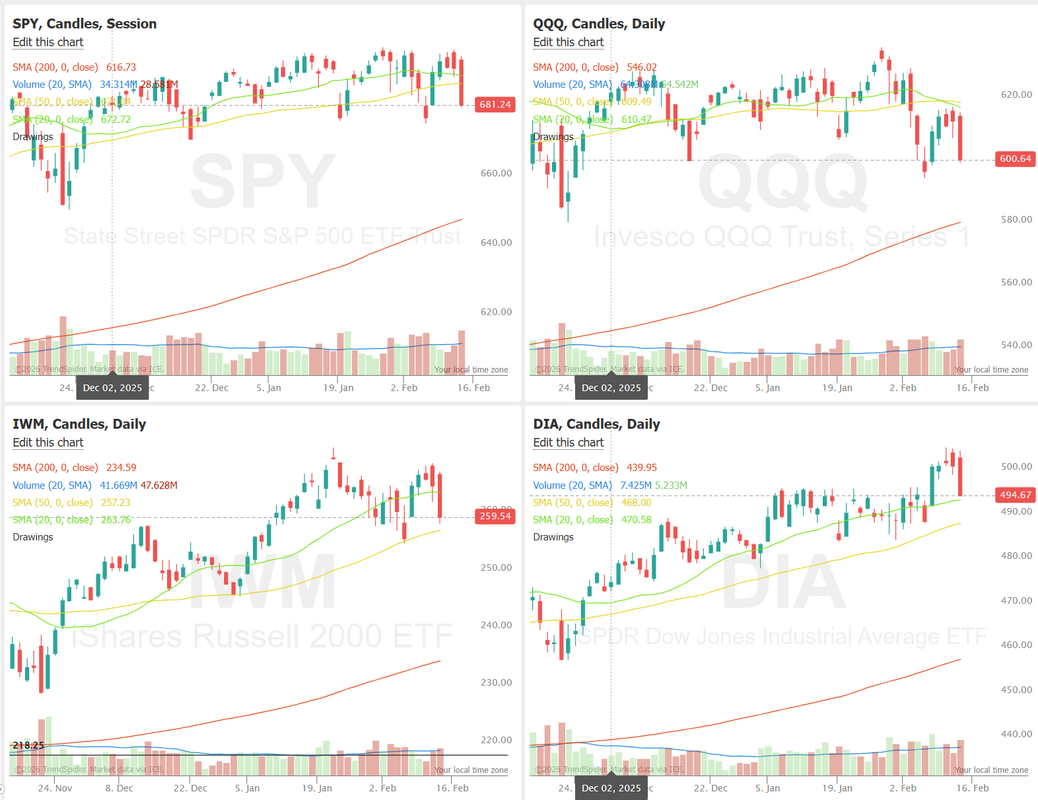

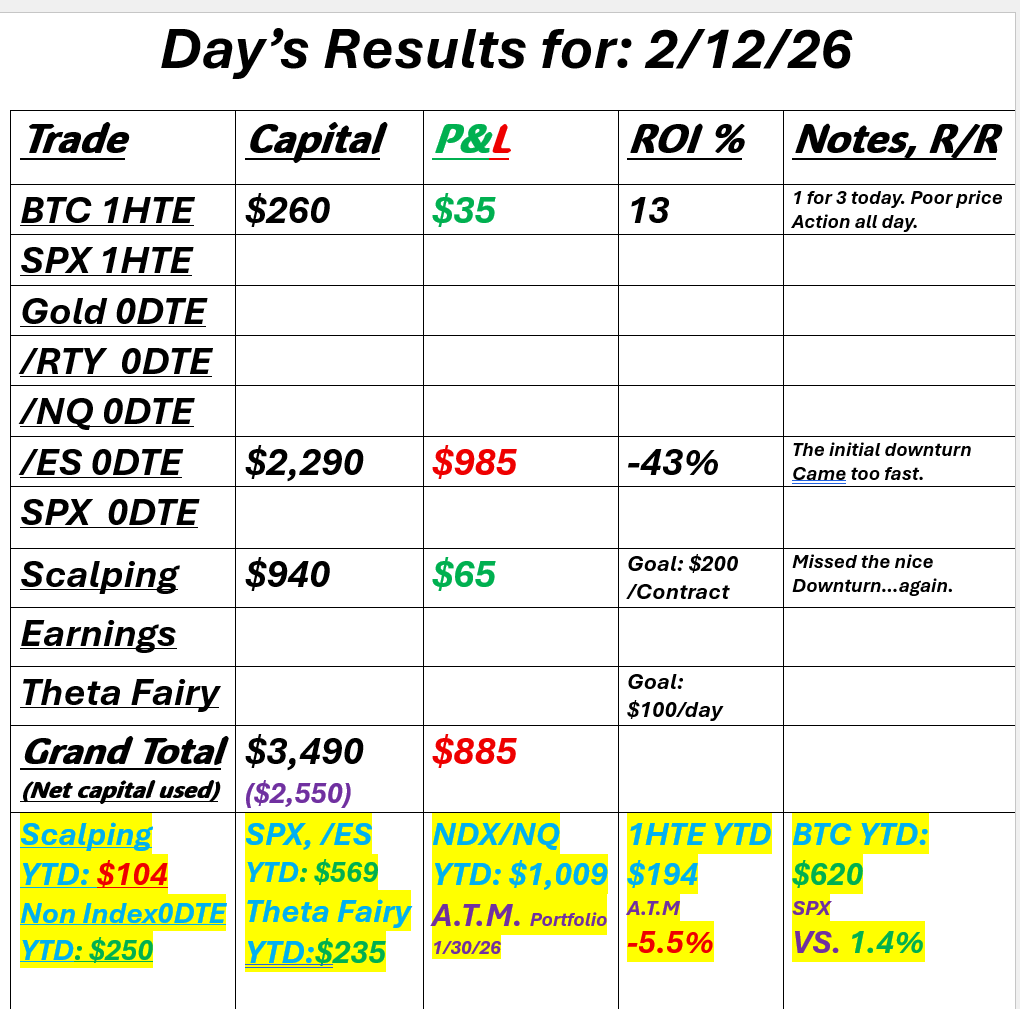

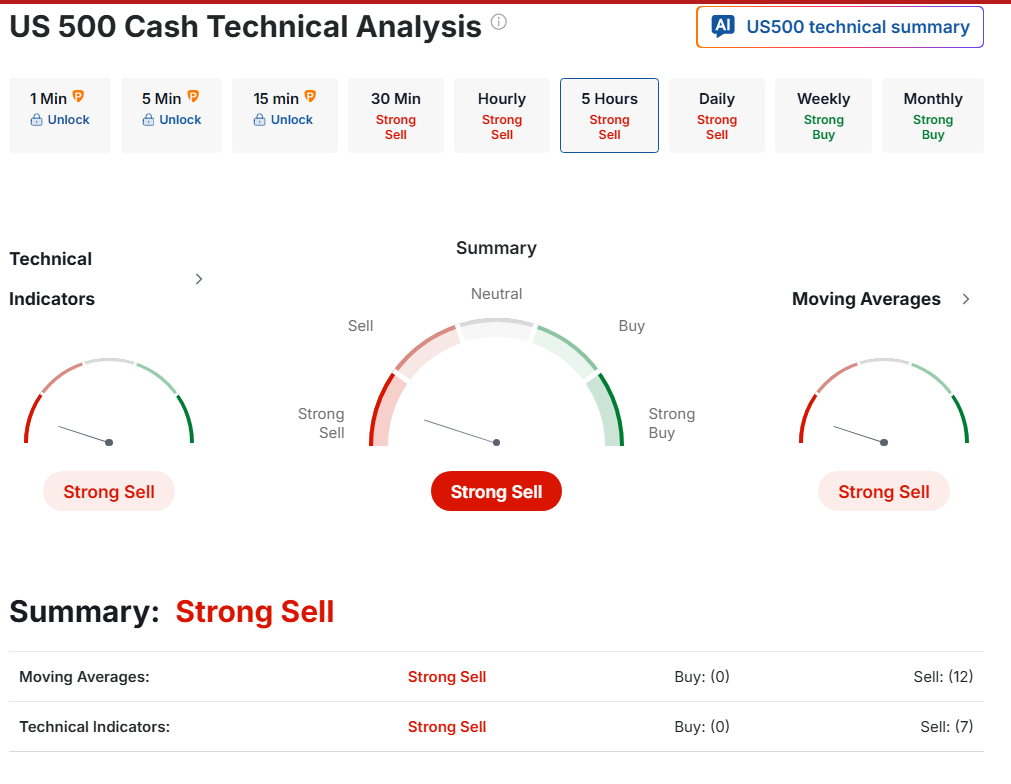

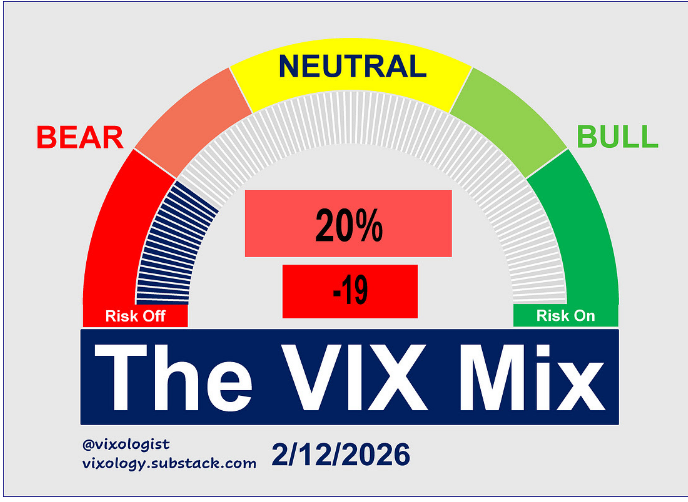

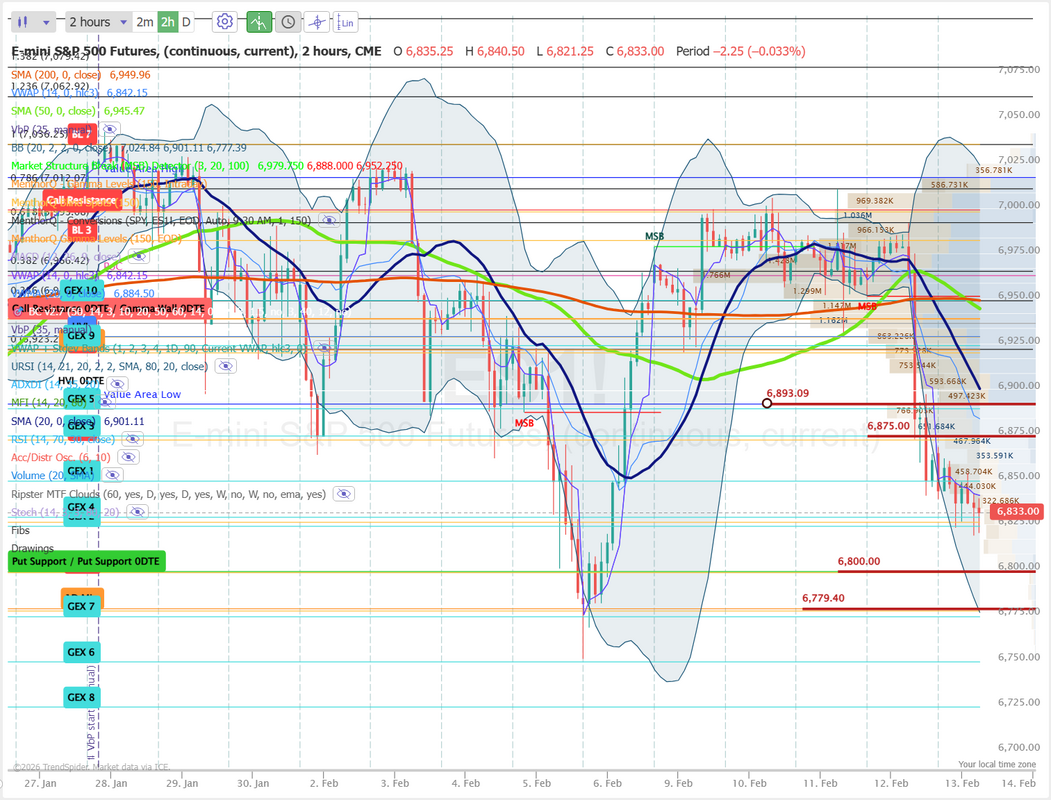

Friday the 13th and CPI dayI'm not superstitious but...just saying. Do we have a real change of directions starting? We have talked the last few days about shorting the DIA. Looks like yesterday would have been a good entry for that trade. A tame CPI release could step in to save the bulls but its starting to look a bit weak. I had a losing day yesterday on my main 0DTE. I couldn't get out fast enough on the initial downward move. I adjusted four times throughout the day but it wasn't enough. Here's a look at my results. Gold fell 3% alongside equities, which is not how a clean risk-off tape behaves. That was deleveraging, not rotation. WTI crude slipped to $62.74 after the IEA cut its demand forecast and maintained its call for a deep supply glut this year. Bitcoin dropped to roughly $65,000, confirming cross-asset deleveraging. Thursday was the ugliest session of 2026. The Dow shed 669 points. The S&P lost 1.57%. The Nasdaq fell 2.03%. All seven Mag 7 names closed red. Cisco (CSCO) lost 12%. Apple (AAPL) lost 5%. Technicals are decidedly bearish before CPI release. The "VIX mix" is moving into the risk off zone. It would be nice if we could get some real selling pressure. Bear markets are easier for us to find setups in. The S&P 500 Index ($SPX) (SPY) on Thursday closed down -1.57%, the Dow Jones Industrial Average ($DOWI) (DIA) closed down -1.34%, and the Nasdaq 100 Index ($IUXX) (QQQ) closed down -2.04%. March E-mini S&P futures (ESH26) fell -1.55%, and March E-mini Nasdaq futures (NQH26) fell -2.02%. Stock indexes gave up an early advance and sold off sharply on Thursday as the Magnificent Seven technology stocks retreated, weighing on the broader market. Also, Cisco Systems fell more than -12% after saying that higher memory-chip prices are expected to eat into its profitability. In addition, trucking and logistics companies fell sharply amid the threat of AI on future earnings. Lower bond yields were supportive of stocks, as the 10-year T-note yield fell to a 2.25-month low of 4.10% after weekly jobless claims fell less than expected and Jan existing home sales fell more than expected to a 16-month low. US weekly initial unemployment claims fell -5,000 to 227,000, showing a slightly weaker labor market than expectations of 223,000. US Jan existing home sales fell -8.4% m/m to a 16-month low of 3.91 million, weaker than expectations of 4.5 million. The markets this week will focus on corporate earnings results and economic news. On Friday, Jan CPI is expected to be up +2.5% y/y, and Jan core CPI is expected to be up +2.5% y/y. Q4 earnings season is in full swing, as more than two-thirds of the S&P 500 companies have reported earnings results. Earnings have been a positive factor for stocks, with 76% of the 358 S&P 500 companies that have reported beating expectations. According to Bloomberg Intelligence, S&P earnings growth is expected to climb by +8.4% in Q4, marking the tenth consecutive quarter of year-over-year growth. Excluding the Magnificent Seven megacap technology stocks, Q4 earnings are expected to increase by +4.6%. The markets are discounting a 9% chance for a -25 bp rate cut at the next policy meeting on March 17-18. Overseas stock markets settled mixed on Thursday. The Euro Stoxx 50 fell from a new all-time high and closed down by -0.40%. China’s Shanghai Composite closed up +0.05%. Japan’s Nikkei Stock 225 fell from a record high and closed down by -0.02%. CPI will likely be our driver today so I'll look at some of the major /ES intraday levels. 6875 and 6893 are resistance with 6800 and 67709 working as support. Today could be a decent directional day so I'll look initially for a debit setup. See you all shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |