ Joshua Mahony. A survey conducted by 22V Research showed that 42% of investors expect the key jobs report to be “risk on,” 37% said “mixed/negligible,” and 21% “risk off.” Investors will also focus on U.S. Average Hourly Earnings data. Economists expect the January figures to be +0.3% m/m and +3.6% y/y, compared to +0.3% m/m and +3.8% y/y in December. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will remain steady at 4.4% in January. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -0.2 million barrels, compared to last week’s value of -3.5 million barrels. In addition, market participants will parse comments today from Kansas City Fed President Jeff Schmid, Fed Vice Chair for Supervision Michelle Bowman, Cleveland Fed President Beth Hammack, and Dallas Fed President Lorie Logan. On the earnings front, prominent companies such as Cisco Systems (CSCO), McDonald’s (MCD), T-Mobile US (TMUS), Shopify (SHOP), and AppLovin (APP) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.129%, down -0.39%. SPX has rebounded from the 6,780–6,800 region and is currently trading within the 6,940–6,970 area. Recent price activity places the index between prior support near 6,800 and resistance levels just below 7,000, areas that have previously attracted notable supply and demand. The volatility risk premium has compressed to approximately 0.6% and now sits near the lower end of its recent range. This indicates that implied volatility has moderated relative to realized volatility following the recent spike. At present, SPX remains positioned within a defined range established by recent highs and lows, with price activity reflecting stabilization after the earlier pullback. NDX has recovered from its recent decline toward the 24,500 area and is currently trading back above 25,000. Despite the rebound, 1-month skew remains elevated with a pronounced put bias, and its 3-month percentile reading near 89% indicates sustained demand for downside protection relative to recent history. The persistence of elevated skew alongside improving price levels reflects continued asymmetry in options positioning. Risk reversals remain tilted toward puts, suggesting that protective structures remain in place even as price stabilizes. This configuration highlights an options market that is pricing downside sensitivity more heavily than upside extension in the near term. Our training today will be part II on risk management. Come join us today. This is another keeper. We've already got several trades working this morning. We are profitable on our 1HTE's so far. Our Gold 0DTE is already up and running. We'll see how NFP affects that but its green right now. We also have an interesting theta fairy start to our day, which we put on last night, in preparation for NFP release. It's likely we will build on this today. Possibly with an Iron condor wrap. Wednesday

Let's take a look at todays /ES levels. There's not much movement as the market awaits NFP numbers. 6980, 6990, 6993, 7000, 7006 are resistance levels. 6966, 6961, 6950, 6945, 6929 are support levels. We've got plenty to keep us busy today! I'll see you all shortly in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |