|

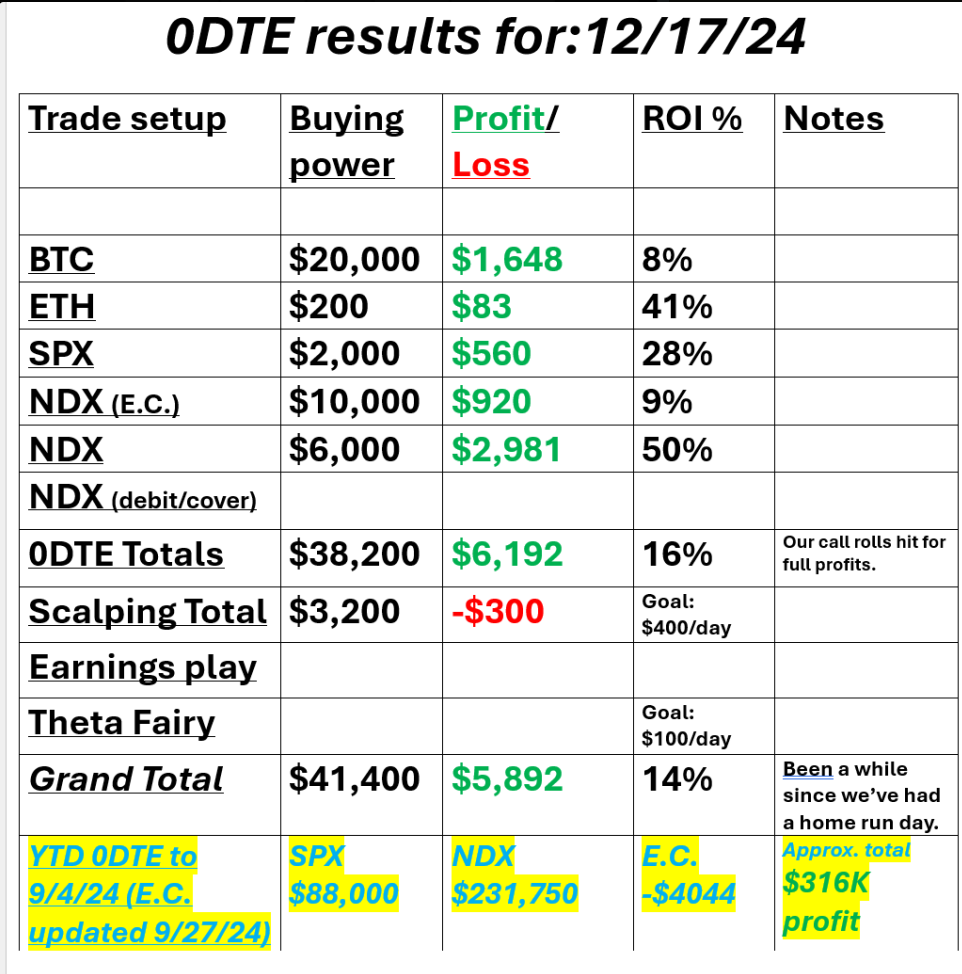

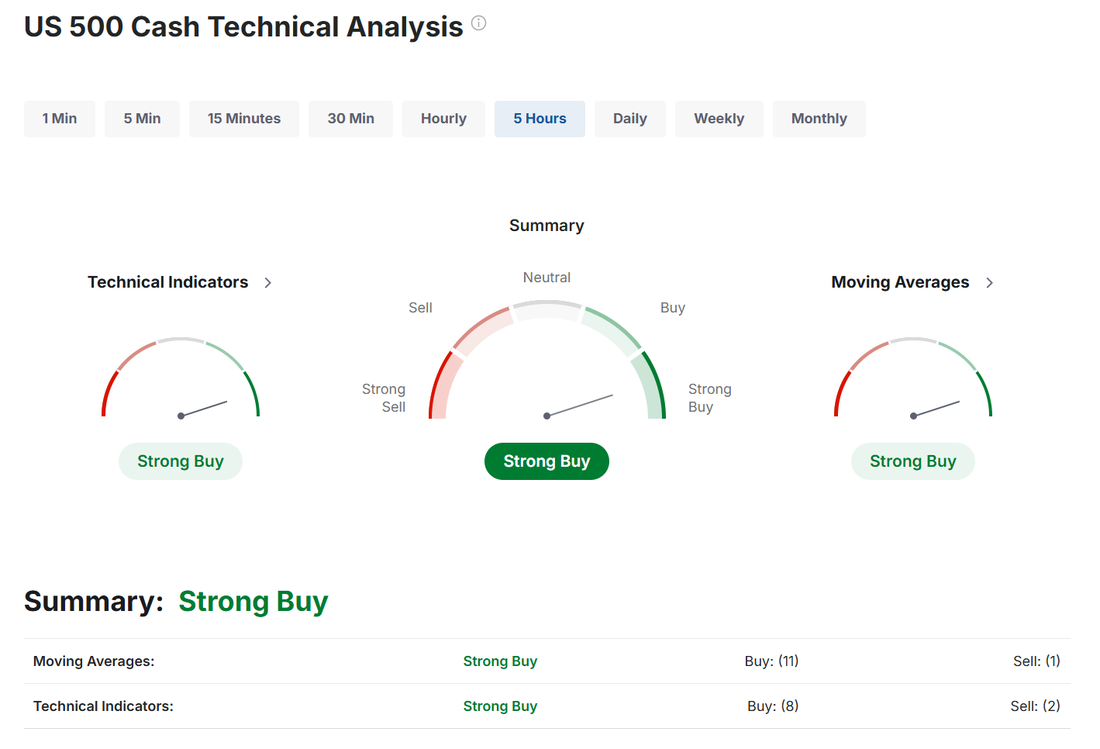

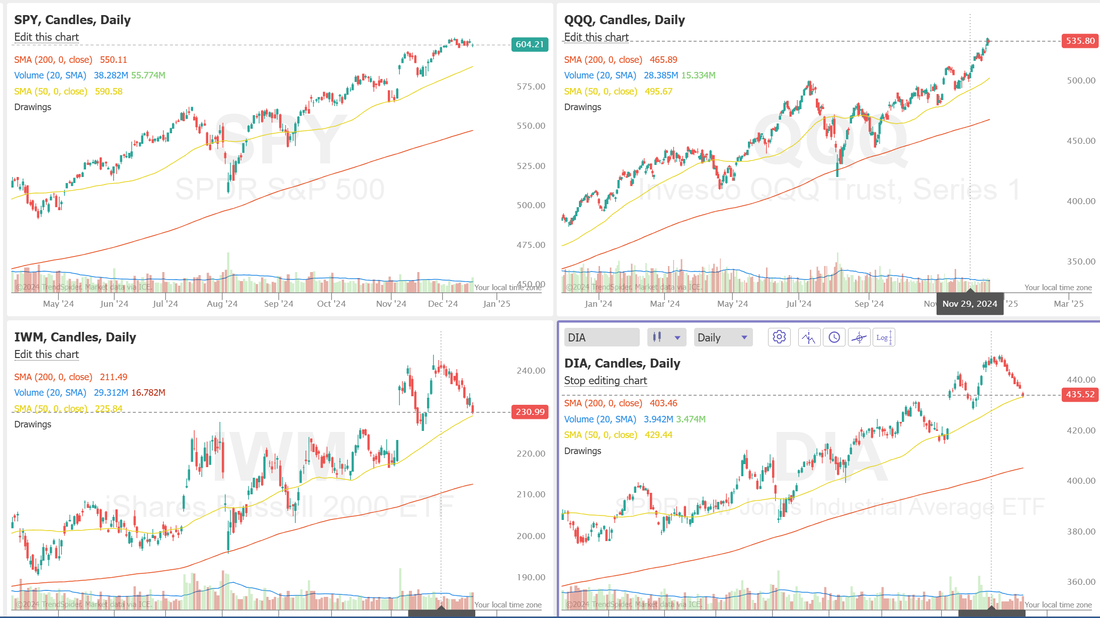

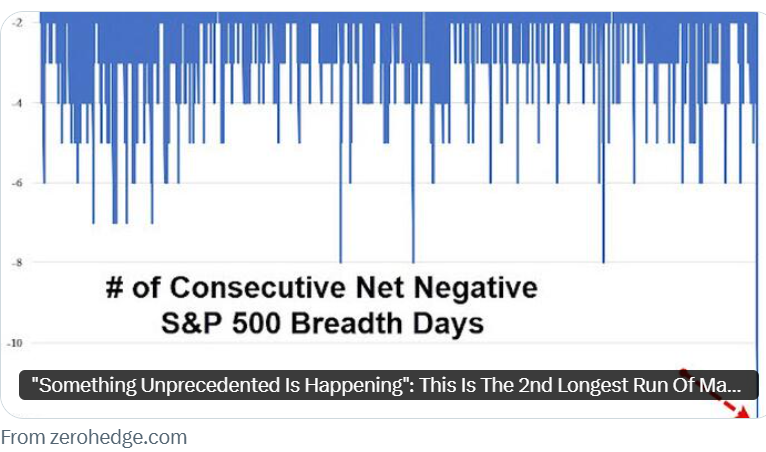

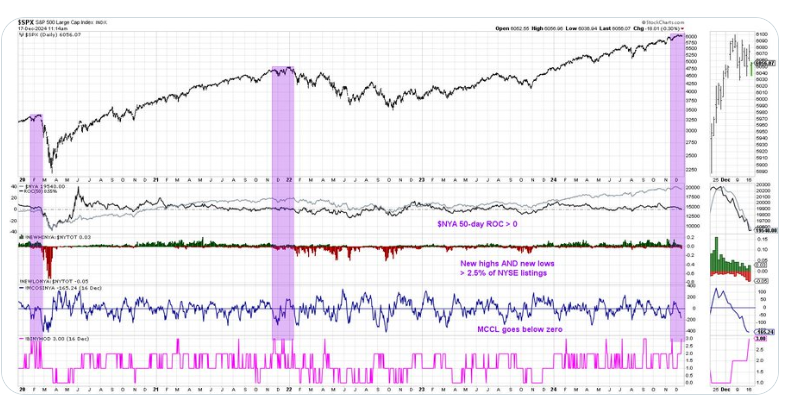

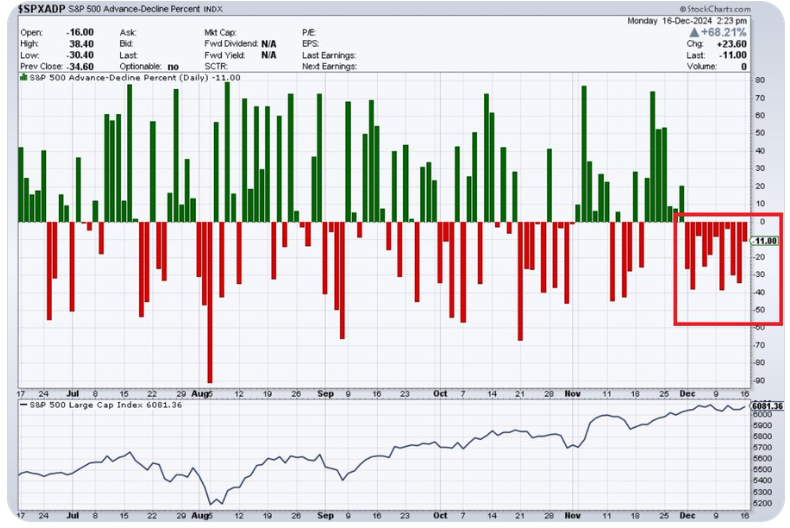

Welcome back to FOMC day! We had a rare home run yesterday with everything clicking for us. Check out our results below: We've already got two 0DTE's working this morning. Our goal will be to pull them at a profit prior to FOMC and then we pounce once again and double dip. Also...big news! The regulators have FINALLY approved the 1 hour to expiration trades! It's been a regulatory nightmare and took almost a year longer than planned but they are very close to being rolled out to a few select platforms in the U.S. and we are one of the lucky ones! If you're not already signed up for Kalshi so you can trade these, now it the time! There's no cost and you can trade with twenty bucks if you like so there's no reason to not get set up to take advantage. Frankly, I'm not sure what the best way to trade them is. It will be a learning opportunity for us all. Grab your spot below: In other big news...I'm continuing to work on an autotrade bot that will automate 0DTE setups and most of our weekly trades! If you have wanted to trade 0DTE's but havent been able to because of screen time limitations we may have a fix for you! I'll chat about this more on the zoom today. I'm very excited about this. December S&P 500 E-Mini futures (ESZ24) are up +0.22%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.26% this morning as investors looked ahead to the Federal Reserve’s final policy decision of the year. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the red. Managed care stocks came under pressure after Pfizer CEO Albert Bourla said U.S. President-elect Donald Trump is “very committed” to reforming the pharmacy benefit manager industry, with Humana (HUM) plunging over -10% to lead losers in the S&P 500 and CVS Health (CVS) falling more than -5%. Also, chip stocks lost ground, with Marvell Technology (MRVL) slumping over -10% to lead losers in the Nasdaq 100 and Broadcom (AVGO) sliding nearly -4%. In addition, Red Cat Holdings (RCAT) dropped over -7% after reporting weaker-than-expected FQ2 results. On the bullish side, Pfizer (PFE) climbed more than +4% and was the top percentage gainer on the S&P 500 after the drugmaker reaffirmed its 2024 guidance and provided a better-than-expected 2025 adjusted EPS forecast. Also, Tesla (TSLA) gained over +3% and was the top percentage gainer on the Nasdaq 100 after Mizuho upgraded the stock to Outperform from Neutral with a $515 price target. Economic data released on Tuesday showed that U.S. retail sales climbed +0.7% m/m in November, beating the +0.6% m/m consensus. Also, U.S. November core retail sales, which exclude motor vehicles and parts, edged up +0.2% m/m, weaker than expectations of +0.4% m/m. In addition, U.S. industrial production unexpectedly fell -0.1% m/m in November, weaker than expectations of +0.3% m/m, while manufacturing production rose +0.2% m/m, weaker than expectations of +0.5% m/m. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. Fed officials are widely expected to lower interest rates by a quarter percentage point, but the trajectory for the following months is less clear. While the U.S. economy remains resilient, the prospect of inflationary import tariffs proposed by the incoming Donald Trump administration may cause policymakers to reconsider the pace of future interest rate cuts. Market watchers will closely follow the central bank’s quarterly “dot plot” in its Summary of Economic Projections and Chair Jerome Powell’s post-decision press conference. “Whether [today’s] Fed decision is positive, negative or neutral for stocks and bonds likely won’t be determined by any actual rate cut, but instead by what the FOMC says about cuts in 2025,” wrote Tom Essaye, president and founder of Sevens Report and a former Merrill Lynch trader. On the earnings front, notable companies like Micron Technology (MU), Lennar (LEN), General Mills (GIS), and Jabil Circuit (JBL) are scheduled to report their quarterly figures today. On the economic data front, investors will focus on U.S. Building Permits (preliminary) and Housing Starts data, set to be released in a couple of hours. Economists forecast November Building Permits to be 1.430M and Housing Starts to be 1.350M, compared to the prior figures of 1.419M and 1.311M, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be -1.600M, compared to last week’s value of -1.425M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.407%, up +0.50%. Let's take a brief look at the markets before FOMC. The technicals are still bullish but... There are different stories going on, depending on what index you choose to look at. SPY is stalled at ATH's, IWM and DIA are in one their longest losing streaks in a while. Just clinging to their 50DMA's. Its only the QQQ's that continue to climb and climb. Internally this market looks tired. Take a look at a few things I'm thinking about today. "Something Unprecedented Is Happening": This Is The 2nd Longest Run Of Market Bad Breadth In 100 Years We now have a CONFIRMED Hindenburg Omen after two bearish signals occurred within one month. The last two times this has occurred for $SPX: Dec 2021 and Feb 2020. Tune in today's episode of CHART THIS for a deeper discussion and implications of this rare but powerful bearish signal! https://buff.ly/3P04dTh S&P 500 Value Stocks have declined for 11 consecutive trading days, the longest losing streak in history Over the last 11 trading days STRAIGHT, more stocks of the S&P 500 finished lower than closed higher each day, the longest streak in 28 YEARS. The US stock market is absolutely weak under the surface. Time for a pullback? I have no bias or lean on FOMC days and we don't look at levels because the Algos will drive the markets today. We just look to jump on a trend, if one develops. Trade docket today: We already have two 0DTE's working. We should have a good shot at booking profits on those before FOMC. We'll then look to re-enter new setups. We'll continue to work our Nat gas trade. PLTR?, MU, LEN earnings setups. BTC and ETH 0DTE's. See you all in the zoom shortly. I'm excited to talk about the 1HTE trades and auto trading.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |