The AI rotation trade is still in progressWelcome back to another holiday shortened trading week. The theme in the market continues to be the sector rotation caused by the AI revaluation. Matthew Tuttle did an excellent overview of the Goldman Sachs pairs trade. I'll post that here: Goldman’s desk introduced a Software Pair Trade:

Goldman’s key point: the long basket’s growth expectations have materially improved since 2023, while the “AI-exposed” bucket is closer to stagnation. That’s the whole trade: separate the AI winners from the AI casualties… inside software itself. Our Take: This Is the “Software Civil War” Here’s the cleanest way to think about it: Two types of software exist now: 1) AI Tollbooths (the winners) These businesses sit in the path of AI traffic. When AI adoption rises, they don’t lose seats… they gain:

AI doesn’t replace them. AI makes them necessary. 2) AI-Replaceables (the losers) These companies sell software that is basically:

When agents get good enough, these products don’t always die… but they often get:

Winners and Losers Watchlist (Symbols) Important: Goldman isn’t publishing basket constituents publicly anymore, so the lists below are our translation of the framework into actionable tickers (not “Goldman’s official basket members”). I’m a client of Goldman so I could get the basket if I wanted it, but then I couldn’t write about it, and that’s no fun. Winners: “AI Tollbooths” to Own / Overweight Edge + Security + Trust (AI traffic creates more attack surface):

Observability (agents create chaos; someone must measure reality):

Data + Database Gravity (hard to rip out; harder to replicate):

“High-consequence” software (compliance + accountability):

Losers: “AI-Replaceables” to Short / Avoid / Underweight Seat-based workflow apps with weak data gravity (risk of “feature-ization”):

Marketplaces / outsourcing exposure (if AI reduces labor-hours demand):

IT services / outsourcing (if enterprises internalize work via agents):

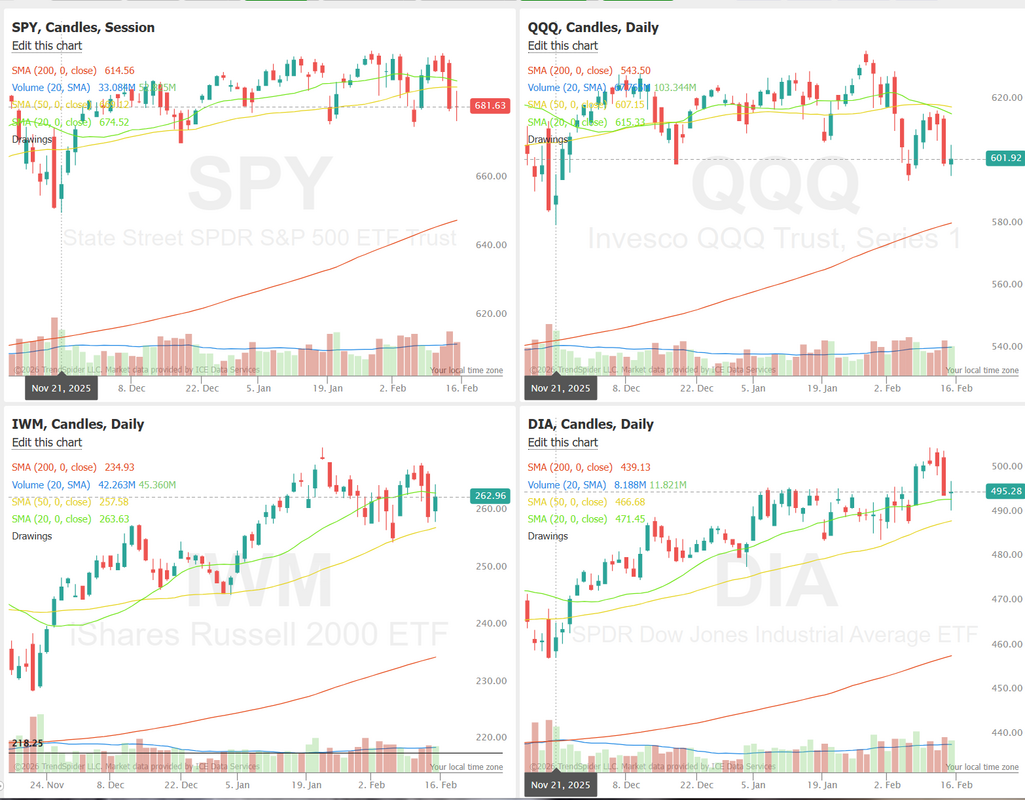

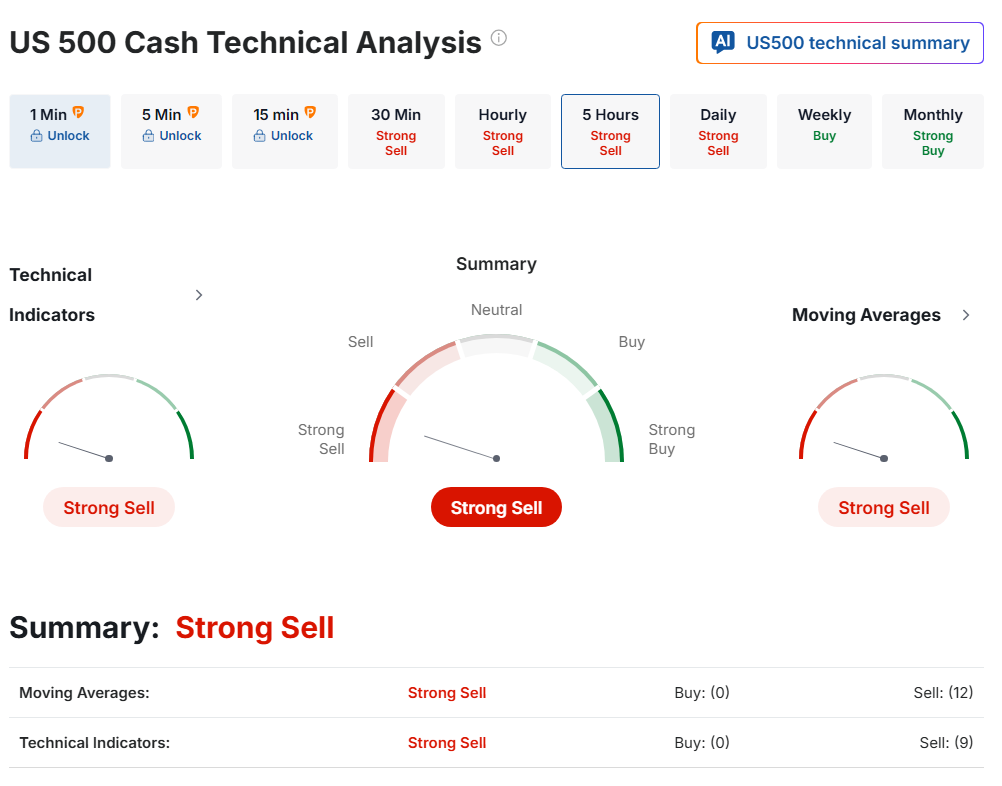

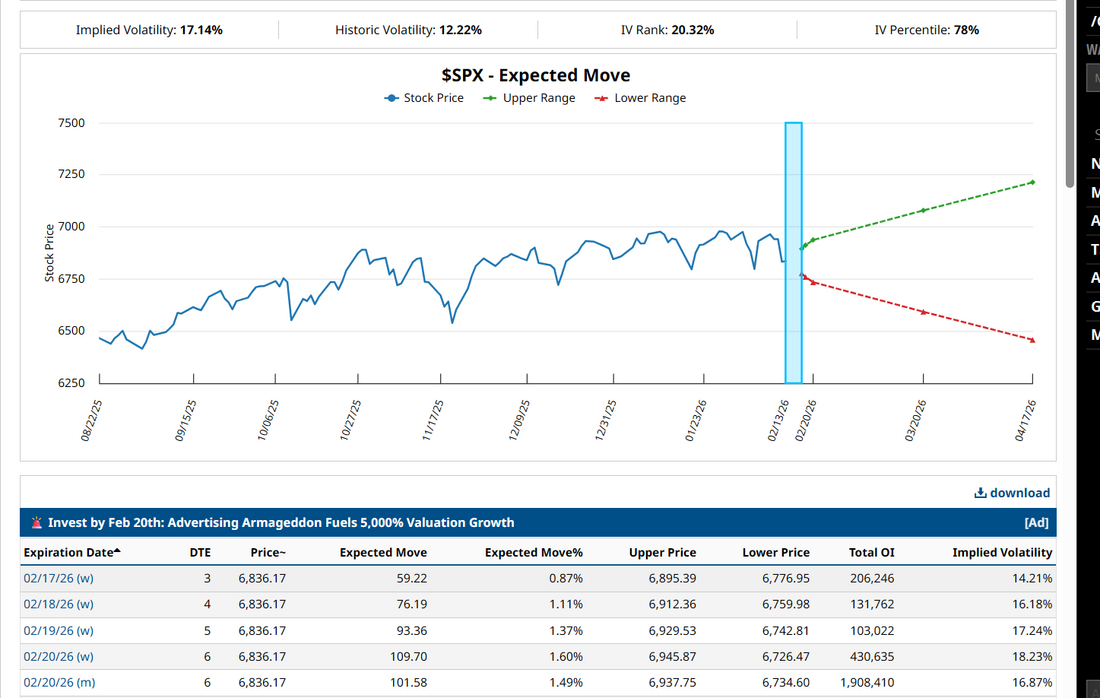

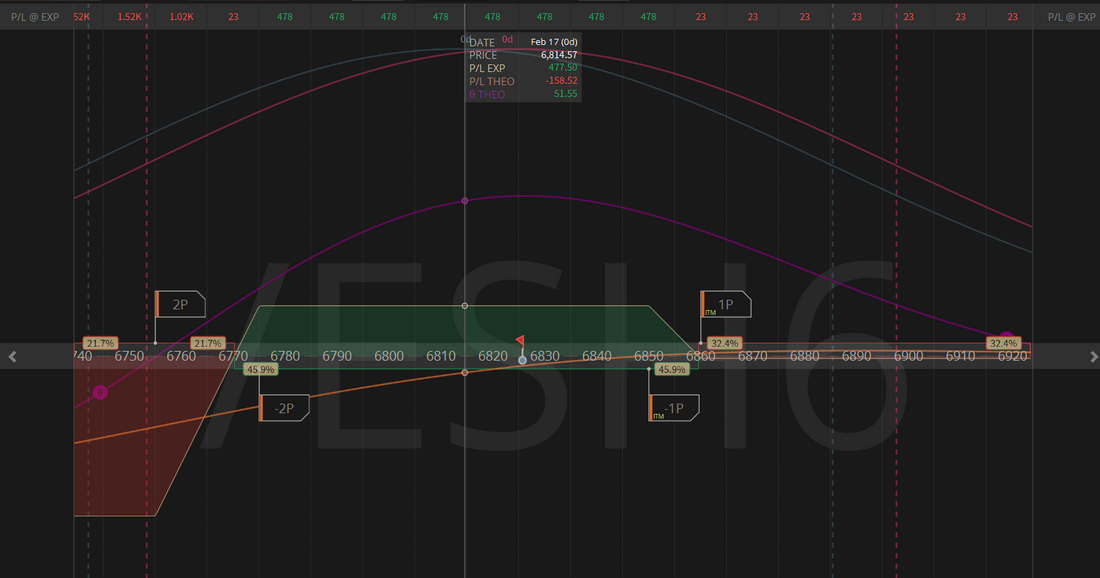

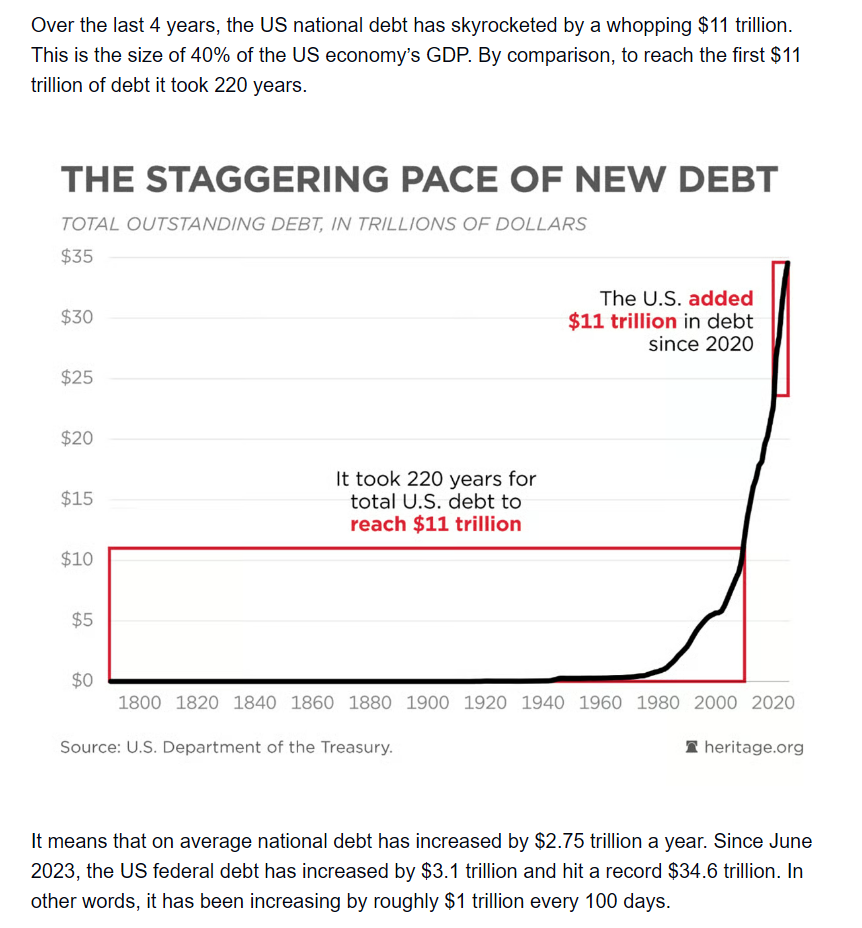

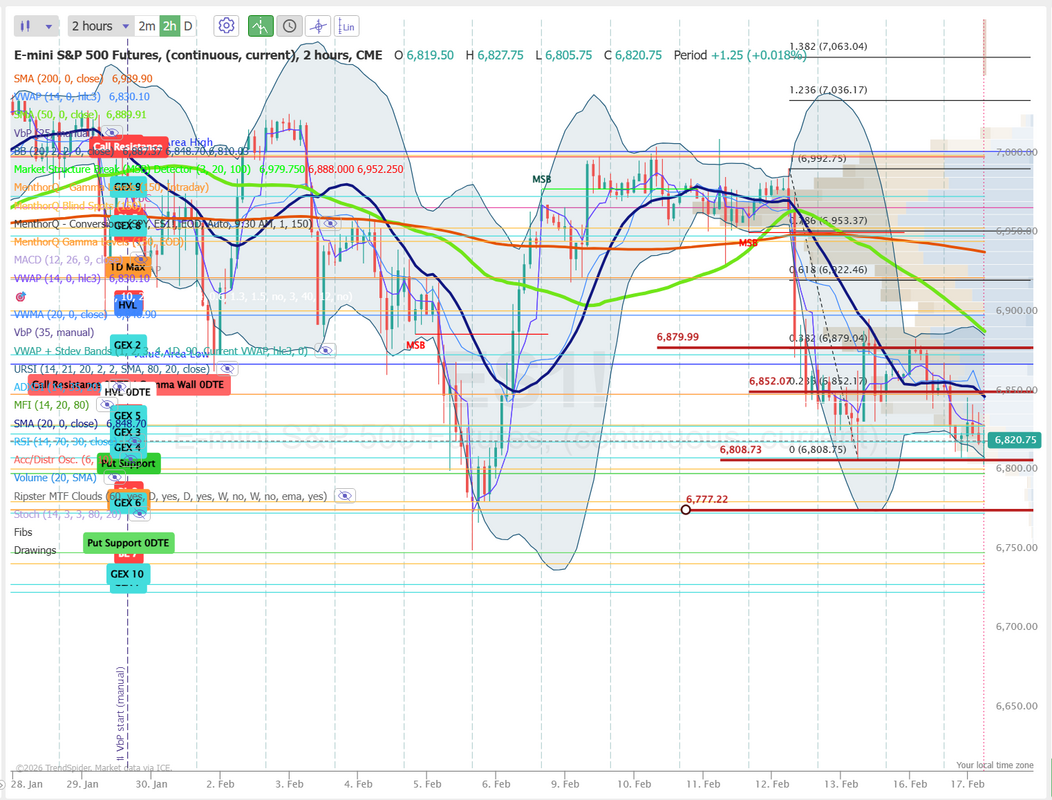

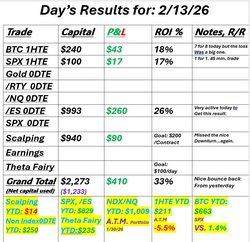

There's a lot to process there, but these types of pairs trades are my favorite. We had an excellent result from our trading last Friday. It was one of the best daily ROI's we've ever had. It was an excellent use of capital. Here's a look at our results.  Let's take a look at the markets: Thursday was a bit of a blood bath, and we wanted to see if bulls would show up on Friday. They tried but couldn't really break the trend. We continue to sell strangles on the RUT. It's been a solid producer for us in the ATM portfolio. Technicals continue to lean to the sell side this morning. A 1.49% expected move the this shortened week isn't bad. We could have some movement this week! Let's hope it's to the downside. LOL March S&P 500 E-Mini futures (ESH26) are down -0.40%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.85% this morning, pointing to a lower open on Wall Street after the long weekend as concerns around AI continue to weigh on sentiment. Investors remain concerned about companies’ swelling AI budgets as well as the technology’s potential to disrupt industries beyond the tech sector. There is “lingering anxiety about whether AI spending will be profitable enough, concerns about competition, and a broader de-risking from the most crowded trades after a very strong run,” according to Aneeka Gupta at WisdomTree. Investor focus this week is on a flurry of U.S. economic data, with particular attention on the PCE inflation reading and the advance estimate of fourth-quarter GDP, the minutes of the Federal Reserve’s latest policy meeting, and earnings reports from several high-profile companies. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Software stocks climbed, with CrowdStrike Holdings (CRWD) rising over +4% and ServiceNow (NOW) gaining more than +3%. Also, cryptocurrency-exposed stocks popped after the price of Bitcoin rose more than +4%, with Coinbase Global (COIN) jumping over +16% to lead gainers in the S&P 500 and Strategy (MSTR) surging more than +8% to lead gainers in the Nasdaq 100. In addition, Applied Materials (AMAT) advanced over +8% after the largest U.S. supplier of chipmaking gear posted better-than-expected FQ1 results and issued surprisingly strong FQ2 guidance. On the bearish side, Constellation Brands (STZ) slumped more than -8% and was the top percentage loser on the S&P 500 after the alcoholic beverage company said Nicholas Fink would succeed Bill Newlands as CEO. The U.S. Bureau of Labor Statistics report released on Friday showed that consumer prices rose +0.2% m/m in January, weaker than expectations of +0.3% m/m and the smallest gain since July. On an annual basis, headline inflation eased to +2.4% in January from +2.7% in December, weaker than expectations of +2.5%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.3% m/m and +2.5% y/y in January, in line with expectations. “For the Fed, [the CPI report] probably doesn’t change much in the near term,” said James McCann at Edward Jones. “We do see scope for further easing later this year. However, this is contingent on a more convincing decline in inflation towards target with the urgency for additional cuts lower now that downside risks in the labor market have seemingly eased.” Chicago Fed President Austan Goolsbee said on Friday that the central bank could lower interest rates further if inflation is on course to hit its 2% target, but that is not currently the case. “Right now, we are not on a path back to 2%. We’re kind of stuck at 3%, and that’s not acceptable,” Goolsbee said. U.S. rate futures have priced in a 92.2% chance of no rate change and a 7.8% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. In this holiday-shortened week, the December reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight, as investors continue to gauge the timing of the next interest rate cut. The advance estimate of U.S. gross domestic product for the fourth quarter will also be closely watched, encompassing a period that included the longest-ever federal government shutdown. Other noteworthy data releases include U.S. Durable Goods Orders, Core Durable Goods Orders, Housing Starts, Building Permits, Industrial Production, Manufacturing Production, the Philly Fed Manufacturing Index, Initial Jobless Claims, Trade Balance, Pending Home Sales, the Conference Board’s Leading Economic Index, Personal Spending, Personal Income, the S&P Global Manufacturing PMI (preliminary), the S&P Global Services PMI (preliminary), New Home Sales, and the University of Michigan’s Consumer Sentiment Index. Market participants will also be monitoring the Fed’s minutes from the January 27-28 meeting, set for release on Wednesday, to assess the debate between officials who support keeping rates steady and those who advocate for rate cuts. The FOMC left interest rates unchanged last month following three consecutive cuts at the end of 2025. “The January minutes will likely detail the arguments that support a wait-and-see approach versus those that could support rate cuts, consistent with the different viewpoints expressed by various FOMC policymakers since the meeting,” according to HSBC analysts. In addition, market watchers will scrutinize remarks from a host of Fed officials. Fed Governor Michael Barr, San Francisco Fed President Mary Daly, Fed Vice Chair for Supervision Michelle Bowman, Atlanta Fed President Raphael Bostic, Minneapolis Fed President Neel Kashkari, Chicago Fed President Austan Goolsbee, and Dallas Fed President Lorie Logan are scheduled to speak this week. Fourth-quarter corporate earnings season is winding down, but several notable companies are due to report this week, including Walmart (WMT), Palo Alto Networks (PANW), Cadence Design Systems (CDNS), Analog Devices (ADI), Booking Holdings (BKNG), Deere & Company (DE), and Constellation Energy (CEG). Meanwhile, quarterly 13F filings detailing the holdings and transactions of Berkshire Hathaway and other major investors are set to begin appearing this week, shedding light on fourth-quarter portfolio changes. Today, investors will focus on the New York Fed-compiled Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists expect the February figure to come in at 6.4, compared to 7.7 in January. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.028%, down -0.59%. SPY ended the week in the red at $681.75 (-1.28%), as its weekly Bollinger Band Width approaches its lowest level seen in nearly a year, indicating tightening price action. Despite persistent weakness in tech, price continues to find support at the middle band, suggesting the broader trend remains intact for now. With a multi-month squeeze in play, traders are watching closely to see which direction the compression ultimately resolves. Tech remained under pressure last week, with QQQ closing at $601.92 (-1.27%). A weekly TTM Squeeze has been in play since November, marking the first such signal since the setup that preceded the early 2025 bear market. With NVDA accounting for nearly 9% of the index and set to report earnings at the end of February, its results could be the primary catalyst that determines where price moves next. Small caps showed relative strength last week, with IWM closing down slightly at $262.96 (-0.78%). Its Bollinger Band Width is expanding rather than compressing, as the index pushes higher and builds on its ~6% year-to-date gain. With price continuing to test the upper Bollinger Band, traders are watching closely to see whether this leadership can persist or begin to fade. We are already off to a fast start today with 1HTE's on Bitcoin already working and a 0DTE on the /ES that has a wonderful R/R ratio. Here's a look at our initial setup. We'll look to build around this as our foundation for today. I know we talk about this all the time but as some point this will become a factor. Let's take a look at the intraday levels for our 0DTE entries. I have two main support/resistance levels that are particularly important for our 0DTE today. 6852 and 6880 are resistance with 6808 and 6777 working as support levels. 6777 is key for us today as that's close to our short put leg on our /ES 0DTE. I'll see you all shortly in the live trading room and scalping feed!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |