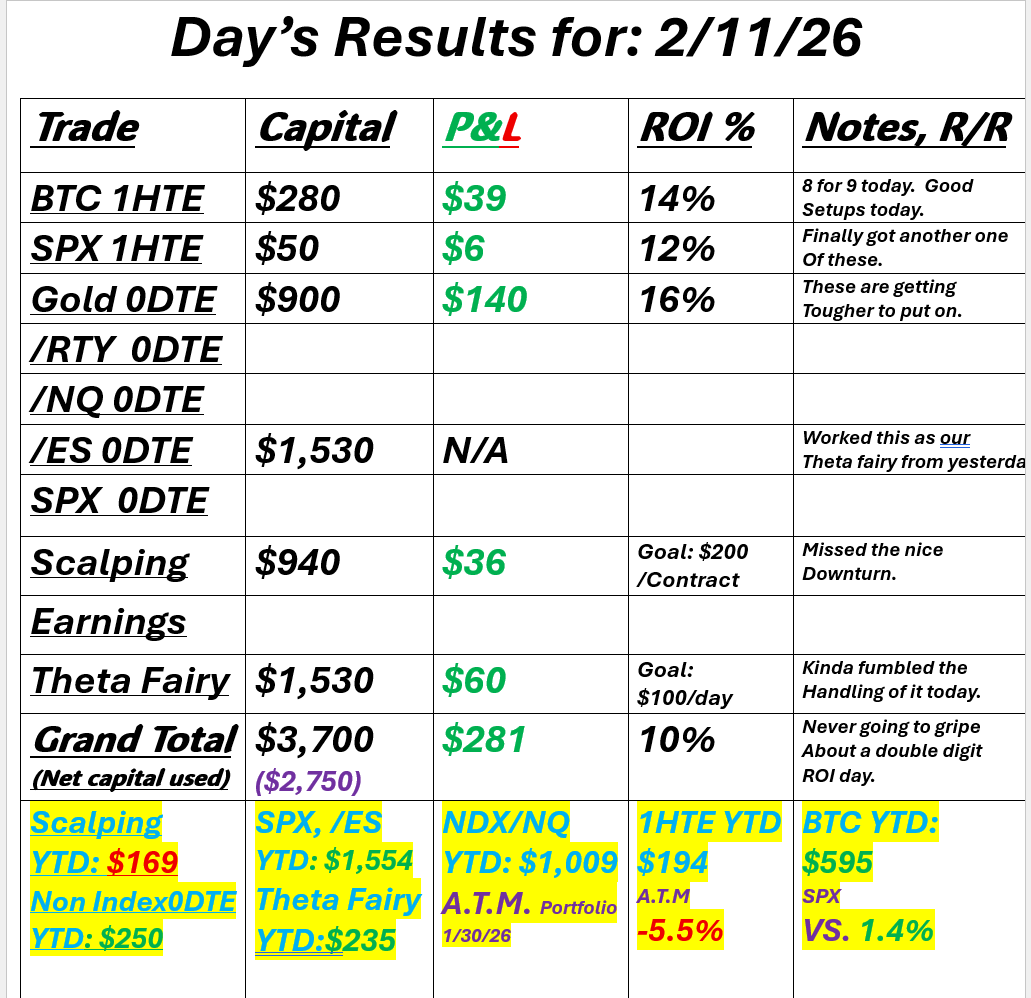

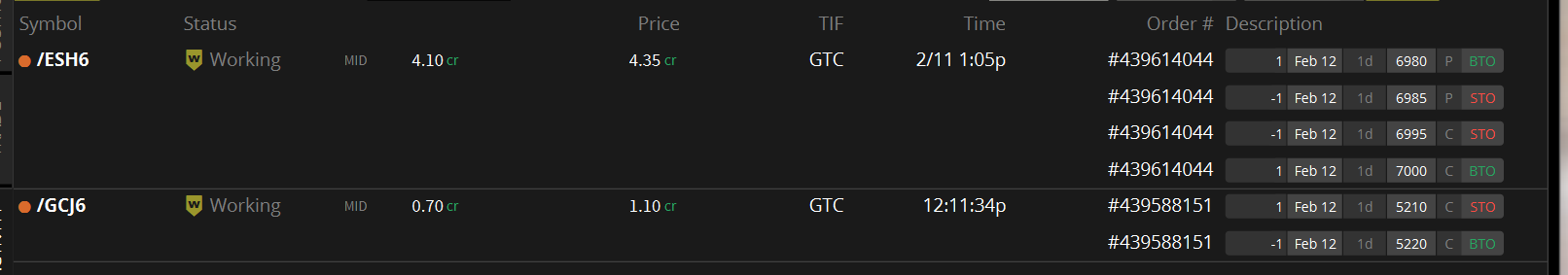

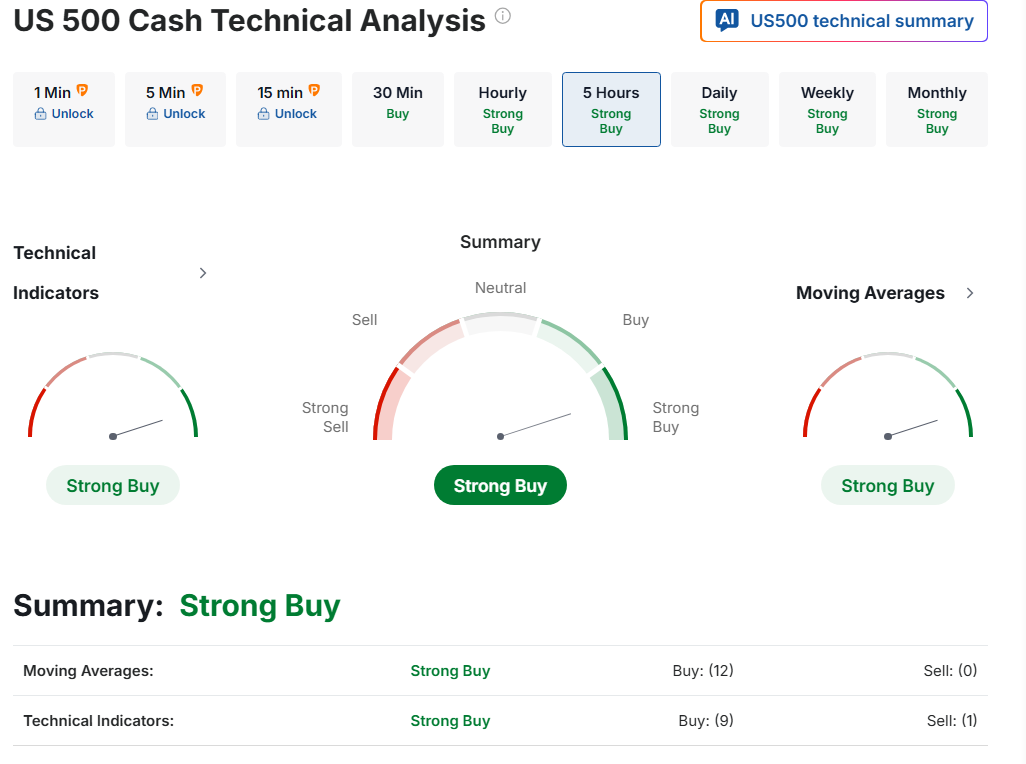

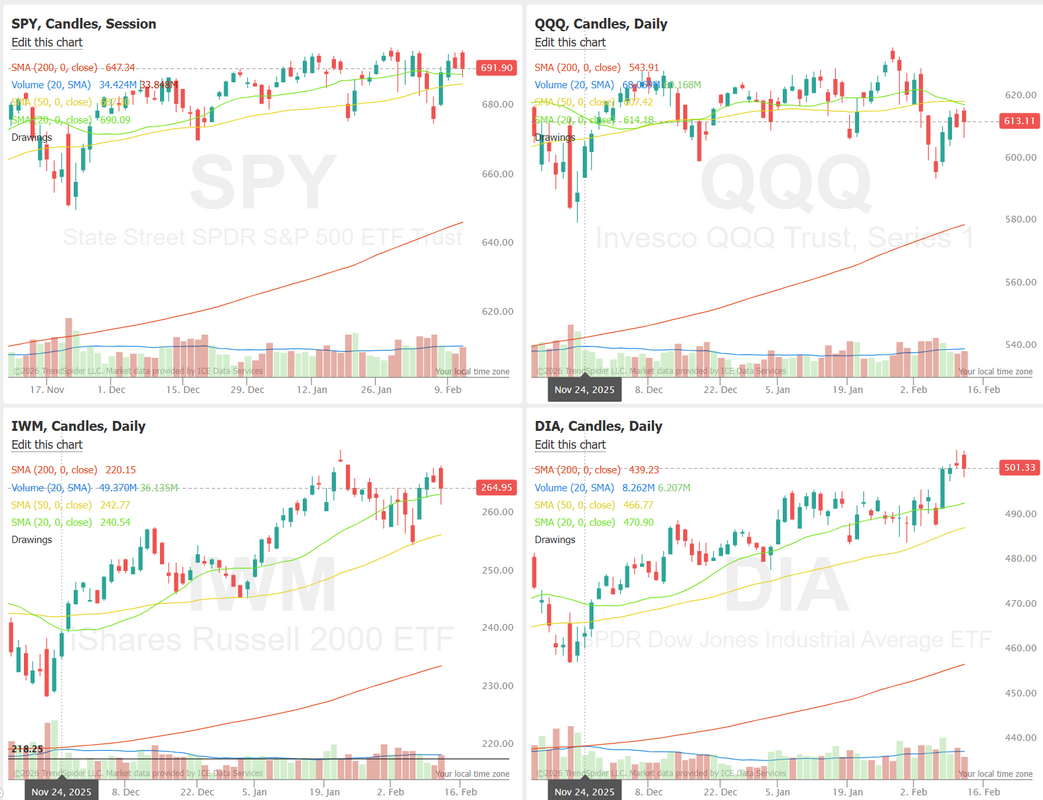

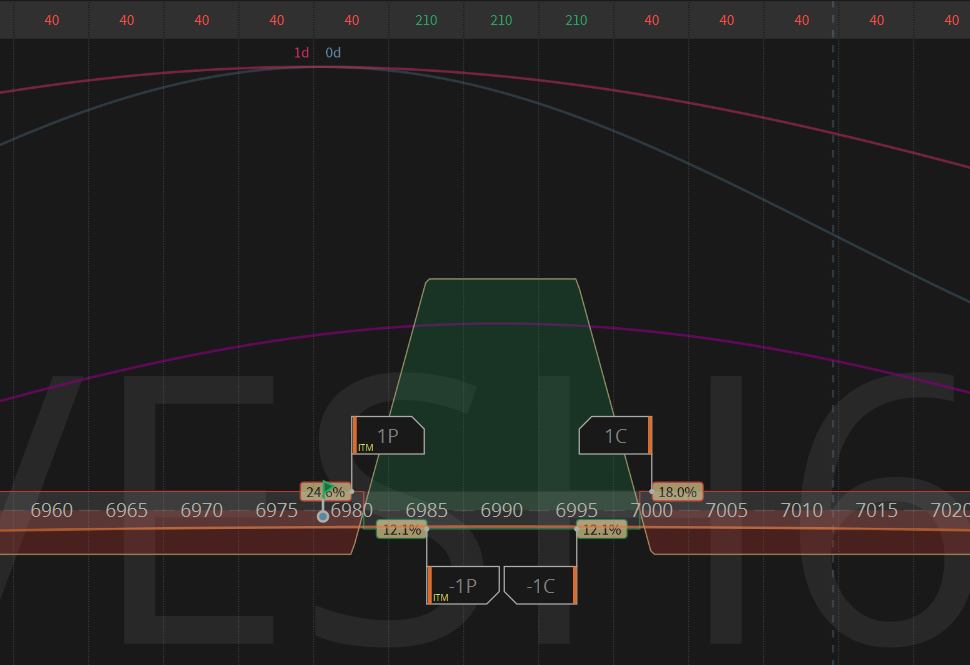

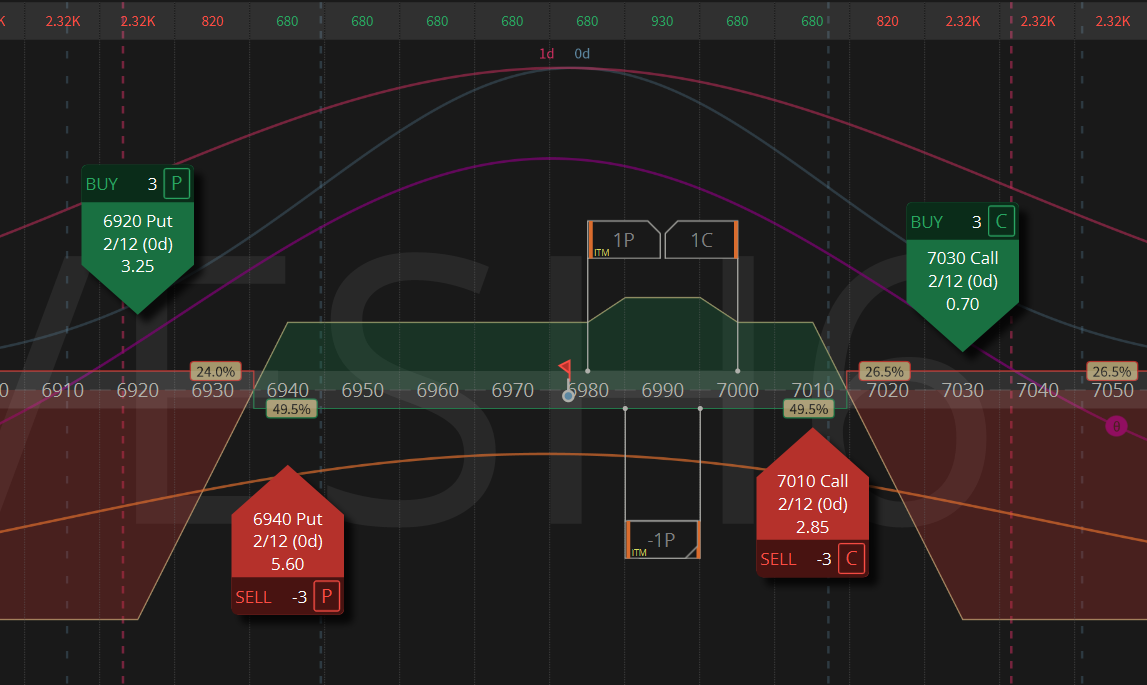

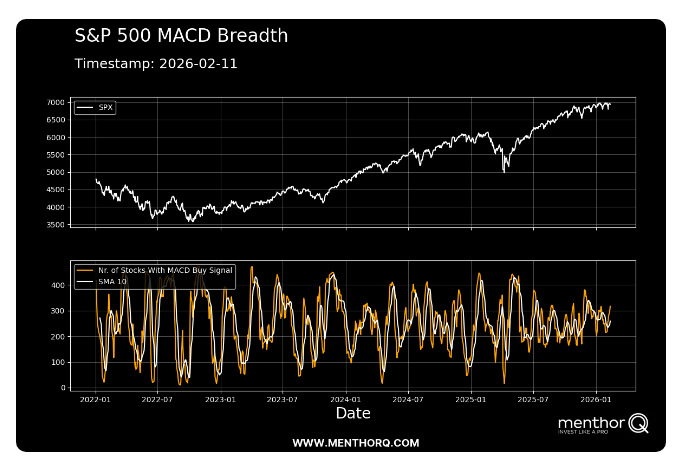

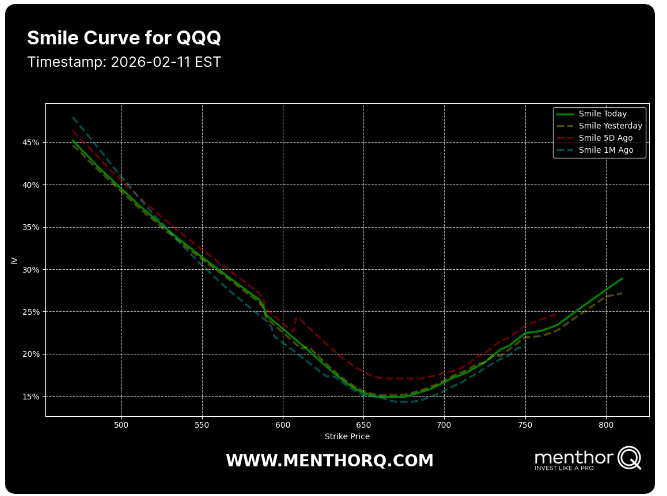

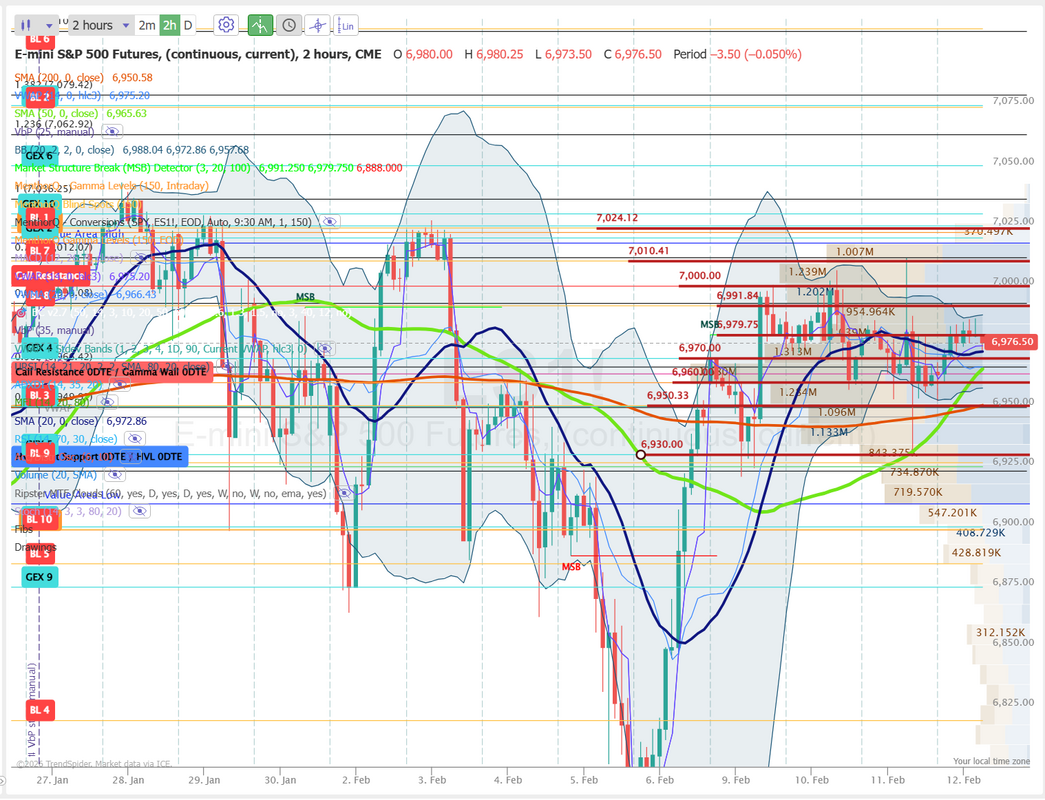

Success usually comes quick.One of the attributes of our (and most peoples) trades are that you first have to develop a bias or premise. If you aren't bullish, bearish or neutral it's going to be pretty hard to setup a trade. The other attribute we see over and over is that IF you're right, you're usually right (and your trade idea is validated) quickly. If you're still battling your trade and the trading session is almost over, your chances of success diminish. We've seen this play out every day this week. We haven't really hit any homeruns but everyday has been profitable and maybe more interesting, we've been done in just a few hours. Nobody complains about shortened work days! Yesterday was a continuation of this theme for us. Here's a look at our shortened trading session. We also have two working trade entries for Gold and /ES If we get these filled we'll be off to the races for todays trades. Let's take a look at the markets to start us off today. Technicals continue to be supportive. The interest rate sensitive IWM backed off. QQQ remains weak and I'm continuing to look for an entry on a DIA short. March S&P 500 E-Mini futures (ESH26) are up +0.33%, and March Nasdaq 100 E-Mini futures (NQH26) are up +0.23% this morning, pointing to a higher open on Wall Street as strong U.S. jobs data boosted optimism about the nation’s economic outlook. Investors now await U.S. jobless claims data and a new wave of corporate earnings reports. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed. Software stocks sank, with Atlassian (TEAM) sliding over -6% and Intuit (INTU) falling more than -5%. Also, real estate services stocks slumped amid concerns that the latest wave of AI applications and tools could disrupt the industry, with Cushman & Wakefield (CWK) tumbling over -13% and CBRE Group (CBRE) plunging more than -12% to lead losers in the S&P 500. In addition, Mattel (MAT) plummeted over -24% after the toymaker posted downbeat results for the crucial holiday quarter and provided disappointing FY26 adjusted EPS guidance. On the bullish side, chip stocks climbed, led by a more than +9% jump in Micron Technology (MU) after CFO Mark Murphy said the company had begun volume production and shipments of its next-generation high-bandwidth memory chips. The U.S. Labor Department’s report on Wednesday showed that nonfarm payrolls rose by 130K in January, much stronger than expectations of 66K. Also, the U.S. unemployment rate unexpectedly fell to 4.3% in January, stronger than expectations of no change at 4.4%. In addition, U.S. January average hourly earnings rose +0.4% m/m and +3.7% y/y, stronger than expectations of +0.3% m/m and +3.6% y/y. President Trump lauded the figures in a social media post on Wednesday and said the U.S. should have the lowest interest rates in the world. “GREAT JOBS NUMBERS, FAR GREATER THAN EXPECTED!” Mr. Trump wrote. “[Wednesday’s] employment report was a 10 out of 10 with positive surprises across the board,” said Peter Graf at Amova Asset Management Americas. “It should quell recent concerns about growth, but puts incoming Fed Chair Warsh in the hot seat — it will be even harder to persuade the FOMC members to go along with the president’s mandate to cut rates.” Kansas City Fed President Jeff Schmid said on Wednesday that the central bank should keep rates at a “somewhat restrictive” level, as he voiced continued concerns about inflation remaining too high. “In my view, further rate cuts risk allowing high inflation to persist even longer,” Schmid said. U.S. rate futures have priced in a 94.1% chance of no rate change and a 5.9% chance of a 25 basis point rate cut at the March monetary policy meeting. Meanwhile, President Trump’s tariff policies faced their strongest political setback yet as the Republican-led U.S. House passed legislation aimed at ending the president’s levies on Canadian imports. Today, investors will focus on U.S. Initial Jobless Claims data, set to be released in a couple of hours. Economists expect this figure to be 222K, compared to last week’s number of 231K. The National Association of Realtors’ existing home sales data will also be released today. Economists foresee this figure coming in at 4.16 million in January, compared to 4.35 million in December. On the earnings front, notable companies such as Applied Materials (AMAT), Arista Networks (ANET), Airbnb (ABNB), and Coinbase Global (COIN) are scheduled to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +8.4% increase in quarterly earnings for Q4 compared to the previous year. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.168%, down -0.10%. Todays training will finish up part III of risk management with the focus on money management and the law of large numbers. Make sure to download the powerpoint for your reference library after we finish today! This market is wound tighter than a $10 dollar banjo at an East Texas wedding! Look, there are two types of market volatility...expanding and contracting. We're wound up pretty tight right now. Expansion ALWAYS follows contraction. At some point well get another directional change but for now, we'll start today with our /ES trade that filled last night. This is an incredibly low risk setup which can be built on in many different ways today. Here's an example. I'll try to be a bit more patient with our setup today. I jumped the gun a bit yesterday. SPX remains near recent highs, while MACD breadth reflects a more measured internal backdrop. The number of stocks registering MACD buy signals has rebounded into the mid-range of its recent distribution but remains below prior expansion peaks seen during stronger participation phases. The 10-day average of MACD buy signals has turned higher, indicating improvement from recent lows, though breadth levels are not yet extended relative to historical highs. At current levels, price and breadth are no longer deeply oversold nor broadly overheated. Participation has recovered from prior weakness but remains moderate compared to earlier periods of stronger momentum expansion. This reflects an environment where internal strength has improved, yet remains selective rather than broad-based. QQQ’s volatility smile remains well-defined, with elevated implied volatility on the downside relative to at-the-money strikes, signaling persistent demand for put protection. The front-end of the curve is broadly in line with yesterday but still below levels seen five days ago and one month ago, suggesting some moderation in tail hedging despite the bid for downside skew. At-the-money IV is hovering in the mid-teens, while deep out-of-the-money puts remain priced at a notable premium, reflecting a cautious tone beneath the surface. Overall, the curve points to a market that is stable near spot but still willing to pay up for protection against sharper downside moves. Let's take a look at our /ES intraday levels for 0DTE setups. 6980, 6992, 7000, 7010 are resistance levels with 6970, 6960, 6945, 6930 support levels. I look forward to seeing you all in the live trading room shortly. We'll have a great wrap up to our training this week and should have a nice shot at profits on our /ES 0DTE.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |