|

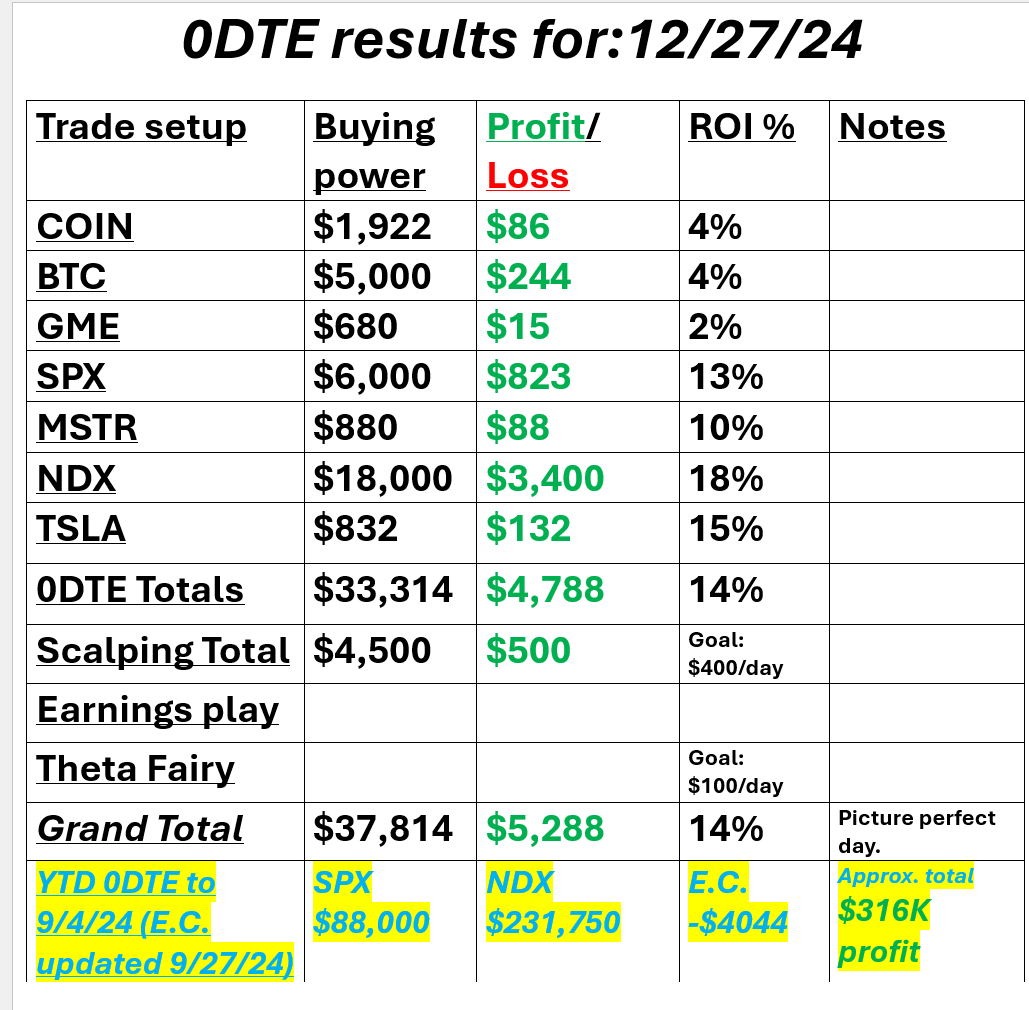

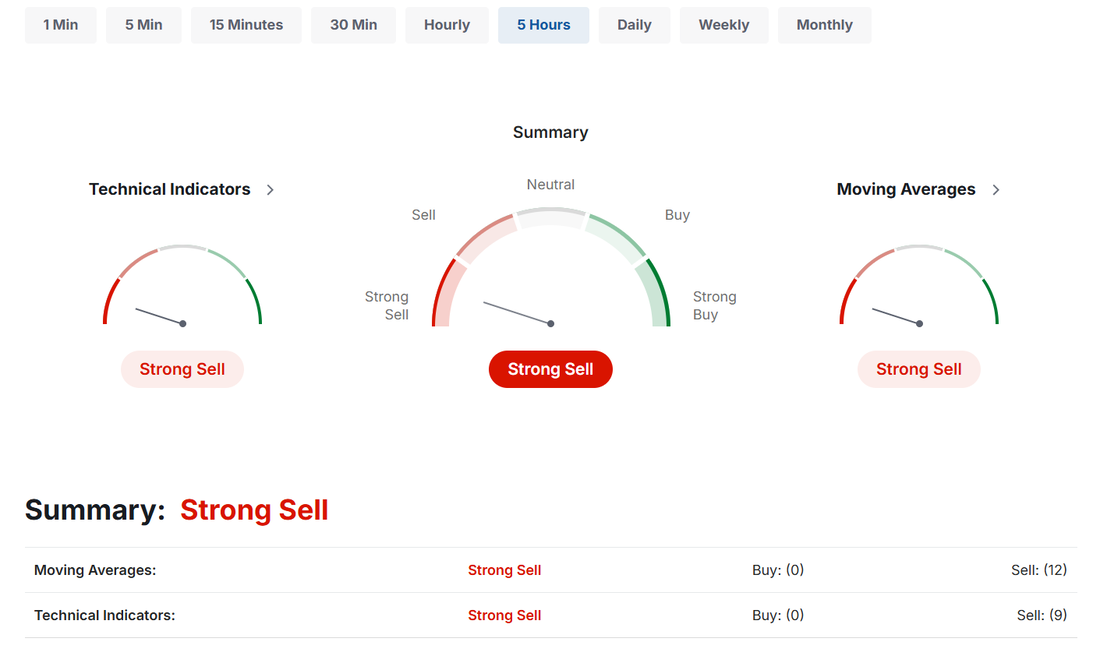

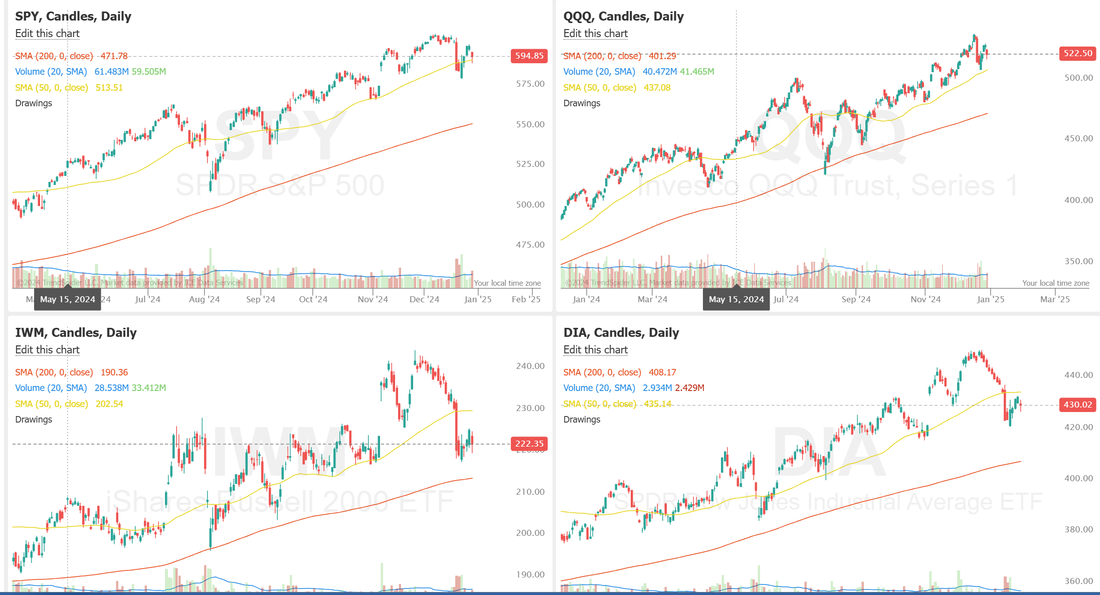

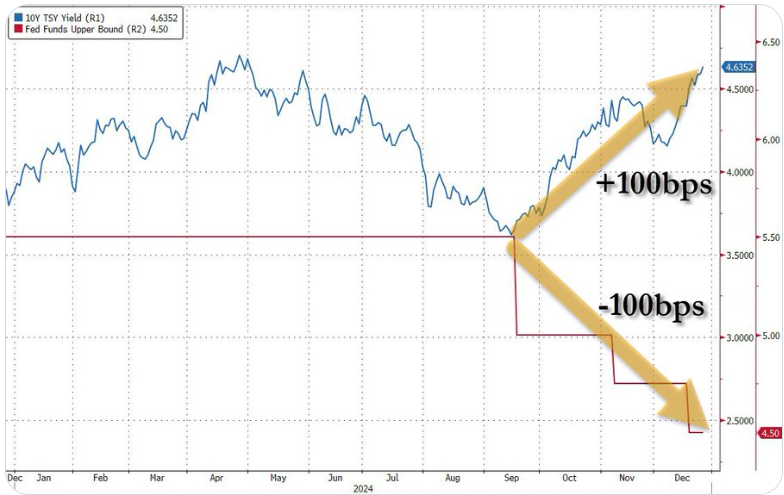

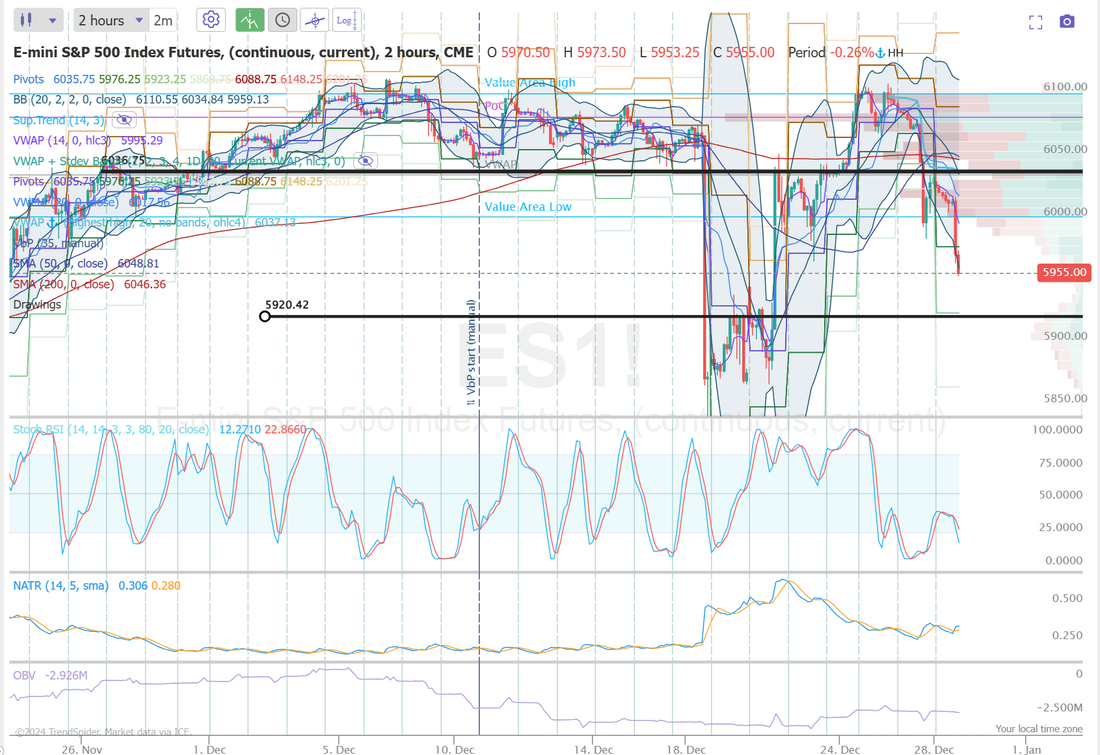

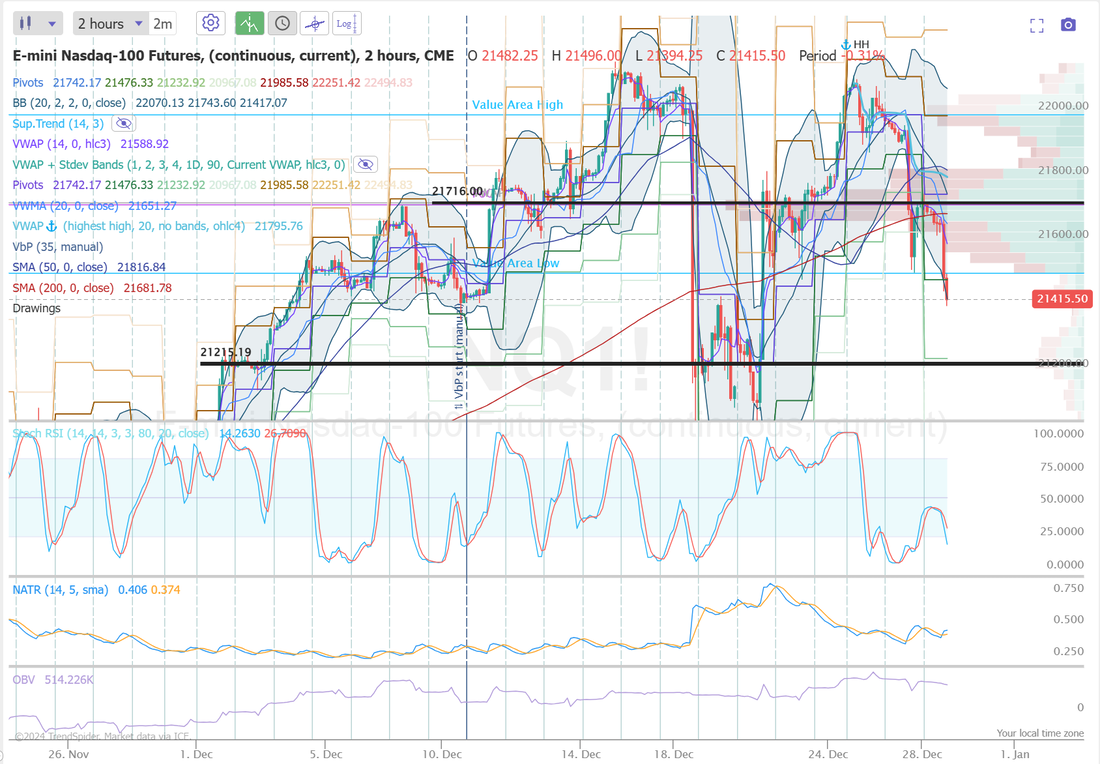

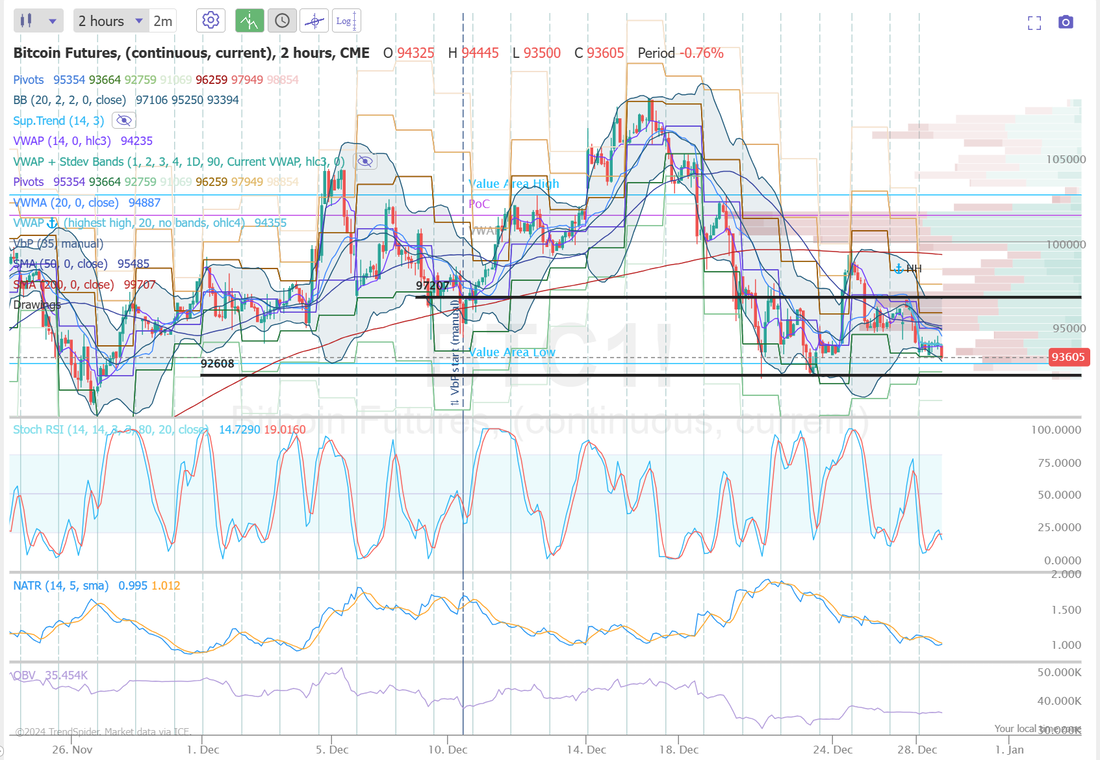

Welcome back traders to the last few days of 2024. Markets look to continue the profit taking instead of the "Santa rally" that so many were hoping for. We had a stellar day last Friday. Our results are below: Let's take a look at the markets: Sell mode continues. The SPY is now threatening to join the IWM and DIA, trading down below their 50DMA. March S&P 500 E-Mini futures (ESH25) are down -0.22%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.20% this morning, adding to Friday’s declines on Wall Street, as market participants reduced positions amid uncertainty heading into year-end. In Friday’s trading session, Wall Street’s major equity averages closed in the red. Mega-cap technology stocks slumped, with Tesla (TSLA) sliding nearly -5% to lead losers in the Nasdaq 100 and Nvidia (NVDA) dropping over -2% to lead losers in the Dow. Also, Netflix (NFLX) fell more than -2% after receiving mixed reviews for its new release, “Squid Game Season 2,” which debuted on Thursday. In addition, Viracta Therapeutics (VIRX) tumbled over -32% after announcing the termination of its ongoing Nana-val trial and that its board has begun a process to explore strategic options. On the bullish side, Lamb Weston Holdings (LW) rose over +2% and was the top percentage gainer on the S&P 500 after a filing showed that activist investor Jana Partners is working with a sixth executive to advocate for changes at the French fry maker. “[It] feels like there is quite a bit of profit-taking across the board. We are more than two years into a pretty strong bull market ... so it’s really not surprising to see some people taking their profits and rebalancing their portfolios ahead of the new year,” said Michael Reynolds, vice president of investment strategy at Glenmede. Economic data released on Friday showed that the U.S. November trade deficit widened to -$102.86B from -$98.26B in October, a larger deficit than expectations of -$101.30B. Also, U.S. wholesale inventories unexpectedly fell -0.2% m/m in November, compared to expectations of a +0.1% m/m increase. Meanwhile, U.S. rate futures have priced in an 88.8% chance of no rate change and an 11.2% chance of a 25 basis point rate cut at the next central bank meeting in January. The U.S. stock and bond markets will be closed on Wednesday for the New Year’s Day holiday. Also, the U.S. bond market will close early at 2 p.m. Eastern Time on Tuesday for New Year’s Eve. In this holiday-shortened week, investors will be eyeing several economic data releases, including the U.S. S&P/CS HPI Composite - 20 n.s.a., Initial Jobless Claims, the S&P Global Manufacturing PMI, Construction Spending, Crude Oil Inventories, and the ISM Manufacturing PMI. Market participants will also focus on remarks from Richmond Fed President Tom Barkin on Friday. Today, all eyes are on the U.S. Chicago PMI, which is set to be released in a couple of hours. Economists forecast that the Chicago PMI will stand at 42.7 in December, compared to last month’s value of 40.2. U.S. Pending Home Sales data will be released today as well. Economists expect the November figure to be +0.9% m/m, compared to the previous figure of +2.0% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.596%, down -0.50%. Some things I'm thinking about today: If the S&P 500 closes this 7-day trading period in the red, it would make history. This would mark the 3rd time since 1950 with back-to-back losses in the "Santa Claus" rally period. In 2023, the S&P 500 lost -0.9% during this period and it is now down -0.1% since December 24. The first time in history when 100bps of rate cuts raised 10Y yields by 100bps. What does this mean? I'm not sure anyone knows but one thing is for sure. The bond market isn't buying what the FED is selling. Bonds have a much better track record for accuracy than the FED does. Trade docket: ADP, CAG, TDG, RJF, UPS, BABA, 0DTE, 1HTE. Let's take a look at the intra-day levels. /ES: New key levels for us today with this mornings selloff. 6037 resistance with 5920 support. /NQ: Resistance now at 21716 with support at 21215 BTC: Bitcoin continues to show weakness below the key 100,000 level. Resitance now at 97,208 and support is close at 92,608. If we lose this support much stronger weakness could prevail. My lean or bias today is bearish. It seems like the year end profit taking is still pushing the markets. See you all in the trading room today. I'm excited to build another 0DTE ratio trade with you live on the zoom feed this morning and set some 2025 income goals for ourselves!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |