|

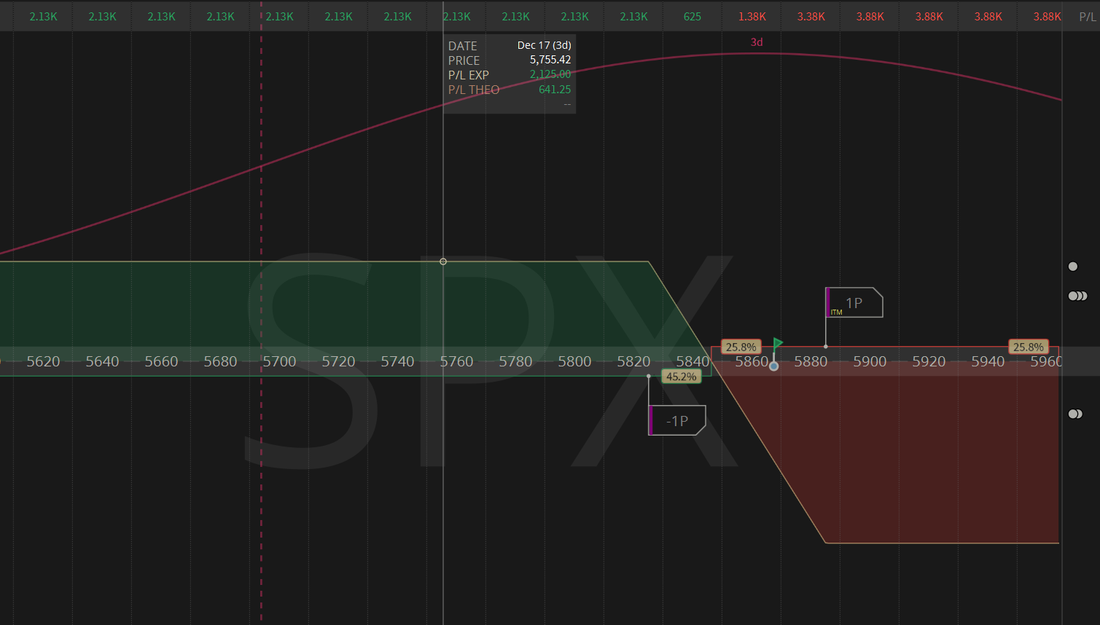

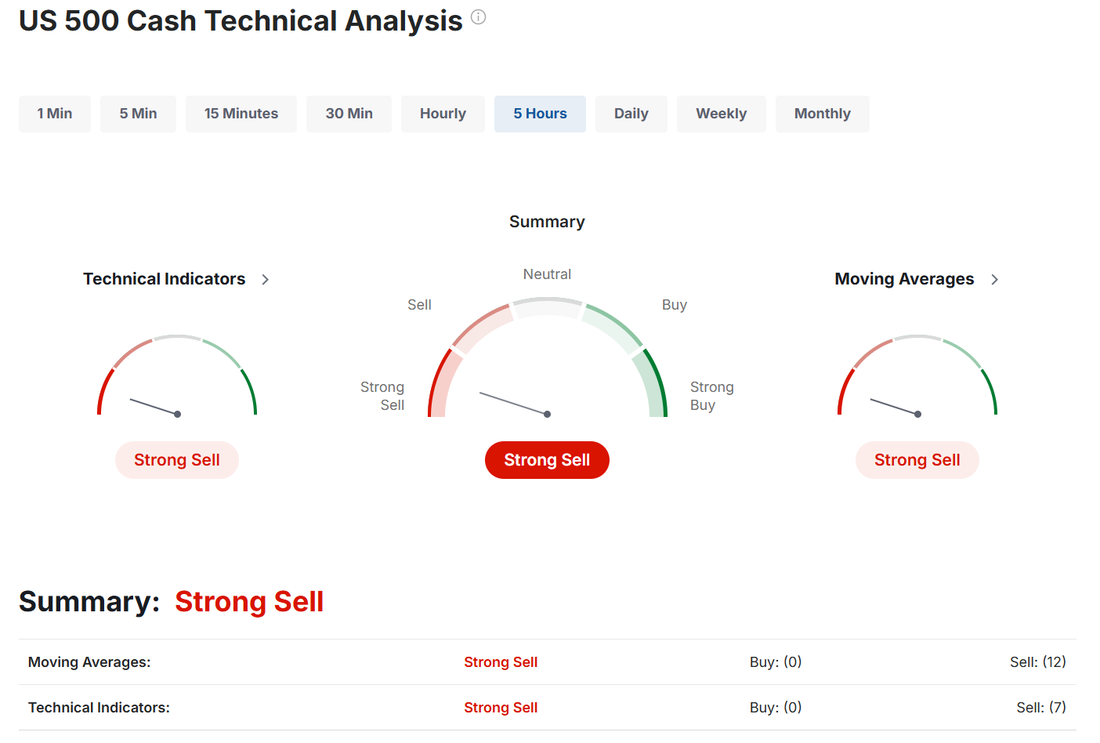

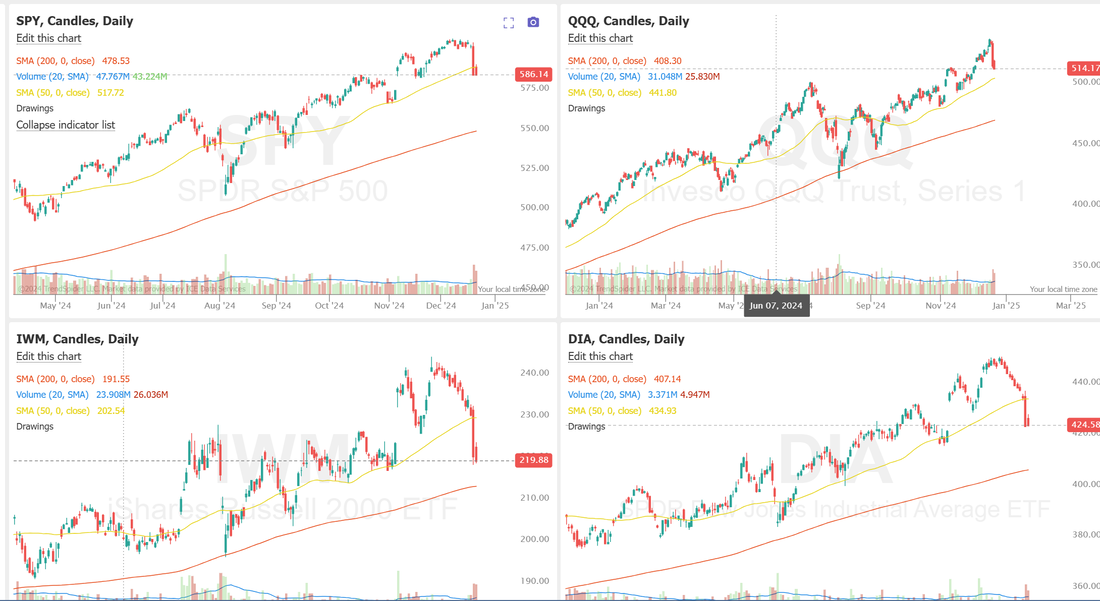

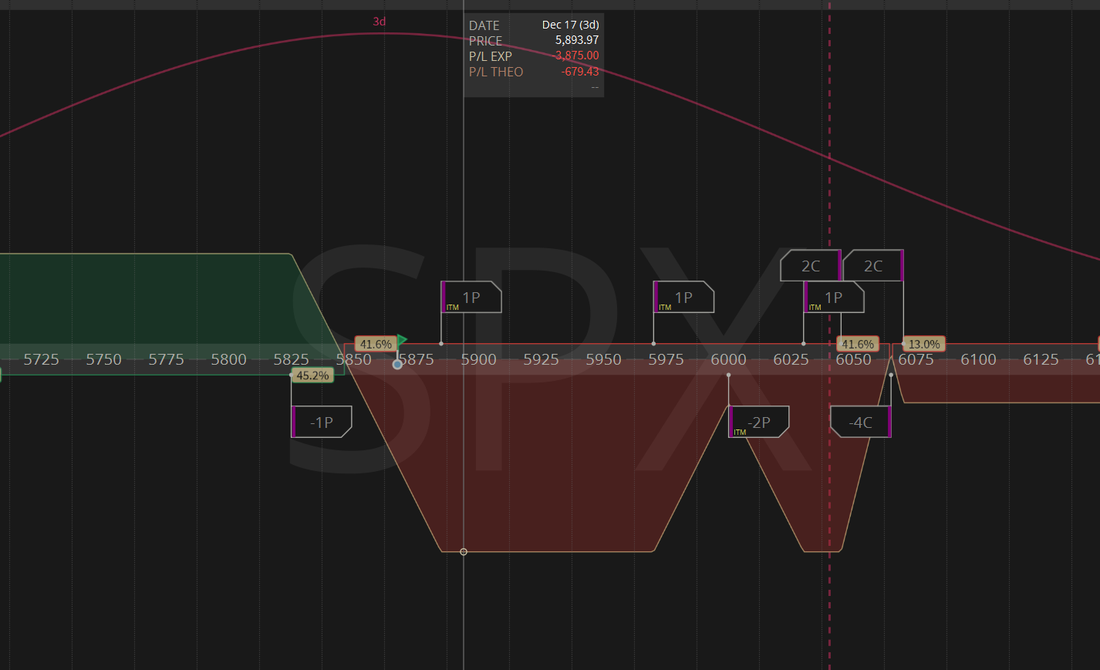

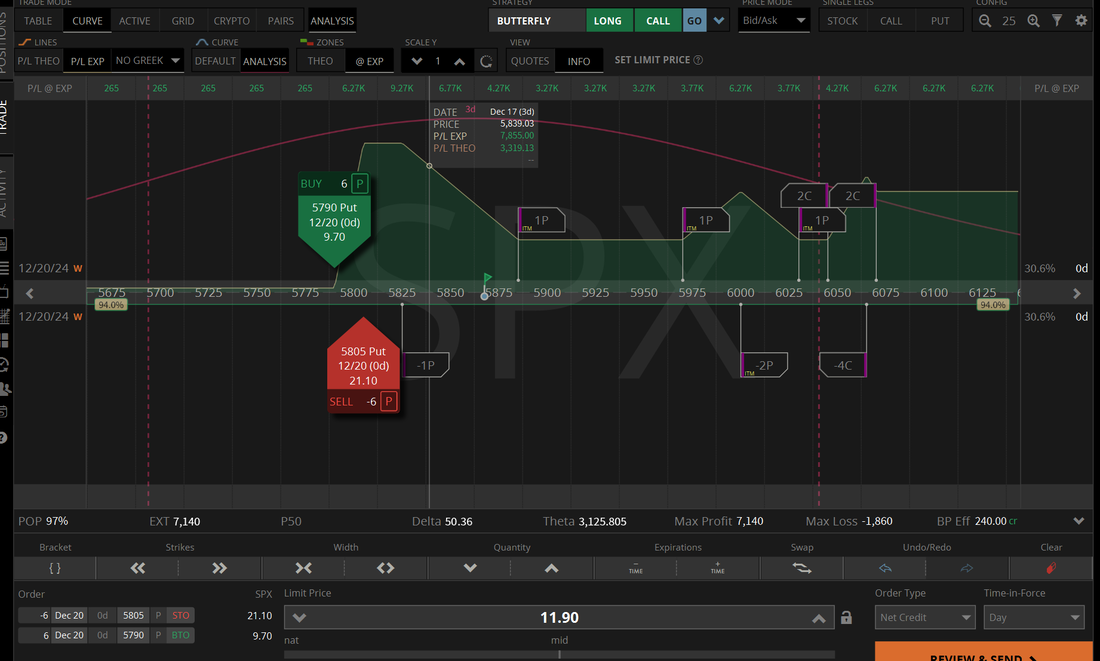

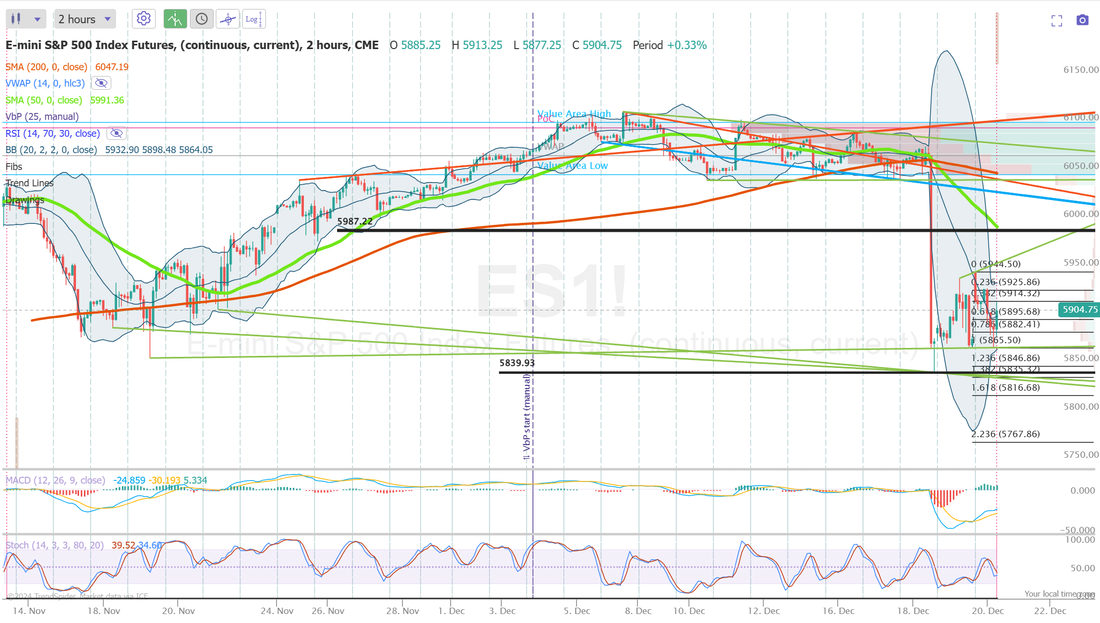

Welcome to Friday, once again! This week flew by. We had a productive day yesterday but it was a little different. We set up a bearish SPX trade going into today and that should cash flow our whole SPX position today. It could be as much as a $4,000 profit after we finish working it. We also started working with the 1HTE trades on Bitcoin. We've still got a lot of work to do. I'd like to get 10 full days of trading data before we start implementing a plan and setting expectations. This is a quick review of our results that I posted to twitter yesterday. Scaling, Position sizing and stop losses are what we need to get a handle on. Our fist day test went well but it needs to generate at least $200 a day to make it worth it. Bookmark the website 1HTE.com as we'll be adding more data as we build out the trading system. Let's take a look at the markets. Sell mode is back! Will it hold? It certainly looks like it right now. The only major index still hovering above it's 50DMA is the QQQ. Granted, The SPY, IWM and DIA are sitting on new support levels but there's no way around it. Things look bearish. CTGO, GNK, ICFI, MU, LEN, MSTR, MRNA, 0DTE with SPX, 1HTE's on Bitcoin. December S&P 500 E-Mini futures (ESZ24) are trending down -0.80% this morning as risk sentiment took a hit on worries about a possible U.S. government shutdown, while investors awaited the Federal Reserve’s first-line inflation gauge for fresh clues on its policy outlook. The United States faced renewed political uncertainty on Thursday evening after the Republican-led House rejected a temporary funding plan supported by President-elect Donald Trump. Dozens of Republican lawmakers opposed the deal to fund the government for three months and suspend the U.S. debt ceiling for two years, with less than 24 hours remaining before a U.S. government shutdown. In yesterday’s trading session, Wall Street’s major indices ended mixed. Lamb Weston Holdings (LW) tumbled over -20% and was the top percentage loser on the S&P 500 after the company posted downbeat FQ2 results and cut its annual adjusted EPS guidance. Also, Micron Technology (MU) plunged more than -16% and was the top percentage loser on the Nasdaq 100 after the memory maker issued below-consensus FQ2 guidance. In addition, Lennar (LEN) slid over -5% after the homebuilder reported weaker-than-expected FQ4 results and offered a soft FQ1 new orders forecast. On the bullish side, Darden Restaurants (DRI) surged more than +14% and was the top percentage gainer on the S&P 500 after posting upbeat FQ2 results and boosting its 2025 sales guidance. The U.S. Commerce Department said Thursday that the Q3 GDP growth estimate was revised upward to 3.1% (q/q annualized) in its final print, stronger than expectations of no change at 2.8%. Also, U.S. November existing home sales rose +4.8% m/m to an 8-month high of 4.15M, stronger than expectations of 4.09M. In addition, the Conference Board’s leading economic index for the U.S. unexpectedly rose +0.3% m/m in November, stronger than expectations of -0.1% m/m and the largest increase in 2-3/4 years. At the same time, the U.S. Philadelphia Fed manufacturing index unexpectedly fell to a 20-month low of -16.4 in December, weaker than expectations of 2.9. Finally, the number of Americans filing for initial jobless claims in the past week fell by -22K to 220K, compared with the 229K consensus. “This week’s data show the economy is set to end 2024 on a solid note, which is fortunate since we’ll have to contend with heightened policy uncertainty and possibly greater challenges in 2025. We think the Fed maintains an easing bias, but the bar for rate cuts just got higher,” Oren Klachkin, an economist at Nationwide, said in a note. U.S. rate futures have priced in an 89.3% probability of no rate change and a 10.7% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. Meanwhile, Wall Street is preparing for a quarterly event known as triple witching, during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. About $6.5 trillion worth of options tied to individual stocks, indexes, and exchange-traded funds are set to expire today, according to an estimate from derivatives analytical firm Asym 500. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.9% y/y in November, compared to the previous figures of +0.3% m/m and +2.8% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate November Personal Spending to be +0.5% m/m and Personal Income to be +0.4% m/m, compared to October’s figures of +0.4% m/m and +0.6% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists estimate this figure to arrive at 74.1 in December, compared to 71.8 in November. In addition, market participants will be looking toward a speech from San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.547%, down -0.50%. My bias or lean today is bearish. This rollover looks serious. Yes, we are sitting back on support/consolidation levels for SPY, IWM and DIA but the trend right now is down. While we have serveral trades to work today, our main focus will be on the SPX. Here's what we currently have. This would give us a $2,100 net proift as is if it finishes in ITM. Right now it looks good. Adding a credit put spread could juice it up to a $4,000 profit. Regardless...the opportunity for us to have a great day is in our hands. We just need to manage it correctly. Let's take a look at our intra-day levels on /ES and Bitcoin since we don't have NDX options today with the third Friday of the month expirations. /ES: Levels from yesterday, admittedly wide, are still in play. 5987 is resistance with 5947 acting as support. This is a heavy consolidation zone. I wouldn't read too much into any movement that does NOT take us out of this zone. BTC: We will continue to build history and data with trading the 1HTE's today. Three key levels I'm focusing on today. 103,204 looks like resistance with 92,349 working as support. 97,554 is the current consolidation area. As I've mentioned. We have a good shot at a $4,000+ profit day today. Let's see if we can NOT screw it up! LOL. See you all in the trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |