|

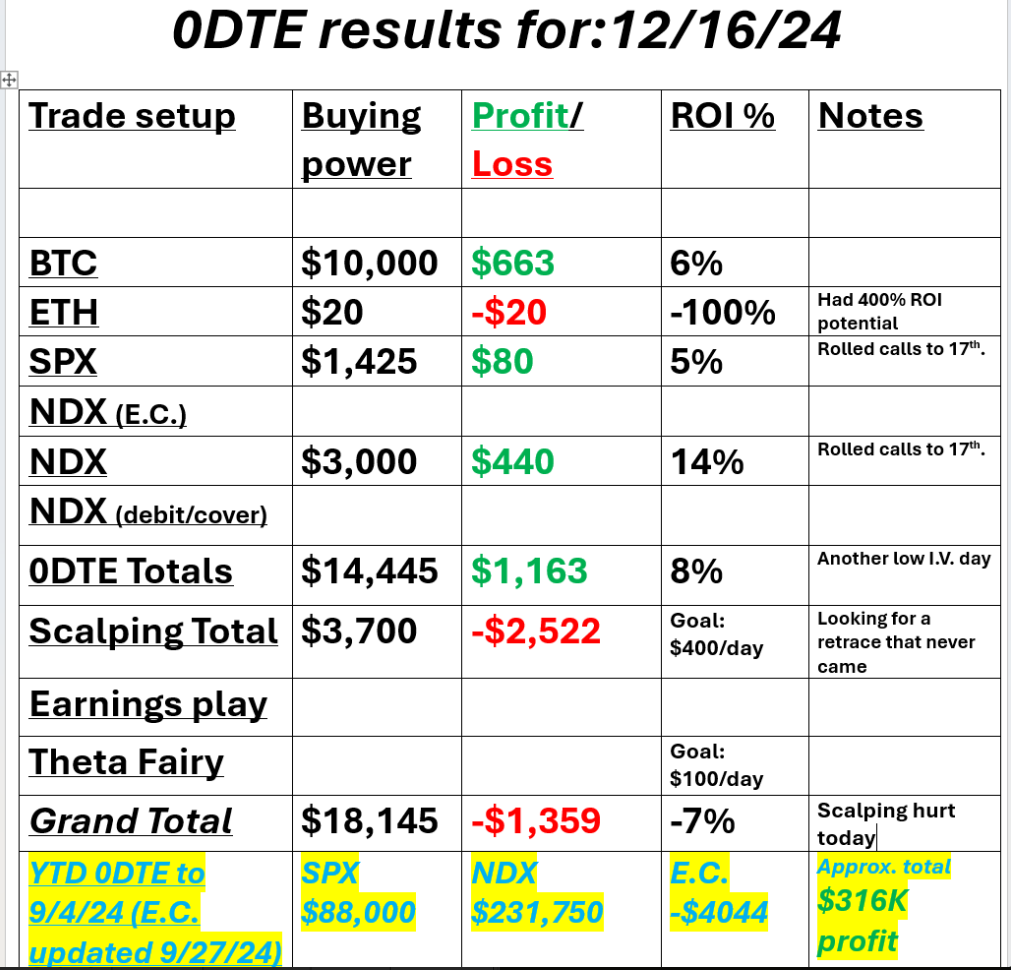

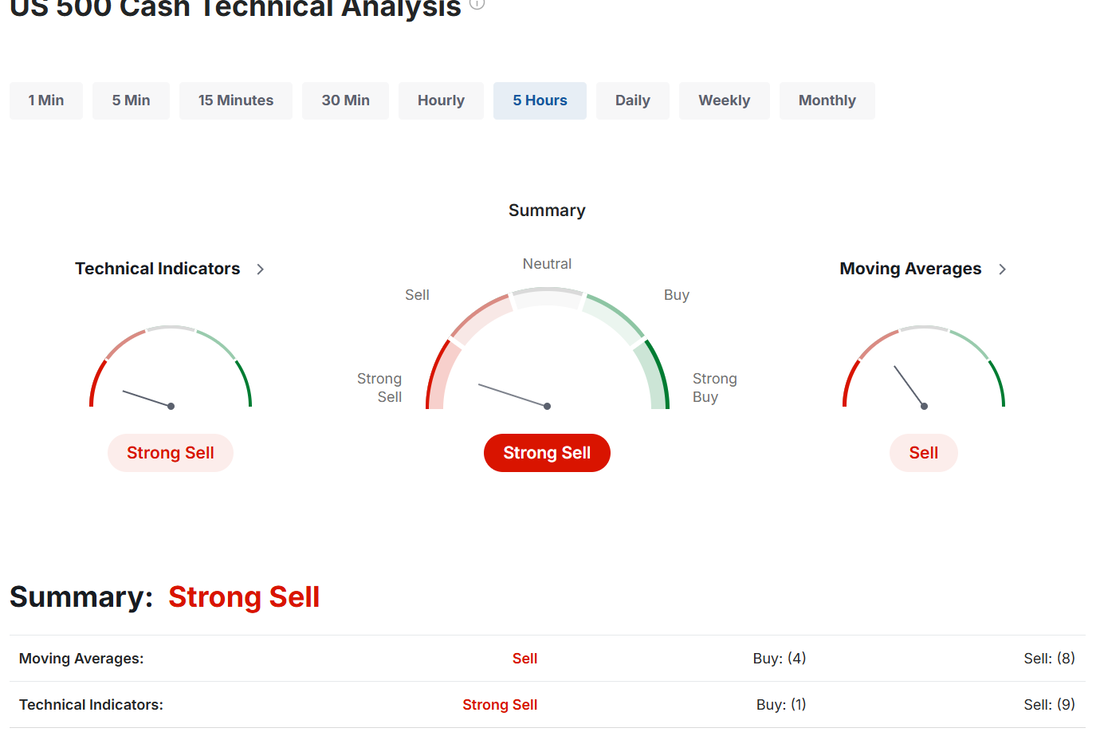

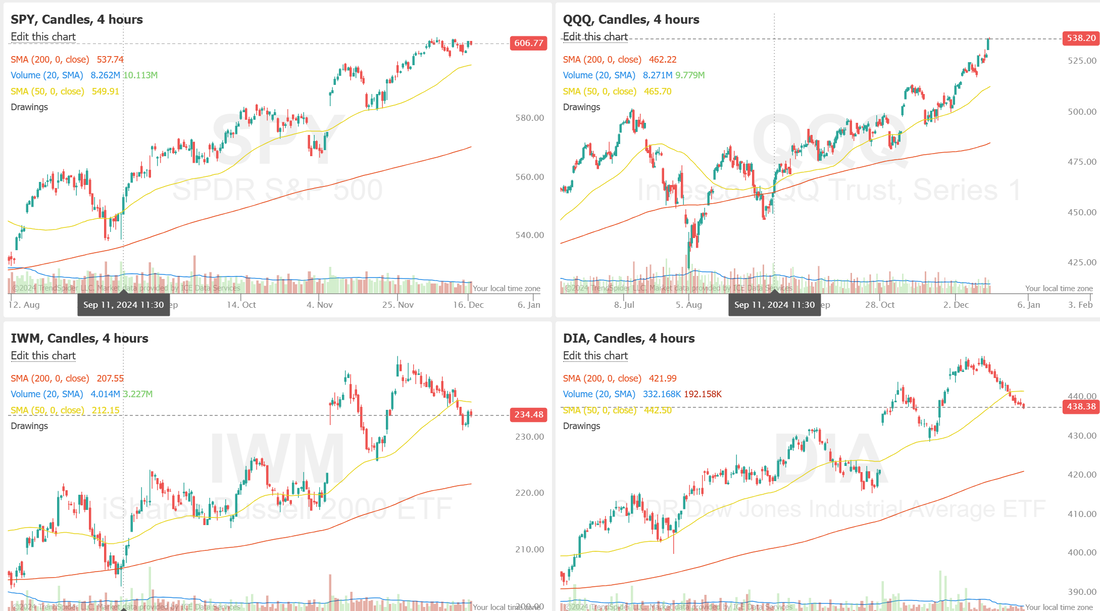

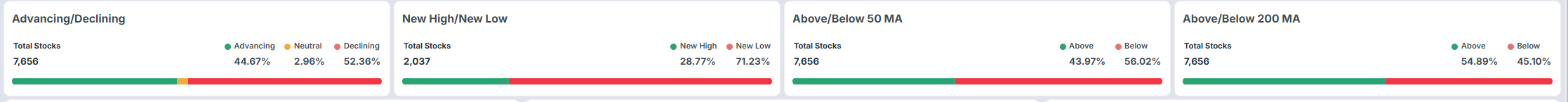

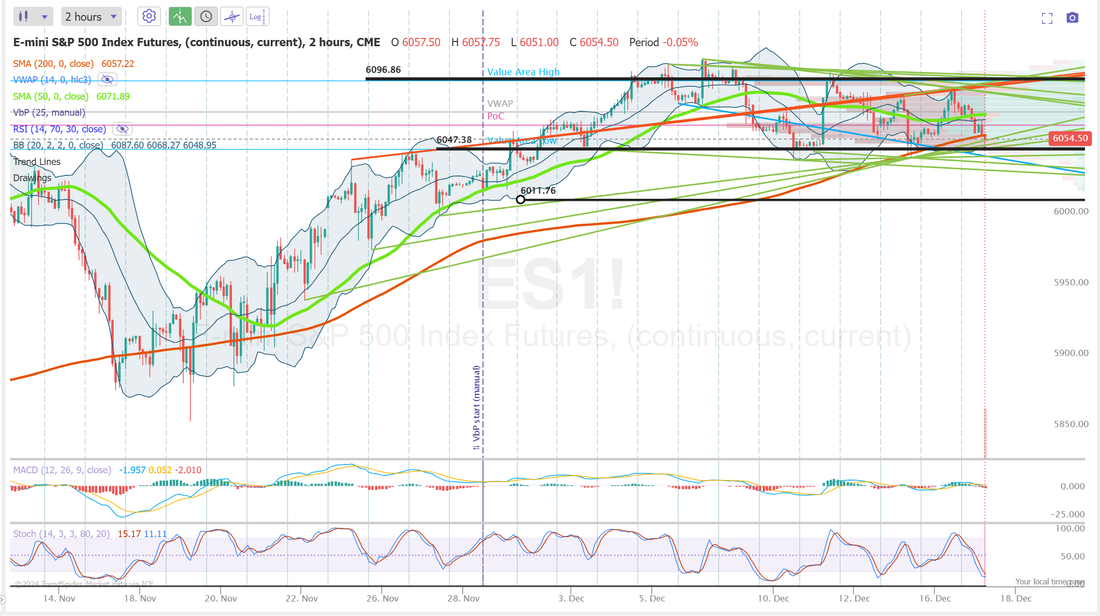

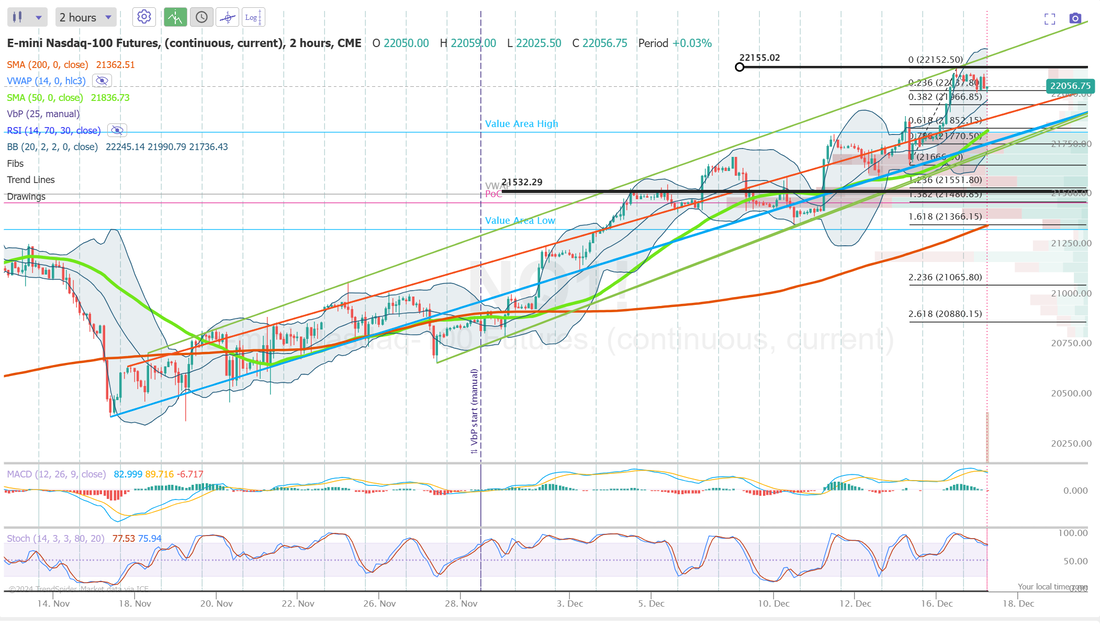

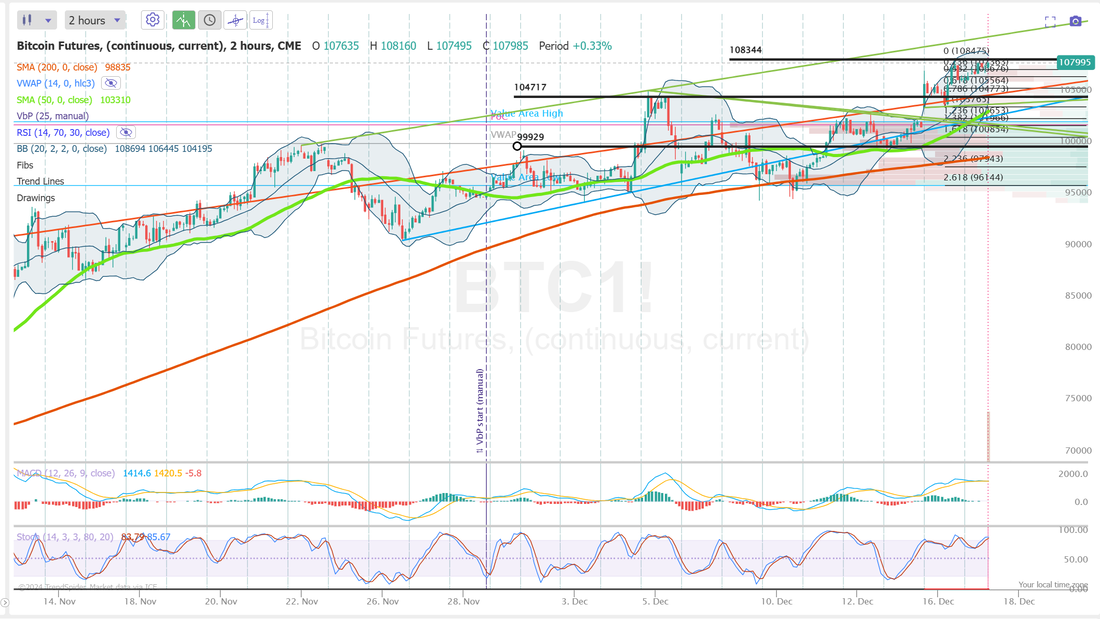

Welcome back traders! Well?...another day of low I.V. Our day trades were fine. We rolled the call sides of both the NDX and SPX and those look like they should cash flow well today so we may have a bit of a gift coming this session. Scalping killed my yesterday so we'll look for better results today. It feels like we are topping here. More on that lower down. Here's my results from yesterday. We have about $3,400 of potential profits today on our rolled calls so hopefully we can get a bigger score today than we've been getting. Let's take a look at the markets and see where we think today's trend will take us. We've got a sell mode signal coming into today. We've had a few of these and EVERY SINGLE ONE has been a "buy the dip" opportunity. One of these times is going to be a clear "change of direction" signal. Will today be that day? Who knows? We've got FOMC tomorrow. I do think we are getting close to a retrace. You could make the argument that the markets been in decline for over a week now. SPY is stuck and can't go higher. DIA and IWM are in a clear downtrend with the DIA in one of it's longest downtrends in recent time. It's the tech heavy QQQ's that keep exploding to new ATH's every day, it seems. I've mentioned this before. The market internals don't look great. December S&P 500 E-Mini futures (ESZ24) are trending down -0.45% this morning as investors braced for the start of the Federal Reserve’s two-day policy meeting while also awaiting a new batch of U.S. economic data, with a particular focus on the retail sales report. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed, with the tech-heavy Nasdaq 100 notching a new all-time high and the blue-chip Dow posting a 3-week low. Broadcom (AVGO) climbed over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100, extending last Friday’s rally after it reported better-than-expected FQ4 adjusted EPS and provided upbeat FQ1 revenue guidance. Also, Tesla (TSLA) gained more than +6% after Wedbush Securities raised its price target on the stock to $515 from $400. In addition, Honeywell International (HON) rose over +3% and was the top percentage gainer on the Dow after saying it’s exploring a separation of its aerospace business. On the bearish side, Super Micro Computer (SMCI) slumped more than -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after Nasdaq announced that the stock would be removed from the tech-heavy index later this month. Economic data released on Monday showed that the U.S. S&P Global manufacturing PMI fell to 48.3 in December, weaker than expectations of 49.4. Also, the Empire State manufacturing index came in at 0.20 in December, weaker than expectations of 6.40. At the same time, the U.S. December S&P Global services PMI unexpectedly rose to 58.5, stronger than expectations of 55.7. The Federal Reserve kicks off its two-day meeting later in the day. While Fed officials are widely expected to cut interest rates by a quarter percentage point on Wednesday, the trajectory for the following months is less clear. Market watchers will closely follow the central bank’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC member forecasts regarding the path of interest rates, and Chair Jerome Powell’s post-decision press conference. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that November Retail Sales will stand at +0.6% m/m, compared to the October figure of +0.4% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.1% m/m in October. Economists foresee the November figure to be +0.4% m/m. U.S. Industrial Production and Manufacturing Production data will be released today as well. Economists forecast November Industrial Production at +0.3% m/m and Manufacturing Production at +0.5% m/m, compared to October’s figures of -0.3% m/m and -0.5% m/m, respectively. “Near-term momentum may depend on what Fed Chair Powell says after the announcement, and whether retail sales or the PCE Price Index catch the market off guard,” said Chris Larkin, managing director of trading and investing at E*Trade from Morgan Stanley. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.423%, up +0.53%. My lean or bias today is bearish. Futures are down. That's not news. They've been down most mornings lately and have come roaring back either by the open or later in the day. There's very little buying happening right now. We would benefit greatly today with a down day. Trade docket for today: Super simple. We'll continue to be more proactive and work our Nat gas position once again. MRNA, 0DTE's. Tomorrow we'll get some earnings setups. If we can get our 0DTE's to the finish line today it will be a very successful day. We don't need much else. One thing I'm thinking about today: P/E ratios. Take a look at where we are at. Compare that to historical levels. You tell me. Are we overvalued? Once we get an exit on our current 0DTE's I believe it's time to switch over to some bearish debit anchors. Let's take a look at our intra-day levels for 0DTE. /ES: While we are still inside the "chop zone" that I've laid out for over a week now, we are sitting right on top of the support level of 6047. A drop below that could trigger a sell all the way down to 6011. Resistance is up at 6096. /NQ: The Nasdaq just keeps on keeping on. Every day seems like another new ATH. As I type this the /NQ futures are down 50 points. If we can shake that off and push above current resistance at 22,155 then I'll tip my hat to the bulls. It's been an impressive run as all the other indices languish or retrace. Support is all the way down at 21,532. BTC: There are three key levels I'm watching on Bitcoin today. 108,344 is now near term resistance. The bulls want to run. Can they make a new ATH today? It's got a fair chance however, the longer the upward run and the more intense it becomes, the more I look for that "break" and a retrace. Thank heavens for Bitcoin. I never thought I'd say this but it's been our most reliable source of profit lately for our 0DTE's. Support levels for me are 104,717 first then the ever important 100,000 level. Today's a big one for us with our 0DTE's. Firstly, we could book a nice profit if the market stays down and our rolled calls hit for a full profit but secondly, With FOMC incoming tomorrow it would be nice to start tomorrow with a fresh, clean slate.

I'll see you all in the trading rooms shortly. Let's make some money today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |